|

|

市場調査レポート

商品コード

1301541

砲兵システムの世界市場:種類別 (榴弾砲、ロケットランチャー、迫撃砲、対空兵器、大砲)・射程距離別 (短距離、中距離、長距離)・サブシステム別・地域別 (北米、欧州、アジア太平洋、その他の地域 (ROW)) の将来予測 (2028年まで)Artillery Systems Market by Type (Howitzers, Rocket Launchers, Mortars, Anti-air weapons, Artillery), Range(Short-range, Medium-range, Long-range), Subsystem and Region (North America, Europe, Asia Pacific, ROW) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 砲兵システムの世界市場:種類別 (榴弾砲、ロケットランチャー、迫撃砲、対空兵器、大砲)・射程距離別 (短距離、中距離、長距離)・サブシステム別・地域別 (北米、欧州、アジア太平洋、その他の地域 (ROW)) の将来予測 (2028年まで) |

|

出版日: 2023年06月29日

発行: MarketsandMarkets

ページ情報: 英文 219 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の砲兵システムの市場規模は、2023年に118億米ドルと推定され、予測期間中は6.2%のCAGRで成長し、2030年には160億米ドルに達すると予測されています。

いくつかの要因により、砲兵システムの世界市場は大幅に拡大しています。砲兵システムは、長距離火力、精度と正確さ、機動性、多用途性、抑止力、戦略的価値を含むいくつかの重要な利点を提供します。砲兵システムは現代戦のあり方を変えてきました。

"ロケットランチャーの中でも、多連装ロケットシステム (MLRS) 市場は2023年に最大のシェアを占める"

ロケットランチャーは、携帯型防空兵器システム (MANPADS) と多連装ロケットシステム (MLRS) に区分され、MLRSが最大の市場シェアを占めると予想されます。MLRSは、高火力弾、クラスター弾、誘導弾など様々な弾頭を搭載した複数のロケット弾を同時に発射することができます。この能力により、目標を迅速に飽和させることができ、敵の陣地、砲台、防空システム、その他の価値の高い目標を効果的に無力化することができます。MLRSの破壊力は、攻撃的、防衛的作戦の両方において手強い戦力となります。

"対ロケット弾・大砲・迫撃砲 (C-RAM):予測期間中に最も急成長する"

対空兵器は、防空砲と対ロケット弾・大砲・迫撃砲 (C-RAM) システムに区分されます。C-RAMシステムの利用が拡大しているのは、飛来する弾丸をリアルタイムで探知・追跡する能力があるためです。この迅速な探知により、迅速な警戒と対応が可能となり、C-RAMシステムは飛来する脅威が意図した目標に到達する前に交戦し、迎撃することができます。この迅速な対応能力により、敵のロケット砲、大砲、迫撃砲の攻撃による損害や死傷者の可能性が大幅に減少します。

"中口径:迫撃砲の中でも最も急速に成長する分野 (2023年)"

中口径迫撃砲システムは、可搬性と火力のバランスを提供します。中口径迫撃砲は、大型の砲兵システムと比べて軽量かつコンパクトであるため、機動性が向上し、配備が容易になります。そのため汎用性が高く、歩兵の降下作戦や市街戦、迅速な対応任務など、さまざまな作戦シナリオに適しています。その可搬性により、歩兵部隊は地上の仲間に近接・即時の火力支援を行うことができます。

"インドが砲兵システム市場で最速のCAGRを予測"

インドは近年、砲兵システムの開発において著しい成長を遂げています。この動向にはいくつかの要因があります。

一つは国防予算の配分で、政府は国防予算を年々増額しており、砲兵システムの研究開発・調達に多くの資金を提供しています。このような予算の増加は、同国における砲兵システム開発の成長を促進しています。もう一つは国産化と自立で、インドは、"Make in India"のような取り組みを通じて、防衛生産における国産化と自立を推進してきました。自国の砲兵システムを開発することで、インドは外国からの輸入品への依存を減らし、防衛産業を後押しし、国内に雇用機会を創出しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 砲兵システム市場に対する不況の影響

- 平均販売価格分析

- 砲兵システムの市場規模 (数量ベース):種類別

- エコシステムマッピング

- バリューチェーン分析

- 使用事例の分析

- 貿易分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 関税と規制状況

- 主要な会議とイベント (2023年~2024年)

第6章 業界動向

- イントロダクション

- 主要技術の動向

- メガトレンドの影響

- サプライチェーン分析

第7章 砲兵システム市場:種類別

- イントロダクション

- 榴弾砲

- 中口径

- 大口径

- 迫撃砲

- 小口径

- 中口径

- 対空兵器

- 防空砲

- 対ロケット弾・大砲・迫撃砲 (C-RAM)

- ロケットランチャー

- 携帯型防空兵器システム (MANPADS)

- 多連装ロケットシステム (MLRS)

- 砲兵

- 艦上砲兵

- 沿岸砲兵

第8章 砲兵システム市場:サブシステム別

- イントロダクション

- 砲塔

- エンジン

- 防火システム

- 弾薬処理システム

- シャーシ

- 補助システム

第9章 砲兵システム市場:射程距離別

- イントロダクション

- 短距離

- 中距離

- 長距離

第10章 砲兵システム市場:地域別

- イントロダクション

- 不況の影響分析:地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- ポーランド

- イタリア

- ロシア

- その他欧州

- その他の欧州

- 中国

- 日本

- インド

- 韓国

- シンガポール

- その他のアジア太平洋

- その他の地域 (ROW)

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- イントロダクション

- 競合の概要

- ランキング分析 (2022年)

- 市場シェア分析 (2022年)

- 収益分析 (2022年)

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 企業フットプリント分析

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- LOCKHEED MARTIN CORPORATION

- BAE SYSTEMS

- HANWHA GROUP

- ELBIT SYSTEMS

- NEXTER GROUP

- RUAG GROUP

- NORINCO INTERNATIONAL COOPERATION LTD.

- ROSTEC

- THALES GROUP

- GENERAL DYNAMICS CORPORATION

- ST ENGINEERING

- RHEINMETALL AG

- LEONARDO

- DENEL SOC LTD.

- AVIBRAS

- その他の企業

- NAVANTIA

- ROKETSAN AS

- TATA ADVANCED SYSTEMS LIMITED

- ARSENAL JSCO

- OTOKAR

- OTO MELARA

- SOLTAM SYSTEMS

- POONGSAN CORPORATION

- KALYANI GROUP

- ASELSAN A.S.

第13章 付録

The artillery systems Market is estimated to be USD 11.8 billion in 2023 and is projected to reach USD 16.0 billion by 2030, at a CAGR of 6.2 % during the forecast period. Due to several factors, the global market for artillery systems is expanding significantly. Artillery systems deliver several key advantages which includes Long-Range Firepower, Precision and Accuracy, Mobility, Versatility, Deterrence and Strategic Value. Artillery systems have changed the way of modern warfare.

" Multiple launch rocket system MLRS": The largest share of the Artillery systems Market by Rocket Launcher Segment in 2023." Based on Rocket launchers, the artillery systems market has been segmented into Man-Portable Air-Defense Systems (MANPADS) and Multiple launch rocket system (MLRS), MLRS is expected to account for the largest market share. MLRS can simultaneously launch multiple rockets equipped with various warhead types, such as high-explosive, cluster, or guided munitions. This capability allows for the rapid saturation of targets, effectively neutralizing enemy positions, artillery batteries, air defense systems, or other high-value targets. The destructive power of the MLRS makes it a formidable asset in both offensive and defensive operations.

" Counter Rocket, Artillery and Mortar C-RAM": The fastest growing segment of the artillery systems Market by Anti-air weapons during the forecasted period." Based on Anti-air weapons, the artillery systems market has been segmented into Air Defense gun and Counter Rocket, Artillery and Mortar (C-RAM). The use of C- RAM artillery systems is growing due to their ability to detect and track incoming projectiles in real time. This quick detection enables a rapid alert and response, allowing the C-RAM system to engage and intercept the incoming threats before they reach their intended targets. This rapid response capability greatly reduces the potential for damage and casualties caused by enemy rocket, artillery, and mortar attacks.

" Medium Caliber ": The fastest growing segment of the artillery systems Market by Mortar in 2023"

Medium caliber mortar systems provide a balance between portability and firepower. They are generally lighter and more compact compared to larger artillery systems, allowing for increased mobility and ease of deployment. This makes them highly versatile and suitable for various operational scenarios, including dismounted infantry operations, urban warfare, and rapid response missions. Their portability enables infantry units to provide close and immediate fire support to their comrades on the ground.

"India to account for the fastest CAGR in the Artillery systems Market in forecasted year"

India has witnessed significant growth in the development of artillery systems in recent years. Several factors contribute to this trend:

Defense Budget Allocation: The Indian government has been increasing the defense budget over the years, providing more resources for research, development, and procurement of artillery systems. This increased funding has facilitated the growth of artillery systems development in the country. Indigenous Manufacturing and Self-Reliance: India has been promoting indigenous manufacturing and self-reliance in defense production through initiatives like "Make in India." By developing its own artillery systems, India reduces its dependence on foreign imports, boosts its defense industry, and creates job opportunities in the country.

Break-up of profiles of primary participants in the multispectral camera market: By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20% By Designation: C-Level Executives - 35%, Director level - 25%, and Others - 40% By Region: North America - 25%, Asia Pacific - 45%, Europe - 15%, Middle East - 10%, RoW - 5%

Prominent companies in the artillery systems market are Lockheed Martin Corporation (US), Bae Systems (UK), Hanwha Group (South Korea), Rheinmetall AG ( Germany), Nexter Group (France), Norinco Internation Cooperation Ltd. (China), Rostec (Russia), General Dynamics Corporation (US), Avibras (Brazil), Elbit Systems (Israel).

Research Coverage: The market study covers the artillery systems market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as type, range, subsystem, and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies. Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall artillery systems market and its subsegments. The report covers the entire ecosystem of the artillery systems industry and will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and there are several factors that could contribute to an increase in the artillery systems market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the artillery systems market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the artillery systems market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the artillery systems market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Lockheed Martin Corporation (US), Bae Systems (UK), Hanwha Group (South Korea), Rheinmetall AG ( Germany), Nexter Group (France), Norinco Internation Cooperation Ltd. (China), Rostec (Russia), General Dynamics Corporation (US), Avibras (Brazil), Elbit Systems (Israel) among others in the artillery systems market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 ARTILLERY SYSTEMS MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY AND PRICING

- TABLE 2 USD EXCHANGE RATES

- 1.6 LIMITATIONS

- 1.7 MARKET STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 INTRODUCTION

- 2.3.2 DEMAND-SIDE INDICATORS

- 2.3.3 SUPPLY-SIDE INDICATORS

- 2.3.4 RECESSION IMPACT ANALYSIS

- 2.4 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.5 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISKS

3 EXECUTIVE SUMMARY

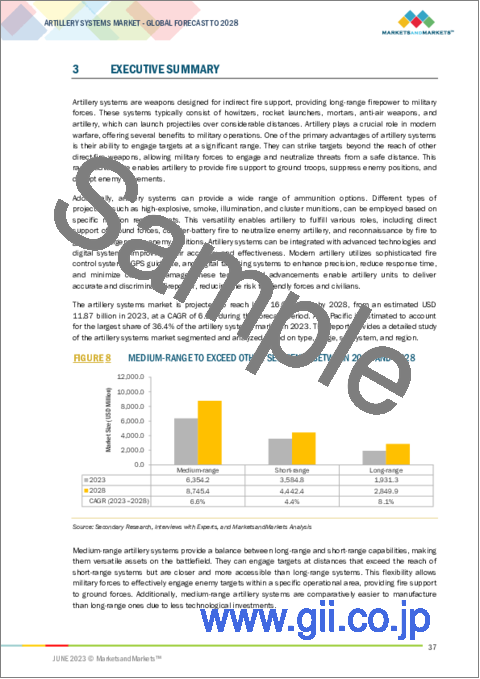

- FIGURE 8 MEDIUM-RANGE TO EXCEED OTHER SEGMENTS BETWEEN 2023 AND 2028

- FIGURE 9 AUXILIARY SYSTEMS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ANTI-AIR WEAPONS TO BE FASTEST-GROWING SEGMENT FROM 2023 TO 2028

- FIGURE 11 MEDIUM CALIBER TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 12 MULTIPLE LAUNCH ROCKET SYSTEMS TO SECURE MAXIMUM SHARE IN 2028

- FIGURE 13 AIR DEFENSE GUNS TO HOLD LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ARTILLERY SYSTEMS MARKET

- FIGURE 15 INCREASED ADOPTION OF ARTILLERY SYSTEMS AND TECHNOLOGIES

- 4.2 ARTILLERY SYSTEMS MARKET, BY TYPE

- FIGURE 16 HOWITZERS TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- 4.3 ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM

- FIGURE 17 TURRETS TO ACQUIRE LARGEST MARKET SHARE IN 2028

- 4.4 ARTILLERY SYSTEMS MARKET, BY RANGE

- FIGURE 18 MEDIUM-RANGE TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- 4.5 ARTILLERY SYSTEMS MARKET, BY REGION

- FIGURE 19 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- 4.6 ARTILLERY SYSTEMS MARKET, BY COUNTRY

- FIGURE 20 INDIA TO BE FASTEST-GROWING COUNTRY FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 ARTILLERY SYSTEMS MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Incorporation of latest technologies and equipment

- 5.2.1.2 Strategic importance of artillery in modern warfare

- 5.2.1.3 Rising preference for multi-role capabilities

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited ammunition storage space in artillery systems

- 5.2.2.2 Need for high maintenance and logistics in artillery operations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adaptability of unmanned artillery systems

- 5.2.3.2 Increased defense budgets

- TABLE 3 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (USD BILLION)

- FIGURE 22 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (%)

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex procurement procedures

- 5.2.4.2 High cost of artillery systems

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 23 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ARTILLERY SYSTEM MANUFACTURERS

- 5.4 IMPACT OF RECESSION ON ARTILLERY SYSTEMS MARKET

- FIGURE 24 IMPACT OF RECESSION ON ARTILLERY SYSTEMS MARKET

- 5.5 AVERAGE SELLING PRICE ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE OF ARTILLERY SYSTEMS (USD MILLION)

- 5.6 ARTILLERY SYSTEMS VOLUME, BY TYPE

- TABLE 5 ARTILLERY SYSTEMS VOLUME, BY TYPE

- 5.7 ECOSYSTEM MAPPING

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 END USERS

- FIGURE 25 ARTILLERY SYSTEMS MARKET ECOSYSTEM

- TABLE 6 ARTILLERY SYSTEMS MARKET ECOSYSTEM

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS

- 5.9 USE CASE ANALYSIS

- 5.9.1 INACCURATE TARGETING

- 5.9.2 TACTICAL FIRE SUPPORT

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT VALUE OF ARTILLERY WEAPONS (PRODUCT HARMONIZED SYSTEM CODE: 930110)

- TABLE 7 COUNTRY-WISE IMPORTS, 2021-2022 (USD THOUSAND)

- 5.10.2 EXPORT VALUE OF ARTILLERY WEAPONS (PRODUCT HARMONIZED SYSTEM CODE: 930110)

- TABLE 8 COUNTRY-WISE EXPORTS, 2021-2022 (USD THOUSAND)

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ARTILLERY SYSTEMS, BY TYPE

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ARTILLERY SYSTEMS, BY TYPE (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR ARTILLERY SYSTEMS, BY RANGE

- TABLE 11 KEY BUYING CRITERIA FOR ARTILLERY SYSTEMS, BY RANGE

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 16 KEY CONFERENCES AND EVENTS, 2023-2024

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- FIGURE 30 EVOLUTION OF ARTILLERY SYSTEMS: ROADMAP FROM 1980 TO 2050

- 6.2 KEY TECHNOLOGY TRENDS

- FIGURE 31 TECHNOLOGICAL TRENDS IN ARTILLERY SYSTEMS MARKET

- 6.2.1 PROGRAMMABLE AMMUNITION

- 6.2.2 IMPROVED AMMUNITION-CARRYING CAPABILITY

- 6.2.3 ADVANCED AUTOLOADERS

- FIGURE 32 PROPERTIES OF ADVANCED AUTOLOADERS

- 6.2.4 INTEGRATED TURRET GUN SYSTEMS

- 6.2.5 HYBRID POWER SYSTEMS

- FIGURE 33 HYBRID POWER SYSTEMS

- FIGURE 34 BENEFITS OF HYBRID POWER SYSTEMS

- 6.2.6 MULTIPLE ROUNDS SIMULTANEOUS IMPACT

- 6.2.7 TRAJECTORY CORRECTION SYSTEMS

- 6.2.8 ADVANCED FIRE CONTROL SYSTEMS

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 INTEGRATION OF INTERNET OF THINGS

- 6.4 SUPPLY CHAIN ANALYSIS

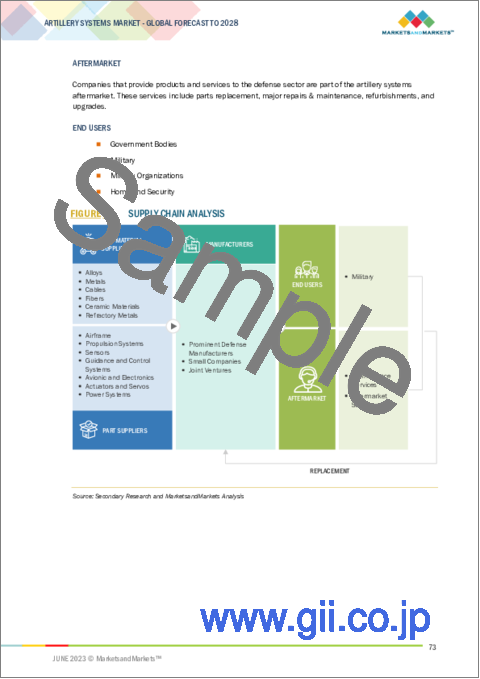

- FIGURE 35 SUPPLY CHAIN ANALYSIS

7 ARTILLERY SYSTEMS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 36 ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 17 ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 18 ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2 HOWITZERS

- 7.2.1 GROWING GEOPOLITICAL TENSIONS TO DRIVE GROWTH

- FIGURE 37 ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2023-2028 (USD MILLION)

- TABLE 19 HOWITZERS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 20 HOWITZERS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2.2 MEDIUM CALIBER

- 7.2.3 LARGE CALIBER

- 7.3 MORTARS

- 7.3.1 EXTENSIVE USE OF LIGHTWEIGHT AND PORTABLE MORTARS TO DRIVE GROWTH

- FIGURE 38 ARTILLERY SYSTEMS MARKET, BY MORTAR, 2023-2028 (USD MILLION)

- TABLE 21 MORTARS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 22 MORTARS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.3.2 SMALL CALIBER

- 7.3.3 MEDIUM CALIBER

- 7.4 ANTI-AIR WEAPONS

- 7.4.1 RISING AERIAL THREATS TO DRIVE GROWTH

- FIGURE 39 ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2023-2028

- TABLE 23 ANTI-AIR WEAPONS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 24 ANTI-AIR WEAPONS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.4.2 AIR DEFENSE GUNS

- 7.4.3 COUNTER ROCKET, ARTILLERY, AND MORTAR (C-RAM)

- 7.5 ROCKET LAUNCHERS

- 7.5.1 INCREASING PREFERENCE FOR LONG-RANGE CAPABILITIES TO DRIVE GROWTH

- FIGURE 40 ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2023-2028 (USD MILLION)

- TABLE 25 ROCKET LAUNCHERS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 26 ROCKET LAUNCHERS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.5.2 MAN-PORTABLE AIR-DEFENSE SYSTEMS (MANPADS)

- 7.5.3 MULTIPLE LAUNCH ROCKET SYSTEMS (MLRS)

- 7.6 ARTILLERY

- 7.6.1 NEED FOR MARITIME SECURITY TO DRIVE GROWTH

- FIGURE 41 ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2023-2028 (USD MILLION)

- TABLE 27 ARTILLERY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 28 ARTILLERY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.6.2 NAVAL ARTILLERY

- 7.6.3 COASTAL ARTILLERY

8 ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM

- 8.1 INTRODUCTION

- FIGURE 42 ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023-2028 (USD MILLION)

- TABLE 29 ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2019-2022 (USD MILLION)

- TABLE 30 ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023-2028 (USD MILLION)

- 8.1.1 TURRETS

- 8.1.2 ENGINES

- 8.1.3 FIRE CONTROL SYSTEMS

- 8.1.4 AMMUNITION HANDLING SYSTEMS

- 8.1.5 CHASSIS

- 8.1.6 AUXILIARY SYSTEMS

9 ARTILLERY SYSTEMS MARKET, BY RANGE

- 9.1 INTRODUCTION

- FIGURE 43 ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- TABLE 31 ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 32 ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 9.2 SHORT-RANGE

- 9.2.1 NEED FOR CLOSE-RANGE ENGAGEMENTS TO DRIVE GROWTH

- 9.3 MEDIUM-RANGE

- 9.3.1 EFFECTIVE FIRE SUPPORT CAPABILITIES TO DRIVE GROWTH

- 9.4 LONG-RANGE

- 9.4.1 VERSATILITY OF LONG-RANGE ARTILLERY SYSTEMS TO DRIVE GROWTH

10 ARTILLERY SYSTEMS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 44 ARTILLERY SYSTEMS MARKET, BY REGION, 2023-2028

- 10.2 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 33 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 34 ARTILLERY SYSTEMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 35 ARTILLERY SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 NORTH AMERICA

- 10.3.1 PESTLE ANALYSIS

- 10.3.2 RECESSION IMPACT ANALYSIS

- FIGURE 45 NORTH AMERICA: ARTILLERY SYSTEMS MARKET SNAPSHOT

- TABLE 36 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2019-2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023-2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2019-2022 (USD MILLION)

- TABLE 43 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2023-2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2019-2022 (USD MILLION)

- TABLE 45 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2023-2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2019-2022 (USD MILLION)

- TABLE 47 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2023-2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2019-2022 (USD MILLION)

- TABLE 49 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2023-2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2019-2022 (USD MILLION)

- TABLE 51 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2023-2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 US

- 10.3.3.1 Advancements in technology to drive growth

- TABLE 54 US: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 55 US: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 56 US: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 57 US: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.3.4 CANADA

- 10.3.4.1 Increased defense budgets to drive growth

- TABLE 58 CANADA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 59 CANADA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 60 CANADA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 61 CANADA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 PESTLE ANALYSIS

- 10.4.2 RECESSION IMPACT ANALYSIS

- FIGURE 46 EUROPE: ARTILLERY SYSTEMS MARKET SNAPSHOT

- TABLE 62 EUROPE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 63 EUROPE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 64 EUROPE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 65 EUROPE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- TABLE 66 EUROPE: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2019-2022 (USD MILLION)

- TABLE 67 EUROPE: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023-2028 (USD MILLION)

- TABLE 68 EUROPE: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2019-2022 (USD MILLION)

- TABLE 69 EUROPE: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2023-2028 (USD MILLION)

- TABLE 70 EUROPE: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2019-2022 (USD MILLION)

- TABLE 71 EUROPE: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2023-2028 (USD MILLION)

- TABLE 72 EUROPE: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2019-2022 (USD MILLION)

- TABLE 73 EUROPE: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2023-2028 (USD MILLION)

- TABLE 74 EUROPE: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2019-2022 (USD MILLION)

- TABLE 75 EUROPE: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2023-2028 (USD MILLION)

- TABLE 76 EUROPE: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2019-2022 (USD MILLION)

- TABLE 77 EUROPE: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2023-2028 (USD MILLION)

- TABLE 78 EUROPE: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 79 EUROPE: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 UK

- 10.4.3.1 Presence of prominent OEMs to drive growth

- TABLE 80 UK: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 81 UK: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 82 UK: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 83 UK: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.4.4 FRANCE

- 10.4.4.1 Increased investments in artillery system manufacturing to drive growth

- TABLE 84 FRANCE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 85 FRANCE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 86 FRANCE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 87 FRANCE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.4.5 GERMANY

- 10.4.5.1 Acquisition of new artillery systems to drive growth

- TABLE 88 GERMANY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 89 GERMANY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 90 GERMANY: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 91 GERMANY: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.4.6 POLAND

- 10.4.6.1 Strategic partnerships with allied countries to drive growth

- TABLE 92 POLAND: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 93 POLAND: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 94 POLAND: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 95 POLAND: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.4.7 ITALY

- 10.4.7.1 International collaborations to drive growth

- TABLE 96 ITALY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 97 ITALY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 98 ITALY: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 99 ITALY: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.4.8 RUSSIA

- 10.4.8.1 Military modernization programs to drive growth

- TABLE 100 RUSSIA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 101 RUSSIA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 102 RUSSIA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 103 RUSSIA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.4.9 REST OF EUROPE

- TABLE 104 REST OF EUROPE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 105 REST OF EUROPE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 106 REST OF EUROPE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.5 ASIA PACIFIC

- 10.5.1 PESTLE ANALYSIS

- 10.5.2 RECESSION IMPACT ANALYSIS

- FIGURE 47 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET SNAPSHOT

- TABLE 108 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2019-2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023-2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2019-2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2023-2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2019-2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2023-2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2019-2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2023-2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2019-2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2023-2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2019-2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2023-2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3 CHINA

- 10.5.3.1 Regional security concerns to drive growth

- TABLE 126 CHINA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 127 CHINA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 128 CHINA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 129 CHINA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.5.4 JAPAN

- 10.5.4.1 Rising geopolitical tension to drive growth

- TABLE 130 JAPAN: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 131 JAPAN: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 132 JAPAN: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 133 JAPAN: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.5.5 INDIA

- 10.5.5.1 Territorial and border disputes to drive growth

- TABLE 134 INDIA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 135 INDIA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 136 INDIA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 137 INDIA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.5.6 SOUTH KOREA

- 10.5.6.1 Need for robust counterbattery capabilities to drive growth

- TABLE 138 SOUTH KOREA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 139 SOUTH KOREA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 140 SOUTH KOREA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 141 SOUTH KOREA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.5.7 SINGAPORE

- 10.5.7.1 Incorporation of advanced technologies to drive growth

- TABLE 142 SINGAPORE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 143 SINGAPORE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 144 SINGAPORE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 145 SINGAPORE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.5.8 REST OF ASIA PACIFIC

- TABLE 146 REST OF ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.6 ROW

- 10.6.1 RECESSION IMPACT ANALYSIS

- TABLE 150 ROW: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 151 ROW: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 152 ROW: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 153 ROW: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- TABLE 154 ROW: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2019-2022 (USD MILLION)

- TABLE 155 ROW: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023-2028 (USD MILLION)

- TABLE 156 ROW: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2019-2022 (USD MILLION)

- TABLE 157 ROW: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2023-2028 (USD MILLION)

- TABLE 158 ROW: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2019-2022 (USD MILLION)

- TABLE 159 ROW: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2023-2028 (USD MILLION)

- TABLE 160 ROW: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2019-2022 (USD MILLION)

- TABLE 161 ROW: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2023-2028 (USD MILLION)

- TABLE 162 ROW: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2019-2022 (USD MILLION)

- TABLE 163 ROW: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2023-2028 (USD MILLION)

- TABLE 164 ROW: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2019-2022 (USD MILLION)

- TABLE 165 ROW: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2023-2028 (USD MILLION)

- TABLE 166 ROW: ARTILLERY SYSTEMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 167 ROW: ARTILLERY SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6.2 MIDDLE EAST & AFRICA

- 10.6.2.1 Need for advanced artillery systems to drive growth

- TABLE 168 MIDDLE EAST & AFRICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 10.6.3 LATIN AMERICA

- 10.6.3.1 Developments in artillery systems to drive growth

- TABLE 172 LATIN AMERICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 173 LATIN AMERICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 COMPETITIVE OVERVIEW

- TABLE 176 KEY DEVELOPMENTS BY LEADING PLAYERS IN ARTILLERY SYSTEMS MARKET, 2020-2023

- 11.3 RANKING ANALYSIS, 2022

- FIGURE 48 MARKET RANKING OF TOP FIVE PLAYERS, 2022

- 11.4 MARKET SHARE ANALYSIS, 2022

- FIGURE 49 MARKET SHARE OF TOP FIVE PLAYERS, 2022

- TABLE 177 ARTILLERY SYSTEMS MARKET: DEGREE OF COMPETITION

- 11.5 REVENUE ANALYSIS, 2022

- FIGURE 50 REVENUE OF TOP FIVE PLAYERS, 2022

- 11.6 COMPANY EVALUATION MATRIX

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 51 COMPANY EVALUATION MATRIX, 2023

- 11.7 START-UP/SME EVALUATION MATRIX

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 52 START-UP/SME EVALUATION MATRIX, 2023

- 11.8 COMPANY FOOTPRINT ANALYSIS

- TABLE 178 COMPANY FOOTPRINT

- TABLE 179 REGION FOOTPRINT

- TABLE 180 WEAPON TYPE FOOTPRINT

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 MARKET EVALUATION FRAMEWORK

- 11.9.2 PRODUCT LAUNCHES

- TABLE 181 PRODUCT LAUNCHES, 2019-2023

- 11.9.3 DEALS

- TABLE 182 DEALS, 2019-2023

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1 KEY PLAYERS

- 12.1.1 LOCKHEED MARTIN CORPORATION

- TABLE 183 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- FIGURE 53 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 184 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 186 LOCKHEED MARTIN CORPORATION: DEALS

- 12.1.2 BAE SYSTEMS

- TABLE 187 BAE SYSTEMS: BUSINESS OVERVIEW

- FIGURE 54 BAE SYSTEMS: COMPANY SNAPSHOT

- TABLE 188 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 BAE SYSTEMS: DEALS

- 12.1.3 HANWHA GROUP

- TABLE 190 HANWHA GROUP: BUSINESS OVERVIEW

- TABLE 191 HANWHA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 HANWHA GROUP: DEALS

- 12.1.4 ELBIT SYSTEMS

- TABLE 193 ELBIT SYSTEMS: BUSINESS OVERVIEW

- FIGURE 55 ELBIT SYSTEMS: COMPANY SNAPSHOT

- TABLE 194 ELBIT SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ELBIT SYSTEMS: DEALS

- 12.1.5 NEXTER GROUP

- TABLE 196 NEXTER GROUP: BUSINESS OVERVIEW

- TABLE 197 NEXTER GROUP: PRODUCT LAUNCHES

- TABLE 198 NEXTER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 NEXTER GROUP: DEALS

- 12.1.6 RUAG GROUP

- TABLE 200 RUAG GROUP: BUSINESS OVERVIEW

- TABLE 201 RUAG GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 RUAG GROUP: DEALS

- 12.1.7 NORINCO INTERNATIONAL COOPERATION LTD.

- TABLE 203 NORINCO INTERNATIONAL COOPERATION LTD.: BUSINESS OVERVIEW

- TABLE 204 NORINCO INTERNATIONAL COOPERATION LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 NORINCO INTERNATIONAL COOPERATION LTD.: DEALS

- 12.1.8 ROSTEC

- TABLE 206 ROSTEC: BUSINESS OVERVIEW

- TABLE 207 ROSTEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 ROSTEC: PRODUCT LAUNCHES

- TABLE 209 ROSTEC: DEALS

- 12.1.9 THALES GROUP

- TABLE 210 THALES GROUP: BUSINESS OVERVIEW

- FIGURE 56 THALES GROUP: COMPANY SNAPSHOT

- TABLE 211 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 THALES GROUP: PRODUCT LAUNCHES

- TABLE 213 THALES GROUP: DEALS

- 12.1.10 GENERAL DYNAMICS CORPORATION

- TABLE 214 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- FIGURE 57 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- TABLE 215 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 GENERAL DYNAMICS CORPORATION: DEALS

- 12.1.11 ST ENGINEERING

- TABLE 217 ST ENGINEERING: BUSINESS OVERVIEW

- TABLE 218 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.12 RHEINMETALL AG

- TABLE 219 RHEINMETALL AG: BUSINESS OVERVIEW

- FIGURE 58 RHEINMETALL AG: COMPANY SNAPSHOT

- TABLE 220 RHEINMETALL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.13 LEONARDO

- TABLE 221 LEONARDO: BUSINESS OVERVIEW

- FIGURE 59 LEONARDO: COMPANY SNAPSHOT

- TABLE 222 LEONARDO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 LEONARDO: DEALS

- 12.1.14 DENEL SOC LTD.

- TABLE 224 DENEL SOC LTD.: BUSINESS OVERVIEW

- TABLE 225 DENEL SOC LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.15 AVIBRAS

- TABLE 226 AVIBRAS: BUSINESS OVERVIEW

- TABLE 227 AVIBRAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 AVIBRAS: PRODUCT LAUNCHES

- 12.2 OTHER PLAYERS

- 12.2.1 NAVANTIA

- TABLE 229 NAVANTIA: COMPANY OVERVIEW

- 12.2.2 ROKETSAN AS

- TABLE 230 ROKETSAN AS: COMPANY OVERVIEW

- 12.2.3 TATA ADVANCED SYSTEMS LIMITED

- TABLE 231 TATA ADVANCED SYSTEMS LIMITED: COMPANY OVERVIEW

- 12.2.4 ARSENAL JSCO

- TABLE 232 ARSENAL JSCO: COMPANY OVERVIEW

- 12.2.5 OTOKAR

- TABLE 233 OTOKAR: COMPANY OVERVIEW

- 12.2.6 OTO MELARA

- TABLE 234 OTO MELARA: COMPANY OVERVIEW

- 12.2.7 SOLTAM SYSTEMS

- TABLE 235 SOLTAM SYSTEMS: COMPANY OVERVIEW

- 12.2.8 POONGSAN CORPORATION

- TABLE 236 POONGSAN CORPORATION: COMPANY OVERVIEW

- 12.2.9 KALYANI GROUP

- TABLE 237 KALYANI GROUP: COMPANY OVERVIEW

- 12.2.10 ASELSAN A.S.

- TABLE 238 ASELSAN A.S.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS