|

|

市場調査レポート

商品コード

1297748

設備総合効率 (OEE) ソフトウェアの世界市場:提供別 (ソフトウェア、サービス)・展開方式別 (オンプレミス、クラウド)・種類別 (SCADA、クラウドERP、予知保全、データヒストリアン)・産業別 (自動車、医療、電力) の将来予測 (2028年まで)Overall Equipment Effectiveness Software Market by Offering (Software, Services), Deployment Mode (On-premises, Cloud), Type (SCADA, Cloud ERP, Predictive Maintenance, Data Historian), Industry (Automotive, Healthcare, Power) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 設備総合効率 (OEE) ソフトウェアの世界市場:提供別 (ソフトウェア、サービス)・展開方式別 (オンプレミス、クラウド)・種類別 (SCADA、クラウドERP、予知保全、データヒストリアン)・産業別 (自動車、医療、電力) の将来予測 (2028年まで) |

|

出版日: 2023年06月19日

発行: MarketsandMarkets

ページ情報: 英文 263 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の設備総合効率 (OEE) ソフトウェアの市場規模は、2023年の675億米ドルから2028年には1,224億米ドルまで、12.6%のCAGRで成長すると予測されます。

OEE市場全体の成長を促進する主な要因として、産業オートメーションソリューションの採用を拡大するイニシアチブの高まりや、効率性向上・リソース最適利用の確保に対するニーズの高まりなどが挙げられます。

"サービス分野が2023~2028年に最も高い成長率を維持"

OEEソフトウェアのサービスには、ユーザーエクスペリエンスを向上させ、ソフトウェアのメーカー向けの特典を最大化するために、ソフトウェアプロバイダーが提供するさまざまな追加機能とサポートが含まれます。ソフトウェア・プロバイダは、トレーニング、メンテナンス、インストール、ソフトウェア・アップグレード、その他様々なサービスを提供しています。専門知識、カスタマイズ、トレーニング、継続的なサポート、最適化サービスの必要性から、サービスに対する需要は急速に高まっています。

"展開方式別では、クラウド分野が予測期間中に最大のシェアを占める"

OEEソフトウェア向けクラウド技術は、設備効果に関連するデータの保存・処理・管理にクラウドコンピューティングインフラとサービスを利用することを指します。インターネットにホストされたリモートサーバーを活用してデータを安全に保存し、OEEソフトウェアのアプリケーションと機能へのアクセスを提供します。OEEソフトウェアのクラウド展開は、メーカーに拡張性・コスト効率性・管理の容易さ・アクセシビリティ・データ統合・継続的イノベーションを提供します。また、設備の有効性を最適化し、オペレーショナル・エクセレンスを推進するための柔軟で俊敏なプラットフォームも提供します。このため、予測期間中、製造業者によるクラウドベースのOEEソフトウェアの採用が増加すると予想されます。

"MES (製造実行システム) 分野が2022年に、種類別で第2位のシェアを占める"

MES (製造実行システム) は、生産スケジューリング、リソース割り当て、品質管理、リアルタイムデータ収集など、製造オペレーションを管理・制御するための包括的な機能を提供します。その結果、MESはOEE機能をより広範な製造実行機能群にシームレスに統合するのに適した立場にあります。この統合により、企業は生産プロセスの全体像を把握し、設備の有効性を監視し、ボトルネックを特定し、全体的な業務効率を最適化することができます。製造環境におけるMESシステムの確立された存在感は、OEE機能を組み込む能力と相まって、OEEソフトウェア市場におけるMESの支配的な地位につながっています。

"産業別では電力が予測期間中、2番目に高い市場成長率を占める"

電力産業は、タービン、発電機、変圧器などの複雑で重要な設備に大きく依存しており、効率的で信頼性の高い運転を確保するために効果的なモニタリングと最適化が必要です。OEEソフトウェアは、機器の性能を追跡し、潜在的な問題を特定し、全体的な効率を最適化するために必要なツールと分析を提供します。また、電力業界は、スマートグリッド、再生可能エネルギーの統合、高度な監視システムに重点を置き、著しいデジタル変革が進んでいます。OEEソフトウェアは、これらの先進技術を管理・最適化する上で重要な役割を果たし、電力業界での採用をさらに促進しています。これらの要因が相まって、予測期間中、電力業界がOEEソフトウェア市場で優位を占めると予想されます。

"北米が2022年にOEEソフトウェア市場を支配"

地域別では、2022年に北米が最大のシェアを占めました。同地域は技術進歩の最前線にあり、インダストリー4.0の原則を採用しています。IoT、人工知能、データ分析などの先進技術を製造プロセスに統合することで、設備の有効性を改善する機会が生まれます。OEEソフトウェアは、これらの技術を活用してリアルタイムデータを収集し、高度な分析を実行し、機器のパフォーマンスを最適化するための実用的な洞察を提供します。北米では、インダストリー4.0とDXへの取り組みへの注目が高まっており、これらの技術を実現する重要な手段としてOEEソフトウェアへの需要が高まっています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ

- 貿易分析

- 特許分析

- 主要な会議とイベント (2023年~2024年)

- 関税・規制状況

第6章 設備総合効率 (OEE) ソフトウェアの手法

- イントロダクション

- 可用性の計算

- 性能の計算

- 品質の計算

- リアルタイム監視

- 根本原因分析

- 予測分析

第7章 設備総合効率 (OEE) ソフトウェア市場:提供別

- イントロダクション

- ソフトウェア

- サービス

第8章 設備総合効率 (OEE) ソフトウェア市場:展開方式別

- イントロダクション

- オンプレミス

- クラウド

第9章 設備総合効率 (OEE) ソフトウェア市場:種類別

- イントロダクション

- SCADA (監視制御・データ収集)

- MES (製造実行システム)

- クラウドERP (企業資源計画)

- 予知保全

- データヒストリアン

第10章 設備総合効率 (OEE) ソフトウェア市場:業種別

- イントロダクション

- 航空宇宙・防衛

- 自動車

- 化学

- 食品・飲料

- 医療

- 金属・鉱業

- 石油・ガス

- 電力

- エレクトロニクス・半導体

- その他

第11章 設備総合効率 (OEE) ソフトウェア市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋

- その他の地域 (ROW)

- 中東・アフリカ

- 南米

第12章 競合情勢

- イントロダクション

- 上位企業の収益分析

- 上位企業の市場シェア分析 (2022年)

- 企業評価クアドラント (2021年)

- 中小企業 (SME) の評価クアドラント (2021年)

- SCADA市場:企業のフットプリント

- 競合ベンチマーキング

- 競争シナリオと動向

第13章 企業プロファイル

- 主要企業

- ABB

- SIEMENS

- SCHNEIDER ELECTRIC

- GENERAL ELECTRIC

- HONEYWELL INTERNATIONAL, INC.

- ROCKWELL AUTOMATION

- SAP

- MICROSOFT

- EMERSON ELECTRIC, CO.

- ORACLE

- その他の企業

- CAPULA LTD.

- ING. PUNZENBERGER COPA-DATA GMBH

- DATA FLOW SYSTEMS, INC.

- DETECHTION TECHNOLOGIES

- ELYNX TECHNOLOGIES, LLC

- 42Q

- AEGIS SOFTWARE

- CRITICAL MANUFACTURING

- EPICOR SOFTWARE CORPORATION

- EYELIT

- TALLY SOLUTIONS PRIVATE LIMITED

- MIE SOLUTIONS

- ACUMATICA, INC.

- GENIUS SOLUTIONS

- BRIGHTPEARL

第14章 付録

The global overall equipment effectiveness software market size is expected to grow from USD 67.5 billion in 2023 to USD 122.4 billion by 2028, at a CAGR of 12.6%. The key factors driving the overall equipment effectiveness software market growth are the rising initiatives to increase the adoption of industrial automation solutions and the growing need for enhancing efficiency and ensuring optimal use of resources.

"Services segment to hold highest growth rate from 2023-2028"

Services in OEE software encompass a range of additional features and support provided by software providers to enhance the user experience and maximize the benefits of the software for manufacturers. Software providers offer services such as training, maintenance, installation, software upgradation, and various other services. The demand for services is rising rapidly owing to the need for specialized expertise, customization, training, ongoing support, and optimization services.

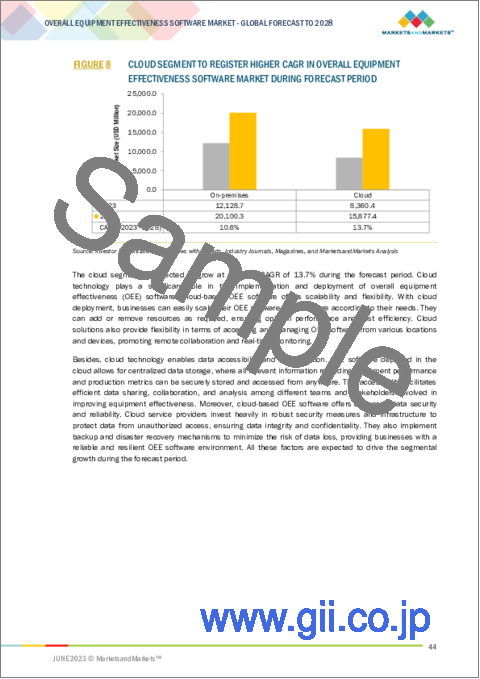

"Cloud segment holds the largest share of overall equipment effectiveness software during the forecast period"

Cloud technology in overall equipment effectiveness software refers to utilizing cloud computing infrastructure and services to store, process, and manage data related to equipment effectiveness. It involves leveraging remote servers hosted on the internet to securely store data and provide access to OEE software applications and functionalities. Cloud deployment in OEE software offers manufacturers scalability, cost efficiency, ease of management, accessibility, data integration, and continuous innovation. It also provides organizations with a flexible and agile platform to optimize their equipment effectiveness and drive operational excellence. This, in turn, is expected to increase the adoption of cloud-based OEE software by manufacturers during the forecast period.

"Manufacturing Execution System (MES) segment holds the second-largest share of overall equipment effectiveness software market in 2022"

Manufacturing execution systems (MES) provide comprehensive capabilities for managing and controlling manufacturing operations, including production scheduling, resource allocation, quality management, and real-time data collection. As a result, they are well-positioned to integrate OEE functionality seamlessly within their broader suite of manufacturing execution capabilities. This integration allows businesses to have a holistic view of their production processes, enabling them to monitor equipment effectiveness, identify bottlenecks, and optimize overall operational efficiency. The established presence of MES systems in manufacturing environments, coupled with their ability to incorporate OEE functionalities, has led to their dominant position in the OEE software market.

"Power industry to hold second-largest growth rate of the market during the forecast period"

The power industry relies heavily on complex and critical equipment, such as turbines, generators, and transformers, which require effective monitoring and optimization to ensure efficient and reliable operations. OEE software provides the necessary tools and analytics to track equipment performance, identify potential issues, and optimize overall efficiency. Besides, the power industry is undergoing significant digital transformation, focusing on smart grids, renewable energy integration, and advanced monitoring systems. OEE software plays a vital role in managing and optimizing these advanced technologies, further driving its adoption in the power industry. These factors combined contribute to the power industry's expected dominance in the OEE software market during the forecast period.

"North America dominated the overall equipment effectiveness software market in 2022"

North America held the largest share of the global overall equipment effectiveness software market in 2022. The region is at the forefront of technological advancements and adopting Industry 4.0 principles. Integrating advanced technologies such as the IoT, artificial intelligence, and data analytics in manufacturing processes creates opportunities for improving equipment effectiveness. OEE software leverages these technologies to collect real-time data, perform advanced analytics, and provide actionable insights for optimizing equipment performance. The growing focus on Industry 4.0 and digital transformation initiatives in North America drives the demand for OEE software as a critical enabler of these technologies.

The break-up of the profiles of primary participants for the report has been given below:

- By Company Type: Tier 1 = 52%, Tier 2 = 31%, and Tier 3 = 17%

- By Designation: C-Level Executives = 47%, Directors = 31%, and Others= 22%

- By Region: North America = 40%, Europe = 27%, Asia Pacific = 26%, and RoW = 08%

Major players operating in the overall equipment effectiveness software market include Siemens (Germany), Schneider Electric (France), ABB (Switzerland), Emerson Electric, Co. (US), and Rockwell Automation (US), among others.

Research Coverage:

The research report on the global overall equipment effectiveness software market covers the market based on overall equipment effectiveness software methods, offering, deployment mode, type, industry, and region. Based on overall equipment effectiveness software methods, the market has been segmented into availability calculation, performance calculation, quality calculation, real-time monitoring, root cause analysis, and predictive analytics. Based on the offering, the market has been segmented into software and services. The market has been segmented based on deployment mode into on-premises and cloud. Based on type, the market has been segmented into supervisory control and data acquisition (SCADA), manufacturing execution system (MES), cloud enterprise resource planning (ERP), predictive maintenance, and data historian. Based on industry, the market has been segmented into aerospace & defense, automotive, chemical, food & beverage, healthcare, metal & mining, oil & gas, power, electronics & semiconductor, and others. The report covers four major regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW).

Key Benefits of Buying the Report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall equipment effectiveness software market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising usage of ERP software for performing a variety of functions across industries. Increase in the number of initiatives to drive the adoption of industrial automation solutions. The rising necessity for improving efficiency and ensuring optimum utilization of resources. Growing demand for cloud-based applications. Need for a connected supply chain and mass production to cater to the rising global population. Rising adoption of IoT and AI across manufacturing industries globally.), restraints (High initial capital investments and growing maintenance and upgradation costs. Concerns pertaining to data breach. Exponentially growing demand for a skilled workforce. Lack of customization options for SaaS ERP solutions), opportunities (Rising integration of MES with PLM and ERP solutions. Growing demand for connected technologies and rising internet penetration. Rapid developments in wireless sensor networks.), and challenges (Growing concerns regarding integration issues of certain OEE software with legacy systems. Growing complexities in deploying OEE software across various industries. Frequent upgradation and maintenance. Growing number of automated cyberattacks) influencing the growth of the overall equipment effectiveness software market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the overall equipment effectiveness software market

- Market Development: Comprehensive information about lucrative markets - the report analyses the overall equipment effectiveness software market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the overall equipment effectiveness software market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Siemens (Germany), Schneider Electric (France), ABB (Switzerland), Emerson Electric, Co. (US), and Rockwell Automation (US), among others in the overall equipment effectiveness software market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED THROUGH SALES OF PRODUCTS/SOLUTIONS/SERVICES PERTAINING TO SCADA MARKET

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 APPROACH TO UNDERSTAND IMPACT OF RECESSION ON OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET

- 2.6 RESEARCH LIMITATIONS AND RISK ASSESSMENT

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- FIGURE 7 SOFTWARE SEGMENT TO DOMINATE OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN 2023

- FIGURE 8 CLOUD SEGMENT TO REGISTER HIGHER CAGR IN OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET DURING FORECAST PERIOD

- FIGURE 9 CLOUD ERP SEGMENT TO DOMINATE OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET DURING FORECAST PERIOD

- FIGURE 10 HEALTHCARE SEGMENT TO REGISTER HIGHEST CAGR IN OVERALL EQUIPMENT EFFECTIVENESS MARKET DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET

- FIGURE 12 RISING DEMAND FOR REAL-TIME MONITORING AND ANALYSIS OF PRODUCTION PERFORMANCE TO DRIVE MARKET

- 4.2 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY OFFERING

- FIGURE 13 SOFTWARE SEGMENT TO ACCOUNT FOR LARGER SHARE OF OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN 2023

- 4.3 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY DEPLOYMENT MODE

- FIGURE 14 CLOUD SEGMENT TO REGISTER HIGHER CAGR IN OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET DURING FORECAST PERIOD

- 4.4 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE

- FIGURE 15 CLOUD ERP SEGMENT TO ACCOUNT FOR LARGEST SHARE OF OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN 2023

- 4.5 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY

- FIGURE 16 AEROSPACE & DEFENSE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN 2023

- 4.6 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION

- FIGURE 17 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Significant rise in demand for ERP software across several industries

- 5.2.1.2 Government initiatives promoting use of industrial automation solutions

- 5.2.1.3 Increased focus of manufacturing firms on improving efficiency, reducing wastage, and optimizing resource utilization

- 5.2.1.4 High demand for cloud-based applications

- 5.2.1.5 Urgent need for connected supply chains and mass production to meet requirements of growing population

- 5.2.1.6 Elevated use of IoT and AI by manufacturing firms

- FIGURE 19 OVERALL EQUIPMENT EFFECTIVENESS (OEE) SOFTWARE MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment, coupled with high costs of maintenance and system upgrade

- 5.2.2.2 Data security concerns

- 5.2.2.3 Indispensable requirement for skilled workforce

- 5.2.2.4 Limited customization options for SaaS ERP solutions

- FIGURE 20 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of MES with PLM and ERP solutions

- 5.2.3.2 Rising demand for connected technologies with growing penetration of internet

- 5.2.3.3 Rapid developments in wireless sensor networks

- FIGURE 21 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues pertaining to integration of certain OEE software with legacy systems

- 5.2.4.2 Complexities associated with deployment of OEE software across various industries

- 5.2.4.3 Need for regular upgrading and maintenance of AI-based IoT solutions

- 5.2.4.4 Growing number of automated cyberattacks

- FIGURE 22 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 23 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 24 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: ECOSYSTEM ANALYSIS

- TABLE 2 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE (ASP) ANALYSIS OF PRODUCTS OFFERED BY KEY PLAYERS

- FIGURE 25 AVERAGE LICENSE SUBSCRIPTION FEE FOR MES OFFERED BY KEY PLAYERS, BY LICENSE/SUBSCRIPTION TYPE

- TABLE 3 APPROXIMATE AVERAGE LICENSE SUBSCRIPTION FEE FOR MES, BY LICENSE/SUBSCRIPTION TYPE

- 5.5.1.1 Average selling price (ASP) trend

- TABLE 4 MANUFACTURING EXECUTION SYSTEM: AVERAGE PRICE ANALYSIS

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 CLOUD COMPUTING

- 5.7.2 ARTIFICIAL INTELLIGENCE (AI)

- 5.7.3 BLOCKCHAIN

- 5.7.4 EDGE COMPUTING

- 5.7.5 BIG DATA

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: PORTER'S FIVE FORCES ANALYSIS (2022)

- 5.8.1 BARGAINING POWER OF SUPPLIERS

- 5.8.2 BARGAINING POWER OF BUYERS

- 5.8.3 THREAT OF NEW ENTRANTS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- 5.9.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- 5.10 CASE STUDIES

- TABLE 7 SIRIO RETAIL OPERATIONS LTD. USED MICROSOFT'S FLEXIBLE ERP SOFTWARE TO STREAMLINE PROCESSES

- TABLE 8 COOPER TIRE ADOPTED ROCKWELL AUTOMATION'S MES SOLUTION TO IMPROVE EFFICIENCY

- TABLE 9 PROPHARMA DISTRIBUTION ADOPTED ACUMATICA'S CLOUD ERP TO ELIMINATE SYSTEM INTEGRATION CHALLENGES

- TABLE 10 LEADING TELECOM OPERATOR DEPLOYED AVANSEUS' FULL-STACK PREDICTIVE MAINTENANCE SOLUTION TO BECOME 5G-READY

- 5.11 TRADE ANALYSIS

- FIGURE 30 IMPORT DATA FOR HS CODE 903289, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR HS CODE 903289, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS DURING LAST 10 YEARS

- FIGURE 33 NUMBER OF PATENTS GRANTED PER YEAR, 2013-2022

- TABLE 11 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 12 LIST OF MAJOR PATENTS

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 13 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: REGION-WISE CONFERENCES AND EVENTS

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS

- TABLE 18 STANDARDS FOR OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET

6 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE METHODS

- 6.1 INTRODUCTION

- FIGURE 34 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE METHODS

- 6.2 AVAILABILITY CALCULATION

- 6.2.1 USED TO DETERMINE EQUIPMENT AVAILABILITY FOR PRODUCTION

- 6.3 PERFORMANCE CALCULATION

- 6.3.1 USED TO ASSESS OPERATING EFFICIENCY AND SPEED OF EQUIPMENT

- 6.4 QUALITY CALCULATION

- 6.4.1 HELPS EVALUATE EQUIPMENT'S ABILITY TO PRODUCE HIGH-QUALITY PRODUCTS

- 6.5 REAL-TIME MONITORING

- 6.5.1 INVOLVES IMMEDIATE AND CONSTANT TRACKING OF EQUIPMENT PERFORMANCE AND STATUS

- 6.6 ROOT CAUSE ANALYSIS

- 6.6.1 IDENTIFIES FACTORS RESPONSIBLE FOR EQUIPMENT FAILURE

- 6.7 PREDICTIVE ANALYTICS

- 6.7.1 USED TO FORECAST FUTURE EQUIPMENT PERFORMANCE

7 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY OFFERING

- 7.1 INTRODUCTION

- FIGURE 35 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY OFFERING

- FIGURE 36 SOFTWARE SEGMENT TO ACCOUNT FOR LARGER SIZE OF OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN 2023

- TABLE 19 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 20 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 7.2 SOFTWARE

- 7.2.1 RISING ADOPTION OF OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE TO ENHANCE EQUIPMENT PERFORMANCE TO BOOST MARKET

- 7.3 SERVICES

- 7.3.1 INCREASING NEED FOR INSTALLATION, TRAINING, MAINTENANCE, AND UPGRADE SERVICES TO DRIVE MARKET

8 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- FIGURE 37 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY DEPLOYMENT MODE

- FIGURE 38 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER SHARE OF OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN 2023

- TABLE 21 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019-2022 (USD MILLION)

- TABLE 22 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 8.2 ON-PREMISES

- 8.2.1 INCLINATION OF MANUFACTURERS TOWARD ON-PREMISES DEPLOYMENT OWING TO SAFETY AND SECURITY BENEFITS

- 8.3 CLOUD

- 8.3.1 INCREASING DEMAND FOR CLOUD-BASED SOLUTIONS DUE TO THEIR HIGH SCALABILITY

9 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE

- 9.1 INTRODUCTION

- FIGURE 39 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE

- FIGURE 40 PREDICTIVE MAINTENANCE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 23 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 24 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.2 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

- 9.2.1 USE OF SCADA OEE SOFTWARE TO IMPROVE PRODUCTION EFFICIENCY AND SCALABILITY

- TABLE 25 SCADA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 26 SCADA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 27 SCADA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 28 SCADA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 29 SCADA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 SCADA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR SCADA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR SCADA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 33 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR SCADA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 34 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR SCADA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR SCADA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 36 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR SCADA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 37 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR SCADA, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR SCADA, BY REGION, 2023-2028 (USD MILLION)

- 9.3 MANUFACTURING EXECUTION SYSTEM (MES)

- 9.3.1 RISING DEMAND FOR MES TO EFFECTIVELY INTEGRATE CRITICAL DATA FROM MULTIPLE SYSTEMS AND PROCESSES

- TABLE 39 MES: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 40 MES: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 41 MES: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 MES: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR MES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR MES, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 45 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR MES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 46 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR MES, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR MES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 48 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR MES, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 49 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR MES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 50 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR MES, BY REGION, 2023-2028 (USD MILLION)

- 9.4 CLOUD ENTERPRISE RESOURCE PLANNING (ERP)

- 9.4.1 SURGING ADOPTION OF CLOUD ERP FOR EFFECTIVE REPORTING AND VISUALIZATION OF OEE DATA

- TABLE 51 CLOUD ERP: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 52 CLOUD ERP: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 53 CLOUD ERP: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2019-2022 (USD MILLION)

- TABLE 54 CLOUD ERP: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 55 CLOUD ERP: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 56 CLOUD ERP: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 57 CLOUD ERP: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 CLOUD ERP: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR CLOUD ERP, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR CLOUD ERP, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 61 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR CLOUD ERP, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 62 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR CLOUD ERP, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR CLOUD ERP, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 64 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR CLOUD ERP, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 65 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR CLOUD ERP, BY REGION, 2019-2022 (USD MILLION)

- TABLE 66 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR CLOUD ERP, BY REGION, 2023-2028 (USD MILLION)

- 9.5 PREDICTIVE MAINTENANCE

- 9.5.1 HEIGHTENED ADOPTION OF PREDICTIVE MAINTENANCE DUE TO SHIFT TOWARD PROACTIVE AND DATA-DRIVEN APPROACH

- TABLE 67 PREDICTIVE MAINTENANCE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 68 PREDICTIVE MAINTENANCE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 69 PREDICTIVE MAINTENANCE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 70 PREDICTIVE MAINTENANCE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 71 PREDICTIVE MAINTENANCE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2019-2022 (USD MILLION)

- TABLE 72 PREDICTIVE MAINTENANCE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 73 PREDICTIVE MAINTENANCE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 74 PREDICTIVE MAINTENANCE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 75 PREDICTIVE MAINTENANCE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 PREDICTIVE MAINTENANCE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR PREDICTIVE MAINTENANCE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR PREDICTIVE MAINTENANCE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 79 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR PREDICTIVE MAINTENANCE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 80 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR PREDICTIVE MAINTENANCE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR PREDICTIVE MAINTENANCE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR PREDICTIVE MAINTENANCE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 83 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR PREDICTIVE MAINTENANCE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 84 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR PREDICTIVE MAINTENANCE, BY REGION, 2023-2028 (USD MILLION)

- 9.6 DATA HISTORIAN

- 9.6.1 INCREASING DEMAND FOR DATA HISTORIAN TO IDENTIFY AND TACKLE DOWNTIME PATTERNS BASED ON HISTORICAL DATA

- TABLE 85 DATA HISTORIAN: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 86 DATA HISTORIAN: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 87 DATA HISTORIAN: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2019-2022 (USD MILLION)

- TABLE 88 DATA HISTORIAN: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 89 DATA HISTORIAN: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 90 DATA HISTORIAN: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 91 DATA HISTORIAN: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 92 DATA HISTORIAN: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 93 DATA HISTORIAN: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 94 DATA HISTORIAN: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR DATA HISTORIAN, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR DATA HISTORIAN, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 97 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR DATA HISTORIAN, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 98 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR DATA HISTORIAN, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR DATA HISTORIAN, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR DATA HISTORIAN, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 101 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR DATA HISTORIAN, BY REGION, 2019-2022 (USD MILLION)

- TABLE 102 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET FOR DATA HISTORIAN, BY REGION, 2023-2028 (USD MILLION)

10 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 41 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY

- FIGURE 42 AEROSPACE & DEFENSE SEGMENT TO CAPTURE LARGEST SHARE OF OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN 2023

- TABLE 103 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 104 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.2 AEROSPACE & DEFENSE

- 10.2.1 INCREASING IMPLEMENTATION OF OEE SOFTWARE TO OPTIMIZE PRODUCTION PROCESSES

- TABLE 105 AEROSPACE & DEFENSE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 106 AEROSPACE & DEFENSE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3 AUTOMOTIVE

- 10.3.1 INCREASING ADOPTION OF OEE SOFTWARE TO REDUCE UNPLANNED DOWNTIME AND OPTIMIZE PRODUCTION SCHEDULES

- TABLE 107 AUTOMOTIVE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 108 AUTOMOTIVE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4 CHEMICAL

- 10.4.1 GROWING DEMAND FOR OEE SOFTWARE TO MEET REGULATORY REQUIREMENTS

- TABLE 109 CHEMICAL: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 110 CHEMICAL: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5 FOOD & BEVERAGE

- 10.5.1 INCREASING NEED TO MONITOR PERFORMANCE OF FOOD & BEVERAGE PRODUCTION EQUIPMENT TO GENERATE DEMAND FOR OEE SOFTWARE

- TABLE 111 FOOD & BEVERAGE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 112 FOOD & BEVERAGE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.6 HEALTHCARE

- 10.6.1 INCREASING IMPLEMENTATION OF OEE SOFTWARE TO TRACK AND ANALYZE UTILIZATION OF MEDICAL EQUIPMENT

- TABLE 113 HEALTHCARE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 114 HEALTHCARE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.7 METAL & MINING

- 10.7.1 RISING ADOPTION OF OEE SOFTWARE FOR MAINTENANCE AND ASSET MANAGEMENT IN MINING

- TABLE 115 METAL & MINING: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 116 METAL & MINING: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.8 OIL & GAS

- 10.8.1 NEED TO IDENTIFY ENERGY-INTENSIVE PROCESSES AND GAIN INSIGHTS TO OPTIMIZE ENERGY IN OIL & GAS OPERATIONS TO INCREASE DEMAND FOR OEE SOFTWARE

- TABLE 117 OIL & GAS: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 118 OIL & GAS: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.9 POWER

- 10.9.1 NEED TO MAKE INFORMED DECISIONS AND IMPROVE ENERGY EFFICIENCY TO FUEL ADOPTION OF OEE SOFTWARE

- TABLE 119 POWER: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 120 POWER: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.10 ELECTRONICS & SEMICONDUCTOR

- 10.10.1 INCREASING COMPLEXITY AND SCALE OF MANUFACTURING OPERATIONS TO RESULT IN ADOPTION OF OEE SOFTWARE

- TABLE 121 ELECTRONICS & SEMICONDUCTOR: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 122 ELECTRONICS & SEMICONDUCTOR: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.11 OTHERS

- TABLE 123 OTHERS: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 124 OTHERS: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

11 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 43 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION

- FIGURE 44 GEOGRAPHIC SNAPSHOT FOR OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, 2023-2028

- TABLE 125 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 126 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: IMPACT OF RECESSION

- FIGURE 45 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET SNAPSHOT

- FIGURE 46 US TO DOMINATE OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN NORTH AMERICA DURING FORECAST PERIOD

- TABLE 127 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 128 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 130 NORTH AMERICA: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Dominated North American market in 2022

- 11.2.3 CANADA

- 11.2.3.1 Demand from automotive and food & beverage sectors to drive market

- 11.2.4 MEXICO

- 11.2.4.1 Growing demand from manufacturing industry to fuel market growth

- 11.3 EUROPE

- 11.3.1 EUROPE: IMPACT OF RECESSION

- FIGURE 47 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET SNAPSHOT

- FIGURE 48 GERMANY TO ACCOUNT FOR LARGEST SHARE OF OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN EUROPE IN 2023

- TABLE 131 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 132 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 133 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 134 EUROPE: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Rising focus on digital transformation to foster market growth

- 11.3.3 GERMANY

- 11.3.3.1 Increasing adoption of OEE software in automotive industry to augment market growth

- 11.3.4 FRANCE

- 11.3.4.1 Growing investments in industrial transformation to lead to market growth

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 49 APAC PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET SNAPSHOT

- FIGURE 50 INDIA TO BE FASTEST-GROWING OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- TABLE 135 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Increasing focus on enhancing digital transformation and manufacturing efficiency to augment market growth

- 11.4.3 JAPAN

- 11.4.3.1 Rising emphasis on smart manufacturing to generate demand for OEE software

- 11.4.4 INDIA

- 11.4.4.1 Increasing government initiatives to boost manufacturing to propel market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 REST OF THE WORLD (ROW)

- 11.5.1 REST OF THE WORLD: IMPACT OF RECESSION

- FIGURE 51 MIDDLE EAST & AFRICA TO DOMINATE OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET IN REST OF THE WORLD IN 2023

- TABLE 139 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 140 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 141 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 142 REST OF THE WORLD: OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Growing adoption of OEE software in oil & gas industry to support market growth

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Increasing adoption of OEE software by various industries to encourage market growth

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- TABLE 143 KEY DEVELOPMENTS IN OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET, 2021-2023

- 12.2 REVENUE ANALYSIS OF TOP COMPANIES

- FIGURE 52 SCADA MARKET: REVENUE ANALYSIS (2022)

- 12.3 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2022

- FIGURE 53 SHARE OF MAJOR PLAYERS IN SCADA MARKET, 2022

- TABLE 144 SCADA MARKET: DEGREE OF COMPETITION

- 12.4 COMPANY EVALUATION QUADRANT, 2021

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- FIGURE 54 SCADA MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

- 12.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- FIGURE 55 SCADA MARKET: SMES EVALUATION QUADRANT, 2021

- 12.6 SCADA MARKET: COMPANY FOOTPRINT

- TABLE 145 COMPANY FOOTPRINT

- TABLE 146 COMPANY END-USER FOOTPRINT

- TABLE 147 COMPANY OFFERING FOOTPRINT

- TABLE 148 COMPANY REGION FOOTPRINT

- 12.7 COMPETITIVE BENCHMARKING

- TABLE 149 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 150 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.8 COMPETITIVE SCENARIOS AND TRENDS

- 12.8.1 PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 151 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, MARCH 2021-OCTOBER 2022

- 12.8.2 DEALS

- TABLE 152 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: DEALS, JANUARY 2021-JANUARY 2023

- 12.8.3 OTHERS

- TABLE 153 OVERALL EQUIPMENT EFFECTIVENESS SOFTWARE MARKET: OTHERS, JUNE 2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 13.1.1 ABB

- TABLE 154 ABB: COMPANY OVERVIEW

- FIGURE 56 ABB: COMPANY SNAPSHOT

- TABLE 155 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 ABB: DEALS

- 13.1.2 SIEMENS

- TABLE 157 SIEMENS: COMPANY OVERVIEW

- FIGURE 57 SIEMENS: COMPANY SNAPSHOT

- TABLE 158 SIEMENS: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 159 SIEMENS: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 160 SIEMENS: DEALS

- 13.1.3 SCHNEIDER ELECTRIC

- TABLE 161 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 58 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 162 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 164 SCHNEIDER ELECTRIC: DEALS

- 13.1.4 GENERAL ELECTRIC

- TABLE 165 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 59 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 166 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 GENERAL ELECTRIC: PRODUCT LAUNCHES AND DEVELOPMENTS

- 13.1.5 HONEYWELL INTERNATIONAL, INC.

- TABLE 168 HONEYWELL INTERNATIONAL, INC.: COMPANY OVERVIEW

- FIGURE 60 HONEYWELL INTERNATIONAL, INC.: COMPANY SNAPSHOT

- TABLE 169 HONEYWELL INTERNATIONAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 HONEYWELL INTERNATIONAL, INC.: DEALS

- 13.1.6 ROCKWELL AUTOMATION

- TABLE 171 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- FIGURE 61 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- TABLE 172 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 ROCKWELL AUTOMATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 174 ROCKWELL AUTOMATION: DEALS

- TABLE 175 ROCKWELL AUTOMATION: OTHERS

- 13.1.7 SAP

- TABLE 176 SAP: COMPANY OVERVIEW

- FIGURE 62 SAP: COMPANY SNAPSHOT

- TABLE 177 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 SAP: PRODUCT LAUNCHES AND DEVELOPMENTS

- 13.1.8 MICROSOFT

- TABLE 179 MICROSOFT: COMPANY OVERVIEW

- FIGURE 63 MICROSOFT: COMPANY SNAPSHOT

- TABLE 180 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 MICROSOFT: PRODUCT LAUNCHES AND DEVELOPMENTS

- 13.1.9 EMERSON ELECTRIC, CO.

- TABLE 182 EMERSON ELECTRIC, CO.: COMPANY OVERVIEW

- FIGURE 64 EMERSON ELECTRIC, CO.: COMPANY SNAPSHOT

- TABLE 183 EMERSON ELECTRIC, CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 EMERSON ELECTRIC, CO.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 185 EMERSON ELECTRIC, CO.: DEALS

- 13.1.10 ORACLE

- TABLE 186 ORACLE: COMPANY OVERVIEW

- FIGURE 65 ORACLE: COMPANY SNAPSHOT

- TABLE 187 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 CAPULA LTD.

- TABLE 188 CAPULA LTD.: COMPANY OVERVIEW

- 13.2.2 ING. PUNZENBERGER COPA-DATA GMBH

- TABLE 189 ING. PUNZENBERGER COPA-DATA GMBH: COMPANY OVERVIEW

- 13.2.3 DATA FLOW SYSTEMS, INC.

- TABLE 190 DATA FLOW SYSTEMS, INC.: COMPANY OVERVIEW

- 13.2.4 DETECHTION TECHNOLOGIES

- TABLE 191 DETECHTION TECHNOLOGIES: COMPANY OVERVIEW

- 13.2.5 ELYNX TECHNOLOGIES, LLC

- TABLE 192 ELYNX TECHNOLOGIES, LLC: COMPANY OVERVIEW

- 13.2.6 42Q

- TABLE 193 42Q: COMPANY OVERVIEW

- 13.2.7 AEGIS SOFTWARE

- TABLE 194 AEGIS SOFTWARE: COMPANY OVERVIEW

- 13.2.8 CRITICAL MANUFACTURING

- TABLE 195 CRITICAL MANUFACTURING: COMPANY OVERVIEW

- 13.2.9 EPICOR SOFTWARE CORPORATION

- TABLE 196 EPICOR SOFTWARE CORPORATION: COMPANY OVERVIEW

- 13.2.10 EYELIT

- TABLE 197 EYELIT: COMPANY OVERVIEW

- 13.2.11 TALLY SOLUTIONS PRIVATE LIMITED

- TABLE 198 TALLY SOLUTIONS PRIVATE LIMITED: COMPANY OVERVIEW

- 13.2.12 MIE SOLUTIONS

- TABLE 199 MIE SOLUTIONS: COMPANY OVERVIEW

- 13.2.13 ACUMATICA, INC.

- TABLE 200 ACUMATICA, INC.: COMPANY OVERVIEW

- 13.2.14 GENIUS SOLUTIONS

- TABLE 201 GENIUS SOLUTIONS: COMPANY OVERVIEW

- 13.2.15 BRIGHTPEARL

- TABLE 202 BRIGHTPEARL: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS