|

|

市場調査レポート

商品コード

1228206

超音波ニードルガイドの世界市場:種類別 (再利用型、使い捨て型)・用途別 (組織生検、体液吸引、神経ブロック・局所麻酔、血管アクセス)・エンドユーザー別 (病院・診療所、外来手術センター (ASC)、画像診断センター) の将来予測 (2027年まで)Ultrasound Needle Guides Market by Type (Reusable, Disposable), Application (Tissue Biopsy, Fluid Aspiration, Nerve Block, Regional Anesthesia, Vascular Access), End User (Hospitals, Clinics, ASC, Diagnostic Imaging Centers) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 超音波ニードルガイドの世界市場:種類別 (再利用型、使い捨て型)・用途別 (組織生検、体液吸引、神経ブロック・局所麻酔、血管アクセス)・エンドユーザー別 (病院・診療所、外来手術センター (ASC)、画像診断センター) の将来予測 (2027年まで) |

|

出版日: 2023年02月16日

発行: MarketsandMarkets

ページ情報: 英文 166 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の超音波ニードルガイドの市場規模は、2022年の2億7,400万米ドルから、2027年には3億6,900万米ドルに達し、6.1%のCAGRで成長すると予測されます。

ニードルガイド手術を行う病院の増加が、予測期間中にこの市場の成長機会を生み出すと考えられています。また、主要市場での人口増加や医療インフラ強化の取り組みが、市場にプラスに働く予想されます。

種類別では、2021年に使い捨て型ニードルが最大のシェアを占めています。その要因として、ニードルガイドが交差汚染に関連するリスクを低減し、清掃時間を短縮する必要性などが挙げられます。

エンドユーザー別では、2021年には病院・診療所セグメントが市場を支配すると考えられています。

北米市場では、2021年に米国が圧倒的なシェアを占めています。米国が他の国々よりも革新的技術の採用率が高いことが、その一因として考えられています。さらに、継続的な技術進歩、医療報酬の引き上げなどが、市場の更なる成長をもたらす見通しです。

当レポートでは、世界の超音波ニードルガイドの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・用途別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界動向

- 関税と規制の状況

- バリューチェーン分析

- サプライチェーン分析

- エコシステムマーケットマップ

- ポーターのファイブフォース分析

- 特許分析

- 技術分析

- 指標価格モデル分析

- 主な会議とイベント (2022年~2023年)

- 主な利害関係者と購入基準

第6章 超音波ニードルガイド市場:種類別

- イントロダクション

- 使い捨て型ニードルガイド

- 再利用型ニードルガイド

第7章 超音波ニードルガイド市場:用途別

- イントロダクション

- 組織生検

- 体液吸引

- 血管アクセス処置

- 神経ブロック・局所麻酔

- その他の用途

第8章 超音波ニードルガイド市場:エンドユーザー別

- イントロダクション

- 病院・診療所

- 外来手術センター (ASC)

- 画像診断センター

- その他のエンドユーザー

第9章 超音波ニードルガイド市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 主要企業の収益分析

- 市場シェア分析

- 企業のフットプリント分析

- 企業のフットプリント:種類別

- 企業のフットプリント:用途別

- 企業のフットプリント:地域別

- 企業評価マトリックス

- 競合ベンチマーキング

- 競合シナリオ

- 資本取引

第11章 企業プロファイル

- 主要企業

- CIVCO MEDICAL SOLUTIONS (ROPER COMPANYの一部門)

- BECTON, DICKINSON AND COMPANY

- ASPEN SURGICAL

- ARGON MEDICAL DEVICES

- FUJIFILM SONOSITE, INC. (FUJIFILM HOLDINGS CORPORATIONの一部門)

- ROCKET MEDICAL

- SIEMENS HEALTHINEERS AG

- HOLOGIC, INC.

- REMINGTON MEDICAL INC.

- GEOTEK MEDICAL

- その他の企業

- INNOFINE

- KOELIS

- BIRR

- IZI MEDICAL

- SHEATHING TECHNOLOGIES, INC.

- WELLGO MEDICAL PRODUCTS GMBH

- ADVANCE MEDICAL DESIGNS, INC.

第12章 付録

The global ultrasound needle guides market is projected to reach USD 369 million by 2027 from USD 274 million in 2022, at a CAGR of 6.1%.

Needle guides attach to the ultrasound transducer, directly or with a bracket, and improve needle placement accuracy and needle visibility. The system consists of a lockable, articulating needle guide that attaches to an ultrasound probe and a user interface that provides real-time visualization of the predicted needle trajectory overlaid on the ultrasound image.

The global ultrasound needle guides market is projected to reach USD 369 million by 2027 from USD 274 million in 2022, at a CAGR of 6.1%.The growth in the number of hospitals performing needle-guided surgeries is expected to create growth opportunities for this market during the forecast period. The rising population and initiatives to strengthen healthcare infrastructure across major markets are expected to prove favorable to the ultrasound needle guides market, as an increase in the number of healthcare facilities and setups will support the growth in diagnostic procedures such as ultrasound procedures..

The disposable needle guides segment accounted for the largest share of the global ultrasound needle guides market

In 2021, the disposable needle guides segment holds the largest share of the global ultrasound needle guides market as these needle guides reduce the risks associated with cross-contamination, as well as reduce clean-up time. Disposable guides can easily snap onto the transducer, while reusable guides have to be secured by working on systems, including screws and latches. This makes disposable guides easier to install and reduces the time required to get the device functioning..

The hospitals & clinics segment is estimated to dominate the ultrasound needle guides market in 2021

The hospitals & clinics segment is estimated to dominate the ultrasound needle guides market during the forecast period owing to the increasing investments and incentives received by hospitals from government bodies and private investors. Additionally, the increasing per capita income and growing healthcare awareness have compelled governments in Asian and Latin American countries to focus on ramping up their respective healthcare delivery infrastructures and providing access to preventive & curative care for a broader population .

US dominated the ultrasound needle guides market in North America in 2021

The US has a higher adoption rate of innovative technologies as compared to other countries, which is a major factor responsible for the large share of the US in the North American ultrasound needle guides market. Moreover, the increasing public emphasis on minimally invasive and effective therapeutic techniques, ongoing technological advancements, the growing availability of medical reimbursements for ultrasound procedures, and the growing number of diagnostic centers and hospitals in the country will further drive the market growth during the forecast period.

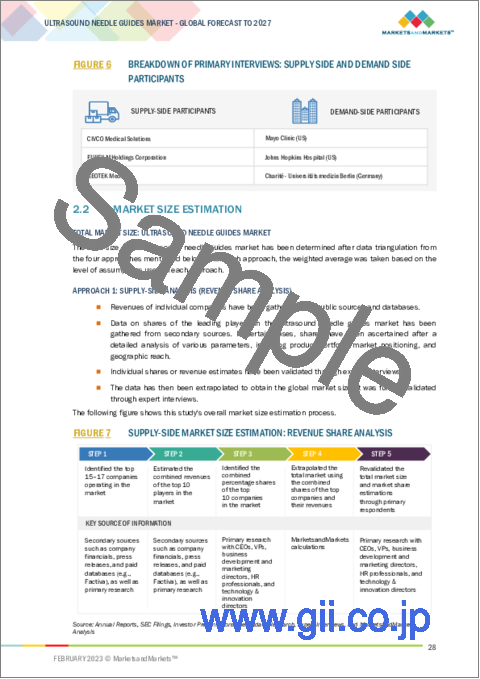

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type- Tier 1- 34%, Tier 2- 38% Tier 3 - 28%

- By Designation- C level - 26%, Managers & Other Level - 74%

- By Region- North America - 17%, Europe - 39%, Asia Pacific - 28%, RoW-16%

Key players in the ultrasound needle guides market

The prominent players in the ultrasound needle guides market are Roper Technologies (CIVCO Medical Solutions) (US), Aspen Surgical (US), FUJIFILM Holdings Corporation (Japan), Siemens Healthineers AG (Germany), Becton, Dickinson and Company (US), Argon Medical Devices (US), Hologic, Inc. (US), Remington Medical Inc. (US), Geotek Medical (Turkey), InnoFine (China), KOELIS (France), Rocket Medical (China), BIRR (Netherlands), IZI Medical (US), Sheathing Technologies, Inc. (US), weLLgo Medical Products GmbH (Germany), and Advance Medical Designs, Inc. (US).

Research Coverage:

The report analyzes the ultrasound needle guides market and aims at estimating the market size and future growth potential of this market based on various segments such as type, application, end user and region. The report also includes a product portfolio matrix of various ultrasound needle guides products available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, and key market strategies.

Reasons to Buy the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn would help them, garner a more significant share of the market. Firms purchasing the report could use one or any combination of the below-mentioned strategies to strengthen their position in the market.

This report provides insights into the following pointers:

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the global ultrasound needle guides market. The report analyzes this market by type, application, end user and region.

- Product Enhancement/Innovation: Detailed insights on upcoming trends and product launches in the global ultrasound needle guides market.

- Market Development: Comprehensive information on the lucrative emerging markets by type, appication, end user and region.

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the global ultrasound needle guides market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players in the global ultrasound needle guides market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 ULTRASOUND NEEDLE GUIDES MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: ROPER TECHNOLOGIES (CIVCO MEDICAL SOLUTIONS)

- FIGURE 9 SUPPLY-SIDE MARKET SIZE ESTIMATION: ULTRASOUND NEEDLE GUIDES MARKET (2021)

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022-2027)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: ULTRASOUND NEEDLE GUIDES MARKET

- 2.8 IMPACT OF RECESSION ON ULTRASOUND NEEDLE GUIDES MARKET

3 EXECUTIVE SUMMARY

- FIGURE 14 ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 17 GEOGRAPHIC SNAPSHOT OF ULTRASOUND NEEDLE GUIDES MARKET

4 PREMIUM INSIGHTS

- 4.1 ULTRASOUND NEEDLE GUIDES MARKET OVERVIEW

- FIGURE 18 INCREASING DEMAND FOR ULTRASOUND PROCEDURES TO DRIVE MARKET GROWTH

- 4.2 ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE AND COUNTRY

- FIGURE 19 DISPOSABLE NEEDLE GUIDES SEGMENT HELD LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

- 4.3 ULTRASOUND NEEDLE GUIDES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 20 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 ULTRASOUND NEEDLE GUIDES MARKET: REGIONAL MIX

- FIGURE 21 NORTH AMERICA WOULD BE LARGEST MARKET FOR ULTRASOUND NEEDLE GUIDES THROUGHOUT FORECAST PERIOD

- 4.5 ULTRASOUND NEEDLE GUIDES MARKET: DEVELOPED VS. DEVELOPING MARKETS

- FIGURE 22 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 ULTRASOUND NEEDLE GUIDES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of target diseases

- TABLE 3 GLOBAL CANCER INCIDENCE FOR GERIATRIC POPULATION (65-85+), 2020 VS. 2040

- 5.2.1.2 Increasing preference for minimally invasive biopsies

- 5.2.1.3 Increasing adoption of ultrasound imaging

- 5.2.1.4 Advantages offered by needle guides

- 5.2.2 RESTRAINTS

- 5.2.2.1 Risk of infections associated with use of aspiration and biopsy needles

- 5.2.2.2 Limited reimbursement in developing countries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in emerging economies

- TABLE 4 RISING INCOME LEVELS IN EMERGING COUNTRIES

- FIGURE 24 GDP GROWTH FORECAST: COMPARISON AMONG INDIA, CHINA, US, AND GERMANY, 2020 VS. 2040 (FORECAST)

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited number of skilled medical professionals

- 5.3 INDUSTRY TRENDS

- 5.3.1 NEEDLE TIP TRACKING TECHNOLOGY

- 5.4 TARIFF AND REGULATORY LANDSCAPE

- 5.4.1 REGULATORY ANALYSIS

- 5.4.1.1 North America

- 5.4.1.1.1 US

- 5.4.1.1 North America

- TABLE 5 US FDA: THREE MAIN CLASSIFICATIONS OF MEDICAL DEVICES

- FIGURE 25 US PREMARKET NOTIFICATION: 510(K) APPROVAL PROCESS FOR MEDICAL DEVICES

- 5.4.1.1.2 Canada

- FIGURE 26 CANADA: APPROVAL PROCESS FOR CLASS II MEDICAL DEVICES

- 5.4.1.2 Europe

- FIGURE 27 EUROPE: CE MARK APPROVAL PROCESS FOR ULTRASOUND NEEDLE GUIDES

- 5.4.1.3 Asia Pacific

- 5.4.1.3.1 Australia

- 5.4.1.3.2 Japan

- 5.4.1.3 Asia Pacific

- TABLE 6 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND THE REVIEWING BODY

- 5.4.1.3.3 India

- 5.4.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.1 REGULATORY ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 28 ULTRASOUND NEEDLE GUIDES MARKET: VALUE CHAIN ANALYSIS

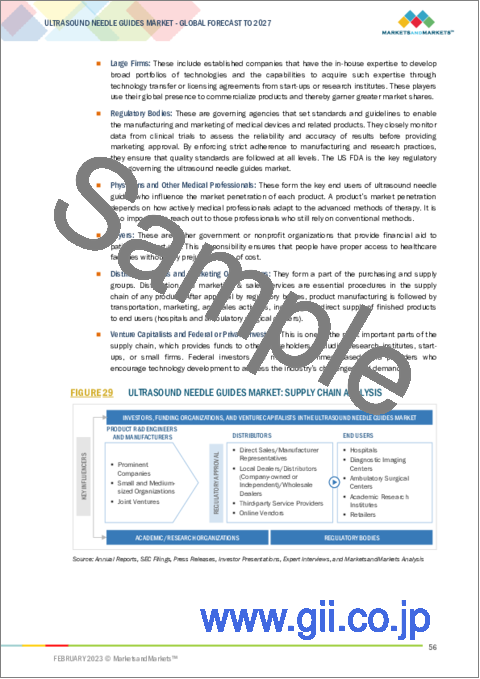

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 29 ULTRASOUND NEEDLE GUIDES MARKET: SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM MARKET MAP

- FIGURE 30 ULTRASOUND NEEDLE GUIDES MARKET: ECOSYSTEM MARKET MAP

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT PUBLICATION TRENDS FOR ULTRASOUND NEEDLE GUIDES

- FIGURE 31 PATENT PUBLICATION TRENDS (JANUARY 2012-JANUARY 2023)

- 5.9.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 32 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR ULTRASOUND NEEDLE GUIDE PATENTS, JANUARY 2012-JANUARY 2023

- FIGURE 33 TOP 10 APPLICANT COUNTRIES/REGIONS FOR ULTRASOUND NEEDLE GUIDE PATENTS (JANUARY 2012-JANUARY 2023)

- TABLE 12 ULTRASOUND NEEDLE GUIDES: LIST OF MAJOR PATENTS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 ROBOTIC ASSISTANCE

- 5.10.2 IMAGE-BASED NEEDLE TRACKING

- 5.11 INDICATIVE PRICING MODEL ANALYSIS

- TABLE 13 AVERAGE SELLING PRICE OF ULTRASOUND NEEDLE GUIDES (2022)

- 5.11.1 AVERAGE SELLING PRICE TRENDS

- 5.12 KEY CONFERENCES AND EVENTS IN 2022-2023

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ULTRASOUND NEEDLE GUIDES

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ULTRASOUND NEEDLE GUIDES

- 5.13.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA FOR ULTRASOUND NEEDLE GUIDES

- TABLE 15 KEY BUYING CRITERIA FOR ULTRASOUND NEEDLE GUIDES

6 ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 16 ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 6.2 DISPOSABLE NEEDLE GUIDES

- 6.2.1 INCREASING HEALTHCARE AWARENESS TO DRIVE GROWTH

- TABLE 17 DISPOSABLE ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3 REUSABLE NEEDLE GUIDES

- 6.3.1 HIGHER PREFERENCE FOR DISPOSABLE NEEDLE GUIDES DUE TO LOWER RISK OF INFECTION TO RESTRAIN MARKET GROWTH

- TABLE 18 REUSABLE ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

7 ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 19 ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 7.2 TISSUE BIOPSY

- 7.2.1 NEEDLE GUIDES ENSURE BETTER SAFETY OF PATIENTS DURING BIOPSY PROCEDURES

- TABLE 20 ULTRASOUND NEEDLE GUIDES MARKET FOR TISSUE BIOPSY, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 FLUID ASPIRATION

- 7.3.1 INCREASING NUMBER OF SURGERIES TO DRIVE GROWTH

- TABLE 21 ULTRASOUND NEEDLE GUIDES MARKET FOR FLUID ASPIRATION, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.4 VASCULAR ACCESS PROCEDURES

- 7.4.1 NEEDLE GUIDES IMPROVE NEEDLE PLACEMENT DURING VASCULAR ACCESS PROCEDURES

- TABLE 22 ULTRASOUND NEEDLE GUIDES MARKET FOR VASCULAR ACCESS PROCEDURES, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.5 NERVE BLOCK AND REGIONAL ANESTHESIA

- 7.5.1 NEEDLE GUIDES ENSURE PLACEMENT OF NEEDLE TIP WITHIN SCAN PLANE DURING NERVE BLOCK AND REGIONAL ANESTHESIA PROCEDURES

- TABLE 23 ULTRASOUND NEEDLE GUIDES MARKET FOR NERVE BLOCK AND REGIONAL ANESTHESIA, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.6 OTHER APPLICATIONS

- TABLE 24 ULTRASOUND NEEDLE GUIDES MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

8 ULTRASOUND NEEDLE GUIDES MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 25 ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.2 HOSPITALS AND CLINICS

- 8.2.1 HOSPITALS PERFORM LARGE NUMBER OF ULTRASOUND-BASED MEDICAL PROCEDURES

- TABLE 26 ULTRASOUND NEEDLE GUIDES MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3 AMBULATORY SURGICAL CENTERS

- 8.3.1 INCREASING NUMBER OF OUTPATIENT VISITS TO DRIVE GROWTH

- TABLE 27 ULTRASOUND NEEDLE GUIDES MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.4 DIAGNOSTIC IMAGING CENTERS

- 8.4.1 INCREASED DEMAND FOR EARLY DIAGNOSIS TO DRIVE MARKET

- TABLE 28 ULTRASOUND NEEDLE GUIDES MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.5 OTHER END USERS

- TABLE 29 ULTRASOUND NEEDLE GUIDES MARKET FOR OTHER END USERS, BY COUNTRY, 2020-2027 (USD MILLION)

9 ULTRASOUND NEEDLE GUIDES MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 36 ULTRASOUND NEEDLE GUIDES MARKET: GEOGRAPHIC SNAPSHOT

- TABLE 30 ULTRASOUND NEEDLE GUIDES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 IMPACT OF RECESSION ON ULTRASOUND NEEDLE GUIDES MARKET IN NORTH AMERICA

- FIGURE 37 NORTH AMERICA: ULTRASOUND NEEDLE GUIDES MARKET SNAPSHOT

- TABLE 31 NORTH AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 32 NORTH AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 33 NORTH AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 34 NORTH AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 US to dominate North American ultrasound needle guides market during forecast period

- TABLE 35 US: KEY MACROINDICATORS

- TABLE 36 US: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 37 US: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 38 US: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Growing awareness about early disease diagnosis to drive market growth

- TABLE 39 CANADA: KEY MACROINDICATORS

- TABLE 40 CANADA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 41 CANADA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 42 CANADA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 IMPACT OF RECESSION ON ULTRASOUND NEEDLE GUIDES MARKET IN EUROPE

- TABLE 43 EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 44 EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 45 EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 46 EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 Germany held largest share of European ultrasound needle guides market in 2021

- TABLE 47 GERMANY: KEY MACROINDICATORS

- TABLE 48 GERMANY: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 49 GERMANY: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 50 GERMANY: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Modernization of healthcare infrastructure fueling market growth

- TABLE 51 FRANCE: KEY MACROINDICATORS

- TABLE 52 FRANCE: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 53 FRANCE: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 54 FRANCE: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.4 UK

- 9.3.4.1 Rising geriatric population to drive market growth

- TABLE 55 UK: KEY MACROINDICATORS

- TABLE 56 UK: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 57 UK: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 58 UK: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Improved reimbursement scenario to support overall market growth

- TABLE 59 ITALY: KEY MACROINDICATORS

- TABLE 60 ITALY: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 61 ITALY: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 62 ITALY: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.6 SPAIN

- 9.3.6.1 Developing healthcare facilities and infrastructure to drive growth

- TABLE 63 SPAIN: KEY MACROINDICATORS

- TABLE 64 SPAIN: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 65 SPAIN: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 66 SPAIN: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 67 REST OF EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 68 REST OF EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 69 REST OF EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- 9.4.1 IMPACT OF RECESSION ON ULTRASOUND NEEDLE GUIDES MARKET IN ASIA PACIFIC

- FIGURE 38 ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET SNAPSHOT

- TABLE 70 ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 71 ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 72 ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 73 ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Increasing patient pool to drive market growth

- TABLE 74 CHINA: KEY MACROINDICATORS

- TABLE 75 CHINA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 76 CHINA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 77 CHINA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Rising geriatric population to drive market growth

- TABLE 78 JAPAN: KEY MACROINDICATORS

- TABLE 79 JAPAN: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 80 JAPAN: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 81 JAPAN: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Significant burden of target diseases and availability of affordable devices to drive market growth

- TABLE 82 INDIA: KEY MACROINDICATORS

- TABLE 83 INDIA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 84 INDIA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 85 INDIA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.5 AUSTRALIA

- 9.4.5.1 Growing awareness campaigns to drive market growth

- TABLE 86 AUSTRALIA: KEY MACROINDICATORS

- TABLE 87 AUSTRALIA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 88 AUSTRALIA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 89 AUSTRALIA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 90 REST OF ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.5 LATIN AMERICA

- 9.5.1 IMPACT OF RECESSION ON ULTRASOUND NEEDLE GUIDES MARKET IN LATIN AMERICA

- TABLE 93 LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 94 LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 95 LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 96 LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.5.2 BRAZIL

- 9.5.2.1 Universal healthcare system to drive market growth

- TABLE 97 BRAZIL: KEY MACROINDICATORS

- TABLE 98 BRAZIL: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 99 BRAZIL: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 100 BRAZIL: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.5.3 MEXICO

- 9.5.3.1 Modernization of healthcare infrastructure to support market growth

- TABLE 101 MEXICO: KEY MACROINDICATORS

- TABLE 102 MEXICO: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 103 MEXICO: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 104 MEXICO: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.5.4 REST OF LATIN AMERICA

- TABLE 105 REST OF LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 106 REST OF LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 107 REST OF LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 IMPACT OF RECESSION ON ULTRASOUND NEEDLE GUIDES MARKET IN MIDDLE EAST & AFRICA

- TABLE 108 MIDDLE EAST & AFRICA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS OPERATING IN ULTRASOUND NEEDLE GUIDES MARKET

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 40 ULTRASOUND NEEDLE GUIDES MARKET SHARE, BY KEY PLAYER (2021)

- 10.5 COMPANY FOOTPRINT ANALYSIS

- 10.5.1 FOOTPRINT OF COMPANIES, BY TYPE

- 10.5.2 FOOTPRINT OF COMPANIES, BY APPLICATION

- 10.5.3 FOOTPRINT OF COMPANIES, BY REGION

- 10.6 COMPANY EVALUATION MATRIX

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 41 ULTRASOUND NEEDLE GUIDES MARKET: COMPANY EVALUATION MATRIX

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 111 ULTRASOUND NEEDLE GUIDES MARKET: KEY START-UPS/SMES

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 DEALS

- TABLE 112 ULTRASOUND NEEDLE GUIDES MARKET: DEALS (JANUARY 2019-JANUARY 2023)

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business overview, Products offered, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats)**

- 11.1.1 CIVCO MEDICAL SOLUTIONS (A ROPER COMPANY)

- TABLE 113 CIVCO MEDICAL SOLUTIONS: BUSINESS OVERVIEW

- FIGURE 42 COMPANY SNAPSHOT: ROPER TECHNOLOGIES, INC. (2021)

- 11.1.2 BECTON, DICKINSON AND COMPANY

- TABLE 114 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- FIGURE 43 COMPANY SNAPSHOT: BECTON, DICKINSON AND COMPANY (2022)

- 11.1.3 ASPEN SURGICAL

- TABLE 115 ASPEN SURGICAL: BUSINESS OVERVIEW

- 11.1.4 ARGON MEDICAL DEVICES

- TABLE 116 ARGON MEDICAL DEVICES: BUSINESS OVERVIEW

- 11.1.5 FUJIFILM SONOSITE, INC. (A PART OF FUJIFILM HOLDINGS CORPORATION)

- TABLE 117 FUJIFILM HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 44 COMPANY SNAPSHOT: FUJIFILM HOLDINGS CORPORATION (2021)

- 11.1.6 ROCKET MEDICAL

- TABLE 118 ROCKET MEDICAL: BUSINESS OVERVIEW

- 11.1.7 SIEMENS HEALTHINEERS AG

- TABLE 119 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

- FIGURE 45 COMPANY SNAPSHOT: SIEMENS HEALTHINEERS (2021)

- 11.1.8 HOLOGIC, INC.

- TABLE 120 HOLOGIC, INC.: BUSINESS OVERVIEW

- FIGURE 46 COMPANY SNAPSHOT: HOLOGIC, INC. (2021)

- 11.1.9 REMINGTON MEDICAL INC.

- TABLE 121 REMINGTON MEDICAL INC.: BUSINESS OVERVIEW

- 11.1.10 GEOTEK MEDICAL

- TABLE 122 GEOTEK MEDICAL: BUSINESS OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 INNOFINE

- TABLE 123 INNOFINE: BUSINESS OVERVIEW

- 11.2.2 KOELIS

- TABLE 124 KOELIS: BUSINESS OVERVIEW

- 11.2.3 BIRR

- TABLE 125 BIRR: BUSINESS OVERVIEW

- 11.2.4 IZI MEDICAL

- TABLE 126 IZI MEDICAL: BUSINESS OVERVIEW

- 11.2.5 SHEATHING TECHNOLOGIES, INC.

- TABLE 127 SHEATHING TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- 11.2.6 WELLGO MEDICAL PRODUCTS GMBH

- TABLE 128 WELLGO MEDICAL PRODUCTS GMBH: BUSINESS OVERVIEW

- 11.2.7 ADVANCE MEDICAL DESIGNS, INC.

- TABLE 129 ADVANCE MEDICAL DESIGNS, INC: BUSINESS OVERVIEW

- *Details on Business overview, Products offered, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS