|

|

市場調査レポート

商品コード

1303035

海軍通信の世界市場:プラットフォーム別 (艦艇、潜水艦、無人システム)・システム技術別 (海軍衛星通信システム、海軍無線システム、海軍セキュリティシステム、通信管理システム)・用途別・地域別の将来予測 (2028年まで)Naval Communication Market by Platform (Ships, Submarines, Unmanned Systems), System Technology (Naval Satcom Systems, Naval Radio Systems, Naval Security Systems and Communication Management Systems), Application and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 海軍通信の世界市場:プラットフォーム別 (艦艇、潜水艦、無人システム)・システム技術別 (海軍衛星通信システム、海軍無線システム、海軍セキュリティシステム、通信管理システム)・用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年07月03日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の海軍通信の市場規模は、2023年に33億米ドル、2028年には43億米ドルに達し、2023年から2028年までの間に5.3%のCAGRで成長すると予測されています。

地政学的要因と各国の防衛予算は、海軍通信市場に大きな影響を与えます。国家間の緊張、領土紛争、地域の安全保障上の懸念などの地政学的状況は、海軍通信システムの需要に直接影響します。世界中の海軍は、自国の海洋権益を守り、競争力を維持するために、通信能力の開発と強化を優先しています。軍事的プレゼンスの増大、領有権の主張、進化する安全保障上の脅威といった地政学的要因が、海軍の作戦を支援する高度な通信システムの必要性を高めています。

"艦艇セグメントが予測期間中に最も高いCAGRで成長する"

プラットフォーム別では、艦艇分野が予測期間中に最も高い成長率を維持すると予測されています。艦艇セグメントは、海軍通信市場で最大の市場シェアを占めると予測されています。航空母艦、潜水艦、駆逐艦、フリゲート、哨戒艇などの艦艇は、海軍作戦の基幹を形成しており、その効果的な機能には信頼性の高い通信システムが不可欠です。艦艇は、シームレスな連携、指揮、制御を可能にする堅牢な通信システムを必要とします。これらのシステムは、安全な音声およびデータ通信、リアルタイムの状況認識、他の海軍資産や司令部との相互運用性を促進します。艦艇セグメントには幅広い種類の艦艇が含まれ、それぞれに独自の通信要件があります。

"用途別では、指揮・統制セグメントが市場を独占する"

用途別では、指揮・統制セグメントが予測期間中に市場シェアを独占すると予測されています。指揮・統制システムは、効果的な調整、リアルタイムの状況認識、合理化された意思決定プロセスを促進し、海軍作戦において重要な役割を果たしています。ネットワーク中心の戦争コンセプトの採用が進むにつれて、堅牢な指揮統制システムの需要は増加の一途をたどっています。これらのシステムは、様々な通信技術、データ分析、AI機能を統合し、より迅速なデータ処理、予測分析、意思決定の強化を可能にします。

"北米が2023年に最大の市場シェアを占める"

海軍通信市場を地域別に見ると、2023年には北米が最大の市場シェアを占めています。特に北米では、米国が最大の市場です。この地域の優位性は、大手防衛請負業者の存在、強力な海軍能力、多額の防衛予算など、いくつかの要因に起因します。特に米国は、その強力な海軍力と防衛分野の技術進歩により、市場に大きな影響を及ぼしています。同国は、海軍の近代化プログラムや、海軍艦隊のための高度通信システムの開発に多額の投資を行っています。北米に本社を置くGeneral DynamicsやLockheed Martinなどの企業が、この地域の市場支配に貢献しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 1900年以降の海軍通信市場の発展

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 市場規模データの分析 (数量ベース)

- エコシステム分析

- バリューチェーン分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 貿易データ分析

- ケーススタディ分析

- 技術分析

- 規制状況

第6章 業界動向

- イントロダクション

- 海軍通信市場に影響を与える技術動向

第7章 海軍通信市場:プラットフォーム別

- イントロダクション

- 艦艇

- 潜水艦

- 無人システム

第8章 海軍通信市場:システム技術別

- イントロダクション

- 海軍衛星通信システム

- 海軍無線システム

- 海軍セキュリティシステム

- 通信管理システム

第9章 海軍通信市場:用途別

- イントロダクション

- 指揮・統制

- 諜報・監視・偵察

- 日常業務

- その他

第10章 海軍通信市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他のアジア太平洋

- その他の地域

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 概要

- 市場シェア分析 (2022年)

- 収益分析 (2022年)

- 市場ランキング分析 (2022年)

- 企業の製品フットプリント分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競争シナリオと動向

第12章 企業プロファイル

- イントロダクション

- 主要企業

- HONEYWELL INTERNATIONAL INC.

- GENERAL DYNAMICS CORPORATION

- LOCKHEED MARTIN CORPORATION

- BAE SYSTEMS PLC

- ELBIT SYSTEMS LTD.

- RAYTHEON TECHNOLOGIES CORPORATION

- L3HARRIS TECHNOLOGIES, INC.

- NORTHROP GRUMMAN CORPORATION

- SAAB AB

- THALES GROUP

- LEONARDO S.P.A.

- CURTISS-WRIGHT CORPORATION

- COBHAM LIMITED

- RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- ASELSAN A.S.

- GARMIN LTD.

- VIASAT INC.

- IRIDIUM COMMUNICATIONS INC.

- その他の企業

- RHODE & SCHWARZ

- DATA LINK SOLUTIONS

- ULTRA ELECTRONICS

- FURUNO ELECTRIC CO., LTD.

- ICOM INC.

- KONGSBERG

- JAPAN RADIO COMPANY

第13章 付録

The global market for naval communication market is estimated to be USD 3.3 billion in 2023 and expected to reach USD 4.3 billion by 2028 at a CAGR of 5.3% from 2023 to 2028 Geopolitical factors and defense budgets of nations have a significant influence on the naval communication market. The geopolitical landscape, including tensions between nations, territorial disputes, and regional security concerns, directly impacts the demand for naval communication systems. Naval forces around the world prioritize the development and enhancement of their communication capabilities to safeguard their maritime interests and maintain a competitive edge. Geopolitical factors such as increased military presence, territorial claims, and evolving security threats drive the need for advanced communication systems to support naval operations.

The ships segment is projected to witness the highest CAGR during the forecast period.

Based on platfrom, the ships segment of the naval communication market is projected to hold the highest growth rate during the forecast period. The ships segment is expected to hold the largest market share in the naval communication market. Naval vessels, including aircraft carriers, submarines, destroyers, frigates, and patrol boats, form the backbone of naval operations, and reliable communication systems are essential for their effective functioning. Ships require robust communication systems to enable seamless coordination, command, and control. These systems facilitate secure voice and data communication, real-time situational awareness, and interoperability with other naval assets and command centers. The ships segment encompasses a wide range of vessel types, each with unique communication requirements.

The command and control segment is projected to dominate the naval communication market by frequency

Based on application, the command coned control segment is projected to dominate the market share during the forecast period. The command and control segment is poised to dominate the naval communication market. Command and control systems play a critical role in naval operations, facilitating effective coordination, real-time situational awareness, and streamlined decision-making processes. With the growing adoption of network-centric warfare concepts, the demand for robust command and control systems continues to rise. These systems integrate various communication technologies, data analytics, and AI capabilities to enable faster data processing, predictive analysis, and enhanced decision-making.

North America is expected to account for the largest market share in 2023

The naval communication market industry has been studied in North America, Europe, Asia Pacific, and Rest of the World. North America accounted for the largest market share in 2023. The largest market for naval communication in North America is typically the US. The region's dominance can be attributed to several factors, including the presence of major defense contractors, robust naval capabilities, and substantial defense budgets. The US, in particular, has a significant influence on the market due to its strong naval force and technological advancements in the defense sector. The country invests heavily in naval modernization programs and the development of advanced communication systems for its naval fleet. Companies such as General Dynamics and Lockheed Martin, which are headquartered in North America, contribute to the region's market dominance.

The break-up of the profile of primary participants in the naval communication market:

- By Company Type: Tier 1 - 55%, Tier 2 - 20%, and Tier 3 - 25%

- By Designation: C Level - 10%, Managers - 50%, Academic Experts-40%

- By Region: North America -10%, Europe - 20%, Asia Pacific - 40%, Rest of the World - 30%

Prominent companies include Honeywell International Inc. (US), General Dynamics Corporation (US), Lockheed Martin Corporation (US), BAE Systems plc (UK), and Elbit Systems Ltd.(Israel) among others.

Research Coverage:

This research report categorizes the naval communication market by application (Command and Control, Intelligence Surveillance and Reconnaissance (ISR), Routine Operations, and Others), by System Technology (Naval Satcom Systems, Naval Radio Systems, Naval Security Systems, and Communication Management Systems), by Platform (Ships, and Submarines), and region (North America, Europe, Asia Pacific, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the naval communication market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the naval communication market. Competitive analysis of upcoming startups in the naval communication market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall naval communication market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on naval communication offered by the top players in the market

- Analysis of key drivers (Increasing geopolitical tensions and defense budgets, Rapid technological advancements, Growing demand for cybersecurity measures), restraints (Spectrum management, Compatibility with legacy systems), opportunities (Adoption of 5G technology, Integration of artificial intelligence (AI), Growing demand for unmanned systems), and challenges (Cybersecurity risks, Environmental factors)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the naval communication market

- Market Development: Comprehensive information about lucrative markets - the report analyses the naval communication market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the naval communication market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players in the naval communication market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 NAVAL COMMUNICATION MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- 1.4.2 REGIONS COVERED

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH METHODOLOGY MODEL

- FIGURE 2 NAVAL COMMUNICATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- FIGURE 3 KEY DATA FROM PRIMARY SOURCES

- 2.1.2.2 Breakdown of primary interviews

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- TABLE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.1.1 Regional split of naval communication market

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 6 NAVAL COMMUNICATION MARKET: DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 SHIPS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 NAVAL SATCOM SYSTEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 COMMAND & CONTROL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NAVAL COMMUNICATION MARKET

- FIGURE 11 ADVANCEMENTS IN NAVAL COMMUNICATION SYSTEMS TO DRIVE MARKET DURING FORECAST PERIOD

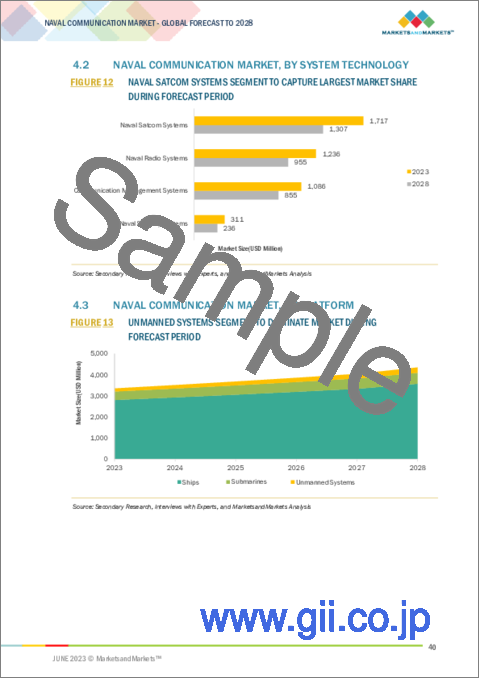

- 4.2 NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY

- FIGURE 12 NAVAL SATCOM SYSTEMS SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 NAVAL COMMUNICATION MARKET, BY PLATFORM

- FIGURE 13 UNMANNED SYSTEMS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 NAVAL COMMUNICATION MARKET, BY APPLICATION

- FIGURE 14 COMMAND & CONTROL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 NAVAL COMMUNICATION MARKET, BY COUNTRY

- FIGURE 15 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 NAVAL COMMUNICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing geopolitical tensions and defense budgets

- 5.2.1.2 Advancements in satellite communication systems and integration of network centric solutions

- 5.2.1.3 Growing demand for cybersecurity

- 5.2.2 RESTRAINTS

- 5.2.2.1 Spectrum management

- 5.2.2.2 Compatibility with legacy systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of 5G technology

- 5.2.3.2 Integration of artificial intelligence

- 5.2.3.3 Growing demand for unmanned systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity risks

- 5.2.4.1.1 Key cybersecurity risks and their implications

- 5.2.4.2 Environmental factors

- 5.2.4.1 Cybersecurity risks

- 5.3 DEVELOPMENTS IN NAVAL COMMUNICATION MARKET SINCE 1900

- 5.3.1 MAJOR DEVELOPMENTS REVOLUTIONIZING NAVAL COMMUNICATION IN LAST 100 YEARS

- FIGURE 17 NAVAL COMMUNICATION MARKET: KEY DEVELOPMENTS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR NAVAL COMMUNICATION SOLUTION PROVIDERS

- FIGURE 18 NAVAL COMMUNICATION MARKET: REVENUE SHIFTS FOR KEY PLAYERS

- 5.5 PRICING ANALYSIS

- TABLE 4 AVERAGE VALUE OF NAVAL COMMUNICATION COMPONENTS

- 5.6 VOLUME DATA ANALYSIS

- TABLE 5 NAVAL COMMUNICATION MARKET: DELIVERIES (IN UNITS)

- 5.7 ECOSYSTEM ANALYSIS

- FIGURE 19 NAVAL COMMUNICATION MARKET: ECOSYSTEM ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 END USERS

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 20 NAVAL COMMUNICATION MARKET: VALUE CHAIN ANALYSIS

- 5.8.1 RAW MATERIAL SUPPLIERS

- TABLE 6 RAW MATERIAL SUPPLIERS

- 5.8.2 PARTS SUPPLIERS

- TABLE 7 PARTS SUPPLIERS

- 5.8.3 MANUFACTURERS

- TABLE 8 MANUFACTURERS

- 5.8.4 END USERS

- TABLE 9 END USERS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 NAVAL COMMUNICATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 NAVAL COMMUNICATION MARKET: IMPACT OF PORTER'S FIVE FORCES

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF NAVAL COMMUNICATION SYSTEMS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF NAVAL COMMUNICATION SYSTEMS (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR NAVAL COMMUNICATION SYSTEMS

- TABLE 12 KEY BUYING CRITERIA FOR NAVAL COMMUNICATION SYSTEMS

- 5.11 TRADE DATA ANALYSIS

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 IMPLEMENTATION OF ADVANCED COMMUNICATION SYSTEMS FOR NAVAL FLEET

- 5.12.2 INTEGRATION OF UNDERWATER COMMUNICATION SYSTEMS INTO SUBMARINES

- 5.12.3 DEVELOPMENT OF CYBERSECURITY SOLUTIONS FOR NAVAL COMMUNICATION SYSTEMS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 SOFTWARE-DEFINED NETWORKING

- 5.13.2 COGNITIVE RADIO

- 5.13.3 SATELLITE COMMUNICATION ADVANCEMENTS

- 5.13.4 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 5.13.5 CYBERSECURITY ENHANCEMENTS

- 5.13.6 INTEGRATION OF UNMANNED SYSTEMS

- 5.13.7 QUANTUM COMMUNICATION

- 5.14 REGULATORY LANDSCAPE

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS IMPACTING NAVAL COMMUNICATION MARKET

- 6.2.1 5G

- 6.2.1.1 5G connectivity for naval communication

- 6.2.2 QUANTUM COMMUNICATION

- 6.2.2.1 Safeguarding naval communication with quantum technology

- 6.2.3 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.2.3.1 Artificial intelligence and machine learning to be future of naval communication

- 6.2.4 AUGMENTED REALITY AND VIRTUAL REALITY

- 6.2.4.1 Augmented reality and virtual reality integration into naval communication systems

- 6.2.5 SOFTWARE-DEFINED NETWORKING

- 6.2.5.1 Software-defined networking to empower naval communication

- 6.2.6 SATELLITE COMMUNICATION SYSTEMS

- 6.2.6.1 Satellite communication systems to enhance naval communication

- 6.2.7 SOUNDING DEPTH

- 6.2.7.1 Adoption of underwater acoustic communication technology for naval communication

- 6.2.8 INTRA-VESSEL WIRELESS NETWORKS

- 6.2.8.1 Intra-vessel wireless networks to transform naval communication

- 6.2.9 COGNITIVE RADIO TECHNOLOGY

- 6.2.9.1 Cognitive radio technology to enable integration of spectrum technology into naval communication

- 6.2.10 ADVANCED RADAR AND SONAR COMMUNICATION SYSTEMS

- 6.2.10.1 Advanced radar and sonar communication systems to enhance situational awareness in naval operations

- 6.2.11 MULTI-FUNCTIONAL ANTENNA ARRAYS

- 6.2.11.1 Multi-functional antenna arrays to enhance naval communication capabilities

- 6.2.12 UNDERWATER OPTICAL COMMUNICATION

- 6.2.12.1 Underwater optical communication to enable high-speed data transfer in naval operations

- 6.2.1 5G

7 NAVAL COMMUNICATION MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- FIGURE 24 SHIPS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 17 NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 18 NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 7.2 SHIPS

- 7.2.1 CRITICALITY OF INTEGRATED COMMUNICATION NETWORKS IN NAVAL SHIPS TO DRIVE MARKET

- 7.2.1.1 Combat vessels

- 7.2.1.1.1 Destroyers

- 7.2.1.1.2 Frigates

- 7.2.1.1.3 Corvettes

- 7.2.1.1.4 Aircraft carriers

- 7.2.1.1.5 Survey vessels

- 7.2.1.1.6 Patrol and mine countermeasure vessels

- 7.2.1.2 COMBAT SUPPORT VESSELS

- 7.2.1.2.1 Offshore support vessels

- 7.2.1.2.2 Landing ship tanks

- 7.2.1.2.3 Other supporting vessels

- 7.2.1.1 Combat vessels

- 7.2.1 CRITICALITY OF INTEGRATED COMMUNICATION NETWORKS IN NAVAL SHIPS TO DRIVE MARKET

- 7.3 SUBMARINES

- 7.3.1 INCREASING DEPENDENCY OF SUBMARINES ON COMMUNICATION TECHNOLOGIES FOR CONDUCTING STEALTHY UNDERWATER OPERATIONS TO DRIVE MARKET

- 7.4 UNMANNED SYSTEMS

- 7.4.1 CRITICALITY OF UNMANNED SYSTEMS TO CONDUCT CRUCIAL OPERATIONS EFFICIENTLY TO DRIVE MARKET

8 NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY

- 8.1 INTRODUCTION

- FIGURE 25 NAVAL SATCOM SYSTEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 19 NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 20 NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2023-2028 (USD MILLION)

- 8.2 NAVAL SATCOM SYSTEMS

- 8.2.1 RESPONSIBLE FOR PROVIDING SHIPS AND SUBMARINES WITH RELIABLE AND SECURE COMMUNICATION CAPABILITIES IN DIVERSE MARITIME ENVIRONMENTS

- 8.2.1.1 Antennas

- 8.2.1.2 Tactical data links

- 8.2.1 RESPONSIBLE FOR PROVIDING SHIPS AND SUBMARINES WITH RELIABLE AND SECURE COMMUNICATION CAPABILITIES IN DIVERSE MARITIME ENVIRONMENTS

- 8.3 NAVAL RADIO SYSTEMS

- 8.3.1 RESPONSIBLE FOR PROVIDING RELIABLE AND EFFECTIVE MEANS OF COMMUNICATION FOR SHIPS, SUBMARINES, AND NAVAL AVIATION

- 8.3.1.1 High frequency

- 8.3.1.2 Ultra high frequency

- 8.3.1.3 Very high frequency

- 8.3.1 RESPONSIBLE FOR PROVIDING RELIABLE AND EFFECTIVE MEANS OF COMMUNICATION FOR SHIPS, SUBMARINES, AND NAVAL AVIATION

- 8.4 NAVAL SECURITY SYSTEMS

- 8.4.1 PLAY VITAL ROLE IN SAFEGUARDING NAVAL ASSETS, PERSONNEL, AND OPERATIONS FROM THREATS

- 8.4.1.1 Data encryption systems

- 8.4.1 PLAY VITAL ROLE IN SAFEGUARDING NAVAL ASSETS, PERSONNEL, AND OPERATIONS FROM THREATS

- 8.5 COMMUNICATION MANAGEMENT SYSTEMS

- 8.5.1 HAVE ABILITY TO INTEGRATE VARIOUS COMMUNICATION CHANNELS INTO CENTRALIZED PLATFORM

- 8.5.1.1 Communication network infrastructure

- 8.5.1 HAVE ABILITY TO INTEGRATE VARIOUS COMMUNICATION CHANNELS INTO CENTRALIZED PLATFORM

9 NAVAL COMMUNICATION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 26 COMMAND & CONTROL TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 21 NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 22 NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 COMMAND & CONTROL

- 9.2.1 NEED FOR RAPID TRANSMISSION OF CRITICAL INFORMATION SUCH AS TARGET DATA AND THREAT ASSESSMENTS TO DRIVE MARKET

- 9.3 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE

- 9.3.1 INCREASING USE OF HIGH-BANDWIDTH DATA LINKS AND SECURE NETWORK ARCHITECTURES TO DRIVE MARKET

- 9.4 ROUTINE OPERATIONS

- 9.4.1 INCREASING NEED TO ESTABLISH SECURE AND RELIABLE COMMUNICATION LINKS TO DRIVE MARKET

- 9.5 OTHERS

10 NAVAL COMMUNICATION MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 27 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN NAVAL COMMUNICATION MARKET DURING FORECAST PERIOD

- 10.1.1 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 23 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 24 NAVAL COMMUNICATION MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 25 NAVAL COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 28 RECESSION IMPACT: GLOBAL PESSIMISTIC AND REALISTIC SCENARIOS

- 10.2 NORTH AMERICA

- 10.2.1 INTRODUCTION

- 10.2.2 PESTLE ANALYSIS

- FIGURE 29 NORTH AMERICA: NAVAL COMMUNICATION MARKET SNAPSHOT

- TABLE 26 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 27 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 29 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Technological advancements to drive market

- TABLE 34 US: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 35 US: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 36 US: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 37 US: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Collaborative R&D and indigenous innovation to drive market

- TABLE 38 CANADA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 39 CANADA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 40 CANADA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 41 CANADA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 INTRODUCTION

- 10.3.2 PESTLE ANALYSIS

- FIGURE 30 EUROPE: NAVAL COMMUNICATION MARKET SNAPSHOT

- TABLE 42 EUROPE: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 43 EUROPE: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 44 EUROPE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 45 EUROPE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 46 EUROPE: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 47 EUROPE: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 48 EUROPE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 49 EUROPE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Innovations and presence of prominent players to drive market

- TABLE 50 UK: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 51 UK: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 52 UK: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 53 UK: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Increasing collaborations between government and private companies to drive market

- TABLE 54 GERMANY: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 55 GERMANY: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 56 GERMANY: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 57 GERMANY: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 Technological innovations to drive market

- TABLE 58 FRANCE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 59 FRANCE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 60 FRANCE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 61 FRANCE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.6 RUSSIA

- 10.3.6.1 Innovations and strategic investments to drive market

- TABLE 62 RUSSIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 63 RUSSIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 64 RUSSIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 65 RUSSIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.7 ITALY

- 10.3.7.1 Focus on R&D to drive market

- TABLE 66 ITALY: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 67 ITALY: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 68 ITALY: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 69 ITALY: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.8 REST OF EUROPE

- TABLE 70 REST OF EUROPE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 71 REST OF EUROPE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 72 REST OF EUROPE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 73 REST OF EUROPE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 INTRODUCTION

- 10.4.2 PESTLE ANALYSIS

- FIGURE 31 ASIA PACIFIC: NAVAL COMMUNICATION MARKET SNAPSHOT

- TABLE 74 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 75 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 77 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 79 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 81 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Investments in advanced communication systems to drive market

- TABLE 82 CHINA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 83 CHINA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 84 CHINA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 85 CHINA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Modernization of naval fleet to drive market

- TABLE 86 INDIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 87 INDIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 88 INDIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 89 INDIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.5 JAPAN

- 10.4.5.1 Presence of key players to drive market

- TABLE 90 JAPAN: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 91 JAPAN: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 92 JAPAN: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 93 JAPAN: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.6 AUSTRALIA

- 10.4.6.1 Upgrade of naval communication systems to drive market

- TABLE 94 AUSTRALIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 95 AUSTRALIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 96 AUSTRALIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 97 AUSTRALIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.7 SOUTH KOREA

- 10.4.7.1 Increasing investments in advanced technologies to drive market

- TABLE 98 SOUTH KOREA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 99 SOUTH KOREA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 100 SOUTH KOREA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 101 SOUTH KOREA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.8 REST OF ASIA PACIFIC

- TABLE 102 REST OF ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5 REST OF THE WORLD

- 10.5.1 INTRODUCTION

- 10.5.2 PESTLE ANALYSIS

- TABLE 106 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 107 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 108 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 109 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 110 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 111 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 112 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 113 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.3 MIDDLE EAST & AFRICA

- 10.5.3.1 Advancements in naval command and control capabilities to drive market

- TABLE 114 MIDDLE EAST & AFRICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.4 LATIN AMERICA

- 10.5.4.1 Increasing focus on enhancing naval capabilities to drive market

- TABLE 118 LATIN AMERICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 119 LATIN AMERICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 120 LATIN AMERICA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 121 LATIN AMERICA: NAVAL COMMUNICATION MARKET, BY APPLICATION 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2022

- TABLE 122 NAVAL COMMUNICATION MARKET: DEGREE OF COMPETITION

- FIGURE 32 NAVAL COMMUNICATION MARKET SHARE ANALYSIS, 2022

- 11.3 REVENUE ANALYSIS, 2022

- FIGURE 33 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2022

- 11.4 MARKET RANKING ANALYSIS, 2022

- FIGURE 34 RANKING ANALYSIS OF TOP 5 PLAYERS IN NAVAL COMMUNICATION MARKET, 2022

- 11.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 123 COMPANY PRODUCT FOOTPRINT

- TABLE 124 COMPANY APPLICATION FOOTPRINT

- TABLE 125 COMPANY REGION FOOTPRINT

- 11.6 COMPANY EVALUATION MATRIX

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 35 NAVAL COMMUNICATION MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.7 START-UP/SME EVALUATION MATRIX

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 36 NAVAL COMMUNICATION MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 11.7.5 COMPETITIVE BENCHMARKING

- TABLE 126 NAVAL COMMUNICATION MARKET: LIST OF START-UPS/SMES

- TABLE 127 NAVAL COMMUNICATION MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 11.8 COMPETITIVE SCENARIOS AND TRENDS

- 11.8.1 DEALS

- TABLE 128 DEALS, 2019-2023

- 11.8.2 PRODUCT LAUNCHES

- TABLE 129 PRODUCT LAUNCHES, 2019-2023

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 HONEYWELL INTERNATIONAL INC.

- TABLE 130 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 37 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 131 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 132 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 133 HONEYWELL INTERNATIONAL INC.: DEALS

- 12.2.2 GENERAL DYNAMICS CORPORATION

- TABLE 134 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- FIGURE 38 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- TABLE 135 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 136 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

- TABLE 137 GENERAL DYNAMICS CORPORATION: DEALS

- 12.2.3 LOCKHEED MARTIN CORPORATION

- TABLE 138 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- FIGURE 39 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 139 LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

- TABLE 140 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 141 LOCKHEED MARTIN CORPORATION: DEALS

- 12.2.4 BAE SYSTEMS PLC

- TABLE 142 BAE SYSTEMS PLC: COMPANY OVERVIEW

- FIGURE 40 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- TABLE 143 BAE SYSTEMS PLC: PRODUCTS OFFERED

- TABLE 144 BAE SYSTEMS PLC: PRODUCT LAUNCHES

- TABLE 145 BAE SYSTEMS PLC: DEALS

- 12.2.5 ELBIT SYSTEMS LTD.

- TABLE 146 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- FIGURE 41 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 147 ELBIT SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 148 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 149 ELBIT SYSTEMS LTD.: DEALS

- 12.2.6 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 150 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- FIGURE 42 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 151 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

- TABLE 152 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 153 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- 12.2.7 L3HARRIS TECHNOLOGIES, INC.

- TABLE 154 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 43 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 155 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 156 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 157 L3HARRIS TECHNOLOGIES, INC.: DEALS

- 12.2.8 NORTHROP GRUMMAN CORPORATION

- TABLE 158 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- FIGURE 44 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 159 NORTHROP GRUMMAN CORPORATION: PRODUCTS OFFERED

- TABLE 160 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 161 NORTHROP GRUMMAN CORPORATION: DEALS

- 12.2.9 SAAB AB

- TABLE 162 SAAB AB: COMPANY OVERVIEW

- FIGURE 45 SAAB AB: COMPANY SNAPSHOT

- TABLE 163 SAAB AB: PRODUCTS OFFERED

- TABLE 164 SAAB AB: PRODUCT LAUNCHES

- TABLE 165 SAAB AB: DEALS

- 12.2.10 THALES GROUP

- TABLE 166 THALES GROUP: COMPANY OVERVIEW

- FIGURE 46 THALES GROUP: COMPANY SNAPSHOT

- TABLE 167 THALES GROUP: PRODUCTS OFFERED

- TABLE 168 THALES GROUP: PRODUCT LAUNCHES

- TABLE 169 THALES GROUP: DEALS

- 12.2.11 LEONARDO S.P.A.

- TABLE 170 LEONARDO S.P.A.: COMPANY OVERVIEW

- FIGURE 47 LEONARDO S.P.A.: COMPANY SNAPSHOT

- TABLE 171 LEONARDO S.P.A.: PRODUCTS OFFERED

- TABLE 172 LEONARDO S.P.A.: PRODUCT LAUNCHES

- TABLE 173 LEONARDO S.P.A.: DEALS

- 12.2.12 CURTISS-WRIGHT CORPORATION

- TABLE 174 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- FIGURE 48 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- TABLE 175 CURTISS-WRIGHT CORPORATION: PRODUCTS OFFERED

- TABLE 176 CURTISS-WRIGHT CORPORATION: DEALS

- 12.2.13 COBHAM LIMITED

- TABLE 177 COBHAM LIMITED: COMPANY OVERVIEW

- FIGURE 49 COBHAM LIMITED: COMPANY SNAPSHOT

- TABLE 178 COBHAM LIMITED: PRODUCTS OFFERED

- TABLE 179 COBHAM LIMITED: PRODUCT LAUNCHES

- TABLE 180 COBHAM LIMITED: DEALS

- 12.2.14 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- TABLE 181 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY OVERVIEW

- FIGURE 50 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 182 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 183 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: PRODUCT LAUNCHES

- 12.2.15 ASELSAN A.S.

- TABLE 184 ASELSAN A.S.: COMPANY OVERVIEW

- FIGURE 51 ASELSAN A.S.: COMPANY SNAPSHOT

- TABLE 185 ASELSAN A.S.: PRODUCTS OFFERED

- 12.2.16 GARMIN LTD.

- TABLE 186 GARMIN LTD.: COMPANY OVERVIEW

- FIGURE 52 GARMIN LTD.: COMPANY SNAPSHOT

- TABLE 187 GARMIN LTD.: PRODUCTS OFFERED

- TABLE 188 GARMIN LTD.: DEALS

- 12.2.17 VIASAT INC.

- TABLE 189 VIASAT INC.: COMPANY OVERVIEW

- FIGURE 53 VIASAT INC.: COMPANY SNAPSHOT

- TABLE 190 VIASAT INC.: PRODUCTS OFFERED

- TABLE 191 VIASAT INC.: PRODUCT LAUNCHES

- TABLE 192 VIASAT INC.: DEALS

- 12.2.18 IRIDIUM COMMUNICATIONS INC.

- TABLE 193 IRIDIUM COMMUNICATIONS INC.: COMPANY OVERVIEW

- FIGURE 54 IRIDIUM COMMUNICATIONS INC.: COMPANY SNAPSHOT

- TABLE 194 IRIDIUM COMMUNICATIONS INC.: PRODUCTS OFFERED

- TABLE 195 IRIDIUM COMMUNICATIONS INC.: PRODUCT LAUNCHES

- 12.3 OTHER PLAYERS

- 12.3.1 RHODE & SCHWARZ

- TABLE 196 RHODE & SCHWARZ: COMPANY OVERVIEW

- 12.3.2 DATA LINK SOLUTIONS

- TABLE 197 DATA LINK SOLUTIONS: COMPANY OVERVIEW

- 12.3.3 ULTRA ELECTRONICS

- TABLE 198 ULTRA ELECTRONICS: COMPANY OVERVIEW

- 12.3.4 FURUNO ELECTRIC CO., LTD.

- TABLE 199 FURUNO ELECTRIC CO., LTD.: COMPANY OVERVIEW

- 12.3.5 ICOM INC.

- TABLE 200 ICOM INC.: COMPANY OVERVIEW

- 12.3.6 KONGSBERG

- TABLE 201 KONGSBERG: COMPANY OVERVIEW

- 12.3.7 JAPAN RADIO COMPANY

- TABLE 202 JAPAN RADIO COMPANY: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS