|

|

市場調査レポート

商品コード

1297755

公共安全用ドローンの世界市場:種類別・操縦モード別・プラットフォーム別・用途別 (警察活動・捜査、消防・災害管理、国境管理、交通監視、海上警備、配送)・地域別の将来予測 (2028年まで)Public Safety Drone Market by Type, Mode of operation, Platform, Application (Police Operations & Investigations, Firefighting & Disaster Management, Border Management, Traffic Monitoring, Maritime security, Delivery) and Region - Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 公共安全用ドローンの世界市場:種類別・操縦モード別・プラットフォーム別・用途別 (警察活動・捜査、消防・災害管理、国境管理、交通監視、海上警備、配送)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月21日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

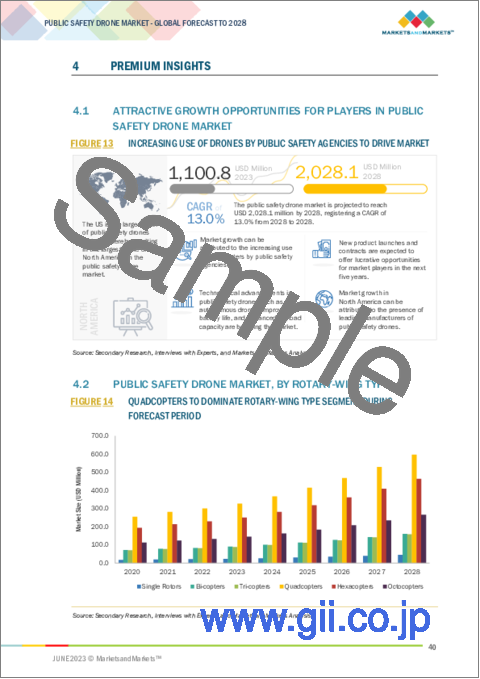

世界の公共安全用ドローンの市場規模は、2023年の11億米ドルから、2028年には20億米ドルに達し、2023年から2028年の間に13.0%のCAGRで成長すると予測されています。

公共安全用ドローンは、自律または遠隔操作で動作することができます。しかし、これらのドローンのほとんどは、人間のオペレーターによって遠隔操作されます。センサーなどの様々なペイロードを搭載したこれらのドローンは、地上のコントロールステーションに接続されています。公共安全用ドローンは、検査や監視、映画やジャーナリズムのための空撮、捜索救助任務、国境を越えた監視、戦略的計画、アクセスできない地域のマッピング、天気予報などのタスクで活用されています。世界のドローン需要は近年大きく伸びており、個人、営利団体、軍事組織、政府機関が多様な目的でドローンを活用しています。危険な地形の効果的なマッピングや迅速なデータ収集に使用される公共安全用ドローンの需要増大は、今後数年間の公共安全用ドローン市場の成長を促進すると予想されています。

"種類別では、固定翼セグメントが予測期間中に高いCAGRで成長する"

種類別に見ると、固定翼セグメントは予測期間中、より高いCAGRで成長します。固定翼の公共安全用ドローンは、より広い地域をカバーし、より長い時間空中に留まることができるため、捜索救助任務、災害評価、監視活動に特に有用です。固定翼ドローンは、ほとんどのマルチロータードローンよりも厳しい気象状況で優れた性能を発揮します。より高い高度で飛行でき、厳しい風の中でも安定して飛行できるため、厳しい地形、沿岸地域、遠隔地でのミッションに最適です。また、固定翼ドローンはマルチロータードローンよりも貨物容量が大きくなっています。

"操縦モード別では、完全自律型セグメントは予測期間中に最も高いCAGRで成長する"

操縦モード別に見ると、完全自律型セグメントが予測期間中に最も高いCAGRで成長します。これは、完全自律型ドローンが、強化された自動化、オペレータの作業負担の軽減、信頼性の向上、拡張性、継続的な運用能力を提供するためです。ドローンは、人間の介入なしに、事前にプログラムされた飛行経路やタスクを実行することができ、大規模で中断のないオペレーションに適しています。

"北米が最も高い市場シェアを占める"

北米は2023年に、世界の公共安全用ドローン市場をリードすると予測されています。特に米国は公共安全用ドローン市場の域内最大市場です。北米は政治的に安定した地域であり、米国とカナダは良好なビジネス関係を築いており、公共安全用ドローン市場で事業を展開する主要企業の本拠地となっています。北米の安定性と公共安全規制は、多くの観光客や企業を惹きつけています。北米は世界的に起こっている技術革命の最前線にいます。カナダと米国は科学技術のパイオニアです。ドローンは長い間、世界の防衛や商業分野で使用されてきました。当初から、この地域は技術進歩のリーダーでした。北米は他の先進国や発展途上国との競合に直面しながらも、技術分野での覇権を維持し続けています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 公共安全用ドローン市場のエコシステム

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- 公共安全用ドローン市場のバリューチェーン分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 主な会議とイベント (2023年)

- 貿易データ分析

- 関税・規制状況

- 市場規模データ (数量ベース)

- 価格分析

第6章 業界動向

- イントロダクション

- 新規技術の動向

- 使用事例の分析

- 関連する使用事例

- メガトレンドの影響

- 特許分析

第7章 公共安全用ドローン市場:種類別

- イントロダクション

- 回転翼

- 固定翼

- ハイブリッド

第8章 公共安全用ドローン市場:プラットフォーム別

- イントロダクション

- マイクロ (250g~-2kg)

- 小型 (2kg~25kg)

第9章 公共安全用ドローン市場:操縦モード別

- イントロダクション

- 半自律型

- 完全自律型

第10章 公共安全用ドローン市場:用途別

- イントロダクション

- 警察活動・捜査

- 消防・災害管理

- 国境管理

- 交通監視

- 海上警備

- 配達

第11章 公共安全用ドローン市場:地域別

- イントロダクション

- 北米

- イントロダクション

- 米国

- カナダ

- 欧州

- イントロダクション

- 英国

- ドイツ

- フランス

- イタリア

- ロシア

- その他の欧州

- アジア太平洋

- イントロダクション

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- 中東・アフリカ

- イントロダクション

- イスラエル

- トルコ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ラテンアメリカ

- イントロダクション

- ブラジル

- メキシコ

- アルゼンチン

第12章 競合情勢

- イントロダクション

- 企業概要

- 公共安全用ドローン市場:主要企業のランキング分析 (2022年)

- 収益分析 (2022年)

- 市場シェア分析 (2022年)

- 競合評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合ベンチマーキング

- 市場参入企業の競合シナリオ

- 競合シナリオ

第13章 企業プロファイル

- イントロダクション

- 主要企業

- DJI

- PARROT DRONE SAS

- TELEDYNE FLIR LLC

- AUTEL ROBOTICS

- SKYDIO, INC.

- YUNEEC

- DRAGANFLY INC.

- BRINC DRONES, INC.

- ONDAS HOLDINGS INC.

- HARRIS AERIAL, INC.

- LOCKHEED MARTIN CORPORATION

- TEAL DRONES

- DELAIR

- FLYABILITY

- WINGTRA

- その他の企業

- AEE AVIATION TECHNOLOGY INC.

- KESPRY

- INSITU, INC.

- HOVERFLY TECHNOLOGIES

- MICRODRONES

- ELISTAIR

- ZIPLINE

- VOLOCOPTER GMBH

- AGEAGLE AERIAL SYSTEMS INC.

- AUTERION GS

第14章 付録

The public safety drone market is projected to grow from USD 1.1 billion in 2023 to USD 2.0 billion by 2028, at a CAGR of 13.0% from 2023 to 2028. An unmanned aerial vehicle (UAV) is an airplane that operates autonomously or is remotely piloted. UAVs are also termed drones. Public safety drones can operate autonomously or remotely operated. However, most of these drones are controlled remotely by human operators. Equipped with various payloads such as sensors, these drones are connected to ground control stations. Public safety drones find applications in tasks such as inspection, surveillance, aerial photography for film and journalism, search and rescue missions, cross-border surveillance, strategic planning, mapping inaccessible areas, and weather forecasting. The global demand for drones has witnessed significant growth in recent years, with individuals, commercial entities, military organizations, and government agencies utilizing them for diverse purposes. Rising demand for public safety drones, with their use in the effective mapping of dangerous terrains and quick data gathering, is expected to fuel the growth of the market for public safety drones in the coming years.

Based on the type, the Fixed wing segment is to grow at a higher CAGR during the forecast period.

Based on type, the public safety drone market has been classified into fixed-wing, rotary-wing, and hybrid-wing. The fixed-wing segment is to grow at a higher CAGR during the forecast period. Fixed-wing public safety drones cover larger regions and can stay in the air for longer periods of time, making them especially useful in search and rescue missions, disaster assessment, and surveillance activities. Fixed-wing drones perform better in harsh weather situations than most multi-rotor drones. Their ability to fly at greater altitudes and steadiness in severe winds make them ideal for missions in tough terrain, coastal areas, or remote locales. Fixed-wing drones have a greater cargo capacity than multi-rotor drones.

Based on the mode of operation, the fully autonomous segment is to grow at the highest CAGR during the forecast period.

Based on the mode of operation segment, the public safety drone market has been classified into semi-autonomous and fully autonomous. The fully autonomous segment is to grow at the highest CAGR during the forecast period. This is due to fully autonomous drones offering enhanced automation, reduced operator workload, improved reliability, scalability, and the ability to operate continuously. They can execute pre-programmed flight paths and tasks without human intervention, making them suitable for large-scale and uninterrupted operations.

"North America is expected to hold the highest market share."

North America is projected to lead the public safety drone market in 2023. The US is the largest market for public safety drone market in North America. North America is a politically stable region owing to the stable governments of countries in the region. The US and Canada have good business relations and are home to some key players operating in the public safety drone market. The stability and public safety regulations in North America attract a number of tourists and businesses. North America has been at the forefront of the technological revolution taking place globally. Canada and the US are pioneers in science and technology. Drones have been used for a long time in defense and commercial sectors worldwide. Since the beginning, the region has been a leader in technological advancements. Though North America faced competition from some other developed and developing regions, it continues to retain its supremacy in the technological field.

The break-up of the profile of primary participants in the Public Safety Drone market:

- By Company Type: Tier 1 - 32%, Tier 2 - 40%, and Tier 3 - 28%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 40%, Europe - 21%, Asia Pacific - 29%, Middle East & Africa -5%, Latin America-5%

The major players in the Public Safety Drone market mainly resorted to contracts to drive their growth. They also entered new markets by launching technologically advanced and cost-effective products. DJI (China), Autel Robotics (China), Skydio Inc (US), Parrot Drone SAS (France), and Teledyne FLIR LLC (US) are some of the leading players in the market who adopted this strategy. An increase in the demand for advanced Public Safety Drone products and the growth of emerging markets have encouraged companies to adopt this strategy to enter new regions.

Research Coverage:

This market study covers the public safety drone market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on type, mode of operation, application, platform, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Public Safety Drone market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and there are several factors that could contribute to an increase in the Public Safety Drone market.

- Market Penetration: Comprehensive information on Public Safety Drone systems offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Public Safety Drone market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the Public Safety Drone market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Public Safety Drone market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the Public Safety Drone market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 PUBLIC SAFETY DRONE MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 PUBLIC SAFETY DRONE MARKET: INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- 1.6 USD EXCHANGE RATES

- 1.7 LIMITATIONS

- 1.8 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.3 KEY PRIMARY INSIGHTS

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Step-by-step approach

- 2.3.1.2 Regional split of public safety drone market

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 TRIANGULATION AND VALIDATION

- FIGURE 6 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5.1 ASSUMPTIONS USED IN MARKET SIZING AND FORECAST

- 2.6 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 8 HYBRID SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 9 SMALL DRONE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE THAN MICRO DRONE SEGMENT FROM 2023 TO 2028

- FIGURE 10 FULLY AUTONOMOUS SEGMENT TO EXHIBIT HIGHER CAGR THAN SEMI-AUTONOMOUS SEGMENT DURING FORECAST PERIOD

- FIGURE 11 POLICE OPERATIONS & INVESTIGATIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN PUBLIC SAFETY DRONE MARKET

- FIGURE 13 INCREASING USE OF DRONES BY PUBLIC SAFETY AGENCIES TO DRIVE MARKET

- 4.2 PUBLIC SAFETY DRONE MARKET, BY ROTARY-WING TYPE

- FIGURE 14 QUADCOPTERS TO DOMINATE ROTARY-WING TYPE SEGMENT DURING FORECAST PERIOD

- 4.3 PUBLIC SAFETY DRONE MARKET, BY PLATFORM

- FIGURE 15 SMALL DRONE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 PUBLIC SAFETY DRONE MARKET, BY APPLICATION

- FIGURE 16 POLICE OPERATIONS & INVESTIGATIONS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- 4.5 PUBLIC SAFETY DRONE MARKET, BY MODE OF OPERATION

- FIGURE 17 SEMI-AUTONOMOUS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 PUBLIC SAFETY DRONE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for hybrid drones

- 5.2.1.2 Need for enhanced situational awareness

- 5.2.1.3 Growing use of drones for border management

- 5.2.1.4 Increasing use of public safety drones for marine border patrolling

- 5.2.1.5 Decreasing price of drone components

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of skilled personnel to operate drones

- 5.2.2.2 Weather conditions and environmental factors

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancement in drone payloads

- 5.2.3.2 Simultaneous localization and mapping

- 5.2.3.3 Integration with other technologies

- 5.2.3.4 Partnerships and collaborations

- 5.2.4 CHALLENGES

- 5.2.4.1 Delivery authentication and cybersecurity concerns

- 5.2.4.2 Beyond visual line of sight operations

- 5.3 PUBLIC SAFETY DRONE MARKET ECOSYSTEM

- 5.3.1 PROMINENT COMPANIES

- 5.3.2 PRIVATE AND SMALL ENTERPRISES

- 5.3.3 STARTUPS

- 5.3.4 END USERS

- FIGURE 19 PUBLIC SAFETY DRONE MARKET ECOSYSTEM MAP

- TABLE 2 PUBLIC SAFETY DRONE MARKET ECOSYSTEM

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PUBLIC SAFETY DRONE MARKET

- FIGURE 20 REVENUE SHIFT IN PUBLIC SAFETY DRONE MARKET

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 AI IN PUBLIC SAFETY DRONES

- TABLE 3 COMPANIES WORKING TOWARD DEVELOPMENT OF DRONES WITH AI SOFTWARE

- TABLE 4 COMPANIES WORKING TOWARD DEVELOPMENT OF DRONE EQUIPMENT WITH AI

- 5.5.2 DRONES WITH LIDAR SYSTEMS

- 5.6 VALUE CHAIN ANALYSIS OF PUBLIC SAFETY DRONE MARKET

- FIGURE 21 VALUE CHAIN ANALYSIS

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 PUBLIC SAFETY DRONE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 PUBLIC SAFETY DRONE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 TYPES

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 TYPES (%)

- 5.8.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 TYPES

- TABLE 7 KEY BUYING CRITERIA FOR TOP 3 TYPES

- 5.9 KEY CONFERENCES AND EVENTS IN 2023

- TABLE 8 PUBLIC SAFETY DRONE MARKET: CONFERENCES AND EVENTS, 2023

- 5.10 TRADE DATA ANALYSIS

- TABLE 9 COUNTRY-WISE IMPORTS FOR DRONES, 2020-2022 (USD THOUSAND)

- TABLE 10 COUNTRY-WISE EXPORTS FOR DRONES, 2020-2022 (USD THOUSAND)

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 NORTH AMERICA

- 5.11.2.1 US

- TABLE 16 US: RULES AND GUIDELINES BY FAA FOR DRONE OPERATIONS

- 5.11.2.2 Canada

- TABLE 17 CANADA: RULES AND GUIDELINES FOR DRONE OPERATIONS

- 5.11.3 EUROPE

- 5.11.3.1 UK

- TABLE 18 UK: RULES AND GUIDELINES BY CAA FOR DRONE OPERATIONS

- 5.11.3.2 Germany

- TABLE 19 GERMANY: RULES AND GUIDELINES FOR DRONE OPERATIONS

- 5.11.3.3 France

- TABLE 20 FRANCE: RULES AND GUIDELINES FOR DRONE OPERATIONS

- TABLE 21 PUBLIC SAFETY DRONE REGULATIONS, BY COUNTRY

- 5.12 VOLUME DATA

- FIGURE 25 PUBLIC SAFETY DRONE MARKET, MARKET VOLUME (UNITS), 2020-2028

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE

- FIGURE 26 AVERAGE SELLING PRICES OF KEY PLAYERS

- TABLE 22 AVERAGE SELLING PRICES OF KEY PLAYERS (USD)

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 EMERGING TECHNOLOGY TRENDS

- 6.2.1 SYNTHETIC APERTURE RADAR

- 6.2.2 SWARMING TECHNOLOGY

- 6.2.3 NETWORK FUNCTIONS VIRTUALIZATION

- 6.2.4 NEW SCOPE FOR DRONE REST AND RECHARGE

- 6.2.5 SOFTWARE-DEFINED NETWORKING

- 6.2.6 DRONE INSURANCE

- TABLE 23 INSURANCE COVERAGE OFFERED

- TABLE 24 COMPANIES PROVIDING DRONE INSURANCE

- 6.3 USE CASE ANALYSIS

- 6.3.1 ZIPLINE DRONES USED TO DELIVER COVID-19 VACCINES

- TABLE 25 COVID-19 VACCINES DELIVERED TO GHANA BY ZIPLINE

- 6.3.2 TRANSFER OF MEDICAL PRESCRIPTIONS USING DRONES FROM MANNA AERO

- TABLE 26 ESSENTIAL SUPPLIES DELIVERED BY MANNA AERO IN RURAL AREAS

- 6.3.3 DRONE FIELD TESTS IN AMAZON FOREST IN PERU

- TABLE 27 FIELD TESTS USING CARGO DRONES TO DELIVER VACCINES AND BLOOD SAMPLES

- 6.3.4 TEAR GAS BY DRONES

- TABLE 28 EXPERIMENTING WITH DRONES FOR TEAR GAS DROP

- 6.4 CONNECTED USE CASES

- 6.4.1 DRONE TECHNOLOGY FOR RADIOLOGICAL MONITORING

- 6.4.2 DRONE TECHNOLOGY FOR CONSERVATION

- TABLE 29 UAV-RELATED USE CASES IN DIFFERENT GEOGRAPHIES

- 6.4.3 TRAFFIC AND CROWD MONITORING

- 6.5 IMPACT OF MEGATRENDS

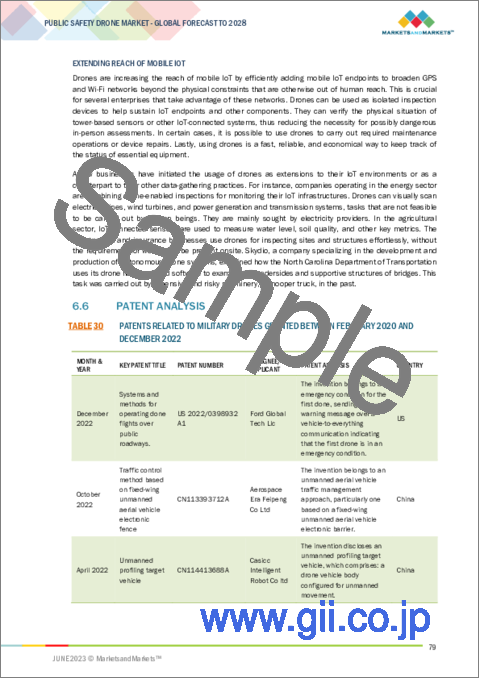

- 6.6 PATENT ANALYSIS

- TABLE 30 PATENTS RELATED TO MILITARY DRONES GRANTED BETWEEN FEBRUARY 2020 AND DECEMBER 2022

7 PUBLIC SAFETY DRONE MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 27 HYBRID SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- TABLE 31 PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 32 PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2 ROTARY-WING

- 7.2.1 INCREASING USE OF ROTARY-WING DRONES IN CLOSE-PROXIMITY OPERATIONS

- TABLE 33 ROTARY-WING PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 34 ROTARY-WING PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2.1.1 Single rotors

- 7.2.1.2 Bi-copters

- 7.2.1.3 Tri-copters

- 7.2.1.4 Quadcopters

- 7.2.1.5 Hexacopters

- 7.2.1.6 Octocopters

- 7.3 FIXED-WING

- 7.3.1 EXTENDED FLIGHT ENDURANCE, LONG-DISTANCE OPERATION, AND WIDE AREA COVERAGE CAPABILITIES TO DRIVE DEMAND FOR FIXED-WING DRONES

- 7.4 HYBRID

- 7.4.1 GROWING DEMAND FOR EXTENDED FLIGHT RANGE TO BOOST DEMAND FOR HYBRID DRONES

8 PUBLIC SAFETY DRONE MARKET, BY PLATFORM

- 8.1 INTRODUCTION

- FIGURE 28 SMALL SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE THAN MICRO SEGMENT FROM 2023 TO 2028

- TABLE 35 PUBLIC SAFETY DRONE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 36 PUBLIC SAFETY DRONE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 8.2 MICRO (250 GM-2 KG)

- 8.2.1 INCREASING DEMAND FOR EASILY MANEUVERABLE COMPACT DRONES

- 8.3 SMALL (2 KG-25 KG)

- 8.3.1 QUICK DEPLOYMENT FOR IMMEDIATE SURVEILLANCE NEEDS

9 PUBLIC SAFETY DRONE MARKET, BY MODE OF OPERATION

- 9.1 INTRODUCTION

- FIGURE 29 FULLY AUTONOMOUS SEGMENT TO RECORD HIGHER GROWTH RATE THAN SEMI-AUTONOMOUS SEGMENT DURING FORECAST PERIOD

- TABLE 37 PUBLIC SAFETY DRONE MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 38 PUBLIC SAFETY DRONE MARKET, BY MODE OF OPERATION, 2023-2028 (USD MILLION)

- 9.2 SEMI-AUTONOMOUS

- 9.2.1 INCREASED ADOPTION OF PUBLIC SAFETY DRONES TO DRIVE DEMAND

- 9.3 FULLY AUTONOMOUS

- 9.3.1 INCREASED DEMAND FOR MISSION EFFICIENCY AND PRECISION TO DRIVE SEGMENT

10 PUBLIC SAFETY DRONE MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 30 POLICE OPERATIONS & INVESTIGATIONS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- TABLE 39 PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 40 PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2 POLICE OPERATIONS & INVESTIGATIONS

- 10.2.1 EMERGENCE OF PUBLIC SAFETY DRONES AS COST-EFFECTIVE SOLUTIONS TO IDENTIFY SUSPECTS

- 10.2.1.1 Crime scene-photography

- 10.2.1.2 Investigating armed and dangerous suspects

- 10.2.1.3 Bombs and materials observation

- 10.2.1.4 Fugitive apprehension

- 10.2.1.5 Crowd monitoring

- 10.2.1.6 Surveillance

- 10.2.1.7 Search and rescue

- 10.2.1 EMERGENCE OF PUBLIC SAFETY DRONES AS COST-EFFECTIVE SOLUTIONS TO IDENTIFY SUSPECTS

- 10.3 FIREFIGHTING & DISASTER MANAGEMENT

- 10.3.1 EMPOWERING FIREFIGHTING AND DISASTER MANAGEMENT EFFORTS THROUGH PUBLIC SAFETY DRONES

- 10.4 BORDER MANAGEMENT

- 10.4.1 ENHANCING BORDER SECURITY AND PUBLIC SAFETY THROUGH DRONE TECHNOLOGY

- 10.5 TRAFFIC MONITORING

- 10.5.1 IMPROVING TRAFFIC MONITORING AND SAFETY THROUGH PUBLIC SAFETY DRONES

- 10.6 MARITIME SECURITY

- 10.6.1 STRENGTHENING MARITIME SECURITY THROUGH PUBLIC SAFETY DRONES

- 10.7 DELIVERY

- 10.7.1 INCREASED USAGE OF DRONES FOR MEDICAL AND EMERGENCY RESPONSE

11 PUBLIC SAFETY DRONE MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 31 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- TABLE 41 PUBLIC SAFETY DRONE MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 42 PUBLIC SAFETY DRONE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 INTRODUCTION

- 11.2.2 RECESSION IMPACT ANALYSIS: NORTH AMERICA

- 11.2.3 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 32 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET SNAPSHOT

- TABLE 43 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.4 US

- 11.2.4.1 Focus on development of UAVs for US Army to drive market

- TABLE 49 US: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 50 US: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 51 US: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 52 US: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.5 CANADA

- 11.2.5.1 Increasing use of drones for public safety to drive market

- TABLE 53 CANADA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 54 CANADA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 55 CANADA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 56 CANADA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 INTRODUCTION

- 11.3.2 RECESSION IMPACT ANALYSIS: EUROPE

- 11.3.3 PESTLE ANALYSIS: EUROPE

- FIGURE 33 EUROPE: PUBLIC SAFETY DRONE MARKET SNAPSHOT

- TABLE 57 EUROPE: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 58 EUROPE: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 59 EUROPE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 60 EUROPE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 61 EUROPE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 62 EUROPE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.4 UK

- 11.3.4.1 Presence of key players to drive market

- TABLE 63 UK: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 64 UK: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 65 UK: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 66 UK: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5 GERMANY

- 11.3.5.1 Increased adoption of drones for safety to drive market

- TABLE 67 GERMANY: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 68 GERMANY: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 69 GERMANY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 70 GERMANY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.6 FRANCE

- 11.3.6.1 Government initiatives supporting UAVs to boost market

- TABLE 71 FRANCE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 72 FRANCE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 73 FRANCE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 74 FRANCE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.7 ITALY

- 11.3.7.1 Growing demand for drones for public safety to drive market

- TABLE 75 ITALY: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 76 ITALY PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 77 ITALY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 78 ITALY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.8 RUSSIA

- 11.3.8.1 Investments in research & development to elevate public safety and security

- TABLE 79 RUSSIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 80 RUSSIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 81 RUSSIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 82 RUSSIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.9 REST OF EUROPE

- TABLE 83 REST OF EUROPE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 84 REST OF EUROPE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 85 REST OF EUROPE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 86 REST OF EUROPE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 INTRODUCTION

- 11.4.2 RECESSION IMPACT ANALYSIS: ASIA PACIFIC

- 11.4.3 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 34 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET SNAPSHOT

- TABLE 87 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 88 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.4 CHINA

- 11.4.4.1 Increased innovations in drone technology to contribute to market growth

- TABLE 93 CHINA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 94 CHINA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 95 CHINA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 96 CHINA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.5 INDIA

- 11.4.5.1 Government initiatives to promote use of drones for public safety to lead to market growth

- TABLE 97 INDIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 98 INDIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 99 INDIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 100 INDIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.6 JAPAN

- 11.4.6.1 Growing need for traffic monitoring to boost market

- TABLE 101 JAPAN: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 102 JAPAN: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 103 JAPAN: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 104 JAPAN: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.7 AUSTRALIA

- 11.4.7.1 Increasing use of drones for surveillance to drive market

- TABLE 105 AUSTRALIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 106 AUSTRALIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 107 AUSTRALIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 108 AUSTRALIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.8 SOUTH KOREA

- 11.4.8.1 Innovations in drone technology to lead to market growth

- TABLE 109 SOUTH KOREA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 110 SOUTH KOREA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 111 SOUTH KOREA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 112 SOUTH KOREA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 INTRODUCTION

- 11.5.2 RECESSION IMPACT ANALYSIS: MIDDLE EAST & AFRICA

- FIGURE 35 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET SNAPSHOT

- TABLE 113 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.3 ISRAEL

- 11.5.3.1 Government investments in building drone networks to boost market

- TABLE 119 ISRAEL: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 120 ISRAEL: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 121 ISRAEL: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 122 ISRAEL: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.4 TURKEY

- 11.5.4.1 Garuda Aerospace drones to be used for relief operations

- TABLE 123 TURKEY: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 124 TURKEY: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 125 TURKEY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 126 TURKEY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.5 UAE

- TABLE 127 UAE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 128 UAE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 129 UAE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 130 UAE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.6 SAUDI ARABIA

- 11.5.6.1 Public-private partnerships to boost market

- TABLE 131 SAUDI ARABIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 132 SAUDI ARABIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 133 SAUDI ARABIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 134 SAUDI ARABIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.7 SOUTH AFRICA

- 11.5.7.1 Increased government focus on drone-based public safety initiatives to fuel market

- TABLE 135 SOUTH ARICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 136 SOUTH ARICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 137 SOUTH ARICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 138 SOUTH ARICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 INTRODUCTION

- 11.6.2 RECESSION IMPACT ANALYSIS: LATIN AMERICA

- 11.6.3 PESTLE ANALYSIS: LATIN AMERICA

- FIGURE 36 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET SNAPSHOT

- TABLE 139 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 140 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 141 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 142 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 143 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 144 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.4 BRAZIL

- 11.6.4.1 Increasing use of drones by government agencies to boost market

- TABLE 145 BRAZIL: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 146 BRAZIL: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 147 BRAZIL: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 148 BRAZIL: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.5 MEXICO

- 11.6.5.1 Increased use of drones for disaster management and monitoring to drive market

- TABLE 149 MEXICO: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 150 MEXICO: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 151 MEXICO: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 152 MEXICO: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.6 ARGENTINA

- 11.6.6.1 Increased adoption of drones by government authorities to drive market

- TABLE 153 ARGENTINA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 154 ARGENTINA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 155 ARGENTINA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 156 ARGENTINA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 COMPANY OVERVIEW

- TABLE 157 KEY DEVELOPMENTS OF LEADING PLAYERS IN PUBLIC SAFETY DRONE MARKET (2022-2023)

- 12.3 RANKING ANALYSIS OF KEY PLAYERS IN PUBLIC SAFETY DRONE MARKET, 2022

- FIGURE 37 RANKING OF KEY PLAYERS IN PUBLIC SAFETY DRONE MARKET, 2022

- 12.4 REVENUE ANALYSIS, 2022

- FIGURE 38 REVENUE ANALYSIS FOR KEY COMPANIES IN PUBLIC SAFETY DRONE MARKET, 2022

- 12.5 MARKET SHARE ANALYSIS, 2022

- FIGURE 39 MARKET SHARE ANALYSIS FOR KEY COMPANIES IN PUBLIC SAFETY DRONE MARKET, 2022

- TABLE 158 PUBLIC SAFETY DRONE MARKET: DEGREE OF COMPETITION

- 12.6 COMPETITIVE EVALUATION QUADRANT

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 40 PUBLIC SAFETY DRONE MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.7 STARTUP/SME EVALUATION QUADRANT

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 STARTING BLOCKS

- 12.7.4 DYNAMIC COMPANIES

- FIGURE 41 PUBLIC SAFETY DRONE MARKET (STARTUP/SME): COMPANY EVALUATION QUADRANT, 2022

- 12.8 COMPETITIVE BENCHMARKING

- TABLE 159 PUBLIC SAFETY DRONE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 12.9 COMPETITIVE SCENARIO OF MARKET PLAYERS

- TABLE 160 PUBLIC SAFETY DRONE MARKET: COMPETITIVE SCENARIO OF KEY PLAYERS [MAJOR PLAYERS]

- TABLE 161 PUBLIC SAFETY DRONE MARKET: COMPETITIVE SCENARIO OF KEY PLAYERS [STARTUPS/SMES]

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 MARKET EVALUATION FRAMEWORK

- 12.10.2 NEW PRODUCT LAUNCHES

- TABLE 162 NEW PRODUCT LAUNCHES, JUNE 2020-MAY 2023

- 12.10.3 DEALS

- TABLE 163 DEALS, FEBRUARY 2020-MAY 2023

- 12.10.4 OTHERS

- TABLE 164 OTHERS, OCTOBER 2021-MARCH 2023

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 13.2 KEY PLAYERS

- 13.2.1 DJI

- TABLE 165 DJI: BUSINESS OVERVIEW

- TABLE 166 DJI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 DJI: NEW PRODUCT LAUNCHES

- TABLE 168 DJI: DEALS

- 13.2.2 PARROT DRONE SAS

- TABLE 169 PARROT DRONE SAS: BUSINESS OVERVIEW

- FIGURE 42 PARROT DRONE SAS: COMPANY SNAPSHOT

- TABLE 170 PARROT DRONE SAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 PARROT DRONE SAS: NEW PRODUCT LAUNCHES

- TABLE 172 PARROT DRONE SAS: DEALS

- TABLE 173 PARROT DRONE SAS: OTHERS

- 13.2.3 TELEDYNE FLIR LLC

- TABLE 174 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

- FIGURE 43 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- TABLE 175 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 TELEDYNE FLIR LLC: NEW PRODUCT LAUNCHES

- TABLE 177 TELEDYNE FLIR LLC: DEALS

- 13.2.4 AUTEL ROBOTICS

- TABLE 178 AUTEL ROBOTICS: BUSINESS OVERVIEW

- TABLE 179 AUTEL ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 AUTEL ROBOTICS: NEW PRODUCT LAUNCHES

- TABLE 181 AUTEL ROBOTICS: DEALS

- TABLE 182 AUTEL ROBOTICS: OTHERS

- 13.2.5 SKYDIO, INC.

- TABLE 183 SKYDIO, INC.: COMPANY OVERVIEW

- TABLE 184 SKYDIO, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 SKYDIO, INC.: NEW PRODUCT LAUNCHES

- TABLE 186 SKYDIO, INC.: DEALS

- 13.2.6 YUNEEC

- TABLE 187 YUNEEC: BUSINESS OVERVIEW

- TABLE 188 YUNEEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 YUNEEC HOLDING LTD.: DEALS

- 13.2.7 DRAGANFLY INC.

- TABLE 190 DRAGANFLY INC.: BUSINESS OVERVIEW

- TABLE 191 DRAGANFLY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 DRAGANFLY INC.: DEALS

- 13.2.8 BRINC DRONES, INC.

- TABLE 193 BRINC DRONES, INC.: COMPANY OVERVIEW

- TABLE 194 BRINC DRONES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 BRINC DRONES, INC.: NEW PRODUCT LAUNCHES

- TABLE 196 BRINC DRONES, INC.: DEALS

- 13.2.9 ONDAS HOLDINGS INC.

- TABLE 197 ONDAS HOLDINGS INC.: BUSINESS OVERVIEW

- FIGURE 44 ONDAS HOLDINGS INC.: COMPANY SNAPSHOT

- TABLE 198 ONDAS HOLDINGS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 ONDAS HOLDINGS INC.: DEALS

- 13.2.10 HARRIS AERIAL, INC.

- TABLE 200 HARRIS AERIAL, INC. COMPANY OVERVIEW

- TABLE 201 HARRIS AERIAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.11 LOCKHEED MARTIN CORPORATION

- TABLE 202 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- FIGURE 45 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 203 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 LOCKHEED MARTIN CORPORATION: DEALS

- 13.2.12 TEAL DRONES

- TABLE 205 TEAL DRONES: BUSINESS OVERVIEW

- TABLE 206 TEAL DRONES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 TEAL DRONES: NEW PRODUCT LAUNCHES

- TABLE 208 TEAL DRONES: OTHERS

- 13.2.13 DELAIR

- TABLE 209 DELAIR: BUSINESS OVERVIEW

- TABLE 210 DELAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.14 FLYABILITY

- TABLE 211 FLYABILITY: COMPANY OVERVIEW

- TABLE 212 FLYABILITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 FLYABILITY: NEW PRODUCT LAUNCHES

- TABLE 214 FLYABILITY: DEALS

- 13.2.15 WINGTRA

- TABLE 215 WINGTRA: COMPANY OVERVIEW

- TABLE 216 WINGTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 WINGTRA: NEW PRODUCT LAUNCHES

- TABLE 218 WINGTRA: DEALS

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 13.3 OTHER PLAYERS

- 13.3.1 AEE AVIATION TECHNOLOGY INC.

- TABLE 219 AEE AVIATION TECHNOLOGY INC.: COMPANY OVERVIEW

- 13.3.2 KESPRY

- TABLE 220 KESPRY: COMPANY OVERVIEW

- 13.3.3 INSITU, INC.

- TABLE 221 INSITU, INC.: COMPANY OVERVIEW

- 13.3.4 HOVERFLY TECHNOLOGIES

- TABLE 222 HOVERFLY TECHNOLOGIES: COMPANY OVERVIEW

- 13.3.5 MICRODRONES

- TABLE 223 MICRODRONES: COMPANY OVERVIEW

- 13.3.6 ELISTAIR

- TABLE 224 ELISTAIR: COMPANY OVERVIEW

- 13.3.7 ZIPLINE

- TABLE 225 ZIPLINE: COMPANY OVERVIEW

- 13.3.8 VOLOCOPTER GMBH

- TABLE 226 VOLOCOPTER GMBH: COMPANY OVERVIEW

- 13.3.9 AGEAGLE AERIAL SYSTEMS INC.

- TABLE 227 AGEAGLE AERIAL SYSTEMS INC.: COMPANY OVERVIEW

- 13.3.10 AUTERION GS

- TABLE 228 AUTERION GS: COMPANY OVERVIEW

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 MARKET DEFINITION

- 14.3 MARKET DYNAMICS

- 14.4 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.5 CUSTOMIZATION OPTIONS

- 14.6 RELATED REPORTS

- 14.7 AUTHOR DETAILS