|

|

市場調査レポート

商品コード

1192512

自己修復ネットワークの世界市場:コンポーネント別・ネットワークの種類別・用途別・業種別・地域別の将来予測 (2027年)Self-healing Networks Market by Component (Solutions, Services), Network Type (Public, Private, & Hybrid), Application (Network Provisioning, Network Traffic Management), Vertical (Telecom, Healthcare & Life Sciences) & Region - Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自己修復ネットワークの世界市場:コンポーネント別・ネットワークの種類別・用途別・業種別・地域別の将来予測 (2027年) |

|

出版日: 2023年01月17日

発行: MarketsandMarkets

ページ情報: 英文 265 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自己修復ネットワークの市場規模は、2022年の6億米ドルから、2027年には24億米ドルに成長し、予測期間中は33.3%のCAGRで推移すると予測されます。

ネットワークトラフィックを監視・制御する新たなニーズ、自己修復と自動化技術 (統合型AI・MLなど) の普及促進、ネットワーク中断を引き起こす手動システムのヒューマンエラー率の急増が、世界各国で自己修復ネットワークソリューションの導入に道を開くことにつながっています。

サービスの種類別では、マネージドサービスは予測期間中に高いCAGRを記録する見込みです。組織規模別では、大企業が市場の大半を占めています。

地域別に見ると、アジア太平洋が予測期間中に最も高いCAGRを維持する見通しです。アジア太平洋では、接続デバイスの数が増加しており、構成管理の自動化のニーズが高まっています。このため、同地域の企業では、信頼性の高い自己回復型ネットワークソリューションの採用が進んでいます。

当レポートでは、世界の自己修復ネットワークの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・ネットワークの種類別・展開方法別・組織規模別・用途別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場の概要と動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 進化

- 自己修復ネットワーク市場:エコシステム

- ケーススタディ分析

- 技術分析

- 自己修復ネットワークと5G LAN

- 自己修復ネットワークと人工知能 (AI)・機械学習 (ML)

- 自己修復ネットワークとクラウドコンピューティング

- 自己修復ネットワークとブロックチェーン

- 自己修復ネットワークとモノのインターネット (IoT)

- ポーターのファイブフォース分析

- 規制状況

- 価格モデル分析

- 特許分析

- 主な会議とイベント (2022年~2023年)

- 関税と規制の状況

- 自己修復ネットワーク市場のバイヤー/クライアントに影響を与えるトレンド/混乱

- 主な利害関係者と購入基準

第6章 自己修復ネットワーク市場:コンポーネント別

- イントロダクション

- ソリューション

- ネットワーク監視ツール

- ネットワーク自動化ソフトウェア

- インテントベースネットワーク (IBN) ソフトウェア

- その他のソリューション

- サービス

- 専門サービス

- マネージドサービス

第7章 自己修復ネットワーク市場:ネットワークの種類別

- イントロダクション

- 物理的

- 仮想

- ハイブリッド

第8章 自己修復ネットワーク市場:展開方法別

- イントロダクション

- オンプレミス

- クラウド

第9章 自己修復ネットワーク市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第10章 自己修復ネットワーク市場:用途別

- イントロダクション

- ネットワークプロビジョニング

- ネットワーク帯域幅監視

- ポリシー管理

- セキュリティコンプライアンス管理

- 根本原因分析

- ネットワークトラフィック管理

- ネットワークアクセス制御

- その他の用途

第11章 自己修復ネットワーク市場:業種別

- イントロダクション

- IT・ITeS

- BFSI

- 医療・ライフサイエンス

- メディア・エンターテイメント

- 通信

- 小売業・消費財

- 教育

- その他の業種

第12章 自己修復ネットワーク市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 他のアジア太平洋諸国

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- 他の中東・アフリカ諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第13章 競合情勢

- 概要

- 主要企業が採用した戦略

- 収益分析

- 過去の収益分析

- 市場シェア分析

- 市場評価フレームワーク

- 企業評価クアドラント

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- スタートアップ/中小企業の競合ベンチマーキング

- 競合シナリオと動向

- 製品の発売

- 資本取引

第14章 企業プロファイル

- イントロダクション

- 主要企業

- VMWARE

- IBM

- COMMSCOPE

- BMC SOFTWARE

- FORTRA

- SOLARWINDS

- MANAGEENGINE

- ELISA POLYSTAR

- HPE

- CISCO

- その他の企業

- IVANTI

- EASYVISTA

- HUAWEI

- NOKIA

- ACT

- ERICSSON

- ANUTA NETWORKS

- JUNIPER

- BLUECAT

- PARK PLACE TECHNOLOGIES

- APPNOMIC

- スタートアップ/中小企業のプロファイル

- PARALLEL WIRELESS

- ITENTIAL

- VERSA NETWORKS

- KENTIK

- DOMOTZ

- BEEGOL

第15章 隣接・関連市場

- イントロダクション

- ネットワーク管理システム市場:世界市場の予測 (2027年まで)

- IT運用分析市場:世界市場の予測 (2026年まで)

第16章 付録

The Self-healing networks market size to grow from USD 0.6 billion in 2022 to USD 2.4 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 33.3% during the forecast period. The emerging need to monitor and control network traffic, boosting adoption of automation technologies such as AI and ML integrated with self-healing, and surge in human error rates in manual systems causing network downtime to pave the way for self-healing networks solutions adoption across the globe.

Self-healing networks solutions comprises of network automation solutions with self-healing capabilities which are implemented through distributed communication protocols which take advantage of redundant links to improve the connectivity of the network system. Some of the major business applications of self-healing networks are in the important field of infrastructural networks such as gas, power, water, oil distribution systems.

Managed Services to register for the higher CAGR during the forecast period

The services segment includes professional and managed services. The professional services are offered through specialists or professionals for business support and are offered specifically by network solution vendors and are segmented into consulting, system integration and implementation, and support and maintenance. Managed services are offered by third parties and are outsourced. Services are considered as the backbone of self-healing networks as they are instrumental in fulfilling the customized requirements of clients. Networking experts consult their clients about the weak links in their networks and suggest solutions that would suit their business needs. The overall services segment includes a range of activities, such as planning, design, equipment installation, training, commissioning, testing, network optimization, maintenance, post-deployment assistance, root cause analysis, and 24*7 support.

Large enterprises to hold larger market size during the forecast period

Based on organization size, the self-healing networks market has been segmented into SMEs and large enterprises. Organizations with several employees between 0 and 999 are said to be SMEs. For any large or small organization, access, optimization, and availability are of utmost importance for the management of the network. Large enterprises are the dominant spenders for incorporating networking solutions in their ecosystem. Large enterprises are organizations that have an employee strength of more than 1,000 employees and annual revenue higher than USD 1 billion. These organizations need the expertise of IT staff to manage specific applications and IT infrastructure due to the large amount of data they generate.

Asia Pacific to hold highest CAGR during the forecast period

Based on regions, the Edge AI market is segmented into North America, Asia Pacific, Europe, Middle East and Africa and Latin America. Asia Pacific is witnessing an increase in the number of connected devices, which is fueling the need for automated configuration management. This, in turn, is increasing the adoption of reliable self-healing network solutions by enterprises in the region. Similarly, the wider adoption of advanced technologies and government initiatives for digitalization across Middle East and Africa and Latin America are expected to pave the way for the adoption of more advanced self-healing networks solution in these regions

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the frontline workers training market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, D-Level Executives: 25%, and Managers: 40%

- By Region: APAC: 30%, Europe: 20%, North America: 45%, Rest of the World: 5%

The report includes the study of key players offering Self-healing networks solution and services. The major players in the Self-healing networks market include Fortra (US), VMWare (US), IBM (US), CommScope (US), SolarWinds (US), ManageEngine (US), BMC Software (US), Elisa Polystar (Sweden), HPE (US), Ivanti (US), Easyvista (France), Huawei (China), ACT (India), Ericsson (Sweden), Anuta Networks (US), Juniper (US), Bluecat (Canada), Park Place Technologies (US), Appnomic (India), Parallel Wireless (US), Itential (US), Volta Networks (US), Kentik (US), Domotz (US), Minim (US), Nyansa (US), and Beegol (Brazil).

Research Coverage

The new research study includes the market drivers for each segment and regions on the self-healing networks market. The market dynamics and industry trends have been updated. A few sections such as vertical-wise use cases, government regulations, patent analysis, pricing analysis for 2022, supply chain, architecture, and ecosystem have been updated as per the latest trends. The new study also comprises operational drivers for adoption in each segment and region. The new research study features 27 players and financial information/product portfolio of players in 2021: The new edition of the report provides updated financial information in the context of the self-healing networks market till 2021-2022 for each listed company in graphical representation. The new research study includes the updated market developments of profiled players, including those from 2020 to 2022. The new study includes quantitative data for historical years (2018-2021), base year (2021), and forecast years (2022-2027). The new study also includes quantitative data from adjacent markets.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Self-healing networks market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 SELF-HEALING NETWORKS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 SELF-HEALING NETWORKS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF SELF-HEALING NETWORKS MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES OF SELF-HEALING NETWORKS MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES OF SELF-HEALING NETWORKS MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM UP (DEMAND SIDE): SHARE OF SELF-HEALING NETWORKS THROUGH OVERALL SELF-HEALING NETWORKS SPENDING

- 2.4 MARKET FORECAST

- TABLE 1 FACTOR ANALYSIS

- 2.5 COMPANY EVALUATION MATRIX METHODOLOGY

- FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

- FIGURE 9 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 2.7 ASSUMPTIONS

- 2.8 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 2 GLOBAL SELF-HEALING NETWORKS MARKET AND GROWTH RATE, 2019-2021 (USD MILLION, Y-O-Y %)

- TABLE 3 GLOBAL SELF-HEALING NETWORKS MARKET AND GROWTH RATE, 2022-2027 (USD MILLION, Y-O-Y %)

- FIGURE 10 SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2022

- FIGURE 11 PROFESSIONAL SERVICES TO HOLD LARGER MARKET SHARE IN 2022

- FIGURE 12 TRAINING & CONSULTING SEGMENT TO LEAD MARKET IN 2022

- FIGURE 13 NETWORK AUTOMATION SOFTWARE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2022

- FIGURE 14 NETWORK PROVISIONING TO DOMINATE APPLICATION SEGMENT IN 2022

- FIGURE 15 PHYSICAL NETWORK TYPE SEGMENT TO DOMINATE MARKET IN 2022

- FIGURE 16 LARGE ENTERPRISES TO DOMINATE MARKET IN 2022

- FIGURE 17 CLOUD SEGMENT TO HOLD LARGEST MARKET IN 2022

- FIGURE 18 HEALTHCARE AND LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR IN 2022

- FIGURE 19 NORTH AMERICA TO HOLD LARGEST MARKET SHARE AND ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST YEAR

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN SELF-HEALING NETWORKS MARKET

- FIGURE 20 RISING NEED TO MANAGE NETWORK TRAFFIC TO REDUCE NETWORK DOWNTIME

- 4.2 SELF-HEALING NETWORKS MARKET: TOP THREE APPLICATIONS

- FIGURE 21 NETWORK TRAFFIC MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT AND TOP THREE VERTICALS

- FIGURE 22 SOLUTIONS SEGMENT AND TELECOM SEGMENT TO HOLD LARGEST MARKET SHARE IN NORTH AMERICA IN 2022

- 4.4 SELF-HEALING NETWORKS MARKET: BY REGION

- FIGURE 23 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SELF-HEALING NETWORKS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need to control and manage network traffic

- 5.2.1.2 Increasing adoption of automation technologies such as AI and ML

- 5.2.1.3 Surge in human error rates in manual systems to cause network downtime

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising security threats across networks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising investments in R&D and emerging self-healing technologies

- 5.2.3.2 Increasing number of startups to offer networking solutions with self-healing capabilities

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness among network administrators

- 5.3 EVOLUTION

- FIGURE 25 EVOLUTION: SELF-HEALING NETWORKS MARKET

- 5.4 SELF-HEALING NETWORKS MARKET: ECOSYSTEM

- TABLE 4 SELF-HEALING NETWORKS MARKET: ECOSYSTEM

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 MEDIA AND ENTERTAINMENT

- 5.5.1.1 Juniper offers AI-driven proactive automation and self-healing capabilities to JoongAng

- 5.5.1.2 SolarWinds enables Springer Nature to unify monitoring solutions

- 5.5.2 TELECOM

- 5.5.2.1 Anuta Networks helps Tata Communication Ltd. to improve self-service capabilities

- 5.5.2.2 Elisa Polystar enables Deri to automate operations for radio access network

- 5.5.3 ENERGY AND UTILITY

- 5.5.3.1 IBM helps Austin Energy to develop Intelligent Utility Network

- 5.5.4 MANUFACTURING

- 5.5.4.1 Entuity Analytics Network helps Grundfos Pumps to streamline and automate configuration management processes

- 5.5.5 BFSI

- 5.5.5.1 BMC software helped Sichuan Rural Credit Union and Cooperative Bank to replace manual IT service management processes

- 5.5.6 HEALTHCARE AND LIFE SCIENCES

- 5.5.6.1 VMware helps Northeast Georgia Health System to deliver prompt and effective patient care

- 5.5.1 MEDIA AND ENTERTAINMENT

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 SELF-HEALING NETWORKS AND 5G LAN

- 5.6.2 SELF-HEALING NETWORKS, ARTIFICIAL INTELLIGENCE (AI), AND MACHINE LEARNING (ML)

- 5.6.3 SELF-HEALING NETWORKS AND CLOUD COMPUTING

- 5.6.4 SELF-HEALING NETWORKS AND BLOCKCHAIN

- 5.6.5 SELF-HEALING NETWORKS AND INTERNET OF THINGS (IOT)

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 SELF-HEALING NETWORKS: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 SELF-HEALING NETWORKS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)

- 5.8.2 GENERAL DATA PROTECTION REGULATION (GDPR)

- 5.8.3 GRAMM-LEACH-BLILEY ACT (GLBA)

- 5.8.4 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION STANDARD 27001

- 5.8.5 HEALTH LEVEL SEVEN INTERNATIONAL (HL7)

- 5.8.6 COMMUNICATIONS DECENCY ACT

- 5.9 PRICING MODEL ANALYSIS

- TABLE 6 PRICING ANALYSIS

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.10.2 DOCUMENT TYPE

- TABLE 7 PATENTS FILED, 2019-2021

- 5.10.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 27 TOTAL NUMBER OF PATENTS GRANTED, 2019-2021

- 5.10.3.1 Top applicants

- FIGURE 28 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019-2021

- TABLE 8 TOP 10 PATENT OWNERS (US) IN SELF-HEALING NETWORKS MARKET, 2019-2021

- 5.11 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 9 SELF-HEALING NETWORKS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022-2023

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF SELF-HEALING NETWORKS MARKET

- FIGURE 29 SELF-HEALING NETWORKS MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.14.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 SELF-HEALING NETWORKS MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: SELF-HEALING NETWORKS MARKET DRIVERS

- FIGURE 32 SERVICES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 17 SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 18 SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2 SOLUTIONS

- FIGURE 33 NETWORK MONITORING TOOLS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 19 SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 20 SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 21 SELF-HEALING NETWORKS SOLUTIONS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 22 SELF-HEALING NETWORKS SOLUTIONS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1 NETWORK MONITORING TOOLS

- 6.2.1.1 Tools to enable network administrators to monitor and diagnose problems

- TABLE 23 NETWORK MONITORING TOOLS: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 24 NETWORK MONITORING TOOLS: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.2 NETWORK AUTOMATION SOFTWARE

- 6.2.2.1 Software to reduce cost of network maintenance

- TABLE 25 NETWORK AUTOMATION SOFTWARE: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 26 NETWORK AUTOMATION SOFTWARE: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.3 INTENT-BASED NETWORKING SOFTWARE

- 6.2.3.1 Networking software to increase operational efficiency

- TABLE 27 INTENT-BASED NETWORKING SOFTWARE: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 28 INTENT-BASED NETWORKING SOFTWARE: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.4 OTHER SOLUTIONS

- TABLE 29 OTHER SOLUTIONS: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 30 OTHER SOLUTIONS: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 SERVICES

- FIGURE 34 MANAGED SERVICES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 31 SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019-2021 (USD MILLION)

- TABLE 32 SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

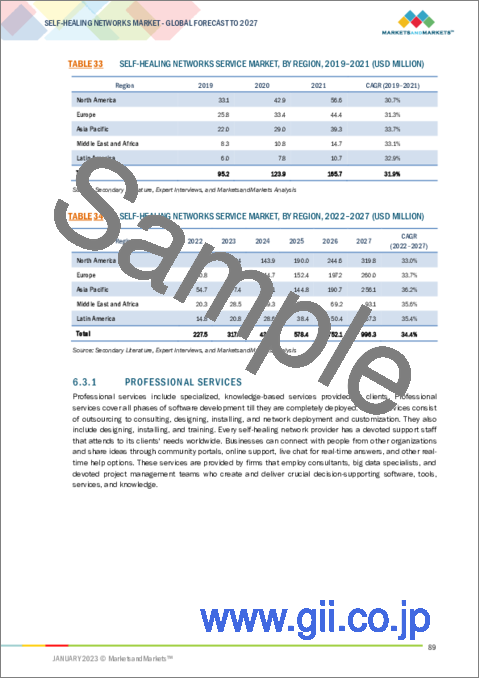

- TABLE 33 SELF-HEALING NETWORKS SERVICE MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 34 SELF-HEALING NETWORKS SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.1 PROFESSIONAL SERVICES

- FIGURE 35 SYSTEM INTEGRATION & TESTING SERVICES SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 35 SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019-2021 (USD MILLION)

- TABLE 36 SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD MILLION)

- TABLE 37 PROFESSIONAL SERVICE: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 38 PROFESSIONAL SERVICE: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.1.1 Training and Consulting

- 6.3.1.1.1 Enhancement of network efficiency and performance

- 6.3.1.1 Training and Consulting

- TABLE 39 TRAINING AND CONSULTING: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 40 TRAINING AND CONSULTING: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.1.2 Support and Maintenance

- 6.3.1.2.1 Troubleshooting and upgrades to enable clients to update network ecosystem

- 6.3.1.2 Support and Maintenance

- TABLE 41 SUPPORT AND MAINTENANCE: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 42 SUPPORT AND MAINTENANCE: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.1.3 System Integration and Testing

- 6.3.1.3.1 Avoid complexities involved while deploying self-healing networks solutions

- 6.3.1.3 System Integration and Testing

- TABLE 43 SYSTEM INTEGRATION AND TESTING: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 44 SYSTEM INTEGRATION AND TESTING: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Services to fulfill pre- and post-deployment needs

- TABLE 45 MANAGED SERVICES: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 46 MANAGED SERVICES: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

7 SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE

- 7.1 INTRODUCTION

- 7.1.1 NETWORK TYPE: SELF-HEALING NETWORKS MARKET DRIVERS

- FIGURE 36 VIRTUAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 47 SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019-2021 (USD MILLION)

- TABLE 48 SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022-2027 (USD MILLION)

- 7.2 PHYSICAL

- 7.2.1 PHYSICAL NETWORK TO PROVIDE ACCESS TO CENTRALIZED MODEL

- TABLE 49 PHYSICAL: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 50 PHYSICAL: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 VIRTUAL

- 7.3.1 CLOUD-BASED SERVICES ENABLE BUSINESSES TO MANAGE AND CONFIGURE VIRTUAL NETWORKS

- TABLE 51 VIRTUAL: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 52 VIRTUAL: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 HYBRID

- 7.4.1 HYBRID NETWORK TO COMBINE VIRTUAL AND PHYSICAL NETWORK INFRASTRUCTURE

- TABLE 53 HYBRID: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 54 HYBRID: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

8 SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT MODE: SELF-HEALING NETWORKS MARKET DRIVERS

- FIGURE 37 ON-PREMISES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 55 SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019-2021 (USD MILLION)

- TABLE 56 SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- 8.2 ON-PREMISES

- 8.2.1 BUSINESSES TO EMBRACE ON-PREMISES SELF-HEALING NETWORKS SOLUTIONS DUE TO SECURITY CONCERNS

- TABLE 57 ON-PREMISES: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 58 ON-PREMISES: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 CLOUD

- 8.3.1 QUICK AND SECURE NETWORK CONFIGURATION TO OFFER BUSINESS AGILITY AND COST MANAGEMENT

- TABLE 59 CLOUD: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 60 CLOUD: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

9 SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- 9.1.1 ORGANIZATION SIZE: SELF-HEALING NETWORKS SYSTEM MARKET DRIVERS

- FIGURE 38 SMALL AND MEDIUM-SIZED ENTERPRISES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 61 SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019-2021 (USD MILLION)

- TABLE 62 SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.2 LARGE ENTERPRISES

- 9.2.1 BENEFITS OF NETWORK INFRASTRUCTURE OPTIMIZATION AND LOW OPERATIONAL COSTS

- TABLE 63 SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 64 SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 9.3.1 INTEGRATION OF CUTTING-EDGE TECHNOLOGIES TO DRIVE ADOPTION OF SELF-HEALING NETWORKS

- TABLE 65 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 66 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2022-2027 (USD MILLION)

10 SELF-HEALING NETWORKS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.1.1 APPLICATION: SELF-HEALING NETWORKS MARKET DRIVERS

- FIGURE 39 NETWORK TRAFFIC MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 67 SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 68 SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.2 NETWORK PROVISIONING

- 10.2.1 SELF-HEALING NETWORKS TOOLS TO MONITOR AND ENHANCE NETWORK OPTIMIZATION

- TABLE 69 NETWORK PROVISIONING: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 70 NETWORK PROVISIONING: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 NETWORK BANDWIDTH MONITORING

- 10.3.1 BANDWIDTH MONITOR TO SUPPORT REAL-TIME BANDWIDTH ANALYSIS AND DATA COLLECTION

- TABLE 71 NETWORK BANDWIDTH MONITORING: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 72 NETWORK BANDWIDTH MONITORING: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 POLICY MANAGEMENT

- 10.4.1 SELF-HEALING NETWORKS TO REDUCE SECURITY RISKS

- TABLE 73 POLICY MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 74 POLICY MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 SECURITY COMPLIANCE MANAGEMENT

- 10.5.1 SELF-HEALING NETWORKS TO DETECT ANOMALOUS BEHAVIOR IN APPLICATION PERFORMANCE AND SECURITY

- TABLE 75 SECURITY COMPLIANCE MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 76 SECURITY COMPLIANCE MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.6 ROOT CAUSE ANALYSIS

- 10.6.1 SELF-HEALING NETWORKS TO MAXIMIZE RETURN ON INVESTMENT (ROI)

- TABLE 77 ROOT CAUSE ANALYSIS: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 78 ROOT CAUSE ANALYSIS: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.7 NETWORK TRAFFIC MANAGEMENT

- 10.7.1 SELF-HEALING NETWORKS TO MONITOR TRAFFIC PATTERNS TO DETECT AND PREVENT BOTTLENECKS

- TABLE 79 NETWORK TRAFFIC MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 80 NETWORK TRAFFIC MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.8 NETWORK ACCESS CONTROL

- 10.8.1 NETWORK ACCESS CONTROL TO PREVENT UNAUTHORIZED ACCESS TO DATA

- TABLE 81 NETWORK ACCESS CONTROL: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 82 NETWORK ACCESS CONTROL: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.9 OTHER APPLICATIONS

- TABLE 83 OTHER APPLICATIONS: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 84 OTHER APPLICATIONS: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

11 SELF-HEALING NETWORKS MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.1.1 VERTICAL: SELF-HEALING NETWORKS MARKET DRIVERS

- FIGURE 40 HEALTHCARE AND LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 85 SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 86 SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.2 IT AND ITES

- 11.2.1 SELF-HEALING CAPABILITIES MAKE IT ECOSYSTEMS MORE RELIABLE

- TABLE 87 IT AND ITES: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 88 IT AND ITES: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 BFSI

- 11.3.1 NEW GENERATION NETWORKS TO IMPROVE DIGITAL BUSINESS RESILIENCY

- TABLE 89 BFSI: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 90 BFSI: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4 HEALTHCARE AND LIFE SCIENCES

- 11.4.1 SELF-HEALING NETWORKS TO DELIVER ACCURATE AND LOGICAL DIAGNOSIS

- TABLE 91 HEALTHCARE AND LIFE SCIENCES: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 92 HEALTHCARE AND LIFE SCIENCES: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5 MEDIA AND ENTERTAINMENT

- 11.5.1 SELF-HEALING NETWORKS SOLUTION REDUCE OPEX AND INCREASE BANDWIDTH

- TABLE 93 MEDIA AND ENTERTAINMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 94 MEDIA AND ENTERTAINMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.6 TELECOM

- 11.6.1 SELF-HEALING NETWORKS TO IDENTIFY AND RECTIFY POTENTIAL FAULTS

- TABLE 95 TELECOM: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 96 TELECOM: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.7 RETAIL AND CONSUMER GOODS

- 11.7.1 SELF-HEALING NETWORKS TO PROVIDE RETAILERS GREAT IN-STORE USER EXPERIENCE

- TABLE 97 RETAIL AND CONSUMER GOODS: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 98 RETAIL AND CONSUMER GOODS: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.8 EDUCATION

- 11.8.1 SELF-HEALING NETWORKS TO ENHANCE ASSESSMENTS AND IMPROVE STUDENT ENGAGEMENT

- TABLE 99 EDUCATION: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 100 EDUCATION: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.9 OTHER VERTICALS

- TABLE 101 OTHER VERTICALS: SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 102 OTHER VERTICALS: SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

12 SELF-HEALING NETWORKS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 41 INDIA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 103 SELF-HEALING NETWORKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 104 SELF-HEALING NETWORKS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: RECESSION IMPACT

- 12.2.2 NORTH AMERICA: SELF-HEALING NETWORKS MARKET DRIVERS

- FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 105 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019-2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 109 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019-2021 (USD MILLION)

- TABLE 110 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD MILLION)

- TABLE 111 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 112 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 113 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019-2021 (USD MILLION)

- TABLE 114 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022-2027 (USD MILLION)

- TABLE 115 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019-2021 (USD MILLION)

- TABLE 116 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 117 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019-2021 (USD MILLION)

- TABLE 118 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 119 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 120 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 121 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 122 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 123 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 124 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.2.3 US

- 12.2.3.1 Technological awareness and presence of several network providers to drive market

- 12.2.4 CANADA

- 12.2.4.1 Threats against network infrastructure to drive adoption of self-healing networks

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT

- 12.3.2 EUROPE: SELF-HEALING NETWORKS MARKET DRIVERS

- TABLE 125 EUROPE: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 126 EUROPE: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 127 EUROPE: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019-2021 (USD MILLION)

- TABLE 128 EUROPE: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 129 EUROPE: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019-2021 (USD MILLION)

- TABLE 130 EUROPE: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD MILLION)

- TABLE 131 EUROPE: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 132 EUROPE: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 133 EUROPE: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019-2021 (USD MILLION)

- TABLE 134 EUROPE: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022-2027 (USD MILLION)

- TABLE 135 EUROPE: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019-2021 (USD MILLION)

- TABLE 136 EUROPE: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 137 EUROPE: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019-2021 (USD MILLION)

- TABLE 138 EUROPE: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 139 EUROPE: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 140 EUROPE: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 141 EUROPE: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 142 EUROPE: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 143 EUROPE: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 144 EUROPE: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Growing demand for comprehensive technologies to manage network infrastructure

- 12.3.4 GERMANY

- 12.3.4.1 Positive business environment to boost adoption of self-healing networks

- 12.3.5 FRANCE

- 12.3.5.1 Technically competent end consumers to utilize self-healing networks

- 12.3.6 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT

- 12.4.2 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET DRIVERS

- FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 145 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 146 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019-2021 (USD MILLION)

- TABLE 148 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019-2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 152 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 153 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019-2021 (USD MILLION)

- TABLE 154 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022-2027 (USD MILLION)

- TABLE 155 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019-2021 (USD MILLION)

- TABLE 156 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 157 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019-2021 (USD MILLION)

- TABLE 158 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 159 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 160 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 161 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 162 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 163 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 164 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.4.3 CHINA

- 12.4.3.1 Initiatives taken by government and private players to raise demand for self-healing networks

- 12.4.4 JAPAN

- 12.4.4.1 Presence of highly efficient and competitive companies to drive demand for self-healing networks

- 12.4.5 INDIA

- 12.4.5.1 Growing penetration of cutting-edge technologies to drive market growth

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST AND AFRICA

- 12.5.1 MIDDLE EAST AND AFRICA: RECESSION IMPACT

- 12.5.2 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET DRIVERS

- TABLE 165 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 166 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 167 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019-2021 (USD MILLION)

- TABLE 168 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 169 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019-2021 (USD MILLION)

- TABLE 170 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD MILLION)

- TABLE 171 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 172 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 173 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019-2021 (USD MILLION)

- TABLE 174 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022-2027 (USD MILLION)

- TABLE 175 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019-2021 (USD MILLION)

- TABLE 176 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 177 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019-2021 (USD MILLION)

- TABLE 178 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 179 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 180 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 181 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 182 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 183 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 184 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.5.3 UAE

- 12.5.3.1 Adoption of cutting-edge technologies to drive adoption of self-healing networks

- 12.5.4 SAUDI ARABIA

- 12.5.4.1 Government initiatives to fuel adoption of self-healing networks

- 12.5.5 SOUTH AFRICA

- 12.5.5.1 Presence of global players and technological development to create opportunities

- 12.5.6 REST OF MIDDLE EAST AND AFRICA

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: RECESSION IMPACT

- 12.6.2 LATIN AMERICA: SELF-HEALING NETWORKS MARKET DRIVERS

- TABLE 185 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 186 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 187 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019-2021 (USD MILLION)

- TABLE 188 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 189 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019-2021 (USD MILLION)

- TABLE 190 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD MILLION)

- TABLE 191 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 192 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 193 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019-2021 (USD MILLION)

- TABLE 194 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022-2027 (USD MILLION)

- TABLE 195 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019-2021 (USD MILLION)

- TABLE 196 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 197 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019-2021 (USD MILLION)

- TABLE 198 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 199 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 200 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 201 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 202 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 203 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 204 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.6.3 BRAZIL

- 12.6.3.1 Investments by private players to drive market

- 12.6.4 MEXICO

- 12.6.4.1 Growing integration of technologies to boost adoption of advanced network infrastructure

- 12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 205 OVERVIEW OF STRATEGIES ADOPTED BY KEY SELF-HEALING NETWORKS VENDORS

- 13.3 REVENUE ANALYSIS

- 13.3.1 HISTORICAL REVENUE ANALYSIS

- FIGURE 45 HISTORICAL REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2019-2021 (USD MILLION)

- 13.4 MARKET SHARE ANALYSIS

- FIGURE 46 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2021

- TABLE 206 SELF-HEALING NETWORKS MARKET: DEGREE OF COMPETITION

- 13.5 MARKET EVALUATION FRAMEWORK

- FIGURE 47 MARKET EVALUATION FRAMEWORK: EXPANSIONS AND CONSOLIDATIONS IN SELF-HEALING NETWORKS MARKET BETWEEN 2019-2022

- 13.6 COMPANY EVALUATION QUADRANT

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- FIGURE 48 KEY SELF-HEALING NETWORKS MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- 13.7 COMPETITIVE BENCHMARKING

- 13.7.1 COMPANY PRODUCT FOOTPRINT

- FIGURE 49 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

- FIGURE 50 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS

- TABLE 207 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, 2021

- 13.8 STARTUP/SME EVALUATION QUADRANT

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- FIGURE 51 STARTUPS/SMES SELF-HEALING NETWORKS PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- 13.9 STARTUP/SME COMPETITIVE BENCHMARKING

- 13.9.1 COMPANY PRODUCT FOOTPRINT

- FIGURE 52 PRODUCT PORTFOLIO ANALYSIS OF STARTUPS/SMES

- FIGURE 53 BUSINESS STRATEGY EXCELLENCE OF STARTUPS/SMES

- TABLE 208 SELF-HEALING NETWORKS MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SMES

- TABLE 209 SELF-HEALING NETWORKS MARKET: DETAILED LIST OF KEY STARTUP/SMES

- 13.10 COMPETITIVE SCENARIO AND TRENDS

- 13.10.1 PRODUCT LAUNCHES

- TABLE 210 SERVICE/PRODUCT LAUNCHES, 2019-2022

- 13.10.2 DEALS

- TABLE 211 DEALS, 2019-2022

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- (Business Overview, Solutions/Services offered, Recent Developments, Deals, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats) **

- 14.2 KEY PLAYERS

- 14.2.1 VMWARE

- TABLE 212 VMWARE: BUSINESS OVERVIEW

- FIGURE 54 VMWARE: COMPANY SNAPSHOT

- TABLE 213 VMWARE: SOLUTIONS/SERVICES OFFERED

- TABLE 214 VMWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 215 VMWARE: DEALS

- 14.2.2 IBM

- TABLE 216 IBM: BUSINESS OVERVIEW

- FIGURE 55 IBM: COMPANY SNAPSHOT

- TABLE 217 IBM: SOLUTIONS/SERVICES OFFERED

- TABLE 218 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 219 IBM: DEALS

- 14.2.3 COMMSCOPE

- TABLE 220 COMMSCOPE: BUSINESS OVERVIEW

- FIGURE 56 COMMSCOPE: COMPANY SNAPSHOT

- TABLE 221 COMMSCOPE: SOLUTIONS/SERVICES OFFERED

- TABLE 222 COMMSCOPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 223 COMMSCOPE: DEALS

- 14.2.4 BMC SOFTWARE

- TABLE 224 BMC SOFTWARE: BUSINESS OVERVIEW

- TABLE 225 BMC SOFTWARE: SOLUTIONS/SERVICES OFFERED

- TABLE 226 BMC SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 227 BMC SOFTWARE: DEALS

- 14.2.5 FORTRA

- TABLE 228 FORTRA: BUSINESS OVERVIEW

- TABLE 229 FORTRA: SOLUTIONS/SERVICES OFFERED

- TABLE 230 FORTRA: DEALS

- 14.2.6 SOLARWINDS

- TABLE 231 SOLARWINDS: BUSINESS OVERVIEW

- FIGURE 57 SOLARWINDS: COMPANY SNAPSHOT

- TABLE 232 SOLARWINDS: SOLUTIONS/SERVICES OFFERED

- TABLE 233 SOLARWINDS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 234 SOLARWINDS: DEALS

- 14.2.7 MANAGEENGINE

- TABLE 235 MANAGEENGINE: BUSINESS OVERVIEW

- TABLE 236 MANAGEENGINE: SOLUTIONS/SERVICES OFFERED

- TABLE 237 MANAGEENGINE: PRODUCT LAUNCHES AND ENHANCEMENTS

- 14.2.8 ELISA POLYSTAR

- TABLE 238 ELISA POLYSTAR: BUSINESS OVERVIEW

- TABLE 239 ELISA POLYSTAR: SOLUTIONS/SERVICES OFFERED

- TABLE 240 ELISA POLYSTAR: DEALS

- 14.2.9 HPE

- TABLE 241 HPE: BUSINESS OVERVIEW

- FIGURE 58 HPE: COMPANY SNAPSHOT

- TABLE 242 HPE: SOLUTIONS/SERVICES OFFERED

- TABLE 243 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 244 HPE: DEALS

- 14.2.10 CISCO

- TABLE 245 CISCO: BUSINESS OVERVIEW

- FIGURE 59 CISCO: COMPANY SNAPSHOT

- TABLE 246 CISCO: SOLUTIONS/SERVICES OFFERED

- TABLE 247 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 248 CISCO: DEALS

- 14.3 OTHER KEY PLAYERS

- 14.3.1 IVANTI

- 14.3.2 EASYVISTA

- 14.3.3 HUAWEI

- 14.3.4 NOKIA

- 14.3.5 ACT

- 14.3.6 ERICSSON

- 14.3.7 ANUTA NETWORKS

- 14.3.8 JUNIPER

- 14.3.9 BLUECAT

- 14.3.10 PARK PLACE TECHNOLOGIES

- 14.3.11 APPNOMIC

- 14.4 STARTUP/SME PROFILES

- 14.4.1 PARALLEL WIRELESS

- 14.4.2 ITENTIAL

- 14.4.3 VERSA NETWORKS

- 14.4.4 KENTIK

- 14.4.5 DOMOTZ

- 14.4.6 BEEGOL

- *Details on Business Overview, Solutions/Services offered, Recent Developments, Deals, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 NETWORK MANAGEMENT SYSTEM MARKET - GLOBAL FORECAST TO 2027

- 15.2.1 MARKET DEFINITION

- 15.2.2 MARKET OVERVIEW

- 15.2.2.1 Network management system market, by component

- TABLE 249 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 250 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 15.2.2.2 Network management system market, by deployment type

- TABLE 251 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 252 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- 15.2.2.3 Network management system market, by organization size

- TABLE 253 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 254 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 15.2.2.4 Network management system market, by end user

- TABLE 255 NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 256 NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 15.2.2.5 Network management system market, by region

- TABLE 257 NETWORK MANAGEMENT SYSTEM MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 258 NETWORK MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 15.3 IT OPERATIONS ANALYTICS MARKET - GLOBAL FORECAST TO 2026

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.3.2.1 IT Operations Analytics market, by component

- TABLE 259 IT OPERATIONS ANALYTICS MARKET, BY COMPONENT, 2014-2019 (USD MILLION)

- TABLE 260 IT OPERATIONS ANALYTICS MARKET, BY COMPONENT, 2019-2025 (USD MILLION)

- 15.3.2.2 IT Operations Analytics market, by deployment mode

- TABLE 261 IT OPERATIONS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2014-2019 (USD MILLION)

- TABLE 262 IT OPERATIONS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2019-2025 (USD MILLION)

- 15.3.2.3 IT Operations Analytics market, by organization size

- TABLE 263 IT OPERATIONS ANALYTICS MARKET, BY ORGANIZATION SIZE, 2014-2019 (USD MILLION)

- TABLE 264 IT OPERATIONS ANALYTICS MARKET, BY ORGANIZATION SIZE, 2019-2025 (USD MILLION)

- 15.3.2.4 IT Operations Analytics market, by end user

- TABLE 265 IT OPERATIONS ANALYTICS MARKET, BY END USER, 2014-2019 (USD MILLION)

- TABLE 266 IT OPERATIONS ANALYTICS MARKET, BY END USER, 2019-2025 (USD MILLION)

- 15.3.2.5 IT Operations Analytics market, by region

- TABLE 267 IT OPERATIONS ANALYTICS MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 268 IT OPERATIONS ANALYTICS MARKET, BY REGION, 2019-2025 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS