|

|

市場調査レポート

商品コード

1248054

GPS追跡装置の世界市場:種類別 (スタンドアロントラッカー、OBDデバイス、高度トラッカー)・展開方法別 (商用車、貨物・コンテナ)・通信技術別 (衛星、セルラー)・業種別・地域別の将来予測 (2028年まで)GPS Tracking Device Market by Type (Standalone Trackers, OBD Devices, Advance Trackers), Deployment (Commercial Vehicles, Cargo and Containers), Communication Technologies (Satellite, Cellular), Industry and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| GPS追跡装置の世界市場:種類別 (スタンドアロントラッカー、OBDデバイス、高度トラッカー)・展開方法別 (商用車、貨物・コンテナ)・通信技術別 (衛星、セルラー)・業種別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月23日

発行: MarketsandMarkets

ページ情報: 英文 163 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のGPS追跡装置の市場規模は、2023年の31億米ドルから2028年には57億米ドルに成長する見通しで、予測期間中に13.1%のCAGRで成長すると予想されています。

GPS追跡装置の進歩により、リアルタイムモニタリング・ジオフェンシング・レポートカスタマイズなどの機能が開発されています。こうした取り組みにより、GPS追跡装置は、輸送・物流・建設・農業の各業界にとって魅力的なものとなっています。

"高度トラッカーは予測期間中、最大の市場シェアを獲得する"

高度トラッカーは、独自のセンサーではなく、エンジンから車両性能パラメーターを直接取得するため、スタンドアロントラッカーよりも優れており、特に車載用途に適しています。こうした装置は、車両追跡・トレース以外の優れたサービスを提供するために、さまざまなフリート管理サービスプロバイダーによって使用されています。車両の所有者は、より高いROIを達成するために、運用効率を高めることに関心を寄せています。しかし、高度なデータ分析ツールを利用できるようになったことで、その需要はさらに高まっています。

"貨物・コンテナ分野は、予測期間中に大きな成長機会を提供する"

企業経営者は、GPS追跡装置によって実現されるサプライチェーンの可視化や貨物・コンテナのセキュリティに重点を置いているため、貨物やコンテナにおけるこれらの装置の市場は、予測期間中に高い成長率で成長すると予想されます。貴重な資産や貨物が世界中に輸送されますが、こうしたコンテナ・貨物の紛失や損傷は、メーカーやバイヤーに大きな金銭的損失をもたらす可能性があります。したがって、輸送中のコンテナを追跡することは非常に重要となっています。

"アジア太平洋は、予測期間中に最も高いCAGRで成長する"

アジア太平洋のGPS追跡装置市場は主に、安全・安心への関心の高まり、eコマース市場の拡大、政府の取り組み、技術進歩といった様々な要因が絡み合う形で促進しています。商用車は、中国経済において重要な役割を担っています。世界の製造拠点である中国では、輸送と物流が国の発展にとって重要な産業です。道路輸送は、中国市場で輸送される総物資の大部分を占めています。したがって、中国のGPS追跡装置市場は、高い成長を示すことが期待されています。

当レポートでは、世界のGPS追跡装置の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・展開方法別・通信技術別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- 価格分析

- 主な利害関係者と購入基準

- 貿易分析

- 主な会議とイベント (2023年~2024年)

第6章 GPS追跡装置市場:種類別

- イントロダクション

- スタンドアロントラッカー

- OBDデバイス

- 高度トラッカー

第7章 GPS追跡装置市場:展開方法別

- イントロダクション

- 商用車

- 貨物・コンテナ

第8章 GPS追跡装置の通信技術

- イントロダクション

- 衛星

- セルラー

第9章 GPS追跡装置市場:業種別

- イントロダクション

- 輸送・物流

- 建設業

- 石油・ガス

- 金属・鉱業

- 政府

- その他

- 教育

- ホスピタリティ

- 農業

- 医療

第10章 GPS追跡装置市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 韓国

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要企業の収益分析

- 上位企業の市場シェア分析 (2022年)

- 競合リーダーシップマッピング

- 競合シナリオと動向

- GPS追跡装置市場:製品発売 (2021年1月~2022年11月)

- GPS追跡装置市場:資本取引 (2021年9月~2022年7月)

第12章 企業プロファイル

- 主要企業

- CALAMP CORPORATION

- ORBCOMM INC.

- SIERRA WIRELESS, INC.

- SHENZHEN CONCOX INFORMATION TECHNOLOGY CO., LTD.

- QUECLINK WIRELESS SOLUTIONS CO., LTD.

- TOMTOM INTERNATIONAL BV

- MEITRACK GROUP

- TELTONIKA UAB

- ATRACK TECHNOLOGY INC.

- GEOTAB INC.

- TRACKIMO

- その他の企業

- AZUGA INC.

- VERIZON WIRELESS

- SPYTEC GPS

- T42 IOT TRACKING SOLUTIONS PLC

- TRACKINGFOX, INC.

- TKSTAR TECHNOLOGY CO., LIMITED

- SKYPATROL LLC

- LAIPAC TECHNOLOGY, INC.

- ARKNAV INTERNATIONAL, INC.

- GEOFORCE

- SENSATA TECHNOLOGIES, INC.

- BRICKHOUSE SECURITY

- RUPTELA

- SUNTECH INTERNATIONAL LTD.

第13章 隣接・関連市場

- イントロダクション

- 研究の限界

- 道路市場:システム別

第14章 付録

The GPS tracking device market is projected to grow from USD 3.1 billion in 2023 to USD 5.7 billion in 2028; it is expected to grow at a CAGR of 13.1% during the forecasted period. Advancements in GPS tracking devices have developed features such as real-time monitoring, geofencing, custom reporting, etc. Such initiatives have made GPS tracking devices more attractive to transportation, logistics, construction, and agriculture industries.

"Advance trackers is expected to register largest market share during the forecast period"

Advance trackers are better than standalone trackers, especially in-vehicle applications, as they capture vehicle performance parameters directly from the engine rather than its own sensors. These devices are being used by various fleet management service providers to offer superior services beyond vehicle tracking and tracing. Fleet owners are interested in increasing operational efficiency to achieve higher ROI. However, the availability of advanced data analytics tools further favors their demand.

"Cargo & containers segment to provide significant growth opportunities during the forecast period"

Business owners focus on better visibility of the supply chain and security of the cargo and container that is enabled by GPS tracking devices; thus, the market of these devices in cargo and container is expected to grow at the highest growth rate during the forecast period. Valuable assets and freights are often transported across the world. The loss or damage of these containers or cargo may cause significant financial loss to the manufacturer or the buyer. Thus, it is very important to keep track of containers during their transportation.

"Market in Asia Pacific to grow at highest CAGR during the forecast period"

The GPS tracking device market in Asia Pacific Region is mainly driven by a combination of factors, including increasing focus on safety and security, growing e-commerce market, government initiatives, and advancement in technology. Commercial vehicle plays a vital role in China's economy. Being the global manufacturing hub, transportation and logistics is a crucial industries for the development of the country. Road transport represents a major chunk of the total goods transported in the Chinese market. Thus, the GPS tracking devices market in China is expected to witness high growth.

Breakdown of the profiles of primary participants:

- By Company Type: Tier 1 - 30%, Tier 2 - 35%, and Tier 3 - 35%

- By Designation: C-level Executives - 55%, Directors - 30%, and others - 15%

- By Region: North America - 20%, Europe - 35%, Asia Pacific - 35%, and RoW - 10%

Major players profiled in this report are as follows: CalAmp Corp. (US), Orbcomm Inc. (US), Sierra Wireless, Inc. (Canada), Shenzhen Concox Information Technology Co., Ltd. (China), Queclink Wireless Solutions Co., Ltd. (China), TomTom International BV (Netherlands), Teltonika UAB (Lithuania), ATrack Technology Inc. (Taiwan), Ruptela (Lithuania), and Sensata Technologies, Inc. (US).

Research Coverage

This research report categorizes the GPS tracking device market on the basis of type, deployment, industry, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the GPS tracking device market and forecasts the same till 2028. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the GPS tracking device ecosystem.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall GPS tracking device market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 SEGMENTATION OF GPS TRACKING DEVICE MARKET

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 GPS TRACKING DEVICE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.1.1 Key industry insights

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 7 RESEARCH STUDY ASSUMPTIONS

- TABLE 1 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON GPS TRACKING DEVICE MARKET

3 EXECUTIVE SUMMARY

- FIGURE 8 ADVANCE TRACKERS TO DOMINATE GPS TRACKING DEVICE MARKET DURING FORECAST PERIOD

- FIGURE 9 CARGO AND CONTAINERS PROJECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 TRANSPORTATION & LOGISTICS TO DOMINATE GPS TRACKING DEVICE MARKET

- FIGURE 11 MARKET IN EUROPE HELD LARGEST MARKET SHARE IN 2022

- 3.1 IMPACT ANALYSIS OF RECESSION ON GPS TRACKING DEVICE MARKET

- FIGURE 12 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES (PERCENTAGE CHANGE)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GPS TRACKING DEVICE MARKET

- FIGURE 13 INCREASE IN DEMAND FOR CLOUD TECHNOLOGY AND IOT TO DRIVE GROWTH OF GPS TRACKING DEVICE MARKET

- 4.2 GPS TRACKING DEVICE MARKET, BY TYPE

- FIGURE 14 ADVANCE TRACKERS TO DOMINATE GPS TRACKING DEVICE MARKET BETWEEN 2023 AND 2O28

- 4.3 GPS TRACKING DEVICE MARKET, BY DEPLOYMENT

- FIGURE 15 COMMERCIAL VEHICLES TO CAPTURE HIGHEST MARKET SHARE IN 2028

- 4.4 ASIA PACIFIC GPS TRACKING DEVICE MARKET, BY INDUSTRY AND COUNTRY

- FIGURE 16 IN ASIA PACIFIC, TRANSPORTATION & LOGISTICS TO BE MOST LUCRATIVE INDUSTRY; CHINA LIKELY TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 GPS TRACKING DEVICE MARKET, BY REGION

- FIGURE 17 EUROPE HELD LARGEST SHARE OF GPS TRACKING DEVICE MARKET IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 GPS TRACKING DEVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for commercial vehicles

- 5.2.1.2 Demand for compact size and durable GPS tracking devices

- 5.2.1.3 Increasing popularity of cloud computing and IoT

- 5.2.2 RESTRAINTS

- 5.2.2.1 Impact of nonstandard products leads to poor user experience

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Demand for GPS tracking devices for usage-based insurance

- 5.2.3.2 Development of real-time monitoring features

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing adoption of hardware-agnostic tracking solutions and regular maintenance of GPS device

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 19 SUPPLY CHAIN ANALYSIS: GPS TRACKING DEVICE MARKET

- 5.4 PRICING ANALYSIS

- TABLE 2 INDICATIVE PRICING ANALYSIS OF GPS TRACKING DEVICES OFFERED BY COMPANIES

- FIGURE 20 AVERAGE SELLING PRICE OF GPS TRACKING DEVICE

- 5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- 5.6 TRADE ANALYSIS

- FIGURE 22 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8526, 2017-2021 (USD MILLION)

- FIGURE 23 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8526, 2017-2021 (USD MILLION)

- 5.7 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 4 GPS TRACKING DEVICE MARKET: CONFERENCES AND EVENTS, 2023-2024

6 GPS TRACKING DEVICE MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 24 ADVANCE TRACKERS EXPECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 5 GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 6 GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.2 STANDALONE TRACKERS

- 6.2.1 PROVIDE NEAR REAL-TIME LOCATION OF VEHICLES

- TABLE 7 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 8 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 9 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 10 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 11 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 12 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- 6.3 OBD DEVICES

- 6.3.1 OFFERS INFORMATION BY READING DTCS FROM VEHICLE COMPUTER SYSTEM

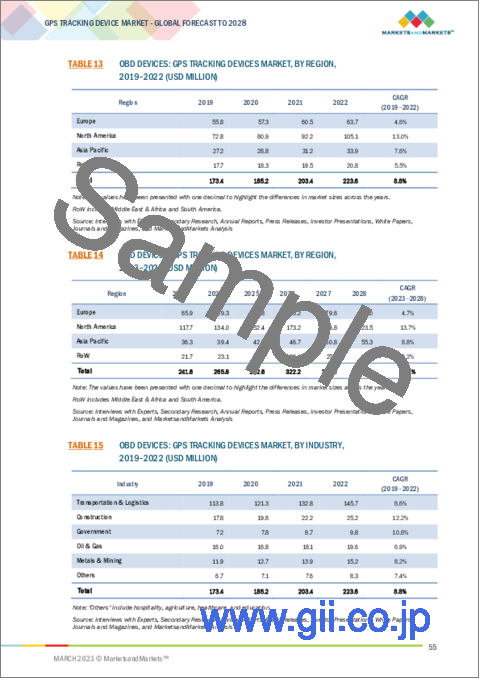

- TABLE 13 OBD DEVICES: GPS TRACKING DEVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 14 OBD DEVICES: GPS TRACKING DEVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 15 OBD DEVICES: GPS TRACKING DEVICES MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 16 OBD DEVICES: GPS TRACKING DEVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 6.4 ADVANCE TRACKERS

- 6.4.1 CONNECTED TO AUTOMOTIVE COMMUNICATION PORT TO PROVIDE VEHICLE-RELATED DATA

- TABLE 17 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 18 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 19 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 20 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 21 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 22 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

7 GPS TRACKING DEVICE MARKET, BY DEPLOYMENT

- 7.1 INTRODUCTION

- FIGURE 25 GPS TRACKING DEVICE MARKET FOR CARGO AND CONTAINERS TO EXPAND AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 23 GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 24 GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- 7.2 COMMERCIAL VEHICLES

- 7.2.1 ADVANCE TRACKERS TO GAIN POPULARITY IN COMMERCIAL VEHICLES

- TABLE 25 COMMERCIAL VEHICLE: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 26 COMMERCIAL VEHICLE: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.3 CARGO AND CONTAINERS

- 7.3.1 OFFERS SIMPLIFIED AND EFFECTIVE SOLUTIONS TO TRACK CARGO AND CONTAINERS

- TABLE 27 CARGO AND CONTAINER: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 28 CARGO AND CONTAINER: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

8 COMMUNICATION TECHNOLOGIES FOR GPS TRACKING DEVICE

- 8.1 INTRODUCTION

- 8.2 SATELLITE

- 8.3 CELLULAR

9 GPS TRACKING DEVICE MARKET, BY INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 26 TRANSPORTATION & LOGISTICS TO DOMINATE GPS TRACKING DEVICE MARKET FROM 2023 TO 2028

- TABLE 29 GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 30 GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 9.2 TRANSPORTATION & LOGISTICS

- 9.2.1 AUTOMATES WORKFLOW PROCESS AND ENSURES STREAMLINED OPERATIONS

- TABLE 31 TRANSPORTATION & LOGISTICS: GPS TRACKING DEVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 TRANSPORTATION & LOGISTICS: GPS TRACKING DEVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 33 TRANSPORTATION & LOGISTICS: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 34 TRANSPORTATION & LOGISTICS: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.3 CONSTRUCTION

- 9.3.1 IMPORTANCE OF TRACKING HEAVY VEHICLES AND ASSETS

- TABLE 35 CONSTRUCTION: GPS TRACKING DEVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 CONSTRUCTION: GPS TRACKING DEVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 37 CONSTRUCTION: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 38 CONSTRUCTION: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.4 OIL & GAS

- 9.4.1 TRACKS MOVEMENT OF LARGE-SCALE GENERATORS AND HEAVY VEHICLES

- TABLE 39 OIL & GAS: GPS TRACKING DEVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 OIL & GAS: GPS TRACKING DEVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 41 OIL & GAS: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 42 OIL & GAS: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.5 METALS & MINING

- 9.5.1 ENABLES TRANSPARENCY AND ACCOUNTABILITY IN MINING OPERATIONS

- TABLE 43 METALS & MINING: GPS TRACKING DEVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 METALS & MINING: GPS TRACKING DEVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 45 METALS & MINING: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 46 METALS & MINING: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.6 GOVERNMENT

- 9.6.1 MEETS COMMUNITY SAFETY DEMANDS, SAVES FUEL, AND PROVIDES QUICK RESPONSE IN EMERGENCIES

- TABLE 47 GOVERNMENT: GPS TRACKING DEVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 GOVERNMENT: GPS TRACKING DEVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 49 GOVERNMENT: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 50 GOVERNMENT: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.7 OTHERS

- 9.7.1 EDUCATION

- 9.7.2 HOSPITALITY

- 9.7.3 AGRICULTURE

- 9.7.4 HEALTHCARE

- TABLE 51 OTHERS: GPS TRACKING DEVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 52 OTHERS: GPS TRACKING DEVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 53 OTHERS: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 54 OTHERS: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

10 GPS TRACKING DEVICE MARKET, BY GEOGRAPHY

- 10.1 INTRODUCTION

- FIGURE 27 GPS TRACKING DEVICE MARKET: REGIONAL SNAPSHOT (2023-2028)

- TABLE 55 GPS TRACKING DEVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 GPS TRACKING DEVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 28 NORTH AMERICA: GPS TRACKING DEVICE MARKET SNAPSHOT

- TABLE 57 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Introduction of 4G technology to boost market growth

- 10.2.2 CANADA

- 10.2.2.1 Government as end-use segment to offer significant opportunities

- 10.2.3 MEXICO

- 10.2.3.1 Automotive industry to offer growth opportunities

- 10.3 EUROPE

- FIGURE 29 EUROPE: GPS TRACKING DEVICE MARKET SNAPSHOT

- TABLE 63 EUROPE: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 64 EUROPE: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 65 EUROPE: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 66 EUROPE: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 67 EUROPE: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 68 EUROPE: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.1 UK

- 10.3.1.1 Fleet management offerings to drive growth

- 10.3.2 GERMANY

- 10.3.2.1 Commercial vehicles play significant role in developing market

- 10.3.3 FRANCE

- 10.3.3.1 Agriculture likely to drive market for GPS tracking devices

- 10.3.4 REST OF EUROPE

- 10.4 ASIA PACIFIC

- FIGURE 30 ASIA PACIFIC: GPS TRACKING DEVICE MARKET SNAPSHOT

- TABLE 69 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 70 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 72 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Lucrative global manufacturing hub

- 10.4.2 JAPAN

- 10.4.2.1 Growing implementation of modern fleet solutions to drive growth

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Focus on advancement of GPS technology to create opportunities

- 10.4.4 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD

- TABLE 75 ROW: GPS TRACKING DEVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 ROW: GPS TRACKING DEVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 77 ROW: GPS TRACKING DEVICE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 78 ROW: GPS TRACKING DEVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 79 ROW: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 80 ROW: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.1 MIDDLE EAST & AFRICA

- 10.5.1.1 Expanding transportation and logistics industry

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Mainly driven by fleet management

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS OF KEY COMPANIES

- FIGURE 31 GPS TRACKING DEVICE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021

- 11.3 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2022

- FIGURE 32 SHARE OF MAJOR PLAYERS IN GPS TRACKING DEVICE MARKET, 2022

- TABLE 81 MARKET SHARE OF TOP PLAYERS IN GPS TRACKING DEVICE MARKET, 2022

- 11.4 COMPETITIVE LEADERSHIP MAPPING

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 33 GPS TRACKING DEVICE MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- 11.5 COMPETITIVE SCENARIOS AND TRENDS

- 11.5.1 GPS TRACKING DEVICE MARKET: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2022

- TABLE 82 GPS TRACKING DEVICE MARKET: PRODUCT LAUNCHES JANUARY 2021-NOVEMBER 2022

- 11.5.2 GPS TRACKING DEVICE MARKET: DEALS, SEPTEMBER 2021- JULY 2022

- TABLE 83 GPS TRACKING DEVICE MARKET: DEALS, SEPTEMBER 2021-JULY 2022

12 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, MNM view)*

- 12.1 KEY PLAYERS

- 12.1.1 CALAMP CORPORATION

- TABLE 84 CALAMP CORP.: BUSINESS OVERVIEW

- FIGURE 34 CALAMP CORP.: COMPANY SNAPSHOT

- TABLE 85 CALAMP CORP.: PRODUCTS OFFERED

- TABLE 86 CALAMP CORP.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 87 CALAMP CORP.: DEALS

- 12.1.2 ORBCOMM INC.

- TABLE 88 ORBCOMM INC.: BUSINESS OVERVIEW

- TABLE 89 ORBCOMM INC.: PRODUCTS OFFERED

- TABLE 90 ORBCOMM INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 91 ORBCOMM INC.: DEALS

- 12.1.3 SIERRA WIRELESS, INC.

- TABLE 92 SIERRA WIRELESS, INC.: BUSINESS OVERVIEW

- TABLE 93 SIERRA WIRELESS, INC.: PRODUCTS OFFERED

- 12.1.4 SHENZHEN CONCOX INFORMATION TECHNOLOGY CO., LTD.

- TABLE 94 SHENZHEN CONCOX INFORMATION TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 95 SHENZHEN CONCOX INFORMATION TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 96 SHENZHEN CONCOX INFORMATION TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 97 SHENZHEN CONCOX INFORMATION TECHNOLOGY CO., LTD.: DEALS

- 12.1.5 QUECLINK WIRELESS SOLUTIONS CO., LTD.

- TABLE 98 QUECLINK WIRELESS SOLUTIONS CO., LTD.: BUSINESS OVERVIEW

- FIGURE 35 QUECLINK WIRELESS SOLUTIONS CO., LTD.: COMPANY SNAPSHOT

- TABLE 99 QUECLINK WIRELESS SOLUTIONS CO., LTD.: PRODUCTS OFFERED

- TABLE 100 QUECLINK WIRELESS SOLUTIONS CO., LTD: PRODUCT LAUNCHES

- 12.1.6 TOMTOM INTERNATIONAL BV

- TABLE 101 TOMTOM INTERNATIONAL BV: BUSINESS OVERVIEW

- FIGURE 36 TOMTOM INTERNATIONAL BV: COMPANY SNAPSHOT

- TABLE 102 TOMTOM INTERNATIONAL BV: PRODUCTS OFFERED

- TABLE 103 TOMTOM INTERNATIONAL BV: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 104 TOMTOM INTERNATIONAL BV: DEALS

- 12.1.7 MEITRACK GROUP

- TABLE 105 MEITRACK GROUP: BUSINESS OVERVIEW

- TABLE 106 MEITRACK GROUP: PRODUCTS OFFERED

- 12.1.8 TELTONIKA UAB

- TABLE 107 TELTONIKA UAB: BUSINESS OVERVIEW

- TABLE 108 TELTONIKA UAB: PRODUCTS OFFERED

- 12.1.9 ATRACK TECHNOLOGY INC.

- TABLE 109 ATRACK TECHNOLOGIES INC.: BUSINESS OVERVIEW

- FIGURE 37 ATRACK TECHNOLOGIES INC.: COMPANY SNAPSHOT

- TABLE 110 ATRACK TECHNOLOGIES INC.: PRODUCTS OFFERED

- TABLE 111 ATRACK TECHNOLOGIES INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.1.10 GEOTAB INC.

- TABLE 112 GEOTAB INC.: BUSINESS OVERVIEW

- TABLE 113 GEOTAB INC.: PRODUCTS OFFERED

- TABLE 114 GEOTAB INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 115 GEOTAB INC.: DEALS

- 12.1.11 TRACKIMO

- TABLE 116 TRACKIMO: BUSINESS OVERVIEW

- TABLE 117 TRACKIMO: PRODUCTS OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 AZUGA INC.

- TABLE 118 AZUGA INC.: BUSINESS OVERVIEW

- 12.2.2 VERIZON WIRELESS

- TABLE 119 VERIZON WIRELESS: BUSINESS OVERVIEW

- 12.2.3 SPYTEC GPS

- TABLE 120 SPYTEC GPS: BUSINESS OVERVIEW

- 12.2.4 T42 IOT TRACKING SOLUTIONS PLC

- TABLE 121 T42 IOT TRACKING SOLUTIONS PLC: BUSINESS OVERVIEW

- 12.2.5 TRACKINGFOX, INC.

- TABLE 122 TRACKINGFOX, INC.: BUSINESS OVERVIEW

- 12.2.6 TKSTAR TECHNOLOGY CO., LIMITED

- TABLE 123 TKSTAR TECHNOLOGY CO., LIMITED: BUSINESS OVERVIEW

- 12.2.7 SKYPATROL LLC

- TABLE 124 SKYPATROL LLC: BUSINESS OVERVIEW

- 12.2.8 LAIPAC TECHNOLOGY, INC.

- 12.2.9 ARKNAV INTERNATIONAL, INC.

- 12.2.10 GEOFORCE

- 12.2.11 SENSATA TECHNOLOGIES, INC.

- 12.2.12 BRICKHOUSE SECURITY

- 12.2.13 RUPTELA

- 12.2.14 SUNTECH INTERNATIONAL LTD.

Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 STUDY LIMITATIONS

- 13.3 ITS MARKET FOR ROADWAYS, BY SYSTEM

- TABLE 125 ITS MARKET FOR ROADWAYS, BY SYSTEM, 2018-2022 (USD MILLION)

- TABLE 126 ITS MARKET FOR ROADWAYS, BY SYSTEM, 2023-2028 (USD MILLION)

- 13.3.1 ADVANCED TRAFFIC MANAGEMENT SYSTEMS

- 13.3.2 ADVANCED TRAVELER INFORMATION SYSTEMS

- 13.3.3 ITS-ENABLED TRANSPORTATION PRICING SYSTEMS

- 13.3.4 ADVANCED PUBLIC TRANSPORTATION SYSTEMS

- 13.3.5 COMMERCIAL VEHICLE OPERATIONS SYSTEMS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS