|

|

市場調査レポート

商品コード

1307905

赤外線画像の世界市場:技術別 (冷却型赤外線画像、非冷却型赤外線画像)・波長別 (近赤外線、短波赤外線、中波赤外線、長波赤外線)・用途別 (セキュリティ・監視、モニタリング・検査、検出)・地域別の将来予測 (2028年まで)Infrared Imaging Market by Technology (Cooled & Uncooled Infrared Imaging), Wavelength (Near, Shortwave, Mid-wave, & Long-wave Infrared), Application (Security & Surveillance, Monitoring & Inspection, Detection), Vertical - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 赤外線画像の世界市場:技術別 (冷却型赤外線画像、非冷却型赤外線画像)・波長別 (近赤外線、短波赤外線、中波赤外線、長波赤外線)・用途別 (セキュリティ・監視、モニタリング・検査、検出)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年07月06日

発行: MarketsandMarkets

ページ情報: 英文 213 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の赤外線画像の市場規模は、2023年の67億米ドルから、2028年には96億米ドルに達し、2023年から2028年の間に7.3%のCAGRで成長すると予測されています。

家電産業における赤外線カメラの普及と、自動車分野における赤外線画像の新たな用途が、同市場の主なビジネスチャンスです。

"冷却型赤外線画像技術の台頭が市場成長を促進"

冷却型赤外線画像技術は、セキュリティシステムに革命をもたらし、低照度下での効率的な監視と脅威検知能力の向上を可能にしました。医療分野では、疾患の早期発見、血管症状の特定、非侵襲的診断に役立っています。また、エネルギー使用を最適化し、断熱ギャップを特定し、建物や工業プロセスのエネルギー効率を高めます。さらに、森林火災の正確な検出、気候パターンのマッピング、環境モニタリングにおける野生生物の保護活動も容易になります。

"食品品質と安全性検査における近赤外線 (NIR) 画像の使用増加が市場を牽引"

NIR画像は、品質管理、材料分析、欠陥の特定などの産業分野で有用であり、製品製造の強化に貢献します。NIR画像の多用途性、非破壊性、費用対効果により、様々な産業で著しい成長を遂げ、技術革新と進歩の原動力となっています。

"検査用途における赤外線画像の需要が市場成長を促進"

赤外線画像は、様々な材料や製品の欠陥、不規則性、異常を特定することができます。特に製造業、自動車産業、エレクトロニクス産業で有用であり、隠れた欠陥を検出し、構造的完全性を評価し、製品品質を保証することができます。

"予測期間中、北米が最大の市場シェアを占める"

北米市場は、2023年に赤外線画像市場で最大のシェアを占めました。北米の赤外線画像市場は、防衛・セキュリティ、医療、産業オートメーションなど様々な産業での需要増加により大きく成長しています。この成長を促進する要因には、技術の進歩、赤外線画像の利点に関する認知度の向上、これらの分野における効率性、安全性、品質管理の強化ニーズなどがあります。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 赤外線画像のエコシステム

- 赤外線画像企業:収益の変化と新たな収益源

- 価格分析

- 技術動向

- ポーターのファイブフォース分析

- 購入プロセスおよび購入基準における主要な利害関係者

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主要な会議とイベント (2023年~2024年)

- 料金分析

- 基準と規制状況

第6章 赤外線画像装置

- イントロダクション

- 携帯型

- 航空写真

- ハンドヘルド型

- 据置型

第7章 赤外線画像市場:技術別

- イントロダクション

- 冷却型赤外線画像

- 非冷却型赤外線画像

第8章 赤外線画像市場:波長別

- イントロダクション

- 近赤外線 (NIR)

- 短波赤外線 (SWIR)

- 中波赤外線 (MWIR)

- 長波赤外線 (LWIR)

第9章 赤外線画像市場:用途別

- イントロダクション

- セキュリティ・監視

- モニタリング・検査

- 状態監視

- 構造的健全性モニタリング

- 品質管理

- 検出

- ガス検知

- 火災/フレア検出

- 体温測定

第10章 赤外線画像市場:業種別

- イントロダクション

- 産業用

- 自動車

- 航空宇宙

- エレクトロニクス・半導体

- 石油・ガス

- 食品・飲料

- ガラス

- その他

- 非産業用

- 軍事・防衛

- 民間インフラ

- 医療

- 科学研究

第11章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋

- その他の地域

- 南米

- 中東・アフリカ

第12章 競合情勢

- 概要

- 赤外線画像市場:主要企業が採用した戦略

- 市場シェア分析 (2022年)

- 赤外線画像市場:主要企業の収益分析

- 企業評価マトリックス (2022年)

- 競合ベンチマーキング

- スタートアップ/中小企業 (SME) の評価マトリックス (2022年)

- 競争シナリオと動向

第13章 企業プロファイル

- 主要企業

- TELEDYNE FLIR LLC

- FLUKE CORPORATION

- RAYTHEON TECHNOLOGIES CORPORATION

- LEONARDO DRS

- AXIS COMMUNICATIONS AB

- XENICS NV.

- OPGAL OPTRONIC INDUSTRIES LTD.

- NEW IMAGING TECHNOLOGIES

- ALLIED VISION TECHNOLOGIES GMBH

- L3HARRIS TECHNOLOGIES, INC.

- その他の主な企業

- LYNRED

- INTEVAC, INC.

- ZHEJIANG DALI TECHNOLOGY CO., LTD.

- C-THERMAL

- IRCAMERAS LLC

- HGH

- RAPTOR PHOTONICS

- EPISENSORS

- INFRATEC GMBH

- PRINCETON INFRARED TECHNOLOGIES, INC.

- SIERRA-OLYMPIA TECH.

- COX CO., LTD.

- TONBO IMAGING

- OPTOTHERM, INC.

- SEEK THERMAL

- INFRARED CAMERAS, INC.

第14章 付録

The infrared imaging market is projected to reach USD 9.6 billion by 2028 from USD 6.7 billion in 2023, at a CAGR of 7.3% from 2023 to 2028. Penetration of infrared cameras in the consumer electronics industry and emerging infrared imaging applications in the automotive sector are the major opportunities in the market.

The Rise of Cool Infrared Imaging by technology to propel market growth.

Cool infrared imaging technology has revolutionized security systems, enabling efficient surveillance in low-light conditions and improved threat detection capabilities. In the healthcare sector, it aids in early disease detection, vascular issue identification, and non-invasive diagnostics. Moreover, it optimizes energy usage, identifies insulation gaps, and enhances energy efficiency in buildings and industrial processes. Additionally, it facilitates accurate detection of forest fires, climate pattern mapping, and wildlife conservation efforts in environmental monitoring.

Increased use of NIR imaging in food quality and safety inspection to drive market.

NIR imaging finds utility in the industrial sector for quality control, material analysis, and identifying defects, contributing to enhanced product manufacturing. The versatility, non-destructive nature, and cost-effectiveness of NIR imaging have propelled its remarkable growth in various industries, empowering innovation and driving progress.

Demand for infrared imaging in inspection application to fuel market growth.

Infrared imaging can identify defects, irregularities, or anomalies in various materials and products. It is particularly useful in manufacturing, automotive, and electronics industries, where it can detect hidden defects, assess structural integrity, and ensure product quality.

North America is expected to account for largest market share during the forecast period.

The market in North America accounted for the largest share of the infrared imaging market in 2023. The North American infrared imaging market has grown substantially due to increasing demand across various industries, such as defense and security, healthcare, and industrial automation. Factors driving this growth include technological advancements, rising awareness about the benefits of infrared imaging, and the need for enhanced efficiency, safety, and quality control in these sectors.

The break-up of profile of primary participants in the infrared imaging market-

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, Tier 3 - 34%

- By Designation Type: C Level - 40%, Director Level - 30%, Others - 30%

- By Region Type: North America - 35%, Europe - 35%, Asia Pacific - 20%, Rest of the World - 10%

The major players of infrared imaging market are Teledyne FLIR LLC (US), Fluke Corporation (US), Raytheon Technologies Corporation (US), Leonardo DRS (US), Axis Communications AB (Sweden), among others.

Research Coverage

The report segments the infrared market and forecasts its size based on Technology; Wavelength; Application; Vertical and Region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall infrared imaging market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Dynamics: Analysis of key drivers (Increased adoption of infrared imaging products in security & surveillance application; Increasing use of infrared cameras in quality control and inspection application; Growing popularity of uncooled infrared cameras; Rise in use of SWIR cameras in machine vision applications), restraints (Stringent import and export regulations limit growth of infrared imaging market; Limitations associated with image resolution and sensitivity of infrared cameras), opportunities (Emerging infrared imaging applications in automotive sector; Increase in application areas for infrared cameras; Penetration of infrared cameras in consumer electronics industry), and challenges (High cost of infrared cameras to challenge adoption; Need of improving accuracy of infrared cameras; Integration and compatibility challenges in infrared imaging technologies).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the infrared imaging market

- Market Development: Comprehensive information about lucrative markets - the report analyses the infrared imaging market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the infrared imaging market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Teledyne FLIR LLC (US), Fluke Corporation (US), Raytheon Technologies Corporation (US), Leonardo DRS (US), Axis Communications AB (Sweden), L3Harris Technologies (US), Inc, Xenics nv (Belgium), Zhejiang Dali Technology Co.,Ltd. (China), OPGAL Optronics Industries Ltd (Israel) and Allied Vision Technologies GmbH (Germany) among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 INFRARED IMAGING MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 SUMMARY OF CHANGES

- 1.7 STAKEHOLDERS

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 INFRARED IMAGING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Estimating market size using bottom-up approach (demand side)

- FIGURE 4 INFRARED IMAGING MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 INFRARED IMAGING MARKET: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE)-REVENUE GENERATED FROM SALE OF INFRARED IMAGING PRODUCTS

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

- TABLE 1 RESEARCH ASSUMPTIONS

- 2.5.1 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

- 2.7 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON INFRARED IMAGING MARKET

3 EXECUTIVE SUMMARY

- FIGURE 8 UNCOOLED INFRARED IMAGING SEGMENT TO HOLD MAJORITY OF MARKET SHARE IN 2023 AND 2028

- FIGURE 9 LONG-WAVE INFRARED SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 10 SECURITY & SURVEILLANCE SEGMENT TO COMMAND INFRARED IMAGING MARKET IN 2023

- FIGURE 11 NON-INDUSTRIAL SEGMENT TO HOLD LARGER SHARE OF INFRARED IMAGING MARKET IN 2028

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR INFRARED IMAGING DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN INFRARED IMAGING MARKET

- FIGURE 13 INCREASING ADOPTION OF INFRARED IMAGING TECHNOLOGY IN ASIA PACIFIC TO DRIVE MARKET GROWTH

- 4.2 INFRARED IMAGING MARKET, BY APPLICATION

- FIGURE 14 MONITORING & INSPECTION TO REGISTER HIGHEST CAGR IN INFRARED IMAGING MARKET, BY APPLICATION, DURING FORECAST PERIOD

- 4.3 INFRARED IMAGING MARKET, BY WAVELENGTH

- FIGURE 15 NEAR INFRARED SEGMENT DOMINATED INFRARED IMAGING MARKET IN 2022

- 4.4 INFRARED IMAGING MARKET IN NORTH AMERICA, BY COUNTRY AND APPLICATION

- FIGURE 16 US AND SECURITY & SURVEILLANCE APPLICATIONS TO HOLD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2028

- 4.5 INFRARED IMAGING MARKET, BY VERTICAL

- FIGURE 17 NON-INDUSTRIAL SEGMENT TO RECORD HIGHER CAGR FROM 2023 TO 2028

- 4.6 INFRARED IMAGING MARKET, BY COUNTRY

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR IN INFRARED IMAGING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: INFRARED IMAGING MARKET

- 5.2.1 DRIVERS

- FIGURE 20 ANALYSIS OF IMPACT OF DRIVERS ON INFRARED IMAGING MARKET

- 5.2.1.1 Increasing use of infrared imaging products in security & surveillance applications

- FIGURE 21 MILITARY EXPENDITURE IN US, 2021 VS. 2022 (USD BILLION)

- 5.2.1.2 Rising adoption of infrared cameras in quality control and inspection applications

- 5.2.1.3 Growing popularity of uncooled infrared cameras

- 5.2.1.4 Boosting demand for SWIR cameras in machine vision applications

- 5.2.2 RESTRAINTS

- FIGURE 22 ANALYSIS OF IMPACT OF RESTRAINTS ON INFRARED IMAGING MARKET

- 5.2.2.1 Stringent import and export regulations for selling infrared cameras in US

- 5.2.2.2 Limitations associated with image resolution and sensitivity of infrared cameras

- 5.2.3 OPPORTUNITIES

- FIGURE 23 ANALYSIS OF IMPACT OF OPPORTUNITIES ON INFRARED IMAGING MARKET

- 5.2.3.1 Emerging applications of IR imaging technology in automotive sector

- 5.2.3.2 Newer application areas of SWIR cameras

- 5.2.3.3 Integration of infrared imaging technology into consumer electronics

- 5.2.4 CHALLENGES

- FIGURE 24 ANALYSIS OF IMPACT OF CHALLENGES ON INFRARED IMAGING MARKET

- 5.2.4.1 High cost associated with infrared cameras

- 5.2.4.2 Designing highly accurate IR imaging products

- 5.2.4.3 Integration and compatibility challenges pertaining to infrared imaging technology

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS: INFRARED IMAGING MARKET

- 5.4 INFRARED IMAGING ECOSYSTEM

- FIGURE 26 INFRARED IMAGING ECOSYSTEM

- 5.5 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN INFRARED IMAGING MARKET

- FIGURE 27 REVENUE SHIFT IN INFRARED IMAGING MARKET

- 5.6 PRICING ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE OF INFRARED CAMERAS OFFRED BY TOP COMPANIES (USD)

- 5.6.1 AVERAGE SELLING PRICE OF INFRARED IMAGING PRODUCTS OFFERED BY KEY PLAYERS

- FIGURE 28 AVERAGE SELLING PRICE OF LWIR CAMERA, BY KEY PLAYER

- 5.7 TECHNOLOGY TRENDS

- 5.7.1 USE OF IR IMAGING TECHNOLOGY TO ANALYZE ORGANIC COMPOST

- 5.7.2 IMPLEMENTATION OF VIBRATIONAL SPECTROSCOPIC TECHNIQUES TO ANALYZE TEA QUALITY AND SAFETY

- 5.7.3 ADOPTION OF THERMAL CAMERAS IN SECURITY AND INSPECTION APPLICATIONS

- 5.7.4 TRANSFORMATION IN INFRARED IMAGING TECHNOLOGY WITH CLOUD INTEGRATION

- 5.7.5 ADVANCEMENTS IN AI-BASED INFRARED IMAGING

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 IMPACT OF FORCES ON INFRARED IMAGING MARKET

- FIGURE 29 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS IN BUYING PROCESS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA FOR APPLICATIONS

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ROCKWOOL GROUP USED TELEDYNE FLIR'S THERMAL IMAGING TECHNOLOGY TO EVALUATE INSULATION EFFECTIVENESS AND PROVIDE COMPREHENSIVE BUILDING ANALYSIS

- 5.10.2 VICENZA COURT RESOLVED CONSTRUCTION DISPUTE BY HIRING SERVICES OF THERMAL IMAGING EXPERTS FROM MULTITES SRL

- 5.10.3 HIGHLAND HELICOPTERS DEPLOYED THERMAL CAMERAS FROM INFRATEC TO COMBAT WILDFIRES

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO OF MAGNETIC OR OPTICAL READERS

- TABLE 6 IMPORT DATA OF PRODUCTS COVERED UNDER HS CODE 847190, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.11.2 EXPORT SCENARIO OF MAGNETIC OR OPTICAL READERS

- TABLE 7 EXPORT DATA OF PRODUCTS COVERED UNDER HS CODE 902750, BY COUNTRY, 2018-2022 (USD MILLION)

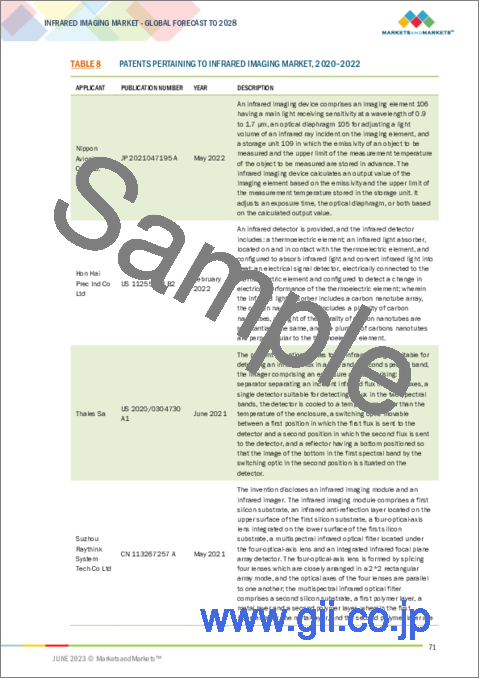

- 5.12 PATENT ANALYSIS

- TABLE 8 PATENTS PERTAINING TO INFRARED IMAGING MARKET, 2020-2022

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 9 INFRARED IMAGING MARKET: LIST OF CONFERENCES AND EVENTS

- 5.14 TARIFF ANALYSIS

- TABLE 10 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 11 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 12 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY INDIA

- 5.15 STANDARDS AND REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 GOVERNMENT REGULATIONS

- 5.15.3 REGULATORY LANDSCAPE

- 5.15.4 GOVERNMENT REGULATIONS

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 India

6 INFRARED IMAGING DEVICES

- 6.1 INTRODUCTION

- 6.2 PORTABLE 85 6.2.1 USE OF PORTABLE CAMERAS FOR CONVENIENCE AND EFFORTLESS IMAGING

- 6.2.2 AERIAL

- 6.2.2.1 Deployment of aerial cameras for thermographic view and improved visibility of objects to be monitored or inspected

- 6.2.3 HANDHELD

- 6.2.3.1 Implementation of handheld cameras in buildings to inspect heat loss and detect insulation issues

- 6.2.2 AERIAL

- 6.3 FIXED

- 6.3.1 ADOPTION OF FIXED CAMERAS TO ENSURE CONSISTENT AND RELIABLE IMAGING OUTPUT

7 INFRARED IMAGING MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 32 INFRARED IMAGING MARKET, BY TECHNOLOGY

- FIGURE 33 UNCOOLED INFRARED IMAGING TECHNOLOGY TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 17 INFRARED IMAGING MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 18 INFRARED IMAGING MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.2 COOLED INFRARED IMAGING

- 7.2.1 LIMITED APPLICATIONS DUE TO HIGH COST AND LONG STARTUP TIME

- TABLE 19 COOLED INFRARED IMAGING: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 20 COOLED INFRARED IMAGING: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.3 UNCOOLED INFRARED IMAGING

- 7.3.1 INCREASED USE IN HIGH-VOLUME APPLICATIONS OWING TO LOW COST AND EASY INSTALLATION

- TABLE 21 UNCOOLED INFRARED IMAGING: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 22 UNCOOLED INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

8 INFRARED IMAGING MARKET, BY WAVELENGTH

- 8.1 INTRODUCTION

- FIGURE 34 INFRARED IMAGING MARKET, BY WAVELENGTH

- FIGURE 35 SHORT-WAVE INFRARED SEGMENT TO WITNESS HIGHEST CAGR IN INFRARED IMAGING MARKET DURING FORECAST PERIOD

- TABLE 23 INFRARED IMAGING MARKET, BY WAVELENGTH, 2019-2022 (USD MILLION)

- TABLE 24 INFRARED IMAGING MARKET, BY WAVELENGTH, 2023-2028 (USD MILLION)

- 8.2 NEAR INFRARED (NIR)

- 8.2.1 HIGH ADOPTION OF NIR CCTV CAMERAS FOR SECURITY & SURVEILLANCE TO DRIVE MARKET

- TABLE 25 NEAR INFRARED: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 26 NEAR INFRARED: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 27 NEAR INFRARED: INFRARED IMAGING MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 28 NEAR INFRARED: INFRARED IMAGING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3 SHORT-WAVE INFRARED (SWIR)

- 8.3.1 INCREASED USE OF SWIR IMAGING TECHNOLOGY IN NON-DESTRUCTIVE TESTING TO DRIVE MARKET

- TABLE 29 SHORT-WAVE INFRARED: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 30 SHORT-WAVE INFRARED: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 31 SHORT-WAVE INFRARED: INFRARED IMAGING MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 32 SHORT-WAVE INFRARED: INFRARED IMAGING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.4 MID-WAVE INFRARED (MWIR)

- 8.4.1 RAPID TECHNOLOGICAL ADVANCEMENTS IN MWIR TO BOOST SEGMENTAL GROWTH

- FIGURE 36 SECURITY & SURVEILLANCE APPLICATIONS TO ACCOUNT FOR LARGEST SHARE OF MID-WAVE INFRARED IMAGING MARKET IN 2028

- TABLE 33 MID-WAVE INFRARED: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 34 MID-WAVE INFRARED: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 35 MID-WAVE INFRARED: INFRARED IMAGING MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 36 MID-WAVE INFRARED: INFRARED IMAGING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.5 LONG-WAVE INFRARED (LWIR)

- 8.5.1 SIGNIFICANT USE OF LWIR CAMERAS IN WEARABLES, DRONES, AND HANDHELD DEVICES TO FUEL SEGMENTAL GROWTH

- TABLE 37 LONG-WAVE INFRARED: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 38 LONG-WAVE INFRARED: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 39 LONG-WAVE INFRARED: INFRARED IMAGING MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 40 LONG-WAVE INFRARED: INFRARED IMAGING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

9 INFRARED IMAGING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 37 INFRARED IMAGING MARKET, BY APPLICATION

- FIGURE 38 MONITORING & INSPECTION SEGMENT TO WITNESS HIGHEST CAGR IN INFRARED IMAGING MARKET, BY APPLICATION, DURING FORECAST PERIOD

- TABLE 41 INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 42 INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 SECURITY & SURVEILLANCE

- 9.2.1 SURGING DEMAND FOR INFRARED IMAGING CAMERAS DUE TO INCREASED TERRORISM TO DRIVE MARKET

- TABLE 43 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 44 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 45 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY WAVELENGTH, 2019-2022 (USD MILLION)

- TABLE 46 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY WAVELENGTH, 2023-2028 (USD MILLION)

- TABLE 47 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 SECURITY & SURVEILLANCE: INFRARED IMAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 MONITORING & INSPECTION

- TABLE 49 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 50 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 51 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY WAVELENGTH, 2019-2022 (USD MILLION)

- TABLE 52 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY WAVELENGTH, 2023-2028 (USD MILLION)

- TABLE 53 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 MONITORING & INSPECTION: INFRARED IMAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3.1 CONDITION MONITORING

- 9.3.1.1 Increased use of IR cameras to detect faults in electrical and mechanical equipment to drive segmental growth

- 9.3.2 STRUCTURAL HEALTH MONITORING

- 9.3.2.1 High adoption of early warning systems to monitor potentially risky structures to drive market

- 9.3.3 QUALITY CONTROL

- 9.3.3.1 Significant demand for high-quality and high-performance products to promote use of infrared imaging cameras

- 9.4 DETECTION

- TABLE 55 DETECTION: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 56 DETECTION: INFRARED IMAGING MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 57 DETECTION: INFRARED IMAGING MARKET, BY WAVELENGTH, 2019-2022 (USD MILLION)

- TABLE 58 DETECTION: INFRARED IMAGING MARKET, BY WAVELENGTH, 2023-2028 (USD MILLION)

- TABLE 59 DETECTION: INFRARED IMAGING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 DETECTION: INFRARED IMAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4.1 GAS DETECTION

- 9.4.1.1 Use of infrared imaging cameras to monitor gas leaks and emissions in real time to fuel market growth

- 9.4.2 FIRE/FLARE DETECTION

- 9.4.2.1 Rising adoption of infrared imaging cameras to detect smoke and temperature differences during firefighting to drive market

- 9.4.3 BODY TEMPERATURE MEASUREMENT

- 9.4.3.1 Growing use of IR-enabled body temperature detectors owing to increased international travel and migration to boost segmental growth

10 INFRARED IMAGING MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 39 INFRARED IMAGING MARKET, BY VERTICAL

- FIGURE 40 NON-INDUSTRIAL SEGMENT TO COMMAND INFRARED IMAGING MARKET DURING FORECAST PERIOD

- TABLE 61 INFRARED IMAGING MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 62 INFRARED IMAGING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2 INDUSTRIAL

- TABLE 63 INDUSTRIAL: INFRARED IMAGING MARKET, BY WAVELENGTH, 2019-2022 (USD MILLION)

- TABLE 64 INDUSTRIAL: INFRARED IMAGING MARKET, BY WAVELENGTH, 2023-2028 (USD MILLION)

- 10.2.1 AUTOMOTIVE

- 10.2.1.1 Integration of infrared imaging technology into ADAS to drive market

- 10.2.2 AEROSPACE

- 10.2.2.1 Utilization of advanced vision systems in aerospace industry to boost demand for IR imaging technology

- 10.2.3 ELECTRONICS & SEMICONDUCTOR

- 10.2.3.1 Growing use of SWIR cameras to inspect semiconductor materials to fuel market growth

- 10.2.4 OIL & GAS

- 10.2.4.1 Growing focus of oil & gas companies on predictive maintenance to boost demand for IR imaging products

- 10.2.5 FOOD & BEVERAGES

- 10.2.5.1 Increasing adoption of hyperspectral imaging to identify potential food safety risks to boost demand for IR products

- 10.2.6 GLASS

- 10.2.6.1 High adoption of SWIR cameras by glass manufacturers to minimize scrap to drive market

- 10.2.7 OTHERS

- 10.3 NON-INDUSTRIAL

- TABLE 65 NON-INDUSTRIAL: INFRARED IMAGING MARKET, BY WAVELENGTH, 2019-2022 (USD MILLION)

- TABLE 66 NON-INDUSTRIAL: INFRARED IMAGING MARKET, BY WAVELENGTH, 2023-2028 (USD MILLION)

- 10.3.1 MILITARY & DEFENSE

- 10.3.1.1 Rising demand for vision enhancement technology in battlefield environments to contribute to market growth

- 10.3.2 CIVIL INFRASTRUCTURE

- 10.3.2.1 Deployment of infrared imaging cameras in residential and commercial buildings and transportation infrastructure to drive market

- 10.3.3 MEDICAL

- 10.3.3.1 Adoption of infrared imaging cameras in newer medical applications to fuel market growth

- 10.3.4 SCIENTIFIC RESEARCH

- 10.3.4.1 Emerging applications of spectroscopy in scientific research to support market growth

11 GEOGRAPHIC ANALYSIS

- 11.1 INTRODUCTION

- FIGURE 41 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN INFRARED IMAGING MARKET DURING FORECAST PERIOD

- TABLE 67 INFRARED IMAGING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 68 INFRARED IMAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 42 NORTH AMERICA: INFRARED IMAGING MARKET SNAPSHOT

- TABLE 69 NORTH AMERICA: INFRARED IMAGING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: INFRARED IMAGING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 Increased utilization of infrared imaging in civil infrastructure projects to fuel market growth

- TABLE 73 US: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 74 US: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Increasing use of infrared imaging cameras in security & surveillance to support market growth

- TABLE 75 CANADA: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 76 CANADA: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.3 MEXICO

- 11.2.3.1 Enhanced focus on adopting security measures to boost demand for infrared imaging technology

- TABLE 77 MEXICO: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 78 MEXICO: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.4 NORTH AMERICA: RECESSION IMPACT

- 11.3 EUROPE

- FIGURE 43 EUROPE: INFRARED IMAGING MARKET SNAPSHOT

- TABLE 79 EUROPE: INFRARED IMAGING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 80 EUROPE: INFRARED IMAGING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 81 EUROPE: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 82 EUROPE: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Booming automotive sector to accelerate infrared imaging technology demand

- TABLE 83 GERMANY: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 84 GERMANY: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Medical and pharmaceutical companies to contribute most to market growth

- TABLE 85 UK: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 86 UK: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Technology advancements in automotive sector to propel market growth

- TABLE 87 FRANCE: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 88 FRANCE: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.4 REST OF EUROPE

- TABLE 89 REST OF EUROPE: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 90 REST OF EUROPE: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5 EUROPE: RECESSION IMPACT

- 11.4 ASIA PACIFIC

- FIGURE 44 ASIA PACIFIC: INFRARED IMAGING MARKET SNAPSHOT

- TABLE 91 ASIA PACIFIC: INFRARED IMAGING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: INFRARED IMAGING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Rising demand for security and surveillance solutions for border control to drive market

- TABLE 95 CHINA: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 96 CHINA: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.2 JAPAN

- 11.4.2.1 High reliance of consumer electronics, automotive, and healthcare sectors on infrared imaging technology to accelerate market growth

- TABLE 97 JAPAN: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 98 JAPAN: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Increasing use of IR imaging technology in predictive maintenance and quality control applications to support market growth

- TABLE 99 INDIA: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 100 INDIA: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.4 REST OF ASIA PACIFIC

- TABLE 101 REST OF ASIA PACIFIC: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.5 ASIA PACIFIC: RECESSION IMPACT

- 11.5 REST OF THE WORLD

- TABLE 103 ROW: INFRARED IMAGING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 104 ROW: INFRARED IMAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 105 ROW: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 106 ROW: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.1 SOUTH AMERICA

- 11.5.1.1 High demand from medical and sports industries to support market growth

- TABLE 107 SOUTH AMERICA: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 108 SOUTH AMERICA: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Thriving oil & gas industry to contribute to market growth

- TABLE 109 MIDDLE EAST & AFRICA: INFRARED IMAGING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: INFRARED IMAGING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.3 REST OF THE WORLD: RECESSION IMPACT

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS IN INFRARED IMAGING MARKET

- TABLE 111 OVERVIEW OF STRATEGIES FOLLOWED BY KEY PLAYERS IN INFRARED IMAGING MARKET

- 12.3 MARKET SHARE ANALYSIS, 2022

- TABLE 112 INFRARED IMAGING MARKET: MARKET SHARE ANALYSIS (2022)

- 12.4 REVENUE ANALYSIS OF KEY PLAYERS IN INFRARED IMAGING MARKET

- FIGURE 45 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS IN INFRARED IMAGING MARKET

- 12.4.1 KEY PLAYERS IN INFRARED IMAGING MARKET, 2022

- 12.5 COMPANY EVALUATION MATRIX, 2022

- 12.5.1 STARS

- 12.5.2 PERVASIVE PLAYERS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PARTICIPANTS

- FIGURE 46 INFRARED IMAGING MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 12.6 COMPETITIVE BENCHMARKING

- 12.6.1 COMPANY FOOTPRINT, BY VERTICAL

- 12.6.2 COMPANY FOOTPRINT, BY REGION

- 12.6.3 OVERALL COMPANY FOOTPRINT

- 12.7 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 47 INFRARED IMAGING MARKET (GLOBAL): STARTUPS/SMES EVALUATION MATRIX, 2022

- 12.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 113 INFRARED IMAGING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 114 INFRARED IMAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (VERTICAL FOOTPRINT)

- TABLE 115 INFRARED IMAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (REGION FOOTPRINT)

- 12.8 COMPETITIVE SCENARIOS AND TRENDS

- 12.8.1 DEALS

- TABLE 116 INFRARED IMAGING MARKET: DEALS, 2021-2023

- TABLE 117 INFRARED IMAGING MARKET: PRODUCT LAUNCHES, 2021-2023

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View)**

- 13.1.1 TELEDYNE FLIR LLC

- TABLE 118 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- FIGURE 48 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- 13.1.2 FLUKE CORPORATION

- TABLE 119 FLUKE CORPORATION: COMPANY OVERVIEW

- FIGURE 49 FLUKE CORPORATION: COMPANY SNAPSHOT

- 13.1.3 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 120 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- FIGURE 50 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- 13.1.4 LEONARDO DRS

- TABLE 121 LEONARDO DRS: COMPANY OVERVIEW

- 13.1.5 AXIS COMMUNICATIONS AB

- TABLE 122 AXIS COMMUNICATIONS AB: COMPANY OVERVIEW

- FIGURE 51 AXIS COMMUNICATIONS AB: COMPANY SNAPSHOT

- 13.1.6 XENICS NV.

- TABLE 123 XENICS NV.: COMPANY OVERVIEW

- 13.1.7 OPGAL OPTRONIC INDUSTRIES LTD.

- TABLE 124 OPGAL OPTRONIC INDUSTRIES LTD.: COMPANY OVERVIEW

- 13.1.8 NEW IMAGING TECHNOLOGIES

- TABLE 125 NEW IMAGING TECHNOLOGIES: COMPANY OVERVIEW

- 13.1.9 ALLIED VISION TECHNOLOGIES GMBH

- TABLE 126 ALLIED VISION TECHNOLOGIES: COMPANY OVERVIEW

- 13.1.10 L3HARRIS TECHNOLOGIES, INC.

- TABLE 127 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 52 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- * Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 13.2 OTHER KEY PLAYERS

- 13.2.1 LYNRED

- 13.2.2 INTEVAC, INC.

- 13.2.3 ZHEJIANG DALI TECHNOLOGY CO., LTD.

- 13.2.4 C-THERMAL

- 13.2.5 IRCAMERAS LLC

- 13.2.6 HGH

- 13.2.7 RAPTOR PHOTONICS

- 13.2.8 EPISENSORS

- 13.2.9 INFRATEC GMBH

- 13.2.10 PRINCETON INFRARED TECHNOLOGIES, INC.

- 13.2.11 SIERRA-OLYMPIA TECH.

- 13.2.12 COX CO., LTD.

- 13.2.13 TONBO IMAGING

- 13.2.14 OPTOTHERM, INC.

- 13.2.15 SEEK THERMAL

- 13.2.16 INFRARED CAMERAS, INC.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS