|

|

市場調査レポート

商品コード

1257583

電気泳動の世界市場:製品別 (試薬 (タンパク質・核酸)、ゲル電気泳動 (1D・2D)、キャピラリー電気泳動 (CZE・CGE)、GDS、ソフトウェア)・用途別 (研究、診断)・エンドユーザー別 (病院)・地域別の将来予測 (2028年まで)Electrophoresis Market by Product (Reagents (Protein & Nucleic Acid), (Gel Electrophoresis (1D & 2D), Capillary Electrophoresis (CZE, CGE), GDS, Software), Application (Research, Diagnostics), End User (Hospitals) & Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 電気泳動の世界市場:製品別 (試薬 (タンパク質・核酸)、ゲル電気泳動 (1D・2D)、キャピラリー電気泳動 (CZE・CGE)、GDS、ソフトウェア)・用途別 (研究、診断)・エンドユーザー別 (病院)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年04月06日

発行: MarketsandMarkets

ページ情報: 英文 282 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の電気泳動市場は、2023年の31億米ドルから、2028年には41億米ドルに達すると予測され、予測期間中のCAGRは5.7%となります。

この市場の成長は、がん・感染症・遺伝性疾患の発生率の上昇、植物由来からゲノムベースの創薬へのシフトが主な要因です。しかし、時間のかかる操作や限られたサンプルの分析が電気泳動市場の成長を抑制します。

"種類別の市場シェアでは、予測期間中、ゲル電気泳動分野が最も高いシェアを占める"

電気泳動装置市場は、セグメントの種類に基づき、ゲル電気泳動装置とキャピラリー電気泳動装置に分類されます。ゲル電気泳動装置は、予測期間中に高い市場シェアを獲得すると予想されます。これは、研究者、教育機関、製薬・バイオテクノロジー企業において、自動電気泳動装置の導入が進んでいることなどが要因として挙げられます。

"縦型ゲル電気泳動装置は、予測期間中に最も高いCAGRとなる"

ゲル電気泳動装置市場を種類別に見ると、横型ゲル電気泳動装置と縦型ゲル電気泳動装置に区分されます。2022年には、横型ゲル電気泳動装置が市場を独占し、縦型ゲル電気泳動装置が最も高い成長率を観察することになります。縦型ゲル電気泳動装置の成長を支える要因として、横型装置よりも大きなサンプルサイズに対応できることが挙げられ、そのため、タンパク質研究において大きなサンプルを分析するためにますます使用されるようになっています。

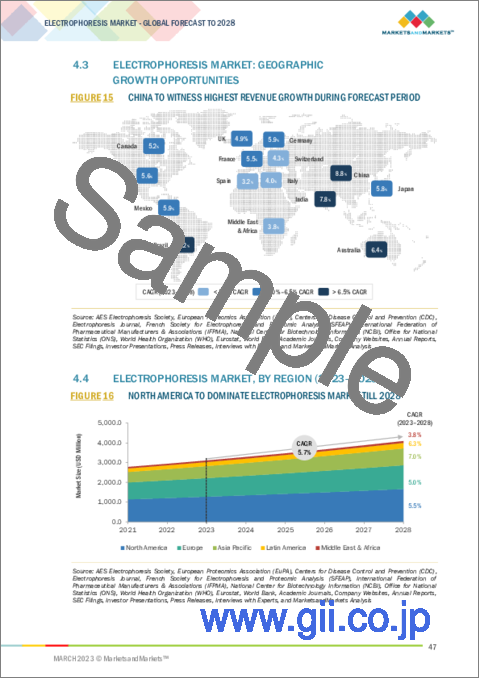

"予測期間中、電気泳動装置市場の地域別シェアは、北米セグメントが最も高くなる"

地域別に見ると、北米が予測期間中に高い市場シェアを占めると予想されています。米国の製薬業界における品質モニタリングやプロセスバリデーションに関する厳しい規制も、電気泳動市場の成長を後押ししています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界考察

- イントロダクション

- 業界動向

- 価格分析

- CE-MS装置

- バリューチェーン分析

第7章 電気泳動市場:製品別

- イントロダクション

- 電気泳動用試薬

- タンパク質電気泳動試薬

- 核酸電気泳動試薬

- 電気泳動装置

- ゲル電気泳動装置

- キャピラリー電気泳動装置

- GDS (ゲル撮影装置)

- ソフトウェア

第8章 電気泳動市場:用途別

- イントロダクション

- 研究用途

- 診断用途

- 品質管理・プロセス検証

第9章 電気泳動市場:エンドユーザー別

- イントロダクション

- 教育・研究機関

- 製薬・バイオテクノロジー企業

- 病院・診断センター

- その他のエンドユーザー

第10章 電気泳動市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スイス

- スペイン

- その他欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 上位企業の収益シェア分析

- 市場シェア分析

- 競合リーダーシップマッピング

- 中小企業/スタートアップ向けの企業評価クアドラント

- 企業のフットプリント分析

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- BIO-RAD LABORATORIES, INC.

- THERMO FISHER SCIENTIFIC INC.

- DANAHER CORPORATION

- AGILENT TECHNOLOGIES, INC.

- MERCK KGAA

- PERKINELMER, INC.

- QIAGEN N.V.

- LONZA

- SHIMADZU CORPORATION

- HOEFER INC.

- SEBIA

- TAKARA BIO INC.

- C.B.S. SCIENTIFIC

- HELENA LABORATORIES CORPORATION

- その他の企業

- SYNGENE

- VWR INTERNATIONAL, LLC (AVANTOR)

- TBG DIAGNOSTICS LIMITED

- ANALYTIK JENA GMBH

- OPRL BIOSCIENCES PVT., LTD.

- KANEKA EUROGENTEC S.A.

- CLEAVER SCIENTIFIC LTD.

- MAJOR SCIENCE CO., LTD.

- BIO WORLD

- NATIONAL ANALYTICAL CORPORATION

- AES LIFE SCIENCES

第13章 付録

The global electrophoresis market is projected to reach USD 4.1 Billion by 2028 from USD 3.1 Billion in 2023, at a CAGR of 5.7% during the forecast period. The growth of this market is majorly driven by the growth in the increasing incidence of cancer, infectious disease, and genetic disorders, and shift from plant-based to genome-based drug discovery. However, time consuming operations and limited sample analysis to restrain the growth of electrophoresis market.

"The gel electrophoresis segment accounted for the highest market share in the electrophoresis systems market, by type, during the forecast period"

Based on the type of segment, the electrophoresis system market is categorized into gel electrophoresis systems, and capillary electrophoresis systems. The gel electrophoresis system is expected to witness a high market share during the forecast period. This can be attributed to factors such as the growing uptake of automated electrophoresis systems among researchers, academic institutions, and pharmaceutical & biotechnology companies.

"Vertical gel electrophoresis systems accounted for the highest CAGR during the forecast period"

Based on type, the gel electrophoresis systens market is segmented into horizontal gel electrophoresis systems and vertical gel electrophoresis systems. In 2022, the horizontal gel electrophoresis system dominated the market and vertical gel electrophoresis systems to observe the highest growth rate. Factors supporting the growth of vertical gel electrophoresis systems include accommodating larger sample sizes than horizontal instruments, owing to which they are increasingly used in analyzing large samples in protein studies.

"The North America segment accounted for the highest market share in the electrophoresis systems market, by region, during the forecast period"

Based on the region, the global electrophoresis market is categorized into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. North America is expected to witness high market share during the forecast period. Stringent regulations for quality monitoring and process validation in the US pharmaceutical sector are also supporting the growth of the electrophoresis market.

Breakdown of supply-side primary interviews, by company type, designation, and region:

- By Company Type: Tier 1 (30%), Tier 2 (45%), and Tier 3 (25%)

- By Designation: C-level (20%), Director-level (20%), and Others (45%)

- By Region: North America (40%), Asia- Pacific (30%), Europe (20%), Latin America (7%) and Middle East & Africa(3%)

Prominent companies include Bio-Rad Laboratories, Inc. (US), Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Merck KGaA (Germany), Agilent Technologies, Inc. (US), PerkinElmer Inc. Inc. (US), QIAGEN N.V. (Netherlands), Lonza (Switzerland), Shimadzu Corporation (Japan), HOEFER INC.(US), Sebia Group (UK), Takara Bio Inc.(US), C.B.S. Scientific (US), 4Basebio PLC. (Germany), Helena Laboratories Corporation (US), Syngene (UK), VWR International (US), TBG Diagnostics Ltd. (Australia), Analytik Jena GMBH (Germany), Oprl Biosciences PVT.LTD. (India), Kaneka Eurogentec S.A. (Germany), Cleaver Scientific Ltd. (UK), Major Science Co., Ltd. (Taiwan), Bio World (India), National Analytical Corporation (India) and AES life sciences (Canada)

Research Coverage

This research report categorizes the electrophoresis market by product (electrophoresis reagents, electrophoresis systems, gel documentation systems and software), by application (research application, diagnostic applications, and quality control & process validation), by end user (academic & research institutes, pharmaceutical & biotechnology companies, hospitals & diagnostic centers and other end users), and region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the electrophoresis market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the electrophoresis market. Competitive analysis of upcoming startups in the electrophoresis market ecosystem is covered in this report.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall electrophoresis market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising funding for proteomics and genomics research, growing industry-academia research collaborations, growing use of NGS and decliening cost of DNA sequencing, increasing number of clinical, forensic, and research labs, rising incidence of cancer, infectious diseases, and genetic disorders, and growing prominence of nanoproteomics), restraints (presence of alternative technologies offering better efficiency and results, and time-consuming operations and limited sample analysis), opportunities (high growth opportunities in developing countries, increasing demand for personalized medicines, and shift from plant-based to genome-based drug discovery), and challenges (safety concerns associated with electrophoresis reagents, and need for high procedural efficiency to ensure accurate results) influencing the growth of the electrophoresis market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the electrophoresis market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the electrophoresis market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the electrophoresis market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Bio-Rad Laboratories, Inc. (US), Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Merck KGaA (Germany), Agilent Technologies, Inc. (US), among others in the electrophoresis market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKETS COVERED

- FIGURE 1 ELECTROPHORESIS MARKET

- 1.2.3 GEOGRAPHIC SCOPE

- 1.2.4 YEARS CONSIDERED

- 1.3 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.6 RESEARCH LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.1 GROWTH FORECAST

- FIGURE 6 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- FIGURE 7 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT

- 2.7 IMPACT OF RECESSION: ELECTROPHORESIS MARKET

3 EXECUTIVE SUMMARY

- FIGURE 9 ELECTROPHORESIS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 ELECTROPHORESIS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 ELECTROPHORESIS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 GEOGRAPHIC ANALYSIS OF ELECTROPHORESIS MARKET

4 PREMIUM INSIGHTS

- 4.1 ELECTROPHORESIS MARKET OVERVIEW

- FIGURE 13 INCREASING RESEARCH IN LIFE SCIENCES INDUSTRY TO DRIVE MARKET

- 4.2 EUROPE: CAPILLARY ELECTROPHORESIS SYSTEMS MARKET, BY TYPE

- FIGURE 14 CAPILLARY ZONE ELECTROPHORESIS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF EUROPEAN CAPILLARY ELECTROPHORESIS MARKET IN 2023

- 4.3 ELECTROPHORESIS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 15 CHINA TO WITNESS HIGHEST REVENUE GROWTH DURING FORECAST PERIOD

- 4.4 ELECTROPHORESIS MARKET, BY REGION (2023-2028)

- FIGURE 16 NORTH AMERICA TO DOMINATE ELECTROPHORESIS MARKET TILL 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 ELECTROPHORESIS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising funding for proteomics and genomics research

- 5.2.1.2 Growing industry-academia research collaborations

- 5.2.1.3 Growing use of NGS and declining cost of DNA sequencing

- FIGURE 18 REDUCTION IN COST OF DNA SEQUENCING PER RAW MEGABASE, 2016-2021 (USD)

- 5.2.1.4 Increasing number of clinical, forensic, and research labs

- 5.2.1.5 Rising incidence of cancer, infectious diseases, and genetic disorders

- TABLE 2 INCREASING INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (IN MILLION)

- 5.2.1.6 Growing prominence of nanoproteomics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Presence of alternative technologies offering better efficiency and results

- 5.2.2.2 Time-consuming operations and limited sample analysis

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth opportunities in developing countries

- 5.2.3.2 Increasing demand for personalized medicines

- FIGURE 19 PERSONALIZED MEDICINES ACCOUNTED FOR MORE THAN 25% OF FDA APPROVALS FOR LAST SEVEN YEARS

- 5.2.3.3 Shift from plant-based to genome-based drug discovery

- 5.2.4 CHALLENGES

- 5.2.4.1 Safety concerns associated with electrophoresis reagents

- 5.2.4.2 Need for high procedural efficiency to ensure accurate results

6 INDUSTRY INSIGHTS

- 6.1 INTRODUCTION

- 6.2 INDUSTRY TRENDS

- 6.2.1 INTEGRATION OF MICROFLUIDIC/LAB-ON-CHIP TECHNOLOGIES IN CAPILLARY ELECTROPHORESIS

- 6.2.2 NANOMATERIAL-BASED CAPILLARY ELECTROPHORESIS

- 6.2.3 TRANSITION FROM MANUAL ELECTROPHORESIS SYSTEMS TO AUTOMATED ELECTROPHORESIS SYSTEMS

- 6.3 PRICING ANALYSIS

- TABLE 3 PRICE RANGE FOR ELECTROPHORESIS MARKET

- 6.4 CE-MS SYSTEMS

- 6.5 VALUE CHAIN ANALYSIS

- FIGURE 20 ELECTROPHORESIS MARKET: VALUE CHAIN ANALYSIS

7 ELECTROPHORESIS MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- TABLE 4 ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 7.2 ELECTROPHORESIS REAGENTS

- TABLE 5 ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 6 ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.1 PROTEIN ELECTROPHORESIS REAGENTS

- 7.2.1.1 Increased use of electrophoresis techniques for protein-based research to propel market

- TABLE 7 PROTEIN ELECTROPHORESIS REAGENTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2 NUCLEIC ACID ELECTROPHORESIS REAGENTS

- 7.2.2.1 Growing focus on DNA and RNA analyses to augment market

- TABLE 8 NUCLEIC ACID ELECTROPHORESIS REAGENTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3 ELECTROPHORESIS SYSTEMS

- TABLE 9 ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 10 ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY REGION, 2021-2028 (USD MILLION)

- 7.3.1 GEL ELECTROPHORESIS SYSTEMS

- TABLE 11 GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.1.1 Gel electrophoresis systems, by instrument type

- TABLE 12 GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- 7.3.1.2 Horizontal gel electrophoresis systems

- 7.3.1.2.1 Horizontal gel electrophoresis systems to account for larger market share during forecast period

- 7.3.1.2 Horizontal gel electrophoresis systems

- TABLE 13 HORIZONTAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.1.3 Vertical gel electrophoresis systems

- TABLE 14 VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 15 VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.1.3.1 1D gel electrophoresis systems

- 7.3.1.3.1.1 High accuracy of 1D gel electrophoresis systems to drive demand

- 7.3.1.3.1 1D gel electrophoresis systems

- TABLE 16 1D GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.1.3.2 2D gel electrophoresis systems

- 7.3.1.3.2.1 2D gel electrophoresis to provide best high-resolution profiling of low-abundance proteins

- 7.3.1.3.2 2D gel electrophoresis systems

- TABLE 17 2D GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.1.4 Gel electrophoresis systems, by gel type

- TABLE 18 GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- 7.3.1.5 Polyacrylamide gel electrophoresis

- 7.3.1.5.1 Difficulty in preparation, handling, and detection of DNA to hinder market

- 7.3.1.5 Polyacrylamide gel electrophoresis

- TABLE 19 GEL CONCENTRATIONS FOR SIZE SEPARATION

- TABLE 20 POLYACRYLAMIDE GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.1.6 Agarose gel electrophoresis

- 7.3.1.6.1 Agarose gel electrophoresis to be widely used for separation of DNA and RNA samples

- 7.3.1.6 Agarose gel electrophoresis

- TABLE 21 AGAROSE GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2 CAPILLARY ELECTROPHORESIS SYSTEMS

- TABLE 22 CAPILLARY ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 23 CAPILLARY ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2.1 Capillary zone electrophoresis systems

- 7.3.2.1.1 Capillary zone electrophoresis systems to be adopted for identifying and verifying purity of human growth hormone

- 7.3.2.1 Capillary zone electrophoresis systems

- TABLE 24 CAPILLARY ZONE ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2.2 Capillary gel electrophoresis systems

- 7.3.2.2.1 Capillary gel electrophoresis systems to separate large biological molecules based on their size

- 7.3.2.2 Capillary gel electrophoresis systems

- TABLE 25 CAPILLARY GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2.3 Capillary isoelectric focusing systems

- 7.3.2.3.1 Higher detectivity and lesser analysis time to result in high demand from pharmaceutical and biotechnology companies

- 7.3.2.3 Capillary isoelectric focusing systems

- TABLE 26 CAPILLARY ISOELECTRIC FOCUSING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2.4 Micellar electrokinetic capillary chromatography systems

- 7.3.2.4.1 Micellar electrokinetic capillary chromatography systems to determine drugs with high protein content

- 7.3.2.4 Micellar electrokinetic capillary chromatography systems

- TABLE 27 MICELLAR ELECTROKINETIC CAPILLARY CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2.5 Capillary isotachophoresis systems

- 7.3.2.5.1 Capillary isotachophoresis to be widely used in proteomic studies and preclinical research

- 7.3.2.5 Capillary isotachophoresis systems

- TABLE 28 CAPILLARY ISOTACHOPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2.6 Capillary electrochromatography systems

- 7.3.2.6.1 High efficiency, resolution, and selectivity of electrochromatography systems to aid market

- 7.3.2.6 Capillary electrochromatography systems

- TABLE 29 CAPILLARY ELECTROCHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2.7 Other capillary electrophoresis systems

- TABLE 30 OTHER CAPILLARY ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.4 GEL DOCUMENTATION SYSTEMS

- 7.4.1 GROWING CLINICAL RESEARCH INDUSTRY AND INCREASING USE OF MOLECULAR BIOLOGY TECHNIQUES IN PATHOLOGY LABORATORY PRACTICES TO PROPEL MARKET

- TABLE 31 ELECTROPHORESIS MARKET FOR GEL DOCUMENTATION SYSTEMS, BY REGION, 2021-2028 (USD MILLION)

- 7.5 SOFTWARE

- 7.5.1 INCREASING USE OF SOFTWARE SOLUTIONS TO ANALYZE DATA AND DRAW CONCLUSIONS FROM ELECTROPHORESIS APPLICATIONS TO FUEL MARKET

- TABLE 32 ELECTROPHORESIS MARKET FOR SOFTWARE, BY REGION, 2021-2028 (USD MILLION)

8 ELECTROPHORESIS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 33 ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2 RESEARCH APPLICATIONS

- 8.2.1 TECHNOLOGICAL IMPROVEMENTS IN CAPILLARY ELECTROPHORESIS TO PROPEL MARKET

- TABLE 34 ELECTROPHORESIS MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 8.3 DIAGNOSTIC APPLICATIONS

- 8.3.1 INCREASED USE OF CE MICROCHIP-BASED DIAGNOSTICS TO AID MARKET

- TABLE 35 ELECTROPHORESIS MARKET FOR DIAGNOSTIC APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 8.4 QUALITY CONTROL & PROCESS VALIDATION

- 8.4.1 INCREASING FOCUS ON REGULATORY COMPLIANCE TO INCREASE ADOPTION OF ELECTROPHORETIC TECHNIQUES IN QUALITY CHECKS

- TABLE 36 ELECTROPHORESIS MARKET FOR QUALITY CONTROL & PROCESS VALIDATION, BY REGION, 2021-2028 (USD MILLION)

9 ELECTROPHORESIS MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 37 ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 ACADEMIC & RESEARCH INSTITUTES

- 9.2.1 INCREASED FUNDING FOR RESEARCH TO RESULT IN HIGH ADOPTION OF ELECTROPHORESIS TECHNOLOGY

- TABLE 38 ELECTROPHORESIS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2021-2028 (USD MILLION)

- 9.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 9.3.1 INCREASING FOCUS ON LAUNCHING QUALITY DRUGS TO SUPPORT MARKET

- FIGURE 21 FDA APPROVALS FOR PERSONALIZED MEDICINES (2015-2021)

- TABLE 39 ELECTROPHORESIS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- 9.4 HOSPITALS & DIAGNOSTIC CENTERS

- 9.4.1 SERUM PROTEIN ELECTROPHORESIS IN HOSPITALS AND DIAGNOSTIC CENTERS TO HELP IDENTIFY DIFFERENT DISEASES

- TABLE 40 ELECTROPHORESIS MARKET FOR HOSPITALS & DIAGNOSTIC CENTERS, BY REGION, 2021-2028 (USD MILLION)

- 9.5 OTHER END USERS

- TABLE 41 ELECTROPHORESIS MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

10 ELECTROPHORESIS MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 42 ELECTROPHORESIS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 22 NORTH AMERICA: ELECTROPHORESIS MARKET SNAPSHOT

- 10.2.1 NORTH AMERICA: IMPACT OF RECESSION

- TABLE 43 NORTH AMERICA: ELECTROPHORESIS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 US to dominate North American electrophoresis market during forecast period

- TABLE 53 US: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 54 US: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 55 US: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 56 US: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 57 US: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 58 US: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 59 US: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 60 US: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 61 US: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Strong infrastructure and availability of funding for biomedical research to support market

- TABLE 62 CANADA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 63 CANADA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 64 CANADA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 65 CANADA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 66 CANADA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 67 CANADA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 68 CANADA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 69 CANADA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 70 CANADA: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: IMPACT OF RECESSION

- TABLE 71 EUROPE: ELECTROPHORESIS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 72 EUROPE: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 73 EUROPE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 74 EUROPE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 75 EUROPE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 76 EUROPE: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 77 EUROPE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 78 EUROPE: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 79 EUROPE: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 80 EUROPE: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Germany to hold largest share in European electrophoresis market during forecast period

- TABLE 81 GERMANY: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 82 GERMANY: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 83 GERMANY: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 84 GERMANY: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 85 GERMANY: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 86 GERMANY: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 87 GERMANY: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 88 GERMANY: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 89 GERMANY: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Government of France to strongly support and invest in genomics and proteomics research

- TABLE 90 FRANCE: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 91 FRANCE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 92 FRANCE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 FRANCE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 94 FRANCE: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 FRANCE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 96 FRANCE: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 FRANCE: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 98 FRANCE: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.4 UK

- 10.3.4.1 Increasing awareness and research in personalized medicine to support market

- TABLE 99 UK: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 100 UK: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 UK: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 UK: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 103 UK: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 104 UK: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 105 UK: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 UK: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 107 UK: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Increasing life sciences R&D funding by government to drive market

- TABLE 108 ITALY: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 109 ITALY: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 110 ITALY: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 ITALY: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 112 ITALY: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 ITALY: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 114 ITALY: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 ITALY: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 116 ITALY: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6 SWITZERLAND

- 10.3.6.1 Well-established pharmaceutical & biotechnology industry to aid market

- TABLE 117 SWITZERLAND: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 118 SWITZERLAND: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 119 SWITZERLAND: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 SWITZERLAND: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 121 SWITZERLAND: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 SWITZERLAND: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 123 SWITZERLAND: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 SWITZERLAND: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 125 SWITZERLAND: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.7 SPAIN

- 10.3.7.1 Well-established network of hospitals and research centers to increase initiatives for translational medicine research

- TABLE 126 SPAIN: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 127 SPAIN: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 128 SPAIN: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 129 SPAIN: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 130 SPAIN: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 131 SPAIN: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 132 SPAIN: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 SPAIN: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 134 SPAIN: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.8 REST OF EUROPE

- TABLE 135 REST OF EUROPE: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 136 REST OF EUROPE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 REST OF EUROPE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 138 REST OF EUROPE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 139 REST OF EUROPE: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 REST OF EUROPE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 141 REST OF EUROPE: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 142 REST OF EUROPE: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 143 REST OF EUROPE: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 23 ASIA PACIFIC: ELECTROPHORESIS MARKET SNAPSHOT

- 10.4.1 ASIA PACIFIC: IMPACT OF RECESSION

- TABLE 144 ASIA PACIFIC: ELECTROPHORESIS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Initiatives toward development of precision medicine to support market

- TABLE 154 JAPAN: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 155 JAPAN: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 JAPAN: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 JAPAN: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 158 JAPAN: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 159 JAPAN: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 160 JAPAN: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 161 JAPAN: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 162 JAPAN: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Rising biopharmaceutical research to drive market

- TABLE 163 CHINA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 164 CHINA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 165 CHINA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 166 CHINA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 167 CHINA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 168 CHINA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 169 CHINA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 170 CHINA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 171 CHINA: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Increasing pharma R&D and government funding in biotechnology sector to propel market

- TABLE 172 INDIA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 173 INDIA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 174 INDIA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 175 INDIA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 176 INDIA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 177 INDIA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 178 INDIA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 179 INDIA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 180 INDIA: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increasing focus on precision medicine to fuel market

- TABLE 181 AUSTRALIA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 182 AUSTRALIA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 183 AUSTRALIA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 184 AUSTRALIA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 185 AUSTRALIA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 186 AUSTRALIA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 187 AUSTRALIA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 188 AUSTRALIA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 189 AUSTRALIA: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 190 REST OF ASIA PACIFIC: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 192 REST OF ASIA PACIFIC: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 194 REST OF ASIA PACIFIC: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 195 REST OF ASIA PACIFIC: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 LATIN AMERICA: IMPACT OF RECESSION

- TABLE 199 LATIN AMERICA: ELECTROPHORESIS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 200 LATIN AMERICA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 201 LATIN AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 202 LATIN AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 203 LATIN AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 204 LATIN AMERICA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 205 LATIN AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 206 LATIN AMERICA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 207 LATIN AMERICA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 208 LATIN AMERICA: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.2 BRAZIL

- 10.5.2.1 Growing genomics research and increasing pharmaceutical & biologics QC to drive market

- TABLE 209 BRAZIL: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 210 BRAZIL: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 211 BRAZIL: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 212 BRAZIL: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 213 BRAZIL: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 214 BRAZIL: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 215 BRAZIL: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 216 BRAZIL: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 217 BRAZIL: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.3 MEXICO

- 10.5.3.1 Strong pharmaceutical industry to provide growth opportunities

- TABLE 218 MEXICO: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 219 MEXICO: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 220 MEXICO: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 221 MEXICO: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 222 MEXICO: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 223 MEXICO: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 224 MEXICO: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 225 MEXICO: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 226 MEXICO: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.4 REST OF LATIN AMERICA

- TABLE 227 REST OF LATIN AMERICA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 228 REST OF LATIN AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 229 REST OF LATIN AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 230 REST OF LATIN AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 231 REST OF LATIN AMERICA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 232 REST OF LATIN AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 233 REST OF LATIN AMERICA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 234 REST OF LATIN AMERICA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 235 REST OF LATIN AMERICA: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 INCREASING R&D FUNDING BY PRIVATE SECTOR FOR BIOMARKER DISCOVERY TO SUPPORT MARKET

- 10.6.2 MIDDLE EAST & AFRICA: IMPACT OF RECESSION

- TABLE 236 MIDDLE EAST & AFRICA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021-2028 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021-2028 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: ELECTROPHORESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- TABLE 245 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ELECTROPHORESIS MARKET

- 11.2 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 24 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN ELECTROPHORESIS MARKET

- 11.3 MARKET SHARE ANALYSIS

- TABLE 246 ELECTROPHORESIS MARKET: DEGREE OF COMPETITION

- 11.4 COMPETITIVE LEADERSHIP MAPPING

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 25 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS: ELECTROPHORESIS MARKET

- 11.5 COMPANY EVALUATION QUADRANT FOR SMES/START-UPS

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 STARTING BLOCKS

- 11.5.3 RESPONSIVE COMPANIES

- 11.5.4 DYNAMIC COMPANIES

- FIGURE 26 COMPANY EVALUATION MATRIX FOR SMES/START-UPS: ELECTROPHORESIS MARKET

- 11.6 COMPANY FOOTPRINT ANALYSIS

- TABLE 247 OVERALL COMPANY FOOTPRINT

- TABLE 248 COMPANY REGIONAL FOOTPRINT

- TABLE 249 COMPANY PRODUCT FOOTPRINT

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 KEY PRODUCT LAUNCHES

- TABLE 250 KEY PRODUCT LAUNCHES

- 11.7.2 KEY DEALS

- TABLE 251 KEY DEALS

- 11.7.3 OTHER KEY DEVELOPMENTS

- TABLE 252 OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View)**

- 12.1.1 BIO-RAD LABORATORIES, INC.

- TABLE 253 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- FIGURE 27 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- 12.1.2 THERMO FISHER SCIENTIFIC INC.

- TABLE 254 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 28 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- 12.1.3 DANAHER CORPORATION

- TABLE 255 DANAHER CORPORATION: COMPANY OVERVIEW

- FIGURE 29 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.4 AGILENT TECHNOLOGIES, INC.

- TABLE 256 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 30 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- 12.1.5 MERCK KGAA

- TABLE 257 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 31 MERCK KGAA: COMPANY SNAPSHOT (2022)

- 12.1.6 PERKINELMER, INC.

- TABLE 258 PERKINELMER, INC.: COMPANY OVERVIEW

- FIGURE 32 PERKINELMER, INC.: COMPANY SNAPSHOT (2022)

- 12.1.7 QIAGEN N.V.

- TABLE 259 QIAGEN N.V.: COMPANY OVERVIEW

- FIGURE 33 QIAGEN N.V.: COMPANY SNAPSHOT (2022)

- 12.1.8 LONZA

- TABLE 260 LONZA: COMPANY OVERVIEW

- FIGURE 34 LONZA: COMPANY SNAPSHOT (2022)

- 12.1.9 SHIMADZU CORPORATION

- TABLE 261 SHIMADZU CORPORATION: COMPANY OVERVIEW

- FIGURE 35 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.10 HOEFER INC.

- TABLE 262 HOEFER INC.: COMPANY OVERVIEW

- 12.1.11 SEBIA

- TABLE 263 SEBIA: COMPANY OVERVIEW

- 12.1.12 TAKARA BIO INC.

- TABLE 264 TAKARA BIO INC.: COMPANY OVERVIEW

- FIGURE 36 TAKARA BIO INC.: COMPANY SNAPSHOT (2022)

- 12.1.13 C.B.S. SCIENTIFIC

- TABLE 265 4BASEBIO: COMPANY OVERVIEW

- FIGURE 37 4BASEBIO: COMPANY SNAPSHOT (2021)

- 12.1.14 HELENA LABORATORIES CORPORATION

- TABLE 266 HELENA LABORATORIES CORPORATION: COMPANY OVERVIEW

- 12.2 OTHER PLAYERS

- 12.2.1 SYNGENE

- 12.2.2 VWR INTERNATIONAL, LLC (AVANTOR)

- 12.2.3 TBG DIAGNOSTICS LIMITED

- 12.2.4 ANALYTIK JENA GMBH

- 12.2.5 OPRL BIOSCIENCES PVT., LTD.

- 12.2.6 KANEKA EUROGENTEC S.A.

- 12.2.7 CLEAVER SCIENTIFIC LTD.

- 12.2.8 MAJOR SCIENCE CO., LTD.

- 12.2.9 BIO WORLD

- 12.2.10 NATIONAL ANALYTICAL CORPORATION

- 12.2.11 AES LIFE SCIENCES

- *Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS