|

|

市場調査レポート

商品コード

1267431

水溶性肥料の世界市場:種類別 (窒素系、リン酸系、カリウム系)・適用方式別 (葉面散布、滴下施肥)・形状別 (乾式、液体)・作物の種類別 (畑作物、園芸、芝生・観葉植物)・地域別の将来予測 (2028年まで)Water-soluble Fertilizers Market by Type (Nitrogenous, Phosphatic, and Potassic), Mode of Application (Foliar and Fertigation), Form (Dry and Liquid), Crop Type (Field Crop, Horticulture Crops, Turf & ornaments) and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 水溶性肥料の世界市場:種類別 (窒素系、リン酸系、カリウム系)・適用方式別 (葉面散布、滴下施肥)・形状別 (乾式、液体)・作物の種類別 (畑作物、園芸、芝生・観葉植物)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年04月28日

発行: MarketsandMarkets

ページ情報: 英文 255 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の水溶性肥料の市場規模は、2023年に183億米ドル、2028年には239億米ドルに達し、金額ベースで5.5%のCAGRで成長すると予測されています。

高効率肥料の需要の高まり、精密農業の普及浸透、温室野菜の生産動向の高まりなど、さまざまな要因が市場を牽引しています。

水溶性肥料は、植物の成長と発達に不可欠な栄養素を供給するため、農業で広く使用されています。水溶性肥料は、植物が容易に吸収できるため、従来の肥料よりも効果的であり、収穫量の増加や作物の品質の向上につながります。さらに、灌漑システムを通して簡単に散布することができるため、滴下施肥に適しています。点滴灌漑や滴下施肥などの精密農業技術は、水や肥料の使用量の削減、作物の収量と品質の向上、資源管理の改善など、いくつかの利点があるため、大幅に普及しつつあります。

水溶性肥料市場は、高効率肥料の需要増加、精密農業技術の導入、温室野菜生産の動向などから、予測期間中に大きな成長が見込まれます。メーカーは、水溶性肥料の需要増に対応するため、継続的に投資し、市場を拡大しています。例えば、Israel Chemical Ltd (ICL) は、オランダ・アムステルダムのICL肥料生産拠点にリン酸塩リサイクルユニットを新設し、リン酸塩の生産を拡大しました。

"種類別では、カリウム系のセグメントが予測期間中に最大となる"

カリウムは、植物が水分調節、気孔の動き、酵素の活性化、光合成など様々な機能を発揮するために必要な栄養素です。果物・野菜・花卉などの高価値作物の需要により、カリウム系水溶性肥料のセグメントは予測期間中に最大となる見込みです。水溶性肥料は水に溶けやすいため、植物にカリウムを供給するのに便利で効果的な方法であり、滴下施肥システムで散布することができます。そのため、消費者の嗜好の変化や利便性へのニーズの高まりから、需要が変化しています。水溶性肥料は、従来の肥料に比べて、水に素早く溶け、作物に高い栄養分を供給できるなど、いくつかの利点があります。このような利点から、各社は水溶性肥料の新製品に投資し、需要に応えています。

"用途別では、滴下施肥のセグメントが予測期間中に最も高い成長率で成長する"

滴下施肥は、灌漑システムを通じて肥料を散布するもので、植物に正確かつ効率的に栄養分を供給することができます。この肥料散布の方法は、農業・園芸・芝生の手入れに広く採用されています。水溶性肥料は、水に溶けやすく、灌漑システムを介して分配することができるため、滴下施肥システムに非常に有効です。水溶性肥料は、従来の肥料に比べて、栄養分の吸収が良く、溶出や流出が少なく、作物の収量が増えるなどの利点があります。また、水溶性肥料を使用した灌漑システムでは、農家が作物ごとに必要な栄養素をカスタマイズして供給できるため、最適な成長と収量を実現することができます。このような動向から、水溶性肥料を使用した滴下施肥システムの採用が増加しています。

"作物の種類別では、園芸セグメントが予測期間中に最も高い成長率で成長する"

園芸セグメントは水溶性肥料の最大市場であり、予測期間中に最も高い成長率で成長すると予測されています。園芸には、果物、野菜、花卉、観賞用植物の栽培が含まれ、これらの植物の成長と生産性を高めるために高品質の肥料が必要とされます。水溶性肥料は、園芸作物に必要な栄養素を溶解した状態で供給できるため、栄養素の吸収をより早く、より効率的に行えるという点で非常に有効です。また、水溶性肥料は、園芸作物ごとに必要な栄養素をカスタマイズすることができ、最適な生育と収量を確保することができます。このような水溶性肥料の柔軟な適用が、園芸セグメントでの水溶性肥料の採用拡大に寄与しています。

"形状別では、乾式のセグメントが予測期間中に市場を独占する"

乾式水溶性肥料は、取り扱いや保管が容易で、保存期間が長く、費用対効果が高いなどの利点があるため、広く利用されています。また、粉末や顆粒などの様々な形態で提供されているため、農家は作物の必要に応じて簡単に施肥することができます。高度な農業技術の導入が進み、高品質な作物への需要が高まっていることが、乾式水溶性肥料市場の成長を後押ししています。また、従来の肥料に比べ、水溶性肥料の利点に対する認識が高まっていることも、乾式水溶性肥料の需要をさらに高めています。

"アジア太平洋市場は、水溶性肥料市場において最も急速に成長している地域である"

アジア太平洋地域は人口が多く、食糧や農産物の需要が高い地域です。農家は作物の収量と品質を高めるために、高効率の水溶性肥料を採用するようになってきています。各国政府は、環境に優しく効率的な肥料の使用を含む持続可能な農業の実践に力を入れています。また、作物の成長と収量を最適化するために特殊な肥料を使用する精密農業の技術も採用されています。水溶性肥料は、施用や取り扱いが容易なため、精密農業に適しています。全体として、アジア太平洋地域における高効率肥料の需要の増加、持続可能な農業の実践、精密農業技術の採用が、水溶性肥料市場の成長を後押ししています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- 顧客のビジネスに影響を与える動向

- 価格分析

- バリューチェーン分析

- マーケットマッピングとエコシステム

- 貿易データ

- ポーターのファイブフォース分析

- 技術分析

- 特許分析

- 主な会議とイベント

- 関税と規制の状況

- 主な利害関係者と購入基準

- ケーススタディ

第7章 水溶性肥料市場:種類別

- イントロダクション

- 窒素系水溶性肥料

- リン酸系水溶性肥料

- カリウム系水溶性肥料

- 微量栄養素

第8章 水溶性肥料市場:適用方式別

- イントロダクション

- 葉面散布

- 滴下施肥

第9章 水溶性肥料市場:作物の種類別

- イントロダクション

- 畑作物

- 園芸

- 果樹園

- 野菜・花卉

- 芝生・観葉植物

- 他の作物の種類

第10章 水溶性肥料市場:形状別

- イントロダクション

- 乾式

- 液体

第11章 水溶性肥料市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- その他アジア太平洋

- その他の地域 (ROW)

- ブラジル

- 南アフリカ

- その他の国々

第12章 競合情勢

- 概要

- 主要企業が採用した戦略

- 主要企業の過去の収益分析

- 市場シェア分析

- 企業評価クアドラント (主要企業)

- 企業評価クアドラント (スタートアップ/中小企業)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- NUTRIEN

- ISRAEL CHEMICAL LTD.

- SOCIEDAD QUIMICA Y MINERA DE CHILE (SQM)

- K+S AKTIENGESELLSCHAFT

- YARA INTERNATIONAL

- HAIFA GROUP

- COROMANDEL INTERNATIONAL LIMITED

- THE MOSAIC COMPANY

- HEBEI MONBAND WATER SOLUBLE FERTILIZER CO., LTD.

- EUROCHEM GROUP

- その他の企業

- AGAFERT SRL.

- SPIC

- ARIES AGRO LIMITED

- THE AZOTY GROUP

- VAKI-CHIM

- GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED

- INCITEC PIVOT LTD

- IFFCO

- MANGALORE CHEMICALS & FERTILIZERS LTD

- DFPCL

第14章 隣接・関連市場

- イントロダクション

- 制限事項

- 農薬市場

- 特殊肥料市場

第15章 付録

According to MarketsandMarkets, the water-soluble fertilizers market size is estimated to be valued at USD 18.3 billion in 2023 and is projected to reach USD 23.9 billion by 2028, recording a CAGR of 5.5% in terms of value. Various factors, such as the rising demand for high-efficiency fertilizers, the increasing adoption of precision farming, and the growing trend of greenhouse vegetable production drive the market.

Water-soluble fertilizers are widely used in agriculture as they provide essential nutrients for plants' growth and development. They are more effective than conventional fertilizers as they can be easily absorbed by plants, resulting in higher yields and better crop quality. Moreover, they can be easily applied through irrigation systems, making them a preferred choice for fertigation. The adoption of precision farming techniques such as drip irrigation and fertigation has increased significantly as they offer several advantages, such as reduced water and fertilizer use, improved crop yield and quality, and better resource management.

The water-soluble fertilizers market is expected to witness significant growth during the forecast period due to the increasing demand for high-efficiency fertilizers, the adoption of precision farming techniques, and the growing trend of greenhouse vegetable production. Manufacturers are continuously investing and expanding their market to meet the growing demand for water-soluble fertilizers. For example, Israel Chemical Ltd (ICL) expanded its phosphate production by opening a new phosphate recycling unit in the ICL fertilizer production site in Amsterdam, Netherlands.

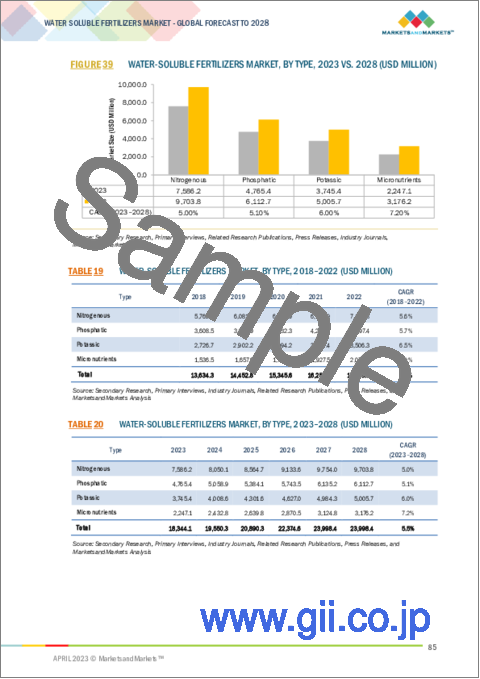

"By type, the Potassic segment is the largest segment during the forecast period."

Potassium is an essential nutrient plants require to perform various functions like water regulation, stomatal movements, enzyme activation, and photosynthesis. The sector for potassic water-soluble fertilizers is expected to be the largest over the projected period due to the demand for high-value crops such as fruits, vegetables, and flowers. Water-soluble fertilizers provide a convenient and effective way to deliver potassium to plants, as they dissolve easily in water and can be applied through fertigation systems. This has led to a shift in demand due to changing consumer preferences and an increasing need for convenience. Water-soluble fertilizers offer several advantages over traditional fertilizers, such as their ability to dissolve quickly in water and provide a high level of nutrient availability to crops. As a result of these benefits, companies are investing in new water-soluble fertilizer products to meet demand.

"By application, the fertigation segment is expected to grow at the highest growth rate during the forecast period."

Fertigation involves the application of fertilizers through irrigation systems, enabling precise and efficient nutrient delivery to plants. This method of fertilizer application is widely adopted in agriculture, horticulture, and turf care. Water- soluble fertilizers are highly effective in fertigation systems, as they can be easily dissolved and distributed through the irrigation system. They offer advantages over traditional fertilizers, such as improved nutrient uptake, reduced leaching and runoff, and increased crop yields. Additionally, fertigation systems using water-soluble fertilizers enable farmers to customize nutrient delivery based on the specific needs of different crops, resulting in optimal growth and yield. These trends has led to the increased adoption of water-soluble fertilizers in fertigation.

"By crop type, the horticulture segment is expected to grow at the highest growth rate during the forecast period."

The horticulture segment is the largest market for water-soluble fertilizers, and it is estimated to grow at the highest rate during the forecast period. Horticulture includes the cultivation of fruits, vegetables, flowers, and ornamental plants, which require high-quality fertilizers to enhance their growth and productivity. Water-soluble fertilizers are highly effective in providing essential nutrients to horticultural crops in a soluble form, enabling faster and more efficient nutrient uptake. Water soluble fertilizers can be customized to meet the specific nutrient requirements of different horticultural crops, ensuring optimal growth and yield. These flexibility in the application of water-soluble fertilizers have contributed to the increased adoption of water-soluble fertilizers in horticulture.

"By form, the dry segment is expected to dominate the market during the forecast period."

Dry water-soluble fertilizers are widely used due to their benefits, such as easy handling and storage, longer shelf life, and cost-effectiveness. They are available in different forms, such as powder and granules, making it easy for farmers to apply them as per crop requirements. The increasing adoption of advanced farming techniques and the growing demand for high-quality crops are driving the growth of the dry water-soluble fertilizers market. Additionally, the increasing awareness about the benefits of water-soluble fertilizers over traditional fertilizers is further fuelling the demand for dry water-soluble fertilizers. They provide better absorption of nutrients by the crops, improving their overall health and yield, and can be customized as per the specific crops' needs.

"Asia Pacific market is estimated to be the fastest-growing region in the water-soluble fertilizers market."

Asia Pacific has a large population, leading to a high demand for food and agricultural products. Farmers are increasingly adopting high-efficiency water-soluble fertilizers to enhance crop yields and quality. Governments are focusing on sustainable agriculture practices, which involve the use of eco-friendly and efficient fertilizers. Precision farming techniques are also being adopted, which require the use of specialized fertilizers to optimize crop growth and yield. Water soluble fertilizers are well-suited to precision farming practices due to their ease of application and handling. Overall, the Asia Pacific's increasing demand for high-efficiency fertilizers, adoption of sustainable agriculture practices, and adoption of precision farming techniques are driving the growth of the water-soluble fertilizers market.

Breakdown of Primaries:

In-depth interviews were conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Value Chain: Demand side- 41%, Supply side- 59%

By Designation: CXOs- 33%, Managers- 25%, Executives- 42%

By Region: Asia Pacific- 30%, Europe- 29%, North America- 24%, and RoW - 17%

Key-players operating in this market are Nutrien (Canada), Israel Chemical Company (Israel), Sociedad Quimicay Minera De Chile (SQM) (Chile), K+S aktiengesellschaft (Germany), Yara International (Norway), Haifa Chemicals Ltd (Israel), and Compo GmbH (Germany).

Research Coverage:

This research report categorizes the Water-soluble fertilizers market by Type (Nitrogenous, Phosphatic, Potassic, and Micronutrient), by Mode of Application (Fertigation and Foliar), by Crop Type (Field crops, Horticultural crops, Turf & Ornamentals, and Others), by Form (Dry and Liquid) and Region (North America, Europe, Asia Pacific, and RoW). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the water-soluble fertilizers market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, new product launches, mergers & acquisitions, partnerships, agreements, and other recent developments in the water-soluble fertilizers market. Competitive analysis of coming startups in the water-soluble fertilizers market is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall water-soluble fertilizers market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (High efficiency of water-soluble fertilizers coupled with rise in demand for nutritive foods, Ease of application, Rapid growth in greenhouse vegetable production, Decreasing arable land, Environment concerns), restraints (Growth in the organic fertilizers industry, The lack of awareness of water-soluble fertilizers among farmers), opportunities (Increasing awareness of adopting agricultural technologies in new emerging markets, Growing demand for water-soluble nutrients), and challenges (Increasing number of players with similar product formulations, Rising prices of natural gas) influencing the growth of the water-soluble fertilizers market

- Product Development/Innovation: Detailed insights on coming technologies, R&D activities, and product launches in the water-soluble fertilizers market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the water-soluble fertilizers market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the water-soluble fertilizers market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Nutrien, Israel Chemical Company, Sociedad Quimicay Minera De Chile (SQM), K+S Aktiengesellschaft, Yara International, and among others in the water-soluble fertilizers market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 WATER-SOLUBLE FERTILIZERS MARKET SEGMENTATION

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.3.2 REGIONS COVERED

- FIGURE 2 WATER-SOLUBLE FERTILIZERS MARKET: REGIONAL SEGMENTATION

- 1.4 YEARS CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.5.1 CURRENCY UNIT

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2022

- 1.5.2 VOLUME UNIT

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 WATER-SOLUBLE FERTILIZERS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.4 Primary sources

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE: BOTTOM-UP

- FIGURE 5 WATER-SOLUBLE FERTILIZERS MARKET: APPROACH ONE (BOTTOM-UP)

- 2.2.2 APPROACH TWO: TOP-DOWN

- FIGURE 6 WATER-SOLUBLE FERTILIZERS MARKET: APPROACH TWO (TOP-DOWN)

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 8 MARKET RESEARCH ASSUMPTIONS CONSIDERED

- 2.5 RESEARCH LIMITATIONS

- FIGURE 9 STUDY LIMITATIONS AND RISK ASSESSMENT

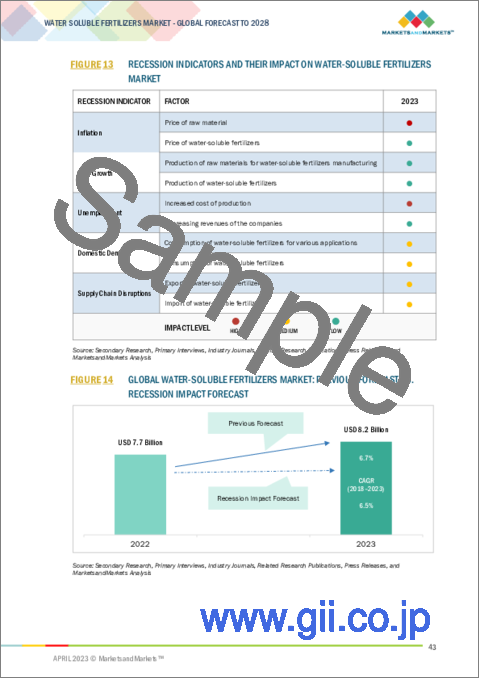

- 2.6 RECESSION IMPACT ON WATER-SOLUBLE FERTILIZERS MARKET

- 2.6.1 MACROECONOMIC INDICATORS OF RECESSION

- FIGURE 10 INDICATORS OF RECESSION

- FIGURE 11 GLOBAL INFLATION RATE, 2011-2021

- FIGURE 12 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 13 RECESSION INDICATORS AND THEIR IMPACT ON WATER-SOLUBLE FERTILIZERS MARKET

- FIGURE 14 GLOBAL WATER-SOLUBLE FERTILIZERS MARKET: PREVIOUS FORECAST VS. RECESSION IMPACT FORECAST

3 EXECUTIVE SUMMARY

- TABLE 2 WATER-SOLUBLE FERTILIZERS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 15 WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 WATER-SOLUBLE FERTILIZERS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 WATER-SOLUBLE FERTILIZERS MARKET SHARE, BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY WATER-SOLUBLE FERTILIZERS MARKET PLAYERS

- FIGURE 20 GROWTH IN DEMAND FOR HIGH-VALUE CROPS, SCARCE WATER RESOURCES, AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET DEMAND

- 4.2 WATER-SOLUBLE FERTILIZERS MARKET: SHARES OF MAJOR REGIONAL SUBMARKETS

- FIGURE 21 US WAS LARGEST GLOBAL MARKET FOR WATER-SOLUBLE FERTILIZERS IN 2022

- 4.3 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE & KEY COUNTRY

- FIGURE 22 NITROGENOUS WATER-SOLUBLE FERTILIZERS ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC

- 4.4 WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE & REGION

- FIGURE 23 EUROPE AND NITROGENOUS TYPE TO DOMINATE RESPECTIVE SEGMENTS

- 4.5 WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE

- FIGURE 24 HORTICULTURAL CROPS TO LEAD DURING FORECAST PERIOD

- 4.6 WATER-SOLUBLE FERTILIZERS MARKET, BY FORM

- FIGURE 25 DRY WATER-SOLUBLE FERTILIZERS TO DOMINATE MARKET

- 4.7 WATER-SOLUBLE FERTILIZERS MARKET, BY MODE OF APPLICATION

- FIGURE 26 FERTIGATION TO LEAD OVER FOLIAR MODE OF APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 27 BENEFITS OF WATER-SOLUBLE FERTILIZERS

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GROWTH IN GLOBAL POPULATION AND POPULATION DENSITY

- FIGURE 28 GLOBAL POPULATION, 1970-2050

- TABLE 3 GLOBAL POPULATION DENSITY, 2020

- 5.2.2 RISE IN FOOD PRICES

- 5.3 MARKET DYNAMICS

- FIGURE 29 MARKET DYNAMICS: WATER-SOLUBLE FERTILIZERS MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 High efficiency of water-soluble fertilizers coupled with rise in demand for nutritive food

- 5.3.1.2 Ease of application

- 5.3.1.3 Rapid growth in greenhouse vegetable production

- 5.3.1.4 Decrease in arable land for agriculture

- FIGURE 30 ANNUALLY AVAILABLE ARABLE LAND, 1950-2020 (HECTARES/PERSON)

- 5.3.1.5 Environmental concerns

- 5.3.2 RESTRAINTS

- 5.3.2.1 Growth in organic fertilizers industry

- FIGURE 31 INDIA: AREA UNDER ORGANIC CERTIFICATION PROCESS, 2018-2021 (MILLION HECTARES)

- 5.3.2.2 Limited awareness among farmers and high costs

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Government initiatives to increase awareness to adopt agricultural technologies in emerging markets

- 5.3.3.2 Growth in demand for water-soluble nutrients

- 5.3.4 CHALLENGES

- 5.3.4.1 Increasing number of players with similar product formulations

- 5.3.4.2 Rise in prices of natural gas

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMERS' BUSINESS

- FIGURE 32 TREND INVOLVING REVENUE SHIFT FOR WATER-SOLUBLE FERTILIZERS MARKET

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE TREND ANALYSIS

- TABLE 4 NITROGENOUS WATER-SOLUBLE FERTILIZERS MARKET: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD/TON)

- TABLE 5 PHOSPHATIC WATER-SOLUBLE FERTILIZERS MARKET: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD/TON)

- TABLE 6 POTASSIC WATER-SOLUBLE FERTILIZERS MARKET: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD/TON)

- TABLE 7 MICRONUTRIENT-BASED WATER-SOLUBLE FERTILIZERS MARKET: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD/TON)

- 6.4 VALUE CHAIN ANALYSIS

- 6.4.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.4.2 RAW MATERIAL SOURCING

- 6.4.3 PRODUCTION AND PROCESSING

- 6.4.4 DISTRIBUTION

- 6.4.5 MARKETING & SALES

- FIGURE 33 VALUE CHAIN ANALYSIS OF WATER-SOLUBLE FERTILIZERS MARKET

- 6.5 MARKET MAPPING AND ECOSYSTEM

- 6.5.1 DEMAND SIDE

- 6.5.2 SUPPLY SIDE

- FIGURE 34 WATER-SOLUBLE FERTILIZERS MARKET ECOSYSTEM MAP

- TABLE 8 WATER-SOLUBLE FERTILIZERS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- 6.6 TRADE DATA

- TABLE 9 IMPORT VALUE OF FERTILIZERS INCLUDING MONO AMMONIUM PHOSPHATE, SULFATE OF POTASH, AND AMMONIUM NITRATE FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 10 EXPORT VALUE OF FERTILIZERS INCLUDING MONO AMMONIUM PHOSPHATE, SULFATE OF POTASH, AND AMMONIUM NITRATE FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- 6.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 WATER-SOLUBLE FERTILIZERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.7.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.7.2 BARGAINING POWER OF SUPPLIERS

- 6.7.3 BARGAINING POWER OF BUYERS

- 6.7.4 THREAT OF SUBSTITUTES

- 6.7.5 THREAT OF NEW ENTRANTS

- 6.8 TECHNOLOGY ANALYSIS

- 6.9 PATENT ANALYSIS

- FIGURE 35 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2023

- TABLE 12 PATENTS PERTAINING TO WATER-SOLUBLE FERTILIZERS, 2020-2023

- 6.10 KEY CONFERENCES & EVENTS

- TABLE 13 KEY CONFERENCES & EVENTS IN WATER-SOLUBLE FERTILIZERS MARKET, 2023-2024

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 REGULATOR BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 NORTH AMERICA: REGULATIONS

- 6.11.2.1 US

- 6.11.3 EUROPE: REGULATIONS

- 6.11.4 ASIA PACIFIC: REGULATIONS

- 6.11.4.1 China

- 6.11.4.2 Australia

- 6.11.4.3 India

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 INFLUENCE OF STAKEHOLDERS ON BUYING DECISIONS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING DIFFERENT TYPES OF WATER-SOLUBLE FERTILIZERS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR WATER-SOLUBLE FERTILIZERS

- 6.12.2 BUYING CRITERIA

- FIGURE 37 KEY BUYING CRITERIA FOR TOP WATER-SOLUBLE FERTILIZER TYPES

- TABLE 18 KEY BUYING CRITERIA FOR KEY WATER-SOLUBLE FERTILIZER TYPES

- 6.13 CASE STUDY

- 6.13.1 NEED FOR STANDARD NUTRIENT MANAGEMENT PRACTICES WITH LESS UTILIZATION OF FERTILIZERS

7 WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 38 WATER-SOLUBLE FERTILIZER MACRONUTRIENTS: MAJOR FUNCTION

- FIGURE 39 WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 19 WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 20 WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 21 WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 22 WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 7.2 NITROGENOUS WATER-SOLUBLE FERTILIZERS

- 7.2.1 VARYING QUANTITIES AND TYPES OF NITROGENOUS FERTILIZERS REQUIRED AT DIFFERENT CROP GROWTH STAGES

- FIGURE 40 BENEFITS OF NITROGENOUS WATER-SOLUBLE FERTILIZERS

- 7.2.2 TYPES OF NITROGENOUS FERTILIZERS

- 7.2.2.1 Urea

- 7.2.2.2 Ammonia

- 7.2.2.3 Ammonia nitrate

- 7.2.2.4 Urea-ammonia nitrate

- TABLE 23 NITROGENOUS WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 NITROGENOUS WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 25 NITROGENOUS WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 26 NITROGENOUS WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (KT)

- 7.3 PHOSPHATIC WATER-SOLUBLE FERTILIZERS

- 7.3.1 AWARENESS OF ILL EFFECTS OF LOW PHOSPHORUS IN PLANT GROWTH

- FIGURE 41 BENEFITS OF PHOSPHATIC WATER-SOLUBLE FERTILIZERS

- 7.3.2 TYPES OF PHOSPHATIC FERTILIZERS

- 7.3.2.1 Phosphoric acid

- 7.3.2.2 Monopotassium Phosphate

- 7.3.2.3 Monoammonium Phosphate

- 7.3.2.4 Diammonium Phosphate

- 7.3.2.5 Other Phosphatic Fertilizers

- 7.3.2.5.1 Acidulated monopotassium phosphate

- 7.3.2.5.2 Polyphosphate fertilizers

- 7.3.2.5.3 Urea phosphate

- TABLE 27 PHOSPHATIC WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 PHOSPHATIC WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 29 PHOSPHATIC WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 30 PHOSPHATIC WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (KT)

- 7.4 POTASSIC WATER-SOLUBLE FERTILIZERS

- 7.4.1 HIGH REQUIREMENT OF POTASSIUM FOR PROPER NUTRIENT UPTAKE

- FIGURE 42 BENEFITS OF POTASSIC WATER-SOLUBLE FERTILIZERS

- 7.4.2 TYPES OF POTASSIC FERTILIZERS

- 7.4.2.1 Potassium chloride

- 7.4.2.2 Potassium nitrate

- 7.4.2.3 Potassium sulfate

- TABLE 31 POTASSIC WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 POTASSIC WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 33 POTASSIC WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 34 POTASSIC WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (KT)

- 7.5 MICRONUTRIENTS

- 7.5.1 MICRONUTRIENT DEFICIENCY LEADS TO STUNTED PLANT GROWTH

- 7.5.2 TYPES OF MICRONUTRIENTS

- 7.5.2.1 Calcium (Ca)

- 7.5.2.2 Sulfur (S)

- 7.5.2.3 Boron (B)

- 7.5.2.4 Chlorine (Cl)

- 7.5.2.5 Copper (Cu)

- 7.5.2.6 Iron (Fe)

- 7.5.2.7 Manganese (Mn)

- 7.5.2.8 Molybdenum (Mo)

- 7.5.2.9 Zinc (Zn)

- TABLE 35 MICRONUTRIENT-BASED WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 MICRONUTRIENT-BASED WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 37 MICRONUTRIENT-BASED WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 38 MICRONUTRIENT-BASED WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (KT)

8 WATER-SOLUBLE FERTILIZERS MARKET, BY MODE OF APPLICATION

- 8.1 INTRODUCTION

- FIGURE 43 WATER-SOLUBLE FERTILIZERS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- TABLE 39 WATER-SOLUBLE FERTILIZERS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 40 WATER-SOLUBLE FERTILIZERS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- 8.2 FOLIAR

- 8.2.1 EFFICIENT NUTRIENT ABSORPTION ALONG WITH HIGH PEST RESISTANCE

- TABLE 41 FOLIAR WATER-SOLUBLE FERTILIZER APPLICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 FOLIAR WATER-SOLUBLE FERTILIZER APPLICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 FERTIGATION

- 8.3.1 COST-EFFECTIVE AND EASY APPLICATION

- TABLE 43 FERTIGATION WATER-SOLUBLE FERTILIZER APPLICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 44 FERTIGATION WATER-SOLUBLE FERTILIZER APPLICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

9 WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE

- 9.1 INTRODUCTION

- FIGURE 44 WATER-SOLUBLE FERTILIZERS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- TABLE 45 WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 46 WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 9.2 FIELD CROPS

- 9.2.1 HIGHEST DEMAND AMONG CROP TYPES ACROSS REGIONS

- TABLE 47 WATER-SOLUBLE FERTILIZERS MARKET IN FIELD CROPS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 WATER-SOLUBLE FERTILIZERS MARKET IN FIELD CROPS, BY REGION, 2023-2028 (USD MILLION)

- 9.3 HORTICULTURE

- 9.3.1 INCREASE IN IMPORTANCE OF CONSUMING FRUITS & VEGETABLES AND TREND OF AESTHETIC DECORATION

- 9.3.2 ORCHARD CROPS

- 9.3.3 VEGETABLE & FLOWER CROPS

- TABLE 49 WATER-SOLUBLE FERTILIZERS MARKET IN HORTICULTURE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 WATER-SOLUBLE FERTILIZERS MARKET IN HORTICULTURE, BY REGION, 2023-2028 (USD MILLION)

- 9.4 TURF & ORNAMENTALS

- 9.4.1 VARYING NUTRIENT REQUIREMENTS DEMAND OPTIMUM WATER-SOLUBLE FERTILIZERS

- TABLE 51 WATER-SOLUBLE FERTILIZERS MARKET IN TURF & ORNAMENTALS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 WATER-SOLUBLE FERTILIZERS MARKET IN TURF & ORNAMENTALS, BY REGION, 2023-2028 (USD MILLION)

- 9.5 OTHER CROP TYPES

- TABLE 53 WATER-SOLUBLE FERTILIZERS MARKET IN OTHER CROP TYPES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 WATER-SOLUBLE FERTILIZERS MARKET IN OTHER CROP TYPES, BY REGION, 2023-2028 (USD MILLION)

10 WATER-SOLUBLE FERTILIZERS MARKET, BY FORM

- 10.1 INTRODUCTION

- FIGURE 45 WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- TABLE 55 ADVANTAGES AND DISADVANTAGES OF LIQUID AND DRY WATER-SOLUBLE FERTILIZERS

- TABLE 56 WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 57 WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 10.2 DRY

- 10.2.1 EASE OF USE AND LONGER SHELF LIFE OF DRY FERTILIZERS

- TABLE 58 DRY WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 DRY WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 LIQUID

- 10.3.1 UNIFORM NUTRIENT AVAILABILITY AND CONVENIENCE IN APPLICATION

- TABLE 60 LIQUID WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 LIQUID WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 46 GEOGRAPHIC SNAPSHOT (2023-2028): RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

- TABLE 62 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 63 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 64 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 65 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (KT)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 47 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, RECESSION IMPACT ANALYSIS, 2022-2023

- TABLE 66 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 69 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (KT)

- TABLE 70 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 73 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 74 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Advancements in precision farming techniques

- TABLE 80 US: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 81 US: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 82 US: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 83 US: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.2.3 CANADA

- 11.2.3.1 Rise in demand for food and government support

- TABLE 84 CANADA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 85 CANADA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 86 CANADA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 87 CANADA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.2.4 MEXICO

- 11.2.4.1 Demand for sustainable agriculture practices

- TABLE 88 MEXICO: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 89 MEXICO: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 90 MEXICO: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 91 MEXICO: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3 EUROPE

- 11.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 48 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET SNAPSHOT

- TABLE 92 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 93 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 94 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 95 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023-2028 (KT)

- TABLE 96 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 97 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 98 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 99 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 100 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 101 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 102 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 103 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 104 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 105 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Increase in demand from agricultural industry and potential for crop-specific fertilizers

- TABLE 106 GERMANY: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 107 GERMANY: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 108 GERMANY: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 109 GERMANY: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3.3 UK

- 11.3.3.1 Increase in consumer awareness and government support

- TABLE 110 UK: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 111 UK: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 112 UK: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 113 UK: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3.4 FRANCE

- 11.3.4.1 Adoption of sustainable agriculture

- TABLE 114 FRANCE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 115 FRANCE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 116 FRANCE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 117 FRANCE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3.5 ITALY

- 11.3.5.1 Demand for high-quality crops and government initiatives

- TABLE 118 ITALY: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 119 ITALY: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 120 ITALY: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 121 ITALY: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3.6 SPAIN

- 11.3.6.1 Increase in farmer awareness and government initiatives

- TABLE 122 SPAIN: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 123 SPAIN: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 124 SPAIN: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 125 SPAIN: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3.7 REST OF EUROPE

- TABLE 126 REST OF EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 127 REST OF EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 128 REST OF EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 129 REST OF EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 49 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS SNAPSHOT

- TABLE 130 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY COUNTRY, 2018-2022 (KT)

- TABLE 133 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 134 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 137 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 138 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 High agricultural potential with larger arable land

- TABLE 144 CHINA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 145 CHINA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 146 CHINA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 147 CHINA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.4.3 INDIA

- 11.4.3.1 Government initiatives toward drip irrigation and fertilizer subsidies

- TABLE 148 INDIA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 149 INDIA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 150 INDIA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 151 INDIA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.4.4 JAPAN

- 11.4.4.1 Need to improve produce yield and quality

- TABLE 152 JAPAN: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 153 JAPAN: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 154 JAPAN: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 155 JAPAN: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 Demand for high-quality crops

- TABLE 156 AUSTRALIA & NEW ZEALAND: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 157 AUSTRALIA & NEW ZEALAND: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 158 AUSTRALIA & NEW ZEALAND: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 159 AUSTRALIA & NEW ZEALAND: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 160 REST OF ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 163 REST OF ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.5 REST OF THE WORLD (ROW)

- 11.5.1 ROW: RECESSION IMPACT ANALYSIS

- TABLE 164 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 165 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 166 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY COUNTRY, 2018-2022 (KT)

- TABLE 167 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 168 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 169 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 170 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 171 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 172 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 173 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 174 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 175 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 176 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 177 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Adoption of National Fertilizer Plan

- TABLE 178 BRAZIL: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 179 BRAZIL: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 180 BRAZIL: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 181 BRAZIL: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Growth in popularity of water-soluble fertilizers

- TABLE 182 SOUTH AFRICA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 183 SOUTH AFRICA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 184 SOUTH AFRICA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 185 SOUTH AFRICA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 11.5.4 OTHERS IN ROW

- TABLE 186 OTHERS IN ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 187 OTHERS IN ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 188 OTHERS IN ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 189 OTHERS IN ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 190 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 50 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD BILLION)

- 12.4 MARKET SHARE ANALYSIS

- TABLE 191 SHARE ANALYSIS OF WATER-SOLUBLE FERTILIZERS MARKET, 2022

- 12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 12.5.1 STARS

- 12.5.2 PERVASIVE PLAYERS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PARTICIPANTS

- FIGURE 51 WATER-SOLUBLE FERTILIZERS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 12.5.5 COMPANY PRODUCT FOOTPRINT (KEY PLAYERS)

- TABLE 192 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

- TABLE 193 COMPANY FOOTPRINT, BY CROP TYPE (KEY PLAYERS)

- TABLE 194 COMPANY FOOTPRINT, BY MODE OF APPLICATION (KEY PLAYERS)

- TABLE 195 COMPANY FOOTPRINT, BY FORM (KEY PLAYERS)

- TABLE 196 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

- TABLE 197 COMPETITIVE BENCHMARKING (KEY PLAYERS)

- 12.6 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 52 WATER-SOLUBLE FERTILIZERS MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- TABLE 198 WATER-SOLUBLE FERTILIZERS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- TABLE 199 WATER-SOLUBLE FERTILIZERS MARKET: PRODUCT LAUNCHES, 2019-2023

- TABLE 200 WATER-SOLUBLE FERTILIZERS MARKET: DEALS, 2019-2022

- TABLE 201 WATER-SOLUBLE FERTILIZERS MARKET: OTHERS, 2019-2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

(Business overview, Products/Services/Solutions offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats)**

- 13.1.1 NUTRIEN

- TABLE 202 NUTRIEN: BUSINESS OVERVIEW

- FIGURE 53 NUTRIEN: COMPANY SNAPSHOT

- TABLE 203 NUTRIEN: PRODUCTS OFFERED

- TABLE 204 NUTRIEN: DEALS

- 13.1.2 ISRAEL CHEMICAL LTD.

- TABLE 205 ISRAEL CHEMICAL LTD.: BUSINESS OVERVIEW

- FIGURE 54 ISRAEL CHEMICAL LTD.: COMPANY SNAPSHOT

- TABLE 206 ISRAEL CHEMICAL LTD.: PRODUCTS OFFERED

- TABLE 207 ISRAEL CHEMICAL LTD.: DEALS

- TABLE 208 ISRAEL CHEMICAL LTD.: OTHERS

- 13.1.3 SOCIEDAD QUIMICA Y MINERA DE CHILE (SQM)

- TABLE 209 SOCIEDAD QUIMICA Y MINERA DE CHILE (SQM): BUSINESS OVERVIEW

- FIGURE 55 SOCIEDAD QUIMICA Y MINERA DE CHILE (SQM): COMPANY SNAPSHOT

- TABLE 210 SOCIEDAD QUIMICA Y MINERA DE CHILE (SQM): PRODUCTS OFFERED

- 13.1.4 K+S AKTIENGESELLSCHAFT

- TABLE 211 K+S AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- FIGURE 56 K+S AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- TABLE 212 K+S AKTIENGESELLSCHAFT: PRODUCTS OFFERED

- TABLE 213 K+S AKTIENGESELLSCHAFT: DEALS

- TABLE 214 K+S AKTIENGESELLSCHAFT: OTHERS

- 13.1.5 YARA INTERNATIONAL

- TABLE 215 YARA INTERNATIONAL: BUSINESS OVERVIEW

- FIGURE 57 YARA INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 216 YARA INTERNATIONAL: PRODUCTS OFFERED

- TABLE 217 YARA INTERNATIONAL: DEALS

- 13.1.6 HAIFA GROUP

- TABLE 218 HAIFA GROUP: BUSINESS OVERVIEW

- TABLE 219 HAIFA GROUP: PRODUCTS OFFERED

- TABLE 220 HAIFA GROUP: DEALS

- TABLE 221 HAIFA GROUP: OTHERS

- 13.1.7 COROMANDEL INTERNATIONAL LIMITED

- TABLE 222 COROMANDEL INTERNATIONAL LIMITED: BUSINESS OVERVIEW

- FIGURE 58 COROMANDEL INTERNATIONAL LIMITED: COMPANY SNAPSHOT

- TABLE 223 COROMANDEL INTERNATIONAL LIMITED: PRODUCTS OFFERED

- TABLE 224 COROMANDEL INTERNATIONAL LIMITED: OTHERS

- 13.1.8 THE MOSAIC COMPANY

- TABLE 225 THE MOSAIC COMPANY: BUSINESS OVERVIEW

- FIGURE 59 THE MOSAIC COMPANY: COMPANY SNAPSHOT

- TABLE 226 THE MOSAIC COMPANY: PRODUCTS OFFERED

- TABLE 227 THE MOSAIC COMPANY: PRODUCT LAUNCHES

- TABLE 228 THE MOSAIC COMPANY: DEALS

- 13.1.9 HEBEI MONBAND WATER SOLUBLE FERTILIZER CO., LTD.

- TABLE 229 HEBEI MONBAND WATER SOLUBLE FERTILIZER CO., LTD.: BUSINESS OVERVIEW

- TABLE 230 HEBEI MONBAND WATER SOLUBLE FERTILIZER CO., LTD.: PRODUCTS OFFERED

- 13.1.10 EUROCHEM GROUP

- TABLE 231 EUROCHEM GROUP: BUSINESS OVERVIEW

- FIGURE 60 EUROCHEM GROUP: COMPANY SNAPSHOT

- TABLE 232 EUROCHEM GROUP: PRODUCTS OFFERED

- TABLE 233 EUROCHEM GROUP: DEALS

- TABLE 234 EUROCHEM GROUP: OTHERS

- 13.2 OTHER PLAYERS

- 13.2.1 AGAFERT SRL.

- TABLE 235 AGAFERT SRL.: BUSINESS OVERVIEW

- TABLE 236 AGAFERT SRL.: PRODUCTS OFFERED

- 13.2.2 SPIC

- TABLE 237 SPIC: BUSINESS OVERVIEW

- FIGURE 61 SPIC: COMPANY SNAPSHOT

- TABLE 238 SPIC: PRODUCTS OFFERED

- 13.2.3 ARIES AGRO LIMITED

- TABLE 239 ARIES AGRO LIMITED: BUSINESS OVERVIEW

- FIGURE 62 ARIES AGRO LIMITED: COMPANY SNAPSHOT

- TABLE 240 ARIES AGRO LIMITED: PRODUCTS OFFERED

- 13.2.4 THE AZOTY GROUP

- TABLE 241 THE AZOTY GROUP: BUSINESS OVERVIEW

- FIGURE 63 THE AZOTY GROUP: COMPANY SNAPSHOT

- TABLE 242 THE AZOTY GROUP: PRODUCTS OFFERED

- TABLE 243 THE AZOTY GROUP: OTHERS

- 13.2.5 VAKI-CHIM

- TABLE 244 VAKI-CHIM: BUSINESS OVERVIEW

- TABLE 245 VAKI-CHIM: PRODUCTS OFFERED

- 13.2.6 GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED

- TABLE 246 GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED: BUSINESS OVERVIEW

- FIGURE 64 GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED: COMPANY SNAPSHOT

- TABLE 247 GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED: PRODUCTS OFFERED

- TABLE 248 GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED: PRODUCT LAUNCHES

- 13.2.7 INCITEC PIVOT LTD

- TABLE 249 INCITEC PIVOT LTD: BUSINESS OVERVIEW

- FIGURE 65 INCITEC PIVOT LTD: COMPANY SNAPSHOT

- TABLE 250 INCITEC PIVOT LTD: PRODUCTS OFFERED

- 13.2.8 IFFCO

- 13.2.9 MANGALORE CHEMICALS & FERTILIZERS LTD

- 13.2.10 DFPCL

- *Details on Business overview, Products/Services/Solutions offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 251 ADJACENT MARKETS

- 14.2 LIMITATIONS

- 14.3 AGROCHEMICALS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 252 AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2018-2022 (USD MILLION)

- TABLE 253 AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2023-2028 (USD MILLION)

- 14.4 SPECIALTY FERTILIZERS MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 254 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (USD MILLION)

- TABLE 255 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS