|

|

市場調査レポート

商品コード

1617392

スマート農業の世界市場:精密農業、家畜モニタリング、精密水産養殖、オンクラウド、オンプレミス、システムインテグレーション・コンサルティング、収穫管理、HVAC管理、水・肥料管理 - 予測(~2029年)Smart Agriculture Market by Precision Farming, Livestock Monitoring, Precision Aquaculture, On-Cloud, On-Premises, System Integration & Consulting, Harvesting Management, HVAC Management and Water and Fertilizer Management - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| スマート農業の世界市場:精密農業、家畜モニタリング、精密水産養殖、オンクラウド、オンプレミス、システムインテグレーション・コンサルティング、収穫管理、HVAC管理、水・肥料管理 - 予測(~2029年) |

|

出版日: 2024年12月16日

発行: MarketsandMarkets

ページ情報: 英文 296 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のスマート農業の市場規模は、2024年の144億米ドルから2029年までに233億8,000万米ドルに達すると予測され、2024年~2029年にCAGRで10.2%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 農業タイプ、提供、農場規模、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「持続可能な実践への注目の高まりがスマート農業市場の拡大を後押ししています。」

スマート農業の市場成長は、持続可能な農業の実践に対するニーズの高まりによって促進されています。これらの技術は、環境に対する影響を軽減し、より高い生産性を維持する基本的なツールを提供するためです。そのため、スマート農業は、無駄や非効率を削減するデータ主導の意思決定を通じて、農家が資源をより有効に活用できるようにします。IoTセンサー、AIアナリティクス、自動化された機械は、リアルタイムでモニターし制御できるため、さまざまな作物条件下で農業に対する持続可能なアプローチを実現します。この精度は、土壌の健全性と生物多様性を維持しながら、最小の資源でより高い収穫高を生み出します。世界中で持続可能性に対する意識が高まっているため、こうした利点により、スマート農業は環境と生態系の双方にとって重要な投資となります。

「家畜モニタリングが予測期間にもっとも高いCAGRを記録する見込みです。」

家畜モニタリングは、近代的な畜産において重要な役割を果たしており、家畜の健康状態、生産性、福祉の向上に焦点を当てています。家畜モニタリングは、さまざまな技術や技法を採用することで、農家が動物の行動、健康状態、パフォーマンスに関連するデータを収集、分析、解釈することを可能にします。このデータ主導のアプローチは、農家が家畜の管理方法に関して十分な情報に基づいた決定を下すのに役立ちます。家畜モニタリングにおいて重要なツールは、首輪やイヤータグのようなウェアラブルデバイスです。これらのデバイスはリアルタイムモニタリングを提供するため、農家は家畜の健康状態とウェルビーイングについて常に情報を得ることができます。したがって、家畜モニタリング用途が予測期間にもっとも高いCAGRを記録する見込みです。

「アジア太平洋が予測期間に最高のCAGRで成長する見込みです。」

可変レートシステム、スマート灌漑コントローラー、AIを活用した農場アナリティクスサービスなどの技術の採用の増加が、この地域の主な成長促進要因です。さらに、この地域全体で畜産と水産養殖の自動化に対する需要が高まっているため、市場はさらに拡大すると予測されます。中国、オーストラリア、インド、日本などでは、家畜の数が増加し、さらに多くの食肉製品へのニーズが高まっています。迅速な反応、信頼性、コスト効率など、スマート農業技術の利点に関する農場所有者の知識の増加は、アジア太平洋におけるそのようなソリューションの需要をさらに押し上げると見られます。

当レポートでは、世界のスマート農業市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- スマート農業市場における魅力的な成長機会

- スマート農業市場:用途別

- スマート農業市場:農場規模別

- スマート農業市場:農業タイプ別

- スマート農業市場:提供別

- 南北アメリカのスマート農業市場:農業タイプ別、国別(2024年)

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- 主要企業の平均販売価格

- スマート農業システムの平均販売価格の動向:製品別

- スマート農業システムの平均販売価格の動向:地域別

- 主なステークホルダーと購入基準

- ポーターのファイブフォース分析

- スマート農業市場に対するAI/生成AIの影響

- ケーススタディ

- 貿易分析

- 輸入シナリオ(HSコード8432)

- 輸出シナリオ(HSコード8432)

- 特許分析

- 規制情勢

- 規制機関、政府機関、その他の組織

- 標準

- 主な会議とイベント(2024年~2025年)

第6章 スマート農業で使用される接続技術

- イントロダクション

- IoT

- セルラーIoT

- LoRa

- 全地球航法衛星システム(GNSS)

第7章 スマート農業市場:農場規模別

- イントロダクション

- 大規模農場

- 中規模農場

- 小規模農場

第8章 スマート農業市場:農業タイプ別

- イントロダクション

- 精密農業

- 家畜モニタリング

- 精密水産養殖

- 精密林業

- スマートグリーンハウス

- その他の農業タイプ

第9章 スマート農業市場:提供別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第10章 スマート農業市場:用途別

- イントロダクション

- 精密農業

- 家畜モニタリング

- 精密水産養殖

- 精密林業

- スマートグリーンハウス

- その他の用途

第11章 スマート農業市場:地域別

- イントロダクション

- 南北アメリカ

- アメリカのマクロ経済の見通し

- 北米

- 南米

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- オランダ

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- オーストラリア

- インド

- 韓国

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- アフリカ

- ロシア

- 中東

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2020年~2024年)

- 収益分析

- 市場シェア分析(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 競争の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合状況と動向

第13章 企業プロファイル

- イントロダクション

- 主要企業

- DEERE & COMPANY

- TRIMBLE INC.

- AGCO CORPORATION

- TOPCON

- DELAVAL

- AKVA GROUP

- ALLFLEX LIVESTOCK INTELLIGENCE (MSD ANIMAL HEALTH)

- INNOVASEA SYSTEMS INC.

- AFIMILK LTD.

- HELIOSPECTRA

- その他の企業

- PONSSE OYJ

- KOMATSU FOREST

- SCALEAQ

- TIGERCAT INTERNATIONAL INC.

- AG LEADER TECHNOLOGY

- CERTHON

- NEDAP N.V.

- ARGUS CONTROL SYSTEMS LIMITED

- DAIRYMASTER

- DICKEY-JOHN

- ABACO S.P.A.

- TEEJET TECHNOLOGIES

- FANCOM BV

- SENSAPHONE

- BOUMATIC

- CERESAI

- RAVEN INDUSTRIES, INC.

第14章 付録

List of Tables

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- TABLE 2 RISK ASSESSMENT: SMART AGRICULTURE MARKET

- TABLE 3 SMART AGRICULTURE MARKET: ROLES OF COMPANIES IN ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE TREND OF SMART AGRICULTURE SYSTEMS, BY KEY PLAYERS, 2020-2023 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF SMART AGRICULTURE SYSTEMS, BY REGION, 2020-2023 (USD THOUSAND)

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO APPLICATIONS

- TABLE 7 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- TABLE 8 SMART AGRICULTURE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 IMPORT DATA FOR HS CODE 8432-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 8432-COMPLIANT PRODUCTS, BY COUNTRY 2019-2023 (USD MILLION)

- TABLE 11 NUMBER OF PATENTS FILED BETWEEN 2013 AND 2023

- TABLE 12 LIST OF PATENTS RELATED OT SMART AGRICULTURE MARKET, 2021-2024

- TABLE 13 AMERICAS: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SMART AGRICULTURE MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- TABLE 17 SMART AGRICULTURE MARKET, BY FARM SIZE, 2020-2023 (USD MILLION)

- TABLE 18 SMART AGRICULTURE MARKET, BY FARM SIZE, 2024-2029 (USD MILLION)

- TABLE 19 PRECISION FARMING: SMART AGRICULTURE MARKET, BY FARM SIZE, 2020-2023 (USD MILLION)

- TABLE 20 PRECISION FARMING: SMART AGRICULTURE MARKET, BY FARM SIZE, 2024-2029 (USD MILLION)

- TABLE 21 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY FARM SIZE, 2020-2023 (USD MILLION)

- TABLE 22 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY FARM SIZE, 2024-2029 (USD MILLION)

- TABLE 23 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY FARM SIZE, 2020-2023 (USD MILLION)

- TABLE 24 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY FARM SIZE, 2024-2029 (USD MILLION)

- TABLE 25 SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2020-2023 (USD MILLION)

- TABLE 26 SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 27 PRECISION FARMING: SMART AGRICULTURE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 28 PRECISION FARMING: SMART AGRICULTURE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 29 PRECISION FARMING: SMART AGRICULTURE MARKET, BY HARDWARE TYPE, 2020-2023 (USD MILLION)

- TABLE 30 PRECISION FARMING: SMART AGRICULTURE MARKET, BY HARDWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 31 PRECISION FARMING: AUTOMATION AND CONTROL SYSTEMS IN SMART AGRICULTURE MARKET, BY DEVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 32 PRECISION FARMING: AUTOMATION AND CONTROL SYSTEMS IN SMART AGRICULTURE MARKET, BY DEVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 33 PRECISION FARMING: DRONES/UAVS IN SMART AGRICULTURE MARKET, 2020-2023 (THOUSAND UNITS)

- TABLE 34 PRECISION FARMING: DRONES/UAVS IN SMART AGRICULTURE MARKET, 2024-2029 (THOUSAND UNITS)

- TABLE 35 PRECISION FARMING: SENSING AND MONITORING DEVICES IN SMART AGRICULTURE MARKET, BY DEVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 36 PRECISION FARMING: SENSING AND MONITORING DEVICES IN SMART AGRICULTURE MARKET, BY DEVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 37 PRECISION FARMING: SENSING AND MONITORING DEVICES IN SMART AGRICULTURE MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 38 PRECISION FARMING: SENSING AND MONITORING DEVICES IN SMART AGRICULTURE MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 39 PRECISION FARMING: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 40 PRECISION FARMING: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 41 PRECISION FARMING: SMART AGRICULTURE MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 42 PRECISION FARMING: SMART AGRICULTURE MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 43 PRECISION FARMING: SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 44 PRECISION FARMING: SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 45 PRECISION FARMING: GUIDANCE TECHNOLOGY IN SMART AGRICULTURE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 PRECISION FARMING: GUIDANCE TECHNOLOGY IN SMART AGRICULTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 47 PRECISION FARMING: REMOTE SENSING IN SMART AGRICULTURE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 PRECISION FARMING: REMOTE SENSING IN SMART AGRICULTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 PRECISION FARMING: VARIABLE RATE TECHNOLOGY IN SMART AGRICULTURE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 PRECISION FARMING: VARIABLE RATE TECHNOLOGY IN SMART AGRICULTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 PRECISION FARMING: GUIDANCE TECHNOLOGY IN SMART AGRICULTURE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 52 PRECISION FARMING: GUIDANCE TECHNOLOGY IN SMART AGRICULTURE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 53 PRECISION FARMING: REMOTE SENSING IN SMART AGRICULTURE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 54 PRECISION FARMING: REMOTE SENSING IN SMART AGRICULTURE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 55 PRECISION FARMING: VARIABLE RATE TECHNOLOGY IN SMART AGRICULTURE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 56 PRECISION FARMING: VARIABLE RATE TECHNOLOGY IN SMART AGRICULTURE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 57 PRECISION FARMING: SMART AGRICULTURE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 PRECISION FARMING: SMART AGRICULTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 60 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 61 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY HARDWARE TYPE, 2020-2023 (USD MILLION)

- TABLE 62 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY HARDWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 63 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 64 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 65 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 66 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 67 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 69 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY FARM TYPE, 2020-2023 (USD MILLION)

- TABLE 70 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY FARM TYPE, 2024-2029 (USD MILLION)

- TABLE 71 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 72 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 73 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY HARDWARE TYPE, 2020-2023 (USD MILLION)

- TABLE 74 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY HARDWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 75 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 76 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 77 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 78 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 79 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 80 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 82 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 83 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY HARDWARE TYPE, 2020-2023 (USD MILLION)

- TABLE 84 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY HARDWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 85 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 86 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 87 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 88 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 89 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 90 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 91 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 92 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 93 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY HARDWARE TYPE, 2020-2023 (USD MILLION)

- TABLE 94 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY HARDWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 95 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 96 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 97 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 98 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY SERVICE TYPE 2024-2029 (USD MILLION)

- TABLE 99 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 100 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 101 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 102 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 103 OTHER AGRICULTURE TYPES: SMART AGRICULTURE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 104 OTHER AGRICULTURE TYPES: SMART AGRICULTURE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 105 OTHER AGRICULTURE TYPES: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 106 OTHER AGRICULTURE TYPES: SMART AGRICULTURE MARKET, BY SOFTWARE DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 107 OTHER AGRICULTURE TYPES: SMART AGRICULTURE MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 108 OTHER AGRICULTURE TYPES: SMART AGRICULTURE MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 109 OTHER AGRICULTURE TYPES: SMART AGRICULTURE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 110 OTHER AGRICULTURE TYPES: SMART AGRICULTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 111 OTHER AGRICULTURE TYPES: SMART AGRICULTURE MARKET, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 112 OTHER AGRICULTURE TYPES: SMART AGRICULTURE MARKET, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 113 SMART AGRICULTURE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 114 SMART AGRICULTURE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 115 HARDWARE: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2020-2023 (USD MILLION)

- TABLE 116 HARDWARE: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 117 SOFTWARE: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2020-2023 (USD MILLION)

- TABLE 118 SOFTWARE: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 119 SOFTWARE: SMART AGRICULTURE MARKET, BY DEPLOYMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 120 SOFTWARE: SMART AGRICULTURE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 121 ON-PREMISE SOFTWARE: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2020-2023 (USD MILLION)

- TABLE 122 ON-PREMISE SOFTWARE: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 123 ON-CLOUD SOFTWARE: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2020-2023 (USD MILLION)

- TABLE 124 ON-CLOUD SOFTWARE: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 125 SERVICES: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2020-2023 (USD MILLION)

- TABLE 126 SERVICES: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 127 SMART AGRICULTURE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 128 SMART AGRICULTURE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 129 PRECISION FARMING: SMART AGRICULTURE MARKET, BY SUB-APPLICATION, 2020-2023 (USD MILLION)

- TABLE 130 PRECISION FARMING: SMART AGRICULTURE MARKET, BY SUB-APPLICATION, 2024-2029 (USD MILLION)

- TABLE 131 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY SUB-APPLICATION, 2020-2023 (USD MILLION)

- TABLE 132 LIVESTOCK MONITORING: SMART AGRICULTURE MARKET, BY SUB-APPLICATION, 2024-2029 (USD MILLION)

- TABLE 133 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY SUB-APPLICATION, 2020-2023 (USD MILLION)

- TABLE 134 PRECISION AQUACULTURE: SMART AGRICULTURE MARKET, BY SUB-APPLICATION, 2024-2029 (USD MILLION)

- TABLE 135 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY SUB-APPLICATION, 2020-2023 (USD MILLION)

- TABLE 136 PRECISION FORESTRY: SMART AGRICULTURE MARKET, BY SUB-APPLICATION, 2024-2029 (USD MILLION)

- TABLE 137 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY SUB-APPLICATION, 2020-2023 (USD MILLION)

- TABLE 138 SMART GREENHOUSE: SMART AGRICULTURE MARKET, BY SUB-APPLICATION, 2024-2029 (USD MILLION)

- TABLE 139 SMART AGRICULTURE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 140 SMART AGRICULTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 141 AMERICAS: SMART AGRICULTURE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 142 AMERICAS: SMART AGRICULTURE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 143 AMERICAS: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2020-2023 (USD MILLION)

- TABLE 144 AMERICAS: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 145 AMERICAS: PRECISION FARMING IN SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 146 AMERICAS: PRECISION FARMING IN SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 147 NORTH AMERICA: SMART AGRICULTURE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 148 NORTH AMERICA: SMART AGRICULTURE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 149 SOUTH AMERICA: SMART AGRICULTURE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 150 SOUTH AMERICA: SMART AGRICULTURE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 151 EUROPE: SMART AGRICULTURE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 152 EUROPE: SMART AGRICULTURE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 153 EUROPE: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2020-2023 (USD MILLION)

- TABLE 154 EUROPE: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 155 EUROPE: PRECISION FARMING IN SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 156 EUROPE: PRECISION FARMING IN SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 157 ASIA PACIFIC: SMART AGRICULTURE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 158 ASIA PACIFIC: SMART AGRICULTURE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 159 ASIA PACIFIC: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2020-2023 (USD MILLION)

- TABLE 160 ASIA PACIFIC: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 161 ASIA PACIFIC: PRECISION FARMING IN SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 162 ASIA PACIFIC: PRECISION FARMING IN SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 163 ROW: SMART AGRICULTURE MARKET, BY REGION/COUNTRY, 2020-2023 (USD MILLION)

- TABLE 164 ROW: SMART AGRICULTURE MARKET, BY REGION/COUNTRY, 2024-2029 (USD MILLION)

- TABLE 165 ROW: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2020-2023 (USD MILLION)

- TABLE 166 ROW: SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 167 ROW: PRECISION FARMING IN SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 168 ROW: PRECISION FARMING IN SMART AGRICULTURE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 169 MIDDLE EAST: SMART AGRICULTURE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 170 MIDDLE EAST: SMART AGRICULTURE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 171 SMART AGRICULTURE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS, 2020-2024

- TABLE 172 SMART AGRICULTURE MARKET: DEGREE OF COMPETITION, 2023

- TABLE 173 SMART AGRICULTURE MARKET: REGION FOOTPRINT

- TABLE 174 SMART AGRICULTURE MARKET: OFFERING FOOTPRINT

- TABLE 175 SMART AGRICULTURE MARKET: APPLICATION FOOTPRINT

- TABLE 176 SMART AGRICULTURE MARKET: AGRICULTURE TYPE FOOTPRINT

- TABLE 177 SMART AGRICULTURE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 178 SMART AGRICULTURE MARKET: COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- TABLE 179 SMART AGRICULTURE MARKET: PRODUCT LAUNCHES, DECEMBER 2020-OCTOBER 2024

- TABLE 180 SMART AGRICULTURE MARKET: DEALS, DECEMBER 2020-OCTOBER 2024

- TABLE 181 SMART AGRICULTURE MARKET: EXPANSIONS, DECEMBER 2020-OCTOBER 2024

- TABLE 182 SMART AGRICULTURE MARKET: OTHERS, DECEMBER 2020-OCTOBER 2024

- TABLE 183 DEERE & COMPANY: COMPANY OVERVIEW

- TABLE 184 DEERE & COMPANY: PRODUCTS OFFERED

- TABLE 185 DEERE & COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 186 DEERE & COMPANY: DEALS

- TABLE 187 DEERE & COMPANY: EXPANSIONS

- TABLE 188 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 189 TRIMBLE INC.: PRODUCTS OFFERED

- TABLE 190 TRIMBLE INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 191 TRIMBLE INC.: DEALS

- TABLE 192 AGCO CORPORATION: COMPANY OVERVIEW

- TABLE 193 AGCO CORPORATION: PRODUCTS OFFERED

- TABLE 194 AGCO CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 195 AGCO CORPORATION: DEALS

- TABLE 196 TOPCON: COMPANY OVERVIEW

- TABLE 197 TOPCON: PRODUCTS OFFERED

- TABLE 198 TOPCON: DEALS

- TABLE 199 DELAVAL: COMPANY OVERVIEW

- TABLE 200 DELAVAL: PRODUCTS OFFERED

- TABLE 201 DELAVAL: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 202 DELAVAL: DEALS

- TABLE 203 AKVA GROUP: COMPANY OVERVIEW

- TABLE 204 AKVA GROUP: PRODUCTS OFFERED

- TABLE 205 AKVA GROUP: DEALS

- TABLE 206 AKVA GROUP: EXPANSIONS

- TABLE 207 AKVA GROUP: OTHERS

- TABLE 208 ALLFLEX LIVESTOCK INTELLIGENCE (MSD ANIMAL HEALTH): COMPANY OVERVIEW

- TABLE 209 ALLFLEX LIVESTOCK INTELLIGENCE (MSD ANIMAL HEALTH): PRODUCTS OFFERED

- TABLE 210 ALLFLEX LIVESTOCK INTELLIGENCE (MSD ANIMAL HEALTH): PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 211 ALLFLEX LIVESTOCK INTELLIGENCE (MSD ANIMAL HEALTH): DEALS

- TABLE 212 INNOVASEA SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 213 INNOVASEA SYSTEMS INC.: PRODUCTS OFFERED

- TABLE 214 INNOVASEA SYSTEMS INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 215 INNOVASEA SYSTEMS INC.: DEALS

- TABLE 216 AFIMILK LTD.: COMPANY OVERVIEW

- TABLE 217 AFIMILK LTD.: PRODUCTS OFFERED

- TABLE 218 AFIMILK LTD.: DEALS

- TABLE 219 HELIOSPECTRA: COMPANY OVERVIEW

- TABLE 220 HELIOSPECTRA: PRODUCTS OFFERED

- TABLE 221 HELIOSPECTRA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 222 HELIOSPECTRA: DEALS

List of Figures

- FIGURE 1 SMART AGRICULTURE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SMART AGRICULTURE MARKET: RESEARCH DESIGN

- FIGURE 3 SMART AGRICULTURE MARKET: BOTTOM-UP APPROACH

- FIGURE 4 SMART AGRICULTURE MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS (APPROACH 1)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS (APPROACH 2)

- FIGURE 7 DATA TRIANGULATION: SMART AGRICULTURE MARKET

- FIGURE 8 SMART AGRICULTURE MARKET: GLOBAL SNAPSHOT

- FIGURE 9 PRECISION FARMING TO DOMINATE SMART AGRICULTURE MARKET DURING FORECAST PERIOD

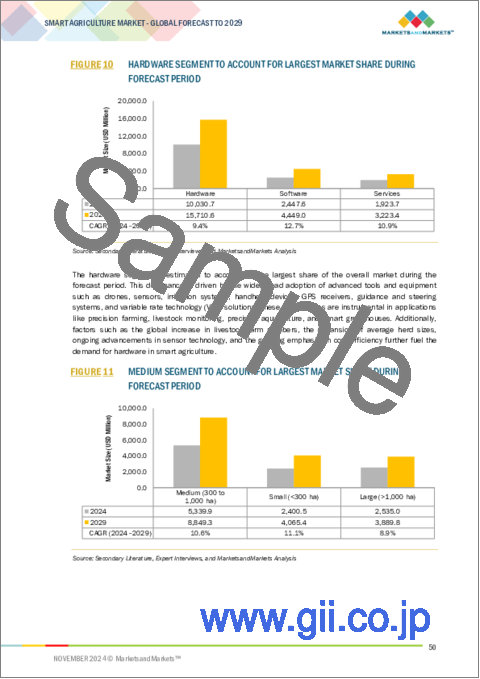

- FIGURE 10 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 MEDIUM SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 GROWING PRESSURE ON FOOD SUPPLY CHAIN TO DRIVE MARKET GROWTH

- FIGURE 14 PRECISION FARMING TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 MEDIUM FARMS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 PRECISION FARMING TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 HARDWARE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 US TO DOMINATE SMART AGRICULTURE MARKET IN AMERICAS

- FIGURE 19 SMART AGRICULTURE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 SMART AGRICULTURE MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 21 SMART AGRICULTURE MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 22 SMART AGRICULTURE MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 23 SMART AGRICULTURE MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS: SMART AGRICULTURE MARKET

- FIGURE 25 SMART AGRICULTURE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 AVERAGE SELLING PRICE OF SMART AGRICULTURE SYSTEMS, BY KEY PLAYERS

- FIGURE 29 AVERAGE SELLING PRICE TREND OF SMART AGRICULTURE SYSTEMS, BY OFFERING

- FIGURE 30 AVERAGE SELLING PRICE TREND FOR SMART AGRICULTURE SYSTEMS, BY REGION

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- FIGURE 33 SMART AGRICULTURE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 IMPACT OF AI/GEN AI ON SMART AGRICULTURE MARKET

- FIGURE 35 IMPORT SCENARIO FOR HS CODE 8432-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 36 EXPORT SCENARIO FOR HS CODE 8432-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 37 PATENTS GRANTED AND APPLIED, 2013-2023

- FIGURE 38 MEDIUM FARMS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 PRECISION FARMING TO DOMINATE SMART AGRICULTURE MARKET DURING FORECAST PERIOD

- FIGURE 40 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 PRECISION FARMING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 42 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 AMERICAS: SMART AGRICULTURE MARKET SNAPSHOT

- FIGURE 44 EUROPE: SMART AGRICULTURE MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: SMART AGRICULTURE MARKET SNAPSHOT

- FIGURE 46 SMART AGRICULTURE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2023

- FIGURE 47 SMART AGRICULTURE MARKET SHARE ANALYSIS, 2023

- FIGURE 48 COMPANY VALUATION, 2024

- FIGURE 49 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 50 BRAND/PRODUCT COMPARISON

- FIGURE 51 SMART AGRICULTURE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 52 SMART AGRICULTURE MARKET: COMPANY FOOTPRINT

- FIGURE 53 SMART AGRICULTURE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 54 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 55 TRIMBLE INC.: COMPANY SNAPSHOT

- FIGURE 56 AGCO CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 DELAVAL: COMPANY SNAPSHOT

- FIGURE 58 AKVA GROUP: COMPANY SNAPSHOT

- FIGURE 59 HELIOSPECTRA: COMPANY SNAPSHOT

The smart agriculture market is expected to reach USD 23.38 billion by 2029 from USD 14.40 billion in 2024, at a CAGR of 10.2% during the 2024-2029 period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Agriculture Type, Offering, Farm Size, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The growing emphasis on sustainable practices is propelling the expansion of the smart agriculture market."

Market growth in smart agriculture is driven by increased need for sustainable agricultural practices. As these technologies deliver fundamental tools that lessen environmental impact and maintain higher productivity. Smart agriculture thus empowers the farmers to use their resources better through data-driven decisions which reduces any wastage or inefficiency. IOT sensors, AI analytics, and automated machinery deliver a sustainable approach towards farming in various crop conditions as they can be monitored and regulated in real-time. This accuracy produces enhanced yields with minimum resources, while maintaining soil health and biodiversity. Due to the growing awareness of sustainability across the world, these benefits make smart agriculture an important investment for both environmental and ecological issues.

"Livestock monitoring is expected to register the highest CAGR during the forecast period"

Livestock monitoring plays a crucial role in modern animal husbandry, focusing on enhancing the health, productivity, and welfare of farm animals. By employing various technologies and techniques, livestock monitoring enables farmers to collect, analyze, and interpret data related to animal behavior, health, and performance. This data-driven approach helps farmers make informed decisions regarding animal management practices. A key tool in livestock monitoring is wearable devices, such as collars or ear tags, which are equipped with sensors that track vital parameters like movement, temperature, and other physiological data of individual animals. These devices provide real-time monitoring, allowing farmers to stay informed about the health and well-being of their animals. Therefore, livestock monitoring application is expected to register the highest CAGR during the forecast period

"Asia Pacific is projected to grow at the highest CAGR during the forecast period"

The Asia Pacific region is expected to grow at the highest CAGR during the forecast period in the smart agriculture market. The rising adoption of technologies such as variable rate systems, smart irrigation controllers, and AI-powered farm analytics services is a major growth driver in this region. Moreover, the growing demand for automation in livestock and aquaculture farming across the region is anticipated to further enhance the market. Increasing animal numbers and the need for more meat products in places such as China, Australia, India, and Japan further catalyzes regional growth. The growing knowledge among farm owners about the benefits of smart agricultural technologies, such as faster responses, reliability, and cost efficiency, will further boost demand for such solutions in the Asia Pacific.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the smart agriculture market.

The break-up of the profile of primary participants in the smart agriculture market-

- By Company Type: Tier 1 - 40%, Tier 2 - 40%, Tier 3 - 20%

- By Designation Type: Directors - 40%, Managers - 40%, Others - 20%

- By Region Type: Americas - 40%, Europe -20 %, Asia Pacific- 30%, RoW - 10%,

The major players in the smart agriculture market are Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), Topcon (US), DeLaval (Sweden), AKVA Group (Norway), Allflex Livestock Intelligence (MSD Animal Health), Innovasea Systems Inc. (US), Afimilk Ltd. (Israel), Heliospectra (Sweden), Ponsse Oyj (Finland), Komatsu Forest (Sweden), ScaleAQ (Norway), Tigercat International Inc. (Canada), Ag Leader Technology (US), Certhon, Nedap N.V. (Netherlands), Argus Control Systems Limited (Canada), DAIRYMASTER (Ireland), DICKEY-john (US), ABACO S.P.A. (Italy), TeeJet Technologies (US), Fancom BV (Netherlands), Sensaphone (US), BouMatic (US), and CeresAI (US).

Research Coverage

This report has categorized the smart agriculture market by agriculture type (precision farming, precision forestry, livestock monitoring, precision aquaculture, smart greenhouse, other agriculture types), offering (hardware, software, services), farm size (small, medium, and large), application (precision farming, precision forestry, livestock monitoring, precision aquaculture, smart greenhouse, other applications), and region (Americas, Europe, Asia Pacific, RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the smart agriculture market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; collaborations, partnerships, agreements, contracts, product launches, product developments, joint ventures, sales partnerships, acquisitions, and recent developments associated with the smart agriculture market. Competitive analysis of upcoming startups in the smart agriculture market ecosystem is covered in this report

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall smart agriculture market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the objectives of the market and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (The growing emphasis on sustainable practices is propelling the expansion of the smart agriculture market), restraints (interoperability issues due to absence of standardization and protocols), opportunities (accelerating investments and initiatives towards smart agriculture), and challenges (presence of security and privacy risks)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches, and product developments in the smart agriculture market

- Market Development: Comprehensive information about lucrative markets - the report analyses the smart agriculture market across varied regions.

- Market Diversification: Detailed information about new products, untapped geographies, recent developments, and investments in the smart agriculture market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), Topcon (US), DeLaval (Sweden).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS, BY COMPANY

- 1.3.3 INCLUSIONS AND EXCLUSIONS, BY AGRICULTURE TYPE

- 1.3.4 INCLUSIONS AND EXCLUSIONS, BY OFFERING

- 1.3.5 INCLUSIONS AND EXCLUSIONS, BY FARM SIZE

- 1.3.6 INCLUSIONS AND EXCLUSIONS, BY APPLICATION

- 1.3.7 INCLUSIONS AND EXCLUSIONS, BY REGION

- 1.3.8 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key data from primary sources

- 2.1.2.5 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to obtain market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to obtain market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 GROWTH FORECAST ASSUMPTIONS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN SMART AGRICULTURE MARKET

- 4.2 SMART AGRICULTURE MARKET, BY APPLICATION

- 4.3 SMART AGRICULTURE MARKET, BY FARM SIZE

- 4.4 SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE

- 4.5 SMART AGRICULTURE MARKET, BY OFFERING

- 4.6 SMART AGRICULTURE MARKET IN AMERICAS, BY AGRICULTURE TYPE AND COUNTRY, 2024

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing pressure on food supply chain

- 5.2.1.2 Accelerating demand for IoT and AI-based systems

- 5.2.1.3 Surging demand for sustainable practices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Interoperability issues due to lack of standardization and protocols

- 5.2.2.2 High initial cost

- 5.2.2.3 Connectivity and infrastructure limitations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing integration of drones and robotic systems

- 5.2.3.2 Surging investment and initiatives towards smart agriculture

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of digital literacy

- 5.2.4.2 Security and privacy infringement

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Internet of Things (IoT)

- 5.7.1.2 M2M solutions

- 5.7.1.3 Robotics

- 5.7.1.4 Artificial Intelligence (AI)

- 5.7.1.5 Blockchain

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Robotic cages

- 5.7.2.2 Underwater drones

- 5.7.2.3 Telematics integration with forest mechanization

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 LiDAR-fitted UAVs

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF KEY PLAYERS

- 5.8.2 AVERAGE SELLING PRICE TREND OF SMART AGRICULTURE SYSTEMS, BY OFFERING

- 5.8.3 AVERAGE SELLING PRICE TREND OF SMART AGRICULTURE SYSTEMS, BY REGION

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 IMPACT OF AI/GEN AI ON SMART AGRICULTURE MARKET

- 5.12 CASE STUDIES

- 5.12.1 ADOPTION OF INNOVASEA SYSTEM'S TURN-KEY SOLUTION HELPED ESTABLISH OPEN BLUE'S OPEN-OCEAN FISH FARM

- 5.12.2 INNOVASEA SYSTEM DEVELOPED EVOLUTION PEN FOR EARTH OCEAN FARMS TO RESOLVE SEASONAL CHALLENGES

- 5.12.3 PHILIPS LIGHTING AND LEROY SEAFOOD DEVELOPED INTELLIGENT LED LIGHTING SOLUTION FOR NORWAY'S SALMON INDUSTRY

- 5.12.4 AKVA GROUP PROVIDED AQUACULTURE PRODUCTS TO ERKO SEAFOOD TO SUPPORT SALMON AND TROUT PRODUCTION

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 8432)

- 5.13.2 EXPORT SCENARIO (HS CODE 8432)

- 5.14 PATENT ANALYSIS

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS

- 5.16 KEY CONFERENCES & EVENTS, 2024-2025

6 CONNECTING TECHNOLOGIES USED IN SMART AGRICULTURE

- 6.1 INTRODUCTION

- 6.2 INTERNET OF THINGS (IOT)

- 6.3 CELLULAR IOT

- 6.3.1 LTE-M

- 6.3.2 NB-IOT

- 6.4 LORA

- 6.5 GLOBAL NAVIGATION SATELLITE SYSTEM (GNSS)

7 SMART AGRICULTURE MARKET, BY FARM SIZE

- 7.1 INTRODUCTION

- 7.2 LARGE FARMS

- 7.2.1 GROWING DEPENDENCE ON HIRED LABOR FOR OPERATIONAL MANAGEMENT

- 7.3 MEDIUM FARMS

- 7.3.1 SURGING NEED TO LOWER LABOR COSTS AND IMPROVE PRODUCTIVITY

- 7.4 SMALL FARMS

- 7.4.1 SMALL FARMS IN ASIA PACIFIC REGION INCREASINGLY ADOPTING ADVANCED TECHNOLOGIES FOR FARMING

8 SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE

- 8.1 INTRODUCTION

- 8.2 PRECISION FARMING

- 8.2.1 RISING DEMAND FOR HIGHER FARM EFFICIENCY AND INCREASE IN CROP PRODUCTIVITY

- 8.3 LIVESTOCK MONITORING

- 8.3.1 DEMAND FOR CUTTING-EDGE TECHNOLOGIES AND TOOLS GROWING TO ENHANCE PRODUCTIVITY AND PROFITABILITY IN DAIRY FARMING

- 8.4 PRECISION AQUACULTURE

- 8.4.1 INCREASING INTEGRATION OF SMART TECHNOLOGIES TO MONITOR AQUAFARMS

- 8.4.2 SMART FEEDING SYSTEMS

- 8.4.3 MONITORING AND CONTROL SYSTEMS

- 8.4.4 UNDERWATER REMOTELY OPERATED VEHICLES

- 8.5 PRECISION FORESTRY

- 8.5.1 GROWING NEED TO GATHER REAL-TIME INFORMATION FOR DECISION-MAKING TO DRIVE MARKET

- 8.6 SMART GREENHOUSE

- 8.6.1 SURGING NEED TO IMPROVE OPERATIONS USING WIRED AND WIRELESS TECHNOLOGIES

- 8.7 OTHER AGRICULTURE TYPES

9 SMART AGRICULTURE MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 HARDWARE

- 9.2.1 PRECISION FARMING HARDWARE

- 9.2.1.1 Growing availability of precision farming tools to fuel demand

- 9.2.1.2 Automation & control systems

- 9.2.1.2.1 Drones/UAVs

- 9.2.1.2.1.1 Growing need for significant cost savings and accurate data for VRT applications to drive demand

- 9.2.1.2.2 Irrigation controllers

- 9.2.1.2.2.1 Increasing need to improve efficiency, reduce energy consumption, and maximize crop productivity to support market growth

- 9.2.1.2.3 GPS/GNSS devices

- 9.2.1.2.3.1 Accelerating need to resolve poor visibility conditions to increase demand

- 9.2.1.2.4 Flow and application control devices

- 9.2.1.2.4.1 Helps eliminate overlap and double coverage, saves inputs, and promotes efficiency

- 9.2.1.2.5 Guidance and steering systems

- 9.2.1.2.5.1 Helps reduce overlap and inward drift

- 9.2.1.2.6 Handheld mobile devices/handheld computers

- 9.2.1.2.6.1 Rising need for collection of field records, soil nutrient data, and soil moisture information to increase adoption

- 9.2.1.2.7 Displays

- 9.2.1.2.7.1 Surging need for farmers to view farm-related information in real time

- 9.2.1.2.8 Others

- 9.2.1.2.1 Drones/UAVs

- 9.2.1.3 Sensing & monitoring devices

- 9.2.1.3.1 Yield monitors

- 9.2.1.3.1.1 Rising need to collect real-time data on crop yields

- 9.2.1.3.2 Soil sensors

- 9.2.1.3.2.1 Rising need to provide real-time data on various soil properties to drive market

- 9.2.1.3.3 Nutrient sensors

- 9.2.1.3.3.1 Increasing need to measure levels of essential plant nutrients

- 9.2.1.3.4 Moisture sensors

- 9.2.1.3.4.1 Accelerating demand for moisture sensors to manage irrigation systems more efficiently

- 9.2.1.3.5 Temperature sensors

- 9.2.1.3.5.1 Temperature sensors used to make sowing decisions and check soil sustainability for planting

- 9.2.1.3.1 Yield monitors

- 9.2.1.4 Water sensors

- 9.2.1.4.1 Assist farmers in determining most efficient and effective times to water crops

- 9.2.1.5 Climate sensors

- 9.2.1.5.1 Rising need to monitor and record climate changes to drive demand

- 9.2.1.6 Other sensors

- 9.2.2 LIVESTOCK MONITORING HARDWARE

- 9.2.2.1 Increasing demand for efficient resource management, livestock tracking, and devising and managing feeding and milking plans

- 9.2.2.2 RFID tags & readers

- 9.2.2.2.1 Growing need to track and monitor livestock, crops, and farm assets to drive demand

- 9.2.2.3 Sensors

- 9.2.2.3.1 Growing demand for enhanced livestock monitoring applications

- 9.2.2.4 Transmitters & mounting equipment

- 9.2.2.4.1 Enables owners to observe animals' behavior through video feed

- 9.2.2.5 GPS

- 9.2.2.5.1 Rising need for aid in animal management to drive market

- 9.2.2.6 Others

- 9.2.3 PRECISION FORESTRY HARDWARE

- 9.2.3.1 Rising need to optimize efficiency and accuracy of forest management operations

- 9.2.3.2 Harvesters & forwarders

- 9.2.3.2.1 Surging importance for precision forestry operations to fuel market growth

- 9.2.3.3 UAVs/Drones

- 9.2.3.3.1 Rising need for planting trees and reducing associated costs

- 9.2.3.4 GPS

- 9.2.3.4.1 Rising demand for site-specific tree management with high precision

- 9.2.3.5 Cameras

- 9.2.3.5.1 Growing need to monitor trees in forests to drive demand

- 9.2.3.6 Sensors & RFID tags

- 9.2.3.6.1 Rising number of illegal cutting and smuggling of trees

- 9.2.3.7 Variable rate controllers

- 9.2.3.7.1 Rising adoption in application of herbicides and fertilizers

- 9.2.3.8 Others

- 9.2.4 PRECISION AQUACULTURE HARDWARE

- 9.2.4.1 Surging need for effective management of aquaculture farms

- 9.2.4.2 Monitoring devices

- 9.2.4.2.1 Increasing need for aquatic farm efficiency and productivity

- 9.2.4.2.2 Temperature and environmental monitoring devices

- 9.2.4.2.3 pH and dissolved oxygen sensors

- 9.2.4.2.4 Others

- 9.2.4.3 Camera systems

- 9.2.4.3.1 Rising demand to monitor feeding response, feeding rate, and fish behavior

- 9.2.4.4 Control systems

- 9.2.4.4.1 Need for comprehensive control over aquaculture operations to drive demand

- 9.2.4.5 Others

- 9.2.5 SMART GREENHOUSE HARDWARE

- 9.2.5.1 Increasing need to improve plant growth, increase yields, and reduce waste

- 9.2.5.2 HVAC systems

- 9.2.5.2.1 Demand for improved indoor environment in smart greenhouses

- 9.2.5.3 LED grow lights

- 9.2.5.3.1 Growing use as supplemental lighting source to drive market

- 9.2.5.4 Irrigation systems

- 9.2.5.4.1 Surging adoption for proper and timely watering of each zone in greenhouses

- 9.2.5.5 Material handling equipment

- 9.2.5.5.1 Growing adoption for mechanization of greenhouses

- 9.2.5.6 Valves & pumps

- 9.2.5.6.1 Growing need to maintain optimal flow of water in greenhouses

- 9.2.5.7 Control systems

- 9.2.5.7.1 Rising need for ease in heating and cooling operations

- 9.2.5.8 Sensors & cameras

- 9.2.5.8.1 Growing need for quantitative information to guide farm owners

- 9.2.6 OTHER HARDWARE

- 9.2.1 PRECISION FARMING HARDWARE

- 9.3 SOFTWARE

- 9.3.1 ON-PREMISES SOFTWARE

- 9.3.1.1 Offers lower cost of ownership

- 9.3.2 ON-CLOUD

- 9.3.2.1 Enables shared processing of resources and data to users

- 9.3.2.2 Software-as-a-Service (SaaS)

- 9.3.2.3 Platform-as-a-Service (PaaS)

- 9.3.3 AI & DATA ANALYTICS

- 9.3.3.1 Growing need to improve harvest quality and accuracy

- 9.3.3.2 Farm management software

- 9.3.1 ON-PREMISES SOFTWARE

- 9.4 SERVICES

- 9.4.1 SYSTEM INTEGRATION AND CONSULTING SERVICES

- 9.4.1.1 Growing demand for troubleshooting and diagnosing farm management issues

- 9.4.2 MANAGED SERVICES

- 9.4.2.1 Need for suggestions to farmers to enhance production

- 9.4.2.2 Farm operation services

- 9.4.2.3 Data services

- 9.4.2.4 Analytics services

- 9.4.3 CONNECTIVITY SERVICES

- 9.4.3.1 Rising demand for proper communication between devices and end users

- 9.4.4 ASSISTED PROFESSIONAL SERVICES

- 9.4.4.1 Helps improve standards of projects to meet industry benchmarks

- 9.4.4.2 Supply chain management services

- 9.4.4.3 Climate information services

- 9.4.4.4 Other services

- 9.4.5 MAINTENANCE AND SUPPORT SERVICES

- 9.4.5.1 Growing demand for efficient farm operations to increase adoption

- 9.4.5.2 Installation and deployment services

- 9.4.1 SYSTEM INTEGRATION AND CONSULTING SERVICES

10 SMART AGRICULTURE MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 PRECISION FARMING

- 10.2.1 GROWING DEMAND FOR ENHANCED AGRICULTURAL PRODUCTION

- 10.2.2 YIELD MONITORING

- 10.2.2.1 Helps maximize yields by optimizing irrigation and fertilizer application

- 10.2.2.2 On-farm yield monitoring

- 10.2.2.3 Off-farm yield monitoring

- 10.2.3 CROP SCOUTING

- 10.2.3.1 Rising demand for crop management tool for making timely decisions during harvesting

- 10.2.4 FIELD MAPPING

- 10.2.4.1 Helps farmers in decision-making related to yield production

- 10.2.4.2 Boundary mapping

- 10.2.4.3 Drainage mapping

- 10.2.5 VARIABLE RATE APPLICATION

- 10.2.5.1 Increasing need to optimize crop input for efficient farming

- 10.2.5.2 Precision irrigation

- 10.2.5.3 Precision seeding

- 10.2.5.4 Precision fertilization

- 10.2.5.5 Pesticide VRA

- 10.2.6 WEATHER TRACKING & FORECASTING

- 10.2.6.1 Rising need to take precautionary measures for farm protection from natural calamities

- 10.2.7 INVENTORY MANAGEMENT

- 10.2.7.1 Growing demand to track and organize materials, irrigation parts, and chemicals to drive market

- 10.2.8 FARM LABOR MANAGEMENT

- 10.2.8.1 Helps optimize production and manage cost

- 10.2.9 FINANCIAL MANAGEMENT

- 10.2.9.1 Financial management critical for optimum fund utilization and determining capital investment

- 10.2.10 OTHERS

- 10.3 LIVESTOCK MONITORING

- 10.3.1 NEED TO ENABLE REAL-TIME MONITORING OF HEALTH AND WELL-BEING OF ANIMALS TO DRIVE MARKET

- 10.3.2 MILK HARVESTING MANAGEMENT

- 10.3.2.1 Need to reduce labor costs and increase milking efficiency through automated milk harvesting

- 10.3.3 BREEDING MANAGEMENT

- 10.3.3.1 Breeding management necessary for enhancing long-term animal productivity

- 10.3.4 FEEDING MANAGEMENT

- 10.3.4.1 Rising need to accurately formulate animal diet to drive market

- 10.3.5 HEAT STRESS MANAGEMENT

- 10.3.5.1 Need for maintaining comfortable environment for dairy cows to drive demand

- 10.3.6 ANIMAL COMFORT MANAGEMENT

- 10.3.6.1 Increasing awareness about animal health and well-being to support market growth

- 10.3.7 BEHAVIOR MONITORING AND CONTROL

- 10.3.7.1 Rising demand for early detection of any deviations in animal behavior

- 10.3.8 OTHERS

- 10.4 PRECISION AQUACULTURE

- 10.4.1 GROWING NEED TO OPTIMIZE AQUACULTURE PRODUCTION AND MANAGEMENT

- 10.4.2 FEEDING MANAGEMENT

- 10.4.2.1 Feeding management necessary to avoid overfeeding

- 10.4.3 MONITORING, CONTROL, AND SURVEILLANCE

- 10.4.3.1 Rising need to minimize waste and environmental impact

- 10.4.4 OTHERS

- 10.5 PRECISION FORESTRY

- 10.5.1 RISING NEED TO IMPROVE SUSTAINABILITY OF FORESTRY PRACTICES

- 10.5.2 GENETICS & NURSERIES

- 10.5.2.1 Use of UAVs in seed planting revolutionizing plantation management

- 10.5.3 SILVICULTURE & FIRE MANAGEMENT

- 10.5.3.1 Rising need to minimize damage and casualties due to wildfires

- 10.5.4 HARVESTING MANAGEMENT

- 10.5.4.1 Harvesting management essential for preventing forest damage

- 10.5.5 INVENTORY & LOGISTICS MANAGEMENT

- 10.5.5.1 Need to diminish manual error and enable quick reporting and data processing

- 10.6 SMART GREENHOUSE

- 10.6.1 HVAC MANAGEMENT WIDELY ADOPTED IN SMART GREENHOUSES

- 10.6.2 HVAC MANAGEMENT

- 10.6.2.1 Need to regulate temperature for favorable plant growth to drive demand

- 10.6.3 YIELD MONITORING & HARVESTING

- 10.6.3.1 Surging need for improved efficiency and productivity of greenhouse operations

- 10.6.4 WATER & FERTILIZER MANAGEMENT

- 10.6.4.1 Need to reduce water wastage and production costs of greenhouses to drive market

- 10.6.5 OTHERS

- 10.7 OTHER APPLICATIONS

11 SMART AGRICULTURE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 AMERICAS

- 11.2.1 MACROECONOMIC OUTLOOK FOR AMERICAS

- 11.2.2 NORTH AMERICA

- 11.2.2.1 US

- 11.2.2.1.1 Increasing presence of key players to boost market growth

- 11.2.2.2 Canada

- 11.2.2.2.1 Surging government initiatives and investments to fuel market growth

- 11.2.2.3 Mexico

- 11.2.2.3.1 Government initiatives to promote use of remote sensing technology to accelerate market growth

- 11.2.2.1 US

- 11.2.3 SOUTH AMERICA

- 11.2.3.1 Brazil

- 11.2.3.1.1 Availability of large lands at low cost to propel market

- 11.2.3.2 Argentina

- 11.2.3.2.1 Increasing crop production areas to drive market growth

- 11.2.3.3 Rest of South America

- 11.2.3.1 Brazil

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Increasing number of livestock farms to drive market growth

- 11.3.3 UK

- 11.3.3.1 Growing innovation supporting market growth

- 11.3.4 FRANCE

- 11.3.4.1 Increasing adoption of smart agriculture technologies to drive market growth

- 11.3.5 ITALY

- 11.3.5.1 Ongoing shift toward smart farming techniques to spur market growth

- 11.3.6 NETHERLANDS

- 11.3.6.1 Rising adoption of advanced technologies for harvesting processes to fuel market growth

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Government initiatives to advance agriculture sector to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Labor shortage to fuel demand for smart agriculture solutions

- 11.4.4 AUSTRALIA

- 11.4.4.1 Government support and presence of research organizations to play major role in market growth

- 11.4.5 INDIA

- 11.4.5.1 Government initiatives to increase adoption of smart agriculture solutions

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Rising need to produce high-value agricultural products to fuel market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR REST OF THE WORLD

- 11.5.2 AFRICA

- 11.5.2.1 Increasing awareness among farmers to contribute to market growth

- 11.5.3 RUSSIA

- 11.5.3.1 Increasing awareness about benefits of smart agriculture to support market

- 11.5.4 MIDDLE EAST

- 11.5.4.1 Developments in big data analytics and cloud-computing platforms to support market growth

- 11.5.4.2 GCC countries

- 11.5.4.2.1 Growing adoption of smart irrigation systems driving market growth

- 11.5.4.3 Rest of Middle East

- 11.5.4.3.1 Escalating demand for food, water, and energy to fuel market growth

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2020-2024

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Application footprint

- 12.7.5.5 Agriculture type footprint

- 12.8 COMPETITIVE EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.8.5.1 Detailed list of startups/SMEs

- 12.8.5.2 Competitive benchmarking for startups/SMEs

- 12.9 COMPETITIVE SITUATION AND TRENDS

- 12.9.1 PRODUCT LAUNCHES, PRODUCT DEVELOPMENTS, AND BRAND LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHERS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 DEERE & COMPANY

- 13.2.1.1 Business overview

- 13.2.1.2 Products offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches/developments

- 13.2.1.3.2 Deals

- 13.2.1.3.3 Expansions

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 TRIMBLE INC.

- 13.2.2.1 Business overview

- 13.2.2.2 Products offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches/developments

- 13.2.2.4 Deals

- 13.2.2.5 MnM view

- 13.2.2.5.1 Key strengths

- 13.2.2.5.2 Strategic choices

- 13.2.2.5.3 Weaknesses and competitive threats

- 13.2.3 AGCO CORPORATION

- 13.2.3.1 Business overview

- 13.2.3.2 Products offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches/developments

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 TOPCON

- 13.2.4.1 Business overview

- 13.2.4.2 Products offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 DELAVAL

- 13.2.5.1 Business overview

- 13.2.5.2 Products offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches/developments

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 AKVA GROUP

- 13.2.6.1 Business overview

- 13.2.6.2 Products offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Deals

- 13.2.6.3.2 Expansions

- 13.2.6.3.3 Others

- 13.2.7 ALLFLEX LIVESTOCK INTELLIGENCE (MSD ANIMAL HEALTH)

- 13.2.7.1 Business overview

- 13.2.7.2 Products offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product launches/developments

- 13.2.7.3.2 Deals

- 13.2.8 INNOVASEA SYSTEMS INC.

- 13.2.8.1 Business overview

- 13.2.8.2 Products offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Product launches/developments

- 13.2.8.3.2 Deals

- 13.2.9 AFIMILK LTD.

- 13.2.9.1 Business overview

- 13.2.9.2 Products offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Deals

- 13.2.10 HELIOSPECTRA

- 13.2.10.1 Business overview

- 13.2.10.2 Products offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Product launches/developments

- 13.2.10.3.2 Deals

- 13.2.1 DEERE & COMPANY

- 13.3 OTHER PLAYERS

- 13.3.1 PONSSE OYJ

- 13.3.2 KOMATSU FOREST

- 13.3.3 SCALEAQ

- 13.3.4 TIGERCAT INTERNATIONAL INC.

- 13.3.5 AG LEADER TECHNOLOGY

- 13.3.6 CERTHON

- 13.3.7 NEDAP N.V.

- 13.3.8 ARGUS CONTROL SYSTEMS LIMITED

- 13.3.9 DAIRYMASTER

- 13.3.10 DICKEY-JOHN

- 13.3.11 ABACO S.P.A.

- 13.3.12 TEEJET TECHNOLOGIES

- 13.3.13 FANCOM BV

- 13.3.14 SENSAPHONE

- 13.3.15 BOUMATIC

- 13.3.16 CERESAI

- 13.3.17 RAVEN INDUSTRIES, INC.

14 APPENDIX

- 14.1 INSIGHTS OF INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS