|

|

市場調査レポート

商品コード

1303031

動物用API (医薬品原薬) の世界市場:APIの種類別 (抗菌剤 (フルオロキノロン、テトラサイクリン)、ワクチン、ホルモン)・合成方法別・投与経路別・動物の種類別の将来予測 (2028年まで)Veterinary API Market by API Type (Antimicrobials (Fluoroquinolones, Tetracyclines), Vaccines, Hormones, Antimicrobials, Anti-inflammatory, Hormones), Synthesis Type, Route of Administration, and Animal Type - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 動物用API (医薬品原薬) の世界市場:APIの種類別 (抗菌剤 (フルオロキノロン、テトラサイクリン)、ワクチン、ホルモン)・合成方法別・投与経路別・動物の種類別の将来予測 (2028年まで) |

|

出版日: 2023年06月21日

発行: MarketsandMarkets

ページ情報: 英文 272 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の動物用API (医薬品原薬) 市場は今後大きく成長すると考えられています。

2023年の52億米ドルから、予測期間中に6.5%のCAGRで成長し、2028年までに71億米ドルに達すると予測されます。動物用API市場の成長要因として、越境・人獣共通感染症の発生率の上昇、動物人口とペット飼育数の増加、疾病管理・疾病予防対策の強化などが挙げられます。

"合成方法別では、化学ベースAPIのセグメントが最も高いシェアを占める"

合成方法別に見ると、2022年には化学ベースAPI分野が最も高いシェアを占めています。血漿由来の医薬品に対する需要の増加、血漿分画技術の進歩、コールドチェーンインフラ向け需要の拡大などが、今後の市場拡大の促進要因になると考えられています。動物用医薬品の需要の開拓、新規感染症の発生、研究開発活動の活発化もまた、予測期間を通じて市場拡大を促進する考えられています。

"コンパニオンアニマルの分野が最も高いシェアを占める"

動物の種類別では、2022年にはコンパニオンアニマルが最も高いシェアを占めました。コンパニオンアニマルの予防医療が重視されるようになり、ペットの飼育が増加していることが、市場シェアの高さの要因の一つです。

"アジア太平洋が予測期間中に最速の成長率で成長する"

地域別では、予測期間にアジア太平洋の動物用API市場が最も急速に成長します。動物病院・医療施設の数の多さ、動物向け疾病の蔓延、動物用API製造のための製造インフラの台頭などが、市場成長を促進する主な要因です。アジア太平洋地域では、動物の健康と福祉に対する意識の高まりと相まって、ペットの飼育数が増加しています。このため、同地域では動物用医薬品やAPIの需要が高まっています。アジア太平洋の多くの国々 (中国、インド、韓国など) では、大幅な経済成長と可処分所得の増加が見られます。その結果、コンパニオンアニマルの医療に投資する能力と意欲が高まり、動物用APIの製造インフラの拡大を後押ししています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界動向

- 価格分析

- サプライチェーン分析

- エコシステム分析

- 特許分析

- バリューチェーン分析

- ケーススタディ

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 隣接市場分析

- 主な会議とイベント (2023年~2024年)

- 主要な利害関係者と購入基準

- 貿易分析

- 動物用API市場に対する景気後退の影響

第6章動物用API市場:種類別

- イントロダクション

- 寄生虫駆除剤

- アルベンダゾール・フェンベンダゾール

- イベルメクチン

- プラジカンテル

- レバミソール

- その他の寄生虫駆除剤

- ワクチン

- 犬パルボウイルス・犬ジステンパーウイルスワクチン

- ニューカッスル病ウイルスワクチン

- 感染性ファブリーズ病ウイルスワクチン

- 猫白血病ウイルスワクチン

- その他のワクチン

- 抗菌剤

- ベータラクタム

- テトラサイクリン

- アミノグリコシド

- フルオロキノロン

- その他の抗菌剤

- 抗炎症剤

- メロキシカム・ピロキシカム

- カルプロフェン

- デラコキシブ・フィロコキシブ

- その他の抗炎症薬

- ホルモン

- プロゲステロン・テストステロン

- エストラジオール

- 黄体形成ホルモン

- その他のホルモン

- その他の動物用API

第7章 動物用API市場:合成方法別

- イントロダクション

- 化学ベースAPI

- 生物学的API

- 高薬理活性原薬 (HPAPI)

第8章 動物用API市場:投与経路別

- イントロダクション

- 経口薬

- 注入薬

- 局所薬

- その他の経路

第9章 動物用API市場:動物の種類別

- イントロダクション

- コンパニオンアニマル

- 家畜

第10章 動物用API市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要プレーヤーの戦略

- 主要企業の収益シェア分析

- 市場シェア分析

- 企業評価マトリックス (2022年)

- 競合ベンチマーキング

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- BOEHRINGER INGELHEIM GMBH

- ZOETIS, INC.

- ELANCO ANIMAL HEALTH INCORPORATED

- MERCK & CO., INC.

- VIRBAC

- VETOQUINOL S.A.

- SEQUENT SCIENTIFIC LIMITED

- PHIBRO ANIMAL HEALTH CORPORATION

- FABBRICA ITALIANA SINTETICI S.P.A.

- EXCEL INDUSTRIES LTD.

- NGL FINE-CHEM LTD.

- QILU PHARMACEUTICAL

- OLON S.P.A.

- SHANDONG LUKANG PHARMACEUTICAL CO., LTD.

- ZHEJIANG HUADI PHARMACEUTICAL GROUP CO., LTD.

- INSUD PHARMA

- MENADIONA SL

- ROCHEM INTERNATIONAL, INC.

- AFTON PHARMA

- SHAANXI HANJIANG PHARMACEUTICAL GROUP CO. LTD.

- その他の企業

- DALIAN LAUNCHER FINE CHEMICAL CO., LTD.

- AMGIS LIFESCIENCE LTD.

- D.H. ORGANICS

- SIFLON DRUGS

- SBD HEALTHCARE PVT. LTD.

- CENTURY PHARMACEUTICALS LTD.

- SIDHIV PHARMA

- FERMION

- CHEMINO PHARMA PRIVATE LIMITED

- SUANFARMA

第13章 付録

The global Veterinary API Market is estimated to grow significantly. By 2028, it is projected to reach a value of USD 7.1 billion, showing a compound annual growth rate (CAGR) of 6.5% during the forecast period, starting from USD 5.2 billion in 2023. The expansion of the Veterinary API Market is driven by various factors, including rising incidence of transboundary & zoonotic diseases, increasing animal population and pet ownership, and increasing disease control & disease prevention measures.

"Chemical based API segment was dominated by the highest share in Veterinary API Market"

The Veterinary API Market is divided into three types based on synthesis types such as Chemical based API, Biological API, and Highly potent API. The Chemical based API segment accounted for the highest share of the global Veterinary API Market in 2022. Increasing Demand for Plasma-Derived Medicinal Products, Advancements in Plasma Fractionation Technologies, and Growing Need for Cold Chain Infrastructure all some of the factors that are anticipated to promote market expansion throughout the projected period. Growing demand for veterinary medicines, occurrence of new or emerging infectious diseases, and increasing research and development activities are some of the factors that are anticipated to promote market expansion throughout the projected period.

"Companion animal segment was dominated by the highest share in Veterinary API Market"

The Veterinary API Market, based on Animal Type is divided into two types such as companion animals and livestock animals. In 2022, companion animals held the highest market share for Veterinary API Market. Growing emphasis on preventive healthcare for companion animals and Increasing pet ownership are some of the factors that contribute to the big proportion of this market.

"Asia Pacific is expected to witness the fastest growth in the forecast period." In the forecast period, Asia Pacific in the Veterinary API Market will have the fastest rising regional growth. Large number of veterinary hospitals and healthcare facilities, increasing spread of diseases in animals, and rising manufacturing infrasturcture for veterinary API manufacturing are the main factors driving market growth. Asia Pacific region has experienced an increase in pet ownership, coupled with a rising awareness of animal health and welfare. This has led to a higher demand for veterinary medicines and APIs in the region. Many countries in the Asia Pacific region, such as China, India, and South Korea, have seen substantial economic growth and increased disposable income. This has resulted in a greater ability and willingness to invest in the healthcare of companion animals, driving the expansion of veterinary API manufacturing infrastructure.

Following is a list of the major players (supply-side) in the Veterinary API Marketthat this study refers to: By Company Type: Tier 1- 34%, Tier 2- 46%, and Tier 3- 20% By Designation: C-level- 35%, Director Level-25%, and Others- 40% By Region: North America-30%, Europe-45%, Asia Pacific-20%, Latin America- 3%, and Middle East and Africa-2% Several of the major companies in the market for Veterinary API Market includes Phibro Animal Health Corporation (US), Fabbrica Italiana Sintetici S.p.A. (Italy), Sequent Scientific Ltd. (India), Excel Industries Ltd. (India), NGL Fine-Chem Ltd. (India), Insulnsud Pharma (Spain), Menadiona Sl (Spain), Rochem International Inc. (US), and Shaanxi Hanjiang Pharmaceutical Group Co. Ltd. (China)

Research Coverage:

The market study analyzes the main market segments for Veterinary APIs. The objective of this study is to estimate the market's size and growth potential across several categories according to API Type, Synthesis Type, Route of Administration, and Animal Type. The report also provides a thorough competition analysis of the major market participants, together with company profiles, major insights regarding their product and service offerings, recent advancements, and key market strategies.

Key Benefits of Buying the Report:

The study provides data regarding the Veterinary API Market's closest approximations and its segments, which will benefit market leaders and new entrants. This study will assist stakeholders in comprehending the competitive environment, obtaining insights to better position of their businesses, and developing appropriate go-to-market strategies. The research will also assist stakeholders in obtaining insights into the market's pulse and learning about its major drivers, inhibitors, opportunities, and problems.

The report provides insights on the following pointers:

Analysis of key drivers (Rising incidence of transboundary & zoonotic diseases, increasing animal population and pet ownership, and increasing disease control & disease prevention measures), restraints (High costs of veterinary diagnostic and treatment) opportunities (Rising awareness about animal health and welfare and Untapped emerging economies), and challenges (Challenges In Large Molecule APIs Synthesis) influencing the growth of the Veterinary API Market.

Product Development/innovation:

Comprehensive details on new technologies, R&D initiatives, and product and service launches for Veterinary API Market

Market Development:

Comprehensive data on attractive markets, and the research analyzes the global Veterinary API Market

Market Diversification:

Detailed information on emerging products and services, unexplored regions, current trends, and investments in the Veterinary API Market.

Competitive Assessment:

Comprehensive analysis of market shares, growth plans, and service offerings of major companies operating in the Veterinary API Market like Phibro Animal Health Corporation (US), Fabbrica Italiana Sintetici S.p.A. (Italy), Sequent Scientific Ltd. (India), Excel Industries Ltd. (India), NGL Fine-Chem Ltd. (India)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 VETERINARY API MARKET SEGMENTATION

- FIGURE 2 VETERINARY API MARKET, BY REGION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.4.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS FOR PHIBRO ANIMAL HEALTH CORPORATION (2022)

- FIGURE 9 VETERINARY API MARKET: SUPPLY-SIDE ANALYSIS (2022)

- FIGURE 10 VETERINARY API MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES AND THEIR IMPACT ON MARKET GROWTH AND CAGR (2023-2028)

- FIGURE 11 VETERINARY API MARKET: CAGR PROJECTIONS (2023-2028)

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 1 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 LIMITATIONS

- 2.8 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 13 VETERINARY API MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 VETERINARY API MARKET, BY SYNTHESIS TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 VETERINARY API MARKET, BY ANIMAL TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 VETERINARY API MARKET: GEOGRAPHIC SNAPSHOT, 2022

4 PREMIUM INSIGHTS

- 4.1 VETERINARY API MARKET OVERVIEW

- FIGURE 18 GROWING PREVALENCE OF ANIMAL DISEASES AND RISING DEMAND FOR ANIMAL-DERIVED FOOD PRODUCTS TO DRIVE MARKET

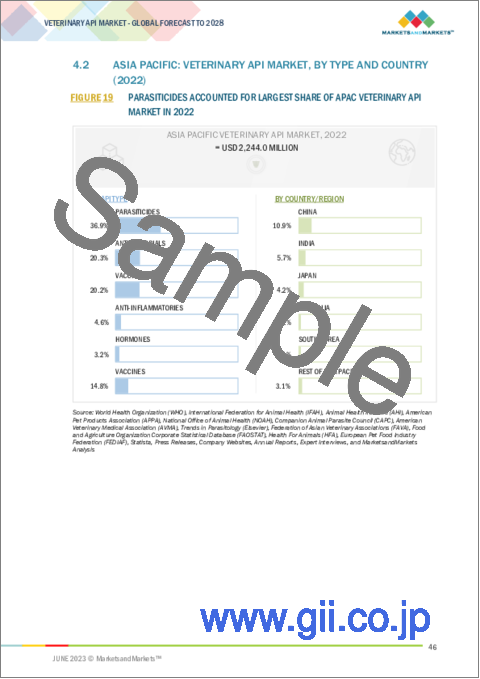

- 4.2 ASIA PACIFIC: VETERINARY API MARKET, BY TYPE AND COUNTRY (2022)

- FIGURE 19 PARASITICIDES ACCOUNTED FOR LARGEST SHARE OF APAC VETERINARY API MARKET IN 2022

- 4.3 VETERINARY API MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 20 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.4 VETERINARY API MARKET: REGIONAL MIX

- FIGURE 21 NORTH AMERICA TO CONTINUE TO DOMINATE VETERINARY API MARKET IN 2022

- 4.5 VETERINARY API MARKET: EMERGING ECONOMIES VS. DEVELOPED COUNTRIES

- FIGURE 22 EMERGING ECONOMIES TO OFFER GROWTH OPPORTUNITIES TO MARKET PLAYERS DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 VETERINARY API MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising incidence of transboundary and zoonotic diseases

- 5.2.1.2 Increasing animal population and pet ownership

- FIGURE 24 US: INCREASING PET EXPENDITURE, 2010-2021 (USD BILLION)

- 5.2.1.3 Increasing disease control and prevention measures

- 5.2.1.4 Growing demand for animal protein

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulations restricting use of parasiticides on food-producing animals

- 5.2.2.2 Growing concerns about antibiotic resistance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Untapped emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Challenges in large-molecule API synthesis

- 5.2.4.2 High costs of veterinary diagnostics and treatment

- 5.3 INDUSTRY TRENDS

- 5.3.1 GROWING FRAGMENTATION IN VETERINARY API INDUSTRY

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE, BY TYPE

- TABLE 2 AVERAGE SELLING PRICE, BY TYPE (USD)

- 5.4.2 AVERAGE SELLING PRICE TRENDS

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS: VETERINARY API MARKET

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 26 ECOSYSTEM ANALYSIS: VETERINARY API MARKET

- 5.7 PATENT ANALYSIS

- FIGURE 27 PATENT PUBLICATION TRENDS (JANUARY 2013-MAY 2023)

- 5.7.1 TOP APPLICANTS (COMPANIES/INSTITUTES)

- FIGURE 28 VETERINARY API MARKET: TOP APPLICANTS (COMPANIES/INSTITUTES) FOR PATENTS (2013-2023)

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 29 VALUE CHAIN ANALYSIS: VETERINARY API MARKET

- 5.9 CASE STUDIES

- 5.9.1 IDENTIFYING BUSINESS OPPORTUNITIES IN BROAD-SPECTRUM PARASITICIDES, US

- 5.10 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC AND ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 PORTER'S FIVE FORCES ANALYSIS: VETERINARY API MARKET

- 5.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.11.2 BARGAINING POWER OF SUPPLIERS

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 THREAT OF NEW ENTRANTS

- 5.11.5 THREAT OF SUBSTITUTES

- 5.12 ADJACENT MARKET ANALYSIS

- FIGURE 30 ANIMAL ANTIBIOTICS AND ANTIMICROBIALS MARKET: MARKET OVERVIEW

- 5.13 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 7 VETERINARY API MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE API TYPES

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE API TYPES

- 5.14.2 BUYING CRITERIA

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE API TYPES

- 5.15 TRADE ANALYSIS

- TABLE 10 TOP 10 IMPORTERS OF ANTIBIOTICS (HS CODE-2941)

- TABLE 11 TOP 10 EXPORTERS OF ANTIBIOTICS (HS CODE-2941)

- TABLE 12 TOP 10 IMPORTERS OF HORMONES, PROSTAGLANDINS, THROMBOXANES, AND LEUKOTRIENES (HS CODE-2937)

- TABLE 13 TOP 10 EXPORTERS OF HORMONES, PROSTAGLANDINS, THROMBOXANES, AND LEUKOTRIENES (HS CODE-2937)

- 5.16 IMPACT OF RECESSION ON VETERINARY API MARKET

6 VETERINARY API MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 14 VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2 PARASITICIDES

- TABLE 15 PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 16 PARASITICIDES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1 ALBENDAZOLE & FENBENDAZOLE

- 6.2.1.1 Growing prevalence of infections in animals to boost adoption

- TABLE 17 ALBENDAZOLE & FENBENDAZOLE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.2 IVERMECTIN

- 6.2.2.1 Effectiveness in treating parasitic infections to drive market

- TABLE 18 IVERMECTIN MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.3 PRAZIQUANTEL

- 6.2.3.1 Growing resistance to other treatment options to drive demand

- TABLE 19 PRAZIQUANTEL MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.4 LEVAMISOLE

- 6.2.4.1 Cost-effectiveness to drive usage in parasitic infection treatment

- TABLE 20 LEVAMISOLE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.5 OTHER PARASITICIDES

- TABLE 21 OTHER PARASITICIDES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 VACCINES

- TABLE 22 VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 23 VACCINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.1 CANINE PARVOVIRUS & CANINE DISTEMPER VIRUS VACCINES

- 6.3.1.1 Availability of effective vaccines against highly contagious diseases to drive market

- TABLE 24 CPV & CDV VACCINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2 NEWCASTLE DISEASE VIRUS VACCINES

- 6.3.2.1 Need to ensure poultry health to boost vaccine usage

- TABLE 25 NDV VACCINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.3 INFECTIOUS BURSAL DISEASE VIRUS VACCINES

- 6.3.3.1 Veterinarian recommendations to drive vaccine demand

- TABLE 26 IBDV VACCINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.4 FELINE LEUKEMIA VIRUS VACCINES

- 6.3.4.1 Rising feline population to drive market

- TABLE 27 FELV VACCINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.5 OTHER VACCINES

- TABLE 28 OTHER VACCINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 ANTIMICROBIALS

- TABLE 29 ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 30 ANTIMICROBIALS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.1 BETA-LACTAMS

- 6.4.1.1 Rising incidence of zoonotic diseases in livestock to drive demand for beta-lactams

- TABLE 31 BETA-LACTAMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.2 TETRACYCLINES

- 6.4.2.1 Decreasing prices to support demand growth

- TABLE 32 TETRACYCLINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.3 AMINOGLYCOSIDES

- 6.4.3.1 Growing food-producing animal population to boost demand

- TABLE 33 AMINOGLYCOSIDES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

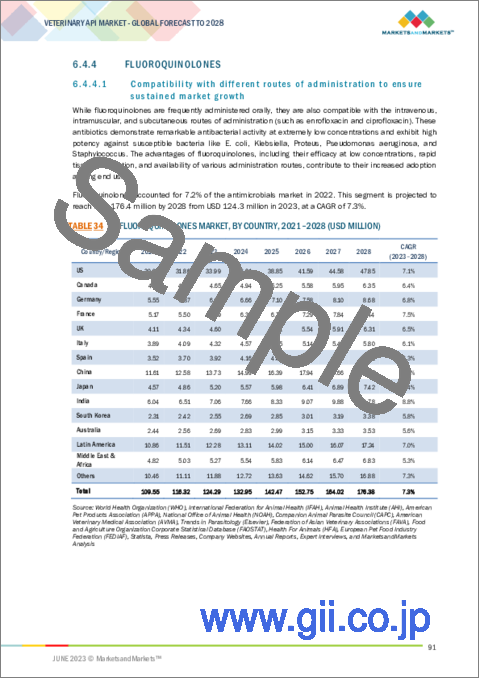

- 6.4.4 FLUOROQUINOLONES

- 6.4.4.1 Compatibility with different routes of administration to ensure sustained market growth

- TABLE 34 FLUOROQUINOLONES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.5 OTHER ANTIMICROBIALS

- TABLE 35 OTHER ANTIMICROBIALS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5 ANTI-INFLAMMATORIES

- TABLE 36 ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 37 ANTI-INFLAMMATORIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5.1 MELOXICAM & PIROXICAM

- 6.5.1.1 Relatively low side-effect profiles to drive market growth

- TABLE 38 MELOXICAM & PIROXICAM MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5.2 CARPROFEN

- 6.5.2.1 Wide treatment applications to drive market

- TABLE 39 CARPROFEN MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5.3 DERACOXIB & FIROCOXIB

- 6.5.3.1 Effectiveness in pain relief and inflammation to boost demand

- TABLE 40 DERACOXIB & FIROCOXIB MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5.4 OTHER ANTI-INFLAMMATORIES

- TABLE 41 OTHER ANTI-INFLAMMATORIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.6 HORMONES

- TABLE 42 HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 43 HORMONES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.6.1 PROGESTERONE & TESTOSTERONE

- 6.6.1.1 Progesterone & testosterone to hold largest share of hormones market over forecast period

- TABLE 44 PROGESTERONE & TESTOSTERONE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.6.2 ESTRADIOL

- 6.6.2.1 Wide applications in regulating animal reproductive functions to drive market

- TABLE 45 ESTRADIOL MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.6.3 LUTEINIZING HORMONE

- 6.6.3.1 Wide usage in assisted reproduction to ensure continued demand

- TABLE 46 LUTEINIZING HORMONE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.6.4 OTHER HORMONES

- TABLE 47 OTHER HORMONES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.7 OTHER VETERINARY APIS

- TABLE 48 OTHER VETERINARY APIS, BY COUNTRY, 2021-2028 (USD MILLION)

7 VETERINARY API MARKET, BY SYNTHESIS TYPE

- 7.1 INTRODUCTION

- TABLE 49 VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- 7.2 CHEMICAL-BASED API

- 7.2.1 CHEMICAL-BASED API TO HOLD LARGEST SHARE OVER FORECAST PERIOD

- TABLE 50 CHEMICAL-BASED VETERINARY API MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 BIOLOGICAL API

- 7.3.1 GROWING INDUSTRY RECOGNITION TO DRIVE FOCUS ON BIOLOGICAL API PRODUCTION

- TABLE 51 BIOLOGICAL VETERINARY API MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 HIGHLY POTENT API

- 7.4.1 RISING NEED FOR ADVANCED TREATMENT AND IMPROVED OUTCOMES TO DRIVE MARKET

- TABLE 52 HIGHLY POTENT VETERINARY API MARKET, BY COUNTRY 2021-2028 (USD MILLION)

8 VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION

- 8.1 INTRODUCTION

- TABLE 53 VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- 8.2 ORAL

- 8.2.1 CONVENIENCE AND EASE OF ADMINISTRATION TO SUSTAIN DEMAND

- TABLE 54 ORAL VETERINARY API MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 INJECTABLE 121 8.3.1 RAPID ONSET OF ACTION AND PRECISE DOSAGE AND DELIVERY TO BOOST DEMAND FOR INJECTABLES

- TABLE 55 INJECTABLE VETERINARY API MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 TOPICAL

- 8.4.1 OPTIMIZED, TARGETED DELIVERY CAPABILITIES TO DRIVE GROWTH

- TABLE 56 TOPICAL VETERINARY API MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.5 OTHER ROUTES

- TABLE 57 VETERINARY API MARKET FOR OTHER ROUTES, BY COUNTRY, 2021-2028 (USD MILLION)

9 VETERINARY API MARKET, BY ANIMAL TYPE

- 9.1 INTRODUCTION

- TABLE 58 VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 9.2 COMPANION ANIMALS

- 9.2.1 COMPANION ANIMALS SEGMENT TO DOMINATE MARKET, BY ANIMAL TYPE

- TABLE 59 VETERINARY API MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 LIVESTOCK ANIMALS

- 9.3.1 FOCUS ON OPTIMIZING PRODUCTION AND PREVENTING OUTBREAKS TO DRIVE MARKET

- TABLE 60 VETERINARY API MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2021-2028 (USD MILLION)

10 VETERINARY API MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 32 VETERINARY API MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 61 VETERINARY API MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 62 VETERINARY API MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 33 NORTH AMERICA: VETERINARY API MARKET SNAPSHOT

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- TABLE 63 NORTH AMERICA: VETERINARY API MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Growing demand for veterinary APIs to drive market

- TABLE 73 US: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 74 US: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 75 US: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 76 US: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 77 US: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 78 US: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 79 US: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 80 US: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 81 US: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Increasing number of pets in Canada to boost the market

- TABLE 82 CANADA: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 83 CANADA: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 84 CANADA: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 85 CANADA: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 86 CANADA: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 87 CANADA: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 88 CANADA: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 89 CANADA: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 90 CANADA: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- TABLE 91 EUROPE: VETERINARY API MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 92 EUROPE: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 EUROPE: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 94 EUROPE: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 EUROPE: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 96 EUROPE: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 EUROPE: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 98 EUROPE: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 99 EUROPE: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 100 EUROPE: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Germany to hold largest market share in Europe

- TABLE 101 GERMANY: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 GERMANY: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 GERMANY: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 104 GERMANY: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 GERMANY: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 GERMANY: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 GERMANY: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 108 GERMANY: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 109 GERMANY: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Strong animal welfare regulations to drive market

- TABLE 110 FRANCE: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 FRANCE: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 FRANCE: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 FRANCE: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 114 FRANCE: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 FRANCE: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 116 FRANCE: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 117 FRANCE: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 118 FRANCE: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.4 UK

- 10.3.4.1 Focus on preventive care to drive market

- TABLE 119 UK: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 UK: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 121 UK: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 UK: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 123 UK: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 UK: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 UK: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 126 UK: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 127 UK: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Increasing prevalence of animal diseases to drive market

- TABLE 128 ITALY: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 129 ITALY: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 130 ITALY: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 131 ITALY: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 ITALY: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 ITALY: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 134 ITALY: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 135 ITALY: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 136 ITALY: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.6 SPAIN

- 10.3.6.1 Growing focus on animal health in Spain to support growth

- TABLE 137 SPAIN: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 138 SPAIN: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 139 SPAIN: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 SPAIN: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 SPAIN: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 142 SPAIN: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 143 SPAIN: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 144 SPAIN: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 145 SPAIN: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 146 REST OF EUROPE: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 147 REST OF EUROPE: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 REST OF EUROPE: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 149 REST OF EUROPE: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 150 REST OF EUROPE: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 151 REST OF EUROPE: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 152 REST OF EUROPE: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 153 REST OF EUROPE: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 154 REST OF EUROPE: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 34 ASIA PACIFIC: VETERINARY API MARKET SNAPSHOT

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- TABLE 155 ASIA PACIFIC: VETERINARY API MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 159 ASIA PACIFIC: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 161 ASIA PACIFIC: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 163 ASIA PACIFIC: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 China to retain market leadership in APAC over forecast period

- TABLE 165 CHINA: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 166 CHINA: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 167 CHINA: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 168 CHINA: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 169 CHINA: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 170 CHINA: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 171 CHINA: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 172 CHINA: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 173 CHINA: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Growing pet ownership and companion animal care to drive market

- TABLE 174 JAPAN: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 175 JAPAN: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 176 JAPAN: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 177 JAPAN: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 178 JAPAN: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 179 JAPAN: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 180 JAPAN: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 181 JAPAN: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 182 JAPAN: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Expanding livestock industry and prevalence of veterinary diseases to support growth

- TABLE 183 INDIA: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 184 INDIA: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 185 INDIA: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 186 INDIA: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 187 INDIA: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 188 INDIA: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 189 INDIA: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 190 INDIA: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 191 INDIA: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Increasing awareness of animal health to drive market

- TABLE 192 SOUTH KOREA: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 193 SOUTH KOREA: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 194 SOUTH KOREA: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 195 SOUTH KOREA: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 196 SOUTH KOREA: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 197 SOUTH KOREA: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 198 SOUTH KOREA: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 199 SOUTH KOREA: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 200 SOUTH KOREA: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4.6 AUSTRALIA

- 10.4.6.1 Well-developed veterinary services in Australia to drive market

- TABLE 201 AUSTRALIA: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 202 AUSTRALIA: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 203 AUSTRALIA: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 204 AUSTRALIA: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 205 AUSTRALIA: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 206 AUSTRALIA: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 207 AUSTRALIA: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 208 AUSTRALIA: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 209 AUSTRALIA: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 210 REST OF ASIA PACIFIC: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 215 REST OF ASIA PACIFIC: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 217 REST OF ASIA PACIFIC: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 218 REST OF ASIA PACIFIC: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 RISING LIVESTOCK AND COMPANION ANIMAL POPULATION TO BOOST DEMAND

- 10.5.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 219 LATIN AMERICA: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 220 LATIN AMERICA: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 221 LATIN AMERICA: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 223 LATIN AMERICA: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 224 LATIN AMERICA: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 225 LATIN AMERICA: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 227 LATIN AMERICA: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RISING INCIDENCE OF PARASITIC INFECTIONS TO DRIVE DEMAND FOR TREATMENTS

- 10.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 228 MIDDLE EAST & AFRICA: VETERINARY API MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: PARASITICIDES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: VACCINES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: ANTIMICROBIALS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: ANTI-INFLAMMATORIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: HORMONES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: VETERINARY API MARKET, BY SYNTHESIS TYPE, 2021-2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: VETERINARY API MARKET, BY ROUTE OF ADMINISTRATION, 2021-2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: VETERINARY API MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- FIGURE 35 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN VETERINARY API MARKET

- 11.3 REVENUE SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 36 REVENUE ANALYSIS FOR KEY PLAYERS IN VETERINARY API MARKET

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 37 VETERINARY API MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- TABLE 237 VETERINARY API MARKET: DEGREE OF COMPETITION

- 11.5 COMPANY EVALUATION MATRIX, 2022

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- FIGURE 38 VETERINARY API MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.6 COMPETITIVE BENCHMARKING

- TABLE 238 OVERALL COMPANY FOOTPRINT

- TABLE 239 COMPANY FOOTPRINT ANALYSIS, BY TYPE

- TABLE 240 COMPANY FOOTPRINT ANALYSIS, BY SYNTHESIS TYPE

- TABLE 241 COMPANY FOOTPRINT ANALYSIS, BY ROUTE OF ADMINISTRATION

- TABLE 242 COMPANY FOOTPRINT ANALYSIS, BY ANIMAL TYPE

- TABLE 243 COMPANY FOOTPRINT ANALYSIS, BY REGION

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES & APPROVALS

- TABLE 244 PRODUCT LAUNCHES & APPROVALS, JANUARY 2019-MAY 2023

- 11.7.2 DEALS

- TABLE 245 DEALS, JANUARY 2021-MAY 2023

- 11.7.3 OTHER DEVELOPMENTS

- TABLE 246 OTHER DEVELOPMENTS, JANUARY 2019- MAY 2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 12.1.1 BOEHRINGER INGELHEIM GMBH

- TABLE 247 BOEHRINGER INGELHEIM GMBH: BUSINESS OVERVIEW

- FIGURE 39 BOEHRINGER INGELHEIM GMBH: COMPANY SNAPSHOT (2022)

- 12.1.2 ZOETIS, INC.

- TABLE 248 ZOETIS, INC.: BUSINESS OVERVIEW

- FIGURE 40 ZOETIS, INC.: COMPANY SNAPSHOT (2022)

- 12.1.3 ELANCO ANIMAL HEALTH INCORPORATED

- TABLE 249 ELANCO ANIMAL HEALTH INCORPORATED: BUSINESS OVERVIEW

- FIGURE 41 ELANCO ANIMAL HEALTH INCORPORATED: COMPANY SNAPSHOT (2022)

- 12.1.4 MERCK & CO., INC.

- TABLE 250 MERCK & CO., INC.: BUSINESS OVERVIEW

- FIGURE 42 MERCK & CO., INC.: COMPANY SNAPSHOT (2022)

- 12.1.5 VIRBAC

- TABLE 251 VIRBAC: BUSINESS OVERVIEW

- FIGURE 43 VIRBAC: COMPANY SNAPSHOT (2022)

- 12.1.6 VETOQUINOL S.A.

- TABLE 252 VETOQUINOL S.A.: BUSINESS OVERVIEW

- FIGURE 44 VETOQUINOL S.A.: COMPANY SNAPSHOT (2022)

- 12.1.7 SEQUENT SCIENTIFIC LIMITED

- TABLE 253 SEQUENT SCIENTIFIC LIMITED: BUSINESS OVERVIEW

- FIGURE 45 SEQUENT SCIENTIFIC LIMITED: COMPANY SNAPSHOT (2022)

- 12.1.8 PHIBRO ANIMAL HEALTH CORPORATION

- TABLE 254 PHIBRO ANIMAL HEALTH CORPORATION: BUSINESS OVERVIEW

- FIGURE 46 PHIBRO ANIMAL HEALTH CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.9 FABBRICA ITALIANA SINTETICI S.P.A.

- TABLE 255 FABBRICA ITALIANA SINTETICI: BUSINESS OVERVIEW

- FIGURE 47 FABBRICA ITALIANA SINTETICI: COMPANY SNAPSHOT (2022)

- 12.1.10 EXCEL INDUSTRIES LTD.

- TABLE 256 EXCEL INDUSTRIES LTD.: BUSINESS OVERVIEW

- FIGURE 48 EXCEL INDUSTRIES LTD.: COMPANY SNAPSHOT (2022)

- 12.1.11 NGL FINE-CHEM LTD.

- TABLE 257 NGL FINE-CHEM: BUSINESS OVERVIEW

- FIGURE 49 NGL FINE-CHEM: COMPANY SNAPSHOT (2022)

- 12.1.12 QILU PHARMACEUTICAL

- TABLE 258 QILU PHARMACEUTICAL: BUSINESS OVERVIEW

- 12.1.13 OLON S.P.A.

- TABLE 259 OLON S.P.A: BUSINESS OVERVIEW

- 12.1.14 SHANDONG LUKANG PHARMACEUTICAL CO., LTD.

- TABLE 260 SHANDONG LUKANG PHARMACEUTICAL CO., LTD.: BUSINESS OVERVIEW

- 12.1.15 ZHEJIANG HUADI PHARMACEUTICAL GROUP CO., LTD.

- TABLE 261 ZHEJIANG HUADI PHARMACEUTICAL GROUP CO., LTD.: BUSINESS OVERVIEW

- 12.1.16 INSUD PHARMA

- TABLE 262 INSUD PHARMA: BUSINESS OVERVIEW

- 12.1.17 MENADIONA SL

- TABLE 263 MENADIONA SL: BUSINESS OVERVIEW

- 12.1.18 ROCHEM INTERNATIONAL, INC.

- TABLE 264 ROCHEM INTERNATIONAL: BUSINESS OVERVIEW

- 12.1.19 AFTON PHARMA

- TABLE 265 LIMITED AFTON PHARMA: BUSINESS OVERVIEW

- 12.1.20 SHAANXI HANJIANG PHARMACEUTICAL GROUP CO. LTD.

- TABLE 266 SHAANXI HANJIANG PHARMACEUTICAL GROUP CO. LTD.: BUSINESS OVERVIEW

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 DALIAN LAUNCHER FINE CHEMICAL CO., LTD.

- 12.2.2 AMGIS LIFESCIENCE LTD.

- 12.2.3 D.H. ORGANICS

- 12.2.4 SIFLON DRUGS

- 12.2.5 SBD HEALTHCARE PVT. LTD.

- 12.2.6 CENTURY PHARMACEUTICALS LTD.

- 12.2.7 SIDHIV PHARMA

- 12.2.8 FERMION

- 12.2.9 CHEMINO PHARMA PRIVATE LIMITED

- 12.2.10 SUANFARMA

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS