|

|

市場調査レポート

商品コード

1309761

IVD (体外診断薬) 受託製造の世界市場:製品種類別 (消耗品、装置)・技術別 (イムノアッセイ、臨床化学、分子診断、微生物検査、血液検査、凝固検査)・サービス別 (製造、アッセイ開発) の将来予測 (2028年まで)IVD Contract Manufacturing Market by Device Type (Consumables, Equipment), Technology (Immunoassay, Clinical Chemistry, Molecular Diagnostics, Microbiology, Hematology, Coagulation), Service (Manufacturing, Assay Development) - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| IVD (体外診断薬) 受託製造の世界市場:製品種類別 (消耗品、装置)・技術別 (イムノアッセイ、臨床化学、分子診断、微生物検査、血液検査、凝固検査)・サービス別 (製造、アッセイ開発) の将来予測 (2028年まで) |

|

出版日: 2023年06月22日

発行: MarketsandMarkets

ページ情報: 英文 211 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のIVD (体外診断薬) 受託製造の市場規模は、2023年の150億米ドルから2028年には255億米ドルに達し、予測期間中の11.2%のCAGRで成長すると予測されています。

市場の主な促進要因として、自社製IVDのコストの高さや、IVDの受託製造業者による効率的な製品開発のための新技術の採用、製造負担を軽減し新技術の開発に集中するために大手メーカーがCMOに製造を委託する必要性の高まりなどが挙げられます。

CMOは、この非常に細分化された市場で競争し、その地位を強化するために、先端技術機器の製造活動や開発を強化しています。

"IVD装置の分野が、IVD受託製造市場で大きなシェアを占める"

IVD受託製造市場では、2022年にIVD装置の分野がより大きなシェアを占めました。また、このセグメントは予測期間中、安定したCAGRで成長すると推定されます。このセグメントの成長の主な要因として、世界的に実施されるIVD検査量の増加や、COVID-19パンデミック後の分子検査機器ニーズの急増などが挙げられます。

"分子診断セグメントが、予測期間中に最も高いCAGRで成長する"

技術別に見ると、分子診断セグメントは予測期間中に最大のCAGRで成長します。同分野の成長の主な要因は、感染症・がん・各種遺伝性疾患の有病率の上昇、薬理遺伝学・PoC検査における分子診断技術の応用の増加です。さらに、個別化医療に対する認識と受容の高まり、技術進歩、遺伝性疾患検査と出生前検査におけるMDxの応用拡大も市場成長に影響を与える見通しです。プロテオミクスとゲノミクスにおけるPCRの使用の増加、機器の自動化、qRT-PCRのような先端技術の出現も、市場成長を支えると考えられています。"

"アジア太平洋は予測期間中に最大のCAGRで成長する"

アジア太平洋地域は予測期間中、地域別で最高のCAGRで成長します。この市場の成長を促進する主な要因は、多数の受託製造業者の存在、中国とインドにおけるCMOの数が非常に高い割合で増加していること、この地域における新興国工場の製造能力と効率性、サプライチェーン・ロジスティクスの容易さ、高品質機器のコスト管理された生産などです。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界の動向

- ポーターのファイブフォース分析

- 関税と規制状況

- 主要な会議とイベント (2022年~2023年)

- 特許分析

- 技術分析

- サプライチェーン分析

- 主要な利害関係者と購入基準

- エコシステム分析

- 収益源:技術ベースソリューションへの移行

- IVD受託製造市場:不況の影響

第6章 IVD受託製造市場:製品種類別

- イントロダクション

- 消耗品

- 装置

第7章 IVD受託製造市場:技術別

- イントロダクション

- イムノアッセイ

- 臨床化学

- 分子診断

- 血液検査

- 微生物検査

- 凝固・止血検査

- その他の技術

第8章 IVD受託製造市場:サービスの種類別

- イントロダクション

- 製造サービス

- アッセイ開発

- その他のサービス

第9章 IVD受託製造市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- ラテンアメリカ

- メキシコ

- ブラジル

- その他のラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 概要

- 企業が採用した主な戦略

- 上位企業の収益シェア分析

- 市場シェア分析

- 企業評価マトリックス (2022年)

- 競合ベンチマーキング

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- JABIL INC.

- SANMINA CORPORATION

- TE CONNECTIVITY

- CELESTICA, INC.

- WEST PHARMACEUTICAL SERVICES, INC.

- SAVYON DIAGNOSTICS, LTD.

- KMC SYSTEMS

- CENOGENICS CORPORATION

- NOVA BIOMEDICAL

- CONE BIOPRODUCTS

- INVETECH

- AVIOQ, INC.

- MERIDIAN BIOSCIENCE, INC.

- KIMBALL ELECTRONICS, INC.

- NEMERA

- VIANT MEDICAL HOLDINGS, INC.

- PHILLIPS-MEDISIZE CORPORATION

- NOLATO GW, INC.

- STRATEC SE

- THERMO FISHER SCIENTIFIC, INC.

- FUJIREBIO

- BIOKIT (WERFEN)

- その他の企業

- AFFINITY LIFESCIENCE

- SEKISUI

- PRESTIGE DIAGNOSTICS

第12章 付録

The global IVD contract manufacturing market is projected to reach USD 25.5 billion by 2028 from USD 15.0 billion in 2023, at a CAGR of 11.2% during the forecast period. The high cost associated with in-house manufactured IVD products, the adoption of new technology to develop efficient products by IVD contract manufacturers, and the increased need to outsource manufacturing to CMOs by large manufacturers to reduce the manufacturing burden and focus on the development of newer technology.

There has been increased manufacturing activities and development by CMOs of advanced technological equipments to compete in this highly fragmented market and strengthen its position.

"IVD Equipment segment accounted for a larger share of the IVD contract manufacturing market"

In 2022, the IVD equipment segment accounted for a larger share of the IVD contract manufacturing market. This segment is also estimated to grow at a stable CAGR during the forecast period. Growth in this segment can primarily be attributed to the increasing volume of IVD tests performed globally and need burst of molecular test equipment post the Covid-19 pandemic.

"The molecular diagnostic segment will grow at highest CAGR during the forecast period"

Based on technology, the molecular diagnostic segment will grow at highest CAGR during the forecast period. Growth in this segment can primarily be attributed to the rising prevalence of infectious diseases, cancer, and various genetic disorders, increasing applications of molecular diagnostic technologies in pharmacogenetics and point-of-care testing. Moreover, the increasing awareness and acceptance of personalized medicine, technological advancements, and the growing application of MDx in hereditary disease testing & prenatal testing is also likely to influence the market growth. The growing use of PCR in proteomics and genomics, automation of instruments, and the emergence of advanced technologies such as qRT-PCR is also likely to support the growth of the market"

"Asia Pacific will grow at highest CAGR during the forecast period"

In 2022, Asia Pacific will grow at highest CAGR during the forecast period. Major factors driving the growth of this market are the presence of large numebr of conntract manufacturers, the rise in number of CMOs in China and India at an exobidantly high rate, the manufacturing capabilites and effienciency of the development plants in this region, ease of supply chain logistics, and cost controlled production of high quality equipments.

The break-up of the profile of primary participants in the IVD contract manufacturing market:

- By Company Type: Tier 1 - 34%, Tier 2 - 38%, and Tier 3 - 28%

- By Designation: C Level - 26%, Director Level - 35%, Others-39%

- By Region: Asia Pacific - 39%, North America - 28%, Europe -17%, Latin America - 9%

- Middle East - 7%

The prominent players in the IVD contract manufacturing market include Jabil Inc. (US), Sanmina Corporation (US), TE Connectivity (Switzerland), Celestica Inc.(Canada),Thermofisher (US) Savyon Diagnostics (Israel),

Research Coverage:

The report analyzes the IVD contract manufacturing market and aims at estimating the market size and future growth potential of this market based on various segments such as device type, technology, service and region. The report also includes a product portfolio matrix of various IVD contract manufactured equipment or consumables available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, and key market strategies.

Reasons to Buy the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall IVD contract manufacturing market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (high cost effective manufacturing of high technological and patented technology), restraints (risk to OEMs intellectual property and quality control), opportunities (high growth in developing countries), and challenges (shortage of skilled labour) influencing the growth of the IVD contract manufacturing market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the IVD contract manufacturing market

- Market Development: Comprehensive information on the lucrative emerging markets by type, application, end user and region.

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the global IVD contract manufacturing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players like Jabil Inc. (US), Sanmina Corporation (US), TE Connectivity (Switzerland), Celestica Inc.(Canada), Savyon Diagnostics (Israel), Thermofisher (US) in the global IVD contract manufacturing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 IVD CONTRACT MANUFACTURING MARKET SEGMENTATION

- FIGURE 2 IVD CONTRACT MANUFACTURING MARKET: REGIONAL SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- TABLE 1 STANDARD CURRENCY CONVERSION RATES (UNIT OF USD)

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END-USER, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 8 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 9 REVENUE SHARE ANALYSIS ILLUSTRATION: JABIL INC.

- FIGURE 10 SUPPLY-SIDE ANALYSIS: IVD CONTRACT MANUFACTURING MARKET (2022)

- FIGURE 11 DEMAND-SIDE ESTIMATION FOR IVD CONTRACT MANUFACTURING MARKET

- FIGURE 12 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2023-2028)

- FIGURE 13 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.2.1 TOP-DOWN APPROACH

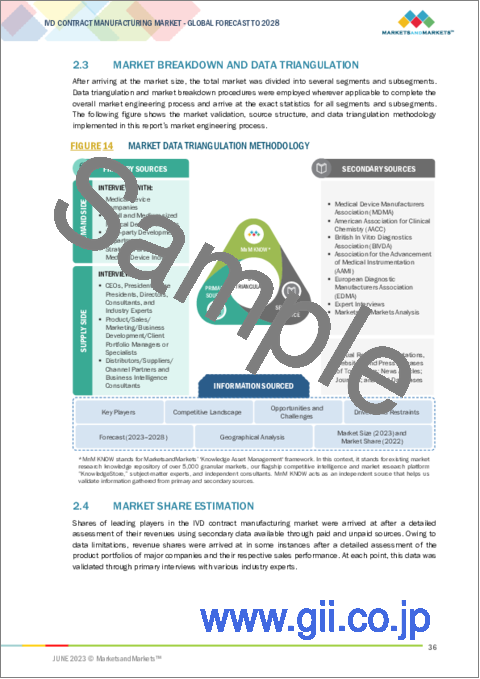

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 14 MARKET DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 LIMITATIONS & RISK ASSESSMENT

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.6.3 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: IVD CONTRACT MANUFACTURING MARKET

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 15 IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 IVD CONTRACT MANUFACTURING MARKET: GEOGRAPHICAL SNAPSHOT, 2022

4 PREMIUM INSIGHTS

- 4.1 IVD CONTRACT MANUFACTURING MARKET OVERVIEW

- FIGURE 19 TECHNOLOGICAL ADVANCEMENTS IN IVD TO DRIVE MARKET

- 4.2 IVD CONTRACT MANUFACTURING MARKET: DEVELOPED VS. DEVELOPING MARKETS

- FIGURE 20 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.3 IVD CONTRACT MANUFACTURING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 21 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.4 IVD CONTRACT MANUFACTURING MARKET: REGIONAL MIX

- FIGURE 22 ASIA PACIFIC TO DOMINATE MARKET IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 MARKET DYNAMICS: IVD CONTRACT MANUFACTURING MARKET

- TABLE 3 MARKET DYNAMICS: IMPACT ANALYSIS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing outsourcing activity by IVD manufacturers

- 5.2.1.2 High cost of in-house IVD manufacturing

- 5.2.2 RESTRAINTS

- 5.2.2.1 IP protection concerns and possibility of theft

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth potential of emerging economies

- FIGURE 24 ASIA PACIFIC: HEALTHCARE EXPENDITURE, 2010-2020 (% OF GDP)

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled labor

- 5.3 INDUSTRY TRENDS

- 5.3.1 AUTOMATION OF CLINICAL LABORATORY TECHNIQUES

- 5.3.2 MICROFLUIDICS-BASED POC AND LAB-ON-A-CHIP DIAGNOSTIC DEVICES FOR LABORATORY TESTING

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 IVD CONTRACT MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 IVD CONTRACT MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF SUBSTITUTES

- 5.4.2 BARGAINING POWER OF SUPPLIERS

- 5.4.3 INTENSITY OF COMPETITIVE RIVALRY

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 THREAT OF NEW ENTRANTS

- 5.5 TARIFF AND REGULATORY LANDSCAPE

- 5.5.1 REGULATORY ANALYSIS

- 5.5.1.1 North America

- 5.5.1.1.1 US

- 5.5.1.1 North America

- TABLE 5 US: CLASSIFICATION OF MEDICAL EQUIPMENT

- TABLE 6 US: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.5.1.1.2 Canada

- TABLE 7 CANADA: RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.5.1.2 Europe

- TABLE 8 EUROPE: RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- FIGURE 26 EUROPE: IVDR TIMELINE

- 5.5.1.3 Asia Pacific

- 5.5.1.3.1 Japan

- 5.5.1.3 Asia Pacific

- FIGURE 27 REGULATORY PROCESS FOR IVD DEVICES IN JAPAN

- TABLE 9 JAPAN: CLASSIFICATION OF IVD REAGENTS IN JAPAN

- TABLE 10 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.5.1.3.2 China

- TABLE 11 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.5.1.3.3 India

- FIGURE 28 INDIA: REGULATORY PROCESS FOR IVD DEVICES

- 5.5.1.4 South Korea

- TABLE 12 SOUTH KOREA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.5.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.1 REGULATORY ANALYSIS

- 5.6 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 18 IVD CONTRACT MANUFACTURING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.7 PATENT ANALYSIS

- 5.7.1 PATENT PUBLICATION TRENDS FOR IVD DEVICES

- FIGURE 29 PATENT PUBLICATION TRENDS (JANUARY 2013-JULY 2023)

- 5.7.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 30 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR IVD DEVICES PATENTS (JANUARY 2013-JULY 2023)

- FIGURE 31 TOP 10 APPLICANT COUNTRIES/REGIONS FOR IVD DEVICES PATENTS (JANUARY 2013-JULY 2023)

- 5.7.3 PATENT PUBLICATION TRENDS FOR IVD DEVICES

- TABLE 19 IVD DEVICES: LIST OF MAJOR PATENTS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES: IVD CONTRACT MANUFACTURING MARKET

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.9 SUPPLY CHAIN ANALYSIS

- FIGURE 32 IVD CONTRACT MANUFACTURING MARKET: SUPPLY CHAIN (2022)

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF IVD PRODUCTS

- 5.10.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR IVD PRODUCTS

- TABLE 20 KEY BUYING CRITERIA FOR IVD PRODUCTS

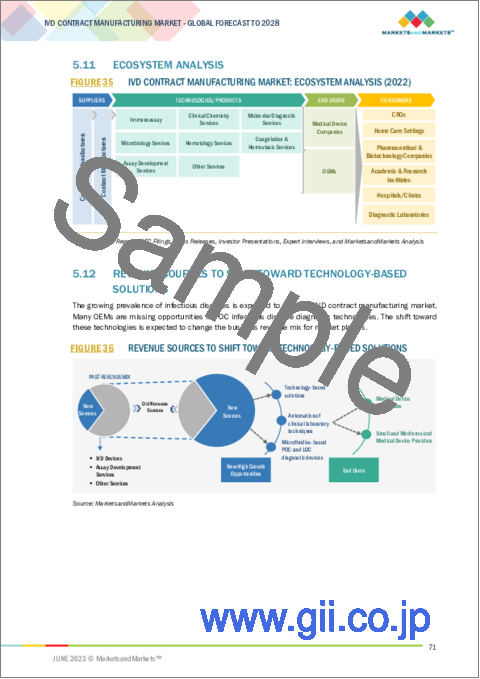

- 5.11 ECOSYSTEM ANALYSIS

- FIGURE 35 IVD CONTRACT MANUFACTURING MARKET: ECOSYSTEM ANALYSIS (2022)

- 5.12 REVENUE SOURCES TO SHIFT TOWARD TECHNOLOGY-BASED SOLUTIONS

- FIGURE 36 REVENUE SOURCES TO SHIFT TOWARD TECHNOLOGY-BASED SOLUTIONS

- 5.13 IVD CONTRACT MANUFACTURING MARKET: RECESSION IMPACT

6 IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- TABLE 21 IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- 6.2 CONSUMABLES

- 6.2.1 CONSUMABLES TO DOMINATE IVD CONTRACT MANUFACTURING MARKET

- TABLE 22 IVD CONTRACT MANUFACTURING MARKET FOR CONSUMABLES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 EQUIPMENT

- 6.3.1 AUTOMATION, ADVANCEMENTS, AND EMPHASIS ON EFFICIENT DIAGNOSTICS TO DRIVE MARKET

- TABLE 23 IVD CONTRACT MANUFACTURING MARKET FOR EQUIPMENT, BY COUNTRY, 2021-2028 (USD MILLION)

7 IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 24 IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 7.2 IMMUNOASSAYS

- 7.3 RISING PREVALENCE OF CANCER TO DRIVE GROWTH

- TABLE 25 IVD CONTRACT MANUFACTURING MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 CLINICAL CHEMISTRY

- 7.4.1 GROWING INCIDENCE OF LIFESTYLE DISEASES TO DRIVE DEMAND FOR CLINICAL CHEMISTRY ASSAY TESTING

- TABLE 26 IVD CONTRACT MANUFACTURING MARKET FOR CLINICAL CHEMISTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.5 MOLECULAR DIAGNOSTICS

- 7.5.1 TECHNOLOGICAL INNOVATION IN PCR TESTING TO BOOST GROWTH

- TABLE 27 IVD CONTRACT MANUFACTURING MARKET FOR MOLECULAR DIAGNOSTICS, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.6 HEMATOLOGY

- 7.6.1 RISING ADOPTION OF AUTOMATED HEMATOLOGY ANALYZERS TO DRIVE MARKET

- TABLE 28 IVD CONTRACT MANUFACTURING MARKET FOR HEMATOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.7 MICROBIOLOGY

- 7.7.1 RISING PREVALENCE OF MICROBIAL INFECTIONS TO DRIVE MARKET

- TABLE 29 IVD CONTRACT MANUFACTURING MARKET FOR MICROBIOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.8 COAGULATION & HEMOSTASIS

- 7.8.1 GROWING USE OF ANTICOAGULATION THERAPY IN SURGICAL PROCEDURES TO DRIVE MARKET

- TABLE 30 IVD CONTRACT MANUFACTURING MARKET FOR COAGULATION & HEMOSTASIS, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.9 OTHER TECHNOLOGIES

- TABLE 31 IVD CONTRACT MANUFACTURING MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021-2028 (USD MILLION)

8 IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE

- 8.1 INTRODUCTION

- TABLE 32 IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- 8.2 MANUFACTURING SERVICES

- 8.2.1 MANUFACTURING SERVICES TO HOLD LARGEST MARKET SHARE TILL 2028

- TABLE 33 MANUFACTURING SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 ASSAY DEVELOPMENT

- 8.3.1 LOW-COST SETUP, EFFICIENCY, AND HIGH THROUGHPUT TO DRIVE DEMAND FOR ASSAY DEVELOPMENT

- TABLE 34 ASSAY DEVELOPMENT SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 OTHER SERVICES

- TABLE 35 OTHER SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

9 IVD CONTRACT MANUFACTURING MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 37 IVD CONTRACT MANUFACTURING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 36 IVD CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 ASIA PACIFIC

- 9.2.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 38 ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET SNAPSHOT

- TABLE 37 ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.2.2 CHINA

- 9.2.2.1 Low labor costs and rapidly changing healthcare infrastructure to drive market

- TABLE 41 CHINA: KEY MACROINDICATORS

- TABLE 42 CHINA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 43 CHINA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 44 CHINA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.2.3 JAPAN

- 9.2.3.1 Universal healthcare reimbursement policies to propel market

- TABLE 45 JAPAN: KEY MACROINDICATORS

- TABLE 46 JAPAN: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 47 JAPAN: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 48 JAPAN: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.2.4 INDIA

- 9.2.4.1 Rising contract manufacturing capabilities to support growth

- TABLE 49 INDIA: KEY MACROINDICATORS

- TABLE 50 INDIA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 51 INDIA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 52 INDIA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.2.5 AUSTRALIA

- 9.2.5.1 Need for advanced medical and diagnostic tools to fuel growth

- TABLE 53 AUSTRALIA: KEY MACROINDICATORS

- TABLE 54 AUSTRALIA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 55 AUSTRALIA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 56 AUSTRALIA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.2.6 SOUTH KOREA

- 9.2.6.1 Rising spending on innovative IVD technologies to support market growth

- TABLE 57 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 58 SOUTH KOREA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 59 SOUTH KOREA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 60 SOUTH KOREA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.2.7 REST OF ASIA PACIFIC

- TABLE 61 REST OF ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.3 NORTH AMERICA

- 9.3.1 NORTH AMERICA: RECESSION IMPACT

- TABLE 64 NORTH AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.3.2 US

- 9.3.2.1 Increasing in-house manufacturing costs to encourage shift to contract manufacturing

- TABLE 68 US: KEY MACROINDICATORS

- TABLE 69 US: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 70 US: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 71 US: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.3.3 CANADA

- 9.3.3.1 Strong presence of key contract manufacturing companies to drive market

- TABLE 72 CANADA: KEY MACROINDICATORS

- TABLE 73 CANADA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 74 CANADA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 75 CANADA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.4 EUROPE

- 9.4.1 EUROPE: RECESSION IMPACT

- TABLE 76 EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 77 EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 78 EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 79 EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.4.2 GERMANY

- 9.4.2.1 Germany to hold largest market share

- TABLE 80 GERMANY: KEY MACROINDICATORS

- TABLE 81 GERMANY: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 82 GERMANY: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 83 GERMANY: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.4.3 FRANCE

- 9.4.3.1 Increasing government pressure to reduce healthcare costs and budgetary constraints

- TABLE 84 FRANCE: KEY MACROINDICATORS

- TABLE 85 FRANCE: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 86 FRANCE: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 87 FRANCE: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.4.4 UK

- 9.4.4.1 Risng adoption of genome-based testing and increasing accessibility of IVD

- TABLE 88 UK: KEY MACROINDICATORS

- TABLE 89 UK: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 90 UK: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 91 UK: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.4.5 ITALY

- 9.4.5.1 Rising incidence of chronic illnesses to drive market

- TABLE 92 ITALY: KEY MACROINDICATORS

- TABLE 93 ITALY: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 94 ITALY: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 95 ITALY: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.4.6 SPAIN

- 9.4.6.1 Increasing adoption of home-use medical devices to drive market

- TABLE 96 SPAIN: KEY MACROINDICATORS

- TABLE 97 SPAIN: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 98 SPAIN: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 99 SPAIN: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.4.7 REST OF EUROPE

- TABLE 100 REST OF EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 102 REST OF EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.5 LATIN AMERICA

- 9.5.1 LATIN AMERICA: RECESSION IMPACT

- TABLE 103 LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 104 LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 105 LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 106 LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.5.2 MEXICO

- 9.5.2.1 Mexico to hold largest share of Latin American market

- TABLE 107 MEXICO: KEY MACROINDICATORS

- TABLE 108 MEXICO: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 109 MEXICO: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 110 MEXICO: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.5.3 BRAZIL

- 9.5.3.1 Favorable government initiatives and willingness to pay for better healthcare to drive market

- TABLE 111 BRAZIL: KEY MACROINDICATORS

- TABLE 112 BRAZIL: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 113 BRAZIL: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 114 BRAZIL: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.5.4 REST OF LATIN AMERICA

- TABLE 115 REST OF LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 116 REST OF LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 117 REST OF LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWING HEALTHCARE INVESTMENTS AND INFRASTRUCTURAL IMPROVEMENTS TO DRIVE MARKET

- 9.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 118 MIDDLE EAST & AFRICA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY STRATEGIES ADOPTED BY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 39 TOP MARKET PLAYERS DOMINATE IVD CONTRACT MANUFACTURING MARKET

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 40 IVD CONTRACT MANUFACTURING MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- 10.5 COMPANY EVALUATION MATRIX, 2022

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 41 IVD CONTRACT MANUFACTURING MARKET: COMPANY EVALUATION QUADRANT (2022)

- 10.6 COMPETITIVE BENCHMARKING

- TABLE 121 OVERALL COMPANY FOOTPRINT

- TABLE 122 OMPANY FOOTPRINT ANALYSIS, BY PRODUCT TYPE

- TABLE 123 COMPANY FOOTPRINT ANALYSIS, BY SERVICE TYPE

- TABLE 124 COMPANY FOOTPRINT ANALYSIS, BY REGION

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 PRODUCT LAUNCHES

- TABLE 125 PRODUCT LAUNCHES (JANUARY 2020-MAY 2023)

- 10.7.2 DEALS

- TABLE 126 DEALS (JANUARY 2020-MAY 2023)

- 10.7.3 OTHER DEVELOPMENTS

- TABLE 127 OTHER DEVELOPMENTS (JANUARY 2020-MAY 2023)

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1.1 JABIL INC.

- TABLE 128 JABIL INC.: COMPANY OVERVIEW

- FIGURE 42 JABIL INC.: COMPANY SNAPSHOT (2022)

- 11.1.2 SANMINA CORPORATION

- TABLE 129 SANMINA CORPORATION: COMPANY OVERVIEW

- FIGURE 43 SANMINA CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.3 TE CONNECTIVITY

- TABLE 130 TE CONNECTIVITY: COMPANY OVERVIEW

- FIGURE 44 TE CONNECTIVITY: COMPANY SNAPSHOT (2022)

- 11.1.4 CELESTICA, INC.

- TABLE 131 CELESTICA, INC.: COMPANY OVERVIEW

- FIGURE 45 CELESTICA, INC.: COMPANY SNAPSHOT (2022)

- 11.1.5 WEST PHARMACEUTICAL SERVICES, INC.

- TABLE 132 WEST PHARMACEUTICALS SERVICES, INC.: COMPANY OVERVIEW

- FIGURE 46 WEST PHARMACEUTICAL SERVICES, INC.: COMPANY SNAPSHOT (2022)

- 11.1.6 SAVYON DIAGNOSTICS, LTD.

- TABLE 133 SAVYON DIAGNOSTICS, LTD.: COMPANY OVERVIEW

- 11.1.7 KMC SYSTEMS

- TABLE 134 KMC SYSTEMS: COMPANY OVERVIEW

- FIGURE 47 ELBIT SYSTEMS: COMPANY SNAPSHOT (2022)

- 11.1.8 CENOGENICS CORPORATION

- TABLE 135 CENOGENICS CORPORATION: COMPANY OVERVIEW

- 11.1.9 NOVA BIOMEDICAL

- TABLE 136 NOVA BIOMEDICAL: COMPANY OVERVIEW

- 11.1.10 CONE BIOPRODUCTS

- TABLE 137 CORE BIOPRODUCTS: COMPANY OVERVIEW

- 11.1.11 INVETECH

- TABLE 138 INVETECH: COMPANY OVERVIEW

- FIGURE 48 FORTIVE: COMPANY SNAPSHOT (2022)

- 11.1.12 AVIOQ, INC.

- TABLE 139 AVIOQ, INC.: COMPANY OVERVIEW

- 11.1.13 MERIDIAN BIOSCIENCE, INC.

- TABLE 140 MERIDIAN BIOSCIENCE, INC.: COMPANY OVERVIEW

- FIGURE 49 MERIDIAN BIOSCIENCE, INC.: COMPANY SNAPSHOT (2022)

- 11.1.14 KIMBALL ELECTRONICS, INC.

- TABLE 141 KIMBALL ELECTRONICS, INC.: COMPANY OVERVIEW

- FIGURE 50 KIMBALL ELECTRONICS, INC.: COMPANY SNAPSHOT (2022)

- 11.1.15 NEMERA

- TABLE 142 NEMERA: COMPANY OVERVIEW

- 11.1.16 VIANT MEDICAL HOLDINGS, INC.

- TABLE 143 VIANT MEDICAL HOLDINGS, INC.: COMPANY OVERVIEW

- 11.1.17 PHILLIPS-MEDISIZE CORPORATION

- TABLE 144 PHILLIPS-MEDISIZE CORPORATION: COMPANY OVERVIEW

- 11.1.18 NOLATO GW, INC.

- TABLE 145 NOLATO GW, INC.: COMPANY OVERVIEW

- FIGURE 51 NOLATO GW, INC.: COMPANY SNAPSHOT (2022)

- 11.1.19 STRATEC SE

- TABLE 146 STRATEC SE: COMPANY OVERVIEW

- FIGURE 52 STRATEC SE: COMPANY SNAPSHOT (2022)

- 11.1.20 THERMO FISHER SCIENTIFIC, INC.

- TABLE 147 THERMO FISHER SCIENTIFIC, INC.: COMPANY OVERVIEW

- FIGURE 53 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- 11.1.21 FUJIREBIO

- TABLE 148 FUJIREBIO: COMPANY OVERVIEW

- FIGURE 54 H.U. GROUP: COMPANY SNAPSHOT (2022)

- 11.1.22 BIOKIT (WERFEN)

- TABLE 149 BIOKIT: COMPANY OVERVIEW

- FIGURE 55 WERFEN: COMPANY SNAPSHOT (2022)

- 11.2 OTHER COMPANIES

- 11.2.1 AFFINITY LIFESCIENCE

- 11.2.2 SEKISUI

- 11.2.3 PRESTIGE DIAGNOSTICS

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS