|

|

市場調査レポート

商品コード

1305952

薄型・プリント電池の世界市場:種類別 (薄型、プリント)・電圧別 (1.5V未満、1.5~3V、3V超)・容量別 (10mAh未満、10~100mAh、100mAh超)・電池の種類別 (一次電池、二次電池)・用途別・地域別の将来予測 (2028年まで)Thin Film and Printed Battery Market by Type (Thin Film, Printed), Voltage (Below 1.5 V, 1.5 to 3 V, Above 3 V), Capacity (Below 10 mAh, 10 to 100 mAh, Above 100 mAh), Battery Type (Primary, Secondary), Application, Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 薄型・プリント電池の世界市場:種類別 (薄型、プリント)・電圧別 (1.5V未満、1.5~3V、3V超)・容量別 (10mAh未満、10~100mAh、100mAh超)・電池の種類別 (一次電池、二次電池)・用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年07月03日

発行: MarketsandMarkets

ページ情報: 英文 199 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の薄型・プリント電池の市場規模は、2023年の1億8,700万米ドルから、2028年には6億5,000万米ドルに達し、2023年から2028年までの間に28.2%のCAGRで成長すると予測されています。

薄型・プリント電池の需要増加は、折りたたみ型電子機器やスマートウェアラブルの技術革新が進んでいること、医療機器や電子機器における薄型・フレキシブル電池の需要が高まっていることに起因しています。

"電圧1.5~3Vのセグメントが、予測期間中に著しいCAGRで成長する"

電圧が1.5~3Vの薄型・プリント電池は、非常に薄く軽量で柔軟性があり、耐久性に優れています。形状やサイズもさまざまです。これらの電池には水銀・鉛・カドミウムなどの重金属成分が含まれていません。この電圧範囲の薄型・プリント電池は、密閉型セル構造であるため、過酷な環境でも効果的に機能します。また、完全に安全な使い捨てが可能です。これらの電池は薄く柔軟なフォームファクターを持ち、RFIDタグ、医療機器、電源付きスマートカードに使用されています。これらの電池はポリマーラミネートで作られた外部筐体を持っています。電圧、サイズ、形状、容量、極性において高度にカスタマイズ可能です。

"スマート包装が予測期間中に相当量のシェアを占める"

薄型・プリント電池は薄く、柔軟で軽量です。エネルギーを失うことなく転がすことができ、廃棄も簡単です。そのため、スマート包装メーカーは、かさばり硬い従来の電池よりも薄型・プリント電池を好みます。包装メーカーによる薄型電池の採用の増加は、予測期間中のスマート包装セグメントの成長を促進すると予想されます。パワーカードとしても知られるスマートカードも、自己完結型の電源を必要とします。スマートカードと一体化した薄型・プリント電池は通常、寿命が尽きるとスマートカードとともに廃棄されます。このため、スマートカードへの使い捨て型電池の導入が増加しています。

"欧州市場は予測期間中に著しいCAGRで成長する"

欧州市場は予測期間中に著しいCAGRで成長すると予測されています。欧州市場は、IoTデバイスの需要増加、ウェアラブル分野の活況、薄型・プリント電池の研究開発活動の増加、同地域の薄型・プリント電池生産に対する各国政府の支援の高まりによって成長しています。欧州の包装業界では、最終消費者の衛生と利便性を向上させるために包装メーカーがスマート包装を選択し、スマート包装の採用が増加しています。このため、包装メーカーはディスプレイ、RFIDタグ、スマートラベルをパッケージに使用するようになっています。さらに、欧州各国の政府は、ワイヤレス用途におけるIoTとクラウドコンピューティングの採用を推進しており、薄型電源の需要につながっています。これらすべての要因が、欧州における薄型・プリント電池の需要を促進すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 薄型・プリント電池の進化

- バリューチェーン分析

- エコシステムマッピング

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主要な会議とイベント (2023年~2024年)

- 関税・規制状況

第6章 薄型・プリント電池市場:コンポーネント別

- イントロダクション

- 電極

- カソード

- アノード

- 基板

- 電解質

- その他のコンポーネント

第7章 薄型・プリント電池市場:材料別

- イントロダクション

- リチウムイオン

- リチウムポリマー

- 亜鉛

第8章 薄型・プリント電池市場:種類別

- イントロダクション

- 薄型電池

- プリント電池

第9章 薄型・プリント電池市場:電圧別

- イントロダクション

- 1.5V未満

- 1.5~3V

- 3V超

第10章 薄型・プリント電池市場:容量別

- イントロダクション

- 10mAh未満

- 10~100mAh

- 100mAh超

第11章 薄型・プリント電池市場:電池の種類別

- イントロダクション

- 一次電池

- 二次電池

第12章 薄型・プリント電池市場:用途別

- イントロダクション

- 民生用電子機器

- スマートフォン/タブレット

- ウェアラブルデバイス

- 医療機器

- 美容用・医療用パッチ

- ペースメーカー

- 補聴器

- 医療用インプラント

- スマート包装

- スマートラベル

- スマートカード

- ワイヤレスセンサー

- その他

第13章 薄型・プリント電池市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋

- その他の地域 (ROW)

- 中東・アフリカ

- 南米

第14章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 上位5企業の収益分析

- 市場シェア分析 (2022年)

- 企業評価マトリックス (2022年)

- 企業評価マトリックス:中小企業向け (2022年)

- 薄型・プリント電池市場:企業のフットプリント

- 競合ベンチマーキング

- 競争シナリオと動向

第15章 企業プロファイル

- 主要企業

- SAMSUNG SDI CO., LTD.

- ENFUCELL

- MOLEX, LLC

- NGK INSULATORS, LTD.

- ULTRALIFE CORPORATION

- CYMBET CORPORATION

- ILIKA PLC

- JENAX INC.

- PROLOGIUM TECHNOLOGY CO., LTD.

- RENATA SA

- VARTA AG

- その他の企業

- CENTRAL MIDORI INT'L PTE LTD.

- ENERGY DIAGNOSTICS

- GMB CO., LTD.

- IMPRINT ENERGY

- PRELONIC TECHNOLOGIES

- PRINTED ENERGY PTY LTD.

- ROCKET POLAND SP. Z O.O.

- SHENZHEN GREPOW BATTERY CO., LTD.

- ZINERGY

第16章 隣接・関連市場

- イントロダクション

- フロー電池市場:用途別

第17章 付録

The global thin film and printed battery market size is expected to grow from USD 187 million in 2023 to USD 650 million by 2028, at a CAGR of 28.2% from 2023 to 2028. The increasing demand for thin film and printed batteries can be attributed to the growing innovations in foldable electronics and smart wearables and the rising demand for thin and flexible batteries in medical and electronic devices.

" 1.5 to 3 V voltage segment is projected to grow at significant CAGR during the forecast period"

Thin film and printed batteries ranging from 1.5 to 3 V are extremely thin, lightweight, flexible, and durable. They are available in different shapes and sizes. These batteries have no heavy metal components such as mercury, lead, and cadmium. Thin film and printed batteries with this voltage range have sealed cell construction, allowing them to function effectively in severe environments. They are also entirely and safely disposable. These batteries have a thin, flexible form factor and are used in RFID tags, medical devices, and smart-powered cards. These batteries have an exterior casing made of polymer laminates. They are highly customizable in voltage, size, shape, capacity, and polarity.

"Smart Packaging is expected to hold a considerable share during the forecast period"

Thin film and printed batteries are thin, flexible, and lightweight. They can be rolled without any loss of energy and are easy to dispose of. Thus, smart packaging manufacturers prefer thin film and printed batteries over conventional batteries, which are bulky and rigid. The increasing adoption of thin film batteries by packaging manufacturers is expected to fuel the growth of the smart packaging segment during the forecast period. Smart cards, also known as power cards, also require a self-contained power source. Thin film and printed batteries integrated with smart cards are usually disposed of, along with the smart cards, at the end of their lifespan. This leads to increased deployment of single-use batteries in smart cards.

"The market in Europe is expected to grow at a significant CAGR during the forecast period"

Europe is projected to grow at a significant CAGR during the forecast period. The European market is growing due to the increasing demand for IoT devices, the booming wearables sector, increasing R&D activities for thin film and printed batteries, and the rising support of governments of different countries for the region's thin film and printed battery production. The European packaging industry is witnessing an increased adoption of smart packaging as manufacturers opt for this packaging to ensure improved hygiene and convenience for end consumers. This drives packaging manufacturers to use displays, RFID tags, and smart labels in their packages. Moreover, the governments of different European countries are promoting the adoption of IoT and cloud computing in wireless applications, thereby leading to the demand for thin power sources. All these factors are expected to drive the demand for thin film and printed batteries in Europe.

Breakdown of the profiles of primary participants:

- By Company Type: Tier 1 - 25%, Tier 2 - 30%, and Tier 3 - 45%

- By Designation: C-level Executives - 50%, Directors - 27%, and Others - 23%

- By Region: North America - 38%, Europe - 25%, Asia Pacific - 30%, and RoW - 7%

Major players profiled in this report are as follows: Samsung SDI Co., Ltd. (South Korea), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), NGK Insulators, Ltd. (Japan), Cymbet Corporation (US), Ilika plc (UK), Jenax Inc. (South Korea), ProLogium Technology Co., Ltd. (Taiwan), Renata SA (Switzerland), and VARTA AG (Germany), and others.

Research Coverage

This report has segmented the thin film and printed battery market based on component, material, type, voltage, capacity, battery type, application, and region. The thin film and printed battery market based on component has been segmented into electrodes, substrates, and electrolytes. The market has been segmented based on material: lithium-Ion, lithium polymer, and zinc. The market has been segmented based on type into thin film and printed batteries. The market has been segmented based on voltage into below 1.5 V, 1.5 to 3 V, and above 3 V. Based on capacity, the market has been segmented into below 10 mAh, 10 to 100 mAh, and above 100 mAh. The market has been segmented into primary and secondary batteries based on battery type. Based on application, the market has been segmented into consumer electronics, medical devices, smart packaging, smart cards, wireless sensors, and others. The study also forecasts the market size in four key regions-North America, Europe, Asia Pacific, and RoW.

Key Benefits of Buying the Report:

The report provides insights on the following pointers:

Analysis of key drivers (Growing emphasis on foldable electronics and wearables; Proliferation of thin, flexible, and printed batteries in medical and electronic devices; Rising trend of miniaturized electronic devices, Rising demand for printed flexible batteries in IoT sector), restraints (High initial investments, Lack of standardization), opportunities (Advancements in next-generation thin film and printed lithium-air batteries, Increasing adoption of wireless sensors globally), and challenges (Fabrication complexity of thin film lithium-ion batteries, Selection of raw materials and their costs, Low energy density challenges) influencing the growth of the thin film and printed battery market

Product Development/Innovation: Detailed insights on upcoming products, technologies, research & development activities, funding activities, industry partnerships, and new product launches in the thin film and printed battery market

Market Development: Comprehensive information about lucrative markets - the report analyses the thin film and printed battery market across regions such as North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Market Diversification: Exhaustive information about new products & technologies, untapped geographies, recent developments, and investments in the thin film and printed battery market

Competitive Assessment: In-depth assessment of market ranks, growth strategies, and product offerings of leading players like Samsung SDI Co., Ltd. (South Korea), Enfucell (Finland), Ultralife Corporation (US), and Molex, LLC (US), among others in the thin film and printed battery market

Strategies: The report also helps stakeholders understand the pulse of the thin film and printed battery market and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 REGIONAL SCOPE

- FIGURE 2 REGIONAL ANALYSIS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 3 THIN FILM AND PRINTED BATTERY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 4 THIN FILM AND PRINTED BATTERY MARKET: RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market share using bottom-up analysis

- FIGURE 5 THIN FILM AND PRINTED BATTERY MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market share using top-down analysis

- FIGURE 6 THIN FILM AND PRINTED BATTERY MARKET: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR THIN FILM AND PRINTED BATTERY MARKET: SUPPLY-SIDE ANALYSIS

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 9 ASSUMPTIONS

- 2.5 RECESSION IMPACT ON THIN FILM AND PRINTED BATTERY MARKET

- 2.6 RISK ASSESSMENT

- TABLE 1 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 10 THIN FILM AND PRINTED BATTERY MARKET, 2019-2028 (USD MILLION)

- FIGURE 11 THIN FILM BATTERIES TYPE TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 12 10 TO 100 MAH SEGMENT TO HOLD LARGEST SHARE OF THIN FILM AND PRINTED BATTERY MARKET IN 2022

- FIGURE 13 MEDICAL DEVICES SEGMENT TO DOMINATE THIN FILM AND PRINTED BATTERY MARKET IN 2028

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN THIN FILM AND PRINTED BATTERY MARKET

- FIGURE 15 GROWING DEMAND FOR FOLDABLE ELECTRONICS AND WEARABLES TO DRIVE MARKET

- 4.2 THIN FILM AND PRINTED BATTERY MARKET, BY TYPE

- FIGURE 16 THIN FILM BATTERIES SEGMENT TO CAPTURE LARGER MARKET SHARE THROUGHOUT FORECAST PERIOD

- 4.3 THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION

- FIGURE 17 MEDICAL DEVICES SEGMENT TO DOMINATE MARKET IN 2028

- 4.4 THIN FILM AND PRINTED BATTERY MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

- FIGURE 18 MEDICAL DEVICES AND US TO HOLD LARGEST SHARE OF NORTH AMERICAN MARKET THIN FILM AND PRINTED BATTERY MARKET IN 2028

- 4.5 THIN FILM AND PRINTED BATTERY MARKET, BY COUNTRY

- FIGURE 19 CHINA TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 THIN FILM AND PRINTED BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for foldable electronics and wearables

- 5.2.1.2 Adoption of thin, flexible, and printed batteries in wearable medical devices

- 5.2.1.3 Rising trend of miniaturization across sectors

- 5.2.1.4 Extensive use of IoT devices

- FIGURE 21 IMPACT OF DRIVERS ON THIN FILM AND PRINTED BATTERY MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investments required for manufacturing printed batteries

- 5.2.2.2 Lack of standardization in battery manufacturing processes

- FIGURE 22 IMPACT OF RESTRAINTS ON THIN FILM AND PRINTED BATTERY MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption of wireless sensors

- 5.2.3.2 Development of next-generation thin film lithium-air batteries

- FIGURE 23 IMPACT OF OPPORTUNITIES ON THIN FILM AND PRINTED BATTERY MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Fabrication challenges associated with thin film batteries

- 5.2.4.2 High cost of raw materials

- FIGURE 24 IMPACT OF CHALLENGES ON THIN FILM AND PRINTED BATTERY MARKET

- 5.3 EVOLUTION OF THIN FILM AND PRINTED BATTERIES

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 25 THIN FILM AND PRINTED BATTERY MARKET: VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM MAPPING

- FIGURE 26 THIN FILM AND PRINTED BATTERY MARKET: ECOSYSTEM MAPPING

- TABLE 2 THIN FILM AND BATTERY MARKET: ROLE OF KEY COMPANIES IN ECOSYSTEM

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND

- FIGURE 27 AVERAGE SELLING PRICE TREND FOR THIN FILM AND PRINTED BATTERIES, 2022-2028

- 5.6.2 AVERAGE SELLING PRICE TREND, BY TYPE

- TABLE 3 THIN FILM AND PRINTED BATTERY MARKET: AVERAGE SELLING PRICE AND VOLUME

- 5.6.3 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- FIGURE 28 AVERAGE SELLING PRICE OF THIN FILM AND PRINTED BATTERY OFFERED BY KEY PLAYER

- TABLE 4 AVERAGE SELLING PRICE OF THIN FILM BATTERIES OFFERED BY KEY PLAYER

- TABLE 5 AVERAGE SELLING PRICE OF THIN FILM AND PRINTED BATTERIES, BY REGION

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN THIN FILM AND PRINTED BATTERY MARKET

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 SOLID-STATE BATTERIES

- 5.8.2 METAL-AIR BATTERIES

- 5.8.3 LIQUID-METAL BATTERIES

- 5.8.4 ZINC-MANGANESE BATTERIES

- 5.8.5 VANADIUM-FLOW BATTERIES

- 5.8.6 LITHIUM-SILICON BATTERIES

- 5.8.7 LITHIUM-COBALT OXIDE BATTERIES

- 5.8.8 NICKEL-MANGANESE-COBALT BATTERIES

- 5.8.9 LITHIUM-NICKEL-COBALT-ALUMINUM OXIDE BATTERIES

- 5.8.10 LITHIUM-SULFUR BATTERIES

- 5.9 PORTER'S FIVE FORCE ANALYSIS

- TABLE 6 THIN FILM AND PRINTED BATTERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 THIN FILM AND PRINTED BATTERY MARKET: PORTERS FIVE FORCES ANALYSIS, 2022

- 5.9.1 BARGAINING POWER OF SUPPLIERS

- 5.9.2 BARGAINING POWER OF BUYERS

- 5.9.3 THREAT OF NEW ENTRANTS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- 5.10.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.11 CASE STUDY ANALYSIS

- TABLE 9 THIN FILM BATTERIES USED IN SPORTS APPLICATIONS

- TABLE 10 THIN FILM BATTERIES USED IN POWER SKIN PATCHES

- TABLE 11 SAFE BED-EXIT SENSORS DEVELOPED USING THIN FILM BATTERIES

- TABLE 12 NGK INSULATORS, LTD. AND INNOLUX CORPORATION DEVELOPED FLEXIBLE SENSOR TAG EQUIPPED WITH THIN FILM BATTERIES TO TRACK SHIPMENTS

- TABLE 13 NGK INSULATORS' ENERCERA THIN BATTERIES POWERED BITKEY'S COMPACT CARD-SIZED KEY

- 5.12 TRADE ANALYSIS

- FIGURE 33 IMPORT DATA FOR LITHIUM CELLS AND BATTERIES, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 34 EXPORT DATA FOR LITHIUM CELLS AND BATTERIES, BY COUNTRY, 2018-2022 (USD MILLION)

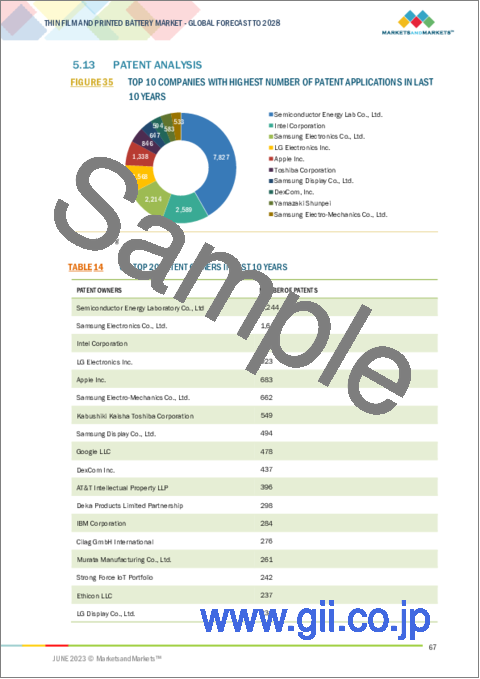

- 5.13 PATENT ANALYSIS

- FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 14 US: TOP 20 PATENT OWNERS IN LAST 10 YEARS

- FIGURE 36 NUMBER OF PATENTS GRANTED PER YEAR, 2013-2022

- TABLE 15 THIN FILM AND PRINTED BATTERY MARKET: LIST OF PATENTS, 2019-2022

- 5.14 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 16 THIN FILM AND PRINTED BATTERY MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS

- TABLE 21 STANDARDS FOR THIN FILM AND PRINTED BATTERY MARKET

6 THIN FILM AND PRINTED BATTERY MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 37 THIN FILM AND PRINTED BATTERY MARKET, BY COMPONENT

- 6.2 ELECTRODES

- 6.2.1 CATHODE

- 6.2.2 ANODE

- 6.3 SUBSTRATES

- 6.4 ELECTROLYTES

- 6.5 OTHER COMPONENTS

7 THIN FILM AND PRINTED BATTERY MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- FIGURE 38 THIN FILM AND PRINTED BATTERY MARKET, BY MATERIAL

- 7.2 LITHIUM-ION

- 7.3 LITHIUM POLYMER

- 7.4 ZINC

8 THIN FILM AND PRINTED BATTERY MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 39 THIN FILM AND PRINTED BATTERY MARKET, BY TYPE

- FIGURE 40 THIN FILM BATTERIES TO HOLD LARGER MARKET SHARE BY 2028

- TABLE 22 THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 23 THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.2 THIN FILM BATTERIES

- 8.2.1 SAFETY CONCERNS IN COMPACT DEVICES TO BOOST DEMAND FOR THIN FILM BATTERIES

- TABLE 24 THIN FILM BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 25 THIN FILM BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 26 THIN FILM BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 27 THIN FILM BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY VOLTAGE, 2023-2028 (USD MILLION)

- TABLE 28 THIN FILM BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 29 THIN FILM BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 30 THIN FILM BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 31 THIN FILM BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 PRINTED BATTERIES

- 8.3.1 NON-TOXIC, NON-VOLATILE, AND MODERATE POWER CAPACITY FEATURES OF PRINTED BATTERIES TO DRIVE SEGMENTAL GROWTH

- TABLE 32 PRINTED BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 33 PRINTED BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 34 PRINTED BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 35 PRINTED BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY VOLTAGE, 2023-2028 (USD MILLION)

- TABLE 36 PRINTED BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 37 PRINTED BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 38 PRINTED BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 PRINTED BATTERIES: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

9 THIN FILM AND PRINTED BATTERY MARKET, BY VOLTAGE

- 9.1 INTRODUCTION

- FIGURE 41 THIN FILM AND PRINTED BATTERY, BY VOLTAGE

- FIGURE 42 1.5 TO 3 V SEGMENT TO CAPTURE LARGEST MARKET SHARE BY 2028

- TABLE 40 THIN FILM AND PRINTED BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 41 THIN FILM AND PRINTED BATTERY MARKET, BY VOLTAGE, 2023-2028 (USD MILLION)

- 9.2 BELOW 1.5 V

- 9.2.1 IDEAL FOR LOW-POWER SINGLE-USE APPLICATIONS

- 9.3 1.5 TO 3 V

- 9.3.1 SUITABLE FOR USAGE IN MEDICAL DEVICES

- 9.4 ABOVE 3 V

- 9.4.1 USED IN CONSUMER ELECTRONICS AND WEARABLES DUE TO THEIR LIGHT WEIGHT AND COMPACT DESIGN

10 THIN FILM AND PRINTED BATTERY MARKET, BY CAPACITY

- 10.1 INTRODUCTION

- FIGURE 43 THIN FILM AND PRINTED BATTERY, BY CAPACITY

- FIGURE 44 10 TO 100 MAH THIN FILM AND PRINTED BATTERIES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- TABLE 42 THIN FILM AND PRINTED BATTERY MARKET, BY CAPACITY, 2019-2022 (USD MILLION)

- TABLE 43 THIN FILM AND PRINTED BATTERY MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- 10.2 BELOW 10 MAH

- 10.2.1 INCREASING DEMAND FOR LIGHTWEIGHT AND COMPACT BATTERIES TO DRIVE SEGMENTAL GROWTH

- 10.3 10 TO 100 MAH

- 10.3.1 GROWING TREND OF PORTABLE ELECTRONICS TO BOOST DEMAND FOR BATTERIES WITH CAPACITY OF 10 TO 100 MAH

- 10.4 ABOVE 100 MAH

- 10.4.1 BOOMING MARKET FOR CONSUMER ELECTRONICS TO ACCELERATE DEMAND FOR ABOVE 100 MAH BATTERIES

11 THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE

- 11.1 INTRODUCTION

- FIGURE 45 THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE

- FIGURE 46 SECONDARY BATTERIES TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 44 THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 45 THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- 11.2 PRIMARY

- 11.2.1 RISING DEMAND FOR LOW-COST AND ECO-FRIENDLY BATTERIES ACROSS APPLICATIONS TO DRIVE SEGMENTAL GROWTH

- TABLE 46 PRIMARY: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 47 PRIMARY: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 48 PRIMARY: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 49 PRIMARY: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3 SECONDARY

- 11.3.1 ADOPTION OF WEARABLES AND MEDICAL DEVICES TO BOOST DEMAND FOR SECONDARY BATTERIES

- TABLE 50 SECONDARY: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 51 SECONDARY: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 52 SECONDARY: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 53 SECONDARY: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

12 THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- FIGURE 47 THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION

- FIGURE 48 MEDICAL DEVICES SEGMENT TO LEAD THIN FILM AND PRINTED BATTERY MARKET IN 2028

- TABLE 54 THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 55 THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 56 THIN FILM AND PRINTED BATTERY MARKET: APPLICATION ROADMAP

- 12.2 CONSUMER ELECTRONICS

- 12.2.1 THRIVING CONSUMER ELECTRONICS INDUSTRY TO BOOST DEMAND FOR THIN FILM AND PRINTED BATTERIES

- 12.2.2 SMARTPHONES/TABLETS

- 12.2.3 WEARABLE DEVICES

- TABLE 57 CONSUMER ELECTRONICS: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 58 CONSUMER ELECTRONICS: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 59 CONSUMER ELECTRONICS: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3 MEDICAL DEVICES

- 12.3.1 INTEGRATION OF FLEXIBLE BATTERIES INTO MEDICAL DEVICES OWING TO THEIR RELIABILITY TO DRIVE MARKET

- 12.3.2 COSMETIC AND MEDICAL PATCHES

- 12.3.3 PACEMAKERS

- 12.3.4 HEARING AIDS

- 12.3.5 MEDICAL IMPLANTS

- TABLE 60 MEDICAL DEVICES: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 61 MEDICAL DEVICES: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 62 MEDICAL DEVICES: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 63 MEDICAL DEVICES: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 64 MEDICAL DEVICES: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 MEDICAL DEVICES: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.4 SMART PACKAGING

- 12.4.1 RISING INCLINATION TOWARD SMART PACKAGING PRODUCTS TO BOOST DEMAND FOR THIN FILM AND PRINTED BATTERIES

- 12.4.2 SMART LABELS

- TABLE 66 SMART PACKAGING: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 67 SMART PACKAGING: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 68 SMART PACKAGING: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 69 SMART PACKAGING: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 70 SMART PACKAGING: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 71 SMART PACKAGING: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.5 SMART CARDS

- 12.5.1 GROWING USE OF SELF-POWERED CREDIT, GIFT, AND ACCESS CARDS TO FUEL DEMAND FOR THIN FILM AND PRINTED BATTERIES

- TABLE 72 SMART CARDS: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 73 SMART CARDS: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 74 SMART CARDS: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 75 SMART CARDS: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 76 SMART CARDS: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 SMART CARDS: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.6 WIRELESS SENSORS

- 12.6.1 SPACE CONSTRAINTS OF WIRELESS SENSORS TO PROMOTE USE OF THIN FILM AND PRINTED BATTERIES

- TABLE 78 WIRELESS SENSORS: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 79 WIRELESS SENSORS: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 80 WIRELESS SENSORS: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 81 WIRELESS SENSORS: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 82 WIRELESS SENSORS: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 83 WIRELESS SENSORS: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.7 OTHERS

- TABLE 84 OTHERS: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 85 OTHERS: THIN FILM AND PRINTED BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 86 OTHERS: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

13 THIN FILM AND PRINTED BATTERY MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 49 THIN FILM AND PRINTED BATTERY MARKET, BY REGION

- FIGURE 50 THIN FILM AND PRINTED BATTERY MARKET IN CHINA TO WITNESS HIGHEST CAGR FROM 2023 TO 2028

- TABLE 87 THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 88 THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: IMPACT OF RECESSION

- FIGURE 51 NORTH AMERICA: THIN FILM AND PRINTED BATTERY MARKET SNAPSHOT

- FIGURE 52 US TO ACCOUNT FOR LARGEST SHARE OF THIN FILM AND PRINTED BATTERY MARKET IN NORTH AMERICA DURING FORECAST PERIOD

- TABLE 89 NORTH AMERICA: THIN FILM AND PRINTED BATTERY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: THIN FILM AND PRINTED BATTERY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 13.2.2 US

- 13.2.2.1 Demand for smart packaging to fuel need for thin film and printed batteries

- 13.2.3 CANADA

- 13.2.3.1 Adoption of IoT in medical devices and wireless sensors to create opportunities for market players

- 13.2.4 MEXICO

- 13.2.4.1 Growing popularity of wearables to boost demand for thin film and printed batteries

- 13.3 EUROPE

- 13.3.1 EUROPE: IMPACT OF RECESSION

- FIGURE 53 EUROPE: THIN FILM AND PRINTED BATTERY MARKET SNAPSHOT

- FIGURE 54 GERMANY TO SECURE LARGEST SHARE OF THIN FILM AND PRINTED BATTERY MARKET IN EUROPE BY 2028

- TABLE 95 EUROPE: THIN FILM AND PRINTED BATTERY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 96 EUROPE: THIN FILM AND PRINTED BATTERY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 97 EUROPE: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 98 EUROPE: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 99 EUROPE: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 100 EUROPE: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 13.3.2 GERMANY

- 13.3.2.1 Government emphasis on R&D activities to revolutionize medical devices to support market growth

- 13.3.3 UK

- 13.3.3.1 Growth of wearables market to induce demand for thin film and printed batteries

- 13.3.4 FRANCE

- 13.3.4.1 Increasing use of smart cards to present opportunities for market players

- 13.3.5 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 55 ASIA PACIFIC: THIN FILM AND PRINTED BATTERY MARKET SNAPSHOT

- FIGURE 56 CHINA TO RECORD HIGHEST CAGR IN THIN FILM AND PRINTED BATTERY MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- TABLE 101 ASIA PACIFIC: THIN FILM AND PRINTED BATTERY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: THIN FILM AND PRINTED BATTERY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 13.4.2 CHINA

- 13.4.2.1 Strong industrial and battery manufacturing sectors to favor market growth

- 13.4.3 JAPAN

- 13.4.3.1 High adoption of consumer electronics to drive market

- 13.4.4 INDIA

- 13.4.4.1 Growing economy, digitalization, and industrial development to boost market growth

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 REST OF THE WORLD (ROW)

- 13.5.1 REST OF THE WORLD: IMPACT OF RECESSION

- FIGURE 57 MIDDLE EAST AND AFRICA TO REGISTER HIGHER CAGR IN THIN FILM AND PRINTED BATTERY MARKET IN ROW FROM 2023 TO 2028

- TABLE 107 ROW: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 108 ROW: THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 109 ROW: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 110 ROW: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 111 ROW: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 112 ROW: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 13.5.2 MIDDLE EAST & AFRICA

- 13.5.2.1 Rising demand for consumer electronics and wearables to accelerate market growth

- 13.5.3 SOUTH AMERICA

- 13.5.3.1 Growing demand for consumer electronics devices to foster market growth

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 113 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 TOP FIVE COMPANY REVENUE ANALYSIS

- FIGURE 58 THIN FILM AND PRINTED BATTERY MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2017-2021

- 14.4 MARKET SHARE ANALYSIS, 2022

- TABLE 114 THIN FILM AND PRINTED BATTERY MARKET SHARE ANALYSIS (2022)

- FIGURE 59 SHARE OF KEY PLAYERS IN THIN FILM AND PRINTED BATTERY MARKET, 2022

- 14.5 COMPANY EVALUATION MATRIX, 2022

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- FIGURE 60 THIN FILM AND PRINTED BATTERY MARKET: COMPANY EVALUATION MATRIX, 2022

- 14.6 COMPANY EVALUATION MATRIX FOR SMES, 2022

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- FIGURE 61 THIN FILM AND PRINTED BATTERY MARKET: COMPANY EVALUATION MATRIX FOR SMES, 2022

- 14.7 THIN FILM AND PRINTED BATTERY MARKET: COMPANY FOOTPRINT

- TABLE 115 COMPANY FOOTPRINT

- TABLE 116 APPLICATION: COMPANY FOOTPRINT

- TABLE 117 REGION: COMPANY FOOTPRINT

- 14.8 COMPETITIVE BENCHMARKING

- TABLE 118 THIN FILM AND PRINTED BATTERY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 119 THIN FILM AND PRINTED BATTERY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 14.9 COMPETITIVE SCENARIOS AND TRENDS

- 14.9.1 THIN FILM AND PRINTED BATTERY MARKET: PRODUCT LAUNCHES

- TABLE 120 PRODUCT LAUNCHES

- 14.9.2 THIN FILM AND PRINTED BATTERY MARKET: DEALS

- TABLE 121 DEALS

15 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 15.1 KEY PLAYERS

- 15.1.1 SAMSUNG SDI CO., LTD.

- TABLE 122 SAMSUNG SDI CO., LTD.: COMPANY OVERVIEW

- FIGURE 62 SAMSUNG SDI CO., LTD.: COMPANY SNAPSHOT

- TABLE 123 SAMSUNG SDI CO., LTD.: PRODUCTS OFFERED

- TABLE 124 SAMSUNG SDI CO., LTD.: OTHERS

- 15.1.2 ENFUCELL

- TABLE 125 ENFUCELL: COMPANY OVERVIEW

- TABLE 126 ENFUCELL: PRODUCTS OFFERED

- TABLE 127 ENFUCELL: PRODUCT LAUNCHES

- 15.1.3 MOLEX, LLC

- TABLE 128 MOLEX, LLC: COMPANY OVERVIEW

- TABLE 129 MOLEX, LLC: PRODUCTS OFFERED

- 15.1.4 NGK INSULATORS, LTD.

- TABLE 130 NGK INSULATORS, LTD.: COMPANY OVERVIEW

- FIGURE 63 NGK INSULATORS, LTD.: COMPANY SNAPSHOT

- TABLE 131 NGK INSULATORS, LTD.: PRODUCTS OFFERED

- 15.1.5 ULTRALIFE CORPORATION

- TABLE 132 ULTRALIFE CORPORATION: COMPANY OVERVIEW

- FIGURE 64 ULTRALIFE CORPORATION: COMPANY SNAPSHOT

- TABLE 133 ULTRALIFE CORPORATION: PRODUCTS OFFERED

- TABLE 134 ULTRALIFE CORPORATION: DEALS

- 15.1.6 CYMBET CORPORATION

- TABLE 135 CYMBET CORPORATION: COMPANY OVERVIEW

- TABLE 136 CYMBET CORPORATION: PRODUCTS OFFERED

- TABLE 137 CYMBET CORPORATION: PRODUCT LAUNCHES

- TABLE 138 CYMBET CORPORATION: DEALS

- 15.1.7 ILIKA PLC

- TABLE 139 ILIKA PLC: COMPANY OVERVIEW

- FIGURE 65 ILIKA PLC: COMPANY SNAPSHOT

- TABLE 140 ILIKA PLC: PRODUCTS OFFERED

- TABLE 141 ILIKA PLC: DEALS

- TABLE 142 ILIKA PLC: OTHERS

- 15.1.8 JENAX INC.

- TABLE 143 JENAX INC.: COMPANY OVERVIEW

- TABLE 144 JENAX INC.: PRODUCTS OFFERED

- TABLE 145 JENAX INC.: DEALS

- 15.1.9 PROLOGIUM TECHNOLOGY CO., LTD.

- TABLE 146 PROLOGIUM TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 147 PROLOGIUM TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- 15.1.10 RENATA SA

- TABLE 148 RENATA SA: COMPANY OVERVIEW

- TABLE 149 RENATA SA: PRODUCTS OFFERED

- TABLE 150 RENATA SA: PRODUCT LAUNCHES

- 15.1.11 VARTA AG

- TABLE 151 VARTA AG: COMPANY OVERVIEW

- FIGURE 66 VARTA AG: COMPANY SNAPSHOT

- TABLE 152 VARTA AG: PRODUCTS OFFERED

- TABLE 153 VARTA AG: DEALS

- TABLE 154 VARTA AG: OTHERS

- 15.2 OTHER PLAYERS

- 15.2.1 CENTRAL MIDORI INT'L PTE LTD.

- 15.2.2 ENERGY DIAGNOSTICS

- 15.2.3 GMB CO., LTD.

- 15.2.4 IMPRINT ENERGY

- 15.2.5 PRELONIC TECHNOLOGIES

- 15.2.6 PRINTED ENERGY PTY LTD.

- 15.2.7 ROCKET POLAND SP. Z O.O.

- 15.2.8 SHENZHEN GREPOW BATTERY CO., LTD.

- 15.2.9 ZINERGY

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 FLOW BATTERY MARKET, BY APPLICATION

- 16.2.1 INTRODUCTION

- TABLE 155 FLOW BATTERY MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 156 FLOW BATTERY MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- 16.2.2 UTILITIES

- 16.2.2.1 Growing adoption of flow batteries by utilities to boost market growth

- 16.2.3 COMMERCIAL & INDUSTRIAL

- 16.2.3.1 Commercial & industrial segment to hold significant market share during forecast period

- 16.2.4 EV CHARGING STATION

- 16.2.4.1 Growing need for fast recharging of vehicles to fuel adoption of flow batteries in charging stations

- 16.2.5 OTHERS

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS