|

|

市場調査レポート

商品コード

1252561

mヘルスソリューションの世界市場:アプリ別・接続機器別・サービス別・エンドユーザー別・地域別の将来予測 (2028年まで)mHealth Solutions Market by Apps, Connected Devices, Services, End User & Region - Global Forecasts to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| mヘルスソリューションの世界市場:アプリ別・接続機器別・サービス別・エンドユーザー別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月27日

発行: MarketsandMarkets

ページ情報: 英文 348 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のmヘルスソリューションの市場規模は、2023年の1,195億米ドルから、2028年には3,950億米ドルに達すると予測され、予測期間中のCAGRは27.0%となります。

北米では、在宅医療への傾倒が進んでいます。また、遠隔患者モニタリングプログラムは、病院から患者の自宅にケアを移すことで、慢性的なケアコストと病院の再入院を減らすのに役立ちます。これらのプログラムは、広範囲な医療支援に役立ち、主治医に提供される機器やmヘルスプラットフォームを通じて、患者が生成した健康データを自宅から収集することに重点を置いています。在宅医療サービスに対する需要の高まりは、患者の健康状態や医療データを自宅で記録するモニタリング機器の使用を促進する主な要因となっています。また、医療業界では専門家が不足しているため、コネクテッドデバイスの需要が高まり、在宅医療サービスやmヘルスソリューションの需要も増加すると思われます。

"製品・サービス別では、mヘルスアプリ分野が最大のセグメントとなる"

製品・サービス別に見ると、mヘルスアプリ部門が予測期間中に最大のセグメントとなると予測されています。その要因として、スマートフォンの普及と使用の増加、mヘルスアプリに関する患者や医師の意識の高まり、在宅医療の需要の高まりと医療を使用する利便性などの要因によるものと考えられます。より高速なプロセッサ、改良されたメモリ、より小さなバッテリー、複雑な機能を実行する高効率なオープンソースOSなどの技術進歩は、業務用・個人用のmヘルスアプリに道を開いています。

"エンドユーザー別では、2022年に医療提供者が最大のセグメントとなる"

mヘルスソリューション市場では2022年に、医療提供者分野が最も高い成長率で成長すると予測されています。その要因として、ポータブルな特殊用途の技術が利用可能であること、遠隔地の患者にアプローチできる可能性があること、それによって病院の再入院率が低下すること、などが挙げられます。さらに、医療費抑制ニーズの高まり、より良い財務結果に対するニーズの高まり、医療改革、業務効率を高めながら患者ケアを改善する必要性が、今後数年間で医療提供者向け需要を促進すると予想されます。

"予測期間中、アジア太平洋が最も高い成長率を記録する"

アジア太平洋地域は、予測期間中に最も高いCAGRで成長すると予測されています。市場成長の主な要因として、メディカルツーリズム産業の成長、生活習慣病や慢性疾患の発生率の増加、ワイヤレス技術の採用の増加による要因によってもたらされます。アジア太平洋地域はまた、政府の取り組み強化や生活習慣病の増加により、市場関係者にとって有利な成長機会を提供しています。その他の主な成長要因には、慢性疾患の有病率の上昇、一人当たりの所得の増加、スマートフォンの採用率の上昇、これらの国々における高度な接続性とネットワークの存在などがあります。

当レポートでは、世界のmヘルスソリューションの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・車両タイプ別・サポート技術別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界考察

- 業界動向

- mヘルスアプリ:市場のハイライト

- mヘルスのエコシステム:利害関係者の分析

第7章 mヘルスソリューション市場:製品・サービス別

- イントロダクション

- mヘルスアプリ

- コネクテッド医療機器

- バイタルサイン監視装置

- ピークフローメーター

- 睡眠時無呼吸モニター

- マルチパラメーター・トラッカー

- 胎児モニタリング装置

- 神経モニタリング装置

- その他のコネクテッド医療機器

- mヘルスサービス

- 遠隔モニタリングサービス

- 診断・相談サービス

- 治療サービス

- 医療体制強化サービス

- フィットネス・ウェルネスサービス

- 予防サービス

第8章 mヘルスソリューション市場:エンドユーザー別

- イントロダクション

- 医療提供者 (プロバイダー)

- 患者/消費者

- 支払者

- その他のエンドユーザー

第9章 mヘルスソリューション市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

- 中東・アフリカ

第10章 競合情勢

- 概要

- 市場ランキング分析

- 大手企業の収益シェア分析

- mヘルスソリューション市場:研究開発費

- 企業評価クアドラント (2022年)

- 新興企業/中小企業向けの企業評価クアドラント (2022年)

- 競合シナリオ

- 製品・サービスの発売と承認

- 資本取引

第11章 企業プロファイル

- 主要企業

- KONINKLIJKE PHILIPS N.V.

- MEDTRONIC PLC

- OMRON HEALTHCARE CO., LTD.

- JOHNSON & JOHNSON

- CERNER CORPORATION

- APPLE, INC.

- ALIVECOR, INC.

- AIRSTRIP TECHNOLOGIES

- ATHENAHEALTH, INC.

- IHEALTH LABS, INC.

- AT&T, INC.

- AGAMATRIX, INC.

- CISCO SYSTEMS, INC.

- FITBIT, INC.

- VODAFONE GROUP PLC

- QUALCOMM TECHNOLOGIES, INC.

- GARMIN LTD.

- TUNSTALL HEALTHCARE

- その他の企業

- SOFTSERVE

- OSP LABS

- OMADA HEALTH

- DEXCOM, INC.

- TELADOC HEALTH, INC.

- ZTE CORPORATION

- MY MHEALTH LIMITED

第12章 付録

The global mHealth solutions market is projected to reach USD 395.0 billion by 2028 from USD 119.5 billion in 2023, at a CAGR of 27.0% during the forecast period. There is a growing inclination for home healthcare in North America. In addition, remote patient monitoring programs help reduce chronic care costs and hospital readmissions by moving care from hospitals into the patient's home. These programs help in providing extensive healthcare assistance and focus on collecting patient-generated health data from home through devices and mobile health platforms provided to the primary healthcare provider. The rising demand for home healthcare services is a major factor driving the use of monitoring devices to record patient health and medical data from their homes. The demand is also likely to boost for connected devices because of the shortage of professionals in the healthcare industry, which, in turn, will increase the demand for home health services and mHealth solutions

"The mHealth Apps segment is projected to be the largest segment in the mHealth Solutions market"

Based on the products and services, the mHealth Apps segment is projected to be the largest segment during the forecast period. This share can be attributed to factors such as increasing penetration & use of smartphones, rising awareness among patients & doctors regarding mHealth apps, and growing demand for home healthcare & the convenience of using healthcare apps. Technological advancements, such as faster processors, improved memory, smaller batteries, and highly efficient open-source operating systems that perform complex functions, have paved the way for medical mHealth apps for professional and personal use

"Providers was the largest segment by the end user of mHealth Solutions market in 2022"

Healthcare providers segment is projected to grow at the highest growth rate in the mHealth Solutions market in 2022. The high growth can be attributed to the availability of portable special-purpose technologies and the potential to reach patients in remote areas, thereby reducing hospital readmission rates.Furthermore growing need to curtail healthcare costs, rising need for better financial outcomes, healthcare reforms, and the need to improve patient care while increasing operational efficiency is expected to drive the demand for Providers segment in the coming years.

"APAC to witness the highest growth rate during the forecast period."

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. Market growth in the APAC region is mainly driven by factors owing to the growing medical tourism industry, increasing incidence of lifestyle and chronic disorders, and the rising adoption of wireless technologies. Asia Pacific market offer lucrative growth opportunities for market players, mainly due to the growing government initiatives and the increasing incidence of lifestyle disorders. The growth in these markets will likely be centered in India, China, South Korea, Australia, Singapore, This is mainly due to the rising prevalence of chronic disorders, increasing per capita income, higher adoption of smartphones, and the presence of advanced connectivity and networks in these countries.

The break-down of primary participants is as mentioned below:

- By Company Type - Tier 1: 35%, Tier 2: 45%, and Tier 3: 20%

- By Designation - C-level: 31%, Director-level: 27%, and Others: 42%

- By Region - North America: 40%, Europe: 20%, Asia Pacific: 30%, Latin America: 5%, and Middle East & Africa: 5%.

Key players in the mHealth Solutions Market

The key players operating in the mHealth solutions market include Koninklijke Philips N.V. (Netherlands), Medtronic plc (Ireland), Johnson & Johnson (US), OMRON Healthcare Co., Ltd. (Japan), Cerner Corporation (US), Apple, Inc. (US), AliveCor, Inc. (US), AirStrip Technologies (US), athenahealth, Inc. (US), iHealth Lab Inc. (US), AT&T Inc. (US), AgaMatrix, Inc. (US), Cisco Systems, Inc. (US), Fitbit Inc. (US), OSP Labs (US), SoftServe (US), Garmin, Ltd. (US), Dexcom, Inc. (US), Tunstall Healthcare (UK), Teladoc Health, Inc. (US), ZTE Corporation (China), and My mHealth Limited (UK).

Research Coverage:

The report analyzes the mHealth solutions market and aims to estimate the market size and future growth potential of various market segments, based on product & services, components, end user, and region. The report also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing penetration of smartphones, tablets, and other mobile platforms, Increasing utilization of connected devices and mHealth apps to manage chronic diseases, Cost containment in healthcare delivery, Growing penetration of 4G & 5G networks to ensure uninterrupted healthcare, Rising focus on patient-centric healthcare delivery, Lack of standards & regulations and insufficient reimbursements), restraints (Resistance from traditional healthcare providers and limited guidance from physicians), opportunities (Growing adoption of mHealth solutions in other mobile platforms,and challenges (Authenticity and reliability, patent protection for mHealth devices and apps, Lack of data security and concerns regarding data theft and healthcare fraud are influencing the growth of the mHealth Solutions market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the mHealth Solutions market

- Market Development: Comprehensive information about lucrative markets - the report analyses the mHealth Solutions market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the mHealth Solutions market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Koninklijke Philips N.V. (Netherlands), Medtronic plc (Ireland), Johnson & Johnson (US), OMRON Healthcare Co., Ltd. (Japan), Cerner Corporation (US), Apple, Inc. (US), AliveCor, Inc. (US), AirStrip Technologies (US), athenahealth, Inc. (US), iHealth Lab Inc. (US), AT&T Inc. (US), AgaMatrix, Inc. (US), Cisco Systems, Inc. (US), among others in the mHeath Solutions market strategies. The report also helps stakeholders understand the pulse of the remote care market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 MHEALTH SOLUTIONS MARKET SEGMENTATION

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.3 Insights from primary experts

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.3 MARKET BREAKDOWN DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: MHEALTH SOLUTIONS MARKET

- 2.8 IMPACT OF RECESSION ON MHEALTH SOLUTIONS MARKET

3 EXECUTIVE SUMMARY

- FIGURE 9 MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD BILLION)

- FIGURE 10 CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 11 MHEALTH APPS MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 12 MHEALTH SERVICES MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 13 MHEALTH SOLUTIONS MARKET, BY END USER, 2023 VS. 2028 (USD BILLION)

- FIGURE 14 MHEALTH SOLUTIONS MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 MHEALTH SOLUTIONS MARKET OVERVIEW

- FIGURE 15 INCREASING PENETRATION OF SMARTPHONES, TABLETS, AND OTHER MOBILE PLATFORMS TO DRIVE MARKET GROWTH

- 4.2 ASIA PACIFIC: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE

- FIGURE 16 MHEALTH APPS TO COMMAND LARGEST SHARE IN 2023

- 4.3 GEOGRAPHIC SNAPSHOT OF MHEALTH SOLUTIONS MARKET

- FIGURE 17 MARKET IN CHINA TO GROW AT HIGHEST CAGR

- 4.4 REGIONAL MIX: MHEALTH SOLUTIONS MARKET

- FIGURE 18 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- 4.5 MHEALTH SOLUTIONS MARKET: DEVELOPED VS. DEVELOPING MARKETS

- FIGURE 19 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- TABLE 3 MARKET DYNAMICS: MHEALTH SOLUTIONS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing penetration of smartphones, tablets, and other mobile platforms

- FIGURE 20 SMARTPHONE USERS WORLDWIDE, 2016-2027

- 5.2.1.2 Increasing utilization of connected devices and mHealth apps to manage chronic diseases

- 5.2.1.3 Cost containment in healthcare delivery

- 5.2.1.4 Growing penetration of 4G & 5G networks to ensure uninterrupted healthcare

- FIGURE 21 NUMBER OF MOBILE BROADBAND SUBSCRIPTIONS, 2011-2021

- 5.2.1.5 Rising focus on patient-centric healthcare delivery

- 5.2.1.6 Increasing demand for home healthcare services

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of standards & regulations and insufficient reimbursement

- 5.2.2.2 Resistance from traditional healthcare providers & limited guidance from physicians

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of mHealth solutions in other mobile platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 Authenticity and reliability

- 5.2.4.2 Patent protection for mHealth devices and apps

- 5.2.4.3 Lack of data security and concerns regarding data theft and healthcare fraud

6 INDUSTRY INSIGHTS

- 6.1 INDUSTRY TRENDS

- 6.1.1 INCREASING UTILIZATION OF MHEALTH SOLUTIONS FOR PERSONALIZED PATIENT ENGAGEMENT

- 6.1.2 RISE OF DIGITAL THERAPEUTICS

- 6.1.3 REMOTE MONITORING AND GROWING FOCUS ON CONSUMER-CENTRIC MOBILITY SOLUTIONS

- 6.1.4 APPLICATIONS OF CLOUD-BASED MHEALTH SOLUTIONS IN HEALTHCARE

- 6.1.5 WEARABLE HEALTH SENSORS

- TABLE 4 NOTABLE WEARABLE DEVICES OFFERED BY PLAYERS

- 6.1.6 INCREASING DEMAND FOR URGENT CARE APPS

- TABLE 5 NOTABLE URGENT CARE APPS OFFERED BY PLAYERS

- 6.1.7 FUTURE TRENDS IN MHEALTH DEVICES

- 6.1.8 ADOPTION ANALYSIS OF CONNECTED DEVICES

- FIGURE 22 ADOPTION OF HIGH-GROWTH CONNECTED DEVICES DURING NEXT FIVE YEARS

- 6.2 MHEALTH APPS: MARKET HIGHLIGHTS

- 6.2.1 DEMAND AND SUPPLY

- 6.2.2 ADOPTION ANALYSIS

- FIGURE 23 APPLICATION OF MHEALTH APPS DURING NEXT FIVE YEARS

- FIGURE 24 ADOPTION OF HIGH-GROWTH THERAPEUTIC APPS DURING NEXT FIVE YEARS

- 6.2.3 MHEALTH REVENUE TRENDS

- TABLE 6 REVENUE SOURCES: MHEALTH SOLUTIONS MARKET

- 6.2.4 FUTURE TRENDS

- 6.3 MOBILE HEALTHCARE ECOSYSTEM: STAKEHOLDER ANALYSIS

- FIGURE 25 MOBILE HEALTHCARE ECOSYSTEM

- FIGURE 26 MHEALTH REVENUE SHARE, BY STAKEHOLDER, 2022

- 6.3.1 MHEALTH DEVICE MANUFACTURERS

- 6.3.2 APPLICATION DEVELOPERS

- 6.3.3 MHEALTH SERVICE PROVIDERS

- 6.3.4 NETWORK PROVIDERS

7 MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE

- 7.1 INTRODUCTION

- FIGURE 27 MHEALTH SOLUTIONS MARKET SEGMENTATION, BY PRODUCT & SERVICE

- TABLE 7 MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- 7.2 MHEALTH APPS

- TABLE 8 MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 9 MHEALTH APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1 HEALTHCARE APPS

- TABLE 10 HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 11 HEALTHCARE APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.1 Chronic care management apps

- TABLE 12 CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 13 CHRONIC CARE MANAGEMENT APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.1.1 Mental health & behavioral disorder management apps

- 7.2.1.1.1.1 Increased access to therapies through mobiles to drive growth

- 7.2.1.1.1 Mental health & behavioral disorder management apps

- TABLE 14 MENTAL HEALTH & BEHAVIORAL DISORDER MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 15 MENTAL HEALTH & BEHAVIORAL DISORDER MANAGEMENT APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.1.2 Diabetes management apps

- 7.2.1.1.2.1 Growing prevalence of diabetes to drive demand

- 7.2.1.1.2 Diabetes management apps

- TABLE 16 DIABETES MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 17 DIABETES MANAGEMENT APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.1.3 Blood pressure & ECG monitoring apps

- 7.2.1.1.3.1 Rising incidence of CVDs to boost market

- 7.2.1.1.3 Blood pressure & ECG monitoring apps

- TABLE 18 BLOOD PRESSURE & ECG MONITORING APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 19 BLOOD PRESSURE & ECG MONITORING APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.1.4 Cancer management apps

- 7.2.1.1.4.1 Need to educate patients on news and trends in oncology to support app usage

- 7.2.1.1.4 Cancer management apps

- TABLE 20 CANCER MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 21 CANCER MANAGEMENT APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.1.5 Other chronic care management apps

- TABLE 22 OTHER CHRONIC CARE MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 23 OTHER CHRONIC CARE MANAGEMENT APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.2 General health & fitness apps

- TABLE 24 GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 25 GENERAL HEALTH & FITNESS APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.2.1 Health tracking apps

- 7.2.1.2.1.1 Growing preference for health self-management to drive market

- 7.2.1.2.1 Health tracking apps

- TABLE 26 HEALTH TRACKING APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.2.2 Obesity & weight management apps

- 7.2.1.2.2.1 Rising obese population to increase demand for apps

- 7.2.1.2.2 Obesity & weight management apps

- TABLE 27 OBESITY & WEIGHT MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 28 OBESITY & WEIGHT MANAGEMENT APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.2.3 Fitness & nutrition apps

- 7.2.1.2.3.1 Rising demand for support in meeting food and fitness goals to boost adoption

- 7.2.1.2.3 Fitness & nutrition apps

- TABLE 29 FITNESS & NUTRITION APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 30 FITNESS & NUTRITION APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.3 Medication management apps

- 7.2.1.3.1 Increasing awareness of self-care to drive market growth

- 7.2.1.3 Medication management apps

- TABLE 31 MEDICAL MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 32 MEDICATION MANAGEMENT APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.4 Women's health apps

- TABLE 33 WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 34 WOMEN'S HEALTH APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.4.1 Pregnancy apps

- 7.2.1.4.1.1 Increasing awareness & focus of women on health during pregnancy to bolster growth

- 7.2.1.4.1 Pregnancy apps

- TABLE 35 PREGNANCY APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.4.2 Breastfeeding apps

- 7.2.1.4.2.1 Rising awareness about baby care to play a pivotal role in growth

- 7.2.1.4.2 Breastfeeding apps

- TABLE 36 BREASTFEEDING APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.4.3 Fertility apps

- 7.2.1.4.3.1 Increasing prevalence of reproductive organ disorders to boost market

- 7.2.1.4.3 Fertility apps

- TABLE 37 FERTILITY APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.4.4 Other women's health apps

- TABLE 38 OTHER WOMEN'S HEALTH APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.5 Personal health record apps

- 7.2.1.5.1 Convenience of personal health apps in scheduling appointments and viewing test results to support adoption

- 7.2.1.5 Personal health record apps

- TABLE 39 PERSONAL HEALTH RECORD APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.6 Other healthcare apps

- TABLE 40 OTHER HEALTHCARE APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.2 MEDICAL APPS

- TABLE 41 MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 42 MEDICAL APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.2.1 Patient management & monitoring apps

- 7.2.2.1.1 Growing availability and enhanced quality of medical software apps to drive market

- 7.2.2.1 Patient management & monitoring apps

- TABLE 43 PATIENT MANAGEMENT & MONITORING APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 44 PATIENT MANAGEMENT & MONITORING APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.2.2 Medical reference apps

- 7.2.2.2.1 Reliability issues and resistance from physicians to limit adoption

- 7.2.2.2 Medical reference apps

- TABLE 45 MEDICAL REFERENCE APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 46 MEDICAL REFERENCE APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.2.3 Communication & consulting apps

- 7.2.2.3.1 Rising focus on patient-centric care delivery to boost usage

- 7.2.2.3 Communication & consulting apps

- TABLE 47 COMMUNICATION & CONSULTING APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 48 COMMUNICATION & CONSULTING APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.2.4 Continuing medical education apps

- 7.2.2.4.1 Rapid adoption of touchscreen tablets to push deployment of CME apps

- 7.2.2.4 Continuing medical education apps

- TABLE 49 MEDICAL EDUCATION APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 50 CONTINUING MEDICAL EDUCATION APPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 CONNECTED MEDICAL DEVICES

- TABLE 51 CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 52 CONNECTED MEDICAL DEVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.1 VITAL SIGNS MONITORING DEVICES

- TABLE 53 VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 54 VITAL SIGNS MONITORING DEVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.1.1 Blood pressure monitors

- 7.3.1.1.1 Rising prevalence of hypertension to boost demand

- 7.3.1.1 Blood pressure monitors

- TABLE 55 BLOOD PRESSURE MONITORS OFFERED BY KEY MARKET PLAYERS

- TABLE 56 BLOOD PRESSURE MONITORS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.1.2 Blood glucose meters

- 7.3.1.2.1 Increasing diabetic population to propel adoption of blood glucose monitoring devices

- 7.3.1.2 Blood glucose meters

- TABLE 57 BLOOD GLUCOSE METERS OFFERED BY KEY MARKET PLAYERS

- TABLE 58 BLOOD GLUCOSE METERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.1.3 ECG/heart rate monitors

- 7.3.1.3.1 Growing prevalence of coronary diseases to support market

- 7.3.1.3 ECG/heart rate monitors

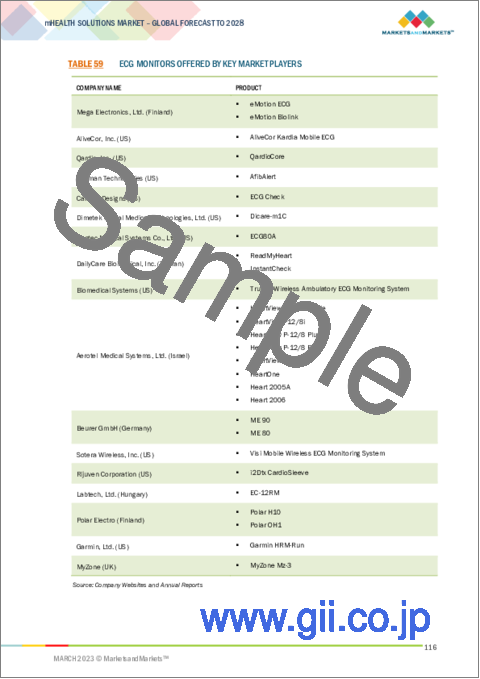

- TABLE 59 ECG MONITORS OFFERED BY KEY MARKET PLAYERS

- TABLE 60 ECG/HEART RATE MONITORS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.1.4 Pulse oximeters

- 7.3.1.4.1 Rising adoption for self-monitoring to propel market

- 7.3.1.4 Pulse oximeters

- TABLE 61 PULSE OXIMETERS OFFERED BY KEY MARKET PLAYERS

- TABLE 62 PULSE OXIMETERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.2 PEAK FLOW METERS

- 7.3.2.1 Increasing asthma prevalence to contribute to market growth

- TABLE 63 PEAK FLOW METERS OFFERED BY KEY MARKET PLAYERS

- TABLE 64 PEAK FLOW METERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.3 SLEEP APNEA MONITORS

- 7.3.3.1 Rising instances of chronic snoring to drive demand for sleep apnea monitors

- TABLE 65 SLEEP APNEA MONITORS OFFERED BY KEY PLAYERS

- TABLE 66 SLEEP APNEA MONITORS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.4 MULTIPARAMETER TRACKERS

- 7.3.4.1 Rising prevalence of chronic diseases to boost market

- TABLE 67 MULTIPARAMETER TRACKERS OFFERED BY KEY MARKET PLAYERS

- TABLE 68 MULTIPARAMETER TRACKERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.5 FETAL MONITORING DEVICES

- 7.3.5.1 Rising preterm births from successful in vitro fertilization to bolster growth

- TABLE 69 FETAL MONITORING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 70 FETAL MONITORING DEVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.6 NEUROLOGICAL MONITORING DEVICES

- 7.3.6.1 Increasing prevalence of neurological diseases to drive growth

- TABLE 71 NEUROLOGICAL MONITORING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 72 NEUROLOGICAL MONITORING DEVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.7 OTHER CONNECTED MEDICAL DEVICES

- TABLE 73 OTHER CONNECTED MEDICAL DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 74 OTHER CONNECTED MEDICAL DEVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 MHEALTH SERVICES

- TABLE 75 MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 76 MHEALTH SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4.1 REMOTE MONITORING SERVICES

- 7.4.1.1 Shift toward home healthcare to boost demand

- TABLE 77 REMOTE MONITORING SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 78 REMOTE MONITORING SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4.2 DIAGNOSIS & CONSULTATION SERVICES

- 7.4.2.1 Need to enhance healthcare access to propel demand

- TABLE 79 DIAGNOSIS & CONSULTATION SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 80 DIAGNOSIS & CONSULTATION SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4.3 TREATMENT SERVICES

- 7.4.3.1 Demand for remote treatment to boost market

- TABLE 81 TREATMENT SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 82 TREATMENT SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4.4 HEALTHCARE SYSTEM STRENGTHENING SERVICES

- 7.4.4.1 Need to collate information and track outbreaks to support adoption

- TABLE 83 HEALTHCARE SYSTEM STRENGTHENING SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4.5 FITNESS & WELLNESS SERVICES

- 7.4.5.1 Rising health awareness in developed countries to boost adoption

- TABLE 84 FITNESS & WELLNESS SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 85 FITNESS & WELLNESS SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4.6 PREVENTION SERVICES

- 7.4.6.1 Rising disease prevalence to propel demand for prevention services

- TABLE 86 PREVENTION SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

8 MHEALTH SOLUTIONS MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 87 MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 PROVIDERS

- 8.2.1 PROVIDERS TO HOLD LARGEST MARKET SHARE

- TABLE 88 MHEALTH SOLUTIONS MARKET FOR PROVIDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 PATIENTS/CONSUMERS

- 8.3.1 RISING DISEASE PREVALENCE AND EMERGENCE OF ADVANCED WEARABLE MONITORS TO DRIVE DEMAND

- TABLE 89 MHEALTH SOLUTIONS MARKET FOR PATIENTS/CONSUMERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 PAYERS

- 8.4.1 POTENTIAL TO REDUCE READMISSIONS AND OVERHEAD COSTS TO DRIVE ADOPTION

- TABLE 90 MHEALTH SOLUTIONS MARKET FOR PAYERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.5 OTHER END USERS

- TABLE 91 MHEALTH SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

9 MHEALTH SOLUTIONS MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 92 MHEALTH SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 28 NORTH AMERICA: MHEALTH SOLUTIONS MARKET SNAPSHOT, 2022

- 9.2.1 NORTH AMERICA: IMPACT OF ECONOMIC RECESSION

- TABLE 93 NORTH AMERICA: MHEALTH SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 US to dominate North American market

- TABLE 105 US: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 106 US: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 US: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 108 US: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 109 US: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 110 US: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 US: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 US: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 US: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 114 US: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 US: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Need to curtail escalating healthcare costs to drive market

- TABLE 116 CANADA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 117 CANADA: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 118 CANADA: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 119 CANADA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 CANADA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 121 CANADA: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 CANADA: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 123 CANADA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 CANADA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 CANADA: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 CANADA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: IMPACT OF ECONOMIC RECESSION

- TABLE 127 EUROPE: MHEALTH SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 128 EUROPE: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 129 EUROPE: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 130 EUROPE: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 131 EUROPE: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 EUROPE: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 EUROPE: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 134 EUROPE: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 135 EUROPE: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 EUROPE: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 EUROPE: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 138 EUROPE: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 Need for better and improved healthcare services to drive adoption of mHealth

- TABLE 139 GERMANY: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 140 GERMANY: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 GERMANY: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 142 GERMANY: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 143 GERMANY: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 GERMANY: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 145 GERMANY: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 GERMANY: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 147 GERMANY: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 GERMANY: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 149 GERMANY: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 High penetration of mobile apps and wearable devices to support growth

- TABLE 150 UK: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 151 UK: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 152 UK: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 153 UK: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 154 UK: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 155 UK: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 UK: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 UK: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 158 UK: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 159 UK: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 160 UK: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.4 FRANCE

- 9.3.4.1 Use of telehealth solutions and services through big data to boost market

- TABLE 161 FRANCE: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 162 FRANCE: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 163 FRANCE: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 164 FRANCE: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 165 FRANCE: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 166 FRANCE: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 167 FRANCE: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 168 FRANCE: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 169 FRANCE: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 170 FRANCE: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 171 FRANCE: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Increasing government initiatives to implement eHealth to propel market

- TABLE 172 ITALY: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 173 ITALY: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 174 ITALY: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 175 ITALY: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 176 ITALY: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 177 ITALY: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 178 ITALY: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 179 ITALY: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 180 ITALY: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 181 ITALY: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 182 ITALY: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.6 SPAIN

- 9.3.6.1 High phone penetration rate to support mHealth adoption

- TABLE 183 SPAIN: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 184 SPAIN: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 185 SPAIN: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 186 SPAIN: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 187 SPAIN: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 188 SPAIN: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 189 SPAIN: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 190 SPAIN: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 191 SPAIN: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 192 SPAIN: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 193 SPAIN: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 194 REST OF EUROPE: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 195 REST OF EUROPE: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 196 REST OF EUROPE: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 197 REST OF EUROPE: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 198 REST OF EUROPE: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 199 REST OF EUROPE: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 200 REST OF EUROPE: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 201 REST OF EUROPE: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 202 REST OF EUROPE: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 203 REST OF EUROPE: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 204 REST OF EUROPE: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: MHEALTH SOLUTIONS SNAPSHOT

- 9.4.1 ASIA PACIFIC: IMPACT OF ECONOMIC RECESSION

- TABLE 205 ASIA PACIFIC: MHEALTH SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 206 ASIA PACIFIC: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 207 ASIA PACIFIC: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 208 ASIA PACIFIC: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 209 ASIA PACIFIC: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 210 ASIA PACIFIC: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 211 ASIA PACIFIC: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 213 ASIA PACIFIC: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 215 ASIA PACIFIC: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 China to dominate Asia Pacific mHealth solutions market

- TABLE 217 CHINA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 218 CHINA: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 219 CHINA: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 220 CHINA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 221 CHINA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 222 CHINA: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 223 CHINA: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 224 CHINA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 225 CHINA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 226 CHINA: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 227 CHINA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Rising geriatric population and health expenditure to support market growth

- TABLE 228 JAPAN: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 229 JAPAN: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 230 JAPAN: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 231 JAPAN: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 232 JAPAN: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 233 JAPAN: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 234 JAPAN: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 235 JAPAN: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 236 JAPAN: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 237 JAPAN: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 238 JAPAN: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Rising need to reduce healthcare costs to boost mHealth adoption

- TABLE 239 INDIA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 240 INDIA: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 241 INDIA: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 242 INDIA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 243 INDIA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 244 INDIA: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 245 INDIA: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 246 INDIA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 247 INDIA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 248 INDIA: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 249 INDIA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 250 REST OF ASIA PACIFIC: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 251 REST OF ASIA PACIFIC: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 252 REST OF ASIA PACIFIC: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 253 REST OF ASIA PACIFIC: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 254 REST OF ASIA PACIFIC: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 256 REST OF ASIA PACIFIC: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 257 REST OF ASIA PACIFIC: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 258 REST OF ASIA PACIFIC: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 259 REST OF ASIA PACIFIC: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 260 REST OF ASIA PACIFIC: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5 LATIN AMERICA

- 9.5.1 LATIN AMERICA: IMPACT OF ECONOMIC RECESSION

- TABLE 261 LATIN AMERICA: MHEALTH SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 262 LATIN AMERICA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 263 LATIN AMERICA: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 264 LATIN AMERICA: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 265 LATIN AMERICA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 266 LATIN AMERICA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 267 LATIN AMERICA: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 268 LATIN AMERICA: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 269 LATIN AMERICA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 270 LATIN AMERICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 271 LATIN AMERICA: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 272 LATIN AMERICA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.2 BRAZIL

- 9.5.2.1 Brazil to dominate mHealth solutions market in Latin America

- TABLE 273 BRAZIL: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 274 BRAZIL: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 275 BRAZIL: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 276 BRAZIL: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 277 BRAZIL: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 278 BRAZIL: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 279 BRAZIL: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 280 BRAZIL: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 281 BRAZIL: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 282 BRAZIL: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 283 BRAZIL: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.3 MEXICO

- 9.5.3.1 Rising need to curtail healthcare expenditure to drive mHealth adoption

- TABLE 284 MEXICO: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 285 MEXICO: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 286 MEXICO: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 287 MEXICO: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 288 MEXICO: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 289 MEXICO: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 290 MEXICO: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 291 MEXICO: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 292 MEXICO: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 293 MEXICO: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 294 MEXICO: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.4 REST OF LATIN AMERICA

- TABLE 295 REST OF LATIN AMERICA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 296 REST OF LATIN AMERICA: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 297 REST OF LATIN AMERICA: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 298 REST OF LATIN AMERICA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 299 REST OF LATIN AMERICA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 300 REST OF LATIN AMERICA: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 301 REST OF LATIN AMERICA: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 302 REST OF LATIN AMERICA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 303 REST OF LATIN AMERICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 304 REST OF LATIN AMERICA: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 305 REST OF LATIN AMERICA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 RISING INTEREST IN BUILDING REGIONAL HEALTHCARE MOBILITY FRAMEWORKS TO FAVOR MHEALTH SEGMENT

- 9.6.2 MIDDLE EAST & AFRICA: IMPACT OF ECONOMIC RECESSION

- TABLE 306 MIDDLE EAST & AFRICA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: MHEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 308 MIDDLE EAST & AFRICA: HEALTHCARE APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: WOMEN'S HEALTH APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 312 MIDDLE EAST & AFRICA: MEDICAL APPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 313 MIDDLE EAST & AFRICA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 314 MIDDLE EAST & AFRICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 315 MIDDLE EAST & AFRICA: MHEALTH SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 316 MIDDLE EAST & AFRICA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- FIGURE 30 KEY DEVELOPMENTS OF MARKET PLAYERS BETWEEN JANUARY 2020 AND MARCH 2023

- 10.2 MARKET RANKING ANALYSIS

- FIGURE 31 MHEALTH APPLICATIONS AND DEVICES MARKET RANKING ANALYSIS, BY PLAYER, 2022

- 10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 32 MHEALTH SOLUTIONS MARKET: REVENUE ANALYSIS OF KEY PLAYERS

- 10.4 MHEALTH SOLUTIONS MARKET: R&D EXPENDITURE

- FIGURE 33 R&D EXPENDITURE OF KEY PLAYERS (2020 VS. 2021)

- 10.5 COMPANY EVALUATION QUADRANT (2022)

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 34 MHEALTH SOLUTIONS MARKET: COMPANY EVALUATION QUADRANT (2022)

- 10.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2022)

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 DYNAMIC COMPANIES

- 10.6.3 RESPONSIVE COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 35 MHEALTH SOLUTIONS MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2022)

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 PRODUCT & SERVICE LAUNCHES & APPROVALS

- TABLE 317 PRODUCT & SERVICE LAUNCHES & APPROVALS, JANUARY 2020-MARCH 2023

- 10.7.2 DEALS

- TABLE 318 DEALS, JANUARY 2020-MARCH 2023

11 COMPANY PROFILES

(Business overview, Products & services offered, Recent Developments, MNM view)*

- 11.1 KEY PLAYERS

- 11.1.1 KONINKLIJKE PHILIPS N.V.

- TABLE 319 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- FIGURE 36 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- 11.1.2 MEDTRONIC PLC

- TABLE 320 MEDTRONIC PLC: BUSINESS OVERVIEW

- FIGURE 37 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

- 11.1.3 OMRON HEALTHCARE CO., LTD.

- TABLE 321 OMRON HEALTHCARE CO., LTD.: BUSINESS OVERVIEW

- FIGURE 38 OMRON CORPORATION.: COMPANY SNAPSHOT (2021)

- 11.1.4 JOHNSON & JOHNSON

- TABLE 322 JOHNSON & JOHNSON: BUSINESS OVERVIEW

- FIGURE 39 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

- 11.1.5 CERNER CORPORATION

- TABLE 323 CERNER CORPORATION: BUSINESS OVERVIEW

- FIGURE 40 CERNER CORPORATION: COMPANY SNAPSHOT (2021)

- 11.1.6 APPLE, INC.

- TABLE 324 APPLE, INC.: BUSINESS OVERVIEW

- FIGURE 41 APPLE, INC.: COMPANY SNAPSHOT (2022)

- 11.1.7 ALIVECOR, INC.

- TABLE 325 ALIVECOR, INC.: BUSINESS OVERVIEW

- 11.1.8 AIRSTRIP TECHNOLOGIES

- TABLE 326 AIRSTRIP TECHNOLOGIES: BUSINESS OVERVIEW

- 11.1.9 ATHENAHEALTH, INC.

- TABLE 327 ATHENAHEALTH, INC.: BUSINESS OVERVIEW

- 11.1.10 IHEALTH LABS, INC.

- TABLE 328 IHEALTH LABS, INC.: BUSINESS OVERVIEW

- 11.1.11 AT&T, INC.

- TABLE 329 AT&T, INC.: BUSINESS OVERVIEW

- FIGURE 42 AT&T, INC.: COMPANY SNAPSHOT (2021)

- 11.1.12 AGAMATRIX, INC.

- TABLE 330 AGAMATRIX, INC.: BUSINESS OVERVIEW

- 11.1.13 CISCO SYSTEMS, INC.

- TABLE 331 CISCO SYSTEMS, INC.: BUSINESS OVERVIEW

- FIGURE 43 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- 11.1.14 FITBIT, INC.

- TABLE 332 FITBIT, INC.: BUSINESS OVERVIEW

- 11.1.15 VODAFONE GROUP PLC

- TABLE 333 VODAFONE GROUP PLC: BUSINESS OVERVIEW

- FIGURE 44 VODAFONE GROUP PLC: COMPANY SNAPSHOT (2022)

- 11.1.16 QUALCOMM TECHNOLOGIES, INC.

- TABLE 334 QUALCOMM TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 45 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- 11.1.17 GARMIN LTD.

- TABLE 335 GARMIN LTD.: BUSINESS OVERVIEW

- FIGURE 46 GARMIN LTD.: COMPANY SNAPSHOT (2022)

- 11.1.18 TUNSTALL HEALTHCARE

- TABLE 336 TUNSTALL HEALTHCARE: BUSINESS OVERVIEW

- 11.2 ADDITIONAL COMPANIES

- 11.2.1 SOFTSERVE

- 11.2.2 OSP LABS

- 11.2.3 OMADA HEALTH

- 11.2.4 DEXCOM, INC.

- 11.2.5 TELADOC HEALTH, INC.

- 11.2.6 ZTE CORPORATION

- 11.2.7 MY MHEALTH LIMITED

Details on Business overview, Products & services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS