|

|

市場調査レポート

商品コード

1277590

医療向け量子コンピューティングの世界市場:コンポーネント別、展開別(オンプレミス、クラウドベース)、技術別(超伝導量子ビット、イオントラップ型)、アプリケーション別(創薬、ゲノミクス)、エンドユーザー別、地域別 - 2028年までの予測Quantum Computing in Healthcare Market by Component (Hardware, Software), Deployment (0n-premises, Cloud-based), Technology (Superconducting qubits, Trapped ions), Application (Drug discovery, Genomics), End User, and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 医療向け量子コンピューティングの世界市場:コンポーネント別、展開別(オンプレミス、クラウドベース)、技術別(超伝導量子ビット、イオントラップ型)、アプリケーション別(創薬、ゲノミクス)、エンドユーザー別、地域別 - 2028年までの予測 |

|

出版日: 2023年05月15日

発行: MarketsandMarkets

ページ情報: 英文 210 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の医療向け量子コンピューティングの市場規模は、2023年の8,500万米ドルから、2028年までに5億300万米ドルに達し、予測期間中にCAGRで42.5%の高い成長が予測されています。

様々な医療アプリケーションをサポートする量子コンピューティングの技術的進歩は、予測期間中、市場に有利な機会を提供するでしょう。

"クラウドベースセグメントは、医療向け量子コンピューティング市場の展開別で、予測期間中に最も高いCAGRを記録する"

2022年、医療向け量子コンピューティング市場では、クラウドベースセグメントが大きなシェアを占めています。クラウドベースセグメントの成長は、急速に進歩している量子コンピューティングシステムの寿命が限られていること、手間のかからないスケーラビリティと柔軟性、ひいては量子クラウドサービスを利用しながら究極の意思決定プロセスを改善することに起因すると考えられます。

"超伝導量子ビットセグメントは、医療向け量子コンピューティング市場の技術別で、最大シェアを占める"

2022年、医療向け量子コンピューティング市場では、超伝導量子ビットセグメントが最大のシェアを占めました。この大きなシェアは、超伝導量子ビットを用いた量子コンピューティングシステムのゲート速度が速く、このタイプの量子ビットで高度な制御が可能なため、創薬、画像診断、個別化医療などのさまざまなアプリケーションに柔軟に使用できることに起因しているものと考えられます。

"2022年、製薬企業・バイオ医薬品企業セグメントが、医療向け量子コンピューティング市場のエンドユーザー別で、最大となる"

2022年、医療向け量子コンピューティング市場では、製薬企業・バイオ医薬品企業セグメントが大きなシェアを占めています。製薬企業・バイオ医薬品企業セグメントの成長は、量子コンピューティングが、標的の特定、薬剤設計、毒性試験の試行錯誤への依存を軽減することで、研究開発を劇的に速く、より的を絞って正確に行うことができるため、複雑な創薬・開発手順の迅速化や、精度の強化につながることに起因すると考えられます。また、長期的には、リソースや資本の有効活用、投資対効果の向上、慢性疾患に対する新薬の提供の大幅な増加などのメリットがあります。

"予測期間中、アジア太平洋地域が最も高い成長率を示す"

アジア太平洋市場は、予測期間中に最も高いCAGRで成長すると予測されています。研究・ゲノミクス目的での量子コンピューティングなどの先端技術への需要の高まり、新興地域での量子コンピューティングへの認識と導入の拡大、医療インフラの改善などの要因が挙げられます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 市場促進要因

- 抑制要因

- 機会

- 課題

第6章 業界考察

- 業界動向

- 技術分析

- ポーターのファイブフォース分析

- 規制分析

- バリューチェーン分析

- エコシステム分析

- 特許分析

- ケーススタディ分析

- 主要な利害関係者と購入基準

- 主要な会議とイベント(2023年~2024年)

- 顧客のビジネスに影響を与える動向/混乱

第7章 医療向け量子コンピューティング市場:コンポーネント別

- イントロダクション

- ソフトウェア

- ハードウェア

- サービス

第8章 医療向け量子コンピューティング市場:展開別

- イントロダクション

- オンプレミス

- クラウドベース

第9章 医療向け量子コンピューティング市場:技術別

- イントロダクション

- 超伝導量子ビット

- イオントラップ型

- 量子アニーリング

- その他

第10章 医療向け量子コンピューティング市場:アプリケーション別

- イントロダクション

- 創薬・開発

- 医療診断

- ゲノミクス・精密医療

- 放射線治療

- リスク分析

- その他(PHM、医療向けセキュリティ)

第11章 医療向け量子コンピューティング市場:エンドユーザー別

- イントロダクション

- 製薬企業・バイオ医薬品企業

- 研究所・研究機関

- 医療提供者

- 医療保険者

第12章 医療向け量子コンピューティング市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋地域

- 日本

- 中国

- その他のアジア太平洋地域

- その他の地域

第13章 競合情勢

- 概要

- 市場ランキング分析

- 市場上位企業の収益シェア分析

- 医療向け量子コンピューティング市場:研究開発費

- 主要企業の地域による収益評価

- 競合ベンチマーキング

- 企業評価象限

- スタートアップ/中小企業向けの企業評価象限

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- RIGETTI & CO, LLC.

- IBM

- D-WAVE QUANTUM INC.

- QUANDELA

- IONQ

- QUANTINUUM LTD.

- GOOGLE LLC

- ID QUANTIQUE

- ZAPATA COMPUTING

- ATOS SE

- QC WARE

- CLASSIQ TECHNOLOGIES LTD.

- XANADU QUANTUM TECHNOLOGIES INC.

- HEFEI ORIGIN QUANTUM COMPUTING TECHNOLOGY CO., LTD.

- PROTIVITI INC.

- PWC

- DELOITTE

- ACCENTURE

- その他の企業

- AMAZON WEB SERVICES(AWS)

- PASQAL

- FUJITSU

- SANDBOX AQ

- SEEQC

- QUINTESSENCELABS

- QNAMI

第15章 付録

The global quantum computing in healthcare market is projected to reach USD 503 million by 2028 from USD 85 million in 2023, at a high CAGR of 42.5% during the forecast period. The technological advancements in quantum computing supporting various healthcare applications will provide lucrative opportunities to the market during the forecast period.

"The cloud based segment registered the highest CAGR during the forecast period in healthcare market, by deployment "

In 2022, the cloud-based segment accounted for a significant share of the quantum computing in healthcare market. The growth of the cloud-based segment can be attributed to the limited lifespan of rapidly advancing quantum computing systems, hassle-free scalability and flexibility, which in turn improves the ultimate decision-making process while using the quantum cloud services.

"Superconducting Qubits segment accounted for the largest share of the quantum computing in healthcare market, By Technology"

In 2022, the superconducting qubits segment accounted for the largest share of the quantum computing in healthcare market. The large share can be attributed to the fast gate speed of quantum computing systems based on superconducting qubits and the high degree of control possible with this type of qubit, making them flexible to be used for various applications such as drug discovery, imaging diagnostics, personalized medicine, etc.

"Pharmaceutical and Biopharmaceutical companies was the largest segment by end user of quantum computing in healthcare market in 2022"

In 2022, the pharmaceutical & biopharmaceutical companies segment accounted for a significant share of the quantum computing in healthcare market. The growth of the pharmaceutical & biopharmaceutical companies segment can be attributed to the ability of quantum computing to make R&D dramatically faster and more targeted and precise by making target identification, drug design, and toxicity testing less dependent on trial and error and therefore expedite complex drug discovery & development procedures, and enhanced accuracy. Its long-term benefits include the better utilization of resources and capital, better return on investment, and a substantial increase in the delivery of new medicines for chronic diseases.

"APAC to witness the highest growth rate during the forecast period."

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. Factors such as growing demand for advanced technologies such as quantum computing for research & genomics purposes, growing awareness and adoption of quantum computing in emerging regions, and improving healthcare infrastructure.

The break-down of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation - C-level: 42%, Director-level: 31%, and Others: 27%

- By Region - North America: 32%, Europe: 32%, Asia Pacific: 26%, Middle East & Africa: 5%, Latin America: 5%

Key Players in the Quantum Computing In Healthcare Market

The key players operating in the Quantum Computing in Healthcare Market include IBM (US), Google, Inc. (US), Rigetti & Co, LLC. (US), Quandela (France), D-Wave Quantum Inc. (Canada), Quantinuum, Ltd. (US & UK), ID Quantique (Switzerland), Zapata Computing (US), Atos SE (France), IonQ (US), Classiq Technologies, Inc. (US), Xanadu Quantum Technologies Inc. (Canada), QC Ware (California), Protiviti, Inc. (US), Hefei Origin Quantum Computing Technology Co., Ltd. (China), PwC (UK), Deloitte (UK), Accenture (Ireland), Amazon Web Services (US), Pasqal (France), Fujitsu (Japan), Sandbox AQ (US), SEEQC (US), Quintessence Labs (Australia), and Qnami (Switzerland).

Research Coverage:

The report analyzes the Quantum Computing in Healthcare Market and aims to estimate the market size and future growth potential of various market segments, based on components, deployment mode, application, technology, end user, and region. The report also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers (increasing Investments in quantum computing in developed as well as emerging economies, growing inclination of payers toward quantum computing, rising demand for personalized medicine, increasing funding and investments in quantum computing startups), restraints (accuracy issues with quantum computing systems and high implementation costs), opportunities (technological advancements in quantum computing supporting various healthcare applications, potential applications in medical image analysis and oncology),and challenges (lack of technical expertise & data management issues) influencing the growth of the healthcare interoperability solutions market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the quantum computing in healthcare market.

- Market Development: Comprehensive information on the lucrative emerging markets, component, deployment mode, technology, application, end user, and region.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the quantum computing in healthcare market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the quantum computing in healthcare market like IBM (US), Google, Inc. (US), Rigetti & Co, LLC. (US), Quandela (France), D-Wave Quantum Inc. (Canada), Quantinuum, Ltd. (US & UK).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY REGION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- 1.5 STAKEHOLDERS

- 1.6 LIMITATIONS

- 1.7 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.4 Insights from primary experts

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF QUANTUM COMPUTING IN HEALTHCARE INDUSTRY

- FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

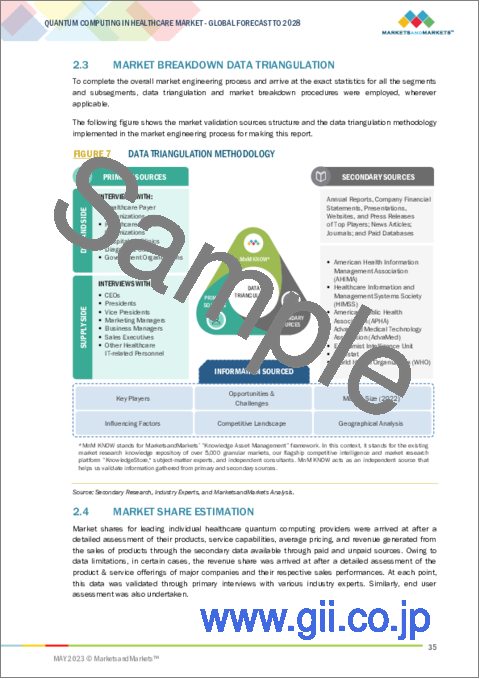

- 2.3 MARKET BREAKDOWN DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 3 RISK ASSESSMENT: QUANTUM COMPUTING IN HEALTHCARE MARKET

- 2.8 IMPACT OF RECESSION ON QUANTUM COMPUTING IN HEALTHCARE MARKET

3 EXECUTIVE SUMMARY

- FIGURE 8 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 QUANTUM COMPUTING IN HEALTHCARE MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF QUANTUM COMPUTING IN HEALTHCARE MARKET

- FIGURE 14 GOVERNMENT SUPPORT FOR ADOPTION OF QUANTUM COMPUTING TO DRIVE MARKET GROWTH

- 4.2 ASIA PACIFIC: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT

- FIGURE 15 HARDWARE SEGMENT AND JAPAN TO COMMAND LARGEST SHARES OF ASIA PACIFIC MARKET IN 2022

- 4.3 GEOGRAPHIC SNAPSHOT OF QUANTUM COMPUTING IN HEALTHCARE MARKET

- FIGURE 16 MARKET IN CHINA TO GROW AT HIGHEST CAGR

- 4.4 REGIONAL MIX: QUANTUM COMPUTING IN HEALTHCARE MARKET

- FIGURE 17 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 QUANTUM COMPUTING IN HEALTHCARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 4 MARKET DYNAMICS: QUANTUM COMPUTING IN HEALTHCARE MARKET

- 5.2.1 MARKET DRIVERS

- 5.2.1.1 Increasing investments in quantum computing in developed as well as emerging economies

- 5.2.1.2 Growing inclination of payers toward quantum computing

- 5.2.1.3 Rising demand for personalized medicine

- 5.2.1.4 Increasing funding and investments in quantum computing startups

- 5.2.2 RESTRAINTS

- 5.2.2.1 Accuracy issues with quantum computing systems and high implementation costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in quantum computing supporting various healthcare applications

- 5.2.3.2 Potential applications in medical image analysis and oncology

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of technical expertise and data management issues

6 INDUSTRY INSIGHTS

- 6.1 INDUSTRY TRENDS

- 6.1.1 HYBRID QUANTUM-CLASSICAL COMPUTING

- 6.1.2 QUANTUM MACHINE LEARNING

- 6.1.3 GROWING NUMBER OF APPLICATIONS IN HEALTHCARE INDUSTRY

- 6.2 TECHNOLOGY ANALYSIS

- 6.2.1 QUANTUM ARTIFICIAL INTELLIGENCE

- 6.2.2 QUANTUM COMMUNICATION TECHNOLOGY

- 6.2.3 QUANTUM COMPUTING ACADEMIA

- 6.2.4 CYBERSECURITY TRANSFORMATION

- 6.2.5 QUANTUM SENSING

- 6.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 QUANTUM COMPUTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.4 REGULATORY ANALYSIS

- 6.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.4.2 REGULATORY STANDARDS

- 6.4.2.1 P1913 - Software-defined quantum communication

- 6.4.2.2 P7130 - Standard for quantum technologies definitions

- 6.4.2.3 P7131 - Standard for quantum computing performance metrics and benchmarking

- 6.5 VALUE CHAIN ANALYSIS

- FIGURE 20 QUANTUM COMPUTING IN HEALTHCARE MARKET: VALUE CHAIN ANALYSIS

- 6.5.1 RESEARCH, DESIGN, AND DEVELOPMENT

- 6.5.2 MANUFACTURERS & SERVICE PROVIDERS

- 6.5.3 MARKETING & SALES EXECUTIVES

- 6.5.4 END USERS

- 6.6 ECOSYSTEM ANALYSIS

- FIGURE 21 QUANTUM COMPUTING IN HEALTHCARE MARKET: ECOSYSTEM ANALYSIS

- 6.7 PATENT ANALYSIS

- FIGURE 22 TOP PATENT OWNERS AND APPLICANTS FOR HEALTHCARE IT SOLUTIONS (JANUARY 2011-APRIL 2023)

- FIGURE 23 PATENT ANALYSIS: QUANTUM COMPUTING IN HEALTHCARE MARKET (JANUARY 2015-APRIL 2023)

- 6.8 CASE STUDY ANALYSIS

- TABLE 9 MENTEN AI LEVERAGED D-WAVE QUANTUM COMPUTING PRODUCTS TO BATTLE COVID-19 WITH QUANTUM PEPTIDE THERAPEUTICS

- 6.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.9.1 KEY STAKEHOLDERS ON BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 6.9.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR QUANTUM COMPUTING BY COMPONENTS

- TABLE 11 KEY BUYING CRITERIA FOR QUANTUM COMPUTING BY COMPONENT

- 6.10 KEY CONFERENCES AND EVENTS (2023-2024)

- 6.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 26 REVENUE SHIFT IN QUANTUM COMPUTING IN HEALTHCARE MARKET

7 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- TABLE 12 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- 7.2 SOFTWARE

- 7.2.1 SHIFT TO WEB/CLOUD-BASED MODELS TO SUPPORT GROWTH

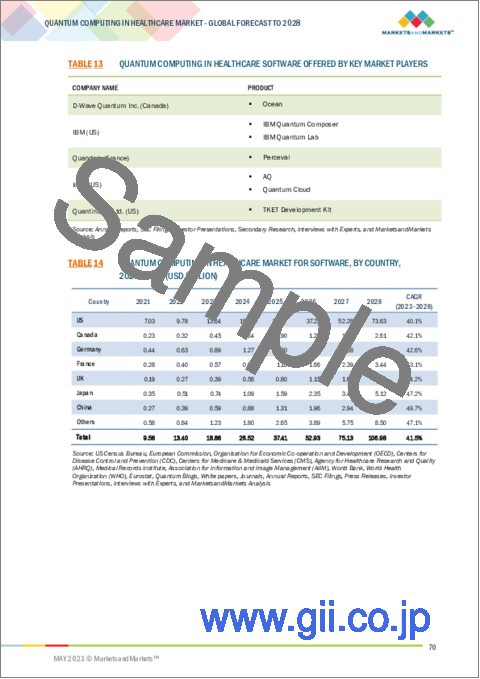

- TABLE 13 QUANTUM COMPUTING IN HEALTHCARE SOFTWARE OFFERED BY KEY MARKET PLAYERS

- TABLE 14 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR SOFTWARE, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 HARDWARE

- 7.3.1 NEED FOR FREQUENT HARDWARE UPGRADES TO DRIVE MARKET GROWTH

- TABLE 15 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR HARDWARE, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 SERVICES

- 7.4.1 INTRODUCTION OF COMPLEX SOFTWARE TO DRIVE DEMAND FOR SERVICES

- TABLE 16 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

8 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT

- 8.1 INTRODUCTION

- TABLE 17 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- 8.2 ON-PREMISES

- 8.2.1 RISING DEPLOYMENT OF ON-PREMISES QUANTUM COMPUTERS BY ORGANIZATIONS TO ENSURE DATA SECURITY

- TABLE 18 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR ON-PREMISES SOLUTIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 CLOUD-BASED

- 8.3.1 INCREASING PREFERENCE FOR CLOUD-BASED QUANTUM COMPUTING FOR RESEARCH & DEVELOPMENT USING DIFFERENT APPROACHES

- TABLE 19 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR CLOUD-BASED SOLUTIONS, BY COUNTRY, 2021-2028 (USD MILLION)

9 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- TABLE 20 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.2 SUPERCONDUCTING QUBITS

- 9.2.1 LOW POWER CONSUMPTION, HIGH SPEED, AND ABILITY TO OPERATE AT LOW TEMPERATURES TO DRIVE MARKET

- TABLE 21 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR SUPERCONDUCTING QUBITS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 TRAPPED IONS

- 9.3.1 SUPERIOR CONNECTIVITY AND HIGHER GATE FIDELITY TO DRIVE MARKET

- TABLE 22 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR TRAPPED IONS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.4 QUANTUM ANNEALING

- 9.4.1 QUICK DISCOVERY OF MOST EFFICIENT CONFIGURATIONS AMONG POSSIBLE COMBINATIONS OF VARIABLES TO DRIVE MARKET

- TABLE 23 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR QUANTUM ANNEALING, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.5 OTHERS

- TABLE 24 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021-2028 (USD MILLION)

10 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- TABLE 25 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.2 DRUG DISCOVERY & DEVELOPMENT

- 10.2.1 ENABLING ACCURATE DATA PROJECTIONS AND SOLUTIONS FOR DRUG DISCOVERY AND DEVELOPMENT TO BOOST MARKET GROWTH

- TABLE 26 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.3 MEDICAL DIAGNOSTICS

- 10.3.1 PRECISE AND SENSITIVE MEDICAL DIAGNOSTICS PROCEDURES TO DRIVE MARKET

- TABLE 27 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR MEDICAL DIAGNOSTICS, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.4 GENOMICS & PRECISION MEDICINE

- 10.4.1 UNLOCKING POWER OF GENOMICS & PRECISION MEDICINE WITH QUANTUM COMPUTING TECHNOLOGY

- TABLE 28 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR GENOMICS & PRECISION MEDICINE, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.5 RADIOTHERAPY

- 10.5.1 QUANTUM RADIOTHERAPY: ENABLING MORE PERSONALIZED AND PRECISE TREATMENT IN FIGHT AGAINST CANCER

- TABLE 29 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR RADIOTHERAPY, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.6 RISK ANALYSIS

- 10.6.1 ENHANCES PRICING MODEL MANAGEMENT AND DECREASE IN COSTS ASSOCIATED WITH FRAUD

- TABLE 30 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR RISK ANALYSIS, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.7 OTHERS (POPULATION HEALTH MANAGEMENT, SECURITY IN HEALTHCARE)

- 10.7.1 SECURELY TRANSFORMING POPULATION HEALTH WITH QUANTUM COMPUTING

- TABLE 31 QUANTUM COMPUTING IN HEALTHCARE MARKET OTHER APPLICATIONS (POPULATION HEALTH MANAGEMENT, SECURITY IN HEALTHCARE), BY COUNTRY, 2021-2028 (USD MILLION)

11 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY END USER

- 11.1 INTRODUCTION

- TABLE 32 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2 PHARMA & BIOPHARMA COMPANIES

- 11.2.1 RISING DEMAND FOR SOLUTIONS TO REDUCE TIME AND COSTS OF DRUG DEVELOPMENT

- TABLE 33 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR PHARMA & BIOPHARMA COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.3 LABS & RESEARCH INSTITUTES

- 11.3.1 INCREASED RESEARCH ACTIVITIES TO ENCOURAGE USE OF AI IN GENOMICS IN ACADEMIC AND GOVERNMENT INSTITUTES

- TABLE 34 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR LABS & RESEARCH INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.4 HEALTHCARE PROVIDERS

- 11.4.1 HIGH NUMBER OF BENEFITS TO IMPROVE PATIENT MANAGEMENT, LOWER COSTS, AND DELIVER BETTER PATIENT TREATMENT

- TABLE 35 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.5 HEALTHCARE PAYERS

- 11.5.1 POTENTIAL TO REDUCE READMISSIONS AND OVERHEAD COSTS TO DRIVE ADOPTION

- TABLE 36 QUANTUM COMPUTING IN HEALTHCARE MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2021-2028 (USD MILLION)

12 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY REGION

- 12.1 INTRODUCTION

- TABLE 37 QUANTUM COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 27 NORTH AMERICA: QUANTUM COMPUTING IN HEALTHCARE MARKET SNAPSHOT, 2022

- TABLE 38 NORTH AMERICA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.2.1 US

- 12.2.1.1 Expanding applications of quantum computing in healthcare to bolster market growth

- TABLE 44 US: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 45 US: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 46 US: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 47 US: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 48 US: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.2.2 CANADA

- 12.2.2.1 Investments and developments in quantum computing industry to drive market

- TABLE 49 CANADA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 50 CANADA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 51 CANADA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 52 CANADA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 53 CANADA: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3 EUROPE

- TABLE 54 EUROPE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 55 EUROPE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 56 EUROPE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 57 EUROPE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 58 EUROPE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 59 EUROPE: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3.1 GERMANY

- 12.3.1.1 Collaborations & partnerships to drive adoption of quantum computing solutions

- TABLE 60 GERMANY: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 61 GERMANY: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 62 GERMANY: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 63 GERMANY: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 64 GERMANY: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3.2 UK

- 12.3.2.1 Increased focus on quantum computing applications to support growth

- TABLE 65 UK: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 66 UK: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 67 UK: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 68 UK: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 69 UK: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Government funding for quantum computing to bolster growth

- TABLE 70 FRANCE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 71 FRANCE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 72 FRANCE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 73 FRANCE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 74 FRANCE: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3.4 REST OF EUROPE

- TABLE 75 REST OF EUROPE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 76 REST OF EUROPE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 77 REST OF EUROPE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 79 REST OF EUROPE: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 28 ASIA PACIFIC: QUANTUM COMPUTING IN HEALTHCARE SNAPSHOT

- TABLE 80 ASIA PACIFIC: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.4.1 JAPAN

- 12.4.1.1 Rising penetration of technologies to support market growth

- TABLE 86 JAPAN: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 87 JAPAN: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 88 JAPAN: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 89 JAPAN: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 90 JAPAN: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Dominating healthcare market in Asia Pacific

- TABLE 91 CHINA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 92 CHINA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 93 CHINA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 94 CHINA: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 95 CHINA: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.4.3 REST OF ASIA PACIFIC

- TABLE 96 REST OF ASIA PACIFIC: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 99 REST OF ASIA PACIFIC: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 100 REST OF ASIA PACIFIC: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.5 REST OF THE WORLD

- TABLE 101 REST OF THE WORLD: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 102 REST OF THE WORLD: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 103 REST OF THE WORLD: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 104 REST OF THE WORLD: QUANTUM COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 105 REST OF THE WORLD: QUANTUM COMPUTING IN MARKET, BY END USER, 2021-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- FIGURE 29 KEY DEVELOPMENTS OF MAJOR PLAYERS BETWEEN JANUARY 2020 AND APRIL 2023

- 13.2 MARKET RANKING ANALYSIS

- FIGURE 30 QUANTUM COMPUTING IN HEALTHCARE MARKET RANKING ANALYSIS, BY PLAYER, 2022

- 13.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 31 QUANTUM COMPUTING IN HEALTHCARE MARKET: REVENUE ANALYSIS OF KEY PLAYERS

- 13.4 QUANTUM COMPUTING IN HEALTHCARE MARKET: R&D EXPENDITURE

- FIGURE 32 R&D EXPENDITURE OF KEY PLAYERS (2021 VS. 2022)

- 13.5 GEOGRAPHIC REVENUE ASSESSMENT OF KEY PLAYERS

- FIGURE 33 QUANTUM COMPUTING IN HEALTHCARE MARKET: GEOGRAPHIC REVENUE MIX

- 13.6 COMPETITIVE BENCHMARKING

- TABLE 106 FOOTPRINTS OF COMPANIES IN QUANTUM COMPUTING IN HEALTHCARE MARKET

- TABLE 107 COMPANY PRODUCT FOOTPRINT (26 COMPANIES)

- TABLE 108 COMPANY APPLICATION FOOTPRINT (16 COMPANIES)

- TABLE 109 COMPANY REGION FOOTPRINT (25 COMPANIES)

- 13.7 COMPANY EVALUATION QUADRANT

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- FIGURE 34 QUANTUM COMPUTING IN HEALTHCARE MARKET: COMPANY EVALUATION QUADRANT (2022)

- 13.8 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 DYNAMIC COMPANIES

- 13.8.3 RESPONSIVE COMPANIES

- 13.8.4 STARTING BLOCKS

- FIGURE 35 QUANTUM COMPUTING IN HEALTHCARE MARKET: COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES (2022)

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT/SERVICE LAUNCHES & APPROVALS

- TABLE 110 PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2020- APRIL 2023

- 13.9.2 DEALS

- TABLE 111 DEALS, JANUARY 2020- APRIL 2023

14 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 14.1 KEY PLAYERS

- 14.1.1 RIGETTI & CO, LLC.

- TABLE 112 RIGETTI & CO, LLC.: COMPANY OVERVIEW

- FIGURE 36 RIGETTI & CO, LLC.: COMPANY SNAPSHOT (2022)

- 14.1.2 IBM

- TABLE 113 IBM: COMPANY OVERVIEW

- FIGURE 37 IBM: COMPANY SNAPSHOT (2022)

- 14.1.3 D-WAVE QUANTUM INC.

- TABLE 114 D-WAVE QUANTUM INC.: COMPANY OVERVIEW

- FIGURE 38 D-WAVE QUANTUM INC.: COMPANY SNAPSHOT (2022)

- 14.1.4 QUANDELA

- TABLE 115 QUANDELA: COMPANY OVERVIEW

- 14.1.5 IONQ

- TABLE 116 IONQ: COMPANY OVERVIEW

- FIGURE 39 IONQ: COMPANY SNAPSHOT (2022)

- 14.1.6 QUANTINUUM LTD.

- TABLE 117 QUANTINUUM LTD.: COMPANY OVERVIEW

- 14.1.7 GOOGLE LLC

- TABLE 118 GOOGLE LLC: COMPANY OVERVIEW

- FIGURE 40 GOOGLE LLC: COMPANY SNAPSHOT (2022)

- 14.1.8 ID QUANTIQUE

- TABLE 119 ID QUANTIQUE: COMPANY OVERVIEW

- 14.1.9 ZAPATA COMPUTING

- TABLE 120 ZAPATA COMPUTING: COMPANY OVERVIEW

- 14.1.10 ATOS SE

- TABLE 121 ATOS SE: COMPANY OVERVIEW

- FIGURE 41 ATOS SE: COMPANY SNAPSHOT (2022)

- 14.1.11 QC WARE

- TABLE 122 QC WARE: COMPANY OVERVIEW

- 14.1.12 CLASSIQ TECHNOLOGIES LTD.

- TABLE 123 CLASSIQ TECHNOLOGIES LTD.: COMPANY OVERVIEW

- 14.1.13 XANADU QUANTUM TECHNOLOGIES INC.

- TABLE 124 XANADU QUANTUM TECHNOLOGIES INC.: COMPANY OVERVIEW

- 14.1.14 HEFEI ORIGIN QUANTUM COMPUTING TECHNOLOGY CO., LTD.

- TABLE 125 HEFEI ORIGIN QUANTUM COMPUTING TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- 14.1.15 PROTIVITI INC.

- TABLE 126 PROTIVITI INC.: COMPANY OVERVIEW

- 14.1.16 PWC

- TABLE 127 PWC: COMPANY OVERVIEW

- 14.1.17 DELOITTE

- TABLE 128 DELOITTE: COMPANY OVERVIEW

- 14.1.18 ACCENTURE

- TABLE 129 ACCENTURE: COMPANY OVERVIEW

- FIGURE 42 ACCENTURE: COMPANY SNAPSHOT (2022)

- 14.2 OTHER PLAYERS

- 14.2.1 AMAZON WEB SERVICES (AWS)

- 14.2.2 PASQAL

- 14.2.3 FUJITSU

- 14.2.4 SANDBOX AQ

- 14.2.5 SEEQC

- 14.2.6 QUINTESSENCELABS

- 14.2.7 QNAMI

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS