|

|

市場調査レポート

商品コード

1297941

自動車用TIC (試験・検査・認証) の世界市場:車種別 (乗用車、商用車)・サービスの種類別 (試験サービス、検査サービス、認証サービス)・調達の種類別 (社内、外部委託)・用途別・地域別の将来予測 (2028年まで)Automotive TIC Market Vehicle Type (Passenger Cars, Commercial Vehicles), Service Type (Testing Services, Inspection Services, Certification Services), Sourcing Type (In-House, Outsourced), Application and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自動車用TIC (試験・検査・認証) の世界市場:車種別 (乗用車、商用車)・サービスの種類別 (試験サービス、検査サービス、認証サービス)・調達の種類別 (社内、外部委託)・用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月20日

発行: MarketsandMarkets

ページ情報: 英文 268 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用TIC (試験・検査・認証) の市場規模は、2023年の177億米ドルから2028年には209億米ドルに成長し、CAGRは3.4%に達すると予測されています。

自動車産業における持続可能性や環境規制への注目の高まりが、TICサービスに対する需要の変化をもたらしています。電気自動車の台頭と正確な排出ガス試験・認証の必要性により、TICプロバイダーは環境基準の遵守を確保する上で重要な役割を果たしています。さらに、ADAS (先進運転支援システム) や自律走行車などの新技術の出現により、TIC企業がこれらの革新的ソリューションの試験・認証サービスを提供する機会が生まれています。さらに、自動車用TIC市場は、安全性と性能を保証するために包括的な試験・検査を必要とする自動車部品やシステムの複雑化からも恩恵を受けています。自動車産業が進化を続け、変化する市場の需要に適応していく中で、品質保証、安全コンプライアンス、環境持続性へのニーズが自動車用TIC市場の成長を牽引していくと思われます。

"予測期間中、検査サービス向けTICが北米市場の最大セグメントに"

サービスの種類別では、車両検査用TICが予測期間中に最大セグメントとなる見込みです。北米では、自動車の安全性、排出ガス、基準への全体的な準拠に関する規制が厳しいです。車両検査サービスは、車両がこれらの規制要件を満たし、安全で走行可能であることを確認・保証するために不可欠です。品質と信頼性の高い車両に対する消費者の意識と需要は、車検サービスの成長に寄与しています。北米のバイヤーは安全性と品質に対する意識が高まっており、中古車の状態と信頼性を評価するために独立した検査を求めることが多くなっています。

"コネクティビティ・テレマティクス向けTICは、予測期間中に有望なセグメントになる"

テレマティクスとは、自動車における通信と情報工学の統合を指します。ハンズフリー音声通信、ナビゲーション、車載コンピューティング、ワイヤレスネットワークなどの消費者向け通信・情報機能を、自動車用エンターテインメントシステムの標準機能と組み合わせたものです。アジア太平洋の急速なデジタル化と技術進歩により、自動車の接続性が高まり、さまざまなデジタルプラットフォームやサービスとの統合が進んでいます。通信とインフォマティクスを含むテレマティクスシステムは、車両がリアルタイムで通信、データ交換、サービスへのアクセスを行うことを可能にします。この接続性により、車両の機能性、安全性、ユーザー体験が向上し、テレマティクス・システムの信頼性、セキュリティ、コンプライアンスを確保するためのTICサービスに対する需要が高まっています。コネクテッドカーの機能やサービスに対する消費者の需要の高まりが、自動車市場におけるテレマティクスとコネクティビティの需要を促進しています。消費者は、車載インフォテインメント・システム、ナビゲーション、緊急サービス、遠隔操作機能など、利便性、娯楽性、安全性の強化された機能を自動車に求めています。TICサービスは、これらのコネクテッドカー・システムの機能性、相互運用性、サイバーセキュリティを認証し、消費者と自動車メーカーに保証を提供する上で重要な役割を果たしています。

"予測期間中、EVモーター向けTICが欧州市場で最も急成長するセグメントとなる"

自動車用TIC市場の成長は、電気自動車 (EV) の急速な拡大が牽引すると予想されます。欧州が電動モビリティの導入をリードする中、EVモーターに特化したTICサービスの需要が高まっています。TICプロバイダーは、包括的な試験・検査・認証プロセスを実施することで、EVモーターの安全性・品質・コンプライアンスを確保する上で重要な役割を果たしています。EVモーターはますます複雑化し、技術進歩が進んでいるため、規制要件や業界標準を確実に満たすための専門的なTICサービスが必要となっています。欧州の自動車産業が電気自動車に大きくシフトしていることから、EVモーターに関連するTICサービスの需要は大幅に伸びると予測されています。TIC企業は、欧州自動車産業におけるEVモーターの信頼性が高く効率的な試験・認証サービスを提供することで、EV市場の拡大を支える重要な役割を果たすと思われます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- マクロ経済指標

- 自動車用TIC市場のエコシステム

- 自動車用TICのサービスプロバイダーとその専門分野

- 主要な利害関係者と購入基準

- 技術分析

- 特許分析

- ケーススタディ分析

- 規制の概要

- 動向と混乱

- 主要な会議とイベント (2023年~2024年)

- 自動車用TIC市場:シナリオ分析

第6章 自動車用TIC市場:サービスの種類別

- イントロダクション

- 試験サービス

- 検査サービス

- 認証サービス

- その他のサービス

- 主要な洞察

第7章 自動車用TIC市場:用途別・推進方式別

- イントロダクション

- 電気システムとコンポーネント

- EVバッテリー

- テレマティクス・コネクティビティ

- 燃料・液体・潤滑剤

- 自動車用内装材・外装材

- 車検サービス

- ホモロゲーション

- EV充電器

- EVモーター

- ADAS・安全システム

- その他

- 主要な洞察

第8章 自動車用TIC市場:調達の種類別

- イントロダクション

- 社内

- 外部委託

- 主要な洞察

第9章 自動車用TIC市場:車種別

- イントロダクション

- 乗用車

- 商用車

- 主要な洞察

第10章 自動車用TIC市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- その他の地域 (ROW)

- 南米

- 中東・アフリカ

第11章 競合情勢

- 概要

- 市場シェア分析

- 競合シナリオ

- 自動車用TIC市場における競合リーダーシップマッピング

- 競合評価クアドラント:中小企業

- 競合ベンチマーキング

第12章 企業プロファイル

- 主要企業

- DEKRA SE

- TUV SUD

- APPLUS+

- SGS GROUP

- TUV RHEINLAND AG GROUP

- TUV NORD GROUP

- BUREAU VERITAS S.A.

- INTERTEK

- EUROFINS

- ELEMENT MATERIALS

- KIWA NV

- A2LA

- その他の企業

- BRITISH STANDARDS INSTITUTION (BSI)

- RINA S.P.A.

- NORGES ELEKTRISKE MATERIELLKONTROLL (NEMKO)

- NSF INTERNATIONAL

- ENGINEERING QUALITY SOLUTIONS, INC. (EQS)

- LLOYD'S REGISTER GROUP LIMITED

- MISTRAS

- DNV GL

- UL LLC

第13章 MarketsandMarketsの提言

第14章 付録

The global automotive TIC market is projected to grow from USD 17.7 billion in 2023 to USD 20.9 billion by 2028, registering a CAGR of 3.4%. The increasing focus on sustainability and environmental regulations in the automotive industry has led to a shift in demand for TIC services. With the rise of electric vehicles and the need for accurate emissions testing and certification, TIC providers play a crucial role in ensuring compliance with environmental standards. Additionally, the emergence of new technologies such as advanced driver assistance systems and autonomous vehicles, has created opportunities for TIC companies to offer testing and certification services for these innovative solutions. Furthermore, the automotive TIC market has benefited from the increasing complexity of vehicle components and systems, requiring comprehensive testing and inspection to guarantee safety and performance. As the automotive industry continues to evolve and adapt to changing market demands, the need for quality assurance, safety compliance, and environmental sustainability will drive the growth of automotive TIC market.

"TIC for vehicle inspection services to be the largest segment in North American market during the forecast period"

TIC for vehicle inspection is expected to be the largest segment during the forecast period. North America has stringent regulations regarding vehicle safety, emissions, and overall compliance with standards. Vehicle inspection services are essential for verifying and ensuring that vehicles meet these regulatory requirements and are safe and roadworthy. Consumer awareness and demand for quality and reliable vehicles contribute to the growth of vehicle inspection services. Buyers in North America are increasingly conscious of safety and quality aspects and often seek independent inspections to assess the condition and reliability of used vehicles.

"TIC for Connectivity and Telematics to be a promising segment during the forecast period"

Telematics refers to the integration of telecommunication and informatics in an automobile. It combines consumer communications and information features, including hands-free voice communications, navigation, in-car computing, and wireless networking with the standard functions of automotive entertainment systems. Rapid digitalization and technological advancements across the Asia Pacific region have led to increased connectivity and integration of vehicles with various digital platforms and services. Telematics systems involving telecommunications and informatics enable vehicles to communicate, exchange data, and access services in real-time. This connectivity enhances vehicle functionality, safety, and user experience, driving the demand for TIC services to ensure telematics systems' reliability, security, and compliance. The increasing consumer demand for connected car features and services is driving the demand for telematics and connectivity in the automotive market. Consumers are seeking enhanced convenience, entertainment, and safety features in their vehicles, such as in-car infotainment systems, navigation, emergency services, and remote-control capabilities. TIC services play a vital role in certifying these connected car systems' functionality, interoperability, and cybersecurity, providing assurance to consumers and automotive manufacturers.

"TIC for EV Motors to be the fastest growing segment in the European market during the forecast period"

The growth of the automotive TIC market is expected to be driven by the rapid expansion of electric vehicle (EVs). As Europe leads the way in the adoption of electric mobility, the demand for TIC services tailored explicitly to EV motors is on the rise. TIC providers play a crucial role in ensuring EV motors' safety, quality, and compliance by conducting comprehensive testing, inspection, and certification processes. EV motors' increasing complexity and technological advancements necessitate specialized TIC services to ensure they meet regulatory requirements and industry standards. With the European automotive industry witnessing a significant shift towards electric vehicles, the demand for TIC services related to EV motors is projected to experience substantial growth. TIC companies will play a vital role in supporting the expansion of the EV market by providing reliable and efficient testing and certification services for EV motors in the European automotive industry.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Respondent Type: Tier I - 67%, Tier II and Tier III - 9%, and OEMs - 24%

- By Designation: CXOs - 26%, Managers - 40%, Executives - 34%

- By Region: North America - 26%, Europe - 30%, Asia Pacific - 35%, Rest of the World -9%

The automotive TIC market is dominated by established players such as DEKRA SE (Germany), TUV SUD (Germany), Applus+ (Spain), SGS Group (Switzerland), and TUV Rheinland AG Group (Germany), among others. They have worked on providing automotive TIC services for the automotive TIC market ecosystem. They have initiated partnerships to provide best-in-class services to their customers.

Research Coverage:

The report covers the automotive TIC market based on vehicle type, service type, sourcing type, application and region (North America, Europe, Asia-Pacific and Rest of the World). It covers the competitive landscape and company profiles of the major players in the automotive TIC market ecosystem.

The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- This report will help market leaders/new entrants in this market with information on the closest approximations of revenue numbers for the overall automotive TIC market ecosystem and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- This report will also help stakeholders understand the market's pulse and provide information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 AUTOMOTIVE TIC MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 2 AUTOMOTIVE TIC MARKET DEFINITION, BY SERVICE TYPE

- TABLE 3 AUTOMOTIVE TIC MARKET DEFINITION, BY SOURCING TYPE

- TABLE 4 AUTOMOTIVE TIC MARKET DEFINITION, BY PROPULSION

- TABLE 5 AUTOMOTIVE TIC MARKET DEFINITION, BY APPLICATION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 MARKETS COVERED

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 6 CURRENCY EXCHANGE RATES

- 1.6 LIST OF KEY STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights from primary interviews

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.3 List of primary participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 AUTOMOTIVE TIC MARKET: BOTTOM-UP APPROACH

- 2.2.3 TOP-DOWN APPROACH

- FIGURE 7 AUTOMOTIVE TIC MARKET: TOP-DOWN APPROACH

- FIGURE 8 AUTOMOTIVE TIC MARKET: RESEARCH DESIGN AND METHODOLOGY

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- 2.4 FACTOR ANALYSIS

- FIGURE 11 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 12 AUTOMOTIVE TIC MARKET: MARKET OVERVIEW

- FIGURE 13 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

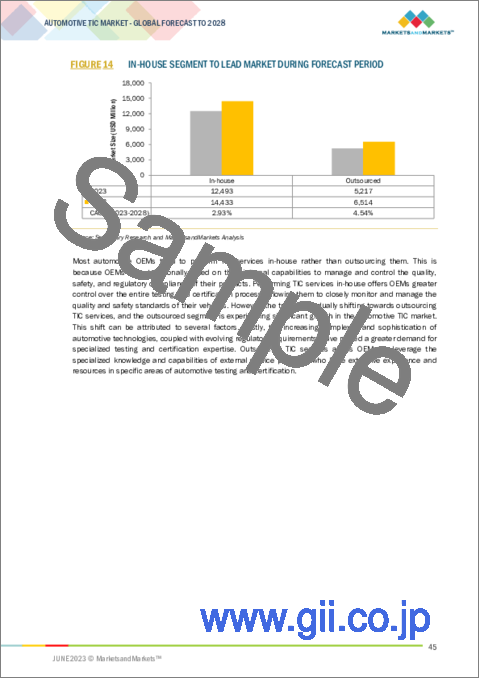

- FIGURE 14 IN-HOUSE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 NEW TECHNOLOGIES TO DRIVE AUTOMOTIVE TIC MARKET

- FIGURE 16 TESTING SERVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS OPERATING IN AUTOMOTIVE TIC MARKET

- FIGURE 17 INCREASING AUTOMOTIVE PRODUCTION IN DEVELOPING COUNTRIES TO BOOST DEMAND FOR AUTOMOTIVE TIC SERVICES

- 4.2 AUTOMOTIVE TIC MARKET, BY SERVICE TYPE

- FIGURE 18 TESTING SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 AUTOMOTIVE TIC MARKET, BY VEHICLE TYPE

- FIGURE 19 PASSENGER CARS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 AUTOMOTIVE TIC MARKET, BY SOURCING TYPE

- FIGURE 20 OUTSOURCED SEGMENT TO EXHIBIT HIGHER CAGR THAN IN-HOUSE SEGMENT FROM 2023 TO 2028

- 4.5 AUTOMOTIVE TIC MARKET, BY APPLICATION

- FIGURE 21 VEHICLE INSPECTION SERVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 AUTOMOTIVE TIC MARKET, BY REGION

- FIGURE 22 ASIA PACIFIC ESTIMATED TO HOLD LARGEST MARKET SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 23 AUTOMOTIVE TIC ROADMAP

- 5.2 MARKET DYNAMICS

- FIGURE 24 AUTOMOTIVE TIC MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for connectivity in luxury vehicles

- 5.2.1.2 Global expansion of automotive market across different countries

- 5.2.1.3 Increasing acquisitions in TIC sector

- 5.2.1.4 Rapid advancements in automotive sector

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs associated with automotive TIC processes

- 5.2.2.2 Lack of harmonization in TIC standards across different regions and markets

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for hydrogen as alternate fuel and autonomous vehicles

- 5.2.3.2 Adoption of new technologies and methodologies like digital testing tools, automation, and data analytics to enhance efficiency and accuracy

- 5.2.3.3 Collaboration between OEMs and component manufacturers to offer integrated testing and certification solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Maintaining compliance with diverse regulatory requirements and standards across different countries

- 5.2.4.2 Highly competitive market

- TABLE 7 AUTOMOTIVE TIC MARKET: IMPACT OF MARKET DYNAMICS

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN OF AUTOMOTIVE TIC SERVICES

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- TABLE 8 GDP TRENDS AND FORECASTS, BY MAJOR ECONOMIES, 2018-2026 (USD BILLION)

- 5.5 AUTOMOTIVE TIC MARKET ECOSYSTEM

- FIGURE 26 AUTOMOTIVE TIC MARKET: ECOSYSTEM ANALYSIS

- 5.5.1 TIC PROVIDERS

- 5.5.2 TIE-1 MANUFACTURERS

- 5.5.3 OEMS

- 5.5.4 END USERS

- TABLE 9 AUTOMOTIVE TIC MARKET: ECOSYSTEM

- 5.6 AUTOMOTIVE TIC SERVICE PROVIDERS AND THEIR AREAS OF EXPERTISE

- TABLE 10 OFFERINGS OF AUTOMOTIVE TIC PROVIDERS

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 IN-HOUSE

- 5.7.2 OUTSOURCED

- 5.7.3 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 SOURCING TYPES

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 SOURCING TYPES (%)

- 5.7.4 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 2 SOURCING TYPES

- 5.8 TECHNOLOGY ANALYSIS

- FIGURE 29 NEW TECHNOLOGIES IN AUTOMOTIVE TIC MARKET

- TABLE 12 NEW DEVELOPMENTS IN AUTOMOTIVE TESTING AND INSPECTION TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- FIGURE 30 NUMBER OF PUBLISHED PATENTS (2012-2022)

- TABLE 13 IMPORTANT PATENT REGISTRATIONS RELATED TO AUTOMOTIVE TIC MARKET

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 CASE STUDY 1: KAWASAKI'S SUCCESS WITH 5-AXIS CMM INSPECTION USING RENISHAW REVO SYSTEMS

- 5.10.2 CASE STUDY 2: COMMERCIAL VEHICLE TESTING - ENHANCING REAL-WORLD PERFORMANCE AND ROBUSTNESS

- 5.10.3 CASE STUDY 3: ENHANCING CAR RENTAL INSPECTION WITH MOTIONCAM-3D

- 5.10.4 CASE STUDY 4: ENHANCED VEHICLE INSPECTION WITH HIGH-CURRENT LED BAR LIGHTS

- 5.10.5 CASE STUDY 5: INSPECTION SOFTWARE FOR AUTOMOTIVE COMPONENT TRACKING

- 5.11 REGULATORY OVERVIEW

- TABLE 14 CHINESE NATIONAL STANDARDS (GB STANDARDS)

- TABLE 15 US FEDERAL MOTOR VEHICLE SAFETY STANDARDS (FMVSS)

- TABLE 16 CANADA MOTOR VEHICLE SAFETY REGULATIONS (CMVSS)

- TABLE 17 BRITISH STANDARDS INSTITUTION (BSI)

- TABLE 18 AUTOMOTIVE RESEARCH ASSOCIATION OF INDIA (ARAI) STANDARDS

- TABLE 19 GERMAN ASSOCIATION OF THE AUTOMOTIVE INDUSTRY (VDA)

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 TRENDS AND DISRUPTIONS

- FIGURE 31 AUTOMOTIVE TIC MARKET: TRENDS AND DISRUPTIONS

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 23 AUTOMOTIVE TIC MARKET: CONFERENCES AND EVENTS

- 5.14 AUTOMOTIVE TIC MARKET: SCENARIO ANALYSIS

- FIGURE 32 AUTOMOTIVE TIC MARKET: FUTURE TRENDS AND SCENARIOS, 2021-2028

- 5.14.1 REALISTIC SCENARIO

- TABLE 24 AUTOMOTIVE TIC MARKET: REALISTIC SCENARIO, BY REGION, 2023-2028 (USD MILLION)

- 5.14.2 OPTIMISTIC SCENARIO

- TABLE 25 AUTOMOTIVE TIC MARKET: OPTIMISTIC SCENARIO, BY REGION, 2023-2028 (USD MILLION)

- 5.14.3 PESSIMISTIC SCENARIO

- TABLE 26 AUTOMOTIVE TIC MARKET: PESSIMISTIC SCENARIO, BY REGION, 2023-2028 (USD MILLION)

6 AUTOMOTIVE TIC MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- FIGURE 33 SERVICES OFFERED BY TIC PROVIDERS FOR AUTOMOTIVE INDUSTRY

- FIGURE 34 AUTOMOTIVE TIC MARKET, BY SERVICE TYPE, 2023-2028

- TABLE 27 AUTOMOTIVE TIC MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 28 AUTOMOTIVE TIC MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 6.2 TESTING SERVICES

- 6.2.1 GROWING EMPHASIS ON EV AND ADAS TESTING SERVICES TO SUPPORT TRANSITION TOWARD SUSTAINABLE AND SAFE MOBILITY

- FIGURE 35 TYPES OF TESTING SERVICES

- TABLE 29 TESTING SERVICES: AUTOMOTIVE TIC MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 TESTING SERVICES: AUTOMOTIVE TIC MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 INSPECTION SERVICES

- 6.3.1 INCREASING ADOPTION OF DIGITAL TECHNOLOGIES AND REMOTE INSPECTIONS TO DRIVE MARKET

- FIGURE 36 DEVELOPMENTS IN INSPECTION SERVICES

- FIGURE 37 TYPES OF INSPECTION SERVICES

- TABLE 31 INSPECTION SERVICES: AUTOMOTIVE TIC MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 INSPECTION SERVICES: AUTOMOTIVE TIC MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 CERTIFICATION SERVICES

- 6.4.1 CHANGING CERTIFICATION LANDSCAPE WITH SHIFT TO EVS TO CREATE NEW OPPORTUNITIES FOR AUTOMOTIVE CERTIFICATION

- FIGURE 38 TYPES OF AUTOMOTIVE HOMOLOGATION/CERTIFICATION SERVICES

- TABLE 33 CERTIFICATION SERVICES: AUTOMOTIVE TIC MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 CERTIFICATION SERVICES: AUTOMOTIVE TIC MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.5 OTHER SERVICES

- FIGURE 39 TYPES OF OTHER SERVICES

- TABLE 35 OTHER SERVICES: AUTOMOTIVE TIC MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 OTHER SERVICES: AUTOMOTIVE TIC MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.6 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE TIC MARKET, BY APPLICATION & PROPULSION

- 7.1 INTRODUCTION

- FIGURE 40 SEGMENTS BY APPLICATION

- FIGURE 41 AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028

- TABLE 37 AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 38 AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.2 ELECTRICAL SYSTEMS AND COMPONENTS

- 7.2.1 SHIFT TO EVS AND DEMAND FOR EMC TESTING IN ELECTRONIC COMPONENTS OF VEHICLES TO DRIVE MARKET

- TABLE 39 AUTOMOTIVE TIC MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 40 AUTOMOTIVE TIC MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- TABLE 41 EV: AUTOMOTIVE TIC MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 EV: AUTOMOTIVE TIC MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 ICE: AUTOMOTIVE TIC MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 ICE: AUTOMOTIVE TIC MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY REGION, 2023-2028 (USD MILLION)

- 7.3 EV BATTERIES

- 7.3.1 RISING DEMAND FOR BATTERIES IN EV INDUSTRY TO DRIVE MARKET

- TABLE 45 AUTOMOTIVE TIC MARKET FOR EV BATTERIES, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 46 AUTOMOTIVE TIC MARKET FOR EV BATTERIES, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- TABLE 47 EV: AUTOMOTIVE TIC MARKET FOR EV BATTERIES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 EV: AUTOMOTIVE TIC MARKET FOR EV BATTERIES, BY REGION, 2023-2028 (USD MILLION)

- 7.4 TELEMATICS AND CONNECTIVITY

- 7.4.1 FLOURISHING CONNECTED VEHICLE ECOSYSTEM TO DRIVE MARKET

- TABLE 49 AUTOMOTIVE TIC MARKET FOR TELEMATICS AND CONNECTIVITY, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 50 AUTOMOTIVE TIC MARKET FOR TELEMATICS AND CONNECTIVITY, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- TABLE 51 EV: AUTOMOTIVE TIC MARKET FOR TELEMATICS AND CONNECTIVITY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 52 EV: AUTOMOTIVE TIC MARKET FOR TELEMATICS AND CONNECTIVITY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 53 ICE: AUTOMOTIVE TIC MARKET FOR TELEMATICS AND CONNECTIVITY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 ICE: AUTOMOTIVE TIC MARKET FOR TELEMATICS AND CONNECTIVITY, BY REGION, 2023-2028 (USD MILLION)

- 7.5 FUELS, FLUIDS, AND LUBRICANTS

- 7.5.1 DEMAND FOR FUEL EFFICIENCY AND EMISSION CONTROL IN ICE/HYBRID VEHICLES TO DRIVE MARKET

- TABLE 55 AUTOMOTIVE TIC MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 56 AUTOMOTIVE TIC MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- TABLE 57 EV: AUTOMOTIVE TIC MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 EV: AUTOMOTIVE TIC MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 59 ICE: AUTOMOTIVE TIC MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 ICE: AUTOMOTIVE TIC MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY REGION, 2023-2028 (USD MILLION)

- 7.6 AUTOMOTIVE INTERIOR/EXTERIOR BODIES

- 7.6.1 INTEGRATION OF SMART AND SUSTAINABLE MATERIALS TO DRIVE MARKET

- TABLE 61 AUTOMOTIVE TIC MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 62 AUTOMOTIVE TIC MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- TABLE 63 EV: AUTOMOTIVE TIC MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 EV: AUTOMOTIVE TIC MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 65 ICE: AUTOMOTIVE TIC MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 66 ICE: AUTOMOTIVE TIC MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY REGION, 2023-2028 (USD MILLION)

- 7.7 VEHICLE INSPECTION SERVICES

- 7.7.1 CHANGING AUTOMOTIVE LANDSCAPE TO DRIVE DEMAND FOR VEHICLE INSPECTION SERVICES

- TABLE 67 AUTOMOTIVE TIC MARKET FOR VEHICLE INSPECTION SERVICES, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 68 AUTOMOTIVE TIC MARKET FOR VEHICLE INSPECTION SERVICES, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- TABLE 69 EV: AUTOMOTIVE TIC MARKET FOR VEHICLE INSPECTION SERVICES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 70 EV: AUTOMOTIVE TIC MARKET FOR VEHICLE INSPECTION SERVICES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 71 ICE: AUTOMOTIVE TIC MARKET FOR VEHICLE INSPECTION SERVICES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 ICE: AUTOMOTIVE TIC MARKET FOR VEHICLE INSPECTION SERVICES, BY REGION, 2023-2028 (USD MILLION)

- 7.8 HOMOLOGATION

- 7.8.1 INCREASING STRINGENCY OF EMISSION AND ROAD SAFETY NORMS TO DRIVE MARKET

- TABLE 73 AUTOMOTIVE TIC MARKET FOR HOMOLOGATION, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 74 AUTOMOTIVE TIC MARKET FOR HOMOLOGATION, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- TABLE 75 EV: AUTOMOTIVE TIC MARKET FOR HOMOLOGATION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 EV: AUTOMOTIVE TIC MARKET FOR HOMOLOGATION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 77 ICE: AUTOMOTIVE TIC MARKET FOR HOMOLOGATION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 78 ICE: AUTOMOTIVE TIC MARKET FOR HOMOLOGATION, BY REGION, 2023-2028 (USD MILLION)

- 7.9 EV CHARGERS

- 7.9.1 DEVELOPMENT OF CHARGING INFRASTRUCTURE TO INCREASE DEMAND FOR CHARGER TESTING

- TABLE 79 AUTOMOTIVE TIC MARKET FOR EV CHARGERS, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 80 AUTOMOTIVE TIC MARKET FOR EV CHARGERS, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- TABLE 81 EV: AUTOMOTIVE TIC MARKET FOR EV CHARGERS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 82 EV: AUTOMOTIVE TIC MARKET FOR EV CHARGERS, BY REGION, 2023-2028 (USD MILLION)

- 7.10 EV MOTORS

- 7.10.1 INCREASING FOCUS ON SUSTAINABLE ELECTRIC MOBILITY TO DRIVE MOTOR TESTING

- TABLE 83 AUTOMOTIVE TIC MARKET FOR EV MOTORS, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 84 AUTOMOTIVE TIC MARKET FOR EV MOTORS, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- TABLE 85 EV: AUTOMOTIVE TIC MARKET FOR EV MOTORS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 86 EV: AUTOMOTIVE TIC MARKET FOR EV MOTORS, BY REGION, 2023-2028 (USD MILLION)

- 7.11 ADAS AND SAFETY SYSTEMS

- 7.11.1 RISING FOCUS ON SAFER MOBILITY TECHNOLOGIES TO INCREASE DEMAND

- TABLE 87 AUTOMOTIVE TIC MARKET FOR ADAS AND SAFETY SYSTEMS, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 88 AUTOMOTIVE TIC MARKET FOR ADAS AND SAFETY SYSTEMS, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- TABLE 89 EV: AUTOMOTIVE TIC MARKET FOR ADAS AND SAFETY SYSTEMS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 90 EV: AUTOMOTIVE TIC MARKET FOR ADAS AND SAFETY SYSTEMS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 91 ICE: AUTOMOTIVE TIC MARKET FOR ADAS AND SAFETY SYSTEMS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 92 ICE: AUTOMOTIVE TIC MARKET FOR ADAS AND SAFETY SYSTEMS, BY REGION, 2023-2028 (USD MILLION)

- 7.12 OTHERS

- TABLE 93 AUTOMOTIVE TIC MARKET FOR OTHER APPLICATIONS, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 94 AUTOMOTIVE TIC MARKET FOR OTHER APPLICATIONS, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- TABLE 95 EV: AUTOMOTIVE TIC MARKET FOR OTHER APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 96 EV: AUTOMOTIVE TIC MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 97 ICE: AUTOMOTIVE TIC MARKET FOR OTHER APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 98 ICE: AUTOMOTIVE TIC MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- 7.13 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE TIC MARKET, BY SOURCING TYPE

- 8.1 INTRODUCTION

- FIGURE 42 SEGMENTS BY SOURCING TYPE

- FIGURE 43 AUTOMOTIVE TIC MARKET, BY SOURCING TYPE, 2023-2028

- TABLE 99 AUTOMOTIVE TIC MARKET, BY SOURCING TYPE, 2019-2022 (USD MILLION)

- TABLE 100 AUTOMOTIVE TIC MARKET, BY SOURCING TYPE, 2023-2028 (USD MILLION)

- 8.2 IN-HOUSE

- 8.2.1 ENHANCED QUALITY CONTROL AND COST EFFICIENCY THROUGH IN-HOUSE SOURCING

- FIGURE 44 BENEFITS OF IN-HOUSE SOURCING TYPE

- TABLE 101 AUTOMOTIVE TIC MARKET FOR IN-HOUSE SOURCING, BY REGION, 2019-2022 (USD MILLION)

- TABLE 102 AUTOMOTIVE TIC MARKET FOR IN-HOUSE SOURCING, BY REGION, 2023-2028 (USD MILLION)

- TABLE 103 AUTOMOTIVE TIC MARKET FOR IN-HOUSE SOURCING, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 104 AUTOMOTIVE TIC MARKET FOR IN-HOUSE SOURCING, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.3 OUTSOURCED

- 8.3.1 NEED FOR SPECIFIC EXPERTISE, FLEXIBILITY, AND COST OPTIMIZATION TO DRIVE DEMAND FOR OUTSOURCING SERVICES

- FIGURE 45 BENEFITS OF OUTSOURCED SOURCING TYPE

- TABLE 105 AUTOMOTIVE TIC MARKET FOR OUTSOURCED SOURCING, BY REGION, 2019-2022 (USD MILLION)

- TABLE 106 AUTOMOTIVE TIC MARKET FOR OUTSOURCED SOURCING, BY REGION, 2023-2028 (USD MILLION)

- TABLE 107 AUTOMOTIVE TIC MARKET FOR OUTSOURCED SOURCING, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 108 AUTOMOTIVE TIC MARKET FOR OUTSOURCED SOURCING, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.4 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE TIC MARKET, BY VEHICLE TYPE

- 9.1 INTRODUCTION

- TABLE 109 OFFERINGS BY TIC PROVIDERS, BY VEHICLE TYPE

- FIGURE 46 AUTOMOTIVE TIC MARKET, BY VEHICLE TYPE, 2023-2028

- TABLE 110 AUTOMOTIVE TIC MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 111 AUTOMOTIVE TIC MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.2 PASSENGER CARS

- 9.2.1 GROWING EMPHASIS ON SUSTAINABLE AND SAFE MOBILITY TO INCREASE TIC DEMAND

- TABLE 112 AUTOMOTIVE TIC MARKET FOR PASSENGER CARS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 113 AUTOMOTIVE TIC MARKET FOR PASSENGER CARS, BY REGION, 2023-2028 (USD MILLION)

- 9.3 COMMERCIAL VEHICLES

- 9.3.1 INCREASING FOCUS ON TELEMATICS AND FLEET MANAGEMENT SOLUTIONS TO DRIVE MARKET

- TABLE 114 AUTOMOTIVE TIC MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 115 AUTOMOTIVE TIC MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2023-2028 (USD MILLION)

- 9.4 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE TIC MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 47 AUTOMOTIVE TIC MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 116 AUTOMOTIVE TIC MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 117 AUTOMOTIVE TIC MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 48 NORTH AMERICA: AUTOMOTIVE TIC MARKET SNAPSHOT

- TABLE 118 NORTH AMERICA: AUTOMOTIVE TIC MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: AUTOMOTIVE TIC MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Presence of major automotive OEMs to drive market

- TABLE 122 US: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 123 US: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Growing international trade, exports, and passenger safety awareness to increase demand

- TABLE 124 CANADA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 125 CANADA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.3 MEXICO

- 10.2.3.1 Growing production of automobiles to boost market

- TABLE 126 MEXICO: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 127 MEXICO: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- FIGURE 49 EUROPE: AUTOMOTIVE TIC MARKET, 2023-2028 (USD MILLION)

- TABLE 128 EUROPE: AUTOMOTIVE TIC MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 129 EUROPE: AUTOMOTIVE TIC MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 130 EUROPE: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 131 EUROPE: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Presence of several established automotive and manufacturing sectors to drive market

- TABLE 132 GERMANY: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 133 GERMANY: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Stringent regulatory standards and certifications to drive demand

- TABLE 134 UK: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 135 UK: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Continuous improvements in automotive safety and environmental standards to drive demand

- TABLE 136 FRANCE: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 137 FRANCE: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Increasing shift toward electric mobility to drive market

- TABLE 138 ITALY: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 139 ITALY: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 Regular technical inspections for all vehicles to drive market

- TABLE 140 SPAIN: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 141 SPAIN: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 142 REST OF EUROPE: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 143 REST OF EUROPE: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 50 ASIA PACIFIC: AUTOMOTIVE TIC MARKET SNAPSHOT

- TABLE 144 ASIA PACIFIC: AUTOMOTIVE TIC MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AUTOMOTIVE TIC MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 High production of automobiles to propel market

- TABLE 148 CHINA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 149 CHINA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Technological advancements in automobile industry to add to market growth

- TABLE 150 JAPAN: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 151 JAPAN: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Government incentives for EV adoption to drive demand

- TABLE 152 INDIA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 153 INDIA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Technological shift of major OEMs to increase demand

- TABLE 154 SOUTH KOREA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 155 SOUTH KOREA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.5 REST OF ASIA PACIFIC

- TABLE 156 REST OF ASIA PACIFIC: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5 REST OF THE WORLD (ROW)

- TABLE 158 REST OF THE WORLD: AUTOMOTIVE TIC MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 159 REST OF THE WORLD: AUTOMOTIVE TIC MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 160 REST OF THE WORLD: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 161 REST OF THE WORLD: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Brazil to lead market in South America

- TABLE 162 SOUTH AMERICA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 163 SOUTH AMERICA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Growing EV market to drive demand

- TABLE 164 MIDDLE EAST & AFRICA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- TABLE 166 MARKET SHARE ANALYSIS, 2022

- FIGURE 51 MARKET SHARE ANALYSIS FOR AUTOMOTIVE TIC MARKET, 2022

- FIGURE 52 TOP PUBLIC/LISTED PLAYERS DOMINATING AUTOMOTIVE TIC MARKET DURING LAST FIVE YEARS

- 11.3 COMPETITIVE SCENARIO

- 11.3.1 PRODUCT DEVELOPMENTS/LAUNCHES

- TABLE 167 PRODUCT DEVELOPMENTS/LAUNCHES, 2020-2023

- 11.3.2 DEALS

- TABLE 168 DEALS, 2020-2023

- 11.3.3 OTHERS, 2020-2023

- TABLE 169 OTHERS, 2020-2023

- 11.4 COMPETITIVE LEADERSHIP MAPPING FOR AUTOMOTIVE TIC MARKET

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 53 AUTOMOTIVE TIC MARKET: COMPANY EVALUATION MATRIX FOR TOP AUTOMOTIVE TIC PROVIDERS, 2023

- TABLE 170 AUTOMOTIVE TIC MARKET: COMPANY FOOTPRINT FOR KEY AUTOMOTIVE TIC PROVIDERS, 2023

- TABLE 171 AUTOMOTIVE TIC MARKET: COMPANY APPLICATION FOOTPRINT FOR KEY AUTOMOTIVE TIC PROVIDERS, 2023

- TABLE 172 AUTOMOTIVE TIC MARKET: REGIONAL FOOTPRINT FOR KEY AUTOMOTIVE TIC PROVIDERS, 2023

- 11.5 COMPETITIVE EVALUATION QUADRANT: SMES

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 54 AUTOMOTIVE TIC MARKET (STARTUP/SME): COMPANY EVALUATION QUADRANT, 2023

- 11.6 COMPETITIVE BENCHMARKING

- TABLE 173 AUTOMOTIVE TIC MARKET: DETAILED LIST OF KEY STARTUPS

- TABLE 174 AUTOMOTIVE TIC MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

12 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 12.1 KEY PLAYERS

- 12.1.1 DEKRA SE

- TABLE 175 DEKRA SE: BUSINESS OVERVIEW

- FIGURE 55 DEKRA SE: COMPANY SNAPSHOT

- TABLE 176 DEKRA SE: PRODUCTS AND SERVICES OFFERED

- TABLE 177 DEKRA SE: NEW PRODUCT DEVELOPMENTS

- TABLE 178 DEKRA SE: DEALS

- TABLE 179 DEKRA SE: OTHERS

- 12.1.2 TUV SUD

- TABLE 180 TUV SUD: BUSINESS OVERVIEW

- FIGURE 56 TUV SUD: COMPANY SNAPSHOT

- TABLE 181 TUV SUD: PRODUCTS AND SERVICES OFFERED

- TABLE 182 TUV SUD: NEW PRODUCT DEVELOPMENTS

- TABLE 183 TUV SUD: DEALS

- TABLE 184 TUV SUD: OTHERS

- 12.1.3 APPLUS+

- TABLE 185 APPLUS+: BUSINESS OVERVIEW

- FIGURE 57 APPLUS+: COMPANY SNAPSHOT

- FIGURE 58 APPLUS+: FUNCTIONAL SAFETY SUPPORT THROUGHOUT DEVELOPMENT CYCLES

- TABLE 186 APPLUS+: PRODUCTS AND SERVICES OFFERED

- TABLE 187 APPLUS+: NEW PRODUCT DEVELOPMENTS

- TABLE 188 APPLUS+: DEALS

- TABLE 189 APPLUS+: OTHERS

- 12.1.4 SGS GROUP

- TABLE 190 SGS GROUP: BUSINESS OVERVIEW

- FIGURE 59 SGS GROUP: COMPANY SNAPSHOT

- TABLE 191 SGS GROUP: PRODUCTS AND SERVICES OFFERED

- TABLE 192 SGS GROUP: DEALS

- TABLE 193 SGS GROUP: OTHERS

- 12.1.5 TUV RHEINLAND AG GROUP

- TABLE 194 TUV RHEINLAND AG GROUP: BUSINESS OVERVIEW

- FIGURE 60 TUV RHEINLAND AG GROUP: COMPANY SNAPSHOT

- FIGURE 61 TUV RHEINLAND AG GROUP: TIC SERVICES OFFERED FOR AUTOMOTIVE INDUSTRY

- TABLE 195 TUV RHEINLAND AG GROUP: PRODUCTS AND SERVICES OFFERED

- TABLE 196 TUV RHEINLAND AG GROUP: NEW PRODUCT DEVELOPMENTS

- TABLE 197 TUV RHEINLAND AG GROUP: DEALS

- TABLE 198 TUV RHEINLAND AG GROUP: OTHERS

- 12.1.6 TUV NORD GROUP

- TABLE 199 TUV NORD GROUP: BUSINESS OVERVIEW

- FIGURE 62 TUV NORD GROUP: COMPANY SNAPSHOT

- FIGURE 63 TUV NORD GROUP: AUTOMOTIVE SERVICES

- TABLE 200 TUV NORD GROUP: PRODUCTS AND SERVICES OFFERED

- TABLE 201 TUV NORD GROUP: DEALS

- 12.1.7 BUREAU VERITAS S.A.

- TABLE 202 BUREAU VERITAS S.A.: BUSINESS OVERVIEW

- FIGURE 64 BUREAU VERITAS S.A.: COMPANY SNAPSHOT

- TABLE 203 BUREAU VERITAS S.A.: CONNECTED VEHICLE SERVICES

- TABLE 204 BUREAU VERITAS S.A.: PRODUCTS AND SERVICES OFFERED

- TABLE 205 BUREAU VERITAS S.A.: NEW PRODUCT DEVELOPMENTS

- TABLE 206 BUREAU VERITAS S.A.: DEALS

- 12.1.8 INTERTEK

- TABLE 207 INTERTEK: BUSINESS OVERVIEW

- FIGURE 65 INTERTEK: COMPANY SNAPSHOT

- TABLE 208 INTERTEK: PRODUCTS AND SERVICES OFFERED

- TABLE 209 INTERTEK: NEW PRODUCT DEVELOPMENTS

- TABLE 210 INTERTEK: OTHERS

- 12.1.9 EUROFINS

- TABLE 211 EUROFINS: BUSINESS OVERVIEW

- FIGURE 66 EUROFINS: COMPANY SNAPSHOT

- FIGURE 67 EUROFINS: NUMBER OF EMPLOYEES AND LABORATORIES

- TABLE 212 EUROFINS: PRODUCTS AND SERVICES OFFERED

- 12.1.10 ELEMENT MATERIALS

- TABLE 213 ELEMENT MATERIALS: BUSINESS OVERVIEW

- TABLE 214 ELEMENT MATERIALS: PRODUCTS AND SERVICES OFFERED

- TABLE 215 ELEMENT MATERIALS: DEALS

- 12.1.11 KIWA NV

- TABLE 216 KIWA NV: BUSINESS OVERVIEW

- TABLE 217 KIWA NV: PRODUCTS AND SERVICES OFFERED

- TABLE 218 KIWA NV: OTHERS

- 12.1.12 A2LA

- TABLE 219 A2LA: BUSINESS OVERVIEW

- FIGURE 68 A2LA: COMPANY SNAPSHOT

- TABLE 220 A2LA: PRODUCTS AND SERVICES OFFERED

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 BRITISH STANDARDS INSTITUTION (BSI)

- 12.2.2 RINA S.P.A.

- 12.2.3 NORGES ELEKTRISKE MATERIELLKONTROLL (NEMKO)

- 12.2.4 NSF INTERNATIONAL

- 12.2.5 ENGINEERING QUALITY SOLUTIONS, INC. (EQS)

- 12.2.6 LLOYD'S REGISTER GROUP LIMITED

- 12.2.7 MISTRAS

- 12.2.8 DNV GL

- 12.2.9 UL LLC

13 RECOMMENDATIONS BY MARKETSANDMARKETS

- 13.1 ELECTRIFICATION OF VEHICLES TO CREATE NEW GROWTH OPPORTUNITIES

- 13.2 ASIA PACIFIC KEY FOCUS REGION FOR AUTOMOTIVE TIC MARKET

- 13.3 EMERGING AUTOMOTIVE TECHNOLOGIES TO DRIVE GROWTH

- 13.4 CONCLUSION

14 APPENDIX

- 14.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS