|

|

市場調査レポート

商品コード

1718872

コラーゲンおよびゼラチンの世界市場 (~2030年):原料 (牛・豚・海産物)・用途 (整形外科・循環器・歯科・外科)・エンドユーザー・地域別Collagen & Gelatin Market by Source (Bovine, Porcine, Marine), Application (Orthopedic, Cardiovascular, Dental, Surgical), Competitive Landscape (Company Profile, Market share, Company Evaluation Matrix), End User, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| コラーゲンおよびゼラチンの世界市場 (~2030年):原料 (牛・豚・海産物)・用途 (整形外科・循環器・歯科・外科)・エンドユーザー・地域別 |

|

出版日: 2025年04月29日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のコラーゲンおよびゼラチンの市場規模は、2025年の12億9,550万米ドルから、予測期間中はCAGR 5.8%で推移し、2030年には16億7,130万米ドルに達すると予測されています。

糖尿病、癌、心血管疾患の罹患率の上昇により、効率的な治療、特に高度な創傷ケアを備えた製品に対する需要が高まっています。コラーゲンドレッシング材は、創傷を迅速に治癒し、感染リスクを最小限に抑えることができるため、人気が高まっています。さらに、外科手術の増加により、縫合糸、足場、インプラント用のコラーゲンベースのバイオマテリアルの需要に拍車がかかっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | 製品タイプ・原料・用途・エンドユーザー |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

さらに、組織工学や再生医療におけるコラーゲンの用途の拡大、特にバイオエンジニアリングされた皮膚、軟骨、骨の開発は、治療用途の新たな道を切り開いています。

"製品タイプ別では、コラーゲン部門が予測期間中に最大シェアを占めす見通し"

再生医療、整形外科用インプラント、皮膚治療などにおいて、ネイティブコラーゲンや型特異的コラーゲンが、組織の足場形成や修復において重要な役割を果たしていることから、その採用が拡大しています。さらに、組換えコラーゲン技術や海洋由来のコラーゲンの革新により、細胞治療、3Dプリンティング、個別化医療といった次世代分野への応用が広がっており、医療ソリューションの次世代的アプローチにおける主要素材の一つとしての地位を確立しつつあります。

"エンドユーザー別では、病院の部門が予測期間中に最大のシェアを占める見通し"

コラーゲンおよびゼラチン製品は、主に病院業界で消費されています。病院はまた、慢性創傷、熱傷、糖尿病性潰瘍、術後ケアの治療の中心的な拠点でもあり、こうした治療においては、組織の再生と早期回復を促進する効果が確立されているコラーゲンドレッシング材が広く使用されています。さらに、病院は常に次世代の医療機器、再生医療、整形外科用インプラント、薬物送達システムといった最先端技術の導入に積極的であり、これらにはコラーゲン系製品が多く活用されています。

"アジア太平洋地域は予測期間中にもっとも急成長する地域となる見通し"

その要因としては、バイオ医薬品製造能力の急速な拡大や、再生医療および高度なドラッグデリバリーシステムへの投資の増加が挙げられます。中国、インド、韓国、日本は、コラーゲンベースの足場材、細胞治療、組織工学に関する研究開発を優先課題として推進しており、潤沢な資金供給や産学連携の強化がその背景にあります。

また、コラーゲンやゼラチンを、医薬品カプセル化、創傷治癒用製剤、3Dバイオプリンティング技術の主要素材として取り入れている臨床試験や受託製造機関 (CROやCMO) の増加も、この地域における市場成長を牽引する主な要因となっています。

当レポートでは、世界のコラーゲンおよびゼラチンの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/ディスラプション

- バリューチェーン分析

- サプライチェーン分析

- コラーゲン&ゼラチン市場:エコシステム分析

- 技術分析

- 規制状況

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- 特許分析

- 主な会議とイベント

- 価格分析

- 貿易分析

- AI/生成AIがコラーゲン&ゼラチン市場に与える影響

- 投資と資金調達のシナリオ

第6章 コラーゲンおよびゼラチン市場:製品タイプ別

- コラーゲン

- ゼラチン

第7章 コラーゲンおよびゼラチン市場:原料別

- 牛由来

- 豚由来

- その他

第8章 コラーゲン市場:用途別

- 整形外科

- 創傷ケア

- 歯科

- 外科手術

- 心血管

- その他

第9章 ゼラチン市場:用途別

- 整形外科

- 創傷ケア

- その他

第10章 コラーゲンとゼラチン市場:エンドユーザー別

- 病院

- 外科センター

第11章 コラーゲンおよびゼラチン市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- マクロ経済見通し

- ドイツ

- 英国

- フランス

- その他

- アジア太平洋

- マクロ経済見通し

- 日本

- 中国

- インド

- その他

- ラテンアメリカ

- マクロ経済見通し

- 中東・アフリカ

- マクロ経済見通し

第12章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- INTEGRA LIFESCIENCES HOLDINGS CORPORATION

- SMITH+NEPHEW

- DSM-FIRMENICH

- NITTA GELATIN INC.

- TESSENDERLO GROUP

- SOLVENTUM

- MEDTRONIC PLC

- COLLPLANT BIOTECHNOLOGIES LTD.

- ZIMVIE INC.

- JELLAGEN

- COLLAGEN SOLUTIONS PLC

- REGENITY

- SYMATESE LABS

- GELITA AG

- その他の企業

- BICO

- MATRICEL GMBH

- DARLING INGREDIENTS

- WEISHARDT

- HYFINE GELATIN CO., LTD.

- GEISTLICH PHARMA AG

- SYNERHEAL PHARMACEUTICALS

- BIOREGEN TECHNOLOGIES

- MERIL LIFE SCIENCES PVT. LTD.

- MEDSKIN SUWELACK

- COLOGENESIS HEALTHCARE PVT LTD

- DERMARITE INDUSTRIES, LLC

- EUCARE PHARMACEUTICALS PRIVATE LIMITED

第14章 付録

List of Tables

- TABLE 1 IMPACT ANALYSIS OF SUPPLY-SIDE AND DEMAND-SIDE FACTORS

- TABLE 2 COLLAGEN & GELATIN MARKET: RISK ANALYSIS

- TABLE 3 COLLAGEN & GELATIN MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 4 NUMBER OF SURGERIES PERFORMED IN US, 2023-2024

- TABLE 5 COLLAGEN & GELATIN MARKET: KEY PRODUCT PROVIDERS

- TABLE 6 COLLAGEN & GELATIN MARKET: KEY END USERS

- TABLE 7 COLLAGEN & GELATIN MARKET: REGULATORY BODIES

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 COLLAGEN & GELATIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 14 KEY PATENTS IN GELATIN MARKET, 2022-2024

- TABLE 15 KEY PATENTS IN COLLAGEN MARKET, 2022-2024

- TABLE 16 COLLAGEN & GELATIN MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 AVERAGE SELLING PRICE TREND OF COLLAGEN AND GELATIN PRODUCTS, BY KEY PLAYERS, 2023-2024 (USD/KG)

- TABLE 18 BOVINE: AVERAGE SELLING PRICE TREND, BY REGION, 2023-2024 (USD/TON)

- TABLE 19 PORCINE: AVERAGE SELLING PRICE TREND, BY REGION, 2023-2024 (USD/TON)

- TABLE 20 POULTRY: AVERAGE SELLING PRICE TREND, BY REGION, 2023-2024 (USD/TON)

- TABLE 21 MARINE: AVERAGE SELLING PRICE TREND, BY REGION, 2023-2024 (USD/TON)

- TABLE 22 IMPORT VOLUME FOR HS CODE 350300, 2020-2024 (US DOLLAR THOUSAND)

- TABLE 23 EXPORT VOLUME FOR HS CODE 854330, 2020-2024 (US DOLLAR THOUSAND)

- TABLE 24 COLLAGEN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

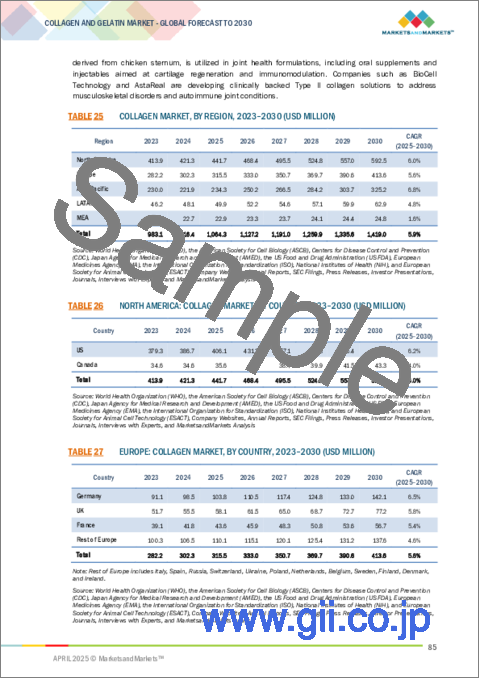

- TABLE 25 COLLAGEN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 NORTH AMERICA: COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 27 EUROPE: COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 ASIA PACIFIC: COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 GELATIN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 NORTH AMERICA: GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 EUROPE: GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 ASIA PACIFIC: GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 34 GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 35 BOVINE COLLAGEN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 NORTH AMERICA: BOVINE COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 EUROPE: BOVINE COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 ASIA PACIFIC: BOVINE COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 BOVINE GELATIN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: BOVINE GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 EUROPE: BOVINE GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 ASIA PACIFIC: BOVINE GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 PORCINE COLLAGEN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: PORCINE COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 EUROPE: PORCINE COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: PORCINE COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 PORCINE GELATIN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: PORCINE GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 EUROPE: PORCINE GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 ASIA PACIFIC: PORCINE GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 OTHER COLLAGEN SOURCES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: OTHER COLLAGEN SOURCES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 EUROPE: OTHER COLLAGEN SOURCES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 ASIA PACIFIC: OTHER COLLAGEN SOURCES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 OTHER GELATIN SOURCES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: OTHER GELATIN SOURCES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 EUROPE: OTHER GELATIN SOURCES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 ASIA PACIFIC: OTHER GELATIN SOURCES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 60 COLLAGEN MARKET FOR ORTHOPEDIC APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: COLLAGEN MARKET FOR ORTHOPEDIC APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 EUROPE: COLLAGEN MARKET FOR ORTHOPEDIC APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 ASIA PACIFIC: COLLAGEN MARKET FOR ORTHOPEDIC APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 COLLAGEN MARKET FOR WOUND CARE APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: COLLAGEN MARKET FOR WOUND CARE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 EUROPE: COLLAGEN MARKET FOR WOUND CARE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 ASIA PACIFIC: COLLAGEN MARKET FOR WOUND CARE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 COLLAGEN MARKET FOR DENTAL APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: COLLAGEN MARKET FOR DENTAL APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 EUROPE: COLLAGEN MARKET FOR DENTAL APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: COLLAGEN MARKET FOR DENTAL APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 COLLAGEN MARKET FOR SURGICAL APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: COLLAGEN MARKET FOR SURGICAL APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 EUROPE: COLLAGEN MARKET FOR SURGICAL APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 ASIA PACIFIC: COLLAGEN MARKET FOR SURGICAL APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 COLLAGEN MARKET FOR CARDIOVASCULAR APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: COLLAGEN MARKET FOR CARDIOVASCULAR APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 EUROPE: COLLAGEN MARKET FOR CARDIOVASCULAR APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: COLLAGEN MARKET FOR CARDIOVASCULAR APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 COLLAGEN MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: COLLAGEN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: COLLAGEN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 ASIA PACIFIC: COLLAGEN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 85 GELATIN MARKET FOR ORTHOPEDIC APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: GELATIN MARKET FOR ORTHOPEDIC APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: GELATIN MARKET FOR ORTHOPEDIC APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: GELATIN MARKET FOR ORTHOPEDIC APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 GELATIN MARKET FOR WOUND CARE APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: GELATIN MARKET FOR WOUND CARE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 EUROPE: GELATIN MARKET FOR WOUND CARE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: GELATIN MARKET FOR WOUND CARE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 GELATIN MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: GELATIN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 EUROPE: GELATIN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: GELATIN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 98 GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 99 HOSPITALS: COLLAGEN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: COLLAGEN MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 EUROPE: COLLAGEN MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: COLLAGEN MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 HOSPITALS: GELATIN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: GELATIN MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 105 EUROPE: GELATIN MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: GELATIN MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 SURGICAL CENTERS: COLLAGEN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: COLLAGEN MARKET FOR SURGICAL CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 EUROPE: COLLAGEN MARKET FOR SURGICAL CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: COLLAGEN MARKET FOR SURGICAL CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 111 SURGICAL CENTERS: GELATIN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: GELATIN MARKET FOR SURGICAL CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: GELATIN MARKET FOR SURGICAL CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: GELATIN MARKET FOR SURGICAL CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 GLOBAL COLLAGEN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 116 GLOBAL GELATIN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: KEY MACROINDICATORS

- TABLE 118 NORTH AMERICA: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 127 US: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 128 US: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 129 US: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 130 US: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 131 US: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 132 US: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 133 US: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 134 CANADA: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 135 CANADA: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 136 CANADA: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 137 CANADA: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 138 CANADA: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 139 CANADA: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 140 CANADA: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 141 EUROPE: KEY MACROINDICATORS

- TABLE 142 EUROPE: COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 143 EUROPE: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 144 EUROPE: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 145 EUROPE: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 146 EUROPE: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 147 EUROPE: GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 148 EUROPE: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 149 EUROPE: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 150 EUROPE: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 151 GERMANY: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 152 GERMANY: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 153 GERMANY: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 154 GERMANY: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 155 GERMANY: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 156 GERMANY: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 157 GERMANY: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 158 UK: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 159 UK: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 160 UK: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 161 UK: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 162 UK: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 163 UK: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 164 UK: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 165 FRANCE: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 166 FRANCE: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 167 FRANCE: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 168 FRANCE: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 169 FRANCE: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 170 FRANCE: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 171 FRANCE: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 172 REST OF EUROPE: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 173 REST OF EUROPE: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 174 REST OF EUROPE: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 175 REST OF EUROPE: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 176 REST OF EUROPE: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 177 REST OF EUROPE: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 178 REST OF EUROPE: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: KEY MACROINDICATORS

- TABLE 180 ASIA PACIFIC: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: COLLAGEN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 182 ASIA PACIFIC: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 184 ASIA PACIFIC: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 185 ASIA PACIFIC: GELATIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 186 ASIA PACIFIC: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 189 JAPAN: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 190 JAPAN: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 191 JAPAN: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 192 JAPAN: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 193 JAPAN: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 194 JAPAN: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 195 JAPAN: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 196 CHINA: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 197 CHINA: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 198 CHINA: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 199 CHINA: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 200 CHINA: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 201 CHINA: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 202 CHINA: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 203 INDIA: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 204 INDIA: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 205 INDIA: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 206 INDIA: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 207 INDIA: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 208 INDIA: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 209 INDIA: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 215 REST OF ASIA PACIFIC: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 217 LATIN AMERICA: KEY MACROINDICATORS

- TABLE 218 LATIN AMERICA: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 219 LATIN AMERICA: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 220 LATIN AMERICA: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 221 LATIN AMERICA: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 222 LATIN AMERICA: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 223 LATIN AMERICA: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 224 LATIN AMERICA: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: KEY MACROINDICATORS

- TABLE 226 MIDDLE EAST & AFRICA: COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: COLLAGEN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: COLLAGEN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: COLLAGEN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: GELATIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: GELATIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: GELATIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 233 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COLLAGEN AND GELATIN PLAYERS

- TABLE 234 COLLAGEN & GELATIN MARKET: DEGREE OF COMPETITION

- TABLE 235 COLLAGEN & GELATIN MARKET: REGION FOOTPRINT

- TABLE 236 COLLAGEN & GELATIN MARKET: SOURCE FOOTPRINT

- TABLE 237 COLLAGEN & GELATIN MARKET: APPLICATION FOOTPRINT

- TABLE 238 COLLAGEN & GELATIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 239 COLLAGEN & GELATIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 240 COLLAGEN & GELATIN MARKET: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 241 COLLAGEN & GELATIN MARKET: DEALS, JANUARY 2021- MARCH 2025

- TABLE 242 COLLAGEN & GELATIN MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 243 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 244 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 245 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: DEALS, JANUARY 2021-MARCH 2025

- TABLE 246 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 247 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 248 SMITH+NEPHEW: PRODUCTS OFFERED

- TABLE 249 DSM-FIRMENICH: COMPANY OVERVIEW

- TABLE 250 DSM-FIRMENICH: PRODUCTS OFFERED

- TABLE 251 DSM FIRMENICH: DEALS, JANUARY 2021-MARCH 2025

- TABLE 252 NITTA GELATIN INC.: COMPANY OVERVIEW

- TABLE 253 NITTA GELATIN INC.: PRODUCTS OFFERED

- TABLE 254 TESSENDERLO GROUP: COMPANY OVERVIEW

- TABLE 255 TESSENDERLO GROUP: PRODUCTS OFFERED

- TABLE 256 TESSENDERLO GROUP: DEALS, JANUARY 2021-MARCH 2025

- TABLE 257 TESSENDERLO GROUP: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 258 SOLVENTUM: COMPANY OVERVIEW

- TABLE 259 SOLVENTUM: PRODUCTS OFFERED

- TABLE 260 SOLVENTUM: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 261 MEDTRONIC PLC: COMPANY OVERVIEW

- TABLE 262 MEDTRONIC PLC: PRODUCTS OFFERED

- TABLE 263 COLLPLANT BIOTECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 264 COLLPLANT BIOTECHNOLOGIES LTD.: PRODUCTS OFFERED

- TABLE 265 COLLPLANT BIOTECHNOLOGIES LTD.: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 266 COLLPLANT BIOTECHNOLOGIES LTD.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 267 ZIMVIE INC.: COMPANY OVERVIEW

- TABLE 268 ZIMVIE INC: PRODUCTS OFFERED

- TABLE 269 JELLAGEN: COMPANY OVERVIEW

- TABLE 270 JELLAGEN: PRODUCTS OFFERED

- TABLE 271 JELLAGEN: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 272 COLLAGEN SOLUTIONS PLC: COMPANY OVERVIEW

- TABLE 273 COLLAGEN SOLUTIONS PLC: PRODUCTS OFFERED

- TABLE 274 REGENITY: COMPANY OVERVIEW

- TABLE 275 REGENITY: PRODUCTS OFFERED

- TABLE 276 REGENITY: DEALS, JANUARY 2021-MARCH 2025

- TABLE 277 SYMATESE LABS: COMPANY OVERVIEW

- TABLE 278 SYMATESE LABS: PRODUCTS OFFERED

- TABLE 279 GELITA AG: COMPANY OVERVIEW

- TABLE 280 GELITA AG: PRODUCTS OFFERED

List of Figures

- FIGURE 1 COLLAGEN & GELATIN MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 COLLAGEN & GELATIN MARKET: RESEARCH DESIGN

- FIGURE 3 COLLAGEN & GELATIN MARKET: BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 COLLAGEN & GELATIN MARKET: LIST OF PRIMARY PARTICIPANTS

- FIGURE 5 COLLAGEN & GELATIN MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2024

- FIGURE 6 GLOBAL MARKET SIZE ESTIMATION APPROACH 1 (COMPANY REVENUE ANALYSIS-BASED ESTIMATION), 2024

- FIGURE 7 ILLUSTRATIVE EXAMPLE OF INTEGRA LIFESCIENCES CORPORATION: REVENUE SHARE ANALYSIS (2024)

- FIGURE 8 MARKET SIZE VALIDATION FROM PRIMARY SOURCES

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 10 COLLAGEN & GELATIN MARKET: CAGR PROJECTIONS

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 COLLAGEN & GELATIN MARKET, BY PRODUCT TYPE, 2025 VS. 2030

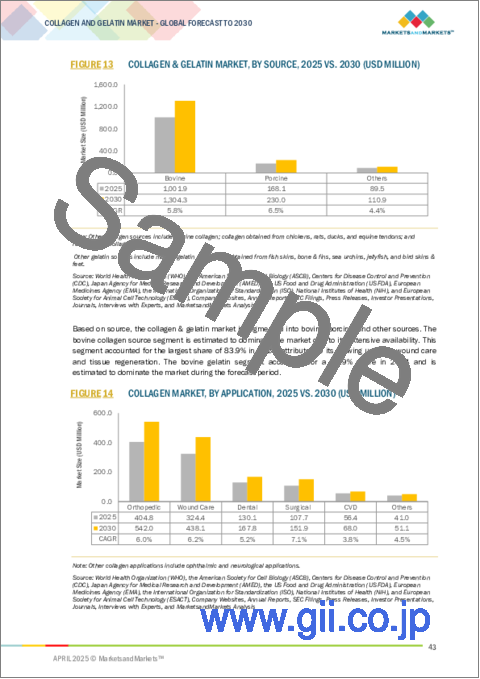

- FIGURE 13 COLLAGEN & GELATIN MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 COLLAGEN MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 GELATIN MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 COLLAGEN & GELATIN MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 REGIONAL SNAPSHOT OF COLLAGEN & GELATIN MARKET

- FIGURE 18 RISING DEMAND FOR ADVANCED WOUND CARE PRODUCTS TO DRIVE MARKET

- FIGURE 19 BOVINE AND US ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN COLLAGEN & GELATIN MARKET

- FIGURE 20 BOVINE SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 21 HOSPITALS SEGMENT HELD LARGER MARKET SHARE IN 2024

- FIGURE 22 CHINA TO REGISTER SECOND-HIGHEST CAGR IN COLLAGEN MARKET FROM 2025 TO 2030

- FIGURE 23 INDIA TO EXHIBIT HIGHEST CAGR IN GELATIN MARKET FROM 2025 TO 2030

- FIGURE 24 COLLAGEN & GELATIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 COLLAGEN AND GELATIN VALUE CHAIN

- FIGURE 27 SUPPLY CHAIN OF COLLAGEN & GELATIN MARKET

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP END USERS

- FIGURE 30 PATENTS GRANTED FOR GELATIN MARKET, JANUARY 2014-DECEMBER 2024

- FIGURE 31 PATENTS GRANTED FOR COLLAGEN MARKET, JANUARY 2014-DECEMEBER 2024

- FIGURE 32 AVERAGE SELLING PRICE TREND OF COLLAGEN AND GELATIN PRODUCTS, BY KEY PLAYERS, 2023-2024 (USD/KG)

- FIGURE 33 AVERAGE SELLING PRICE TREND OF COLLAGEN AND GELATIN PRODUCTS, BY KEY REGION, 2023-2024 (USD/TON)

- FIGURE 34 COLLAGEN & GELATIN MARKET: IMPACT OF AI

- FIGURE 35 NORTH AMERICA: COLLAGEN & GELATIN MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: COLLAGEN & GELATIN MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS IN COLLAGEN & GELATIN MARKET, 2020-2024

- FIGURE 38 MARKET SHARE ANALYSIS OF KEY PLAYERS IN COLLAGEN & GELATIN MARKET (2024)

- FIGURE 39 COLLAGEN & GELATIN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 COLLAGEN & GELATIN MARKET: COMPANY FOOTPRINT

- FIGURE 41 COLLAGEN & GELATIN MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 COMPANY VALUATION & FINANCIAL METRICS OF KEY VENDORS

- FIGURE 43 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 44 COLLAGEN & GELATIN MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 45 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 SMITH+NEPHEW: COMPANY SNAPSHOT

- FIGURE 47 DSM-FIRMENICH: COMPANY SNAPSHOT

- FIGURE 48 NITTA GELATIN INC.: COMPANY SNAPSHOT

- FIGURE 49 TESSENDERLO GROUP: COMPANY SNAPSHOT

- FIGURE 50 SOLVENTUM: COMPANY SNAPSHOT

- FIGURE 51 MEDTRONIC PLC: COMPANY SNAPSHOT

- FIGURE 52 COLLPLANT BIOTECHNOLOGIES LTD.: COMPANY SNAPSHOT

- FIGURE 53 ZIMVIE INC.: COMPANY SNAPSHOT

The global collagen & gelatin market is projected to reach USD 1,671.3 million in 2030 from USD 1,295.5 million in 2025, growing at a CAGR of 5.8% during the forecast period. The rising incidence of diabetes, cancer, and cardiovascular diseases increased the demand for efficient treatment, particularly products with advanced wound care. Collagen dressings are becoming popular because they can rapidly heal wounds and minimize infection risk. Moreover, the hike in surgeries has spurred demand for collagen-based biomaterials for sutures, scaffolds, and implants.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Product Type, Source, Application, End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Additionally, the expanding uses of collagen in tissue engineering and regenerative medicine, specifically in developing bioengineered skin, cartilage, and bone, are creating new avenues for therapeutic use.

"The collagen segment held the largest share in the product type market during the forecast period"

In 2024, collagen held the largest market within the collagen & gelatin market by product type. The rising adoption of regenerative medicine, orthopedic implants, and dermatological therapies, where native and type-specific collagen plays a critical role in tissue scaffolding and repair. Further, the innovation of recombinant collagen technology and marine-based sources is pushing the boundaries of application into next-generation areas of cell therapy, 3D printing, and custom medicine, thus solidifying it as one of the key material players in the next-generation approach to healthcare solutions.

"The hospital end user segment is projected to hold the largest market share during the forecast period"

Collagen & gelatin products are mainly consumed by the hospital industry. Hospitals are also the central focal points for healing chronic wounds, burns, diabetes ulcers, and postoperative care, wherein dressings made from collagen find extensive use on account of the well-established efficacy of the product for inducing tissue regrowth and recovery at a faster pace. Moreover, hospitals are always on the edge when using next-generation medical devices, regenerative medicines, orthopedic implants, and drug-delivery systems that heavily utilize collagen-based products.

"Asia Pacific is projected to be the fastest-growing region during the forecast period"

The Asia Pacific collagen & gelatin market is projected to register the highest growth rate during the forecast period, attributed to the rapidly expanding biopharmaceutical manufacturing capabilities and increasing investment in regenerative medicine and advanced drug delivery systems. China, India, South Korea, and Japan are upscaling their priority in R&D on collagen-based scaffolds, cell therapies, and tissue engineering, driven by substantial financing and academia-industry linkages.

Also, an increase in clinical trials and contract manufacturing organizations (CROS and CMOs), which are embracing collagen and gelatin as key substances in drug encapsulation, wound healing formulations, and 3D bioprinting technologies, is another primary driver driving the region's highest growth over the forecast period.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 44%, Tier 2 - 32%, and Tier 3 - 24%

- By Designation: (Managers) - 45%, (CXOs, Directors) - 30%, and (Executives) -25%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 20%, ROW - 15%

Integra LifeSciences Corporation (US), Smith+Nephew plc (UK), DSM-Firmenich (Netherlands), Nitta Gelatin Inc. (Japan), Tessenderlo Group (Belgium), Collplant biotechnologies Ltd (Israel), Collagen Solutions plc (UK), Regenity (US), Medtronic plc (Ireland), and Solventum (US) are some of the key players in the collagen & gelatin market .

The study includes an in-depth competitive analysis of these key players in the collagen & gelatin market , with their company profiles, recent developments, and key market strategies.

Research Coverage:

This report provides a detailed picture of the global collagen & gelatin market. It aims to estimate the size and future growth potential of the market across different segments such as the product type, source, application end user, and region. The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the collagen & gelatin market.

Reasons to buy this report :

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall collagen & gelatin market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (growing incidence of diabetes, cancer and chronic diseases, rising demand for advanced wound care products, growing number of surgical procedures, increasing use in tissue engineering and regenerative medicine, and rising application of collagen as drug delivery system), restraints (high manufacturing costs, allergenic & ethical concerns), opportunities (growing adoption of marine & recombinant collagen, expansion of 3D bioprinting for organ and tissue fabrication), and challenges (supply chain vulnerabilities) influencing the growth of the collagen & gelatin market

- Product Development/Innovation: Detailed insights into upcoming technologies and new product launches in the collagen & gelatin market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the collagen & gelatin market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players in the collagen & gelatin market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 MARKET ESTIMATION

- 2.2.2 INSIGHTS FROM PRIMARY EXPERTS

- 2.2.3 TOP-DOWN APPROACH

- 2.3 MARKET GROWTH RATE PROJECTION

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 GROWTH OPPORTUNITIES FOR PLAYERS IN COLLAGEN & GELATIN MARKET

- 4.2 COLLAGEN & GELATIN MARKET IN NORTH AMERICA, BY SOURCE AND COUNTRY, 2024

- 4.3 COLLAGEN & GELATIN MARKET SHARE, BY SOURCE, 2025 TO 2030

- 4.4 COLLAGEN & GELATIN MARKET, BY END USER, 2024

- 4.5 COLLAGEN & GELATIN MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing incidence of diabetes, cancers, and chronic diseases

- 5.2.1.2 Increasing use in tissue engineering and regenerative medicine

- 5.2.1.3 Rising demand for advanced wound care products

- 5.2.1.4 Growing number of surgical procedures

- 5.2.1.5 Surge in use of collagen as drug delivery system

- 5.2.2 RESTRAINTS

- 5.2.2.1 High manufacturing cost

- 5.2.2.2 Allergenic & ethical concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of marine & recombinant collagen

- 5.2.3.2 Expansion of 3D bioprinting for organ and tissue fabrication

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain vulnerabilities

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 COLLAGEN & GELATIN MARKET: ECOSYSTEM ANALYSIS

- 5.6.1 PRODUCT PROVIDERS

- 5.6.2 END USERS

- 5.6.3 REGULATORY BODIES

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Extraction technologies

- 5.7.1.2 Hydrolyzation & purification

- 5.7.1.3 Recombinant production

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 3D scanning & printing

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Encapsulation

- 5.7.1 KEY TECHNOLOGIES

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 REGULATORY FRAMEWORK

- 5.8.2.1 North America

- 5.8.2.2 Europe

- 5.8.2.3 Asia Pacific

- 5.8.2.4 Rest of the World

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS

- 5.10.2 BUYING CRITERIA

- 5.11 PATENT ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND OF COLLAGEN AND GELATIN PRODUCTS, BY KEY PLAYERS, 2023-2024

- 5.13.2 AVERAGE SELLING PRICE TREND OF COLLAGEN AND GELATIN PRODUCTS, BY REGION, 2023-2024

- 5.14 TRADE ANALYSIS

- 5.14.1 IMPORT DATA FOR HS CODE 350300

- 5.14.2 EXPORT DATA HS CODE 350300

- 5.15 IMPACT OF AI/GEN AI ON COLLAGEN & GELATIN MARKET

- 5.16 INVESTMENT AND FUNDING SCENARIO

6 COLLAGEN AND GELATIN MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 COLLAGEN

- 6.2.1 GROWING FOCUS ON REGENERATIVE MEDICINE AND DRUG DELIVERY INNOVATION TO BOOST DEMAND

- 6.3 GELATIN

- 6.3.1 RISING FOCUS ON SOFT AND HARD GELATIN CAPSULES IN ORAL DELIVERY TO DRIVE MARKET

7 COLLAGEN AND GELATIN MARKET, BY SOURCE

- 7.1 INTRODUCTION

- 7.2 BOVINE SOURCES

- 7.2.1 INCREASED USE IN TISSUE ENGINEERING APPLICATIONS TO DRIVE MARKET

- 7.3 PORCINE SOURCES

- 7.3.1 LOW ALLERGIC RESPONSE AND BIOCOMPATIBILITY OF PORCINE COLLAGEN AND GELATIN TO BOOST DEMAND

- 7.4 OTHER SOURCES

8 COLLAGEN MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 ORTHOPEDIC

- 8.2.1 INCREASING USE OF COLLAGEN IN ORTHOPEDIC SURGERIES TO DRIVE MARKET

- 8.3 WOUND CARE

- 8.3.1 RISING PREVALENCE OF CHRONIC WOUND CONDITIONS TO BOOST COLLAGEN ADOPTION

- 8.4 DENTAL

- 8.4.1 RISING INCIDENCE OF ORAL DISORDERS TO DRIVE MARKET

- 8.5 SURGICAL

- 8.5.1 INCREASING NUMBER OF SURGICAL PROCEDURES GLOBALLY TO BOOST DEMAND FOR COLLAGEN PRODUCTS

- 8.6 CARDIOVASCULAR

- 8.6.1 GROWING USE OF COLLAGEN PATCHES TO IMPROVE HEART FUNCTION TO SUPPORT MARKET GROWTH

- 8.7 OTHER APPLICATIONS

9 GELATIN MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 ORTHOPEDIC

- 9.2.1 USE OF GELATIN IN BONE AND CARTILAGE REGENERATION TREATMENT TO DRIVE MARKET

- 9.3 WOUND CARE

- 9.3.1 APPLICATION OF GELATIN-BASED HYDROGELS IN TREATING BURNS TO DRIVE MARKET

- 9.4 OTHER APPLICATIONS

10 COLLAGEN AND GELATIN MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS

- 10.2.1 SIGNIFICANT USE OF BIOSURGERY PRODUCTS IN HOSPITALS TO DRIVE MARKET

- 10.3 SURGICAL CENTERS

- 10.3.1 AVAILABILITY OF HIGH-QUALITY AND LOW-COST MEDICAL SERVICES AT SURGICAL CENTERS TO BOOST DEMAND

11 COLLAGEN & GELATIN MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing incidence of periodontitis and burn injuries to drive market

- 11.2.3 CANADA

- 11.2.3.1 Growing geriatric population and volume of surgeries to boost collagen and gelatin demand

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Increase in healthcare expenditure to boost adoption of collagen and gelatin products

- 11.3.3 UK

- 11.3.3.1 High risk of pressure ulcers in diabetic patients to drive market

- 11.3.4 FRANCE

- 11.3.4.1 Well-established healthcare sector to provide lucrative opportunities to collagen and gelatin vendors

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Rising elderly population to support market growth

- 11.4.3 CHINA

- 11.4.3.1 Significant elderly population with diabetes to push demand for collagen and gelatin products

- 11.4.4 INDIA

- 11.4.4.1 Increasing healthcare spending by government to stimulate market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 INCREASING NUMBER OF DIABETIC PATIENTS TO RISE DEMAND FOR COLLAGEN AND GELATIN PRODUCTS

- 11.5.2 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GROWING FOCUS ON HEALTHCARE INFRASTRUCTURE IMPROVEMENT TO DRIVE MARKET

- 11.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN COLLAGEN & GELATIN MARKET

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Source footprint

- 12.5.5.4 Application footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 INTEGRA LIFESCIENCES HOLDINGS CORPORATION

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SMITH+NEPHEW

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 DSM-FIRMENICH

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 NITTA GELATIN INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 TESSENDERLO GROUP

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 SOLVENTUM

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Other developments

- 13.1.7 MEDTRONIC PLC

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.8 COLLPLANT BIOTECHNOLOGIES LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.9 ZIMVIE INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 JELLAGEN

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Other developments

- 13.1.11 COLLAGEN SOLUTIONS PLC

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.12 REGENITY

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.13 SYMATESE LABS

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.14 GELITA AG

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.1 INTEGRA LIFESCIENCES HOLDINGS CORPORATION

- 13.2 OTHER PLAYERS

- 13.2.1 BICO

- 13.2.2 MATRICEL GMBH

- 13.2.3 DARLING INGREDIENTS

- 13.2.4 WEISHARDT

- 13.2.5 HYFINE GELATIN CO., LTD.

- 13.2.6 GEISTLICH PHARMA AG

- 13.2.7 SYNERHEAL PHARMACEUTICALS

- 13.2.8 BIOREGEN TECHNOLOGIES

- 13.2.9 MERIL LIFE SCIENCES PVT. LTD.

- 13.2.10 MEDSKIN SUWELACK

- 13.2.11 COLOGENESIS HEALTHCARE PVT LTD

- 13.2.12 DERMARITE INDUSTRIES, LLC

- 13.2.13 EUCARE PHARMACEUTICALS PRIVATE LIMITED

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS