|

|

市場調査レポート

商品コード

1296490

バイオエタノールの世界市場:原料別 (デンプンベース、砂糖ベース、セルロースベース)・燃料ブレンド別 (E5、E10、E15~E70、E75・E85)・最終用途産業別 (輸送、医薬品、化粧品、アルコール飲料)・燃料の世代別・地域別の将来予測 (2028年まで)Bioethanol Market by Feedstock (Starch based, Sugar based, Cellulose-based), Fuel blend (E5, E10, E15 to E70, E75& E85), End-use (transportation, pharmaceutical, cosmetic, alcoholic beverages), Generation and Region Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| バイオエタノールの世界市場:原料別 (デンプンベース、砂糖ベース、セルロースベース)・燃料ブレンド別 (E5、E10、E15~E70、E75・E85)・最終用途産業別 (輸送、医薬品、化粧品、アルコール飲料)・燃料の世代別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月16日

発行: MarketsandMarkets

ページ情報: 英文 212 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のバイオエタノールの市場規模は、2023年に834億米ドル、2028年には1,147億米ドルに達し、6.6%のCAGRで成長すると予測されます。

バイオエタノールの4種類の原料 (デンプンベース、砂糖ベース、セルロースベース、その他) のうち、デンプンベースのバイオエタノールには多くの利点があり、従来の化石燃料に代わる有望な燃料として位置づけられています。大きな利点は、バイオエタノール生産に利用可能なデンプン原料の豊富さにあります。トウモロコシ、小麦、大麦といったデンプンを多く含む作物は、様々な地域で広く栽培されており、入手しやすく持続可能なデンプン供給源が確保されています。この豊富な資源は安定供給を保証し、有限な化石燃料埋蔵量への依存を減らし、長期的なエネルギー安全保障と持続可能性を促進します。

"燃料ブレンド別では、E10が予測期間中にCAGRが最も高くなる"

10%のエタノールと90%のガソリンから成る混合燃料であるバイオエタノールE10は、様々な要因により普及浸透しつつあります。重要な促進要因のひとつは、温室効果ガスの排出削減と気候変動問題への対応が急務となっていることです。再生可能なバイオマス資源に由来するバイオエタノールは、ガソリンと混合することで二酸化炭素排出量を大幅に削減し、環境の持続可能性と排出削減目標の達成に有利な選択肢となります。バイオエタノールE10の普及には、政府の政策とインセンティブが重要な役割を果たしています。多くの国で、バイオエタノールを含むバイオ燃料を一定の割合で輸送用燃料に混合することを義務付ける再生可能燃料基準や義務付けが実施されています。こうした政策は安定した市場と規制の枠組みを作り、バイオエタノール生産者と燃料販売業者に確実性をもたらし、バイオエタノール・インフラへの投資を促進します。

"最終用途産業別では、輸送分野が予測期間中に最大の市場となる"

バイオエタノールは、従来の化石燃料に代わる実行可能で持続可能な代替燃料として、輸送業界で大きな支持を得ています。輸送分野でのバイオエタノールの利用には、いくつかの利点があります。また、バイオエタノールの生産は、社会経済にも好影響を与えます。バイオエタノールは、農家や農業コミュニティに新たな機会を創出することで、農村開発を促進します。バイオエタノール生産のための原料作物の栽培は、地域経済を活性化し、雇用を創出し、輸入化石燃料への依存を減らします。インフラの面では、バイオエタノールの流通と貯蔵は、既存の石油インフラに最小限の変更で組み込むことができます。そのため、バイオエタノールの流通網を構築しやすく、消費者に利用しやすいです。

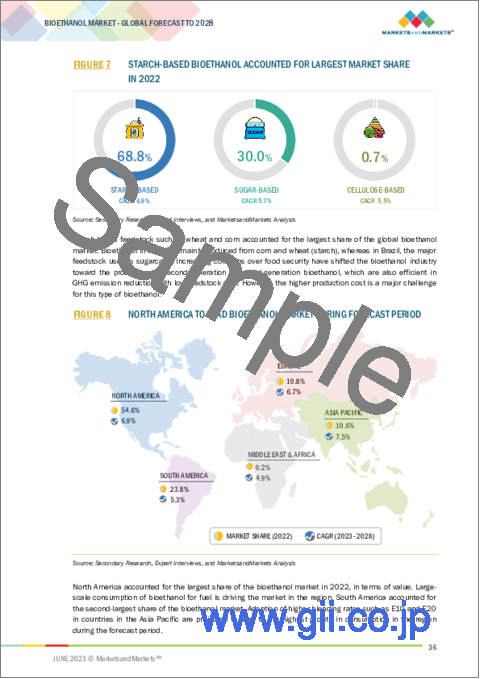

"原料別では、デンプンベースが2022年に最大のシェアを占める"

デンプンベースのバイオエタノールは、エネルギー安全保障や気候変動緩和など様々な要因によって推進されています。化石燃料の代替となる再生可能な国産バイオエタノールは、輸入石油への依存度を低下させ、エネルギー安全保障を強化し、自給自足を促進します。さらに、デンプン原料由来のバイオエタノールは、化石燃料と比較して二酸化炭素排出量を削減できるため、温室効果ガス (GHG) 排出量を緩和する大きな可能性を秘めています。デンプンベースのバイオエタノールの生産と利用において、トウモロコシ、小麦、ジャガイモのようなデンプンを多く含む原料の利用は、より持続可能で環境に優しいエネルギーシステムへの移行において極めて重要な役割を果たします。

"アジア太平洋市場は予測期間中、最も高いCAGRで成長する"

アジア太平洋は複数の重要な要因により、バイオエタノール産業が大きく成長する態勢を整えています。主な促進要因の一つは、この地域の豊富な農業資源です。中国・インド・タイ・インドネシア・マレーシアなどのアジア太平洋諸国は、農業部門が充実しており、サトウキビ・トウモロコシ・キャッサバなど、バイオエタノール生産の優れた原料となる作物を栽培しています。これらの原料が入手可能なため、バイオエタノール生産用の原料が安定供給され、業界の成長を支えています。さらに、アジア太平洋におけるエネルギー需要の増加と環境の持続可能性に対する懸念の高まりが、政府や政策立案者に再生可能エネルギー源の探求を促しています。バイオマス由来の再生可能燃料であるバイオエタノールは、同地域の持続可能性目標に合致し、温室効果ガス排出と大気汚染を削減するための実行可能な解決策を提供します。アジア太平洋地域の政府は、輸送部門におけるバイオエタノールの使用を促進するため、再生可能燃料の義務付けや奨励金といった支援政策を導入しています。これらの政策措置は、良好なビジネス環境を作り出し、バイオエタノール生産施設への投資を刺激します。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 市場の成長に影響を与える動向と混乱

- バリューチェーン分析

- 主要国の輸出入市場

- 特許分析

- 技術分析

- 関税・規制状況

- エコシステム分析

- 主要な会議とイベント (2023年~2024年)

- マクロ経済の概要

- 価格分析

- ケーススタディ分析

- 主要な利害関係者と購入基準

第6章 バイオエタノール市場:燃料の世代別

- イントロダクション

- 第1世代

- 第2世代

- 第3世代

第7章 バイオエタノール市場:原料別

- イントロダクション

- デンプンベース

- 砂糖ベース

- セルロースベース

- その他

第8章 バイオエタノール市場:燃料ブレンド別

- イントロダクション

- E5

- E10

- E15~E70

- E75・E85

- その他

第9章 バイオエタノール市場:最終用途産業別

- イントロダクション

- 輸送

- アルコール飲料

- 化粧品

- 医薬品

- その他

第10章 バイオエタノール市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他の南米

- 欧州

- ドイツ

- フランス

- 英国

- スウェーデン

- オランダ

- ポーランド

- スペイン

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- タイ

- フィリピン

- 日本

- その他のアジア太平洋

- 中東・アフリカ

- トルコ

- 南アフリカ

第11章 競合情勢

- イントロダクション

- 市場シェア分析

- 主要企業の戦略

- 上位5社の収益分析

- 企業評価クアドラント

- スタートアップ・中小企業 (SME) の評価クアドラント

- 競合ベンチマーキング

- 競争シナリオと動向

第12章 企業プロファイル

- 主要企業

- ARCHER DANIELS MIDLAND COMPANY

- POET LLC

- GREEN PLAINS, INC.

- VALERO ENERGY CORPORATION

- TEREOS

- RAIZEN

- THE ANDERSONS, INC.

- ALTO INGREDIENTS, INC.

- SEKAB BIOFUELS & CHEMICALS AB

- AEMETIS, INC.

- その他の企業

- PANNONIA BIO ZRT

- BP P.L.C.

- ABSOLUTE ENERGY L.L.C.

- BIG RIVER RESOURCES LLC

- UNITED PETROLEUM PTY LTD.

- CROPENERGIES BIOETHANOL GMBH

- WHITE ENERGY, INC.

- GUARDIAN ENERGY, LLC

- BLUE BIOFUELS, INC.

第13章 隣接・関連市場

- イントロダクション

- 制限事項

- バイオ潤滑剤市場

- バイオ潤滑剤市場:地域別

第14章 付録

The bioethanol market size is estimated to be USD 83.4 billion in 2023, and it is projected to reach USD 114.7 billion by 2028 at a CAGR of 6.6%. Out of four feedstock types of bioethanol (Starch Based, Sugar-Based, Cellulose Based, and Others). Starch-based bioethanol provides numerous advantages as a renewable fuel source, positioning it as a promising alternative to conventional fossil fuels. A significant advantage lies in the abundance of starch feedstocks available for bioethanol production. Crops rich in starch, such as corn, wheat, and barley, are extensively grown in various regions, ensuring a readily accessible and sustainable source of starch. This abundance guarantees a stable supply and reduces reliance on finite fossil fuel reserves, promoting long-term energy security and sustainability.

By Fuel blend, E10 accounted for the one of the highest CAGR during the forecast period.

The introduction and growing popularity of bioethanol E10, a blend consisting of 10% ethanol and 90% gasoline, is driven by various factors that contribute to its widespread adoption. One significant driver is the imperative to reduce greenhouse gas emissions and address climate change concerns. Bioethanol, derived from renewable biomass sources, significantly reduces the carbon footprint when blended with gasoline, making it a favorable option for achieving environmental sustainability and meeting emission reduction targets. Government policies and incentives have played a vital role in driving the adoption of bioethanol E10. Many countries have implemented renewable fuel standards and mandates that require a certain percentage of biofuels, including bioethanol, to be blended into transportation fuels. These policies create a stable market and regulatory framework, providing certainty for bioethanol producers and fuel distributors and encouraging investment in bioethanol infrastructure.

By End-Use Industry, the Transportation segment accounted for the largest market during the forecast period.

Bioethanol has gained significant traction in the transportation industry as a viable and sustainable alternative to conventional fossil fuels. Its utilization in the transportation sector offers several advantages and benefits. The production of bioethanol also has positive socio-economic impacts. It promotes rural development by creating new opportunities for farmers and agricultural communities. The cultivation of feedstock crops for bioethanol production stimulates local economies, generates employment, and reduces the reliance on imported fossil fuels. In terms of infrastructure, the distribution and storage of bioethanol can be integrated into existing petroleum infrastructure with minimal modifications. This makes it easier to establish a bioethanol distribution network and provide accessibility to consumers.

By feedstock, starch-based accounted for the largest share in 2022.

Starch-based bioethanol is propelled by various factors, including energy security and climate change mitigation. Serving as a renewable and domestically produced substitute for fossil fuels, starch-based bioethanol diminishes reliance on imported oil, bolstering energy security and fostering self-sufficiency. Furthermore, bioethanol derived from starch feedstocks exhibits substantial potential for mitigating greenhouse gas (GHG) emissions, as it aids in reducing carbon dioxide emissions in comparison to fossil fuels. The utilization of starch-rich feedstocks like corn, wheat, or potatoes in the production and utilization of starch-based bioethanol plays a pivotal role in transitioning toward a more sustainable and environmentally friendly energy system.

Asia Pacific is projected to register the highest CAGR in the bioethanol market during the forecast period.

Asia Pacific is poised for significant growth in the bioethanol industry due to several key factors. One of the primary drivers is the region's abundant agricultural resources. Asia Pacific countries, such as China, India, Thailand, Indonesia, and Malaysia, have substantial agricultural sectors and cultivate crops like sugarcane, corn, and cassava, which serve as excellent feedstocks for bioethanol production. The availability of these feedstocks ensures a steady supply of raw materials for bioethanol production, supporting the growth of the industry. Additionally, the rising energy demand and increasing concerns about environmental sustainability in Asia Pacific have prompted governments and policymakers to explore renewable energy sources. Bioethanol, as a renewable fuel derived from biomass, aligns with the region's sustainability goals and offers a viable solution for reducing greenhouse gas emissions and air pollution. Governments in Asia Pacific have introduced supportive policies, such as renewable fuel mandates and incentives, to promote the use of bioethanol in the transportation sector. These policy measures create a favorable business environment and stimulate investments in bioethanol production facilities.

Further in-depth interviews were conducted with the Chief Experience Officer (CXO), Managers, Marketing Officers, Production Officers, and other related key executives from various key companies and organizations operating in the bioethanol market.

By Company Type: Tier 1: 11.1%, Tier 2: 33.3%, and Tier 3: 55.6%

By Designation: C-level: 20%, Director: 10%, and Others: 70%

By Region: Europe: 33.3%, Asia Pacific: 25%, North America: 25%, and Rest of the world: 16.7%.

Companies Covered: POET LLC (US), Archer Daniels Midland Company (US), Green Plains (US) and Valero Energy (US), Pacific Ethanol (US) The Anderson Inc. (US), Flint Hills Resources (US), and Tereos (France) and others.

Research Coverage

The market study covers the bioethanol market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on type, end-use, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the bioethanol market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall bioethanol market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities. Moreover, the report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for bioethanol in various end-use industries, Growing awareness of the environmental impact)

- Product Development/Innovation: Detailed insights on current technologies, research & development activities, and new product & service launches in the bioethanol market.

- Market Development: The report analyses the bioethanol market across varied regions

- Market Diversification: Exhaustive information about new products & services, recent developments, and investments in the bioethanol market.

- Competitive Assessment: In-depth assessment of market rankings, growth strategies, and product offerings of leading players like POET LLC (US), Archer Daniels Midland Company (US), Green Plains (US) and Valero Energy (US), Pacific Ethanol (US) The Anderson Inc. (US), Flint Hills Resources (US), and Tereos (France) and among others in the bioethanol market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 BIOETHANOL MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

- 1.9 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 BIOETHANOL MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BASED ON DEMAND

- FIGURE 4 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.2.2 BASED ON PRODUCTION

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- FIGURE 6 BIOETHANOL MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 RESEARCH LIMITATIONS

- 2.4.2 GROWTH RATE ASSUMPTIONS

- 2.4.3 RECESSION IMPACT ANALYSIS

- TABLE 1 GDP GROWTH RATE, BY REGION, (2019-2027)

3 EXECUTIVE SUMMARY

- FIGURE 7 STARCH-BASED BIOETHANOL ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 8 NORTH AMERICA TO LEAD BIOETHANOL MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BIOETHANOL MARKET

- FIGURE 9 EMERGING COUNTRIES TO OFFER ATTRACTIVE OPPORTUNITIES IN BIOETHANOL MARKET

- 4.2 NORTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND AND COUNTRY

- FIGURE 10 NORTH AMERICA: US AND E10 BLEND ACCOUNTED FOR LARGEST SHARES OF BIOETHANOL MARKET IN 2022

- 4.3 BIOETHANOL MARKET, BY TYPE

- FIGURE 11 E10 SEGMENT TO LEAD BIOETHANOL MARKET DURING FORECAST PERIOD

- 4.4 BIOETHANOL MARKET, BY APPLICATION

- FIGURE 12 TRANSPORTATION END-USE INDUSTRY TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.5 BIOETHANOL MARKET, BY COUNTRY

- FIGURE 13 CHINESE BIOETHANOL MARKET TO RECORD HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BIOETHANOL MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Need for energy security

- 5.2.1.2 Adoption of higher blending standards leads to higher consumption of bioethanol

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising demand for EVs and phase-out of fossil fuel vehicles

- 5.2.2.2 Engine modification required for higher blends of bioethanol

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand from pharmaceutical industry

- 5.2.3.2 Policy changes regarding use of bioethanol blends

- 5.2.4 CHALLENGES

- 5.2.4.1 Adverse environmental impact of bioethanol production

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 BIOETHANOL MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 BIOETHANOL MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 TRENDS AND DISRUPTIONS IMPACTING MARKET GROWTH

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 16 VALUE CHAIN

- 5.5.1 RAW MATERIAL PROCUREMENT

- 5.5.2 BIOETHANOL PRODUCTION PLANTS

- 5.5.3 DISTRIBUTION CHANNELS

- 5.5.4 APPLICATION SEGMENTS

- 5.6 KEY MARKETS FOR EXPORT/IMPORT

- 5.7 PATENT ANALYSIS

- FIGURE 17 GRANTED PATENTS ACCOUNTED FOR 77% OF TOTAL COUNT IN LAST 5 YEARS

- FIGURE 18 PUBLICATION TRENDS

- FIGURE 19 JURISDICTION ANALYSIS

- FIGURE 20 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- 5.8 TECHNOLOGICAL ANALYSIS

- 5.8.1 TECHNOLOGY FOR STARCH-BASED FEEDSTOCK (CORN)

- 5.8.1.1 Dry mill method

- 5.8.1.2 Wet mill method

- TABLE 3 DIFFERENCE BETWEEN DRY MILL METHOD AND WET MILL METHOD

- 5.8.2 BIOETHANOL FROM SUGARCANE

- 5.8.3 SUGAR VS. STARCH

- 5.8.1 TECHNOLOGY FOR STARCH-BASED FEEDSTOCK (CORN)

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES AND GOVERNMENT AGENCIES

- 5.10 ECOSYSTEM ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 4 BIOETHANOL MARKET: KEY CONFERENCES AND EVENTS

- 5.12 MACROECONOMIC OVERVIEW

- 5.12.1 INTRODUCTION

- 5.12.2 TRENDS AND GDP FORECASTS

- TABLE 5 WORLDWIDE GDP GROWTH PROJECTION (2018-2026)

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE, BY REGION

- FIGURE 21 AVERAGE SELLING PRICE, BY REGION (USD/LITER)

- 5.13.2 AVERAGE SELLING PRICE, BY FUEL BLEND

- TABLE 6 AVERAGE SELLING PRICE, BY FUEL BLEND (USD/LITER)

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 IMPLEMENTATION OF ETHANOL BLENDING PROGRAM

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN BIOETHANOL MARKET

- 5.15.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA IN BIOETHANOL INDUSTRY

- TABLE 8 KEY BUYING CRITERIA FOR BIOETHANOL INDUSTRY

6 BIOETHANOL MARKET, BY FUEL GENERATION

- 6.1 INTRODUCTION

- 6.2 FIRST GENERATION

- 6.3 SECOND GENERATION

- 6.4 THIRD GENERATION

7 BIOETHANOL MARKET, BY FEEDSTOCK

- 7.1 INTRODUCTION

- FIGURE 24 STARCH-BASED BIOETHANOL TO GROW AT HIGHEST RATE

- TABLE 9 BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 10 BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- 7.2 STARCH-BASED

- 7.2.1 US TO DRIVE MARKET DURING FORECAST PERIOD

- 7.3 SUGAR-BASED

- 7.3.1 BRAZIL TO BE LARGEST CONSUMER OF SUGAR-BASED FEEDSTOCK FOR BIOETHANOL PRODUCTION

- 7.4 CELLULOSE-BASED

- 7.4.1 GROWING CONCERNS ABOUT FOOD SECURITY TO DRIVE MARKET

- 7.5 OTHERS

8 BIOETHANOL MARKET, BY FUEL BLEND

- 8.1 INTRODUCTION

- TABLE 11 BLENDING MANDATES, BY KEY COUNTRY

- FIGURE 25 E10 SEGMENT TO DRIVE BIOETHANOL MARKET FROM 2023 TO 2028

- TABLE 12 BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 13 BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- 8.2 E5

- 8.2.1 EMERGING COUNTRIES ADOPTING E5 TO DRIVE MARKET

- 8.3 E10

- 8.3.1 INCREASING ADOPTION OF E10 TO LEAD TO FASTEST GROWTH OF SEGMENT

- 8.4 E15 TO E70

- 8.4.1 BRAZIL TO DOMINATE E15-E70 BLEND SEGMENT WITH HIGHEST ETHANOL-FUEL BLEND RATIO

- 8.5 E75 & E85

- 8.5.1 WIDE USE IN FLEX-FUEL VEHICLES TO DRIVE MARKET

- 8.6 OTHERS

9 BIOETHANOL MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 26 TRANSPORTATION END-USE INDUSTRY TO DOMINATE BIOETHANOL MARKET

- TABLE 14 BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- TABLE 15 BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- 9.2 TRANSPORTATION

- 9.2.1 CHANGES IN ETHANOL BLENDING MANDATES TO INCREASE DEMAND

- 9.3 ALCOHOLIC BEVERAGES

- 9.3.1 SEGMENT TO GROW AT MODERATE PACE

- 9.4 COSMETICS

- 9.4.1 USE IN COSMETIC PRODUCTS FOR SKIN-FRIENDLY AND ODORLESS PROPERTIES TO DRIVE MARKET

- 9.5 PHARMACEUTICALS

- 9.5.1 DEMAND FOR HAND SANITIZERS TO DRIVE MARKET

- 9.6 OTHERS

10 BIOETHANOL MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 27 BIOETHANOL CONSUMPTION SHARE, BY COUNTRY, 2022

- FIGURE 28 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICAN MARKET TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 16 BIOETHANOL MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 17 BIOETHANOL MARKET, BY REGION, 2021-2028 (MILLION LITERS)

- 10.2 NORTH AMERICA

- 10.2.1 RECESSION IMPACT

- FIGURE 30 NORTH AMERICA: BIOETHANOL MARKET SNAPSHOT

- TABLE 18 NORTH AMERICA: BIOETHANOL MARKET, BY COUNTRY, 2021-2028 (MILLION LITERS)

- TABLE 19 NORTH AMERICA: BIOETHANOL MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 20 NORTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 21 NORTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 22 NORTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 24 NORTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.2.2 US

- 10.2.2.1 Easing of regulatory norms for ethanol blending to drive market

- TABLE 26 RENEWABLE FUEL STANDARD (RFS), EPA FINAL/PROPOSED VOLUME STANDARDS (BILLION OF ETHANOL-EQUIVALENT GALLONS)

- TABLE 27 US: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 28 US: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 29 US: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 30 US: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 31 US: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 32 US: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.2.3 CANADA

- 10.2.3.1 Largest imports of ethanol fuel to drive market

- TABLE 33 CANADA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 34 CANADA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 35 CANADA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 36 CANADA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 37 CANADA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 38 CANADA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.2.4 MEXICO

- 10.2.4.1 Liberalization of fuel market to boost demand for bioethanol

- TABLE 39 MEXICO: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 40 MEXICO: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 41 MEXICO: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 42 MEXICO: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 43 MEXICO: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 44 MEXICO: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.3 SOUTH AMERICA

- 10.3.1 RECESSION IMPACT

- TABLE 45 SOUTH AMERICA: BIOETHANOL MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 46 SOUTH AMERICA: BIOETHANOL MARKET, BY COUNTRY, 2021-2028 (MILLION LITERS)

- TABLE 47 SOUTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 48 SOUTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 49 SOUTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 50 SOUTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 51 SOUTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 52 SOUTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.3.2 BRAZIL

- 10.3.2.1 Government support for ethanol production and consumption as biofuel to drive market

- TABLE 53 BRAZIL: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 54 BRAZIL: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 55 BRAZIL: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 56 BRAZIL: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 57 BRAZIL: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 58 BRAZIL: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.3.3 ARGENTINA

- 10.3.3.1 Increasing use of bioethanol in fuel blends to boost demand

- TABLE 59 ARGENTINA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 60 ARGENTINA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 61 ARGENTINA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 62 ARGENTINA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 63 ARGENTINA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 64 ARGENTINA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.3.4 COLOMBIA

- 10.3.4.1 Imposition of 20% per gallon tariff on US ethanol imports to drive market

- TABLE 65 COLOMBIA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 66 COLOMBIA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 67 COLOMBIA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 68 COLOMBIA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 69 COLOMBIA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 70 COLOMBIA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.3.5 REST OF SOUTH AMERICA

- TABLE 71 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 72 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 73 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 74 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 75 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 76 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT

- FIGURE 31 EUROPE: BIOETHANOL MARKET SNAPSHOT

- TABLE 77 EUROPE: BIOETHANOL MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 78 EUROPE: BIOETHANOL MARKET, BY COUNTRY, 2021-2028 (MILLION LITERS)

- TABLE 79 EUROPE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 80 EUROPE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 81 EUROPE: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 82 EUROPE: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 83 EUROPE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 84 EUROPE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.4.2 GERMANY

- 10.4.2.1 Higher emission reduction goals to drive market

- TABLE 85 GERMANY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 86 GERMANY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 87 GERMANY: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 88 GERMANY: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 89 GERMANY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 90 GERMANY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.4.3 FRANCE

- 10.4.3.1 Government policies to drive use of E85

- TABLE 91 FRANCE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 92 FRANCE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 93 FRANCE: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 94 FRANCE: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 95 FRANCE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 96 FRANCE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.4.4 UK

- 10.4.4.1 Starch-based feedstock to be fastest-growing segment during forecast period

- TABLE 97 UK: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 98 UK: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 99 UK: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 100 UK: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 101 UK: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 102 UK: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.4.5 SWEDEN

- 10.4.5.1 Remarkable growth in bioethanol industry to drive market

- TABLE 103 SWEDEN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 104 SWEDEN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 105 SWEDEN: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 106 SWEDEN: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 107 SWEDEN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 108 SWEDEN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.4.6 NETHERLANDS

- 10.4.6.1 Stringent regulatory mandates to fuel market

- TABLE 109 NETHERLANDS: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 110 NETHERLANDS: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 111 NETHERLANDS: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 112 NETHERLANDS: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 113 NETHERLANDS: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 114 NETHERLANDS: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.4.7 POLAND

- 10.4.7.1 Starch-based segment to dominate market

- TABLE 115 POLAND: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 116 POLAND: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 117 POLAND: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 118 POLAND: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 119 POLAND: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 120 POLAND: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.4.8 SPAIN

- 10.4.8.1 Implementation of blending mandates to drive demand

- TABLE 121 SPAIN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 122 SPAIN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 123 SPAIN: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 124 SPAIN: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 125 SPAIN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 126 SPAIN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.4.9 ITALY

- 10.4.9.1 Starch-based feedstock segment to register highest growth during forecast period

- TABLE 127 ITALY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 128 ITALY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 129 ITALY: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 130 ITALY: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 131 ITALY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 132 ITALY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.4.10 REST OF EUROPE

- TABLE 133 REST OF EUROPE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 134 REST OF EUROPE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 135 REST OF EUROPE: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 136 REST OF EUROPE: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 137 REST OF EUROPE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 138 REST OF EUROPE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.5 ASIA PACIFIC

- 10.5.1 RECESSION IMPACT

- TABLE 139 ASIA PACIFIC: BIOETHANOL MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: BIOETHANOL MARKET, BY COUNTRY, 2021-2028 (MILLION LITERS)

- TABLE 141 ASIA PACIFIC: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 143 ASIA PACIFIC: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 145 ASIA PACIFIC: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.5.2 CHINA

- 10.5.2.1 Mandating use of E10 blends to meet carbon emission standards to boost market

- TABLE 147 CHINA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 148 CHINA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 149 CHINA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 150 CHINA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 151 CHINA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 152 CHINA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.5.3 INDIA

- 10.5.3.1 Promotion of E10 fuel blends to support market growth

- TABLE 153 INDIA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 154 INDIA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 155 INDIA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 156 INDIA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 157 INDIA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 158 INDIA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.5.4 THAILAND

- 10.5.4.1 Government to increase use of renewable sources in energy mix to boost demand

- TABLE 159 THAILAND: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 160 THAILAND: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 161 THAILAND: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 162 THAILAND: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 163 THAILAND: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 164 THAILAND: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.5.5 PHILIPPINES

- 10.5.5.1 Mandatory use of fuel blends to drive bioethanol demand

- TABLE 165 PHILIPPINES: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 166 PHILIPPINES: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 167 PHILIPPINES: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 168 PHILIPPINES: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 169 PHILIPPINES: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 170 PHILIPPINES: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.5.6 JAPAN

- 10.5.6.1 Consumption of ethanol to be stagnant during forecast period

- TABLE 171 JAPAN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 172 JAPAN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 173 JAPAN: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 174 JAPAN: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 175 JAPAN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 176 JAPAN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.5.7 REST OF ASIA PACIFIC

- TABLE 177 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 179 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 181 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RECESSION IMPACT

- TABLE 183 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY COUNTRY, 2021-2028 (MILLION LITERS)

- TABLE 185 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 187 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 189 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.6.2 TURKEY

- 10.6.2.1 Increasing demand for bioenergy as alternative source to drive market

- TABLE 191 TURKEY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 192 TURKEY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 193 TURKEY: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 194 TURKEY: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 195 TURKEY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 196 TURKEY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

- 10.6.3 SOUTH AFRICA

- 10.6.3.1 Government support and mandatory blending regulation to boost market

- TABLE 197 SOUTH AFRICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (USD MILLION)

- TABLE 198 SOUTH AFRICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021-2028 (MILLION LITERS)

- TABLE 199 SOUTH AFRICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (USD MILLION)

- TABLE 200 SOUTH AFRICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021-2028 (MILLION LITERS)

- TABLE 201 SOUTH AFRICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 202 SOUTH AFRICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION LITERS)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- FIGURE 32 COMPANIES ADOPTED PARTNERSHIP & COLLABORATION AS KEY GROWTH STRATEGY BETWEEN 2019 AND 2023

- 11.2 MARKET SHARE ANALYSIS

- FIGURE 33 RANKING OF KEY PLAYERS IN BIOETHANOL MARKET, 2022

- FIGURE 34 MARKET SHARE OF BIOETHANOL MANUFACTURERS (2022)

- 11.3 KEY PLAYERS' STRATEGIES

- 11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- FIGURE 35 TOP FIVE PLAYERS DOMINATED MARKET IN LAST FIVE YEARS

- 11.5 COMPANY EVALUATION QUADRANT

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE

- 11.5.4 PARTICIPANTS

- FIGURE 36 COMPANY EVALUATION QUADRANT, 2022

- 11.6 STARTUP AND SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANT

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 37 SME MATRIX: BIOETHANOL MARKET, 2022

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 204 BIOETHANOL MARKET: LIST OF KEY PLAYERS

- TABLE 205 BIOETHANOL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 11.8 COMPETITIVE SCENARIOS AND TRENDS

- 11.8.1 DEALS

- TABLE 206 DEALS, 2019-2023

- 11.8.2 OTHERS

- TABLE 207 OTHERS, 2019-2023

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services, Recent Developments, MnM view, Key strengths, Strategic choices, Weakness and competitive threats) **

- 12.1 KEY PLAYERS

- 12.1.1 ARCHER DANIELS MIDLAND COMPANY

- TABLE 208 ARCHER DANIELS MIDLAND COMPANY: COMPANY OVERVIEW

- FIGURE 38 ARCHER DANIELS MIDLAND COMPANY.: COMPANY SNAPSHOT

- TABLE 209 ARCHER DANIELS MIDLAND COMPANY: DEALS

- TABLE 210 ARCHER DANIELS MIDLAND COMPANY: OTHERS

- 12.1.2 POET LLC

- TABLE 211 POET LLC: COMPANY OVERVIEW

- TABLE 212 POET LLC: DEALS

- TABLE 213 POET LLC: OTHERS

- 12.1.3 GREEN PLAINS, INC.

- TABLE 214 GREEN PLAINS, INC.: COMPANY OVERVIEW

- FIGURE 39 GREEN PLAINS, INC.: COMPANY SNAPSHOT

- TABLE 215 GREEN PLAINS, INC.: DEALS

- TABLE 216 GREEN PLAINS, INC.: OTHERS

- 12.1.4 VALERO ENERGY CORPORATION

- TABLE 217 VALERO ENERGY CORPORATION: COMPANY OVERVIEW

- FIGURE 40 VALERO ENERGY CORPORATION: COMPANY SNAPSHOT

- TABLE 218 VALERO ENERGY CORPORATION: OTHERS

- 12.1.5 TEREOS

- TABLE 219 TEREOS: COMPANY OVERVIEW

- FIGURE 41 TEREOS: COMPANY SNAPSHOT

- 12.1.6 RAIZEN

- TABLE 220 RAIZEN: COMPANY OVERVIEW

- TABLE 221 RAIZEN: DEALS

- TABLE 222 RAIZEN: OTHERS

- 12.1.7 THE ANDERSONS, INC.

- TABLE 223 THE ANDERSONS, INC.: COMPANY OVERVIEW

- FIGURE 42 THE ANDERSONS, INC.: COMPANY SNAPSHOT

- TABLE 224 THE ANDERSONS, INC.: DEALS

- TABLE 225 THE ANDERSONS, INC.: OTHERS

- 12.1.8 ALTO INGREDIENTS, INC.

- TABLE 226 ALTO INGREDIENTS, INC.: COMPANY OVERVIEW

- FIGURE 43 ALTO INGREDIENTS, INC.: COMPANY SNAPSHOT

- TABLE 227 ALTO INGREDIENTS, INC.: DEALS

- TABLE 228 ALTO INGREDIENTS, INC.: OTHERS

- 12.1.9 SEKAB BIOFUELS & CHEMICALS AB

- TABLE 229 SEKAB BIOFUELS & CHEMICALS AB: COMPANY OVERVIEW

- TABLE 230 SEKAB BIOFUELS & CHEMICALS AB.: OTHERS

- 12.1.10 AEMETIS, INC.

- TABLE 231 AEMETIS, INC.: COMPANY OVERVIEW

- FIGURE 44 AEMETIS, INC.: COMPANY SNAPSHOT

- TABLE 232 AEMETIS, INC.: OTHERS

- *Details on Business Overview, Products/Solutions/Services, Recent Developments, MnM view, Key strengths, Strategic choices, Weakness and competitive threats might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 PANNONIA BIO ZRT

- TABLE 233 PANNONIA BIO ZRT: COMPANY OVERVIEW

- 12.2.2 BP P.L.C.

- TABLE 234 BP P.L.C.: COMPANY OVERVIEW

- 12.2.3 ABSOLUTE ENERGY L.L.C.

- TABLE 235 ABSOLUTE ENERGY L.L.C.: COMPANY OVERVIEW

- 12.2.4 BIG RIVER RESOURCES LLC

- TABLE 236 BIG RIVER RESOURCES LLC: COMPANY OVERVIEW

- 12.2.5 UNITED PETROLEUM PTY LTD.

- TABLE 237 UNITED PETROLEUM PTY LTD.: COMPANY OVERVIEW

- 12.2.6 CROPENERGIES BIOETHANOL GMBH

- TABLE 238 CROPENERGIES BIOETHANOL GMBH: COMPANY OVERVIEW

- 12.2.7 WHITE ENERGY, INC.

- TABLE 239 WHITE ENERGY, INC.: COMPANY OVERVIEW

- 12.2.8 GUARDIAN ENERGY, LLC

- TABLE 240 GUARDIAN ENERGY, LLC: COMPANY OVERVIEW

- 12.2.9 BLUE BIOFUELS, INC.

- TABLE 241 BLUE BIOFUELS, INC.: COMPANY OVERVIEW

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 BIO-LUBRICANTS MARKET

- FIGURE 45 VEGETABLE OIL-BASED SEGMENT ACCOUNTED FOR LARGEST SHARE OF BIO-LUBRICANTS MARKET IN 2019

- FIGURE 46 INDUSTRIAL SEGMENT ACCOUNTED FOR LARGEST SHARE OF BIO-LUBRICANTS MARKET IN 2019

- FIGURE 47 EUROPE ACCOUNTED FOR LARGEST SHARE IN BIO-LUBRICANTS MARKET

- 13.4 BIO-LUBRICANTS MARKET, BY REGION

- FIGURE 48 ASIA PACIFIC TO BE FASTEST-GROWING BIO-LUBRICANTS MARKET FROM 2020-2025

- TABLE 242 BIO-LUBRICANTS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

- TABLE 243 BIO-LUBRICANTS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS