|

|

市場調査レポート

商品コード

1538577

PTFE市場:形状別、用途別、最終用途産業別、地域別 - 2029年までの予測PTFE Market by Form, Application, End Use Industry (Chemical & Industrial Processing, Automotive & Aerospace, Electrical & Electronics, Building & Construction, Consumer Goods), and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| PTFE市場:形状別、用途別、最終用途産業別、地域別 - 2029年までの予測 |

|

出版日: 2024年08月14日

発行: MarketsandMarkets

ページ情報: 英文 275 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

PTFEの市場規模は、2024年の28億米ドルから2029年には35億米ドルに成長し、予測期間中のCAGRは4.3%を記録すると予測されています。

世界のPTFE市場は、その汎用性の高い特性により成長を遂げており、また、卓越した耐薬品性、低摩擦性、温度耐性などの特性により、さまざまな産業で広く使用されています。さらに、PTFEは高級な品質を備えた新しく革新的なアイテムの創造に必要とされており、これがPTFE産業を牽引しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | 形態、最終用途、産業、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

パイプは、いくつかの要因から、PTFE市場で3番目に急成長する用途になると予測されています。PTFEパイプは無毒性で非反応性という特性が評価され、食品、製薬、その他の産業への応用に理想的な選択肢となっています。PTFEパイプが持つ主な利点は耐腐食性で、酸、溶剤、その他の危険物など腐食性の高い化学物質の輸送にも役立ちます。PTFEパイプは、さまざまなサイズや形状があり、顧客に選択肢を与えています。

微粉末は、2023年に量的に第2位のシェアを占めると予想されています。PTFE微粉末はフッ素樹脂の多用途な形態であり、ペースト押出のプロセスによって、これらの微粉末は様々な形状、テープ、絶縁ワイヤーに変換することができ、材料の密度をさらに高めます。他のPTFEフォームと比較すると、微粉末は優れた耐ストレスクラック性、高い熱安定性、低い透過性、高い透明性を示します。また、ワイヤー・ケーブル絶縁、テープ、ホース、チューブなど、さまざまな用途に使用されており、この分野にも貢献しています。

当レポートでは、世界のPTFE市場について調査し、形状別、用途別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- AI生成AIの影響

- 市場力学

- ポーターのファイブフォース分析

- マクロ経済指標

- 主な利害関係者と購入基準

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- 規制状況

- 技術分析

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 2024年~2025年の主な会議とイベント

- 価格分析

- 投資と資金調達のシナリオ

- 特許分析

第6章 PTFE市場(形状別)

- イントロダクション

- 粒状/成型粉末

- 微粉末

- 分散

- 微粉化粉末

第7章 PTFE市場(用途別)

- イントロダクション

- シート

- コーティング

- パイプ

- フィルム

- その他

第8章 PTFE市場(最終用途産業別)

- イントロダクション

- 化学・工業処理

- 自動車・航空宇宙

- 電気・電子

- 建築・建設

- 消費財

- その他

第9章 PTFE市場(地域別)

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 市場シェア分析、2023年

- 収益分析、2021年~2023年

- 企業価値評価と財務指標

- ブランド/生産の比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競争シナリオと動向

第11章 企業プロファイル

- 主要参入企業

- DAIKIN INDUSTRIES, LTD.

- DONGYUE GROUP

- GUJARAT FLUOROCHEMICALS LIMITED

- THE CHEMOURS COMPANY

- SYENSQO

- AGC INC.

- 3M

- HALOPOLYMER, OJSC

- SHANGHAI HUAYI 3F NEW MATERIALS CO. LTD.

- MICROPOWDERS, INC.

- その他の企業

- DALAU LTD.

- FREUDENBERG FST GMBH

- EVERFLON FLUOROPOLYMERS

- FLUOROCARBON GROUP

- SHAMROCK TECHNOLOGIES, INC.

- BERGHOF GMBH

- IN2PLASTICS

- PBY PLASTICS, INC.

- ROCHLING SE & CO. KG

- SHANDONG HENGYI NEW MATERIAL TECHNOLOGY CO., LTD.

- MAFLON S.P.A

- AFT FLUROTEC

- THE MITSUBISHI CHEMICAL GROUP CORPORATION

- HANGZHOU FINE FLUOROTECH CO., LTD.

- SRF LIMITED

第12章 付録

List of Tables

- TABLE 1 PTFE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 GROWING APPLICATIONS OF PTFE IN VARIOUS END-USE INDUSTRIES

- TABLE 3 FUTURE GROWTH OPPORTUNITIES IN DIFFERENT END-USE INDUSTRIES

- TABLE 4 ALTERED KEY PROPERTIES OF FLUOROPOLYMERS WITH AN INCREASING PERCENTAGE OF REPROCESSED PTFE

- TABLE 5 PTFE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2029

- TABLE 7 AUTOMOBILE PRODUCTION IN KEY COUNTRIES, 2021-2023

- TABLE 8 PROJECTED EV PRODUCTION IN KEY COUNTRIES, 2018-2023

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 10 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 11 ROLES OF COMPANIES IN PTFE ECOSYSTEM

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 PTFE MARKET: REGULATORY BODIES, AGENCIES, AND ORGANIZATIONS

- TABLE 16 IMPORT DATA RELATED TO HS CODE 390461 POLYTETRAFLUOROETHYLENE, IN PRIMARY FORMS FOR TOP COUNTRIES, 2019-2023 (USD THOUSAND)

- TABLE 17 EXPORT DATA RELATED TO HS CODE 390461 POLYTETRAFLUOROETHYLENE, IN PRIMARY FORMS FOR TOP COUNTRIES, 2019-2023 (USD THOUSAND)

- TABLE 18 PTFE MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 19 AVERAGE SELLING PRICE TREND OF PTFE OFFERED BY KEY PLAYERS, BY FORM (USD/KG)

- TABLE 20 AVERAGE SELLING PRICE TREND OF PTFE OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY (USD/KG)

- TABLE 21 PROPERTIES AND END-USE INDUSTRIES OF VARIOUS GRADES OF PTFE

- TABLE 22 PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 23 PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 24 PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 25 PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 26 PTFE MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 27 PTFE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 28 PTFE MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 29 PTFE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 30 PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 31 PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 32 PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 33 PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 34 PTFE MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 35 PTFE MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 36 PTFE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 37 PTFE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 ASIA PACIFIC: PTFE MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 39 ASIA PACIFIC: PTFE MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 40 ASIA PACIFIC: PTFE MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 41 ASIA PACIFIC: PTFE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 42 ASIA PACIFIC: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 43 ASIA PACIFIC: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 44 ASIA PACIFIC: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 45 ASIA PACIFIC: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 46 ASIA PACIFIC: PTFE MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 47 ASIA PACIFIC: PTFE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 48 ASIA PACIFIC: PTFE MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 49 ASIA PACIFIC: PTFE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 50 ASIA PACIFIC: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 51 ASIA PACIFIC: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 52 ASIA PACIFIC: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 53 ASIA PACIFIC: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 54 CHINA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 55 CHINA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 56 CHINA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 57 CHINA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 58 CHINA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 59 CHINA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 60 CHINA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 61 CHINA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 62 JAPAN: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 63 JAPAN: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 64 JAPAN: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 65 JAPAN: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 66 JAPAN: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 67 JAPAN: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 68 JAPAN: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 69 JAPAN: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 70 SOUTH KOREA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 71 SOUTH KOREA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 72 SOUTH KOREA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 73 SOUTH KOREA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 74 SOUTH KOREA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 75 SOUTH KOREA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 76 SOUTH KOREA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 77 SOUTH KOREA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 78 INDIA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 79 INDIA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 80 INDIA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 81 INDIA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 82 INDIA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 83 INDIA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 84 INDIA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 85 INDIA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 86 TAIWAN: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 87 TAIWAN: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 88 TAIWAN: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 89 TAIWAN: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 90 TAIWAN: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 91 TAIWAN: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 92 TAIWAN: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 93 TAIWAN: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 94 AUSTRALIA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 95 AUSTRALIA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 96 AUSTRALIA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 97 AUSTRALIA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 98 AUSTRALIA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 99 AUSTRALIA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 100 AUSTRALIA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 101 AUSTRALIA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 103 REST OF ASIA PACIFIC: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 104 REST OF ASIA PACIFIC: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 107 REST OF ASIA PACIFIC: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 108 REST OF ASIA PACIFIC: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 110 NORTH AMERICA: PTFE MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 111 NORTH AMERICA: PTFE MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 112 NORTH AMERICA: PTFE MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 113 NORTH AMERICA: PTFE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 114 NORTH AMERICA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 115 NORTH AMERICA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 116 NORTH AMERICA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 117 NORTH AMERICA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 118 NORTH AMERICA: PTFE MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 119 NORTH AMERICA: PTFE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 120 NORTH AMERICA: PTFE MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 121 NORTH AMERICA: PTFE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 122 NORTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 123 NORTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 124 NORTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 125 NORTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 126 US: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 127 US: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 128 US: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 129 US: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 130 US: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 131 US: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 132 US: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 133 US: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 134 CANADA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 135 CANADA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 136 CANADA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 137 CANADA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 138 CANADA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 139 CANADA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 140 CANADA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 141 CANADA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 142 MEXICO: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 143 MEXICO: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 144 MEXICO: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 145 MEXICO: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 146 MEXICO: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 147 MEXICO: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 148 MEXICO: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 149 MEXICO: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 150 EUROPE: PTFE MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 151 EUROPE: PTFE MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 152 EUROPE: PTFE MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 153 EUROPE: PTFE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 154 EUROPE: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 155 EUROPE: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 156 EUROPE: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 157 EUROPE: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 158 EUROPE: PTFE MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 159 EUROPE: PTFE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 160 EUROPE: PTFE MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 161 EUROPE: PTFE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 162 EUROPE: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 163 EUROPE: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 164 EUROPE: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 165 EUROPE: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 166 GERMANY: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 167 GERMANY: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 168 GERMANY: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 169 GERMANY: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 170 GERMANY: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 171 GERMANY: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 172 GERMANY: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 173 GERMANY: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 174 FRANCE: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 175 FRANCE: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 176 FRANCE: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 177 FRANCE: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 178 FRANCE: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 179 FRANCE: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 180 FRANCE: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 181 FRANCE: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 182 UK: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 183 UK: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 184 UK: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 185 UK: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 186 UK: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 187 UK: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 188 UK: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 189 UK: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 190 ITALY: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 191 ITALY: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 192 ITALY: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 193 ITALY: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 194 ITALY: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 195 ITALY: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 196 ITALY: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 197 ITALY: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 198 SPAIN: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 199 SPAIN: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 200 SPAIN: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 201 SPAIN: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 202 SPAIN: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 203 SPAIN: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 204 SPAIN: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 205 SPAIN: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 206 REST OF EUROPE: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 207 REST OF EUROPE: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 208 REST OF EUROPE: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 209 REST OF EUROPE: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 210 REST OF EUROPE: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 211 REST OF EUROPE: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 212 REST OF EUROPE: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 213 REST OF EUROPE: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: PTFE MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 215 MIDDLE EAST & AFRICA: PTFE MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 216 MIDDLE EAST & AFRICA: PTFE MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: PTFE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 219 MIDDLE EAST & AFRICA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 220 MIDDLE EAST & AFRICA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: PTFE MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 223 MIDDLE EAST & AFRICA: PTFE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 224 MIDDLE EAST & AFRICA: PTFE MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: PTFE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 227 MIDDLE EAST & AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 228 MIDDLE EAST & AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 230 SAUDI ARABIA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 231 SAUDI ARABIA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 232 SAUDI ARABIA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 233 SAUDI ARABIA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 234 SAUDI ARABIA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 235 SAUDI ARABIA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 236 SAUDI ARABIA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 237 SAUDI ARABIA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 238 UAE: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 239 UAE: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 240 UAE: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 241 UAE: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 242 UAE: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 243 UAE: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 244 UAE: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 245 UAE: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 246 REST OF GCC: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 247 REST OF GCC: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 248 REST OF GCC: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 249 REST OF GCC: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 250 REST OF GCC: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 251 REST OF GCC: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 252 REST OF GCC: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 253 REST OF GCC: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 254 SOUTH AFRICA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 255 SOUTH AFRICA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 256 SOUTH AFRICA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 257 SOUTH AFRICA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 258 SOUTH AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 259 SOUTH AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 260 SOUTH AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 261 SOUTH AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 262 REST OF MIDDLE EAST & AFRICA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 263 REST OF MIDDLE EAST & AFRICA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 264 REST OF MIDDLE EAST & AFRICA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 265 REST OF MIDDLE EAST & AFRICA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 266 REST OF MIDDLE EAST & AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 267 REST OF MIDDLE EAST & AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 268 REST OF MIDDLE EAST & AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 269 REST OF MIDDLE EAST & AFRICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 270 SOUTH AMERICA: PTFE MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 271 SOUTH AMERICA: PTFE MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 272 SOUTH AMERICA: PTFE MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 273 SOUTH AMERICA: PTFE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 274 SOUTH AMERICA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 275 SOUTH AMERICA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 276 SOUTH AMERICA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 277 SOUTH AMERICA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 278 SOUTH AMERICA: PTFE MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 279 SOUTH AMERICA: PTFE MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 280 SOUTH AMERICA: PTFE MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 281 SOUTH AMERICA: PTFE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 282 SOUTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 283 SOUTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 284 SOUTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 285 SOUTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 286 BRAZIL: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 287 BRAZIL: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 288 BRAZIL: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 289 BRAZIL: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 290 BRAZIL: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 291 BRAZIL: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 292 BRAZIL: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 293 BRAZIL: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 294 ARGENTINA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 295 ARGENTINA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 296 ARGENTINA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 297 ARGENTINA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 298 ARGENTINA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 299 ARGENTINA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 300 ARGENTINA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 301 ARGENTINA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 302 REST OF SOUTH AMERICA: PTFE MARKET, BY FORM, 2021-2023 (KILOTON)

- TABLE 303 REST OF SOUTH AMERICA: PTFE MARKET, BY FORM, 2024-2029 (KILOTON)

- TABLE 304 REST OF SOUTH AMERICA: PTFE MARKET, BY FORM, 2021-2023 (USD MILLION)

- TABLE 305 REST OF SOUTH AMERICA: PTFE MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 306 REST OF SOUTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 307 REST OF SOUTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 308 REST OF SOUTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 309 REST OF SOUTH AMERICA: PTFE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 310 PTFE MARKET: DEGREE OF COMPETITION, 2023

- TABLE 311 PTFE MARKET: REGION FOOTPRINT

- TABLE 312 PTFE MARKET: FORM FOOTPRINT

- TABLE 313 PTFE MARKET: APPLICATION FOOTPRINT

- TABLE 314 PTFE MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 315 PTFE MARKET: LIST OF KEY START-UPS/SMES

- TABLE 316 PTFE: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 317 PTFE MARKET: DEALS, JANUARY 2O20-JUNE 2024

- TABLE 318 PTFE MARKET: EXPANSIONS, JANUARY 2O20-JUNE 2024

- TABLE 319 PTFE MARKET: OTHER DEVELOPMENTS, JANUARY 2O20-JUNE 2024

- TABLE 320 DAIKIN INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 321 DAIKIN INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 DAIKIN INDUSTRIES, LTD.: EXPANSIONS

- TABLE 323 DONGYUE GROUP: COMPANY OVERVIEW

- TABLE 324 DONGYUE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 GUJARAT FLUOROCHEMICALS LIMITED: COMPANY OVERVIEW

- TABLE 326 GUJARAT FLUOROCHEMICALS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 GUJARAT FLUOROCHEMICALS LIMITED: EXPANSIONS

- TABLE 328 THE CHEMOURS COMPANY: COMPANY OVERVIEW

- TABLE 329 THE CHEMOURS COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 THE CHEMOURS COMPANY: EXPANSIONS

- TABLE 331 THE CHEMOURS COMPANY: OTHERS

- TABLE 332 THE CHEMOURS COMPANY: DEALS

- TABLE 333 SYENSQO: COMPANY OVERVIEW

- TABLE 334 SYENSQO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 AGC INC.: COMPANY OVERVIEW

- TABLE 336 AGC INC.: PRODUCTS OFFERED

- TABLE 337 3M: COMPANY OVERVIEW

- TABLE 338 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 HALOPOLYMER, OJSC: COMPANY OVERVIEW

- TABLE 340 HALOPOLYMER, OJSC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 SHANGHAI HUAYI 3F NEW MATERIALS CO. LTD.: COMPANY OVERVIEW

- TABLE 342 SHANGHAI HUAYI 3F NEW MATERIALS CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 MICROPOWDERS, INC.: COMPANY OVERVIEW

- TABLE 344 MICROPOWDERS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 345 FLUOROCARBON GROUP: COMPANY OVERVIEW

- TABLE 346 IN2PLASTICS: COMPANY OVERVIEW

- TABLE 347 PBY PLASTICS, INC.: COMPANY OVERVIEW

- TABLE 348 ROCHLING SE & CO. KG: COMPANY OVERVIEW

- TABLE 349 SHANDONG HENGYI NEW MATERIAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PTFE MARKET SEGMENTATION

- FIGURE 2 PTFE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION APPROACH: DEMAND SIDE

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 PTFE MARKET: DATA TRIANGULATION

- FIGURE 7 FINE POWDER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 COATINGS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 CHEMICAL & INDUSTRIAL PROCESSING TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 11 ASIA PACIFIC TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 DISPERSION TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 COATINGS TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 14 AUTOMOTIVE & AEROSPACE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 COATINGS AND ASIA PACIFIC REGION ACCOUNTED FOR LARGEST MARKET SHARES IN 2023

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PTFE MARKET

- FIGURE 17 PTFE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 19 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 20 PTFE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 PTFE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF PTFE, BY REGION (USD/KG)

- FIGURE 24 INVESTMENT AND FUNDING SCENARIO

- FIGURE 25 PATENT SHARE IN PTFE MARKET

- FIGURE 26 NO. OF PATENTS YEAR-WISE IN LAST 10 YEARS

- FIGURE 27 APPLICANT ANALYSIS

- FIGURE 28 FINE POWDER TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 29 COATINGS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 30 CHEMICAL & INDUSTRIAL PROCESSING TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 31 INDIA PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC: PTFE MARKET SNAPSHOT

- FIGURE 33 NORTH AMERICA: PTFE MARKET SNAPSHOT

- FIGURE 34 EUROPE: PTFE MARKET SNAPSHOT

- FIGURE 35 PTFE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- FIGURE 37 PTFE MARKET: TOTAL AND SEGMENTAL REVENUE ANALYSIS OF KEY COMPANIES, 2023 (USD BILLION)

- FIGURE 38 PTFE MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2019-2023 (USD BILLION)

- FIGURE 39 PTFE MARKET: COMPANY VALUATION OF LEADING COMPANIES, 2023

- FIGURE 40 PTFE MARKET: FINANCIAL METRICS OF LEADING COMPANIES, 2023

- FIGURE 41 PTFE MARKET: BRAND/PRODUCTION COMPARISON

- FIGURE 42 PTFE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 43 PTFE MARKET: COMPANY FOOTPRINT

- FIGURE 44 PTFE MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES),2023

- FIGURE 45 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 46 DONGYUE GROUP: COMPANY SNAPSHOT

- FIGURE 47 GUJARAT FLUOROCHEMICALS LIMITED: COMPANY SNAPSHOT

- FIGURE 48 THE CHEMOURS COMPANY: COMPANY SNAPSHOT

- FIGURE 49 SYENSQO: COMPANY SNAPSHOT

- FIGURE 50 AGC INC.: COMPANY SNAPSHOT

- FIGURE 51 3M: COMPANY SNAPSHOT

The PTFE market size is projected to grow from USD 2.8 billion in 2024 to USD 3.5 billion by 2029, registering a CAGR of 4.3% during the forecast period. The global PTFE market is witnessing growth due to its versatile properties and it is also widely used in various industries due to its exceptional chemical resistance, low friction, and temperature tolerance properties. Furthermore, PTFE is required for the creation of new and innovative items with premium qualities, which drives the PTFE industry.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million), Volume (Kilo tons) |

| Segments | Form, Application, End-use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Pipes is projected to be the third fastest growing application in terms of value."

Pipes is projected to be the third fastest growing application in the PTFE market due to several factors. As PTFE pipes are valued because of their non-toxic and non-reactive properties, making them an ideal choice for application in food, pharmaceutical and other industries. The main advantage PTFE pipes possess is its resistance to corrosion, which also helps in transporting highly corrosive chemicals such as acids, solvents and other hazardous materials. They are also available in different sizes and configuration which gives the option to the customers

"Fine powder segment is expected to account for the second-largest share in 2023.."

Fine powder is expected to account for the second largest share in 2023 in terms of volume. PTFE fine powders are versatile form of fluoropolymer, by the process of paste extrusion, these fine powders can be converted into various shapes, tapes and insulation wires, which further increases density of material. When compared with other PTFE forms, fine powder exhibits superior stress crack resistance, higher thermal stability, lower permeability, and higher clarity. It is also used in various applications such as wire & cable insulation, tapes, hoses, tubings and others which contributes to this segment.

"North America is the second-largest market for PTFE."

North America holds a significant position as the second-largest region in the global PTFE market, driven by several factors such as the presence of many manufacturers, particularly in the chemical and electrical & electronics end-use industries which influences the demand for PTFE. The chemical industry is the heart of North America's manufacturing sector. It supplies two-thirds of its production to other industries within the manufacturing sector. The North American chemical industry is a significant part of the region's economy.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the PTFE market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

- By Region: North America - 20%, Europe - 20%, APAC - 40%, South America- 10% , and

the Middle East & Africa -10%

The PTFE market comprises major players such as AGC Inc. (US), Gujarat Fluorochemical Limited (India), DAIKIN INDUSTRIES, Ltd., (Japan), Dongyue Group (China), The Chemours Company (US), 3M (US), SYENSQO (Belgium), HaloPolymer, OJSC (Russia), Shanghai Huayi 3F New Materials Co.Ltd (China), and Micropowders,Inc. (US). The study includes in-depth competitive analysis of these key players in the PTFE market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for PTFE market on the basis of form, application, end use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for PTFE market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the PTFE market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the PTFE market offered by top players in the global PTFE market.

- Analysis of drivers: (High growth in end use industries, Demand from emerging countries in Asia Pacific) restraints (Environmental impact of PTFE production, New perfluorooctanoic acid (PFOA) regulations restraining the PTFE market), opportunities (Increasing use of PTFE in medical applications, Government encouraging the development of green hydrogen and hydrogen fuel cells) and challenges (Non-biodegradable nature of PTFE, Use of reprocessed PTFE)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the PTFE market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for PTFE market across regions.

- Market Capacity: Production capacities of companies producing PTFE are provided wherever available with upcoming capacities for the PTFE market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the PTFE market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary participants

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 FACTOR ANALYSIS

- 2.6 GROWTH FORECAST

- 2.6.1 SUPPLY SIDE

- 2.6.2 DEMAND SIDE

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PTFE MARKET

- 4.2 PTFE MARKET, BY FORM

- 4.3 PTFE MARKET, BY APPLICATION

- 4.4 PTFE MARKET, BY END-USE INDUSTRY

- 4.5 PTFE MARKET, BY APPLICATION AND REGION

- 4.6 PTFE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 IMPACT OF AI/GEN AI

- 5.2.1 INTRODUCTION

- 5.2.2 OVERVIEW OF IMPACT

- 5.2.2.1 Optimizing production process in polymers

- 5.2.2.2 Enhancing design, production, and optimization of polymers

- 5.2.2.3 AI/GenAI impact on end-use industries

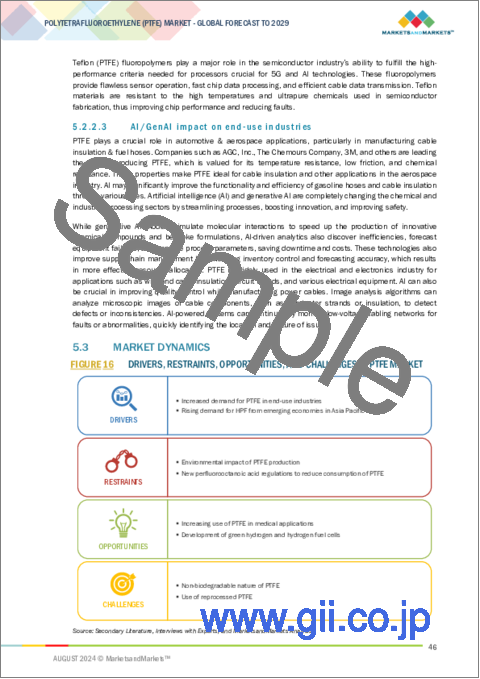

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increased demand for PTFE in end-use industries

- 5.3.1.2 Rising demand for HPF from emerging economies in Asia Pacific

- 5.3.2 RESTRAINTS

- 5.3.2.1 Environmental impact of PTFE production

- 5.3.2.2 New perfluorooctanoic acid regulations to reduce consumption of PTFE

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increasing use of PTFE in medical applications

- 5.3.3.2 Development of green hydrogen and hydrogen fuel cells

- 5.3.4 CHALLENGES

- 5.3.4.1 Non-biodegradable nature of PTFE

- 5.3.4.2 Use of reprocessed PTFE

- 5.3.1 DRIVERS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 BARGAINING POWER OF BUYERS

- 5.4.2 BARGAINING POWER OF SUPPLIERS

- 5.4.3 THREAT OF NEW ENTRANTS

- 5.4.4 THREAT OF SUBSTITUTES

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.5.2 AUTOMOBILE PRODUCTION TRENDS

- 5.5.2.1 EV production

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 RAW MATERIAL SUPPLIERS

- 5.7.2 MANUFACTURERS

- 5.7.3 DISTRIBUTORS

- 5.7.4 CONVERTORS

- 5.7.5 END USERS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 IMPROVING SEAL PERFORMANCE IN HIGH-PRESSURE AND TEMPERATURE APPLICATIONS WITH SPRING-ENERGIZED PTFE SEALS

- 5.9.2 ADDRESSING FRICTION AND THERMAL EXPANSION ISSUES IN FLAT SCREEN MOUNTING SYSTEMS WITH PTFE COATINGS

- 5.9.3 ENHANCING CONVEYOR RELIABILITY AND UPTIME IN FOOD MANUFACTURING WITH PTFE COMPONENTS

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATIONS

- 5.10.1.1 North America

- 5.10.1.2 Asia Pacific

- 5.10.1.3 Europe

- 5.10.1.4 Middle East & Africa

- 5.10.1.5 South America

- 5.10.2 REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER ORGANIZATIONS

- 5.10.1 REGULATIONS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Emulsion polymerization

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Plasma treatment

- 5.11.2.2 3D treatment

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 PTFE fiber technology

- 5.11.1 KEY TECHNOLOGIES

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 390461)

- 5.13.2 EXPORT SCENARIO (HS CODE 390461)

- 5.14 KEY CONFERENCES AND EVENTS IN 2024-2025

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY FORM

- 5.15.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- 5.15.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 PATENT ANALYSIS

- 5.17.1 METHODOLOGY

- 5.17.2 DOCUMENT TYPES

- 5.17.3 PUBLICATION TRENDS IN LAST 10 YEARS

- 5.17.4 INSIGHTS

- 5.17.5 JURISDICTION ANALYSIS

- 5.17.6 TOP 10 COMPANIES/APPLICANTS

- 5.17.7 PATENTS BY CANON INC.

- 5.17.8 PATENTS BY 3M

- 5.17.9 PATENTS BY SHANDONG LANXIANG ENVIRONMENTAL TECHNOLOGY CO. LTD.

- 5.17.10 TOP 10 PATENT OWNERS IN LAST 10 YEARS

6 PTFE MARKET, BY FORM

- 6.1 INTRODUCTION

- 6.2 GRANULAR/MOLDED POWDER

- 6.2.1 MANUFACTURING

- 6.2.2 PROPERTIES

- 6.2.3 APPLICATIONS

- 6.3 FINE POWDER

- 6.3.1 MANUFACTURING

- 6.3.2 PROPERTIES

- 6.3.3 APPLICATIONS

- 6.4 DISPERSION

- 6.4.1 MANUFACTURING

- 6.4.2 PROPERTIES

- 6.4.3 APPLICATIONS

- 6.5 MICRONIZED POWDER

- 6.5.1 MANUFACTURING

- 6.5.2 PROPERTIES

- 6.5.3 APPLICATIONS

7 PTFE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 SHEETS

- 7.2.1 PERSISTENT USE OF PTFE SHEETS IN FOOD AND PACKAGING INDUSTRY TO DRIVE MARKET

- 7.3 COATINGS

- 7.3.1 HIGH-TEMPERATURE ENDURANCE AND CHEMICAL RESISTANCE TO BOOST DEMAND

- 7.4 PIPES

- 7.4.1 RISING DEMAND FOR PTFE PIPES IN CHEMICAL AND INDUSTRIAL PROCESSING TO DRIVE MARKET

- 7.5 FILMS

- 7.5.1 WIDE APPLICATION IN END-USE INDUSTRIES TO BOOST DEMAND

- 7.6 OTHER APPLICATIONS

8 PTFE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 CHEMICAL & INDUSTRIAL PROCESSING

- 8.2.1 PRESSING NEED FOR PTFE IN CHEMICAL AND INDUSTRIAL PROCESSING TO DRIVE MARKET

- 8.2.2 CHEMICAL PROCESSING

- 8.2.3 OIL & GAS

- 8.2.4 PHARMACEUTICALS

- 8.2.5 OTHER INDUSTRIAL PROCESSING APPLICATIONS

- 8.3 AUTOMOTIVE & AEROSPACE

- 8.3.1 IMPROVING COMPONENT PERFORMANCE AND LONGEVITY TO BOOST DEMAND FOR PTFE

- 8.3.2 AUTOMOTIVE

- 8.3.3 AEROSPACE

- 8.4 ELECTRICAL & ELECTRONICS

- 8.4.1 EMERGING TECHNOLOGIES AND RISING DEMAND FOR ELECTRONICS TO DRIVE MARKET

- 8.4.2 TELECOMMUNICATIONS

- 8.4.3 SEMICONDUCTORS

- 8.4.4 ELECTRONIC COMPONENTS AND GADGETS

- 8.4.5 ELECTRICAL

- 8.5 BUILDING & CONSTRUCTION

- 8.5.1 SURGE IN CONSTRUCTION ACTIVITIES TO DRIVE MARKET

- 8.6 CONSUMER GOODS

- 8.6.1 NON-STICK CHARACTERISTICS OF PTFE TO DRIVE DEMAND IN CONSUMER GOODS INDUSTRY

- 8.7 OTHER END-USE INDUSTRIES

- 8.7.1 HEALTHCARE

- 8.7.2 DEFENSE

- 8.7.3 AGROCHEMICAL

9 PTFE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 High demand from chemical and industrial processing sector to drive market

- 9.2.2 JAPAN

- 9.2.2.1 Surge in production of chemical and petrochemical-based products to drive market

- 9.2.3 SOUTH KOREA

- 9.2.3.1 Increase in exports to surge demand for PTFE

- 9.2.4 INDIA

- 9.2.4.1 Rising imports and rapid industrialization to boost market

- 9.2.5 TAIWAN

- 9.2.5.1 Rising demand for PTFE in semiconductor coatings to drive market

- 9.2.6 AUSTRALIA

- 9.2.6.1 Increasing investments in new infrastructure to boost demand for PTFE coatings

- 9.2.7 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Wide establishment of various manufacturing and end-use industries to drive market

- 9.3.2 CANADA

- 9.3.2.1 Abundance of natural resources and rising export of chemicals to boost market

- 9.3.3 MEXICO

- 9.3.3.1 Immense growth potential for domestic production of chemicals to drive market

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Constant innovations in major end-use industries to drive market

- 9.4.2 FRANCE

- 9.4.2.1 Foreign investments to boost construction industry growth

- 9.4.3 UK

- 9.4.3.1 Growth of chemical and construction industries to positively influence market

- 9.4.4 ITALY

- 9.4.4.1 Growth of transportation industry and rise in pipeline construction projects to drive market

- 9.4.5 SPAIN

- 9.4.5.1 Growing domestic demand and rising exports of automobiles to drive market

- 9.4.6 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Government initiatives for economic diversification to boost consumption

- 9.5.1.2 UAE

- 9.5.1.2.1 Increasing demand for PTFE from oil & gas sector to drive market

- 9.5.1.3 Rest of GCC

- 9.5.1.1 Saudi Arabia

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Growth of automotive industry to boost consumption of PTFE components

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Expanding renewable energy projects and oil & gas exploration to increase demand for PTFE

- 9.6.2 ARGENTINA

- 9.6.2.1 Increased investments in renewable energy to drive market

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 10.3 MARKET SHARE ANALYSIS, 2023

- 10.4 REVENUE ANALYSIS, 2021-2023

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCTION COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Form footprint

- 10.7.5.4 Application footprint

- 10.7.5.5 End-use industry footprint

- 10.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 10.8.5.1 Detailed list of key start-ups/SMEs

- 10.8.5.2 Competitive benchmarking of key start-ups/SMEs

- 10.9 COMPETITIVE SCENARIOS AND TRENDS

- 10.9.1 DEALS

- 10.9.2 EXPANSIONS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 DAIKIN INDUSTRIES, LTD.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 DONGYUE GROUP

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Key strengths

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 GUJARAT FLUOROCHEMICALS LIMITED

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 THE CHEMOURS COMPANY

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 SYENSQO

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 AGC INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.6.3.1 Key strengths

- 11.1.6.3.2 Strategic choices

- 11.1.6.3.3 Weaknesses and competitive threats

- 11.1.7 3M

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 MnM view

- 11.1.7.3.1 Key strengths

- 11.1.7.3.2 Strategic choices

- 11.1.7.3.3 Weaknesses and competitive threats

- 11.1.8 HALOPOLYMER, OJSC

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 MnM view

- 11.1.8.3.1 Key strengths

- 11.1.8.3.2 Strategic choices

- 11.1.8.3.3 Weaknesses and competitive threats

- 11.1.9 SHANGHAI HUAYI 3F NEW MATERIALS CO. LTD.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.9.3.1 Key strengths

- 11.1.9.3.2 Strategic choices

- 11.1.9.3.3 Weaknesses and competitive threats

- 11.1.10 MICROPOWDERS, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 MnM view

- 11.1.10.3.1 Key strengths

- 11.1.10.3.2 Strategic choices

- 11.1.10.3.3 Weaknesses and competitive threats

- 11.1.1 DAIKIN INDUSTRIES, LTD.

- 11.2 OTHER PLAYERS

- 11.2.1 DALAU LTD.

- 11.2.2 FREUDENBERG FST GMBH

- 11.2.3 EVERFLON FLUOROPOLYMERS

- 11.2.4 FLUOROCARBON GROUP

- 11.2.5 SHAMROCK TECHNOLOGIES, INC.

- 11.2.6 BERGHOF GMBH

- 11.2.7 IN2PLASTICS

- 11.2.8 PBY PLASTICS, INC.

- 11.2.9 ROCHLING SE & CO. KG

- 11.2.10 SHANDONG HENGYI NEW MATERIAL TECHNOLOGY CO., LTD.

- 11.2.11 MAFLON S.P.A

- 11.2.12 AFT FLUROTEC

- 11.2.13 THE MITSUBISHI CHEMICAL GROUP CORPORATION

- 11.2.14 HANGZHOU FINE FLUOROTECH CO., LTD.

- 11.2.15 SRF LIMITED

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS