|

|

市場調査レポート

商品コード

1524079

ディスプレイの世界市場:ディスプレイ技術別、解像度別、パネルサイズ別、パネルタイプ別、次元別、製品別、業界別、地域別 - 予測(~2029年)Display Market by Display Technology, Resolution, Panel Size (Micro Display, Small and Medium-sized Panels, Large Panels), Panel Type (Fixed Panel, Flexible Panel), Dimension (2D, 3D), Product, Vertical and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ディスプレイの世界市場:ディスプレイ技術別、解像度別、パネルサイズ別、パネルタイプ別、次元別、製品別、業界別、地域別 - 予測(~2029年) |

|

出版日: 2024年07月10日

発行: MarketsandMarkets

ページ情報: 英文 274 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のディスプレイの市場規模は、2024年の1,352億米ドルから2029年までに1,737億米ドルに達すると予測され、2024年~2029年にCAGRで5.1%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | ディスプレイ解像度別、技術別、パネルサイズ別、パネルタイプ別、寸法別、製品別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

LED技術は、発光ダイオードを使用して照明ディスプレイやソリューション、その他の用途を作成します。LED技術は、スマートフォン、テレビ、ビデオウォール、デジタルサイネージなど幅広い産業で利用されています。LEDディスプレイは、さまざまな用途で使用されるディスプレイ技術の中でもっとも広く普及している技術の1つとなっており、その他の技術に比べて大きな市場シェアを占めています。近年、LEDディスプレイ産業は成長を示していますが、革新的な技術には欠けていました。しかし近年の動向として、LEDスクリーンの小型化に必要な材料があります。これらの進歩により、LEDスクリーンは信じられないほど薄くなり、巨大なサイズに拡大され、屋内外を問わずあらゆる表面での使用に適したものとなっています。解像度の向上、輝度の増加、材料の多様性、複雑な表面LED、マイクロLEDの登場といった技術の進歩が、LED利用の成長に寄与しました。

小売、オフィス、教育などのさまざまな産業で、カスタマーサービスや共同作業の効率を向上させたいという要求が、大型ディスプレイ、特にLEDディスプレイの需要を高めていますが、こうした需要の高まりは、新技術やソリューションの絶え間ない導入も起因していると言えます。LEDビデオウォールは、シンプルな映像と優れた品質で人気を博しており、大型ディスプレイの最先端を行く存在となっています。画像、図表、動画などの視覚的な補助でプレゼンテーションに付加価値を与えるこれらのLEDビデオウォールは、デスクトップPC、スマートフォン、タブレットなどのさまざまなデバイスに対応しています。

デジタルサイネージにおけるLEDの使用は、その優れた光学的視認性、効率性、堅牢性により、同様に急速なペースで増加しており、LEDは、ホットスポットにおけるダイナミックなスライドディスプレイのアイデアや、企業にとってのコスト削減にも望ましいものとなっています。例えば2020年2月、SamsungはLEDバーチャルサインを使用し、カリフォルニア州のiquan Casino ResortでSamsungのプロモーション活動を強化しました。従来のカードや静的なディスプレイをバーチャルサイネージに置き換えることで、カジノは視認性を高め、プロモーションのエンゲージメントを高めることができるように生まれ変わりました。デジタルディスプレイは、コンテンツをダイナミックに表示し、素早く簡単にプロモーションを変更することを可能にしました。SAMSUNG DISPLAY、Sony Group Corporation、LG Display、Panasonic Holdings Corporationは、デジタルサイネージパッケージ向けのLEDディスプレイを提供している主要企業です。

「インタラクティブディスプレイの人気向上でディスプレイ市場の需要が増加」

インタラクティブディスプレイは、ユーザーがタッチあるいは動き、音声コマンドなどの入力方法を使ってスクリーンと対話することを可能にします。インタラクティブディスプレイやジェスチャーコントロールデバイス/スクリーンは、家庭、自動車、小売、オフィススペース、銀行、輸送などのさまざまな部門で重要性を増しています。

当レポートでは、世界のディスプレイ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- ディスプレイ市場の企業にとって魅力的な機会

- ディスプレイ市場:業界別

- ディスプレイ市場:製品タイプ別

- ディスプレイ市場:地域別

- アジア太平洋のディスプレイ市場:ディスプレイ技術別、国別(2024年)

第5章 市場の概要

- イントロダクション

- ディスプレイの市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 主要企業の平均販売価格の動向:パネルサイズ別

- LCDディスプレイの価格動向:地域別

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入シナリオ(HSコード8537)

- 輸出シナリオ(HSコード8537)

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 ディスプレイ次元

- イントロダクション

- 2Dディスプレイ

- 3Dディスプレイ

第7章 ディスプレイ解像度

- イントロダクション

- 8K

- 4K

- FHD

- HD

- HD未満

第8章 ディスプレイパネルタイプ

- イントロダクション

- 固定式パネル

- フレキシブルパネル

第9章 ディスプレイ市場:ディスプレイ技術別

- イントロダクション

- LCD(液晶ディスプレイ)

- 有機発光ダイオード(OLED)

- マイクロLED

- ダイレクトビューLED(DLED)

- 量子ドットディスプレイ(QDディスプレイ)

- その他のディスプレイ技術

第10章 ディスプレイ市場:パネルサイズ別

- イントロダクション

- マイクロディスプレイ

- 小型・中型パネル

- 大型パネル

第11章 ディスプレイ市場:製品タイプ別

- イントロダクション

- スマートフォン

- テレビ

- モニター・ラップトップ

- デジタルサイネージ・大型ディスプレイ

- 自動車用ディスプレイ

- タブレット

- ウェアラブル

- その他の製品タイプ

第12章 ディスプレイ市場:業界別

- イントロダクション

- コンシューマーエレクトロニクス

- 自動車

- スポーツ・エンターテインメント

- 輸送

- 小売・ホスピタリティ・BFSI

- 工業・企業

- 教育

- 医療

- 航空宇宙・防衛

- その他の業界

第13章 ディスプレイ市場:地域別

- イントロダクション

- 北米

- 北米に対する不況の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州に対する不況の影響

- ドイツ

- フランス

- 英国

- その他の欧州

- アジア太平洋

- アジア太平洋に対する不況の影響

- 中国

- 韓国

- 日本

- 台湾

- その他のアジア太平洋

- その他の地域

- その他の地域に対する不況の影響

- 中東・アフリカ

- 南米

第14章 競合情勢

- 概要

- 主要企業戦略/有力企業(2023年~2024年)

- 収益分析(2019年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

第15章 企業プロファイル

- イントロダクション

- 主要企業

- SAMSUNG DISPLAY

- LG DISPLAY CO., LTD.

- SHARP CORPORATION

- BOE TECHNOLOGY GROUP CO., LTD.

- INNOLUX CORPORATION

- AUO CORPORATION

- SONY GROUP CORPORATION

- QISDA CORPORATION

- TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.

- LEYARD

- その他の企業

- E INK HOLDINGS INC.

- TIANMA MICROELECTRONICS CO., LTD.

- UNIVERSAL DISPLAY

- TRULY INTERNATIONAL HOLDINGS LIMITED

- PANASONIC HOLDINGS CORPORATION

- HANNSTAR

- EMAGIN

- KOPIN CORPORATION

- NORITAKE ITRON CORP.

- JAPAN DISPLAY INC.

- JOLED INC.

- ELUX, INC.

- VISIONOX COMPANY

- WINSTAR DISPLAY CO., LTD.

- WISECHIP SEMICONDUCTOR INC.

第16章 付録

List of Tables

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- TABLE 2 RISK FACTOR ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE TREND OF LARGE DISPLAY PANELS PROVIDED BY KEY PLAYERS, 2020-2024 (USD)

- TABLE 4 INDICATIVE PRICING TREND OF LCD DISPLAYS, BY REGION, 2020-2024 (USD)

- TABLE 5 ROLE OF COMPANIES IN DISPLAY ECOSYSTEM

- TABLE 6 DISPLAY MARKET: MAJOR PATENTS, 2023-2024

- TABLE 7 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 8 MFN TARIFF FOR HS CODE 8537-COMPLIANT PRODUCTS EXPORTED BY GERMANY (2023)

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 IMPACT ANALYSIS OF PORTER'S FIVE FORCES

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FROM TOP THREE PRODUCTS (%)

- TABLE 15 KEY BUYING CRITERIA, BY PRODUCT TYPES

- TABLE 16 DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD BILLION)

- TABLE 17 DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD BILLION)

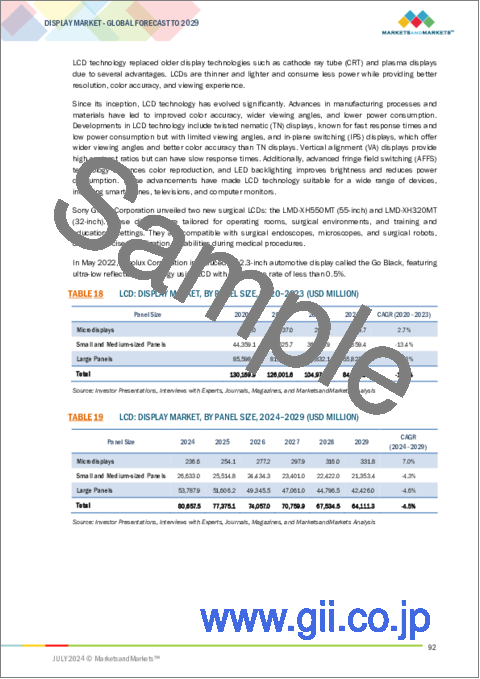

- TABLE 18 LCD: DISPLAY MARKET, BY PANEL SIZE, 2020-2023 (USD MILLION)

- TABLE 19 LCD: DISPLAY MARKET, BY PANEL SIZE, 2024-2029 (USD MILLION)

- TABLE 20 LCD: DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD BILLION)

- TABLE 21 LCD: DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD BILLION)

- TABLE 22 LCD: DISPLAY MARKET, BY WEARABLE TYPE, 2020-2023 (USD MILLION)

- TABLE 23 LCD: DISPLAY MARKET, BY WEARABLE TYPE, 2024-2029 (USD MILLION)

- TABLE 24 LCD: DISPLAY MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 25 LCD: DISPLAY MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 26 LCD: DISPLAY MARKET FOR SMARTPHONES, BY REGION, 2020-2023 (USD BILLION)

- TABLE 27 LCD: DISPLAY MARKET FOR SMARTPHONES, BY REGION, 2024-2029 (USD BILLION)

- TABLE 28 LCD: DISPLAY MARKET FOR TELEVISION SETS, BY REGION, 2020-2023 (USD BILLION)

- TABLE 29 LCD: DISPLAY MARKET FOR TELEVISION SETS, BY REGION, 2024-2029 (USD BILLION)

- TABLE 30 LCD: DISPLAY MARKET FOR MONITORS & LAPTOPS, BY REGION, 2020-2023 (USD BILLION)

- TABLE 31 LCD: DISPLAY MARKET FOR MONITORS & LAPTOPS, BY REGION, 2024-2029 (USD BILLION)

- TABLE 32 LCD: DISPLAY MARKET FOR DIGITAL SIGNAGE & LARGE FORMAT DISPLAYS, BY REGION, 2020-2023 (USD BILLION)

- TABLE 33 LCD: DISPLAY MARKET FOR DIGITAL SIGNAGE & LARGE FORMAT DISPLAYS, BY REGION, 2024-2029 (USD BILLION)

- TABLE 34 LCD: DISPLAY MARKET FOR AUTOMOTIVE DISPLAYS, BY REGION, 2020-2023 (USD BILLION)

- TABLE 35 LCD: DISPLAY MARKET FOR AUTOMOTIVE DISPLAYS, BY REGION, 2024-2029 (USD BILLION)

- TABLE 36 LCD: DISPLAY MARKET FOR TABLETS, BY REGION, 2020-2023 (USD BILLION)

- TABLE 37 LCD: DISPLAY MARKET FOR TABLETS, BY REGION, 2024-2029 (USD BILLION)

- TABLE 38 LCD: DISPLAY MARKET FOR WEARABLES, BY REGION, 2020-2023 (USD BILLION)

- TABLE 39 LCD: DISPLAY MARKET FOR WEARABLES, BY REGION, 2024-2029 (USD BILLION)

- TABLE 40 LCD: DISPLAY MARKET FOR OTHER PRODUCT TYPES, BY REGION, 2020-2023 (USD BILLION)

- TABLE 41 LCD: DISPLAY MARKET FOR OTHER PRODUCT TYPES, BY REGION, 2024-2029 (USD BILLION)

- TABLE 42 OLED: DISPLAY MARKET, BY PANEL SIZE, 2020-2023 (USD MILLION)

- TABLE 43 OLED: DISPLAY MARKET, BY PANEL SIZE, 2024-2029 (USD MILLION)

- TABLE 44 OLED: DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD BILLION)

- TABLE 45 OLED: DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD BILLION)

- TABLE 46 OLED: DISPLAY MARKET, BY WEARABLE TYPE, 2020-2023 (USD MILLION)

- TABLE 47 OLED: DISPLAY MARKET, BY WEARABLE TYPE, 2024-2029 (USD MILLION)

- TABLE 48 OLED: DISPLAY MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 49 OLED: DISPLAY MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 50 OLED: DISPLAY MARKET FOR SMARTPHONES, BY REGION, 2020-2023 (USD BILLION)

- TABLE 51 OLED: DISPLAY MARKET FOR SMARTPHONES, BY REGION, 2024-2029 (USD BILLION)

- TABLE 52 OLED: DISPLAY MARKET FOR TELEVISION SETS, BY REGION, 2020-2023 (USD BILLION)

- TABLE 53 OLED: DISPLAY MARKET FOR TELEVISION SETS, BY REGION, 2024-2029 (USD BILLION)

- TABLE 54 OLED: DISPLAY MARKET FOR MONITORS & LAPTOPS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 OLED: DISPLAY MARKET FOR MONITORS & LAPTOPS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 OLED: DISPLAY MARKET FOR DIGITAL SIGNAGE & LARGE FORMAT DISPLAYS, BY REGION, 2020-2023 (USD BILLION)

- TABLE 57 OLED: DISPLAY MARKET FOR DIGITAL SIGNAGE & LARGE FORMAT DISPLAYS, BY REGION, 2024-2029 (USD BILLION)

- TABLE 58 OLED: DISPLAY MARKET FOR AUTOMOTIVE DISPLAYS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 59 OLED: DISPLAY MARKET FOR AUTOMOTIVE DISPLAYS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 60 OLED: DISPLAY MARKET FOR TABLETS, BY REGION, 2020-2023 (USD BILLION)

- TABLE 61 OLED: DISPLAY MARKET FOR TABLETS, BY REGION, 2024-2029 (USD BILLION)

- TABLE 62 OLED: DISPLAY MARKET FOR WEARABLES, BY REGION, 2020-2023 (USD BILLION)

- TABLE 63 OLED: DISPLAY MARKET FOR WEARABLES, BY REGION, 2024-2029 (USD BILLION)

- TABLE 64 OLED: DISPLAY MARKET FOR OTHER PRODUCT TYPES, BY REGION, 2020-2023 (USD MILLION)

- TABLE 65 OLED: DISPLAY MARKET FOR OTHER PRODUCT TYPES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 66 MICRO-LED: DISPLAY MARKET, BY PANEL SIZE, 2020-2023 (USD MILLION)

- TABLE 67 MICRO-LED: DISPLAY MARKET, BY PANEL SIZE, 2024-2029 (USD MILLION)

- TABLE 68 MICRO-LED: DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 69 MICRO-LED: DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 70 MICRO-LED: DISPLAY MARKET, BY WEARABLE TYPE, 2020-2023 (USD MILLION)

- TABLE 71 MICRO-LED: DISPLAY MARKET, BY WEARABLE TYPE, 2024-2029 (USD MILLION)

- TABLE 72 MICRO-LED: DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 MICRO-LED: DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 74 DIRECT-VIEW LED: DISPLAY MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 75 DIRECT-VIEW LED: DISPLAY MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 76 DIRECT-VIEW LED: DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD BILLION)

- TABLE 77 DIRECT-VIEW LED: DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD BILLION)

- TABLE 78 QUANTUM DOT DISPLAY: DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD BILLION)

- TABLE 79 QUANTUM DOT DISPLAY: DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD BILLION)

- TABLE 80 QUANTUM DOT DISPLAY: DISPLAY MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 81 QUANTUM DOT DISPLAY: DISPLAY MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 82 OTHER DISPLAY TECHNOLOGIES: DISPLAY MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 83 OTHER DISPLAY TECHNOLOGIES: DISPLAY MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 84 OTHER DISPLAY TECHNOLOGIES: DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD BILLION)

- TABLE 85 OTHER DISPLAY TECHNOLOGIES: DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD BILLION)

- TABLE 86 DISPLAY MARKET, BY PANEL SIZE, 2020-2023 (USD BILLION)

- TABLE 87 DISPLAY MARKET, BY PANEL SIZE, 2024-2029 (USD BILLION)

- TABLE 88 MICRODISPLAYS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 89 MICRODISPLAYS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 90 SMALL & MEDIUM-SIZED PANELS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 91 SMALL & MEDIUM-SIZED PANELS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 92 SMALL & MEDIUM-SIZED PANELS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (MILLION UNITS)

- TABLE 93 SMALL & MEDIUM-SIZED PANELS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (MILLION UNITS)

- TABLE 94 LARGE PANELS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 95 LARGE PANELS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 96 LARGE PANELS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (MILLION UNITS)

- TABLE 97 LARGE PANELS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (MILLION UNITS)

- TABLE 98 DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD BILLION)

- TABLE 99 DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD BILLION)

- TABLE 100 SMARTPHONES: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD BILLION)

- TABLE 101 SMARTPHONES: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD BILLION)

- TABLE 102 TELEVISION SETS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 103 TELEVISION SETS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 104 MONITORS & LAPTOPS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD BILLION)

- TABLE 105 MONITORS & LAPTOPS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD BILLION)

- TABLE 106 DIGITAL SIGNAGE & LARGE FORMAT DISPLAYS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 107 DIGITAL SIGNAGE & LARGE FORMAT DISPLAYS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 108 DIGITAL SIGNAGE & LARGE FORMAT DISPLAYS: DISPLAY MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 109 DIGITAL SIGNAGE & LARGE FORMAT DISPLAYS: DISPLAY MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 110 AUTOMOTIVE DISPLAYS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 111 AUTOMOTIVE DISPLAYS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 112 TABLETS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD BILLION)

- TABLE 113 TABLETS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD BILLION)

- TABLE 114 WEARABLES: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 115 WEARABLES: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 116 SMARTWATCHES: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 117 SMARTWATCHES: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 118 VR HMDS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 119 VR HMDS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 120 VR HMDS: DISPLAY MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 121 VR HMDS: DISPLAY MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 122 AR HMDS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 123 AR HMDS: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 124 AR HMDS: DISPLAY MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 125 AR HMDS: DISPLAY MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 126 OTHER PRODUCT TYPES: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD BILLION)

- TABLE 127 OTHER PRODUCT TYPES: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD BILLION)

- TABLE 128 OTHER PRODUCT TYPES: DISPLAY MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 129 OTHER PRODUCT TYPES: DISPLAY MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 130 DISPLAY MARKET, BY VERTICAL, 2020-2023 (USD BILLION)

- TABLE 131 DISPLAY MARKET, BY VERTICAL, 2024-2029 (USD BILLION)

- TABLE 132 DISPLAY MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 133 DISPLAY MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 134 NORTH AMERICA: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 135 NORTH AMERICA: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 136 NORTH AMERICA: DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 137 NORTH AMERICA: DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 138 EUROPE: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 139 EUROPE: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 140 EUROPE: DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 141 EUROPE: DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 142 ASIA PACIFIC: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 143 ASIA PACIFIC: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 144 ASIA PACIFIC: DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 145 ASIA PACIFIC: DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 146 ROW: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 147 ROW: DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 148 ROW: DISPLAY MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 149 ROW: DISPLAY MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 150 ROW: DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 151 ROW: DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 152 DISPLAY MARKET: KEY STRATEGIES ADOPTED BY LEADING PLAYERS, JANUARY 2023-JUNE 2024

- TABLE 153 DISPLAY MARKET: DEGREE OF COMPETITION

- TABLE 154 DISPLAY MARKET: REGION FOOTPRINT (18 COMPANIES)

- TABLE 155 DISPLAY MARKET: DISPLAY TECHNOLOGY FOOTPRINT (18 COMPANIES)

- TABLE 156 DISPLAY MARKET: RESOLUTION FOOTPRINT (18 COMPANIES)

- TABLE 157 DISPLAY MARKET: PANEL FOOTPRINT (18 COMPANIES)

- TABLE 158 DISPLAY MARKET: PANEL FOOTPRINT (18 COMPANIES)

- TABLE 159 DISPLAY MARKET: DIMENSION FOOTPRINT (18 COMPANIES)

- TABLE 160 DISPLAY MARKET: PRODUCT FOOTPRINT (18 COMPANIES)

- TABLE 161 DISPLAY MARKET: VERTICAL FOOTPRINT (12 COMPANIES)

- TABLE 162 LIST OF KEY DISPLAY MARKET: KEY STARTUPS/SMES

- TABLE 163 DISPLAY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 164 DISPLAY MARKET: PRODUCT LAUNCHES, JANUARY 2023-JUNE 2024

- TABLE 165 DISPLAY MARKET: DEALS, JANUARY 2023-JUNE 2024

- TABLE 166 SAMSUNG DISPLAY: COMPANY OVERVIEW

- TABLE 167 SAMSUNG DISPLAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 SAMSUNG DISPLAY: PRODUCT LAUNCHES

- TABLE 169 SAMSUNG DISPLAY: DEALS

- TABLE 170 LG DISPLAY CO., LTD.: COMPANY OVERVIEW

- TABLE 171 LG DISPLAY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 LG DISPLAY CO., LTD.: PRODUCT LAUNCHES

- TABLE 173 LG DISPLAY CO., LTD.: DEALS

- TABLE 174 SHARP CORPORATION: COMPANY OVERVIEW

- TABLE 175 SHARP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 SHARP CORPORATION: PRODUCT LAUNCHES

- TABLE 177 SHARP CORPORATION: DEALS

- TABLE 178 BOE TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 179 BOE TECHNOLOGY GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 BOE TECHNOLOGY GROUP CO., LTD.: PRODUCT LAUNCHES

- TABLE 181 BOE TECHNOLOGY GROUP CO., LTD.: DEALS

- TABLE 182 INNOLUX CORPORATION: COMPANY OVERVIEW

- TABLE 183 INNOLUX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 INNOLUX CORPORATION: PRODUCT LAUNCHES

- TABLE 185 INNOLUX CORPORATION: DEALS

- TABLE 186 AUO CORPORATION: COMPANY OVERVIEW

- TABLE 187 AUO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 AUO CORPORATION: PRODUCT LAUNCHES

- TABLE 189 AUO CORPORATION: DEALS

- TABLE 190 SONY GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 191 SONY GROUP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 SONY GROUP CORPORATION: PRODUCT LAUNCHES

- TABLE 193 SONY GROUP CORPORATION: DEALS

- TABLE 194 QISDA CORPORATION: COMPANY OVERVIEW

- TABLE 195 QISDA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 197 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 LEYARD: COMPANY OVERVIEW

- TABLE 199 LEYARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 LEYARD: DEALS

- TABLE 201 E INK HOLDINGS INC.: BUSINESS OVERVIEW

- TABLE 202 TIANMA MICROELECTRONICS CO., LTD.: BUSINESS OVERVIEW

- TABLE 203 UNIVERSAL DISPLAY: BUSINESS OVERVIEW

- TABLE 204 TRULY INTERNATIONAL HOLDINGS LIMITED: BUSINESS OVERVIEW

- TABLE 205 PANASONIC HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 206 HANNSTAR: BUSINESS OVERVIEW

- TABLE 207 EMAGIN: BUSINESS OVERVIEW

- TABLE 208 KOPIN CORPORATION: BUSINESS OVERVIEW

- TABLE 209 NORITAKE ITRON CORP.: BUSINESS OVERVIEW

- TABLE 210 JAPAN DISPLAY INC.: BUSINESS OVERVIEW

- TABLE 211 JOLED INC.: BUSINESS OVERVIEW

- TABLE 212 ELUX, INC.: BUSINESS OVERVIEW

- TABLE 213 VISIONOX COMPANY: BUSINESS OVERVIEW

- TABLE 214 WINSTAR DISPLAY CO., LTD.: BUSINESS OVERVIEW

- TABLE 215 WISECHIP SEMICONDUCTOR INC.: BUSINESS OVERVIEW

List of Figures

- FIGURE 1 DISPLAY MARKET SEGMENTATION

- FIGURE 2 DISPLAY MARKET: REGIONAL SCOPE

- FIGURE 3 DISPLAY MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - REVENUE GENERATED BY KEY PLAYERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE) - REVENUE ESTIMATION OF KEY PLAYERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE) -BOTTOM-UP ESTIMATION BASED ON REGION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 LCD SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 LARGE PANELS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO DOMINATE DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 13 RISING DEMAND FOR OLED DISPLAYS TO FUEL MARKET GROWTH

- FIGURE 14 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 SMARTPHONES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 CANADA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD IN DISPLAY MARKET

- FIGURE 17 LCD AND CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 18 DISPLAY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL CUMULATIVE SALES/REGISTRATION OF NEW VEHICLES, 2019-2023 (MILLION UNITS)

- FIGURE 20 DISPLAY MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 21 DISPLAY MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 22 DISPLAY MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 23 DISPLAY MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 24 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF LARGE DISPLAY PANELS OFFERED BY KEY PLAYERS, 2024

- FIGURE 26 VALUE CHAIN ANALYSIS: DISPLAY MARKET

- FIGURE 27 KEY PLAYERS IN DISPLAY ECOSYSTEM

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO FOR STARTUPS, 2017-2024

- FIGURE 29 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 30 IMPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 32 DISPLAY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PRODUCT TYPES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE PRODUCT TYPES

- FIGURE 35 OLED SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 36 SMALL & MEDIUM-SIZED PANELS TO DOMINATE MICRO-LED MARKET DURING FORECAST PERIOD

- FIGURE 37 MICRODISPLAYS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 SMARTPHONES TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 OLED SEGMENT TO DOMINATE SMARTPHONE DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 40 LCD TO ACCOUNT FOR LARGEST SHARE OF DISPLAY MARKET FOR TELEVISION SETS DURING FORECAST PERIOD

- FIGURE 41 CONSUMER ELECTRONICS SEGMENT TO DOMINATE DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 42 MARKET SEGMENTATION, BY REGION

- FIGURE 43 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: DISPLAY MARKET SNAPSHOT

- FIGURE 45 EUROPE: DISPLAY MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: DISPLAY MARKET SNAPSHOT

- FIGURE 47 SOUTH AMERICA TO HOLD LARGEST SHARE IN ROW DURING FORECAST PERIOD

- FIGURE 48 DISPLAY MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2019-2023

- FIGURE 49 DISPLAY MARKET SHARE ANALYSIS, 2023

- FIGURE 50 DISPLAY MARKET: COMPANY VALUATION, 2024

- FIGURE 51 DISPLAY MARKET: FINANCIAL METRICS, 2023

- FIGURE 52 DISPLAY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 53 DISPLAY MARKET: COMPANY FOOTPRINT

- FIGURE 54 DISPLAY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 55 SAMSUNG DISPLAY: COMPANY SNAPSHOT

- FIGURE 56 LG DISPLAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 SHARP CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 BOE TECHNOLOGY GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 INNOLUX CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 AUO CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 QISDA CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

The display market is expected to reach USD 173.7 billion by 2029 from USD 135.2 billion in 2024, at a CAGR of 5.1 % during the 2024-2029 period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Display Technology, Resolution, Panel Size, Panel Type, Dimension, Product, Vertical and Region |

| Regions covered | North America, Europe, APAC, RoW |

LED technology uses light-emitting diodes to create lighting displays, solutions, and other applications. LED technology is used in a wide range of industries including smartphones, TVs, video walls and digital signage. LED displays have become one of the most widely used display technologies used in various applications and hold a large market share compared to other technologies. Although the LED display industry has grown in recent years, there has been a lack of innovation. But one recent development is the materials needed to make a miniaturized LED screen. These advances have made LED screens incredibly thin and expanded to huge sizes, making them suitable for use on any surface, indoors and outdoors. Technological advancements, such as improved resolution, increased brightness, materials versatility, complex surface LEDs and the emergence of micro-LEDs contributed to the growth of LED applications.

The demand to improve customer service and collaboration efficiencies in various industries including retail, office and education has increased the demand for large-scale displays, especially LED displays, we can also state that this growing demand is also due to the constant introduction of new technologies and solutions. LED video walls are gaining popularity due to their ability to deliver a simple image and excellent quality, making them the most advanced form of large display In the commercial world, LED video walls with room is important as an active background in convention halls. Adding value to presentations with visual aids such as images, charts and videos, these LED video walls are compatible with a variety of devices, including desktop PCs, smartphones and tablets.

The use of LEDs in digital signage is growing at an equally rapid pace due to their superior optical visibility, efficiency, and robustness, making LEDs desirable for dynamic, sliding displays ideas in hot spots even and costs green for businesses. Green solutions For example, in February 2020, Samsung used LED virtual signs to enhance Samsung's promotional efforts at the Siquan Casino Resort in California. By replacing traditional cards and static displays with virtual signage, the casino was transformed to allow for increased visibility and promotional engagement. Digital displays allowed for dynamic presentation of content, with quick and easy promotional changes. SAMSUNG DISPLAY, Sony Group Corporation, LG Display Co., Ltd, and Panasonic Holdings Corporation are major players offering LED displays for digital signage packages.

"Growing popularity of interactive display to increase in the demand of display market."

Interactive displays allow users to interact with the screen using touch or other input methods like motion or voice commands. interactive display and gesture control devices or screens have gained importance in homes, automobiles, retail, office spaces, banks, transport among different sectors. In the smart home sector, interactive displays are integrated into various appliances such as washing machines, refrigerators, microwaves, and chimneys. Similarly, branches of automobile industry and manufacturing have adopted the use of interactive displays in the systems such as navigational screens, digital rearview mirrors, and instrument clusters/dashboards. Gone are the days when touch screens were only part of technology; nowadays, they are an essential part of most industries, particularly of the kiosk industry. Digital signage in the form of interactive kiosks, whiteboards, table/shelves and monitors are slowly but surely making their way to almost all business fields. This need for touch interfaces has consequently made a great impact on the ever-renewing need for interaction displays.

The switch has now moved towards digital learning and the education process which is essential for educational institutions, students or teachers. Social technologies have come in handy in making this transition seamless making it easier to foster an innovative environment for a classroom setting. LCD, LED-LCD and OLED are the primary technologies that are applied to interactive displays currently. All types of display technology have their own superiorities and inferiorities, where kind of display technology should be used totally depends on some conditions.

In commercial places, displays are also utilized for aesthetic and promotional purposes with an aim of improving customers' perception of their business as well as organizational effectiveness. In commercial facilities, especially stores and markets, shelves, stands and other units often serve to advertise and present goods to make it possible for customers to peruse and touch the products before buying them. Some of the companies that offer interactive displays today are LG corporation, a South Korean company, Samsung electronics also from South Korea, Sharp corporation from Japan, ViewSonic corporation from US, Planar systems from United States and Horizon display from United States.

"Small & medium-sized panel segment of display market projected to have the highest market share during the forecast period."

Small & medium-sized display panels, ranging in diagonal size from 1 to 9 inches, are widely used in small display devices. These display panels are used in smartphones, selected tablets, smart watches, VRHMDs, digital cameras, gaming consoles, photo frames, e-readers, small medical devices and this market segment smartphones -Heavily influenced by the dynamics of the smartwatch market.

These displays are used in a variety of industries, including smartphones, wearables, automobiles, consumer electronics and medical devices. Especially in the healthcare industry, many interactive healthcare philosophies have been developed for specialized clinical settings.

Leading suppliers of small & large displays include SAMSUNG DISPLAY (Republic of Korea), LG Display Co., Ltd., (South Korea), Sharp Corporation (Japan), BOE Technology Group Co., Ltd. (China), Innolux Corporation (Taiwan) and many others.

Smartphone performance dominates the market for small & medium size display. The average smartphone display size is about 6.3 inches, and majorly LCD technology is used in smartphones display. LCDs dominate the market because of their versatility and affordability. However, in recent years OLED technology has also gained traction in the display market and is now emerging as a viable alternative by providing better color accuracy, wider viewing angles, faster response time, and better contrast ratio. Despite advances in OLED technology, mainly due to its affordability and versatility, LCDs are the dominant display technology in terms of market share

"Micro-LED display is expected to grow at the highest CAGR during the forecast period from 2024 to 2029."

Micro-LED is a display that makes use of microscopic LEDs to form single pixel elements. Micro-LED provides multiple advantage over traditional LCD shows, consisting of response instances, better evaluation, and power efficiency. Compared to LCD technology, micro-LED display provides a large reduction in energy utilization. In micro-LED display only, that pixel is Enlighted which wants to be lit rather than the whole pixel. Additionally, micro-LED presentations have a high assessment ratio, this means that that they could show deeper blacks and brighter whites.

One advantage that micro-LED displays have over OLED displays is their durability. Micro-LEDs are inorganic, which means they degrade less over time, and display brighter images, also provide fast processing time. With sub-nanosecond response times, micro-LED displays are used in 3D, AR, and VR displays that use high frame rates and fast response times to provide a seamless, immersive experience.

Micro-LED displays have several advantages over conventional LCD displays, such as better energy efficiency, better contrast, and faster response times. Micro-LEDs are a promising technology, with potential applications. Notably, the two most important application areas lie at opposite ends of the magnitude spectrum. At one end, wearable devices such as smart watches, near-eye devices (NTEs) with minute displays benefit greatly from micro-LED technology Conversely, the public very large indoor displays represent the other end of the size spectrum that can benefit from the unique quality with micro-LEDs.

The break-up of the profile of primary participants in the display market-

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, Tier 3 - 20%

- By Designation Type: C Level - 35%, Director Level - 30%, Others - 35%

- By Region Type: North America - 40%, Europe -25 %, Asia Pacific - 20%, RoW - 15%,

The major players in the display market are SAMSUNG DISPLAY (Republic of Korea), LG Display Co., Ltd., (South Korea), Sharp Corporation (Japan), BOE Technology Group Co., Ltd. (China), Innolux Corporation (Taiwan), AUO Corporation (Taiwan), Sony Group Corporation (Japan), Qisda Corporation (Taiwan), TCL China Star Optoelectronics Technology Co.,Ltd. (China), LEYARD (China), E INK HOLDINGS INC., (Taiwan), Tianma Microelectronics Co., Ltd. (China), Universal Display (US), TRULY INTERNATIONAL HOLDINGS LIMITED (Netherlands), Panasonic Holdings Corporation (Japan), HannStar (Taiwan), eMagin (US), Kopin Corpssoration (US), NORITAKE ITRON CORP. (Japan), Japan Display Inc. (Japan), JOLED Inc. (Japan), Elux, Inc. (US), Visionox Company (China), Winstar Display Co., Ltd. (Taiwan), and WiseChip Semiconductor Inc. (Taiwan).

Research Coverage

The report segments the display market and forecasts its size based and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall display market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing use of LED displays for video walls, TVs, and digital signage applications), restraints (Deployment of widescreen alternatives, such as projectors and screenless displays, and emergence of new display concepts), opportunities (Rapid adoption of AMOLED displays, especially post 5G rollout), and challenges (Technological obsolescence)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the display market

- Market Development: Comprehensive information about lucrative markets - the report analyses the display market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the display market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like SAMSUNG DISPLAY, LG Display Co., Ltd., BOE Technology Group Co., Ltd., AUO Corporation, and Innolux Corporation.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 INCLUSIONS & EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 IMPACT OF RECESSION ON DISPLAY MARKET

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 Key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary participants

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Insights of industry experts

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 GROWTH FORECAST ASSUMPTIONS

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach to derive market size using bottom-up analysis

- 2.2.3 TOP-DOWN APPROACH

- 2.2.3.1 Approach to derive market size using top-down analysis

- 2.3 MARKET SIZE ESTIMATION

- 2.4 DATA TRIANGULATION

- 2.5 RISK ANALYSIS

- 2.6 RECESSION IMPACT ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.7.1 RESEARCH ASSUMPTIONS

- 2.7.2 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DISPLAY MARKET

- 4.2 DISPLAY MARKET, BY VERTICAL

- 4.3 DISPLAY MARKET, BY PRODUCT TYPE

- 4.4 DISPLAY MARKET, BY REGION

- 4.5 DISPLAY MARKET IN ASIA PACIFIC, BY DISPLAY TECHNOLOGY AND COUNTRY, 2024

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 DISPLAY MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Escalating demand for OLED technology-based consumer electronics

- 5.2.1.2 Advancements and innovations in LED technology

- 5.2.1.3 Constant launch and adoption of innovative display products

- 5.2.1.4 Increasing adoption of interactive displays across various industries

- 5.2.1.5 Surging adoption of smart sensor-integrated IoT devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Decreasing demand from retail sector due to growing trend of online advertising and shopping

- 5.2.2.2 Adoption of interactive projector alternatives and emergence of screenless display technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for flexible and foldable displays

- 5.2.3.2 Rapid adoption of AMOLED displays following 5G rollout

- 5.2.3.3 Emergence of micro-LED and mini-LED technologies

- 5.2.3.4 Integration of advanced control and interactive features into display technology

- 5.2.4 CHALLENGES

- 5.2.4.1 High costs associated with R&D, manufacturing, and limited production

- 5.2.4.2 Risks related to technological obsolescence

- 5.2.4.3 Adverse impact of severe weather or harsh conditions on display functionality and lifespan

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PANEL SIZE

- 5.4.2 INDICATIVE PRICING TREND OF LCD DISPLAYS, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Mini-LED displays

- 5.8.1.2 Electrowetting displays

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Immersive displays

- 5.8.2.2 Foldable displays

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Augmented reality (AR) and virtual reality (VR)

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 8537)

- 5.10.2 EXPORT SCENARIO (HS CODE 8537)

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 LG DISPLAY INTRODUCES TRANSPARENT OLEDS FOR HIGH-SPEED TRAIN INNOVATION

- 5.12.2 VOESTALPINE AG TRANSFORMS EVENT EXPERIENCES BY DEPLOYING ADVANCED LED TECHNOLOGY

- 5.12.3 SYCUAN CASINO RESORT ENHANCES REVENUE AND ENGAGEMENT THROUGH DYNAMIC DIGITAL SIGNAGE

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

6 DISPLAY DIMENSIONS

- 6.1 INTRODUCTION

- 6.2 2D DISPLAYS

- 6.3 3D DISPLAYS

7 DISPLAY RESOLUTIONS

- 7.1 INTRODUCTION

- 7.2 8K

- 7.3 4K

- 7.4 FULL HIGH DEFINITION (FHD)

- 7.5 HIGH DEFINITION (HD)

- 7.6 LOWER THAN HD

8 DISPLAY PANEL TYPES

- 8.1 INTRODUCTION

- 8.2 FIXED PANEL

- 8.2.1 TRANSPARENT PANEL

- 8.2.2 NON-TRANSPARENT PANEL

- 8.3 FLEXIBLE PANEL

- 8.3.1 FOLDABLE PANEL

- 8.3.2 OTHERS

9 DISPLAY MARKET, BY DISPLAY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 LCD (LIQUID CRYSTAL DISPLAY)

- 9.2.1 HIGH ADOPTION OF LCD IN SMARTPHONES AND TELEVISION SETS TO DRIVE MARKET

- 9.2.2 TWISTED NEMATIC (TN) DISPLAY

- 9.2.3 IN-PLANE SWITCHING (IPS) DISPLAY

- 9.2.4 VERTICAL ALIGNMENT (VA)

- 9.2.5 ADVANCED FRINGE FIELD SWITCHING (AFFS)

- 9.2.6 LED-BACKLIGHT LCD

- 9.2.7 THIN-FILM TRANSISTORS (TFTS)

- 9.3 ORGANIC LIGHT-EMITTING DIODE (OLED)

- 9.3.1 BETTER ALTERNATIVE TO LCD TECHNOLOGY TO FOSTER SEGMENTAL GROWTH

- 9.3.2 PASSIVE MATRIX ORGANIC LIGHT-EMITTING DIODE (PMOLED)

- 9.3.3 ACTIVE-MATRIX ORGANIC LIGHT-EMITTING DIODE (AMOLED)

- 9.4 MICRO-LED

- 9.4.1 ENHANCED CONTRAST, ENERGY EFFICIENCY, AND FASTER RESPONSE TIME TO BOOST DEMAND

- 9.5 DIRECT-VIEW LED (DLED)

- 9.5.1 TRANSFORMATIVE SHIFT TOWARD VIDEO WALL TECHNOLOGY TO CREATE OPPORTUNITY

- 9.5.2 DIRECT-VIEW FINE-PIXEL LED

- 9.5.3 DIRECT-VIEW LARGE-PIXEL LED

- 9.6 QUANTUM DOT DISPLAY (QD DISPLAY)

- 9.6.1 ENHANCED COLOR GAMUT AND ENERGY EFFICIENCY TO DRIVE MARKET

- 9.6.2 QD-LCD

- 9.6.3 MINI-LED

- 9.6.4 QD-OLED

- 9.7 OTHER DISPLAY TECHNOLOGIES

- 9.7.1 E-PAPER DISPLAY (ELECTROPHORETIC DISPLAYS)

- 9.7.2 DIGITAL LIGHT PROCESSING (DLP)

- 9.7.3 PROJECTION CUBES

- 9.7.4 LIQUID CRYSTAL ON SILICON (LCOS)

10 DISPLAY MARKET, BY PANEL SIZE

- 10.1 INTRODUCTION

- 10.2 MICRODISPLAYS

- 10.2.1 GROWING DEMAND FOR WEARABLE DEVICES TO DRIVE ADOPTION

- 10.3 SMALL & MEDIUM-SIZED PANELS

- 10.3.1 RISING DEMAND FOR SMARTPHONES TO SUPPORT MARKET GROWTH

- 10.4 LARGE PANELS

- 10.4.1 INCREASING TREND OF BIG SCREEN LAPTOPS AND TELEVISION SETS TO ACCELERATE MARKET GROWTH

11 DISPLAY MARKET, BY PRODUCT TYPE

- 11.1 INTRODUCTION

- 11.2 SMARTPHONES

- 11.2.1 DEPLOYMENT OF LARGE-SIZED AND HIGH-RESOLUTION TO PROPEL MARKET

- 11.3 TELEVISION SETS

- 11.3.1 GROWING DEMAND FOR HIGH-QUALITY VISUAL CONTENT TO AUGMENT MARKET

- 11.4 MONITORS & LAPTOPS

- 11.4.1 GROWING TREND OF SMART HOMES AND IOT TECHNOLOGIES TO CREATE OPPORTUNITIES

- 11.5 DIGITAL SIGNAGE & LARGE FORMAT DISPLAYS

- 11.5.1 RISING DEMAND FOR INTERACTIVE AND VISUALLY ENGAGING CONTENT TO STIMULATE MARKET GROWTH

- 11.6 AUTOMOTIVE DISPLAYS

- 11.6.1 INCREASING INTEGRATION OF IN-CAR DISPLAYS TO CONTRIBUTE TO MARKET GROWTH

- 11.7 TABLETS

- 11.7.1 INCREASING DEMAND FOR HIGH-RESOLUTION DISPLAYS TO PROPEL GROWTH

- 11.8 WEARABLES

- 11.8.1 SMARTWATCHES

- 11.8.1.1 Increasing demand for superior visuals, longer battery life, and more flexible design options to accelerate market

- 11.8.2 VR HMDS

- 11.8.2.1 Advancements in display technologies to fuel demand

- 11.8.3 AR HMDS

- 11.8.3.1 Growing demand in healthcare and consumer applications to drive market

- 11.8.1 SMARTWATCHES

- 11.9 OTHER PRODUCT TYPES

12 DISPLAY MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.2 CONSUMER ELECTRONICS

- 12.2.1 INCREASING ADOPTION OF OLED AND MICRO-LED DISPLAY TECHNOLOGY TO PROPEL MARKET

- 12.3 AUTOMOTIVE

- 12.3.1 EXPANDING ADOPTION OF OLED DISPLAYS IN AUTOMOTIVE APPLICATIONS TO PROPEL MARKET

- 12.4 SPORTS & ENTERTAINMENT

- 12.4.1 SURGING USE OF AR/VR HEAD-MOUNTED DISPLAYS IN SPORTS & ENTERTAINMENT APPLICATIONS TO DRIVE MARKET

- 12.5 TRANSPORTATION

- 12.5.1 GROWING DEMAND FOR LARGE FORMAT DISPLAYS TO DRIVE MARKET

- 12.6 RETAIL, HOSPITALITY, & BFSI

- 12.6.1 EXPANDING USE OF DIGITAL SIGNAGE TO PROPEL MARKET GROWTH

- 12.7 INDUSTRIAL & ENTERPRISE

- 12.7.1 EXPANDING ADOPTION OF AR/VR IN INDUSTRIES AND ENTERPRISES TO DRIVE MARKET EXPANSION

- 12.8 EDUCATION

- 12.8.1 SHIFT TOWARD ONLINE EDUCATION TO BOOST MARKET EXPANSION

- 12.9 HEALTHCARE

- 12.9.1 RISING ADOPTION OF DISPLAYS FOR MEDICAL IMAGE VISUALIZATION TO BOOST MARKET

- 12.10 AEROSPACE & DEFENSE

- 12.10.1 GROWING ADOPTION OF HUDS AND MFDS TO PROPEL MARKET EXPANSION

- 12.11 OTHER VERTICALS

13 DISPLAY MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: RECESSION IMPACT

- 13.2.2 US

- 13.2.2.1 Technological advancements in displays to drive market

- 13.2.3 CANADA

- 13.2.3.1 Rapid expansion of restaurants, cafes, and fast-food chains to propel market

- 13.2.4 MEXICO

- 13.2.4.1 Expanding consumer electronics, automotive, and retail sectors to drive market

- 13.3 EUROPE

- 13.3.1 EUROPE: RECESSION IMPACT

- 13.3.2 GERMANY

- 13.3.2.1 Rising adoption of display technology in various industries to propel market

- 13.3.3 FRANCE

- 13.3.3.1 Increasing adoption of gaming, virtual reality, and augmented reality applications to drive market growth

- 13.3.4 UK

- 13.3.4.1 Increasing demand for smartphones and AR/VR head-mounted displays (HMDs) to stimulate market growth

- 13.3.5 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: RECESSION IMPACT

- 13.4.2 CHINA

- 13.4.2.1 Rapid industrialization and infrastructural advancements to boost market growth

- 13.4.3 SOUTH KOREA

- 13.4.3.1 Rising investments to develop innovative display technologies to fuel market growth

- 13.4.4 JAPAN

- 13.4.4.1 Accelerated demand for OLED display technology to support market growth

- 13.4.5 TAIWAN

- 13.4.5.1 Rising display panel production to foster market growth

- 13.4.6 REST OF ASIA PACIFIC

- 13.5 REST OF WORLD

- 13.5.1 ROW: RECESSION IMPACT

- 13.5.2 MIDDLE EAST & AFRICA

- 13.5.2.1 Growing retail and transportation sectors to boost market

- 13.5.2.2 GCC Countries

- 13.5.2.3 Rest of Middle East & Africa

- 13.5.3 SOUTH AMERICA

- 13.5.3.1 Rising utilization of large format displays in outdoor advertising to support market growth

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2024

- 14.3 REVENUE ANALYSIS, 2019-2023

- 14.4 MARKET SHARE ANALYSIS, 2023

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Display technology footprint

- 14.7.5.4 Resolution footprint

- 14.7.5.5 Panel size footprint

- 14.7.5.6 Panel type footprint

- 14.7.5.7 Dimension footprint

- 14.7.5.8 Product footprint

- 14.7.5.9 Vertical footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023

- 14.8.5.1 Detailed list of startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO AND TRENDS

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS

- 15.2.1 SAMSUNG DISPLAY

- 15.2.1.1 Business overview

- 15.2.1.2 Products/Solutions/Services offered

- 15.2.1.3 Recent developments

- 15.2.1.3.1 Product launches

- 15.2.1.3.2 Deals

- 15.2.1.4 MnM view

- 15.2.1.4.1 Right to win

- 15.2.1.4.2 Strategic choices

- 15.2.1.4.3 Weaknesses and competitive threats

- 15.2.2 LG DISPLAY CO., LTD.

- 15.2.2.1 Business overview

- 15.2.2.2 Products/Solutions/Services offered

- 15.2.2.3 Recent developments

- 15.2.2.3.1 Deals

- 15.2.2.4 MnM view

- 15.2.2.4.1 Right to win

- 15.2.2.4.2 Strategic choices

- 15.2.2.4.3 Weaknesses and competitive threats

- 15.2.3 SHARP CORPORATION

- 15.2.3.1 Business overview

- 15.2.3.2 Products/Solutions/Services offered

- 15.2.3.3 Recent developments

- 15.2.3.3.1 Deals

- 15.2.3.4 MnM view

- 15.2.3.4.1 Right to win

- 15.2.3.4.2 Strategic choices

- 15.2.3.4.3 Weaknesses and competitive threats

- 15.2.4 BOE TECHNOLOGY GROUP CO., LTD.

- 15.2.4.1 Business overview

- 15.2.4.2 Products/Solutions/Services offered

- 15.2.4.3 Recent developments

- 15.2.4.3.1 Deals

- 15.2.4.4 MnM view

- 15.2.4.4.1 Right to win

- 15.2.4.4.2 Strategic choices

- 15.2.4.4.3 Weaknesses and competitive threats

- 15.2.5 INNOLUX CORPORATION

- 15.2.5.1 Business overview

- 15.2.5.2 Products/Solutions/Services offered

- 15.2.5.3 Recent developments

- 15.2.5.3.1 Deals

- 15.2.5.4 MnM view

- 15.2.5.4.1 Right to win

- 15.2.5.4.2 Strategic choices

- 15.2.5.4.3 Weaknesses and competitive threats

- 15.2.6 AUO CORPORATION

- 15.2.6.1 Business overview

- 15.2.6.2 Products/Solutions/Services offered

- 15.2.6.3 Recent developments

- 15.2.6.3.1 Deals

- 15.2.7 SONY GROUP CORPORATION

- 15.2.7.1 Business overview

- 15.2.7.2 Products/Solutions/Services offered

- 15.2.7.3 Recent developments

- 15.2.7.3.1 Deals

- 15.2.8 QISDA CORPORATION

- 15.2.8.1 Business overview

- 15.2.8.2 Products/Solutions/Services offered

- 15.2.9 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.

- 15.2.9.1 Business overview

- 15.2.9.2 Products/Solutions/Services offered

- 15.2.10 LEYARD

- 15.2.10.1 Business overview

- 15.2.10.2 Products/Solutions/Services offered

- 15.2.10.3 Recent developments

- 15.2.10.3.1 Deals

- 15.2.1 SAMSUNG DISPLAY

- 15.3 OTHER PLAYERS

- 15.3.1 E INK HOLDINGS INC.

- 15.3.2 TIANMA MICROELECTRONICS CO., LTD.

- 15.3.3 UNIVERSAL DISPLAY

- 15.3.4 TRULY INTERNATIONAL HOLDINGS LIMITED

- 15.3.5 PANASONIC HOLDINGS CORPORATION

- 15.3.6 HANNSTAR

- 15.3.7 EMAGIN

- 15.3.8 KOPIN CORPORATION

- 15.3.9 NORITAKE ITRON CORP.

- 15.3.10 JAPAN DISPLAY INC.

- 15.3.11 JOLED INC.

- 15.3.12 ELUX, INC.

- 15.3.13 VISIONOX COMPANY

- 15.3.14 WINSTAR DISPLAY CO., LTD.

- 15.3.15 WISECHIP SEMICONDUCTOR INC.

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS