|

|

市場調査レポート

商品コード

1304611

小包仕分けシステムの世界市場:種類別 (ARBソーター、ポップアップソーター、シューソーター、クロスベルトソーター、チルトトレイソーター)・提供別 (ハードウェア、ソフトウェア、サービス)・用途別 (ロジスティクス、eコマース) の将来予測 (2028年まで)Parcel Sortation System Market by Type (Activated Roller Belt Sorters, Pop Up Sorters, Shoe Sorters, Cross Belt Sorters, Tilt Tray Sorters), Offering (Hardware, Software, Services), Application (Logistics, E-commerce) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 小包仕分けシステムの世界市場:種類別 (ARBソーター、ポップアップソーター、シューソーター、クロスベルトソーター、チルトトレイソーター)・提供別 (ハードウェア、ソフトウェア、サービス)・用途別 (ロジスティクス、eコマース) の将来予測 (2028年まで) |

|

出版日: 2023年07月05日

発行: MarketsandMarkets

ページ情報: 英文 229 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の小包仕分けシステムの市場規模は、2023年に20億米ドル、2028年には28億米ドルに達し、予測期間中に7.0%のCAGRで成長すると予測されています。

この市場の成長は、より迅速な小包配送に対する需要の高まりに起因しています。

"ループ小包仕分けシステムの市場では、2022年にクロスベルトソーターが最大シェアを占める"

クロスベルトソーターで使用される主要技術には、自動ダイバーター・ソーター、スキャン・識別システム、制御ソフトウェア・アルゴリズム、WMSとの統合、人工知能 (AI)、機械学習 (ML)、データ分析・レポート、コンベアベルト制御・追跡、自動採寸・計量などがあります。クロスベルトソーターは、レイアウトが難しくスペースが限られているeコマース、小売、倉庫、配送センターに最適です。さらに、水平クロスベルトソーターによる仕分け先はさまざまな方向に向けることができるため、スペースの有効活用と最適な仕分けシステム性能の両立が可能になります。

"eコマース向け用途が予測期間中、最も高いCAGRで成長する"

オンライン小売やeコマース企業の人気が高まるにつれ、これらの企業では1日あたり数百万個の小包の形で注文を処理する必要が生じ、最終的に企業にとって大きな課題となります。小包仕分けシステムは拡張性と柔軟性に優れているため、eコマース業界のダイナミックな性質に適しています。さらに、小包仕分けシステムは手順を自動化・合理化し、エラーや手作業の必要性を最小限に抑えます。企業は、仕分けとルーティング作業を最適化することで、人件費、輸送費、総合物流コストを大幅に削減することができます。

"北米が予測期間中、地域別で最大の市場シェアを占める"

北米市場の成長要因として、同地域に重要なロジスティクス企業やeコマース企業が存在することが挙げられます。この地域は技術的に進んでおり、インターネットの普及率も高いです。さらに、広範な3PL (サードパーティーロジスティクス) ネットワークが北米の倉庫部門の成長につながっています。さらに、この地域の既存空港の改修は、手荷物ハンドリング・システムの設置と能力拡張をもたらし、小包仕分けシステム市場の成長に寄与しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステムマッピング

- 顧客のビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- ケーススタディ分析

- 技術分析

- 価格分析

- 主要な利害関係者と購入基準

- 貿易分析

- 主要な会議とイベント (2022年~2025年)

- 特許分析

- 規制状況

第6章 小包仕分けシステム市場に影響を与える動向

- イントロダクション

- オートメーションとロボット工学

- モジュール式でスケーラブルなシステム

- リアルタイム追跡・トレーサビリティ

- ラストマイル配送との統合

- 持続可能なソリューション

- 人工知能 (AI) の最適化

第7章 小包仕分けシステム市場:提供別

- イントロダクション

- ハードウェア

- プロセッサー

- カメラ

- センサー

- ダイバーター

- その他

- ソフトウェア

- サービス

第8章 小包仕分けシステム市場:種類別

- イントロダクション

- リニア式小包仕分けシステム

- ARB (アクティベーテッドローラーベルト) ソーター

- ポップアップソーター

- シューソーター

- パドルソーター

- プッシャーソーター

- その他

- ループ式小包仕分けシステム

- クロスベルトソーター

- フラットソーター

- チルトトレイソーター

- その他

第9章 小包仕分けシステム市場:用途別

- イントロダクション

- ロジスティクス

- 宅配業者

- 貨物輸送

- 郵便サービス

- 倉庫・保管

- eコマース

- 空港

- 医薬品・医療用品

- 食品・飲料

- その他

第10章 小包仕分けシステム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 韓国

- 日本

- その他のアジア太平洋

- その他の地域 (ROW)

- 南米

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- 上位企業の収益分析

- 市場シェア分析

- 企業評価マトリックス

- 中小企業 (SME) の評価クアドラント

- 小包仕分けシステム市場:企業のフットプリント

- 競合ベンチマーキング

- 競争シナリオと動向

第12章 企業プロファイル

- 主要企業

- VANDERLANDE

- BEUMER GROUP

- HONEYWELL INTERNATIONAL

- BASTIAN SOLUTIONS

- FIVES

- SIEMENS

- DEMATIC

- INTERROLL

- INVATA INTRALOGISTICS

- MURATA MACHINERY

- その他の企業

- AMH MATERIAL HANDLING

- ATMOS

- BOWE SYSTEC

- CONVEYCO

- DORNER

- EQUINOX MHE

- EUROSORT

- FALCON AUTOTECH

- ICONVEY

- INTRALOX

- KNAPP

- OKURA YUSOKI

- PITNEY BOWES

- SOLYSTIC

- VIASTORE SYSTEMS

第13章 隣接市場

- 自動倉庫 (AS/RS) 市場

- イントロダクション

- ユニットロード

- ミニロード

- 垂直リフトモジュール (VLM)

- カルーセル

- ミッドロード

第14章 付録

The parcel sortation system market is estimated to be worth USD 2.0 billion in 2023 and is projected to reach USD 2.8 billion by 2028, at a CAGR of 7.0% during the forecast period. The growth of this market is attributed to the rising demand for faster parcel delivery.

"Cross Belt Sorters to hold largest market share of Loop parcel sortation system market in 2022."

Some of the key technologies used in cross belt sortation includes automated diverters & sorters, scanning & identification systems, control software & algorithms, integration with WMS, artificial intelligence (AI), machine learning (ML), data analytics & reporting, conveyor belt control & tracking, automated dimensions & weighing. Cross belt sorters are ideal for e-commerce, retail, warehouses and distribution centers with challenging layouts and limited space. Moreover, sortation destinations through horizontal cross belt sorters can be oriented in several ways enabling users to both better utilize space and achieve optimal sortation system performance.

"E-commerce application is to grow with the highest CAGR during the forecast period"

The increasing popularity of online retail and e-commerce companies has resulted in the need for these companies to process orders in the form of millions of parcels per day, which ultimately poses a major challenge for the companies. Parcel sortation systems are highly scalable and flexible, making them well-suited for the dynamic nature of the e-commerce industry. Moreover, Systems for sorting packages automate and streamline the procedure, minimizing errors and the need for manual labor. Businesses may significantly reduce labor, transportation, and total logistics costs by optimizing sorting and routing activities.

"North America is anticipated to contribute the largest share of the market during the forecast period." The market growth in North America can be attributed to the presence of significant logistics and e-commerce companies in the region. This region is technologically advanced and has a high internet penetration; moreover, an extensive third-party logistics (3PL) network has led to the growth of the warehousing sector in North America. Moreover, renovating existing airports in this region has resulted in the installation and capacity expansion of baggage handling systems, thereby contributing to the growth of the parcel sortation system market.

The break-up of the profiles of primary participants:

- By Company Type - Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

- By Designation - C-level Executives - 35%, Directors - 45%, and Others - 20%

- By Region - North America - 30%, Europe - 25%, Asia Pacific - 35%, and Rest of the World - 10%

Major players in the parcel sortation system market include Vanderlande (Netherlands), Beumer Group (Germany), Honeywell International (US), and Bastian Solutions (US), Fives (France).

Research Coverage

The report segments the parcel sortation system market by offering, type, application, and region. The report also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall parcel sortation system market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Labor cost inflation and increase in industrial automation, the rising demand for faster parcel delivery, the thriving e-commerce industry and growing adoption of parcel sortation systems in industry), restraints (Higher cost related to deployment and maintenance of parcel sortation system), opportunities (unfolding new application areas of parcel sortation system, integration of emerging technologies like AI, Industrt 4.0, IoT with sorting systems), and challenges (Real time technical issue during sortation, large requirement of initial investment) influencing the growth of the parcel sortation system market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the parcel sortation system market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the parcel sortation system market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the parcel sortation system market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Vanderlande (Netherlands), Beumer Group (Germany), Honeywell International (US), and Bastian Solutions (US), Fives (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 PARCEL SORTATION SYSTEM MARKET SEGMENTATION

- 1.4.2 GEOGRAPHIC SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PARCEL SORTATION SYSTEM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using bottom-up analysis

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS FROM PARCEL SORTATION SYSTEMS

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON PARCEL SORTATION SYSTEM MARKET

- 2.6 LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 7 PARCEL SORTATION SYSTEM MARKET, 2019-2028 (USD MILLION)

- FIGURE 8 LINEAR PARCEL SORTATION SYSTEMS SEGMENT HELD LARGER MARKET SHARE IN 2022

- FIGURE 9 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

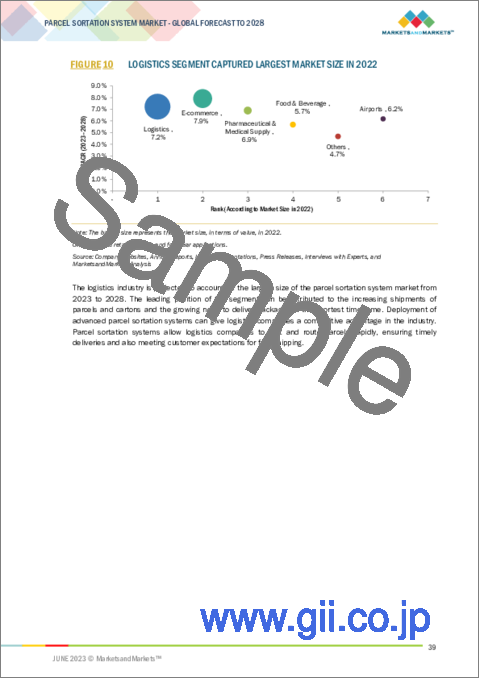

- FIGURE 10 LOGISTICS SEGMENT CAPTURED LARGEST MARKET SIZE IN 2022

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN PARCEL SORTATION SYSTEM MARKET

- FIGURE 12 RISING AUTOMATION IN LOGISTICS AND E-COMMERCE INDUSTRIES TO SUPPORT MARKET GROWTH

- 4.2 PARCEL SORTATION SYSTEM MARKET, BY OFFERING

- FIGURE 13 HARDWARE SEGMENT ACCOUNTED FOR LARGEST MARKET SIZE IN 2022

- 4.3 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY TYPE

- FIGURE 14 SHOE SORTERS TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- 4.4 PARCEL SORTATION SYSTEM MARKET, BY APPLICATION

- FIGURE 15 LOGISTICS SEGMENT TO CAPTURE LARGEST SHARE OF PARCEL SORTATION SYSTEM MARKET IN 2023

- 4.5 PARCEL SORTATION SYSTEM MARKET, BY REGION

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR IN PARCEL SORTATION SYSTEM MARKET DURING 2023-2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 PARCEL SORTATION SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Labor cost inflation and increase in industrial automation

- FIGURE 18 CHANGES IN LABOR COSTS BETWEEN 2015 AND 2022, BY REGION

- 5.2.1.2 Thriving e-commerce industry and subsequent rise in adoption of parcel sortation systems

- FIGURE 19 E-COMMERCE SALES AS PERCENTAGE OF TOTAL RETAIL SALES IN US, 2019-2022

- TABLE 1 TOP 10 COUNTRIES IN TERMS OF E-COMMERCE CONTRIBUTION TO GDP IN 2022

- 5.2.1.3 Rising demand for faster parcel delivery

- FIGURE 20 IMPACT ANALYSIS OF DRIVERS AND OPPORTUNITIES ON PARCEL SORTATION SYSTEM MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs related to deployment and maintenance of parcel sortation systems

- FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS AND CHALLENGES ON PARCEL SORTATION SYSTEM MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging application areas of parcel sorting systems

- 5.2.3.2 Integration of emerging technologies, such as AI, Industry 4.0, and IoT, with sorting systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Real-time technical issues during sortation

- 5.2.4.2 Requirement for high initial investments

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 22 PARCEL SORTATION SYSTEM MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- TABLE 2 PARCEL SORTATION SYSTEM MARKET: ECOSYSTEM

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN PARCEL SORTATION SYSTEM MARKET

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 PARCEL SORTATION SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 PARCEL SORTATION SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7 CASE STUDY ANALYSIS

- TABLE 4 UPS DEVELOPED ORION SYSTEM TO IMPROVE ROUTE PLANNING AND PACKAGE SORTING PROCESSES

- TABLE 5 ZALANDO USES FERAG'S PARCEL SORTATION SYSTEM IN ITS DISTRIBUTION CENTERS

- TABLE 6 MARKET ASSESSMENT FOR OPTIMIZING REVERSE LOGISTICS THROUGH PARCEL SORTATION

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 PREDICTIVE ANALYTICS

- 5.8.2 INTERNET OF THINGS

- 5.8.3 INDUSTRY 4.0

- 5.8.4 MACHINE LEARNING

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE (ASP) TREND

- TABLE 7 AVERAGE SELLING PRICE OF VARIOUS TYPES OF PARCEL SORTATION SYSTEMS

- TABLE 8 AVERAGE SELLING PRICE OF PARCEL SORTATION SYSTEMS, BY REGION

- FIGURE 25 AVERAGE SELLING PRICE OF PARCEL SORTATION SYSTEMS, 2019-2028

- 5.9.2 PRICING ANALYSIS OF PRODUCTS OFFERED BY KEY PLAYERS

- FIGURE 26 AVERAGE SELLING PRICE OF PARCEL SORTATION SYSTEMS, BY RUNNING SPEED

- TABLE 9 APPROXIMATE AVERAGE SELLING PRICE OF PARCEL SORTATION SYSTEMS, BY RUNNING SPEED

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.10.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- FIGURE 29 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8437, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.11.2 EXPORT SCENARIO

- FIGURE 30 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8437, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 KEY CONFERENCES AND EVENTS, 2022-2025

- TABLE 12 PARCEL SORTATION SYSTEM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.13 PATENT ANALYSIS

- FIGURE 31 TOP 10 COMPANIES/INSTITUTIONS WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 13 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- FIGURE 32 NUMBER OF PATENTS GRANTED EVERY YEAR, 2013-2022

- TABLE 14 LIST OF KEY PATENTS IN PARCEL SORTATION SYSTEM MARKET, 2021-2023

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS AND REGULATIONS RELATED TO PARCEL SORTATION SYSTEM MARKET

- 5.14.3 SAFETY STANDARDS FOR PARCEL SORTATION SYSTEMS

- TABLE 18 MAJOR SAFETY STANDARDS

6 TRENDS IMPACTING PARCEL SORTATION SYSTEM MARKET

- 6.1 INTRODUCTION

- 6.2 AUTOMATION AND ROBOTICS

- 6.3 MODULAR AND SCALABLE SYSTEMS

- 6.4 REAL-TIME TRACKING AND TRACEABILITY

- 6.5 INTEGRATION WITH LAST-MILE DELIVERY

- 6.6 SUSTAINABLE SOLUTIONS

- 6.7 ARTIFICIAL INTELLIGENCE (AI) OPTIMIZATION

7 PARCEL SORTATION SYSTEM MARKET, BY OFFERING

- 7.1 INTRODUCTION

- FIGURE 33 PARCEL SORTATION SYSTEM MARKET, BY OFFERING

- FIGURE 34 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR IN PARCEL SORTATION SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 19 PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 20 PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 7.2 HARDWARE

- 7.2.1 PROCESSORS

- 7.2.1.1 Help in data processing and coordination of components

- 7.2.2 CAMERAS

- 7.2.2.1 Used to capture images of parcels from different angles

- 7.2.3 SENSORS

- 7.2.3.1 Used to extract information about parcels and make decisions based on that data

- 7.2.4 DIVERTERS

- 7.2.4.1 Separate single parcel from streams of parcels

- 7.2.5 OTHERS

- TABLE 21 HARDWARE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 22 HARDWARE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.1 PROCESSORS

- 7.3 SOFTWARE

- 7.3.1 MAKES DECISIONS BY ANALYZING COLLECTED DATA

- TABLE 23 SOFTWARE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 24 SOFTWARE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 SERVICES

- 7.4.1 INCLUDE MAINTENANCE AND UPGRADES

- TABLE 25 SERVICES: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 26 SERVICES: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

8 PARCEL SORTATION SYSTEM MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 35 PARCEL SORTATION SYSTEM MARKET, BY TYPE

- FIGURE 36 LOOP PARCEL SORTATION SYSTEMS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 27 PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 28 PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.2 LINEAR PARCEL SORTATION SYSTEMS

- TABLE 29 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 30 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 31 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 32 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 33 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1 ACTIVATED ROLLER BELT SORTERS

- 8.2.1.1 Ideal for installation at warehouses with space constraints

- 8.2.2 POP UP SORTERS

- 8.2.2.1 Ensure safe handling of delicate items

- 8.2.3 SHOE SORTERS

- 8.2.3.1 Used to sort fragile products that require smooth, gentle movement

- 8.2.4 PADDLE SORTERS

- 8.2.4.1 Ideal for difficult-to-sort parcels

- 8.2.5 PUSHER SORTERS

- 8.2.5.1 Ideal for applications in warehouses with space constraints

- 8.2.6 OTHERS

- 8.3 LOOP PARCEL SORTATION SYSTEMS

- TABLE 35 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 36 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 37 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 38 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 39 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.1 CROSS BELT SORTERS

- 8.3.1.1 Versatile and efficient solutions for parcel sorting

- 8.3.2 FLAT SORTERS

- 8.3.2.1 Used for parcel sorting applications by mid-sized and small end users

- 8.3.3 TILT TRAY SORTERS

- 8.3.3.1 Easy-to-use sortation systems used in small warehouses and distribution centers

- 8.4 OTHERS

- TABLE 41 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 42 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 43 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

9 PARCEL SORTATION SYSTEM MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 37 PARCEL SORTATION SYSTEM MARKET, BY APPLICATION

- FIGURE 38 E-COMMERCE SEGMENT TO REGISTER HIGHEST CAGR IN PARCEL SORTATION SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 45 PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 46 PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 LOGISTICS

- TABLE 47 LOGISTICS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 48 LOGISTICS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 49 LOGISTICS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 50 LOGISTICS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.1 COURIER

- 9.2.1.1 Courier companies prime end users of parcel sortation systems

- 9.2.2 FREIGHT FORWARDING

- 9.2.2.1 Parcel sortation systems used by freight forwarding companies to distribute goods and products effectively

- 9.2.3 POSTAL SERVICES

- 9.2.3.1 Substantial adoption of parcel sortation systems in postal services to handle increasing volume of parcels

- 9.2.4 STORAGE AND WAREHOUSING

- 9.2.4.1 Use parcel sortation systems to streamline operations and expedite delivery process

- 9.3 E-COMMERCE

- 9.3.1 RAPID GROWTH OF E-COMMERCE INDUSTRY TO SUPPORT MARKET GROWTH

- FIGURE 39 NORTH AMERICA TO ACCOUNT FOR LARGEST SIZE OF PARCEL SORTATION SYSTEM MARKET FOR E-COMMERCE DURING FORECAST PERIOD

- TABLE 51 E-COMMERCE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 52 E-COMMERCE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 53 E-COMMERCE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 E-COMMERCE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 AIRPORTS

- 9.4.1 RISING AIR CARGO TRANSPORTATION TO DRIVE MARKET

- TABLE 55 AIRPORTS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 56 AIRPORTS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 57 AIRPORTS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 AIRPORTS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 PHARMACEUTICAL AND MEDICAL SUPPLY

- FIGURE 40 LOOP PARCEL SORTATION SYSTEMS TO ACCOUNT FOR LARGEST SIZE OF PARCEL SORTATION SYSTEM MARKET FOR PHARMACEUTICAL & MEDICAL SUPPLY FROM 2023-2028

- TABLE 59 PHARMACEUTICAL & MEDICAL SUPPLY: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 60 PHARMACEUTICAL & MEDICAL SUPPLY: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 61 PHARMACEUTICAL & MEDICAL SUPPLY: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 62 PHARMACEUTICAL & MEDICAL SUPPLY: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5.1 ACTIVE PHARMACEUTICAL INGREDIENT SUPPLIERS

- 9.5.1.1 Use parcel sortation systems to improve efficiency in API manufacturing

- 9.5.2 DRUG MANUFACTURERS

- 9.5.2.1 Use parcel sortation systems to speed up drug distribution

- 9.5.3 DISTRIBUTORS

- 9.5.3.1 Accelerate pharmaceutical and medical supplies with parcel sortation systems

- 9.6 FOOD & BEVERAGE

- TABLE 63 FOOD & BEVERAGE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 64 FOOD & BEVERAGE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 65 FOOD & BEVERAGE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 66 FOOD & BEVERAGE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6.1 UNPROCESSED OR MINIMALLY PROCESSED FOOD

- 9.6.1.1 Parcel sortation systems used to optimize supply chain of unprocessed or minimally processed food items

- 9.6.2 PROCESSED FOOD

- 9.6.2.1 Parcel sortation systems used to examine and sort eatables before dispatch

- 9.7 OTHERS

- TABLE 67 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 68 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 69 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 70 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

10 PARCEL SORTATION SYSTEM MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 41 PARCEL SORTATION SYSTEM MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- TABLE 71 PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 42 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET SNAPSHOT

- TABLE 73 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Thriving e-commerce and logistics industries to drive market

- 10.2.3 CANADA

- 10.2.3.1 Presence of logistics and e-commerce companies to favor market growth

- 10.2.4 MEXICO

- 10.2.4.1 Entry of prominent logistics and food and beverage companies to create opportunities for market players

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- FIGURE 43 EUROPE: PARCEL SORTATION SYSTEM MARKET SNAPSHOT

- TABLE 81 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 82 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 83 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 84 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 85 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 86 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 87 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 88 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Rising demand from e-commerce industry to support market growth

- 10.3.3 UK

- 10.3.3.1 Growing adoption of automation solutions in warehouses to create conducive environment for market growth

- 10.3.4 FRANCE

- 10.3.4.1 Increasing adoption of AI and Industry 4.0 in industrial sector to support market growth

- 10.3.5 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 44 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET SNAPSHOT

- TABLE 89 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Growing e-commerce industry and presence of key market players to drive market

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Growing number of pharmaceutical and medical supply, food & beverage, and logistics companies to drive market

- 10.4.4 JAPAN

- 10.4.4.1 Presence of prominent parcel sortation system providers to boost market

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD (ROW)

- TABLE 97 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 98 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 99 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 100 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 101 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 102 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 103 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 104 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Automation of food processing facilities to induce demand for parcel sortation systems

- 10.5.2 MIDDLE EAST

- TABLE 105 MIDDLE EAST: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 106 MIDDLE EAST: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.2.1 Saudi Arabia

- 10.5.2.1.1 Growing investments in parcel sortation systems by logistics companies to support market growth

- 10.5.2.2 UAE

- 10.5.2.2.1 Demand from pharmaceuticals and food & beverages industries to create growth opportunities for market players

- 10.5.2.3 Rest of Middle East

- 10.5.2.1 Saudi Arabia

- 10.5.3 AFRICA

- 10.5.3.1 High focus on warehouse automation to accelerate market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 107 OVERVIEW OF STRATEGIES ADOPTED BY PARCEL SORTATION SYSTEM VENDORS

- 11.3 REVENUE ANALYSIS OF TOP COMPANIES

- FIGURE 45 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN PARCEL SORTATION SYSTEM MARKET

- 11.4 MARKET SHARE ANALYSIS

- TABLE 108 PARCEL SORTATION SYSTEM MARKET SHARE ANALYSIS, 2022

- FIGURE 46 PARCEL SORTATION SYSTEM MARKET: SHARE OF KEY PLAYERS

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 47 PARCEL SORTATION SYSTEM MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 11.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 48 PARCEL SORTATION SYSTEM MARKET (GLOBAL): SMES EVALUATION MATRIX, 2022

- 11.7 PARCEL SORTATION SYSTEM MARKET: COMPANY FOOTPRINT

- TABLE 109 COMPANY FOOTPRINT

- TABLE 110 TYPE: COMPANY FOOTPRINT

- TABLE 111 APPLICATION: COMPANY FOOTPRINT

- TABLE 112 REGION: COMPANY FOOTPRINT

- 11.8 COMPETITIVE BENCHMARKING

- TABLE 113 PARCEL SORTATION SYSTEM MARKET: LIST OF KEYS STARTUPS/SMES

- TABLE 114 PARCEL SORTATION SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.9 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 115 PARCEL SORTATION SYSTEM MARKET: PRODUCT LAUNCHES, 2021-2022

- TABLE 116 PARCEL SORTATION SYSTEM MARKET: DEALS, 2021-2022

- TABLE 117 PARCEL SORTATION SYSTEM MARKET: OTHERS, 2022

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business overview, Products offered, Recent Developments, MNM view)**

- 12.1.1 VANDERLANDE

- TABLE 118 VANDERLANDE: BUSINESS OVERVIEW

- FIGURE 49 VANDERLANDE: COMPANY SNAPSHOT

- TABLE 119 VANDERLANDE: PRODUCT OFFERINGS

- TABLE 120 VANDERLANDE: PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.1.2 BEUMER GROUP

- TABLE 121 BEUMER GROUP: BUSINESS OVERVIEW

- TABLE 122 BEUMER GROUP: PRODUCT OFFERINGS

- TABLE 123 BEUMER GROUP: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 124 BEUMER GROUP: DEALS

- 12.1.3 HONEYWELL INTERNATIONAL

- TABLE 125 HONEYWELL INTERNATIONAL: BUSINESS OVERVIEW

- FIGURE 50 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 126 HONEYWELL INTERNATIONAL: PRODUCT OFFERINGS

- 12.1.4 BASTIAN SOLUTIONS

- TABLE 127 BASTIAN SOLUTIONS: BUSINESS OVERVIEW

- TABLE 128 BASTIAN SOLUTIONS: PRODUCT OFFERINGS

- TABLE 129 BASTIAN SOLUTIONS: DEALS

- 12.1.5 FIVES

- TABLE 130 FIVES: BUSINESS OVERVIEW

- FIGURE 51 FIVES: COMPANY SNAPSHOT

- TABLE 131 FIVES: PRODUCT OFFERINGS

- TABLE 132 FIVES: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 133 FIVES: DEALS

- TABLE 134 FIVES: OTHERS

- 12.1.6 SIEMENS

- TABLE 135 SIEMENS: BUSINESS OVERVIEW

- FIGURE 52 SIEMENS: COMPANY SNAPSHOT

- TABLE 136 SIEMENS: PRODUCT OFFERINGS

- TABLE 137 SIEMENS: PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.1.7 DEMATIC

- TABLE 138 DEMATIC: BUSINESS OVERVIEW

- TABLE 139 DEMATIC: PRODUCT OFFERINGS

- 12.1.8 INTERROLL

- TABLE 140 INTERROLL: BUSINESS OVERVIEW

- FIGURE 53 INTERROLL: COMPANY SNAPSHOT

- TABLE 141 INTERROLL: PRODUCT OFFERINGS

- 12.1.9 INVATA INTRALOGISTICS

- TABLE 142 INVATA: BUSINESS OVERVIEW

- TABLE 143 INVATA: PRODUCT OFFERINGS

- 12.1.10 MURATA MACHINERY

- TABLE 144 MURATA MACHINERY: BUSINESS OVERVIEW

- FIGURE 54 MURATA MACHINERY: COMPANY SNAPSHOT

- TABLE 145 MURATA MACHINERY: PRODUCT OFFERINGS

- TABLE 146 MURATA MACHINERY: OTHERS

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 AMH MATERIAL HANDLING

- TABLE 147 AMH MATERIAL HANDLING: COMPANY OVERVIEW

- 12.2.2 ATMOS

- TABLE 148 ATMOS: COMPANY OVERVIEW

- 12.2.3 BOWE SYSTEC

- TABLE 149 BOWE SYSTEC: COMPANY OVERVIEW

- 12.2.4 CONVEYCO

- TABLE 150 CONVEYCO: COMPANY OVERVIEW

- 12.2.5 DORNER

- TABLE 151 DORNER: COMPANY OVERVIEW

- 12.2.6 EQUINOX MHE

- TABLE 152 EQUINOX MHE: COMPANY OVERVIEW

- 12.2.7 EUROSORT

- TABLE 153 EUROSORT: COMPANY OVERVIEW

- 12.2.8 FALCON AUTOTECH

- TABLE 154 FALCON AUTOTECH: COMPANY OVERVIEW

- 12.2.9 ICONVEY

- TABLE 155 ICONVEY: COMPANY OVERVIEW

- 12.2.10 INTRALOX

- TABLE 156 INTRALOX: COMPANY OVERVIEW

- 12.2.11 KNAPP

- TABLE 157 KNAPP: COMPANY OVERVIEW

- 12.2.12 OKURA YUSOKI

- TABLE 158 OKURA YUSOKI: COMPANY OVERVIEW

- 12.2.13 PITNEY BOWES

- TABLE 159 PITNEY BOWES: COMPANY OVERVIEW

- 12.2.14 SOLYSTIC

- TABLE 160 SOLYSTIC: COMPANY OVERVIEW

- 12.2.15 VIASTORE SYSTEMS

- TABLE 161 VIASTORE: COMPANY OVERVIEW

13 ADJACENT MARKET

- 13.1 ASRS MARKET

- 13.2 INTRODUCTION

- FIGURE 55 ASRS MARKET, BY TYPE

- FIGURE 56 UNIT LOAD SEGMENT HELD LARGEST SHARE OF ASRS MARKET IN 2022

- TABLE 162 ASRS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 163 ASRS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 13.3 UNIT LOAD

- 13.3.1 OFFERS UNIQUE OPERATIONAL, SECURITY, AND PRODUCTIVITY BENEFITS

- TABLE 164 UNIT LOAD: ASRS MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 165 UNIT LOAD: ASRS MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 166 UNIT LOAD: ASRS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 167 UNIT LOAD: ASRS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.4 MINI LOAD

- 13.4.1 PROVIDES HIGH-DENSITY OPERATIONS, RAPID ACCELERATION, AND HIGH-SPEED MOVEMENT ON THREE-DIMENSIONAL AXIS

- TABLE 168 MINI LOAD: ASRS MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 169 MINI LOAD: ASRS MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 170 MINI LOAD: ASRS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 171 MINI LOAD: ASRS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.5 VERTICAL LIFT MODULE (VLM)

- 13.5.1 OFFERS ADVANTAGES OF GREATER ACCURACY AND EFFICIENT SPACE UTILIZATION

- TABLE 172 VLM: ASRS MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 173 VLM: ASRS MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- FIGURE 57 ASIA PACIFIC TO HOLD LARGEST SHARE OF ASRS MARKET FOR VLM DURING FORECAST PERIOD

- TABLE 174 VLM: ASRS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 175 VLM: ASRS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.6 CAROUSEL

- 13.6.1 VERTICAL CAROUSEL

- 13.6.1.1 Helps to save floor space

- 13.6.2 HORIZONTAL CAROUSEL

- 13.6.2.1 Ensures effective storage and retrieval processes

- TABLE 176 CAROUSEL: ASRS MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 177 CAROUSEL: ASRS MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 178 CAROUSEL: ASRS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 179 CAROUSEL: ASRS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.6.1 VERTICAL CAROUSEL

- 13.7 MID LOAD

- 13.7.1 HIGHLY FLEXIBLE SOLUTION THAT CAN AUTOMATE NEW OR EXISTING PROCESSES

- TABLE 180 MID LOAD: ASRS MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 181 MID LOAD: ASRS MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 182 MID LOAD: ASRS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 183 MID LOAD: ASRS MARKET, BY REGION, 2022-2027 (USD MILLION)

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS