|

|

市場調査レポート

商品コード

1306577

コーディエライトの世界市場:種類別 (焼結、多孔質)・用途別 (自動車部品、脱臭・脱酸・煙抽出、セラミックキルン、赤外線ラジエーター、絶縁体、溶接ストリップリング)・地域別の将来予測 (2028年まで)Cordierite Market by Type (Sintered, Porous), Application (Automotive Parts, Deodorization, Deoxidation Smoke Extraction, Ceramic Kiln, Infrared Radiator, Electrical Insulators, Welding Strip Rings), And Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| コーディエライトの世界市場:種類別 (焼結、多孔質)・用途別 (自動車部品、脱臭・脱酸・煙抽出、セラミックキルン、赤外線ラジエーター、絶縁体、溶接ストリップリング)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年07月06日

発行: MarketsandMarkets

ページ情報: 英文 235 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のコーディエライトの市場規模は、2023年の25億米ドルから5.1%のCAGRで成長し、2028年には32億米ドルに達すると予測されています。

コーディエライトは熱安定性に優れており、大きな変形や劣化を起こすことなく高温に耐えることができます。熱膨張係数が低いため、温度変化にさらされても均一に膨張・収縮します。コーディエライトはこの特性により、触媒コンバーターやディーゼル微粒子フィルターなど、耐熱衝撃性が重要視される用途に適しています。さらに、コーディエライトは比較的密度が低いため、この材料で作られた部品は軽量になります。そのため、燃費や全体的な性能の向上に貢献でき、自動車や航空宇宙などの軽量化が望まれる産業において有益です。

"多孔質コーディエライトのセグメントが、予測期間中に種類別で2番目に急成長する (金額ベース)"

多孔質コーディエライトは、セルラーコーディエライトまたはハニカムコーディエライトとしても知られ、独自の利点を提供し、特定の要因によって牽引されています。多孔質コーディエライトは、その優れた気孔率と透過性により、高温ガス濾過・液体濾過・溶融金属濾過などの用途に広く採用されています。多孔質コーディエライトは、粒子・不純物・汚染物質を効率的に捕捉・保持する能力があるため、これらの用途で好んで使用されます。

"セラミックキルンは、用途別で2番目に急成長する (金額ベース)"

コーディエライトセラミックスは、その優れた熱特性と熱衝撃に対する高い耐性により、セラミックキルンにおいて一般的に使用されています。また、棚板 (キルンシェルフ) の製造に広く使用されています。棚板は、窯の中で陶磁器を積み重ねたり焼成したりする際に、平らで安定した表面を提供します。コーディエライトは熱膨張率が低く、耐熱衝撃性が高いため、急速な加熱・冷却サイクルにも割れや反りを生じることなく耐えることができ、この用途に適しています。コーディエライトセラミックスは、その耐久性、熱衝撃への耐性、高温での寸法安定性を維持する能力により、セラミックキルンで高く評価されています。コーディエライトセラミックスは、セラミック製品を焼成するための制御された安定した環境を作り出し、適切な熱分布を確保し、焼成されるセラミックへの損傷や歪みのリスクを最小限に抑える上で重要な役割を果たしています。

"中東・アフリカは予測期間中、地域別で2番目に急速に成長する"

中東・アフリカはコーディエライトの新興市場であり、今後数年間は良好な成長が見込まれます。この地域は自動車産業で著しい成長を遂げており、南アフリカ、エジプト、モロッコ、アラブ首長国連邦のような国々がリードしています。同地域で自動車の生産と販売が増加するにつれて、触媒コンバーターやディーゼル微粒子フィルターなどのコージェライト系部品の需要も増加します。さらに、大気汚染に対処し、自動車の排出ガスを削減するために、この地域では環境規制と排出基準が厳しくなっています。各国政府は、自動車が特定の排ガス規制を満たすことを義務付ける規制を実施しています。コーディエライトをベースとする触媒コンバーターとDPFは、自動車から排出される有害な排出ガスを削減し、これらの規制を確実に遵守する上で重要な役割を果たしています。排ガス規制を満たす必要性が、この地域におけるコージェライトの需要を牽引しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 不況の影響

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 原料処理分析

- ポーターのファイブフォース分析

- マクロ経済指標

- 関税と規制

- 特許分析

- 貿易分析

- 価格分析

- エコシステム・マッピング

- 顧客のビジネスに影響を与える動向/混乱

- 技術動向

- 購入決定に影響を与える主な要因

- ケーススタディ

第6章 コーディエライト市場:種類別

- イントロダクション

- 焼結コーディエライト

- 多孔質コーディエライト

第7章 コーディエライト市場:用途別

- イントロダクション

- 自動車部品

- 自動車の排気システム

- 触媒コンバーター

- 断熱部品

- その他の自動車用途

- 脱臭・脱酸素・煙抽出

- セラミックキルン (窯業炉)

- 棚板 (キルンシェルフ)

- 支柱

- 匣鉢・セッター

- バーナーチューブ・火炎拡散器

- 赤外線ラジエーター

- 放射管

- 反射板・拡散器

- 補助器具

- 絶縁体

- 点火プラグ用絶縁体

- 高電圧絶縁体

- 発熱体用セラミック絶縁体

- 絶縁ブッシュ・スリーブ

- 溶接ストリップリング

- その他

- 触媒サポート

- ガス・化学ろ過

- 熱交換器

- 耐火物

- 金属鋳造

- 半導体製造

第8章 コーディエライト市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- インドネシア

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第9章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場評価の枠組み

- 収益分析

- 主要選手のランキング

- 市場シェア分析

- 企業評価マトリックス (ティア1)

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 企業評価マトリックス (スタートアップ・中小企業)

- 製品ポートフォリオの強み (スタートアップ・中小企業)

- 事業戦略の優秀性 (スタートアップ・中小企業)

- 競合ベンチマーキング

- 競争シナリオ

第10章 企業プロファイル

- 主要企業

- DENSO CORPORATION

- KYOCERA CORPORATION

- CORNING INC.

- TOTO LTD.

- NGK INSULATORS, LTD.

- VESUVIUS PLC

- ELEMENTIS PLC

- COORSTEK, INC.

- UNIFRAX

- CERAMTEC

- その他の企業

- NORITAKE CO., LIMITED

- RESCO PRODUCTS, INC.

- GOODFELLOW CORPORATION

- DU-CO CERAMICS COMPANY

- DINEX A/S

- ELAN TECHNOLOGY

- BLASCH PRECISION CERAMICS, INC.

- STEATIT S.R.O.

- E.R. ADVANCED CERAMICS, INC.

- YUNNAN FILTER ENVIRONMENT PROTECTION S.&T. CO., LTD.

- ADVANCED CERAMIC MATERIALS

- SINOTRADE RESOURCES CO., LTD.

- TIANJIN CENTURY ELECTRONICS CO., LTD.

- TRANS-TECH, INC.

- YANSHI CITY GUANGMING HI-TECH REFRACTORIES PRODUCTS CO., LTD.

- GLOBAL CERAMIC INDUSTRY CO., LTD.

第11章 付録

The cordierite market is projected to reach USD 3.2 billion by 2028, at a CAGR of 5.1% from USD 2.5 billion in 2023. Cordierite has excellent thermal stability, meaning it can withstand high temperatures without significant deformation or degradation. It has a low thermal expansion coefficient, which allows it to expand and contract evenly when exposed to temperature variations. This property makes cordierite suitable for applications where thermal shock resistance is important, such as in catalytic converters and diesel particulate filters. In addition, cordierite has a relatively low density, making components made from this material lightweight. This is beneficial in industries where weight reduction is desired, such as automotive and aerospace, as it can contribute to improved fuel efficiency and overall performance.

Porous cordierite segment is estimated to be the second-fastest growing in terms of value in the cordierite market, during the forecast period

Porous cordierite, also known as cellular or honeycomb cordierite, offers unique advantages and is driven by specific factors. Porous cordierite is widely used in filtration and separation applications due to its excellent porosity and permeability. It is commonly employed in applications such as hot gas filtration, liquid filtration, and molten metal filtration. The ability of porous cordierite to efficiently capture and retain particles, impurities, and contaminants makes it a preferred choice in these applications.

Ceramic kiln is projected to grow into the second-fastest growing application in the cordierite market, in terms of value.

Cordierite ceramics are commonly used in ceramic kilns due to their excellent thermal properties and high resistance to thermal shock. Cordierite is widely used in the production of kiln shelves, also known as kiln furniture. Kiln shelves provide a flat and stable surface for stacking and firing ceramic ware in the kiln. Cordierite's low thermal expansion and high thermal shock resistance make it well-suited for this application, as it can withstand rapid heating and cooling cycles without cracking or warping. Cordierite ceramics are valued in ceramic kilns for their durability, resistance to thermal shock, and ability to maintain dimensional stability at high temperatures. They play a critical role in creating a controlled and stable environment for firing ceramic ware, ensuring proper heat distribution and minimizing the risk of damage or distortion to the ceramics being fired.

Middle East & Africa is projected to be the second-fastest in the cordierite market during the forecast period.

The Middle East & Africa is an emerging market for cordierite and is expected to witness good growth in the coming years. The region has experienced significant growth in the automotive industry, with countries like South Africa, Egypt, Morocco, and the United Arab Emirates leading the way. As automotive production and sales increase in the region, the demand for cordierite-based components, such as catalytic converters and diesel particulate filters, also rises. In addition, environmental regulations and emission standards are becoming more stringent in the region to address air pollution and reduce vehicle emissions. Governments are implementing regulations that require vehicles to meet specific emission limits. Cordierite-based catalytic converters and DPFs play a crucial role in reducing harmful emissions from vehicles and ensuring compliance with these regulations. The need to meet emission standards drives the demand for cordierite in the region.

Extensive primary interviews were conducted to determine and verify the sizes of several segments and subsegments of the cordierite market gathered through secondary research.

The breakdown of primary interviews has been given below.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives - 20%, Director Level - 10%, Others - 70%

- By Region: North America - 20%, Asia Pacific - 30%, Europe - 30%, Middle East & Africa - 10%, Latin America-10%.

The key players in the cordierite market are DENSO Corporation (Japan), Kyocera Corporation (Japan), Corning Inc. (US), TOTO Ltd. (Japan), NGK Insulators (Japan), Vesuvius Plc (UK), Elementis Plc (UK), CoorsTek (US), Unifrax (US), and CeramTec (Germany), among others. The cordierite market report analyzes the key growth strategies, such as partnerships, expansions, and acquisitions to strengthen their market positions.

Research Coverage

This report provides detailed segmentation of the cordierite market and forecasts its market size until 2028. The market has been segmented based on by type (sintered, porous), application (Automotive Parts, Deodorization, Deoxidation Smoke Extraction, Ceramic Kiln, Infrared Radiator, Electrical Insulators, Welding Strip Rings), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, partnerships, expansions, and acquisitions associated with the cordierite market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the cordierite market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (growing automotive industry, stringent emission regulations, growing industrial applications, increasing demand for energy-efficient solutions, growth in construction industry, increasing demand for lightweight materials), restraints (high manufacturing costs, competition from substitute materials, limited heat resistance, market volatility and cyclical nature, limited availability of raw materials), opportunities (advancements in ceramic manufacturing technologies, increasing demand in emerging economies, expansion of energy sector), and challenges (regulatory compliance and environmental concerns, complex manufacturing process and quality control) influencing the growth of the cordierite market.

- Market Penetration: Comprehensive information on cordierite offered by top players in the global cordierite market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and acquisitions in the cordierite market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for cordierite market across regions

- Market Diversification: Exhaustive information about partnerships, growing geographies, and recent developments in the cordierite market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 CORDIERITE MARKET SEGMENTATION

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 IMPACT OF SLOWDOWN/RECESSION

- 2.2 RESEARCH DATA

- FIGURE 2 CORDIERITE MARKET: RESEARCH DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.3 PRIMARY LIST

- 2.2.3.1 Demand and supply sides

- 2.2.3.2 Key data from primary sources

- 2.2.3.3 Key industry insights

- 2.2.3.4 Breakdown of primary interviews

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 CORDIERITE MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 6 CORDIERITE MARKET: DATA TRIANGULATION

- 2.5 ASSUMPTIONS

- 2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6.1 SUPPLY SIDE

- 2.6.2 DEMAND SIDE

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 7 SINTERED SEGMENT TO ACCOUNT FOR LARGER SHARE OF OVERALL CORDIERITE MARKET

- FIGURE 8 DEODORIZATION, DEOXIDATION SMOKE EXTRACTION TO BE FASTEST-GROWING APPLICATION OF CORDIERITE DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

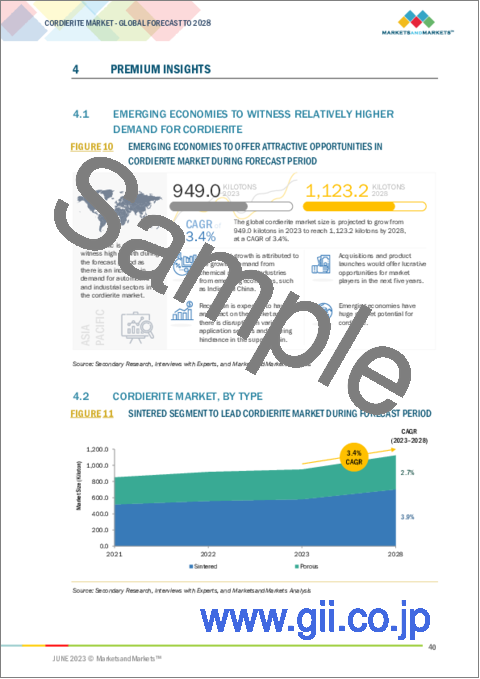

- 4.1 EMERGING ECONOMIES TO WITNESS RELATIVELY HIGHER DEMAND FOR CORDIERITE

- FIGURE 10 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN CORDIERITE MARKET DURING FORECAST PERIOD

- 4.2 CORDIERITE MARKET, BY TYPE

- FIGURE 11 SINTERED SEGMENT TO LEAD CORDIERITE MARKET DURING FORECAST PERIOD

- 4.3 CORDIERITE MARKET, BY APPLICATION

- FIGURE 12 AUTOMOTIVE PARTS SEGMENT TO WITNESS HIGHEST DEMAND IN CORDIERITE MARKET

- 4.4 CORDIERITE MARKET, BY COUNTRY

- FIGURE 13 CORDIERITE MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 IMPACT OF RECESSION

- 5.3 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CORDIERITE MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Growing demand from automotive and industrial sectors

- 5.3.1.2 Stringent emission regulations

- 5.3.1.3 Increasing demand for energy-efficient solutions

- 5.3.1.4 Increasing demand for lightweight materials

- 5.3.2 RESTRAINTS

- 5.3.2.1 High manufacturing costs

- 5.3.2.2 Competition from substitute materials

- 5.3.2.3 Limited heat resistance

- 5.3.2.4 Limited availability of raw materials

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Advancements in ceramic manufacturing technologies

- 5.3.3.2 Expansion of energy sector

- 5.3.4 CHALLENGES

- 5.3.4.1 Complex manufacturing processes and quality control

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 15 OVERVIEW OF VALUE CHAIN OF CORDIERITE MARKET

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 MATERIAL PROCESSING AND CORDIERITE MANUFACTURING COMPANIES

- 5.4.3 MANUFACTURERS

- 5.4.4 DISTRIBUTORS

- 5.4.5 END USERS

- TABLE 2 CORDIERITE: VALUE CHAIN STAKEHOLDERS

- 5.5 RAW MATERIAL PROCESSING ANALYSIS

- FIGURE 16 CORDIERITE RAW MATERIAL PROCESSING ANALYSIS

- 5.5.1 RAW MATERIAL SOURCING

- 5.5.2 PRIMARY STAGE: PRE-PROCESSING AND SORTING

- 5.5.3 CHEMICAL TREATMENT AND REFINING

- 5.5.4 POLISHING STAGE: SIZE REDUCTION AND GRINDING

- 5.5.5 BLENDING AND MIXING

- 5.5.6 FORMING

- 5.5.7 DRYING

- 5.5.8 FIRING

- 5.5.9 FINISHING AND SURFACE TREATMENT

- 5.5.10 QUALITY CONTROL AND TESTING

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS: CORDIERITE MARKET

- 5.6.1 BARGAINING POWER OF SUPPLIERS

- 5.6.2 BARGAINING POWER OF BUYERS

- 5.6.3 THREAT OF NEW ENTRANTS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 CORDIERITE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7 MACROECONOMIC INDICATORS

- 5.7.1 GLOBAL GDP TRENDS

- TABLE 4 TRENDS OF PER CAPITA GDP, 2020-2022 (USD)

- TABLE 5 GDP GROWTH ESTIMATES AND PROJECTIONS FOR KEY COUNTRIES, 2023-2027 (USD MILLION)

- 5.8 TARIFFS & REGULATIONS

- 5.8.1 REGULATIONS

- 5.8.1.1 European Union

- 5.8.1.1.1 REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals)

- 5.8.1.1.2 CLP Regulation (Classification, Labeling, and Packaging)

- 5.8.1.1.3 WEEE Directive (Waste Electrical and Electronic Equipment)

- 5.8.1.2 US

- 5.8.1.2.1 TSCA (Toxic Substances Control Act)

- 5.8.1.2.2 FCC (Federal Communications Commission) Regulations

- 5.8.1.2.3 OSHA (Occupational Safety and Health Administration) Standards

- 5.8.1.3 Global regulations

- 5.8.1.3.1 ISO standards

- 5.8.1.3.2 RoHS (Restriction of Hazardous Substances)

- 5.8.1.1 European Union

- 5.8.1 REGULATIONS

- 5.9 PATENT ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 METHODOLOGY

- 5.9.3 DOCUMENT TYPE

- FIGURE 18 PATENTS REGISTERED (2012 TO 2022)

- 5.9.4 PUBLICATION TRENDS (2012-2022)

- FIGURE 19 NUMBER OF PATENTS REGISTERED DURING LAST 10 YEARS

- 5.9.5 INSIGHTS

- 5.9.6 JURISDICTION ANALYSIS

- FIGURE 20 TOP JURISDICTIONS

- 5.9.7 TOP COMPANIES/APPLICANTS

- FIGURE 21 NGK INSULATORS, LTD. REGISTERED MAXIMUM NUMBER OF PATENTS

- TABLE 6 LIST OF PATENTS BY NGK INSULATORS, LTD.

- TABLE 7 LIST OF PATENTS BY CORNING, INC.

- TABLE 8 TOP 10 PATENT OWNERS DURING LAST 10 YEARS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT TRADE ANALYSIS

- TABLE 9 COUNTRY-WISE IMPORT TRADE (USD THOUSAND)

- 5.10.2 EXPORT TRADE ANALYSIS

- TABLE 10 COUNTRY-WISE EXPORT TRADE (USD THOUSAND)

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE, BY REGION

- FIGURE 22 AVERAGE SELLING PRICE, BY REGION (USD/KILOTON)

- 5.11.2 AVERAGE SELLING PRICE, BY TYPE

- TABLE 11 AVERAGE SELLING PRICE, BY TYPE (USD/KILOTON)

- 5.11.3 AVERAGE SELLING PRICE, BY COMPANY

- TABLE 12 AVERAGE SELLING PRICE, BY COMPANY (USD/KILOTON)

- 5.12 ECOSYSTEM MAPPING

- FIGURE 23 CORDIERITE MARKET ECOSYSTEM

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 AUTOMOTIVE INDUSTRY TO DRIVE GROWTH IN CORDIERITE MARKET

- 5.14 TECHNOLOGY TRENDS

- 5.14.1 AUTOMOTIVE PARTS

- 5.14.2 DEODORIZATION

- 5.14.3 CERAMIC KILNS

- 5.14.4 INFRARED RADIATORS

- 5.14.5 ELECTRICAL INSULATORS

- 5.14.6 WELDING STRIP RINGS

- 5.15 KEY FACTORS AFFECTING BUYING DECISION

- 5.15.1 QUALITY AND PERFORMANCE

- 5.15.2 PRICE AND VALUE FOR MONEY

- 5.15.3 TECHNICAL SUPPORT AND EXPERTISE

- 5.15.4 REPUTATION AND TRUSTWORTHINESS

- 5.15.5 CUSTOMIZATION AND FLEXIBILITY

- 5.15.6 ENVIRONMENTAL CONSIDERATIONS

- 5.15.7 SUPPLY CHAIN AND LOGISTICS

- 5.15.8 AFTER-SALES SUPPORT AND WARRANTY

- FIGURE 25 SUPPLIER SELECTION CRITERIA

- 5.16 CASE STUDY

- 5.16.1 KYOCERA'S CUSTOMIZED CORDIERITE MATERIAL ENABLED ENHANCED PERFORMANCE OF SUBARU TELESCOPE

- 5.16.2 REVOLUTIONIZING VEHICLE EMISSION CONTROL: CORNING'S INNOVATION IN CATALYTIC CONVERTER

6 CORDIERITE MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 26 SINTERED CORDIERITE SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- TABLE 13 CORDIERITE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 14 CORDIERITE MARKET, BY TYPE, 2023-2028 (USD MILLION)

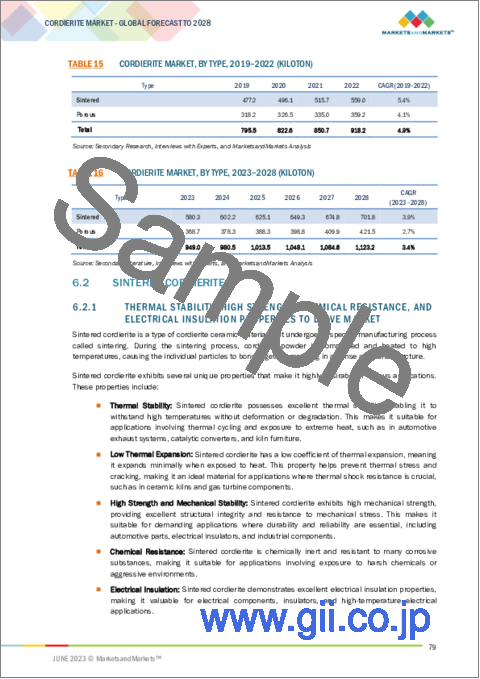

- TABLE 15 CORDIERITE MARKET, BY TYPE, 2019-2022 (KILOTON)

- TABLE 16 CORDIERITE MARKET, BY TYPE, 2023-2028 (KILOTON)

- 6.2 SINTERED CORDIERITE

- 6.2.1 THERMAL STABILITY, HIGH STRENGTH, CHEMICAL RESISTANCE, AND ELECTRICAL INSULATION PROPERTIES TO DRIVE MARKET

- 6.3 POROUS CORDIERITE

- 6.3.1 HIGH POROSITY, THERMAL INSULATION, CHEMICAL & CORROSION RESISTANCE, AND ACOUSTIC ABSORPTION PROPERTIES TO DRIVE MARKET

7 CORDIERITE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 27 AUTOMOTIVE PARTS SEGMENT TO LEAD CORDIERITE MARKET TILL 2028

- TABLE 17 CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 18 CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 19 CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 20 CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 7.2 AUTOMOTIVE PARTS

- 7.2.1 EMISSION REDUCTION, ENHANCEMENT OF ENGINE PERFORMANCE, AND IMPROVEMENT IN FUEL EFFICIENCY TO DRIVE MARKET

- 7.2.2 AUTOMOTIVE EXHAUST SYSTEMS

- 7.2.3 CATALYTIC CONVERTERS

- 7.2.4 HEAT INSULATION COMPONENTS

- 7.2.5 OTHER AUTOMOTIVE APPLICATIONS

- 7.3 DEODORIZATION, DEOXIDATION SMOKE EXTRACTION

- 7.3.1 EXCELLENT THERMAL STABILITY, CHEMICAL RESISTANCE, AND HIGH POROSITY TO DRIVE MARKET

- 7.4 CERAMIC KILNS

- 7.4.1 HIGH THERMAL STABILITY, LOW THERMAL EXPANSION, EXCELLENT RESISTANCE TO THERMAL SHOCK, AND GOOD CHEMICAL DURABILITY TO DRIVE MARKET

- 7.4.2 KILN SHELVES

- 7.4.3 POSTS AND SUPPORTS

- 7.4.4 SAGGERS AND SETTERS

- 7.4.5 BURNER TUBES AND FLAME DIFFUSERS

- 7.5 INFRARED RADIATORS

- 7.5.1 CONTROLLED EMISSION OF INFRARED RADIATION TO FACILITATE EFFECTIVE HEATING AND DRYING PROCESSES IN VARIOUS INDUSTRIAL APPLICATIONS

- 7.5.2 RADIANT TUBES

- 7.5.3 REFLECTORS AND DIFFUSERS

- 7.5.4 ELEMENT SUPPORTS

- 7.6 ELECTRICAL INSULATORS

- 7.6.1 LOW ELECTRICAL CONDUCTIVITY, HIGH DIELECTRIC STRENGTH, AND THERMAL SHOCK RESISTANCE TO DRIVE MARKET

- 7.6.2 SPARK PLUG INSULATORS

- 7.6.3 HIGH VOLTAGE INSULATORS

- 7.6.4 CERAMIC INSULATORS FOR HEATING ELEMENTS

- 7.6.5 INSULATING BUSHINGS AND SLEEVES

- 7.7 WELDING STRIP RINGS

- 7.7.1 HEAT RESISTANCE, THERMAL INSULATION, MECHANICAL STABILITY, CHEMICAL INERTNESS, AND WEAR RESISTANCE TO DRIVE MARKET

- 7.8 OTHERS

- 7.8.1 CATALYST SUPPORTS

- 7.8.2 GAS AND CHEMICAL FILTRATION

- 7.8.3 HEAT EXCHANGERS

- 7.8.4 REFRACTORY MATERIALS

- 7.8.5 FOUNDRY AND METAL CASTING

- 7.8.6 SEMICONDUCTOR MANUFACTURING

8 CORDIERITE MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 28 CORDIERITE MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 21 CORDIERITE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 22 CORDIERITE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 23 CORDIERITE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 24 CORDIERITE MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.2 ASIA PACIFIC

- 8.2.1 IMPACT OF RECESSION ON ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: CORDIERITE MARKET SNAPSHOT

- TABLE 25 ASIA PACIFIC: CORDIERITE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 26 ASIA PACIFIC: CORDIERITE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 27 ASIA PACIFIC: CORDIERITE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 28 ASIA PACIFIC: CORDIERITE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 29 ASIA PACIFIC: CORDIERITE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 30 ASIA PACIFIC: CORDIERITE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: CORDIERITE MARKET, BY TYPE, 2019-2022 (KILOTON)

- TABLE 32 ASIA PACIFIC: CORDIERITE MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 33 ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 34 ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 36 ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.2.2 CHINA

- 8.2.2.1 High growth of automotive sector to boost market

- TABLE 37 CHINA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 38 CHINA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 39 CHINA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 40 CHINA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.2.3 JAPAN

- 8.2.3.1 Automotive and industrial processing units to dominate market

- TABLE 41 JAPAN: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 42 JAPAN: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 43 JAPAN: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 44 JAPAN: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.2.4 INDIA

- 8.2.4.1 Low cost of production and raw materials, availability of skilled labor, and robust R&D centers to drive market

- TABLE 45 INDIA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 46 INDIA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 47 INDIA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 48 INDIA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.2.5 SOUTH KOREA

- 8.2.5.1 Significant automotive sector to boost market

- TABLE 49 SOUTH KOREA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 50 SOUTH KOREA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 51 SOUTH KOREA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 52 SOUTH KOREA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.2.6 INDONESIA

- 8.2.6.1 Automotive sector and exports to drive market

- TABLE 53 INDONESIA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 54 INDONESIA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 55 INDONESIA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 56 INDONESIA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.2.7 REST OF ASIA PACIFIC

- TABLE 57 REST OF ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 58 REST OF ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 59 REST OF ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 60 REST OF ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.3 NORTH AMERICA

- 8.3.1 IMPACT OF RECESSION ON NORTH AMERICA

- FIGURE 30 NORTH AMERICA: CORDIERITE MARKET SNAPSHOT

- TABLE 61 NORTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: CORDIERITE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 64 NORTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 65 NORTH AMERICA: CORDIERITE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: CORDIERITE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: CORDIERITE MARKET, BY TYPE, 2019-2022 (KILOTON)

- TABLE 68 NORTH AMERICA: CORDIERITE MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 69 NORTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 72 NORTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.3.2 US

- 8.3.2.1 Increasing government support to lead to market growth

- TABLE 73 US: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 74 US: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 75 US: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 76 US: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.3.3 CANADA

- 8.3.3.1 Emerging automotive technologies to drive market

- TABLE 77 CANADA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 78 CANADA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 79 CANADA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 80 CANADA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.3.4 MEXICO

- 8.3.4.1 Private investments in manufacturing and automotive sectors to enhance market growth

- TABLE 81 MEXICO: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 82 MEXICO: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 83 MEXICO: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 84 MEXICO: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.4 EUROPE

- 8.4.1 IMPACT OF RECESSION ON EUROPE

- FIGURE 31 DEMAND FOR AUTOMOTIVE PARTS TO BE HIGHEST IN REGION

- TABLE 85 EUROPE: CORDIERITE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 86 EUROPE: CORDIERITE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 87 EUROPE: CORDIERITE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 88 EUROPE: CORDIERITE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 89 EUROPE: CORDIERITE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 90 EUROPE: CORDIERITE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 91 EUROPE: CORDIERITE MARKET, BY TYPE, 2019-2022 (KILOTON)

- TABLE 92 EUROPE: CORDIERITE MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 93 EUROPE: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 94 EUROPE: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 95 EUROPE: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 96 EUROPE: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.4.2 GERMANY

- 8.4.2.1 Global automotive manufacturing hub to drive market

- TABLE 97 GERMANY: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 98 GERMANY: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 99 GERMANY: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 100 GERMANY: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.4.3 UK

- 8.4.3.1 Growing urbanization and innovations to boost market growth

- TABLE 101 UK: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 102 UK: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 103 UK: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 104 UK: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.4.4 FRANCE

- 8.4.4.1 Rising industrial and automotive sectors to drive market

- TABLE 105 FRANCE: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 106 FRANCE: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 107 FRANCE: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 108 FRANCE: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.4.5 ITALY

- 8.4.5.1 Investments in automotive sector for developing advanced production systems to drive market

- TABLE 109 ITALY: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 110 ITALY: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 111 ITALY: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 112 ITALY: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.4.6 SPAIN

- 8.4.6.1 Investments in eco and electric mobility infrastructure and R&D initiatives in automotive sector to drive market

- TABLE 113 SPAIN: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 114 SPAIN: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 115 SPAIN: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 116 SPAIN: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.4.7 REST OF EUROPE

- TABLE 117 REST OF EUROPE: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 118 REST OF EUROPE: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 120 REST OF EUROPE: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 IMPACT OF RECESSION ON MIDDLE EAST & AFRICA

- TABLE 121 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: CORDIERITE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 124 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 125 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY TYPE, 2019-2022 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 132 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.5.2 SAUDI ARABIA

- 8.5.2.1 Aftermarket for off-road vehicles and sports utility vehicles (SUVs) to offer significant potential

- TABLE 133 SAUDI ARABIA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 134 SAUDI ARABIA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 135 SAUDI ARABIA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 136 SAUDI ARABIA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.5.3 SOUTH AFRICA

- 8.5.3.1 Expansion of automotive sector to drive market

- TABLE 137 SOUTH AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 138 SOUTH AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 139 SOUTH AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 140 SOUTH AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.5.4 UAE

- 8.5.4.1 Focus on energy efficiency and sustainability to drive market

- TABLE 141 UAE: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 142 UAE: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 143 UAE: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 144 UAE: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 145 REST OF MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 146 REST OF MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 147 REST OF MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.6 SOUTH AMERICA

- 8.6.1 IMPACT OF RECESSION ON SOUTH AMERICA

- TABLE 149 SOUTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 150 SOUTH AMERICA: CORDIERITE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 151 SOUTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 152 SOUTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 153 SOUTH AMERICA: CORDIERITE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 154 SOUTH AMERICA: CORDIERITE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 155 SOUTH AMERICA: CORDIERITE MARKET, BY TYPE, 2019-2022 (KILOTON)

- TABLE 156 SOUTH AMERICA: CORDIERITE MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 157 SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 158 SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 159 SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 160 SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.6.2 BRAZIL

- 8.6.2.1 Growing industrialization to lead to market growth

- TABLE 161 BRAZIL: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 162 BRAZIL: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 163 BRAZIL: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 164 BRAZIL: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.6.3 ARGENTINA

- 8.6.3.1 Presence of global automotive players to lead to market growth

- TABLE 165 ARGENTINA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 166 ARGENTINA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 167 ARGENTINA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 168 ARGENTINA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.6.4 REST OF SOUTH AMERICA

- TABLE 169 REST OF SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 170 REST OF SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 171 REST OF SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 172 REST OF SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 32 COMPANIES ADOPTED ACQUISITIONS AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2023

- 9.3 MARKET EVALUATION FRAMEWORK

- TABLE 173 MARKET EVALUATION FRAMEWORK

- 9.4 REVENUE ANALYSIS

- TABLE 174 REVENUE ANALYSIS OF KEY COMPANIES (2020-2022)

- 9.5 RANKING OF KEY PLAYERS

- FIGURE 33 RANKING OF TOP FIVE PLAYERS IN CORDIERITE MARKET

- 9.6 MARKET SHARE ANALYSIS

- FIGURE 34 CORDIERITE MARKET SHARE, BY COMPANY (2022)

- TABLE 175 CORDIERITE MARKET: DEGREE OF COMPETITION

- 9.7 COMPANY EVALUATION MATRIX (TIER 1)

- 9.7.1 STARS

- 9.7.2 PERVASIVE PLAYERS

- 9.7.3 EMERGING LEADERS

- 9.7.4 PARTICIPANTS

- FIGURE 35 CORDIERITE MARKET: COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2023

- 9.8 STRENGTH OF PRODUCT PORTFOLIO

- 9.9 BUSINESS STRATEGY EXCELLENCE

- 9.10 COMPANY EVALUATION MATRIX (STARTUPS AND SMES)

- 9.10.1 PROGRESSIVE COMPANIES

- 9.10.2 RESPONSIVE COMPANIES

- 9.10.3 STARTING BLOCKS

- 9.10.4 DYNAMIC COMPANIES

- FIGURE 36 CORDIERITE MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS AND SMES, 2023

- 9.11 STRENGTH OF PRODUCT PORTFOLIO (STARTUPS AND SMES)

- 9.12 BUSINESS STRATEGY EXCELLENCE (STARTUPS AND SMES)

- 9.13 COMPETITIVE BENCHMARKING

- TABLE 176 DETAILED LIST OF COMPANIES

- 9.13.1 COMPANY TYPE FOOTPRINT

- TABLE 177 OVERALL TYPE FOOTPRINT

- 9.13.2 COMPANY APPLICATION FOOTPRINT

- TABLE 178 OVERALL APPLICATION FOOTPRINT

- 9.13.3 COMPANY REGION FOOTPRINT

- TABLE 179 OVERALL REGION FOOTPRINT

- 9.13.4 COMPANY FOOTPRINT

- TABLE 180 OVERALL COMPANY FOOTPRINT

- 9.14 COMPETITIVE SCENARIOS

- 9.14.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 181 PRODUCT LAUNCHES/DEVELOPMENTS, 2018-2023

- 9.14.2 DEALS

- TABLE 182 DEALS, 2018-2023

- 9.14.3 OTHERS

- TABLE 183 OTHERS, 2018-2023

10 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 10.1 KEY PLAYERS

- 10.1.1 DENSO CORPORATION

- TABLE 184 DENSO CORPORATION: COMPANY OVERVIEW

- FIGURE 37 DENSO CORPORATION: COMPANY SNAPSHOT

- TABLE 185 PRODUCT OFFERINGS

- TABLE 186 DEALS

- TABLE 187 OTHER DEVELOPMENTS

- TABLE 188 PRODUCT LAUNCHES

- 10.1.2 KYOCERA CORPORATION

- TABLE 189 KYOCERA CORPORATION: COMPANY OVERVIEW

- FIGURE 38 KYOCERA CORPORATION: COMPANY SNAPSHOT

- TABLE 190 PRODUCT OFFERINGS

- TABLE 191 DEALS

- TABLE 192 OTHER DEVELOPMENTS

- 10.1.3 CORNING INC.

- TABLE 193 CORNING INC.: COMPANY OVERVIEW

- FIGURE 39 CORNING INC.: COMPANY SNAPSHOT

- TABLE 194 PRODUCT OFFERINGS

- TABLE 195 OTHER DEVELOPMENTS

- 10.1.4 TOTO LTD.

- TABLE 196 TOTO LTD.: COMPANY OVERVIEW

- FIGURE 40 TOTO LTD.: COMPANY SNAPSHOT

- TABLE 197 PRODUCT OFFERINGS

- 10.1.5 NGK INSULATORS, LTD.

- TABLE 198 NGK INSULATORS, LTD.: COMPANY OVERVIEW

- FIGURE 41 NGK INSULATORS, LTD.: COMPANY SNAPSHOT

- TABLE 199 PRODUCT OFFERINGS

- TABLE 200 RECENT DEVELOPMENTS

- 10.1.6 VESUVIUS PLC

- TABLE 201 VESUVIUS PLC: COMPANY OVERVIEW

- FIGURE 42 VESUVIUS PLC: COMPANY SNAPSHOT

- TABLE 202 PRODUCT OFFERINGS

- TABLE 203 DEALS

- 10.1.7 ELEMENTIS PLC

- TABLE 204 ELEMENTIS PLC: COMPANY OVERVIEW

- FIGURE 43 ELEMENTIS PLC: COMPANY SNAPSHOT

- TABLE 205 PRODUCT OFFERINGS

- TABLE 206 DEALS

- TABLE 207 OTHER DEVELOPMENTS

- 10.1.8 COORSTEK, INC.

- TABLE 208 COORSTEK, INC: COMPANY OVERVIEW

- TABLE 209 PRODUCT OFFERINGS

- TABLE 210 DEALS

- TABLE 211 OTHER DEVELOPMENTS

- 10.1.9 UNIFRAX

- TABLE 212 UNIFRAX: COMPANY OVERVIEW

- TABLE 213 PRODUCT OFFERINGS

- TABLE 214 DEALS

- 10.1.10 CERAMTEC

- TABLE 215 CERAMTEC: COMPANY OVERVIEW

- FIGURE 44 CERAMTEC: COMPANY SNAPSHOT

- TABLE 216 PRODUCT OFFERINGS

- TABLE 217 DEALS

- TABLE 218 OTHER DEVELOPMENTS

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 10.2 OTHER PLAYERS

- 10.2.1 NORITAKE CO., LIMITED

- TABLE 219 NORITAKE CO., LIMITED: COMPANY OVERVIEW

- 10.2.2 RESCO PRODUCTS, INC.

- TABLE 220 RESCO PRODUCTS, INC.: COMPANY OVERVIEW

- 10.2.3 GOODFELLOW CORPORATION

- TABLE 221 GOODFELLOW CORPORATION: COMPANY OVERVIEW

- 10.2.4 DU-CO CERAMICS COMPANY

- TABLE 222 DU-CO CERAMICS COMPANY: COMPANY OVERVIEW

- 10.2.5 DINEX A/S

- TABLE 223 DINEX A/S: COMPANY OVERVIEW

- 10.2.6 ELAN TECHNOLOGY

- TABLE 224 ELAN TECHNOLOGY: COMPANY OVERVIEW

- 10.2.7 BLASCH PRECISION CERAMICS, INC.

- TABLE 225 BLASCH PRECISION CERAMICS, INC.: COMPANY OVERVIEW

- 10.2.8 STEATIT S.R.O.

- TABLE 226 STEATIT S.R.O.: COMPANY OVERVIEW

- 10.2.9 E.R. ADVANCED CERAMICS, INC.

- TABLE 227 E.R. ADVANCED CERAMICS, INC.: COMPANY OVERVIEW

- 10.2.10 YUNNAN FILTER ENVIRONMENT PROTECTION S.&T. CO., LTD.

- TABLE 228 YUNNAN FILTER ENVIRONMENT PROTECTION S.&T. CO., LTD.: COMPANY OVERVIEW

- 10.2.11 ADVANCED CERAMIC MATERIALS

- TABLE 229 ADVANCED CERAMIC MATERIALS: COMPANY OVERVIEW

- 10.2.12 SINOTRADE RESOURCES CO., LTD.

- TABLE 230 SINOTRADE RESOURCES CO., LTD.: COMPANY OVERVIEW

- 10.2.13 TIANJIN CENTURY ELECTRONICS CO., LTD.

- TABLE 231 TIANJIN CENTURY ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- 10.2.14 TRANS-TECH, INC.

- TABLE 232 TRANS-TECH, INC.: COMPANY OVERVIEW

- 10.2.15 YANSHI CITY GUANGMING HI-TECH REFRACTORIES PRODUCTS CO., LTD.

- TABLE 233 YANSHI CITY GUANGMING HI-TECH REFRACTORIES PRODUCTS CO., LTD.: COMPANY OVERVIEW

- 10.2.16 GLOBAL CERAMIC INDUSTRY CO., LTD.

- TABLE 234 GLOBAL CERAMIC INDUSTRY CO., LTD.: COMPANY OVERVIEW

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS