|

|

市場調査レポート

商品コード

1306572

麻酔機器の世界市場:種類別 (麻酔装置、使い捨て用品)・用途別・エンドユーザー別・地域別の将来予測 (2028年まで)Anesthesia Equipment Market by Type (Anesthesia Devices, Disposables), Application, End User & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 麻酔機器の世界市場:種類別 (麻酔装置、使い捨て用品)・用途別・エンドユーザー別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月16日

発行: MarketsandMarkets

ページ情報: 英文 219 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の麻酔機器市場は、2023年の80億米ドルから、2028年には110億米ドルに達し、予測期間中に6.7%のCAGRで成長すると予測されています。

新技術 (ワイヤレス通信など) の統合により、処置中の麻酔投与と患者モニタリングの制御が改善されました。機械学習のような人工知能 (AI) アプローチの活用は、この分野をさらに変革し、患者ケアを改善する大きな可能性を示しています。

近年、患者の安全性向上や効率化、医療費削減を目的とした麻酔機器の技術進歩がいくつか見られます。

"麻酔ワークステーション分野が、麻酔機器市場で大きなシェアを占める"

2022年の麻酔機器市場では、麻酔ワークステーション分野がより大きなシェアを占めました。また、このセグメントは予測期間中により高いCAGRで成長すると推定されます。このセグメントの成長は、主に外科手術の増加と技術の進歩に起因しています。

"心臓病は予測期間中に最も高いCAGRで成長する"

用途別では、心臓病が予測期間中に最高のCAGRで成長します。この分野の成長は主に、心血管疾患の有病率の増加、心臓手術の需要の増加に起因しています。

"アジア太平洋は予測期間中に最大のCAGRで成長する"

2022年、アジア太平洋は予測期間中に最大のCAGRで成長します。この市場の成長を促進する主な要因は、日本には国民皆保険制度があり医療制度が発達していること、中国やインドなどの国々では、がんや腫瘍などの重篤な疾病を抱える患者を大量に抱え、医療インフラの改善に注力していることです。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界動向

- 規制分析

- 規制機関・政府機関・その他の組織

- バリューチェーン分析

- サプライチェーン分析

- エコシステム・市場マップ

- ポーターのファイブフォース分析

- 特許分析

- 技術分析

- 価格モデル分析

- 主要な会議とイベント

- 主要な利害関係者と購入基準

第6章 麻酔機器市場:種類別

- イントロダクション

- 麻酔装置

- 麻酔ワークステーション

- 麻酔投与装置

- 麻酔用人工呼吸器

- 麻酔モニター

- その他の装置

- 麻酔用使い捨て用品

- 麻酔回路

- 麻酔マスク

- 気管内チューブ

- ラリンジアルマスク (LMA)

- その他の付属品

第7章 麻酔機器市場:用途別

- イントロダクション

- 整形外科

- 神経学

- 呼吸器治療

- 泌尿器科

- 心臓病

- その他の用途

第8章 麻酔機器市場:エンドユーザー別

- イントロダクション

- 病院

- クリニック

- 外来手術センター

- その他のエンドユーザー

第9章 麻酔機器市場:地域別

- イントロダクション

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- 北米

- 米国

- カナダ

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 主要企業の収益シェア分析

- 市場シェア分析

- 麻酔機器市場:企業フットプリント分析

- 企業評価マトリックス

- 競合ベンチマーキング

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- KONINKLIJKE PHILIPS N.V.

- AMBU A/S

- DRAGERWERK AG & CO. KGAA

- GE HEALTHCARE

- BEIJING AEONMED CO., LTD.

- MEDTRONIC PLC

- GETINGE AB

- BECTON, DICKINSON AND COMPANY

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- FISHER & PAYKEL HEALTHCARE CO. LTD.

- MEDLINE INDUSTRIES, INC.

- SHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD.

- ALLIED MEDICAL LIMITED

- BPL MEDICAL TECHNOLOGIES

- MEDEC INTERNATIONAL BV

- SKANRAY TECHNOLOGIES LTD.

- その他の企業

- MEDITEC INTERNATIONAL ENGLAND LTD.

- PENLON LIMITED

- SPACELABS HEALTHCARE

- TELEFLEX INCORPORATED

- SUNMED

- INFINIUM MEDICAL

- INTERSURGICAL, LTD.

- NIHON KOHDEN CORPORATION

- AVASARALA TECHNOLOGIES LIMITED

- AXCENT MEDICAL GMBH

第12章 付録

The global anesthesia equipment marketis projected to reach USD 11.0 billion by 2028 from USD 8.0 billion in 2023, at a CAGR of 6.7% during the forecast period. The integration of new technologies (like wireless communication) has improved control of anesthesia delivery and patient monitoring during procedures. Application of artificial intelligence (AI) approaches, like machine learning, has shown a great potential to further transform the field and improve patient care.

There have been several technological advancements in anesthesia equipment in recent years aimed at improving patient safety, increasing efficiency, and reducing the cost of healthcare.

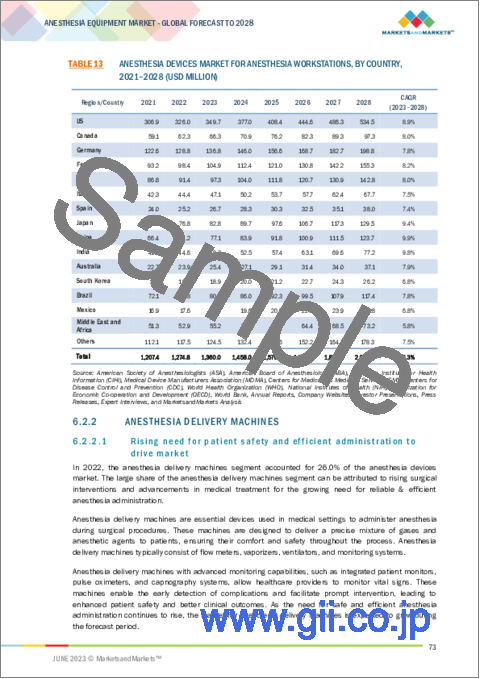

"Anesthesia workstations segment accounted for a larger share of the anesthesia devices market"

In 2022, the anesthesia workstations segment accounted for a larger share of the anesthesia devices market. This segment is also estimated to grow at a higher CAGR during the forecast period. Growth in this segment can primarily be attributed to the increasing number of surgical procedures and technological advancements.

"The cardiology will grow at highest CAGR during the forecast period"

Based on application, the cardiology will grow at highest CAGR during the forecast period. Growth in this segment can primarily be attributed to the increasing prevalence of cardiovascular diseases, the growing demand for cardiac surgeries.

"Asia Pacific will grow at highest CAGR during the forecast period"

In 2022, Asia Pacific will grow at highest CAGR during the forecast period. Major factors driving the growth of this market are the existence of a well-developed healthcare system in Japan with universal health insurance coverage and the focus of countries such as China and India on healthcare infrastructure improvements to serve large populations of patients with critical illnesses, including cancer and tumors.

The break-up of the profile of primary participants in the anesthesia equipment market:

- By Company Type: Tier 1 - 34%, Tier 2 - 38%, and Tier 3 - 28%

- By Designation: C Level - 26%, Director Level - 35%, Others-39%

- By Region: North America - 17%, Europe - 39%, Asia Pacific - 28%, Middle East - 8%, and Latin America - 8%

The prominent players in the anesthesia equipment market include GE Healthcare (US), Dragerwerk Ag & Co. KGAA (Germany), Koninklijke Philips N.V. (Netherlands), Ambu AS (Denmark), Medline Industries Inc. (US).

Research Coverage:

The report analyzes the anesthesia equipment market and aims at estimating the market size and future growth potential of this market based on various segments such as type, disease, technology, route of administration, distribution channel and region. The report also includes a product portfolio matrix of various anesthesia equipment available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, and key market strategies.

Reasons to Buy the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall anesthesia equipment market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing technological advancements in anesthesia equipment, increasing number of surgeries, growing geriatric population and rising prevalence of chronic disorders), restraints (unfavorable reimbursement scenario and shortage of medical professionals), opportunities (high growth in developing countries), and challenges (low awareness in emerging countries) influencing the growth of the anesthesia equipment market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the anesthesia equipment market

- Market Development: Comprehensive information on the lucrative emerging markets by type, application, end user and region.

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the global anesthesia equipment market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players like GE Healthcare (US), Dragerwerk Ag & Co. KGAA (Germany), Koninklijke Philips N.V. (Netherlands), Ambu AS (Denmark), Medline Industries Inc. (US) in the global anesthesia equipment market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 ANESTHESIA EQUIPMENT MARKET SEGMENTATION

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: KONINKLIJKE PHILIPS N.V.

- FIGURE 9 ANESTHESIA EQUIPMENT MARKET: SUPPLY-SIDE MARKET ESTIMATION

- FIGURE 10 ANESTHESIA EQUIPMENT MARKET: DEMAND-SIDE MARKET ESTIMATION

- FIGURE 11 ANESTHESIA EQUIPMENT MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 13 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 ANESTHESIA EQUIPMENT MARKET: RISK ASSESSMENT ANALYSIS

- 2.8 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 15 ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 ANESTHESIA EQUIPMENT MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF ANESTHESIA EQUIPMENT MARKET

4 PREMIUM INSIGHTS

- 4.1 ANESTHESIA EQUIPMENT MARKET OVERVIEW

- FIGURE 19 RISING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET

- 4.2 ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY TYPE AND COUNTRY

- FIGURE 20 ANESTHESIA DEVICES SEGMENT IN JAPAN ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.3 ANESTHESIA EQUIPMENT MARKET: GEOGRAPHICAL MIX

- FIGURE 21 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 ANESTHESIA EQUIPMENT MARKET: REGIONAL MIX

- FIGURE 22 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.5 ANESTHESIA EQUIPMENT MARKET: DEVELOPED MARKETS VS. EMERGING ECONOMIES

- FIGURE 23 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 ANESTHESIA EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising technological advancements in anesthesia equipment

- 5.2.1.2 Increasing number of surgical procedures

- 5.2.1.3 High prevalence of chronic diseases

- 5.2.2 RESTRAINTS

- 5.2.2.1 Unfavorable reimbursements across healthcare systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in emerging economies

- FIGURE 25 ANESTHESIA EQUIPMENT MARKET: GDP GROWTH FORECAST COMPARISON (2020 VS. 2040)

- 5.2.4 CHALLENGES

- 5.2.4.1 Budgetary constraints in hospitals

- 5.2.4.2 Shortage of skilled medical professionals

- 5.3 INDUSTRY TRENDS

- 5.3.1 TECHNOLOGICAL ADVANCEMENTS FOR IMPROVED PATIENT SAFETY

- 5.3.2 GROWING PREFERENCE FOR PORTABLE AND LIGHTWEIGHT ANESTHESIA DEVICES

- 5.4 REGULATORY ANALYSIS

- 5.4.1 NORTH AMERICA

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.2 EUROPE

- 5.4.3 REST OF THE WORLD

- 5.4.1 NORTH AMERICA

- 5.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 26 ANESTHESIA EQUIPMENT MARKET: VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- FIGURE 27 ANESTHESIA EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- 5.8 ECOSYSTEM MARKET MAP

- FIGURE 28 ANESTHESIA EQUIPMENT MARKET: ECOSYSTEM ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 PATENT ANALYSIS

- 5.10.1 PATENT PUBLICATION TRENDS FOR ANESTHESIA EQUIPMENT

- FIGURE 29 ANESTHESIA EQUIPMENT MARKET: GLOBAL PATENT PUBLICATION TRENDS (2015-2023)

- 5.10.2 ANESTHESIA EQUIPMENT MARKET: TOP APPLICANTS

- FIGURE 30 TOP APPLICANTS FOR ANESTHESIA EQUIPMENT PATENTS (2015-2023)

- 5.10.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS

- FIGURE 31 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR ANESTHESIA EQUIPMENT PATENTS (2015-2023)

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 PRICING MODEL ANALYSIS

- TABLE 7 AVERAGE SELLING PRICE OF ANESTHESIA EQUIPMENT OFFERED BY LEADING PLAYERS

- 5.13 KEY CONFERENCES AND EVENTS

- 5.13.1 LIST OF KEY CONFERENCES AND EVENTS (2023-2025)

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ANESTHESIA EQUIPMENT

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ANESTHESIA EQUIPMENT

- 5.14.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR ANESTHESIA EQUIPMENT

- TABLE 9 KEY BUYING CRITERIA FOR ANESTHESIA EQUIPMENT

6 ANESTHESIA EQUIPMENT MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 10 ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2 ANESTHESIA DEVICES

- TABLE 11 ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 12 ANESTHESIA DEVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1 ANESTHESIA WORKSTATIONS

- 6.2.1.1 Increasing number of surgical procedures to drive market

- TABLE 13 ANESTHESIA DEVICES MARKET FOR ANESTHESIA WORKSTATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.2 ANESTHESIA DELIVERY MACHINES

- 6.2.2.1 Rising need for patient safety and efficient administration to drive market

- TABLE 14 ANESTHESIA DEVICES MARKET FOR ANESTHESIA DELIVERY MACHINES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.3 ANESTHESIA VENTILATORS

- 6.2.3.1 Advanced monitoring capabilities and adaptive ventilation modes to support market growth

- TABLE 15 ANESTHESIA DEVICES MARKET FOR ANESTHESIA VENTILATORS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.4 ANESTHESIA MONITORS

- 6.2.4.1 Ability to provide continuous monitoring and real-time information to drive market

- TABLE 16 ANESTHESIA DEVICES MARKET FOR ANESTHESIA MONITORS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.5 OTHER DEVICES

- TABLE 17 ANESTHESIA DEVICES MARKET FOR OTHER DEVICES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 ANESTHESIA DISPOSABLES

- TABLE 18 ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 19 ANESTHESIA DISPOSABLES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.1 ANESTHESIA CIRCUITS

- 6.3.1.1 Ability to deliver gases and anesthetic agents during surgery to propel market

- TABLE 20 ANESTHESIA DISPOSABLES MARKET FOR ANESTHESIA CIRCUITS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2 ANESTHESIA MASKS

- 6.3.2.1 Advancements in mask design to support market growth

- TABLE 21 ANESTHESIA DISPOSABLES MARKET FOR ANESTHESIA MASKS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.3 ENDOTRACHEAL TUBES

- 6.3.3.1 Reduced risk of HAIs to fuel uptake

- TABLE 22 ANESTHESIA DISPOSABLES MARKET FOR ENDOTRACHEAL TUBES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.4 LARYNGEAL MASK AIRWAYS

- 6.3.4.1 Less invasive method for delivery of anesthetic gases to support market growth

- TABLE 23 ANESTHESIA DISPOSABLES MARKET FOR LARYNGEAL MASK AIRWAYS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.5 OTHER ACCESSORIES

- TABLE 24 ANESTHESIA DISPOSABLES MARKET FOR OTHER ACCESSORIES, BY COUNTRY, 2021-2028 (USD MILLION)

7 ANESTHESIA EQUIPMENT MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 25 ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 7.2 ORTHOPEDICS

- 7.2.1 RISING NEED FOR PATIENT COMFORT DURING SURGICAL PROCEDURES TO DRIVE MARKET

- TABLE 26 ANESTHESIA EQUIPMENT MARKET FOR ORTHOPEDICS, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 NEUROLOGY

- 7.3.1 INCREASING UPTAKE OF ANESTHESIA DELIVERY MACHINES TO SUPPORT MARKET GROWTH

- TABLE 27 ANESTHESIA EQUIPMENT MARKET FOR NEUROLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 RESPIRATORY CARE

- 7.4.1 RISING DEMAND FOR ADVANCED RESPIRATORY SUPPORT AND VENTILATION SYSTEMS TO PROPEL MARKET

- TABLE 28 ANESTHESIA EQUIPMENT MARKET FOR RESPIRATORY CARE, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.5 UROLOGY

- 7.5.1 INCREASING PREVALENCE OF UROLOGICAL CONDITIONS TO SUPPORT MARKET GROWTH

- TABLE 29 ANESTHESIA EQUIPMENT MARKET FOR UROLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.6 CARDIOLOGY

- 7.6.1 GROWING PREFERENCE FOR MINIMALLY INVASIVE CARDIAC INTERVENTIONS TO DRIVE MARKET

- TABLE 30 ANESTHESIA EQUIPMENT MARKET FOR CARDIOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.7 OTHER APPLICATIONS

- TABLE 31 ANESTHESIA EQUIPMENT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

8 ANESTHESIA EQUIPMENT MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 32 ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 HOSPITALS

- 8.2.1 GROWING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES TO PROPEL MARKET

- TABLE 33 ANESTHESIA EQUIPMENT MARKET FOR HOSPITALS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 CLINICS

- 8.3.1 RISING PREVALENCE OF TARGET CONDITIONS TO SUPPORT MARKET GROWTH

- TABLE 34 ANESTHESIA EQUIPMENT MARKET FOR CLINICS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 AMBULATORY SURGERY CENTERS

- 8.4.1 INCREASING NUMBER OF OUTPATIENT VISITS AND REDUCED COSTS TO DRIVE MARKET

- TABLE 35 ANESTHESIA EQUIPMENT MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.5 OTHER END USERS

- TABLE 36 ANESTHESIA EQUIPMENT MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

9 ANESTHESIA EQUIPMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 34 ANESTHESIA EQUIPMENT MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- TABLE 37 ANESTHESIA EQUIPMENT MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 EUROPE

- FIGURE 35 EUROPE: ANESTHESIA EQUIPMENT MARKET SNAPSHOT

- TABLE 38 EUROPE: ANESTHESIA EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 39 EUROPE: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 40 EUROPE: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 41 EUROPE: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 42 EUROPE: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 43 EUROPE: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1 GERMANY

- 9.2.1.1 High healthcare spending for innovative medical technologies to drive market

- TABLE 44 GERMANY: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 45 GERMANY: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 46 GERMANY: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 47 GERMANY: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 48 GERMANY: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.2 FRANCE

- 9.2.2.1 Favorable reimbursements and advanced healthcare infrastructure to fuel market

- TABLE 49 FRANCE: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 50 FRANCE: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 51 FRANCE: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 52 FRANCE: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 53 FRANCE: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.3 UK

- 9.2.3.1 Rising investments by hospitals in medical equipment to propel market

- TABLE 54 UK: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 55 UK: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 56 UK: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 57 UK: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 58 UK: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.4 ITALY

- 9.2.4.1 High growth in medical device industry to fuel uptake

- TABLE 59 ITALY: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 60 ITALY: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 61 ITALY: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 62 ITALY: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 63 ITALY: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.5 SPAIN

- 9.2.5.1 Rising prevalence of cancer to drive market

- TABLE 64 SPAIN: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 65 SPAIN: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 66 SPAIN: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 67 SPAIN: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 68 SPAIN: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.6 REST OF EUROPE

- TABLE 69 REST OF EUROPE: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 70 REST OF EUROPE: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 71 REST OF EUROPE: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 72 REST OF EUROPE: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 73 REST OF EUROPE: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.7 EUROPE: RECESSION IMPACT

- 9.3 NORTH AMERICA

- TABLE 74 NORTH AMERICA: ANESTHESIA EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1 US

- 9.3.1.1 Favorable reimbursement policies for surgical procedures to drive market

- TABLE 80 US: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 81 US: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 82 US: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 83 US: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 84 US: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.2 CANADA

- 9.3.2.1 Rising prevalence of target conditions to drive market

- TABLE 85 CANADA: AGE-STANDARDIZED INCIDENCE RATES (ASIR) FOR SELECTED CANCERS IN MEN AND WOMEN, 2020 VS. 2040

- TABLE 86 CANADA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 87 CANADA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 88 CANADA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 89 CANADA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 90 CANADA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.3 NORTH AMERICA: RECESSION IMPACT

- 9.4 ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET SNAPSHOT

- TABLE 91 ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.1 JAPAN

- 9.4.1.1 Supportive medical device reimbursement policies to drive market

- TABLE 97 JAPAN: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 98 JAPAN: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 99 JAPAN: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 JAPAN: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 101 JAPAN: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Large target patient pool and rise in age-associated surgeries to fuel market

- TABLE 102 CHINA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 CHINA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 104 CHINA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 CHINA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 106 CHINA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Government initiatives for improvements in healthcare infrastructure to support market growth

- TABLE 107 INDIA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 108 INDIA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 109 INDIA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 110 INDIA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 111 INDIA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.4 AUSTRALIA

- 9.4.4.1 Growing awareness campaigns for novel technologies to drive market

- TABLE 112 AUSTRALIA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 AUSTRALIA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 114 AUSTRALIA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 AUSTRALIA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 116 AUSTRALIA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Significant uptake of anesthesia equipment technology to support market growth

- TABLE 117 SOUTH KOREA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 118 SOUTH KOREA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 119 SOUTH KOREA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 SOUTH KOREA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 121 SOUTH KOREA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 122 REST OF ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.7 ASIA PACIFIC: RECESSION IMPACT

- 9.5 LATIN AMERICA

- TABLE 127 LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 129 LATIN AMERICA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 130 LATIN AMERICA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 131 LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.1 BRAZIL

- 9.5.1.1 Universal public health coverage system to support market growth

- TABLE 133 BRAZIL: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 134 BRAZIL: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 135 BRAZIL: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 BRAZIL: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 137 BRAZIL: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.2 MEXICO

- 9.5.2.1 Rising initiatives on import of medical devices to support market growth

- TABLE 138 MEXICO: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 139 MEXICO: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 MEXICO: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 MEXICO: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 142 MEXICO: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.3 REST OF LATIN AMERICA

- TABLE 143 REST OF LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 REST OF LATIN AMERICA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 145 REST OF LATIN AMERICA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 REST OF LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 147 REST OF LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.4 LATIN AMERICA: RECESSION IMPACT

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 IMPROVEMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- 9.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 148 MIDDLE EAST & AFRICA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS

- FIGURE 37 ANESTHESIA EQUIPMENT MARKET: REVENUE SHARE ANALYSIS OF KEY PLAYERS

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 38 ANESTHESIA EQUIPMENT MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- 10.5 ANESTHESIA EQUIPMENT MARKET: COMPANY FOOTPRINT ANALYSIS

- 10.5.1 ANESTHESIA EQUIPMENT MARKET: COMPANY FOOTPRINT, BY TYPE

- 10.5.2 ANESTHESIA EQUIPMENT MARKET: COMPANY FOOTPRINT, BY END USER

- 10.5.3 ANESTHESIA EQUIPMENT MARKET: COMPANY FOOTPRINT, BY REGION

- 10.6 COMPANY EVALUATION MATRIX

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 39 ANESTHESIA EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (2022)

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 153 ANESTHESIA EQUIPMENT MARKET: COMPETITIVE BENCHMARKING FOR KEY STARTUPS/SMES (2022)

- 10.8 COMPETITIVE SCENARIO AND TRENDS

- 10.8.1 PRODUCT LAUNCHES & APPROVALS

- TABLE 154 ANESTHESIA EQUIPMENT MARKET: PRODUCT LAUNCHES & APPROVALS (JANUARY 2019-JUNE 2023)

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1.1 KONINKLIJKE PHILIPS N.V.

- TABLE 155 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- FIGURE 40 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- 11.1.2 AMBU A/S

- TABLE 156 AMBU A/S: BUSINESS OVERVIEW

- FIGURE 41 AMBU A/S: COMPANY SNAPSHOT (2022)

- 11.1.3 DRAGERWERK AG & CO. KGAA

- TABLE 157 DRAGERWERK AG & CO. KGAA: BUSINESS OVERVIEW

- FIGURE 42 DRAGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2022)

- 11.1.4 GE HEALTHCARE

- TABLE 158 GE HEALTHCARE: BUSINESS OVERVIEW

- FIGURE 43 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- 11.1.5 BEIJING AEONMED CO., LTD.

- TABLE 159 BEIJING AEONMED CO., LTD.: BUSINESS OVERVIEW

- 11.1.6 MEDTRONIC PLC

- TABLE 160 MEDTRONIC PLC: BUSINESS OVERVIEW

- FIGURE 44 MEDTRONIC PLC: COMPANY SNAPSHOT (2022)

- 11.1.7 GETINGE AB

- TABLE 161 GETINGE AB: BUSINESS OVERVIEW

- FIGURE 45 GETINGE AB: COMPANY SNAPSHOT (2022)

- 11.1.8 BECTON, DICKINSON AND COMPANY

- TABLE 162 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- FIGURE 46 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- 11.1.9 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- TABLE 163 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: BUSINESS OVERVIEW

- FIGURE 47 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY SNAPSHOT (2022)

- 11.1.10 FISHER & PAYKEL HEALTHCARE CO. LTD.

- TABLE 164 FISHER & PAYKEL HEALTHCARE CO. LTD.: BUSINESS OVERVIEW

- FIGURE 48 FISHER & PAYKEL HEALTHCARE CO. LTD.: COMPANY SNAPSHOT (2022)

- 11.1.11 MEDLINE INDUSTRIES, INC.

- TABLE 165 MEDLINE INDUSTRIES INC.: BUSINESS OVERVIEW

- 11.1.12 SHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD.

- TABLE 166 SHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD.: BUSINESS OVERVIEW

- 11.1.13 ALLIED MEDICAL LIMITED

- TABLE 167 ALLIED MEDICAL LIMITED: BUSINESS OVERVIEW

- 11.1.14 BPL MEDICAL TECHNOLOGIES

- TABLE 168 BPL MEDICAL TECHNOLOGIES: BUSINESS OVERVIEW

- 11.1.15 MEDEC INTERNATIONAL BV

- TABLE 169 MEDEC INTERNATIONAL BV: BUSINESS OVERVIEW

- 11.1.16 SKANRAY TECHNOLOGIES LTD.

- TABLE 170 SKANRAY TECHNOLOGIES LTD.: BUSINESS OVERVIEW

- 11.2 OTHER COMPANIES

- 11.2.1 MEDITEC INTERNATIONAL ENGLAND LTD.

- 11.2.2 PENLON LIMITED

- 11.2.3 SPACELABS HEALTHCARE

- 11.2.4 TELEFLEX INCORPORATED

- 11.2.5 SUNMED

- 11.2.6 INFINIUM MEDICAL

- 11.2.7 INTERSURGICAL, LTD.

- 11.2.8 NIHON KOHDEN CORPORATION

- 11.2.9 AVASARALA TECHNOLOGIES LIMITED

- 11.2.10 AXCENT MEDICAL GMBH

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS