|

|

市場調査レポート

商品コード

1734982

生成AIの世界市場:ソフトウェア別、モダリティ別、用途別 - 予測(~2032年)Generative AI Market by Software, Modality, Application - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 生成AIの世界市場:ソフトウェア別、モダリティ別、用途別 - 予測(~2032年) |

|

出版日: 2025年05月22日

発行: MarketsandMarkets

ページ情報: 英文 628 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の生成AIの市場規模は、2025年の713億6,000万米ドルから2032年までに8,905億9,000万米ドルに達すると予測され、2025年~2032年にCAGRで43.4%の成長が見込まれます。

市場は、企業採用の増加、マルチモーダルAIソリューションの需要の拡大、コンテンツ作成やその他のビジネスタスクの自動化に向けた生成AIの利用の拡大などによって急成長しています。各業界の企業が生成AIを活用することで、効率性の向上、コスト削減、よりよい顧客体験の提供を実現しています。しかし、複数の抑制要因もあります。インフラやコンピューティングのコストが高いため、中小企業がこの技術を採用することは困難です。さらに、AIモデルが偏った内容や誤った内容(ハルシネーションとして知られる)を生成するといった問題は、信頼性や信用に関する懸念を引き起こします。潜在能力は高い一方で、ベンダーは生成AIの価値を最大限に引き出すために、これらの抑制要因に対処する必要があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 10億米ドル |

| セグメント | 提供、データモダリティ、用途、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「エンドユーザー別では、医療・ライフサイエンスセグメントが予測期間にもっとも高い成長率を記録します。」

この成長の促進要因は、創薬、医用画像、患者データの分析、個別化治療計画への生成AIの利用の増加です。生成AIは合成データを作成して複雑な生物学的プロセスをシミュレートすることで、時間とコストを削減し、研究を加速させるのに役立ちます。また、診断の改良やルーチンタスクの自動化によって医療提供者をサポートし、患者のケアを強化します。医療データの増加と効率的で正確なソリューションへのニースにより、生成AIはこの業界で不可欠なツールになりつつあり、ベンダーやイノベーターに大きな機会をもたらしています。

「提供別では、ソフトウェアセグメントが2032年までに最大の市場シェアを占めます。」

ソフトウェアセグメントが2032年までに生成AIインフラを抜いて最大の市場シェアを占めると予測されます。これは、ソフトウェアが生成AIアプリケーションの中核を形成し、テキスト生成、画像作成、コード生成、バーチャルアシスタントなどのタスクを可能にするためです。ユーザーフレンドリーなプラットフォーム、API、学習済みモデルの台頭により、業界を問わず企業が生成AIソフトウェアを採用し、生産性の向上、プロセスの自動化、顧客エンゲージメントの強化を図っています。クラウドベースの展開と既存システムとの容易な統合が、ソフトウェアの採用をさらに後押ししています。創造的でインテリジェントなアプリケーションへの需要が高まるにつれて、ソフトウェアセグメントが最終的に市場をリードし、ベンダーや開発者に大きな機会をもたらすとみられます。

「地域別では、北米が2025年に最大の市場シェアを占め、アジア太平洋が予測期間に最速の成長率を記録します。」

北米が2025年に生成AI市場で最大のシェアを占めると推定されます。これは主に、生成AI機能を継続的に進歩させているMicrosoft、Google、OpenAI、NVIDIA、AWSといった主要技術企業の力強いプレゼンスによるものです。この地域はまた、成熟したデジタルインフラ、高いクラウド採用率、AI研究とイノベーションへの強力な投資からも恩恵を受けています。医療、BFSI、小売、メディアなどの各部門の企業は、コンテンツ作成の自動化、顧客体験の向上、業務効率の改良に向けて生成AIソリューションの採用を増やしています。加えて、政府による有利な支援と大きなタレントプールが、早期の採用と迅速なイノベーションに寄与しています。

当レポートでは、世界の生成AI市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 生成AI市場の企業にとって魅力的な機会

- 生成AI市場:上位3つのデータモダリティ

- 北米の生成AI市場:提供別、エンドユーザー別

- 生成AI市場:地域別

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 生成AIの進化

- 生成AIの成熟度曲線

- サプライチェーン分析

- エコシステム分析

- 生成AIインフラプロバイダー

- 生成AIソフトウェアプロバイダー

- 生成AIサービスプロバイダー

- 米国関税の影響 - 生成AI市場(2025年)

- イントロダクション

- 主要関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

- 投資と資金調達のシナリオ

- ケーススタディ分析

- FORTUNE ANALYTICS - ACCENTUREの技術を活用したAIによるビジネスインサイト

- VODAFONE GROUP PLC、PERSADOのMOTIVATION AIを通じて主要動向と豊かな知見を発見

- WPPがSYNTHESIAと提携 - AI動画で5万人の従業員をトレーニング

- OPPLUSとINBENTA - BBVAに対するAIによるカスタマーサービスの変革

- CISCO、LUMEN5を使用して動画コンテンツのローカリゼーションを拡大

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 関税と規制情勢

- プロセッサーとコントローラーに関連する関税(HSN:854231)

- 規制機関、政府機関、その他の組織

- 規制

- 貿易分析

- プロセッサーとコントローラーの輸出シナリオ

- プロセッサーとコントローラーの輸入シナリオ

- 特許分析

- 調査手法

- 出願された特許:文献タイプ別

- イノベーションと特許出願

- 価格分析

- 平均販売価格:主要企業別(2025年)

- 平均販売価格:用途別(2025年)

- 主な会議とイベント

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 顧客ビジネスに影響を与える動向/混乱

第6章 生成AI市場

- イントロダクション

- インフラ

- コンピューティング

- メモリ

- ネットワークハードウェア

- ストレージ

- ソフトウェア

- 基盤モデル

- モデル有効化・オーケストレーションツール

- 生成AI SaaS

- サービス

- 生成AIトレーニング・コンサルティングサービス

- モデル開発・ファインチューニングサービス

- プロンプトエンジニアリングサービス

- 統合・展開サービス

- サポート・メンテナンスサービス

- 生成AIトレーニングデータサービス

- マネージド生成AIサービス

第7章 生成AI市場:データモダリティ別

- イントロダクション

- テキスト

- 画像

- 動画

- 音声

- コード

- マルチモーダル

第8章 生成AI市場:用途別

- イントロダクション

- ビジネスインテリジェンス・可視化

- コンテンツ管理

- 合成データ管理

- 検索・発見

- 自動化・統合

- ジェネレーティブデザインAI

- その他の用途

第9章 生成AI市場:エンドユーザー別

- イントロダクション

- 消費者

- 企業

- BFSI

- 小売・eコマース

- 政府・防衛

- 通信

- メディア・エンターテインメント

- 輸送・ロジスティクス

- 製造

- 医療・ライフサイエンス

- ソフトウェア・テクノロジープロバイダー

- エネルギー・公益事業

- その他の企業

第10章 生成AI市場:地域別

- イントロダクション

- 北米

- 北米の生成AI市場の促進要因

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州の生成AI市場の促進要因

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- フィンランド

- その他の欧州

- アジア太平洋

- アジア太平洋の生成AI市場の促進要因

- アジア太平洋のマクロ経済の見通し

- 中国

- インド

- 日本

- 韓国

- シンガポール

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカの生成AI市場の促進要因

- 中東・アフリカのマクロ経済の見通し

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- イスラエル

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカの生成AI市場の促進要因

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他のラテンアメリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2020年~2024年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 製品の比較

- 製品の比較分析:テキストジェネレーター別

- 製品の比較分析:画像ジェネレーター別

- 製品の比較分析:動画ジェネレーター別

- 製品の比較分析:音声ジェネレーター別

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要企業

- MICROSOFT

- AWS

- ADOBE

- OPENAI

- IBM

- META

- ANTHROPIC

- NVIDIA

- ACCENTURE

- CAPGEMINI

- HPE

- AMD

- ORACLE

- SALESFORCE

- TELUS INTERNATIONAL

- INNODATA

- IMERIT

- DIALPAD

- CENTIFIC

- FRACTAL ANALYTICS

- TIGER ANALYTICS

- QUANTIPHI

- APPEN

- DATABRICKS

- スタートアップ/中小企業

- CURSOR

- DEEPSEEK

- XAI

- ABRIDGE

- PERPLEXITY AI

- SAMBANOVA

- INSILICO MEDICINE

- SIMPLIFIED

- AI21 LABS

- HUGGING FACE

- PERSADO

- SCALE AI

- SNORKEL

- LABELBOX

- HQE SYSTEMS

- LIGHTRICKS

- SPEECHIFY

- MIDJOURNEY

- FIREFLIES

- SYNTHESIA

- MOSTLY AI

- CHARACTER.AI

- HYPOTENUSE AI

- WRITESONIC

- COPY.AI

- SYNTHESIS AI

- COLOSSYAN

- INFLECTION AI

- JASPER

- RUNWAY

- INWORLD AI

- TYPEFACE

- INSTADEEP

- FORETHOUGHT

- TOGETHER AI

- UPSTAGE

- MISTRAL AI

- ADEPT

- STABILITY AI

- COHERE

- オープンソース企業

- APPLE

- LG

- NOUS RESEARCH

- FONTJOY

- ELEUTHERAI

- TECHNOLOGY INNOVATION INSTITUTE

- STARRYAI

- MAGIC STUDIO

- ABACUS.AI

- OPENLM

第13章 隣接市場と関連市場

- イントロダクション

- 大規模言語モデル市場 - 世界の予測(~2030年)

- 市場の定義

- 市場の概要

- AI市場 - 世界の予測(~2032年)

- 市場の定義

- 市場の概要

第14章 付録

List of Tables

- TABLE 1 GENERATIVE AI MARKET DETAILED SEGMENTATION

- TABLE 2 USD EXCHANGE RATE, 2019-2023

- TABLE 3 PRIMARY INTERVIEWS

- TABLE 4 FACTOR ANALYSIS

- TABLE 5 GENERATIVE AI MARKET: RESEARCH ASSUMPTIONS

- TABLE 6 GENERATIVE AI MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 7 GENERATIVE AI MARKET SIZE AND GROWTH RATE, 2025-2032 (USD MILLION, Y-O-Y %)

- TABLE 8 GENERATIVE AI MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 9 GENERATIVE AI MARKET: ECOSYSTEM

- TABLE 10 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 11 TARIFF RELATED TO GEN AI PROCESSORS AND CONTROLLERS (HSN: 854231), 2024

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 PATENTS FILED, 2016-2025

- TABLE 18 LIST OF FEW PATENTS IN GENERATIVE AI MARKET, 2024-2025

- TABLE 19 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- TABLE 20 AVERAGE SELLING PRICE, BY APPLICATION, 2025

- TABLE 21 GENERATIVE AI MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 IMPACT OF PORTER'S FIVE FORCES ON GENERATIVE AI MARKET

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISE END USERS

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE END-USERS

- TABLE 25 GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 26 GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 27 GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 28 GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2025-2032 (USD MILLION)

- TABLE 29 GENERATIVE AI MARKET, BY COMPUTE, 2020-2024 (USD MILLION)

- TABLE 30 GENERATIVE AI MARKET, BY COMPUTE, 2025-2032 (USD MILLION)

- TABLE 31 GRAPHICS PROCESSING UNITS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 GRAPHICS PROCESSING UNITS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 33 CENTRAL PROCESSING UNITS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 CENTRAL PROCESSING UNITS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 35 FIELD-PROGRAMMABLE GATE ARRAYS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 FIELD-PROGRAMMABLE GATE ARRAYS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 37 GENERATIVE AI MARKET, BY MEMORY, 2020-2024 (USD MILLION)

- TABLE 38 GENERATIVE AI MARKET, BY MEMORY 2025-2032 (USD MILLION)

- TABLE 39 DDR: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 DDR: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 41 HBM: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 HBM: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 GENERATIVE AI MARKET, BY NETWORKING HARDWARE, 2020-2024 (USD MILLION)

- TABLE 44 GENERATIVE AI MARKET, BY NETWORKING HARDWARE, 2025-2032 (USD MILLION)

- TABLE 45 GENERATIVE AI MARKET, BY NIC/NETWORK ADAPTER, 2020-2024 (USD MILLION)

- TABLE 46 GENERATIVE AI MARKET, BY NIC/NETWORK ADAPTER, 2025-2032 (USD MILLION)

- TABLE 47 ETHERNET: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 ETHERNET: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 49 INFINIBAND: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 INFINIBAND: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 51 INTERCONNECTS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 INTERCONNECTS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 53 STORAGE: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 STORAGE: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 GENERATIVE AI MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 56 GENERATIVE AI MARKET, BY SOFTWARE, 2025-2032 (USD MILLION)

- TABLE 57 FOUNDATION MODELS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 FOUNDATION MODELS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 59 GENERATIVE AI MARKET, BY MODEL ENABLEMENT & ORCHESTRATION TOOL, 2020-2024 (USD MILLION)

- TABLE 60 GENERATIVE AI MARKET, BY MODEL ENABLEMENT & ORCHESTRATION TOOL, 2025-2032 (USD MILLION)

- TABLE 61 MODEL HOSTING & ACCESS PLATFORMS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 MODEL HOSTING & ACCESS PLATFORMS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 63 LLMOPS & PROMPT ENGINEERING TOOLS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 LLMOPS & PROMPT ENGINEERING TOOLS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 65 MODEL FINE-TUNING TOOLS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 MODEL FINE-TUNING TOOLS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 MODEL MONITORING & EVALUATION TOOLS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 MODEL MONITORING & EVALUATION TOOLS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 69 GOVERNANCE & RISK PLATFORMS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 GOVERNANCE & RISK PLATFORMS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 71 GENERATIVE AI MARKET, BY GEN AI SAAS, 2020-2024 (USD MILLION)

- TABLE 72 GENERATIVE AI MARKET, BY GEN AI SAAS, 2025-2032 (USD MILLION)

- TABLE 73 CODE GENERATORS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 CODE GENERATORS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 75 GENERATIVE DESIGN & PROTOTYPING TOOLS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 GENERATIVE DESIGN & PROTOTYPING TOOLS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 77 SYNTHETIC DATA GENERATORS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 SYNTHETIC DATA GENERATORS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 79 GENERATIVE AI AGENTS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 GENERATIVE AI AGENTS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 81 DOMAIN-SPECIFIC GEN AI TOOLS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 DOMAIN-SPECIFIC GEN AI TOOLS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 83 GENERATIVE AI MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 84 GENERATIVE AI MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 85 GEN AI TRAINING & CONSULTING SERVICES: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 86 GEN AI TRAINING & CONSULTING SERVICES: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 87 MODEL DEVELOPMENT & FINE-TUNING SERVICES: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 MODEL DEVELOPMENT & FINE-TUNING SERVICES: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 89 PROMPT ENGINEERING SERVICES: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 PROMPT ENGINEERING SERVICES: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 91 INTEGRATION & DEPLOYMENT SERVICES: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 INTEGRATION & DEPLOYMENT SERVICES: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 93 SUPPORT & MAINTENANCE SERVICES: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 94 SUPPORT & MAINTENANCE SERVICES: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 95 GEN AI TRAINING DATA SERVICES: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 GEN AI TRAINING DATA SERVICES: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 97 MANAGED GEN AI SERVICES: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 98 MANAGED GEN AI SERVICES: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 99 GENERATIVE AI MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 100 GENERATIVE AI MARKET, BY DATA MODALITY, 2025-2032 (USD MILLION)

- TABLE 101 TEXT: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 102 TEXT: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 103 IMAGE: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 104 IMAGE: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 105 VIDEO: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 106 VIDEO: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 107 AUDIO & SPEECH: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 108 AUDIO & SPEECH: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 109 CODE: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 110 CODE: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 111 MULTIMODAL: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 112 MULTIMODAL: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 113 GENERATIVE AI MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 114 GENERATIVE AI MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 115 APPLICATION: GENERATIVE AI MARKET, BY BUSINESS INTELLIGENCE & VISUALIZATION, 2020-2024 (USD MILLION)

- TABLE 116 APPLICATION: GENERATIVE AI MARKET, BY BUSINESS INTELLIGENCE & VISUALIZATION, 2025-2032 (USD MILLION)

- TABLE 117 SALES INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 118 SALES INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 119 MARKETING INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 120 MARKETING INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 121 HUMAN RESOURCE INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 122 HUMAN RESOURCE INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 123 FINANCE INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 124 FINANCE INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 125 OPERATIONS & SUPPLY CHAIN INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 126 OPERATIONS & SUPPLY CHAIN INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 127 APPLICATION: GENERATIVE AI MARKET, BY CONTENT MANAGEMENT, 2020-2024 (USD MILLION)

- TABLE 128 APPLICATION: GENERATIVE AI MARKET, BY CONTENT MANAGEMENT, 2025-2032 (USD MILLION)

- TABLE 129 CONTENT GENERATION: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 130 CONTENT GENERATION: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 131 CONTENT CURATION, TAGGING, & CATEGORIZATION: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 132 CONTENT CURATION, TAGGING, & CATEGORIZATION: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 133 DIGITAL MARKETING: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 134 DIGITAL MARKETING: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 135 MEDIA EDITING: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 136 MEDIA EDITING: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 137 APPLICATION: GENERATIVE AI MARKET, BY SYNTHETIC DATA MANAGEMENT, 2020-2024 (USD MILLION)

- TABLE 138 APPLICATION: GENERATIVE AI MARKET, BY SYNTHETIC DATA MANAGEMENT, 2025-2032 (USD MILLION)

- TABLE 139 SYNTHETIC DATA AUGMENTATION: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 140 SYNTHETIC DATA AUGMENTATION: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 141 SYNTHETIC DATA TRAINING: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 142 SYNTHETIC DATA TRAINING: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 143 APPLICATION: GENERATIVE AI MARKET, BY SEARCH & DISCOVERY, 2020-2024 (USD MILLION)

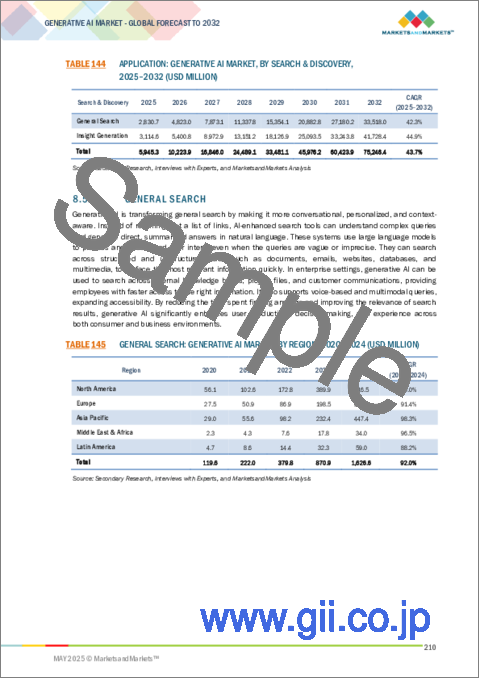

- TABLE 144 APPLICATION: GENERATIVE AI MARKET, BY SEARCH & DISCOVERY, 2025-2032 (USD MILLION)

- TABLE 145 GENERAL SEARCH: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 146 GENERAL SEARCH: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 147 INSIGHT GENERATION: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 148 INSIGHT GENERATION: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 149 APPLICATION: GENERATIVE AI MARKET, BY AUTOMATION & INTEGRATION, 2020-2024 (USD MILLION)

- TABLE 150 APPLICATION: GENERATIVE AI MARKET, BY AUTOMATION & INTEGRATION, 2025-2032 (USD MILLION)

- TABLE 151 PERSONALIZATION & RECOMMENDATION SYSTEMS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 152 PERSONALIZATION & RECOMMENDATION SYSTEMS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 153 CUSTOMER EXPERIENCE MANAGEMENT: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 154 CUSTOMER EXPERIENCE MANAGEMENT: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 155 APPLICATION DEVELOPMENT & API INTEGRATION: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 156 APPLICATION DEVELOPMENT & API INTEGRATION: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 157 CYBERSECURITY INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 158 CYBERSECURITY INTELLIGENCE: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 159 APPLICATION: GENERATIVE AI MARKET, BY GENERATIVE DESIGN AI, 2020-2024 (USD MILLION)

- TABLE 160 APPLICATION: GENERATIVE AI MARKET, BY GENERATIVE DESIGN AI, 2025-2032 (USD MILLION)

- TABLE 161 DESIGN EXPLORATION & VARIATION: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 162 DESIGN EXPLORATION & VARIATION: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 163 MODELING & PROTOTYPING: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 164 MODELING & PROTOTYPING: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 165 PRODUCT RENDERING & VISUAL COLLATERALS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 166 PRODUCT RENDERING & VISUAL COLLATERALS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 167 OTHER APPLICATIONS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 168 OTHER APPLICATIONS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 169 GENERATIVE AI MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 170 GENERATIVE AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 171 CONSUMERS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 172 CONSUMERS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 173 ENTERPRISES: GENERATIVE AI MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 174 ENTERPRISES: GENERATIVE AI MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 175 BFSI: GENERATIVE AI MARKET, BY USE CASE, 2020-2024 (USD MILLION)

- TABLE 176 BFSI: GENERATIVE AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 177 BFSI: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 178 BFSI: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 179 RETAIL & E-COMMERCE: GENERATIVE AI MARKET, BY USE CASE, 2020-2024 (USD MILLION)

- TABLE 180 RETAIL & E-COMMERCE: GENERATIVE AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 181 RETAIL & E-COMMERCE: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 182 RETAIL & E-COMMERCE: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 183 GOVERNMENT & DEFENSE: GENERATIVE AI MARKET, BY USE CASE, 2020-2024 (USD MILLION)

- TABLE 184 GOVERNMENT & DEFENSE: GENERATIVE AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 185 GOVERNMENT & DEFENSE: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 186 GOVERNMENT & DEFENSE: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 187 TELECOMMUNICATIONS: GENERATIVE AI MARKET, BY USE CASE, 2020-2024 (USD MILLION)

- TABLE 188 TELECOMMUNICATIONS: GENERATIVE AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 189 TELECOMMUNICATIONS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 190 TELECOMMUNICATIONS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 191 MEDIA & ENTERTAINMENT: GENERATIVE AI MARKET, BY USE CASE, 2020-2024 (USD MILLION)

- TABLE 192 MEDIA & ENTERTAINMENT: GENERATIVE AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 193 MEDIA & ENTERTAINMENT: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 194 MEDIA & ENTERTAINMENT: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 195 TRANSPORTATION & LOGISTICS: GENERATIVE AI MARKET, BY USE CASE, 2020-2024 (USD MILLION)

- TABLE 196 TRANSPORTATION & LOGISTICS: GENERATIVE AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 197 TRANSPORTATION & LOGISTICS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 198 TRANSPORTATION & LOGISTICS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 199 MANUFACTURING: GENERATIVE AI MARKET, BY USE CASE, 2020-2024 (USD MILLION)

- TABLE 200 MANUFACTURING: GENERATIVE AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 201 MANUFACTURING: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 202 MANUFACTURING: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 203 HEALTHCARE & LIFE SCIENCES: GENERATIVE AI MARKET, BY USE CASE, 2020-2024 (USD MILLION)

- TABLE 204 HEALTHCARE & LIFE SCIENCES: GENERATIVE AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 205 HEALTHCARE & LIFE SCIENCES: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 206 HEALTHCARE & LIFE SCIENCES: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 207 SOFTWARE & TECHNOLOGY PROVIDERS: GENERATIVE AI MARKET, BY USE CASE, 2020-2024 (USD MILLION)

- TABLE 208 SOFTWARE & TECHNOLOGY PROVIDERS: GENERATIVE AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 209 SOFTWARE & TECHNOLOGY PROVIDERS: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 210 SOFTWARE & TECHNOLOGY PROVIDERS: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 211 ENERGY & UTILITIES: GENERATIVE AI MARKET, BY USE CASE, 2020-2024 (USD MILLION)

- TABLE 212 ENERGY & UTILITIES: GENERATIVE AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 213 ENERGY & UTILITIES: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 214 ENERGY & UTILITIES: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 215 OTHER ENTERPRISES: GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 216 OTHER ENTERPRISES: GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 217 GENERATIVE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 218 GENERATIVE AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 219 NORTH AMERICA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 220 NORTH AMERICA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 221 NORTH AMERICA: GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 222 NORTH AMERICA: GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2025-2032 (USD MILLION)

- TABLE 223 NORTH AMERICA: GENERATIVE AI MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 224 NORTH AMERICA: GENERATIVE AI MARKET, BY SOFTWARE, 2025-2032 (USD MILLION)

- TABLE 225 NORTH AMERICA: GENERATIVE AI MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 226 NORTH AMERICA: GENERATIVE AI MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 227 NORTH AMERICA: GENERATIVE AI MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 228 NORTH AMERICA: GENERATIVE AI MARKET, BY DATA MODALITY, 2025-2032 (USD MILLION)

- TABLE 229 NORTH AMERICA: GENERATIVE AI MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 230 NORTH AMERICA: GENERATIVE AI MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 231 NORTH AMERICA: GENERATIVE AI MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 232 NORTH AMERICA: GENERATIVE AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 233 NORTH AMERICA: GENERATIVE AI MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 234 NORTH AMERICA: GENERATIVE AI MARKET, BY ENTERPRISE, 2025-2032 (USD MILLION)

- TABLE 235 NORTH AMERICA: GENERATIVE AI MARKET, BY BFSI, 2020-2024 (USD MILLION)

- TABLE 236 NORTH AMERICA: GENERATIVE AI MARKET, BY BFSI, 2025-2032 (USD MILLION)

- TABLE 237 NORTH AMERICA: GENERATIVE AI MARKET, BY RETAIL & E-COMMERCE, 2020-2024 (USD MILLION)

- TABLE 238 NORTH AMERICA: GENERATIVE AI MARKET, BY RETAIL & E-COMMERCE, 2025-2032 (USD MILLION)

- TABLE 239 NORTH AMERICA: GENERATIVE AI MARKET, BY GOVERNMENT & DEFENSE, 2020-2024 (USD MILLION)

- TABLE 240 NORTH AMERICA: GENERATIVE AI MARKET, BY GOVERNMENT & DEFENSE, 2025-2032 (USD MILLION)

- TABLE 241 NORTH AMERICA: GENERATIVE AI MARKET, BY TELECOMMUNICATION, 2020-2024 (USD MILLION)

- TABLE 242 NORTH AMERICA: GENERATIVE AI MARKET, BY TELECOMMUNICATION, 2025-2032 (USD MILLION)

- TABLE 243 NORTH AMERICA: GENERATIVE AI MARKET, BY MEDIA & ENTERTAINMENT, 2020-2024 (USD MILLION)

- TABLE 244 NORTH AMERICA: GENERATIVE AI MARKET, BY MEDIA & ENTERTAINMENT, 2025-2032 (USD MILLION)

- TABLE 245 NORTH AMERICA: GENERATIVE AI MARKET, BY TRANSPORTATION & LOGISTICS, 2020-2024 (USD MILLION)

- TABLE 246 NORTH AMERICA: GENERATIVE AI MARKET, BY TRANSPORTATION & LOGISTICS, 2025-2032 (USD MILLION)

- TABLE 247 NORTH AMERICA: GENERATIVE AI MARKET, BY MANUFACTURING, 2020-2024 (USD MILLION)

- TABLE 248 NORTH AMERICA: GENERATIVE AI MARKET, BY MANUFACTURING, 2025-2032 (USD MILLION)

- TABLE 249 NORTH AMERICA: GENERATIVE AI MARKET, BY HEALTHCARE & LIFE SCIENCE, 2020-2024 (USD MILLION)

- TABLE 250 NORTH AMERICA: GENERATIVE AI MARKET, BY HEALTHCARE & LIFE SCIENCE, 2025-2032 (USD MILLION)

- TABLE 251 NORTH AMERICA: GENERATIVE AI MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2020-2024 (USD MILLION)

- TABLE 252 NORTH AMERICA: GENERATIVE AI MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2025-2032 (USD MILLION)

- TABLE 253 NORTH AMERICA: GENERATIVE AI MARKET, BY ENERGY & UTILITY, 2020-2024 (USD MILLION)

- TABLE 254 NORTH AMERICA: GENERATIVE AI MARKET, BY ENERGY & UTILITY, 2025-2032 (USD MILLION)

- TABLE 255 NORTH AMERICA: GENERATIVE AI MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 256 NORTH AMERICA: GENERATIVE AI MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 257 US: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 258 US: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 259 CANADA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 260 CANADA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 261 EUROPE: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 262 EUROPE: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 263 EUROPE: GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 264 EUROPE: GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2025-2032 (USD MILLION)

- TABLE 265 EUROPE: GENERATIVE AI MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 266 EUROPE: GENERATIVE AI MARKET, BY SOFTWARE, 2025-2032 (USD MILLION)

- TABLE 267 EUROPE: GENERATIVE AI MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 268 EUROPE: GENERATIVE AI MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 269 EUROPE: GENERATIVE AI MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 270 EUROPE: GENERATIVE AI MARKET, BY DATA MODALITY, 2025-2032 (USD MILLION)

- TABLE 271 EUROPE: GENERATIVE AI MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 272 EUROPE: GENERATIVE AI MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 273 EUROPE: GENERATIVE AI MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 274 EUROPE: GENERATIVE AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 275 EUROPE: GENERATIVE AI MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 276 EUROPE: GENERATIVE AI MARKET, BY ENTERPRISE, 2025-2032 (USD MILLION)

- TABLE 277 EUROPE: GENERATIVE AI MARKET, BY BFSI, 2020-2024 (USD MILLION)

- TABLE 278 EUROPE: GENERATIVE AI MARKET, BY BFSI, 2025-2032 (USD MILLION)

- TABLE 279 EUROPE: GENERATIVE AI MARKET, BY RETAIL & E-COMMERCE, 2020-2024 (USD MILLION)

- TABLE 280 EUROPE: GENERATIVE AI MARKET, BY RETAIL & E-COMMERCE, 2025-2032 (USD MILLION)

- TABLE 281 EUROPE: GENERATIVE AI MARKET, BY GOVERNMENT & DEFENSE, 2020-2024 (USD MILLION)

- TABLE 282 EUROPE: GENERATIVE AI MARKET, BY GOVERNMENT & DEFENSE, 2025-2032 (USD MILLION)

- TABLE 283 EUROPE: GENERATIVE AI MARKET, BY TELECOMMUNICATION, 2020-2024 (USD MILLION)

- TABLE 284 EUROPE: GENERATIVE AI MARKET, BY TELECOMMUNICATION, 2025-2032 (USD MILLION)

- TABLE 285 EUROPE: GENERATIVE AI MARKET, BY MEDIA & ENTERTAINMENT, 2020-2024 (USD MILLION)

- TABLE 286 EUROPE: GENERATIVE AI MARKET, BY MEDIA & ENTERTAINMENT, 2025-2032 (USD MILLION)

- TABLE 287 EUROPE: GENERATIVE AI MARKET, BY TRANSPORTATION & LOGISTICS, 2020-2024 (USD MILLION)

- TABLE 288 EUROPE: GENERATIVE AI MARKET, BY TRANSPORTATION & LOGISTICS, 2025-2032 (USD MILLION)

- TABLE 289 EUROPE: GENERATIVE AI MARKET, BY MANUFACTURING, 2020-2024 (USD MILLION)

- TABLE 290 EUROPE: GENERATIVE AI MARKET, BY MANUFACTURING, 2025-2032 (USD MILLION)

- TABLE 291 EUROPE: GENERATIVE AI MARKET, BY HEALTHCARE & LIFE SCIENCE, 2020-2024 (USD MILLION)

- TABLE 292 EUROPE: GENERATIVE AI MARKET, BY HEALTHCARE & LIFE SCIENCE, 2025-2032 (USD MILLION)

- TABLE 293 EUROPE: GENERATIVE AI MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2020-2024 (USD MILLION)

- TABLE 294 EUROPE: GENERATIVE AI MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2025-2032 (USD MILLION)

- TABLE 295 EUROPE: GENERATIVE AI MARKET, BY ENERGY & UTILITY, 2020-2024 (USD MILLION)

- TABLE 296 EUROPE: GENERATIVE AI MARKET, BY ENERGY & UTILITY, 2025-2032 (USD MILLION)

- TABLE 297 EUROPE: GENERATIVE AI MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 298 EUROPE: GENERATIVE AI MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 299 UK: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 300 UK: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 301 GERMANY: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 302 GERMANY: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 303 FRANCE: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 304 FRANCE: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 305 ITALY: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 306 ITALY: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 307 SPAIN: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 308 SPAIN: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 309 FINLAND: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 310 FINLAND: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 311 REST OF EUROPE: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 312 REST OF EUROPE: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 313 ASIA PACIFIC: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 314 ASIA PACIFIC: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 315 ASIA PACIFIC: GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 316 ASIA PACIFIC: GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2025-2032 (USD MILLION)

- TABLE 317 ASIA PACIFIC: GENERATIVE AI MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 318 ASIA PACIFIC: GENERATIVE AI MARKET, BY SOFTWARE, 2025-2032 (USD MILLION)

- TABLE 319 ASIA PACIFIC: GENERATIVE AI MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 320 ASIA PACIFIC: GENERATIVE AI MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 321 ASIA PACIFIC: GENERATIVE AI MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 322 ASIA PACIFIC: GENERATIVE AI MARKET, BY DATA MODALITY, 2025-2032 (USD MILLION)

- TABLE 323 ASIA PACIFIC: GENERATIVE AI MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 324 ASIA PACIFIC: GENERATIVE AI MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 325 ASIA PACIFIC: GENERATIVE AI MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 326 ASIA PACIFIC: GENERATIVE AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 327 ASIA PACIFIC: GENERATIVE AI MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 328 ASIA PACIFIC: GENERATIVE AI MARKET, BY ENTERPRISE, 2025-2032 (USD MILLION)

- TABLE 329 ASIA PACIFIC: GENERATIVE AI MARKET, BY BFSI, 2020-2024 (USD MILLION)

- TABLE 330 ASIA PACIFIC: GENERATIVE AI MARKET, BY BFSI, 2025-2032 (USD MILLION)

- TABLE 331 ASIA PACIFIC: GENERATIVE AI MARKET, BY RETAIL & E-COMMERCE, 2020-2024 (USD MILLION)

- TABLE 332 ASIA PACIFIC: GENERATIVE AI MARKET, BY RETAIL & E-COMMERCE, 2025-2032 (USD MILLION)

- TABLE 333 ASIA PACIFIC: GENERATIVE AI MARKET, BY GOVERNMENT & DEFENSE, 2020-2024 (USD MILLION)

- TABLE 334 ASIA PACIFIC: GENERATIVE AI MARKET, BY GOVERNMENT & DEFENSE, 2025-2032 (USD MILLION)

- TABLE 335 ASIA PACIFIC: GENERATIVE AI MARKET, BY TELECOMMUNICATION, 2020-2024 (USD MILLION)

- TABLE 336 ASIA PACIFIC: GENERATIVE AI MARKET, BY TELECOMMUNICATION, 2025-2032 (USD MILLION)

- TABLE 337 ASIA PACIFIC: GENERATIVE AI MARKET, BY MEDIA & ENTERTAINMENT, 2020-2024 (USD MILLION)

- TABLE 338 ASIA PACIFIC: GENERATIVE AI MARKET, BY MEDIA & ENTERTAINMENT, 2025-2032 (USD MILLION)

- TABLE 339 ASIA PACIFIC: GENERATIVE AI MARKET, BY TRANSPORTATION & LOGISTICS, 2020-2024 (USD MILLION)

- TABLE 340 ASIA PACIFIC: GENERATIVE AI MARKET, BY TRANSPORTATION & LOGISTICS, 2025-2032 (USD MILLION)

- TABLE 341 ASIA PACIFIC: GENERATIVE AI MARKET, BY MANUFACTURING, 2020-2024 (USD MILLION)

- TABLE 342 ASIA PACIFIC: GENERATIVE AI MARKET, BY MANUFACTURING, 2025-2032 (USD MILLION)

- TABLE 343 ASIA PACIFIC: GENERATIVE AI MARKET, BY HEALTHCARE & LIFE SCIENCE, 2020-2024 (USD MILLION)

- TABLE 344 ASIA PACIFIC: GENERATIVE AI MARKET, BY HEALTHCARE & LIFE SCIENCE, 2025-2032 (USD MILLION)

- TABLE 345 ASIA PACIFIC: GENERATIVE AI MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2020-2024 (USD MILLION)

- TABLE 346 ASIA PACIFIC: GENERATIVE AI MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2025-2032 (USD MILLION)

- TABLE 347 ASIA PACIFIC: GENERATIVE AI MARKET, BY ENERGY & UTILITY, 2020-2024 (USD MILLION)

- TABLE 348 ASIA PACIFIC: GENERATIVE AI MARKET, BY ENERGY & UTILITY, 2025-2032 (USD MILLION)

- TABLE 349 ASIA PACIFIC: GENERATIVE AI MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 350 ASIA PACIFIC: GENERATIVE AI MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 351 CHINA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 352 CHINA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 353 INDIA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 354 INDIA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 355 JAPAN: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 356 JAPAN: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 357 SOUTH KOREA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 358 SOUTH KOREA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 359 SINGAPORE: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 360 SINGAPORE: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 361 AUSTRALIA & NEW ZEALAND: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 362 AUSTRALIA & NEW ZEALAND: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 363 REST OF ASIA PACIFIC: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 364 REST OF ASIA PACIFIC: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 365 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 366 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 367 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 368 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2025-2032 (USD MILLION)

- TABLE 369 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 370 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY SOFTWARE, 2025-2032 (USD MILLION)

- TABLE 371 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 372 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 373 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 374 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY DATA MODALITY, 2025-2032 (USD MILLION)

- TABLE 375 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 376 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 377 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 378 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 379 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 380 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY ENTERPRISE, 2025-2032 (USD MILLION)

- TABLE 381 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY BFSI, 2020-2024 (USD MILLION)

- TABLE 382 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY BFSI, 2025-2032 (USD MILLION)

- TABLE 383 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY RETAIL & E-COMMERCE, 2020-2024 (USD MILLION)

- TABLE 384 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY RETAIL & E-COMMERCE, 2025-2032 (USD MILLION)

- TABLE 385 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY GOVERNMENT & DEFENSE, 2020-2024 (USD MILLION)

- TABLE 386 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY GOVERNMENT & DEFENSE, 2025-2032 (USD MILLION)

- TABLE 387 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY TELECOMMUNICATION, 2020-2024 (USD MILLION)

- TABLE 388 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY TELECOMMUNICATION, 2025-2032 (USD MILLION)

- TABLE 389 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY MEDIA & ENTERTAINMENT, 2020-2024 (USD MILLION)

- TABLE 390 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY MEDIA & ENTERTAINMENT, 2025-2032 (USD MILLION)

- TABLE 391 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY TRANSPORTATION & LOGISTICS, 2020-2024 (USD MILLION)

- TABLE 392 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY TRANSPORTATION & LOGISTICS, 2025-2032 (USD MILLION)

- TABLE 393 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY MANUFACTURING, 2020-2024 (USD MILLION)

- TABLE 394 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY MANUFACTURING, 2025-2032 (USD MILLION)

- TABLE 395 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY HEALTHCARE & LIFE SCIENCE, 2020-2024 (USD MILLION)

- TABLE 396 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY HEALTHCARE & LIFE SCIENCE, 2025-2032 (USD MILLION)

- TABLE 397 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2020-2024 (USD MILLION)

- TABLE 398 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2025-2032 (USD MILLION)

- TABLE 399 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY ENERGY & UTILITY, 2020-2024 (USD MILLION)

- TABLE 400 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY ENERGY & UTILITY, 2025-2032 (USD MILLION)

- TABLE 401 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 402 MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 403 SAUDI ARABIA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 404 SAUDI ARABIA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 405 UAE: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 406 UAE: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 407 SOUTH AFRICA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 408 SOUTH AFRICA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 409 ISRAEL: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 410 ISRAEL: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 411 REST OF MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 412 REST OF MIDDLE EAST & AFRICA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 413 LATIN AMERICA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 414 LATIN AMERICA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 415 LATIN AMERICA: GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 416 LATIN AMERICA: GENERATIVE AI MARKET, BY INFRASTRUCTURE, 2025-2032 (USD MILLION)

- TABLE 417 LATIN AMERICA: GENERATIVE AI MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 418 LATIN AMERICA: GENERATIVE AI MARKET, BY SOFTWARE, 2025-2032 (USD MILLION)

- TABLE 419 LATIN AMERICA: GENERATIVE AI MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 420 LATIN AMERICA: GENERATIVE AI MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 421 LATIN AMERICA: GENERATIVE AI MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 422 LATIN AMERICA: GENERATIVE AI MARKET, BY DATA MODALITY, 2025-2032 (USD MILLION)

- TABLE 423 LATIN AMERICA: GENERATIVE AI MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 424 LATIN AMERICA: GENERATIVE AI MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 425 LATIN AMERICA: GENERATIVE AI MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 426 LATIN AMERICA: GENERATIVE AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 427 LATIN AMERICA: GENERATIVE AI MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 428 LATIN AMERICA: GENERATIVE AI MARKET, BY ENTERPRISE, 2025-2032 (USD MILLION)

- TABLE 429 LATIN AMERICA: GENERATIVE AI MARKET, BY BFSI, 2020-2024 (USD MILLION)

- TABLE 430 LATIN AMERICA: GENERATIVE AI MARKET, BY BFSI, 2025-2032 (USD MILLION)

- TABLE 431 LATIN AMERICA: GENERATIVE AI MARKET, BY RETAIL & E-COMMERCE, 2020-2024 (USD MILLION)

- TABLE 432 LATIN AMERICA: GENERATIVE AI MARKET, BY RETAIL & E-COMMERCE, 2025-2032 (USD MILLION)

- TABLE 433 LATIN AMERICA: GENERATIVE AI MARKET, BY GOVERNMENT & DEFENSE, 2020-2024 (USD MILLION)

- TABLE 434 LATIN AMERICA: GENERATIVE AI MARKET, BY GOVERNMENT & DEFENSE, 2025-2032 (USD MILLION)

- TABLE 435 LATIN AMERICA: GENERATIVE AI MARKET, BY TELECOMMUNICATION, 2020-2024 (USD MILLION)

- TABLE 436 LATIN AMERICA: GENERATIVE AI MARKET, BY TELECOMMUNICATION, 2025-2032 (USD MILLION)

- TABLE 437 LATIN AMERICA: GENERATIVE AI MARKET, BY MEDIA & ENTERTAINMENT, 2020-2024 (USD MILLION)

- TABLE 438 LATIN AMERICA: GENERATIVE AI MARKET, BY MEDIA & ENTERTAINMENT, 2025-2032 (USD MILLION)

- TABLE 439 LATIN AMERICA: GENERATIVE AI MARKET, BY TRANSPORTATION & LOGISTICS, 2020-2024 (USD MILLION)

- TABLE 440 LATIN AMERICA: GENERATIVE AI MARKET, BY TRANSPORTATION & LOGISTICS, 2025-2032 (USD MILLION)

- TABLE 441 LATIN AMERICA: GENERATIVE AI MARKET, BY MANUFACTURING, 2020-2024 (USD MILLION)

- TABLE 442 LATIN AMERICA: GENERATIVE AI MARKET, BY MANUFACTURING, 2025-2032 (USD MILLION)

- TABLE 443 LATIN AMERICA: GENERATIVE AI MARKET, BY HEALTHCARE & LIFE SCIENCE, 2020-2024 (USD MILLION)

- TABLE 444 LATIN AMERICA: GENERATIVE AI MARKET, BY HEALTHCARE & LIFE SCIENCE, 2025-2032 (USD MILLION)

- TABLE 445 LATIN AMERICA: GENERATIVE AI MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2020-2024 (USD MILLION)

- TABLE 446 LATIN AMERICA: GENERATIVE AI MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2025-2032 (USD MILLION)

- TABLE 447 LATIN AMERICA: GENERATIVE AI MARKET, BY ENERGY & UTILITY, 2020-2024 (USD MILLION)

- TABLE 448 LATIN AMERICA: GENERATIVE AI MARKET, BY ENERGY & UTILITY, 2025-2032 (USD MILLION)

- TABLE 449 LATIN AMERICA: GENERATIVE AI MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 450 LATIN AMERICA: GENERATIVE AI MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 451 BRAZIL: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 452 BRAZIL: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 453 MEXICO: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 454 MEXICO: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 455 ARGENTINA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 456 ARGENTINA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 457 REST OF LATIN AMERICA: GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 458 REST OF LATIN AMERICA: GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 459 OVERVIEW OF STRATEGIES ADOPTED BY KEY GENERATIVE AI VENDORS, 2020-2024

- TABLE 460 GENERATIVE AI MARKET: DEGREE OF COMPETITION

- TABLE 461 GENERATIVE AI MARKET: REGION FOOTPRINT

- TABLE 462 GENERATIVE AI MARKET: OFFERING FOOTPRINT

- TABLE 463 GENERATIVE AI MARKET: DATA MODALITY FOOTPRINT

- TABLE 464 GENERATIVE AI MARKET: END USER FOOTPRINT

- TABLE 465 GENERATIVE AI MARKET: KEY STARTUPS/SMES

- TABLE 466 GENERATIVE AI MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 467 GENERATIVE AI MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2023-MAY 2025

- TABLE 468 GENERATIVE AI MARKET: DEALS, JANUARY 2023-MAY 2025

- TABLE 469 MICROSOFT: COMPANY OVERVIEW

- TABLE 470 MICROSOFT: PRODUCTS OFFERED

- TABLE 471 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 472 MICROSOFT: DEALS

- TABLE 473 AWS: COMPANY OVERVIEW

- TABLE 474 AWS: PRODUCTS OFFERED

- TABLE 475 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 476 AWS: DEALS

- TABLE 477 GOOGLE: COMPANY OVERVIEW

- TABLE 478 GOOGLE: PRODUCTS OFFERED

- TABLE 479 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 480 GOOGLE: DEALS

- TABLE 481 ADOBE: COMPANY OVERVIEW

- TABLE 482 ADOBE: PRODUCTS OFFERED

- TABLE 483 ADOBE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 484 ADOBE: DEALS

- TABLE 485 OPENAI: COMPANY OVERVIEW

- TABLE 486 OPENAI: PRODUCTS OFFERED

- TABLE 487 OPENAI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 488 OPENAI: DEALS

- TABLE 489 IBM: COMPANY OVERVIEW

- TABLE 490 IBM: PRODUCTS OFFERED

- TABLE 491 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 492 IBM: DEALS

- TABLE 493 META: COMPANY OVERVIEW

- TABLE 494 META: PRODUCTS OFFERED

- TABLE 495 META: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 496 META: DEALS

- TABLE 497 ANTHROPIC: COMPANY OVERVIEW

- TABLE 498 ANTHROPIC: PRODUCTS OFFERED

- TABLE 499 ANTHROPIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 500 ANTHROPIC: DEALS

- TABLE 501 NVIDIA: COMPANY OVERVIEW

- TABLE 502 NVIDIA: PRODUCTS OFFERED

- TABLE 503 NVIDIA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 504 NVIDIA: DEALS

- TABLE 505 ACCENTURE: COMPANY OVERVIEW

- TABLE 506 ACCENTURE: PRODUCTS OFFERED

- TABLE 507 ACCENTURE: DEALS

- TABLE 508 CAPGEMINI: COMPANY OVERVIEW

- TABLE 509 CAPGEMINI: PRODUCTS OFFERED

- TABLE 510 CAPGEMINI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 511 CAPGEMINI: DEALS

- TABLE 512 HPE: COMPANY OVERVIEW

- TABLE 513 HPE: PRODUCTS OFFERED

- TABLE 514 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 515 HPE: DEALS

- TABLE 516 AMD: COMPANY OVERVIEW

- TABLE 517 AMD: PRODUCTS OFFERED

- TABLE 518 AMD: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 519 AMD: DEALS

- TABLE 520 ORACLE: COMPANY OVERVIEW

- TABLE 521 ORACLE: PRODUCTS OFFERED

- TABLE 522 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 523 ORACLE: DEALS

- TABLE 524 SALESFORCE: COMPANY OVERVIEW

- TABLE 525 SALESFORCE: PRODUCTS OFFERED

- TABLE 526 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 527 SALESFORCE: DEALS

- TABLE 528 TELUS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 529 TELUS INTERNATIONAL: PRODUCTS OFFERED

- TABLE 530 INNODATA: COMPANY OVERVIEW

- TABLE 531 INNODATA: PRODUCTS OFFERED

- TABLE 532 INNODATA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 533 CENTIFIC: COMPANY OVERVIEW

- TABLE 534 CENTIFIC: PRODUCTS OFFERED

- TABLE 535 CENTIFIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 536 CENTIFIC: DEALS

- TABLE 537 HQE SYSTEMS: COMPANY OVERVIEW

- TABLE 538 HQE SYSTEMS: PRODUCTS OFFERED

- TABLE 539 LARGE LANGUAGE MODEL MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 540 LARGE LANGUAGE MODEL MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 541 LARGE LANGUAGE MODEL MARKET, BY ARCHITECTURE, 2020-2023 (USD MILLION)

- TABLE 542 LARGE LANGUAGE MODEL MARKET, BY ARCHITECTURE, 2024-2030 (USD MILLION)

- TABLE 543 LARGE LANGUAGE MODEL MARKET, BY MODALITY, 2020-2023 (USD MILLION)

- TABLE 544 LARGE LANGUAGE MODEL MARKET, BY MODALITY, 2024-2030 (USD MILLION)

- TABLE 545 LARGE LANGUAGE MODEL MARKET, BY MODEL SIZE, 2020-2023 (USD MILLION)

- TABLE 546 LARGE LANGUAGE MODEL MARKET, BY MODEL SIZE, 2024-2030 (USD MILLION)

- TABLE 547 LARGE LANGUAGE MODEL MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 548 LARGE LANGUAGE MODEL MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 549 LARGE LANGUAGE MODEL MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 550 LARGE LANGUAGE MODEL MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 551 LARGE LANGUAGE MODEL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 552 LARGE LANGUAGE MODEL MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 553 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020-2024 (USD BILLION)

- TABLE 554 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025-2032 (USD BILLION)

- TABLE 555 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020-2024 (USD BILLION)

- TABLE 556 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2025-2032 (USD BILLION)

- TABLE 557 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD BILLION)

- TABLE 558 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2025-2032 (USD BILLION)

- TABLE 559 ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE APPLICATION, 2020-2024 (USD BILLION)

- TABLE 560 ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE APPLICATION, 2025-2032 (USD BILLION)

- TABLE 561 ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2024 (USD BILLION)

- TABLE 562 ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2025-2032 (USD BILLION)

- TABLE 563 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 564 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025-2032 (USD BILLION)

List of Figures

- FIGURE 1 GENERATIVE AI MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 GENERATIVE AI MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM SOFTWARE/INFRASTRUCTURE/SERVICES OF GENERATIVE AI MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/INFRASTRUCTURE/SERVICES OF GENERATIVE AI MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/INFRASTRUCTURE/ SERVICES OF GENERATIVE AI MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF GENERATIVE AI THROUGH OVERALL IT SPENDING

- FIGURE 8 GENERATIVE AI MARKET: RESEARCH LIMITATIONS

- FIGURE 9 INFRASTRUCTURE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2025

- FIGURE 10 COMPUTE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 11 GENERATIVE AI SAAS TO BE LARGEST SOFTWARE SEGMENT IN 2025

- FIGURE 12 MODEL DEVELOPMENT & FINE-TUNING SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 13 TEXT SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 14 CONTENT MANAGEMENT SEGMENT TO LEAD MARKET IN 2025

- FIGURE 15 ENTERPRISES SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 16 HEALTHCARE & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO REGISTER FASTEST GROWTH RATE BETWEEN 2024 AND 2030

- FIGURE 18 INCREASING DEMAND FOR FOUNDATION MODELS AND IMPROVING PERFORMANCE OF GEN AI-POWERED SEARCH TO DRIVE MARKET

- FIGURE 19 MULTIMODAL SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 20 INFRASTRUCTURE AND SOFTWARE & TECHNOLOGY PROVIDERS SEGMENTS TO ACCOUNT FOR LARGEST MARKET SHARES IN NORTH AMERICA IN 2025

- FIGURE 21 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 22 GENERATIVE AI MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 EVOLUTION OF GENERATIVE AI

- FIGURE 24 GENERATIVE AI MATURITY CURVE

- FIGURE 25 GENERATIVE AI MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 KEY PLAYERS IN GENERATIVE AI MARKET ECOSYSTEM

- FIGURE 27 GENERATIVE AI EQUITY FUNDING AND DEALS, 2020-2024

- FIGURE 28 GENERATIVE AI EQUITY FUNDING, BY GEN AI STACK, 2020-2024

- FIGURE 29 LARGEST FUNDING ROUNDS IN GENERATIVE AI, 2024 (USD BILLION)

- FIGURE 30 LEADING AI STARTUPS, BY FUNDING VALUE (MILLION) AND FUNDING ROUND, UNTIL 2025

- FIGURE 31 EXPORT OF PROCESSORS AND CONTROLLERS, BY KEY COUNTRY, 2017-2024 (USD BILLION)

- FIGURE 32 IMPORT OF PROCESSORS AND CONTROLLERS, BY KEY COUNTRY, 2017-2024 (USD BILLION)

- FIGURE 33 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2016-2025

- FIGURE 34 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 35 GENERATIVE AI MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISE END USERS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE END USERS

- FIGURE 38 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 39 SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 MULTIMODAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 SYNTHETIC DATA MANAGEMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR THAN CONSUMERS SEGMENT DURING FORECAST PERIOD

- FIGURE 43 HEALTHCARE & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 INDIA TO WITNESS HIGHEST GROWTH RATE IN GENERATIVE AI MARKET DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: GENERATIVE AI MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: GENERATIVE AI MARKET SNAPSHOT

- FIGURE 48 GENERATIVE AI MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 49 SHARE ANALYSIS OF LEADING COMPANIES IN GENERATIVE AI MARKET, 2024

- FIGURE 50 PRODUCT COMPARATIVE ANALYSIS, BY TEXT GENERATOR

- FIGURE 51 PRODUCT COMPARATIVE ANALYSIS, BY IMAGE GENERATOR

- FIGURE 52 PRODUCT COMPARATIVE ANALYSIS, BY VIDEO GENERATOR

- FIGURE 53 PRODUCT COMPARATIVE ANALYSIS, BY AUDIO & SPEECH GENERATOR

- FIGURE 54 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 55 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 56 GENERATIVE AI MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 57 GENERATIVE AI MARKET: COMPANY FOOTPRINT

- FIGURE 58 GENERATIVE AI MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 59 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 60 AWS: COMPANY SNAPSHOT

- FIGURE 61 GOOGLE: COMPANY SNAPSHOT

- FIGURE 62 ADOBE: COMPANY SNAPSHOT

- FIGURE 63 IBM: COMPANY SNAPSHOT

- FIGURE 64 META: COMPANY SNAPSHOT

- FIGURE 65 NVIDIA: COMPANY SNAPSHOT

- FIGURE 66 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 67 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 68 HPE: COMPANY SNAPSHOT

- FIGURE 69 AMD: COMPANY SNAPSHOT

- FIGURE 70 ORACLE: COMPANY SNAPSHOT

- FIGURE 71 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 72 TELUS INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 73 INNODATA: COMPANY SNAPSHOT

The generative AI market is projected to grow from USD 71.36 billion in 2025 to USD 890.59 billion by 2032, at a CAGR of 43.4% during 2025-2032. The market is growing fast, driven by rising enterprise adoption, growing demand for multimodal AI solutions, and increased use of generative AI for automating content creation and other business tasks. Companies across industries are using generative AI to improve efficiency, reduce costs, and deliver better customer experiences. However, there are also some restraints. High infrastructure and computing costs make it harder for smaller businesses to adopt the technology. In addition, issues like AI models generating biased or incorrect content (known as hallucinations) raise concerns about reliability and trust. While the potential is high, vendors must address these restraints to unlock the full value of generative AI.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | USD (Billion) |

| Segments | Offering, Data Modality, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"By end user, healthcare & life sciences segment to register fastest growth rate during forecast period"

The healthcare & life sciences segment within the generative AI market is expected to grow at a high CAGR during the forecast period. This growth is driven by the increasing use of generative AI for drug discovery, medical imaging, patient data analysis, and personalized treatment plans. Generative AI helps accelerate research by creating synthetic data and simulating complex biological processes, reducing time and costs. It also supports healthcare providers by improving diagnostics and automating routine tasks, enhancing patient care. With rising healthcare data and the need for efficient, accurate solutions, generative AI is becoming a vital tool in this industry, creating strong opportunities for vendors and innovators.

"By offering, software segment to account for largest market share by 2032"

The software segment is expected to hold the largest share of the generative AI market by 2032, overtaking gen AI infrastructure. This is because software forms the core of generative AI applications, enabling tasks like text generation, image creation, code generation, and virtual assistance. With the rise of user-friendly platforms, APIs, and pre-trained models, businesses across industries are adopting generative AI software to improve productivity, automate processes, and enhance customer engagement. Cloud-based deployment and easy integration with existing systems are further boosting software adoption. As demand grows for creative and intelligent applications, the software segment will eventually lead the market, offering strong opportunities for vendors and developers.

"By Region, North America to hold largest market share in 2025 and Asia Pacific to register fastest growth rate during forecast period"

North America is estimated to hold the largest share of the generative AI market in 2025. This is mainly due to the strong presence of leading technology companies such as Microsoft, Google, OpenAI, NVIDIA, and AWS, which are continuously advancing generative AI capabilities. The region also benefits from a mature digital infrastructure, high cloud adoption, and strong investments in AI research and innovation. Enterprises across sectors like healthcare, BFSI, retail, and media are increasingly adopting generative AI solutions to automate content creation, enhance customer experiences, and improve operational efficiency. In addition, favorable government support and a large talent pool contribute to early adoption and rapid innovation. In January 2025, the US Government enforced Executive Order 14179, aiming to enhance US leadership in AI by removing certain regulatory barriers and promoting AI development free from ideological bias. Additionally, Microsoft's USD 3.3 billion investment in an AI hub in Wisconsin underscores the region's ongoing commitment to Generative AI advancement.

The generative AI market is expected to register the highest CAGR in the Asia Pacific region during the forecast period. Countries like China, India, Japan, and South Korea are making strong investments in AI development and digital transformation. Growing demand for AI-driven automation in industries such as manufacturing, healthcare, and e-commerce is driving rapid adoption. Governments in the region are also introducing supportive policies and funding initiatives to boost AI research and adoption. Moreover, the rise of local tech startups and increased awareness among enterprises about the benefits of generative AI are creating new business opportunities. As digitalization spreads across both developed and developing countries in Asia Pacific, the region is set to become a key driver of generative AI growth globally.

Breakdown of Primaries

In-depth interviews were conducted with chief executive officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the generative AI market.

- By Company: Tier I - 22%, Tier II - 31%, and Tier III - 47%

- By Designation: C-Level Executives - 31%, D-Level Executives - 46%, and others - 23%

- By Region: North America - 40%, Europe - 18%, Asia Pacific - 29%, Middle East & Africa - 5%, and Latin America - 8%

The report includes a study of key players offering generative AI solutions. It profiles major vendors in the generative AI market. The major players in the generative AI market include IBM (US), NVIDIA (US), OpenAI (US), Anthropic (US), Meta (US), HPE (US), AMD (US), Oracle (US), Innodata (US), iMerit (US), Salesforce (US), Telus Digital (US), Microsoft (US), Google (US), AWS (US), Adobe (US), Accenture (Ireland), Capgemini (France), Centific (US), Fractal Analytics (US), Tiger Analytics (US), Quantiphi (US), Databricks (US), Dialpad (US), Appen (Australia), Insilico Medicine (Hong Kong), Simplified (US), AI21 Labs (Israel), Hugging Face (US), Persado (US), Copy.ai (US), Synthesis AI (US), Hypotenuse AI (US), Together AI (US), Mistral AI (France), Adept (US), Stability AI (UK), Lightricks (Israel), Cohere (Canada), Writesonic (US), Inflection AI (US), Colossyan (UK), Jasper (US), Runway (US), Inworld AI (US), Typeface (US), Upstage (South Korea), H2O.ai (US), Speechify (US), Midjourney (US), Fireflies (US), Synthesia (UK), Mostly AI (Austria), Forethought (US), Character.ai (US), Cursor (US), DeepSeek (China), XAI (US), Abridge (US), Perplexity AI (US), SambaNova (US), Scale AI (US), Labelbox (US), and HQE Systems (US).

Research Coverage

This research report categorizes the generative AI market by Offering (Infrastructure, Software, and Services), Data Modality (Text, Image, Video, Audio & Speech, and Multimodal), Application (Business Intelligence & Visualization, Content Management, Synthetic Data Management, Search & Discovery, Automation & Integration, and Other Applications), End User (Consumers and Enterprises [BFSI, Retail & E-commerce, Transportation & Logistics, Government & Defense, Healthcare & Life Sciences, Telecommunication, Energy & Utilities, Manufacturing, Software & Technology Providers, Media & Entertainment, and Other Enterprises]), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the generative AI market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, and mergers & acquisitions; and recent developments associated with the generative AI market. This report covers a competitive analysis of upcoming startups in the generative AI market ecosystem.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall generative AI market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Innovation of cloud storage to enable easy access to data, Evolution of AI and deep learning, Rise in content creation and creative applications), restraints (High costs associated with training data preparation, Issues related to bias and inaccurately generated output, Risks associated with data breaches and sensitive information leakage), opportunities (Increase in deployment of large language models, Growth in interest of enterprises in commercializing synthetic images, Robust improvement in generative ML leading to human baseline performance), and challenges (Concerns regarding misuse of generative AI for illegal activities, Quality of output generated by generative AI models, Computational complexity and technical challenges of generative AI).

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the generative AI market.

Market Development: Comprehensive information about lucrative markets - the report analyses the generative AI market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the generative AI market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like IBM (US), NVIDIA (US), OpenAI (US), Anthropic (US), Meta (US), HPE (US), AMD (US), Oracle (US), Innodata (US), iMerit (US), Salesforce (US), Telus Digital (US), Microsoft (US), Google (US), AWS (US), Adobe (US), Accenture (Ireland), Capgemini (France), Centific (US), Fractal Analytics (US), Tiger Analytics (US), Quantiphi (US), Databricks (US), Dialpad (US), Appen (Australia), Insilico Medicine (Hong Kong), Simplified (US), AI21 Labs (Israel), Hugging Face (US), Persado (US), Copy.ai (US), Synthesis AI (US), Hypotenuse AI (US), Together AI (US), Mistral AI (France), Adept (US), Stability AI (UK), Lightricks (Israel), Cohere (Canada), Writesonic (US), Inflection AI (US), Colossyan (UK), Jasper (US), Runway (US), Inworld AI (US), Typeface (US), Upstage (South Korea), H2O.ai (US), Speechify (US), Midjourney (US), Fireflies (US), Synthesia (UK), Mostly AI (Austria), Forethought (US), Character.ai (US), Cursor (US), DeepSeek (China), XAI (US), Abridge (US), Perplexity AI (US), SambaNova (US), Scale AI (US), Labelbox (US), and HQE Systems (US), among others, in the generative AI market. The report also helps stakeholders understand the pulse of the generative AI market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GENERATIVE AI MARKET

- 4.2 GENERATIVE AI MARKET: TOP THREE DATA MODALITIES

- 4.3 NORTH AMERICA: GENERATIVE AI MARKET, BY OFFERING AND END USER

- 4.4 GENERATIVE AI MARKET: BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Innovation of cloud storage to enable easy data access

- 5.2.1.2 Evolution of AI and deep learning

- 5.2.1.3 Rise in content creation and creative applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs associated with training data preparation

- 5.2.2.2 Issues related to bias and inaccurately generated output

- 5.2.2.3 Risks associated with data breaches and sensitive information leakage

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing deployment of large language models

- 5.2.3.2 Growing interest of enterprises in commercializing synthetic images

- 5.2.3.3 Robust improvement in generative AI models leading to human baseline performance

- 5.2.4 CHALLENGES

- 5.2.4.1 Use of generative AI for illegal activities

- 5.2.4.2 Quality of output generated by generative AI models

- 5.2.4.3 Computational complexity and technical challenges of generative AI

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF GENERATIVE AI

- 5.4 GENERATIVE AI MATURITY CURVE

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 GENERATIVE AI INFRASTRUCTURE PROVIDERS

- 5.6.2 GENERATIVE AI SOFTWARE PROVIDERS

- 5.6.3 GENERATIVE AI SERVICE PROVIDERS

- 5.7 IMPACT OF 2025 US TARIFF - GENERATIVE AI MARKET

- 5.7.1 INTRODUCTION

- 5.7.2 KEY TARIFF RATES

- 5.7.3 PRICE IMPACT ANALYSIS

- 5.7.3.1 Strategic shifts and emerging trends

- 5.7.4 IMPACT ON COUNTRY/REGION

- 5.7.4.1 US

- 5.7.4.2 China

- 5.7.4.3 Europe

- 5.7.4.4 Asia Pacific (excluding China)

- 5.7.5 IMPACT ON END-USE INDUSTRIES

- 5.7.5.1 BFSI

- 5.7.5.2 Telecommunications

- 5.7.5.3 Government & Public Sector

- 5.7.5.4 Healthcare & Life Sciences

- 5.7.5.5 Manufacturing

- 5.7.5.6 Media & Entertainment

- 5.7.5.7 Retail & E-commerce

- 5.7.5.8 Software & Technology Providers

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 FORTUNE ANALYTICS - AI-DRIVEN BUSINESS INSIGHTS THROUGH ACCENTURE TECHNOLOGY

- 5.9.2 VODAFONE GROUP PLC UNCOVERED KEY TRENDS AND RICH INSIGHTS THROUGH PERSADO'S MOTIVATION AI

- 5.9.3 WPP PARTNERED WITH SYNTHESIA - TRAINED 50,000 EMPLOYEES WITH AI VIDEOS

- 5.9.4 OPPLUS & INBENTA - AI-DRIVEN CUSTOMER SERVICE TRANSFORMATION FOR BBVA

- 5.9.5 CISCO SCALED VIDEO CONTENT LOCALIZATION USING LUMEN5

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Foundation models

- 5.10.1.2 Transformer architectures

- 5.10.1.3 Diffusion models

- 5.10.1.4 Generative adversarial networks (GANs)

- 5.10.1.5 Reinforcement learning with human feedback (RLHF)

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 High-performance computing (HPC)

- 5.10.2.2 Vector databases

- 5.10.2.3 Retrieval-augmented generation (RAG)

- 5.10.2.4 MLOps & LLMOps

- 5.10.2.5 Model monitoring & governance

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Natural language processing (NLP)

- 5.10.3.2 Computer vision

- 5.10.3.3 Causal AI

- 5.10.3.4 Knowledge graphs

- 5.10.3.5 Speech recognition & synthesis

- 5.10.1 KEY TECHNOLOGIES

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 TARIFF RELATED TO PROCESSORS AND CONTROLLERS (HSN: 854231)

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.3 REGULATIONS

- 5.11.3.1 North America

- 5.11.3.1.1 SCR 17: Artificial Intelligence Bill (California)

- 5.11.3.1.2 S1103: Artificial Intelligence Automated Decision Bill (Connecticut)

- 5.11.3.1.3 National Artificial Intelligence Initiative Act (NAIIA) (US)

- 5.11.3.1.4 Artificial Intelligence and Data Act (AIDA) (Canada)

- 5.11.3.2 Europe

- 5.11.3.2.1 European Union (EU) - Artificial Intelligence Act (AIA)

- 5.11.3.2.2 General Data Protection Regulation (Europe)

- 5.11.3.3 Asia Pacific

- 5.11.3.3.1 Interim Administrative Measures for Generative Artificial Intelligence Services (China)

- 5.11.3.3.2 National AI Strategy (Singapore)

- 5.11.3.3.3 Hiroshima AI Process Comprehensive Policy Framework (Japan)

- 5.11.3.4 Middle East & Africa

- 5.11.3.4.1 National Strategy for Artificial Intelligence (UAE)

- 5.11.3.4.2 National Artificial Intelligence Strategy (Qatar)

- 5.11.3.4.3 AI Ethics Principles and Guidelines (Dubai)

- 5.11.3.5 Latin America

- 5.11.3.5.1 Santiago Declaration (Chile)

- 5.11.3.5.2 Brazilian Artificial Intelligence Strategy (EBIA)

- 5.11.3.1 North America

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO OF PROCESSORS AND CONTROLLERS