|

|

市場調査レポート

商品コード

1293051

次世代太陽電池の世界市場:材料の種類別 (テルル化カドミウム (CdTe)、セレン化銅インジウムガリウム (CIGS)、アモルファスシリコン、ガリウムヒ素、その他)・設置形態別 (オングリッド、オフグリッド)・エンドユーザー産業別・地域別の将来予測 (2028年まで)Next-Generation Solar Cell Market by Material Type (Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Amorphous Silicon, Gallium-Arsenide, Others), Installation (On-Grid, Off-Grid), End User and Geography - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 次世代太陽電池の世界市場:材料の種類別 (テルル化カドミウム (CdTe)、セレン化銅インジウムガリウム (CIGS)、アモルファスシリコン、ガリウムヒ素、その他)・設置形態別 (オングリッド、オフグリッド)・エンドユーザー産業別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月12日

発行: MarketsandMarkets

ページ情報: 英文 185 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の次世代太陽電池の市場規模は、2023年に30億米ドルに達した後、2023年から2028年にかけて19.5%のCAGRで成長し、2028年には74億米ドルに達すると予測されています。

従来型太陽電池に対する次世代太陽電池の優位性は、市場の主要促進要因のひとつです。市場の主な抑制要因のひとつは、風力発電や水力発電など、他の再生可能資源を提供するプレーヤーとの激しい競合です。

"セレン化銅インジウムガリウム (CIGS) が、予測期間中に大きな市場シェアを占める"

セレン化銅インジウムガリウム (CIGS) 太陽電池は、最も効率的な薄膜太陽電池技術のひとつです。CIGS太陽電池は、CIGSを導電層間に圧縮して製造されます。この材料はバンドギャップが直接的であることが特徴で、光の透過率を制限しながら大量のエネルギーを吸収することができます。この材料は、ガラス・プラスチック・鋼鉄・アルミニウムなどの基板の上に蒸着することができ、軟質の裏地に蒸着した場合は、フルパネルの柔軟性を可能にするのに十分な薄さです。CIGS太陽電池モジュールは、実験室では20%を超える効率を持っています。CIGS太陽電池は、発電効率が高いため、屋根などに設置することができます。また、シリコンベースのパネルよりも安価です。

"商業用・産業用:予測期間中に大きな成長を見せるセグメント"

商業用・産業用セグメントには、商業ビル、銀行・金融機関、教育機関、企業、製造工場、病院、ホスピタリティ施設・ビルなどが含まれます。屋上や空き地に太陽光発電システムを設置することで、照明やその他の電力需要を満たしています。発電した余剰電力は、地域の送電網を通じて地域の電力会社に売ることができます (技術的な実現可能性による) 。PVシステムは、公園のビジターセンター、狩猟用のロッジ、公園レンジャー用地、遠隔地の農場作業場、休暇用キャビン、農村部の照明、高速道路の休憩所、公共のビーチなど、さまざまな場所の電化にも利用されています。PVモジュールと熱抽出ユニットからなるハイブリッドPVシステムは、産業用途のために一緒に取り付けられます。これらのシステムは、電気エネルギーと熱エネルギーを同時に供給することができ、吸収された太陽放射のエネルギー変換率が通常の太陽光発電よりも高くなっています。そのため、商業施設や産業施設の発電に利用されています。

"北米では、米国が予測期間中に最大の市場規模を達成する"

米国は、2022年に北米次世代太陽電池市場で最大のシェアを占め、予測期間中も大きなCAGRを記録すると予想されます。米国における次世代太陽電池市場の成長は、州政府・連邦政府の政策やPVシステム採用プログラムの増加などの要因によって牽引されています。北米では技術開発が続き、また再生可能エネルギー発電を推進する政府資金が投入されているため、次世代太陽電池市場は同地域の電力会社からの需要増加を見込むことができます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- ケーススタディ分析

- 技術分析

- ポーターのファイブフォース分析

- エコシステム/市場マップ

- 特許分析

- 貿易分析

- 規制状況と基準

- 市場参入企業および原材料サプライヤーのビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

- 価格分析

第6章 次世代太陽電池の設置形態の種類

- イントロダクション

- オングリッド

- オフグリッド

第7章 次世代太陽電池市場:材料の種類別

- イントロダクション

- アモルファスシリコン (A-SI)

- セレン化銅インジウムガリウム (CIGS)

- テルル化カドミウム (CDTE)

- ガリウムヒ素

- その他の材料

第8章 次世代太陽電池市場:エンドユーザー産業別

- イントロダクション

- 住宅用

- 商業用・産業用

- ユーティリティ用

- その他のエンドユーザー産業

第9章 次世代太陽電池市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- その他の地域 (ROW)

- 南米

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 概要

- 主要企業の戦略/有力企業

- 次世代太陽電池の市場シェア分析 (2022年)

- 3年間の企業収益分析

- 企業評価クアドラント

- 次世代太陽電池:スタートアップ/中小企業のクアドラント

- 競争シナリオと動向

第11章 企業プロファイル

- 主要企業

- FIRST SOLAR

- HANWHA Q CELLS

- ASCENT SOLAR TECHNOLOGIES

- OXFORD PHOTOVOLTAICS (PV)

- KANEKA SOLAR ENERGY

- FLISOM

- SOLACTRON

- MITSUBISHI CHEMICAL GROUP

- MIASOLE

- HANERGY THIN FILM POWER GROUP

- その他の主な企業

- HELIATEK

- POLYSOLAR TECHNOLOGY

- NANOPV SOLAR

- 3D-MICROMAC AG

- SUNTECH POWER HOLDINGS CO., LTD.

- SHARP CORPORATION LIMITED

- TRINA SOLAR

- PANASONIC CORPORATION

- SOL VOLTAICS

- GEO GREEN POWER

- JINKO SOLAR

- CANADIAN SOLAR INC.

- SUNPOWER CORPORATION

- YINGLI SOLAR

- REC GROUP

第12章 付録

The next-generation solar cell market is valued at USD 3.0 billion in 2023 and is projected to reach USD 7.4 billion by 2028, growing at a CAGR of 19.5% from 2023 to 2028. The advantages of the next-generation solar cell over traditional solar cells are one of the major drivers in the market. One of the major restraints in the market is intense competition from players providing other renewable resources, including wind power and hydropower.

Copper indium gallium selenides is expected to account for a significant market share during the forecast period

Copper indium gallium selenides (CIGS) solar cells are among the most efficient thin-film PV technologies. CIGS PV cells are manufactured using CIGS by compressing between conductive layers. This material is characterized by its direct band gap, which allows it to absorb a high amount of energy while limiting the transmittance of light. This material can be deposited over substrates such as glass, plastic, steel, and aluminum and is thin enough to allow full-panel flexibility when deposited on a flexible backing. CIGS PV modules have efficiencies exceeding 20% in laboratories. Its solar panels can be installed on roofs and other surfaces because they are more efficient in producing more electricity. They are also cheaper than silicon-based panels.

Commercial & Industrial segments to exhibit significant growth in the next-generation solar cell market during the forecast period

The commercial and industrial sector includes commercial buildings, banks and financial institutes, educational institutions, enterprises, manufacturing plants, hospitals, hospitality buildings, and so on. The lighting and other electricity needs are fulfilled by installing PV systems on the rooftop and open areas. The excess electricity generated can be sold to local electricity companies by transmitting it through local grids (depending on the technical feasibility). PV systems are also used for electrification in various places, such as visitor centers in parks, hunting lodges, park ranger sites, remote farm workshops, vacation cabins, village lighting, highway rest stops, and public beaches. Hybrid PV systems, comprising PV modules and heat extraction units, are mounted together for industrial applications. These systems can also provide electrical and thermal energy simultaneously and achieve a higher energy conversion rate of the absorbed solar radiation than plain photovoltaics. Hence, they are used to generate electricity for commercial and industrial facilities.

US in North America is expected to record the largest market size during the forecast period

The US held the largest share of the North American next-generation solar cell market in 2022 and is expected to register a significant CAGR during the forecast period. The growth of the next-generation solar cell market in the US is driven by factors like an increase in state and federal policies and PV systems adoption programs, among others. Due to constant developments and government funding promoting renewable energy in North America, the next-generation solar cell market can anticipate rising demand from utilities in the region.

The break-up of the profile of primary participants in the Next-generation Solar Cell Market:

- By Company Type: Tier 1 - 40 %, Tier 2 - 40%, and Tier 3 - 20%

- By Designation: C-Level Executives -40%, Directors- 40%, and Others - 20%

- By Region: North America- 40%, Asia Pacific - 30%, Europe- 20%, and RoW - 10%

The report profiles key players in the next-generation solar cell market and analyzes their market shares. Players profiled in this report are First Solar (US), Hanwha Q CELLS (South Korea), Ascent Solar Technologies (US), Oxford PV (UK), Kaneka Solar Energy (Japan), Flisom (Switzerland), Solactron (US), Mitsubishi Chemical Group (Japan), MiaSole (US), and Hanergy thin film power group (China), Heliatek (Germany), Polysolar Technology (US), NanoPV technologies(US), 3D-Micromac(Germany), Suntech Power Holdings (China), Sharp Corporation(Japan), Trina Solar (China), Panasonic Corporation(Japan), Sol Voltaics(Sweden), Geo Green Power(England), Jinko Solar(China), Canadian Solar(Canada), Sunpower Corporation(US), Yingli Solar(China), REC Group(Norway)

Research Coverage

The report defines, describes, and forecasts the next-generation solar cell market based on material type, installation, end-user industry, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the next-generation solar cell market. It also analyzes competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall next-generation solar cell market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report will help leaders/new entrants in the next-generation solar cell market in the following ways:

1. The report segments the next-generation solar cell market comprehensively and provides the closest market size estimation for all subsegments across regions.

2. The report will help stakeholders understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities in the d next-generation solar cell market.

3. The report will help stakeholders understand their competitors better and gain insights to improve their position in the next-generation solar cell market. The competitive landscape section describes the competitor ecosystem.

4. Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the next-generation solar cell market

5. In-depth assessment of market shares, growth strategies and product offerings of leading players like First Solar (US), Hanwha Q CELLS (South Korea), Ascent Solar Technologies (US), Oxford PV (UK), Kaneka Solar Energy (Japan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 NEXT-GENERATION SOLAR CELL MARKET

- 1.4 INCLUSIONS AND EXCLUSIONS

- 1.4.1 REGIONAL SCOPE

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PROCESS FLOW: NEXT-GENERATION SOLAR CELL MARKET SIZE ESTIMATION

- FIGURE 3 NEXT-GENERATION SOLAR CELL MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Secondary sources

- 2.1.2.2 List of key secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary sources

- 2.1.3.2 Key industry insights

- 2.1.3.3 Primary interviews with experts

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

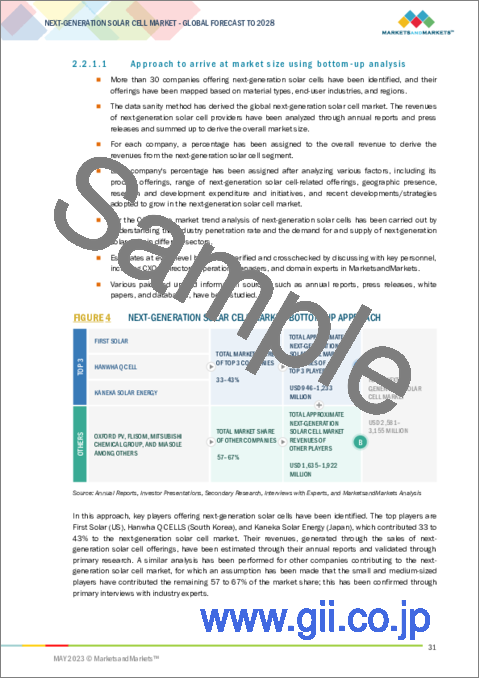

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis

- FIGURE 4 NEXT-GENERATION SOLAR CELL MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis

- FIGURE 5 NEXT-GENERATION SOLAR CELL MARKET: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 7 RESEARCH STUDY ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON NEXT-GENERATION SOLAR CELL MARKET

- 2.6 RISK ASSESSMENT

- TABLE 1 ANALYSIS OF RISK FACTORS

3 EXECUTIVE SUMMARY

- 3.1 NEXT-GENERATION SOLAR CELL MARKET: RECESSION IMPACT

- FIGURE 8 RECESSION IMPACT: GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 9 RECESSION IMPACT ON NEXT-GENERATION SOLAR CELL MARKET, 2019-2028 (USD MILLION)

- FIGURE 10 CADMIUM TELLURIDE SEGMENT TO HOLD LARGEST SHARE OF NEXT-GENERATION SOLAR CELL MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 11 UTILITIES SEGMENT TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC HELD LARGEST SIZE OF NEXT-GENERATION SOLAR CELL MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NEXT-GENERATION SOLAR CELL MARKET

- FIGURE 13 NEXT-GENERATION SOLAR CELL MARKET TO GROW AT SIGNIFICANT RATE OWING TO INCREASING DEMAND FROM UTILITIES

- 4.2 NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE

- FIGURE 14 CADMIUM TELLURIDE TO ACCOUNT FOR LARGEST SHARE OF NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL, IN 2028

- 4.3 NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY

- FIGURE 15 UTILITIES HELD LARGEST MARKET SHARE IN 2022

- 4.4 NEXT-GENERATION SOLAR CELL MARKET, BY COUNTRY

- FIGURE 16 NEXT-GENERATION SOLAR CELL MARKET IN MEXICO TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 NEXT-GENERATION SOLAR CELL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in next-generation solar cell technology

- 5.2.1.2 Advantages of next-generation over traditional solar cells

- 5.2.1.3 Government initiatives in solar PV projects

- 5.2.1.4 Increasing demand for solar cells in residential and commercial sectors

- FIGURE 18 IMPACT OF DRIVERS ON NEXT-GENERATION SOLAR CELL MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation costs and requirement for skilled workforce

- 5.2.2.2 Intense competition from players providing other renewable resources, including wind power and hydropower

- FIGURE 19 IMPACT OF RESTRAINTS ON NEXT-GENERATION SOLAR CELL MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Surging demand for renewable energy

- FIGURE 20 IMPACT OF OPPORTUNITIES ON NEXT-GENERATION SOLAR CELL MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain challenges in next-generation solar cell technologies

- FIGURE 21 IMPACT OF CHALLENGES ON NEXT-GENERATION SOLAR CELL MARKET

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 22 SOLAR CELL VALUE CHAIN ANALYSIS

- 5.4 CASE STUDY ANALYSIS

- 5.4.1 SUNPOWER MANUFACTURES HIGH-EFFICIENCY SOLAR PANELS FOR CUSTOMERS WITH LIMITED BUDGETS

- 5.4.2 HANWHA Q CELLS HELPS COPENHAGEN ZOO IMPLEMENT C&I ROOFTOP SYSTEM TO MEET SUSTAINABILITY GOAL

- 5.4.3 SHARP HELPS BIG C SUPERMARKET (THAILAND) INSTALL ROOFTOP SOLAR PANELS

- 5.4.4 SHARP INSTALLS ROOFTOP SOLAR PANELS FOR HEWLETT PACKARD (HP) TO MINIMIZE CARBON FOOTPRINT

- 5.4.5 TATA POWER SOLAR COMMISSIONS 3 MW SOLAR PV POWER PLANT IN IRON ORE MINE AT NOAMUNDI

- 5.5 TECHNOLOGY ANALYSIS

- TABLE 2 TECHNOLOGIES IN SOLAR CELL ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 NEXT-GENERATION SOLAR CELL MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 ECOSYSTEM/MARKET MAP

- TABLE 4 PLAYERS AND THEIR ROLE IN ECOSYSTEM

- 5.8 PATENT ANALYSIS

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 5 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- FIGURE 24 NUMBER OF PATENTS GRANTED EVERY YEAR, 2012-2022

- TABLE 6 LIST OF PATENTS

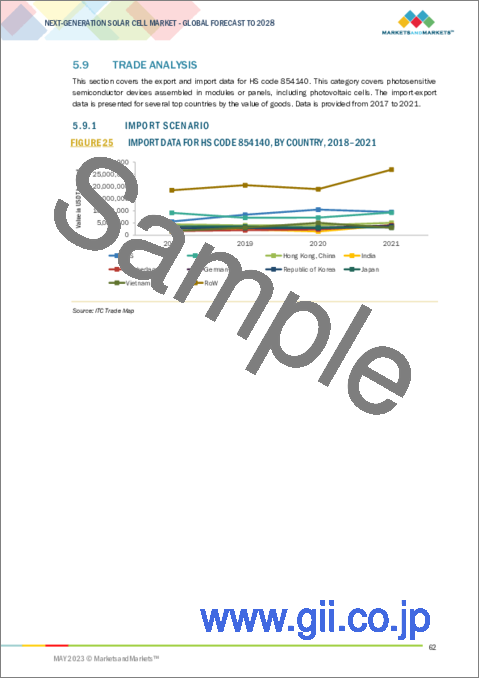

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- FIGURE 25 IMPORT DATA FOR HS CODE 854140, BY COUNTRY, 2018-2021

- TABLE 7 IMPORT DATA, BY COUNTRY, 2018-2021 (USD THOUSAND)

- 5.9.2 EXPORT SCENARIO

- FIGURE 26 EXPORT DATA FOR HS CODE 854140, BY COUNTRY, 2018-2021

- TABLE 8 EXPORT DATA, BY COUNTRY, 2018-2021 (USD THOUSAND)

- 5.10 REGULATORY LANDSCAPE AND STANDARDS

- 5.10.1 REGULATORY COMPLIANCE

- 5.10.1.1 Regulations

- 5.10.1.2 Standards

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 REGULATORY COMPLIANCE

- 5.11 TRENDS/DISRUPTIONS IMPACTING BUSINESS OF MARKET PLAYERS AND RAW MATERIAL SUPPLIERS

- 5.11.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR NEXT-GENERATION SOLAR CELL MARKET PLAYERS

- FIGURE 27 REVENUE SHIFT AND NEW REVENUE POCKETS IN NEXT-GENERATION SOLAR CELL MARKET

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRY (%)

- 5.13 PRICING ANALYSIS

- TABLE 14 AVERAGE SELLING PRICE OF PHOTOVOLTAIC MODULES, 2022

- TABLE 15 AVERAGE SELLING PRICE OF PV SYSTEMS, BY END-USER INDUSTRY

- 5.13.1 AVERAGE SELLING PRICE OF PV MODULES OFFERED BY MARKET PLAYERS

- FIGURE 28 AVERAGE SELLING PRICE OF PV MODULES OFFERED BY KEY PLAYERS, BY END-USER INDUSTRY

- TABLE 16 AVERAGE SELLING PRICE OF PV MODULES OFFERED BY KEY PLAYERS, BY END-USER INDUSTRY (USD/WATT)

- 5.13.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRY

- TABLE 17 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- TABLE 18 NEXT-GENERATION SOLAR CELL MARKET: LIST OF CONFERENCES AND EVENTS

6 INSTALLATION TYPES OF NEXT-GENERATION SOLAR CELLS

- 6.1 INTRODUCTION

- FIGURE 30 INSTALLATION TYPES OF NEXT-GENERATION SOLAR CELLS

- 6.2 ON-GRID

- 6.2.1 FOCUS ON REDUCING TRANSMISSION LOSSES AND STRAIN ON GRIDS TO INCREASE DEMAND FOR ON-GRID SOLAR CELLS

- 6.3 OFF-GRID

- 6.3.1 GROWING USE OF OFF-GRID SOLAR SYSTEMS IN REMOTE AREAS, CABINS, BOATS, AND RVS TO DRIVE DEMAND

7 NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE

- 7.1 INTRODUCTION

- FIGURE 31 NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE

- FIGURE 32 CADMIUM TELLURIDE-BASED SOLAR CELLS TO HOLD LARGEST MARKET SHARE IN 2023

- TABLE 19 NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 20 NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- 7.2 AMORPHOUS SILICON (A-SI)

- 7.2.1 BETTER PERFORMANCE OF A-SI IN LOW-LIGHT CONDITIONS TO BOOST ITS DEMAND

- TABLE 21 AMORPHOUS SILICON (A-SI): NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 22 AMORPHOUS SILICON (A-SI): NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 23 AMORPHOUS SILICON (A-SI): NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 24 AMORPHOUS SILICON (A-SI): NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 7.2.2 COPPER INDIUM GALLIUM SELENIDE (CIGS)

- 7.2.2.1 High demand for lightweight and flexible solar modules for rooftops and portable electronics to fuel segmental growth

- TABLE 25 COPPER INDIUM GALLIUM SELENIDE (CIGS): NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 26 COPPER INDIUM GALLIUM SELENIDE (CIGS): NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 27 COPPER INDIUM GALLIUM SELENIDE (CIGS): NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 28 COPPER INDIUM GALLIUM SELENIDE (CIGS): NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 7.2.3 CADMIUM TELLURIDE (CDTE)

- 7.2.3.1 Low manufacturing cost of CdTe solar modules to propel market

- TABLE 29 CADMIUM TELLURIDE (CDTE): NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 CADMIUM TELLURIDE (CDTE): NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 CADMIUM TELLURIDE (CDTE): NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 32 CADMIUM TELLURIDE (CDTE): NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 7.2.4 GALLIUM ARSENIDE

- 7.2.4.1 High resistance, flexibility, and stability of GaAs PV cells at higher temperatures to fuel segmental growth

- TABLE 33 GALLIUM ARSENIDE (GAAS): NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 GALLIUM ARSENIDE (GAAS): NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 GALLIUM ARSENIDE (GAAS): NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 36 GALLIUM ARSENIDE (GAAS): NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 7.2.5 OTHER MATERIALS

- 7.2.5.1 Perovskite

- 7.2.5.2 Dye-synthesized

- 7.2.5.3 Organic

- TABLE 37 OTHER MATERIALS: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 OTHER MATERIALS: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 39 OTHER MATERIALS: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 40 OTHER MATERIALS: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

8 NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 33 NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY

- FIGURE 34 RESIDENTIAL SEGMENT TO EXHIBIT HIGHEST CAGR IN NEXT-GENERATION SOLAR CELL MARKET DURING FORECAST PERIOD

- TABLE 41 NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 42 NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 8.2 RESIDENTIAL

- 8.2.1 GOVERNMENT SUBSIDIES TO BOOST ADOPTION OF SOLAR CELLS IN RESIDENTIAL APPLICATIONS

- TABLE 43 RESIDENTIAL: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 RESIDENTIAL: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 45 RESIDENTIAL: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 46 RESIDENTIAL: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- 8.3 COMMERCIAL & INDUSTRIAL

- 8.3.1 ENVIRONMENTAL, ECONOMIC, AND TAX BENEFITS TO SUPPORT MARKET GROWTH FOR COMMERCIAL & INDUSTRIAL APPLICATIONS

- TABLE 47 COMMERCIAL & INDUSTRIAL: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 COMMERCIAL & INDUSTRIAL: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 49 COMMERCIAL & INDUSTRIAL: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 50 COMMERCIAL & INDUSTRIAL: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- 8.4 UTILITIES

- 8.4.1 NEED FOR RELIABLE AND CONSISTENT SOURCE OF ELECTRICITY BY UTILITIES TO DRIVE MARKET

- FIGURE 35 OTHER MATERIALS SEGMENT TO WITNESS HIGHEST CAGR IN NEXT-GENERATION SOLAR CELL MARKET FOR UTILITIES DURING FORECAST PERIOD

- TABLE 51 UTILITIES: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 52 UTILITIES: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 53 UTILITIES: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 UTILITIES: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 OTHER END-USER INDUSTRIES

- TABLE 55 OTHER END-USER INDUSTRIES: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 OTHER END-USER INDUSTRIES: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 57 OTHER END-USER INDUSTRIES: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 58 OTHER END-USER INDUSTRIES: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

9 NEXT-GENERATION SOLAR CELL MARKET, BY GEOGRAPHY

- 9.1 INTRODUCTION

- FIGURE 36 NEXT-GENERATION SOLAR CELL MARKET, BY REGION

- TABLE 59 NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 37 NORTH AMERICA: SNAPSHOT OF NEXT-GENERATION SOLAR CELL MARKET

- TABLE 61 NORTH AMERICA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: NEXT-GENERATION SOLAR CELL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: NEXT-GENERATION SOLAR CELL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Rise in state and federal policies and programs to boost adoption of PV modules

- TABLE 67 US: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 68 US: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Abundance of solar energy resources and large areas for installations to drive market

- TABLE 69 CANADA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 70 CANADA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.2.3 MEXICO

- 9.2.3.1 Booming solar industry to boost demand for next-generation solar cells

- TABLE 71 MEXICO: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 72 MEXICO: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.2.4 IMPACT OF RECESSION ON NEXT-GENERATION SOLAR CELL MARKET IN NORTH AMERICA

- 9.3 EUROPE

- FIGURE 38 EUROPE: SNAPSHOT OF NEXT-GENERATION SOLAR CELL MARKET

- TABLE 73 EUROPE: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 74 EUROPE: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 75 EUROPE: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 76 EUROPE: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 77 EUROPE: NEXT-GENERATION SOLAR CELL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 78 EUROPE: NEXT-GENERATION SOLAR CELL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Growing adoption of PV systems to propel market

- TABLE 79 GERMANY: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 80 GERMANY: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Increasing installation of PV systems to harness solar resources to foster market growth

- TABLE 81 UK: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 82 UK: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Collaboration between solar technology providers and government to boost PV installation capacity

- TABLE 83 FRANCE: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 84 FRANCE: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Rising investments in R&D of solar energy

- TABLE 85 ITALY: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 86 ITALY: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.3.5 REST OF EUROPE

- TABLE 87 REST OF EUROPE: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 88 REST OF EUROPE: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.3.6 IMPACT OF RECESSION ON NEXT-GENERATION SOLAR CELL MARKET IN EUROPE

- 9.4 ASIA PACIFIC

- FIGURE 39 ASIA PACIFIC: SNAPSHOT OF NEXT-GENERATION SOLAR CELL MARKET

- TABLE 89 ASIA PACIFIC: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: NEXT-GENERATION SOLAR CELL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: NEXT-GENERATION SOLAR CELL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Rapid expansion of solar industry to boost demand for next-generation solar cells

- TABLE 95 CHINA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 96 CHINA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Large presence of floating PV plants to fuel market

- TABLE 97 JAPAN: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 98 JAPAN: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Government-led developments in next-generation solar cells to accelerate market growth

- TABLE 99 INDIA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 100 INDIA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Focus on powering every public building with solar energy to boost demand for solar cells

- TABLE 101 SOUTH KOREA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 102 SOUTH KOREA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 103 REST OF ASIA PACIFIC: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.6 IMPACT OF RECESSION ON NEXT-GENERATION SOLAR CELL MARKET IN ASIA PACIFIC

- 9.5 ROW

- TABLE 105 ROW: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 106 ROW: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 107 ROW: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 108 ROW: NEXT-GENERATION SOLAR CELL MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 109 ROW: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 110 ROW: NEXT-GENERATION SOLAR CELL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5.1 SOUTH AMERICA

- 9.5.1.1 R&D on perovskite solar cells to contribute to next-generation solar cell market growth

- TABLE 111 SOUTH AMERICA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 112 SOUTH AMERICA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.5.2 MIDDLE EAST & AFRICA

- 9.5.2.1 Increasing adoption of PV technology to support market growth

- TABLE 113 MIDDLE EAST & AFRICA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: NEXT-GENERATION SOLAR CELL MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 9.5.3 IMPACT OF RECESSION ON NEXT-GENERATION SOLAR CELL MARKET IN ROW

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 OVERVIEW

- 10.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 115 OVERVIEW OF STRATEGIES DEPLOYED BY KEY NEXT-GENERATION SOLAR CELL MANUFACTURERS

- 10.4 NEXT-GENERATION SOLAR CELL MARKET SHARE ANALYSIS, 2022

- FIGURE 40 NEXT-GENERATION SOLAR CELL MARKET SHARE ANALYSIS, 2022

- TABLE 116 DEGREE OF COMPETITION, 2022

- TABLE 117 NEXT-GENERATION SOLAR CELL MARKET: RANKING ANALYSIS

- 10.5 THREE-YEAR COMPANY REVENUE ANALYSIS

- FIGURE 41 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN NEXT-GENERATION SOLAR CELL MARKET

- 10.6 COMPANY EVALUATION QUADRANT

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 42 NEXT-GENERATION SOLAR CELL MARKET: COMPANY EVALUATION QUADRANT, 2022

- 10.6.5 COMPETITIVE BENCHMARKING

- TABLE 118 OVERALL COMPANY FOOTPRINT

- TABLE 119 COMPANY MATERIAL TYPE FOOTPRINT

- TABLE 120 COMPANY END-USER INDUSTRY FOOTPRINT

- TABLE 121 COMPANY REGION FOOTPRINT

- 10.7 NEXT-GENERATION SOLAR CELL STARTUPS/SMES QUADRANT

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 43 NEXT-GENERATION SOLAR CELL MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- 10.8 COMPETITIVE SCENARIOS AND TRENDS

- 10.8.1 PRODUCT LAUNCHES

- TABLE 122 NEXT-GENERATION SOLAR CELL MARKET: PRODUCT LAUNCHES, JANUARY 2019-MARCH 2023

- 10.8.2 DEALS

- TABLE 123 NEXT-GENERATION SOLAR CELL MARKET: DEALS, JANUARY 2019-MARCH 2023

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1 KEY COMPANIES

- 11.1.1 FIRST SOLAR

- TABLE 124 FIRST SOLAR: BUSINESS OVERVIEW

- FIGURE 44 FIRST SOLAR: COMPANY SNAPSHOT

- TABLE 125 FIRST SOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 FIRST SOLAR: DEALS

- 11.1.2 HANWHA Q CELLS

- TABLE 127 HANWHA Q CELLS: BUSINESS OVERVIEW

- TABLE 128 HANWHA Q CELLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 HANWHA Q CELLS: PRODUCT LAUNCHES

- TABLE 130 HANWHA Q CELLS: DEALS

- 11.1.3 ASCENT SOLAR TECHNOLOGIES

- TABLE 131 ASCENT SOLAR TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 45 ASCENT SOLAR TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 132 ASCENT SOLAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED.

- TABLE 133 ASCENT SOLAR TECHNOLOGIES: DEALS

- 11.1.4 OXFORD PHOTOVOLTAICS (PV)

- TABLE 134 OXFORD PV: COMPANY OVERVIEW

- TABLE 135 OXFORD PV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 OXFORD PV: DEALS

- TABLE 137 OXFORD PV: OTHERS

- 11.1.5 KANEKA SOLAR ENERGY

- TABLE 138 KANEKA SOLAR ENERGY: COMPANY OVERVIEW

- TABLE 139 KANEKA SOLAR ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.6 FLISOM

- TABLE 140 FLISOM: BUSINESS OVERVIEW

- TABLE 141 FLISOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 FLISOM: OTHERS

- 11.1.7 SOLACTRON

- TABLE 143 SOLACTRON: BUSINESS OVERVIEW

- TABLE 144 SOLACTRON: PRODUCTS/SOLUTIONS/SERVICES OFFERED.

- 11.1.8 MITSUBISHI CHEMICAL GROUP

- TABLE 145 MITSUBISHI CHEMICAL GROUP: COMPANY OVERVIEW

- FIGURE 46 MITSUBISHI CHEMICAL GROUP: COMPANY SNAPSHOT

- TABLE 146 MITSUBISHI CHEMICAL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.9 MIASOLE

- TABLE 147 MIASOLE: COMPANY OVERVIEW

- TABLE 148 MIASOLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 MIASOLE: DEALS

- TABLE 150 MIASOLE: OTHERS

- 11.1.10 HANERGY THIN FILM POWER GROUP

- TABLE 151 HANERGY THIN FILM POWER GROUP: COMPANY OVERVIEW

- TABLE 152 HANERGY THIN FILM POWER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.2 OTHER KEY PLAYERS

- 11.2.1 HELIATEK

- 11.2.2 POLYSOLAR TECHNOLOGY

- 11.2.3 NANOPV SOLAR

- 11.2.4 3D-MICROMAC AG

- 11.2.5 SUNTECH POWER HOLDINGS CO., LTD.

- 11.2.6 SHARP CORPORATION LIMITED

- 11.2.7 TRINA SOLAR

- 11.2.8 PANASONIC CORPORATION

- 11.2.9 SOL VOLTAICS

- 11.2.10 GEO GREEN POWER

- 11.2.11 JINKO SOLAR

- 11.2.12 CANADIAN SOLAR INC.

- 11.2.13 SUNPOWER CORPORATION

- 11.2.14 YINGLI SOLAR

- 11.2.15 REC GROUP

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS