|

|

市場調査レポート

商品コード

1298019

農業用テキスタイルの世界市場:繊維材料別 (ナイロン、ポリエステル、PE、PP、天然繊維)・製織技術別 (織物、ニット、不織布)・製品種類別 (遮光ネット、マルチマット)・用途別・地域別の将来予測 (2028年まで)Agricultural Textiles Market by Fiber Material (Nylon, Polyester, PE, PP, Natural Fiber), Fabric Formation Technology (Woven, Knitted, Nonwoven), Product type (Shade Nets, Mulch Mats), Application and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 農業用テキスタイルの世界市場:繊維材料別 (ナイロン、ポリエステル、PE、PP、天然繊維)・製織技術別 (織物、ニット、不織布)・製品種類別 (遮光ネット、マルチマット)・用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月23日

発行: MarketsandMarkets

ページ情報: 英文 243 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の農業用テキスタイルの市場規模は、2023年の159億米ドルから、2028年には202億米ドルに成長し、2023年から2028年のCAGRは4.8%になると予測されています。

市場の成長を促す主な要因は、温室で保護された栽培面積の増加です。

"屋外農業向け用途が最大のセグメントとなる"

果樹園や畑のような管理されていない環境での農業活動は、環境条件に大きく影響されます。リンゴのような果樹園では、良好な収量を得るために継続的な注意が必要です。開放的な環境、特に寒冷地では、気温の低下や雹によって収穫量が減少する可能性があります。地上用カバーは、紫外線による土壌への影響を軽減し、養分の枯渇を防ぐのに非常に効果的です。また、地上用カバーを使用することで、土壌の水分や空気の流れを調整することもできます。太陽光スクリーン、防鳥ネット、防雹ネット、マルチネット、グランドカバーは、屋外農業でよく使用されるテキスタイル製品です。屋外で使用されるテキスタイルには、耐摩耗性と耐候性が求められます。農業用テキスタイルの使用は増加の一途をたどっており、政府も制度を設けてその使用を促進しています。

"漁網向け用途が最も急成長する"

漁網は長い間使用されており、市場で簡単に入手できます。しかし、漁網は海洋生態系に大きな脅威を与え、ほとんどの水質汚染の原因となっています。先進技術により、この問題を解決するために生分解性漁網が開発されつつあります。漁網は必需品となっており、効果的な代替品がなければ取って代わることはできません。アジア太平洋 (中国・日本・韓国など) は、養殖漁業と捕獲漁業の両分野で世界最大の魚類生産国であり、東シナ海・日本海・黄海は、世界で最も漁獲量の多い海域のひとつです。魚の消費量は多く、この地域の国々は国際貿易が盛んです。そのため、アジア太平洋における漁網の需要は高まると思われます。

"アジア太平洋の農業用テキスタイル市場は、予測期間中に最も急成長する市場となる"

アジア太平洋は世界最大の農業用テキスタイル市場です。これは、消費者の嗜好の変化や高齢化によって農産物の需要が増加しているためです。農業用テキスタイル市場では中国が支配的な地域です。インドや韓国を含む他のアジア経済圏では、農業用テキスタイルの需要が大幅に増加しています。インドネシア、マレーシア、シンガポール、オーストラリア・ニュージーランドでは、2023年から2028年にかけて農業用テキスタイルの大幅な生産と利用が見込まれるため、農業用テキスタイルの需要が増加すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- バリューチェーン分析

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標と主要な動向

- 規制状況

- 価格分析

- エコシステム/市場マップ

- 顧客に影響を与える動向と混乱

- 貿易データ統計:主要輸出国・輸入国

- 世界経済シナリオ:市場成長への影響

- 特許分析

- ケーススタディ分析

- 技術分析

- 主な会議とイベント (2023年~2024年)

- 規制機関、政府機関、その他の組織

第6章 農業用テキスタイル市場:繊維材料別

- イントロダクション

- ナイロン

- ポリエステル

- ポリエチレン (PE)

- ポリプロピレン (PP)

- 天然繊維

- 生分解性合成繊維

- その他

第7章 農業用テキスタイル市場:製織技術別

- イントロダクション

- 織布

- 不織布

- ニット

- その他

第8章 農業用テキスタイル市場:製品種類別

- イントロダクション

- 遮光ネット/クロス

- マルチマット

- 防雹ネット・鳥害防止ネット

- 漁網

- その他

第9章 農業用テキスタイル市場:用途別

- イントロダクション

- 屋外農業

- 環境制御農業

第10章 農業用テキスタイル市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- インドネシア

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- ロシア

- ルーマニア

- トルコ

- スペイン

- その他の欧州

- 中東・アフリカ

- ナイジェリア

- 南アフリカ

- エジプト

- イスラエル

- サウジアラビア

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第11章 競合情勢

- 概要

- 企業評価クアドラントマトリックス (2022年)

- 製品ポートフォリオの強み

- 中小企業の評価クアドラントマトリックス (2022年)

- 競合ベンチマーキング

- 競合シナリオ

- 市場シェア分析

- 市場ランキング分析

- 収益分析

- 戦略展開動向

第12章 企業プロファイル

- 主要企業

- BEAULIEU TECHNICAL TEXTILES

- BELTON INDUSTRIES, INC.

- HY-TEX (UK) LTD.

- DIATEX SAS

- GARWARE TECHNICAL FIBRES LTD.

- B & V AGRO IRRIGATION CO.

- MEYABOND INDUSTRY & TRADING (BEIJING) CO., LTD.

- NEO CORP INTERNATIONAL LTD.

- ADUNO SRL

- LUDVIG SVENSSON

- その他の企業

- PHORMIUM

- DRAPE NET PTY LTD

- HELIOS GROUP S.R.L.

- MILLER NET COMPANY, INC.

- SIANG MAY PTE LTD.

- MEMPHIS NET & TWINE CO., INC.

- NAGAURA NET CO., INC.

- NITTO SEIMO CO., LTD.

- BADINOTTI GROUP S.P.A.

- HUNAN XINHAI CO., LTD.

第13章 隣接・関連市場

- イントロダクション

- 制限事項

- テクニカルテキスタイル市場

第14章 付録

The agricultural textiles market is projected to grow from USD 15.9 billion in 2023 to USD 20.2 billion by 2028, at a CAGR of 4.8% between 2023 and 2028. The key factor driving the growth of the market is increase in the area for greenhouse-protected cultivation.

" Outdoor agriculture application segment is estimated to be the largest segment of the Agricultural Textiles market."

Agricultural activities in uncontrolled environment such as orchards and fields are highly influenced by the environmental conditions. Fruits plantation such as apples require continuous attention to provide a good yield. In open environment especially in colder regions, colder temperatures and hail can lead to less yield, while harsh sunlight or heavy rainfall can easily destroy crops. Ground covers are highly effective in reducing the effects of UV rays on the soil hence preventing depletion of nutrients. The use of ground covers also help in regulating moisture and air flow in the soil. Sunscreens, anti-bird nets, anti-hail nets, mulch nets,and ground covers are commonly used textiles for outdoor agriculture. The textile used for outdoor purposes need high resistance to abrasion and resistance to weather condition. The use of agrotextile has been increasing and governments have been promoting the use by launching schemes.

" Fishing nets application segment is forecasted to be the fastest-growing of the Agricultural Textiles market."

Fishing nets have been used for a long time and are easily available in markets. However, they pose a great threat to the marine ecosystem and are responsible for most water pollution. With advanced technology, biodegradable fishing nets are being developed to solve this problem. Fishing nets have become a staple and cannot be replaced without an effective alternative. Asia Pacific is the world's largest fish producer, from both aquaculture and capture fishery sectors. The major countries in the region are China, Japan, and the Republic of Korea. The East China Sea, the Sea of Japan, and the Yellow Sea are among the most heavily exploited waters in the world. Fish consumption is high, and the countries of the sub-region are very active international traders. Hence, this will boost the demand for fishing nets in Asia Pacific.

"Asia Pacific is the forecasted to be the fastest-growing Agricultural Textiles market during the forecast period."

Asia Pacific is the largest agricultural textiles market globally. This is due to the increased demand for agricultural products, which is caused by shifting consumer tastes and an aging population. China is the dominant region in the agriculture textile market. There is a significant increase in the demand for agricultural textiles in other Asian economies, including India and South Korea. The demand for agricultural textiles is expected to increase in Indonesia, Malaysia, Singapore, and Australia & New Zealand due to the significant production and utilization of agricultural textiles expected in these countries between 2023 and 2028.

Breakdown of Primary Interviews:

- By Company Type: Tier 1 - 46%, Tier 2 - 36%, and Tier 3 - 18%

- By Designation: D Level - 27%, C Level - 18%, and Others - 55%

- By Region: Asia Pacific - 45%, North America - 18%, Europe - 9%, South America- 9%, and the Middle East & Africa - 9%

The key companies profiled in this report are Beaulieu Technical Textiles (Belgium), Belton industries (US), Hy-Tex (UK) Limited, Diatex SAS (France), and Garware Technical Fibres Limited (India).

Research Coverage:

The Agricultural Textiles market has been segmented based on fiber material (Nylon, Polyester, Polyethylene, Polypropylene, Natural Fiber, Biodegradable Synthetic Fibers, and Others), by fabric formation technology (Woven, Knitted, Nonwoven, and Others), by product type (Shade Nets/Cloths, Mulch Mats, Anti-hail Nets and Bird Protection Nets, Fishing Nets, and Others), by application (Outdoor agriculture and controlled-environment agriculture) and by Region (Asia Pacific, North America, Europe, South America, and Middle East & Africa).

This report provides insights on the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges influencing the growth of the agricultural textiles market.

- Product Development/Innovation: Detailed insight of upcoming technologies, research & development activities, and new product launch in the agricultural textiles market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the agricultural textiles market across varied regions.

- Market Diversiification: Exclusive information about the new products & service untapped geographies, recent developments, and investments in agricultural textiles market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Beaulieu Technical Textiles (Belgium), Belton industries (US), Hy-Tex (UK) Limited, Diatex SAS (France), and Garware Technical Fibres Limited (India), among other in the agricultural textiles market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 INCLUSIONS

- 1.3.2 EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 AGRICULTURAL TEXTILES MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AGRICULTURAL TEXTILES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary data sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 MARKET FORECAST APPROACH

- 2.3.1 SUPPLY-SIDE FORECAST

- 2.3.2 DEMAND-SIDE FORECAST

- 2.4 DATA TRIANGULATION

- FIGURE 5 AGRICULTURAL TEXTILES MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 IMPACT OF RECESSION

- 2.7 ASSUMPTIONS

- 2.8 RISK ANALYSIS

- 2.9 LIMITATIONS

- 2.10 GROWTH FORECAST MODEL

3 EXECUTIVE SUMMARY

- TABLE 1 AGRICULTURAL TEXTILES MARKET SNAPSHOT (2023 VS. 2028)

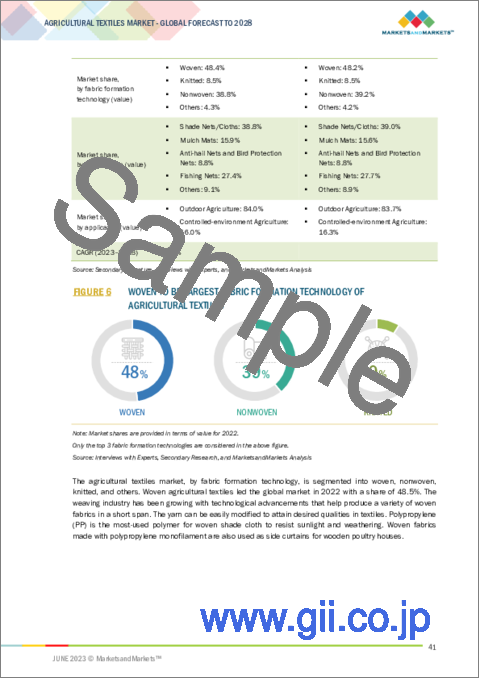

- FIGURE 6 WOVEN TO BE LARGEST FABRIC FORMATION TECHNOLOGY OF AGRICULTURAL TEXTILES

- FIGURE 7 POLYETHYLENE CAPTURED LARGEST MARKET SHARE IN 2022

- FIGURE 8 SHADE NETS/CLOTHS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN AGRICULTURAL TEXTILES MARKET

- FIGURE 10 AGRICULTURAL TEXTILES MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

- 4.2 AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL

- FIGURE 11 POLYETHYLENE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- 4.3 AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY

- FIGURE 12 NONWOVEN TO BE FASTEST-GROWING SEGMENT BETWEEN 2023 AND 2028

- 4.4 AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE

- FIGURE 13 MULCH MATS TO BE LARGEST SEGMENT BETWEEN 2023 AND 2028

- 4.5 AGRICULTURAL TEXTILES MARKET GROWTH, BY APPLICATION

- FIGURE 14 OUTDOOR AGRICULTURE TO BE LARGER SEGMENT BETWEEN 2023 AND 2028

- 4.6 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL AND COUNTRY, 2022

- FIGURE 15 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.7 AGRICULTURAL TEXTILES MARKET: DEVELOPED VS. EMERGING COUNTRIES

- FIGURE 16 EMERGING MARKETS TO GROW FASTER THAN DEVELOPED MARKETS

- 4.8 AGRICULTURAL TEXTILES MARKET, BY COUNTRY

- FIGURE 17 INDIA EMERGING AS LUCRATIVE MARKET FOR AGRICULTURAL TEXTILES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 VALUE CHAIN ANALYSIS

- FIGURE 18 AGRICULTURAL TEXTILES: VALUE CHAIN ANALYSIS

- TABLE 2 SUPPLY CHAIN ECOSYSTEM

- 5.3 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AGRICULTURAL TEXTILES MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Global focus on increasing agricultural output

- 5.3.1.2 Importance of controlled agriculture in greenhouses

- 5.3.1.3 Increased demand for greenhouse-cultivated crops

- 5.3.2 RESTRAINTS

- 5.3.2.1 Volatility in raw material prices

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Advancements in technology

- 5.3.3.2 Opportunities in horticulture

- 5.3.4 CHALLENGES

- 5.3.4.1 Crop protection and weed management

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS: AGRICULTURAL TEXTILES MARKET

- FIGURE 20 PORTER'S FIVE FORCES ANALYSIS: AGRICULTURAL TEXTILES MARKET

- 5.4.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.4.2 BARGAINING POWER OF BUYERS

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 THREAT OF SUBSTITUTES

- 5.4.5 THREAT OF NEW ENTRANTS

- 5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- 5.5.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR AGRICULTURAL TEXTILES

- TABLE 5 KEY BUYING CRITERIA FOR AGRICULTURAL TEXTILES

- 5.6 MACROECONOMIC INDICATORS AND KEY TRENDS

- 5.6.1 INTRODUCTION

- 5.6.2 TRENDS AND FORECAST OF GDP

- TABLE 6 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE OF KEY COUNTRIES, 2019-2028

- 5.6.3 TRENDS IN GLOBAL AGRICULTURAL INDUSTRY

- 5.6.3.1 Decreasing arable land

- 5.6.3.2 Growing production of high-value crops

- 5.6.4 TRENDS AND FORECAST FOR GLOBAL FISHERIES AND AQUACULTURE INDUSTRY

- 5.7 REGULATORY LANDSCAPE

- TABLE 7 EXISTING STANDARDS

- 5.8 PRICING ANALYSIS

- FIGURE 23 AVERAGE PRICE COMPETITIVENESS IN AGRICULTURAL TEXTILES MARKET, BY REGION

- FIGURE 24 AVERAGE PRICE COMPETITIVENESS IN AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL

- FIGURE 25 AVERAGE PRICE COMPETITIVENESS IN AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY

- FIGURE 26 AVERAGE PRICE COMPETITIVENESS IN AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE

- FIGURE 27 AVERAGE PRICE COMPETITIVENESS IN AGRICULTURAL TEXTILES MARKET, BY APPLICATION

- FIGURE 28 AVERAGE PRICING FOR KEY INDUSTRIES, BY MAJOR PLAYER

- 5.9 ECOSYSTEM/MARKET MAP

- FIGURE 29 AGRICULTURAL TEXTILES ECOSYSTEM

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- FIGURE 30 REVENUE SHIFT IN AGRICULTURAL TEXTILES MARKET

- 5.11 TRADE DATA STATISTICS: KEY EXPORTING AND IMPORTING COUNTRIES

- 5.11.1 AGRICULTURAL TEXTILES TRADE SCENARIO 2020-2022

- TABLE 8 COUNTRY-WISE EXPORT DATA, 2020-2022 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE IMPORT DATA, 2020-2022 (USD THOUSAND)

- 5.12 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTH

- 5.13 PATENT ANALYSIS

- 5.13.1 METHODOLOGY

- 5.13.2 PUBLICATION TRENDS

- TABLE 10 PATENT PUBLICATION TRENDS: DOCUMENT COUNT

- FIGURE 31 PATENT PUBLICATION TRENDS: DOCUMENT COUNT

- FIGURE 32 NUMBER OF PATENTS PUBLISHED, 2018-2023

- 5.13.3 LEGAL STATUS OF PATENTS

- FIGURE 33 LEGAL STATUS OF PATENTS

- 5.13.4 TOP JURISDICTION

- FIGURE 34 NUMBER OF PATENTS PUBLISHED, BY JURISDICTION

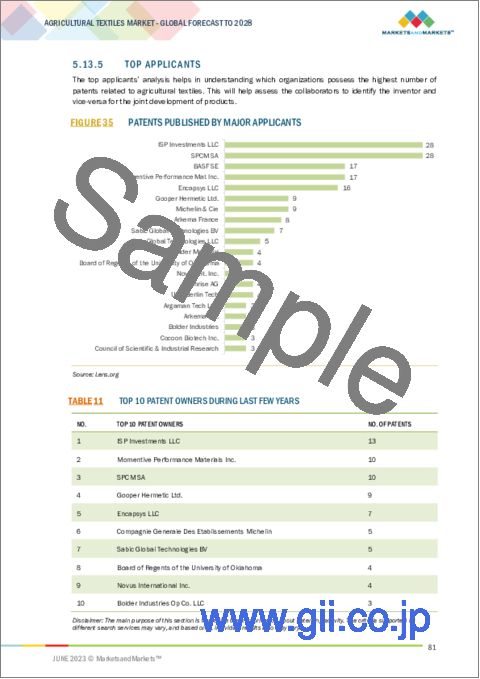

- 5.13.5 TOP APPLICANTS

- FIGURE 35 PATENTS PUBLISHED BY MAJOR APPLICANTS

- TABLE 11 TOP 10 PATENT OWNERS DURING LAST FEW YEARS

- 5.14 CASE STUDY ANALYSIS

- 5.15 TECHNOLOGY ANALYSIS

- 5.16 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 12 DETAILED LIST OF CONFERENCES & EVENTS

- 5.17 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL

- 6.1 INTRODUCTION

- FIGURE 36 POLYETHYLENE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 16 DIFFERENT TYPES OF AGRO-TEXTILE PRODUCTS WITH CONSTITUENT FIBER

- TABLE 17 AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 18 AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 19 AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (KILOTON)

- TABLE 20 AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (KILOTON)

- 6.2 NYLON

- 6.2.1 FISH NET AND SHADE NET MANUFACTURING

- TABLE 21 NYLON: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 22 NYLON: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 23 NYLON: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 24 NYLON: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.3 POLYESTER

- 6.3.1 SUPERIOR HEAT AND WATER RESISTANCE AND HIGH STRENGTH

- TABLE 25 POLYESTER: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 26 POLYESTER: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 27 POLYESTER: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 28 POLYESTER: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.4 POLYETHYLENE

- 6.4.1 POLYETHYLENE ACCOUNTS FOR LARGEST MARKET SHARE

- TABLE 29 POLYETHYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 POLYETHYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 POLYETHYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 32 POLYETHYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.5 POLYPROPYLENE

- 6.5.1 HIGH THERMAL CONDUCTIVITY AND HEAT RETENTION FOR LONGER DURATIONS

- TABLE 33 POLYPROPYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 POLYPROPYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 POLYPROPYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 36 POLYPROPYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.6 NATURAL FIBERS

- 6.6.1 GROWING CONCERN FOR CLIMATE CHANGE TO DRIVE DEMAND

- TABLE 37 NATURAL FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 NATURAL FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 39 NATURAL FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 40 NATURAL FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.7 BIODEGRADABLE SYNTHETIC FIBERS

- 6.7.1 BIODEGRADABLE SYNTHETIC FIBERS TO BE FASTEST-GROWING FIBER MATERIAL

- TABLE 41 BIODEGRADABLE SYNTHETIC FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 BIODEGRADABLE SYNTHETIC FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 BIODEGRADABLE SYNTHETIC FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 44 BIODEGRADABLE SYNTHETIC FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.8 OTHERS

- TABLE 45 OTHER FIBER MATERIALS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 46 OTHER FIBER MATERIALS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 47 OTHER FIBER MATERIALS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 48 OTHER FIBER MATERIALS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

7 AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 49 AGRO-TEXTILE PRODUCTS IN DIFFERENT APPLICATIONS

- FIGURE 37 WOVEN TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 50 AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 51 AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 52 AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (KILOTON)

- TABLE 53 AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (KILOTON)

- 7.2 WOVEN

- 7.2.1 OLDEST METHOD OF FABRIC CREATION

- TABLE 54 WOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 WOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 56 WOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 57 WOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.3 NONWOVEN

- 7.3.1 IMPROVED PROPERTIES AND COST-EFFECTIVENESS

- TABLE 58 NONWOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 NONWOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 NONWOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 61 NONWOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.4 KNITTED

- 7.4.1 FLEXIBILITY OF KNITTED FABRIC INCREASING ITS POPULARITY

- TABLE 62 KNITTED: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 KNITTED: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 64 KNITTED: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 65 KNITTED: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.5 OTHERS

- TABLE 66 OTHER TECHNOLOGIES: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 OTHER TECHNOLOGIES: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 68 OTHER TECHNOLOGIES: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 69 OTHER TECHNOLOGIES: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

8 AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- FIGURE 38 SHADE NETS/CLOTHS TO BE LARGEST MARKET SEGMENT DURING FORECAST PERIOD

- TABLE 70 AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 71 AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 72 AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (KILOTON)

- TABLE 73 AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 8.2 SHADE NETS/CLOTHS

- 8.2.1 PREVENT UV RAYS FROM BURNING SAPLINGS AND HARMING SOIL

- TABLE 74 SHADE NETS/CLOTHS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 75 SHADE NETS/CLOTHS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 76 SHADE NETS/CLOTHS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 77 SHADE NETS/CLOTHS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.3 MULCH MATS

- 8.3.1 BLOCK WEED, RETAIN MOISTURE, PREVENT SOIL EROSION, AND REGULATE SOIL TEMPERATURE

- TABLE 78 MULCH MATS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 MULCH MATS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 80 MULCH MATS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 81 MULCH MATS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.4 ANTI-HAIL NETS AND BIRD PROTECTION NETS

- 8.4.1 PROTECT FROM INSECTS AND PESTS

- TABLE 82 ANTI-HAIL NETS AND BIRD PROTECTION NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 83 ANTI-HAIL NETS AND BIRD PROTECTION NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 84 ANTI-HAIL NETS AND BIRD PROTECTION NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 85 ANTI-HAIL NETS AND BIRD PROTECTION NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.5 FISHING NETS

- 8.5.1 BIODEGRADABLE FISHING NETS TO DRIVE MARKET

- TABLE 86 FISHING NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 87 FISHING NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 88 FISHING NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 89 FISHING NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.6 OTHERS

- TABLE 90 OTHER PRODUCTS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 91 OTHER PRODUCTS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 92 OTHER PRODUCTS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 93 OTHER PRODUCTS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

9 AGRICULTURAL TEXTILES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 39 OUTDOOR AGRICULTURE TO BE LARGER MARKET SEGMENT DURING FORECAST PERIOD

- TABLE 94 AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 95 AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 96 AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 97 AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 9.2 OUTDOOR AGRICULTURE

- 9.2.1 OUTDOOR AGRICULTURE ACCOUNTS FOR LARGE MARKET SHARE

- TABLE 98 OUTDOOR AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 99 OUTDOOR AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 100 OUTDOOR AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 101 OUTDOOR AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.3 CONTROLLED-ENVIRONMENT AGRICULTURE

- 9.3.1 INSECT PROTECTION NETS KEEP PESTS AWAY FROM GREENHOUSE

- TABLE 102 CONTROLLED-ENVIRONMENT AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 103 CONTROLLED-ENVIRONMENT AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 104 CONTROLLED-ENVIRONMENT AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 105 CONTROLLED-ENVIRONMENT AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

10 AGRICULTURAL TEXTILES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.1.1 GLOBAL RECESSION OVERVIEW

- FIGURE 40 AGRICULTURAL TEXTILES MARKET IN ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE

- TABLE 106 AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 107 AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 108 AGRICULTURAL TEXTILES MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 109 AGRICULTURAL TEXTILES MARKET, BY REGION, 2023-2028 (KILOTON)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT ON ASIA PACIFIC

- FIGURE 41 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET SNAPSHOT

- TABLE 110 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 113 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 114 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (KILOTON)

- TABLE 117 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (KILOTON)

- TABLE 118 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (KILOTON)

- TABLE 121 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (KILOTON)

- TABLE 122 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (KILOTON)

- TABLE 125 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- TABLE 126 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 129 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.2.2 CHINA

- 10.2.2.1 Largest consumer of agricultural textiles globally

- 10.2.3 INDIA

- 10.2.3.1 Increase in food demand to drive market

- 10.2.4 JAPAN

- 10.2.4.1 Use of advanced technologies to produce crops

- 10.2.5 INDONESIA

- 10.2.5.1 Largest economy in Southeast Asia

- 10.2.6 REST OF ASIA PACIFIC

- 10.3 NORTH AMERICA

- 10.3.1 RECESSION IMPACT ON NORTH AMERICA

- FIGURE 42 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET SNAPSHOT

- TABLE 130 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 133 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 134 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (KILOTON)

- TABLE 137 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (KILOTON)

- TABLE 138 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (KILOTON)

- TABLE 141 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (KILOTON)

- TABLE 142 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (KILOTON)

- TABLE 145 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- TABLE 146 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 149 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.3.2 US

- 10.3.2.1 Rise in demand from emerging nations

- 10.3.3 CANADA

- 10.3.3.1 Aquaculture practiced widely

- 10.3.4 MEXICO

- 10.3.4.1 Emerging market for agricultural textiles

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT ON EUROPE

- FIGURE 43 EUROPE: AGRICULTURAL TEXTILES MARKET SNAPSHOT

- TABLE 150 EUROPE: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 151 EUROPE: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 152 EUROPE: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 153 EUROPE: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 154 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 155 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 156 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (KILOTON)

- TABLE 157 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (KILOTON)

- TABLE 158 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 159 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 160 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (KILOTON)

- TABLE 161 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (KILOTON)

- TABLE 162 EUROPE: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 163 EUROPE: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 164 EUROPE: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (KILOTON)

- TABLE 165 EUROPE: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- TABLE 166 EUROPE: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 167 EUROPE: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 168 EUROPE: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 169 EUROPE: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.4.2 GERMANY

- 10.4.2.1 Sustainability, innovations, and know-how of greenhouse farming

- 10.4.3 FRANCE

- 10.4.3.1 Major global exporter of agricultural commodities

- 10.4.4 UK

- 10.4.4.1 Manufacture of agricultural textiles compliant with environmental standards

- 10.4.5 RUSSIA

- 10.4.5.1 Agriculture most consistently growing sector

- 10.4.6 ROMANIA

- 10.4.6.1 Increase in import & export of foods

- 10.4.7 TURKEY

- 10.4.7.1 Seventh-largest agricultural producer globally

- 10.4.8 SPAIN

- 10.4.8.1 Extensive use of agricultural textiles to protect greenhouses from direct exposure to sunlight

- 10.4.9 REST OF EUROPE

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- TABLE 170 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 173 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 174 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (KILOTON)

- TABLE 177 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (KILOTON)

- TABLE 178 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (KILOTON)

- TABLE 181 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (KILOTON)

- TABLE 182 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (KILOTON)

- TABLE 185 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- TABLE 186 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 189 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.5.2 NIGERIA

- 10.5.2.1 Agriculture sector facing numerous obstacles

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Increased demand from end users

- 10.5.4 EGYPT

- 10.5.4.1 Food & dairy industry propelling market growth

- 10.5.5 ISRAEL

- 10.5.5.1 Leading agri-tech country

- 10.5.6 SAUDI ARABIA

- 10.5.6.1 Imports most agricultural products

- 10.5.7 REST OF MIDDLE EAST & AFRICA

- 10.6 SOUTH AMERICA

- 10.6.1 RECESSION IMPACT ON SOUTH AMERICA

- TABLE 190 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 191 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 192 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 193 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 194 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 195 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 196 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019-2022 (KILOTON)

- TABLE 197 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023-2028 (KILOTON)

- TABLE 198 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 199 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 200 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019-2022 (KILOTON)

- TABLE 201 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023-2028 (KILOTON)

- TABLE 202 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 203 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 204 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019-2022 (KILOTON)

- TABLE 205 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- TABLE 206 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 207 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 208 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 209 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.6.2 BRAZIL

- 10.6.2.1 Leading producer of coffee, dry beans, soybean, and corn

- 10.6.3 ARGENTINA

- 10.6.3.1 Emerging agricultural textiles market

- 10.6.4 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- TABLE 210 OVERVIEW OF STRATEGIES ADOPTED BY KEY AGRICULTURAL TEXTILE PLAYERS

- 11.2 COMPANY EVALUATION QUADRANT MATRIX, 2022

- 11.2.1 STARS

- 11.2.2 EMERGING LEADERS

- 11.2.3 PERVASIVE PLAYERS

- 11.2.4 PARTICIPANTS

- FIGURE 44 COMPANY EVALUATION QUADRANT MATRIX, 2022

- 11.3 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 45 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN AGRICULTURAL TEXTILES MARKET

- 11.4 SMALL & MEDIUM-SIZED ENTERPRISES EVALUATION QUADRANT MATRIX, 2022

- 11.4.1 RESPONSIVE COMPANIES

- 11.4.2 PROGRESSIVE COMPANIES

- 11.4.3 STARTING BLOCKS

- 11.4.4 DYNAMIC COMPANIES

- FIGURE 46 SMALL & MEDIUM-SIZED ENTERPRISES EVALUATION QUADRANT MATRIX, 2022

- 11.5 COMPETITIVE BENCHMARKING

- TABLE 211 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 212 COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 213 COMPANY EVALUATION MATRIX

- 11.6 COMPETITIVE SCENARIO

- TABLE 214 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 215 INDUSTRY FOOTPRINT OF COMPANIES

- TABLE 216 REGION FOOTPRINT OF COMPANIES

- 11.6.1 MARKET EVALUATION MATRIX

- TABLE 217 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 218 MOST FOLLOWED STRATEGIES

- TABLE 219 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- 11.7 MARKET SHARE ANALYSIS

- FIGURE 47 MARKET SHARE, BY KEY PLAYER, 2022

- TABLE 220 DEGREE OF COMPETITION, 2022

- 11.8 MARKET RANKING ANALYSIS

- FIGURE 48 MARKET RANKING ANALYSIS, 2022

- 11.9 REVENUE ANALYSIS

- FIGURE 49 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2022

- 11.9.1 BEAULIEU TECHNICAL TEXTILES

- 11.9.2 BELTON INDUSTRIES, INC.

- 11.9.3 HY-TEX (UK) LTD.

- 11.9.4 DIATEX SAS

- 11.9.5 GARWARE TECHNICAL FIBRES LIMITED

- 11.10 STRATEGIC DEVELOPMENTS

- 11.10.1 PRODUCT LAUNCHES

- TABLE 221 AGRICULTURAL TEXTILES MARKET: PRODUCT LAUNCHES

12 COMPANY PROFILES

(Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices, Weakness and competitive threats) **

- 12.1 KEY COMPANIES

- 12.1.1 BEAULIEU TECHNICAL TEXTILES

- TABLE 222 BEAULIEU TECHNICAL TEXTILES: COMPANY OVERVIEW

- TABLE 223 BEAULIEU TECHNICAL TEXTILES: PRODUCT OFFERINGS

- TABLE 224 BEAULIEU TECHNICAL TEXTILES: PRODUCT LAUNCHES

- 12.1.2 BELTON INDUSTRIES, INC.

- TABLE 225 BELTON INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 226 BELTON INDUSTRIES INC.: PRODUCT OFFERINGS

- 12.1.3 HY-TEX (UK) LTD.

- TABLE 227 HY-TEX (UK) LTD.: COMPANY OVERVIEW

- TABLE 228 HY-TEX (UK) LTD.: PRODUCT OFFERINGS

- 12.1.4 DIATEX SAS

- TABLE 229 DIATEX SAS: COMPANY OVERVIEW

- TABLE 230 DIATEX SAS: PRODUCT OFFERINGS

- 12.1.5 GARWARE TECHNICAL FIBRES LTD.

- TABLE 231 GARWARE TECHNICAL FIBRES LTD.: COMPANY OVERVIEW

- FIGURE 50 GARWARE TECHNICAL FIBRES LTD.: COMPANY SNAPSHOT

- TABLE 232 GARWARE TECHNICAL FIBRES LTD.: PRODUCT OFFERINGS

- 12.1.6 B & V AGRO IRRIGATION CO.

- TABLE 233 B & V AGRO IRRIGATION CO.: COMPANY OVERVIEW

- TABLE 234 B & V AGRO IRRIGATION CO.: PRODUCT OFFERINGS

- 12.1.7 MEYABOND INDUSTRY & TRADING (BEIJING) CO., LTD.

- TABLE 235 MEYABOND INDUSTRY & TRADING (BEIJING) CO., LTD.: COMPANY OVERVIEW

- TABLE 236 MEYABOND INDUSTRY & TRADING (BEIJING) CO., LTD.: PRODUCT OFFERINGS

- 12.1.8 NEO CORP INTERNATIONAL LTD.

- TABLE 237 NEO CORP INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 238 NEO CORP INTERNATIONAL LTD.: PRODUCT OFFERINGS

- 12.1.9 ADUNO SRL

- TABLE 239 ADUNO SRL: COMPANY OVERVIEW

- TABLE 240 ADUNO SRL: PRODUCT OFFERINGS

- TABLE 241 ADUNO SRL: PRODUCT LAUNCHES

- 12.1.10 LUDVIG SVENSSON

- TABLE 242 LUDVIG SVENSSON: COMPANY OVERVIEW

- TABLE 243 LUDVIG SVENSSON: PRODUCT OFFERINGS

- 12.2 OTHER COMPANIES

- 12.2.1 PHORMIUM

- TABLE 244 PHORMIUM: COMPANY OVERVIEW

- TABLE 245 PHORMIUM: PRODUCT OFFERINGS

- TABLE 246 PHORMIUM: PRODUCT LAUNCHES

- 12.2.2 DRAPE NET PTY LTD

- TABLE 247 DRAPE NET PTY LTD: COMPANY OVERVIEW

- TABLE 248 DRAPE NET PTY LTD: PRODUCT OFFERINGS

- 12.2.3 HELIOS GROUP S.R.L.

- TABLE 249 HELIOS GROUP S.R.L.: COMPANY OVERVIEW

- TABLE 250 HELIOS GROUP S.R.L.: PRODUCT OFFERINGS

- 12.2.4 MILLER NET COMPANY, INC.

- TABLE 251 MILLER NET COMPANY, INC.: COMPANY OVERVIEW

- TABLE 252 MILLER NET COMPANY, INC.: PRODUCT OFFERINGS

- 12.2.5 SIANG MAY PTE LTD.

- TABLE 253 SIANG MAY PTE LTD.: COMPANY OVERVIEW

- TABLE 254 SIANG MAY PTE LTD.: PRODUCT OFFERINGS

- 12.2.6 MEMPHIS NET & TWINE CO., INC.

- TABLE 255 MEMPHIS NET & TWINE CO., INC.: COMPANY OVERVIEW

- TABLE 256 MEMPHIS NET & TWINE CO., INC.: PRODUCT OFFERINGS

- 12.2.7 NAGAURA NET CO., INC.

- TABLE 257 NAGAURA NET CO., INC.: COMPANY OVERVIEW

- TABLE 258 NAGAURA NET CO., INC.: PRODUCT OFFERINGS

- 12.2.8 NITTO SEIMO CO., LTD.

- TABLE 259 NITTO SEIMO CO., LTD.: COMPANY OVERVIEW

- TABLE 260 NITTO SEIMO CO., LTD.: PRODUCT OFFERINGS

- 12.2.9 BADINOTTI GROUP S.P.A.

- TABLE 261 BADINOTTI GROUP S.P.A.: COMPANY OVERVIEW

- TABLE 262 BADINOTTI GROUP S.P.A.: PRODUCT OFFERINGS

- 12.2.10 HUNAN XINHAI CO., LTD.

- TABLE 263 HUNAN XINHAI CO., LTD.: COMPANY OVERVIEW

- TABLE 264 HUNAN XINHAI CO., LTD.: PRODUCT OFFERINGS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices, Weakness and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 TECHNICAL TEXTILE MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 TECHNICAL TEXTILE MARKET ANALYSIS, BY MATERIAL

- 13.3.3.1 Natural Fiber

- 13.3.3.2 Synthetic Polymer

- 13.3.3.3 Mineral

- 13.3.3.4 Metal

- 13.3.3.5 Others

- TABLE 265 TECHNICAL TEXTILE MARKET, BY MATERIAL, 2018-2025 (USD BILLION)

- TABLE 266 TECHNICAL TEXTILE MARKET, BY MATERIAL, 2018-2025 (MILLION TON)

- 13.3.4 TECHNICAL TEXTILE MARKET, BY PROCESS

- TABLE 267 TECHNICAL TEXTILE MARKET, BY PROCESS, 2018-2025 (USD BILLION)

- TABLE 268 TECHNICAL TEXTILE MARKET, BY PROCESS, 2018-2025 (MILLION TON)

- 13.3.5 TECHNICAL TEXTILE MARKET, BY APPLICATION

- TABLE 269 TECHNICAL TEXTILE MARKET, BY APPLICATION, 2018-2025 (USD BILLION)

- TABLE 270 TECHNICAL TEXTILE MARKET, BY APPLICATION, 2018-2025 (MILLION TON)

- 13.3.6 TECHNICAL TEXTILE MARKET, BY REGION

- TABLE 271 TECHNICAL TEXTILE MARKET, BY REGION, 2018-2025 (USD BILLION)

- TABLE 272 TECHNICAL TEXTILE MARKET, BY REGION, 2018-2025 (MILLION TON)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS