|

|

市場調査レポート

商品コード

1296491

遠距離音声認識の世界市場:エンドユーザー別 (マイクロフォン、デジタルシグナルプロセッサ、ソフトウェア)・マイクロフォンソリューション別 (シングルマイクロフォン、リニアアレイ、円形アレイ)・用途別・地域別の将来予測 (2028年まで)Far-Field Speech and Voice Recognition Market by Component (Microphones, Digital Signal Processors, Software), Microphone Solutions (Single Microphone, Linear Arrays, Circular Arrays), Application and Geography - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 遠距離音声認識の世界市場:エンドユーザー別 (マイクロフォン、デジタルシグナルプロセッサ、ソフトウェア)・マイクロフォンソリューション別 (シングルマイクロフォン、リニアアレイ、円形アレイ)・用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月19日

発行: MarketsandMarkets

ページ情報: 英文 243 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の遠距離音声認識の市場規模は、2023年の37億米ドルから、2028年には69億米ドルに達し、2023年から2028年までの間に13.1%のCAGRで成長すると予測されています。

音声制御ベースのスマートスピーカーの普及、高度なフロントエンドハードウェアによる精度向上、深層学習ベースの遠距離マイクの技術進歩といった要因が、遠距離音声認識市場の成長を促進すると考えられています。

"マイクロフォン分野が予測期間中に最も高い成長率で成長する"

コンポーネント別に見ると、マイクロフォン分野が予測期間中に最も高いCAGRで成長すると予測されています。高度なノイズキャンセリング技術とビームフォーミング技術を搭載した遠距離マイクロフォンは、音声認識システムの精度を高めることができ、ノイズレベルの高い環境や長距離でもより優れた性能を発揮することができます。このため、スマートスピーカー・サウンドバー・スマートテレビなどの様々なスマート機器と一体化した、部屋全体から音声コマンドを補足できる高品質マイクに対する需要が高まっています。この動向がハイエンドマイクの新たな市場を生み出し、個人が簡単にデバイスを制御して全体的な体験を向上させることを可能にしています。

"自動車向け用途が予測期間中に大幅な成長を遂げる"

自動車産業向け遠距離音声認識市場の成長は、いくつかの要因によって牽引されています。その中には、コネクテッドカーの需要増加や、より安全な運転の必要性、ハンズフリー通信の利便性などが含まれます。自然言語処理と機械学習の進歩により、自動車システムが音声コマンドを正確に認識し応答することが可能になり、市場の成長をさらに促進しています。その結果、自動車業界の大手企業は、遠距離音声認識の開発に多額の投資を行い、技術革新を推進し、新たな成長機会を生み出しています。

"北米が予測期間中、大きな市場シェアを占める"

予測期間中、北米が遠距離音声認識市場で大きなシェアを占めると予想されます。この地域は、人工知能 (AI) やモノのインターネット (IoT) などの最新技術の統合に高い反応を見せています。北米の遠距離音声認識市場は、民生用電子機器や自動車を含むさまざまな最終用途別の市場において、AIソフトウェアの採用が増加し、ニューラルネットワークが大規模に展開されていることが主な要因となっています。民生用電子機器では、スマートスピーカーが遠距離音声認識市場の主要な応用分野の一つです。コネクテッドデバイスやスマートデバイスの人気の高まりが、この地域のスマートスピーカー市場の成長を後押ししています。National Public Radio (NPR) (米国) の調査によると、2022年時点で米国人の35%がスマートスピーカーを所有しています。2021年には米国成人の32%がスマートスピーカーを所有していました。北米全域でのスマートスピーカーのこの大幅な増加は、同地域の市場機会を促進すると思われます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 技術分析

- バリューチェーン分析

- エコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- 平均販売価格分析

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主な会議とイベント (2023年~2024年)

- 料金分析

- 基準と規制状況

- 主要な利害関係者と購入基準

第6章 遠距離音声認識市場:コンポーネント別

- イントロダクション

- マイクロフォン

- デジタルシグナルプロセッサ

- ソフトウェア

第7章 遠距離音声認識市場:マイクロフォン用ソリューション別

- イントロダクション

- シングルマイクロフォン

- リニアアレイ

- 円形アレイ

第8章 遠距離音声認識市場:用途別

- イントロダクション

- スマートテレビ/STB

- スマートスピーカー

- 自動車

- ロボット工学

- その他

第9章 遠距離音声認識市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域 (ROW)

- 南米

- 中東・アフリカ

第10章 競合情勢

- 概要

- 収益分析

- 市場シェア分析 (2022年)

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合ベンチマーキング

- 遠距離音声認識市場:企業のフットプリント

- 競争シナリオと動向

第11章 企業プロファイル

- 主要企業

- QUALCOMM INCORPORATED

- HARMAN INTERNATIONAL

- STMICROELECTRONICS

- SYNAPTICS INCORPORATED

- NXP SEMICONDUCTORS

- KNOWLES CORPORATION

- ANDREA ELECTRONICS

- CIRRUS LOGIC

- MICROCHIP TECHNOLOGY INC.

- INFINEON TECHNOLOGIES AG

- その他の企業

- ANALOG DEVICES, INC.

- SENSORY INC.

- MEEAMI TECHNOLOGIES

- TDK CORPORATION

- VOCAL TECHNOLOGIES

- VESPER TECHNOLOGIES, INC.

- ALANGO TECHNOLOGIES LTD.

- MEDIATEK INC.

- CEVA, INC.

- FORTEMEDIA, INC.

- XMOS

- MATRIX

- ADAPTIVE DIGITAL TECHNOLOGIES

- GOERTEK

- SENSIBEL

第12章 付録

The far-field speech and voice recognition market is projected to grow from USD 3.7 billion in 2023 and is projected to reach USD 6.9 billion by 2028; it is expected to grow at a CAGR of 13.1% from 2023 to 2028.

Increasing adoption of voice control-based smart speakers, enhanced accuracy through advanced front-end hardware, and technical advancement of deep-learning-based far-field microphones are the factors expected to fuel the growth of the far-field speech and voice recognition market.

"Microphones segment of the far-field speech and voice recognition market to witness highest growth during the forecast period."

By component, the far-field speech and voice recognition market has been segmented into microphones, digital signal processors, and software. The microphones segment is expected to grow at the highest CAGR during the forecast period. Far-field microphones equipped with advanced noise-cancellation and beamforming technology can enhance the precision of voice recognition systems, leading to better performance even in environments with high levels of noise and over longer distances. This has resulted in a growing demand for high-quality microphones that can capture voice commands from across the room, as they have been integrated into various smart devices such as smart speakers, soundbars, and smart TVs. This trend has created a new market for high-end microphones, allowing individuals to easily control their devices and enhance their overall experience.

"Automotive application segment to witness significant growth for far-field speech and voice recognition market during the forecast period." The growth of the far-field speech and voice recognition market in the automotive industry is driven by several factors. These include the increasing demand for connected cars, the need for safer driving, and the convenience of hands-free communication. Advancements in natural language processing and machine learning are making it possible for automotive systems to accurately recognize and respond to spoken commands, further driving the growth of the market. As a result, major players in the automotive industry are investing heavily in the development of far-field speech and voice recognition technology, driving innovation, and creating new growth opportunities.

"North America to hold a major market share of the far-field speech and voice recognition market during the forecast period" North America is expected to hold a major market share for far-field speech and voice recognition market during the forecast period. The region has been highly responsive to the integration of the latest technologies, such as artificial intelligence (AI) and the Internet of Things (IoT). The North American far-field speech and voice recognition market is primarily driven by the increased adoption of AI software and large-scale deployment of neural networks across various end-use verticals, including consumer electronics and automotive. In consumer electronics, smart speakers are among the key application areas of the far-field speech and voice recognition market. The growing popularity of connected and smart devices boosts the growth of the smart speaker market in this region. According to a National Public Radio (NPR) (US) survey, 35% of Americans own a smart speaker as of 2022. In 2021, 32% of US adults owned a smart speaker. This significant increase in smart speakers across North America will fuel market opportunities in the region.

Extensive primary interviews were conducted with key industry experts in the far-field speech and voice recognition market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The break-up of primary participants for the report has been shown below:

The report profiles key players in the far-field speech and voice recognition market with their respective market ranking analysis. Prominent players profiled in this report are Qualcomm Incorporated (US), HARMAN International (US), Synaptics Incorporated (US), NXP Semiconductors (Netherlands), STMicroelectronics (Switzerland), Andrea Electronics (US), Cirrus Logic (US), Microchip Technology Inc. (US), Infineon Technologies AG (Germany) and Knowles Corporation (US).

Apart from this, Analog Devices, Inc. (US), Sensory, Inc. (US), Meeami Technologies (India), TDK Corporation (Japan), Vocal Technologies (US), Vesper Technologies (US), Alango Technologies Ltd. (Israel), MediaTek Inc. (Taiwan), CEVA, Inc. (US), Fortemedia, Inc. (US), XMOS (UK) are among a few emerging companies in the far-field speech and voice recognition market.

Research Coverage: This research report categorizes the far-field speech and voice recognition market on the basis of component, microphone solution, application, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the far-field speech and voice recognition market and forecasts the same till 2028. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the far-field speech and voice recognition ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall far-field speech and voice recognition market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Enhanced accuracy through advanced front-end hardware, Increasing adoption of voice control-based smart speakers, and Technological advancement of deep-learning-based far-field microphones), restraints (Privacy threats, and Lack of accuracy in noisy and harsh environments), opportunities (Expanding into multilingual and global markets, Deployment in smart home devices, and Increasing application in service robotics), and challenges (Power issues and lack of standardization) influencing the growth of the far-field speech and voice recognition market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the far-field speech and voice recognition market.

- Market Development: Comprehensive information about lucrative markets - the report analysis the far-field speech and voice recognition market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the far-field speech and voice recognition market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Qualcomm Incorporated (US), HARMAN International (US), Synaptics Incorporated (US), NXP Semiconductors (Netherlands), STMicroelectronics (Switzerland), among others in the far-field speech and voice recognition market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET SEGMENTATION

- 1.4.2 REGIONS COVERED

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.3 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF MARKET PLAYERS

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.1.1 Approach for capturing market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2.2.1 Approach for capturing market size using top-down analysis (supply side)

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 8 RESEARCH ASSUMPTIONS

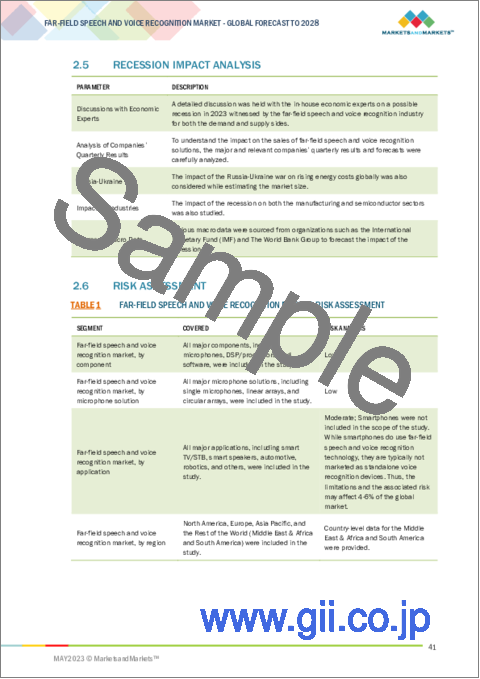

- 2.5 RECESSION IMPACT ANALYSIS

- 2.6 RISK ASSESSMENT

- TABLE 1 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 RECESSION ANALYSIS

- FIGURE 9 GDP GROWTH PROJECTIONS TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 10 RECESSION IMPACT ON FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, 2019-2028 (USD MILLION)

- FIGURE 11 DIGITAL SIGNAL PROCESSORS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 CIRCULAR ARRAYS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 SMART SPEAKERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET OVERVIEW

- FIGURE 15 INCREASING ADOPTION OF VIRTUAL ASSISTANTS AND SMART SPEAKERS TO BOOST MARKET DURING FORECAST PERIOD

- 4.2 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT

- FIGURE 16 DIGITAL SIGNAL PROCESSORS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.3 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY MICROPHONE SOLUTION AND APPLICATION

- FIGURE 17 CIRCULAR ARRAYS AND SMART SPEAKERS TO HOLD LARGEST MARKET SHARES IN 2023

- 4.4 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION

- FIGURE 18 NORTH AMERICA TO HAVE LARGEST SHARE OF FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET IN 2023

- 4.5 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY

- FIGURE 19 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Enhanced accuracy through advanced front-end hardware

- 5.2.1.2 Increasing adoption of voice control-based smart speakers

- 5.2.1.3 Technological advancement of deep learning-based far-field microphones

- FIGURE 21 DRIVERS FOR FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET AND THEIR IMPACT

- 5.2.2 RESTRAINTS

- 5.2.2.1 Privacy threats

- 5.2.2.2 Lack of accuracy in noisy and harsh environments

- FIGURE 22 RESTRAINTS FOR FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET AND THEIR IMPACT

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion into multilingual and global markets

- 5.2.3.2 Deployment in smart home devices

- 5.2.3.3 Increasing application in service robotics

- FIGURE 23 OPPORTUNITIES FOR GLOBAL FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET AND THEIR IMPACT

- 5.2.4 CHALLENGES

- 5.2.4.1 Power issues and lack of standardization

- FIGURE 24 CHALLENGES FOR FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET AND THEIR IMPACT

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 NEURAL NETWORK-BASED SPEECH RECOGNITION

- 5.3.2 ACOUSTIC ECHO CANCELLATION (AEC)

- 5.3.3 BEAMFORMING AND MICROPHONE ARRAYS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 25 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 26 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: ECOSYSTEM ANALYSIS

- TABLE 2 FAR-FILED SPEECH AND VOICE RECOGNITION MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 TRENDS/DISRUPTIONS IN FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.7.2 BARGAINING POWER OF SUPPLIERS

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 THREAT OF SUBSTITUTES

- 5.7.5 THREAT OF NEW ENTRANTS

- 5.8 AVERAGE SELLING PRICE ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE ANALYSIS OF FAR-FIELD MICROPHONES OFFERED BY MARKET PLAYERS FOR TOP THREE APPLICATIONS

- TABLE 4 AVERAGE SELLING PRICE ANALYSIS OF FAR-FIELD MICROPHONES BY MARKET PLAYERS FOR TOP THREE APPLICATIONS

- FIGURE 29 AVERAGE SELLING PRICE ANALYSIS OF FAR-FIELD DSP/PROCESSORS OFFERED BY MARKET PLAYERS FOR TOP THREE APPLICATIONS

- TABLE 5 AVERAGE SELLING PRICE ANALYSIS OF FAR-FIELD DSP/PROCESSORS BY MARKET PLAYERS FOR TOP THREE APPLICATIONS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 USE CASE 1: ARKX LABORATORIES ENABLED ROBUST FAR-FIELD VOICE CONTROL IN CHALLENGING ENVIRONMENTS

- 5.9.2 USE CASE 2: ARKX AFE ENHANCED VOICE INTERACTION IN SELF-SERVICE KIOSKS

- 5.9.3 USE CASE 3: ALEXA HELPED HAWAII PACIFIC HEALTH TO ENHANCE PATIENT EXPERIENCE THROUGH QUERY RESOLUTION

- 5.10 TRADE ANALYSIS

- FIGURE 30 IMPORT DATA FOR HS CODE 851810, BY COUNTRY, 2018-2022

- FIGURE 31 EXPORT DATA FOR HS CODE 851810, BY COUNTRY, 2018-2022

- FIGURE 32 IMPORT DATA FOR HS CODE 854231, BY COUNTRY, 2018-2022

- FIGURE 33 EXPORT DATA FOR HS CODE 854231, BY COUNTRY, 2018-2022

- 5.11 PATENT ANALYSIS

- FIGURE 34 NUMBER OF PATENTS GRANTED PER YEAR FROM 2013 TO 2022

- FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 6 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

- 5.11.1 LIST OF MAJOR PATENTS

- TABLE 7 LIST OF MAJOR PATENTS

- 5.12 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 8 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: KEY CONFERENCES AND EVENTS

- 5.13 TARIFF ANALYSIS

- TABLE 9 MFN TARIFF FOR HS CODE 851810 EXPORTED BY US

- TABLE 10 MFN TARIFF FOR HS CODE 851810 EXPORTED BY CHINA

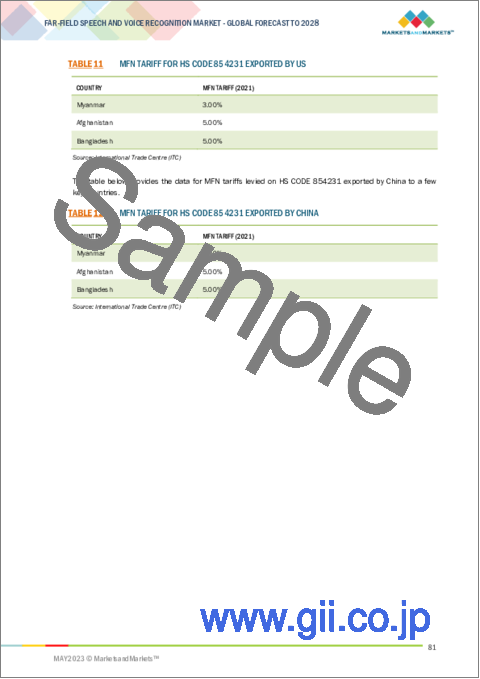

- TABLE 11 MFN TARIFF FOR HS CODE 854231 EXPORTED BY US

- TABLE 12 MFN TARIFF FOR HS CODE 854231 EXPORTED BY CHINA

- 5.14 STANDARDS AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 REGULATORY STANDARDS

- 5.14.2.1 ISO/IEC 19794-2

- 5.14.2.2 ISO/IEC 30107

- 5.14.2.3 Federal Information Processing Standards

- 5.14.2.4 European Telecommunications Standards Institute

- 5.14.2.5 ANSI/CTA-2082

- 5.14.2.6 EU RED Directive

- 5.14.3 GOVERNMENT REGULATIONS

- 5.14.3.1 US

- 5.14.3.2 European Union

- 5.14.3.3 China

- 5.14.3.4 Japan

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 38 DIGITAL SIGNAL PROCESSORS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 19 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 20 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 21 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 22 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 6.2 MICROPHONES

- 6.2.1 RISING DEMAND FOR VOICE-CONTROLLED DEVICES TO FUEL MARKET

- FIGURE 39 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET FOR MICROPHONES DURING FORECAST PERIOD

- TABLE 23 MICROPHONES: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 24 MICROPHONES: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 25 MICROPHONES: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 26 MICROPHONES: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 6.3 DIGITAL SIGNAL PROCESSORS

- 6.3.1 DEMAND FOR IMPROVED ACCURACY AND RELIABILITY IN DIGITAL COMMUNICATION TO DRIVE MARKET

- FIGURE 40 NORTH AMERICA TO LEAD MARKET FOR DIGITAL SIGNAL PROCESSORS DURING FORECAST PERIOD

- TABLE 27 DIGITAL SIGNAL PROCESSORS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 28 DIGITAL SIGNAL PROCESSORS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 29 DIGITAL SIGNAL PROCESSORS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 30 DIGITAL SIGNAL PROCESSORS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 6.4 SOFTWARE

- 6.4.1 CONTINUOUS ADVANCEMENTS IN AI, ML, AND SIGNAL PROCESSING TO ACCELERATE MARKET GROWTH

- FIGURE 41 NORTH AMERICA TO DOMINATE FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET IN SOFTWARE SEGMENT DURING FORECAST PERIOD

- TABLE 31 SOFTWARE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 SOFTWARE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 33 SOFTWARE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 34 SOFTWARE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

7 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY MICROPHONE SOLUTION

- 7.1 INTRODUCTION

- FIGURE 42 CIRCULAR ARRAYS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 35 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY MICROPHONE SOLUTION, 2019-2022 (MILLION UNITS)

- TABLE 36 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY MICROPHONE SOLUTION, 2023-2028 (MILLION UNITS)

- TABLE 37 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY MICROPHONE SOLUTION, 2019-2022 (USD MILLION)

- TABLE 38 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY MICROPHONE SOLUTION, 2023-2028 (USD MILLION)

- 7.2 SINGLE MICROPHONE

- 7.2.1 MAJOR APPLICATIONS IN IOT DEVICES TO DRIVE MARKET

- 7.3 LINEAR ARRAYS

- 7.3.1 DEMAND FOR SOUND LOCALIZATION AND IMPROVED VOICE RECOGNITION TO DRIVE MARKET

- 7.4 CIRCULAR ARRAYS

- 7.4.1 360-DEGREE COVERAGE TO BOOST DEMAND

8 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 43 SMART SPEAKERS TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 39 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 40 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2023-2028 (MILLION UNITS)

- TABLE 41 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 42 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 SMART TV/STB

- 8.2.1 INCREASING DEMAND FOR HANDS-FREE AND INTUITIVE CONTROL TO FUEL MARKET

- TABLE 43 SMART TV/STB: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 44 SMART TV/STB: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 45 SMART TV/STB: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 46 SMART TV/STB: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 47 SMART TV/STB: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 48 SMART TV/STB: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 49 SMART TV/STB: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 50 SMART TV/STB: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 SMART SPEAKERS

- 8.3.1 RISING DEMAND FOR VOICE-ENABLED SMART HOME DEVICES TO DRIVE MARKET

- TABLE 51 SMART SPEAKERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 52 SMART SPEAKERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 53 SMART SPEAKERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 54 SMART SPEAKERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 55 SMART SPEAKERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 56 SMART SPEAKERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 57 SMART SPEAKERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 SMART SPEAKERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 AUTOMOTIVE

- 8.4.1 RISING DEMAND FOR CONNECTED CARS TO BOOST MARKET

- TABLE 59 AUTOMOTIVE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 60 AUTOMOTIVE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 61 AUTOMOTIVE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 62 AUTOMOTIVE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 63 AUTOMOTIVE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 64 AUTOMOTIVE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 65 AUTOMOTIVE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 ROBOTICS

- 8.5.1 ADOPTION OF HOUSEHOLD ROBOTS TO DRIVE DEMAND

- TABLE 67 ROBOTICS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 68 ROBOTICS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 69 ROBOTICS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 70 ROBOTICS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 71 ROBOTICS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 72 ROBOTICS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 73 ROBOTICS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 74 ROBOTICS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 OTHERS

- TABLE 75 OTHERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 76 OTHERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 77 OTHERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 78 OTHERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 79 OTHERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 80 OTHERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 81 OTHERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 82 OTHERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (USD MILLION)

9 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 44 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 83 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 84 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 85 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 86 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 45 NORTH AMERICA: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET SNAPSHOT

- FIGURE 46 US TO DOMINATE NORTH AMERICAN MARKET DURING FORECAST PERIOD

- TABLE 87 NORTH AMERICA: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Improved focus on voice-enabled applications for automotive, healthcare, and retail sectors to fuel demand

- 9.2.3 CANADA

- 9.2.3.1 Technological advancements in AI and ML to drive market

- 9.2.4 MEXICO

- 9.2.4.1 Development of voice recognition systems tailored to local language, accents, and cultural preferences to propel market

- 9.3 EUROPE

- 9.3.1 EUROPE: RECESSION IMPACT

- FIGURE 47 EUROPE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET SNAPSHOT

- FIGURE 48 GERMANY TO DOMINATE EUROPEAN MARKET DURING FORECAST PERIOD

- TABLE 93 EUROPE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 94 EUROPE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 95 EUROPE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 96 EUROPE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 97 EUROPE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 98 EUROPE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 High demand for voice-controlled devices to propel market

- 9.3.3 UK

- 9.3.3.1 Rising penetration of voice-controlled smart TV in domestic households to augment market growth

- 9.3.4 FRANCE

- 9.3.4.1 Increasing adoption of voice-enabled devices to boost market

- 9.3.5 ITALY

- 9.3.5.1 Integration of voice recognition in vehicles by luxury auto brands to drive market

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 49 ASIA PACIFIC: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET SNAPSHOT

- FIGURE 50 CHINA TO DOMINATE ASIA PACIFIC MARKET DURING FORECAST PERIOD

- TABLE 99 ASIA PACIFIC: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Robust presence of key market players to support market

- 9.4.3 INDIA

- 9.4.3.1 Increased prevalence of mobile and Internet users to expand market growth

- 9.4.4 JAPAN

- 9.4.4.1 Rapid deployment of AI into innovative robotic devices to fuel market

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Technological innovations and tax incentives to provide impetus to market growth

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 ROW: RECESSION IMPACT

- TABLE 105 ROW: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 106 ROW: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 107 ROW: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 108 ROW: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 109 ROW: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 110 ROW: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.5.2 SOUTH AMERICA

- 9.5.2.1 Smart home and consumer applications to spur market growth

- 9.5.3 MIDDLE EAST & AFRICA

- 9.5.3.1 Strong focus on digital transformation to contribute to market growth

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.1.1 KEY GROWTH STRATEGIES ADOPTED BY LEADING PLAYERS IN FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET

- TABLE 111 KEY GROWTH STRATEGIES ADOPTED BY LEADING PLAYERS IN FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET

- 10.2 REVENUE ANALYSIS

- FIGURE 51 REVENUE ANALYSIS OF TOP 5 COMPANIES IN FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, 2020-2022

- 10.3 MARKET SHARE ANALYSIS (2022)

- TABLE 112 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: DEGREE OF COMPETITION

- 10.4 COMPANY EVALUATION MATRIX

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- FIGURE 52 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, COMPANY EVALUATION MATRIX, 2022

- 10.5 STARTUP/SME EVALUATION MATRIX

- TABLE 113 STARTUPS IN FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- FIGURE 53 STARTUP/SME EVALUATION MATRIX, 2022

- TABLE 114 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: LIST OF KEY STARTUPS

- 10.6 COMPETITIVE BENCHMARKING

- TABLE 115 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME

- 10.7 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: COMPANY FOOTPRINT

- TABLE 116 COMPANY FOOTPRINT

- TABLE 117 COMPANY COMPONENT FOOTPRINT

- TABLE 118 COMPANY MICROPHONE SOLUTION FOOTPRINT

- TABLE 119 COMPANY APPLICATION FOOTPRINT

- TABLE 120 COMPANY REGIONAL FOOTPRINT

- 10.8 COMPETITIVE SCENARIOS AND TRENDS

- 10.8.1 PRODUCT LAUNCHES

- TABLE 121 PRODUCT LAUNCHES, 2019-2023

- 10.8.2 DEALS

- TABLE 122 DEALS, 2020-2023

11 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 11.1 KEY PLAYERS

- 11.1.1 QUALCOMM INCORPORATED

- TABLE 123 QUALCOMM INCORPORATED: COMPANY OVERVIEW

- FIGURE 54 QUALCOMM INCORPORATED: COMPANY SNAPSHOT

- TABLE 124 QUALCOMM INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 125 QUALCOMM INCORPORATED: PRODUCT LAUNCHES

- TABLE 126 QUALCOMM INCORPORATED: DEALS

- 11.1.2 HARMAN INTERNATIONAL

- TABLE 127 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 55 HARMAN INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 128 HARMAN INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 HARMAN INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 130 HARMAN INTERNATIONAL: DEALS

- 11.1.3 STMICROELECTRONICS

- TABLE 131 STMICROELECTRONICS: COMPANY OVERVIEW

- FIGURE 56 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 132 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 134 STMICROELECTRONICS: DEALS

- 11.1.4 SYNAPTICS INCORPORATED

- TABLE 135 SYNAPTICS INCORPORATED: COMPANY OVERVIEW

- FIGURE 57 SYNAPTICS INCORPORATED: COMPANY SNAPSHOT

- TABLE 136 SYNAPTICS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 SYNAPTICS INCORPORATED: DEALS

- 11.1.5 NXP SEMICONDUCTORS

- TABLE 138 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- FIGURE 58 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- TABLE 139 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

- TABLE 141 NXP SEMICONDUCTORS: DEALS

- 11.1.6 KNOWLES CORPORATION

- TABLE 142 KNOWLES CORPORATION: COMPANY OVERVIEW

- FIGURE 59 KNOWLES CORPORATION: COMPANY SNAPSHOT

- TABLE 143 KNOWLES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 KNOWLES CORPORATION: PRODUCT LAUNCHES

- TABLE 145 KNOWLES CORPORATION: DEALS

- 11.1.7 ANDREA ELECTRONICS

- TABLE 146 ANDREA ELECTRONICS: COMPANY OVERVIEW

- FIGURE 60 ANDREA ELECTRONICS: COMPANY SNAPSHOT

- TABLE 147 ANDREA ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 ANDREA ELECTRONICS: PRODUCT LAUNCHES

- TABLE 149 ANDREA ELECTRONICS: DEALS

- 11.1.8 CIRRUS LOGIC

- TABLE 150 CIRRUS LOGIC: COMPANY OVERVIEW

- FIGURE 61 CIRRUS LOGIC: COMPANY SNAPSHOT

- TABLE 151 CIRRUS LOGIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 CIRRUS LOGIC: PRODUCT LAUNCHES

- TABLE 153 CIRRUS LOGIC: DEALS

- 11.1.9 MICROCHIP TECHNOLOGY INC.

- TABLE 154 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- FIGURE 62 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- TABLE 155 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES

- TABLE 157 MICROCHIP TECHNOLOGY INC.: DEALS

- TABLE 158 MICROCHIP TECHNOLOGY INC.: OTHERS

- 11.1.10 INFINEON TECHNOLOGIES AG

- TABLE 159 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- FIGURE 63 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 160 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 162 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 163 INFINEON TECHNOLOGIES AG: OTHERS

- 11.2 OTHER PLAYERS

- 11.2.1 ANALOG DEVICES, INC.

- 11.2.2 SENSORY INC.

- 11.2.3 MEEAMI TECHNOLOGIES

- 11.2.4 TDK CORPORATION

- 11.2.5 VOCAL TECHNOLOGIES

- 11.2.6 VESPER TECHNOLOGIES, INC.

- 11.2.7 ALANGO TECHNOLOGIES LTD.

- 11.2.8 MEDIATEK INC.

- 11.2.9 CEVA, INC.

- 11.2.10 FORTEMEDIA, INC.

- 11.2.11 XMOS

- 11.2.12 MATRIX

- 11.2.13 ADAPTIVE DIGITAL TECHNOLOGIES

- 11.2.14 GOERTEK

- 11.2.15 SENSIBEL

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, , MNM view might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS