|

|

市場調査レポート

商品コード

1277592

断熱材の世界市場:材料タイプ別(ガラス繊維、ストーンウール、発泡、木質繊維)、温度範囲別(0~100℃、101~500℃、500℃超)、最終用途産業別(建設、自動車、HVAC、工業)、地域別 - 2028年までの予測Thermal Insulation Material Market by Material Type (Fiberglass,Stone Wool,Foam,Wood Fiber), Temperature range (0-100, 100-500, 500 and above), End use industry (Construction,Automotive,HVAC,Industrial), and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 断熱材の世界市場:材料タイプ別(ガラス繊維、ストーンウール、発泡、木質繊維)、温度範囲別(0~100℃、101~500℃、500℃超)、最終用途産業別(建設、自動車、HVAC、工業)、地域別 - 2028年までの予測 |

|

出版日: 2023年05月11日

発行: MarketsandMarkets

ページ情報: 英文 182 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の断熱材の市場規模は、2028年に960億米ドルに達し、予測期間中にCAGRで6.0%の成長が予測されています。

温室効果ガスの排出削減と天然資源の保護が急務であることから、グリーンビルディングの建設を促進する政府の取り組みが世界的に高まっています。また、騒音低減に対する需要の高まりも、断熱材市場を牽引する大きな要因となっています。さらに、屋内の空気の質に対する関心が高まっており、断熱材は屋外の汚染物質やアレルゲン、屋内の空気の質に大きな影響を与える建物の湿気やカビの侵入を防ぐのに役立ちます。また、世界各国の政府は、建築物に特定のエネルギー性能基準を満たすことを求める規則や建築基準を制定しており、断熱材はこれらの基準を満たすために重要な役割を担っています。

"2023年、101~500℃の温度範囲が、第2位の市場シェアを占める"

101~500℃の温度に耐えられる断熱材は、幅広い産業・商業用途で一般的に使用されています。これらの材料は、高温炉、窯、ボイラー、パイプラインなどの環境において、熱絶縁を提供し、高温から保護するために設計されています。産業用途では、この温度範囲に耐性を持つ断熱材が、機器や機械、作業者を高温から守るために使用されます。例えば、高温炉や窯では、望ましいプロセス温度を維持し、熱損失を低減し、エネルギー効率を高めるために断熱材が使用されています。ボイラーやパイプラインでは、これらの材料が熱損失を防ぎ、温度を一定に保つことで、最適なパフォーマンスをを確保します。

"ストーンウールは、予測期間中、断熱材市場において、金額ベースで最も急成長する材料タイプになると予想される"

ストーンウールは、天然または合成の鉱物や金属酸化物から作られた繊維です。無機質の岩石やスラグがストーンウールの主成分(通常98%)です。残りの2%の有機成分は、熱硬化性樹脂のバインダー(接着剤)と少量の油分です。ストーンウールは、圧縮強度や耐熱性が高く、遮音性に優れ、1,000℃までの高温にも耐えられるため、陸屋根、直接レンダリング用の外壁ファサード、サンドイッチパネル、空洞壁、ロフト、勾配屋根、床などの用途に適しています。

"地域別では、アジア太平洋地域が、金額ベースで急成長中の断熱材市場"

アジア太平洋地域は、2022年の金額ベースで、世界の断熱材において最大の市場となりました。アジア太平洋地域の市場は、同地域における環境負荷の増大や水不足とともに、イノベーション、すなわち産業の拡大や技術開発によって牽引されています。世界経済の改善は、市場成長を後押しすると予想されます。アジア太平洋地域の断熱材市場は、中国が圧倒的なシェアを誇っています。しかし、様々な地域の最終用途産業における断熱材の高い使用率により、インド市場は予測期間中に高い成長を示すことになります。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

第6章 業界動向

- COVID-19の影響

- 価格分析

- バリューチェーン分析

- マクロ経済指標

- 断熱材市場規制

- 貿易分析

- 顧客のビジネスに影響を与える動向/混乱

- エコシステム/市場マップ

- 技術分析

- 主要な利害関係者と購入基準

- 特許分析

- 主要な会議とイベント(2023年~2024年)

第7章 断熱材市場:材料タイプ別

- イントロダクション

- ストーンウール

- ガラス繊維

- 発泡プラスチック

- 木質繊維

- その他

- パーライト

- エアロゾル

- セルロース

- セラミック

第8章 断熱材市場:最終用途産業別

- イントロダクション

- 建設

- 住宅

- 非住宅

- 自動車

- HVAC

- 工業

- その他

第9章 断熱材市場:温度範囲別

- イントロダクション

- 0~100℃

- 101~500℃

- 500℃超

第10章 断熱材市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋地域

- 北米

- 北米市場への景気後退の影響

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- 欧州

- ドイツ

- フランス

- スペイン

- イタリア

- 英国

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- ペルー

- その他の南米

第11章 競合情勢

- 主要企業が採用した成長戦略

- 上位5社の市場シェア分析(2022年)

- 5年間の企業収益分析

- 競合評価マトリックス/象限

- スタートアップ/中小企業の評価象限

- 競合ベンチマーキング

- 断熱材市場:企業のフットプリント

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- SAINT-GOBAIN SA

- KINGSPAN GROUP

- ROCKWOOL INTERNATIONAL A/S

- OWENS CORNING

- KNAUF INSULATION

- BASF SE

- ASAHI KASEI CORPORATION

- RECTICEL

- GAF

- EVONIK INDUSTRIES AG

- その他の主要企業

- COVESTRO AG

- HUNTSMAN INTERNATIONAL LLC

- JOHNS MANVILLE

- DOW CHEMICAL COMPANY

- BAYER AG

- E. I. DUPONT DE NEMOURS AND COMPANY

- ASPEN AEROGELS, INC.

- CNBM GROUP CO. LTD.

- HOLCIM LTD.

- KCC CORPORATION

- URSA INSULATION

- SIKA GROUP

- CELLOFOAM NORTH AMERICA LIMITED

- ODE INSULATION

- LLOYD INSULATIONS LIMITED

第13章 付録

The thermal insulation material market is projected to reach USD 96.0 billion in 2028 at a CAGR of 6.0% during the forecast period. The government initiatives to promote the construction of green buildings are rising globally due to the pressing need for the reduction of greenhouse gas emission and conserve natural resources. The increase demand for noise reduction is also a major factor driving the thermal insulation market. In addition to that there is a growing concern for the indoor air quality where thermal insulation materials can help to prevent the penetration of outdoor pollutants and allergens and also building moisture and mold which have a major impact on the indoor air quality. Lastly governments all around the world have enacted rules and building codes that require buildings to fulfill particular energy performance standards and thermal insulation materials play a crucial role in meeting these standards.

"100-500℃ temperature range accounts for the second-largest market share in 2023"

Thermal insulation materials that can withstand temperatures between 100 and 500 degrees Celsius are commonly used in a wide range of industrial and commercial applications. These materials are designed to provide thermal insulation and protect against high temperatures in environments such as high-temperature furnaces, kilns, boilers, and pipelines. In industrial applications, thermal insulation materials with resistance to this temperature range are used to protect equipment, machinery, and workers from high temperatures. For example, in high-temperature furnaces and kilns, thermal insulation materials are used to maintain the desired process temperatures, reduce heat loss, and increase energy efficiency. In boilers and pipelines, these materials help to prevent heat loss and maintain consistent temperatures, ensuring optimal performance.

"Stone Wool is expected to be the-fastest growing material type for thermal insulation material market during the forecast period, in terms of value."

Stone wool is a fiber made from natural or synthetic minerals or metal oxides. Inorganic rock or slag is the main component (typically 98%) of stone wool. The remaining 2% organic content is a thermosetting resin binder (an adhesive) and a little oil. Stone wool has high compressive strength and thermal resistance, provides better sound insulation, and can withstand temperatures up to 1,000°C, making it suitable for applications such as flat roofs, outer wall facades for direct rendering, sandwich panels, cavity walls, lofts, pitched roofs, floor, and others. Some of the major companies producing stone wool include Rockwool International A/S (Denmark) and Paroc Group Oy (Finland) (now part of Owens Corning).

"Based on region, Asia Pacific is the fastest growing market for thermal insulation material, in terms of value."

Asia Pacific was the largest market for global thermal insulation material, in terms of value, in 2022. The market in Asia Pacific is driven by innovation, namely industrial expansion and technological developments, along with the increasing environmental impact and water scarcity in the region. The improving global economy is expected to boost market growth. China is a dominant market player in the Asia Pacific for the thermal insulation material market. However, the high use of thermal insulation material in various regional end-use industries will make the Indian market witness high growth during the forecast period.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 25%, and Tier 3 - 40%

- By Designation: C-Level - 30%, Director Level - 25%, and Others - 45%

- By Region: North America - 30%,Asia Pacific - 30%, Europe - 25%, Middle East & Africa-10%, and South America-5%

The key players in this market are Saint Gobain SA(France),Kingspan Group(Ireland),Rockwool International A/S (Denmark),Owens Corning(US),Knauf Insulation(US), BASF SE(Germany), Asahi Kasei Corporation(Japan), Recticel(Belgium), GAF Material Corporation(US),Evonik(Germany),

Research Coverage

This report segments the market for thermal insulation material market on the basis of material type, end use industry, temperature range and region. It provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for thermal insulation material market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the thermal insulation material market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on thermal insulation material market offered by top players in the global thermal insulation material market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the thermal insulation material market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for the thermal insulation material market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global thermal insulation material market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the thermal insulation material market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 THERMAL INSULATION MATERIAL MARKET SEGMENTATION

- 1.4.1 GEOGRAPHIC SCOPE

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 THERMAL INSULATION MATERIAL MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - top thermal insulation material manufacturers

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.2.1.1 Supply side

- 2.2.2 APPROACH 2: DEMAND-SIDE APPROACH

- 2.2.2.1 Demand side

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 3 THERMAL INSULATION MATERIAL MARKET: DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 4 CONSTRUCTION INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE, IN TERMS OF VALUE, IN 2022

- FIGURE 5 0 TO 100°C SEGMENT ACCOUNTED FOR MAJOR SHARE OF THERMAL INSULATION MARKET, BY TEMPERATURE RANGE, IN TERMS OF VALUE, IN 2022

- FIGURE 6 FIBERGLASS SEGMENT ACCOUNTED FOR MAJORITY OF MARKET SHARE, BY MATERIAL TYPE, IN TERMS OF VALUE, IN 2022

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN THERMAL INSULATION MATERIAL MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN THERMAL INSULATION MATERIAL MARKET

- FIGURE 8 BOOMING CONSTRUCTION INDUSTRY TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- 4.2 THERMAL INSULATION MATERIAL MARKET: REGIONAL ANALYSIS

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- 4.3 THERMAL INSULATION MATERIAL MARKET, BY TEMPERATURE

- FIGURE 10 0 TO 100°C SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.4 THERMAL INSULATION MATERIAL MARKET, BY END-USE INDUSTRY

- FIGURE 11 CONSTRUCTION INDUSTRY ACCOUNTED FOR LARGEST SHARE IN 2022

- 4.5 THERMAL INSULATION MATERIAL MARKET, BY TYPE

- FIGURE 12 FIBERGLASS CAPTURED LARGEST MARKET SHARE IN 2022

- 4.6 THERMAL INSULATION MATERIAL MARKET IN ASIA PACIFIC, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 13 CONSTRUCTION AND CHINA ACCOUNTED FOR SIGNIFICANT MARKET SHARE IN ASIA PACIFIC IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: THERMAL INSULATION MATERIAL MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Government initiatives for green building projects

- 5.2.1.2 Increased use of green and sustainable materials for noise control in buildings

- 5.2.1.3 Strong focus on maintaining good indoor air quality

- 5.2.1.4 Stringent energy efficiency policies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Easy availability of substitute green insulating materials

- 5.2.2.2 Building codes and regulations pertaining to specifications of insulation materials

- 5.2.2.3 Health concerns related to some thermal insulation materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovations in insulation materials and techniques

- 5.2.3.2 Adoption of passive house standards

- 5.2.3.3 Focus on constructing energy-efficient buildings

- 5.2.4 CHALLENGES

- 5.2.4.1 High material and installation costs

- 5.2.4.2 Performance limitation issues associated with certain insulation materials

- TABLE 1 LIFESPAN OF INSULATION MATERIALS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 THERMAL INSULATION MATERIAL MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 PORTER'S FIVE FORCES ANALYSIS: THERMAL INSULATION MATERIAL MARKET

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREATS OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS

- 6.1 COVID-19 IMPACT

- 6.2 PRICING ANALYSIS

- TABLE 3 THERMAL INSULATION MATERIAL: AVERAGE SELLING PRICE TRENDS ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 16 VALUE CHAIN FOR THERMAL INSULATION MATERIALS

- 6.3.1 RAW MATERIAL SUPPLIERS

- 6.3.2 MANUFACTURERS

- 6.3.3 DISTRIBUTORS

- 6.3.4 END USERS/CONSUMERS

- 6.4 MACROECONOMIC INDICATORS

- 6.4.1 GDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

- 6.5 THERMAL INSULATION MATERIAL MARKET REGULATIONS

- 6.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

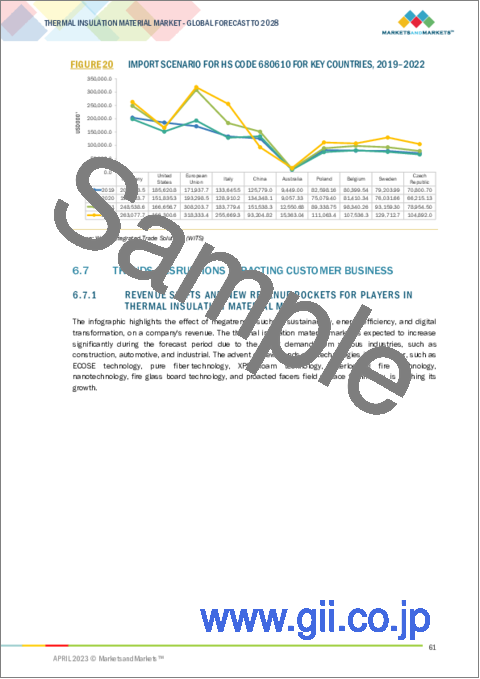

- 6.6 TRADE ANALYSIS

- 6.6.1 EXPORT SCENARIO

- FIGURE 17 EXPORT SCENARIO FOR HS CODE 680610 FOR KEY COUNTRIES, 2019-2022

- FIGURE 18 EXPORT SCENARIO FOR HS CODE 680690 FOR KEY COUNTRIES, 2019-2022

- 6.6.2 IMPORT SCENARIO

- FIGURE 19 IMPORT SCENARIO FOR HS CODE 680690 FOR KEY COUNTRIES, 2019-2022

- FIGURE 20 IMPORT SCENARIO FOR HS CODE 680610 FOR KEY COUNTRIES, 2019-2022

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.7.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN THERMAL INSULATION MATERIAL MARKET

- FIGURE 21 REVENUE SHIFT OF THERMAL INSULATION MATERIAL PROVIDERS

- 6.8 ECOSYSTEM/MARKET MAP

- TABLE 7 GDP TRENDS AND FORECASTS FOR KEY COUNTRIES, 2019-2027

- FIGURE 22 THERMAL INSULATION MATERIAL MARKET: ECOSYSTEM

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 XPS FOAM TECHNOLOGY

- TABLE 8 ADVANTAGES OF XPS FOAM TECHNOLOGY

- 6.9.2 ECOS TECHNOLOGY

- TABLE 9 ADVANTAGES OF ECOS TECHNOLOGY

- 6.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 4 END-USE INDUSTRIES

- TABLE 10 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP 4 END-USE INDUSTRIES

- 6.10.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR END-USE INDUSTRIES

- TABLE 11 KEY BUYING CRITERIA FOR END-USE INDUSTRIES

- 6.11 PATENT ANALYSIS

- 6.11.1 INTRODUCTION

- 6.11.2 APPROACH

- 6.11.3 DOCUMENT TYPE

- 6.11.3.1 Patent status

- TABLE 12 GRANTED PATENTS WERE 2% OF TOTAL COUNT IN LAST FIVE YEARS

- FIGURE 25 PATENTS REGISTERED FOR THERMAL INSULATION MATERIALS, 2017-2022

- FIGURE 26 PATENT PUBLICATION TRENDS FOR THERMAL INSULATION MATERIALS, 2017-2022

- 6.11.4 LEGAL STATUS OF PATENTS

- FIGURE 27 LEGAL STATUS OF PATENTS FILED FOR THERMAL INSULATION MATERIALS

- 6.11.5 JURISDICTION ANALYSIS

- FIGURE 28 HIGHEST NUMBER OF PATENTS FILED IN CHINA

- 6.11.6 TOP APPLICANTS OF PATENTS

- FIGURE 29 BASF REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2017 AND 2022

- TABLE 13 PATENTS BY BASF SE

- TABLE 14 PATENTS BY AEROSPACE RESEARCH INSTITUTE OF MATERIALS & PROCESSING

- TABLE 15 PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

- 6.11.7 TOP 10 PATENT OWNERS (US) IN LAST FIVE YEARS

- 6.12 KEY CONFERENCES AND EVENTS, 2023-2024

7 THERMAL INSULATION MATERIAL MARKET, BY MATERIAL TYPE

- 7.1 INTRODUCTION

- FIGURE 30 THERMAL INSULATION MATERIAL MARKET, BY MATERIAL TYPE, 2022

- TABLE 16 THERMAL INSULATION MATERIAL MARKET SIZE, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 17 THERMAL INSULATION MATERIAL MARKET SIZE, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- 7.2 STONE WOOL

- 7.2.1 BOOMING CONSTRUCTION AND ARCHITECTURAL FIELDS TO DRIVE DEMAND FOR STONE WOOL

- 7.3 FIBERGLASS

- 7.3.1 RISING USE OF FIBERGLASS IN INDUSTRIAL APPLICATIONS REQUIRING HIGH STRENGTH TO PROPEL MARKET

- 7.4 PLASTIC FOAM

- 7.4.1 LONG-DISTANCE TRANSPORT OF FRAGILE GOODS TO INCREASE DEMAND FOR PLASTIC FOAM IN PACKAGING INDUSTRY

- 7.4.2 POLYSTYRENE FOAM

- 7.4.2.1 Extruded polystyrene foam (XPS)

- 7.4.2.2 Expanded polystyrene foam (EPS)

- 7.4.3 POLYURETHANE (PUR) AND POLYISOCYANURATE (PIR) FOAM

- 7.4.4 OTHER PLASTIC FOAM MATERIALS

- 7.5 WOOD FIBER

- 7.5.1 INCREASING USE OF BIO-BASED MATERIALS IN INDUSTRIAL APPLICATIONS TO DRIVE REQUIREMENT FOR WOOD FIBER

- 7.6 OTHER MATERIALS

- 7.6.1 PERLITE

- 7.6.2 AEROSOL

- 7.6.3 CELLULOSE

- 7.6.4 CERAMIC

8 THERMAL INSULATION MATERIAL MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 31 THERMAL INSULATION MATERIAL MARKET, BY END-USE INDUSTRY, 2022

- TABLE 18 THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 19 THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 8.2 CONSTRUCTION

- 8.2.1 URGENT NEED TO REDUCE CARBON EMISSIONS AND OPTIMIZE BUILDING ENERGY TO DRIVE MARKET

- 8.2.2 RESIDENTIAL

- 8.2.2.1 Wall insulation

- 8.2.2.2 Floor insulation

- 8.2.2.3 Roof insulation

- 8.2.3 NON-RESIDENTIAL

- 8.2.3.1 Wall insulation

- 8.2.3.2 Floor insulation

- 8.2.3.3 Wall insulation

- 8.3 AUTOMOTIVE

- 8.3.1 GROWTH IN EV PRODUCTION TO BOOST DEMAND FOR THERMAL INSULATION MATERIALS

- 8.4 HVAC

- 8.4.1 MIDDLE EAST & AFRICA TO CONTRIBUTE MOST TO THERMAL INSULATION MATERIAL MARKET GROWTH IN HVAC SEGMENT

- 8.5 INDUSTRIAL

- 8.5.1 INCREASING NEED TO SAVE ENERGY AND REDUCE CARBON EMISSIONS TO STIMULATE GROWTH

- 8.6 OTHERS

9 THERMAL INSULATION MATERIAL MARKET, BY TEMPERATURE RANGE

- 9.1 INTRODUCTION

- FIGURE 32 THERMAL INSULATION MATERIAL MARKET, BY TEMPERATURE RANGE, 2022

- TABLE 20 THERMAL INSULATION MATERIAL MARKET SIZE, BY TEMPERATURE RANGE, 2019-2022 (USD MILLION)

- TABLE 21 THERMAL INSULATION MATERIAL MARKET SIZE, BY TEMPERATURE RANGE, 2023-2028 (USD MILLION)

- 9.2 0 TO 100°C

- 9.2.1 USE OF 0 TO 100°C THERMAL INSULATION MATERIALS TO IMPROVE ENERGY EFFICIENCY AND SAFETY IN INDUSTRIAL SETUP TO PROPEL MARKET

- 9.3 101 TO 500°C

- 9.3.1 INDUSTRIALIZATION TRENDS IN DEVELOPING COUNTRIES TO BOOST DEMAND FOR THERMAL INSULATION MATERIALS ABLE TO WITHSTAND 101 TO 500°C

- 9.4 >500°C

- 9.4.1 GROWTH OF LARGE-SCALE INDUSTRIES TO DRIVE SEGMENTAL GROWTH

10 THERMAL INSULATION MATERIAL MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR THERMAL INSULATION MATERIALS DURING FORECAST PERIOD

- TABLE 22 THERMAL INSULATION MATERIAL MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 THERMAL INSULATION MATERIAL MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- FIGURE 34 ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SNAPSHOT

- TABLE 24 ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 25 ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 26 ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 27 ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.2 CHINA

- 10.2.2.1 Rapid adoption of energy-efficient systems to boost demand for thermal insulation materials

- TABLE 28 CHINA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 29 CHINA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.3 JAPAN

- 10.2.3.1 Government investments in carbon emission reduction projects to boost requirement for thermal insulation materials

- TABLE 30 JAPAN: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 31 JAPAN: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.4 INDIA

- 10.2.4.1 Development of green buildings to accelerate market growth

- TABLE 32 INDIA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 33 INDIA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Government initiatives to promote use of energy-efficient products to fuel market

- TABLE 34 SOUTH KOREA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 35 SOUTH KOREA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.6 REST OF ASIA PACIFIC

- TABLE 36 REST OF ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 37 REST OF ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3 NORTH AMERICA

- 10.3.1 RECESSION IMPACT ON MARKET IN NORTH AMERICA

- FIGURE 35 NORTH AMERICA: THERMAL INSULATION MATERIAL MARKET SNAPSHOT

- TABLE 38 NORTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.2 US

- 10.3.2.1 Hike in private construction sites to stimulate market

- TABLE 42 US: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 43 US: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.3 CANADA

- 10.3.3.1 Sustainable developments in commercial and residential construction sector to drive market

- TABLE 44 CANADA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 45 CANADA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.4 MEXICO

- 10.3.4.1 Investments by pharma players to develop innovative medical equipment to boost demand for thermal insulation materials

- TABLE 46 MEXICO: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 47 MEXICO: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4 MIDDLE EAST & AFRICA

- 10.4.1 RECESSION IMPACT ON MARKET IN MEA

- FIGURE 36 MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SNAPSHOT

- TABLE 48 MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 49 MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 50 MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 51 MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.2 SAUDI ARABIA

- 10.4.2.1 Government initiatives to promote green building practices to boost demand for thermal insulation materials

- TABLE 52 SAUDI ARABIA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 53 SAUDI ARABIA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.3 SOUTH AFRICA

- 10.4.3.1 Growing adoption of energy-efficient systems in construction industry to boost demand for thermal insulation materials

- TABLE 54 SOUTH AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 55 SOUTH AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.4 REST OF MIDDLE EAST & AFRICA

- TABLE 56 REST OF MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 57 REST OF MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5 EUROPE

- 10.5.1 RECESSION IMPACT ON MARKET IN EUROPE

- FIGURE 37 EUROPE: THERMAL INSULATION MATERIAL MARKET SNAPSHOT

- TABLE 58 EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 59 EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 60 EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 61 EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.2 GERMANY

- 10.5.2.1 Adoption of green building labeling systems to foster market

- TABLE 62 GERMANY: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 63 GERMANY: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.3 FRANCE

- 10.5.3.1 Growing residential projects to increase requirement for thermal insulation materials

- TABLE 64 FRANCE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 65 FRANCE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.4 SPAIN

- 10.5.4.1 Rising demand for thermal insulation materials from automotive industry to drive market

- TABLE 66 SPAIN: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 67 SPAIN: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.5 ITALY

- 10.5.5.1 Government focus on upgrading guidelines for energy certification of buildings to create opportunities for players

- TABLE 68 ITALY: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 69 ITALY: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.6 UK

- 10.5.6.1 Prominent presence of Kingspan, Armacell, and Recticel companies to support market growth

- TABLE 70 UK: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 71 UK: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.7 REST OF EUROPE

- TABLE 72 REST OF EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 73 REST OF EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6 SOUTH AMERICA

- 10.6.1 RECESSION IMPACT ON MARKET IN SOUTH AMERICA

- FIGURE 38 SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SNAPSHOT

- TABLE 74 SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 75 SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 76 SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 77 SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6.2 BRAZIL

- 10.6.2.1 Brazil to hold largest share of South American market throughout forecast period

- TABLE 78 BRAZIL: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 79 BRAZIL: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6.3 ARGENTINA

- 10.6.3.1 Development of new standards for building envelope design to promote use of thermal insulation materials

- TABLE 80 ARGENTINA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 81 ARGENTINA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6.4 PERU

- 10.6.4.1 Government initiatives for green buildings to stimulate market growth

- TABLE 82 PERU: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 83 PERU: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6.5 REST OF SOUTH AMERICA

- TABLE 84 REST OF SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 85 REST OF SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 86 REVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN THERMAL INSULATION MATERIAL MARKET

- 11.2 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2022

- FIGURE 39 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN THERMAL INSULATION MATERIAL MARKET, 2022

- FIGURE 40 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2022

- TABLE 87 THERMAL INSULATION MATERIAL MARKET: DEGREE OF COMPETITION

- 11.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

- 11.4 COMPETITIVE EVALUATION MATRIX/QUADRANT

- 11.4.1 STARS

- 11.4.2 PERVASIVE PLAYERS

- 11.4.3 EMERGING LEADERS

- 11.4.4 PARTICIPANTS

- FIGURE 41 THERMAL INSULATION MATERIAL MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2022

- 11.5 STARTUPS/SMES EVALUATION QUADRANT

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 42 THERMAL INSULATION MATERIAL MARKET: STARTUPS/SMES EVALUATION QUADRANT, 2022

- 11.6 COMPETITIVE BENCHMARKING

- TABLE 88 THERMAL INSULATION MATERIAL MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 89 THERMAL INSULATION MATERIAL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES FOR END-USE INDUSTRY

- 11.7 THERMAL INSULATION MATERIAL MARKET: COMPANY FOOTPRINT

- TABLE 90 END-USE INDUSTRY: COMPANY FOOTPRINT

- TABLE 91 TYPE: COMPANY FOOTPRINT

- TABLE 92 TEMPERATURE RANGE: COMPANY FOOTPRINT

- TABLE 93 REGION: COMPANY FOOTPRINT

- TABLE 94 COMPANY FOOTPRINT

- 11.8 COMPETITIVE SCENARIO

- TABLE 95 THERMAL INSULATION MATERIAL MARKET: PRODUCT LAUNCHES, JUNE 2019-APRIL 2022

- TABLE 96 THERMAL INSULATION MATERIAL MARKET: DEALS, APRIL 2019-JUNE 2022

12 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 SAINT-GOBAIN SA

- TABLE 97 SAINT-GOBAIN SA: BUSINESS OVERVIEW

- FIGURE 43 SAINT-GOBAIN SA: COMPANY SNAPSHOT

- TABLE 98 SAINT-GOBAIN SA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 99 SAINT-GOBAIN SA: DEALS

- 12.1.2 KINGSPAN GROUP

- TABLE 100 KINGSPAN GROUP: BUSINESS OVERVIEW

- FIGURE 44 KINGSPAN GROUP: COMPANY SNAPSHOT

- TABLE 101 KINGSPAN GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 102 KINGSPAN GROUP: DEALS

- TABLE 103 KINGSPAN GROUP: OTHERS

- 12.1.3 ROCKWOOL INTERNATIONAL A/S

- TABLE 104 ROCKWOOL INTERNATIONAL A/S: BUSINESS OVERVIEW

- FIGURE 45 ROCKWOOL INTERNATIONAL A/S: COMPANY SNAPSHOT

- TABLE 105 ROCKWOOL INTERNATIONAL A/S: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 106 ROCKWOOL INTERNATIONAL A/S: DEALS

- TABLE 107 ROCKWOOL INTERNATIONAL A/S: OTHERS

- 12.1.4 OWENS CORNING

- TABLE 108 OWENS CORNING: BUSINESS OVERVIEW

- FIGURE 46 OWENS CORNING: COMPANY SNAPSHOT

- TABLE 109 OWENS CORNING: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.5 KNAUF INSULATION

- TABLE 110 KNAUF INSULATION: BUSINESS OVERVIEW

- TABLE 111 KNAUF INSULATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 112 KNAUF INSULATION: OTHERS

- 12.1.6 BASF SE

- TABLE 113 BASF SE: BUSINESS OVERVIEW

- FIGURE 47 BASF SE: FINANCIAL SNAPSHOT

- TABLE 114 BASF SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 115 BASF SE: PRODUCT LAUNCHES

- 12.1.7 ASAHI KASEI CORPORATION

- TABLE 116 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

- TABLE 117 ASAHI KASEI CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 118 ASAHI KASEI CORPORATION: DEALS

- 12.1.8 RECTICEL

- TABLE 119 RECTICEL: BUSINESS OVERVIEW

- TABLE 120 RECTICEL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 121 RECTICEL: DEALS

- TABLE 122 RECTICEL: OTHERS

- TABLE 123 RECTICEL: PRODUCT LAUNCHES

- 12.1.9 GAF

- TABLE 124 GAF: BUSINESS OVERVIEW

- TABLE 125 GAF: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 126 GAF: PRODUCT LAUNCHES

- 12.1.10 EVONIK INDUSTRIES AG

- TABLE 127 EVONIK: BUSINESS OVERVIEW

- TABLE 128 EVONIK: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.2 OTHER KEY PLAYERS

- 12.2.1 COVESTRO AG

- 12.2.2 HUNTSMAN INTERNATIONAL LLC

- 12.2.3 JOHNS MANVILLE

- 12.2.4 DOW CHEMICAL COMPANY

- 12.2.5 BAYER AG

- 12.2.6 E. I. DUPONT DE NEMOURS AND COMPANY

- 12.2.7 ASPEN AEROGELS, INC.

- 12.2.8 CNBM GROUP CO. LTD.

- 12.2.9 HOLCIM LTD.

- 12.2.10 KCC CORPORATION

- 12.2.11 URSA INSULATION

- 12.2.12 SIKA GROUP

- 12.2.13 CELLOFOAM NORTH AMERICA LIMITED

- 12.2.14 ODE INSULATION

- 12.2.15 LLOYD INSULATIONS LIMITED

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS