|

|

市場調査レポート

商品コード

1295487

床材の世界市場:材料別 (弾力性、非弾力性 (セラミックタイル、木材、ラミネート、石材)、軟質床材)・最終用途産業別 (住宅、非住宅)・地域別 (北米、欧州、アジア太平洋、中東、南米) の将来予測 (2028年まで)Flooring Market by Material (Resilient, Non-Resilient (Ceramic tiles, Wood, Laminate, Stone), Soft-floor covering), End-use Industry (Residential, Non-residential), & Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 床材の世界市場:材料別 (弾力性、非弾力性 (セラミックタイル、木材、ラミネート、石材)、軟質床材)・最終用途産業別 (住宅、非住宅)・地域別 (北米、欧州、アジア太平洋、中東、南米) の将来予測 (2028年まで) |

|

出版日: 2023年06月15日

発行: MarketsandMarkets

ページ情報: 英文 208 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の床材の市場規模は、2023年の3,319億米ドルから、2028年には5,107億米ドルに成長すると予測され、予測期間中のCAGRは9.0%となる見通しです。

人口の増加、一人当たり所得の上昇、急速な工業化、インフラ整備が建設産業の成長につながり、床材市場の需要を牽引しています。

"材料別では、弾力性床材が予測期間中に最も高いCAGRで成長する"

床材の3つの種類 (カーペット・ラグ、弾力性床材、非弾力性床材) のうち、弾力性床材が予測期間中に最も急成長するセグメントです。弾力性床材は、耐久性・柔軟性・耐摩耗性に優れています。その中でもビニル床材が最大の市場シェアを占め、また最も急速に成長しています。ビニル床材は汎用性が高く、安価でメンテナンスが容易なため人気があります。弾性床材は、耐久性、メンテナンスの容易さ、幅広いデザインオプション、費用対効果、快適性、安全性、製造技術の進歩により人気が高まっています。

"最終用途産業別では、予測期間中に非住宅が最も高いCAGRで成長する"

2つの最終用途産業 (住宅、非住宅) のうち、非住宅が予測期間中に最も急成長するセグメントです。非住宅用床材市場は、様々な要因によって成長を遂げています。これには経済発展やインフラ投資が含まれ、商業ビルにおける床材ソリューションの需要を生み出しています。また技術進歩により、革新的で持続可能な床材が開発されています。非住宅分野ではデザインと美観が重視されるため、多様な床材オプションのニーズが高まっています。さらに、安全性、持続可能性、室内空気の質への配慮も市場拡大に寄与しています。

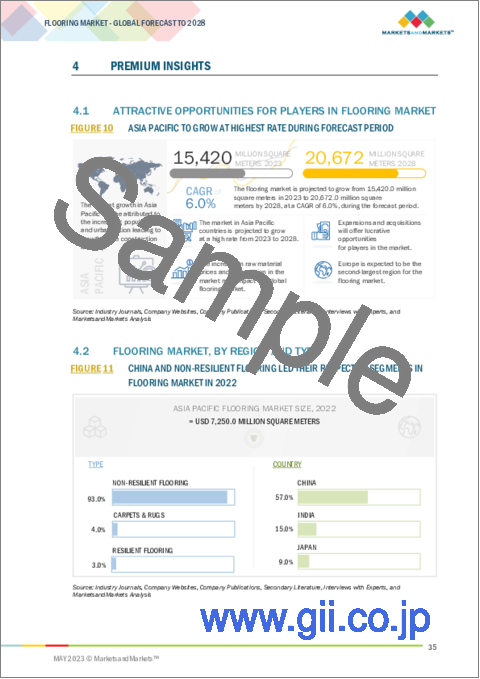

"アジア太平洋が予測期間中に最も高いCAGRで成長する"

アジア太平洋の床材市場は、急速な都市化、堅調な経済成長、建設ブーム、中産階級の増加、デザインと美観重視の高まり、技術の進歩、政府の取り組みなどの要因によって成長が促進されています。こうした要素は、都市部の拡大、消費者の購買力向上、インフラプロジェクトの隆盛に伴い、床材需要を牽引しています。品質、審美性、持続可能性を重視するこの地域の姿勢は、アジア太平洋の床材市場の成長を促進する上で重要な役割を果たしています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- ポーターのファイブフォース分析

- マクロ経済の概要

- バリューチェーン分析

- サプライチェーン分析

- 景気後退の影響:現実的、楽観的、悲観的なシナリオ

- 顧客に影響を与える動向と混乱

- 市場マッピング/エコシステムマップ

- ケーススタディ分析

- 特許分析

- 技術分析

- 規制分析

- 規制機関、政府機関、その他の組織

- 輸出入の主要市場 (貿易分析)

- 価格分析

- 主要な会議

- 主要な利害関係者と購入基準

第7章 床材市場:材料別

- イントロダクション

- 弾力性床材

- ビニール

- その他の種類の弾力性床材 (コルク、リノリウム、ゴム、樹脂)

- 非弾力性床材

- セラミックタイル

- 木材

- ラミネート

- 石材

- その他の非弾力性床材の種類 (竹、人造大理石)

- 軟質床材/カーペット・ラグ

第8章 床材市場:最終用途産業別

- イントロダクション

- 住宅

- 非住宅

第9章 床材市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- オランダ

- その他の欧州

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- トルコ

- その他の中東・アフリカ

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第10章 競合情勢

- 概要

- 主要な成長戦略として製品の発売を採用した企業 (2019年~2022年)

- 市場ランキング分析

- 企業評価クアドラント

- 競合ベンチマーキング

- 中小企業マトリックス (2022年)

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- MOHAWK INDUSTRIES, INC.

- TARKETT

- FORBO

- SHAW INDUSTRIES GROUP, INC.

- INTERFACE, INC.

- TOLI CORPORATION

- BEAULIEU INTERNATIONAL GROUP

- MILLIKEN & COMPANY

- GERFLOR

- KAJARIA CERAMICS

- その他の企業

- CONGOLEUM CORPORATION

- FLOWCRETE

- JAMES HALSTEAD PLC

- THE DIXIE GROUP, INC.

- VICTORIA PLC

- MANNINGTON MILLS INC.

- SWISS KRONO GROUP

- LX HAUSYS, LTD.

- PARADOR GMBH

- INVISTA

- ORIENTAL WEAVERS GROUP

- MIRAGE

- EGGER

- WELSPUN FLOORING LIMITED

- J&J FLOORING LLC

第12章 付録

The flooring market is projected to grow from USD 331.9 billion in 2023 to USD 510.7 billion by 2028, at a CAGR of 9.0% during the forecast period. The growing population, rising per capita income, rapid industrialization, and infrastructural development have led to the growth of the construction industry, thereby driving the demand for flooring market.

By Material, Resilient flooring material accounted for the highest CAGR during the forecast period

Out of the three flooring material types (Carpets & rugs, Resilient and Non-resilient), resilient flooring is the fastest growing segment during the forecast period. Resilient flooring includes: Vinyl flooring and Others (cork, linoleum, rubber, and resin) flooring. Resilient flooring material is designed to be durable, flexible, and resistant to wear and tear. In resilient material type flooring, vinyl flooring holds the largest market share and is also the fastest growing. Vinyl flooring is popular due to its versatility, low cost, and ease of maintenance. Resilient flooring is growing in popularity due to its durability, easy maintenance, wide range of design options, cost-effectiveness, comfort, safety, and advancements in manufacturing technology.

By End-Use Industry, Non-residential accounted for the highest CAGR during the forecast period

Out of the two end-use industries (residential, and non-residential), non-residential is the fastest growing segment during the forecast period. The non-residential flooring market is experiencing growth due to various factors. These include economic development and infrastructure investments, which create a demand for flooring solutions in commercial buildings. Technological advancements have also led to the development of innovative and sustainable flooring materials. The non-residential sector's focus on design and aesthetics drives the need for a diverse range of flooring options. Additionally, safety, sustainability, and indoor air quality considerations contribute to the market's expansion.

Asia Pacific is projected to account for the highest CAGR in the flooring market during the forecast period

The Asia Pacific flooring market is witnessing growth propelled by factors such as rapid urbanization, robust economic growth, a construction boom, the rising middle class, growing emphasis on design and aesthetics, technological advancements, and government initiatives. These elements drive the demand for flooring materials as urban areas expand, consumer purchasing power rises, and infrastructure projects flourish. The region's focus on quality, aesthetics, and sustainability plays a significant role in driving the growth of the flooring market in Asia Pacific.

By Company: Tier1: 40%, Tier 2: 25%, Tier3: 4: 35%

By Designation: C-Level: 35%, Director Level: 30%, Others: 35%

By Region: North America: 25%, Asia Pacific: 45%, Europe: 20%, South America: 5% and Middle East & Africa: 5%.

Companies Covered: Mohawk Industries, Inc. (US), Tarkett (France), Forbo (Switzerland), Shaw Industries Group Inc. (Georgia), Interface, Inc. (US), and others are covered in the flooring market.

Research Coverage

The market study covers the flooring market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on end-use, material, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the flooring market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall flooring market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing population & urbanization, growing investments in construction industry, rising number of renovation activities, and increasing industrialization), restraints (volatile raw material prices), opportunities (Rapidly progressing organized retail sector), and challenges (extremely competitive market) influencing the growth of the flooring market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the flooring market

- Market Development: Comprehensive information about lucrative markets - the report analyses the flooring market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the flooring market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Mohawk Industries, Inc. (US), Tarkett (France), Forbo (Switzerland), Shaw Industries Group Inc. (Georgia), Interface, Inc. (US), and among others in the flooring market. The report also helps stakeholders understand the pulse of the flooring market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 FLOORING MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 FLOORING MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- FIGURE 2 FLOORING MARKET, BY REGION

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 LIMITATIONS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 FLOORING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 FLOORING MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 CERAMIC TILES SEGMENT TO HAVE LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 8 RESIDENTIAL SECTOR TO LEAD FLOORING MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF FLOORING MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLOORING MARKET

- FIGURE 10 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.2 FLOORING MARKET, BY REGION AND TYPE

- FIGURE 11 CHINA AND NON-RESILIENT FLOORING LED THEIR RESPECTIVE SEGMENTS IN FLOORING MARKET IN 2022

- 4.3 FLOORING MARKET, BY COUNTRY

- FIGURE 12 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FLOORING MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Investments in infrastructure industry

- FIGURE 14 ANNUAL GROWTH RATE FOR INDUSTRY (INCLUDING CONSTRUCTION)

- 5.2.1.2 Rise in population & rapid urbanization

- FIGURE 15 INCREASING POPULATION TREND IN DIFFERENT REGIONS

- TABLE 2 REGIONAL URBANIZATION PROSPECTS

- FIGURE 16 URBAN POPULATION VS. RURAL POPULATION FOR DIFFERENT REGIONS

- 5.2.1.3 Rise in renovation & remodeling activities

- 5.2.1.4 Growing industrialization

- TABLE 3 INDUSTRIAL PRODUCTION GROWTH RATE (%), 2021

- 5.2.1.5 Increasing demand for high-end residential units and multi-story buildings

- FIGURE 17 BUILDINGS 200 METERS OR TALLER COMPLETED IN 2022, BY REGION

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatile raw material prices

- 5.2.2.2 Environmental concerns associated with flooring materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapidly growing organized retail sector

- 5.2.3.2 Rise in demand from emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental concerns associated with product waste management

- 5.2.4.2 Extremely competitive market

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS

- 6.2.1 THREAT OF NEW ENTRANTS

- 6.2.2 THREAT OF SUBSTITUTES

- 6.2.3 BARGAINING POWER OF SUPPLIERS

- 6.2.4 BARGAINING POWER OF BUYERS

- 6.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.3 MACROECONOMIC OVERVIEW

- 6.3.1 INTRODUCTION

- 6.3.2 GLOBAL GDP OUTLOOK

- 6.3.3 GDP TRENDS AND FORECASTS

- TABLE 5 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- 6.4 VALUE CHAIN ANALYSIS

- FIGURE 19 PRODUCTION PROCESS CONTRIBUTES MOST VALUE TO OVERALL PRICE OF FLOORING PRODUCTS

- 6.5 SUPPLY CHAIN ANALYSIS

- FIGURE 20 SUPPLY CHAIN OF FLOORING INDUSTRY

- 6.6 RECESSION IMPACT: REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

- 6.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- 6.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR FLOORING PRODUCT MANUFACTURERS

- FIGURE 21 REVENUE SHIFT FOR FLOORING PRODUCT MANUFACTURERS

- 6.8 MARKET MAPPING/ECOSYSTEM MAP

- FIGURE 22 ECOSYSTEM MAP

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 PROJECT TO IDENTIFY AND SHOWCASE GOOD PRACTICES AND INNOVATIVE FLOORING METHODS

- 6.10 PATENT ANALYSIS

- 6.10.1 INTRODUCTION

- 6.10.2 METHODOLOGY

- 6.10.3 DOCUMENT TYPES

- FIGURE 23 PATENT COUNT, 2019-2023

- FIGURE 24 PUBLICATION TRENDS, 2019-2023

- 6.10.4 INSIGHTS

- FIGURE 25 JURISDICTION ANALYSIS, 2019-2023

- 6.10.5 TOP APPLICANTS

- FIGURE 26 TOP APPLICANTS, BY NUMBER OF PATENTS

- 6.11 TECHNOLOGY ANALYSIS

- 6.11.1 SMART CARPETS

- 6.11.2 DIGITAL PRINTING

- 6.11.3 ANTI-SLIP TECHNOLOGY

- 6.11.4 UNDERFLOOR HEATING TECHNOLOGY

- 6.11.5 HYBRID VINYL FLOORING

- 6.11.6 SHAPES AND SIZES

- 6.12 REGULATORY ANALYSIS

- 6.13 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.14 KEY MARKETS FOR IMPORTS AND EXPORTS (TRADE ANALYSIS)

- TABLE 7 BRICKS, BLOCKS, TILES, AND OTHER CERAMIC GOODS IMPORT DATA, 2022 (USD MILLION)

- TABLE 8 BRICKS, BLOCKS, TILES, AND OTHER CERAMIC GOODS EXPORT DATA, 2022 (USD MILLION)

- TABLE 9 CARPETS AND OTHER TEXTILE FLOOR COVERINGS, TUFTED, NEEDLE PUNCHED, WHETHER OR NOT MADE UP OF WOOL OR FINE ANIMAL HAIR, IMPORT DATA 2022 (USD MILLION)

- TABLE 10 CARPETS AND OTHER TEXTILE FLOOR COVERINGS, TUFTED, NEEDLE PUNCHED, WHETHER OR NOT MADE UP OF WOOL OR FINE ANIMAL HAIR, EXPORT DATA 2022 (USD MILLION)

- 6.15 PRICING ANALYSIS

- 6.15.1 CHANGES IN PRICING OF FLOORING PRODUCTS IN 2022

- 6.15.2 PRICING ANALYSIS BY FLOORING MATERIAL

- 6.15.3 PRICING ANALYSIS, BY REGION

- FIGURE 27 AVERAGE PRICING ANALYSIS, BY REGION

- 6.16 KEY CONFERENCES

- TABLE 11 FLOORING MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 6.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF FLOORING PRODUCTS

- 6.17.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA OF FLOORING MARKET

- TABLE 13 KEY BUYING CRITERIA FOR FLOORING MARKET

7 FLOORING MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- FIGURE 30 CERAMIC TILES SEGMENT TO CAPTURE LARGEST SHARE OF FLOORING MARKET BETWEEN 2023 AND 2028

- TABLE 14 FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 15 FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- 7.2 RESILIENT FLOORING

- 7.2.1 VINYL

- 7.2.2 OTHER RESILIENT FLOORING (CORK, LINOLEUM, RUBBER, AND RESIN) TYPES

- 7.3 NON-RESILIENT FLOORING

- 7.3.1 CERAMIC TILES

- 7.3.2 WOOD

- 7.3.3 LAMINATE

- 7.3.4 STONE

- 7.3.5 OTHER NON-RESILIENT FLOORING (BAMBOO, TERRAZZO) TYPES

- 7.4 SOFT FLOOR COVERING/CARPETS & RUGS

8 FLOORING MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 31 RESIDENTIAL SEGMENT TO CAPTURE LARGER SHARE OF FLOORING MARKET BETWEEN 2023 AND 2028

- TABLE 16 FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 17 FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 8.2 RESIDENTIAL

- 8.2.1 CERAMIC TILES ARE DURABLE AND EASY TO MAINTAIN

- 8.3 NON-RESIDENTIAL

- 8.3.1 INCREASING SPENDING ON OFFICE SPACE AND OTHER COMMERCIAL & INSTITUTIONAL CONSTRUCTION

9 FLOORING MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 32 FLOORING MARKET GROWTH RATE, BY COUNTRY, 2023-2028

- TABLE 18 FLOORING MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 19 FLOORING MARKET, BY REGION 2021-2028 (MILLION SQUARE METER)

- 9.2 ASIA PACIFIC

- 9.2.1 RECESSION IMPACT

- FIGURE 33 ASIA PACIFIC: FLOORING MARKET SNAPSHOT

- TABLE 20 ASIA PACIFIC: FLOORING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 21 ASIA PACIFIC: FLOORING MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METER)

- TABLE 22 ASIA PACIFIC: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 23 ASIA PACIFIC: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 24 ASIA PACIFIC: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.2.2 CHINA

- 9.2.2.1 Fastest-growing market for flooring in Asia Pacific

- TABLE 26 CHINA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 27 CHINA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 28 CHINA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 29 CHINA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.2.3 INDIA

- 9.2.3.1 Developing economy and rising urbanization to boost market

- TABLE 30 INDIA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 31 INDIA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 32 INDIA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 33 INDIA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.2.4 JAPAN

- 9.2.4.1 Government initiatives to propel market

- TABLE 34 JAPAN: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 35 JAPAN: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 36 JAPAN: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 37 JAPAN: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.2.5 AUSTRALIA

- 9.2.5.1 Growing non-residential sector to support market

- TABLE 38 AUSTRALIA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 39 AUSTRALIA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 40 AUSTRALIA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 41 AUSTRALIA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.2.6 SOUTH KOREA

- 9.2.6.1 Increasing demand for residential houses to propel market

- TABLE 42 SOUTH KOREA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 43 SOUTH KOREA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 44 SOUTH KOREA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 45 SOUTH KOREA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.2.7 REST OF ASIA PACIFIC

- TABLE 46 REST OF ASIA PACIFIC: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 47 REST OF ASIA PACIFIC: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 48 REST OF ASIA PACIFIC: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 49 REST OF ASIA PACIFIC: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.3 EUROPE

- 9.3.1 RECESSION IMPACT

- FIGURE 34 EUROPE: FLOORING MARKET SNAPSHOT

- TABLE 50 EUROPE: FLOORING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 51 EUROPE: FLOORING MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METER)

- TABLE 52 EUROPE: FLOORING TYPE MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 53 EUROPE: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 54 EUROPE: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 55 EUROPE: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.3.2 GERMANY

- 9.3.2.1 Growing construction industry to drive flooring market

- TABLE 56 GERMANY: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 57 GERMANY: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 58 GERMANY: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 59 GERMANY: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.3.3 UK

- 9.3.3.1 New construction projects to drive market

- TABLE 60 UK: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 61 UK: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 62 UK: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 63 UK: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.3.4 FRANCE

- 9.3.4.1 Rise in construction industry to drive demand

- TABLE 64 FRANCE: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 65 FRANCE: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 66 FRANCE: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 67 FRANCE: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.3.5 RUSSIA

- 9.3.5.1 Growth potential of construction sector lucrative for market growth

- TABLE 68 RUSSIA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 69 RUSSIA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 70 RUSSIA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 71 RUSSIA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.3.6 SPAIN

- 9.3.6.1 Government investment in construction projects to boost market

- TABLE 72 SPAIN: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 73 SPAIN: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 74 SPAIN: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 75 SPAIN: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.3.7 NETHERLANDS

- 9.3.7.1 Increasing housing demand to propel market

- TABLE 76 NETHERLANDS: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 77 NETHERLANDS: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 78 NETHERLANDS: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 79 NETHERLANDS: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2023 (MILLION SQUARE METER)

- 9.3.8 REST OF EUROPE

- TABLE 80 REST OF EUROPE: FLOORING MARKET, MATERIAL, 2021-2028 (USD MILLION)

- TABLE 81 REST OF EUROPE: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 82 REST OF EUROPE: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 83 REST OF EUROPE: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.4 MIDDLE EAST & AFRICA

- TABLE 84 MIDDLE EAST & AFRICA: FLOORING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 85 MIDDLE EAST & AFRICA: FLOORING MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METER)

- TABLE 86 MIDDLE EAST & AFRICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 87 MIDDLE EAST & AFRICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 88 MIDDLE EAST & AFRICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 89 MIDDLE EAST & AFRICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.4.1 UAE

- 9.4.1.1 Investments in construction sector to fuel market growth

- TABLE 90 UAE: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 91 UAE: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 92 UAE: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 93 UAE: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.4.2 SAUDI ARABIA

- 9.4.2.1 Commencement of new construction projects to boost demand

- TABLE 94 SAUDI ARABIA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 95 SAUDI ARABIA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 96 SAUDI ARABIA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 97 SAUDI ARABIA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.4.3 SOUTH AFRICA

- 9.4.3.1 Rapid recovery of construction sector to drive market

- TABLE 98 SOUTH AFRICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 99 SOUTH AFRICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 100 SOUTH AFRICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 101 SOUTH AFRICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.4.4 TURKEY

- 9.4.4.1 Growing construction industry to boost demand for flooring products

- TABLE 102 TURKEY: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 103 TURKEY: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 104 TURKEY: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 105 TURKEY: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.4.5 REST OF MIDDLE EAST & AFRICA

- TABLE 106 REST OF MIDDLE EAST & AFRICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 107 REST OF MIDDLE EAST & AFRICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 108 REST OF MIDDLE EAST & AFRICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 109 REST OF MIDDLE EAST & AFRICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.5 NORTH AMERICA

- 9.5.1 RECESSION IMPACT

- TABLE 110 NORTH AMERICA: FLOORING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: FLOORING MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METER)

- TABLE 112 NORTH AMERICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 114 NORTH AMERICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.5.2 US

- 9.5.2.1 Largest market for flooring products in North America

- FIGURE 35 NEW PRIVATELY OWNED HOUSING UNITS COMPLETED IN US IN 2020, 2021, AND 2022

- TABLE 116 US: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 117 US: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 118 US: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 119 US: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.5.3 CANADA

- 9.5.3.1 Rise in residential and non-residential construction activities to drive market

- TABLE 120 CANADA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 121 CANADA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 122 CANADA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 123 CANADA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.5.4 MEXICO

- 9.5.4.1 Increase in infrastructure investment to drive growth

- TABLE 124 MEXICO: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 125 MEXICO: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 126 MEXICO: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 127 MEXICO: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.6 SOUTH AMERICA

- 9.6.1 RECESSION IMPACT

- TABLE 128 SOUTH AMERICA: FLOORING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 129 SOUTH AMERICA: FLOORING MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METER)

- TABLE 130 SOUTH AMERICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 131 SOUTH AMERICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 132 SOUTH AMERICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 133 SOUTH AMERICA: FLOORING MARKET SIZE, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.6.2 BRAZIL

- 9.6.2.1 Government efforts for fiscal sustainability to boost market

- TABLE 134 BRAZIL: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 135 BRAZIL: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 136 BRAZIL: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 137 BRAZIL: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.6.3 ARGENTINA

- 9.6.3.1 Growing tourism to boost market

- TABLE 138 ARGENTINA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 139 ARGENTINA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 140 ARGENTINA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 141 ARGENTINA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

- 9.6.4 REST OF SOUTH AMERICA

- TABLE 142 REST OF SOUTH AMERICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (USD MILLION)

- TABLE 143 REST OF SOUTH AMERICA: FLOORING MARKET, BY MATERIAL, 2021-2028 (MILLION SQUARE METER)

- TABLE 144 REST OF SOUTH AMERICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 145 REST OF SOUTH AMERICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METER)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 COMPANIES ADOPTED PRODUCT LAUNCHES AS A KEY GROWTH STRATEGY BETWEEN 2019 AND 2022

- 10.3 MARKET RANKING ANALYSIS

- FIGURE 36 FLOORING MARKET: MARKET RANKING ANALYSIS

- 10.4 COMPANY EVALUATION QUADRANT

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PARTICIPANTS

- 10.4.4 PERVASIVE COMPANIES

- FIGURE 37 COMPANY EVALUATION MATRIX: FLOORING MARKET, 2022

- 10.5 COMPETITIVE BENCHMARKING

- TABLE 146 FLOORING MARKET: DETAILED LIST OF PLAYERS

- TABLE 147 FLOORING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 10.6 SME MATRIX, 2022

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 38 SME MATRIX: FLOORING MARKET, 2022

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 DEALS

- TABLE 148 DEALS, 2019-2023

- 10.7.2 PRODUCT LAUNCHES

- TABLE 149 PRODUCT LAUNCHES, 2019-2023

11 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 11.1 KEY PLAYERS

- 11.1.1 MOHAWK INDUSTRIES, INC.

- TABLE 150 MOHAWK INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 39 MOHAWK INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 151 MOHAWK INDUSTRIES, INC.: DEALS

- TABLE 152 MOHAWK INDUSTRIES, INC.: OTHER DEVELOPMENTS

- 11.1.2 TARKETT

- TABLE 153 TARKETT: COMPANY OVERVIEW

- FIGURE 40 TARKETT: COMPANY SNAPSHOT

- TABLE 154 TARKETT: DEALS

- TABLE 155 TARKETT: PRODUCT LAUNCHES

- 11.1.3 FORBO

- TABLE 156 FORBO: COMPANY OVERVIEW

- FIGURE 41 FORBO: COMPANY SNAPSHOT

- TABLE 157 FORBO: DEALS

- TABLE 158 FORBO: PRODUCT LAUNCHES

- TABLE 159 FORBO: OTHER DEVELOPMENTS

- 11.1.4 SHAW INDUSTRIES GROUP, INC.

- TABLE 160 SHAW INDUSTRIES GROUP INC.: COMPANY OVERVIEW

- TABLE 161 SHAW INDUSTRIES GROUP INC.: DEALS

- TABLE 162 SHAW INDUSTRIES GROUP INC.: OTHER DEVELOPMENTS

- 11.1.5 INTERFACE, INC.

- TABLE 163 INTERFACE, INC.: COMPANY OVERVIEW

- FIGURE 42 INTERFACE, INC.: COMPANY SNAPSHOT

- TABLE 164 INTERFACE, INC.: PRODUCT LAUNCHES

- 11.1.6 TOLI CORPORATION

- TABLE 165 TOLI CORPORATION: COMPANY OVERVIEW

- FIGURE 43 TOLI CORPORATION: COMPANY SNAPSHOT

- TABLE 166 TOLI CORPORATION: DEALS

- TABLE 167 TOLI CORPORATION: PRODUCT LAUNCHES

- TABLE 168 TOLI CORPORATION: OTHER DEVELOPMENTS

- 11.1.7 BEAULIEU INTERNATIONAL GROUP

- TABLE 169 BEAULIEU INTERNATIONAL GROUP: COMPANY OVERVIEW

- TABLE 170 BEAULIEU INTERNATIONAL GROUP: DEALS

- TABLE 171 BEAULIEU INTERNATIONAL GROUP: PRODUCT LAUNCHES

- TABLE 172 BEAULIEU INTERNATIONAL GROUP: OTHER DEVELOPMENTS

- 11.1.8 MILLIKEN & COMPANY

- TABLE 173 MILLIKEN & COMPANY: COMPANY OVERVIEW

- 11.1.9 GERFLOR

- TABLE 174 GERFLOR: COMPANY OVERVIEW

- TABLE 175 GERFLOR: DEALS

- TABLE 176 GERFLOR: PRODUCT LAUNCHES

- 11.1.10 KAJARIA CERAMICS

- TABLE 177 KAJARIA CERAMICS: COMPANY OVERVIEW

- FIGURE 44 KAJARIA CERAMICS: COMPANY SNAPSHOT

- TABLE 178 KAJARIA CERAMICS: PRODUCT LAUNCHES

- TABLE 179 KAJARIA CERAMICS: OTHER DEVELOPMENTS

- 11.2 OTHER PLAYERS

- 11.2.1 CONGOLEUM CORPORATION

- TABLE 180 CONGOLEUM CORPORATION: COMPANY OVERVIEW

- 11.2.2 FLOWCRETE

- TABLE 181 FLOWCRETE: COMPANY OVERVIEW

- 11.2.3 JAMES HALSTEAD PLC

- TABLE 182 JAMES HALSTEAD PLC: COMPANY OVERVIEW

- 11.2.4 THE DIXIE GROUP, INC.

- TABLE 183 THE DIXIE GROUP, INC.: COMPANY OVERVIEW

- 11.2.5 VICTORIA PLC

- TABLE 184 VICTORIA PLC: COMPANY OVERVIEW

- 11.2.6 MANNINGTON MILLS INC.

- TABLE 185 MANNINGTON MILLS INC.: COMPANY OVERVIEW

- 11.2.7 SWISS KRONO GROUP

- TABLE 186 SWISS KRONO GROUP: COMPANY OVERVIEW

- 11.2.8 LX HAUSYS, LTD.

- TABLE 187 LX HAUSYS, LTD.: COMPANY OVERVIEW

- 11.2.9 PARADOR GMBH

- TABLE 188 PARADOR GMBH: COMPANY OVERVIEW

- 11.2.10 INVISTA

- TABLE 189 INVISTA: COMPANY OVERVIEW

- 11.2.11 ORIENTAL WEAVERS GROUP

- TABLE 190 ORIENTAL WEAVERS GROUP: COMPANY OVERVIEW

- 11.2.12 MIRAGE

- TABLE 191 MIRAGE: COMPANY OVERVIEW

- 11.2.13 EGGER

- TABLE 192 EGGER: COMPANY OVERVIEW

- 11.2.14 WELSPUN FLOORING LIMITED

- TABLE 193 WELSPUN FLOORING LIMITED: COMPANY OVERVIEW

- 11.2.15 J&J FLOORING LLC

- TABLE 194 J&J FLOORING LLC: COMPANY OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS