|

|

市場調査レポート

商品コード

1266813

ディーゼルエンジンの世界市場:速度別 (低速、中速、高速)・出力定格別 (0.5MW未満、0.5~1.0MW、1.1~2.0MW、2.1~5.0MW、5.0MW超)・エンドユーザー別 (発電、船舶、機関車、鉱業、石油・ガス、建設)・地域別の将来予測 (2028年まで)Diesel Engines Market by Speed (Low, Medium, High), Power Rating (Below 0.5 MW, 0.5-1.0 MW, 1.1-2.0 MW, 2.1-5.0 MW, Above 5.0 MW), End User (Power Generation, Marine, Locomotive, Mining, Oil & Gas, Construction) & Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ディーゼルエンジンの世界市場:速度別 (低速、中速、高速)・出力定格別 (0.5MW未満、0.5~1.0MW、1.1~2.0MW、2.1~5.0MW、5.0MW超)・エンドユーザー別 (発電、船舶、機関車、鉱業、石油・ガス、建設)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年04月26日

発行: MarketsandMarkets

ページ情報: 英文 269 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

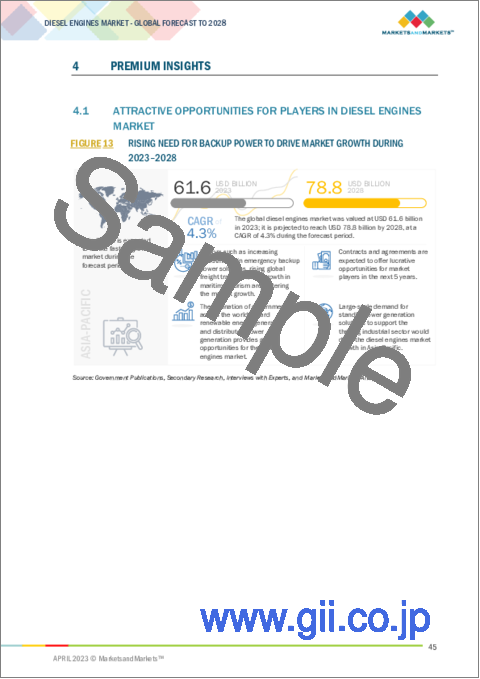

世界のディーゼルエンジンの市場規模は、2023年の639億米ドルから、2028年までに788億米ドルに達し、予測期間中に4.3%のCAGRで成長すると予想されています。

電力消費量の増加により、バックアップ電力用ソリューションで増大するエネルギー需要を満たす必要性が高まり、市場が活性化すると予想されます。

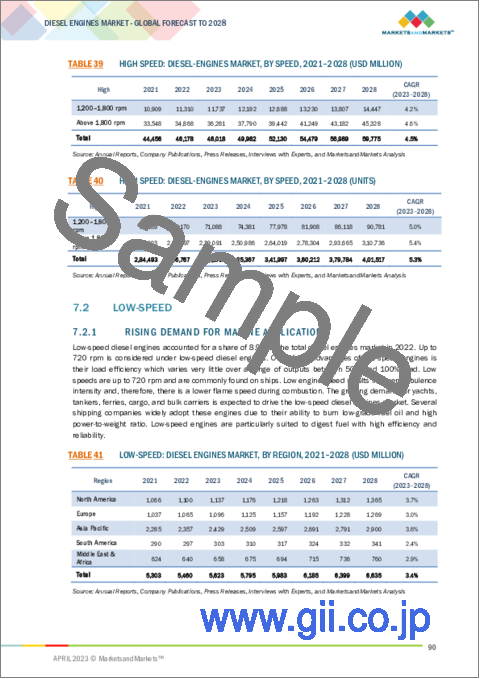

"高速エンジンは、市場で最も成長するセグメントとなる"

高速エンジンは、ディーゼルエンジン市場において最大のセグメントとなると予想されます。高速エンジンには、エンジン回転数1200~1800rpmと1800rpm以上が含まれます。発電産業はディーゼルエンジンの主要なエンドユーザーであり、特に高速エンジンが主体であるため、このセグメントの成長を促進すると予想されます。

"出力定格別では、0.5MW未満、1.1~2.0MWの順に、最大のセグメントとして浮上していく"

1.1~2.0MWのセグメントは、ディーゼルエンジン市場の中で2番目に大きなセグメントです。住宅や商業施設のエンドユーザーは、通常、低出力のオプションを好みます。中出力モデルは、一般的に商業用・小規模産業用で使用されます。また、大規模病院・データセンター・商業施設では、大規模な接続負荷をサポートするために、複数の1.1~2.0MWのユニットを並行して稼働させる設備が導入されています。したがって、データセンターへの投資の増加が、この分野の成長に寄与すると予想されます。

"エンドユーザー別では、発電分野が予測期間中に最も急成長する市場になる"

エンドユーザー別では、発電分野が予測期間中に最も急成長することが予想されます。発電のエンドユーザーは、業務を支障なく遂行するために、信頼性が高く中断のない電力供給を必要としています。従来の発電所から発電される電力とは異なり、再生可能エネルギー源は調整が不可能で、時間と共に変動します。したがって、ディーゼルエンジンで建設された発電所は、発電分野における断続的な再生可能エネルギーを補完する理想的な存在と言えます。

"北米は、ディーゼルエンジン市場で2番目に急成長する地域となる"

北米は、アジア太平洋に次いで、予測期間中、ディーゼルエンジン市場で2番目に急成長する地域になると予想されています。北米の市場成長は、同地域の都市化に起因しています。同地域では、インフラの老朽化により停電が発生し、経済的損失が発生しています。大規模な停電が発生した場合、ディーゼルパワーエンジンはバックアップ電源として重要な役割を果たすと思われます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 価格分析

- 主な会議とイベント (2022年~2024年)

- バリューチェーン分析

- マーケットマップ

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 購入基準

- ケーススタディ分析

第6章 世界のディーゼルエンジン市場:出力定格別

- イントロダクション

- 0.5MW未満

- 0.5~1.0MW

- 1.1~2.0MW

- 2.1~5.0MW

- 5.0MW超

第7章 ディーゼルエンジン市場:速度別

- イントロダクション

- 低速

- 中速

- 高速

第8章 世界のディーゼルエンジン市場:エンドユーザー別

- イントロダクション

- 発電

- 船舶

- 機関車

- 鉱業

- 石油・ガス

- 建設

- その他

第9章 ディーゼルエンジン市場:地域別

- イントロダクション

- アジア太平洋

- 欧州

- 南米

- 北米

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 上位5社の市場シェア分析

- 上位5社の収益分析

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント (2022年)

- 競合ベンチマーキング

- ディーゼルエンジン市場:企業のフットプリント

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- CATERPILLAR

- CUMMINS

- VOLVO PENTA

- MAN ENERGY SOLUTIONS

- HYUNDAI HEAVY INDUSTRIES CO., LTD.

- WARTSILA

- MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGERS(MHIET)

- ROLLS-ROYCE HOLDINGS

- DOOSAN INFRACORE

- YANMAR HOLDINGS CO., LTD.

- IHI POWER SYSTEMS CO., LTD.

- KOHLER

- CHINA NATIONAL PETROLEUM CORPORATION JICHAI POWER COMPANY LIMITED

- FPT INDUSTRIAL

- DAIHATSU DIESEL MFG.

- その他の企業

- ANGLO BELGIAN CORPORATION

- KUBOTA ENGINE AMERICA CORPORATION

- THE LIEBHERR GROUP

- GUANGZHOU DIESEL ENGINE FACTORY CO. LTD

- MAHINDRA POWERTRAIN

第12章 付録

The global diesel engines market is estimated to grow from USD 63.9 Billion in 2023 to USD 78.8 Billion by 2028; it is expected to record a CAGR of 4.3% during the forecast period. Increasing rising electricity consumption driving the need to fulfill the growing energy requirements with backup power solutions is expected to boost the market.

"High-Speed engines is projected to be the largest growing segment in the market "

Based on speed, the diesel engine market has been categorized into low, medium, and high. High-speed engines are expected to be the largest segment in the diesel engines market. The high-speed engines include engine speeds of 1200-1800 rpm and above 1800 rpm. The power generation industry is the primary end-user for diesel engines, majorly of high speed, hence expected to drive the growth of this segment.

"Below 0.5 MW followed by 1.1-2.0 MW segment is expected to emerge as the largest segments based on power rating"

The diesel engine market has been categorized based on power rating as below 0.5 MW, 0.5-1 MW, 1.1-2 MW, 2.1-5 MW, and above 5 MW. 1.1-2.0 MW is the second largest diesel engine segment in the diesel engine market. Residential and commercial end users usually prefer low-power options. Medium-power models are generally used in commercial and small-scale industrial applications. Large hospitals, data centers, and commercial facilities also install multiple 1.1-2.0 MW units operating in parallel to support their large connected loads. Therefore, increased investments in the data center space are expected to contribute to segment growth.

"By End User, the power generation segment is expected to be the fastest growing market during the forecast period."

Based on end user, the power generation segment is expected to be the fastest-growing segment during the forecast period. Power generation end users require a reliable, uninterrupted power supply to carry out operations without hindrances. Unlike the power generated from conventional power plants, renewable sources are not dispatchable and fluctuate over time. Hence, power plants constructed with diesel engines are the ideal complement to intermittent renewables in the power generation sector.

"North America is expected to be the second fastest-growing region in the diesel engines market."

North America, after Asia Pacific, is expected to be the second fastest region in the diesel engines market during the forecast period. The market growth in North America can be attributed to the urbanization in the region. Aging infrastructures resulting in power blackouts in the region, lead to economic losses. In a large-scale outage, diesel power engines will likely play a key role as a backup source of electricity generation.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 40%, Tier 2- 35%, and Tier 3- 25%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 5%, Asia Pacific- 60%, Europe- 5%, South America- 5%, Middle East & Africa- 25%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The diesel engines market is dominated by many global players that have a wide regional and gloal presence. The leading players in the diesel engine market are Caterpillar (US), Cummins Inc. (US), Volvo Penta (Sweden), Hyundai Heavy Industries (South Korea), and MAN Energy Solutions (Germany).

Research Coverage:

The report defines, describes, and forecasts the global diesel engine market by speed, power rating, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the diesel engines market.

Key Benefits of Buying the Report

- High rate of adoption of power backup solutions driving the need for diesel engines is a major driver for the market.

- Product Development/ Innovation: With built-in upgradability and fuel flexibility, Wartsila adds two-stage turbocharging to deliver unprecedented efficiency and power density across a wide operational range for vessels in every segment. It represents the next generation of medium-speed engines. It is designed to set a new benchmark for fuel efficiency and emissions performance and is ready to run on future fuels.

- Market Development: Cummins Inc. and Isuzu Motors Limited (Isuzu) announced agreements for a global mid-range diesel powertrain and an advanced engineering collaboration, marking another step forward in the Isuzu Cummins Powertrain Partnership (ICPP). Under this global mid-range diesel collaboration agreement, Cummins provided Isuzu mid-range B6.7 diesel platforms for medium-size trucks to meet global customer needs.

- Market Diversification: The power demands of remote sites are met through diesel generators. However, the growing power demand can be met by deploying hybrid power systems designed according to the individual power requirements of residential and non-residential customers. The hybrid power system combines diesel generators with renewable sources (wind, solar, or both) to ensure a 24*7 power supply to off-grid sites with fewer interruptions.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Caterpillar (US), Cummins Inc. (US), Volvo Penta (Sweden), Hyundai Heavy Industries (South Korea), and MAN Energy Solutions (Germany) among others in the diesel engines market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 DIESEL ENGINES MARKET, BY SPEED: INCLUSIONS AND EXCLUSIONS

- TABLE 2 DIESEL ENGINES MARKET, BY POWER RATING: INCLUSIONS AND EXCLUSIONS

- TABLE 3 DIESEL ENGINES MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKETS COVERED

- 1.4.1 GEOGRAPHICAL SCOPE

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 DIESEL POWER ENGINE MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Breakdown of primaries

- 2.2.2.2 Key data from primary sources

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR DIESEL ENGINES

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Regional analysis

- 2.3.3.2 Country analysis

- 2.3.3.3 Demand-side assumptions

- 2.3.3.4 Demand-side calculations

- 2.3.4 SUPPLY-SIDE ANALYSIS

- FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF DIESEL ENGINES

- FIGURE 8 DIESEL ENGINES MARKET: SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side calculations

- 2.3.4.2 Supply-side assumptions

- 2.3.5 RECESSION IMPACT

- 2.3.6 RESEARCH FORECAST

3 EXECUTIVE SUMMARY

- TABLE 4 DIESEL ENGINES MARKET SNAPSHOT

- FIGURE 9 ASIA PACIFIC DOMINATED DIESEL ENGINES MARKET IN 2022

- FIGURE 10 HIGH-SPEED SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD, BY SPEED

- FIGURE 11 BELOW 0.5 MW SEGMENT TO DOMINATE DIESEL ENGINES MARKET BY 2028

- FIGURE 12 POWER GENERATION TO SECURE LARGEST MARKET SHARE DURING FORECAST PERIOD, BY END USER

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DIESEL ENGINES MARKET

- FIGURE 13 RISING NEED FOR BACKUP POWER TO DRIVE MARKET GROWTH DURING 2023-2028

- 4.2 DIESEL ENGINES MARKET, BY REGION

- FIGURE 14 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: DIESEL ENGINES MARKET, BY SPEED AND COUNTRY, 2022

- FIGURE 15 BY SPEED, 1,000-1,500 RPM SEGMENT ACCOUNTED FOR LARGER SHARE OF ASIA PACIFIC DIESEL ENGINES MARKET IN 2022

- 4.4 DIESEL ENGINES MARKET, BY SPEED

- FIGURE 16 BY SPEED, HIGH-SPEED DIESEL ENGINES EXPECTED TO SECURE LARGEST SHARE OF MARKET, IN 2028

- 4.5 DIESEL ENGINES MARKET, BY POWER RATING

- FIGURE 17 BY POWER RATING, BELOW 0.5 MW SEGMENT EXPECTED TO SECURE LARGEST SHARE OF MARKET, IN 2028

- 4.6 DIESEL ENGINES MARKET, BY END USER

- FIGURE 18 POWER GENERATION PROJECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DIESEL ENGINES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for reliable and uninterrupted power

- FIGURE 20 GLOBAL ELECTRICITY DEMAND BY SECTOR, 2018-2040

- 5.2.1.2 Growing maritime tourism and international marine freight transportation

- 5.2.1.3 Increasing urbanization and industrialization

- FIGURE 21 GLOBAL POPULATION, 1950-2050

- 5.2.2 RESTRAINTS

- 5.2.2.1 High fuel and operation & maintenance costs

- 5.2.2.2 Competition from alternative energy sources

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in hybrid power generation in rural and remote locations

- 5.2.4 CHALLENGES

- 5.2.4.1 Production of higher levels of NOx and particulate matter emissions

- TABLE 5 CALIFORNIA EMISSION STANDARDS FOR HEAVY-DUTY OTTO CYCLE ENGINES, FTP, G/BHP**HR

- TABLE 6 TIER 4 EMISSION STANDARDS: ENGINES ABOVE 560 KW, G/KWH

- 5.2.4.2 Rising demand for natural gas in power generation applications

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN DIESEL ENGINES MARKET

- FIGURE 22 REVENUE SHIFT FOR DIESEL ENGINE PROVIDERS

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 DIESEL ENGINE TECHNOLOGY

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF DIESEL ENGINES

- TABLE 7 AVERAGE SELLING PRICE OF DIESEL ENGINES, 2022

- TABLE 8 AVERAGE SELLING PRICE OF DIESEL ENGINES OFFERED, BY KEY PLAYERS (2022)

- FIGURE 23 AVERAGE SELLING PRICES OF OFFERINGS OF KEY PLAYERS, BY POWER RATING

- 5.6 KEY CONFERENCES AND EVENTS, 2022-2024

- TABLE 9 DIESEL ENGINES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS: DIESEL ENGINES MARKET

- 5.7.1 RAW MATERIAL PROVIDERS/SUPPLIERS

- 5.7.2 COMPONENT MANUFACTURERS

- 5.7.3 DIESEL ENGINE MANUFACTURERS/ASSEMBLERS

- 5.7.4 DISTRIBUTORS

- 5.7.5 END USERS

- 5.7.6 POST-SALES SERVICE PROVIDERS

- 5.8 MARKET MAP

- TABLE 10 MARKET MAP: DIESEL ENGINES MARKET

- TABLE 11 DIESEL ENGINES MARKET: ROLE IN ECOSYSTEM

- 5.9 TRADE ANALYSIS

- TABLE 12 COUNTRY-WISE IMPORT DATA FOR HARMONIZED SYSTEM CODE: 840810 COMPRESSION-IGNITION INTERNAL COMBUSTION PISTON ENGINES (DIESEL OR SEMI-DIESEL) FOR MARINE PROPULSION (USD THOUSAND)

- TABLE 13 COUNTRY-WISE EXPORT DATA FOR HARMONIZED SYSTEM CODE: 840810 COMPRESSION-IGNITION INTERNAL COMBUSTION PISTON ENGINES (DIESEL OR SEMI-DIESEL) FOR MARINE PROPULSION (USD THOUSAND)

- TABLE 14 COUNTRY-WISE IMPORT DATA FOR HARMONIZED SYSTEM CODE:840890 COMPRESSION-IGNITION INTERNAL COMBUSTION PISTON ENGINE "DIESEL OR SEMI-DIESEL ENGINE" (EXCLUDING ENGINES FOR MARINE PROPULSION AND ENGINES FOR VEHICLES OF CHAPTER 87) (USD THOUSAND)

- TABLE 15 COUNTRY-WISE EXPORT DATA FOR HARMONIZED SYSTEM CODE: 840890 COMPRESSION-IGNITION INTERNAL COMBUSTION PISTON ENGINE "DIESEL OR SEMI-DIESEL ENGINE" (EXCLUDING ENGINES FOR MARINE PROPULSION AND ENGINES FOR VEHICLES OF CHAPTER 87) (USD THOUSAND)

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 CODES AND REGULATIONS RELATED TO DIESEL ENGINES

- TABLE 20 DIESEL ENGINES MARKET: CODES AND REGULATIONS

- 5.10 PATENT ANALYSIS

- TABLE 21 DIESEL ENGINE: INNOVATIONS AND PATENT REGISTRATIONS, 2019-2022

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS FOR DIESEL ENGINES MARKET

- TABLE 22 DIESEL ENGINES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF SUBSTITUTES

- 5.11.2 BARGAINING POWER OF SUPPLIERS

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 THREAT OF NEW ENTRANTS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 23 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.13 BUYING CRITERIA

- FIGURE 27 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 USE OF NEW TECHNOLOGY TO HELP ACHIEVE NET ZERO AMBITIONS

- 5.14.1.1 Problem statement

- 5.14.1.2 Solution

- 5.14.2 DIESEL-POWERED ELECTRICITY GENERATION FOR EMERGENCY POWER SUPPLY

- 5.14.2.1 Isuzu motors limited

- 5.14.2.2 Summa health

- 5.14.1 USE OF NEW TECHNOLOGY TO HELP ACHIEVE NET ZERO AMBITIONS

6 GLOBAL DIESEL ENGINES MARKET, BY POWER RATING

- 6.1 INTRODUCTION

- FIGURE 28 GLOBAL DIESEL ENGINES MARKET, BY POWER RATING IN 2022

- TABLE 25 GLOBAL DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (USD MILLION)

- TABLE 26 GLOBAL DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (UNITS)

- 6.2 BELOW 0.5 MW

- 6.2.1 RISING POPULATION AND DEMAND FOR RESIDENTIAL BACKUP SOLUTIONS

- TABLE 27 BELOW 0.5 MW: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 28 BELOW 0.5 MW: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 6.3 0.5-1 MW

- 6.3.1 GROWING COMMERCIAL REAL ESTATE INVESTMENTS

- TABLE 29 0.5-1 MW: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 30 0.5-1 MW: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 6.4 1.1-2 MW

- 6.4.1 INCREASING DATA CENTER INVESTMENTS

- TABLE 31 1.1-2.0 MW: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 32 1.1-2.0 MW: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 6.5 2.1-5.0 MW

- 6.5.1 RISING INDUSTRIAL INVESTMENTS AND UTILITY RELIABILITY INVESTMENTS

- TABLE 33 2.1-5.0 MW: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 34 2.1-5.0 MW: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 6.6 ABOVE 5.0 MW

- 6.6.1 SURGING DEMAND FROM UTILITY-SCALE DIESEL POWER GENERATION AND LARGE INDUSTRIAL PLANTS

- TABLE 35 ABOVE 5.0 MW: GLOBAL DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 36 ABOVE 5.0 MW: GLOBAL DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

7 DIESEL ENGINES MARKET, BY SPEED

- 7.1 INTRODUCTION

- FIGURE 29 DIESEL ENGINES MARKET, BY SPEED IN 2022

- TABLE 37 DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 38 DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 39 HIGH SPEED: DIESEL-ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 40 HIGH SPEED: DIESEL-ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- 7.2 LOW-SPEED

- 7.2.1 RISING DEMAND FOR MARINE APPLICATIONS

- TABLE 41 LOW-SPEED: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 42 LOW-SPEED: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 7.3 MEDIUM-SPEED

- 7.3.1 UPGRADED VERSIONS AND NEW DESIGNS

- TABLE 43 MEDIUM-SPEED: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 44 MEDIUM-SPEED: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- TABLE 45 MEDIUM-SPEED: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 46 MEDIUM-SPEED: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- 7.4 HIGH-SPEED

- 7.4.1 INCREASING DEMAND FOR TUGBOATS

- TABLE 47 HIGH-SPEED: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 48 HIGH-SPEED: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

8 GLOBAL DIESEL ENGINES MARKET, BY END USER

- 8.1 INTRODUCTION

- FIGURE 30 GLOBAL DIESEL ENGINES MARKET, BY END USER IN 2022

- TABLE 49 DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 50 DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- 8.2 POWER GENERATION

- 8.2.1 INCREASED REQUIREMENT FOR RELIABLE AND CONTINUOUS POWER SUPPLY

- TABLE 51 POWER GENERATION: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 52 POWER GENERATION: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 8.3 MARINES

- 8.3.1 RISING DEMAND FOR MARITIME TRANSPORT

- TABLE 53 MARINES: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 54 MARINES: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 8.4 LOCOMOTIVES

- 8.4.1 ONGOING RAILWAY ELECTRIFICATION PROJECTS TO HINDER GROWTH

- TABLE 55 LOCOMOTIVES: GLOBAL DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 56 LOCOMOTIVES: GLOBAL DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 8.5 MINING

- 8.5.1 GROWING MINING OPERATIONS

- TABLE 57 MINING: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 58 MINING: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 8.6 OIL & GAS

- 8.6.1 INCREASING METAL PRICES PROMPT COMPANIES TO ADOPT BETTER STRATEGIES

- TABLE 59 OIL & GAS: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 60 OIL & GAS: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 8.7 CONSTRUCTION

- 8.7.1 GROWING OPPORTUNITIES IN RESIDENTIAL AND NON-RESIDENTIAL SECTORS

- TABLE 61 CONSTRUCTION: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 62 CONSTRUCTION: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 8.8 OTHERS

- TABLE 63 OTHERS: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 64 OTHERS: DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

9 DIESEL ENGINES MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 31 DIESEL ENGINES MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 DIESEL ENGINES MARKET SHARE, BY REGION, 2022

- TABLE 65 DIESEL ENGINES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 66 DIESEL ENGINES MARKET, BY REGION, 2021-2028 (UNITS)

- 9.2 ASIA PACIFIC

- 9.2.1 RECESSION IMPACT

- FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

- 9.2.2 BY SPEED

- TABLE 67 ASIA PACIFIC: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 69 ASIA PACIFIC: DIESEL ENGINES MARKET, BY HIGH SPEED, 2021-2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: DIESEL ENGINES MARKET, BY HIGH SPEED, 2021-2028 (UNITS)

- 9.2.3 BY MEDIUM SPEED END USER

- TABLE 71 ASIA PACIFIC: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.2.4 BY POWER RATING

- TABLE 73 ASIA PACIFIC: DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (UNITS)

- 9.2.5 BY END USER

- TABLE 75 ASIA PACIFIC: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- 9.2.6 BY COUNTRY

- TABLE 77 ASIA PACIFIC: DIESEL ENGINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: DIESEL ENGINES MARKET, BY COUNTRY, 2021-2028 (UNITS)

- 9.2.6.1 China

- 9.2.6.1.1 Rising defense expenditure on shipbuilding

- 9.2.6.1 China

- TABLE 79 CHINA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 80 CHINA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 81 CHINA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 82 CHINA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 83 CHINA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 84 CHINA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.2.6.2 India

- 9.2.6.2.1 Increasing government investments in construction activities

- 9.2.6.2 India

- TABLE 85 INDIA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 86 INDIA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 87 INDIA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 88 INDIA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 89 INDIA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 90 INDIA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.2.6.3 Australia

- 9.2.6.3.1 Growing demand for high-tech mining equipment

- 9.2.6.3 Australia

- TABLE 91 AUSTRALIA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 92 AUSTRALIA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 93 AUSTRALIA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 94 AUSTRALIA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 95 AUSTRALIA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 96 AUSTRALIA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.2.6.4 Rest of Asia Pacific

- TABLE 97 REST OF ASIA PACIFIC: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 99 REST OF ASIA PACIFIC: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 100 REST OF ASIA PACIFIC: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 101 REST OF ASIA PACIFIC: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.3 EUROPE

- 9.3.1 RECESSION IMPACT

- 9.3.2 BY SPEED

- TABLE 103 EUROPE: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 104 EUROPE: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 105 EUROPE: DIESEL ENGINES MARKET, BY HIGH SPEED, 2021-2028 (USD MILLION)

- TABLE 106 EUROPE: DIESEL ENGINES MARKET, BY HIGH SPEED, 2021-2028 (UNITS)

- 9.3.3 BY MEDIUM SPEED END USER

- TABLE 107 EUROPE: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 108 EUROPE: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.3.4 BY POWER RATING

- TABLE 109 EUROPE: DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (USD MILLION)

- TABLE 110 EUROPE: DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (UNITS)

- 9.3.5 BY END USER

- TABLE 111 EUROPE: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 112 EUROPE: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- 9.3.6 BY COUNTRY

- TABLE 113 EUROPE: DIESEL ENGINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 114 EUROPE: DIESEL ENGINES MARKET, BY COUNTRY, 2021-2028 (UNITS)

- 9.3.6.1 Germany

- 9.3.6.1.1 Rising data center investments and shipbuilding industry

- 9.3.6.1 Germany

- TABLE 115 GERMANY: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 116 GERMANY: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 117 GERMANY: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 118 GERMANY: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 119 GERMANY: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 120 GERMANY: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.3.6.2 UK

- 9.3.6.2.1 High demand for emergency power backup solutions

- 9.3.6.2 UK

- TABLE 121 UK: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 122 UK: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 123 UK: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 124 UK: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 125 UK: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 126 UK: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.3.6.3 France

- 9.3.6.3.1 Growing maritime industry and falling nuclear power production

- 9.3.6.3 France

- TABLE 127 FRANCE: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 128 FRANCE: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 129 FRANCE: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 130 FRANCE: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 131 FRANCE: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 132 FRANCE: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.3.6.4 Italy

- 9.3.6.4.1 Surging demand for reliable backup power solutions

- 9.3.6.4 Italy

- TABLE 133 ITALY: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 134 ITALY: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 135 ITALY: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 136 ITALY: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 137 ITALY: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 138 ITALY: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.3.6.5 Rest of Europe

- TABLE 139 REST OF EUROPE: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 140 REST OF EUROPE: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 141 REST OF EUROPE: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 142 REST OF EUROPE: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 143 REST OF EUROPE: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 144 REST OF EUROPE: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.4 SOUTH AMERICA

- 9.4.1 RECESSION IMPACT

- 9.4.2 BY SPEED

- TABLE 145 SOUTH AMERICA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 147 SOUTH AMERICA: DIESEL ENGINES MARKET, BY HIGH SPEED, 2021-2028 (USD MILLION)

- TABLE 148 SOUTH AMERICA: DIESEL ENGINES MARKET, BY HIGH SPEED, 2021-2028 (UNITS)

- 9.4.3 BY MEDIUM SPEED END USER

- TABLE 149 SOUTH AMERICA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.4.4 BY POWER RATING

- TABLE 151 SOUTH AMERICA: DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (USD MILLION)

- TABLE 152 SOUTH AMERICA: DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (UNITS)

- 9.4.5 BY END USER

- TABLE 153 SOUTH AMERICA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- 9.4.6 BY COUNTRY

- TABLE 155 SOUTH AMERICA: DIESEL ENGINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 156 SOUTH AMERICA: DIESEL ENGINES MARKET, BY COUNTRY, 2021-2028 (UNITS)

- 9.4.6.1 Brazil

- 9.4.6.1.1 Increased demand for backup power supply

- 9.4.6.1 Brazil

- TABLE 157 BRAZIL: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 158 BRAZIL: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 159 BRAZIL: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 160 BRAZIL: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 161 BRAZIL: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 162 BRAZIL: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.4.6.2 Argentina

- 9.4.6.2.1 Growing emphasis of government on shipbuilding and rising naval budget

- 9.4.6.2 Argentina

- TABLE 163 ARGENTINA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 164 ARGENTINA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 165 ARGENTINA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 166 ARGENTINA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 167 ARGENTINA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 168 ARGENTINA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.4.6.3 Chile

- 9.4.6.3.1 Need for diesel engines in construction industry

- 9.4.6.3 Chile

- TABLE 169 CHILE: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 170 CHILE: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 171 CHILE: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 172 CHILE: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 173 CHILE: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 174 CHILE: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.4.6.4 Rest of South America

- TABLE 175 REST OF SOUTH AMERICA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 176 REST OF SOUTH AMERICA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 177 REST OF SOUTH AMERICA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 178 REST OF SOUTH AMERICA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 179 REST OF SOUTH AMERICA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 180 REST OF SOUTH AMERICA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.5 NORTH AMERICA

- 9.5.1 RECESSION IMPACT

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- 9.5.2 BY SPEED

- TABLE 181 NORTH AMERICA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 182 NORTH AMERICA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 183 NORTH AMERICA: DIESEL ENGINES MARKET, BY HIGH SPEED, 2021-2028 (USD MILLION)

- TABLE 184 NORTH AMERICA: DIESEL ENGINES MARKET, BY HIGH SPEED, 2021-2028 (UNITS)

- 9.5.3 BY POWER RATING

- TABLE 185 NORTH AMERICA: DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (USD MILLION)

- TABLE 186 NORTH AMERICA: DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (UNITS)

- 9.5.4 BY END USER

- TABLE 187 NORTH AMERICA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 188 NORTH AMERICA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- 9.5.5 BY MEDIUM SPEED END USER

- TABLE 189 NORTH AMERICA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 190 NORTH AMERICA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.5.6 BY COUNTRY

- TABLE 191 NORTH AMERICA: DIESEL ENGINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 192 NORTH AMERICA: DIESEL ENGINES MARKET, BY COUNTRY, 2021-2028 (UNITS)

- 9.5.6.1 US

- 9.5.6.1.1 Presence of major diesel power engine manufacturers and growing data center investments

- 9.5.6.1 US

- TABLE 193 US: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 194 US: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 195 US: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 196 US: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 197 US: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 198 US: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.5.6.2 Canada

- 9.5.6.2.1 Increasing demand for bulk carriers, oil tankers, and container ships for transporting commodities

- 9.5.6.2 Canada

- TABLE 199 CANADA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 200 CANADA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 201 CANADA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 202 CANADA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 203 CANADA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 204 CANADA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.5.6.3 Mexico

- 9.5.6.3.1 Healthcare sector to boost demand for diesel engines due to their extensive use in energy requirements

- 9.5.6.3 Mexico

- TABLE 205 MEXICO: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 206 MEXICO: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 207 MEXICO: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 208 MEXICO: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 209 MEXICO: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 210 MEXICO: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 RECESSION IMPACT

- 9.6.2 BY SPEED

- TABLE 211 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 213 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY HIGH SPEED, 2021-2028 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY HIGH SPEED, 2021-2028 (UNITS)

- 9.6.3 BY POWER RATING

- TABLE 215 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY POWER RATING, 2021-2028 (UNITS)

- 9.6.4 BY END USER

- TABLE 217 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- 9.6.5 BY MEDIUM SPEED END USER

- TABLE 219 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.6.6 BY COUNTRY

- TABLE 221 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY COUNTRY, 2021-2028 (UNITS)

- 9.6.6.1 Saudi Arabia

- 9.6.6.1.1 Growing government investment in power generation projects

- 9.6.6.1 Saudi Arabia

- TABLE 223 SAUDI ARABIA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 224 SAUDI ARABIA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 225 SAUDI ARABIA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 226 SAUDI ARABIA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 227 SAUDI ARABIA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 228 SAUDI ARABIA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.6.6.2 UAE

- 9.6.6.2.1 Infrastructure growth and high influx of foreign investments

- 9.6.6.2 UAE

- TABLE 229 UAE: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 230 UAE: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 231 UAE: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 232 UAE: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 233 UAE: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 234 UAE: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.6.6.3 Algeria

- 9.6.6.3.1 Demand from hydrocarbons sector and increasing power demand

- 9.6.6.3 Algeria

- TABLE 235 ALGERIA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 236 ALGERIA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 237 ALGERIA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 238 ALGERIA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 239 ALGERIA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 240 ALGERIA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.6.6.4 Nigeria

- 9.6.6.4.1 Use of diesel-powered generators for backup and prime power

- 9.6.6.4 Nigeria

- TABLE 241 NIGERIA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 242 NIGERIA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 243 NIGERIA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 244 NIGERIA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 245 NIGERIA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 246 NIGERIA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.6.6.5 Kuwait

- 9.6.6.5.1 Rise in demand for electricity and oil & gas investments

- 9.6.6.5 Kuwait

- TABLE 247 KUWAIT: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 248 KUWAIT: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 249 KUWAIT: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 250 KUWAIT: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 251 KUWAIT: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 252 KUWAIT: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.6.6.6 Iran

- 9.6.6.6.1 Increasing dependency on diesel-powered generator sets for backup power solutions

- 9.6.6.6 Iran

- TABLE 253 IRAN: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 254 IRAN: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 255 IRAN: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 256 IRAN: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 257 IRAN: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 258 IRAN: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

- 9.6.6.7 Rest of Middle East & Africa

- TABLE 259 REST OF THE MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (USD MILLION)

- TABLE 260 REST OF THE MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY SPEED, 2021-2028 (UNITS)

- TABLE 261 REST OF THE MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 262 REST OF THE MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY END USER, 2021-2028 (UNITS)

- TABLE 263 REST OF THE MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (USD MILLION)

- TABLE 264 REST OF THE MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY MEDIUM SPEED END USER, 2021-2028 (UNITS)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- TABLE 265 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, 2018-2022

- 10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- TABLE 266 DIESEL ENGINES MARKET: DEGREE OF COMPETITION

- FIGURE 35 DIESEL ENGINES MARKET SHARE ANALYSIS, 2021

- 10.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- FIGURE 36 TOP PLAYERS IN DIESEL ENGINES MARKET FROM 2017-2021

- 10.4 COMPANY EVALUATION QUADRANT

- 10.4.1 STARS

- 10.4.2 PERVASIVE PLAYERS

- 10.4.3 EMERGING LEADERS

- 10.4.4 PARTICIPANTS

- FIGURE 37 COMPETITIVE LEADERSHIP QUADRANT: DIESEL ENGINES MARKET, 2022

- 10.5 STARTUP/SME EVALUATION QUADRANT, 2022

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- FIGURE 38 DIESEL ENGINES MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

- 10.6 COMPETITIVE BENCHMARKING

- TABLE 267 DIESEL ENGINES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 268 DIESEL ENGINES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- 10.7 DIESEL ENGINES MARKET: COMPANY FOOTPRINT

- TABLE 269 BY SPEED: COMPANY FOOTPRINT

- TABLE 270 BY POWER OUTPUT: COMPANY FOOTPRINT

- TABLE 271 BY END USER: COMPANY FOOTPRINT

- TABLE 272 COMPANY FOOTPRINT

- 10.8 COMPETITIVE SCENARIO

- TABLE 273 DIESEL ENGINES MARKET: DEALS, 2019-2022

- TABLE 274 DIESEL ENGINES MARKET: PRODUCT LAUNCHES, 2020-2023

11 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 11.1 KEY PLAYERS

- 11.1.1 CATERPILLAR

- TABLE 275 CATERPILLAR: COMPANY OVERVIEW

- FIGURE 39 CATERPILLAR: COMPANY SNAPSHOT

- TABLE 276 CATERPILLAR: PRODUCTS OFFERED

- TABLE 277 CATERPILLAR: PRODUCT LAUNCHES

- 11.1.2 CUMMINS

- TABLE 278 CUMMINS: COMPANY OVERVIEW

- FIGURE 40 CUMMINS: COMPANY SNAPSHOT

- TABLE 279 CUMMINS: PRODUCTS OFFERED

- TABLE 280 CUMMINS: PRODUCT LAUNCHES

- TABLE 281 CUMMINS: DEALS

- 11.1.3 VOLVO PENTA

- TABLE 282 VOLVO PENTA: COMPANY OVERVIEW

- FIGURE 41 VOLVO PENTA: COMPANY SNAPSHOT

- TABLE 283 VOLVO PENTA: PRODUCTS OFFERED

- TABLE 284 VOLVO PENTA: PRODUCT LAUNCHES

- 11.1.4 MAN ENERGY SOLUTIONS

- TABLE 285 MAN ENERGY SOLUTIONS: COMPANY OVERVIEW

- FIGURE 42 MAN ENERGY SOLUTIONS: COMPANY SNAPSHOT

- TABLE 286 MAN ENERGY SOLUTIONS: PRODUCTS OFFERED

- TABLE 287 MAN ENERGY SOLUTIONS: PRODUCT LAUNCHES

- 11.1.5 HYUNDAI HEAVY INDUSTRIES CO., LTD.

- TABLE 288 HYUNDAI HEAVY INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- FIGURE 43 HYUNDAI HEAVY INDUSTRIES CO., LTD.: COMPANY SNAPSHOT

- TABLE 289 HYUNDAI HEAVY INDUSTRIES CO., LTD.: PRODUCTS OFFERED

- TABLE 290 HYUNDAI HEAVY INDUSTRIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 291 HYUNDAI HEAVY INDUSTRIES CO., LTD.: DEALS

- 11.1.6 WARTSILA

- TABLE 292 WARTSILA: BUSINESS OVERVIEW

- FIGURE 44 WARTSILA: COMPANY SNAPSHOT

- TABLE 293 WARTSILA: PRODUCTS OFFERED

- TABLE 294 WARTSILA: PRODUCT LAUNCHES

- TABLE 295 WARTSILA: DEALS

- 11.1.7 MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGERS(MHIET)

- TABLE 296 MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGERS, LTD.: BUSINESS OVERVIEW

- FIGURE 45 MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGERS, LTD.: COMPANY SNAPSHOT

- TABLE 297 MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGERS, LTD.: PRODUCTS OFFERED

- TABLE 298 MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGERS, LTD.: PRODUCT LAUNCHES

- TABLE 299 MITSUBISHI HEAVY INDUSTRIES: DEALS

- 11.1.8 ROLLS-ROYCE HOLDINGS

- TABLE 300 ROLLS-ROYCE HOLDINGS: COMPANY OVERVIEW

- FIGURE 46 ROLLS ROYCE HOLDINGS: COMPANY SNAPSHOT

- TABLE 301 ROLLS-ROYCE HOLDINGS: PRODUCTS OFFERED

- TABLE 302 ROLLS ROYCE HOLDINGS: PRODUCT LAUNCHES

- TABLE 303 ROLLS-ROYCE HOLDINGS: DEALS

- 11.1.9 DOOSAN INFRACORE

- TABLE 304 DOOSAN INFRACORE: COMPANY OVERVIEW

- FIGURE 47 DOOSAN INFRACORE: COMPANY SNAPSHOT

- TABLE 305 DOOSAN INFRACORE: PRODUCTS OFFERED

- TABLE 306 DOOSAN INFRACORE: PRODUCT LAUNCHES

- TABLE 307 DOOSAN INFRACORE: DEALS

- 11.1.10 YANMAR HOLDINGS CO., LTD.

- TABLE 308 YANMAR HOLDINGS CO., LTD.: COMPANY OVERVIEW

- FIGURE 48 YANMAR HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- TABLE 309 YANMAR HOLDINGS CO., LTD.: PRODUCTS OFFERED

- TABLE 310 YANMAR HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- TABLE 311 YANMAR HOLDINGS CO., LTD.: DEALS

- 11.1.11 IHI POWER SYSTEMS CO., LTD.

- TABLE 312 IHI POWER SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 313 IHI POWER SYSTEMS CO., LTD.: PRODUCTS OFFERED

- 11.1.12 KOHLER

- TABLE 314 KOHLER: COMPANY OVERVIEW

- TABLE 315 KOHLER: PRODUCTS OFFERED

- TABLE 316 KOHLER: DEALS

- 11.1.13 CHINA NATIONAL PETROLEUM CORPORATION JICHAI POWER COMPANY LIMITED

- TABLE 317 (CNPC) JICHAI POWER COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 318 (CNPC) JICHAI POWER COMPANY LIMITED: PRODUCTS OFFERED

- 11.1.14 FPT INDUSTRIAL

- TABLE 319 FPT INDUSTRIAL: COMPANY OVERVIEW

- TABLE 320 FPT INDUSTRIAL: PRODUCTS OFFERED

- TABLE 321 FPT INDUSTRIAL: PRODUCT LAUNCHES

- 11.1.15 DAIHATSU DIESEL MFG.

- TABLE 322 DAIHATSU DIESEL MFG.: COMPANY OVERVIEW

- TABLE 323 DAIHATSU DIESEL MFG.: PRODUCTS OFFERED

- TABLE 324 DAIHATSU DIESEL MFG.: DEALS

- 11.2 OTHER PLAYERS

- 11.2.1 ANGLO BELGIAN CORPORATION

- 11.2.2 KUBOTA ENGINE AMERICA CORPORATION

- 11.2.3 THE LIEBHERR GROUP

- 11.2.4 GUANGZHOU DIESEL ENGINE FACTORY CO. LTD

- 11.2.5 MAHINDRA POWERTRAIN

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 INSIGHTS OF INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS