|

|

市場調査レポート

商品コード

1295441

電池リサイクルの世界市場:供給源別 (自動車用電池、産業用電池、民生用・電子機器用電池)・化学成分別 (鉛酸、リチウムベース、ニッケルベース)・材料別 (金属、電解質、プラスチック)・地域別の将来予測 (2030年まで)Battery Recycling Market by Source (Automotive Batteries, Industrial Batteries, Consumer & Electronic Appliance Batteries), Chemistry (Lead Acid, Lithium-based, Nickel-based), Material (Metals, Electrolyte, Plastics) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 電池リサイクルの世界市場:供給源別 (自動車用電池、産業用電池、民生用・電子機器用電池)・化学成分別 (鉛酸、リチウムベース、ニッケルベース)・材料別 (金属、電解質、プラスチック)・地域別の将来予測 (2030年まで) |

|

出版日: 2023年06月13日

発行: MarketsandMarkets

ページ情報: 英文 264 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の電池リサイクルの市場規模は、2023年の269億米ドルから、2030年には543億米ドルへと、10.5%のCAGRで成長すると予測されています。

電池リサイクル市場は、自動車、エレクトロニクス、エネルギー貯蔵など、さまざまな産業で急成長を遂げようとしています。同市場では、鉛蓄電池、リチウム蓄電池、ニッケル蓄電池、ナトリウム蓄電池、アルカリ蓄電池など、さまざまな種類の電池を回収・処理・再生し、循環型経済を支えています。

"供給源別では、2022年には産業用電池部門が第2位のシェアを占める"

産業用電池セグメントは、2022年に第2位のシェアを占めました。このセグメントの成長は、送電網の安定化や再生可能エネルギー源の統合に使用される大型電池のようなエネルギー貯蔵装置に対するニーズの高まりにより、産業部門における電池リサイクルの必要性が高まっていることに起因しています。エネルギー貯蔵装置を設置する産業現場が増えるにつれて、使用済み電池の効率的な管理が必要となります。使用済み電池はリサイクルして重要な材料を回収することができ、将来のエネルギー貯蔵プロジェクトのために安定した供給を維持することができます。

"化学成分別では、リチウムベースの電池セグメントが2022年に第2位のシェアを占める"

リチウムベースのセグメントは、2022年に第2位のシェアを占めました。リチウム製の電池は、再生可能エネルギーの貯蔵や電力の安定供給に不可欠であり、電池市場の拡大に貢献しています。リチウムベースの電池をリサイクルすれば、エネルギーとコストを大幅に節約できます。また再生工程では、原材料の抽出や精製に比べて資源の使用量が少なくて済みます。これらの要因が、リチウムベース電池の再生の必要性をさらに高めています。

"欧州の電池リサイクル市場は、2022年に第2位のシェアを占める"

欧州は、電池の回収・再生・廃棄といった電池管理を確実にするため、厳しい法律とガイドラインを定めています。欧州連合 (EU) の電池指令は、電池の回収とリサイクルに特定の目標を設定することで、循環型経済を推進しています。企業はリサイクル目標を達成し、罰則を回避しようと努力するため、欧州における電池リサイクルの成長は、これらの規制の遵守によって大きな影響を受ける。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステムマップ

- ポーターのファイブフォースモデル

- 技術分析

- 関税・規制状況

- 特許分析

- ケーススタディ

- 主要な会議とイベント (2023年~2024年)

- 主要な利害関係者と購入基準

- 顧客のビジネスに影響を与える動向/混乱

- 原材料の価格分析

- 貿易データ

第6章 電池リサイクル市場:処理状態別

- 材料抽出

- 再利用・再梱包・二次利用

- 廃棄

第7章 電池リサイクル市場:再生プロセス別

- イントロダクション

- 湿式冶金

- 乾式冶金

- 鉛蓄電池の再生プロセス

- リチウムイオン電池の再生プロセス

第8章 電池リサイクル市場:材料別

- イントロダクション

- 金属

- 電解質

- プラスチック

- その他のコンポーネント

第9章 電池リサイクル市場:化学成分別

- イントロダクション

- 鉛酸

- ニッケルベース

- リチウムベース

- その他

第10章 電池リサイクル市場:供給源別

- イントロダクション

- 自動車用電池

- 産業用電池

- 民生用・電子機器用電池

第11章 電池リサイクル市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- インドネシア

- マレーシア

- オーストラリア

- 台湾

- タイ

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他の南米

- 中東・アフリカ

- アラブ首長国連邦

- 南アフリカ

- エジプト

- その他の中東・アフリカ

第12章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 市場シェア分析

- 企業の製品フットプリント分析

- 企業評価マトリックス:ティア1

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- 最近の展開

第13章 企業プロファイル

- 主要企業

- CALL2RECYCLE, INC.

- CIRBA SOLUTIONS

- ELEMENT RESOURCES

- UMICORE

- CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- EXIDE INDUSTRIES LTD.

- ACCUREC RECYCLING GMBH

- AMERICAN BATTERY TECHNOLOGY COMPANY

- AQUA METALS, INC.

- EAST PENN MANUFACTURING COMPANY

- ECOBAT

- ENERSYS

- FORTUM

- GEM CO., LTD.

- GLENCORE

- GOPHER RESOURCE

- GRAVITA INDIA LTD.

- LI-CYCLE CORP.

- NEOMETALS LTD.

- RAW MATERIALS COMPANY

- RECYCLICO BATTERY MATERIALS INC.

- REDWOOD MATERIALS INC.

- SHENZHEN HIGHPOWER TECHNOLOGY CO., LTD.

- STENA RECYCLING

- TERRAPURE

- TES

- THE DOE RUN COMPANY

- THE INTERNATIONAL METALS RECLAMATION COMPANY

- その他の企業

- BATREC INDUSTRIE

- BATTERY RECYCLING MADE EASY (BRME)

- DUESENFELD GMBH

- ENVIROSTREAM AUSTRALIA PTY LTD.

- EURO DIEUZE INDUSTRIE (E.D.I.)

- LITHION RECYCLING

- METALEX PRODUCTS LTD.

- ONTO TECHNOLOGY

- SITRASA

- SMC RECYCLING

- TATA CHEMICALS LIMITED

第14章 隣接・関連市場

- イントロダクション

- 制限事項

- リチウムイオン電池リサイクル市場

第15章 付録

The battery recycling market is projected to grow from USD 26.9 billion in 2023 to USD 54.3 billion by 2030, at a CAGR of 10.5%. The battery recycling market is on the way to intense growth across different industries such as automotive, electronics, and energy storage. The market involves the collection, processing, and recycling of various types of batteries, such as lead-acid, lithium-based, nickel-based, sodium-based, and alkaline batteries to support the circular economy.

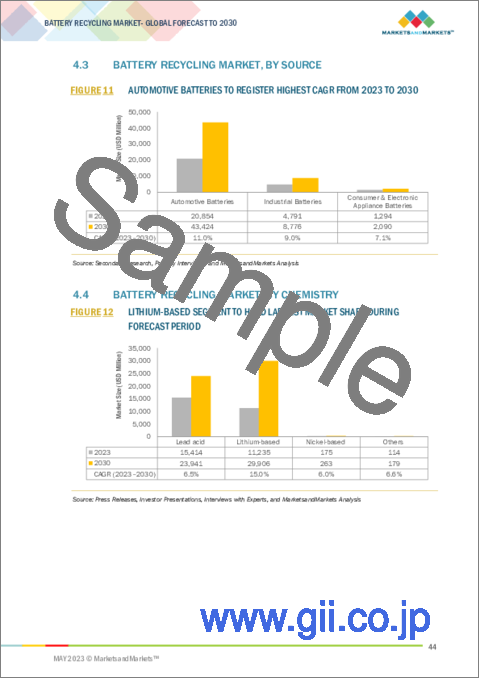

"By source, industrial batteries segment accounted for the second-largest share in battery recycling market in 2022."

The industrial batteries segment held the second-largest share in 2022. The growth of this segment can be attributed to the requirement of battery recycling in the industrial sector due to the rising need for energy storage devices such as large-scale batteries used for grid stabilization and integration of renewable energy sources. Effective battery end-of-life management is necessary as more industrial sites install energy storage devices. Spent batteries can be recycled to recover important materials, maintaining a steady supply for future energy storage projects.

"By chemistry, the lithium-based batteries segment accounted for the second-largest share in battery recycling market in 2022."

The lithium-based chemistry segment held the second-largest share in 2022. Batteries made of lithium are essential for storing renewable energy and ensuring a steady supply of power, which helps the battery market expand. Recycling lithium-based batteries can result in significant energy and cost savings. Also, the recycling process uses less resources compared to the extraction and refining of raw materials. These factors further fuel the need for battery recycling of lithium-based batteries.

"The battery recycling market in Europe accounted for the second-largest share in 2022."

Europe has set strict legislation and guidelines in order to ensure the management of batteries, including their collection, recycling, and disposal. The Battery Directive of the European Union promotes a circular economy by setting specified goals for the collecting and recycling of batteries. The growth of battery recycling in Europe is significantly impacted by compliance with these restrictions, as businesses strive to reach recycling goals and avoid penalties.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 -20%, and Tier 3 - 15%

- By Designation: C-level Executives - 25%, Directors - 30%, and Others - 45%

- By Region: North America - 30%, Europe -20%, Asia Pacific - 40%, Middle East & Africa-7%, South America -3%

The battery recycling report is dominated by players, such as ACCUREC Recycling GmbH (Germany), American Battery Technology Company (US), Aqua Metals, Inc. (US), Call2Recycle, Inc. (US), Cirba Solutions (US), Contemporary Amperex Technology Co., Limited (China), East Penn Manufacturing Company (US), Ecobat (US), Element Resources (US), EnerSys (US), Exide Industries Ltd. (India), Fortum (Finland), GEM Co., Ltd. (China), Glencore (Switzerland), Gopher Resource (US), Gravita India Limited (India), Li-Cycle Corp. (Canada), Neometals Ltd. (Australia), Raw Materials Company (Canada), RecycLiCo Battery Materials Inc. (Canada), Redwood Materials Inc. (US), Shenzhen Highpower Technology Co., Ltd. (China), Stena Recycling (Sweden), TES (Singapore), Terrapure (Canada), The Doe Run Company (US), The International Metals Reclamation Company (US), and Umicore (Belgium), and others

Research Coverage:

The report defines, segments, and projects the size of the battery recycling market based on source, chemistry, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as partnership, agreement, and expansion undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them with the closest approximations of revenue numbers of the battery recycling market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increase in demand for electric vehicles), restraints (safety issues related to the storage and transportation of spent batteries), opportunities (growing demand for renewable energy storage), and challenges (high cost of recycling and dearth of technologies) influencing the growth of the battery recycling market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the battery recycling market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the battery recycling market across varied regions.

- Market Diversification: Exhaustive information about new services, various recycling processes, untapped geographies, recent developments, and investments in the battery recycling market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Call2Recycle, Inc. (US), Cirba Solutions (US), Element Resources (US), Umicore (Belgium), Contemporary Amperex Technology Co., Limited (China), and Exide Industries Ltd. (India) among others in the battery recycling market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 BATTERY RECYCLING MARKET: INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 BATTERY RECYCLING MARKET SEGMENTATION

- 1.3.1 REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 BATTERY RECYCLING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Participating companies for primary research

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.2 MATRIX CONSIDERED FOR ASSESSING DEMAND

- FIGURE 3 MAIN MATRIX CONSIDERED FOR ASSESSING DEMAND FOR BATTERY RECYCLING

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.4 METHODOLOGY FOR SUPPLY-SIDE SIZING OF BATTERY RECYCLING MARKET (1/2)

- 2.5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF BATTERY RECYCLING MARKET (2/2)

- 2.5.1 CALCULATIONS BASED ON SUPPLY-SIDE ANALYSIS

- 2.5.2 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 BATTERY RECYCLING MARKET: DATA TRIANGULATION

- 2.7 IMPACT OF RECESSION

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS

- 2.10 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- TABLE 2 BATTERY RECYCLING MARKET SNAPSHOT: 2023 VS. 2030

- FIGURE 7 AUTOMOTIVE BATTERIES SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 8 EUROPE TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN BATTERY RECYCLING MARKET

- FIGURE 9 HIGH OUTPUT OF SPENT BATTERIES FROM ELECTRIC VEHICLES TO DRIVE BATTERY RECYCLING MARKET

- 4.2 BATTERY RECYCLING MARKET, BY REGION

- FIGURE 10 ASIA PACIFIC SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.3 BATTERY RECYCLING MARKET, BY SOURCE

- FIGURE 11 AUTOMOTIVE BATTERIES TO REGISTER HIGHEST CAGR FROM 2023 TO 2030

- 4.4 BATTERY RECYCLING MARKET, BY CHEMISTRY

- FIGURE 12 LITHIUM-BASED SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BATTERY RECYCLING MARKET

- 5.1.1 DRIVERS

- 5.1.1.1 Increasing demand for electric vehicles

- 5.1.1.2 Stringent government regulations and EPA guidelines

- 5.1.1.3 Rising demand for recycled products and materials

- 5.1.1.4 Increasing awareness of resource conservation

- 5.1.2 RESTRAINTS

- 5.1.2.1 Safety issues related to storage and transportation of spent batteries

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Growing demand for renewable energy storage

- 5.1.3.2 Increasing adoption of lithium-ion batteries due to decline in price

- 5.1.4 CHALLENGES

- 5.1.4.1 High cost of recycling and dearth of technologies

- 5.2 VALUE CHAIN ANALYSIS

- FIGURE 14 VALUE CHAIN ANALYSIS OF BATTERY RECYCLING MARKET

- 5.3 ECOSYSTEM MAP

- FIGURE 15 ECOSYSTEM MAP OF BATTERY RECYCLING MARKET

- TABLE 3 ECOSYSTEM OF BATTERY RECYCLING MARKET

- 5.4 PORTER'S FIVE FORCES MODEL

- 5.4.1 PORTER'S FIVE FORCES ANALYSIS FOR LEAD ACID BATTERY RECYCLING

- FIGURE 16 LEAD ACID BATTERY RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 LEAD ACID BATTERY RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.1.1 Bargaining power of suppliers

- 5.4.1.2 Threat of new entrants

- 5.4.1.3 Threat of substitutes

- 5.4.1.4 Bargaining power of buyers

- 5.4.1.5 Intensity of competitive rivalry

- 5.4.2 PORTER'S FIVE FORCES ANALYSIS FOR LITHIUM-ION BATTERY RECYCLING

- FIGURE 17 LITHIUM-ION BATTERY RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 LITHIUM-ION BATTERY RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.2.1 Bargaining power of suppliers

- 5.4.2.2 Threat of new entrants

- 5.4.2.3 Threat of substitutes

- 5.4.2.4 Bargaining power of buyers

- 5.4.2.5 Intensity of competitive rivalry

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 INTRODUCTION

- 5.5.2 TECHNOLOGY

- 5.5.2.1 Hydrometallurgy

- 5.5.3 PYROMETALLURGY

- 5.5.4 PYROLYSIS

- 5.5.5 MECHANICAL THERMODYNAMIC RECYCLING

- 5.5.6 COMPARATIVE ANALYSIS

- 5.6 TARIFF AND REGULATORY LANDSCAPE

- TABLE 6 REGULATIONS AND STANDARDS FOR BATTERIES

- 5.6.1 NORTH AMERICA BATTERY RECYCLING REGULATIONS

- 5.6.2 EUROPE BATTERY RECYCLING REGULATIONS

- 5.6.3 ASIA PACIFIC BATTERY RECYCLING REGULATIONS

- 5.7 PATENT ANALYSIS

- 5.7.1 METHODOLOGY

- 5.7.2 DOCUMENT TYPE

- FIGURE 18 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 19 PUBLICATION TRENDS - LAST 10 YEARS

- 5.7.3 INSIGHTS

- FIGURE 20 LEGAL STATUS OF PATENTS

- 5.7.4 JURISDICTION ANALYSIS

- FIGURE 21 TOP JURISDICTION, BY DOCUMENT

- 5.7.5 TOP COMPANIES/APPLICANTS

- FIGURE 22 TOP 10 PATENT APPLICANTS

- TABLE 7 RECENT PATENTS BY GUANGDONG BRUNP RECYCLING TECHNOLOGY CO., LTD.

- TABLE 8 RECENT PATENTS BY UNIV CENTRAL SOUTH

- TABLE 9 RECENT PATENTS BY AQUA METALS, INC.

- TABLE 10 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- 5.8 CASE STUDY: ATTERO RECYCLING

- 5.8.1 KEY HIGHLIGHTS

- 5.9 KEY CONFERENCES AND EVENTS (2023-2024)

- TABLE 11 BATTERY RECYCLING MARKET: KEY CONFERENCES AND EVENTS (2023-2024)

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING LITHIUM-ION BATTERY ECOSYSTEM

- 5.12 PRICING ANALYSIS OF RAW MATERIALS

- 5.12.1 LITHIUM

- FIGURE 26 PRICE OF LITHIUM CARBONATE, JANUARY 2019 TO APRIL 2023

- 5.12.2 LEAD

- FIGURE 27 PRICE OF LEAD, JANUARY 2019 TO APRIL 2023

- 5.12.3 NICKEL

- FIGURE 28 PRICE OF NICKEL, JANUARY 2019 TO APRIL 2023

- 5.12.4 COBALT

- FIGURE 29 PRICE OF COBALT, JANUARY 2019 TO APRIL 2023

- 5.13 TRADE DATA

- TABLE 14 IMPORT DATA OF BATTERIES, 2021

- TABLE 15 EXPORT DATA OF BATTERIES, 2021

6 BATTERY RECYCLING MARKET, BY PROCESSING STATE

- 6.1 EXTRACTION OF MATERIAL

- 6.2 REUSE, REPACKAGING, AND SECOND LIFE

- 6.3 DISPOSAL

7 BATTERY RECYCLING MARKET, BY RECYCLING PROCESS

- 7.1 INTRODUCTION

- 7.2 HYDROMETALLURGY

- 7.3 PYROMETALLURGY

- TABLE 16 COMPARISON OF GENERIC RECYCLING METHODS USED TO RECOVER BATTERY COMPONENTS

- TABLE 17 BATTERY RECYCLING PROCESSES USED BY DIFFERENT COMPANIES

- 7.4 LEAD ACID BATTERY RECYCLING PROCESS

- 7.5 LITHIUM-ION BATTERY RECYCLING PROCESS

- 7.5.1 GROWTH OPPORTUNITIES FOR LITHIUM-ION BATTERY RECYCLING MARKET

- TABLE 18 OVERALL BATTERY RECYCLING CAPACITIES OF VARIOUS COUNTRIES

8 BATTERY RECYCLING MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 METALS

- TABLE 19 METALS BY WEIGHT PERCENTAGE IN MOST COMMON BATTERY CHEMISTRIES

- TABLE 20 MAJOR RECOVERABLE METALS FROM VARIOUS BATTERY CHEMISTRIES AFTER RECYCLING

- 8.3 ELECTROLYTES

- 8.4 PLASTICS

- 8.5 OTHER COMPONENTS

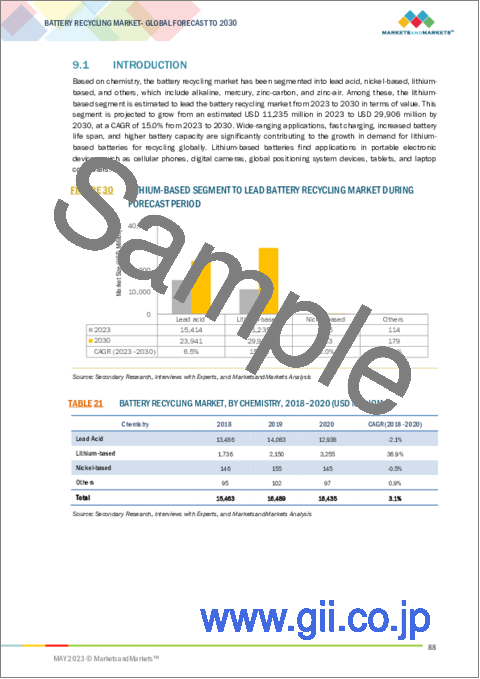

9 BATTERY RECYCLING MARKET, BY CHEMISTRY

- 9.1 INTRODUCTION

- FIGURE 30 LITHIUM-BASED SEGMENT TO LEAD BATTERY RECYCLING MARKET DURING FORECAST PERIOD

- TABLE 21 BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018-2020 (USD MILLION)

- TABLE 22 BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021-2030 (USD MILLION)

- 9.2 LEAD ACID

- 9.2.1 LOW RECYCLING COSTS AND HIGH RECOVERY RATE TO DRIVE MARKET

- TABLE 23 LEAD ACID BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018-2020 (USD MILLION)

- TABLE 24 LEAD ACID BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021-2030 (USD MILLION)

- 9.3 NICKEL-BASED

- 9.3.1 HIGHER POWER DENSITY TO DRIVE SEGMENT GROWTH

- TABLE 25 NICKEL-BASED BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018-2020 (USD MILLION)

- TABLE 26 NICKEL-BASED BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021-2030 (USD MILLION)

- 9.4 LITHIUM-BASED

- 9.4.1 INCREASING GLOBAL CONSUMPTION TO DRIVE MARKET

- TABLE 27 LITHIUM-BASED BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018-2020 (USD MILLION)

- TABLE 28 LITHIUM-BASED BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021-2030 (USD MILLION)

- TABLE 29 AUTOMOTIVE LITHIUM-BASED: BATTERY RECYCLING MARKET, BY REGION, 2018-2020 (UNITS)

- TABLE 30 AUTOMOTIVE LITHIUM-BASED: BATTERY RECYCLING MARKET, BY REGION, 2021-2030 (UNITS)

- 9.5 OTHERS

- TABLE 31 OTHERS: BATTERY RECYCLING MARKET, BY REGION, 2018-2020 (USD MILLION)

- TABLE 32 OTHERS: BATTERY RECYCLING MARKET, BY REGION, 2021-2030 (USD MILLION)

10 BATTERY RECYCLING MARKET, BY SOURCE

- 10.1 INTRODUCTION

- FIGURE 31 AUTOMOTIVE BATTERIES SEGMENT TO DOMINATE BATTERY RECYCLING MARKET DURING FORECAST PERIOD

- TABLE 33 BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 34 BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 10.2 AUTOMOTIVE BATTERIES

- 10.2.1 HIGH DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET GROWTH

- TABLE 35 AUTOMOTIVE BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018-2020 (USD MILLION)

- TABLE 36 AUTOMOTIVE BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021-2030 (USD MILLION)

- 10.3 INDUSTRIAL BATTERIES

- 10.3.1 NEED FOR POWER BACKUP IN INDUSTRIAL SECTOR TO SUPPORT MARKET GROWTH

- TABLE 37 INDUSTRIAL BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018-2020 (USD MILLION)

- TABLE 38 INDUSTRIAL BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021-2030 (USD MILLION)

- 10.4 CONSUMER & ELECTRONIC APPLIANCE BATTERIES

- 10.4.1 GROWING USE OF CONSUMER & ELECTRONIC APPLIANCES TO PROPEL MARKET DEMAND

- TABLE 39 CONSUMER & ELECTRONIC APPLIANCE BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018-2020 (USD MILLION)

- TABLE 40 CONSUMER & ELECTRONIC APPLIANCE BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021-2030 (USD MILLION)

11 BATTERY RECYCLING MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 32 BATTERY RECYCLING MARKET, BY REGION (USD MILLION)

- TABLE 41 BATTERY RECYCLING MARKET, BY REGION, 2018-2020 (USD MILLION)

- TABLE 42 BATTERY RECYCLING MARKET, BY REGION, 2021-2030 (USD MILLION)

- 11.2 ASIA PACIFIC

- 11.2.1 IMPACT OF RECESSION

- FIGURE 33 ASIA PACIFIC BATTERY RECYCLING MARKET SNAPSHOT

- TABLE 43 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

- TABLE 44 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018-2020 (USD MILLION)

- TABLE 46 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 48 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.2.2 CHINA

- 11.2.2.1 Growing electric vehicle market to propel battery recycling in China

- TABLE 49 CHINA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 50 CHINA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.2.3 INDIA

- 11.2.3.1 Increasing cleaner energy initiatives to drive market

- TABLE 51 INDIA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 52 INDIA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.2.4 JAPAN

- 11.2.4.1 Growth in battery manufacturing to create demand for recycling

- TABLE 53 JAPAN: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 54 JAPAN: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.2.5 SOUTH KOREA

- 11.2.5.1 Substantial growth in automotive sector to positively impact market

- TABLE 55 SOUTH KOREA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 56 SOUTH KOREA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.2.6 INDONESIA

- 11.2.6.1 Lead-acid batteries to drive growth

- TABLE 57 INDONESIA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 58 INDONESIA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.2.7 MALAYSIA

- 11.2.7.1 Requirement of energy storage to increase demand for battery recycling

- TABLE 59 MALAYSIA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 60 MALAYSIA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.2.8 AUSTRALIA

- 11.2.8.1 Supportive government policies to aid market growth

- TABLE 61 AUSTRALIA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 62 AUSTRALIA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.2.9 TAIWAN

- 11.2.9.1 Increasing number of vehicles to support market growth

- TABLE 63 TAIWAN: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 64 TAIWAN: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.2.10 THAILAND

- 11.2.10.1 Electric mobility sector to drive market

- TABLE 65 THAILAND: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 66 THAILAND: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.2.11 REST OF ASIA PACIFIC

- TABLE 67 REST OF ASIA PACIFIC: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 68 REST OF ASIA PACIFIC: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.3 NORTH AMERICA

- 11.3.1 IMPACT OF RECESSION

- FIGURE 34 NORTH AMERICA BATTERY RECYCLING MARKET SNAPSHOT

- TABLE 69 NORTH AMERICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

- TABLE 70 NORTH AMERICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018-2020 (USD MILLION)

- TABLE 72 NORTH AMERICA: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 74 NORTH AMERICA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.3.2 US

- 11.3.2.1 US to lead market in North America

- TABLE 75 US: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 76 US: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.3.3 CANADA

- 11.3.3.1 Battery recycling programs to support market

- TABLE 77 CANADA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 78 CANADA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.3.4 MEXICO

- 11.3.4.1 Government initiatives to fuel demand

- TABLE 79 MEXICO: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 80 MEXICO: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.4 EUROPE

- 11.4.1 IMPACT OF RECESSION

- FIGURE 35 EUROPE BATTERY RECYCLING MARKET SNAPSHOT

- TABLE 81 EUROPE: BATTERY RECYCLING MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

- TABLE 82 EUROPE: BATTERY RECYCLING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

- TABLE 83 EUROPE: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018-2020 (USD MILLION)

- TABLE 84 EUROPE: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021-2030 (USD MILLION)

- TABLE 85 EUROPE: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 86 EUROPE: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.4.2 GERMANY

- 11.4.2.1 Shift toward renewable energy to drive market

- TABLE 87 GERMANY: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 88 GERMANY: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.4.3 UK

- 11.4.3.1 Growth of electric vehicles to propel demand

- TABLE 89 UK: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 90 UK: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.4.4 FRANCE

- 11.4.4.1 Development in battery recycling technologies to fuel market growth

- TABLE 91 FRANCE: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 92 FRANCE: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.4.5 ITALY

- 11.4.5.1 Increasing capacity to recycle batteries and electric vehicles sales to drive market

- TABLE 93 ITALY: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 94 ITALY: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.4.6 SPAIN

- 11.4.6.1 Growing investments to promote electric vehicle sales to propel market

- TABLE 95 SPAIN: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 96 SPAIN: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.4.7 NETHERLANDS

- 11.4.7.1 Growing consumer electronics industry to support market growth

- TABLE 97 NETHERLANDS: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 98 NETHERLANDS: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.4.8 REST OF EUROPE

- TABLE 99 REST OF EUROPE: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 100 REST OF EUROPE: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.5 SOUTH AMERICA

- 11.5.1 IMPACT OF RECESSION

- TABLE 101 SOUTH AMERICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

- TABLE 102 SOUTH AMERICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

- TABLE 103 SOUTH AMERICA: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018-2020 (USD MILLION)

- TABLE 104 SOUTH AMERICA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021-2030 (USD MILLION)

- TABLE 105 SOUTH AMERICA BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 106 SOUTH AMERICA BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Brazil to lead market in South America during forecast period

- TABLE 107 BRAZIL: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 108 BRAZIL: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.5.3 ARGENTINA

- 11.5.3.1 Development of battery recycling facilities to drive market

- TABLE 109 ARGENTINA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 110 ARGENTINA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.5.4 CHILE

- 11.5.4.1 Battery recycling market to register second-highest CAGR in South America

- TABLE 111 CHILE: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 112 CHILE: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.5.5 REST OF SOUTH AMERICA

- TABLE 113 REST OF SOUTH AMERICA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 114 REST OF SOUTH AMERICA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 IMPACT OF RECESSION

- TABLE 115 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018-2020 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021-2030 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.6.2 SAUDI ARABIA

- 11.6.2.1 Government initiatives toward renewable energy sector to drive demand for battery recycling

- TABLE 121 SAUDI ARABIA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 122 SAUDI ARABIA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.6.3 UAE

- 11.6.3.1 Government support to enhance electric vehicles to drive market

- TABLE 123 UAE: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 124 UAE: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.6.4 SOUTH AFRICA

- 11.6.4.1 Automotive batteries segment to lead market

- TABLE 125 SOUTH AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 126 SOUTH AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.6.5 EGYPT

- 11.6.5.1 Focus on electronic waste management to enhance market growth

- TABLE 127 EGYPT: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 128 EGYPT: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

- 11.6.6 REST OF MIDDLE EAST & AFRICA

- TABLE 129 REST OF MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2018-2020 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2021-2030 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 131 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- 12.3 MARKET SHARE ANALYSIS

- 12.3.1 RANKING OF KEY MARKET PLAYERS, 2022

- FIGURE 36 RANKING OF TOP SIX PLAYERS IN BATTERY RECYCLING MARKET, 2022

- 12.3.2 MARKET SHARE OF KEY PLAYERS

- FIGURE 37 BATTERY RECYCLING MARKET SHARE ANALYSIS

- TABLE 132 BATTERY RECYCLING MARKET: DEGREE OF COMPETITION

- 12.3.2.1 Call2Recycle, Inc.

- 12.3.2.2 Cirba Solutions

- 12.3.2.3 Element Resources

- 12.3.2.4 Umicore

- 12.3.2.5 Contemporary Amperex Technology Co., Limited

- 12.3.2.6 Exide Industries Ltd.

- 12.3.3 REVENUE ANALYSIS OF TOP 6 PLAYERS

- FIGURE 38 REVENUE ANALYSIS OF KEY COMPANIES (2018-2022)

- 12.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 39 BATTERY RECYCLING MARKET: COMPANY FOOTPRINT

- TABLE 133 BATTERY RECYCLING MARKET: CHEMISTRY FOOTPRINT

- TABLE 134 BATTERY RECYCLING MARKET: RECYCLING PROCESS FOOTPRINT

- TABLE 135 BATTERY RECYCLING MARKET: COMPANY REGION FOOTPRINT

- 12.5 COMPANY EVALUATION MATRIX (TIER 1)

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 40 COMPANY EVALUATION QUADRANT: BATTERY RECYCLING MARKET (TIER 1 COMPANIES)

- 12.6 COMPETITIVE BENCHMARKING

- TABLE 136 BATTERY RECYCLING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 137 BATTERY RECYCLING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.7 STARTUP/SME EVALUATION QUADRANT

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 41 STARTUP/SM EVALUATION QUADRANT: BATTERY RECYCLING MARKET

- 12.8 RECENT DEVELOPMENTS

- 12.8.1 PRODUCT LAUNCHES

- TABLE 138 BATTERY RECYCLING MARKET: PRODUCT LAUNCHES (2019-APRIL 2023)

- 12.8.2 DEALS

- TABLE 139 BATTERY RECYCLING MARKET: DEALS (2019-APRIL 2023)

- 12.8.3 OTHER DEVELOPMENTS

- TABLE 140 BATTERY RECYCLING MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2019-APRIL 2023)

13 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 13.1 KEY COMPANIES

- 13.1.1 CALL2RECYCLE, INC.

- TABLE 141 CALL2RECYCLE, INC.: COMPANY OVERVIEW

- TABLE 142 CALL2RECYCLE, INC.: PRODUCTS OFFERED

- TABLE 143 CALL2RECYCLE, INC.: DEALS

- 13.1.2 CIRBA SOLUTIONS

- TABLE 144 CIRBA SOLUTIONS: COMPANY OVERVIEW

- TABLE 145 CIRBA SOLUTIONS: PRODUCTS OFFERED

- TABLE 146 CIRBA SOLUTIONS: DEALS

- TABLE 147 CIRBA SOLUTIONS: OTHERS

- 13.1.3 ELEMENT RESOURCES

- TABLE 148 ELEMENT RESOURCES: COMPANY OVERVIEW

- TABLE 149 ELEMENT RESOURCES: PRODUCTS OFFERED

- 13.1.4 UMICORE

- TABLE 150 UMICORE: COMPANY OVERVIEW

- FIGURE 42 UMICORE: COMPANY SNAPSHOT

- TABLE 151 UMICORE: PRODUCTS OFFERED

- TABLE 152 UMICORE: DEALS

- 13.1.5 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- TABLE 153 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: COMPANY OVERVIEW

- TABLE 154 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: PRODUCTS OFFERED

- TABLE 155 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: DEALS

- TABLE 156 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: OTHERS

- 13.1.6 EXIDE INDUSTRIES LTD.

- TABLE 157 EXIDE INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 43 EXIDE INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 158 EXIDE INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 159 EXIDE INDUSTRIES LTD.: OTHERS

- 13.1.7 ACCUREC RECYCLING GMBH

- TABLE 160 ACCUREC RECYCLING GMBH: COMPANY OVERVIEW

- TABLE 161 ACCUREC RECYCLING GMBH: PRODUCTS OFFERED

- TABLE 162 ACCUREC RECYCLING GMBH: OTHERS

- 13.1.8 AMERICAN BATTERY TECHNOLOGY COMPANY

- TABLE 163 AMERICAN BATTERY TECHNOLOGY COMPANY: COMPANY OVERVIEW

- TABLE 164 AMERICAN BATTERY TECHNOLOGY COMPANY: PRODUCTS OFFERED

- TABLE 165 AMERICAN BATTERY TECHNOLOGY COMPANY: DEALS

- TABLE 166 AMERICAN BATTERY TECHNOLOGY COMPANY: OTHERS

- 13.1.9 AQUA METALS, INC.

- TABLE 167 AQUA METALS, INC.: COMPANY OVERVIEW

- FIGURE 44 AQUA METALS, INC.: COMPANY SNAPSHOT

- TABLE 168 AQUA METALS, INC.: PRODUCTS OFFERED

- TABLE 169 AQUA METALS, INC.: DEALS

- TABLE 170 AQUA METALS, INC.: OTHERS

- 13.1.10 EAST PENN MANUFACTURING COMPANY

- TABLE 171 EAST PENN MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 172 EAST PENN MANUFACTURING COMPANY: PRODUCTS OFFERED

- 13.1.11 ECOBAT

- TABLE 173 ECOBAT: COMPANY OVERVIEW

- ABLE 174 ECOBAT: PRODUCTS OFFERED

- TABLE 175 ECOBAT: DEALS

- TABLE 176 ECOBAT: OTHERS

- 13.1.12 ENERSYS

- TABLE 177 ENERSYS: COMPANY OVERVIEW

- FIGURE 45 ENERSYS: COMPANY SNAPSHOT

- TABLE 178 ENERSYS: PRODUCTS OFFERED

- 13.1.13 FORTUM

- TABLE 179 FORTUM: COMPANY OVERVIEW

- FIGURE 46 FORTUM: COMPANY SNAPSHOT

- TABLE 180 FORTUM: PRODUCTS OFFERED

- TABLE 181 FORTUM: DEALS

- TABLE 182 FORTUM: OTHERS

- 13.1.14 GEM CO., LTD.

- TABLE 183 GEM CO., LTD.: COMPANY OVERVIEW

- TABLE 184 GEM CO., LTD.: PRODUCTS OFFERED

- TABLE 185 GEM CO., LTD.: DEALS

- 13.1.15 GLENCORE

- TABLE 186 GLENCORE: COMPANY OVERVIEW

- FIGURE 47 GLENCORE: COMPANY SNAPSHOT

- TABLE 187 GLENCORE: PRODUCTS OFFERED

- TABLE 188 GLENCORE: DEALS

- 13.1.16 GOPHER RESOURCE

- TABLE 189 GOPHER RESOURCE: COMPANY OVERVIEW

- TABLE 190 GOPHER RESOURCE: PRODUCTS OFFERED

- TABLE 191 GOPHER RESOURCE: DEALS

- 13.1.17 GRAVITA INDIA LTD.

- TABLE 192 GRAVITA INDIA LTD.: COMPANY OVERVIEW

- FIGURE 48 GRAVITA INDIA LTD.: COMPANY SNAPSHOT

- TABLE 193 GRAVITA INDIA LTD.: PRODUCTS OFFERED

- TABLE 194 GRAVITA INDIA LTD.: OTHERS

- 13.1.18 LI-CYCLE CORP.

- TABLE 195 LI-CYCLE CORP.: COMPANY OVERVIEW

- FIGURE 49 LI-CYCLE CORP.: COMPANY SNAPSHOT

- TABLE 196 LI-CYCLE CORP.: PRODUCTS OFFERED

- TABLE 197 LI-CYCLE CORP.: DEALS

- TABLE 198 LI-CYCLE CORP.: OTHERS

- 13.1.19 NEOMETALS LTD.

- TABLE 199 NEOMETALS LTD.: COMPANY OVERVIEW

- TABLE 200 NEOMETALS LTD.: PRODUCTS OFFERED

- TABLE 201 NEOMETALS LTD.: PRODUCT LAUNCHES

- TABLE 202 NEOMETALS LTD.: DEALS

- TABLE 203 NEOMETALS LTD.: OTHERS

- 13.1.20 RAW MATERIALS COMPANY

- TABLE 204 RAW MATERIALS COMPANY: COMPANY OVERVIEW

- TABLE 205 RAW MATERIALS COMPANY: PRODUCTS OFFERED

- 13.1.21 RECYCLICO BATTERY MATERIALS INC.

- TABLE 206 RECYCLICO BATTERY MATERIALS INC.: COMPANY OVERVIEW

- TABLE 207 RECYCLICO BATTERY MATERIALS INC.: PRODUCTS OFFERED

- TABLE 208 RECYCLICO BATTERY MATERIALS INC.: PRODUCT LAUNCHES

- TABLE 209 RECYCLICO BATTERY MATERIALS INC.: DEALS

- 13.1.22 REDWOOD MATERIALS INC.

- TABLE 210 REDWOOD MATERIALS INC.: COMPANY OVERVIEW

- TABLE 211 REDWOOD MATERIALS INC.: PRODUCTS OFFERED

- TABLE 212 REDWOOD MATERIALS INC.: DEALS

- TABLE 213 REDWOOD MATERIALS INC.: OTHERS

- 13.1.23 SHENZHEN HIGHPOWER TECHNOLOGY CO., LTD.

- TABLE 214 SHENZHEN HIGHPOWER TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 215 SHENZHEN HIGHPOWER TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- 13.1.24 STENA RECYCLING

- TABLE 216 STENA RECYCLING: COMPANY OVERVIEW

- TABLE 217 STENA RECYCLING: PRODUCTS OFFERED

- TABLE 218 STENA RECYCLING: DEALS

- TABLE 219 STENA RECYCLING: OTHERS

- 13.1.25 TERRAPURE

- TABLE 220 TERRAPURE: COMPANY OVERVIEW

- TABLE 221 TERRAPURE: PRODUCTS OFFERED

- 13.1.26 TES

- TABLE 222 TES: COMPANY OVERVIEW

- TABLE 223 TES: PRODUCTS OFFERED

- TABLE 224 TES: DEALS

- TABLE 225 TES: OTHERS

- 13.1.27 THE DOE RUN COMPANY

- TABLE 226 THE DOE RUN COMPANY: COMPANY OVERVIEW

- TABLE 227 THE DOE RUN COMPANY: PRODUCTS OFFERED

- 13.1.28 THE INTERNATIONAL METALS RECLAMATION COMPANY

- TABLE 228 THE INTERNATIONAL METALS RECLAMATION COMPANY: COMPANY OVERVIEW

- TABLE 229 THE INTERNATIONAL METALS RECLAMATION COMPANY: PRODUCTS OFFERED

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 13.2 OTHER COMPANIES

- 13.2.1 BATREC INDUSTRIE

- TABLE 230 BATREC INDUSTRIE: COMPANY OVERVIEW

- 13.2.2 BATTERY RECYCLING MADE EASY (BRME)

- TABLE 231 BATTERY RECYCLING MADE EASY (BRME): COMPANY OVERVIEW

- 13.2.3 DUESENFELD GMBH

- TABLE 232 DUESENFELD GMBH: COMPANY OVERVIEW

- 13.2.4 ENVIROSTREAM AUSTRALIA PTY LTD.

- TABLE 233 ENVIROSTREAM AUSTRALIA PTY LTD.: COMPANY OVERVIEW

- 13.2.4.1 Recent developments

- TABLE 234 ENVIROSTREAM AUSTRALIA PTY LTD.: OTHERS

- 13.2.5 EURO DIEUZE INDUSTRIE (E.D.I.)

- TABLE 235 EURO DIEUZE INDUSTRIE (E.D.I.): COMPANY OVERVIEW

- 13.2.6 LITHION RECYCLING

- TABLE 236 LITHION RECYCLING: COMPANY OVERVIEW

- 13.2.7 METALEX PRODUCTS LTD.

- TABLE 237 METALEX PRODUCTS LTD.: COMPANY OVERVIEW

- 13.2.8 ONTO TECHNOLOGY

- TABLE 238 ONTO TECHNOLOGY: COMPANY OVERVIEW

- 13.2.9 SITRASA

- TABLE 239 SITRASA: COMPANY OVERVIEW

- 13.2.10 SMC RECYCLING

- TABLE 240 SMC RECYCLING: COMPANY OVERVIEW

- 13.2.11 TATA CHEMICALS LIMITED

- TABLE 241 TATA CHEMICALS LIMITED: COMPANY OVERVIEW

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 LITHIUM-ION BATTERY RECYCLING MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 LITHIUM-ION BATTERY RECYCLING MARKET, BY SOURCE

- TABLE 242 AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 243 AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2021-2031 (USD MILLION)

- TABLE 244 AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2017-2020 (UNITS)

- TABLE 245 AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2021-2031 (UNITS)

- TABLE 246 NON-AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY SOURCE, 2017-2020 (USD MILLION)

- TABLE 247 NON-AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY SOURCE, 2021-2031 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS