|

|

市場調査レポート

商品コード

1175993

エポキシ接着剤の世界市場:タイプ別(一液型、二液型)、最終用途業界別(建築・建設、輸送、船舶、自動車、風力エネルギー、電気・電子)、地域別 - 2027年までの予測Epoxy Adhesives Market by Type (One-component, Two-component), End-Use Industry (Building and Construction, Transportation, Marine, Automotive, Wind Energy, Electrical and Electronics), and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| エポキシ接着剤の世界市場:タイプ別(一液型、二液型)、最終用途業界別(建築・建設、輸送、船舶、自動車、風力エネルギー、電気・電子)、地域別 - 2027年までの予測 |

|

出版日: 2022年12月19日

発行: MarketsandMarkets

ページ情報: 英文 264 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のエポキシ接着剤の市場規模は、2022年の92億米ドルから、2027年には117億米ドルに達する見通しで、2022年から2027年の間にCAGR5.0%で成長すると予測されています。

アジア太平洋地域のタイプ別セグメントでは、2液型エポキシ接着剤が予測期間中にブームとなり、エポキシ接着剤市場の需要増につながると予測されています。

"エポキシ接着剤市場では、2液型エポキシ接着剤が最大セグメントを占める"

2成分エポキシ接着剤は、金額ベースで最大の市場シェアを占めています。これらの接着剤は、用途と性能において独自の多用途性を提供します。機械的、熱的、光学的、電気的特性を提供するために配合された樹脂と硬化剤から構成されています。一液性エポキシ接着剤は、即時硬化性、無溶剤システム、荷重や圧力に対する優れた耐性などの高度な特性により、エポキシ接着剤市場全体の中で急成長している分野です。

"予測期間中、アジア太平洋地域がエポキシ接着剤市場で最も急成長すると予測される"

アジア太平洋地域は、主要な大手接着剤メーカーがここに製造拠点を設けており、依然として最も高い成長率を示しています。生活水準の向上による需要増に対応するため、特に汎用接着剤を大量に使用する消費財市場や使い捨て市場において、製造品の生産が増加しています。輸出向け、国内向けを問わず、多くの新しい生産施設では、先進地域で最初に使用された旧式の機械的締結装置の代わりに、接着剤を使用するために設計された最新の製造工程が使用されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- マクロ経済指標

- 平均価格分析

- エポキシ接着剤のエコシステムと相互接続された市場

- バリューチェーン分析

- 接着剤とシーラント:エコシステム

- 貿易分析

- 特許分析

- ケーススタディ分析

- 技術分析

- 2022年から2024年の主な会議とイベント

- 関税と規制状況

第6章 エポキシ接着剤市場:タイプ別

- イントロダクション

- 一液型エポキシ接着剤

- 二液性エポキシ接着剤

- その他

第7章 エポキシ接着剤市場:最終用途業界別

- イントロダクション

- 建築・建設

- 輸送

- バス・トラック

- 鉄道

- 航空宇宙

- 風力エネルギー

- 電気・電子

- 自動車

- OEM

- アフターマーケット

- 船舶

- その他

第8章 エポキシ接着剤市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- 台湾

- タイ

- ベトナム

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- トルコ

- その他

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他

- 中東およびアフリカ

- アラブ首長国連邦

- サウジアラビア

- アフリカ

- その他

第9章 競合情勢

- 概要

- 企業評価調査手法マトリックス:定義と手法、2021年

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 中小企業(SMES)マトリックス、2021年

- 競合ベンチマーキング

- 市場シェア分析

- 市場ランキング分析

- 収益分析

- HENKEL AG & CO. KGAA

- SIKA GROUP

- 3M

- H.B. FULLER COMPANY

- DUPONT

- 競合の現状と動向

第10章 企業プロファイル

- 主要企業

- HENKEL AG & CO. KGAA

- SIKA GROUP

- 3M

- H.B. FULLER COMPANY

- DUPONT

- ILLINOIS TOOL WORKS INC.

- RPM INTERNATIONAL INC.

- HUNTSMAN INTERNATIONAL LLC

- ARKEMA

- PARKER HANNIFIN CORPORATION

- その他企業

- DELO INDUSTRIE KLEBSTOFFE GMBH & CO. KGAA

- PIDILITE INDUSTRIES

- MAPEI CORPORATION

- PANACOL-ELOSOL GMBH

- PERMABOND LLC

- MASTER BOND INC.

- WEICON GMBH & CO. KG

- HERNON MANUFACTURING INC.

- PARSON ADHESIVES INC.

- JOWAT SE

- HELMINTIN

第11章 隣接および関連市場

- イントロダクション

- 接着剤およびシーラント市場の制限

- 接着剤およびシーラント市場の定義

- 接着剤およびシーラント市場の市場概要

- 接着剤市場分析:製剤技術別

- 接着剤市場分析:用途別

- 接着剤市場分析:地域別

第12章 付録

The epoxy adhesives market is projected to grow from USD 9.2 billion in 2022 and is projected to reach USD 11.7 billion by 2027, at a CAGR of 5.0%, between 2022 and 2027 period. Two-component epoxy adhesives, by type segment in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for epoxy adhesives market.

" Two-component epoxy adhesives accounted for the largest segment of epoxy adhesives market."

Two-component epoxy adhesives account for the largest market share in terms of value. These adhesives offer a unique versatility in application and performance. They consist of a resin and a hardener formulated to offer mechanical, thermal, optical, and electrical properties. One-component epoxy adhesive is a fast-growing segment in the overall epoxy adhesives market because of its advanced properties, which include instant curing properties, solvent-less system, and superior resistance against loads or pressure.

"Asia Pacific is forecasted to be the fastest-growing epoxy adhesives market during the forecast period."

Asia Pacific remains the highest growing region, with key large adhesive producers establishing their manufacturing bases here. The production of manufactured goods is increasing to meet the increasing demand driven by improving living standards, especially in the consumer product and disposable markets, which use large volumes of commodity adhesives. Many new production facilities- export-oriented and for domestic markets-use the latest manufacturing processes designed for using adhesives instead of the older mechanical fastening equipment that manufacturers first used in developed regions.

Breakdown of Primary Interviews:

- By Company Type: Tier 1 - 60%, Tier 2 - 30%, and Tier 3 - 10%

- By Designation: C Level - 30%, D Level - 60%, and Others -10%

- By Region: Asia Pacific - 30%, North America - 35%, Europe - 20%, South America- 5%, and the Middle East & Africa - 10%

The key companies profiled in this report are Henkel AG & Co. KGaA (Germany), Sika Group (Switzerland), 3M (US), H.B. Fuller Company (US), DuPont (US).

Research Coverage:

The epoxy adhesives market has been segmented based on by Type (One-Component, Two-Component, and Others), By End-use Industry (Building & Construction, Transportation, Marine, Automotive, Wind Energy, Electrical & Electronics, and Others), and by Region (Asia Pacific, North America, Europe, South America, and Middle East & Africa).

Reasons to Buy the Report

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the market; high growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on epoxy adhesives offered by top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the market for epoxy adhesives across regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 MARKET INCLUSIONS

- 1.2.2 MARKET EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED FOR STUDY

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DESIGN

- FIGURE 2 EPOXY ADHESIVES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Primary data sources

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 5 EPOXY ADHESIVES MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS ASSESSMENT

- 2.6 LIMITATIONS

- 2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 EPOXY ADHESIVES MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 6 TWO-COMPONENT TO ACCOUNT FOR LARGER SHARE IN EPOXY ADHESIVES MARKET

- FIGURE 7 EPOXY ADHESIVES MARKET TO REGISTER HIGHEST GROWTH IN WIND ENERGY

- FIGURE 8 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR EPOXY ADHESIVES

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EPOXY ADHESIVES MARKET

- FIGURE 9 EMERGING ECONOMIES OFFER LUCRATIVE GROWTH POTENTIAL FOR EPOXY ADHESIVE MARKET PLAYERS

- 4.2 EPOXY ADHESIVES MARKET, BY TYPE

- FIGURE 10 ONE-COMPONENT TYPE TO GROW AT HIGH RATE IN OVERALL EPOXY ADHESIVES MARKET

- 4.3 EPOXY ADHESIVES MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

- FIGURE 11 DEVELOPING COUNTRIES TO GROW FASTER THAN DEVELOPED ONES

- 4.4 ASIA PACIFIC: EPOXY ADHESIVES MARKET, BY TYPE AND END-USE INDUSTRY

- FIGURE 12 BUILDING & CONSTRUCTION INDUSTRY ACCOUNTED FOR LARGEST SHARE

- 4.5 EPOXY ADHESIVES MARKET, BY COUNTRY

- FIGURE 13 INDIA TO REGISTER HIGHEST CAGR IN EPOXY ADHESIVES MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN EPOXY ADHESIVES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for lightweight and low carbon-emitting vehicles

- 5.2.1.2 High demand for epoxy adhesives in aerospace industry

- 5.2.1.3 Increasing demand for epoxy adhesives in building & construction and wind energy industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent environmental regulations in North American and European countries

- 5.2.2.2 Characteristic limitations of epoxy adhesives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for non-hazardous, green, and sustainable adhesives

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited opportunities in developed countries

- 5.2.4.2 Changing regulatory policies and standards

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS: EPOXY ADHESIVES MARKET

- FIGURE 15 EPOXY ADHESIVES MARKET: PORTER'S FIVE FORCES

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES (%)

- 5.4.2 BUYING CRITERIA

- FIGURE 17 KEY BUYING CRITERIA FOR EPOXY ADHESIVES

- TABLE 4 KEY BUYING CRITERIA FOR EPOXY ADHESIVES

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 TRENDS AND FORECAST OF GDP

- TABLE 5 GDP ANNUAL PERCENTAGE CHANGE OF KEY COUNTRIES, 2018-2027

- 5.5.2 TRENDS IN AUTOMOTIVE INDUSTRY

- TABLE 6 AUTOMOTIVE INDUSTRY PRODUCTION (2020-2021)

- 5.5.3 TRENDS IN CONSTRUCTION INDUSTRY

- FIGURE 18 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014-2035

- 5.5.4 TRENDS IN AEROSPACE INDUSTRY

- TABLE 7 GROWTH INDICATORS OF AEROSPACE INDUSTRY, 2015-2033

- TABLE 8 GROWTH INDICATORS OF AEROSPACE INDUSTRY, BY REGION, 2015-2033

- FIGURE 19 AIRBUS COMMERCIAL AIRCRAFT DELIVERIES PER REGION, 2021

- 5.5.5 TRENDS IN WIND ENERGY INDUSTRY

- FIGURE 20 GLOBAL WIND POWER MARKET OUTLOOK, BY REGION, 2020-2025 (GW)

- FIGURE 21 ONSHORE & OFFSHORE WIND POWER OUTLOOK, 2020-2025 (GW)

- FIGURE 22 NEW WIND POWER INSTALLATIONS, PERCENTAGE SHARE BY COUNTRY, 2020

- 5.6 AVERAGE PRICING ANALYSIS

- FIGURE 23 PRICING ANALYSIS OF EPOXY ADHESIVES MARKET, BY REGION, 2021

- FIGURE 24 PRICING ANALYSIS OF EPOXY ADHESIVES MARKET, BY TYPE, 2021

- FIGURE 25 PRICING ANALYSIS OF EPOXY ADHESIVES MARKET, BY END-USE INDUSTRY, 2021

- FIGURE 26 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE INDUSTRIES

- 5.7 EPOXY ADHESIVES ECOSYSTEM AND INTERCONNECTED MARKET

- TABLE 9 EPOXY ADHESIVES MARKET: SUPPLY CHAIN

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 27 EPOXY ADHESIVES: VALUE CHAIN ANALYSIS

- 5.9 ADHESIVES & SEALANTS: ECOSYSTEM

- 5.9.1 ADHESIVE INDUSTRY: YC AND YCC SHIFT

- 5.10 TRADE ANALYSIS

- TABLE 10 COUNTRY-WISE EXPORT DATA, 2019-2021 (USD THOUSAND)

- TABLE 11 COUNTRY-WISE IMPORT DATA, 2019-2021 (USD THOUSAND)

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PUBLICATION TRENDS

- FIGURE 28 NUMBER OF PATENTS PUBLISHED, 2017-2022

- 5.11.3 TOP JURISDICTION

- FIGURE 29 PATENTS PUBLISHED BY JURISDICTION, 2017-2022

- 5.11.4 TOP APPLICANTS

- FIGURE 30 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2017-2022

- TABLE 12 RECENT PATENTS BY OWNERS

- 5.12 CASE STUDY ANALYSIS

- 5.13 TECHNOLOGY ANALYSIS

- 5.14 KEY CONFERENCES & EVENTS IN 2022-2024

- TABLE 13 ELECTRONIC ADHESIVES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 EPOXY ADHESIVES MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 31 TWO-COMPONENT EPOXY ADHESIVES TO DOMINATE MARKET

- TABLE 17 EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 18 EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 19 EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (KILOTON)

- TABLE 20 EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (KILOTON)

- 6.2 ONE-COMPONENT EPOXY ADHESIVES

- 6.2.1 ONE-COMPONENT EPOXY ADHESIVES HAVE FASTER CURING SPEED THAN TWO-COMPONENT SYSTEMS

- TABLE 21 ONE-COMPONENT EPOXY ADHESIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 22 ONE-COMPONENT EPOXY ADHESIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 23 ONE-COMPONENT EPOXY ADHESIVES MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 24 ONE-COMPONENT EPOXY ADHESIVES MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

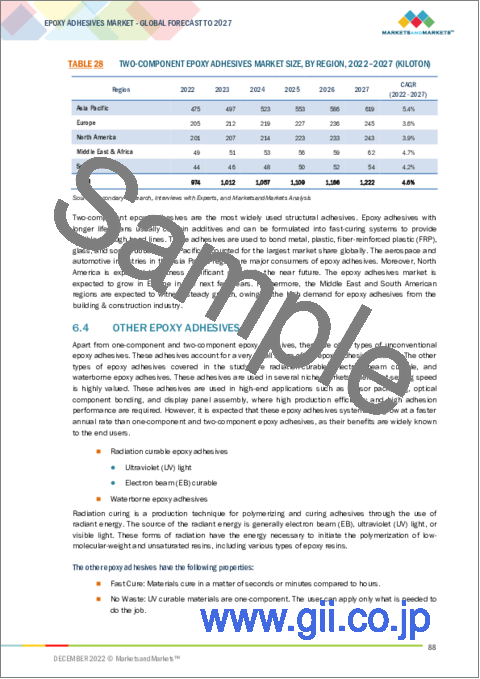

- 6.3 TWO-COMPONENT EPOXY ADHESIVES

- 6.3.1 TWO-COMPONENT EPOXY ADHESIVES WIDELY USED IN VARIOUS END-USE INDUSTRIES

- TABLE 25 TWO-COMPONENT EPOXY ADHESIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 TWO-COMPONENT EPOXY ADHESIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 27 TWO-COMPONENT EPOXY ADHESIVES MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 28 TWO-COMPONENT EPOXY ADHESIVES MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.4 OTHER EPOXY ADHESIVES

- TABLE 29 OTHER EPOXY ADHESIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 OTHER EPOXY ADHESIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 31 OTHER EPOXY ADHESIVES MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 32 OTHER EPOXY ADHESIVES MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

7 EPOXY ADHESIVES MARKET, BY END-USE INDUSTRY

- 7.1 INTRODUCTION

- FIGURE 32 BUILDING & CONSTRUCTION END-USE INDUSTRY TO DOMINATE MARKET

- TABLE 33 EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 34 EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 35 EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 36 EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 7.2 BUILDING & CONSTRUCTION

- 7.2.1 EPOXY ADHESIVES WIDELY USED FOR THEIR STRENGTH, AESTHETICS, AND REDUCED MANUFACTURING COSTS

- TABLE 37 EPOXY ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 EPOXY ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2022-2027 (USD MILLION)

- TABLE 39 EPOXY ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018-2021 (KILOTON)

- TABLE 40 EPOXY ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2022-2027 (KILOTON)

- 7.3 TRANSPORTATION

- 7.3.1 AEROSPACE SEGMENT IS BIGGEST CONSUMER OF EPOXY ADHESIVES

- TABLE 41 EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY REGION, 2022-2027 (USD MILLION)

- TABLE 43 EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY REGION, 2018-2021 (KILOTON)

- TABLE 44 EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY REGION, 2022-2027 (KILOTON)

- TABLE 45 EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 46 EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 47 EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 48 EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (TON)

- 7.3.2 BUS AND TRUCK

- FIGURE 33 GLOBAL COMMERCIAL VEHICLE PRODUCTION, BY COUNTRY (2021)

- TABLE 49 EPOXY ADHESIVES MARKET SIZE IN BUS SUB-APPLICATION, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 50 EPOXY ADHESIVES MARKET SIZE IN BUS SUB-APPLICATION, BY REGION, 2022-2027 (USD THOUSAND)

- TABLE 51 EPOXY ADHESIVES MARKET SIZE IN BUS SUB-APPLICATION, BY REGION, 2018-2021 (TON)

- TABLE 52 EPOXY ADHESIVES MARKET SIZE IN BUS SUB-APPLICATION, BY REGION, 2022-2027 (TON)

- TABLE 53 EPOXY ADHESIVES MARKET SIZE IN TRUCK SUB-APPLICATION, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 54 EPOXY ADHESIVES MARKET SIZE IN TRUCK SUB-APPLICATION, BY REGION, 2022-2027 (USD THOUSAND)

- TABLE 55 EPOXY ADHESIVES MARKET SIZE IN TRUCK SUB-APPLICATION, BY REGION, 2018-2021 (TON)

- TABLE 56 EPOXY ADHESIVES MARKET SIZE IN TRUCK SUB-APPLICATION, BY REGION, 2022-2027 (TON)

- 7.3.3 RAILWAYS

- TABLE 57 EPOXY ADHESIVES MARKET SIZE IN RAIL SUB-APPLICATION, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 58 EPOXY ADHESIVES MARKET SIZE IN RAIL SUB-APPLICATION, BY REGION, 2022-2027 (USD THOUSAND)

- TABLE 59 EPOXY ADHESIVES MARKET SIZE IN RAIL SUB-APPLICATION, BY REGION, 2018-2021 (TON)

- TABLE 60 EPOXY ADHESIVES MARKET SIZE IN RAIL SUB-APPLICATION, BY REGION, 2022-2027 (TON)

- 7.3.4 AEROSPACE

- FIGURE 34 NEW AIRPLANES DELIVERY, BY REGION, 2022-2041

- TABLE 61 EPOXY ADHESIVES MARKET SIZE IN AEROSPACE SUB-APPLICATION, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 62 EPOXY ADHESIVES MARKET SIZE IN AEROSPACE SUB-APPLICATION, BY REGION, 2022-2027 (USD THOUSAND)

- TABLE 63 EPOXY ADHESIVES MARKET SIZE IN AEROSPACE SUB-APPLICATION, BY REGION, 2018-2021 (TON)

- TABLE 64 EPOXY ADHESIVES MARKET SIZE IN AEROSPACE SUB-APPLICATION, BY REGION, 2022-2027 (TON)

- 7.4 WIND ENERGY

- 7.4.1 INCREASE IN FOCUS ON GREEN ENERGY SOURCES TO DRIVE DEMAND

- TABLE 65 EPOXY ADHESIVES MARKET SIZE IN WIND ENERGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 66 EPOXY ADHESIVES MARKET SIZE IN WIND ENERGY, BY REGION, 2022-2027 (USD MILLION)

- TABLE 67 EPOXY ADHESIVES MARKET SIZE IN WIND ENERGY, BY REGION, 2018-2021 (KILOTON)

- TABLE 68 EPOXY ADHESIVES MARKET SIZE IN WIND ENERGY, BY REGION, 2022-2027 (KILOTON)

- 7.5 ELECTRICAL & ELECTRONICS

- 7.5.1 GROWTH IN ADOPTION OF MULTI-FUNCTIONAL ELECTRONIC DEVICES PROPELLING DEMAND

- TABLE 69 EPOXY ADHESIVES MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 70 EPOXY ADHESIVES MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 71 EPOXY ADHESIVES MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2018-2021 (KILOTON)

- TABLE 72 EPOXY ADHESIVES MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2022-2027 (KILOTON)

- 7.6 AUTOMOTIVE

- 7.6.1 ADVANCEMENT IN ELECTRIC VEHICLES TO INCREASE DEMAND

- FIGURE 35 CAR PRODUCTION IN KEY COUNTRIES, 2021

- TABLE 73 EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 74 EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 75 EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018-2021 (KILOTON)

- TABLE 76 EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022-2027 (KILOTON)

- TABLE 77 EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 78 EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 79 EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 80 EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (TON)

- 7.6.2 OEM

- TABLE 81 EPOXY ADHESIVES MARKET SIZE IN OEM SUB-APPLICATION, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 82 EPOXY ADHESIVES MARKET SIZE IN OEM SUB-APPLICATION, BY REGION, 2022-2027 (USD THOUSAND)

- TABLE 83 EPOXY ADHESIVES MARKET SIZE IN OEM SUB-APPLICATION, BY REGION, 2018-2021 (TON)

- TABLE 84 EPOXY ADHESIVES MARKET SIZE IN OEM SUB-APPLICATION, BY REGION, 2022-2027 (TON)

- 7.6.3 AFTERMARKET

- TABLE 85 EPOXY ADHESIVES MARKET SIZE IN AFTERMARKET SUB-APPLICATION, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 86 EPOXY ADHESIVES MARKET SIZE IN AFTERMARKET SUB-APPLICATION, BY REGION, 2022-2027 (USD THOUSAND)

- TABLE 87 EPOXY ADHESIVES MARKET SIZE IN AFTERMARKET SUB-APPLICATION, BY REGION, 2018-2021 (TON)

- TABLE 88 EPOXY ADHESIVES MARKET SIZE IN AFTERMARKET SUB-APPLICATION, BY REGION, 2022-2027 (TON)

- 7.7 MARINE

- 7.7.1 INCREASE IN USE OF PLASTIC AND COMPOSITES IN FABRICATING BOATS FUELING DEMAND

- TABLE 89 EPOXY ADHESIVES MARKET SIZE IN MARINE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 90 EPOXY ADHESIVES MARKET SIZE IN MARINE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 91 EPOXY ADHESIVES MARKET SIZE IN MARINE, BY REGION, 2018-2021 (KILOTON)

- TABLE 92 EPOXY ADHESIVES MARKET SIZE IN MARINE, BY REGION, 2022-2027 (KILOTON)

- 7.8 OTHER END-USE INDUSTRIES

- TABLE 93 EPOXY ADHESIVES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2021 (USD MILLION)

- TABLE 94 EPOXY ADHESIVES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022-2027 (USD MILLION)

- TABLE 95 EPOXY ADHESIVES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2021 (KILOTON)

- TABLE 96 EPOXY ADHESIVES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022-2027 (KILOTON)

8 EPOXY ADHESIVES MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 36 ASIA PACIFIC TO DOMINATE EPOXY ADHESIVES MARKET IN 2027

- TABLE 97 EPOXY ADHESIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 98 EPOXY ADHESIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 99 EPOXY ADHESIVES MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 100 EPOXY ADHESIVES MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 8.2 ASIA PACIFIC

- FIGURE 37 ASIA PACIFIC: EPOXY ADHESIVES MARKET SNAPSHOT

- TABLE 101 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 102 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 103 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 104 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 105 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 106 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (KILOTON)

- TABLE 108 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (KILOTON)

- TABLE 109 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 112 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 113 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 114 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 115 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 116 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (TON)

- TABLE 117 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 118 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 119 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 120 ASIA PACIFIC: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (TON)

- 8.2.1 CHINA

- 8.2.1.1 China accounted for largest share of epoxy adhesives market in Asia Pacific

- 8.2.2 JAPAN

- 8.2.2.1 Growing demand for lightweight and small passenger cars driving need for epoxy adhesives

- 8.2.3 INDIA

- 8.2.3.1 Government's initiatives to boost country's economy contributing to market growth

- 8.2.4 SOUTH KOREA

- 8.2.4.1 Aerospace industry driving epoxy adhesives market in country

- 8.2.5 TAIWAN

- 8.2.5.1 Growth in demand for aircraft part manufacturing boosting market growth

- 8.2.6 THAILAND

- 8.2.6.1 Rapid industrialization and increasing consumer spending driving demand

- 8.2.7 VIETNAM

- 8.2.7.1 Increase in supply of parts of cabins and storage cabins boosting epoxy adhesives market

- 8.2.8 REST OF ASIA PACIFIC

- 8.3 NORTH AMERICA

- FIGURE 38 NORTH AMERICA: EPOXY ADHESIVES MARKET SNAPSHOT

- TABLE 121 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 122 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 123 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 124 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 125 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 126 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 127 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (KILOTON)

- TABLE 128 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (KILOTON)

- TABLE 129 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 130 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 131 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 132 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 133 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 134 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 135 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 136 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (TON)

- TABLE 137 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 138 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 139 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 140 NORTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (TON)

- 8.3.1 US

- 8.3.1.1 Presence of manufacturing facilities, strong economic sector, and increase in expenditure key market drivers

- 8.3.2 CANADA

- 8.3.2.1 Wide range of manufacturing capabilities boosting market growth

- 8.3.3 MEXICO

- 8.3.3.1 Growth in building & construction, transportation, and automotive industries driving epoxy adhesives market

- 8.4 EUROPE

- FIGURE 39 EUROPE: EPOXY ADHESIVES MARKET SNAPSHOT

- TABLE 141 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 142 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 143 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 144 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 145 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 146 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 147 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (KILOTON)

- TABLE 148 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (KILOTON)

- TABLE 149 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 150 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 151 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 152 EUROPE: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 153 EUROPE: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 154 EUROPE: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 155 EUROPE: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 156 EUROPE: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (TON)

- TABLE 157 EUROPE: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 158 EUROPE: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 159 EUROPE: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 160 EUROPE: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (TON)

- 8.4.1 GERMANY

- 8.4.1.1 Growing domestic and international consumer markets to aid growth

- 8.4.2 FRANCE

- 8.4.2.1 New commercial and defense contracts in aerospace sector to drive market

- 8.4.3 ITALY

- 8.4.3.1 Motor manufacturing companies shifting production facilities to Italy to create growth opportunities

- 8.4.4 UK

- 8.4.4.1 Growth in building & construction and transportation industries to drive market growth

- 8.4.5 RUSSIA

- 8.4.5.1 Demand from domestic and regional airline services to impact market growth

- 8.4.6 TURKEY

- 8.4.6.1 Spending by companies on branding to drive market

- 8.4.7 REST OF EUROPE

- 8.5 SOUTH AMERICA

- FIGURE 40 SOUTH AMERICA: BRAZIL TO BE LARGEST EPOXY ADHESIVES MARKET

- TABLE 161 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 162 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 163 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 164 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 165 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 166 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 167 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (KILOTON)

- TABLE 168 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (KILOTON)

- TABLE 169 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 170 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 171 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 172 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 173 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 174 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 175 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 176 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (TON)

- TABLE 177 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 178 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 179 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 180 SOUTH AMERICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (TON)

- 8.5.1 BRAZIL

- 8.5.1.1 Fast growth of manufacturing sector driving consumption of epoxy adhesives in Brazil

- 8.5.2 ARGENTINA

- 8.5.2.1 Huge investments by government to modernize economy supporting market growth

- 8.5.3 COLOMBIA

- 8.5.3.1 Continuous investments in wind energy, automotive, and industrial assembly driving market

- 8.5.4 REST OF SOUTH AMERICA

- 8.6 MIDDLE EAST & AFRICA

- FIGURE 41 MIDDLE EAST & AFRICA: SAUDI ARABIA TO BE LARGEST EPOXY ADHESIVES MARKET

- TABLE 181 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 184 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 185 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2018-2021 (KILOTON)

- TABLE 188 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY TYPE, 2022-2027 (KILOTON)

- TABLE 189 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 192 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 193 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 194 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 195 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 196 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE IN TRANSPORTATION, BY SUB-APPLICATION, 2022-2027 (TON)

- TABLE 197 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 198 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 199 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2018-2021 (TON)

- TABLE 200 MIDDLE EAST & AFRICA: EPOXY ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY SUB-APPLICATION, 2022-2027 (TON)

- 8.6.1 UAE

- 8.6.1.1 Growth in building & construction sector to drive epoxy adhesives market

- 8.6.2 SAUDI ARABIA

- 8.6.2.1 Real estate development to fuel demand for epoxy adhesives in Saudi Arabia

- 8.6.3 AFRICA

- 8.6.3.1 Rapid urbanization to boost building & construction industry

- 8.6.4 REST OF MIDDLE EAST & AFRICA

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- TABLE 201 OVERVIEW OF STRATEGIES ADOPTED BY KEY EPOXY ADHESIVE PLAYERS (2017-2022)

- 9.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021

- 9.2.1 STARS

- 9.2.2 EMERGING LEADERS

- 9.2.3 PARTICIPANTS

- 9.2.4 PERVASIVE PLAYERS

- FIGURE 42 EPOXY ADHESIVES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.3 STRENGTH OF PRODUCT PORTFOLIO

- 9.4 BUSINESS STRATEGY EXCELLENCE

- 9.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MATRIX, 2021

- 9.5.1 RESPONSIVE COMPANIES

- 9.5.2 PROGRESSIVE COMPANIES

- 9.5.3 STARTING BLOCKS

- 9.5.4 DYNAMIC COMPANIES

- FIGURE 43 EPOXY ADHESIVES MARKET: SMES COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.6 COMPETITIVE BENCHMARKING

- TABLE 202 EPOXY ADHESIVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 203 EPOXY ADHESIVES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 204 COMPANY EVALUATION MATRIX: EPOXY ADHESIVES

- 9.7 MARKET SHARE ANALYSIS

- FIGURE 44 MARKET SHARE, BY KEY PLAYERS (2021)

- TABLE 205 EPOXY ADHESIVES MARKET: INTENSITY OF COMPETITIVE RIVALRY, 2021

- 9.8 MARKET RANKING ANALYSIS

- FIGURE 45 MARKET RANKING ANALYSIS, 2021

- 9.9 REVENUE ANALYSIS

- FIGURE 46 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017-2021

- 9.9.1 HENKEL AG & CO. KGAA

- 9.9.2 SIKA GROUP

- 9.9.3 3M

- 9.9.4 H.B. FULLER COMPANY

- 9.9.5 DUPONT

- 9.10 COMPETITIVE SITUATION & TRENDS

- TABLE 206 EPOXY ADHESIVES MARKET: PRODUCT LAUNCHES, 2016-2022

- TABLE 207 EPOXY ADHESIVES MARKET: DEALS, 2016-2022

10 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 10.1 MAJOR PLAYERS

- 10.1.1 HENKEL AG & CO. KGAA

- TABLE 208 HENKEL AG & CO. KGAA: BUSINESS OVERVIEW

- FIGURE 47 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- TABLE 209 HENKEL AG & CO. KGAA: DEALS

- 10.1.2 SIKA GROUP

- TABLE 210 SIKA GROUP: BUSINESS OVERVIEW

- FIGURE 48 SIKA GROUP: COMPANY SNAPSHOT

- TABLE 211 SIKA GROUP: DEALS

- 10.1.3 3M

- TABLE 212 3M: BUSINESS OVERVIEW

- FIGURE 49 3M: COMPANY SNAPSHOT

- 10.1.4 H.B. FULLER COMPANY

- TABLE 213 H.B. FULLER COMPANY: BUSINESS OVERVIEW

- FIGURE 50 H.B. FULLER: COMPANY SNAPSHOT

- TABLE 214 H.B. FULLER COMPANY: DEALS

- 10.1.5 DUPONT

- TABLE 215 DUPONT: BUSINESS OVERVIEW

- FIGURE 51 DUPONT: COMPANY SNAPSHOT

- TABLE 216 DUPONT: DEALS

- 10.1.6 ILLINOIS TOOL WORKS INC.

- TABLE 217 ILLINOIS TOOL WORKS INC.: BUSINESS OVERVIEW

- FIGURE 52 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

- 10.1.7 RPM INTERNATIONAL INC.

- TABLE 218 RPM INTERNATIONAL INC.: BUSINESS OVERVIEW

- FIGURE 53 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

- 10.1.8 HUNTSMAN INTERNATIONAL LLC

- TABLE 219 HUNTSMAN INTERNATIONAL LLC: BUSINESS OVERVIEW

- FIGURE 54 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

- TABLE 220 HUNTSMAN INTERNATIONAL LLC: DEALS

- 10.1.9 ARKEMA

- TABLE 221 ARKEMA: BUSINESS OVERVIEW

- FIGURE 55 ARKEMA: COMPANY SNAPSHOT

- TABLE 222 ARKEMA: DEALS

- 10.1.10 PARKER HANNIFIN CORPORATION

- TABLE 223 PARKER HANNIFIN CORPORATION: BUSINESS OVERVIEW

- FIGURE 56 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

- TABLE 224 PARKER HANNIFIN CORPORATION: PRODUCT LAUNCH

- TABLE 225 PARKER HANNIFIN CORPORATION: DEALS

- 10.2 OTHER COMPANIES

- 10.2.1 DELO INDUSTRIE KLEBSTOFFE GMBH & CO. KGAA

- TABLE 226 DELO INDUSTRIE KLEBSTOFFE GMBH & CO. KGAA: BUSINESS OVERVIEW

- 10.2.2 PIDILITE INDUSTRIES

- TABLE 227 PIDILITE INDUSTRIES: BUSINESS OVERVIEW

- 10.2.3 MAPEI CORPORATION

- TABLE 228 MAPEI CORPORATION: BUSINESS OVERVIEW

- TABLE 229 MAPEI CORPORATION: DEALS

- 10.2.4 PANACOL-ELOSOL GMBH

- TABLE 230 PANACOL-ELOSOL GMBH: BUSINESS OVERVIEW

- TABLE 231 PANACOL-ELOSOL GMBH: PRODUCT LAUNCH

- 10.2.5 PERMABOND LLC

- TABLE 232 PERMABOND LLC: BUSINESS OVERVIEW

- TABLE 233 PERMABOND LLC: PRODUCT LAUNCH

- 10.2.6 MASTER BOND INC.

- TABLE 234 MASTER BOND INC.: BUSINESS OVERVIEW

- 10.2.7 WEICON GMBH & CO. KG

- TABLE 235 WEICON GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 236 WEICON GMBH & CO. KG: PRODUCT LAUNCH

- 10.2.8 HERNON MANUFACTURING INC.

- TABLE 237 HERNON MANUFACTURING INC.: BUSINESS OVERVIEW

- 10.2.9 PARSON ADHESIVES INC.

- TABLE 238 PARSON ADHESIVES INC.: BUSINESS OVERVIEW

- 10.2.10 JOWAT SE

- TABLE 239 JOWAT SE: BUSINESS OVERVIEW

- 10.2.11 HELMINTIN

- TABLE 240 HELMINTIN: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 ADJACENT AND RELATED MARKETS

- 11.1 INTRODUCTION

- 11.2 ADHESIVES & SEALANTS MARKET LIMITATIONS

- 11.3 ADHESIVES & SEALANTS MARKET DEFINITION

- 11.4 ADHESIVES & SEALANTS MARKET OVERVIEW

- 11.5 ADHESIVES MARKET ANALYSIS, BY FORMULATING TECHNOLOGY

- TABLE 241 ADHESIVES MARKET SIZE, BY FORMULATING TECHNOLOGY, 2017-2020 (USD MILLION)

- TABLE 242 ADHESIVES MARKET SIZE, BY FORMULATING TECHNOLOGY, 2021-2026 (USD MILLION)

- TABLE 243 ADHESIVES MARKET SIZE, BY FORMULATING TECHNOLOGY, 2017-2020 (KILOTON)

- TABLE 244 ADHESIVES MARKET SIZE, BY FORMULATING TECHNOLOGY, 2021-2026 (KILOTON)

- 11.6 ADHESIVES MARKET ANALYSIS, BY APPLICATION

- TABLE 245 ADHESIVES MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 246 ADHESIVES MARKET SIZE, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 247 ADHESIVES MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 248 ADHESIVES MARKET SIZE, BY APPLICATION, 2021-2026 (KILOTON)

- 11.7 ADHESIVES MARKET ANALYSIS, BY REGION

- TABLE 249 ADHESIVES MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 250 ADHESIVES MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

- TABLE 251 ADHESIVES MARKET SIZE, BY REGION, 2017-2020 (KILOTON)

- TABLE 252 ADHESIVES MARKET SIZE, BY REGION, 2021-2026 (KILOTON)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS