|

|

市場調査レポート

商品コード

1301544

自律航法の世界市場:ソリューション別 (ハードウェア、ソフトウェア)・プラットフォーム別 (航空機(自律型航法機、自律型ドローン)、陸上、海上、宇宙、兵器)・用途別 (商用、軍事・政府)・地域別の将来予測 (2028年まで)Autonomous Navigation Market by Solution (Hardware, and Software), Platform (Airborne (Autonomous Aircraft, Autonomous Drones), Land, Marine, Space, Weapons), Application (Commercial, Military & Government), Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自律航法の世界市場:ソリューション別 (ハードウェア、ソフトウェア)・プラットフォーム別 (航空機(自律型航法機、自律型ドローン)、陸上、海上、宇宙、兵器)・用途別 (商用、軍事・政府)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月30日

発行: MarketsandMarkets

ページ情報: 英文 221 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自律航法の市場規模は、2023年には60億米ドルと推定され、予測期間中に16.4%のCAGRで成長し、2028年には129億米ドルに達すると予測されています。

自律航法市場は、物流業務への自律型ロボットの採用の高まりや、商用・軍事用途への自律型ロボットの普及など、さまざまな要因によって牽引されています。しかし、不慣れな環境での性能が実証されていないことや、高レベルのインターフェイスが不十分であること、新興国では自律システムに必要なインフラが整備されていないことなどが、市場全体の成長を制限しています。

"空中:2023年にプラットフォーム別で第2位のシェア"

2023年には空中セグメントが第2位のシェアを占めると予測されています。空中自律航法は、センサー技術、人工知能、接続性の進歩に後押しされ、急速に進歩しています。無人航空機(UAV)は現在、独立して航行する能力を持ち、様々な分野を変革しています。空中監視、荷物配送、捜索救助活動は、自律型UAVが提供する効率性、安全性、拡張性の向上から恩恵を受けています。この分野における継続的な進歩は、産業に革命をもたらし、空域の理解と利用を再構築する計り知れない可能性を秘めています。

"商用:2023年に用途別で第2位のシェア"

商用セグメントは2023年に第2位のシェアを持つと予測されています。商用セグメントには、航空、自動車、物流、海洋などの分野で使用されるすべての自律型ロボットが含まれます。商業セグメントは、ロボット工学、コンピュータビジョン、人工知能、エッジコンピューティング機能の継続的な研究開発により、将来的に飛躍的な増加が見込まれています。農業分野でのロボット需要も、コストを削減しながら生産量を増加させる可能性があるため、今後拡大が見込まれています。

"アジア太平洋地域:2023年に地域別で第2位のシェア"

アジア太平洋は、2023年に自律航法市場で第2位のシェアを占めると推定されます。アジア太平洋地域は、技術の進歩、多額の投資、広範な研究努力に後押しされ、自律航法において目覚ましい進歩を遂げてきました。この成長は、輸送、物流、農業、製造などの様々な業種における自律走行車、ドローン、ロボットシステムの広範な統合を促進しています。技術革新の先陣を切ることで、アジア太平洋地域は自律航法機能の継続的な拡大と強化の原動力であり続けています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 自律航法市場のエコシステム

- ポーターのファイブフォース分析

- 貿易データ統計

- 価格分析

- 規制状況

- 主要な利害関係者と購入基準

- 主な会議とイベント (2023年~2024年)

第6章 業界動向

- イントロダクション

- 自動運転市場における主要な技術動向

- 技術ロードマップ

- 使用事例の分析

- メガトレンドの影響

- イノベーションと特許登録

第7章 自律航法市場:プラットフォーム別

- イントロダクション

- 空中

- 自律型航空機

- 自律型ドローン

- 陸上

- 自動運転車

- 自動運転列車

- 自律型産業ロボット

- 海上

- 自律船

- 自律型水上艇

- 自律型潜水艇

- 宇宙

- 兵器

- 戦術ミサイル

- 誘導ロケット

- 誘導弾薬

- 魚雷

- 徘徊兵器

第8章 自律航法市場:用途別

- イントロダクション

- 商用

- 軍隊・政府

第9章 自律航法市場:ソリューション別

- イントロダクション

- ハードウェア

- 検知システム

- 処理ユニット

- ソフトウェア

- 人工知能

第10章 自律航法市場:地域別

- イントロダクション

- 不況の影響分析:地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- ロシア

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他のアジア太平洋

- 中東

- イスラエル

- アラブ首長国連邦

- サウジアラビア

- その他の中東

- その他の地域

- ラテンアメリカ

- アフリカ

第11章 競合情勢

- イントロダクション

- 自律航法市場:主要企業のランキング分析 (2022年)

- 収益分析 (2022年)

- 市場シェア分析 (2022年)

- 競合評価マトリックス

- 評価クアドラント:スタートアップ/中小企業

- 競合ベンチマーキング

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要企業

- RAYTHEON TECHNOLOGIES CORPORATION

- HONEYWELL INTERNATIONAL INC.

- NORTHROP GRUMMAN CORPORATION

- THALES GROUP

- SAFRAN SA

- ABB

- L3HARRIS TECHNOLOGIES, INC.

- GENERAL DYNAMICS CORPORATION

- ROLLS-ROYCE PLC

- MOOG INC.

- KONGSBERG GRUPPEN ASA

- RH MARINE

- TRIMBLE INC.

- FURUNO ELECTRIC CO., LTD.

- その他の企業

- SHIELD AI

- SKYDIO, INC.

- NEAR EARTH AUTONOMY INC.

- CLEARPATH ROBOTICS INC.

- BLUEBOTICS

- VELODYNE LIDAR, INC.

- LEDDARTECH INC.

- NOVATEL INC.

- SEA MACHINES

- AUTONODYNE LLC

第13章 付録

Autonomous navigation is estimated to be USD 6.0 billion in 2023 and is projected to reach USD 12.9 billion by 2028, at a CAGR of 16.4% during the forecast period. The market for autonomous navigation is driven by various factors, such as the rising adoption of autonomous robots for logistic operations and the widespread adoption of autonomous robots for commercial and military applications. However, Unproven performance in unfamiliar environments and inadequate high-level interfacing, and lack of required infrastructure for autonomous systems in developing countries are limiting the overall growth of the market.

"Airborne: The second largest share in platform segment in the autonomous navigation market in 2023."

The airborne segment is projected to have the second-largest share in 2023. Airborne autonomous navigation has rapidly progressed, fueled by advancements in sensor technology, artificial intelligence, and connectivity. Unmanned aerial vehicles (UAVs) now possess the ability to navigate independently, transforming various sectors. Aerial surveillance, package delivery, and search and rescue operations benefit from the enhanced efficiency, safety, and scalability offered by autonomous UAVs. Continual advancements in this field hold immense potential for revolutionizing industries and reshaping our understanding and utilization of airspace.

"Commercial: The second largest share in application segment in the autonomous navigation market in 2023."

The commercial segment is projected to have the second-largest share in 2023. The commercial segment includes all the autonomous robots used in sectors such as aviation, automotive, logistics, and marine. The commercial segment is expected to increase tremendously in the future owing to the continuous research and development in robotics, computer vision, artificial intelligence, and edge computing capabilities. The demand for robotics in agriculture is also expected to grow in the future due to the potential for increasing output while reducing cost.

"The Asia Pacific region is estimated to have the second largest share in the autonomous navigation market in 2023."

Asia Pacific is estimated to account for the second-largest share in autonomous navigation in 2023. The Asia Pacific region has experienced remarkable progress in autonomous navigation, fueled by technological advancements, substantial investments, and extensive research efforts. This growth has facilitated the widespread integration of autonomous vehicles, drones, and robotic systems in diverse sectors such as transportation, logistics, agriculture, and manufacturing. By spearheading innovation, the Asia Pacific region remains a driving force behind the continuous expansion and enhancement of autonomous navigation capabilities.

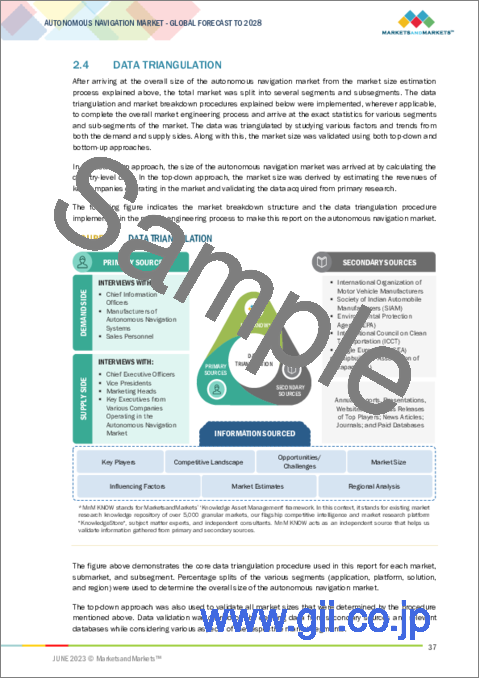

The break-up of the profiles of primary participants in the autonomous navigation market is as follows:

- By Company Type: Tier 1 - 35%; Tier 2 - 45%; and Tier 3 - 20%

- By Designation: C Level Executives - 35%; Directors - 25%; and Others - 40%

- By Region: North America - 45%; Europe - 25%; Asia Pacific - 17%; Middle East - 8%; Rest of the World- 5%

Major Players in the autonomous navigation market are Thales Group (France), Moog Inc. (US), Furuno Electric Co., Ltd. (Japan), RH Marine (Netherlands), and ABB (Switzerland).

Research Coverage

The market study covers the Autonomous navigation market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on solution, platform, application, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall autonomous navigation market and its subsegments. The report covers the entire ecosystem of the autonomous navigation industry and will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Incorporation of advanced sense and avoid systems in unmanned vehicles; Widespread adoption of autonomous robots for commercial and military applications; Improved safety and efficiency with autonomous navigation technology; Rising adoption of autonomous robots for logistic operations), restraints (Unproven performance in unfamiliar environments and inadequate high-level interfacing; Lack of required infrastructure for autonomous systems in developing countries), opportunities (Increasing adoption of 5G and AI; Growing efforts aimed at advancing autonomous systems; Assistance and services offered by autonomous robots), and challenges (Vulnerability of autonomous systems to cyber threats due to automation; Unclear regulatory framework for autonomous systems use) influencing the growth of the autonomous navigation market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the autonomous navigation market

- Market Development: Comprehensive information about lucrative markets - the report analyses the autonomous navigation market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the autonomous navigation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Honeywell International Inc. (US), Thales Group (France), L3 Harris Technologies, Inc. (US), Kongsberg Gruppen ASA (Norway) and Safran SA (France) among others in the autonomous navigation market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 AUTONOMOUS NAVIGATION MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 REGIONAL SCOPE

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 AUTONOMOUS NAVIGATION MARKET: INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 MARKET STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Primary sources

- 2.1.2.4 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Regional autonomous navigation market

- 2.3.1.2 Autonomous navigation market for platform segment

- 2.3.1.3 Autonomous navigation market for solution segment

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH ASSUMPTIONS

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

- 2.7 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 9 HARDWARE SEGMENT TO LEAD AUTONOMOUS NAVIGATION MARKET FROM 2023 TO 2028

- FIGURE 10 COMMERCIAL SEGMENT TO RECORD HIGHER GROWTH RATE THAN MILITARY & GOVERNMENT SEGMENT DURING FORECAST PERIOD

- FIGURE 11 LAND SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN AUTONOMOUS NAVIGATION MARKET

- FIGURE 12 WIDESPREAD ADOPTION OF AUTONOMOUS PLATFORMS IN COMMERCIAL AND MILITARY APPLICATIONS TO DRIVE MARKET

- 4.2 AUTONOMOUS NAVIGATION MARKET, BY APPLICATION

- FIGURE 13 COMMERCIAL SEGMENT TO LEAD MARKET BY 2028

- 4.3 AUTONOMOUS NAVIGATION MARKET, BY SOLUTION

- FIGURE 14 SOFTWARE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 AUTONOMOUS NAVIGATION MARKET, BY PLATFORM

- FIGURE 15 MARINE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 AUTONOMOUS NAVIGATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Incorporation of advanced sense and avoid systems in unmanned vehicles

- 5.2.1.2 Widespread adoption of autonomous robots for commercial and military applications

- TABLE 3 LIST OF PRODUCTS WITH AUTONOMOUS NAVIGATION CAPABILITIES

- 5.2.1.3 Improved safety and efficiency with autonomous navigation technology

- 5.2.1.4 Rising adoption of autonomous robots for logistic operations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Unproven performance in unfamiliar environments and inadequate high-level interfacing

- 5.2.2.2 Lack of required infrastructure for autonomous systems in emerging economies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption of 5G and AI

- 5.2.3.2 Growing efforts aimed at advancing autonomous systems

- TABLE 4 TIMELINE AND DESIGN DEVELOPMENT TARGETS FOR AUTONOMOUS SHIPS

- TABLE 5 AUTONOMOUS DRIVING INITIATIVES BY AUTOMAKERS

- 5.2.3.3 Assistance and services offered by autonomous robots

- 5.2.4 CHALLENGES

- 5.2.4.1 Vulnerability of autonomous systems to cyber threats due to automation

- FIGURE 17 POTENTIAL CYBERATTACK ROUTES FOR MARINE VESSELS

- 5.2.4.2 Unclear regulatory framework for use of autonomous systems

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 18 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AUTONOMOUS NAVIGATION MANUFACTURERS

- FIGURE 19 REVENUE SHIFT IN AUTONOMOUS NAVIGATION MARKET

- 5.5 AUTONOMOUS NAVIGATION MARKET ECOSYSTEM

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END-USE INDUSTRIES

- FIGURE 20 AUTONOMOUS NAVIGATION MARKET ECOSYSTEM

- TABLE 6 AUTONOMOUS NAVIGATION MARKET ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 AUTONOMOUS NAVIGATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS FOR AUTONOMOUS NAVIGATION MARKET

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 TRADE DATA STATISTICS

- TABLE 8 COUNTRY-WISE IMPORTS, 2019-2021 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE EXPORTS, 2019-2021 (USD THOUSAND)

- 5.8 PRICING ANALYSIS

- TABLE 10 COST OF INERTIAL NAVIGATION SYSTEMS OFFERED BY INS MANUFACTURERS FOR VARIOUS GRADES

- 5.9 REGULATORY LANDSCAPE

- TABLE 11 AUTONOMOUS NAVIGATION MARKET: REGULATORY LANDSCAPE

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- 5.11 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 14 AUTONOMOUS NAVIGATION MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 KEY TECHNOLOGICAL TRENDS IN AUTONOMOUS NAVIGATION MARKET

- 6.2.1 NAVIGATION TECHNOLOGY FOR AUTONOMOUS SYSTEMS

- 6.2.1.1 Sensor fusion solutions

- 6.2.1.2 Control algorithms

- 6.2.1.3 Research on standard operating systems for robots

- 6.2.1.4 Micro-electro-mechanical systems-based inertial navigation systems

- 6.2.1.5 High-end inertial navigation systems

- 6.2.1 NAVIGATION TECHNOLOGY FOR AUTONOMOUS SYSTEMS

- 6.3 TECHNOLOGY ROADMAP

- FIGURE 24 TECHNOLOGICAL TRENDS IN AUTONOMOUS NAVIGATION MARKET

- 6.4 USE CASE ANALYSIS

- 6.4.1 AUTONOMOUS DELIVERY DRONES IN URBAN ENVIRONMENTS

- 6.4.2 AUTONOMOUS MINING TRUCKS IN OPEN-PIT MINES

- 6.5 IMPACT OF MEGATRENDS

- 6.5.1 ARTIFICIAL INTELLIGENCE

- 6.5.2 BIG DATA ANALYTICS

- 6.5.3 SATELLITE NAVIGATION

- 6.6 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 15 INNOVATIONS AND PATENT REGISTRATIONS, 2022

7 AUTONOMOUS NAVIGATION MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- FIGURE 25 AIRBORNE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 17 AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 7.2 AIRBORNE

- TABLE 18 AIRBORNE: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 19 AIRBORNE: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2.1 AUTONOMOUS AIRCRAFT

- 7.2.1.1 Increasing demand for autonomous aircraft to drive airborne autonomous navigation market

- 7.2.2 AUTONOMOUS DRONES

- 7.2.2.1 Increasing need for air medical services and cargo delivery in commercial and military sectors to drive demand for navigation systems in autonomous drones

- 7.3 LAND

- TABLE 20 LAND: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 21 LAND: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.3.1 AUTONOMOUS VEHICLES

- 7.3.1.1 High demand from military and commercial sectors to drive market for autonomous self-driving vehicles

- 7.3.2 AUTONOMOUS TRAINS

- 7.3.2.1 Need for efficient transportation, low electricity consumption, and more passenger room to drive demand for autonomous trains.

- 7.3.3 AUTONOMOUS INDUSTRIAL ROBOTS

- 7.3.3.1 Increasing demand for autonomous industrial robots in logistics to drive market

- 7.4 MARINE

- TABLE 22 MARINE: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 23 MARINE: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.4.1 AUTONOMOUS SHIPS

- 7.4.1.1 Increasing investments in autonomous ships to drive market

- 7.4.2 AUTONOMOUS SURFACE VEHICLES

- 7.4.2.1 Increasing demand from commercial and defense sectors to drive market for autonomous surface vehicles

- 7.4.3 AUTONOMOUS UNDERWATER VEHICLES

- 7.4.3.1 Growing military and commercial operations to drive demand for autonomous underwater vehicles

- 7.5 SPACE

- 7.5.1 INCREASING DEMAND FOR SPACE EXPLORATION ACTIVITIES TO DRIVE MARKET

- 7.6 WEAPONS

- TABLE 24 WEAPONS: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 25 WEAPONS: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.6.1 TACTICAL MISSILES

- 7.6.1.1 Rising military testing to drive demand for autonomous tactical missiles

- 7.6.2 GUIDED ROCKETS

- 7.6.2.1 Advancements in autonomous guided rockets to drive demand

- 7.6.3 GUIDED AMMUNITION

- 7.6.3.1 Rising deployment of autonomous guided ammunition to drive segment

- 7.6.4 TORPEDOES

- 7.6.4.1 Increased flexibility, operational range, and improved effectiveness in underwater warfare to drive demand for torpedoes

- 7.6.5 LOITERING MUNITION

- 7.6.5.1 Advancements in drone technology to drive loitering munition segment

8 AUTONOMOUS NAVIGATION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 26 COMMERCIAL SEGMENT TO RECORD HIGHER CAGR THAN MILITARY & GOVERNMENT SEGMENT BETWEEN 2023 AND 2028

- TABLE 26 AUTONOMOUS NAVIGATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 27 AUTONOMOUS NAVIGATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 COMMERCIAL

- 8.2.1 INCREASING DEMAND FOR AUTONOMOUS ROBOTS IN LOGISTICS, AUTOMOTIVE, AND MARINE SECTORS TO DRIVE COMMERCIAL SEGMENT

- 8.3 MILITARY & GOVERNMENT

- 8.3.1 APPLICATION OF ROBOTS IN SURVEILLANCE OPERATIONS AND DECLINE IN CASUALTIES DUE TO REPLACEMENT OF HUMANS WITH OFFENSIVE ROBOTS TO DRIVE MILITARY & GOVERNMENT SEGMENT

9 AUTONOMOUS NAVIGATION MARKET, BY SOLUTION

- 9.1 INTRODUCTION

- FIGURE 27 SOFTWARE SEGMENT TO RECORD HIGHER CAGR THAN HARDWARE SEGMENT DURING FORECAST PERIOD

- TABLE 28 AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 29 AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- 9.2 HARDWARE

- TABLE 30 AUTONOMOUS NAVIGATION MARKET, BY HARDWARE SOLUTION, 2020-2022 (USD MILLION)

- TABLE 31 AUTONOMOUS NAVIGATION MARKET, BY HARDWARE SOLUTION, 2023-2028 (USD MILLION)

- 9.2.1 SENSING SYSTEMS

- TABLE 32 SENSING SYSTEMS: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 33 SENSING SYSTEMS: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.2.1.1 INS

- 9.2.1.1.1 Rising need for INS in autonomous robots to drive market

- 9.2.1.2 GNSS

- 9.2.1.2.1 High accuracy to drive demand for GNSS

- 9.2.1.3 Radar

- 9.2.1.3.1 Increasing demand for commercial and military applications to drive market for radar-based autonomous navigation systems

- 9.2.1.4 LiDAR

- 9.2.1.4.1 High navigational accuracy to drive demand for LiDAR systems in autonomous robots

- 9.2.1.5 Ultrasonic systems

- 9.2.1.5.1 Growing use of ASVs, AUVs, and autonomous cars to increase demand for ultrasonic systems

- 9.2.1.6 Cameras

- 9.2.1.6.1 Increasing use of electro-optical and visual cameras in UAVs to drive segment

- 9.2.1.7 AIS

- 9.2.1.7.1 Increasing demand for autonomous ships to drive market for AIS

- 9.2.1.8 Others

- 9.2.1.1 INS

- 9.2.2 PROCESSING UNITS

- 9.2.2.1 Growing requirement for sensors in autonomous platforms to increase demand for processing units

- 9.3 SOFTWARE

- 9.3.1 ARTIFICIAL INTELLIGENCE

- 9.3.1.1 Machine learning

- 9.3.1.1.1 Increasing demand for autonomous vehicles to drive machine learning segment

- 9.3.1.2 Computer vision

- 9.3.1.2.1 Increasing usage of digital cameras for 3D view of surroundings to drive computer vision segment

- 9.3.1.1 Machine learning

- 9.3.1 ARTIFICIAL INTELLIGENCE

10 AUTONOMOUS NAVIGATION MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 28 REGIONAL SNAPSHOT: GROWTH RATE ANALYSIS, 2023-2028

- 10.2 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 34 AUTONOMOUS NAVIGATION MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 35 AUTONOMOUS NAVIGATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 NORTH AMERICA

- 10.3.1 RECESSION IMPACT ANALYSIS: NORTH AMERICA

- 10.3.2 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 29 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET SNAPSHOT

- TABLE 36 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 US

- 10.3.3.1 Increasing investment in autonomous vehicles and systems to enhance safety and reduce human effort

- TABLE 42 US: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 43 US: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 44 US: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 45 US: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.3.4 CANADA

- 10.3.4.1 Growing demand for industrial robots, increasing government grants & funds, and growing venture capital investments to drive market

- TABLE 46 CANADA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 47 CANADA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 48 CANADA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 49 CANADA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT ANALYSIS: EUROPE

- 10.4.2 PESTLE ANALYSIS: EUROPE

- FIGURE 30 EUROPE: AUTONOMOUS NAVIGATION MARKET SNAPSHOT

- TABLE 50 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 51 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 52 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 53 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 54 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 55 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 UK

- 10.4.3.1 Rising government investment in R&D activities to drive market

- TABLE 56 UK: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 57 UK: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 58 UK: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 59 UK: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.4.4 FRANCE

- 10.4.4.1 Surge in demand for autonomous robots from various industries to drive market

- TABLE 60 FRANCE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 61 FRANCE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 62 FRANCE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 63 FRANCE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.4.5 GERMANY

- 10.4.5.1 Increasing investment in autonomous cars and ships to drive market

- TABLE 64 GERMANY: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 65 GERMANY: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 66 GERMANY: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 67 GERMANY: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.4.6 RUSSIA

- 10.4.6.1 Surge in adoption of ships with advanced navigation capability to boost market

- TABLE 68 RUSSIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 69 RUSSIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 70 RUSSIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 71 RUSSIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.4.7 ITALY

- 10.4.7.1 Increasing investment in autonomous UAVs to drive market

- TABLE 72 ITALY: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 73 ITALY: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 74 ITALY: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 75 ITALY: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.4.8 REST OF EUROPE

- TABLE 76 REST OF EUROPE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 77 REST OF EUROPE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 79 REST OF EUROPE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.5 ASIA PACIFIC

- 10.5.1 RECESSION IMPACT ANALYSIS: ASIA PACIFIC

- 10.5.2 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 31 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET SNAPSHOT

- TABLE 80 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 81 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 83 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3 CHINA

- 10.5.3.1 Increasing demand for efficient transportation solutions and military modernization to boost market

- TABLE 86 CHINA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 87 CHINA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 88 CHINA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 89 CHINA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.5.4 INDIA

- 10.5.4.1 Increasing focus on improving defense capabilities and border surveillance to boost market

- TABLE 90 INDIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 91 INDIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 92 INDIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 93 INDIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.5.5 JAPAN

- 10.5.5.1 Increasing aging population and advancements in mobility solutions to drive market

- TABLE 94 JAPAN: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 95 JAPAN: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 96 JAPAN: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 97 JAPAN: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.5.6 SOUTH KOREA

- 10.5.6.1 Increasing investment in autonomous cars to drive market

- TABLE 98 SOUTH KOREA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 99 SOUTH KOREA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 100 SOUTH KOREA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 101 SOUTH KOREA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.5.7 AUSTRALIA

- 10.5.7.1 Growing investment in autonomous cars and UAVs to drive market

- TABLE 102 AUSTRALIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 103 AUSTRALIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 104 AUSTRALIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 105 AUSTRALIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.5.8 REST OF ASIA PACIFIC

- TABLE 106 REST OF ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.6 MIDDLE EAST

- 10.6.1 RECESSION IMPACT ANALYSIS: MIDDLE EAST

- 10.6.2 PESTLE ANALYSIS: MIDDLE EAST

- FIGURE 32 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET SNAPSHOT

- TABLE 110 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 111 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 112 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 113 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 114 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 115 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 ISRAEL

- 10.6.3.1 Increasing investment in autonomous robots to drive market

- TABLE 116 ISRAEL: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 117 ISRAEL: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 118 ISRAEL: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 119 ISRAEL: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.6.4 UAE

- 10.6.4.1 Growing adoption of self-driving cars to drive market

- TABLE 120 UAE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 121 UAE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 122 UAE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 123 UAE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.6.5 SAUDI ARABIA

- 10.6.5.1 High investment in mass transit systems to drive market

- TABLE 124 SAUDI ARABIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 125 SAUDI ARABIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 126 SAUDI ARABIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 127 SAUDI ARABIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.6.6 REST OF MIDDLE EAST

- TABLE 128 REST OF MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 129 REST OF MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 131 REST OF MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.7 REST OF THE WORLD

- TABLE 132 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 133 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 134 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 135 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 136 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 137 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7.1 LATIN AMERICA

- 10.7.1.1 Increasing investment in autonomous vehicles to drive market

- TABLE 138 LATIN AMERICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 139 LATIN AMERICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 140 LATIN AMERICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 141 LATIN AMERICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.7.2 AFRICA

- 10.7.2.1 Increasing investment in developing autonomous cars to drive market

- TABLE 142 AFRICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 143 AFRICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 144 AFRICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 145 AFRICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- TABLE 146 KEY GROWTH STRATEGIES OF LEADING PLAYERS IN AUTONOMOUS NAVIGATION MARKET

- 11.2 RANKING ANALYSIS OF KEY PLAYERS IN AUTONOMOUS NAVIGATION MARKET, 2022

- FIGURE 33 RANKING OF KEY PLAYERS IN AUTONOMOUS NAVIGATION MARKET, 2022

- 11.3 REVENUE ANALYSIS, 2022

- FIGURE 34 REVENUE ANALYSIS OF KEY COMPANIES IN AUTONOMOUS NAVIGATION MARKET, 2020-2022

- 11.4 MARKET SHARE ANALYSIS, 2022

- FIGURE 35 AUTONOMOUS NAVIGATION MARKET SHARE ANALYSIS OF KEY COMPANIES, 2022

- TABLE 147 AUTONOMOUS NAVIGATION MARKET: DEGREE OF COMPETITION

- 11.5 COMPETITIVE EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 36 AUTONOMOUS NAVIGATION MARKET (KEY PLAYERS): COMPANY EVALUATION MATRIX, 2022

- 11.6 STARTUP/SME EVALUATION QUADRANT

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 37 AUTONOMOUS NAVIGATION MARKET (STARTUPS/SMES): COMPANY EVALUATION MATRIX, 2022

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 148 COMPANY FOOTPRINT

- TABLE 149 COMPANY PLATFORM FOOTPRINT

- TABLE 150 COMPANY REGION FOOTPRINT

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 MARKET EVALUATION FRAMEWORK

- 11.8.2 PRODUCT LAUNCHES

- TABLE 151 PRODUCT LAUNCHES, FEBRUARY 2019-MAY 2023

- 11.8.3 DEALS

- TABLE 152 DEALS, JULY 2019-MAY 2023

- 11.8.4 OTHERS

- TABLE 153 OTHERS, JUNE 2019-MARCH 2023

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- (Business overview, Products/Services/Solutions offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats)**

- 12.2.1 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 154 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 38 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 155 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 156 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 157 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 158 RAYTHEON TECHNOLOGIES CORPORATION: OTHERS

- 12.2.2 HONEYWELL INTERNATIONAL INC.

- TABLE 159 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- FIGURE 39 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 160 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 161 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 162 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 163 HONEYWELL INTERNATIONAL INC.: OTHERS

- 12.2.3 NORTHROP GRUMMAN CORPORATION

- TABLE 164 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- FIGURE 40 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 165 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 166 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 167 NORTHROP GRUMMAN CORPORATION: DEALS

- 12.2.4 THALES GROUP

- TABLE 168 THALES GROUP: BUSINESS OVERVIEW

- FIGURE 41 THALES GROUP: COMPANY SNAPSHOT

- TABLE 169 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 THALES GROUP: DEALS

- 12.2.5 SAFRAN SA

- TABLE 171 SAFRAN SA: BUSINESS OVERVIEW

- FIGURE 42 SAFRAN SA: COMPANY SNAPSHOT

- TABLE 172 SAFRAN SA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 173 SAFRAN SA: PRODUCT LAUNCHES

- TABLE 174 SAFRAN SA: DEALS

- TABLE 175 SAFRAN SA: OTHERS

- 12.2.6 ABB

- TABLE 176 ABB: BUSINESS OVERVIEW

- FIGURE 43 ABB: COMPANY SNAPSHOT

- TABLE 177 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 178 ABB: PRODUCT LAUNCHES

- TABLE 179 ABB: DEALS

- TABLE 180 ABB: OTHERS

- 12.2.7 L3HARRIS TECHNOLOGIES, INC.

- TABLE 181 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 44 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 182 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 183 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 184 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 185 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- 12.2.8 GENERAL DYNAMICS CORPORATION

- TABLE 186 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- FIGURE 45 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- TABLE 187 GENERAL DYNAMICS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 188 GENERAL DYNAMICS CORPORATION: OTHERS

- 12.2.9 ROLLS-ROYCE PLC

- TABLE 189 ROLLS-ROYCE PLC: BUSINESS OVERVIEW

- FIGURE 46 ROLLS-ROYCE PLC: COMPANY SNAPSHOT

- TABLE 190 ROLLS-ROYCE PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 191 ROLLS-ROYCE PLC: DEALS

- 12.2.10 MOOG INC.

- TABLE 192 MOOG INC.: BUSINESS OVERVIEW

- FIGURE 47 MOOG INC.: COMPANY SNAPSHOT

- TABLE 193 MOOG INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 194 MOOG INC.: OTHERS

- 12.2.11 KONGSBERG GRUPPEN ASA

- TABLE 195 KONGSBERG GRUPPEN ASA: BUSINESS OVERVIEW

- FIGURE 48 KONGSBERG GRUPPEN ASA: COMPANY SNAPSHOT

- TABLE 196 KONGSBERG GRUPPEN ASA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.2.12 RH MARINE

- TABLE 197 RH MARINE: BUSINESS OVERVIEW

- TABLE 198 RH MARINE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.2.13 TRIMBLE INC.

- TABLE 199 TRIMBLE INC.: BUSINESS OVERVIEW

- FIGURE 49 TRIMBLE INC.: COMPANY SNAPSHOT

- TABLE 200 TRIMBLE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 TRIMBLE INC.: PRODUCT LAUNCHES

- TABLE 202 TRIMBLE INC.: DEALS

- 12.2.14 FURUNO ELECTRIC CO., LTD.

- TABLE 203 FURUNO ELECTRIC CO., LTD.: BUSINESS OVERVIEW

- FIGURE 50 FURUNO ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- TABLE 204 FURUNO ELECTRIC CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 205 FURUNO ELECTRIC CO., LTD.: OTHERS

- 12.3 OTHER PLAYERS

- 12.3.1 SHIELD AI

- TABLE 206 SHIELD AI: COMPANY OVERVIEW

- 12.3.2 SKYDIO, INC.

- TABLE 207 SKYDIO, INC.: COMPANY OVERVIEW

- 12.3.3 NEAR EARTH AUTONOMY INC.

- TABLE 208 NEAR EARTH AUTONOMY INC.: COMPANY OVERVIEW

- 12.3.4 CLEARPATH ROBOTICS INC.

- TABLE 209 CLEARPATH ROBOTICS INC.: COMPANY OVERVIEW

- 12.3.5 BLUEBOTICS

- TABLE 210 BLUEBOTICS: COMPANY OVERVIEW

- 12.3.6 VELODYNE LIDAR, INC.

- TABLE 211 VELODYNE LIDAR, INC.: COMPANY OVERVIEW

- 12.3.7 LEDDARTECH INC.

- TABLE 212 LEDDARTECH INC.: COMPANY OVERVIEW

- 12.3.8 NOVATEL INC.

- TABLE 213 NOVATEL INC.: COMPANY OVERVIEW

- 12.3.9 SEA MACHINES

- TABLE 214 SEA MACHINES: COMPANY OVERVIEW

- 12.3.10 AUTONODYNE LLC

- TABLE 215 AUTONODYNE LLC: COMPANY OVERVIEW

- *Details on Business overview, Products/Services/Solutions offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS