|

|

市場調査レポート

商品コード

1240612

自動車向け量子コンピューティングの世界市場:用途別 (ルート計画・交通管理、バッテリー最適化、材料研究、生産計画・スケジューリング)・展開方法別・コンポーネント別・ステークホルダー別・地域別の将来予測 (2035年まで)Quantum Computing in Automotive Market by Application (Route Planning & Traffic Management, Battery Optimization, Material Research, Production Planning & Scheduling), Deployment, Component, Stakeholder & Region - Global Forecast to 2035 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自動車向け量子コンピューティングの世界市場:用途別 (ルート計画・交通管理、バッテリー最適化、材料研究、生産計画・スケジューリング)・展開方法別・コンポーネント別・ステークホルダー別・地域別の将来予測 (2035年まで) |

|

出版日: 2023年03月08日

発行: MarketsandMarkets

ページ情報: 英文 199 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車向け量子コンピューティングの市場規模は、2026年の1億4,300万米ドルに達した後、2031年から2035年にかけて35.0%のCAGRで成長し、2035年には52億300万米ドルに成長すると予測されています。

自動車業界は、電気自動車やハイブリッド車、燃料電池の最適化、コネクテッドモビリティ、自動運転機能 (ADAS) 内の技術的専門性を高めるために、常に革新的な技術の開発に注力しています。バリューチェーン全体において、量子コンピューティングによる革新的な技術が、自動車産業に大きな変化をもたらすと予測されています。

"用途別では、予測期間中、自動運転車・コネクテッドカーが最も急速に成長するセグメントとなる"

自動運転車の開発は、近い将来に大きな意味を持つことになるでしょう。将来、レベル3・4・5の自動運転車が採用されれば、乗客が車に乗っている時間が長くなり、物理的に運転する時間が短くなる可能性があります。このような自動運転車の約90%は共有され、10%は個人的な通勤に使われるという調査結果もあります。このような利点から、量子コンピューティングは、自動運転車をより低い誤差ですぐに実現するための画期的な進歩として機能することができます。例えば、量子コンピューティングのアルゴリズムは、LiDAR・レーダー・画像センサーなどの高度システムから生成される膨大な量のデータを迅速に処理し、計算することができます。これは、手動での操作をほとんど必要としない車両内のインテリジェンスを訓練・開発するのに役立つと思われます。量子最適化アルゴリズムとシミュレーションアルゴリズムの助けを借りれば、処理に何年もかかるような従来のコンピューターに対して、ほんのわずかな時間でこのデータを最適化することが可能です。量子コンピュータは、より高速な計算を提供し、自動車の適切な機能に必要な重要な領域について意味のある洞察を開発するのに役立つと思われます。同様に、量子マシンのアルゴリズムは、物体を検出し、パターンを認識することもできます。より速く、より正確な結果を提供し、車両の全体的な性能と安全性を向上させることができる可能性があります。自動運転車のルート最適化、各種センサーが生成するデータの統合、3Dオブジェクト認識、サイバーセキュリティなど、さまざまな用途で自動運転車における量子コンピューティングの用途が増えることは、自動運転車の開発における量子コンピューティング技術の成長を促進すると考えられます。

"コンポーネント別では、ソフトウェア分野が市場をリードする"

自動車向け量子コンピューティング市場をコンポーネント別でみると、ソフトウェア分野がリードすると予測されています。商業的に実行可能で故障のない物理的な量子コンピュータを開発するための民間・公的機関による努力や投資の高まりに伴い、量子コンピュータの性能を向上させるためには、ソフトウェア環境の進歩も必要となっています。複数の業種の顧客が増え続ける中、技術プロバイダーは、様々な業界の今後の要求に応えるため、持続可能な量子コンピュータソフトウェアの開発に注力することになるでしょう。調査によると、66%の企業が、ソフトウェア開発を量子コンピューティング技術の主な優先事項と考えています。既存企業や複数の新興企業が、既存のソフトウェアのギャップを埋め、量子コンピュータの性能を向上させることができる、さまざまなバージョンのソフトウェアプラットフォームを開発すると予想されます。物理的な量子コンピュータの開発に必要な複雑さ、莫大な資本投資、有能な専門家の不足から、ハードウェア開発への新規参入は今後少なくなると予想されます。一方、ソフトウェア開発者にとっては、既存のスタックに統合して破壊的なソフトウェアを開発し、今後数年間で莫大なビジネス収益を得ることができる絶好の成長機会となります。

"地域別では、アジア太平洋が2035年まで急成長を遂げる市場になる"

予測期間中、アジア太平洋は自動車向け量子コンピューティング市場として急成長すると思われます。アジア太平洋地域は近年、自動車生産の中心地として浮上しており、自動車メーカーや部品メーカーの多くはアジア諸国を拠点としています。中国、インド、日本、韓国はこの地域の主要な自動車生産拠点であり、量子コンピューティング技術に投資するために有望な施設を計画しています。また、Hyundai MotorsやAISIN Groupなど、一部の地域企業は、電気自動車のバッテリー、自動運転車、材料研究において、量子コンピューティング機能の研究を開始しています。一人当たりの所得の向上、消費者の嗜好の変化、排ガス規制の強化により、市場競争はさらに激化し、域内企業は市場を維持することが難しくなっています。この量子コンピューティング技術は、今後数年間、競争力を維持するのに役立つと考えられます。

当レポートでは、世界の自動車向け量子コンピューティングの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、用途別・ステークホルダー別・コンポーネント別・展開方法別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 自動車産業における量子コンピューティングの影響

- ポーターのファイブフォース分析

- 自動車エコシステムにおける量子コンピューティング

- サプライチェーン分析

- ケーススタディ

- 主な会議とイベント (2022年~2023年)

- 規制基準

- 量子コンピューティング vs. 既存のデジタルプラットフォーム

- 技術分析

第6章 自動車向け量子コンピューティング市場:用途別

- イントロダクション

- ルート計画・交通管理

- バッテリー最適化

- 材料研究

- 自動運転車・コネクテッドカー

- 生産計画・スケジューリング

- その他

第7章 自動車向け量子コンピューティング市場:ステークホルダー別

- イントロダクション

- OEM

- ティア1・ディア2

- 倉庫・流通

第8章 自動車向け量子コンピューティング市場:コンポーネント別

- イントロダクション

- ソフトウェア

- ハードウェア

- サービス

第9章 自動車向け量子コンピューティング市場:展開方法別

- イントロダクション

- クラウド

- オンプレミス

第10章 自動車向け量子コンピューティング市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 欧州

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- ロシア

- スウェーデン

- 南北アメリカ

- 米国

- カナダ

- メキシコ

- ブラジル

第11章 MarketsandMarketsの提言

第12章 競合情勢

- 概要

- 市場ランキング分析 (2022年)

- 主な上場企業の収益分析

- 競合評価クアドラント

- 競合シナリオ

- 主要企業が採用した戦略/有力企業 (2018年~2022年)

- 競合ベンチマーキング

第13章 企業プロファイル

- 自動車向け量子コンピューティング市場:主要企業

- IBM CORPORATION

- MICROSOFT CORPORATION

- D-WAVE SYSTEMS INC.

- ALPHABET INC.

- RIGETTI & CO, LLC

- ACCENTURE PLC

- IONQ

- AMAZON

- TERRA QUANTUM

- PASQAL

- PRODUCTS OFFERED

- 自動車向け量子コンピューティング市場:その他の企業

- QUANTINUUM LTD. (CAMBRIDGE QUANTUM COMPUTING LTD.)

- INTEL CORPORATION

- CAPGEMINI

- ZAPATA COMPUTING

- XANADU QUANTUM TECHNOLOGIES INC.

- QUANTICA COMPUTACAO

- QC WARE CORP

- ATOM COMPUTING INC.

- MAGIQ TECHNOLOGIES INC.

- ANYON SYSTEMS

第14章 付録

The automotive quantum computing market is projected to grow from USD 143 million in 2026 to USD 5,203 million by 2035, at a CAGR of 35.0% from 2031 to 2035. The automotive industry has constantly focused on developing innovative technologies to advance technological expertise within electric and hybrid vehicles, fuel cell optimization, connected mobility, and automated driving features (ADAS). Immense quantum computing capabilities are projected to bring life-changing results across the entire value chain of the automotive industry.

Autonomous & connected vehicles to become the fastest-growing segment during the forecast period

Developments in autonomous vehicles will be significant in the near years. The future adoption of Level 3, 4, and 5 autonomous vehicles could result in passengers spending more time in cars and less time physically driving them. Few surveys suggest that about 90% of these autonomous vehicles will be shared, and 10% will be used for personal commuting. Owing to these advantages, quantum computing can act as a breakthrough advancement to make autonomous vehicles a reality soon with lower error margins. For instance, quantum computing algorithms can rapidly process and calculate huge amounts of data generated from LIDAR, RADAR, & image sensors, and other advanced systems. This would be helpful in training & developing intelligence within the vehicle to operate with little manual intervention. With the help of quantum optimization and simulation algorithms, it is possible to optimize this data in a fraction of the time against traditional computers, which may require years to process. Quantum computing would be useful to provide faster computation and develop meaningful insights for critical areas necessary for proper vehicle functioning. Likewise, Quantum machine algorithms can also detect objects and recognize patterns. They can potentially provide faster and more accurate results, improving the overall performance and safety of the vehicle. Rising applications of quantum computing in autonomous vehicles for different applications, such as route optimization of the autonomous vehicle, integration of data produced by various sensors, 3D object recognition, and cybersecurity, would fuel the growth of quantum computing technology for developing autonomous vehicles.

Software segment to lead the quantum computing market in the automotive industry

The software segment is projected to lead the quantum computing market in the automotive industry by component. With the rising efforts and investments by private and public entities to develop a commercially viable and fault-free physical quantum computer, the advancement in the software environment is also necessary to improve quantum computer performance. As clients from multiple industry industries continue to grow, technology providers would focus on developing sustainable quantum computing software to cater to the upcoming requirements of various industries. According to the "State of Quantum 2022 Report", 66% of companies consider software development a main priority for quantum computing technology. Established companies and multiple start-ups are expected to develop different versions of software platforms that can fill gaps in existing software and enhance the performance of quantum computers. Associated complexity, huge capital investments, and scarcity of qualified professionals required to develop physical quantum computers are expected to limit fewer new entrants in hardware development in the future. Alternatively, this will bring immense growth opportunities for software developers to integrate themselves into the existing stack to develop disruptive software and reap tremendous business revenues in the coming years

Asia Pacific is projected to be the fastest-growing market for quantum computing in the Automotive market by 2035

During the forecast period, Asia Pacific will be the fastest-growing market for quantum computing in the automotive industry. Asia Pacific has emerged as a hub for automotive production in recent years, due to which most automotive OEMs and component manufacturers are based out of Asian countries. China, India, Japan, and South Korea are major vehicle production hubs in the region and have planned some promising considerable to be invested in quantum computing technology. Further few regional players, such as Hyundai Motors and AISIN Group, have started exploring quantum computing capabilities in electric vehicle batteries, autonomous vehicles, and material research. Improving per capita income, changing consumer preferences, and tightening emission norms have further increased competition among the regional players to sustain their market hold. This quantum computing technology can help them remain competitive in the coming years.

In-depth interviews were conducted with CXOs, VPs, directors from business development, marketing, product development/innovation teams, independent consultants, and executives from various key organizations operating in this market.

- By Stake Holders: Demand Side - 20%, Supply Side - 80%

- By Designation: Director Level - 30%, C Level Executives - 10%, and Others - 60%

- By Region: Asia Pacific - 40%, Europe - 20%, and North America - 40%

Quantum computing in the automotive market is led by globally established players such as IBM Corporation (US), Microsoft Corporation (US), Amazon (US), D-Wave Systems, Inc.(US), and Rigetti & Co, LLC (US).

Research Coverage:

The study segments the automotive quantum computing market and forecasts are based on the application type (Route Planning & Traffic Management, Battery Optimization, Material Research, Autonomous, and Connected Vehicles, Production Planning and Scheduling, and others), by deployment type (Cloud, and On-premises), by component type (Software, Hardware, and Services), by Stakeholder type (OEM, Automotive tier 1 and 2, and Warehousing and Distribution), and Region (Asia Pacific, Europe, and Americas).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall quantum computing in the automotive market and the sub-segments. This report will help to understand the potential applications of quantum computing technology and OEM tie-ups for the use of quantum computing technology for various applications. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. This report will help stakeholders to understand the potential applications and their penetration rate in the automotive industry. This report provides insights on strategic developments by automotive companies in quantum computing technology across short-term and long-term automotive applications. This report will offer the futuristic market potential of various components such as hardware, software, and services, enabling readers to understand market investment areas. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: INCLUSIONS

- AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 QUANTUM COMPUTING IN AUTOMOTIVE MARKET SEGMENTATION

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN - QUANTUM COMPUTING IN AUTOMOTIVE MARKET

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for market sizing

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- 2.1.2.2 Sampling techniques and data collection methods

- 2.1.2.3 Primary participants

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 4 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: TOP-DOWN APPROACH

- 2.2.2 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY- SIDES

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 ASSUMPTIONS AND ASSOCIATED RISKS

- 2.4.1 RESEARCH ASSUMPTIONS

- 2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 REPORT SUMMARY

- FIGURE 5 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2026 VS. 2035 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES FOR QUANTUM COMPUTING PROVIDERS IN AUTOMOTIVE INDUSTRY

- FIGURE 6 RISING GOVERNMENT INVESTMENTS AND TECHNICAL COLLABORATIONS OF OEMS WITH QUANTUM COMPUTING PROVIDERS TO DRIVE MARKET

- 4.2 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION

- FIGURE 7 ROUTE PLANNING AND TRAFFIC MANAGEMENT TO DOMINATE APPLICATION SEGMENT DURING FORECAST PERIOD

- 4.3 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY DEPLOYMENT

- FIGURE 8 CLOUD SEGMENT TO HOLD LARGEST MARKET SHARE (2026-2035)

- 4.4 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY COMPONENT

- FIGURE 9 SOFTWARE SEGMENT TO HAVE HIGHEST GROWTH FROM 2026 TO 2035

- 4.5 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY STAKEHOLDER

- FIGURE 10 OEM SEGMENT PROJECTED TO HOLD MAXIMUM MARKET SHARE DURING FORECAST PERIOD

- 4.6 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION

- FIGURE 11 AMERICAS TO WITNESS HIGHEST MARKET GROWTH IN 2026

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 12 QUANTUM COMPUTING IN AUTOMOTIVE MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased government investments

- TABLE 2 COUNTRY-WISE OVERALL INVESTMENTS IN QUANTUM COMPUTING TECHNOLOGY

- 5.2.1.2 Strategic partnerships and collaborations

- TABLE 3 LIST OF AUTOMOTIVE COMPANIES COLLABORATING WITH QUANTUM COMPUTING TECHNOLOGY PROVIDERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stability and quantum error correction issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in sales of electric and hybrid vehicles

- FIGURE 13 ELECTRIC AND PLUG-IN HYBRID VEHICLE SALES FORECAST, 2021 VS. 2030 (THOUSAND UNITS)

- 5.2.3.2 Advancements in quantum computing technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled professionals and infrastructure

- 5.3 IMPACT OF QUANTUM COMPUTING IN AUTOMOTIVE INDUSTRY

- FIGURE 14 TECHNOLOGIES/PROCESSES/TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF SUBSTITUTES

- 5.4.2 THREAT OF NEW ENTRANTS

- 5.4.3 BARGAINING POWER OF BUYERS

- 5.4.4 BARGAINING POWER OF SUPPLIERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 QUANTUM COMPUTING IN AUTOMOTIVE ECOSYSTEM

- FIGURE 16 QUANTUM COMPUTING IN AUTOMOTIVE MARKET ECOSYSTEM

- TABLE 5 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 17 SUPPLY CHAIN ANALYSIS: QUANTUM COMPUTING IN AUTOMOTIVE MARKET

- 5.6.1 ROLE OF STAKEHOLDERS IN SUPPLY CHAIN

- 5.7 CASE STUDIES

- 5.7.1 QUANTUM COMPUTING APPLICATIONS

- 5.7.1.1 Pharmaceutical and Healthcare

- 5.7.1.1.1 Accenture Labs and Biogen applied quantum computing to accelerate drug discovery

- 5.7.1.2 Banking and Finance

- 5.7.1.2.1 BBVA and Zapata Computing demonstrated potential to speedup for Monte Carlo simulations for credit valuation adjustments (CVA) and derivative pricing

- 5.7.1.3 Aerospace & Defense

- 5.7.1.3.1 IonQ and Airbus developed quantum computing solutions for aircraft loading

- 5.7.1.4 Automotive Industry

- 5.7.1.1 Pharmaceutical and Healthcare

- 5.7.2 DAIMLER AG AND IBM CORPORATION WORKING ON QUANTUM COMPUTING TO UNDERSTAND SIMULATION OF LI-SULFUR BATTERIES

- 5.7.3 BMW GROUP AND PASQAL COMPUTING DEVELOPED QUANTUM COMPUTING SYSTEM TO IMPROVE AUTO DESIGN AND MANUFACTURING

- 5.7.4 HYUNDAI MOTOR COMPANY AND IONQ WORKING ON QUANTUM COMPUTING FOR 3D OBJECT DETECTION FOR AUTONOMOUS VEHICLES

- 5.7.5 VOLKSWAGEN AND GOOGLE TO DEVELOP QUANTUM COMPUTERS FOR MATERIAL RESEARCH AND TRAFFIC MANAGEMENT

- 5.7.1 QUANTUM COMPUTING APPLICATIONS

- 5.8 KEY CONFERENCES AND EVENTS IN 2022-2023

- 5.8.1 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: UPCOMING CONFERENCES AND EVENTS

- 5.9 REGULATORY STANDARDS

- 5.9.1 P1913 - SOFTWARE-DEFINED QUANTUM COMMUNICATION

- 5.9.2 P7130 - STANDARD FOR QUANTUM TECHNOLOGIES DEFINITIONS

- 5.9.3 P7131 - STANDARD FOR QUANTUM TECHNOLOGIES DEFINITIONS

- 5.10 QUANTUM COMPUTING VS. EXISTING DIGITAL PLATFORM

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 DEVELOPMENT OF QUANTUM COMMUNICATION TECHNOLOGY

- 5.11.2 DEVELOPMENT OF ERROR MITIGATION APPROACH AND DYNAMIC CIRCUITS FOR ADVANCED QUANTUM COMPUTING SYSTEM

6 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.1.1 RESEARCH METHODOLOGY

- 6.1.2 ASSUMPTIONS

- 6.1.3 INDUSTRY INSIGHTS

- FIGURE 18 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION, 2026 VS. 2035 (USD MILLION)

- TABLE 6 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION, 2026-2030 (USD MILLION)

- TABLE 7 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION, 2031-2035 (USD MILLION)

- 6.2 ROUTE PLANNING AND TRAFFIC MANAGEMENT

- 6.2.1 SHOWCASES REAL-TIME VEHICLE TRAFFIC AND TRACKING

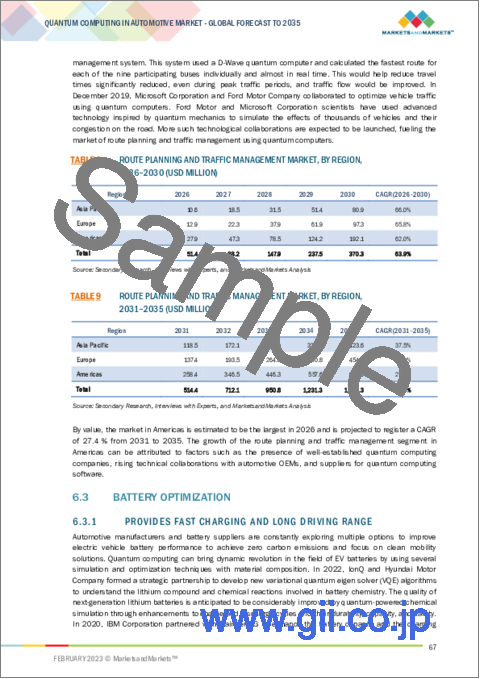

- TABLE 8 ROUTE PLANNING AND TRAFFIC MANAGEMENT MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 9 ROUTE PLANNING AND TRAFFIC MANAGEMENT MARKET, BY REGION, 2031-2035 (USD MILLION)

- 6.3 BATTERY OPTIMIZATION

- 6.3.1 PROVIDES FAST CHARGING AND LONG DRIVING RANGE

- TABLE 10 BATTERY OPTIMIZATION MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 11 BATTERY OPTIMIZATION MARKET, BY REGION, 2031-2035 (USD MILLION)

- 6.4 MATERIAL RESEARCH

- 6.4.1 RISING FOCUS ON MATERIAL COMPOSITION FOR ENHANCED PRODUCT DEVELOPMENT

- TABLE 12 MATERIAL RESEARCH MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 13 MATERIAL RESEARCH MARKET, BY REGION, 2031-2035 (USD MILLION)

- 6.5 AUTONOMOUS AND CONNECTED VEHICLES

- 6.5.1 INCORPORATES ADAS FEATURES

- TABLE 14 AUTONOMOUS AND CONNECTED VEHICLES MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 15 AUTONOMOUS AND CONNECTED VEHICLES MARKET, BY REGION, 2031-2035 (USD MILLION)

- 6.6 PRODUCTION PLANNING AND SCHEDULING

- 6.6.1 HELPS IN PRODUCTION SCHEDULING, INVENTORY MANAGEMENT, AND QUALITY CONTROL

- TABLE 16 PRODUCTION PLANNING AND SCHEDULING MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 17 PRODUCTION PLANNING AND SCHEDULING MARKET, BY REGION, 2031-2035 (USD MILLION)

- 6.7 OTHERS

- 6.7.1 PROVIDES PREDICTIVE MAINTENANCE AND BETTER SUPPLY CHAIN MANAGEMENT

- TABLE 18 OTHERS MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 19 OTHERS MARKET, BY REGION, 2031-2035 (USD MILLION)

7 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY STAKEHOLDER

- 7.1 INTRODUCTION

- 7.1.1 RESEARCH METHODOLOGY

- 7.1.2 ASSUMPTIONS

- 7.1.3 INDUSTRY INSIGHTS

- FIGURE 19 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY STAKEHOLDER, 2026 VS. 2035 (USD MILLION)

- TABLE 20 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY STAKEHOLDER TYPE, 2026-2030 (USD MILLION)

- TABLE 21 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY STAKEHOLDER TYPE, 2031-2035 (USD MILLION)

- 7.2 OEM

- 7.2.1 INCREASING TECHNICAL COLLABORATION BETWEEN OEMS AND QUANTUM COMPUTING SUPPLIERS

- TABLE 22 OEM: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 23 OEM: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2031-2035 (USD MILLION)

- 7.3 TIER 1 AND 2

- 7.3.1 INCREASING POTENTIAL APPLICATIONS IN PRODUCT DESIGN AND MATERIAL RESEARCH

- TABLE 24 TIER 1 AND 2: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 25 TIER 1 AND 2: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2031-2035 (USD MILLION)

- 7.4 WAREHOUSING AND DISTRIBUTION

- 7.4.1 ASSISTS IN SUPPLY CHAIN OPTIMIZATION AND DEMAND FORECASTING

- TABLE 26 WAREHOUSING AND DISTRIBUTION: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 27 WAREHOUSING AND DISTRIBUTION: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2031-2035 (USD MILLION)

8 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.1.1 RESEARCH METHODOLOGY

- 8.1.2 ASSUMPTIONS

- 8.1.3 INDUSTRY INSIGHTS

- FIGURE 20 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY COMPONENT, 2026 VS. 2035 (USD MILLION)

- TABLE 28 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY COMPONENT, 2026-2030 (USD MILLION)

- TABLE 29 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY COMPONENT, 2031-2035 (USD MILLION)

- 8.2 SOFTWARE

- 8.2.1 GROWING END USE AND NUMBER OF SOFTWARE STARTUPS

- TABLE 30 SOFTWARE: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 31 SOFTWARE: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2031-2035 (USD MILLION)

- 8.3 HARDWARE

- 8.3.1 RISING GOVERNMENT AND PRIVATE INVESTMENTS IN QUANTUM HARDWARE

- TABLE 32 HARDWARE: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 33 HARDWARE: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2031-2035 (USD MILLION)

- 8.4 SERVICES

- 8.4.1 INCREASING ACCESS TO CLOUD QUANTUM COMPUTING SERVICES

- TABLE 34 SERVICES: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 35 SERVICES: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2031-2035 (USD MILLION)

9 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY DEPLOYMENT

- 9.1 INTRODUCTION

- 9.1.1 RESEARCH METHODOLOGY

- 9.1.2 ASSUMPTIONS

- 9.1.3 INDUSTRY INSIGHTS

- FIGURE 21 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY DEPLOYMENT, 2026 VS. 2035 (USD MILLION)

- TABLE 36 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY DEPLOYMENT, 2026-2030 (USD MILLION)

- TABLE 37 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY DEPLOYMENT, 2031-2035 (USD MILLION)

- 9.2 CLOUD

- 9.2.1 EASY ACCESS AND LESS MAINTENANCE

- TABLE 38 CLOUD: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 39 CLOUD: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2031-2035 (USD MILLION)

- 9.3 ON-PREMISES

- 9.3.1 GREATER CONTROL OVER QUANTUM HARDWARE AND DATA SECURITY

- TABLE 40 ON-PREMISES: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 41 ON-PREMISES: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2031-2035 (USD MILLION)

10 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.1.1 RESEARCH METHODOLOGY

- 10.1.2 ASSUMPTIONS

- 10.1.3 INDUSTRY INSIGHTS: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE

- FIGURE 22 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, 2026 VS. 2035 (USD MILLION)

- TABLE 42 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 43 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY REGION, 2031-2035 (USD MILLION)

- 10.2 ASIA PACIFIC

- FIGURE 23 ASIA PACIFIC: QUANTUM COMPUTING IN AUTOMOTIVE MARKET SNAPSHOT

- TABLE 44 ASIA PACIFIC: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY COUNTRY, 2026-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- 10.2.1 CHINA

- 10.2.1.1 Rising investment in quantum computing

- TABLE 46 CHINA: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030(USD MILLION)

- TABLE 47 CHINA: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.2.2 INDIA

- 10.2.2.1 Rising government support and collaboration with quantum suppliers

- TABLE 48 INDIA: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030(USD MILLION)

- TABLE 49 INDIA: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.2.3 JAPAN

- 10.2.3.1 Growing government investments and launch of new advanced quantum computers

- TABLE 50 JAPAN: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030(USD MILLION)

- TABLE 51 JAPAN: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Initiatives by government and automotive OEMs

- TABLE 52 SOUTH KOREA: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030(USD MILLION)

- TABLE 53 SOUTH KOREA: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.3 EUROPE

- FIGURE 24 EUROPE: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, 2026-2035 (USD MILLION)

- TABLE 54 EUROPE: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY COUNTRY, 2026-2030 (USD MILLION)

- TABLE 55 EUROPE: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Government initiatives to spread awareness about importance of quantum computing for economy

- TABLE 56 GERMANY: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030 (USD MILLION)

- TABLE 57 GERMANY: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.3.2 FRANCE

- 10.3.2.1 Growing demand for advanced technologies to ensure secure communication in automotive industry

- TABLE 58 FRANCE: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030 (USD MILLION)

- TABLE 59 FRANCE: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Rising preference of OEMs for advanced technology

- TABLE 60 UK: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030 (USD MILLION)

- TABLE 61 UK: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.3.4 SPAIN

- 10.3.4.1 Financial support by government to develop quantum computing

- TABLE 62 SPAIN: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030 (USD MILLION)

- TABLE 63 SPAIN: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Rising focus on R&D

- TABLE 64 ITALY: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030 (USD MILLION)

- TABLE 65 ITALY: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.3.6 RUSSIA

- 10.3.6.1 Increasing government spending and investments on quantum computers

- TABLE 66 RUSSIA: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030 (USD MILLION)

- TABLE 67 RUSSIA: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.3.7 SWEDEN

- 10.3.7.1 R&D by universities on quantum computing

- TABLE 68 SWEDEN: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030 (USD MILLION)

- TABLE 69 SWEDEN: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.4 AMERICAS

- FIGURE 25 AMERICAS: QUANTUM COMPUTING IN AUTOMOTIVE MARKET SNAPSHOT

- TABLE 70 AMERICAS: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY COUNTRY, 2026-2030 (USD MILLION)

- TABLE 71 AMERICAS: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- 10.4.1 US

- 10.4.1.1 Increasing government investment and presence of leading suppliers

- TABLE 72 US: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION, 2026-2030 (USD MILLION)

- TABLE 73 US: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.4.2 CANADA

- 10.4.2.1 Technological advancements by academic institutions, businesses, and government programs

- TABLE 74 CANADA: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030 (USD MILLION)

- TABLE 75 CANADA: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.4.3 MEXICO

- 10.4.3.1 Growing demand for quantum computing for various applications

- TABLE 76 MEXICO: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030 (USD MILLION)

- TABLE 77 MEXICO: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

- 10.4.4 BRAZIL

- 10.4.4.1 Requires more funding and infrastructure

- TABLE 78 BRAZIL: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026-2030 (USD MILLION)

- TABLE 79 BRAZIL: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2031-2035 (USD MILLION)

11 RECOMMENDATIONS BY MARKETSANDMARKETS

- 11.1 AMERICAS TO DOMINATE REGIONAL MARKET AND ASIA PACIFIC TO GROW AT FASTEST RATE

- 11.2 KEY FOCUS AREAS TO BE ROUTE OPTIMIZATION, BATTERY OPTIMIZATION, AND AUTONOMOUS AND CONNECTED VEHICLES

- 11.3 CONCLUSION

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET RANKING ANALYSIS, 2022

- FIGURE 26 RANKING OF KEY PLAYERS, 2022

- 12.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- 12.4 COMPETITIVE EVALUATION QUADRANT

- 12.4.1 TERMINOLOGY

- 12.4.2 STARS

- 12.4.3 EMERGING LEADERS

- 12.4.4 PERVASIVE PLAYERS

- 12.4.5 PARTICIPANTS

- TABLE 80 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: COMPANY PRODUCT FOOTPRINT, 2021

- TABLE 81 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: COMPANY APPLICATION FOOTPRINT, 2021

- TABLE 82 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: COMPANY REGION FOOTPRINT, 2021

- FIGURE 27 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: COMPETITIVE EVALUATION MATRIX, 2021

- 12.5 COMPETITIVE SCENARIO

- 12.5.1 PRODUCT LAUNCHES

- TABLE 83 PRODUCT LAUNCHES, 2018-2022

- 12.5.2 DEALS

- TABLE 84 DEALS, 2017-2022

- 12.5.3 EXPANSIONS

- TABLE 85 EXPANSIONS, 2020-2022

- 12.6 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN, 2018-2022

- TABLE 86 KEY GROWTH STRATEGIES, 2017-2022

- 12.7 COMPETITIVE BENCHMARKING

- TABLE 87 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: KEY PLAYERS

13 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

- 13.1 QUANTUM COMPUTING IN AUTOMOTIVE MARKET - KEY PLAYERS

- 13.1.1 IBM CORPORATION

- TABLE 88 IBM CORPORATION: BUSINESS OVERVIEW

- FIGURE 28 IBM CORPORATION: COMPANY SNAPSHOT

- TABLE 89 IBM CORPORATION: PRODUCT LAUNCHES

- TABLE 90 IBM CORPORATION - BOSCH GMBH

- TABLE 91 IBM CORPORATION - DAIMLER AG

- TABLE 92 IBM CORPORATION: EXPANSIONS

- 13.1.2 MICROSOFT CORPORATION

- TABLE 93 MICROSOFT CORPORATION.: BUSINESS OVERVIEW

- FIGURE 29 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- TABLE 94 MICROSOFT CORPORATION- PRODUCT LAUNCHES

- TABLE 95 MICROSOFT CORPORATION-FORD MOTOR COMPANY

- 13.1.3 D-WAVE SYSTEMS INC.

- TABLE 96 D-WAVE SYSTEMS INC.: BUSINESS OVERVIEW

- FIGURE 30 D-WAVE SYSTEMS INC.: COMPANY SNAPSHOT

- TABLE 97 D-WAVE SYSTEMS INC.: PRODUCT LAUNCHES

- TABLE 98 D-WAVE SYSTEMS INC.-VOLKSWAGEN AG

- TABLE 99 D-WAVE SYSTEMS INC.-DENSO CORPORATION

- TABLE 100 D-WAVE SYSTEMS INC.: EXPANSIONS

- 13.1.4 ALPHABET INC.

- TABLE 101 ALPHABET INC.: BUSINESS OVERVIEW

- FIGURE 31 ALPHABET INC.: COMPANY SNAPSHOT

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- TABLE 102 ALPHABET INC. - PRODUCT LAUNCHES

- TABLE 103 ALPHABET INC.- DAIMLER AG

- TABLE 104 ALPHABET INC.- VOLKSWAGEN AG

- TABLE 105 ALPHABET INC.: OTHERS

- 13.1.5 RIGETTI & CO, LLC

- TABLE 106 RIGETTI & CO, LLC: BUSINESS OVERVIEW

- FIGURE 32 RIGETTI & CO, LLC: COMPANY SNAPSHOT

- TABLE 107 RIGETTI & CO, LLC - PRODUCT LAUNCHES

- TABLE 108 RIGETTI & CO, LLC: DEALS

- TABLE 109 RIGETTI & CO, LLC: EXPANSIONS

- 13.1.6 ACCENTURE PLC

- TABLE 110 ACCENTURE PLC: BUSINESS OVERVIEW

- FIGURE 33 ACCENTURE PLC: COMPANY SNAPSHOT

- TABLE 111 ACCENTURE PLC: DEALS

- TABLE 112 ACCENTURE PLC-FAURECIA

- 13.1.7 IONQ

- TABLE 113 IONQ: BUSINESS OVERVIEW

- TABLE 114 IONQ - PRODUCT LAUNCHES

- TABLE 115 IONQ: DEALS

- TABLE 116 IONQ- HYUNDAI MOTOR COMPANY

- TABLE 117 IONQ: EXPANSIONS

- 13.1.8 AMAZON

- TABLE 118 AMAZON: BUSINESS OVERVIEW

- FIGURE 34 AMAZON: COMPANY SNAPSHOT

- TABLE 119 AMAZON - PRODUCT LAUNCHES

- TABLE 120 AMAZON -BMW GROUP

- TABLE 121 AMAZON: EXPANSIONS

- 13.1.9 TERRA QUANTUM

- TABLE 122 TERRA QUANTUM: BUSINESS OVERVIEW

- TABLE 123 TERRA QUANTUM: DEALS

- TABLE 124 TERRA QUANTUM-VOLKSWAGEN AG

- 13.1.10 PASQAL

- TABLE 125 PASQAL: BUSINESS OVERVIEW

- 13.1.11 PRODUCTS OFFERED

- TABLE 126 PASQAL - PRODUCT LAUNCHES

- TABLE 127 PASQAL-BMW GROUP

- TABLE 128 PASQAL: DEALS

- TABLE 129 PASQAL: EXPANSIONS

- 13.2 QUANTUM COMPUTING IN AUTOMOTIVE MARKET - ADDITIONAL PLAYERS

- 13.2.1 QUANTINUUM LTD. (CAMBRIDGE QUANTUM COMPUTING LTD.)

- TABLE 130 QUANTINUUM LTD. (CAMBRIDGE QUANTUM COMPUTING LTD.): COMPANY OVERVIEW

- 13.2.2 INTEL CORPORATION

- TABLE 131 INTEL CORPORATION: COMPANY OVERVIEW

- 13.2.3 CAPGEMINI

- TABLE 132 CAPGEMINI: COMPANY OVERVIEW

- 13.2.4 ZAPATA COMPUTING

- TABLE 133 ZAPATA COMPUTING: COMPANY OVERVIEW

- 13.2.5 XANADU QUANTUM TECHNOLOGIES INC.

- TABLE 134 XANADU QUANTUM TECHNOLOGIES INC.: COMPANY OVERVIEW

- 13.2.6 QUANTICA COMPUTACAO

- TABLE 135 QUANTICA COMPUTACAO: COMPANY OVERVIEW

- 13.2.7 QC WARE CORP

- TABLE 136 QC WARE CORPORATION: COMPANY OVERVIEW

- 13.2.8 ATOM COMPUTING INC.

- TABLE 137 ATOM COMPUTING INC.: COMPANY OVERVIEW

- 13.2.9 MAGIQ TECHNOLOGIES INC.

- TABLE 138 MAGIQ TECHNOLOGIES INC.: COMPANY OVERVIEW

- 13.2.10 ANYON SYSTEMS

- TABLE 139 ANYON SYSTEMS: COMPANY OVERVIEW

- Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INDUSTRY INSIGHTS FROM EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.4.1 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY STAKEHOLDER AND DEPLOYMENT TYPE

- 14.4.1.1 OEMs

- 14.4.1.2 Tier 1 and Tier 2

- 14.4.1.3 Warehouse and Distribution

- 14.4.1 QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY STAKEHOLDER AND DEPLOYMENT TYPE

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS