|

|

市場調査レポート

商品コード

1167091

CaaS (Containers as a Service) の世界市場:サービスの種類別 (管理・オーケストレーション、セキュリティ、監視・分析)・展開方式別 (パブリック、プライベート、ハイブリッド)・組織規模別・業種別・地域別の将来予測 (2027年まで)Containers as a Service Market by Service Type (Management and Orchestration, Security, Monitoring and Analytics), Deployment Model (Public, Private, Hybrid), Organization Size, Vertical and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| CaaS (Containers as a Service) の世界市場:サービスの種類別 (管理・オーケストレーション、セキュリティ、監視・分析)・展開方式別 (パブリック、プライベート、ハイブリッド)・組織規模別・業種別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月30日

発行: MarketsandMarkets

ページ情報: 英文 205 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のCaaS (サービスとしてのコンテナ) の市場規模は、2022年の20億米ドルから2027年には56億米ドルへと、予測期間中に22.7%のCAGRで成長すると予測されています。

IoTアプリケーションの出現やハイブリッドクラウドの導入増加は、CaaS市場の成長を促進する要因の1つです。

組織規模別では、政府のコンプライアンスや組織データ管理に関連する規制要件の必要性から、中小企業におけるCaaSの導入が増加すると考えられます。市場競争の激化により、中小企業はCaaSに投資し、大規模なデータプールから洞察を得てビジネスの成長を図ることが推奨されています。大企業と比較して、中小企業はリソース不足に直面しており、資産と要件のコスト最適化のために、複雑な問題を解決する費用対効果の高い方法を必要としています。

地域別では2022年に、北米がCaaS市場を独占する見通しです。北米には米国とカナダという2つの先進国が存在するため、同地域におけるCaaSの採用が進むと予想されます。また、同地域のBFSIや小売などのエンドユーザー産業は、顧客体験の向上と販売サイクルの短縮に注力しており、これが予測期間中の市場を牽引すると見られています。

当レポートでは、世界のCaaS (Containers as a Service) の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、サービスの種類別・展開方式別・組織規模別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場の概要と動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- アーキテクチャの枠組み

- 価格設定と取引分析

- 関税と規制の状況

第6章 CaaS市場:サービスの種類別

- イントロダクション

- 監視・分析

- セキュリティ

- 継続的インテグレーション・継続的展開

- ストレージ・ネットワーク

- 管理・オーケストレーション

- 訓練・コンサルティング

- サポート・整備

第7章 CaaS市場:展開方式別

- イントロダクション

- パブリッククラウド

- プライベートクラウド

- ハイブリッドクラウド

第8章 CaaS市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第9章 CaaS市場:業種別

- イントロダクション

- 銀行・金融サービス・保険 (BFSI)

- 製造業

- メディア・エンターテイメント・ゲーム

- IT・通信

- 小売業・消費財

- 輸送・ロジスティクス

- 医療・ライフサイエンス

- 旅行業・ホスピタリティ

- その他の業種

第10章 CaaS市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- オーストラリア・ニュージーランド

- シンガポール

- 他のアジア太平洋諸国

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第11章 競合情勢

- イントロダクション

- 上位ベンダーの市場シェア

- 主要企業の過去の収益分析

- 競合シナリオ

- 企業評価クアドラント

- 企業の製品フットプリント分析

第12章 企業プロファイル

- イントロダクション

- 主要企業

- MICROSOFT

- CISCO

- HUAWEI TECHNOLOGIES

- ORACLE

- IBM

- AMAZON WEB SERVICES (AWS)

- HEWLETT PACKARD ENTERPRISE

- VMWARE

- DOCKER

- SUSE

- RED HAT

- TATA COMMUNICATIONS

- ALIBABA CLOUD

- DXC TECHNOLOGY

第13章 隣接市場

- イントロダクション

- FaaS (Function-as-a-Service) 市場

- クラウドオーケストレーション市場

第14章 付録

The CaaS market size is expected to grow from USD 2.0 billion in 2022 to USD 5.6 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 22.7% during the forecast period. The emergence of IoT applications and rise in hybrid cloud deployments are a few factors driving the growth of the CaaS market.

The security services can help organizations reduce huge losses by cyber attacks

The container runtime is one of the most difficult parts of a container stack to secure because traditional security tools were not designed to monitor the running containers. The next layer to be secured is the registries. Since the registry is central to the way a containerized environment operates, it is essential to secure it. Intrusions or vulnerabilities within the registry provide an easy opening for compromising the running application. Another essential component of the stack that needs security is the orchestrator. Containers are useful for both stateless and stateful applications. Protecting the attached storage is a key element of securing stateful services. Thus, the container security service is an important part of CaaS and is provided by many pure-play vendors, such as Black Duck, Aqua Security, and Tenable.

The private clouds are created for specific groups or organizations that require granular data control

As security is the most important concern, many organizations are in favor of adopting the private cloud deployment model within the corporate firewall. The private cloud offers better control of the data along with reduced risk of data loss and concerns related to regulatory compliance. Due to these benefits, many enterprises prefer private cloud usage to ensure safety and security. Unlike the public cloud, private cloud infrastructure is managed either internally or through a third party, which may host it internally or externally. Private clouds are created for specific groups or organizations that require granular control over their data. Enterprises opting for private cloud need a highly secure and centralized storage infrastructure that can be accessed by an authorized user.

The need for government compliance and regulatory requirements related to managing organizational data would increase the adoption of CaaS among SMEs.

The intense competitive market scenario has encouraged the SMEs to invest in CaaS, and derive insights from a large pool of data for their business growth. As compared to large enterprises, the SMEs face resource crunch and require cost-effective methods to solve complexities for better cost optimization of their assets and requirements.

Adoption of containerized applications to help enterprises estimate demand accurately and quickly

The manufacturing vertical is categorized into different types of manufacturers, which include heavy manufacturers, light manufacturers, process manufacturers, and discrete manufacturers. Access to the right type of computing resources, at the right time, in the right quantity is a big challenge for many enterprises. Cloud adoption is growing across the manufacturing vertical to plan, build, and orchestrate business models and IT services. By using cloud-based container services, enterprises can speed-up their product design and testing, and gain a competitive advantage. Manufacturing processes are highly complex as they need to analyze and forecast the demand and supply of goods regularly.

North America to dominate the CaaS market in 2022

The presence of two major economies in North America: the US and Canada are expected to boost the adoption of CaaS in the region. Moreover, the end-use industries in the region such as BFSI and retail are focusing on improving customer experience and reducing sales cycle, which is expected to drive the market during the forecast period. The adoption of the CaaS is expected to be the highest in North America due to the rapid adoption of IaaS among insight-intensive enterprises in this region as compared to other regions. The region is an early adopter and host to innovative initiatives for advanced analytics solutions and practices, such as big data, machine learning, information science, and high-performance computing. Most of CaaS vendors, including major players, have direct or indirect presence in this region via system integrators, distributors, and resellers.

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews were conducted with the key people. The breakup of the profiles of the primary participants as follows:

- By Company Type: Tier I: 35%, Tier II: 25%, and Tier III: 40%

- By Designation: C-Level: 25%, D-Level: 30%, and Others: 45%

- By Region: North America: 42%, Europe: 25%, APAC: 18%, Row: 15%

The report profiles the following key vendors:

1. Cisco Systems, Inc. (US)

2. Hewlett Packard Enterprise Company (US)

3. IBM Corporation (US)

4. Huawei Technologies Co., Ltd. (China)

5. Amazon Web Services (US)

6. Google (US)

7. Microsoft (US)

8. VMWare (US)

9. Docker (US)

10. SUSE (Germany)

11. Red Hat (US)

12. Tata Communications (India)

13. Alibaba Cloud (Singapore)

14. DXC Technology (US)

15. Oracle (US)

Research Coverage

The scope of this report covers the CaaS market by service type, deployment model, organization size, vertical, and region. The service type segment includes management & orchestration security, monitoring & analytics, storage & networking, continuous integration & continuous deployment (CI/CD), training & consulting, and support & maintenance. The deployment model segment has been segmented into public cloud, private cloud, and hybrid cloud. In terms of organization size, the CaaS market has been segmented into SMEs and large enterprises. The market for SMEs is expected to grow at a higher CAGR during the forecast period. Different verticals using CaaS include retail & consumer goods, manufacturing, media, entertainment & gaming, IT & telecommunications, healthcare & life sciences, BFSI, transportation & logistics, travel & hospitality, and other verticals (education, and government & public sector). The geographic analysis of the CaaS market is spread across five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in the CaaS market with information on the closest approximations of the revenue numbers for the overall CaaS market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 CONTAINERS AS A SERVICE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primaries

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 4 CONTAINERS AS A SERVICE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

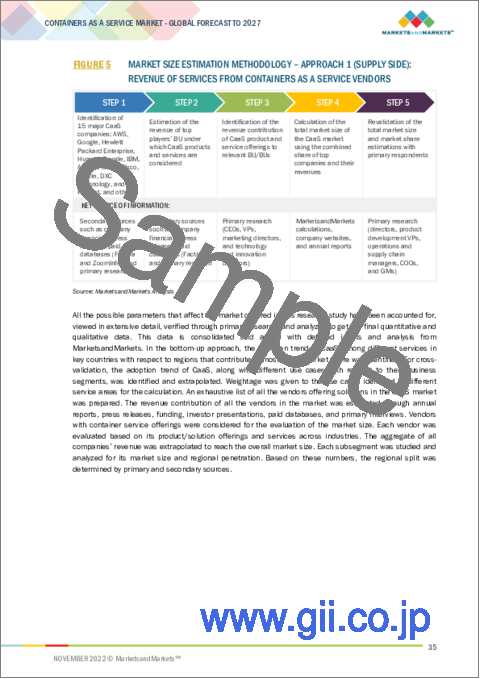

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM CONTAINERS AS A SERVICE VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF CONTAINERS AS A SERVICE VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): CONTAINERS AS A SERVICE MARKET

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 COMPANY EVALUATION MATRIX METHODOLOGY

- FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 2.6 START-UP/SME EVALUATION MATRIX METHODOLOGY

- FIGURE 9 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 2.7 ASSUMPTIONS

- 2.8 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 CONTAINERS AS A SERVICE MARKET: GLOBAL SNAPSHOT, 2020-2027

- FIGURE 11 TOP-GROWING SEGMENTS IN CONTAINERS AS A SERVICE MARKET

- FIGURE 12 MANAGEMENT & ORCHESTRATION TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 13 PUBLIC CLOUD TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 14 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 15 RETAIL & CONSUMER GOODS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF CONTAINERS AS A SERVICE MARKET

- FIGURE 17 MICROSERVICE ARCHITECTURE TO FUEL MARKET GROWTH

- 4.2 CONTAINERS AS A SERVICE MARKET, BY COMPONENT, 2022 VS. 2027

- FIGURE 18 MANAGEMENT & ORCHESTRATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

- 4.3 CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2022 VS. 2027

- FIGURE 19 PUBLIC CLOUD SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

- 4.4 CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

- FIGURE 20 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET SHARE BY 2027

- 4.5 CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2022 VS. 2027

- FIGURE 21 RETAIL & CONSUMER GOODS TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

- 4.6 CONTAINERS AS A SERVICE MARKET: INVESTMENT SCENARIO

- FIGURE 22 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CONTAINERS AS A SERVICE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Benefits of cost-effectiveness and increased productivity

- 5.2.1.2 Greater flexibility than on-premises containers

- 5.2.1.3 Increasing popularity of microservices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Heavy increase in container sprawl

- 5.2.2.2 Difficulty in achieving security and compliance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of IoT applications

- 5.2.3.2 Rise in hybrid cloud deployment models

- 5.2.4 CHALLENGES

- 5.2.4.1 Persistent storage issues

- 5.2.4.2 Lack of enterprise DevOps culture

- 5.3 ARCHITECTURAL FRAMEWORK

- FIGURE 24 CONTAINERS AS A SERVICE REFERENCE ARCHITECTURE

- 5.4 PRICING AND DEAL ANALYSIS

- 5.5 TARIFF AND REGULATORY LANDSCAPE

- 5.5.1 REGULATIONS

- 5.5.1.1 North America

- 5.5.1.2 Europe

- 5.5.1.3 Asia Pacific

- 5.5.1.4 Middle East and South Africa

- 5.5.1.5 Latin America

- 5.5.1 REGULATIONS

6 CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- FIGURE 25 SECURITY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 3 CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2016-2020 (USD MILLION)

- TABLE 4 CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2021-2027 (USD MILLION)

- 6.1.1 SERVICE TYPE: CONTAINERS AS A SERVICE MARKET DRIVERS

- 6.2 MONITORING & ANALYTICS

- 6.2.1 MODERN MONITORING SOLUTIONS TO PROVIDE ROBUST CAPABILITIES TO TRACK POTENTIAL FAILURES

- TABLE 5 MONITORING & ANALYTICS: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 6 MONITORING & ANALYTICS: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 6.3 SECURITY

- 6.3.1 ENABLES ENTERPRISES TO PROTECT WORKLOADS AGAINST MODERN THREATS

- TABLE 7 SECURITY: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 8 SECURITY: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 6.4 CONTINUOUS INTEGRATION & CONTINUOUS DEPLOYMENT

- 6.4.1 CI/CD FRAMEWORK OVER CONTAINERS AUTOMATICALLY BUILD, PACKAGE, AND DEPLOY APPLICATIONS

- TABLE 9 CONTINUOUS INTEGRATION & CONTINUOUS DEPLOYMENT: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 10 CONTINUOUS INTEGRATION & CONTINUOUS DEPLOYMENT: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 6.5 STORAGE & NETWORKING

- 6.5.1 NETWORK & STORAGE SERVICES DELIVERED BY SOFTWARE-DEFINED, CONTAINER-NATIVE PLUGINS DESIGNED FOR KUBERNETES

- TABLE 11 STORAGE & NETWORKING: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 12 STORAGE & NETWORKING: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 6.6 MANAGEMENT & ORCHESTRATION

- 6.6.1 CONTAINER ORCHESTRATION TO AUTOMATE DEPLOYMENT, MANAGEMENT, SCALING, AND NETWORKING

- TABLE 13 MANAGEMENT & ORCHESTRATION: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 14 MANAGEMENT & ORCHESTRATION: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 6.7 TRAINING & CONSULTING

- 6.7.1 CONSULTING SERVICES HELP ENTERPRISES MAKE INFORMED DECISIONS

- TABLE 15 TRAINING & CONSULTING: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 16 TRAINING & CONSULTING: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 6.8 SUPPORT & MAINTENANCE

- 6.8.1 HELPS ADDRESS TECHNICAL QUERIES AND DELIVERS COST-EFFECTIVE SUPPORT

- TABLE 17 SUPPORT & MAINTENANCE: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 18 SUPPORT & MAINTENANCE: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

7 CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL

- 7.1 INTRODUCTION

- FIGURE 26 HYBRID CLOUD TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 19 CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2016-2020 (USD MILLION)

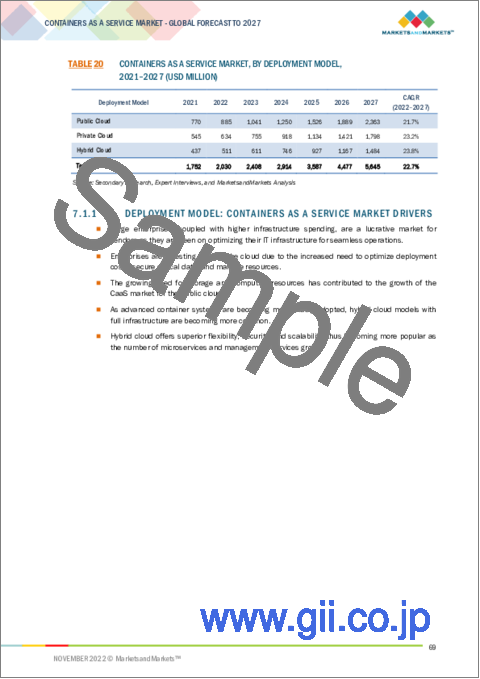

- TABLE 20 CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2021-2027 (USD MILLION)

- 7.1.1 DEPLOYMENT MODEL: CONTAINERS AS A SERVICE MARKET DRIVERS

- 7.2 PUBLIC CLOUD

- 7.2.1 OFFERS SCALABILITY, RELIABILITY, FLEXIBILITY, AND LOCATION-INDEPENDENT SERVICES

- TABLE 21 PUBLIC CLOUD: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 22 PUBLIC CLOUD: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 7.3 PRIVATE CLOUD

- 7.3.1 PRIVATE CLOUDS CREATED FOR SPECIFIC GROUPS OR ORGANIZATIONS THAT REQUIRE GRANULAR DATA CONTROL

- TABLE 23 PRIVATE CLOUD: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 24 PRIVATE CLOUD: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 7.4 HYBRID CLOUD

- 7.4.1 RISING HYBRID CLOUD USAGE DUE TO INCREASING MICROSERVICE AND MANAGEMENT SERVICE DATA ENVIRONMENT

- TABLE 25 HYBRID CLOUD: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 26 HYBRID CLOUD: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

8 CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- FIGURE 27 SMES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 27 CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 28 CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 8.1.1 ORGANIZATION SIZE: CONTAINERS AS A SERVICE MARKET DRIVERS

- 8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 8.2.1 ADOPTION OF CAAS TO RESULT IN INCREASED REVENUE AND IMPROVED BUSINESS EFFICIENCY

- TABLE 29 SMALL AND MEDIUM-SIZED ENTERPRISES: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 30 SMALL AND MEDIUM-SIZED ENTERPRISES: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 8.3 LARGE ENTERPRISES

- 8.3.1 CAAS SOLUTIONS AND SERVICES ENABLE LARGE ENTERPRISES TO IMPROVE PROFIT MARGINS BY REDUCING OPEX AND CAPEX

- TABLE 31 LARGE ENTERPRISES: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 32 LARGE ENTERPRISES: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

9 CONTAINERS AS A SERVICE MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 28 BFSI TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 33 CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 34 CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2021-2027 (USD MILLION)

- 9.1.1 VERTICAL: CONTAINERS AS A SERVICE MARKET DRIVERS

- 9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 9.2.1 CAAS SOLUTIONS HELP BANKS MODERNIZE DIGITAL FOUNDATIONS FOR A COMPETITIVE EDGE

- TABLE 35 BANKING, FINANCIAL SERVICES, AND INSURANCE: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 36 BANKING, FINANCIAL SERVICES, AND INSURANCE: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 9.3 MANUFACTURING

- 9.3.1 ADOPTION OF CONTAINERIZED APPLICATIONS TO HELP ENTERPRISES ESTIMATE DEMAND ACCURATELY AND QUICKLY

- TABLE 37 MANUFACTURING: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 38 MANUFACTURING: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 9.4 MEDIA, ENTERTAINMENT & GAMING

- 9.4.1 MEDIA, ENTERTAINMENT & GAMING COMPANIES TO REDUCE OPEX AND OFFER BETTER CUSTOMER EXPERIENCES USING CAAS

- TABLE 39 MEDIA, ENTERTAINMENT & GAMING: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 40 MEDIA, ENTERTAINMENT & GAMING: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 9.5 IT & TELECOMMUNICATIONS

- 9.5.1 IT & TELECOMMUNICATIONS VERTICAL TO PROVIDE ON-DEMAND AVAILABILITY OF INFORMATION AND REAL-TIME SERVICES

- TABLE 41 IT & TELECOMMUNICATIONS: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 42 IT & TELECOMMUNICATIONS: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 9.6 RETAIL & CONSUMER GOODS

- 9.6.1 CAAS TO LEVERAGE NEW TECHNOLOGIES TO GATHER INSIGHTS INTO CONSUMER'S PURCHASE PREFERENCES

- TABLE 43 RETAIL & CONSUMER GOODS: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 44 RETAIL & CONSUMER GOODS: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 9.7 TRANSPORTATION & LOGISTICS

- 9.7.1 ADOPTION OF CONTAINER SERVICES ACROSS ORGANIZATIONS TO HELP ACHIEVE FREIGHT AND FARE MANAGEMENT

- TABLE 45 TRANSPORTATION & LOGISTICS: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 46 TRANSPORTATION & LOGISTICS: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 9.8 HEALTHCARE & LIFE SCIENCES

- 9.8.1 CAAS TO ENABLE HEALTHCARE IT AND DEVOPS TEAMS DEPLOY APPLICATIONS IN HIPAA-COMPLIANT CLOUD

- TABLE 47 HEALTHCARE & LIFE SCIENCES: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 48 HEALTHCARE & LIFE SCIENCES: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 9.9 TRAVEL & HOSPITALITY

- 9.9.1 CAAS TO HELP TRAVEL & HOSPITALITY COMPANIES BETTER MANAGE CURRENT AND FUTURE INDUSTRY CHALLENGES

- TABLE 49 TRAVEL & HOSPITALITY: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 50 TRAVEL & HOSPITALITY: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 9.10 OTHER VERTICALS

- TABLE 51 OTHER VERTICALS: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 52 OTHER VERTICALS: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

10 CONTAINERS AS A SERVICE MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 29 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- TABLE 53 CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 54 CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 55 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2016-2020 (USD MILLION)

- TABLE 56 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2021-2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2016-2020 (USD MILLION)

- TABLE 58 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2021-2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 60 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 62 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2021-2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET, BY COUNTRY, 2016-2020 (USD MILLION)

- TABLE 64 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Advanced IT infrastructure, presence of several enterprises, and availability of proficient technical expertise

- TABLE 65 US: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 66 US: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Growth driven by technological evolutions, increasing demand for microservices, and CaaS solutions

- TABLE 67 CANADA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 68 CANADA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: CONTAINERS AS A SERVICE MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 69 EUROPE: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2016-2020 (USD MILLION)

- TABLE 70 EUROPE: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2021-2027 (USD MILLION)

- TABLE 71 EUROPE: CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2016-2020 (USD MILLION)

- TABLE 72 EUROPE: CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2021-2027 (USD MILLION)

- TABLE 73 EUROPE: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 74 EUROPE: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- TABLE 75 EUROPE: CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 76 EUROPE: CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2021-2027 (USD MILLION)

- TABLE 77 EUROPE: CONTAINERS AS A SERVICE MARKET, BY COUNTRY, 2016-2020 (USD MILLION)

- TABLE 78 EUROPE: CONTAINERS AS A SERVICE MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Companies adopting CaaS applications to enhance their operational efficiency

- TABLE 79 UK: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 80 UK: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Germany's consumer base and existing infrastructure to fuel growth of cloud services

- TABLE 81 GERMANY: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 82 GERMANY: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 Organizations to adopt robust solutions to enhance business effectivity and understand customers

- TABLE 83 FRANCE: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 84 FRANCE: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 85 REST OF EUROPE: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 86 REST OF EUROPE: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 87 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2016-2020 (USD MILLION)

- TABLE 88 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2021-2027 (USD MILLION)

- TABLE 89 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2016-2020 (USD MILLION)

- TABLE 90 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2021-2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 92 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2021-2027 (USD MILLION)

- TABLE 95 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY COUNTRY, 2016-2020 (USD MILLION)

- TABLE 96 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Chinese CaaS companies to expand operations in other countries to serve customers globally

- TABLE 97 CHINA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 98 CHINA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Japan to be focus of CaaS in future

- TABLE 99 JAPAN: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 100 JAPAN: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.4.5 AUSTRALIA & NEW ZEALAND

- 10.4.5.1 Increased spending on CaaS in ANZ driven by rapid adoption of digital transformation initiatives

- TABLE 101 AUSTRALIA & NEW ZEALAND: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 102 AUSTRALIA & NEW ZEALAND: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.4.6 SINGAPORE

- 10.4.6.1 Increasing number of CaaS vendors tapping into growth opportunities

- TABLE 103 SINGAPORE: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 104 SINGAPORE: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 105 REST OF ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 107 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2016-2020 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2021-2027 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2016-2020 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2021-2027 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2021-2027 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021-2027 (USD MILLION)

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Enterprises adopting cloud technologies and reducing their CAPEX to save time and effort

- TABLE 117 MIDDLE EAST: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 118 MIDDLE EAST: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.5.4 AFRICA

- 10.5.4.1 Increasing need for mobility to be major driving factor for CaaS implementation

- TABLE 119 AFRICA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 120 AFRICA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 121 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2016-2020 (USD MILLION)

- TABLE 122 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2021-2027 (USD MILLION)

- TABLE 123 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2016-2020 (USD MILLION)

- TABLE 124 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2021-2027 (USD MILLION)

- TABLE 125 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 126 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- TABLE 127 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 128 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY VERTICAL, 2021-2027 (USD MILLION)

- TABLE 129 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY COUNTRY, 2016-2020 (USD MILLION)

- TABLE 130 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- 10.6.3 BRAZIL

- TABLE 131 BRAZIL: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 132 BRAZIL: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.6.4 MEXICO

- TABLE 133 MEXICO: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 134 MEXICO: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- 10.6.5 REST OF LATIN AMERICA

- TABLE 135 REST OF LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 136 REST OF LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- FIGURE 32 MARKET EVALUATION FRAMEWORK, 2019-2022

- 11.2 MARKET SHARE OF TOP VENDORS

- FIGURE 33 MARKET SHARE ANALYSIS OF COMPANIES IN CONTAINERS AS A SERVICE MARKET

- 11.3 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

- FIGURE 34 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2017-2021

- 11.4 COMPETITIVE SCENARIO

- TABLE 137 CONTAINERS AS A SERVICE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2019-2022

- TABLE 138 CONTAINERS AS A SERVICE MARKET: DEALS, 2019-2022

- 11.5 COMPANY EVALUATION QUADRANT

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 35 CONTAINERS AS A SERVICE MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 139 COMPANY FOOTPRINT, BY SERVICE TYPE

- TABLE 140 COMPANY FOOTPRINT, BY VERTICAL

- TABLE 141 COMPANY FOOTPRINT, BY REGION

- TABLE 142 COMPANY FOOTPRINT

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key Right to win, Strategic choices made, Weakness/competitive threats) **

- 12.2 KEY COMPANIES

- 12.2.1 MICROSOFT

- TABLE 143 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 36 MICROSOFT: COMPANY SNAPSHOT

- TABLE 144 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 146 MICROSOFT: DEALS

- 12.2.2 CISCO

- TABLE 147 CISCO: BUSINESS OVERVIEW

- FIGURE 37 CISCO: COMPANY SNAPSHOT

- TABLE 148 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.2.3 HUAWEI TECHNOLOGIES

- TABLE 150 HUAWEI TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 151 HUAWEI TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 HUAWEI TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.2.4 ORACLE

- TABLE 153 ORACLE: BUSINESS OVERVIEW

- FIGURE 38 ORACLE: COMPANY SNAPSHOT

- TABLE 154 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.2.5 IBM

- TABLE 156 IBM: BUSINESS OVERVIEW

- FIGURE 39 IBM: COMPANY SNAPSHOT

- TABLE 157 IBM: SOLUTIONS OFFERED

- TABLE 158 IBM: PRODUCT LAUNCHES

- 12.2.6 AMAZON WEB SERVICES (AWS)

- TABLE 159 AMAZON WEB SERVICES: BUSINESS OVERVIEW

- FIGURE 40 AMAZON WEB SERVICES: COMPANY SNAPSHOT

- TABLE 160 AMAZON WEB SERVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 AMAZON WEB SERVICES: PRODUCT LAUNCHES

- 12.2.7 HEWLETT PACKARD ENTERPRISE

- TABLE 162 HEWLETT PACKARD ENTERPRISE: BUSINESS OVERVIEW

- FIGURE 41 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT

- TABLE 163 HEWLETT PACKARD ENTERPRISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 HEWLETT PACKARD ENTERPRISE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 165 HEWLETT PACKARD ENTERPRISE: DEALS

- 12.2.8 GOOGLE

- TABLE 166 GOOGLE: BUSINESS OVERVIEW

- FIGURE 42 GOOGLE: COMPANY SNAPSHOT

- TABLE 167 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 GOOGLE: PRODUCT LAUNCHES

- TABLE 169 GOOGLE: DEALS

- 12.2.9 VMWARE

- TABLE 170 VMWARE: BUSINESS OVERVIEW

- FIGURE 43 VMWARE: COMPANY SNAPSHOT

- TABLE 171 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 VMWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 173 VMWARE: DEALS

- 12.2.10 DOCKER

- TABLE 174 DOCKER: BUSINESS OVERVIEW

- TABLE 175 DOCKER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 DOCKER: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 177 DOCKER: DEALS

- 12.2.11 SUSE

- TABLE 178 SUSE: BUSINESS OVERVIEW

- FIGURE 44 SUSE: COMPANY SNAPSHOT

- TABLE 179 SUSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 SUSE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 181 SUSE: DEALS

- 12.2.12 RED HAT

- TABLE 182 RED HAT: BUSINESS OVERVIEW

- TABLE 183 RED HAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 RED HAT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 185 RED HAT: DEALS

- 12.2.13 TATA COMMUNICATIONS

- TABLE 186 TATA COMMUNICATIONS: BUSINESS OVERVIEW

- FIGURE 45 TATA COMMUNICATIONS: COMPANY SNAPSHOT

- TABLE 187 TATA COMMUNICATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 TATA COMMUNICATIONS: DEALS

- 12.2.14 ALIBABA CLOUD

- TABLE 189 ALIBABA CLOUD: BUSINESS OVERVIEW

- FIGURE 46 ALIBABA CLOUD: COMPANY SNAPSHOT

- TABLE 190 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 ALIBABA CLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 192 ALIBABA CLOUD: DEALS

- TABLE 193 ALIBABA CLOUD: OTHERS

- 12.2.15 DXC TECHNOLOGY

- TABLE 194 DXC TECHNOLOGY: BUSINESS OVERVIEW

- FIGURE 47 DXC TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 195 DXC TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 DXC TECHNOLOGY: DEALS

- TABLE 197 DXC TECHNOLOGY: OTHERS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key Right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

13 ADJACENT MARKETS

- 13.1 INTRODUCTION

- TABLE 198 RELATED MARKETS

- 13.2 FUNCTION-AS-A-SERVICE MARKET

- TABLE 199 FUNCTION-AS-A-SERVICE MARKET, BY USER TYPE, 2014-2021 (USD MILLION)

- TABLE 200 FUNCTION-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2014-2021 (USD MILLION)

- TABLE 201 FUNCTION-AS-A-SERVICE MARKET, BY APPLICATION, 2014-2021 (USD MILLION)

- TABLE 202 FUNCTION-AS-A-SERVICE MARKET, BY DEPLOYMENT MODEL, 2014-2021 (USD MILLION)

- TABLE 203 FUNCTION-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2014-2021 (USD MILLION)

- TABLE 204 FUNCTION-AS-A-SERVICE MARKET, BY INDUSTRY VERTICAL, 2014-2021 (USD MILLION)

- TABLE 205 FUNCTION-AS-A-SERVICE MARKET, BY REGION, 2014-2021 (USD MILLION)

- 13.3 CLOUD ORCHESTRATION MARKET

- TABLE 206 CLOUD ORCHESTRATION MARKET, BY SERVICE TYPE, 2014-2021 (USD MILLION)

- TABLE 207 CLOUD ORCHESTRATION MARKET, BY APPLICATION, 2014-2021 (USD MILLION)

- TABLE 208 CLOUD ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2014-2021 (USD MILLION)

- TABLE 209 CLOUD ORCHESTRATION MARKET, BY ORGANIZATION SIZE, 2014-2021 (USD MILLION)

- TABLE 210 CLOUD ORCHESTRATION MARKET, BY VERTICAL, 2014-2021 (USD MILLION)

- TABLE 211 CLOUD ORCHESTRATION MARKET, BY REGION, 2014-2021 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS