|

|

市場調査レポート

商品コード

1304612

初代細胞の世界市場:種類別・供給源別・エンドユーザー別・地域別の将来予測 (2028年まで)Primary Cells Market by Type, Origin, End User, Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 初代細胞の世界市場:種類別・供給源別・エンドユーザー別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年07月06日

発行: MarketsandMarkets

ページ情報: 英文 217 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

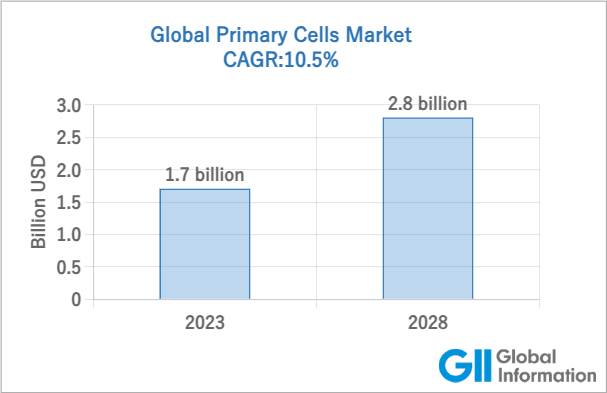

世界の初代細胞 (プライマリーセル) の市場規模は、予測期間中に10.5%のCAGRで成長し、2023年の17億米ドルから2028年には28億米ドルに達すると予測されています。

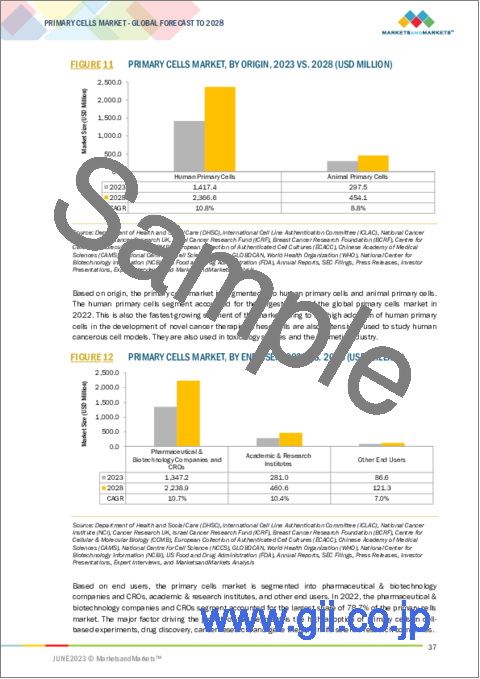

供給源別に見ると、2022年にはヒト初代細胞が最大のシェアを占めています。ヒト初代細胞は、新規がん治療法の開発、ヒトがん細胞モデルの研究や毒性学研究、化粧品産業などに使用されています。ヒト初代細胞市場のその他の主な促進要因としては、正確な疾患モデルの需要、再生医療の台頭、安全性試験要件、科学界における技術革新などが挙げられます。

"造血細胞のセグメントが、2022年に種類別で最大のシェアを占める"

初代細胞市場を種類別に見ると、2022年には造血細胞セグメントが最大の市場シェアを占めました。造血細胞移植は、血液がんや免疫系の他の障害を治療するための新しいがん治療法を開発するために、頻繁に、そして絶え間なく使用されています。造血細胞はまた、腫瘍細胞の生化学的経路やさまざまな薬剤の有効性を理解するためにも使用されます。その結果、この分野は市場で最大のシェアを占めています。

"エンドユーザー別では、2022年に製薬企業・バイオテクノロジー企業・CROのセグメントが最大のシェアを占める"

初代細胞市場をエンドユーザー別に見ると、2022年には、製薬企業・バイオテクノロジー企業・CROが最大のシェアを占めました。これは主に、製薬・バイオテクノロジー企業やCROにおいて細胞ベース実験やがん研究に初代細胞が広く採用されたこと、世界の研究開発施設の増加などが挙げられます。

"アジア太平洋が予測期間中に最も高い成長率を達成する"

2022年には、北米が地域別で最大のシェアを占め、欧州がそれに続きました。北米と欧州は創薬に適した地域であり、これらの地域には確立されたクラスターがあるためです。一方、アジア太平洋は予測期間中に最も高いCAGRを記録すると予測されています。この地域の成長の中心は中国と日本になると予想されます。アジア太平洋市場の成長に寄与している主な要因として、人口の多さやがんの罹患率の上昇、バイオ医薬品プロジェクトに対する研究開発費の増加、新興国におけるバイオテクノロジー産業の成長などが挙げられ、これらがこの地域の初代細胞市場の成長を牽引しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 規制分析

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 主要な会議とイベント (2023年~2024年)

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 初代細胞市場:種類別

- イントロダクション

- 造血細胞

- 皮膚細胞

- 消化管細胞

- 肝細胞

- 凍結保存肝細胞

- 新鮮な肝細胞

- 肺細胞

- 腎細胞

- 心臓細胞

- 筋骨格細胞

- その他の初代細胞

第7章 初代細胞市場:原料別

- イントロダクション

- ヒト初代細胞

- 動物初代細胞

第8章 初代細胞市場:エンドユーザー別

- イントロダクション

- 製薬企業・バイオテクノロジー企業、CRO (医薬品開発業務受託機関)

- 学術研究機関

- その他のエンドユーザー

第9章 初代細胞市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- その他のアジア太平洋

- その他の地域

第10章 競合情勢

- イントロダクション

- 主要企業が採用したアプローチ

- 収益シェア分析

- 市場シェア分析

- 企業評価クアドラント

- 競合ベンチマーキング:上位25社

- 企業評価クアドラント:スタートアップ/中小企業

- 競合ベンチマーキング:スタートアップ/中小企業

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC, INC.

- MERCK KGAA

- CORNING INCORPORATED

- LONZA GROUP

- CHARLES RIVER LABORATORIES, INC.

- PROMOCELL GMBH

- AMERICAN TYPE CULTURE COLLECTION (ATCC)

- CELL BIOLOGICS, INC.

- ZENBIO, INC.

- STEMCELL TECHNOLOGIES, INC.

- ALLCELLS

- IXCELLS BIOTECHNOLOGIES

- NEUROMICS

- その他の企業

- AXOL BIOSCIENCE LTD.

- STEMEXPRESS

- BIOIVT

- SCIENCELL RESEARCH LABORATORIES, INC.

- AMSBIO

- PROMAB BIOTECHNOLOGIES, INC.

- CREATIVE BIOARRAY

- BPS BIOSCIENCE, INC.

- EPITHELIX

- REACHBIO RESEARCH LABS

- ACCEGEN

- KOSHEEKA

第12章 付録

The global primary cells market is projected to reach USD 2.8 billion by 2028 from USD 1.7 billion in 2023, at a CAGR of 10.5% during the forecast period. On the basis of origin, the primary cells market is divided into animal and human primary cells. In 2022, the human primary cells segment accounted for the largest share of the primary cells market. Human primary cells are used for the development of novel cancer therapies, for studying human cancerous cell models and toxicology studies, and in the cosmetic industry. The other key driving factors for the human primary cells market include the demand for accurate disease models, the rise of regenerative medicine, safety testing requirements, and technological innovations within the scientific community. "Hematopoietic cells segment accounted for the largest share in the primary cells market, by type in 2022." Based on type, the primary cells market is segmented into hematopoietic cells, dermatophytes, gastrointestinal cells, hepatocytes, lung cells, renal cells, heart cells, musculoskeletal cells, and other primary cells. In 2022, the hematopoietic cells segment accounted for the largest market share. Hematopoietic cell transplants are frequently and constantly used to develop novel cancer therapies to treat blood cancers and other disorders of the immune system. Hematopoietic cells are also used to understand the biochemical pathways of tumor cells and the efficacy of different drugs. As a result, this segment accounts for the largest market share of the market. "In 2022, the pharmaceutical & biotechnology companies, and CROs segment accounted for the largest share of the global primary cells market, by the end user." On the basis of end users, the primary cells market is segmented into pharmaceutical & biotechnology companies, and CROs, academic & research institutes, and other end users. In 2022, pharmaceutical & biotechnology companies and CROs accounted for the largest share of the primary cells market, mainly due to the high adoption of primary cells in cell-based experiments and cancer research in pharmaceutical & biotechnology companies and CROs; and the increasing number of R&D facilities globally. "Asia Pacific, primary cells market, is expected to witness the highest growth during the forecast period." In 2022, North America accounted for the largest share of the primary cells market, followed by Europe. North America and Europe are the preferred locations for drug discovery due to established clusters in these regions, resulting in the largest market for primary cells. The Asia Pacific is projected to register the highest CAGR during the forecast period. Growth in this region is expected to be centered on China and Japan. Factors such as the presence of a large population and the rising incidence of cancer, increasing R&D spending on biopharmaceutical projects, and the growth of the biotechnology industry in developing countries are the major factors contributing to the growth of the Asia Pacific market are driving the growth of the primary cells market in this region. A breakdown of the primary participants referred to for this report is provided below: By Company: Tier 1 - 20%, Tier 2 - 45%, Tier 3- 35% By Designation: C-Level-30%, Directors - 20%, and Others - 50% By Region: North America-36%, Europe-25%, Asia Pacific-27%, RoW-12% The prominent players in the global primary cells market are Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Corning Incorporated (US), Lonza (Switzerland), Cell Biologics, Inc. (US), PromoCell GmbH (Germany), ZenBio, Inc. (US), STEMCELL Technologies, Inc. (Canada), AllCells (US), American Type Culture Collection (ATCC), and Axol Bioscience Ltd. (UK), among others. Research Coverage: The report analyzes the primary cells market and aims to estimate the market size and future growth potential. The report also includes an in-depth competitive analysis of the key players in this market, along with their company profiles, product offerings, and recent developments. Reasons to Buy the Report

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall primary cells market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing cancer research, Advantages of primary human cells over cell lines, Increasing demand for monoclonal antibodies, Rapid growth in the biotechnology and biopharmaceutical industries, Growing focus on personalized medicine, Government investments for cell-based research), restraints (Concerns regarding primary cell culture contamination, Ethical concerns regarding research in cell biology), opportunities (Advancing biomedical research using primary cells in 3D cultures), and challenges (Sourcing and availability of primary cells) influencing the growth of the primary cells market

- Product Development/Innovation: Detailed insights on upcoming trends, research & development activities, and new product launches in the Primary Cells Market

- Market Development: Comprehensive information about lucrative markets - the report analyses the primary cells market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the primary cells market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Thermo Fisher Scientific Inc. (US), Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Corning Incorporated (US), Lonza (Switzerland), Cell Biologics, Inc. (US), PromoCell GmbH (Germany), ZenBio, Inc. (US), STEMCELL Technologies, Inc. (Canada), AllCells (US), American Type Culture Collection (ATCC), and Axol Bioscience Ltd. (UK).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 PRIMARY CELLS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.2 PRIMARY RESEARCH

- FIGURE 2 PRIMARY CELLS MARKET: BREAKDOWN OF PRIMARIES

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 PRIMARY CELLS MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2022

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1 - REVENUE SHARE ANALYSIS (2022)

- FIGURE 5 ILLUSTRATIVE EXAMPLE OF MERCK KGAA: REVENUE SHARE ANALYSIS (2022)

- FIGURE 6 KEY INDUSTRY INSIGHTS

- 2.3 GROWTH FORECAST

- FIGURE 7 PRIMARY CELLS MARKET: CAGR PROJECTIONS, 2023-2028

- FIGURE 8 PRIMARY CELLS MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RECESSION IMPACT

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2024-2028 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019-2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023-2027 (USD MILLION)

3 EXECUTIVE SUMMARY

- FIGURE 10 PRIMARY CELLS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 PRIMARY CELLS MARKET, BY ORIGIN, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 PRIMARY CELLS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 GEOGRAPHICAL SNAPSHOT OF PRIMARY CELLS MARKET

4 PREMIUM INSIGHTS

- 4.1 PRIMARY CELLS MARKET OVERVIEW

- FIGURE 14 GROWING GLOBAL INCIDENCE OF CANCER TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICA: PRIMARY CELLS MARKET, BY END USER AND COUNTRY (2022)

- FIGURE 15 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS DOMINATED NORTH AMERICAN PRIMARY CELLS MARKET IN 2022

- 4.3 PRIMARY CELLS MARKET SHARE, BY TYPE, 2023 VS. 2028

- FIGURE 16 HEMATOPOIETIC CELLS SEGMENT TO DOMINATE MARKET IN 2028

- 4.4 PRIMARY CELLS MARKET SHARE, BY ORIGIN, 2022

- FIGURE 17 HUMAN PRIMARY CELLS SEGMENT DOMINATED MARKET IN 2022

- 4.5 PRIMARY CELLS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 18 ASIA PACIFIC COUNTRIES TO REGISTER HIGH GROWTH RATES FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 PRIMARY CELLS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 4 PRIMARY CELLS MARKET: IMPACT ANALYSIS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing cancer research

- TABLE 5 PROJECTED INCREASE IN NUMBER OF CANCER PATIENTS, 2015 VS. 2018 VS. 2020 VS. 2035

- TABLE 6 ESTIMATED NUMBER OF NEW CASES OF ALL CANCERS (EXCLUDING NON-MELANOMA SKIN CANCER) FOR BOTH SEXES, 2020 VS. 2040

- 5.2.1.2 Advantages of primary human cells over cell lines

- 5.2.1.3 Increasing demand for monoclonal antibodies

- 5.2.1.4 Rapid growth in biotechnology and biopharmaceutical industries

- FIGURE 20 GLOBAL PHARMACEUTICAL R&D SPENDING, 2014-2028

- 5.2.1.5 Growing focus on personalized medicine

- TABLE 7 GROWTH IN NUMBER OF PERSONALIZED MEDICATIONS, 2015-2022

- 5.2.1.6 Government investments for cell-based research

- 5.2.2 RESTRAINTS

- 5.2.2.1 Concerns regarding primary cell culture contamination

- 5.2.2.2 Ethical concerns regarding research in cell biology

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancing biomedical research using primary cells in 3D cultures

- 5.2.4 CHALLENGES

- 5.2.4.1 Sourcing and availability of primary cells

- 5.3 REGULATORY ANALYSIS

- 5.3.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4 PRICING ANALYSIS

- TABLE 8 AVERAGE PRICE OF PRIMARY CELL PRODUCTS, BY KEY PLAYER (USD)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 21 MAJOR VALUE ADDED DURING MANUFACTURING & ASSEMBLY PHASE

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 22 DISTRIBUTION-A STRATEGY PREFERRED BY PROMINENT COMPANIES

- 5.7 ECOSYSTEM ANALYSIS

- FIGURE 23 ECOSYSTEM ANALYSIS OF PRIMARY CELLS MARKET

- TABLE 9 PRIMARY CELLS MARKET ECOSYSTEM

- 5.8 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 10 PRIMARY CELLS MARKET: LIST OF CONFERENCES & EVENTS

- 5.9 TECHNOLOGY ANALYSIS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 PRIMARY CELLS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF PRIMARY CELL PRODUCTS

- 5.11.2 BUYING CRITERIA FOR PRIMARY CELLS

- FIGURE 25 KEY BUYING CRITERIA FOR END USERS

6 PRIMARY CELLS MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 12 PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2 HEMATOPOIETIC CELLS

- 6.2.1 INCREASING CANCER RESEARCH & FUNDING TO PROPEL MARKET GROWTH

- TABLE 13 TYPES OF HEMATOPOIETIC CELLS

- TABLE 14 HEMATOPOIETIC CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 15 NORTH AMERICA: HEMATOPOIETIC CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 16 EUROPE: HEMATOPOIETIC CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 17 ASIA PACIFIC: HEMATOPOIETIC CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 DERMATOCYTES

- 6.3.1 RISING PREVALENCE OF MELANOMA TO BOOST DEMAND

- TABLE 18 DERMATOCYTES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 19 NORTH AMERICA: DERMATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 20 EUROPE: DERMATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 21 ASIA PACIFIC: DERMATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 GASTROINTESTINAL CELLS

- 6.4.1 GROWING INCIDENCE OF STOMACH CANCER TO BOLSTER GROWTH

- TABLE 22 GASTROINTESTINAL CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: GASTROINTESTINAL CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 24 EUROPE: GASTROINTESTINAL CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: GASTROINTESTINAL CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5 HEPATOCYTES

- TABLE 26 GLOBAL LIVER DISORDER INCIDENCE

- TABLE 27 HEPATOCYTES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: HEPATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 29 EUROPE: HEPATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 30 ASIA PACIFIC: HEPATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 31 HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.5.1 CRYOPRESERVED HEPATOCYTES

- 6.5.1.1 Longer lifespan of cryopreserved hepatocytes than fresh hepatocytes to drive market growth

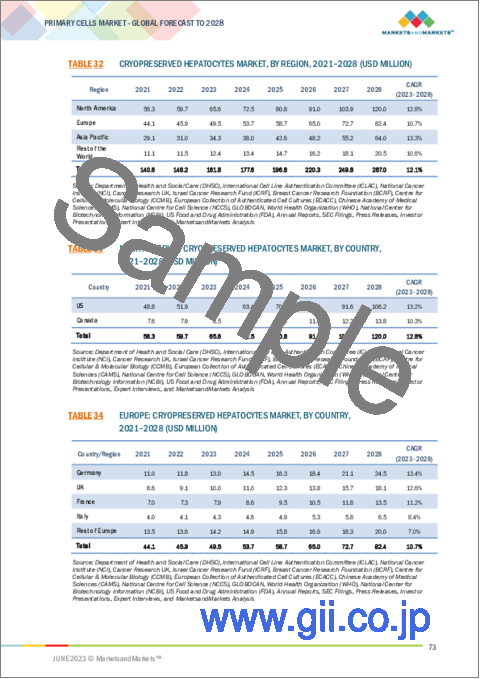

- TABLE 32 CRYOPRESERVED HEPATOCYTES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: CRYOPRESERVED HEPATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 34 EUROPE: CRYOPRESERVED HEPATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC CRYOPRESERVED HEPATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5.2 FRESH HEPATOCYTES

- 6.5.2.1 Stringent regulations and limited availability of fresh hepatocytes to limit market growth

- TABLE 36 FRESH HEPATOCYTES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: FRESH HEPATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 38 EUROPE: FRESH HEPATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: FRESH HEPATOCYTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.6 LUNG CELLS

- 6.6.1 INCREASING RATE OF LUNG CANCER & COPD TO DRIVE DEMAND FOR LUNG CELLS

- TABLE 40 LUNG CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: LUNG CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 42 EUROPE: LUNG CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: LUNG CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.7 RENAL CELLS

- 6.7.1 LACK OF AVAILABILITY OF EFFECTIVE RENAL THERAPIES TO PROPEL MARKET GROWTH

- TABLE 44 RENAL CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: RENAL CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 46 EUROPE: RENAL CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: RENAL CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.8 HEART CELLS

- 6.8.1 HIGH INCIDENCE OF CARDIOVASCULAR DISEASES TO SUPPORT GROWTH

- TABLE 48 HEART CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: HEART CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 50 EUROPE: HEART CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: HEART CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.9 MUSCULOSKELETAL CELLS

- 6.9.1 RISING INCIDENCE OF MUSCULOSKELETAL DISORDERS TO PROPEL MARKET GROWTH

- TABLE 52 MUSCULOSKELETAL CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: MUSCULOSKELETAL CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 54 EUROPE: MUSCULOSKELETAL CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: MUSCULOSKELETAL CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.10 OTHER PRIMARY CELLS

- TABLE 56 OTHER PRIMARY CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: OTHER PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 58 EUROPE: OTHER PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: OTHER PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

7 PRIMARY CELLS MARKET, BY ORIGIN

- 7.1 INTRODUCTION

- TABLE 60 PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- 7.2 HUMAN PRIMARY CELLS

- 7.2.1 INCREASING PREVALENCE OF CANCER TO SUPPORT MARKET GROWTH

- TABLE 61 HUMAN PRIMARY CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: HUMAN PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 63 EUROPE: HUMAN PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 64 ASIA PACIFIC: HUMAN PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 ANIMAL PRIMARY CELLS

- 7.3.1 RISING INVESTMENTS IN ANIMAL CELL RESEARCH TO PROPEL MARKET GROWTH

- TABLE 65 ANIMAL PRIMARY CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: ANIMAL PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 67 EUROPE: ANIMAL PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: ANIMAL PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

8 PRIMARY CELLS MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 69 PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS

- 8.2.1 INCREASING INVESTMENTS IN CELL-BASED RESEARCH TO DRIVE MARKET GROWTH

- TABLE 70 PRIMARY CELLS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 72 EUROPE: PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 ACADEMIC & RESEARCH INSTITUTES

- 8.3.1 INCREASING GOVERNMENT FUNDING FOR RESEARCH AND HIGH PREVALENCE OF CANCER TO FAVOR MARKET GROWTH

- TABLE 74 PRIMARY CELLS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: PRIMARY CELLS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 76 EUROPE: PRIMARY CELLS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: PRIMARY CELLS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 OTHER END USERS

- TABLE 78 PRIMARY CELLS MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: PRIMARY CELLS MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 80 EUROPE: PRIMARY CELLS MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: PRIMARY CELLS MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

9 PRIMARY CELLS MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 82 PRIMARY CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 26 NORTH AMERICA: PRIMARY CELLS MARKET SNAPSHOT

- TABLE 83 NORTH AMERICA: PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 High R&D spending and growing support for stem cell research to drive market growth

- TABLE 88 US: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 89 US: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 US: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 91 US: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Presence of advanced R&D infrastructure to boost market

- TABLE 92 CANADA: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 93 CANADA: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 94 CANADA: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 CANADA: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.3 NORTH AMERICA: IMPACT OF RECESSION

- 9.3 EUROPE

- TABLE 96 EUROPE: PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 97 EUROPE: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 98 EUROPE: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 99 EUROPE: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 EUROPE: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1 UK

- 9.3.1.1 Growth in life science industry to fuel market growth

- TABLE 101 UK: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 102 UK: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 UK: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 104 UK: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 Increasing life science research activities to support market growth

- TABLE 105 GERMANY: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 106 GERMANY: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 GERMANY: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 108 GERMANY: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Robust biotechnology infrastructure to support growth

- TABLE 109 FRANCE: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 110 FRANCE: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 FRANCE: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 FRANCE: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Increasing number of cell biology seminars and conferences to fuel adoption of primary cells

- TABLE 113 ITALY: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 114 ITALY: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 ITALY: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 116 ITALY: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5 REST OF EUROPE

- TABLE 117 REST OF EUROPE: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.6 EUROPE: IMPACT OF RECESSION

- 9.4 ASIA PACIFIC

- FIGURE 27 ASIA PACIFIC: PRIMARY CELLS MARKET SNAPSHOT

- TABLE 121 ASIA PACIFIC: PRIMARY CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Growing focus on cancer therapeutics-related research to bolster growth

- TABLE 126 CHINA: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 127 CHINA: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 128 CHINA: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 129 CHINA: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Government initiatives to propel market growth in Japan

- TABLE 130 JAPAN: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 131 JAPAN: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 JAPAN: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 JAPAN: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.3 REST OF ASIA PACIFIC

- TABLE 134 REST OF ASIA PACIFIC: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.4 ASIA PACIFIC: IMPACT OF RECESSION

- 9.5 REST OF THE WORLD

- TABLE 138 REST OF THE WORLD: PRIMARY CELLS MARKET, BY ORIGIN, 2021-2028 (USD MILLION)

- TABLE 139 REST OF THE WORLD: PRIMARY CELLS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 REST OF THE WORLD: HEPATOCYTES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 REST OF THE WORLD: PRIMARY CELLS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.1 REST OF THE WORLD: IMPACT OF RECESSION

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- FIGURE 28 PRIMARY CELLS MARKET: STRATEGIES ADOPTED

- 10.3 REVENUE SHARE ANALYSIS

- FIGURE 29 REVENUE ANALYSIS OF KEY PLAYERS (2019-2022)

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 30 MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- TABLE 142 PRIMARY CELLS MARKET: DEGREE OF COMPETITION

- 10.5 COMPANY EVALUATION QUADRANT

- FIGURE 31 PRIMARY CELLS MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERS

- 10.6.1 PRODUCT FOOTPRINT OF COMPANIES (25 COMPANIES)

- TABLE 143 PRIMARY CELLS MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS

- 10.6.2 REGIONAL FOOTPRINT OF COMPANIES (25 COMPANIES)

- TABLE 144 PRIMARY CELLS MARKET: REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- 10.7 COMPANY EVALUATION QUADRANT: START-UPS/SMES

- FIGURE 32 PRIMARY CELLS MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 STARTING BLOCKS

- 10.7.3 RESPONSIVE COMPANIES

- 10.7.4 DYNAMIC COMPANIES

- 10.8 COMPETITIVE BENCHMARKING OF START-UP/SME PLAYERS

- TABLE 145 PRIMARY CELLS MARKET: DETAILED LIST OF KEY START-UP/SME PLAYERS

- TABLE 146 PRIMARY CELLS MARKET: COMPETITIVE BENCHMARKING OF START-UP/SME PLAYERS

- 10.9 COMPETITIVE SCENARIO AND TRENDS

- 10.9.1 PRODUCT LAUNCHES

- TABLE 147 PRIMARY CELLS MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2023

- 10.9.2 DEALS

- TABLE 148 PRIMARY CELLS MARKET: DEALS, JANUARY 2020-JUNE 2023

- 10.9.3 OTHER DEVELOPMENTS

- TABLE 149 PRIMARY CELLS MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JUNE 2023

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- (Business overview, Products offered, Recent Developments, MNM view)**

- 11.1.1 THERMO FISHER SCIENTIFIC, INC.

- TABLE 150 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- FIGURE 33 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- 11.1.2 MERCK KGAA

- TABLE 151 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 34 MERCK KGAA: COMPANY SNAPSHOT (2022)

- TABLE 152 OTHER DEVELOPMENTS

- 11.1.3 CORNING INCORPORATED

- TABLE 153 CORNING INCORPORATED: BUSINESS OVERVIEW

- FIGURE 35 CORNING INCORPORATED: COMPANY SNAPSHOT (2022)

- 11.1.4 LONZA GROUP

- TABLE 154 LONZA GROUP: BUSINESS OVERVIEW

- FIGURE 36 LONZA GROUP: COMPANY SNAPSHOT (2022)

- TABLE 155 PRODUCT LAUNCHES

- 11.1.5 CHARLES RIVER LABORATORIES, INC.

- TABLE 156 CHARLES RIVER LABORATORIES, INC.: BUSINESS OVERVIEW

- FIGURE 37 CHARLES RIVER LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- TABLE 157 ACQUISITIONS

- 11.1.6 PROMOCELL GMBH

- TABLE 158 PROMOCELL GMBH: BUSINESS OVERVIEW

- TABLE 159 PRODUCT LAUNCHES

- 11.1.7 AMERICAN TYPE CULTURE COLLECTION (ATCC)

- TABLE 160 AMERICAN TYPE CULTURE COLLECTION (ATCC): BUSINESS OVERVIEW

- 11.1.8 CELL BIOLOGICS, INC.

- TABLE 161 CELL BIOLOGICS, INC.: BUSINESS OVERVIEW

- 11.1.9 ZENBIO, INC.

- TABLE 162 ZENBIO, INC.: BUSINESS OVERVIEW

- 11.1.10 STEMCELL TECHNOLOGIES, INC.

- TABLE 163 STEMCELL TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- 11.1.11 ALLCELLS

- TABLE 164 ALLCELLS: BUSINESS OVERVIEW

- 11.1.12 IXCELLS BIOTECHNOLOGIES

- TABLE 165 IXCELLS BIOTECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 166 AGREEMENTS

- 11.1.13 NEUROMICS

- TABLE 167 NEUROMICS: BUSINESS OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 11.2 OTHER COMPANIES

- 11.2.1 AXOL BIOSCIENCE LTD.

- TABLE 168 AXOL BIOSCIENCE LTD.: COMPANY OVERVIEW

- 11.2.2 STEMEXPRESS

- TABLE 169 STEMEXPRESS: COMPANY OVERVIEW

- 11.2.3 BIOIVT

- TABLE 170 BIOIVT: COMPANY OVERVIEW

- 11.2.4 SCIENCELL RESEARCH LABORATORIES, INC.

- TABLE 171 SCIENCELL RESEARCH LABORATORIES, INC.: COMPANY OVERVIEW

- 11.2.5 AMSBIO

- TABLE 172 AMSBIO: COMPANY OVERVIEW

- 11.2.6 PROMAB BIOTECHNOLOGIES, INC.

- TABLE 173 PROMAB BIOTECHNOLOGIES, INC.: COMPANY OVERVIEW

- 11.2.7 CREATIVE BIOARRAY

- TABLE 174 CREATIVE BIOARRAY: COMPANY OVERVIEW

- 11.2.8 BPS BIOSCIENCE, INC.

- TABLE 175 BPS BIOSCIENCE, INC.: COMPANY OVERVIEW

- 11.2.9 EPITHELIX

- TABLE 176 EPITHELIX: COMPANY OVERVIEW

- 11.2.10 REACHBIO RESEARCH LABS

- TABLE 177 REACHBIO RESEARCH LABS: COMPANY OVERVIEW

- 11.2.11 ACCEGEN

- TABLE 178 ACCEGEN: COMPANY OVERVIEW

- 11.2.12 KOSHEEKA

- TABLE 179 KOSHEEKA: COMPANY OVERVIEW

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS