|

|

市場調査レポート

商品コード

1191023

PTFEファブリックの世界市場:種類別 (PTFEコーティング生地、不織布、PTFE繊維製生地)・最終用途産業別 (食品、建設、ろ過、医療)・地域別 (北米、欧州、アジア太平洋、南米、中東・アフリカ) の将来予測 (2027年まで)PTFE Fabric Market by Type (PTFE Coated Fabric, Nonwoven Fabric, PTFE Fiber- Made Fabric), End-Use Industry (Food, Construction, Filtration, Medical), and Region (North America, Europe, APAC, South America, and MEA) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| PTFEファブリックの世界市場:種類別 (PTFEコーティング生地、不織布、PTFE繊維製生地)・最終用途産業別 (食品、建設、ろ過、医療)・地域別 (北米、欧州、アジア太平洋、南米、中東・アフリカ) の将来予測 (2027年まで) |

|

出版日: 2023年01月17日

発行: MarketsandMarkets

ページ情報: 英文 212 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界のPTFEファブリックの市場規模は、2022年の9億米ドルから、2027年には11億米ドルに達し、2022年から2027年の間に5.7%のCAGRで成長すると予測されています。

新興国の需要拡大と工業化の進展が、PTFEファブリックのメーカーに大きな成長機会を提供すると期待されています。

最終用途産業別では、食品分野が金額ベースで最大のシェアを占めています。PTFEファブリックは耐摩擦性・不燃性・疎水性で無毒なため、食品作業で有用な材料です。

種類別では、PTFEコーティング生地が最も急速に成長しています。PTFEコーティング生地は強度と耐熱性に優れ、食品加工業でベルトコンベア用に使われているほか、建築業界でも屋根材として使用されています。

地域別に見ると、北米が世界第2位の市場となっています。域内には強力な産業基盤があり、世界の大手PTFEファブリック企業が拠点を置いています。

当レポートでは、世界のPTFEファブリックの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・最終用途産業別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- バリューチェーン分析

- 原料サプライヤー

- メーカー

- 流通業者

- 最終消費者

- エコシステムマッピング

- 平均販売価格の分析

- 貿易分析

- 技術分析

- 急速冷却ベルト

- 低摩擦PTFEを使用した環境に優しいテキスタイル

- マクロ経済データ

- 米国の建築・建設投資

- 顧客のビジネスに影響を与える動向/混乱

- 主な会議とイベント (2022年~2023年)

- 購入決定に影響を与える主な要因

- 規制の枠組み

- ケーススタディ

- 景気後退の影響

- 特許分析

第6章 PTFEファブリック市場:種類別

- イントロダクション

- PTFEコーティング生地

- 不織布

- PTFE繊維製生地

第7章 PTFEファブリック市場:最終用途産業別

- イントロダクション

- 食品

- 建設

- 濾過

- 医療

- その他

- 防護服

- 輸送機械

第8章 PTFEファブリック市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- 他の中東・アフリカ諸国

第9章 競合情勢

- 概要

- 主要企業のランキング分析 (2022年)

- 市場シェア分析

- 大手企業の収益分析

- 市場評価マトリックス

- 企業評価マトリックス (ティア1、2022年)

- スタートアップ・中小企業 (SME) の評価マトリックス

- 企業の最終用途産業フットプリント

- 企業の地域フットプリント

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合シナリオ

- 新製品の発売

- 資本取引

- その他の開発

第10章 企業プロファイル

- 主要企業

- TACONIC

- SAINT-GOBAIN PERFORMANCE PLASTICS

- W.L. GORE & ASSOCIATES

- DAIKIN INDUSTRIES

- THE CHEMOURS COMPANY

- BIRDAIR

- CHUKOH CHEMICAL INDUSTRIES

- FIBERFLON

- SEFAR

- W.F. LAKE CORPORATION

- その他の企業

- FOTHERGILL GROUP

- AETNA PLASTICS

- SIFTEX EQUIPMENT COMPANY, INC

- TEXTILES COATED INTERNATIONAL

- ZHEJIANG KERTICE HI-TECH FLUOR-MATERIAL CO., LTD.

- EDER

- TOSS GMBH & CO. KG

- TECHBELT

- ASAHI GLASS CO. LTD.

- URJA FABRICS

- HONDA SANGYO CO. LTD.

- QINGDAO BOCHENG INDUSTRIAL CO. LTD.

- CURBELL PLASTICS

- OM INDUSTRIAL FABRICS

- CS HYDE COMPANY

第11章 付録

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

(Business Overview, Products, Recent Developments, MnM View)

- 10.1.1 TACONIC

- TABLE 277 TACONIC: COMPANY OVERVIEW

- TABLE 278 TACONIC: PRODUCTS OFFERED

- 10.1.2 SAINT-GOBAIN PERFORMANCE PLASTICS

- TABLE 279 SAINT-GOBAIN PERFORMANCE PLASTICS: COMPANY OVERVIEW

- FIGURE 40 SAINT-GOBAIN PERFORMANCE PLASTICS: COMPANY SNAPSHOT

- TABLE 280 SAINT-GOBAIN PERFORMANCE PLASTICS: PRODUCTS OFFERED

- 10.1.3 W.L. GORE & ASSOCIATES

- TABLE 281 W.L. GORE & ASSOCIATES: COMPANY OVERVIEW

- TABLE 282 W.L. GORE & ASSOCIATES: PRODUCTS OFFERED

- TABLE 283 PRODUCT LAUNCHES

- TABLE 284 DEALS

- 10.1.4 DAIKIN INDUSTRIES

- TABLE 285 DAIKIN INDUSTRIES: COMPANY OVERVIEW

- FIGURE 41 DAIKIN INDUSTRIES: COMPANY SNAPSHOT

- TABLE 286 DAIKIN INDUSTRIES: PRODUCTS OFFERED

- TABLE 287 DAIKIN INDUSTRIES: OTHERS

- 10.1.5 THE CHEMOURS COMPANY

- TABLE 288 THE CHEMOURS COMPANY: COMPANY OVERVIEW

- FIGURE 42 THE CHEMOURS COMPANY: COMPANY SNAPSHOT

- TABLE 289 THE CHEMOURS COMPANY: PRODUCTS OFFERED

- TABLE 290 THE CHEMOURS COMPANY: OTHERS

- 10.1.6 BIRDAIR

- TABLE 291 BIRDAIR: COMPANY OVERVIEW

- TABLE 292 BIRDAIR: PRODUCTS OFFERED

- TABLE 293 BIRDAIR: OTHERS

- 10.1.7 CHUKOH CHEMICAL INDUSTRIES

- TABLE 294 CHUKOH CHEMICAL INDUSTRIES: COMPANY OVERVIEW

- TABLE 295 CHUKOH CHEMICAL INDUSTRIES: PRODUCTS OFFERED

- TABLE 296 CHUKOH CHEMICAL INDUSTRIES: PRODUCT LAUNCHES

- 10.1.8 FIBERFLON

- TABLE 297 FIBERFLON: COMPANY OVERVIEW

- TABLE 298 FIBERFLON: PRODUCTS OFFERED

- TABLE 299 FIBERFLON: PRODUCT LAUNCHES

- 10.1.9 SEFAR

- TABLE 300 SEFAR: COMPANY OVERVIEW

- TABLE 301 SEFAR: PRODUCTS OFFERED

- 10.1.10 W.F. LAKE CORPORATION

- TABLE 302 W.F. LAKE CORPORATION: COMPANY OVERVIEW

- TABLE 303 W.F. LAKE CORPORATION: PRODUCTS OFFERED

- TABLE 304 W.F. LAKE CORPORATION: PRODUCT LAUNCHES

- 10.2 OTHER PLAYERS

- 10.2.1 FOTHERGILL GROUP

- 10.2.2 AETNA PLASTICS

- 10.2.3 SIFTEX EQUIPMENT COMPANY, INC

- 10.2.4 TEXTILES COATED INTERNATIONAL

- 10.2.5 ZHEJIANG KERTICE HI-TECH FLUOR-MATERIAL CO., LTD.

- 10.2.6 EDER

- 10.2.7 TOSS GMBH & CO. KG

- 10.2.8 TECHBELT

- 10.2.9 ASAHI GLASS CO. LTD.

- 10.2.10 URJA FABRICS

- 10.2.11 HONDA SANGYO CO. LTD.

- 10.2.12 QINGDAO BOCHENG INDUSTRIAL CO. LTD.

- 10.2.13 CURBELL PLASTICS

- 10.2.14 OM INDUSTRIAL FABRICS

- 10.2.15 CS HYDE COMPANY

Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 INSIGHTS FROM INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.4 CUSTOMIZATION OPTIONS

- 11.5 RELATED REPORTS

- 11.6 AUTHOR DETAILS

The global PTFE fabric market is projected to register a CAGR of 5.7% between 2022 and 2027, in terms of value.

The global PTFE fabric market size is projected to grow from USD 0.9 billion in 2022 to USD 1.1 billion by 2027, at a CAGR of 5.7% between 2022 and 2027. Rising demand from emerging markets and growing industrialization are expected to offer significant growth opportunities to manufacturers of PTFE fabric.

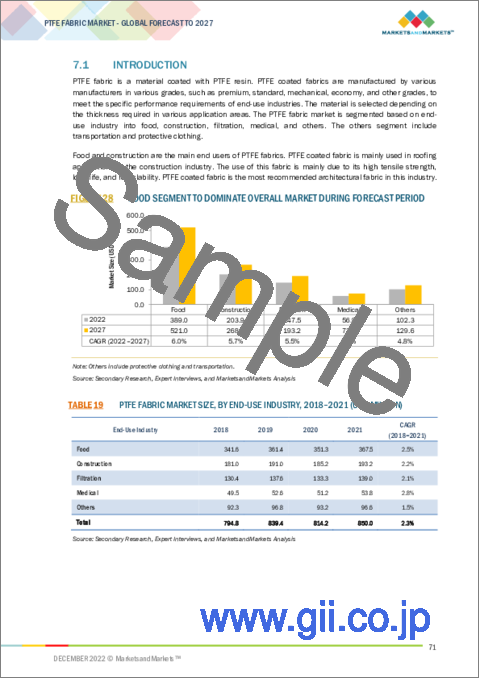

"The food segment accounted for the largest share in the PTFE fabric market in terms of value."

PTFE fabric plays a vital role in the food industry. PTFE fabric is the preferred material for food-grade non-stick coatings. It is widely used in non-stick cookware and other items. The key advantages of PTFE fabric are anti-friction and non-flammability. The material is also hydrophobic and non-toxic, useful in the food industry.

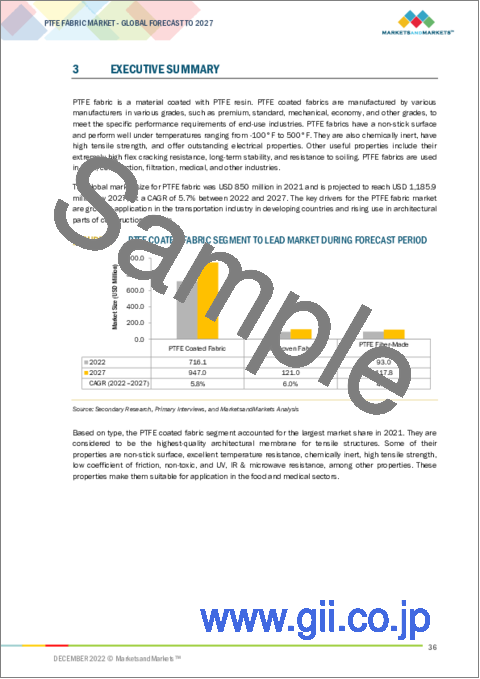

"PTFE coated fabric is the fastest growing PTFE fabric type."

PTFE coated fabric is the highest quality architectural membrane for tensile structures. In the 1960s, the material was developed by DuPont and has been used for structures since the early 1970s. PTFE coated fabric consists of a fiberglass fabric, aramid, or a polyester fabric which is coated with PTFE to improve its strength and heat resistance. PTFE coated fabric is widely used for making conveyor belts in the food processing industry. This fabric is also used in the construction industry for roofing applications. Additionally, it is used to make PTFE adhesive tapes.

"North America is estimated to be the second-largest market for PTFE fabric"

North America is the second-largest market for PTFE fabric. The US, Canada, and Mexico are the major countries in the North American region. The region has a strong industrial base in developed economies, such as the US, Canada, and Mexico. Some of the major players operating in the PTFE fabric market are based in this region, such as Taconic, W.L. Gore Associates, The Chemours Company, and Birdair.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the PTFE fabric market, and information was gathered from secondary research to determine and verify the market size of several segments.

By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

By Region: APAC - 50%, Europe - 20%, North America - 10%, the Middle East & Africa -10%, and South America- 10%

The key players in this market are Taconic (US), Saint Gobain Performance Plastics (France), Fiberflon(Turkey), W.L. Gore Associates(US), Daikin Industries (Japan), The Chemours Company (US), Chukoh Chemical Industries(Japan), Birdair (US), Sefar (Switzerland), and W. F. Lake Corporation (US).

Research Coverage:

The report offers insights into the PTFE fabric market in key regions. It aims at estimating the size of the PTFE fabric market during the forecast period and projects future growth of the market across various segments based on type, application, and region. The report also includes an in-depth competitive analysis of the key players in the PTFE fabric market, along with company profiles, MNM view, recent developments, and key market strategies.

Key Benefits of Buying the Report

From an insight perspective, this research report focuses on various levels of analysis - industry analysis (industry trends), market share ranking of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the PTFE fabric; high growth regions; and market drivers, restraints, opportunities, and challenges.

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.4 REGIONS COVERED

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 PTFE FABRIC MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interviews - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 PTFE FABRIC MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 3 PTFE FABRIC MARKET: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: PTFE FABRIC MARKET

- 2.3 FORECAST NUMBER CALCULATION

- FIGURE 5 DEMAND-SIDE FORECAST PROJECTION

- 2.4 DATA TRIANGULATION

- FIGURE 6 PTFE FABRIC MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

- FIGURE 7 PTFE COATED FABRIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 FOOD SEGMENT TO DOMINATE MARKET BETWEEN 2022 AND 2027

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN 2021

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES IN PTFE FABRIC MARKET

- FIGURE 10 HIGH GROWTH POTENTIAL IN ASIA PACIFIC DURING FORECAST PERIOD

- 4.2 ASIA PACIFIC: PTFE FABRIC MARKET, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 11 CHINA LED PTFE FABRIC MARKET IN ASIA PACIFIC

- 4.3 PTFE FABRIC MARKET, BY TYPE

- FIGURE 12 PTFE COATED FABRIC SEGMENT TO DOMINATE OVERALL MARKET

- 4.4 PTFE FABRIC MARKET, BY END-USE INDUSTRY

- FIGURE 13 FOOD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 PTFE FABRIC MARKET, BY COUNTRY

- FIGURE 14 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 MARKET DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES

- 5.2.1 DRIVERS

- 5.2.1.1 High demand for PTFE fabric in automotive industry

- 5.2.1.2 Growing demand for PTFE-coated woven fabric as architectural fabric

- 5.2.1.3 Increasing consumption of composite fabric for industrial applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of PTFE coated fabric compared with PVC coated fabric

- 5.2.2.2 Environmental impact of PTFE fabric manufacturing

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing investments in food processing industry in emerging countries

- 5.2.3.2 Increasing opportunities from medical industry

- TABLE 1 APPLICATION OF PTFE FIBERS IN MEDICAL TEXTILES

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatility in raw material prices

- TABLE 2 SPOT CRUDE PRICES (USD/BARREL)

- 5.2.4.2 Non-biodegradability of PTFE fabric

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 PORTER'S FIVE FORCES ANALYSIS: PTFE FABRIC MARKET

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 PTFE FABRIC MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 MANUFACTURERS

- 5.4.3 DISTRIBUTORS

- 5.4.4 END CONSUMERS

- FIGURE 17 PTFE FABRIC MARKET: VALUE CHAIN

- 5.5 ECOSYSTEM MAPPING

- FIGURE 18 ECOSYSTEM OF PTFE FABRIC MARKET

- TABLE 4 PTFE FABRIC MARKET: ECOSYSTEM

- 5.6 AVERAGE SELLING PRICE ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE BASED ON REGION

- FIGURE 19 AVERAGE SELLING PRICE BASED ON REGION (USD/KG)

- 5.6.2 AVERAGE SELLING PRICE BASED ON TYPE

- TABLE 5 AVERAGE SELLING PRICES BASED ON TYPE (USD/KG)

- 5.6.3 AVERAGE SELLING PRICE BASED ON COMPETITORS

- FIGURE 20 AVERAGE SELLING PRICE BASED ON COMPETITORS (USD/KG)

- 5.7 TRADE ANALYSIS

- TABLE 6 IMPORT TRADE DATA FOR PTFE FOR TOP TEN COUNTRIES, 2017-2021 (USD THOUSAND)

- TABLE 7 EXPORT TRADE DATA FOR PTFE FOR TOP TEN COUNTRIES, 2017-2021 (USD THOUSAND)

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 QUICK FREEZE BELTS

- 5.8.2 ECO-FRIENDLY TEXTILE WITH LOW FRICTION PTFE

- 5.9 MACROECONOMIC DATA

- 5.9.1 US BUILDING AND CONSTRUCTION INVESTMENT

- TABLE 8 ANNUAL VALUE OF CONSTRUCTION, 2011-2020 (USD BILLION)

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 TRENDS IN PTFE FABRIC MARKET

- 5.11 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 9 PTFE FABRIC MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.12 KEY FACTORS AFFECTING BUYING DECISIONS

- 5.12.1 QUALITY

- 5.12.2 SERVICE

- FIGURE 22 KEY BUYING CRITERIA

- 5.13 REGULATORY FRAMEWORK

- 5.13.1 ASIA PACIFIC

- 5.13.2 EUROPE

- 5.13.3 NORTH AMERICA

- 5.13.3.1 US

- 5.13.3.2 Canada

- TABLE 10 STANDARDS FOR PTFE FLUOROPOLYMER RESINS

- TABLE 11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 CASE STUDIES

- 5.14.1 W.L. GORE & ASSOCIATES

- 5.14.2 BIRDAIR

- 5.15 RECESSION IMPACT

- 5.16 PATENT ANALYSIS

- 5.16.1 METHODOLOGY

- 5.16.2 DOCUMENT TYPE

- TABLE 12 TOTAL NUMBER OF PATENTS

- 5.16.3 PUBLICATION TRENDS

- FIGURE 23 NUMBER OF PATENTS YEAR-WISE, 2011-2022

- 5.16.4 INSIGHTS

- 5.16.5 LEGAL STATUS OF PATENTS

- FIGURE 24 PTFE FABRICS PATENT - LEGAL STATUS

- 5.16.6 JURISDICTION ANALYSIS

- FIGURE 25 TOP JURISDICTION, BY DOCUMENT

- 5.16.7 TOP COMPANIES/APPLICANTS

- FIGURE 26 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- 5.16.7.1 Patents by W.L. Gore & Associates

- TABLE 13 PATENTS BY W.L. GORE & ASSOCIATES

- 5.16.8 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 14 TOP TEN PATENT OWNERS

6 PTFE FABRIC MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 27 PTFE COATED FABRIC ESTIMATED TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 15 PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 16 PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 17 PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 18 PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- 6.2 PTFE COATED FABRIC

- 6.3 NONWOVEN FABRIC

- 6.4 PTFE FIBER-MADE FABRIC

7 PTFE FABRIC MARKET, BY END-USE INDUSTRY

- 7.1 INTRODUCTION

- FIGURE 28 FOOD SEGMENT TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

- TABLE 19 PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 20 PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 21 PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 22 PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 7.2 FOOD

- 7.3 CONSTRUCTION

- 7.4 FILTRATION

- 7.5 MEDICAL

- 7.6 OTHERS

- 7.6.1 PROTECTIVE CLOTHING

- 7.6.2 TRANSPORTATION

8 PTFE FABRIC MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 29 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 23 PTFE FABRIC MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 24 PTFE FABRIC MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 25 PTFE FABRIC MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 26 PTFE FABRIC MARKET SIZE, BY REGION, 2022-2027 (TON)

- 8.2 ASIA PACIFIC

- FIGURE 30 ASIA PACIFIC: PTFE FABRIC MARKET SNAPSHOT

- TABLE 27 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 28 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 29 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 30 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 31 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 32 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 33 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 34 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 35 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 36 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 37 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 38 ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.1 CHINA

- 8.2.1.1 Increased use in medical application driving market

- TABLE 39 CHINA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 40 CHINA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 41 CHINA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 42 CHINA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 43 CHINA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 44 CHINA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 45 CHINA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 46 CHINA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.2 JAPAN

- 8.2.2.1 Rising food and filtration industry to drive demand

- TABLE 47 JAPAN: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 48 JAPAN: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 49 JAPAN: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 50 JAPAN: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 51 JAPAN: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 52 JAPAN: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 53 JAPAN: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 54 JAPAN: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.3 INDIA

- 8.2.3.1 Urbanization and industrialization to fuel market growth

- TABLE 55 INDIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 56 INDIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 57 INDIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 58 INDIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 59 INDIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 60 INDIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 61 INDIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 62 INDIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.4 SOUTH KOREA

- 8.2.4.1 Large food processing industry to fuel demand for PTFE fabric

- TABLE 63 SOUTH KOREA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 64 SOUTH KOREA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 65 SOUTH KOREA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 66 SOUTH KOREA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 67 SOUTH KOREA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 68 SOUTH KOREA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 69 SOUTH KOREA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 70 SOUTH KOREA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.5 AUSTRALIA

- 8.2.5.1 Construction sector to drive market in Australia

- TABLE 71 AUSTRALIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 72 AUSTRALIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 73 AUSTRALIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 74 AUSTRALIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 75 AUSTRALIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 76 AUSTRALIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 77 AUSTRALIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 78 AUSTRALIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.6 REST OF ASIA PACIFIC

- TABLE 79 REST OF ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 80 REST OF ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 81 REST OF ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 82 REST OF ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 83 REST OF ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 84 REST OF ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 85 REST OF ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 86 REST OF ASIA PACIFIC: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3 EUROPE

- FIGURE 31 EUROPE: PTFE FABRIC MARKET SNAPSHOT

- TABLE 87 EUROPE: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 88 EUROPE: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 89 EUROPE: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 90 EUROPE: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 91 EUROPE: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 92 EUROPE: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 93 EUROPE: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 94 EUROPE: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 95 EUROPE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 96 EUROPE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 97 EUROPE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 98 EUROPE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.1 GERMANY

- 8.3.1.1 Construction and food industries play major role in driving demand

- TABLE 99 GERMANY: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 100 GERMANY: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 101 GERMANY: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 102 GERMANY: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 103 GERMANY: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 104 GERMANY: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 105 GERMANY: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 106 GERMANY: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.2 UK

- 8.3.2.1 Growing food industry to influence market

- TABLE 107 UK: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 108 UK: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 109 UK: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 110 UK: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 111 UK: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 112 UK: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 113 UK: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 114 UK: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.3 FRANCE

- 8.3.3.1 Investments in construction sector to drive market

- TABLE 115 FRANCE: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 116 FRANCE: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 117 FRANCE: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 118 FRANCE: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 119 FRANCE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 120 FRANCE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 121 FRANCE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 122 FRANCE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.4 ITALY

- 8.3.4.1 Pipeline construction projects to drive market for PTFE fabric

- TABLE 123 ITALY: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 124 ITALY: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 125 ITALY: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 126 ITALY: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 127 ITALY: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 128 ITALY: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 129 ITALY: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 130 ITALY: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.5 SPAIN

- 8.3.5.1 Growth in infrastructure and real estate sectors to propel demand

- TABLE 131 SPAIN: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 132 SPAIN: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 133 SPAIN: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 134 SPAIN: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 135 SPAIN: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 136 SPAIN: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 137 SPAIN: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 138 SPAIN: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.6 REST OF EUROPE

- TABLE 139 REST OF EUROPE: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 140 REST OF EUROPE: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 141 REST OF EUROPE: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 142 REST OF EUROPE: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 143 REST OF EUROPE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 144 REST OF EUROPE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 145 REST OF EUROPE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 146 REST OF EUROPE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4 NORTH AMERICA

- FIGURE 32 NORTH AMERICA: PTFE FABRIC MARKET SNAPSHOT

- TABLE 147 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 148 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 149 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 150 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 151 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 152 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 153 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 154 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 155 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 156 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 157 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 158 NORTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.1 US

- 8.4.1.1 Presence of large chemical companies fueling demand for PTFE fabric for filtration

- TABLE 159 US: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 160 US: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 161 US: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 162 US: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 163 US: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 164 US: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 165 US: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 166 US: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.2 CANADA

- 8.4.2.1 Government initiatives for construction of skyscrapers and commercial hubs to increase use of PTFE fabric

- TABLE 167 CANADA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 168 CANADA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 169 CANADA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 170 CANADA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 171 CANADA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 172 CANADA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 173 CANADA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 174 CANADA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.3 MEXICO

- 8.4.3.1 Growing food industry to drive demand for PTFE fabric

- TABLE 175 MEXICO: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 176 MEXICO: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 177 MEXICO: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 178 MEXICO: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 179 MEXICO: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 180 MEXICO: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 181 MEXICO: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 182 MEXICO: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5 SOUTH AMERICA

- TABLE 183 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 184 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 185 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 186 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 187 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 188 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 189 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 190 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 191 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 192 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 193 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 194 SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5.1 BRAZIL

- 8.5.1.1 Large food industry and government initiatives to stabilize construction industry to drive market

- TABLE 195 BRAZIL: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 196 BRAZIL: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 197 BRAZIL: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 198 BRAZIL: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 199 BRAZIL: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 200 BRAZIL: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 201 BRAZIL: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 202 BRAZIL: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5.2 ARGENTINA

- 8.5.2.1 Focus on increasing export of food & beverage to drive market

- TABLE 203 ARGENTINA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 204 ARGENTINA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 205 ARGENTINA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 206 ARGENTINA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 207 ARGENTINA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 208 ARGENTINA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 209 ARGENTINA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 210 ARGENTINA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5.3 REST OF SOUTH AMERICA

- TABLE 211 REST OF SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 213 REST OF SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 214 REST OF SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 215 REST OF SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 216 REST OF SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 217 REST OF SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 218 REST OF SOUTH AMERICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6 MIDDLE EAST & AFRICA

- TABLE 219 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 222 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 223 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 226 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 227 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 230 MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6.1 SAUDI ARABIA

- 8.6.1.1 New pipeline projects to influence market growth

- TABLE 231 SAUDI ARABIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 232 SAUDI ARABIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 233 SAUDI ARABIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 234 SAUDI ARABIA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 235 SAUDI ARABIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 236 SAUDI ARABIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 237 SAUDI ARABIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 238 SAUDI ARABIA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6.2 UAE

- 8.6.2.1 Changing energy-mix to drive market

- TABLE 239 UAE: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 240 UAE: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 241 UAE: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 242 UAE: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 243 UAE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 244 UAE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 245 UAE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 246 UAE: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6.3 QATAR

- 8.6.3.1 PTFE fabric used in construction of stadiums

- TABLE 247 QATAR: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 248 QATAR: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 249 QATAR: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 250 QATAR: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 251 QATAR: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 252 QATAR: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 253 QATAR: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 254 QATAR: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6.4 SOUTH AFRICA

- 8.6.4.1 Food segment to be largest and fastest-growing market for PTFE fabric

- TABLE 255 SOUTH AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 256 SOUTH AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 257 SOUTH AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 258 SOUTH AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 259 SOUTH AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 260 SOUTH AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 261 SOUTH AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 262 SOUTH AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6.5 REST OF MIDDLE EAST & AFRICA

- TABLE 263 REST OF MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 264 REST OF MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 265 REST OF MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 266 REST OF MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 267 REST OF MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 268 REST OF MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 269 REST OF MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 270 REST OF MIDDLE EAST & AFRICA: PTFE FABRIC MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- FIGURE 33 COMPANIES ADOPTED ACQUISITION AND EXPANSION AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2022

- 9.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 34 RANKING OF TOP FIVE PLAYERS IN PTFE FABRIC MARKET, 2022

- 9.3 MARKET SHARE ANALYSIS

- FIGURE 35 PTFE FABRIC MARKET SHARE, BY COMPANY (2022)

- TABLE 271 PTFE FABRIC MARKET: DEGREE OF COMPETITION

- 9.4 REVENUE ANALYSIS OF TOP PLAYERS

- TABLE 272 PTFE FABRIC MARKET: REVENUE ANALYSIS

- 9.5 MARKET EVALUATION MATRIX

- TABLE 273 MARKET EVALUATION MATRIX

- 9.6 COMPANY EVALUATION MATRIX, 2022 (TIER 1)

- 9.6.1 STARS

- 9.6.2 EMERGING LEADERS

- 9.6.3 PERVASIVE PLAYERS

- 9.6.4 PARTICIPANTS

- FIGURE 36 PTFE FABRIC MARKET: COMPANY EVALUATION MATRIX, 2022

- 9.7 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 9.7.1 PROGRESSIVE COMPANIES

- 9.7.2 RESPONSIVE COMPANIES

- 9.7.3 DYNAMIC COMPANIES

- 9.7.4 STARTING BLOCKS

- FIGURE 37 PTFE FABRIC MARKET: START-UPS AND SMES MATRIX, 2022

- 9.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 9.9 COMPANY REGION FOOTPRINT

- 9.10 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 38 STRENGTH PRODUCT PORTFOLIO

- 9.11 BUSINESS STRATEGY EXCELLENCE

- FIGURE 39 BUSINESS STRATEGY EXCELLENCE

- 9.12 COMPETITIVE SCENARIO

- 9.12.1 NEW PRODUCT LAUNCHES

- TABLE 274 NEW PRODUCT LAUNCHES, 2018-2022

- 9.12.2 DEALS

- TABLE 275 DEALS, 2018-2022

- 9.12.3 OTHER DEVELOPMENTS

- TABLE 276 OTHER DEVELOPMENTS, 2018-2022

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 TACONIC

- 10.1.1.1 Business overview

- 10.1.1.2 Products offered

- 10.1.1.3 MnM view

- 10.1.1.3.1 Key strengths

- 10.1.1.3.2 Strategic choices

- 10.1.1.3.3 Weaknesses and competitive threats

- 10.1.2 SAINT-GOBAIN PERFORMANCE PLASTICS

- 10.1.3 W.L. GORE & ASSOCIATES

- 10.1.4 DAIKIN INDUSTRIES

- 10.1.5 THE CHEMOURS COMPANY

- 10.1.6 BIRDAIR

- 10.1.7 CHUKOH CHEMICAL INDUSTRIES

- 10.1.8 FIBERFLON

- 10.1.9 SEFAR

- 10.1.10 W.F. LAKE CORPORATION

- 10.1.1 TACONIC

- 10.2 OTHER PLAYERS

- 10.2.1 FOTHERGILL GROUP

- 10.2.2 AETNA PLASTICS

- 10.2.3 SIFTEX EQUIPMENT COMPANY, INC

- 10.2.4 TEXTILES COATED INTERNATIONAL

- 10.2.5 ZHEJIANG KERTICE HI-TECH FLUOR-MATERIAL CO., LTD.

- 10.2.6 EDER

- 10.2.7 TOSS GMBH & CO. KG

- 10.2.8 TECHBELT

- 10.2.9 ASAHI GLASS CO. LTD.

- 10.2.10 URJA FABRICS

- 10.2.11 HONDA SANGYO CO. LTD.

- 10.2.12 QINGDAO BOCHENG INDUSTRIAL CO. LTD.

- 10.2.13 CURBELL PLASTICS

- 10.2.14 OM INDUSTRIAL FABRICS

- 10.2.15 CS HYDE COMPANY