|

|

市場調査レポート

商品コード

1266816

非球面レンズの世界市場:種類別 (ガラス非球面レンズ、プラスチック非球面レンズ)・提供別 (ダブル非球面レンズ、シングル非球面レンズ)・製造技術別 (成形、研磨、研削)・用途別・地域別の将来予測 (2028年まで)Aspherical Lens Market by Type (Glass Aspherical lens, Plastic Aspherical lens), Offering (Double Aspherical lens and Single Aspherical lens), Manufacturing Technology (Molding, Polishing & Grinding), Application and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 非球面レンズの世界市場:種類別 (ガラス非球面レンズ、プラスチック非球面レンズ)・提供別 (ダブル非球面レンズ、シングル非球面レンズ)・製造技術別 (成形、研磨、研削)・用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年04月20日

発行: MarketsandMarkets

ページ情報: 英文 206 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の非球面レンズの市場規模は、2023年の90億米ドルから、2028年までに122億米ドルに達し、予測期間中に6.2%のCAGRで成長すると予測されています。

非球面レンズ市場の成長を促進する主な要因として、デジタルカメラ用非球面レンズの需要増加、ハイエンドスマートフォンカメラでの用途拡大、光学機器や眼科用途での非球面レンズの利用急増などが挙げられます。しかし、設計・製造工程が複雑であることが、今後の市場の課題となるでしょう。市場関係者にとっての主な成長機会としては、医療画像の需要増大や、防犯・監視カメラにおける赤外線非球面レンズの用途の拡大などが挙げられます。

"プラスチック非球面レンズの市場は、予測期間中に高いCAGRで成長する"

非球面レンズ市場のうち、プラスチック非球面レンズの種類が、予測期間中に最大の市場規模と高い成長率を獲得すると予想されます。プラスチック非球面レンズは、カメラ用レンズやメガネ用レンズなどの光学機器への採用が進んでいます。プラスチック非球面レンズは、従来のガラス非球面レンズに比べて軽量かつ安価であるため、多くの消費者にとってより身近な選択肢となっています。

"2023年に、眼科用途が非球面レンズ市場で最大のシェアを占める"

市場規模の面では、眼科用途が非球面レンズ市場を独占し、予測期間中に大きな成長を遂げると予想されます。眼科分野では、このようなレンズは主に眼鏡やコンタクトレンズに使用されています。非球面レンズは、画質と視力を向上させることで、近視や強度近視などに悩む患者をサポートします。非球面眼鏡用レンズは、主にレンズの光学中心以外の方向を見るときに、標準レンズよりも鮮明な視界を確保することができます。また、両目の度数が異なる患者の眼鏡にも適しています。非球面レンズは、乱視・近視・遠視の治療にも役立ちます。

"アジア太平洋は予測期間中、地域別で最も高い成長率を達成する"

予測期間中、アジア太平洋が非球面レンズ市場を独占すると予想されています。アジア太平洋の非球面レンズ市場は、予測期間中に最も高いCAGRを記録すると予想されます。中国や日本などの経済成長中の国々が、この地域の非球面レンズ市場の主な貢献者となっています。中国では、数百万人の市民を監視するための都市監視網の整備や、中小企業への監視カメラの普及が、非球面レンズ素子の需要を促進すると予想されます。近視や遠視、その他の目に関連する病気を矯正するためのコンタクトレンズへの要求が高まっていることが、眼科用途での非球面レンズの使用を促進しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 顧客/バイヤーに影響を与える動向/混乱

- 価格分析

- 技術分析

- ケーススタディ分析

- 特許分析

- 貿易・関税の分析

- 主な利害関係者と購入基準

- ポーターのファイブフォース分析

- 主な会議とイベント (2023年~2024年)

- 規制状況

第6章 非球面レンズ市場:種類別

- イントロダクション

- ガラス非球面レンズ

- プラスチック非球面レンズ

- その他の種類

第7章 非球面レンズ市場:製造技術別

- イントロダクション

- 成形

- 研磨

- その他の製造技術

第8章 非球面レンズ市場:提供別

- イントロダクション

- シングル非球面レンズ

- ダブル非球面レンズ

第9章 非球面レンズ市場:用途別

- イントロダクション

- デジタルカメラ

- 自動車

- 家電

- 眼科

- 光ファイバー・フォトニクス

- その他

第10章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- その他アジア太平洋

- その他の地域

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要企業が採用した戦略/有力企業

- 市場シェア分析 (2022年)

- 非球面レンズ市場の上位企業の収益分析

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 企業のフットプリント

- 競合状況・動向

第12章 企業プロファイル

- 主要企業

- NIKON CORPORATION

- CANON INC.

- PANASONIC HOLDING CORPORATION

- HOYA CORPORATION

- AGC INC.

- SCHOTT

- ZEISS INTERNATIONAL

- TOKAI OPTICAL

- SEIKO OPTICAL PRODUCTS CO., LTD.

- CALIN TECHNOLOGY CO., LTD.

- その他の企業

- LARGAN PRECISION CO., LTD.

- GENIUS ELECTRONIC OPTICAL

- ASIA OPTICAL CO., INC.

- SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED

- MINGYUE OPTICAL LENS CO., LTD.

- ZHEJIANG LANTE OPTICS CO., LTD

- ESCO OPTICS, INC.

- SHANGHAI OPTICS

- LIGHTPATH TECHNOLOGIES, INC

- HYPERION OPTICS

- KNIGHT OPTICAL

- DG OPTOELECTRONICS

- SUMITA OPTICAL GLASS INC.

- ESSILOR INTERNATIONAL

- JENOPTIK AG

第13章 付録

The aspherical lens market is projected to grow from USD 9.0 billion in 2023 to USD 12.2 billion by 2028, registering a CAGR of 6.2% during the forecast period. Some of the major factors that are driving the growth of the aspherical lens market include rising demand for aspherical lenses for use in digital cameras, growing applications in high-end smartphone cameras, and surging use of aspherical lenses in optical instruments and ophthalmic applications. However, the complexities of design and manufacturing processes will be a challenge for the market in the future. The major growth opportunities for the market players are rising demand for medical imaging and growing use of infrared aspherical lenses in security and surveillance cameras.

"Market for plastic aspherical lens to grow at higher CAGR during forecast period"

The plastic aspherical lens type segment of the aspherical lens market is expected to account for the largest market size and highest growth rate during the forecast period. Plastic aspherical lenses are optical lenses with aspherical surfaces composed of plastic materials. They are increasingly being used in the production of camera lenses, eyeglass lenses, and other optical equipment. Plastic aspherical lenses are generally lighter and less expensive than traditional glass aspherical lenses, making them a more accessible option for many consumers.

"Ophthalmic application held largest share of aspherical lens market in 2023"

In terms of market size, the ophthalmic application is expected to dominate the aspherical lens market and is likely to witness significant growth during the forecast period. In the ophthalmic segment, such lenses are mainly used in eyeglasses and contact lenses. Aspherical lenses help patients suffering from myopia, hype myopia, and other conditions by increasing the image quality and vision power. Aspherical eyeglass lenses allow for crisper vision than standard lenses, mostly when looking in other directions than the optical center of lens. The lenses are also suited to eyeglasses for patients with differing powers in both eyes. Aspherical lenses can also help address astigmatism, nearsightedness, and farsightedness.

"Asia Pacific to witness highest growth among other regions during forecast period"

Asia Pacific is expected to dominate the aspherical lens market during the forecast period Asia Pacific is one of the emerging markets for aspherical lens. The region has been segmented into China, Japan, South Korea, and Rest of Asia Pacific, which includes Australia, New Zealand, Singapore, and other Southeast Asian countries. The aspherical lens market in Asia Pacific is expected to record the highest CAGR during the forecast period. Growing economies such as China and Japan are the major contributors to the aspherical lens market in this region. In China, the development of city surveillance networks to monitor millions of citizens, and the penetration of surveillance cameras in small and medium-sized enterprises, is expected to drive the demand for aspherical lens elements. The rising requirement for contact lenses to correct myopia, hyperopia, and other eye-related diseases is driving the use of aspherical lenses in the ophthalmic application.

In determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the aspherical lens market. The break-up of primary participants for the report has been shown below:

- By company type: Tier 1 - 30 %, Tier 2 - 30%, and Tier 3 - 40%

- By designation: C-Level Executives - 40%, Managers - 30%, and Others - 30%

- By region: North America - 40%, Europe - 30%, Asia Pacific - 20%, and RoW - 10%

The report profiles key players in the aspherical lens market with their respective market ranking analyses. Prominent players profiled in this report Nikon Corporation (Japan), Canon, Inc. (Japan), Panasonic Holding Corporation (Japan), HOYA (Japan), Asahi Glass (AGC) (Japan), Schott (Germany), ZEISS International (Germany), Tokai Optical (Japan), SEIKO Optical Products Co., Ltd. (Japan), and Calin Technology Co., Ltd. (Taiwan), among others.

Research coverage

This research report categorizes the aspherical lens market on the basis of component, product, application, vertical, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the aspherical lens market and forecasts the same till 2028. Apart from these, the report also consists of leadership mapping and analysis of companies in the aspherical lens ecosystem.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall aspherical lens market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (surging use of aspherical lenses in optical instruments and ophthalmic applications, rising demand for aspherical lenses for use in digital cameras. growing applications in high-end smartphone cameras, and increasing adoption in automotive sector), restraints (high production cost of aspherical lenses), opportunities (growing penetration of infrared (IR) aspherical lenses in security and surveillance camera and rising demand for medical imaging), and challenges (complexity of design and manufacturing processes) influencing the growth of the aspherical lens market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the aspherical lens market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the aspherical lens market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the aspherical lens market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Nikon Corporation (Japan), Canon, Inc. (Japan), Panasonic Holding Corporation (Japan), HOYA (Japan), Asahi Glass (AGC) (Japan), Schott (Germany), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 SCOPE OF STUDY

- 1.3.1 MARKETS COVERED

- FIGURE 1 ASPHERICAL LENS MARKET SEGMENTATION

- 1.4 GEOGRAPHIC SCOPE

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY AND PRICING

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.3 SECONDARY & PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach used to arrive at market size from supply side

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.6 RISK ASSESSMENT

- 2.6.1 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- 3.1 RECESSION ANALYSIS

- FIGURE 6 GDP GROWTH PROJECTION FOR MAJOR ECONOMIES TILL 2023

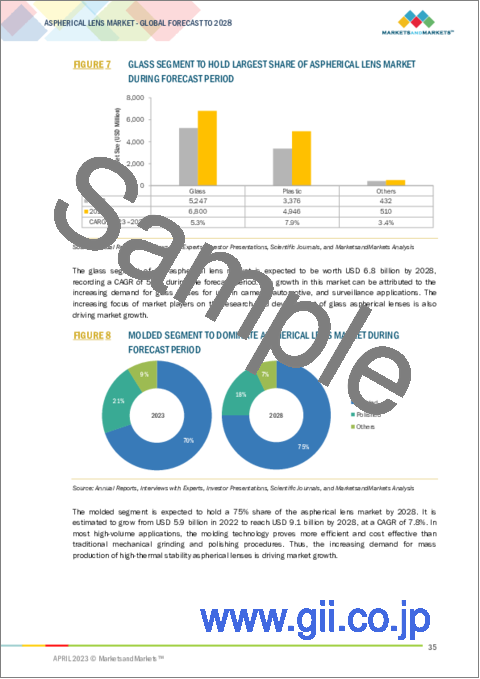

- FIGURE 7 GLASS SEGMENT TO HOLD LARGEST SHARE OF ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- FIGURE 8 MOLDED SEGMENT TO DOMINATE ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- FIGURE 9 DOUBLE ASPHERICAL LENS SEGMENT TO RECORD HIGHER CAGR FROM 2023 TO 2028

- FIGURE 10 OPHTHALMIC APPLICATION TO HOLD LARGEST MARKET SHARE IN FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC HELD LARGEST SHARE OF ASPHERICAL LENS MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ASPHERICAL LENS MARKET

- FIGURE 12 INCREASING DEMAND FROM OPHTHALMIC AND CONSUMER ELECTRONICS APPLICATIONS TO FUEL GROWTH OF ASPHERICAL LENS MARKET

- 4.2 ASPHERICAL LENS MARKET, BY TYPE

- FIGURE 13 GLASS SEGMENT HELD LARGEST SHARE OF ASPHERICAL LENS MARKET IN 2022

- 4.3 ASPHERICAL LENS MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- FIGURE 14 OPHTHALMIC APPLICATION AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC ASPHERICAL LENS MARKET IN 2022

- 4.4 ASPHERICAL LENS MARKET, BY COUNTRY

- FIGURE 15 US TO DOMINATE ASPHERICAL LENS SERVICES MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 ASPHERICAL LENS MARKET: DYNAMICS

- 5.2.1 DRIVERS

- FIGURE 17 ASPHERICAL LENS MARKET DRIVERS: IMPACT ANALYSIS

- 5.2.1.1 Increasing use of aspherical lenses in optical instruments and ophthalmic applications

- 5.2.1.2 Rising demand for aspherical lenses for use in digital cameras

- 5.2.1.3 Increasing application in high-end smartphone cameras

- 5.2.1.4 Growing adoption in automotive sector

- 5.2.2 RESTRAINTS

- FIGURE 18 ASPHERICAL LENS MARKET RESTRAINTS: IMPACT ANALYSIS

- 5.2.2.1 High production cost

- 5.2.3 OPPORTUNITIES

- FIGURE 19 ASPHERICAL LENS MARKET OPPORTUNITIES: IMPACT ANALYSIS

- 5.2.3.1 Growing use of infrared aspherical lenses in security and surveillance cameras

- 5.2.3.2 Rising demand for medical imaging

- 5.2.4 CHALLENGES

- FIGURE 20 ASPHERICAL LENS MARKET CHALLENGES: IMPACT ANALYSIS

- 5.2.4.1 Complexity of design and manufacturing processes

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY MANUFACTURERS AND ASSEMBLY & PACKAGING TEAMS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS/BUYERS

- FIGURE 22 REVENUE SHIFT IN ASPHERICAL LENS MARKET

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE (ASP) OF VARIOUS ASPHERICAL LENSES

- TABLE 1 AVERAGE SELLING PRICE OF VARIOUS ASPHERICAL LENSES, BY TYPE

- FIGURE 23 AVERAGE SELLING PRICE OF KEY GLASS ASPHERICAL LENS MANUFACTURERS (USD)

- TABLE 2 AVERAGE SELLING PRICE OF KEY GLASS ASPHERICAL LENS MANUFACTURERS (USD)

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TRENDS IN ASPHERICAL LENS MARKET

- 5.7.1.1 Augmented reality microscopes and aspherical lenses

- 5.7.1.2 Contact lenses as drug delivery devices

- 5.7.1 KEY TRENDS IN ASPHERICAL LENS MARKET

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 OPTIPRO SYSTEMS HELPS OPTIMIZE LENS POLISHING FOR KREISCHER OPTICS

- 5.8.2 VISION OPTICS PROVIDES ASPHERICAL LENSES FOR AUTO HEAD-UP DISPLAY (HUD) SYSTEM

- 5.9 PATENT ANALYSIS

- FIGURE 24 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 3 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- FIGURE 25 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

- 5.9.1 MAJOR PATENTS

- TABLE 4 MAJOR PATENTS IN ASPHERICAL LENS MARKET

- 5.10 TRADE AND TARIFF ANALYSIS

- 5.10.1 TRADE ANALYSIS

- FIGURE 26 IMPORT DATA FOR HS CODE 900211, BY COUNTRY, 2017-2021 (USD THOUSAND)

- FIGURE 27 EXPORT DATA FOR HS CODE 900211, BY COUNTRY, 2017-2021 (USD THOUSAND)

- FIGURE 28 IMPORT DATA FOR HS CODE 900490, BY COUNTRY, 2017-2021 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR HS CODE 900490, BY COUNTRY, 2017-2021 (USD THOUSAND)

- 5.10.2 TARIFF ANALYSIS

- TABLE 5 MFN TARIFF FOR HS CODE 900211-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 6 MFN TARIFF FOR HS CODE 900211-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 7 MFN TARIFF FOR HS CODE 900490-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 8 MFN TARIFF FOR HS CODE 900490-COMPLIANT PRODUCTS EXPORTED BY CHINA

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.11.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS, 2022

- TABLE 11 ASPHERICAL LENS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 BARGAINING POWER OF SUPPLIERS

- 5.12.5 THREAT OF NEW ENTRANTS

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 12 ASPHERICAL LENS MARKET: CONFERENCES AND EVENTS

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO ASPHERICAL LENS MARKET

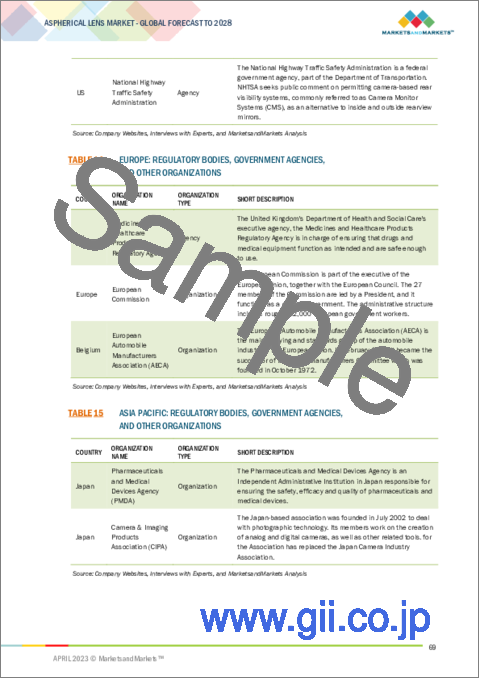

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS AND REGULATIONS RELATED TO ASPHERICAL LENSES

- TABLE 16 NORTH AMERICA: SAFETY STANDARDS FOR ASPHERICAL LENS MARKET

- TABLE 17 EUROPE: SAFETY STANDARDS FOR ASPHERICAL LENS MARKET

- TABLE 18 ASIA PACIFIC: SAFETY STANDARDS FOR ASPHERICAL LENS MARKET

6 ASPHERICAL LENS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 33 ASPHERICAL LENS MARKET, BY TYPE

- FIGURE 34 PLASTIC SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 19 ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 20 ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.2 GLASS ASPHERICAL LENS

- 6.2.1 INCREASINGLY USED IN CAMERAS, AND AUTOMOTIVE AND SURVEILLANCE APPLICATIONS

- FIGURE 35 MOLDED MANUFACTURING TECHNOLOGY TO DOMINATE GLASS ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- TABLE 21 GLASS: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 22 GLASS: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 23 GLASS: ASPHERICAL LENS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 24 GLASS: ASPHERICAL LENS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 25 GLASS: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 26 GLASS: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 PLASTIC ASPHERICAL LENS

- 6.3.1 LIGHT AND CHEAP OPTION USED IN VARIOUS APPLICATIONS

- FIGURE 36 MOLDED MANUFACTURING TECHNOLOGY TO DOMINATE PLASTIC ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- TABLE 27 PLASTIC: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 28 PLASTIC: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 29 PLASTIC: ASPHERICAL LENS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 30 PLASTIC: ASPHERICAL LENS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 31 PLASTIC: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 PLASTIC: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 OTHER TYPES

- FIGURE 37 MOLDED MANUFACTURING TECHNOLOGY TO DOMINATE OTHERS SEGMENT OF ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- TABLE 33 OTHER TYPES: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 34 OTHER TYPES: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 35 OTHER TYPES: ASPHERICAL LENS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 36 OTHER TYPES: ASPHERICAL LENS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 37 OTHER TYPES: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 OTHER TYPES: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

7 ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 38 ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY

- FIGURE 39 MOLDED SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 39 ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 40 ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.2 MOLDED

- 7.2.1 SUITED TO MASS PRODUCTION OF HIGH-THERMAL STABILITY LENSES

- FIGURE 40 GLASS TYPE TO DOMINATE MOLDED ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- TABLE 41 MOLDED: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 42 MOLDED: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 43 MOLDED: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 MOLDED: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 POLISHED

- 7.3.1 WIDELY USED FOR PROTOTYPING AND LOW-VOLUME PRODUCTION

- FIGURE 41 GLASS TYPE TO DOMINATE POLISHED ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- TABLE 45 POLISHED: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 46 POLISHED: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 47 POLISHED: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 POLISHED: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 OTHER MANUFACTURING TECHNOLOGIES

- 7.4.1 INCREASINGLY USED TO CREATE PRECISE OPTICAL SURFACES

- FIGURE 42 PLASTIC TYPE TO RECORD HIGHEST CAGR IN OTHERS SEGMENT DURING FORECAST PERIOD

- TABLE 49 OTHER MANUFACTURING TECHNOLOGIES: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 50 OTHER MANUFACTURING TECHNOLOGIES: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 51 OTHER MANUFACTURING TECHNOLOGIES: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 52 OTHER MANUFACTURING TECHNOLOGIES: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 ASPHERICAL LENS MARKET, BY OFFERING

- 8.1 INTRODUCTION

- FIGURE 43 ASPHERICAL LENS MARKET, BY OFFERING

- FIGURE 44 DOUBLE ASPHERICAL LENS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 53 ASPHERICAL LENS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 54 ASPHERICAL LENS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 8.2 SINGLE ASPHERICAL LENS

- 8.2.1 INCREASINGLY USED FOR OPHTHALMIC APPLICATIONS AND IN OPTICAL SYSTEMS

- FIGURE 45 ASIA PACIFIC TO DOMINATE SINGLE ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- TABLE 55 SINGLE ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 SINGLE ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 DOUBLE ASPHERICAL LENS

- 8.3.1 PROVIDES CLEAR AND PRECISE IMAGES

- FIGURE 46 ASIA PACIFIC TO DOMINATE DOUBLE ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- TABLE 57 DOUBLE ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 DOUBLE ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 ASPHERICAL LENS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 47 ASPHERICAL LENS MARKET, BY APPLICATION

- FIGURE 48 OPHTHALMIC SEGMENT TO DOMINATE DURING FORECAST PERIOD

- TABLE 59 ASPHERICAL LENS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 60 ASPHERICAL LENS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 DIGITAL CAMERAS

- 9.2.1 WIDE USE OF ASPHERICAL LENSES TO REDUCE ERRORS

- TABLE 61 DIGITAL CAMERAS: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 62 DIGITAL CAMERAS: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 63 DIGITAL CAMERAS: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 DIGITAL CAMERAS: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 AUTOMOTIVE

- 9.3.1 GROWING USE OF ASPHERICAL LENSES IN SAFETY-CRITICAL DEVICES

- TABLE 65 AUTOMOTIVE: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 67 AUTOMOTIVE: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 68 AUTOMOTIVE: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 CONSUMER ELECTRONICS

- 9.4.1 RISING ADOPTION IN HIGH-END SMARTPHONES TO IMPROVE IMAGE QUALITY

- TABLE 69 CONSUMER ELECTRONICS: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 70 CONSUMER ELECTRONICS: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 71 CONSUMER ELECTRONICS: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 CONSUMER ELECTRONICS: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 OPHTHALMIC

- 9.5.1 INCREASING USE OF ASPHERICAL LENSES IN DIAGNOSTIC INSTRUMENTS

- TABLE 73 OPHTHALMIC: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 74 OPHTHALMIC: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 75 OPHTHALMIC: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 OPHTHALMIC: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 FIBER OPTICS & PHOTONICS

- 9.6.1 RISING DEMAND FROM TELECOMMUNICATIONS AND OTHER INDUSTRIES

- TABLE 77 FIBER OPTICS & PHOTONICS: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 78 FIBER OPTICS & PHOTONICS: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 79 FIBER OPTICS & PHOTONICS: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 80 FIBER OPTICS & PHOTONICS: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 OTHERS

- 9.7.1 MULTIPLE APPLICATIONS OF ASPHERICAL LENSES TO BOOST MARKET

- TABLE 81 OTHERS: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 82 OTHERS: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 83 OTHERS: ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 84 OTHERS: ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 GEOGRAPHIC ANALYSIS

- 10.1 INTRODUCTION

- FIGURE 49 ASPHERICAL LENS MARKET, BY REGION

- FIGURE 50 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 85 ASPHERICAL LENS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 86 ASPHERICAL LENS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 51 NORTH AMERICA: ASPHERICAL LENS MARKET SNAPSHOT

- TABLE 87 NORTH AMERICA: ASPHERICAL LENS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: ASPHERICAL LENS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: ASPHERICAL LENS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: ASPHERICAL LENS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: ASPHERICAL LENS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: ASPHERICAL LENS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2023-2028 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Growing demand for automotive cameras and smartphones to drive market growth

- 10.2.2 CANADA

- 10.2.2.1 Increasing demand for aspherical lenses for ophthalmic applications to drive growth

- 10.2.3 MEXICO

- 10.2.3.1 Rising demand for video surveillance and automotive cameras to boost market

- 10.3 EUROPE

- FIGURE 52 EUROPE: ASPHERICAL LENS MARKET SNAPSHOT

- TABLE 97 EUROPE: ASPHERICAL LENS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 98 EUROPE: ASPHERICAL LENS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 99 EUROPE: ASPHERICAL LENS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 100 EUROPE: ASPHERICAL LENS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 101 EUROPE: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 102 EUROPE: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 103 EUROPE: ASPHERICAL LENS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 104 EUROPE: ASPHERICAL LENS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 105 EUROPE: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 106 EUROPE: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2023-2028 (USD MILLION)

- 10.3.1 UK

- 10.3.1.1 Increasing adoption of professional cameras to positively impact market

- 10.3.2 GERMANY

- 10.3.2.1 Rising demand for fiber optics & photonics to drive market

- 10.3.3 FRANCE

- 10.3.3.1 Government initiatives to encourage autonomous vehicles to fuel market growth

- 10.3.4 REST OF EUROPE

- 10.3.4.1 Growing need for camera-based safety features in vehicles to boost demand

- 10.4 ASIA PACIFIC

- FIGURE 53 ASIA PACIFIC: ASPHERICAL LENS MARKET SNAPSHOT

- TABLE 107 ASIA PACIFIC: ASPHERICAL LENS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: ASPHERICAL LENS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: ASPHERICAL LENS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ASPHERICAL LENS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ASPHERICAL LENS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ASPHERICAL LENS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2023-2028 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Increasing use of aspherical lenses in smartphones to drive market

- 10.4.2 JAPAN

- 10.4.2.1 Increasing demand for self-driving vehicles to boost market

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Rising security concerns to fuel demand for aspherical lenses

- 10.4.4 REST OF ASIA PACIFIC

- 10.4.4.1 Increasing incidence of eye disease in geriatric population to drive demand

- 10.5 REST OF THE WORLD

- FIGURE 54 ROW: ASPHERICAL LENS MARKET SNAPSHOT

- TABLE 117 ROW: ASPHERICAL LENS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 118 ROW: ASPHERICAL LENS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 119 ROW: ASPHERICAL LENS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 120 ROW: ASPHERICAL LENS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 121 ROW: ASPHERICAL LENS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 122 ROW: ASPHERICAL LENS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 123 ROW: ASPHERICAL LENS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 124 ROW: ASPHERICAL LENS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 125 ROW: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 126 ROW: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2023-2028 (USD MILLION)

- 10.5.1 MIDDLE EAST & AFRICA

- 10.5.1.1 Digital transformation measures to drive market

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Increasing demand for smartphones and high-end cameras to propel market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- TABLE 127 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- 11.2.1 PRODUCT PORTFOLIO

- 11.2.2 REGIONAL FOCUS

- 11.2.3 ORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 MARKET SHARE ANALYSIS, 2022

- TABLE 128 ASPHERICAL LENS MARKET: DEGREE OF COMPETITION

- 11.4 REVENUE ANALYSIS OF TOP PLAYERS IN ASPHERICAL LENS MARKET

- FIGURE 55 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN ASPHERICAL LENS MARKET

- 11.5 COMPANY EVALUATION QUADRANT

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- FIGURE 56 ASPHERICAL LENS MARKET: COMPANY EVALUATION QUADRANT, 2021

- 11.6 STARTUP/SME EVALUATION QUADRANT

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 57 ASPHERICAL LENS MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

- 11.7 COMPANY FOOTPRINT

- TABLE 129 COMPANY FOOTPRINT

- TABLE 130 TYPE FOOTPRINT OF COMPANIES

- TABLE 131 OFFERING FOOTPRINT OF COMPANIES

- TABLE 132 MANUFACTURING TECHNOLOGY FOOTPRINT OF COMPANIES

- TABLE 133 APPLICATION FOOTPRINT OF COMPANIES

- TABLE 134 REGION FOOTPRINT OF COMPANIES

- TABLE 135 ASPHERICAL LENS MARKET: KEY STARTUPS/SMES

- TABLE 136 ASPHERICAL LENS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.8 COMPETITIVE SITUATIONS AND TRENDS

- 11.8.1 PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 137 ASPHERICAL LENS MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2019-JANUARY 2023

- 11.8.2 DEALS

- TABLE 138 ASPHERICAL LENS MARKET: DEALS, JANUARY 2019-JANUARY 2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, Recent Developments, MnM View)**

- 12.1.1 NIKON CORPORATION

- TABLE 139 NIKON CORPORATION: COMPANY OVERVIEW

- FIGURE 58 NIKON CORPORATION: COMPANY SNAPSHOT

- TABLE 140 NIKON CORPORATION: PRODUCT LAUNCHES

- TABLE 141 NIKON CORPORATION: DEALS

- 12.1.2 CANON INC.

- TABLE 142 CANON INC.: COMPANY OVERVIEW

- FIGURE 59 CANON INC.: COMPANY SNAPSHOT

- TABLE 143 CANON INC.: PRODUCT LAUNCHES

- TABLE 144 CANON INC.: DEALS

- 12.1.3 PANASONIC HOLDING CORPORATION

- TABLE 145 PANASONIC HOLDING CORPORATION: COMPANY OVERVIEW

- FIGURE 60 PANASONIC HOLDING CORPORATION: COMPANY SNAPSHOT

- TABLE 146 PANASONIC HOLDING CORPORATION: PRODUCT LAUNCHES

- TABLE 147 PANASONIC HOLDING CORPORATION: DEALS

- 12.1.4 HOYA CORPORATION

- TABLE 148 HOYA CORPORATION: COMPANY OVERVIEW

- FIGURE 61 HOYA CORPORATION: COMPANY SNAPSHOT

- 12.1.5 AGC INC.

- TABLE 149 AGC INC.: COMPANY OVERVIEW

- FIGURE 62 AGC INC.: COMPANY SNAPSHOT

- TABLE 150 AGC INC.: DEALS

- 12.1.6 SCHOTT

- TABLE 151 SCHOTT: COMPANY OVERVIEW

- FIGURE 63 SCHOTT: COMPANY SNAPSHOT

- TABLE 152 SCHOTT: DEALS

- 12.1.7 ZEISS INTERNATIONAL

- TABLE 153 ZEISS INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 64 ZEISS INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 154 ZEISS INTERNATIONAL: PRODUCT LAUNCHES

- 12.1.8 TOKAI OPTICAL

- TABLE 155 TOKAI OPTICAL: COMPANY OVERVIEW

- TABLE 156 TOKAI OPTICAL: PRODUCT LAUNCHES

- 12.1.9 SEIKO OPTICAL PRODUCTS CO., LTD.

- TABLE 157 SEIKO OPTICAL PRODUCTS CO., LTD.: COMPANY OVERVIEW

- 12.1.10 CALIN TECHNOLOGY CO., LTD.

- TABLE 158 CALIN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 65 CALIN TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- * Business Overview, Products/Services/Solutions Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 LARGAN PRECISION CO., LTD.

- 12.2.2 GENIUS ELECTRONIC OPTICAL

- 12.2.3 ASIA OPTICAL CO., INC.

- 12.2.4 SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED

- 12.2.5 MINGYUE OPTICAL LENS CO., LTD.

- 12.2.6 ZHEJIANG LANTE OPTICS CO., LTD

- 12.2.7 ESCO OPTICS, INC.

- 12.2.8 SHANGHAI OPTICS

- 12.2.9 LIGHTPATH TECHNOLOGIES, INC

- 12.2.10 HYPERION OPTICS

- 12.2.11 KNIGHT OPTICAL

- 12.2.12 DG OPTOELECTRONICS

- 12.2.13 SUMITA OPTICAL GLASS INC.

- 12.2.14 ESSILOR INTERNATIONAL

- 12.2.15 JENOPTIK AG

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS