|

|

市場調査レポート

商品コード

1160824

屋外用LED照明の世界市場:設置段階別 (新規設置、改修設置)・提供製品/サービス別・販売チャネル別・通信方式別・ワット数別 (50W未満、50~150W、150W以上)・用途別 (道路、建築物、スポーツ会場、トンネル)・地域別の将来予測 (2027年まで)Outdoor LED Lighting Market by Installation (New, Retrofit), Offering, Sales Channel, Communication, Wattage (Below 50W, 50-150W, Above 150W), Application (Streets and Roads, Architecture, Sports, Tunnels) and Geography - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 屋外用LED照明の世界市場:設置段階別 (新規設置、改修設置)・提供製品/サービス別・販売チャネル別・通信方式別・ワット数別 (50W未満、50~150W、150W以上)・用途別 (道路、建築物、スポーツ会場、トンネル)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月07日

発行: MarketsandMarkets

ページ情報: 英文 244 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の屋外用LED照明の市場規模は、2022年に257億米ドル、2027年には515億米ドルに達すると予測されており、予測期間中のCAGRは14.9%となる見通しです。

活況を呈する照明産業が、エネルギー効率の高い製品の需要増大や、LED技術を用いた既存照明製品の改造需要の拡大に最も寄与しています。また、技術革新や環境問題の高まりが屋外用LED照明市場の成長をさらに加速しています。加えて、競争力のある製造コスト、高い経済成長率、商業部門における大規模な産業建設なども、屋外用LED照明市場の成長を促進する要因となっています。

"ラインフィット (新規設置) が、予測期間中に最大の市場シェアを占める"

世界各国で建設工事が進む中で、インフラ向け技術投資の増加は、明らかに新規設置型の屋外用LED市場の追い風となっています。高速道路やスタジアム、トンネルといった各種用途向けインフラ・建設プロジェクトの拡大により、新規プロジェクト向けLED照明の新規設置が必要になります。したがって、新規設置部門が予測期間中により大きな市場シェアを占めることになります。

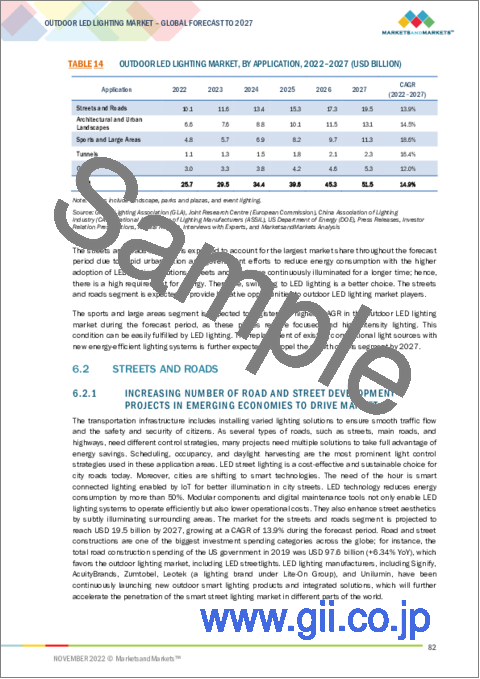

"街路・道路向けのセグメントが、2022年~2027年に市場を独占する"

急速な都市化や、LED照明ソリューション採用によるエネルギー消費量削減に向けた政府の取り組みにより、予測期間を通じて街路・道路セグメントが最大の市場シェアを占めると見られています。街路・道路では照明が継続的に使用されるため、エネルギー消費量が多くなります。したがって、LED照明への切り替えはより良い選択となります。

"欧州は、屋外LED照明市場で2番目に大きな市場シェアを占める"

欧州各国の政府の持続可能な政策が、屋外用LED照明市場の需要を牽引しています。最近の2つの政策 (エコデザイン規制の更新、電気機器の有害物質を管理するRoHS指令の規制) により、EU市場は従来型の水銀入り蛍光灯から最新型のLED照明技術に移行することになります。2023年には、すべての汎用蛍光灯が段階的に廃止される予定です。ノルウェー、スイス、英国はすでにEU-27のエコデザイン規制を採用しており、今後、RoHS指令の規制が追随していくことが予想されます。

当レポートでは、世界の屋外用LED照明の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、用途別・提供製品/サービス別・通信方式別・設置段階別・ワット数別・販売チャネル別・インターフェース規格別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- 平均販売価格分析

- 貿易分析

- エコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- ケーススタディ分析

- 特許分析

- 技術分析

- Li-Fi

- HCL (人間中心の照明)

- IoTライティング

- 政府の規制と基準

- 主要な規制機関・政府機関・その他の組織

- 主な会議とイベント (2022年・2023年)

- 購入プロセスにおける主要な利害関係者

第6章 屋外用LED照明市場:用途別

- イントロダクション

- 街路・道路

- 建築物・都市景観

- スポーツ会場・広域

- トンネル

- その他

第7章 屋外用LED照明市場:提供製品/サービス別

- イントロダクション

- ハードウェア

- ランプ

- 照明器具

- 制御システム

- ソフトウェア

- サービス

- 設置前サービス

- 設置後サービス

第8章 屋外用LED照明市場:通信方式別

- イントロダクション

- 有線

- 無線

第9章 屋外用LED照明市場:設置段階別

- イントロダクション

- ラインフット (新規設置)

- レトロフィット (改修設置)

第10章 屋外用LED照明市場:ワット数別

- イントロダクション

- 50W未満

- 50~150W

- 150W以上

第11章 屋外用LED照明市場:販売チャネル別

- イントロダクション

- 小売・卸売

- 直販・契約ベース

- eコマース

第12章 屋外用LED照明市場:インターフェース規格別

- イントロダクション

- NEMA

- ZHAGA

第13章 屋外用LED照明市場:地域別

- イントロダクション

- 南北アメリカ

- 北米

- 南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東

- アフリカ

第14章 競合情勢

- イントロダクション

- 主要企業の戦略/有力企業

- 製品ポートフォリオ

- 重要な地域

- 製造フットプリント

- 有機的・無機的な成長戦略

- 市場シェア分析 (2021年)

- 屋外用LED照明市場の大手企業の収益分析

- 企業評価クアドラント

- 企業のフットプリント

- 競合ベンチマーキング

- 中小企業の評価クアドラント

- 競争状況と動向

- 製品の発売と開発

- 資本取引

- その他

第15章 企業プロファイル

- 主要企業

- SIGNIFY N.V.

- ACUITY BRANDS, INC.

- CREE LIGHTING (IDEAL INDUSTRIES, INC.の一部門)

- DIALIGHT PLC

- PANASONIC CORPORATION

- CURRENT (TM) (旧GE CURRENT、現在はDAINTREEの子会社)

- EATON CORPORATION

- FAGERHULTS BELYSNING AB

- ZUMTOBEL GROUP

- SCHREDER

- その他の企業

- HENGDIAN GROUP TOSPO LIGHTING CO., LTD.

- SAMSUNG

- SHARP CORPORATION

- OSRAM LIGHT AG (GE)

- SYSKA LED

- DIGITAL LUMENS INC.

- NEPTUN LIGHT, INC.

- ENVISION LIGHTING

- GO GREEN LED

- FOREST LIGHTING

- LIGHTING SCIENCE GROUP CORPORATION

- WIPRO LIGHTING (WIPRO LIMITEDの傘下)

- OPPLE LIGHTING CO., LIMITED

- NVC LIGHTING TECHNOLOGY CORPORATION

- TANKO LIGHTING INC.

第16章 付録

The outdoor LED lighting market size is estimated to be USD 25.7 billion in 2022 and is projected to reach USD 51.5 billion by 2027, at a CAGR of 14.9% during the forecast period. The booming lighting industry contributes most to the rising demand for energy-efficient products and modifications in the existing lighting products using LED technology. Technological innovations and rising environmental concerns have further accelerated the growth of the outdoor LED lighting market. Competitive manufacturing costs, high economic growth rates, and large-scale industrial constructions in commercial segments are some of the other major factors driving the growth of the outdoor LED lighting market.

New installation type to register the largest market share in the forecast period.

With the ongoing developments across the globe, the increasing technological investments towards infrastructure will evidently tend to the new installations in the outdoor LED lighting market. Increased infrastructure and construction projects for various applications, like highways, stadiums, tunnels, etc., will require new installations for new projects. Hence, the new installations segment will hold a larger market share throughout the forecast period.

The streets and roads application segment is likely to dominate the outdoor LED lighting market from 2022 to 2027.

According to market estimates, the streets and roads segment is expected to account for the largest market share throughout the forecast period due to rapid urbanization and government efforts to reduce energy consumption by adopting LED lighting solutions. Streets and roadways are continuously illuminated; hence, there is a high requirement for energy. Therefore, switching to LED lighting is a better choice. Streets and roadways are expected to provide lucrative opportunities to outdoor LED lighting market players.

Europe is projected to account for the second largest market share in the outdoor LED lighting market.

The outdoor LED lighting market in Europe considers Germany, France, Italy, UK, and Rest of Europe for the study. These countries are expected to drive the LED lighting market growth in Europe in the future. The LED lighting market in Europe is highly fragmented, with the presence of several large and medium-sized companies offering products for various applications considered in this study. Germany has more than 50 medium-sized companies that manufacture LED lighting products.

The sustainable policies of the government in this region drive the demand for the outdoor LED lighting market. Two recent policy measures - updated Ecodesign regulations and RoHS Directive regulations governing hazardous substances in electrical equipment - will shift the EU market away from conventional mercury-containing fluorescent lighting to advanced LED lighting technology. In 2023, all general-purpose fluorescent lamps are expected to be phased out. Norway, Switzerland, and UK have already adopted the EU-27 Ecodesign regulation, and the RoHS directive regulations are expected to be followed in the coming years.

Signify Holding (Netherlands), Acuity Brands Lighting, Inc. (US), Cree Lighting (US), Dialight (UK), Panasonic Corporation (Japan), GE Current (US), Eaton (US), OSRAM (Germany), Zumtobel Group AG (Austria) are the key players in the outdoor LED lighting market. These top players have strong portfolios of products and services and a presence in both mature and emerging markets.

The study includes an in-depth competitive analysis of these key players in the outdoor LED lighting market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The report defines, describes, and forecasts the outdoor LED lighting market based on offering, installation, sales channel, application, wattage type, interfacing standard, communication, and geography. It provides detailed information regarding factors such as drivers, restraints, opportunities, and challenges influencing the growth of the outdoor LED lighting market. It also analyzes competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and developments carried out by the key players to grow in the market.

Key Benefits of Buying the Report

The report would help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall outdoor LED lighting market and the subsegments. This report would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 OUTDOOR LED LIGHTING MARKET: MARKET SEGMENTATION

- 1.3.2 REGIONAL SEGMENTATION

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 PACKAGE SIZE

- 1.6 STUDY LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 OUTDOOR LED LIGHTING MARKET: RESEARCH METHODOLOGY

- FIGURE 3 OUTDOOR LED LIGHTING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Key data from secondary sources

- 2.1.2.2 List of major secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Capturing market share of application by bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Capturing market share of application by top-down analysis (supply side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY SIDE ANALYSIS

- 2.3.2 DEMAND SIDE ANALYSIS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT: OUTDOOR LED LIGHTING MARKET

- 2.5.1 GROWTH FORECAST ASSUMPTIONS

- TABLE 2 MARKET GROWTH ASSUMPTIONS

- 2.6 RESEARCH ASSUMPTIONS

- FIGURE 9 KEY RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 GLOBAL OUTDOOR LED LIGHTING MARKET

- FIGURE 11 HARDWARE OFFERING TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 SPORTS AND LARGE AREAS SEGMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 13 NEW INSTALLATION TYPE TO HOLD LARGER MARKET DURING FORECAST PERIOD

- FIGURE 14 WIRED COMMUNICATION TYPE TO POSSESS LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 E-COMMERCE TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 50-150 W TYPE TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO WITNESS FASTEST GROWTH RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OUTDOOR LED LIGHTING MARKET

- FIGURE 18 SIGNIFICANT ADOPTION OF LED LIGHTING IN OUTDOOR APPLICATIONS TO DRIVE MARKET

- 4.2 OUTDOOR LED LIGHTING MARKET, BY APPLICATION

- FIGURE 19 SPORTS AND LARGE AREAS APPLICATION SEGMENT TO POSSESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.3 OUTDOOR LED LIGHTING MARKET, BY OFFERING

- FIGURE 20 HARDWARE SEGMENT TO HOLD LARGEST SHARE IN MARKET DURING FORECAST PERIOD

- 4.4 OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL

- FIGURE 21 E-COMMERCE SALES CHANNEL TO WITNESS FASTEST GROWTH IN DURING FORECAST PERIOD

- 4.5 OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE

- FIGURE 22 RETROFIT SEGMENT TO POSSESS SIGNIFICANT GROWTH IN MARKET BETWEEN 2022 AND 2027

- 4.6 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY OFFERING AND COUNTRY

- FIGURE 23 SOFTWARE TO HAVE HIGHEST GROWTH IN ASIA PACIFIC MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for improvement in visibility and safety

- 5.2.1.2 High demand for LED lighting for infrastructural developments

- 5.2.1.3 Need for energy-efficient lighting systems for highways

- 5.2.1.4 Demand for smart controls in street lighting systems

- 5.2.1.5 Adoption of LED bulbs and luminaires for net-zero emissions by 2050

- TABLE 3 LIGHTING TYPES, INSTALLED UNITS, AND ENERGY SAVINGS IN US (2018)

- FIGURE 25 OUTDOOR LED LIGHTING MARKET DRIVERS AND THEIR IMPACT

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness regarding installation costs for smart lighting and payback periods

- 5.2.2.2 Functional problems associated with LED technology

- 5.2.2.3 Short-to-medium-term impact due to US-China trade conflict and Russia-Ukraine war

- FIGURE 26 OUTDOOR LED LIGHTING MARKET RESTRAINTS AND THEIR IMPACT

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of wireless LED lighting systems for outdoor applications

- 5.2.3.2 Need for energy-efficient light sources in emerging economies

- 5.2.3.3 IoT technology in smart street lighting and smart city projects

- 5.2.3.4 Government initiatives toward adoption of efficient LED lighting

- 5.2.3.5 Continuous decline in prices of LED chips and other components of lighting systems

- FIGURE 27 OUTDOOR LED LIGHTING MARKET OPPORTUNITIES AND THEIR IMPACT

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of common open standards for LED lights

- 5.2.4.2 Slow rate of adoption of LED technology in emerging countries

- FIGURE 28 OUTDOOR LED LIGHTING MARKET CHALLENGES AND THEIR IMPACT

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 29 VALUE CHAIN ANALYSIS: OUTDOOR LED LIGHTING MARKET

- 5.4 PORTER'S FIVE FORCE ANALYSIS

- TABLE 4 IMPACT SCORE AND INTENSITY OF PORTER'S FIVE FORCES

- FIGURE 30 IMPACT OF PORTER'S FIVE FORCES ON OUTDOOR LED LIGHTING MARKET

- 5.4.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.4.2 THREAT OF NEW ENTRANTS

- 5.4.3 THREAT OF SUBSTITUTES

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 BARGAINING POWER OF SUPPLIERS

- 5.5 AVERAGE SELLING PRICE ANALYSIS

- FIGURE 31 OUTDOOR LED LIGHTING MARKET: MID AND LOW-POWER LED PACKAGE PRICING TREND

- FIGURE 32 OUTDOOR LED LIGHTING MARKET: HIGH-POWER LED PACKAGE PRICING TREND

- FIGURE 33 OUTDOOR LED LIGHTING MARKET: LED LAMP (60 W EQUIVALENT) PRICING TREND

- 5.6 TRADE ANALYSIS

- 5.6.1 TRADE ANALYSIS FOR OUTDOOR LED LIGHTING

- TABLE 5 IMPORT DATA FOR LAMPS AND LIGHTING FITTINGS, HS CODE: 9405 (USD MILLION)

- FIGURE 34 IMPORT VALUES OF LAMPS AND LIGHTING FIXTURES, BY COUNTRY, 2017-2021

- TABLE 6 EXPORT DATA FOR LAMPS AND LIGHTING FIXTURES, HS CODE: 9405 (USD MILLION)

- FIGURE 35 EXPORT VALUES OF LAMPS AND LIGHTING FIXTURES, BY COUNTRY, 2017-2021

- 5.7 ECOSYSTEM ANALYSIS

- FIGURE 36 OUTDOOR LED LIGHTING MARKET: ECOSYSTEM ANALYSIS

- TABLE 7 OUTDOOR LED LIGHTING MARKET: ECOSYSTEM ANALYSIS

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 37 REVENUE SHIFT AND NEW REVENUE POCKET FOR OUTDOOR LED LIGHTING

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ABB ATLANTA INTERNATIONAL AIRPORT (ATL) TO HAVE COMPLETE MAKEOVER WITH LED LIGHTING

- 5.9.2 LIGHTING OF NORDHAVNSVEI TUNNEL

- 5.9.3 SMART LIGHTING FOR THE STATE OF NEW YORK

- 5.10 PATENT ANALYSIS

- TABLE 8 KEY PATENT REGISTRATIONS, 2018-2021

- FIGURE 38 PATENT GRANTED WORLDWIDE, 2011-2021

- TABLE 9 TOP 20 PATENT OWNERS, 2011-2021

- FIGURE 39 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2011-2021

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 LI-FI

- 5.11.2 HUMAN-CENTRIC LIGHTING

- 5.11.3 IOT LIGHTING

- 5.12 GOVERNMENT REGULATIONS AND STANDARDS

- 5.12.1 GOVERNMENT REGULATIONS

- 5.12.2 STANDARDS

- 5.12.2.1 IEEE 1789-2015 modulation frequencies for light-emitting diodes (LEDs)

- 5.12.2.2 Energy Star - developed by US Department of Energy (DOE) and US Environmental Protection Agency (EPA)

- 5.12.2.3 NEMA - ANSI C78.51 - electric lamps - LED (light-emitting diode) lamps - method of designation

- 5.13 KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 11 OUTDOOR LED LIGHTING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.15 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 12 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- 5.15.1 BUYING CRITERIA

6 OUTDOOR LED LIGHTING MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- FIGURE 40 OUTDOOR LED LIGHTING MARKET, BY APPLICATION

- TABLE 13 OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2018-2021 (USD BILLION)

- FIGURE 41 STREETS AND ROADS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET BETWEEN 2022 AND 2027

- TABLE 14 OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- 6.2 STREETS AND ROADS

- 6.2.1 INCREASING NUMBER OF ROAD AND STREET DEVELOPMENT PROJECTS IN EMERGING ECONOMIES TO DRIVE MARKET

- TABLE 15 STREETS AND ROADS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 16 STREETS AND ROADS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 6.3 ARCHITECTURAL AND URBAN LANDSCAPES

- 6.3.1 OUTDOOR LED LIGHTING TO WITNESS INCREASED DEMAND FROM ARCHITECTURAL LANDMARKS AND SKYSCRAPERS

- TABLE 17 ARCHITECTURAL AND URBAN LANDSCAPES: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 18 ARCHITECTURAL AND URBAN LANDSCAPES: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 6.4 SPORTS AND LARGE AREAS

- 6.4.1 EXISTING STADIUMS AND SPORTS COMPLEXES SWITCHING TO LED LIGHTING FROM CONVENTIONAL LIGHTS

- TABLE 19 SPORTS AND LARGE AREAS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 20 SPORTS AND LARGE AREAS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 6.5 TUNNELS

- 6.5.1 UPCOMING TUNNEL CONSTRUCTION PROJECTS TO PROVIDE OPPORTUNITIES TO LED LIGHTING SYSTEM PROVIDERS

- TABLE 21 TUNNELS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 22 TUNNELS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 6.6 OTHERS

- TABLE 23 OTHERS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 24 OTHERS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

7 OUTDOOR LED LIGHTING MARKET, BY OFFERING

- 7.1 INTRODUCTION

- FIGURE 42 OUTDOOR LED LIGHTING MARKET, BY OFFERING

- TABLE 25 OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2018-2021 (USD BILLION)

- FIGURE 43 HARDWARE TO ACCOUNT LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 26 OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- 7.2 HARDWARE

- 7.2.1 LAMPS

- 7.2.1.1 Long life and durability of lamps to augment growth

- 7.2.2 LUMINAIRES

- 7.2.2.1 Availability in different varieties for various requirements to drive market

- 7.2.3 CONTROL SYSTEMS

- 7.2.3.1 Increased adoption of intelligent lighting systems to propel market

- TABLE 27 HARDWARE: OUTDOOR LED LIGHTING MARKET, BY TYPE, 2018-2021 (USD BILLION)

- FIGURE 44 LUMINAIRES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 28 HARDWARE: OUTDOOR LED LIGHTING MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 29 HARDWARE: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 30 HARDWARE: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 7.2.1 LAMPS

- 7.3 SOFTWARE

- 7.3.1 INCREASED ACCESS TO CONTROL LIGHTING SYSTEMS TO AID MARKET

- TABLE 31 SOFTWARE: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 32 SOFTWARE: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 7.4 SERVICES

- 7.4.1 SERVICES HOLD SIGNIFICANT MARKET SHARE DUE TO USER-SPECIFIC NEEDS

- 7.4.2 PRE-INSTALLATION SERVICES

- 7.4.2.1 Design and installation

- 7.4.3 POST-INSTALLATION SERVICES

- 7.4.3.1 Maintenance and support

- TABLE 33 SERVICES: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 34 SERVICES: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

8 OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION

- 8.1 INTRODUCTION

- FIGURE 45 OUTDOOR LIGHTING MARKET, BY COMMUNICATION

- TABLE 35 OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2018-2021 (USD BILLION)

- TABLE 36 OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2022-2027 (USD BILLION)

- 8.2 WIRED

- 8.2.1 WIDER ADOPTION DUE TO GREATER RELIABILITY TO BOOST MARKET

- TABLE 37 WIRED: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 38 WIRED: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 8.3 WIRELESS

- 8.3.1 COST AND ENERGY SAVINGS TO DRIVE MARKET

- TABLE 39 WIRELESS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 40 WIRELESS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

9 OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE

- 9.1 INTRODUCTION

- FIGURE 47 OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE

- TABLE 41 OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2018-2021 (USD BILLION)

- FIGURE 48 NEW INSTALLATION TO HOLD LARGER MARKET BETWEEN 2022 AND 2027

- TABLE 42 OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2022-2027 (USD BILLION)

- 9.2 NEW

- 9.2.1 NEW INSTALLATIONS TO HOLD LARGER MARKET SHARE OWING TO INCREASED INFRASTRUCTURE DEVELOPMENTS

- TABLE 43 NEW: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 44 NEW: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 9.3 RETROFIT

- 9.3.1 INCREASED NEED TO MODIFY EXISTING LIGHT FIXTURES TO DRIVE MARKET

- TABLE 45 RETROFIT: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 46 RETROFIT: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

10 OUTDOOR LED LIGHTING MARKET, BY WATTAGE TYPE

- 10.1 INTRODUCTION

- FIGURE 49 OUTDOOR LED LIGHTING MARKET, BY WATTAGE TYPE

- TABLE 47 OUTDOOR LED LIGHTING MARKET, BY WATTAGE TYPE, 2018-2021 (USD BILLION)

- FIGURE 50 WATTAGE RANGE OF 50-150 W TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 48 OUTDOOR LED LIGHTING MARKET, BY WATTAGE TYPE, 2022-2027 (USD BILLION)

- 10.2 LESS THAN 50 W

- 10.2.1 LESSER ADOPTION OF LOW WATTAGE CAPACITY LIGHTING SYSTEMS TO RESTRAIN MARKET

- 10.3 50-150 W

- 10.3.1 WIDER ADOPTION IN HIGHWAYS AND ROADWAYS TO DRIVE MARKET

- 10.4 MORE THAN 150 W

- 10.4.1 INCREASED USAGE IN TUNNELS AND FLOODLIGHTING TO PROPEL MARKET

11 OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL

- 11.1 INTRODUCTION

- TABLE 49 OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2018-2021 (USD BILLION)

- FIGURE 51 E-COMMERCE SEGMENT TO RECORD HIGHEST CAGR BETWEEN 2022 AND 2027

- TABLE 50 OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2022-2027 (USD BILLION)

- 11.2 RETAIL/WHOLESALE

- 11.2.1 RETAIL/WHOLESALE CHANNEL TO ACCOUNT FOR MAJOR MARKET SHARE

- TABLE 51 RETAIL/WHOLESALE: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 52 RETAIL/WHOLESALE: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 11.3 DIRECT SALES/CONTRACT-BASED

- 11.3.1 LESSER INTERFERENCE FROM THIRD PARTIES IN DIRECT SALES TO RESULT IN PROCUREMENT COST REDUCTION

- TABLE 53 DIRECT SALES/CONTRACT-BASED: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 54 DIRECT SALES/CONTRACT-BASED: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 11.4 E-COMMERCE

- 11.4.1 E-COMMERCE-BASED LED LIGHTING SALES TO INCREASE SIGNIFICANTLY UNTIL 2027

- TABLE 55 E-COMMERCE: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 56 E-COMMERCE: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

12 OUTDOOR LED LIGHTING MARKET, BY INTERFACING STANDARD

- 12.1 INTRODUCTION

- 12.2 NEMA

- 12.2.1 NEMA STANDARDIZATION TO BE MAJORLY USED IN AMERICAS

- 12.3 ZHAGA

- 12.3.1 ZHAGA STANDARDIZATION TO BE WIDELY USED IN EUROPE

- TABLE 57 POPULAR INTERFACING STANDARDS IN DIFFERENT REGIONS

13 OUTDOOR LED LIGHTING MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 52 OUTDOOR LED LIGHTING MARKET SEGMENTATION: BY REGION

- FIGURE 53 OUTDOOR LED LIGHTING MARKET: GEOGRAPHIC SNAPSHOT

- TABLE 58 OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 59 OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 13.2 AMERICAS

- FIGURE 54 MERICAS: OUTDOOR LED LIGHTING MARKET SNAPSHOT

- TABLE 60 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 61 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- TABLE 62 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2018-2021 (USD BILLION)

- TABLE 63 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 64 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2018-2021 (USD BILLION)

- TABLE 65 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 66 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2018-2021 (USD BILLION)

- TABLE 67 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2022-2027 (USD BILLION)

- TABLE 68 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2018-2021 (USD BILLION)

- TABLE 69 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2022-2027 (USD BILLION)

- TABLE 70 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2018-2021 (USD BILLION)

- TABLE 71 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2022-2027 (USD BILLION)

- 13.2.1 NORTH AMERICA

- TABLE 72 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 73 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 74 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2018-2021 (USD BILLION)

- TABLE 75 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 76 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2018-2021 (USD BILLION)

- TABLE 77 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 78 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2018-2021 (USD BILLION)

- TABLE 79 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2022-2027 (USD BILLION)

- TABLE 80 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2018-2021 (USD BILLION)

- TABLE 81 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2022-2027 (USD BILLION)

- TABLE 82 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2018-2021 (USD BILLION)

- TABLE 83 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2022-2027 (USD BILLION)

- 13.2.1.1 US

- 13.2.1.1.1 Advancements in LED technology due to ideal environment for innovation to propel market

- 13.2.1.2 Canada

- 13.2.1.2.1 Government energy efficiency regulations to drive adoption of outdoor LED

- 13.2.1.3 MEXICO

- 13.2.1.3.1 Government policies and initiatives to boost market

- 13.2.1.1 US

- 13.2.2 SOUTH AMERICA

- TABLE 84 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 85 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 86 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2018-2021 (USD BILLION)

- TABLE 87 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 88 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2018-2021 (USD BILLION)

- TABLE 89 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 90 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2018-2021 (USD BILLION)

- TABLE 91 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2022-2027 (USD BILLION)

- TABLE 92 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2018-2021 (USD BILLION)

- TABLE 93 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2022-2027 (USD BILLION)

- TABLE 94 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2018-2021 (USD BILLION)

- TABLE 95 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2022-2027 (USD BILLION)

- 13.2.2.1 Brazil

- 13.2.2.1.1 International collaboration to aid adoption of outdoor LED lighting products

- 13.2.2.2 Argentina

- 13.2.2.2.1 New government resolution for adoption of LED lighting products to foster growth

- 13.2.2.3 Rest of South America

- 13.2.2.1 Brazil

- 13.3 EUROPE

- FIGURE 55 EUROPE: OUTDOOR LED LIGHTING MARKET SNAPSHOT

- TABLE 96 EUROPE: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 97 EUROPE: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 98 EUROPE: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2018-2021 (USD BILLION)

- TABLE 99 EUROPE: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 100 EUROPE: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2018-2021 (USD BILLION)

- TABLE 101 EUROPE: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 102 EUROPE: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2018-2021 (USD BILLION)

- TABLE 103 EUROPE: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2022-2027 (USD BILLION)

- TABLE 104 EUROPE: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2018-2021 (USD BILLION)

- TABLE 105 EUROPE: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2022-2027 (USD BILLION)

- TABLE 106 EUROPE: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2018-2021 (USD BILLION)

- TABLE 107 EUROPE: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2022-2027 (USD BILLION)

- 13.3.1 GERMANY

- 13.3.1.1 Sustainability and momentum to reduce dependency on energy imports and stimulate market

- 13.3.2 UK

- 13.3.2.1 Government policies and collaborations for adoption of LED lighting to boost market

- 13.3.3 FRANCE

- 13.3.3.1 Government steps for environmental balance to accelerate adoption of LED lighting

- 13.3.4 ITALY

- 13.3.4.1 Reviving infrastructure and construction sectors to aid adoption of outdoor LED lighting

- 13.3.5 REST OF EUROPE

- 13.4 ASIA PACIFIC

- FIGURE 56 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET SNAPSHOT

- TABLE 108 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 109 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 110 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2018-2021 (USD BILLION)

- TABLE 111 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 112 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2018-2021 (USD BILLION)

- TABLE 113 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 114 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2018-2021 (USD BILLION)

- TABLE 115 OUTDOOR LED LIGHTING MARKET FOR ASIA PACIFIC, BY COMMUNICATION, 2022-2027 (USD BILLION)

- TABLE 116 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2018-2021 (USD BILLION)

- TABLE 117 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2022-2027 (USD BILLION)

- TABLE 118 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2018-2021 (USD BILLION)

- TABLE 119 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2022-2027 (USD BILLION)

- 13.4.1 CHINA

- 13.4.1.1 Government support and presence of LED lighting manufacturers to drive market

- 13.4.2 JAPAN

- 13.4.2.1 New building energy conservation law to reduce energy consumption and aid market

- 13.4.3 INDIA

- 13.4.3.1 Government-run smart city projects to boost demand for LED lighting and control solutions

- 13.4.4 AUSTRALIA

- 13.4.4.1 High penetration rate of LED lighting systems to foster market

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Presence of major LED lighting manufacturers to propel market

- 13.4.6 REST OF ASIA PACIFIC

- 13.5 REST OF THE WORLD

- TABLE 120 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 121 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- TABLE 122 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2018-2021 (USD BILLION)

- TABLE 123 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 124 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2018-2021 (USD BILLION)

- TABLE 125 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 126 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2018-2021 (USD BILLION)

- TABLE 127 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2022-2027 (USD BILLION)

- TABLE 128 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2018-2021 (USD BILLION)

- TABLE 129 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2022-2027 (USD BILLION)

- TABLE 130 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2018-2021 (USD BILLION)

- TABLE 131 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2022-2027 (USD BILLION)

- 13.5.1 MIDDLE EAST

- 13.5.1.1 Eco-friendly green building regulations and streetlight retrofitting programs to drive market

- 13.5.2 AFRICA

- 13.5.2.1 Ongoing urbanization in African regions to significantly boost market

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 132 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS

- 14.2.1 PRODUCT PORTFOLIO

- 14.2.2 REGIONAL FOCUS

- 14.2.3 MANUFACTURING FOOTPRINT

- 14.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

- 14.3 MARKET SHARE ANALYSIS, 2021

- TABLE 133 OUTDOOR LED LIGHTING MARKET: DEGREE OF COMPETITION

- 14.4 REVENUE ANALYSIS OF TOP PLAYERS IN OUTDOOR LED LIGHTING MARKET

- FIGURE 57 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN OUTDOOR LED LIGHTING MARKET

- 14.5 COMPANY EVALUATION QUADRANT

- 14.5.1 STARS

- 14.5.2 PERVASIVE PLAYERS

- 14.5.3 EMERGING LEADERS

- 14.5.4 PARTICIPANTS

- FIGURE 58 OUTDOOR LED LIGHTING MARKET (GLOBAL): COMPANY EVALUATION QUADRANT

- 14.6 COMPANY FOOTPRINT

- TABLE 134 OVERALL COMPANY FOOTPRINT

- TABLE 135 COMPANY FOOTPRINT, BY OFFERING

- TABLE 136 COMPANY FOOTPRINT, BY REGION

- TABLE 137 COMPANY FOOTPRINT, BY APPLICATION

- 14.7 COMPETITIVE BENCHMARKING

- TABLE 138 OUTDOOR LED LIGHTING MARKET: DETAILED LIST OF SMES

- TABLE 139 OUTDOOR LED LIGHTING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 14.8 SME EVALUATION QUADRANT

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- FIGURE 59 OUTDOOR LED LIGHTING MARKET (GLOBAL): START-UPS/SME EVALUATION QUADRANT, 2021

- 14.9 COMPETITIVE SITUATION AND TRENDS

- 14.9.1 PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 140 OUTDOOR LED LIGHTING MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2019-SEPTEMBER 2022

- 14.9.2 DEALS

- TABLE 141 OUTDOOR LED LIGHTING MARKET: DEALS, JANUARY 2019-SEPTEMBER 2022

- 14.9.3 OTHERS

- TABLE 142 OUTDOOR LED LIGHTING MARKET: OTHERS, JANUARY 2019-SEPTEMBER 2022

15 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 15.1 KEY PLAYERS

- 15.1.1 SIGNIFY N.V.

- TABLE 143 SIGNIFY N.V.: COMPANY OVERVIEW

- FIGURE 60 SIGNIFY N.V.: COMPANY SNAPSHOT

- 15.1.2 ACUITY BRANDS, INC.

- TABLE 144 ACUITY BRANDS, INC.: COMPANY OVERVIEW

- FIGURE 61 ACUITY BRANDS, INC.: COMPANY SNAPSHOT

- 15.1.3 CREE LIGHTING (PART OF IDEAL INDUSTRIES, INC.)

- TABLE 145 CREE LIGHTING: COMPANY OVERVIEW

- FIGURE 62 CREE LIGHTING: COMPANY SNAPSHOT

- 15.1.4 DIALIGHT PLC

- TABLE 146 DIALIGHT PLC: COMPANY OVERVIEW

- FIGURE 63 DIALIGHT PLC: COMPANY SNAPSHOT

- 15.1.5 PANASONIC CORPORATION

- TABLE 147 PANASONIC CORPORATION: COMPANY OVERVIEW

- FIGURE 64 PANASONIC CORPORATION: COMPANY SNAPSHOT

- 15.1.6 CURRENT™ (FORMERLY GE CURRENT, A DAINTREE COMPANY)

- TABLE 148 CURRENT™ (FORMERLY GE CURRENT, A DAINTREE COMPANY): COMPANY OVERVIEW

- 15.1.7 EATON CORPORATION

- TABLE 149 EATON CORPORATION: COMPANY OVERVIEW

- FIGURE 65 EATON CORPORATION: COMPANY SNAPSHOT

- 15.1.8 FAGERHULTS BELYSNING AB

- TABLE 150 FAGERHULTS BELYSNING AB: COMPANY OVERVIEW

- 15.1.9 ZUMTOBEL GROUP

- TABLE 151 ZUMTOBEL GROUP: COMPANY OVERVIEW

- FIGURE 66 ZUMTOBEL GROUP: COMPANY SNAPSHOT

- 15.1.10 SCHREDER

- TABLE 152 SCHREDER: COMPANY OVERVIEW

- 15.2 OTHER COMPANIES

- 15.2.1 HENGDIAN GROUP TOSPO LIGHTING CO., LTD.

- 15.2.2 SAMSUNG

- 15.2.3 SHARP CORPORATION

- 15.2.4 OSRAM LIGHT AG (GE)

- 15.2.5 SYSKA LED

- 15.2.6 DIGITAL LUMENS INC.

- 15.2.7 NEPTUN LIGHT, INC.

- 15.2.8 ENVISION LIGHTING

- 15.2.9 GO GREEN LED

- 15.2.10 FOREST LIGHTING

- 15.2.11 LIGHTING SCIENCE GROUP CORPORATION

- 15.2.12 WIPRO LIGHTING (UNDER WIPRO LIMITED)

- 15.2.13 OPPLE LIGHTING CO., LIMITED

- 15.2.14 NVC LIGHTING TECHNOLOGY CORPORATION

- 15.2.15 TANKO LIGHTING INC.

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 AVAILABLE CUSTOMIZATIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS