|

|

市場調査レポート

商品コード

1162475

血管パッチの世界市場:材料別 (生体、合成)・用途別 (腹部大動脈瘤の開腹修復、先天性心疾患、頸動脈内膜切除術)・エンドユーザー別 (病院、外来手術センター) の将来予測 (2027年まで)Vascular Patches Market by Material (Biologic, Synthetic), Application (Open Repair of Abdominal Aortic Aneurysm, Congenital Heart Disease, Carotid Endarterectomy), End User (Hospitals, Ambulatory Surgical Centers) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 血管パッチの世界市場:材料別 (生体、合成)・用途別 (腹部大動脈瘤の開腹修復、先天性心疾患、頸動脈内膜切除術)・エンドユーザー別 (病院、外来手術センター) の将来予測 (2027年まで) |

|

出版日: 2022年11月22日

発行: MarketsandMarkets

ページ情報: 英文 133 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の血管パッチの市場規模は、2022年に3億5,300万米ドル、2027年には5億1,700万米ドルに達すると予測され、予測期間中に7.9%のCAGRで推移する見通しです。

市場の成長は、心血管疾患 (CVD) の発生率の上昇、外科手術の件数増加、血管手術向け生物学的パッチの普及といった要因によってもたらされます。

"材料別では、生体血管パッチが最大のシェアを占めた"

材料別では、生体血管パッチが大きなシェアを占めています。また、最も成長率の高いセグメントでもあります。市場成長は主に、合成パッチと比べての生体パッチの利点の大きさによって促進されています。

"血管バイパス手術のセグメントが、用途別では最速成長のセグメントとなる"

血管バイパス手術は、予測期間中に最も速い成長を示すと予想されます。その要因として、新興国・先進国での償還が可能であることなどが挙げられます。

"エンドユーザー別では、病院分野が最も高い成長で成長する"

エンドユーザー別に見ると、病院分野は予測期間中に最も高い成長率を記録すると予想されます。その要因として、より良い医療サービス・インフラを提供する病院が増加していることなどが挙げられます。

"アジア太平洋が予測期間中に最も高いCAGRで成長する"

地域別に見ると、アジア太平洋は予測期間中に血管パッチ市場で最も高い成長率を示すと予想されます。高成長の要因には、対象人口が多いこと、東南アジア諸国の医療インフラの整備などが挙げられます。

当レポートでは、世界の血管パッチの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、材料別・用途別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 規制状況

- ポーターのファイブフォース分析

- 技術分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

第6章 血管パッチ市場:材料別

- イントロダクション

- 生体血管パッチ

- 合成血管パッチ

第7章 血管パッチ市場:用途別

- イントロダクション

- 頸動脈内膜切除術 (CEA)

- 血管バイパス手術

- 先天性心疾患

- 腹部大動脈瘤 (AAA) 開腹修復

- その他の用途

第8章 血管パッチ市場:エンドユーザー別

- イントロダクション

- 病院

- 外来手術センター

第9章 血管パッチ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

第10章 競合情勢

- 概要

- 主要企業が採用した戦略

- 収益シェア分析

- 市場シェア分析

- 企業評価クアドラント

- 企業のフットプリント分析

- 競合シナリオ

- 資本取引

- その他の動向

第11章 企業プロファイル

- 主要企業

- BAXTER INTERNATIONAL, INC.

- LEMAITRE VASCULAR, INC.

- W. L. GORE & ASSOCIATES, INC.

- GETINGE AB

- B. BRAUN

- EDWARDS LIFESCIENCES CORPORATION

- BECTON, DICKINSON AND COMPANY

- AZIYO BIOLOGICS, INC.

- TERUMO CORPORATION

- ARTIVION, INC.

- LABCOR LABORATORIOS LTDA.

- その他の企業

- VUP MEDICAL

- AEGIS LIFESCIENCES

- SYNKROMAX BIOTECH PVT. LTD.

第12章 付録

The global vascular patches market is valued at an estimated USD 353 million in 2022 and is projected to reach USD 517 million by 2027, at a CAGR of 7.9% during the forecast period. Market growth is driven by factors such as the rising incidence of CVD, the rise in the volume of surgical procedures, coupled with the increasing adoption of biological patches for vascular surgeries.

"The biologic vascular patches held the largest share of the vascular patches market, by material"

Based on material, the global vascular patches market is segmented into biological and synthetic vascular patches. Biologic vascular patches held a significant share in the market. It is also the fastest-growing material segment in this market. Growth in this segment is primarily driven by the advantages offered by the biologic patches over their synthetic counterparts.

"The vascular bypass surgery segment is the fastest growing segment of the vascular patches market, by application"

Based on application, the vascular patches market is segmented into carotid endarterectomy (CEA), open repair of abdominal aortic aneurysm (AAA), congenital heart diseases, vascular bypass surgery, and other applications. The vascular bypass surgery is expected to witness the fastest growth during the forecast period. The high growth rate of vascular bypass surgery can be attributed to the availability of reimbursement in emerging and developed economies.

"Among the end users, the hospitals segment is anticipated to register the highest growth during the forecast period"

Based on end users, the vascular patches market is segmented into hospitals and ambulatory surgical centers. The hospitals segment is anticipated to witness growth at the highest rate during the forecast period. The growth can be attributed to the increasing number of hospitals offering better healthcare services and infrastructure.

"The Asia Pacific market is expected to grow at the highest CAGR during the forecast period"

The global vascular patches market is segmented into four regions - North America, Europe, the Asia Pacific, and Rest of the World. The Asia Pacific region is expected to witness the highest growth in the vascular patches market during the forecast period. The high growth in this region can primarily be attributed to the large number of target population, and improved healthcare infrastructures in Southeast Asian countries.

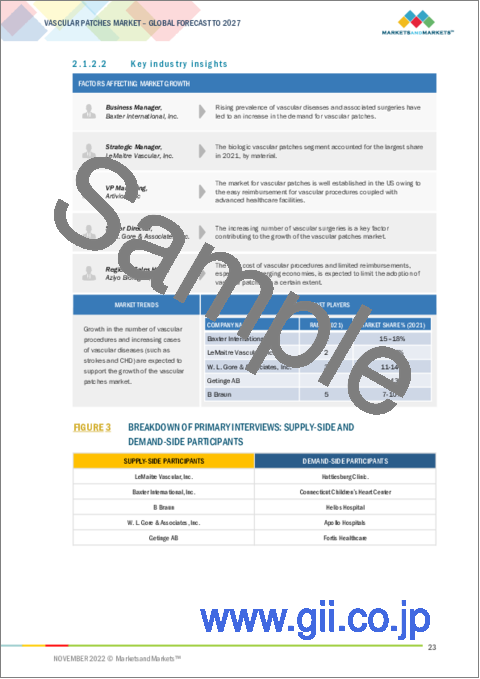

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 30%, Tier 2 - 45%, and Tier 3 - 25%

- By Designation: C-level - 28%, D-level - 32%, and Others - 40%

- By Region: North America - 35%, Europe - 21%, Asia Pacific - 28%, Rest of the World - 16%

Lists of Companies Profiled in the Report:

- Baxter International, Inc. (US)

- LeMaitre Vascular, Inc. (US)

- W. L. Gore & Associates, Inc. (US)

- Getinge AB (Sweden)

- B Braun (Germany)

- Artivion, Inc (US)

- Edwards Lifesciences Corporation (US)

- Aziyo Biologics, Inc. (US)

- Terumo Corporation (Japan)

- BD (US)

- Labcor Laboratorios Ltda. (Brazil)

- VUP Medical (Czech Republic)

- Aegis Lifesciences (India)

- SynkroMax Biotech Pvt. Ltd. (India)

Research Coverage:

This report provides a detailed picture of the global vascular patches market. It aims at estimating the size and future growth potential of the market across different segments, such as material, application, end user, and region. The report also includes an in-depth competitive analysis of the key market players, along with their company profiles, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall vascular patches market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 VASCULAR PATCHES MARKET

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY SOURCES

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT: VASCULAR PATCHES MARKET

- 2.7 LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

- 2.8 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 VASCULAR PATCHES MARKET, BY MATERIAL, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 VASCULAR PATCHES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 VASCULAR PATCHES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 GEOGRAPHICAL SNAPSHOT OF VASCULAR PATCHES MARKET

4 PREMIUM INSIGHTS

- 4.1 VASCULAR PATCHES MARKET OVERVIEW

- FIGURE 13 RISING PREVALENCE OF CVD AND GROWING VOLUME OF CARDIOVASCULAR SURGERIES TO DRIVE MARKET

- 4.2 ASIA PACIFIC: VASCULAR PATCHES MARKET, BY MATERIAL (2021)

- FIGURE 14 BIOLOGICAL VASCULAR PATCHES ACCOUNTED FOR LARGEST SHARE IN 2021

- 4.3 VASCULAR PATCHES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 15 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.4 VASCULAR PATCHES MARKET: GEOGRAPHIC MIX

- FIGURE 16 ASIA PACIFIC MARKET TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- 4.5 VASCULAR PATCHES MARKET: DEVELOPED VS. EMERGING ECONOMIES

- FIGURE 17 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 VASCULAR PATCHES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising incidence of CVD

- 5.2.1.2 Growing geriatric population and subsequent prevalence of vascular diseases

- 5.2.1.3 Rising number of cardiovascular surgeries worldwide

- 5.2.1.4 Availability of reimbursement for vascular procedures

- 5.2.1.5 Growing adoption of biological patches

- 5.2.2 RESTRAINTS

- 5.2.2.1 High procedural cost of vascular surgeries and associated products

- 5.2.2.2 Product failures and recalls

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging economies

- 5.2.3.2 Growth in the number of hospitals & surgical centers

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled professionals

- 5.3 REGULATORY LANDSCAPE

- TABLE 2 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.1 NORTH AMERICA

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.2 EUROPE

- 5.3.3 ASIA PACIFIC

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.4 LATIN AMERICA

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.5 MIDDLE EAST

- 5.3.6 AFRICA

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 VASCULAR PATCHES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT FROM NEW ENTRANTS

- 5.4.2 THREAT FROM SUBSTITUTES

- 5.4.3 BARGAINING POWER OF BUYERS

- 5.4.4 BARGAINING POWER OF SUPPLIERS

- 5.4.5 DEGREE OF COMPETITION

- 5.5 TECHNOLOGY ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- FIGURE 19 VASCULAR PATCHES MARKET: SUPPLY CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- FIGURE 20 VASCULAR PATCHES MARKET: ECOSYSTEM ANALYSIS

- 5.8.1 ECOSYSTEM ROLE

6 VASCULAR PATCHES MARKET, BY MATERIAL

- 6.1 INTRODUCTION

- TABLE 7 VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- 6.2 BIOLOGIC VASCULAR PATCHES

- 6.2.1 WIDE USAGE IN ARTERIAL CLOSURE DURING CARDIAC SURGERIES TO DRIVE MARKET

- TABLE 8 BIOLOGIC VASCULAR PATCHES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 SYNTHETIC VASCULAR PATCHES

- 6.3.1 HIGH RISK OF INFECTION DESPITE BEING COST-EFFICIENT TO RESTRAIN MARKET

- TABLE 9 SYNTHETIC VASCULAR PATCHES MARKET, BY REGION, 2020-2027 (USD MILLION)

7 VASCULAR PATCHES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 10 VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 7.2 CAROTID ENDARTERECTOMY

- 7.2.1 INCREASING PATCH ANGIOPLASTY PROCEDURES TO DRIVE MARKET

- TABLE 11 VASCULAR PATCHES MARKET FOR CAROTID ENDARTERECTOMY, BY REGION, 2020-2027 (USD MILLION)

- 7.3 VASCULAR BYPASS SURGERY

- 7.3.1 RISING PREVALENCE OF VASCULAR DISEASES TO DRIVE MARKET

- TABLE 12 VASCULAR PATCHES MARKET FOR VASCULAR BYPASS SURGERY, BY REGION, 2020-2027 (USD MILLION)

- 7.4 CONGENITAL HEART DISEASE

- 7.4.1 USE OF SYNTHETIC & BIOLOGIC VASCULAR PATCHES FOR CORRECTIVE SURGERIES TO DRIVE MARKET

- TABLE 13 VASCULAR PATCHES MARKET FOR CONGENITAL HEART DISEASE, BY REGION, 2020-2027 (USD MILLION)

- 7.5 OPEN REPAIR OF ABDOMINAL AORTIC ANEURYSM

- 7.5.1 RISING INCIDENCE OF AAA TO DRIVE DEMAND FOR VASCULAR PATCHES

- TABLE 14 VASCULAR PATCHES MARKET FOR OPEN REPAIR OF ABDOMINAL AORTIC ANEURYSM, BY REGION, 2020-2027 (USD MILLION)

- 7.6 OTHER APPLICATIONS

- TABLE 15 VASCULAR PATCHES MARKET FOR OTHER APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

8 VASCULAR PATCHES MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 16 VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.2 HOSPITALS

- 8.2.1 RISING BURDEN OF CVD AND DEVELOPING INFRASTRUCTURE IN EMERGING ECONOMIES TO DRIVE MARKET

- TABLE 17 VASCULAR PATCHES MARKET FOR HOSPITALS, BY REGION, 2020-2027 (USD MILLION)

- 8.3 AMBULATORY SURGICAL CENTERS

- 8.3.1 RISING NUMBER OF ASCS TO PROPEL MARKET GROWTH

- TABLE 18 VASCULAR PATCHES MARKET FOR AMBULATORY SURGICAL CENTERS, BY REGION, 2020-2027 (USD MILLION)

9 VASCULAR PATCHES MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 19 VASCULAR PATCHES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 21 NORTH AMERICA: VASCULAR PATCHES MARKET SNAPSHOT

- TABLE 20 NORTH AMERICA: VASCULAR PATCHES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 21 NORTH AMERICA: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 22 NORTH AMERICA: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 23 NORTH AMERICA: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Favorable government reimbursements for vascular surgeries to drive market

- TABLE 24 US: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 25 US: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 26 US: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 High incidence of vascular diseases to support market growth

- TABLE 27 CANADA: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 28 CANADA: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 29 CANADA: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3 EUROPE

- TABLE 30 EUROPE: VASCULAR PATCHES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 31 EUROPE: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 32 EUROPE: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 33 EUROPE: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Presence of a large target patient population to support market growth

- TABLE 34 GERMANY: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 35 GERMANY: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 36 GERMANY: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.2 FRANCE

- 9.3.2.1 High prevalence of CVD to drive demand for vascular patches

- TABLE 37 FRANCE: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 38 FRANCE: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 39 FRANCE: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Rising geriatric population and subsequent prevalence of CHD to drive market

- TABLE 40 UK: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 41 UK: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 42 UK: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Increasing incidence of CHD to support market growth

- TABLE 43 ITALY: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 44 ITALY: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 45 ITALY: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Rising risk of developing CVD due to age-related disorders to support market growth

- TABLE 46 SPAIN: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 47 SPAIN: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 48 SPAIN: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 49 REST OF EUROPE: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 50 REST OF EUROPE: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 51 REST OF EUROPE: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 22 ASIA PACIFIC: VASCULAR PATCHES MARKET SNAPSHOT (2021)

- TABLE 52 ASIA PACIFIC: VASCULAR PATCHES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 53 ASIA PACIFIC: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 54 ASIA PACIFIC: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 55 ASIA PACIFIC: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Rising prevalence of chronic heart diseases to drive market

- TABLE 56 CHINA: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 57 CHINA: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 58 CHINA: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Rising public healthcare spending to drive demand for vascular patches

- TABLE 59 JAPAN: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 60 JAPAN: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 61 JAPAN: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Rising incidence of CVD to drive market

- TABLE 62 INDIA: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 63 INDIA: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 64 INDIA: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.4 REST OF ASIA PACIFIC

- TABLE 65 REST OF ASIA PACIFIC: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 66 REST OF ASIA PACIFIC: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 67 REST OF ASIA PACIFIC: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.5 REST OF THE WORLD

- TABLE 68 REST OF THE WORLD: VASCULAR PATCHES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 69 REST OF THE WORLD: VASCULAR PATCHES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 70 REST OF THE WORLD: VASCULAR PATCHES MARKET, BY END USER, 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 71 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- 10.3 REVENUE SHARE ANALYSIS

- FIGURE 23 VASCULAR PATCHES MARKET: REVENUE SHARE ANALYSIS OF KEY PLAYERS

- 10.4 MARKET SHARE ANALYSIS

- TABLE 72 VASCULAR PATCHES MARKET: DEGREE OF COMPETITION

- FIGURE 24 VASCULAR PATCHES MARKET SHARE ANALYSIS, 2021

- 10.5 COMPANY EVALUATION QUADRANT

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 25 VASCULAR PATCHES MARKET: COMPANY EVALUATION QUADRANT (2021)

- 10.6 COMPANY FOOTPRINT ANALYSIS

- TABLE 73 COMPANY FOOTPRINT

- TABLE 74 COMPANY MATERIAL FOOTPRINT

- TABLE 75 COMPANY REGIONAL FOOTPRINT

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 DEALS

- TABLE 76 VASCULAR PATCHES MARKET: DEALS, 2019-2022

- 10.7.2 OTHER DEVELOPMENTS

- TABLE 77 VASCULAR PATCHES MARKET: OTHER DEVELOPMENTS, 2019-2022

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1 KEY PLAYERS

- 11.1.1 BAXTER INTERNATIONAL, INC.

- TABLE 78 BAXTER INTERNATIONAL, INC: COMPANY OVERVIEW

- FIGURE 26 BAXTER INTERNATIONAL, INC: COMPANY SNAPSHOT (2021)

- 11.1.2 LEMAITRE VASCULAR, INC.

- TABLE 79 LEMAITRE VASCULAR, INC: COMPANY OVERVIEW

- FIGURE 27 LEMAITRE VASCULAR, INC: COMPANY SNAPSHOT (2021)

- 11.1.3 W. L. GORE & ASSOCIATES, INC.

- TABLE 80 W. L. GORE & ASSOCIATES: COMPANY OVERVIEW

- 11.1.4 GETINGE AB

- TABLE 81 GETINGE AB: COMPANY OVERVIEW

- FIGURE 28 GETINGE AB: COMPANY SNAPSHOT (2021)

- TABLE 82 EXCHANGE RATES UTILIZED FOR CONVERSION OF SEK TO USD

- 11.1.5 B. BRAUN

- TABLE 83 B. BRAUN: COMPANY OVERVIEW

- FIGURE 29 B. BRAUN: COMPANY SNAPSHOT (2021)

- TABLE 84 EXCHANGE RATES UTILIZED FOR CONVERSION OF EUROS TO USD

- 11.1.6 EDWARDS LIFESCIENCES CORPORATION

- TABLE 85 EDWARDS LIFESCIENCES CORPORATION: COMPANY OVERVIEW

- FIGURE 30 EDWARDS LIFESCIENCES CORPORATION: COMPANY SNAPSHOT (2021)

- 11.1.7 BECTON, DICKINSON AND COMPANY

- TABLE 86 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- FIGURE 31 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

- 11.1.8 AZIYO BIOLOGICS, INC.

- TABLE 87 AZIYO BIOLOGICS, INC: COMPANY OVERVIEW

- FIGURE 32 AZIYO BIOLOGICS, INC: COMPANY SNAPSHOT (2021)

- 11.1.9 TERUMO CORPORATION

- TABLE 88 TERUMO CORPORATION: COMPANY OVERVIEW

- FIGURE 33 TERUMO CORPORATION: COMPANY SNAPSHOT (2022)

- TABLE 89 EXCHANGE RATES UTILIZED FOR CONVERSION OF YEN TO USD

- 11.1.10 ARTIVION, INC.

- TABLE 90 ARTIVION, INC.: COMPANY OVERVIEW

- FIGURE 34 ARTIVION, INC: COMPANY SNAPSHOT (2021)

- 11.1.11 LABCOR LABORATORIOS LTDA.

- TABLE 91 LABCOR LABORATORIOS LTDA.: COMPANY OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 VUP MEDICAL

- TABLE 92 VUP MEDICAL: COMPANY OVERVIEW

- 11.2.2 AEGIS LIFESCIENCES

- TABLE 93 AEGIS LIFESCIENCES: COMPANY OVERVIEW

- 11.2.3 SYNKROMAX BIOTECH PVT. LTD.

- TABLE 94 SYNKROMAX BIOTECH PVT. LTD: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 INDUSTRY EXPERT INSIGHTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS