|

|

市場調査レポート

商品コード

1601581

ヘルスケアITの世界市場:ソリューション・サービス別、コンポーネント別、エンドユーザー別、地域別 - 2029年までの予測Healthcare IT Market by Solution (Provider, Payer, Clinical [EHR, PHM, PACs & VNA, Telehealth, RCM, CDSS]), Nonclinical (Analytics, Pharmacy, Interoperability), Service (Claim, Billing, Supply), End User (Hospital, Payer) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ヘルスケアITの世界市場:ソリューション・サービス別、コンポーネント別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年11月14日

発行: MarketsandMarkets

ページ情報: 英文 633 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のヘルスケアITの市場規模は、2024年の4,202億3,000万米ドルから2029年には8,343億5,000万米ドルに達すると予測され、2024年から2029年までのCAGRは14.7%になるとみられています。

技術の進歩によるソリューションの普及が、ヘルスケアIT市場の成長を加速させています。2024年8月に発表されたヘルスケアの記事によると、AIを搭載した臨床意思決定支援システムは、エビデンスに基づいた治療法の推奨を行うことで腫瘍医を支援します。AIは診断の精度を10~15%向上させるのに役立つことが判明しました。さらに、EHRの導入が進むことでデータへのアクセス性が向上し、高度なヘルスケアITソリューションの需要が高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 100万/10億(米ドル) |

| セグメント別 | ソリューション・サービス別、コンポーネント別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東アフリカ |

臨床HCITソリューションのタイプ別では、予測期間中、遠隔医療ソリューションセグメントが最大セグメントになると予測されています。COVID-19の流行は、多くの分野、特にヘルスケア業界において大きな変化をもたらすきっかけとなっています。最も注目すべき変化の1つは、遠隔医療ソリューションの急速な採用と拡大です。これは主に、世界中のeヘルスに対する政府の取り組みによるものです。例えば、WHOのデジタルヘルスに関する世界戦略(2020年~2025年)、Slaintecare Action Plan、HSE Corporate Plan、Healthy Irelandなどの政府のイニシアチブは、遠隔医療ソリューションの開発を促進しています。このように、医療の質を向上させる必要性が高まり、ヘルスケアプロバイダー間の統合が進み、デジタル・コネクテッド・ヘルスケア技術の採用が増加しています。

2023年のヘルスケアIT市場では、ヘルスケアプロバイダー分野が最も高い成長率を示すと予測されています。医療提供者は、デジタル化され、個別化されたサービスに対する高い需要と人材確保の課題に直面しています。同時に、医療システムは、患者の獲得、積極的なケアへの関与、地域社会へのコミットメントの推進に努めています。財政的に持続可能なバリュー・ベース・ケアとポピュレーション・ヘルス・マネジメントの長期的ビジョンを達成するには、患者と従業員のエクスペリエンスを向上させるヘルスケア情報技術ソリューションが必要です。そのため、業務効率を高めながら患者ケアを改善するヘルスケアITソリューションへの需要が高まっています。

当レポートでは、世界のヘルスケアIT市場について調査し、ソリューション・サービス別、コンポーネント別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- 潜在的なHCIT技術

- ヘルスケア市場におけるAI

- 価格分析

- ポーターのファイブフォース分析

- 規制分析

- バリューチェーン分析

- エコシステム分析

- 特許分析

- 主な利害関係者と購入基準

- 主要な会議とイベント(2024年~2025年)

- 顧客ビジネスに影響を与える動向/混乱

- ケーススタディ分析

- エンドユーザー分析

- ヘルスケアITソリューションビジネスモデル

- ヘルスケアITソリューション投資情勢

- ヘルスケアIT市場における生成AIの影響

第6章 ヘルスケアIT市場(ソリューション・サービス別)

- イントロダクション

- ヘルスケアプロバイダーソリューション

- ヘルスケア者向けソリューション

- HCITアウトソーシングサービス

第7章 ヘルスケアIT市場(コンポーネント別)

- イントロダクション

- サービス

- ソフトウェア

- ハードウェア

第8章 ヘルスケアIT市場(エンドユーザー別)

- イントロダクション

- 医療提供者

- 支払者

- ライフサイエンス産業

第9章 ヘルスケアIT市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- ブランド/ソフトウェア比較分析

- 企業価値評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- OPTUM, INC.

- COGNIZANT

- KONINKLIJKE PHILIPS N.V.

- DELL TECHNOLOGIES INC.

- GE HEALTHCARE

- ORACLE

- WIPRO

- ECLINICALWORKS

- SAS INSTITUTE INC.

- INOVALON

- INFOR(KOCH INDUSTRIES)

- CONIFER HEALTH SOLUTIONS, LLC.

- NUANCE COMMUNICATIONS, INC.

- 3M

- MERATIVE

- EPIC SYSTEMS CORPORATION

- INTERSYSTEMS CORPORATION

- VERADIGM LLC

- SALESFORCE, INC.

- CITIUSTECH INC

- その他の企業

- CONDUENT, INC.

- CARESTREAM HEALTH.

- PRACTICE FUSION, INC.

- TATA CONSULTANCY SERVICES LIMITED

- ELSEVIER

- MEDEANALYTICS, INC.

- MEDECISION

- SURGICAL INFORMATION SYSTEMS

- CHARTIS

- CLEARWAVE CORPORATION

第12章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 RISK ASSESSMENT: HCIT MARKET

- TABLE 3 HEALTHCARE DATA BREACHES: ENTITIES, IMPACT, AND CAUSES (2023)

- TABLE 4 KEY CLOUD COMPUTING TOOLS & SAAS IN HCIT MARKET

- TABLE 5 AVERAGE SELLING PRICE OF CDSS SOLUTIONS, BY PRODUCT (2023)

- TABLE 6 PRICING MODEL: HCIT INTEGRATION SOLUTIONS

- TABLE 7 LABORATORY INFORMATION SYSTEMS MARKET: PRICING ANALYSIS

- TABLE 8 PRE-ELEMENT FEE FOR PHM SOLUTIONS

- TABLE 9 ANNUAL MAINTENANCE FEE FOR PHM SOLUTIONS

- TABLE 10 AVERAGE SELLING PRICE OF HEALTHCARE ANALYTICS SOLUTIONS, BY COMPONENT

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 17 KEY BUYING CRITERIA FOR END USERS

- TABLE 18 UNMET NEEDS IN HEALTHCARE IT MARKET

- TABLE 19 END USER EXPECTATIONS IN HEALTHCARE IT MARKET

- TABLE 20 HEALTHCARE PROVIDER SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 21 CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 22 ELECTRONIC HEALTH RECORD SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 23 ELECTRONIC HEALTH RECORDS: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 24 POPULATION HEALTH MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 25 POPULATION HEALTH MANAGEMENT: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 26 SPECIALTY INFORMATION SYSTEMS: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 27 ONCOLOGY INFORMATION SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 28 ONCOLOGY INFORMATION SYSTEMS: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 29 CVIS OFFERED BY KEY MARKET PLAYERS

- TABLE 30 CARDIOVASCULAR INFORMATION SYSTEMS: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 31 OTHER SPECIALTY INFORMATION SYSTEMS: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 32 PACS & VNA OFFERED BY KEY MARKET PLAYERS

- TABLE 33 PACS & VNA: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 34 MHEALTH APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 35 MHEALTH APPS: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 36 HCIT INTEGRATION SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 37 HCIT INTEGRATION: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 38 TELEHEALTH PLATFORMS OFFERED BY KEY MARKET PLAYERS

- TABLE 39 TELEHEALTH: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 40 MEDICAL IMAGE ANALYSIS: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 41 LABORATORY INFORMATION SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 42 LABORATORY INFORMATION SYSTEMS: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 43 PRACTICE MANAGEMENT SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 44 PRACTICE MANAGEMENT: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 45 CDSS OFFERED BY KEY MARKET PLAYERS

- TABLE 46 CLINICAL DECISION SUPPORT SYSTEMS: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 47 EPRESCRIBING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 48 EPRESCRIBING: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 49 RADIOLOGY INFORMATION SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 50 RADIOLOGY INFORMATION SYSTEMS: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 51 COMPUTERIZED PHYSICIAN ORDER ENTRY SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 52 COMPUTERIZED PHYSICIAN ORDER ENTRY: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 53 PATIENT REGISTRY SOFTWARE OFFERED BY KEY MARKET PLAYERS/ORGANIZATIONS

- TABLE 54 PATIENT REGISTRY SOFTWARE: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 55 INFECTION SURVEILLANCE SOLUTIONS OFFERED BY KEY MARKET PLAYERS/ORGANIZATIONS

- TABLE 56 INFECTION SURVEILLANCE: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 57 RADIATION DOSE MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 58 RADIATION DOSE MANAGEMENT: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 59 NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 60 HEALTHCARE ASSET MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 61 HEALTHCARE ASSET MANAGEMENT: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 62 REVENUE CYCLE MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 63 REVENUE CYCLE MANAGEMENT: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 64 FRONT-END RCM SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 65 FRONT-END RCM: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 66 MID-REVENUE MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 67 MID-REVENUE SOLUTIONS: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 68 BACK-END RCM SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 69 BACK-END RCM: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 70 HEALTHCARE ANALYTICS: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 71 CLINICAL ANALYTICS SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 72 CLINICAL ANALYTICS: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 73 FINANCIAL ANALYTICS SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 74 FINANCIAL ANALYTICS: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 75 OPERATIONAL & ADMINISTRATIVE ANALYTICS: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 76 CUSTOMER RELATIONSHIP MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 77 CUSTOMER RELATIONSHIP MANAGEMENT: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 78 PHARMACY INFORMATION SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 79 PHARMACY INFORMATION SYSTEMS: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 80 HEALTHCARE INTEROPERABILITY SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 81 HEALTHCARE INTEROPERABILITY: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 82 QUALITY MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 83 QUALITY MANAGEMENT: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 84 SUPPLY CHAIN MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 85 SUPPLY CHAIN MANAGEMENT: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 86 PROCUREMENT MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 87 PROCUREMENT MANAGEMENT: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 88 INVENTORY MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 89 INVENTORY MANAGEMENT: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 90 MEDICATION MANAGEMENT: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 91 ELECTRONIC MEDICATION ADMINISTRATION SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 92 ELECTRONIC MEDICATION ADMINISTRATION: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 93 BARCODE MEDICATION ADMINISTRATION SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 94 BARCODE MEDICATION ADMINISTRATION: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 95 MEDICATION INVENTORY MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 96 MEDICATION INVENTORY MANAGEMENT: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 97 MEDICATION ASSURANCE: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 98 WORKFORCE MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 99 WORKFORCE MANAGEMENT: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 100 HEALTHCARE INFORMATION EXCHANGE SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 101 HEALTHCARE INFORMATION EXCHANGE: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 102 MEDICAL DOCUMENT MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 103 MEDICAL DOCUMENT MANAGEMENT: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 104 HEALTHCARE PAYER SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 105 CLAIMS MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 106 CLAIMS MANAGEMENT: HEALTHCARE IT PAYER SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

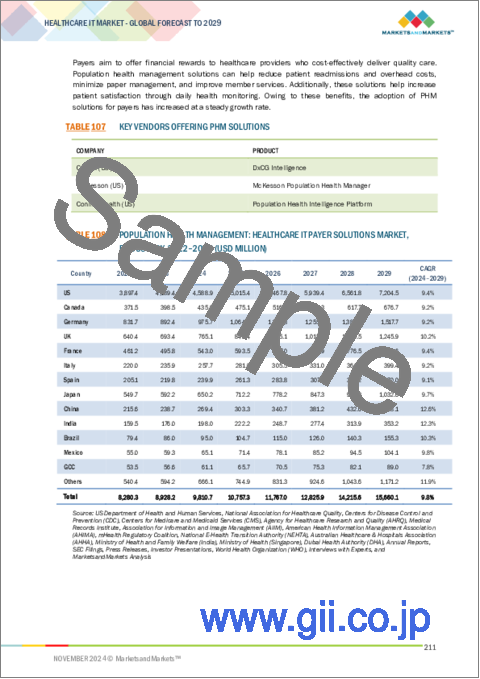

- TABLE 107 KEY VENDORS OFFERING PHM SOLUTIONS

- TABLE 108 POPULATION HEALTH MANAGEMENT: HEALTHCARE IT PAYER SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 109 PHARMACY AUDIT & ANALYSIS SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 110 PHARMACY AUDIT & ANALYSIS: HEALTHCARE IT PAYER SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 111 CUSTOMER RELATIONSHIP MANAGEMENT: HEALTHCARE IT PAYER SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 112 FRAUD ANALYTICS: HEALTHCARE IT PAYER SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 113 PROVIDER NETWORK MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 114 PROVIDER NETWORK MANAGEMENT: HEALTHCARE IT PAYER SOLUTIONS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 115 HEALTHCARE OUTSOURCING SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 116 IT INFRASTRUCTURE MANAGEMENT: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 117 PAYER OUTSOURCING: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 118 CLAIMS MANAGEMENT: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 119 PROVIDER NETWORK MANAGEMENT: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 120 BILLING & ACCOUNTS MANAGEMENT: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 121 FRAUD ANALYTICS: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 122 OTHER PAYER OUTSOURCING: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 123 PROVIDER OUTSOURCING: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 124 REVENUE CYCLE MANAGEMENT: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 125 MEDICAL DOCUMENT MANAGEMENT: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 126 LABORATORY INFORMATION MANAGEMENT: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 127 OTHER PROVIDER OUTSOURCING: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 128 OPERATIONAL OUTSOURCING: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 129 SUPPLY CHAIN MANAGEMENT: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 130 BUSINESS PROCESS MANAGEMENT: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 131 OTHER OPERATIONAL IT OUTSOURCING: HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 132 HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 133 SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 134 HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 135 HEALTHCARE IT SOFTWARE OFFERED BY KEY MARKET PLAYERS

- TABLE 136 HEALTHCARE IT SOFTWARE MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 137 HEALTHCARE IT HARDWARE MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 138 HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 139 HEALTHCARE PROVIDERS: HEALTHCARE IT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 140 HEALTHCARE PROVIDERS: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 141 HOSPITALS: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 142 AMBULATORY CARE CENTERS: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 143 HOME HEALTHCARE AGENCIES & ASSISTED LIVING FACILITIES: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 144 DIAGNOSTIC & IMAGING CENTERS: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 145 PHARMACIES: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 146 HEALTHCARE PAYERS: HEALTHCARE IT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 147 HEALTHCARE PAYERS: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 148 PRIVATE PAYERS: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 149 PUBLIC PAYERS: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 150 LIFE SCIENCES INDUSTRY: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 151 NORTH AMERICA: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 152 NORTH AMERICA: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 153 NORTH AMERICA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 154 NORTH AMERICA: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 155 NORTH AMERICA: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 156 NORTH AMERICA: SPECIALITY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 157 NORTH AMERICA: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 158 NORTH AMERICA: HEALTHCARE ANALYTICS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 159 NORTH AMERICA: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 160 NORTH AMERICA: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 161 NORTH AMERICA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 162 NORTH AMERICA: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 163 NORTH AMERICA: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 164 NORTH AMERICA: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 165 NORTH AMERICA: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 166 NORTH AMERICA: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 167 NORTH AMERICA: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 168 NORTH AMERICA: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 169 NORTH AMERICA: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 170 US: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 171 US: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 172 US: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 173 US: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 174 US: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 175 US: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 176 US: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 177 US: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 178 US: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 179 US: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 180 US: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 181 US: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 182 US: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 183 US: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 184 US: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 185 US: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 186 US: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 187 US: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 188 CANADA: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 189 CANADA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 190 CANADA: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 191 CANADA: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 192 CANADA: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 193 CANADA: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 194 CANADA: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 195 CANADA: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 196 CANADA: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 197 CANADA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 198 CANADA: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 199 CANADA: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 200 CANADA: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 201 CANADA: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 202 CANADA: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 203 CANADA: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 204 CANADA: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 205 CANADA: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 206 EUROPE: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 207 EUROPE: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 208 EUROPE: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 209 EUROPE: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 210 EUROPE: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 211 EUROPE: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 212 EUROPE: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 213 EUROPE: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 214 EUROPE: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 215 EUROPE: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 216 EUROPE: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 217 EUROPE: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 218 EUROPE: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 219 EUROPE: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 220 EUROPE: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 221 EUROPE: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 222 EUROPE: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 223 EUROPE: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 224 EUROPE: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 225 GERMANY: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 226 GERMANY: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 227 GERMANY: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 228 GERMANY: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 229 GERMANY: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 230 GERMANY: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 231 GERMANY: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 232 GERMANY: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 233 GERMANY: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 234 GERMANY: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 235 GERMANY: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 236 GERMANY: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 237 GERMANY: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 238 GERMANY: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 239 GERMANY: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 240 GERMANY: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 241 GERMANY: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 242 GERMANY: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 243 UK: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 244 UK: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 245 UK: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 246 UK: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 247 UK: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 248 UK: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 249 UK: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 250 UK: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 251 UK: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 252 UK: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 253 UK: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 254 UK: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 255 UK: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 256 UK: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 257 UK: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 258 UK: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 259 UK: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 260 UK: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 261 FRANCE: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 262 FRANCE: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 263 FRANCE: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 264 FRANCE: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 265 FRANCE: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 266 FRANCE: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 267 FRANCE: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 268 FRANCE: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 269 FRANCE: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 270 FRANCE: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 271 FRANCE: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 272 FRANCE: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 273 FRANCE: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 274 FRANCE: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 275 FRANCE: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 276 FRANCE: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 277 FRANCE: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 278 FRANCE: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 279 ITALY: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 280 ITALY: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 281 ITALY: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 282 ITALY: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 283 ITALY: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 284 ITALY: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 285 ITALY: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 286 ITALY: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 287 ITALY: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 288 ITALY: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 289 ITALY: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 290 ITALY: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 291 ITALY: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 292 ITALY: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 293 ITALY: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 294 ITALY: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 295 ITALY: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 296 ITALY: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 297 SPAIN: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 298 SPAIN: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 299 SPAIN: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 300 SPAIN: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 301 SPAIN: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 302 SPAIN: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 303 SPAIN: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 304 SPAIN: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 305 SPAIN: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 306 SPAIN: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 307 SPAIN: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 308 SPAIN: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 309 SPAIN: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 310 SPAIN: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 311 SPAIN: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 312 SPAIN: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 313 SPAIN: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 314 SPAIN: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 315 REST OF EUROPE: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 316 REST OF EUROPE: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 317 REST OF EUROPE: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 318 REST OF EUROPE: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 319 REST OF EUROPE: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 320 REST OF EUROPE: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 321 REST OF EUROPE: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 322 REST OF EUROPE: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 323 REST OF EUROPE: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 324 REST OF EUROPE: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 325 REST OF EUROPE: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 326 REST OF EUROPE: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 327 REST OF EUROPE: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 328 REST OF EUROPE: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 329 REST OF EUROPE: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 330 REST OF EUROPE: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 331 REST OF EUROPE: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 332 REST OF EUROPE: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 333 ASIA PACIFIC: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 334 ASIA PACIFIC: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 335 ASIA PACIFIC: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 336 ASIA PACIFIC: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 337 ASIA PACIFIC: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 338 ASIA PACIFIC: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 339 ASIA PACIFIC: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 340 ASIA PACIFIC: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 341 ASIA PACIFIC: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 342 ASIA PACIFIC: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 343 ASIA PACIFIC: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 344 ASIA PACIFIC: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 345 ASIA PACIFIC: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 346 ASIA PACIFIC: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 347 ASIA PACIFIC: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 348 ASIA PACIFIC: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 349 ASIA PACIFIC: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 350 ASIA PACIFIC: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 351 JAPAN: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 352 JAPAN: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 353 JAPAN: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 354 JAPAN: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 355 JAPAN: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 356 JAPAN: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 357 JAPAN: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 358 JAPAN: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 359 JAPAN: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 360 JAPAN: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 361 JAPAN: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 362 JAPAN: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 363 JAPAN: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 364 JAPAN: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 365 JAPAN: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 366 JAPAN: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 367 JAPAN: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 368 JAPAN: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 369 CHINA: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 370 CHINA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 371 CHINA: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 372 CHINA: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 373 CHINA: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 374 CHINA: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 375 CHINA: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 376 CHINA: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 377 CHINA: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 378 CHINA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 379 CHINA: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 380 CHINA: PROVIDER HCIT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 381 CHINA: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 382 CHINA: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 383 CHINA: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 384 CHINA: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 385 CHINA: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 386 CHINA: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 387 INDIA: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 388 INDIA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 389 INDIA: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 390 INDIA: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 391 INDIA: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 392 INDIA: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 393 INDIA: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 394 INDIA: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 395 INDIA: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 396 INDIA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 397 INDIA: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 398 INDIA: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 399 INDIA: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 400 INDIA: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 401 INDIA: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 402 INDIA: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 403 INDIA: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 404 INDIA: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 405 REST OF ASIA PACIFIC: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 406 REST OF ASIA PACIFIC: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 407 REST OF ASIA PACIFIC: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 408 REST OF ASIA PACIFIC: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 409 REST OF ASIA PACIFIC: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 410 REST OF ASIA PACIFIC: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 411 REST OF ASIA PACIFIC: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 412 REST OF ASIA PACIFIC: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 413 REST OF ASIA PACIFIC: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 414 REST OF ASIA PACIFIC: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 415 REST OF ASIA PACIFIC: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 416 REST OF ASIA PACIFIC: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 417 REST OF ASIA PACIFIC: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 418 REST OF ASIA PACIFIC: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 419 REST OF ASIA PACIFIC: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 420 REST OF ASIA PACIFIC: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 421 REST OF ASIA PACIFIC: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 422 REST OF ASIA PACIFIC: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 423 LATIN AMERICA: HEALTHCARE IT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 424 LATIN AMERICA: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 425 LATIN AMERICA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 426 LATIN AMERICA: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 427 LATIN AMERICA: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 428 LATIN AMERICA: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 429 LATIN AMERICA: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 430 LATIN AMERICA: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 431 LATIN AMERICA: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 432 LATIN AMERICA: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 433 LATIN AMERICA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 434 LATIN AMERICA: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 435 LATIN AMERICA: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 436 LATIN AMERICA: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 437 LATIN AMERICA: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 438 LATIN AMERICA: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 439 LATIN AMERICA: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 440 LATIN AMERICA: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 441 LATIN AMERICA: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 442 BRAZIL: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 443 BRAZIL: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 444 BRAZIL: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 445 BRAZIL: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 446 BRAZIL: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 447 BRAZIL: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 448 BRAZIL: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 449 BRAZIL: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 450 BRAZIL: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 451 BRAZIL: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 452 BRAZIL: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 453 BRAZIL: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 454 BRAZIL: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 455 BRAZIL: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 456 BRAZIL: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 457 BRAZIL: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 458 BRAZIL: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 459 BRAZIL: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 460 MEXICO: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 461 MEXICO: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 462 MEXICO: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 463 MEXICO: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 464 MEXICO: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 465 MEXICO: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 466 MEXICO: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 467 MEXICO: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 468 MEXICO: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 469 MEXICO: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 470 MEXICO: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 471 MEXICO: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 472 MEXICO: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 473 MEXICO: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 474 MEXICO: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 475 MEXICO: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 476 MEXICO: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 477 MEXICO: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 478 REST OF LATIN AMERICA: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 479 REST OF LATIN AMERICA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 480 REST OF LATIN AMERICA: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 481 REST OF LATIN AMERICA: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 482 REST OF LATIN AMERICA: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 483 REST OF LATIN AMERICA: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 484 REST OF LATIN AMERICA: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 485 REST OF LATIN AMERICA: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 486 REST OF LATIN AMERICA: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 487 REST OF LATIN AMERICA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 488 REST OF LATIN AMERICA: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 489 REST OF LATIN AMERICA: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 490 REST OF LATIN AMERICA: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 491 REST OF LATIN AMERICA: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 492 REST OF LATIN AMERICA: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 493 REST OF LATIN AMERICA: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 494 REST OF LATIN AMERICA: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 495 REST OF LATIN AMERICA: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 496 MIDDLE EAST & AFRICA: HEALTHCARE IT MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 497 MIDDLE EAST & AFRICA: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 498 MIDDLE EAST & AFRICA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 499 MIDDLE EAST & AFRICA: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 500 MIDDLE EAST & AFRICA: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 501 MIDDLE EAST & AFRICA: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 502 MIDDLE EAST & AFRICA: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 503 MIDDLE EAST & AFRICA: HEALTHCARE ANALYTICS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 504 MIDDLE EAST & AFRICA: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 505 MIDDLE EAST & AFRICA: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 506 MIDDLE EAST & AFRICA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 507 MIDDLE EAST & AFRICA: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 508 MIDDLE EAST & AFRICA: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 509 MIDDLE EAST & AFRICA: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 510 MIDDLE EAST & AFRICA: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 511 MIDDLE EAST & AFRICA: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 512 MIDDLE EAST & AFRICA: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 513 MIDDLE EAST & AFRICA: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 514 MIDDLE EAST & AFRICA: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 515 GCC COUNTRIES: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 516 GCC COUNTRIES: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 517 GCC COUNTRIES: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 518 GCC COUNTRIES: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 519 GCC COUNTRIES: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 520 GCC COUNTRIES: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 521 GCC COUNTRIES: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 522 GCC COUNTRIES: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 523 GCC COUNTRIES: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 524 GCC COUNTRIES: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 525 GCC COUNTRIES: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 526 GCC COUNTRIES: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 527 GCC COUNTRIES: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 528 GCC COUNTRIES: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 529 GCC COUNTRIES: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 530 GCC COUNTRIES: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 531 GCC COUNTRIES: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 532 GCC COUNTRIES: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 533 REST OF MIDDLE EAST & AFRICA: HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2022-2029 (USD MILLION)

- TABLE 534 REST OF MIDDLE EAST & AFRICA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 535 REST OF MIDDLE EAST & AFRICA: CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 536 REST OF MIDDLE EAST & AFRICA: NON-CLINICAL HEALTHCARE IT SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 537 REST OF MIDDLE EAST & AFRICA: SPECIALTY INFORMATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 538 REST OF MIDDLE EAST & AFRICA: RCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 539 REST OF MIDDLE EAST & AFRICA: MEDICATION MANAGEMENT SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 540 REST OF MIDDLE EAST & AFRICA: SCM SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 541 REST OF MIDDLE EAST & AFRICA: HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 542 REST OF MIDDLE EAST & AFRICA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 543 REST OF MIDDLE EAST & AFRICA: HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 544 REST OF MIDDLE EAST & AFRICA: PROVIDER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 545 REST OF MIDDLE EAST & AFRICA: PAYER HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 546 REST OF MIDDLE EAST & AFRICA: OPERATIONAL HEALTHCARE IT OUTSOURCING SERVICES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 547 REST OF MIDDLE EAST & AFRICA: HEALTHCARE IT MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 548 REST OF MIDDLE EAST & AFRICA: HEALTHCARE IT MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 549 REST OF MIDDLE EAST & AFRICA: HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 550 REST OF MIDDLE EAST & AFRICA: HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 551 HEALTHCARE IT MARKET: DEGREE OF COMPETITION

- TABLE 552 HEALTHCARE IT MARKET: SOLUTION AND SERVICE FOOTPRINT (20 COMPANIES), 2023

- TABLE 553 HEALTHCARE IT MARKET: COMPONENT FOOTPRINT (20 COMPANIES), 2023

- TABLE 554 HEALTHCARE IT MARKET: END USER FOOTPRINT (20 COMPANIES), 2023

- TABLE 555 HEALTHCARE IT MARKET: REGIONAL FOOTPRINT (20 COMPANIES), 2023

- TABLE 556 HEALTHCARE IT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 557 HEALTHCARE IT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 558 HEALTHCARE IT MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-SEPTEMBER 2024

- TABLE 559 HEALTHCARE IT MARKET: DEALS, JANUARY 2021-SEPTEMBER 2024

- TABLE 560 OPTUM, INC.: COMPANY OVERVIEW

- TABLE 561 OPTUM, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 562 OPTUM, INC.: PRODUCT LAUNCHES & APPROVALS

- TABLE 563 OPTUM, INC.: DEALS

- TABLE 564 COGNIZANT: COMPANY OVERVIEW

- TABLE 565 COGNIZANT: PRODUCTS & SERVICES OFFERED

- TABLE 566 COGNIZANT: PRODUCT LAUNCHES & APPROVALS

- TABLE 567 COGNIZANT: DEALS

- TABLE 568 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 569 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 570 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES & APPROVALS

- TABLE 571 KONINKLIJKE PHILIPS N.V.: DEALS

- TABLE 572 KONINKLIJKE PHILIPS N.V.: EXPANSIONS

- TABLE 573 DELL TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 574 DELL TECHNOLOGIES INC.: PRODUCTS OFFERED

- TABLE 575 DELL TECHNOLOGIES INC.: PRODUCT LAUNCHES & APPROVALS

- TABLE 576 DELL INC.: DEALS

- TABLE 577 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 578 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 579 GE HEALTHCARE: PRODUCT LAUNCHES & APPROVALS

- TABLE 580 GE HEALTHCARE: DEALS

- TABLE 581 ORACLE: COMPANY OVERVIEW

- TABLE 582 ORACLE: PRODUCTS OFFERED

- TABLE 583 ORACLE: PRODUCT LAUNCHES & APPROVALS

- TABLE 584 ORACLE: DEALS

- TABLE 585 WIPRO: COMPANY OVERVIEW

- TABLE 586 WIPRO: PRODUCTS OFFERED

- TABLE 587 WIPRO: PRODUCT LAUNCHES & APPROVALS

- TABLE 588 WIPRO: DEALS

- TABLE 589 ECLINICALWORKS: COMPANY OVERVIEW

- TABLE 590 ECLINICALWORKS: PRODUCTS OFFERED

- TABLE 591 ECLINICALWORKS: PRODUCT LAUNCHES & APPROVALS

- TABLE 592 ECLINICALWORKS: DEALS

- TABLE 593 SAS INSTITUTE INC.: COMPANY OVERVIEW

- TABLE 594 SAS INSTITUTE INC.: PRODUCTS OFFERED

- TABLE 595 SAS INSTITUTE INC.: PRODUCT LAUNCHES & APPROVALS

- TABLE 596 SAS INSTITUTE INC.: DEALS

- TABLE 597 INOVALON: COMPANY OVERVIEW

- TABLE 598 INOVALON: PRODUCTS OFFERED

- TABLE 599 INOVALON: PRODUCT LAUNCHES & APPROVALS

- TABLE 600 INOVALON: DEALS

- TABLE 601 INFOR: COMPANY OVERVIEW

- TABLE 602 INFOR: PRODUCTS OFFERED

- TABLE 603 INFOR: PRODUCT LAUNCHES & APPROVALS

- TABLE 604 INFOR: DEALS

- TABLE 605 CONIFER HEALTH SOLUTIONS, LLC.: COMPANY OVERVIEW

- TABLE 606 CONIFER HEALTH SOLUTIONS, LLC.: PRODUCTS OFFERED

- TABLE 607 CONIFER HEALTH SOLUTIONS, LLC.: DEALS

- TABLE 608 NUANCE COMMUNICATIONS, INC.: COMPANY OVERVIEW

- TABLE 609 NUANCE COMMUNICATIONS, INC.: PRODUCTS OFFERED

- TABLE 610 NUANCE COMMUNICATIONS, INC.: PRODUCT LAUNCHES & APPROVALS

- TABLE 611 NUANCE COMMUNICATIONS, INC.: DEALS

- TABLE 612 3M: COMPANY OVERVIEW

- TABLE 613 3M: PRODUCTS OFFERED

- TABLE 614 3M: PRODUCT LAUNCHES & APPROVALS

- TABLE 615 3M: DEALS, JANUARY 2021-SEPTEMBER 2024

- TABLE 616 MERATIVE: COMPANY OVERVIEW

- TABLE 617 MERATIVE: PRODUCTS OFFERED

- TABLE 618 MERATIVE: PRODUCT LAUNCHES & APPROVALS

- TABLE 619 MERATIVE: DEALS

- TABLE 620 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 621 EPIC SYSTEMS CORPORATION.: PRODUCTS OFFERED

- TABLE 622 EPIC SYSTEMS CORPORATION.: PRODUCT LAUNCHES & APPROVALS

- TABLE 623 EPIC SYSTEMS CORPORATION.: DEALS, JANUARY 2021-SEPTEMBER 2024

- TABLE 624 INTERSYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 625 INTERSYSTEMS CORPORATION: PRODUCTS OFFERED

- TABLE 626 INTERSYSTEMS CORPORATION: PRODUCT LAUNCHES & APPROVALS

- TABLE 627 INTERSYSTEMS CORPORATION: DEALS

- TABLE 628 VERADIGM LLC: COMPANY OVERVIEW

- TABLE 629 VERADIGM LLC: PRODUCTS OFFERED

- TABLE 630 VERADIGM LLC: DEALS

- TABLE 631 SALESFORCE, INC.: COMPANY OVERVIEW

- TABLE 632 SALESFORCE, INC.: PRODUCTS OFFERED

- TABLE 633 SALESFORCE, INC.: DEALS

- TABLE 634 CITIUSTECH INC: COMPANY OVERVIEW

- TABLE 635 CITIUSTECH INC: PRODUCTS OFFERED

- TABLE 636 CITIUSTECH INC: PRODUCT LAUNCHES & APPROVALS

- TABLE 637 CITIUSTECH INC: DEALS

List of Figures

- FIGURE 1 HEALTHCARE IT MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION

- FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 COMPANY REVENUE SHARE ANALYSIS ILLUSTRATION: EHR MARKET

- FIGURE 8 BOTTOM-UP APPROACH: END USER ADOPTION RATE FOR EHR

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2024-2029)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2024 VS. 2029 (USD BILLION)

- FIGURE 14 CLINICAL HCIT SOLUTIONS MARKET, BY TYPE, 2024 VS. 2029 (USD BILLION)

- FIGURE 15 NON-CLINICAL HCIT SOLUTIONS MARKET, BY TYPE, 2024 VS. 2029 (USD BILLION)

- FIGURE 16 HEALTHCARE IT MARKET, BY END USER, 2024 VS. 2029 (USD BILLION)

- FIGURE 17 HEALTHCARE IT MARKET, BY COMPONENT, 2024 VS. 2029 (USD BILLION)

- FIGURE 18 HCIT MARKET: REGIONAL SNAPSHOT

- FIGURE 19 NEED TO CURTAIL RISING HEALTHCARE COSTS & HIGH RETURNS ON INVESTMENT FOR HCIT SOLUTIONS TO DRIVE MARKET GROWTH

- FIGURE 20 CHINA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 21 HEALTHCARE PROVIDER SOLUTIONS SEGMENT TO DOMINATE NORTH AMERICAN MARKET IN 2023

- FIGURE 22 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING 2024-2029

- FIGURE 23 EMERGING MARKETS TO REGISTER HIGHER GROWTH FROM 2024 TO 2029

- FIGURE 24 HEALTHCARE IT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 TOP FIVE COUNTRIES INVESTING UNDER COHESION POLICY FOR HEALTHCARE INFRASTRUCTURE UPGRADES, 2021 TO 2027 (USD MILLION)

- FIGURE 26 HEALTHCARE SECURITY BREACHES OF 500+ RECORDS, 2009-2023

- FIGURE 27 INDIVIDUALS AFFECTED BY HEALTHCARE SECURITY BREACHES (2009-2023)

- FIGURE 28 IMPROVEMENTS IN INTEROPERABILITY IN HEALTHCARE SYSTEMS

- FIGURE 29 HEALTHCARE IT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 PIPELINE BUSINESS VALUE CHAIN ANALYSIS (2023)

- FIGURE 31 PLATFORM BUSINESS VALUE CHAIN ANALYSIS (2023)

- FIGURE 32 VALUE CHAIN ANALYSIS (2023)

- FIGURE 33 ECOSYSTEM ANALYSIS

- FIGURE 34 PATENT ANALYSIS: HEALTHCARE IT MARKET (JANUARY 2015-OCTOBER 2024)

- FIGURE 35 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR HEALTHCARE IT MARKET (JANUARY 2015 TO OCTOBER 2024)

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 37 KEY BUYING CRITERIA FOR END USERS

- FIGURE 38 REVENUE SHIFT

- FIGURE 39 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING HEALTHCARE IT ACROSS INDUSTRIES

- FIGURE 40 KEY USE CASES OF GEN AI IN HEALTHCARE IT SOLUTIONS FOR END USERS

- FIGURE 41 FIVE-PART APPROACH TO DEPLOYING GEN AI SOLUTIONS AT SCALE

- FIGURE 42 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEM

- FIGURE 43 NORTH AMERICA: HEALTHCARE IT MARKET SNAPSHOT

- FIGURE 44 EUROPE: HEALTHCARE IT MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: HEALTHCARE IT MARKET SNAPSHOT

- FIGURE 46 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HEALTHCARE IT MARKET

- FIGURE 47 REVENUE ANALYSIS OF KEY PLAYERS IN HEALTHCARE IT MARKET, 2019-2023 (USD MILLION)

- FIGURE 48 HEALTHCARE IT MARKET: MARKET SHARE ANALYSIS, 2023

- FIGURE 49 HEALTHCARE IT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 50 HEALTHCARE IT MARKET: COMPANY FOOTPRINT (20 COMPANIES), 2023

- FIGURE 51 HEALTHCARE IT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 52 BRAND/SOFTWARE COMPARATIVE ANALYSIS

- FIGURE 53 EV/EBITDA OF KEY VENDORS, 2024

- FIGURE 54 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND A 5-YEAR STOCK BETA OF HEALTHCARE IT VENDORS, 2024

- FIGURE 55 OPTUM, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 56 COGNIZANT: COMPANY SNAPSHOT (2023)

- FIGURE 57 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2023)

- FIGURE 58 DELL TECHNOLOGIES INC.: COMPANY SNAPSHOT (2023)

- FIGURE 59 GE HEALTHCARE: COMPANY SNAPSHOT (2023)

- FIGURE 60 ORACLE: COMPANY SNAPSHOT (2023)

- FIGURE 61 WIPRO: COMPANY SNAPSHOT (2023)

- FIGURE 62 3M: COMPANY SNAPSHOT (2023)

- FIGURE 63 VERADIGM LLC: COMPANY SNAPSHOT (2021)

- FIGURE 64 SALESFORCE, INC.: COMPANY SNAPSHOT (2023)

The global Healthcare IT market is projected to reach 834.35 billion by 2029 from 420.23 billion in 2024, at a CAGR of 14.7% from 2024 to 2029. The widespread adoption of technology advancement solutions is accelerating the growth of the healthcare IT market. According to the Healthcare article published in August 2024, AI-powered clinical decision support systems assist oncologists by making evidence-based therapy recommendations. It was found that AI helped in improving the dignaostics accuracy by 10-15%. Moreover, increased adoptions of EHRs improve data accessibility and drive the demand for advanced healthcare IT solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Million/Billion (USD) |

| Segments | By Solution & Service, Component, and End-user |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East Africa. |

"The telehealth solutions segment is projected to be the largest segment in the clinical healthcare IT market"

Based on the type of clinical HCIT solutions, the telehealth solutions segment is projected to be the largest segment during the forecast period. The COVID-19 pandemic has been a catalyst for significant changes in many sectors, particularly in the healthcare industry. One of the most notable transformations has been the rapid adoption and scaling up of telehealth solutions. This is majorly attributed to the government initiatives for eHealth across the globe. For instance, the WHO Global Strategy on Digital Health 2020-2025, the Slaintecare Action Plan, the HSE Corporate Plan, and Healthy Ireland government initiatives are promoting the development of telehealth solutions. Thus, there is an increasing need to improve the quality of care, growing consolidation among healthcare providers, and the rising adoption of digital and connected healthcare technologies.

"Healthcare Providers was the largest segment by the end user of healthcare IT market in 2023"

Healthcare providers segment is projected to grow at the highest growth rate in the healthcare IT market in 2023. Providers face high demand for digitized, personalized service with staffing challenges. At the same time, health systems strive to advance patient acquisition, proactive care engagement and commitments to their communities. Achieving long-term visions for financially sustainable value-based care and population health management requires healthcare information technology solutions that can improve the patient and employee experience while allowing providers to focus on what they do best - care. Thus, there is a rising demand for healthcare IT solutions to improve patient care while increasing operational efficiency.

"APAC to witness the highest growth rate during the forecast period."

In this report, the healthcare IT market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East and Africa. The healthcare IT market in APAC is projected to register the highest CAGR rate during the forecast period. The growth in the APAC market is mainly driven by factors such as the improving healthcare infrastructure, adoption of technology solutions and government initiatives for the adoption of HCIT solutions. For instance, the recent initiatives by the National Accreditation Board for Hospitals (NABH) to establish standards and guidelines for Hospital Information Systems (HIS) and Electronic Medical Records (EMR) are significantly driving the demand for healthcare technology solutions in India. Launched in September 2023, these digital health standards have already seen 275 hospitals apply for certification, with 100 achieving it. This regulatory push is not only fostering a robust market for healthcare IT solutions but also positioning India to enhance its healthcare delivery through advanced digital infrastructure.

The break-down of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 35%, and Tier 3: 20%

- By Designation - C-level: 35%, Director-level: 25%, and Others: 40%

- By Region - North America: 45%, Europe: 30%, Asia Pacific: 20%, Latin America: 3%, and Middle East & Africa: 2%.

Optum, Inc.(US), Oracle (US), and Citiustech Inc (US) are some of the key players in the healthcare IT market.

- The study includes an in-depth competitive analysis of these key players in the healthcare IT market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the healthcare IT market by solution & service (healthcare provider solutions, healthcare payer solutions, HCIT outsourcing services), by component (services, software, and hardware), by end-user (Payers, Providers, and Life Sciences Industry), and by region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the healthcare IT market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the healthcare IT market. Competitive analysis of upcoming startups in the healthcare IT market ecosystem is covered in this report.

Reasons to buy this report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the healthcare IT market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Government mandates & support for HCIT solutions, rising use of big data, high returns on investments associated with HCIT solutions, need to crucial escalating healthcare costs, growing adoption of 2-prescribing, telehealth, mhealth, and other HCIT solutions) restraints (IT infrastructural constraints in developing countries, high cost of deploying HCIT solutions in small and medium-sized hospitals in emerging countries, resistance from traditional healthcare providers) opportunities (rising use of HCIT solutions in outpatient care facilities, cloud-based EHR solutions, shift towards patient-centric healthcare delivery challenges (security concerns, interoperability issues) influencing the growth of the healthcare IT market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the healthcare IT market

- Market Development: Comprehensive information about lucrative markets - the report analyses the healthcare IT market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the healthcare IT market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Optum, Inc. (US), Cognizant (US), Koninklijke Philips N.V. (Netherlands), Oracle (US), GE Healthcare (US), Dell Inc. (US), Wipro (India), eClinicalWorks (US), SAS Institute Inc. (US), Inovalon (US); among others in the healthcare IT market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.2 KEY DATA FROM SECONDARY SOURCES

- 2.1.3 PRIMARY DATA

- 2.1.4 KEY DATA FROM PRIMARY SOURCES

- 2.1.5 INSIGHTS FROM PRIMARY EXPERTS

- 2.2 MARKET SIZE ESTIMATION: HEALTHCARE IT MARKET

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 HEALTHCARE IT MARKET OVERVIEW

- 4.2 HEALTHCARE IT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.3 NORTH AMERICA: HEALTHCARE IT MARKET, BY END USER AND COUNTRY (2023)

- 4.4 HEALTHCARE IT MARKET: REGIONAL MIX

- 4.5 HEALTHCARE IT MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Government mandates & support for HCIT solutions

- 5.2.1.2 Rising use of big data in healthcare

- 5.2.1.3 High returns on investment associated with HCIT solutions

- 5.2.1.4 Growing mhealth, telehealth, and remote patient monitoring markets

- 5.2.2 RESTRAINTS

- 5.2.2.1 Infrastructure constraints in developing countries

- 5.2.2.2 High cost of deployment in small and medium-sized hospitals in emerging economies

- 5.2.2.3 Resistance from traditional healthcare providers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising use of HCIT solutions in outpatient care facilities

- 5.2.3.2 Cloud-based EHR solutions

- 5.2.3.3 Shift toward patient-centric healthcare delivery

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising data breach concerns

- 5.2.4.2 Interoperability issues

- 5.2.4.3 Limited availability of skilled personnel

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 INTEROPERABILITY AND INTEGRATED CARE MODELS

- 5.3.2 CLOUD-BASED IT SOLUTIONS

- 5.3.3 BIG DATA IN HEALTHCARE

- 5.3.4 CLOUD COMPUTING

- 5.3.5 SMART ON FHIR

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 MACHINE LEARNING

- 5.4.2 ARTIFICIAL INTELLIGENCE

- 5.4.3 INTERNET OF THINGS

- 5.4.4 BLOCKCHAIN

- 5.4.5 AUGMENTED REALITY

- 5.5 POTENTIAL HCIT TECHNOLOGIES

- 5.5.1 AI PLATFORMS

- 5.5.2 APP-ENABLED PATIENT PORTALS

- 5.5.3 MEDICAL DEVICE DATA INTEGRATION INTO CARE DELIVERY PROCESSES

- 5.6 AI IN HEALTHCARE MARKET

- 5.7 PRICING ANALYSIS

- 5.7.1 CLINICAL DECISION SUPPORT SYSTEMS: PRICING ANALYSIS

- 5.7.2 HCIT INTEGRATION SOLUTIONS: PRICING ANALYSIS

- 5.7.3 LABORATORY INFORMATION SYSTEMS: PRICING ANALYSIS

- 5.7.4 PATIENT REGISTRY SOFTWARE: PRICING ANALYSIS

- 5.7.5 POPULATION HEALTH MANAGEMENT SOLUTIONS: PRICING ANALYSIS

- 5.7.6 INITIAL FEES

- 5.7.7 ANNUAL MAINTENANCE FEES

- 5.7.8 HEALTHCARE ANALYTICS: PRICING ANALYSIS

- 5.7.9 AVERAGE SELLING PRICE, BY REGION

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.9 REGULATORY ANALYSIS

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS