|

|

市場調査レポート

商品コード

1172592

スマート水道メーターの世界市場:メーターの種類別 (超音波、電磁式、スマート機械式)・用途別 (水道事業、産業)・技術別 (AMI、AMR)・コンポーネント別 (メーター・付属品、通信)・地域別の将来予測 (2027年まで)Smart Water Metering Market by Meter type (Ultrasonic, Electromagnetic, Smart Mechanical), Application (Water Utilities, Industries), Technology (AMI, AMR), Component (Meter & Accessories, Communications) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| スマート水道メーターの世界市場:メーターの種類別 (超音波、電磁式、スマート機械式)・用途別 (水道事業、産業)・技術別 (AMI、AMR)・コンポーネント別 (メーター・付属品、通信)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年12月12日

発行: MarketsandMarkets

ページ情報: 英文 193 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のスマート水道メーター市場は、2022年の37億米ドルから2027年には64億米ドルへと、予測期間中に11.6%のCAGRで成長すると予想されています。

工業化と都市化により、水の消費量が増加し、水の総供給量に影響を与えています。このような要因が、水の損失を減らすために水道メーターのインフラを改善する必要性を高めています。

メーターの種類別に見ると、電磁式メーターが最大のセグメントとなる見通しです。電磁式メーターは超音波メーターよりも安価で圧力損失が少なく、気泡水の測定が可能で、寿命が長いなどの利点があります。

コンポーネント別では、ITソリューションのセグメントが最も急速に成長すると見込まれています。水道業界におけるデジタル技術の急速な普及が、ITソリューション分野の高い成長率につながっています。

地域別に見ると、アジア太平洋が、中国・オーストラリア・シンガポール・インドなどの国々で水消費・供給用スマートインフラを開発する動きを受けて、2番目に大きな成長市場になると予想されます。このような取り組みは、サプライヤーにとって同地域での事業拡大の好機となっており、今後の市場成長機会をもたらすものと思われます。

当レポートでは、世界のスマート水道メーターの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、用途別・コンポーネント別・メーターの種類別・技術別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- マーケットマップ

- バリューチェーン分析

- 原材料・部品サプライヤー

- スマート水道メーターメーカー

- ソリューション/サービスプロバイダー、システムインテグレーター

- 流通業者、アフターサービス業者

- エンドユーザー

- 主な会議とイベント (2022年~2024年)

- 規範と規制

- 特許分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 技術分析

- 貿易データ

- 主な利害関係者と購入基準

- 平均販売価格の傾向

第6章 スマート水道メーター市場:用途別

- イントロダクション

- 水道事業

- 産業

第7章 スマート水道メーター市場:コンポーネント別

- イントロダクション

- メーター・付属品

- ITソリューション

- 通信

第8章 スマート水道メーター市場:メーターの種類別

- イントロダクション

- 電磁式メーター

- 超音波メーター

- スマート機械式メーター

第9章 スマート水道メーター市場:技術別

- イントロダクション

- AMR

- AMI

第10章 スマート水道メーター市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- オランダ

- デンマーク

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- マレーシア

- オーストラリア

- インド

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- ウルグアイ

- 他の南米諸国

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- イスラエル

- 南アフリカ

- エジプト

- 他の中東・アフリカ諸国

第11章 競合情勢

- 主要企業の戦略

- 上位5社の市場シェア分析 (2021年)

- スマート水道メーターの市場シェア分析 (2021年)

- 企業収益分析 (5年間分)

- 企業評価マトリックス/クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合ベンチマーキング

- スマート水道メーター市場:企業のフットプリント

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- BADGER METER, INC.

- SENSUS

- DIEHL STIFTUNG & CO. KG

- ACLARA TECHNOLOGIES

- ITRON INC.

- KAMSTRUP A/S

- LANDIS+GYR

- HONEYWELL INTERNATIONAL

- B METERS SRL

- ARAD GROUP

- ZENNER INTERNATIONAL GMBH & CO. KG

- NEPTUNE TECHNOLOGY GROUP

- ISKRAEMECO GROUP

- SAGEMCOM

- WASION GROUP

- その他の企業

- WATERTECH S.P.A.

- BAYLAN WATER METERS

- WEGOT UTILITY SOLUTIONS

- APATOR S.A.

- STMICROELECTRONICS N.V.

第13章 隣接・関連市場

- イントロダクション

- 制限事項

- スマート水道メーター:相互接続市場

- スマートメーター市場

- 米国の水道メーター市場

第14章 付録

The Smart Water Metering market is expected to grow at a CAGR of 11.6% during the forecast period, from an estimated USD 3.7 Billion in 2022 to USD 6.4 Billion in 2027. Industrialization and urbanization have led to an increase in water consumption, thus impacting the total availability of water supply. Such factors are driving the need for improving water metering infrastructure to reduce heavy water losses

"Electromagnetic meters is expected to emerge as the largest segment based on meter type"

The smart water metering market has been segmented into ultrasonic meters, electromagnetic meters, and smart mechanical meters based on meter type. Electromagnetic meters are cheaper than ultrasonic meters and offer benefits such as low-pressure loss, the capability of measuring bubbling water, and a longer lifespan. These factors are driving the growth of the electromagnetic smart water metering market.

"IT solutions: The fastest segment for the smart water metering market, by component "

Based on the component, the smart water metering market has been split into meters and accessories, IT solutions, and communications. IoT sensors and data management software platforms help water utilities avoid such losses by analyzing the probable reasons. The fast adoption rate of digital technologies in the water industry is leading to the high growth rate of the IT solutions segment.

"Asia Pacific is expected to be the second largest market during the forecast period."

The Asia Pacific region is expected to be the second largest growing market due to Countries such as China, Australia, Singapore, and India developing smart infrastructure for water consumption and water supply. Such initiatives are offering lucrative opportunities for suppliers to expand their regional reach in the Asia Pacific and are likely to create growth opportunities in the Asia Pacific smart water metering market during the forecast period

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%and Tier 3- 25%

By Designation: C-Level- 40%, Managers- 25%, and Others- 40%

By Region: North America- 33%, Europe- 27%, Asia Pacific- 20%, the Middle East & Africa- 8%, and South America-12%

Note: Others includes product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined based on their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The smart water metering market is dominated by a few major players that have a wide regional presence. The leading players in the smart water metering are Badger Meter, Inc. (US), Sensus (US), Aclara Technologies (US), Itron, Inc. (US), and Diehl Stiftung & Co. KG (Germany)

Research Coverage:

The report defines, describes, and forecasts the global smart water metering market, by meter type, , component, technology, and Application. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the smart water meters market.

Key Benefits of Buying the Report

1. The report identifies and addresses the key markets for smart water meters, which would help equipment manufacturers review the growth in demand.

2. The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

3. The report will help key players understand the strategies of their competitors better and help them in making better strategic decisions.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 SMART WATER METERING MARKET, BY METER TYPE: INCLUSIONS AND EXCLUSIONS

- 1.3.2 SMART WATER METERING MARKET, BY TECHNOLOGY: INCLUSIONS AND EXCLUSIONS

- 1.3.3 SMART WATER METERING MARKET, BY COMPONENT: INCLUSIONS AND EXCLUSIONS

- 1.3.4 SMART WATER METERING MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 SMART WATER METERING MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 SMART WATER METERING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.2 SCOPE

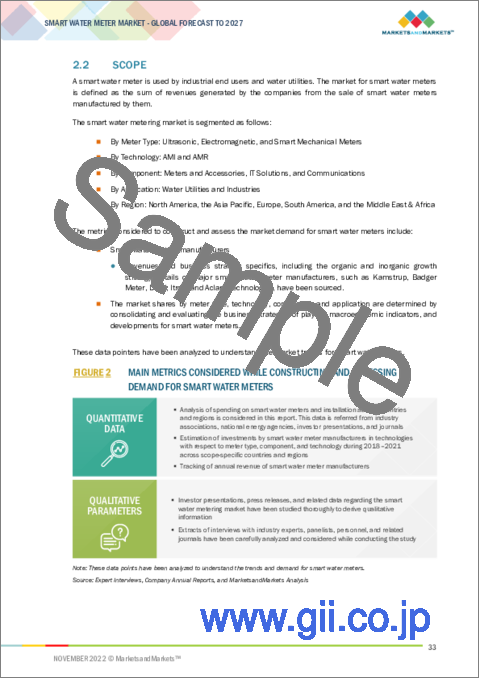

- FIGURE 2 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR SMART WATER METERS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Regional analysis

- 2.3.3.2 Country analysis

- 2.3.3.3 Assumptions for demand side

- 2.3.3.4 Calculations for demand side

- 2.3.4 SUPPLY-SIDE ANALYSIS

- FIGURE 5 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF SMART WATER METERS

- FIGURE 6 SMART WATER METERING MARKET: SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side calculations

- 2.3.4.2 Assumptions for supply side

- FIGURE 7 COMPANY REVENUE ANALYSIS, 2021

- 2.3.5 FORECAST

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

3 EXECUTIVE SUMMARY

- TABLE 1 SMART WATER METERING MARKET SNAPSHOT

- FIGURE 9 ELECTROMAGNETIC METERS SEGMENT TO HOLD LARGEST SHARE OF SMART WATER METERING MARKET, BY METER TYPE, DURING FORECAST PERIOD

- FIGURE 10 AMI SEGMENT TO DOMINATE SMART WATER METERING MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

- FIGURE 11 METERS & ACCESSORIES TO FORM LARGEST COMPONENT SEGMENT IN SMART WATER METERING MARKET DURING FORECAST PERIOD

- FIGURE 12 WATER UTILITIES SEGMENT TO LEAD SMART WATER METERING MARKET, BY APPLICATION, DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN SMART WATER METERING MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN SMART WATER METERING MARKET DURING FORECAST PERIOD

- FIGURE 14 INVESTMENTS IN WATER METERING INFRASTRUCTURE BY WATER UTILITIES TO REDUCE NON-REVENUE WATER EXPECTED TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICAN SMART WATER METERING MARKET, BY TECHNOLOGY AND COUNTRY

- FIGURE 15 WATER UTILITIES SEGMENT DOMINATED NORTH AMERICAN SMART WATER METERING MARKET IN 2021

- 4.3 SMART WATER METERING MARKET, BY METER TYPE

- FIGURE 16 ELECTROMAGNETIC METERS SEGMENT TO DOMINATE SMART WATER METERING MARKET, BY METER TYPE, IN 2027

- 4.4 SMART WATER METERING MARKET, BY COMPONENT

- FIGURE 17 METERS & ACCESSORIES SEGMENT TO DOMINATE SMART WATER METERING MARKET, BY COMPONENT, DURING FORECAST PERIOD

- 4.5 SMART WATER METERING MARKET, BY TECHNOLOGY

- FIGURE 18 AMI SEGMENT TO DOMINATE SMART WATER METERING MARKET, BY TECHNOLOGY, IN 2027

- 4.6 SMART WATER METERING MARKET, BY APPLICATION

- FIGURE 19 WATER UTILITIES SEGMENT TO DOMINATE SMART WATER METERING MARKET, BY APPLICATION, IN 2027

- 4.7 SMART WATER METERING MARKET, BY REGION

- FIGURE 20 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 SMART WATER METERING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Need for significant reduction in loss caused by non-revenue water

- FIGURE 22 PERCENTAGE OF NON-REVENUE WATER OBSERVED BY WATER UTILITIES ACROSS COUNTRIES, 2021

- 5.2.1.2 Need for smart water metering to optimize water consumption

- FIGURE 23 URBAN AND RURAL POPULATION TRENDS (2015-2021)

- 5.2.1.3 Need for accuracy in billing

- 5.2.1.4 Increasing adoption of smart water meters in US and Europe

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of government initiatives

- 5.2.2.2 Lack of awareness and acceptance by end users

- 5.2.2.3 Reduced shelf-life of smart water meters

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Replacement of aging infrastructure

- 5.2.3.2 Digitalization of water industry operations

- 5.2.3.3 Integration of IoT, artificial intelligence, and machine learning technologies into smart water meters

- 5.2.3.4 Increasing focus of developing countries on improving water distribution networks and water management practices

- TABLE 2 WATER AND WASTEWATER TREATMENT PROJECTS IN INDIA

- 5.2.4 CHALLENGES

- 5.2.4.1 High deployment cost and long payback period

- 5.2.4.2 Lack of interoperability and availability of inexpensive digital upgrades

- 5.2.4.3 Maintenance, security, and integrity of smart water meters and associated data, along with requirement for skilled professionals

- 5.2.4.4 Halted smart city projects due to pandemic outbreak

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR SMART WATER METERING PROVIDERS

- FIGURE 24 REVENUE SHIFT FOR SMART WATER METERING PROVIDERS

- 5.4 MARKET MAP

- FIGURE 25 MARKET MAP: SMART WATER METERING MARKET

- TABLE 3 SMART WATER METERING MARKET: ROLE IN ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS: SMART WATER METERING MARKET

- 5.5.1 RAW MATERIAL/COMPONENT SUPPLIERS

- 5.5.2 SMART WATER METER MANUFACTURERS

- 5.5.3 SOLUTION/SERVICE PROVIDERS AND SYSTEM INTEGRATORS

- 5.5.4 DISTRIBUTORS AND POST-SALES SERVICE PROVIDERS

- 5.5.5 END USERS

- 5.6 KEY CONFERENCES AND EVENTS, 2022-2024

- TABLE 4 SMART WATER METERING MARKET: LIST OF CONFERENCES AND EVENTS

- 5.7 CODES AND REGULATIONS

- 5.7.1 CODES AND REGULATIONS RELATED TO SMART WATER METERS

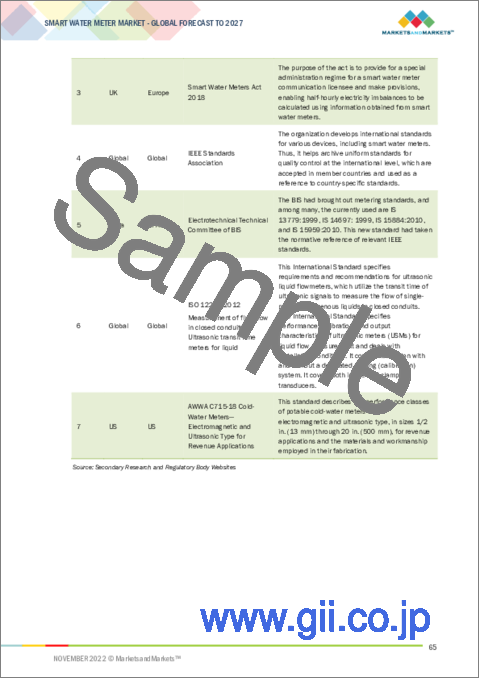

- TABLE 5 SMART WATER METERS: CODES AND REGULATIONS

- 5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 PATENT ANALYSIS

- TABLE 11 SMART WATER METERS: INNOVATIONS AND PATENT REGISTRATIONS, JUNE 2016-JUNE 2022

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 SMART WATER METERING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 SMART WATER METERING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF SUBSTITUTES

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF NEW ENTRANTS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 MIDWESTERN UNIVERSITY IMPROVED SUSTAINABILITY WITH ELECTROMAGNETIC METERS

- 5.10.1.1 Problem statement

- 5.10.1.2 Solution

- 5.10.2 SMART WATER METERS OVERCOME CHALLENGE AT BELLA VISTA PROPERTY OWNERS ASSOCIATION

- 5.10.2.1 Problem statement

- 5.10.2.2 Solution

- 5.10.3 KAMSTRUP HELPS REVERSE WATER LOSS IN RURAL MUNICIPALITY IN ONEIDA, TENNESSEE

- 5.10.3.1 Problem statement

- 5.10.3.2 Solution

- 5.10.4 SMART WATER SYSTEM HELPS MONROE, LOUISIANA, TO IDENTIFY INDIVIDUAL LEAKING HOUSES AFTER WINTER STORMS

- 5.10.4.1 Problem statement

- 5.10.4.2 Solution

- 5.10.1 MIDWESTERN UNIVERSITY IMPROVED SUSTAINABILITY WITH ELECTROMAGNETIC METERS

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 TRADE DATA

- FIGURE 28 GLOBAL IMPORT AND EXPORT SCENARIO FOR HS CODE 9026, 2018-2021 (USD BILLION)

- TABLE 13 GLOBAL TRADE DATA FOR HS CODE 9026, 2018-2021 (USD MILLION)

- FIGURE 29 GLOBAL IMPORT AND EXPORT SCENARIO FOR HS CODE 902810, 2018-2021 (USD BILLION)

- TABLE 14 GLOBAL TRADE DATA FOR HS CODE 902820, 2018-2021 (USD MILLION)

- FIGURE 30 GLOBAL IMPORT AND EXPORT SCENARIO FOR HS CODE 902890, 2018-2021 (USD BILLION)

- TABLE 15 GLOBAL TRADE DATA FOR HS CODE 902890, 2018-2021 (USD MILLION)

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY END-USE INDUSTRY

- TABLE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY END-USE INDUSTRY (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR END-USE INDUSTRY

- TABLE 17 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- 5.14 AVERAGE SELLING PRICE TREND

- FIGURE 33 AVERAGE SELLING PRICES OF DIFFERENT TYPES OF METERS OFFERED BY KEY PLAYERS

- TABLE 18 AVERAGE SELLING PRICES FOR DIFFERENT TYPES OF SMART WATER METERS OFFERED BY KEY PLAYERS (USD), 2021

6 SMART WATER METERING MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- FIGURE 34 WATER UTILITIES SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2021

- TABLE 19 SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2 WATER UTILITIES

- 6.2.1 SIGNIFICANT DEVELOPMENTS IN SMART METERING INFRASTRUCTURE TO DRIVE GROWTH

- TABLE 20 WATER UTILITIES: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 INDUSTRIES

- 6.3.1 GROWING FOCUS ON REDUCING EXPENDITURE DUE TO WATER LOSSES TO SPUR GROWTH

- TABLE 21 INDUSTRIES: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

7 SMART WATER METERING MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 35 METERS & ACCESSORIES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- TABLE 22 SMART WATER METERING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- 7.2 METERS & ACCESSORIES

- 7.2.1 TECHNOLOGICAL INNOVATIONS IN METERING DEVICES TO PROPEL GROWTH

- TABLE 23 METERS & ACCESSORIES: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 IT SOLUTIONS

- 7.3.1 INCREASING DEMAND FOR DATA MANAGEMENT SOFTWARE TO DRIVE GROWTH

- TABLE 24 IT SOLUTIONS: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.4 COMMUNICATIONS

- 7.4.1 CONTINUOUS UPGRADES IN COMMUNICATION NETWORKS TO SUPPORT GROWTH

- TABLE 25 COMMUNICATIONS: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

8 SMART WATER METERING MARKET, BY METER TYPE

- 8.1 INTRODUCTION

- FIGURE 36 ELECTROMAGNETIC METERS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- TABLE 26 SMART WATER METERING MARKET, BY METER TYPE, 2020-2027 (USD MILLION)

- 8.2 ELECTROMAGNETIC METERS

- 8.2.1 ELECTROMAGNETIC METERS OFFER INCREASED ACCURACY LEVEL IN WATER TRACKING

- TABLE 27 ELECTROMAGNETIC METERS: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.3 ULTRASONIC METERS

- 8.3.1 ULTRASONIC METERS OFFER EFFICIENT DETECTION OF LEAKS, BURSTS, AND REVERSE FLOW

- TABLE 28 ULTRASONIC METERS: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.4 SMART MECHANICAL METERS

- 8.4.1 LOW COST OF MECHANICAL METERS TO CREATE GROWTH OPPORTUNITIES IN DEVELOPING COUNTRIES

- TABLE 29 SMART MECHANICAL METERS: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

9 SMART WATER METERING MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- FIGURE 37 AMI SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2021

- TABLE 30 SMART WATER METERING MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 9.2 AMR

- 9.2.1 AMR ENABLES REDUCED MANUAL INTERVENTION FOR DATA COLLECTION

- TABLE 31 AMR: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.3 AMI

- 9.3.1 INCREASE IN RELIABILITY OF AMI COMMUNICATION INFRASTRUCTURE TO DRIVE GROWTH

- TABLE 32 AMI: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

10 SMART WATER METERING MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 38 REGIONAL SNAPSHOT: GROWING MARKETS ARE EMERGING AS NEW HOT SPOTS

- FIGURE 39 NORTH AMERICA: LARGEST SMART WATER METERING MARKET (2021)

- TABLE 33 SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 34 SMART WATER METERING MARKET, BY REGION, 2020-2027 (MILLION UNITS)

- 10.2 NORTH AMERICA

- FIGURE 40 NORTH AMERICA: SMART WATER METERING MARKET SNAPSHOT, 2021

- TABLE 35 NORTH AMERICA: SMART WATER METERING MARKET, BY METER TYPE, 2020-2027 (USD MILLION)

- TABLE 36 NORTH AMERICA: SMART WATER METERING MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 37 NORTH AMERICA: SMART WATER METERING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 38 NORTH AMERICA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: SMART WATER METERING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Focus on improving water infrastructure to drive growth

- TABLE 40 US: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Increased deployment of smart water meters to propel growth

- TABLE 41 CANADA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.2.3 MEXICO

- 10.2.3.1 New infrastructural development and installation of smart water meters to boost growth

- TABLE 42 MEXICO: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.3 EUROPE

- TABLE 43 EUROPE: SMART WATER METERING MARKET, BY METER TYPE, 2020-2027 (USD MILLION)

- TABLE 44 EUROPE: SMART WATER METERING MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 45 EUROPE: SMART WATER METERING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 46 EUROPE: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 47 EUROPE: SMART WATER METERING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Focus on reducing NRW by deploying smart water metering infrastructure to drive growth

- TABLE 48 GERMANY: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.3.2 FRANCE

- 10.3.2.1 Government focus on replacing old water meters with smart water meters to drive growth

- TABLE 49 FRANCE: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Water utilities in UK plan to install 100% smart water meters by 2030

- TABLE 50 UK: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.3.4 NETHERLANDS

- 10.3.4.1 Installation of new water meters by water utilities to drive growth

- TABLE 51 NETHERLANDS: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.3.5 DENMARK

- 10.3.5.1 Water utilities in Denmark increasingly focusing on early leak detection

- TABLE 52 DENMARK: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 53 REST OF EUROPE: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 41 ASIA PACIFIC: SMART WATER METERING MARKET SNAPSHOT, 2021

- TABLE 54 ASIA PACIFIC: SMART WATER METERING MARKET, BY METER TYPE, 2020-2027 (USD MILLION)

- TABLE 55 ASIA PACIFIC: SMART WATER METERING MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 56 ASIA PACIFIC: SMART WATER METERING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 57 ASIA PACIFIC: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 58 ASIA PACIFIC: SMART WATER METERING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Demand for robust water management systems increasing in China due to rapid urbanization

- TABLE 59 CHINA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Large investments for expanding communication networks to drive growth

- TABLE 60 JAPAN: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.4.3 MALAYSIA

- 10.4.3.1 High levels of NRW in Malaysia to create opportunities for market growth

- TABLE 61 MALAYSIA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.4.4 AUSTRALIA

- 10.4.4.1 Water scarcity issues resulting in rapid installation of smart water meters to manage water consumption

- TABLE 62 AUSTRALIA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.4.5 INDIA

- 10.4.5.1 Municipalities in India focusing on managing water and wastewater by installing smart water meters

- TABLE 63 INDIA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 64 REST OF ASIA PACIFIC: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.5 SOUTH AMERICA

- TABLE 65 SOUTH AMERICA: SMART WATER METERING MARKET, BY METER TYPE, 2020-2027 (USD MILLION)

- TABLE 66 SOUTH AMERICA: SMART WATER METERING MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 67 SOUTH AMERICA: SMART WATER METERING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 68 SOUTH AMERICA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 69 SOUTH AMERICA: SMART WATER METERING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.5.1 BRAZIL

- 10.5.1.1 Demand for smart water meters increasing in Brazil for solving water scarcity issues

- TABLE 70 BRAZIL: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.5.2 ARGENTINA

- 10.5.2.1 Smart water meter use can solve increasing water theft challenges in Argentina

- TABLE 71 ARGENTINA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.5.3 URUGUAY

- 10.5.3.1 Infrastructural development for water metering to support growth

- TABLE 72 URUGUAY: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.5.4 REST OF SOUTH AMERICA

- TABLE 73 REST OF SOUTH AMERICA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- TABLE 74 MIDDLE EAST & AFRICA: SMART WATER METERING MARKET, BY METER TYPE, 2020-2027 (USD MILLION)

- TABLE 75 MIDDLE EAST & AFRICA: SMART WATER METERING MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 76 MIDDLE EAST & AFRICA: SMART WATER METERING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 77 MIDDLE EAST & AFRICA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 78 MIDDLE EAST & AFRICA: SMART WATER METERING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.6.1 SAUDI ARABIA

- 10.6.1.1 Focus on establishing smart metering infrastructure to drive growth

- TABLE 79 SAUDI ARABIA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.6.2 UAE

- 10.6.2.1 UAE witnessing wide adoption of smart water meters to improve water operations and billing accuracy

- TABLE 80 UAE: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.6.3 ISRAEL

- 10.6.3.1 Increasing adoption rate of automation technologies by water utilities to drive growth

- TABLE 81 ISRAEL: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.6.4 SOUTH AFRICA

- 10.6.4.1 Initiatives for implementing smart infrastructure technologies to boost growth

- TABLE 82 SOUTH AFRICA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.6.5 EGYPT

- 10.6.5.1 Water metering infrastructural projects to drive growth

- TABLE 83 EGYPT: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 10.6.6 REST OF MIDDLE EAST & AFRICA

- TABLE 84 REST OF MIDDLE EAST & AFRICA: SMART WATER METERING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 KEY PLAYER STRATEGIES

- TABLE 85 REVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS OF SMART WATER METERS

- 11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2021

- FIGURE 42 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN SMART WATER METERING MARKET, 2021

- TABLE 86 SMART WATER METERING MARKET: DEGREE OF COMPETITION

- 11.3 SMART WATER METERING MARKET SHARE ANALYSIS, 2021

- 11.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

- FIGURE 43 REVENUE ANALYSIS OF TOP 5 PLAYERS IN SMART WATER METERING MARKET FROM 2017 TO 2021

- 11.5 COMPANY EVALUATION MATRIX/QUADRANT

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- FIGURE 44 SMART WATER METERING MARKET (GLOBAL): KEY COMPANY EVALUATION MATRIX, 2021

- 11.6 START-UP/SME EVALUATION QUADRANT

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 45 SMART WATER METERING MARKET: START-UP/SME EVALUATION QUADRANT, 2021

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 87 SMART WATER METERING MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 88 SMART WATER METERING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, BY APPLICATION

- TABLE 89 SMART WATER METERING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, BY METER TYPE

- TABLE 90 SMART WATER METERING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, BY TECHNOLOGY

- TABLE 91 SMART WATER METERING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, BY REGION

- 11.8 SMART WATER METERING MARKET: COMPANY FOOTPRINT

- TABLE 92 METER TYPE: COMPANY FOOTPRINT

- TABLE 93 TECHNOLOGY: COMPANY FOOTPRINT

- TABLE 94 APPLICATION: COMPANY FOOTPRINT

- TABLE 95 REGION: COMPANY FOOTPRINT

- TABLE 96 COMPANY FOOTPRINT

- 11.9 COMPETITIVE SCENARIO

- TABLE 97 SMART WATER METERING MARKET: KEY NEW PRODUCT LAUNCHES

- TABLE 98 SMART WATER METERING MARKET: KEY DEALS

- TABLE 99 SMART WATER METERING MARKET: OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES

- (Business overview, Products/services/solutions offered, Recent developments & MnM View)**

- 12.1 KEY PLAYERS

- 12.1.1 BADGER METER, INC.

- TABLE 100 BADGER METER, INC.: COMPANY OVERVIEW

- FIGURE 46 BADGER METER, INC.: COMPANY SNAPSHOT

- TABLE 101 BADGER METER, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 102 BADGER METER, INC.: PRODUCT LAUNCHES

- TABLE 103 BADGER METER, INC.: DEALS

- 12.1.2 SENSUS

- TABLE 104 SENSUS: COMPANY OVERVIEW

- TABLE 105 SENSUS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 106 SENSUS: DEALS

- TABLE 107 SENSUS: OTHER DEVELOPMENTS

- 12.1.3 DIEHL STIFTUNG & CO. KG

- TABLE 108 DIEHL STIFTUNG & CO. KG: COMPANY OVERVIEW

- TABLE 109 DIEHL STIFTUNG & CO. KG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 110 DIEHL STIFTUNG & CO. KG: OTHER DEVELOPMENTS

- 12.1.4 ACLARA TECHNOLOGIES

- TABLE 111 ACLARA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 112 ACLARA TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 113 ACLARA TECHNOLOGIES: OTHER DEVELOPMENTS

- 12.1.5 ITRON INC.

- TABLE 114 ITRON INC.: COMPANY OVERVIEW

- FIGURE 47 ITRON INC.: COMPANY SNAPSHOT

- TABLE 115 ITRON INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 116 ITRON INC.: DEALS

- TABLE 117 ITRON INC.: OTHER DEVELOPMENTS

- 12.1.6 KAMSTRUP A/S

- TABLE 118 KAMSTRUP A/S: COMPANY OVERVIEW

- TABLE 119 KAMSTRUP A/S: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 120 KAMSTRUP A/S: DEALS

- TABLE 121 KAMSTRUP A/S: OTHER DEVELOPMENTS

- 12.1.7 LANDIS+GYR

- TABLE 122 LANDIS+GYR: COMPANY OVERVIEW

- FIGURE 48 LANDIS+GYR: COMPANY SNAPSHOT

- TABLE 123 LANDIS+GYR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 124 LANDIS+GYR: DEALS

- TABLE 125 LANDIS+GYR: OTHER DEVELOPMENTS

- 12.1.8 HONEYWELL INTERNATIONAL

- TABLE 126 HONEYWELL INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 49 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 127 HONEYWELL INTERNATIONAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.9 B METERS SRL

- TABLE 128 B METERS SRL: COMPANY OVERVIEW

- TABLE 129 B METERS SRL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.10 ARAD GROUP

- TABLE 130 ARAD GROUP: COMPANY OVERVIEW

- TABLE 131 ARAD GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.11 ZENNER INTERNATIONAL GMBH & CO. KG

- TABLE 132 ZENNER INTERNATIONAL GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 133 ZENNER INTERNATIONAL GMBH & CO. KG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.12 NEPTUNE TECHNOLOGY GROUP

- TABLE 134 NEPTUNE TECHNOLOGY GROUP: COMPANY OVERVIEW

- TABLE 135 NEPTUNE TECHNOLOGY GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 136 NEPTUNE TECHNOLOGY GROUP: PRODUCT LAUNCHES

- 12.1.13 ISKRAEMECO GROUP

- TABLE 137 ISKRAEMECO GROUP: COMPANY OVERVIEW

- TABLE 138 ISKRAEMECO GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 139 ISKRAEMECO GROUP: PRODUCT LAUNCHES

- TABLE 140 ISKRAEMECO GROUP: DEALS

- TABLE 141 ISKRAEMECO GROUP: OTHER DEVELOPMENTS

- 12.1.14 SAGEMCOM

- TABLE 142 SAGEMCOM: COMPANY OVERVIEW

- TABLE 143 SAGEMCOM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.15 WASION GROUP

- TABLE 144 WASION GROUP: COMPANY OVERVIEW

- FIGURE 50 WASION GROUP: COMPANY SNAPSHOT

- TABLE 145 WASION GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- *Details on Business overview, Products/services/solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 WATERTECH S.P.A.

- 12.2.2 BAYLAN WATER METERS

- 12.2.3 WEGOT UTILITY SOLUTIONS

- 12.2.4 APATOR S.A.

- 12.2.5 STMICROELECTRONICS N.V.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 SMART WATER METERS: INTERCONNECTED MARKETS

- 13.4 SMART METERS MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 LIMITATIONS

- 13.4.3 MARKET OVERVIEW

- 13.4.4 SMART METERS MARKET, BY TYPE

- 13.4.4.1 Smart electric meters

- TABLE 146 SMART METERS MARKET FOR ELECTRIC METERS, BY REGION, 2019-2026 (USD MILLION)

- 13.4.4.2 Smart gas meters

- TABLE 147 SMART METERS MARKET FOR GAS METERS, BY REGION, 2019-2026 (USD MILLION)

- 13.4.5 SMART METERS MARKET, BY COMMUNICATION

- TABLE 148 SMART METERS MARKET, BY COMMUNICATION, 2019-2026 (USD MILLION)

- 13.4.5.1 RF

- TABLE 149 RF: SMART METERS MARKET, BY REGION, 2019-2026 (USD MILLION)

- 13.4.5.2 PLC

- TABLE 150 PLC: SMART METERS MARKET, BY REGION, 2019-2026 (USD MILLION)

- 13.4.5.3 Cellular

- TABLE 151 CELLULAR: SMART METERS MARKET, BY REGION, 2019-2026 (USD MILLION)

- 13.4.6 SMART METERS MARKET, BY COMPONENT

- TABLE 152 SMART METERS MARKET, BY COMPONENT, 2019-2026 (USD MILLION)

- 13.4.6.1 Hardware

- TABLE 153 SMART METERS MARKET FOR HARDWARE, BY REGION, 2019-2026 (USD MILLION)

- 13.4.6.2 Software

- TABLE 154 SMART METERS MARKET FOR SOFTWARE, BY REGION, 2019-2026 (USD MILLION)

- 13.4.7 SMART METERS MARKET, BY REGION

- TABLE 155 SMART METERS MARKET, BY REGION, 2019-2026 (USD MILLION)

- 13.5 US WATER METERS MARKET

- 13.5.1 MARKET DEFINITION

- 13.5.2 LIMITATIONS

- 13.5.3 MARKET OVERVIEW

- 13.5.4 US WATER METERS MARKET, BY PRODUCT

- TABLE 156 US WATER METERS MARKET SIZE, BY PRODUCT, 2016-2026 (USD MILLION)

- 13.5.5 US WATER METERS MARKET, BY APPLICATION

- TABLE 157 US WATER METERS MARKET SIZE, BY APPLICATION, 2016-2026 (USD MILLION)

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS