|

|

市場調査レポート

商品コード

1191021

ビタミン・ミネラルプレミックスの世界市場:種類別 (ビタミン、ミネラル、ビタミン・ミネラル配合)・用途別 (食品・飲料、飼料、健康管理、化粧品・パーソナルケア用品)・形状別 (乾燥、液体)・機能別・地域別の将来予測 (2027年まで)Vitamin & Mineral Premixes Market by Type (Vitamins, Minerals, Vitamin & Mineral Combinations), Application (Food & Beverages, Feed, Healthcare, and Cosmetics & Personal Care), Form (Dry and Liquid), Functionality and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ビタミン・ミネラルプレミックスの世界市場:種類別 (ビタミン、ミネラル、ビタミン・ミネラル配合)・用途別 (食品・飲料、飼料、健康管理、化粧品・パーソナルケア用品)・形状別 (乾燥、液体)・機能別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年01月17日

発行: MarketsandMarkets

ページ情報: 英文 228 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のビタミン・ミネラルプレミックスの市場規模は、2022年に72億米ドル、2027年には98億米ドルに達し、2022年から2027年にかけて6.4%のCAGR (金額ベース) で成長する、と予測されています。

特に、機能性食品や強化食品の需要増加や、高い加工レベルによる食品強化の必要性が、業界で大きな牽引力を得ています。さらに、家畜・成長と発達のための配合飼料消費の増加も、飼料用プレミックスの成長を可能にしています。

種類別では、ビタミン類が予測期間中、支配的なセグメントとしての地位を維持すると予想されます。ビタミンの入手し易さやその効果に関する消費者の関心が、市場に大きなビジネスチャンスをもたらすと考えられています。

形状別では、乾燥セグメントが予測期間中に最大の市場シェアを占めています。乾燥形態での用途の幅広さと便利なパッケージが、今後も大きな成長機会を提供し続けるでしょう。

用途別では、飼料セグメントが圧倒的なシェアを占めると予測されています。特殊な栄養や状態に応じたペットの健康処方の需要が高まっていることが、市場の主な促進要因となっています。

地域別に見ると、予測期間中は北米がビタミン・ミネラルプレミックス市場で支配的な市場シェアを占める見通しです。その要因として、食肉・家禽産業が突出していること、健康食品や機能性食品・飲食品に対する意識が高まっていることなど、さまざまな理由に起因しています。また、肥満、心臓病、その他の健康問題の発生率の上昇も、この地域の成長を後押ししています。

当レポートでは、世界のビタミン・ミネラルプレミックスの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、用途別・形状別・機能別・種類別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 小売売上高の増加

- ビタミン・ミネラルプレミックス市場:市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- イントロダクション

- バリューチェーン分析

- 研究開発

- 原材料と調達

- 製造

- 包装・保管

- 流通・販売・マーケティング

- 技術分析

- 超音波キャビテーション

- 価格分析

- 市場マッピングとエコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- 特許分析

- ポーターのファイブフォース分析

- ケーススタディ

- 主な会議とイベント (2022年~2023年)

- 関税と規制の状況

- 規制の枠組み

- 主な利害関係者と購入基準

第7章 ビタミン・ミネラルプレミックス市場:用途別

- イントロダクション

- 食品・飲料

- ベーカリー製品

- 飲料

- 乳製品

- 穀物

- その他の食品用途

- 健康管理

- 栄養製品

- 栄養補助食品

- 飼料

- 化粧品・パーソナルケア用品

第8章 ビタミン・ミネラルプレミックス市場:形状別

- イントロダクション

- 乾燥

- 液体

第9章 ビタミン・ミネラルプレミックス市場:機能別

- イントロダクション

- 骨の健康

- 肌の健康

- エネルギー

- 免疫

- 消化

- その他の機能

第10章 ビタミン・ミネラルプレミックス市場:種類別

- イントロダクション

- ビタミン・ミネラル配合

- ビタミン

- ミネラル

第11章 ビタミン・ミネラルプレミックス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- 他のアジア太平洋諸国

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- オランダ

- 他の欧州諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 他の国々 (RoW)

- アフリカ

- 中東

第12章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場シェア分析 (2021年)

- 主要企業の過去の収益分析

- 主要企業の評価クアドラント (2021年)

- その他の企業の評価象限 (2021年)

- 競合シナリオ

- 製品の発売

- 資本取引

- その他

第13章 企業プロファイル

- 主要企業

- DSM

- CORBION

- GLANBIA PLC

- VITABLEND NEDERLAND BV

- STERNVITAMIN GMBH & CO. KG

- BASF SE

- ADM

- WRIGHT ENRICHMENT INC.

- ZAGRO

- NUTRECO

- FARBEST-TALLMAN FOODS CORPORATION

- BURKMANN INDUSTRIES, INC.

- BAR-MAGEN LTD.

- INNOV AD NV/SA

- JUBILANT INGREVIA LTD.

- その他の企業

- IDENA

- SPANSULES PHARMATECH PVT. LTD.

- AMESI GROUP

- SA PREMIX

- YESSINERGY

- PHIBRO ANIMAL HEALTH CORPORATION

- DLG

- GK BIOCHEMICAL CORPORATION

- ADVANCED ANIMAL NUTRITION PTY LTD.

- CREDENCE REMEDIES PVT. LTD.

第14章 隣接・関連市場

- イントロダクション

- 制限事項

- 飼料プレミックス市場

- 食品強化剤市場

第15章 付録

According to MarketsandMarkets, the global vitamin and mineral premixes market is estimated to be valued at USD 7.2 billion in 2022. It is projected to reach USD 9.8 billion by 2027, with a CAGR of 6.4%, in terms of value, between 2022 and 2027. The market is gaining momentum as fishmeal & fish oil continue to find increased applications across food and beverages, healthcare, feed, cosmetics and personal care applications. The demand for vitamins and minerals premixes is gaining significant traction in the industry, especially due to the growth in demand for functional and fortified foods combined with the need for food enrichment due to high processing levels of food products. Additionally, the increase in compound feed consumption for the growth and development of farm animals has also enabled the growth of feed premixes.

By type, vitamins segment is expected to retain its position as dominant segment over forecast period."

Based on type, the vitamins segment is likely to account for the dominant segment over the forecast period. Food products, such as dairy-based beverages, bakery products, and flours, are increasingly fortified with different types of B vitamins to enhance their nutritive values. The wide availability of vitamins and the awareness among consumers regarding their benefits are expected to provide significant business opportunities to the vitamin and mineral premixes market over the forecasted period.

"By form, dry segment occupies largest market share during forecast period."

Based on form, the dry segment accounted for the largest market share among all other segments. Pharmaceutical and personal care companies widely use premixes in dry form for manufacturing many products, such as tablets, capsules, toothpaste, and others. The wide usage and the convenient packaging in the dry form will continue to present significant growth opportunities over the forecast period.

"By application, feed segment is forecasted to account for dominant segment during forecast period"

Based on application, the feed segment is likely to dominate over the forecast period owing to the significant growth of consumer awareness regarding pet nutrition, which has led to the demand for specialty nutrition and condition-specific pet health formulas as vitamins and minerals premixes for feed applications. These premixes are useful in regulating the biological process of growth and reproduction in the animal body and help in bodybuilding. All of this contributes to the growth of the feed segment.

"North America accounts for dominant market share of vitamin and mineral premixes market during forecast period"

North America is expected to retain its position as the dominant region for the vitamin and mineral premixes market during the forecast period. The region's large market share is attributed to a variety of reasons, such as the prominent meat and poultry industry and rising level of awareness for healthy foods and functional foods and beverages. The region's growth has also been bolstered due to the rise in incidences of obesity, heart diseases, and other health issues.

Break-up of Primaries

By Company Type: Tier 1 - 25%, Tier 2 - 45% and Tier 3 - 30%

By Designation: Manager- 35%, CXOs- 35%, and Executives - 30%

By Region: Asia Pacific - 25%, Europe - 30%, North America- 35%, and RoW- 10%

Leading players profiled in this report include,

DSM (Netherlands)

Corbion (Netherlands)

Glanbia Plc (Ireland)

Vitablend Nederland BV (Netherlands)

Sternvitamin Gmbh & Co. KG (Germany)

BASF SE (Germany)

ADM (US)

Wright Enrichment Inc (US)

Zagro (Singapore)

Nutreco /(Netherlands)

Research Coverage:

This report segments the vitamins and mineral premixes market on the basis of type, application, form, and region. In terms of insights, this research report focuses on various levels of analyses-competitive landscape, pricing insights, end-use analysis, and company profiles-which together comprise and discuss the basic views on the emerging & high-growth segments of the vitamin and mineral premixes market, high-growth regions, countries, industry trends, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

To get a comprehensive overview of the vitamin and mineral premixes market

To gain wide-ranging information about the top players in this industry, their product portfolio details, and the key strategies adopted by them

To gain insights into the major countries/regions in which the vitamin and mineral premixes market is flourishing

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2021

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE: BOTTOM-UP (BASED ON TYPE AND REGION)

- 2.2.2 APPROACH TWO: TOP-DOWN (BASED ON GLOBAL MARKET)

- 2.3 DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 2 GLOBAL VITAMIN & MINERAL PREMIXES MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 4 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 5 VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 6 VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 7 VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VITAMIN & MINERAL PREMIXES MARKET

- FIGURE 8 GROWING DEMAND FROM LIVESTOCK AND AQUACULTURE INDUSTRIES COUPLED WITH INCREASING HEALTH AWARENESS

- 4.2 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE AND COUNTRY

- FIGURE 9 CHINA AND VITAMIN SEGMENT ACCOUNTED FOR SIGNIFICANT MARKET SHARE IN 2021

- 4.3 VITAMIN & MINERAL PREMIXES MARKET, BY FORM

- FIGURE 10 DRY SEGMENT TO DOMINATE MARKET BY 2027

- 4.4 VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION

- FIGURE 11 FEED SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

- 4.5 VITAMIN & MINERAL PREMIXES MARKET, BY REGION AND TYPE

- FIGURE 12 ASIA PACIFIC AND FEED SEGMENT TO ACCOUNT FOR SIGNIFICANT MARKET SHARE BY 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASE IN RETAIL SALES

- FIGURE 13 US: RETAIL AND FOODSERVICE SALES, 2021-2027 (USD BILLION)

- 5.3 VITAMIN & MINERAL PREMIXES MARKET DYNAMICS

- FIGURE 14 VITAMIN & MINERAL PREMIXES MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growth in demand for functional and fortified food

- 5.3.1.2 Rising need for food enrichment

- 5.3.1.3 Increase in compound feed consumption

- 5.3.1.4 Growing demand for customized premixes

- 5.3.1.5 Rising need for ease of blending nutrients

- 5.3.2 RESTRAINTS

- 5.3.2.1 High costs involved in R&D activities

- 5.3.2.2 Customer unwillingness to buy expensive fortified food products

- 5.3.2.3 Stringent policies regarding feed fortification

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Growing consumer inclination toward healthy food

- 5.3.3.2 Emergence of emerging economies as major consumers of feed

- 5.3.4 CHALLENGES

- 5.3.4.1 Inaccurate labeling of food products

- 5.3.4.2 Lack of awareness regarding benefits of premixes

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND DEVELOPMENT

- 6.2.2 RAW MATERIALS AND SOURCING

- 6.2.3 MANUFACTURING

- 6.2.4 PACKAGING & STORAGE

- 6.2.5 DISTRIBUTION, SALES, AND MARKETING

- FIGURE 15 VALUE CHAIN ANALYSIS

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 ULTRASONIC CAVITATION

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE, BY TYPE, 2020-2022 (USD PER TON)

- FIGURE 16 AVERAGE SELLING PRICE, BY TYPE, 2020-2022 (USD PER TON)

- TABLE 3 VITAMIN & MINERAL PREMIXES: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD PER TON)

- TABLE 4 VITAMIN & MINERAL COMBINATION: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD PER TON)

- TABLE 5 VITAMIN: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD PER TON)

- TABLE 6 MINERAL: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD PER TON)

- TABLE 7 VITAMIN & MINERAL PREMIXES: AVERAGE SELLING PRICE, BY COMPANY, 2022 (USD PER TON)

- 6.5 MARKET MAPPING AND ECOSYSTEM ANALYSIS

- 6.5.1 SUPPLY-SIDE ANALYSIS

- 6.5.2 DEMAND-SIDE ANALYSIS

- FIGURE 17 VITAMIN & MINERAL PREMIXES MARKET MAPPING

- TABLE 8 ECOSYSTEM ANALYSIS

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- FIGURE 18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- 6.7 PATENT ANALYSIS

- FIGURE 19 PATENTS GRANTED, 2012-2021

- FIGURE 20 TOP 10 INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 21 LEADING APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- TABLE 9 PATENTS GRANTED, 2020-2022

- 6.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 PORTER'S FIVE FORCES ANALYSIS

- 6.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.8.2 BARGAINING POWER OF SUPPLIERS

- 6.8.3 BARGAINING POWER OF BUYERS

- 6.8.4 THREAT FROM SUBSTITUTES

- 6.8.5 THREAT FROM NEW ENTRANTS

- 6.9 CASE STUDIES

- 6.9.1 CASE STUDY 1: APEC DESIGNED AUTOMATED PREMIX SYSTEM TO ENABLE PROPER TRACKING AND RECORD KEEPING

- 6.9.2 CASE STUDY 2: PRISTINE LAUNCHED LACTOVIT FOR MILK FORTIFICATION

- 6.10 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 11 KEY CONFERENCES & EVENTS, 2022-2023

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12 REGULATORY FRAMEWORK

- 6.12.1 REGULATIONS FOR FEED APPLICATIONS

- 6.12.1.1 European Union

- 6.12.1.2 US

- 6.12.1.3 China

- 6.12.1.4 Canada

- 6.12.1.5 Brazil

- 6.12.1.6 Japan

- 6.12.1.7 South Africa

- 6.12.2 REGULATIONS FOR FOOD & BEVERAGE AND HEALTHCARE APPLICATIONS

- 6.12.2.1 Dietary Trends

- TABLE 15 PREVALENCE OF MICRONUTRIENT DEFICIENCY AND RISK FACTORS ASSOCIATED

- 6.12.2.2 Recommended Nutrient Intake (RNI)

- TABLE 16 RECOMMENDED NUTRIENT INTAKE FOR SELECTED POPULATION SUBGROUPS (RNIS)

- 6.12.2.3 Canada

- 6.12.2.4 US

- 6.12.2.5 Mexico

- 6.12.2.6 European Union

- 6.12.2.7 Japan

- 6.12.2.8 China

- 6.12.2.9 India

- 6.12.2.10 Australia & New Zealand

- 6.12.2.11 Brazil

- 6.12.1 REGULATIONS FOR FEED APPLICATIONS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES

- 6.13.2 BUYING CRITERIA

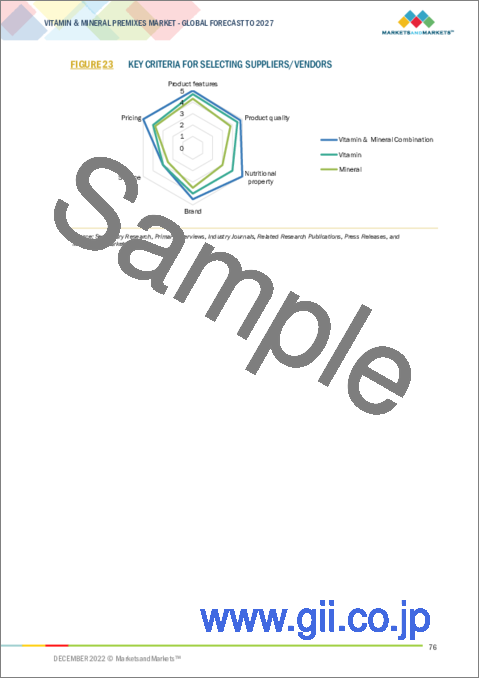

- TABLE 18 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 23 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

7 VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 24 VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 19 VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 20 VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.2 FOOD & BEVERAGES

- TABLE 21 FOOD & BEVERAGES: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 22 FOOD & BEVERAGES: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.1 BAKERY PRODUCTS

- 7.2.1.1 Increasing demand for nutrient-rich bakery products

- 7.2.2 BEVERAGES

- 7.2.2.1 Health benefits offered by fortified beverages

- 7.2.3 DAIRY PRODUCTS

- 7.2.3.1 Lack of essential nutrients in dairy products

- 7.2.4 CEREALS

- 7.2.4.1 Rising need to restore nutrients lost due to processing

- 7.2.5 OTHER FOOD APPLICATIONS

- TABLE 23 FOOD & BEVERAGES: VITAMIN & MINERAL PREMIXES MARKET, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 24 FOOD & BEVERAGES: VITAMIN & MINERAL PREMIXES MARKET, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- 7.3 HEALTHCARE

- TABLE 25 HEALTHCARE: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 26 HEALTHCARE: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.1 NUTRITIONAL PRODUCTS

- 7.3.1.1 Greater need to deal with nutritional deficiencies

- 7.3.2 DIETARY SUPPLEMENTS

- 7.3.2.1 Growing need to supplement inadequate diets

- TABLE 27 HEALTHCARE: VITAMIN & MINERAL PREMIXES MARKET, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 28 HEALTHCARE: VITAMIN & MINERAL PREMIXES MARKET, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- 7.4 FEED

- 7.4.1 RISING DEMAND FOR FEED INGREDIENTS WITH MULTIFUNCTIONAL HEALTH BENEFITS

- TABLE 29 FEED: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 30 FEED: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5 COSMETICS & PERSONAL CARE

- 7.5.1 GROWING CONSCIOUSNESS REGARDING PERSONAL GROWTH AND GROOMING

- TABLE 31 COSMETICS & PERSONAL CARE: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 32 COSMETICS & PERSONAL CARE: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022-2027 (USD MILLION)

8 VITAMIN & MINERAL PREMIXES MARKET, BY FORM

- 8.1 INTRODUCTION

- FIGURE 25 VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- TABLE 33 VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 34 VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022-2027 (USD MILLION)

- 8.2 DRY

- 8.2.1 EXTENSIVE INDUSTRIAL APPLICATIONS OF DRY PREMIXES

- TABLE 35 DRY: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 36 DRY: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 LIQUID

- 8.3.1 INCREASE IN ADOPTION OF BEVERAGE FORTIFICATION

- TABLE 37 LIQUID: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 38 LIQUID: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022-2027 (USD MILLION)

9 VITAMIN & MINERAL PREMIXES MARKET, BY FUNCTIONALITY

- 9.1 INTRODUCTION

- 9.2 BONE HEALTH

- 9.2.1 RISE IN BONE-RELATED DISEASES

- 9.3 SKIN HEALTH

- 9.3.1 INCREASED FOCUS ON WELL-BEING AND OVERALL APPEARANCE

- 9.4 ENERGY

- 9.4.1 RISING INCLINATION TOWARD HEALTH-ORIENTED BEVERAGES

- 9.5 IMMUNITY

- 9.5.1 GROWING DEMAND FOR IMMUNE-BOOSTING PRODUCTS

- 9.6 DIGESTION

- 9.6.1 SURGE IN GASTROINTESTINAL ISSUES

- 9.7 OTHER FUNCTIONALITIES

10 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE

- 10.1 INTRODUCTION

- FIGURE 26 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 39 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 40 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 41 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (KT)

- TABLE 42 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (KT)

- 10.2 VITAMIN & MINERAL COMBINATION

- 10.2.1 RISING AWARENESS REGARDING HEALTH AND NUTRITION

- TABLE 43 VITAMIN & MINERAL COMBINATION PREMIXES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 44 VITAMIN & MINERAL COMBINATION PREMIXES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 45 VITAMIN & MINERAL COMBINATION PREMIXES MARKET, BY REGION, 2019-2021 (KT)

- TABLE 46 VITAMIN & MINERAL COMBINATION PREMIXES MARKET, BY REGION, 2022-2027 (KT)

- 10.3 VITAMIN

- 10.3.1 GROWING PET HUMANIZATION

- TABLE 47 VITAMIN PREMIXES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 48 VITAMIN PREMIXES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 49 VITAMIN PREMIXES MARKET, BY REGION, 2019-2021 (KT)

- TABLE 50 VITAMIN PREMIXES MARKET, BY REGION, 2022-2027 (KT)

- 10.4 MINERAL

- 10.4.1 INCREASING DEMAND FROM FOOD & BEVERAGE INDUSTRY

- TABLE 51 MINERAL PREMIXES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 52 MINERAL PREMIXES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 53 MINERAL PREMIXES MARKET, BY REGION, 2019-2021 (KT)

- TABLE 54 MINERAL PREMIXES MARKET, BY REGION, 2022-2027 (KT)

11 VITAMIN & MINERAL PREMIXES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 27 INDIA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 55 VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 56 VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 57 VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019-2021 (KT)

- TABLE 58 VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022-2027 (KT)

- 11.2 NORTH AMERICA

- FIGURE 28 NORTH AMERICA: REGIONAL SNAPSHOT

- TABLE 59 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (KT)

- TABLE 64 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 65 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 66 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 68 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 70 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 72 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022-2027 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 Rising health-consciousness

- TABLE 73 US: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 74 US: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Growing aquaculture industry

- TABLE 75 CANADA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 76 CANADA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.3 MEXICO

- 11.2.3.1 Large obese population

- TABLE 77 MEXICO: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 78 MEXICO: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3 ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: REGIONAL SNAPSHOT

- TABLE 79 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 80 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 82 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 83 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (KT)

- TABLE 84 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 85 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 86 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 87 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 88 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- TABLE 89 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 90 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 92 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022-2027 (USD MILLION)

- 11.3.1 CHINA

- 11.3.1.1 Rising demand for supplements and shift in eating habits

- TABLE 93 CHINA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 94 CHINA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.2 INDIA

- 11.3.2.1 Surge in consumption of fortified food products

- TABLE 95 INDIA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 96 INDIA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.3 JAPAN

- 11.3.3.1 Growing inclination toward functional food products

- TABLE 97 JAPAN: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 98 JAPAN: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.4 AUSTRALIA & NEW ZEALAND

- 11.3.4.1 Rising demand for functional beverages

- TABLE 99 AUSTRALIA & NEW ZEALAND: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 100 AUSTRALIA & NEW ZEALAND: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.5 REST OF ASIA PACIFIC

- TABLE 101 REST OF ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4 EUROPE

- TABLE 103 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 104 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 105 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 106 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 107 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (KT)

- TABLE 108 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 109 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 110 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 111 EUROPE: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 112 EUROPE: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- TABLE 113 EUROPE: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 114 EUROPE: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- TABLE 115 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 116 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022-2027 (USD MILLION)

- 11.4.1 UK

- 11.4.1.1 Increasing appetite of people for sunshine vitamin

- TABLE 117 UK: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 118 UK: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.2 GERMANY

- 11.4.2.1 Rising demand for healthcare products

- TABLE 119 GERMANY: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 120 GERMANY: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.3 FRANCE

- 11.4.3.1 Growth in beverage and bakery industries

- TABLE 121 FRANCE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 122 FRANCE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.4 ITALY

- 11.4.4.1 Awareness regarding benefits of dietary supplements

- TABLE 123 ITALY: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 124 ITALY: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.5 SPAIN

- 11.4.5.1 Thriving feed industry and efficient supply chain

- TABLE 125 SPAIN: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 126 SPAIN: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.6 RUSSIA

- 11.4.6.1 Rising awareness regarding health and wellness

- TABLE 127 RUSSIA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 128 RUSSIA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.7 NETHERLANDS

- 11.4.7.1 Inadequate consumption of fruits and vegetables

- TABLE 129 NETHERLANDS: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 130 NETHERLANDS: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.8 REST OF EUROPE

- TABLE 131 REST OF EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 132 REST OF EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.5 SOUTH AMERICA

- TABLE 133 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 134 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 135 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 136 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 137 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (KT)

- TABLE 138 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 139 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 140 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 141 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 142 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- TABLE 143 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 144 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- TABLE 145 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 146 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022-2027 (USD MILLION)

- 11.5.1 BRAZIL

- 11.5.1.1 Growing middle-class population

- TABLE 147 BRAZIL: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 148 BRAZIL: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.5.2 ARGENTINA

- 11.5.2.1 Surge in demand for dietary supplements

- TABLE 149 ARGENTINA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 150 ARGENTINA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.5.3 REST OF SOUTH AMERICA

- TABLE 151 REST OF SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 152 REST OF SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.6 REST OF THE WORLD

- TABLE 153 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 154 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 155 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 156 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 157 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (KT)

- TABLE 158 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 159 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 160 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 161 ROW: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 162 ROW: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- TABLE 163 ROW: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2019-2021 (USD MILLION)

- TABLE 164 ROW: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2022-2027 (USD MILLION)

- TABLE 165 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 166 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022-2027 (USD MILLION)

- 11.6.1 AFRICA

- 11.6.1.1 High consumption of fortified food products

- TABLE 167 AFRICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 168 AFRICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Rising pet adoption

- TABLE 169 MIDDLE EAST: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 170 MIDDLE EAST: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 171 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS, 2021

- TABLE 172 MARKET SHARE ANALYSIS, 2021

- 12.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 30 REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021 (USD BILLION)

- 12.5 EVALUATION QUADRANT FOR KEY PLAYERS, 2021

- 12.5.1 STARS

- 12.5.2 PERVASIVE PLAYERS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PARTICIPANTS

- FIGURE 31 COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 12.5.5 VITAMIN & MINERAL PREMIXES MARKET PRODUCT FOOTPRINT

- TABLE 173 COMPANY FOOTPRINT, BY TYPE

- TABLE 174 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 175 COMPANY FOOTPRINT, BY FORM

- TABLE 176 COMPANY FOOTPRINT, BY REGION

- TABLE 177 OVERALL COMPANY FOOTPRINT

- 12.6 EVALUATION QUADRANT FOR OTHER PLAYERS, 2021

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 32 COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- TABLE 178 VITAMIN & MINERAL PREMIXES MARKET: COMPETITIVE BENCHMARKING, 2021 (OTHER PLAYERS)

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- TABLE 179 VITAMIN & MINERAL PREMIXES MARKET: PRODUCT LAUNCHES, 2019-2022

- 12.7.2 DEALS

- TABLE 180 VITAMIN & MINERAL PREMIXES MARKET: DEALS, 2019-2022

- 12.7.3 OTHERS

- TABLE 181 VITAMIN & MINERAL PREMIXES MARKET: OTHERS, 2022

13 COMPANY PROFILES

(Business overview, Products/Services/Solutions offered, Recent developments & MnM View)*

- 13.1 KEY PLAYERS

- 13.1.1 DSM

- TABLE 182 DSM: BUSINESS OVERVIEW

- FIGURE 33 DSM: COMPANY SNAPSHOT

- TABLE 183 DSM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 DSM: PRODUCT LAUNCHES

- TABLE 185 DSM: OTHERS

- 13.1.2 CORBION

- TABLE 186 CORBION: BUSINESS OVERVIEW

- FIGURE 34 CORBION: COMPANY SNAPSHOT

- TABLE 187 CORBION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 CORBION: OTHERS

- 13.1.3 GLANBIA PLC

- TABLE 189 GLANBIA PLC: BUSINESS OVERVIEW

- FIGURE 35 GLANBIA PLC: COMPANY SNAPSHOT

- TABLE 190 GLANBIA PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 GLANBIA PLC: DEALS

- 13.1.4 VITABLEND NEDERLAND BV

- TABLE 192 VITABLEND NEDERLAND BV: BUSINESS OVERVIEW

- TABLE 193 VITABLEND NEDERLAND BV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.5 STERNVITAMIN GMBH & CO. KG

- TABLE 194 STERNVITAMIN GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 195 STERNVITAMIN GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 STERNVITAMIN GMBH & CO. KG: PRODUCT LAUNCHES

- 13.1.6 BASF SE

- TABLE 197 BASF SE: BUSINESS OVERVIEW

- FIGURE 36 BASF SE: COMPANY SNAPSHOT

- TABLE 198 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 BASF SE: OTHERS

- 13.1.7 ADM

- TABLE 200 ADM: BUSINESS OVERVIEW

- FIGURE 37 ADM: COMPANY SNAPSHOT

- TABLE 201 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 ADM: OTHERS

- 13.1.8 WRIGHT ENRICHMENT INC.

- TABLE 203 WRIGHT ENRICHMENT INC.: BUSINESS OVERVIEW

- TABLE 204 WRIGHT ENRICHMENT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.9 ZAGRO

- TABLE 205 ZAGRO: BUSINESS OVERVIEW

- TABLE 206 ZAGRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 ZAGRO: OTHERS

- 13.1.10 NUTRECO

- TABLE 208 NUTRECO: BUSINESS OVERVIEW

- TABLE 209 NUTRECO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 NUTRECO: DEALS

- TABLE 211 NUTRECO: OTHERS

- 13.1.11 FARBEST-TALLMAN FOODS CORPORATION

- TABLE 212 FARBEST-TALLMAN FOODS CORPORATION: BUSINESS OVERVIEW

- TABLE 213 FARBEST-TALLMAN FOODS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 FARBEST-TALLMAN FOODS CORPORATION: DEALS

- 13.1.12 BURKMANN INDUSTRIES, INC.

- TABLE 215 BURKMANN INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 216 BURKMANN INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.13 BAR-MAGEN LTD.

- TABLE 217 BAR-MAGEN LTD.: BUSINESS OVERVIEW

- TABLE 218 BAR-MAGEN LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 BAR-MAGEN LTD.: DEALS

- 13.1.14 INNOV AD NV/SA

- TABLE 220 INNOV AD NV/SA: BUSINESS OVERVIEW

- TABLE 221 INNOV AD NV/SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 INNOV AD NV/SA: DEALS

- 13.1.15 JUBILANT INGREVIA LTD.

- TABLE 223 JUBILANT INGREVIA LIMITED: BUSINESS OVERVIEW

- FIGURE 38 JUBILANT INGREVIA LIMITED: COMPANY SNAPSHOT

- TABLE 224 JUBILANT INGREVIA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 JUBILANT INGREVIA LIMITED: OTHERS

- Details on Business overview, Products/Services/Solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 13.2 OTHER PLAYERS

- 13.2.1 IDENA

- 13.2.2 SPANSULES PHARMATECH PVT. LTD.

- 13.2.3 AMESI GROUP

- 13.2.4 SA PREMIX

- 13.2.5 YESSINERGY

- 13.2.6 PHIBRO ANIMAL HEALTH CORPORATION

- 13.2.7 DLG

- 13.2.8 GK BIOCHEMICAL CORPORATION

- 13.2.9 ADVANCED ANIMAL NUTRITION PTY LTD.

- 13.2.10 CREDENCE REMEDIES PVT. LTD.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 226 MARKETS ADJACENT TO VITAMIN & MINERAL PREMIXES MARKET

- 14.2 LIMITATIONS

- 14.3 FEED PREMIX MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 227 FEED PREMIX MARKET, BY INGREDIENT TYPE, 2021-2026 (USD MILLION)

- 14.4 FOOD FORTIFYING AGENTS MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 228 FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS