|

|

市場調査レポート

商品コード

1491988

1,4-ブタンジオールの世界市場:タイプ別、用途別、技術タイプ別、地域別 - 予測(~2029年)1,4-Butanediol Market by Type (Synthetic, and Bio-Based), Applications (THF, PBT, GBL and PU), Technology Type (Reppe, Davy, Butadiene, Propylene Oxide) and Region (Asia Pacific, Europe, and North America) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 1,4-ブタンジオールの世界市場:タイプ別、用途別、技術タイプ別、地域別 - 予測(~2029年) |

|

出版日: 2024年06月05日

発行: MarketsandMarkets

ページ情報: 英文 184 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の1,4-ブタンジオールの市場規模は、2024年の78億米ドルから2029年までに111億米ドルに達すると予測され、予測期間にCAGRで7.3%の成長が見込まれます。

市場の主な促進要因は、自動車、電子、テキスタイル産業での幅広い使用に起因する、テトラヒドロフラン(THF)やポリウレタン(PU)の生産用途における需要の高まりです。さらに、急速な工業化、技術の進歩、持続可能なバイオベース製品への注目の高まりが、市場成長を大きく後押ししています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(100万/10億米ドル)、数量(キロトン) |

| セグメント | タイプ別、技術別、用途別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、その他の地域 |

「タイプ別では、バイオベース1,4-ブタンジオールが予測期間にもっとも急成長するセグメントになると推定されます。」

バイオベース1,4-ブタンジオール(BDO)は、再生可能な代替品を奨励する有利な規制に支えられた環境意識の高まりにより、タイプ別でもっとも急成長しているセグメントです。技術の進歩により生産効率とコスト効率が向上し、競争力が高まっています。自動車やテキスタイルなどの産業における持続可能な製品に対する需要の高まりが、バイオベース1,4-ブタンジオールの成長をさらに後押ししています。研究開発への投資は技術革新を促進し、生産の拡張性を高めます。このような集合的な勢いにより、バイオベース1,4-ブタンジオールは再生可能化学品の進化における重要な促進要因となっています。

「用途別では、γ-ブチロラクトンが予測期間にもっとも急成長するセグメントになると推定されます。

γ-ブチロラクトン(GBL)は、ピロリドンや溶剤などのさまざまな化学品の中間体として多用途に使用されるため、1,4-ブタンジオールの用途でもっとも急成長しているセグメントです。医薬品、農薬、電子産業における高い需要が、GBLの成長をさらに後押ししています。さらに、スパンデックス繊維の製造における前駆体としての役割や、さまざまな産業用途における溶剤としてのGBLの役割も、市場の急速な拡大に寄与しています。また、高性能材料や持続可能なソリューションへの注目が高まっていることも、γ-ブチロラクトンの需要を高め、1,4-ブタンジオール市場をさらに拡大しています。

当レポートでは、世界の1,4-ブタンジオール市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 1,4-ブタンジオール市場の企業にとって魅力的な機会

- 1,4-ブタンジオール市場:地域別

- 1,4-ブタンジオール市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 価格分析

- サプライチェーン分析

- エコシステムマップ

- 規制情勢

- 技術分析

- 主要技術

- 隣接技術

- 主な会議とイベント

- 取引データ

- 輸入データ

- 輸出データ

- 主なステークホルダーと購入基準

- 特許分析

- 調査手法

- 主要特許

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

第6章 1,4-ブタンジオール市場:技術別

- イントロダクション

- レッペプロセス

- デイビープロセス

- ブタジエンプロセス

- プロピレンオキサイドプロセス

- その他の技術

第7章 1,4-ブタンジオール市場:用途別

- イントロダクション

- テトラヒドロフラン

- ポリブチレンテレフタレート(PBT)

- γ-ブチロラクトン(GBL)

- ポリウレタン(PU)

- その他の用途

第8章 1,4-ブタンジオール市場:タイプ別

- イントロダクション

- 合成

- バイオベース

第9章 1,4-ブタンジオール市場:地域別

- イントロダクション

- 北米

- 景気後退の影響

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 景気後退の影響

- 中国

- 日本

- 台湾

- 韓国

- その他のアジア太平洋

- 欧州

- 景気後退の影響

- ドイツ

- フランス

- 英国

- その他の欧州

- その他の地域

- 中東・アフリカ

- 南米

第10章 競合情勢

- 主要企業の戦略

- 主要市場企業が採用している戦略(2019年~2024年)

- 収益分析

- 市場シェア分析

- ブランド/製品の比較

- BASF-SEの1,4-ブタンジオール

- DCCの1,4-ブタンジオール

- XINJIANG TIANYE GROUP CO., LTD.の1,4-ブタンジオール

- MITSUBISHI CHEMICAL GROUP CORPORATIONの1,4-ブタンジオール

- NAN YA PLASTICS CORPORATIONの1,4-ブタンジオール

- 企業評価マトリクス:主要企業(2023年)

- 企業評価マトリクス:スタートアップ/中小企業(2023年)

- 企業評価と財務指標

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- BASF SE

- SINOPEC YIZHENG CHEMICAL FIBRE COMPANY LIMITED

- DCC

- NAN YA PLASTICS CORPORATION

- XINJIANG TIANYE GROUP CO., LTD.

- MITSUBISHI CHEMICAL GROUP CORPORATION

- SIPCHEM COMPANY

- ASHLAND

- EVONIK INDUSTRIES AG

- INEOS

- GENOMATICA, INC

- MITSUI & CO. ITALIA S.P.A.

- LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- MERCK KGAA

- SHANXI SANWEI GROUP CO., LTD

- その他の企業

- TOKYO CHEMICAL INDUSTRY CO., LTD.

- SPECTRUM CHEMICAL

- XINJIANG BLUE RIDGE TUNHE SCI.&TECH. CO. LTD.

- SK GEO CENTRIC CO., LTD.

第12章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 1,4-ブタンジオール相互接続市場

- ポリエチレンテレフタレート(PET)・ポリブチレンテレフタレート(PBT)樹脂市場

- 市場の定義

- 市場の概要

- ポリエチレンテレフタレート(PET)・ポリブチレンテレフタレート(PBT)樹脂市場:タイプ別

- ポリエチレンテレフタレート(PET)・ポリブチレンテレフタレート(PBT)樹脂市場:用途別

第13章 付録

The global 1,4-butanediol market is projected to grow from USD 7.8 billion in 2024 to USD 11.1 billion by 2029, at a CAGR of 7.3% during the forecast period. The major drivers of the 1,4-butanediol market include the rising demand for its applications in producing tetrahydrofuran (THF) and polyurethane (PU) due to their extensive use in automotive, electronics, and textile industries. Additionally, rapid industrialization, technological advancements, and a growing focus on sustainable and bio-based products are significantly propelling market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) and Volume (Kilotons) |

| Segments | 1,4-Butanediol by type, technology, application, and Region |

| Regions covered | Asia Pacific, Europe, North America and Rest of World |

"Bio-Based 1,4-butanediol, by type, is estimated to account for the fastest growing segment during the forecast period".

Bio-based 1,4-Butanediol (BDO) is the fastest-growing segment by type due to rising environmental awareness, supported by favorable regulations encouraging renewable alternatives. Technological advancements have made production more efficient and cost-effective, driving competitiveness. Increasing demand across industries like automotive and textiles for sustainable products further boosts bio-based 1,4-butanedion's growth. Investments in research and development fuel innovation, enhancing production scalability. This collective momentum positions bio-based 1,4-butanediol as a key driver in the evolving landscape of renewable chemicals.

. "Gamma Butyrolactone, by application, is estimated to account for the fastest growing segment during the forecast period".

Gamma-Butyrolactone (GBL) is the fastest-growing segment in the applications of 1,4-butanediol due to its versatile use as an intermediate in the production of various chemicals, including pyrrolidone's and solvents. Its high demand in pharmaceuticals, agrochemicals, and electronics industries further fuels its growth. Additionally, GBL's role as a precursor in manufacturing spandex fibers and as a solvent in various industrial applications contributes to its rapid market expansion. The increasing focus on high-performance materials and sustainable solutions also enhances the demand for Gamma-Butyrolactone which further increases the 1,4-butanediol market.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: C-level- 25%, Director Level- 30%, and Others - 45%

- By Region: North America - 20%, Europe - 15%, Asia Pacific - 55%, Rest of the world -10%

DCC (Taiwan), BASF-SE (Germany), Xinjiang Tianye Group Co., Ltd. (China), Mitsubishi Chemical Group Corporation (Japan), Nan Ya Plastics Corporation (Taiwan), SIPCHEM Company (Saudi Arabia), are some of the major players operating in the 1,4-butanediol market. These players have adopted strategies such as acquisitions, expansions, partnerships, and agreements to increase their market share business revenue.

Research Coverage:

The report defines segments, and projects the 1,4-butanediol market based on 1,4-butanediol type, technology type, application, and region. It provides detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges. It strategically profiles, 1,4-butanediol manufacturers and comprehensively analyses their market shares and core competencies as well as tracks and analyzes competitive developments, such as expansions, joint ventures, agreements, and acquisitions, undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them with the closest approximations of revenue numbers of the 1,4-butanediol market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growing demand in applications such as tetrahydrofuran, polyurethane), restraints (Health concerns associated with 1,4-butanediol and shutdown of various 1,4-butanediol production plants), opportunities (increasing production of bio-based 1,4-butanediol is expected to provide lucrative opportunities in 1,4-butanediol market), and challenges (Fluctuations in raw material prices pose significant challenges) influencing the growth of the 1,4-butanediol market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the 1,4-butanediol market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the 1,4-butanediol market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the 1,4-butanediol market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players such as DCC (Taiwan), BASF-SE (Germany), Xinjiang Tianye Group Co., Ltd. (China), Mitsubishi Chemical Group Corporation (Japan), Nan Ya Plastics Corporation (Taiwan) , SIPCHEM Company (Saudi Arabia), Ashland (US), INEOS (UK), Genomatica Inc. (UK) Marck KGaA (Germany) , Evonik Industries AG (Germany) and others in the 1,4-butanediol market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 1,4-BUTANEDIOL MARKET: INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 1,4-BUTANEDIOL MARKET: MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 1,4 BUTANEDIOL MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.2 MATRIX CONSIDERED FOR DEMAND SIDE

- FIGURE 3 MAIN MATRIX CONSIDERED FOR CONSTRUCTING AND ASSESSING DEMAND FOR 1,4-BUTANEDIOL

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.2.1 Calculations for supply-side analysis

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF 1,4-BUTANEDIOL MARKET (1/2)

- FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF 1,4-BUTANEDIOL MARKET (2/2)

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- FIGURE 8 1,4-BUTANEDIOL MARKET: DATA TRIANGULATION

- 2.6 IMPACT OF RECESSION

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 2 1,4-BUTANEDIOL MARKET SNAPSHOT: 2024 VS. 2029

- FIGURE 9 TETRAHYDROFURAN TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 SYNTHETIC BASED TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN 1,4-BUTANEDIOL MARKET

- FIGURE 12 1,4-BUTANEDIOL MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- 4.2 1,4-BUTANEDIOL MARKET, BY REGION

- FIGURE 13 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 14 TETRAHYDROFURAN WILL ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 SYNTHETIC TYPE TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 1,4-BUTANEDIOL MARKET, BY MAJOR COUNTRIES

- FIGURE 16 CANADA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN 1,4-BUTANEDIOL MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growth of tetrahydrofuran industry

- 5.2.1.2 Growth of polyurethane industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Health concerns associated with 1,4-butanediol

- 5.2.2.2 Shutdown of 1,4-butanediol production plants

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing production of bio-based 1,4-butanediol

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuation in raw material prices

- FIGURE 18 US: CRUDE OIL FIRST PURCHASE PRICE, 2019-2022

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS: 1,4-BUTANEDIOL MARKET

- TABLE 3 1,4-BUTANEDIOL MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND FOR KEY PLAYERS OF TOP THREE APPLICATIONS

- FIGURE 20 AVERAGE SELLING PRICE TREND FOR KEY PLAYERS FOR TOP THREE APPLICATIONS

- FIGURE 21 AVERAGE SELLING PRICE TREND OF SYNTHETIC 1,4-BUTANEDIOL FOR TOP THREE REGIONS

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 22 SUPPLY CHAIN ANALYSIS FOR 1,4-BUTANEDIOL MARKET

- 5.6 ECOSYSTEM MAP

- FIGURE 23 ECOSYSTEM MAP OF 1,4-BUTANEDIOL MARKET

- TABLE 4 1,4-BUTANEDIOL MARKET: ROLE IN ECOSYSTEM

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Bio-based production

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Process Technologies

- 5.8.1 KEY TECHNOLOGIES

- 5.9 KEY CONFERENCES AND EVENTS

- TABLE 9 1,4-BUTANEDIOL MARKET: KEY CONFERENCES AND EVENTS (2024)

- 5.10 TRADE DATA

- 5.10.1 IMPORT DATA

- TABLE 10 IMPORT DATA ON MALEIC ANHYDRIDE (USD THOUSAND)

- 5.10.2 EXPORT DATA

- TABLE 11 EXPORT DATA ON MALEIC ANHYDRIDE (USD THOUSAND)

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.11.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.12 PATENT ANALYSIS

- 5.12.1 METHODOLOGY

- FIGURE 26 MAJOR PATENTS FOR 1,4-BUTANEDIOL

- 5.12.2 MAJOR PATENTS

- 5.13 INVESTMENT & FUNDING SCENARIO

- FIGURE 27 INVESTMENT & FUNDING OF STARTUP/SMES IN 1,4-BUTANEDIOL

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6 1,4-BUTANEDIOL MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 REPPE PROCESS

- 6.3 DAVY PROCESS

- 6.4 BUTADIENE PROCESS

- 6.5 PROPYLENE OXIDE PROCESS

- 6.6 OTHER TECHNOLOGIES

7 1,4-BUTANEDIOL MARKET, BY APPLICATION

- 7.1 INTRODUCTION

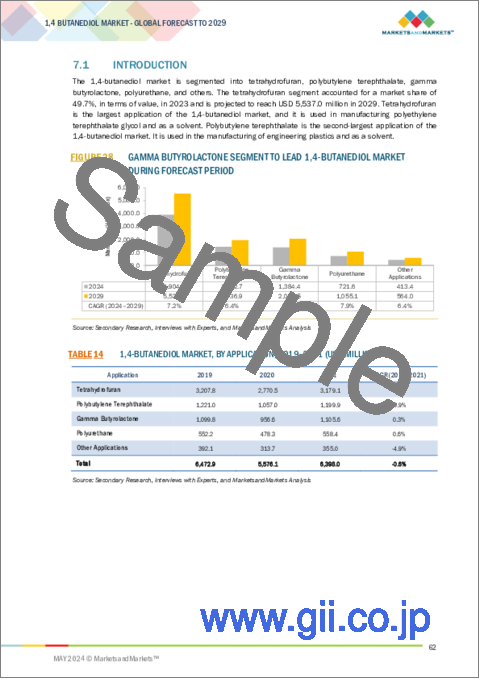

- FIGURE 28 GAMMA BUTYROLACTONE SEGMENT TO LEAD 1,4-BUTANEDIOL MARKET DURING FORECAST PERIOD

- TABLE 14 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 15 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 16 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 17 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 7.2 TETRAHYDROFURAN

- 7.2.1 GROWING DOWNSTREAM SECTOR TO DRIVE MARKET

- TABLE 18 TETRAHYDROFURAN: 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 19 TETRAHYDROFURAN: 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 20 TETRAHYDROFURAN: 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (KILOTON)

- TABLE 21 TETRAHYDROFURAN: 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (KILOTON)

- 7.2.2 POLYTETRAMETHYLENE ETHER GLYCOL

- 7.2.3 SOLVENTS

- 7.2.4 OTHERS

- 7.3 POLYBUTYLENE TEREPHTHALATE (PBT)

- 7.3.1 HIGH HEAT RESISTANCE AND SUPERIOR ELECTRICAL INSULATION PROPERTIES TO DRIVE MARKET

- TABLE 22 POLYBUTYLENE TEREPHTHALATE: 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 23 POLYBUTYLENE TEREPHTHALATE: 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 24 POLYBUTYLENE TEREPHTHALATE: 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (KILOTON)

- TABLE 25 POLYBUTYLENE TEREPHTHALATE: 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (KILOTON)

- 7.3.2 AUTOMOTIVE

- 7.3.3 ELECTRICAL & ELECTRONICS

- 7.3.4 CONSUMER APPLIANCES

- 7.3.5 OTHERS

- 7.4 GAMMA BUTYROLACTONE (GBL)

- 7.4.1 HIGH SOLVENT QUALITY WITH LOW TOXICITY TO DRIVE MARKET

- TABLE 26 GAMMA BUTYROLACTONE: 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 27 GAMMA BUTYROLACTONE: 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 28 GAMMA BUTYROLACTONE: 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (KILOTON)

- TABLE 29 GAMMA BUTYROLACTONE: 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (KILOTON)

- 7.4.2 N-METHYL-2-PYRROLIDONE

- 7.4.3 2-PYRROLIDONE/N-VINYL-2-PYRROLIDONE/ POLYVINYLPYRROLIDONE

- 7.4.4 OTHERS

- 7.5 POLYURETHANE (PU)

- 7.5.1 GROWING DEMAND FROM AUTOMOTIVE AND ELECTRONICS INDUSTRIES TO DRIVE MARKET

- TABLE 30 POLYURETHANE: 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 31 POLYURETHANE: 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 32 POLYURETHANE: 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (KILOTON)

- TABLE 33 POLYURETHANE: 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (KILOTON)

- 7.6 OTHER APPLICATIONS

- TABLE 34 OTHER APPLICATIONS: 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 35 OTHER APPLICATIONS: 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 36 OTHER APPLICATIONS: 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (KILOTON)

- TABLE 37 OTHER APPLICATIONS: 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (KILOTON)

8 1,4-BUTANEDIOL MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 29 BIO BASED TO BE FASTEST GROWING SEGMENT DURING FORECAST PERIOD

- TABLE 38 1,4-BUTANEDIOL MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 39 1,4-BUTANEDIOL MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 40 1,4-BUTANEDIOL MARKET, BY TYPE, 2019-2021 (KILOTON)

- TABLE 41 1,4-BUTANEDIOL MARKET, BY TYPE, 2022-2029 (KILOTON)

- 8.2 SYNTHETIC

- 8.2.1 GROWING DEMAND FROM TEXTILE INDUSTRY TO DRIVE MARKET

- 8.3 BIO BASED

- 8.3.1 VIABILITY AND ATTRACTIVENESS OF GREEN TECHNOLOGIES TO DRIVE MARKET

9 1,4-BUTANEDIOL MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 30 ASIA PACIFIC TO ACCOUNT FOR HIGHEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 42 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 43 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 44 1,4-BUTANEDIOL MARKET, BY REGION, 2019-2021 (KILOTON)

- TABLE 45 1,4-BUTANEDIOL MARKET, BY REGION, 2022-2029 (KILOTON)

- 9.2 NORTH AMERICA

- 9.2.1 RECESSION IMPACT

- FIGURE 31 NORTH AMERICA: 1,4-BUTANEDIOL MARKET SNAPSHOT

- TABLE 46 NORTH AMERICA: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 47 NORTH AMERICA: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 48 NORTH AMERICA: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 49 NORTH AMERICA: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 50 NORTH AMERICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 51 NORTH AMERICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 52 NORTH AMERICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 53 NORTH AMERICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.2.2 US

- 9.2.2.1 Growing demand for green chemicals to drive market

- TABLE 54 US: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 55 US: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 56 US: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 57 US: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.2.3 CANADA

- 9.2.3.1 Government initiatives for enhancement of electric vehicles to drive market

- TABLE 58 CANADA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 59 CANADA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 60 CANADA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 61 CANADA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.2.4 MEXICO

- 9.2.4.1 Government initiatives for adoption of electric vehicles to drive market

- TABLE 62 MEXICO: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 63 MEXICO: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 64 MEXICO: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 65 MEXICO: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.3 ASIA PACIFIC

- 9.3.1 RECESSION IMPACT

- FIGURE 32 ASIA PACIFIC: 1,4-BUTANEDIOL MARKET SNAPSHOT

- TABLE 66 ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 67 ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 68 ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 69 ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 70 ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 71 ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 72 ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 73 ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.3.2 CHINA

- 9.3.2.1 Availability of cheap raw materials, labor, and land to drive market

- TABLE 74 CHINA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 75 CHINA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 76 CHINA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 77 CHINA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.3.3 JAPAN

- 9.3.3.1 Investment in battery and magnet materials to drive market

- TABLE 78 JAPAN: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 79 JAPAN: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 80 JAPAN: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 81 JAPAN: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.3.4 TAIWAN

- 9.3.4.1 Increasing reliance on semiconductors to drive market

- TABLE 82 TAIWAN 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 83 TAIWAN: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 84 TAIWAN: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 85 TAIWAN: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.3.5 SOUTH KOREA

- 9.3.5.1 Increasing subsidies for early vehicle scrapping to drive market

- TABLE 86 SOUTH KOREA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 87 SOUTH KOREA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 88 SOUTH KOREA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 89 SOUTH KOREA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.3.6 REST OF ASIA PACIFIC

- TABLE 90 REST OF ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 93 REST OF ASIA PACIFIC: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.4 EUROPE

- 9.4.1 RECESSION IMPACT

- FIGURE 33 EUROPE: 1,4-BUTANEDIOL MARKET SNAPSHOT

- TABLE 94 EUROPE: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 95 EUROPE: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 96 EUROPE: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 97 EUROPE: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 98 EUROPE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 99 EUROPE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 100 EUROPE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 101 EUROPE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.4.2 GERMANY

- 9.4.2.1 Adoption of lightweight and high-performance plastics to drive market

- TABLE 102 GERMANY: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 103 GERMANY: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 104 GERMANY: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 105 GERMANY: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.4.3 FRANCE

- 9.4.3.1 Increasing demand for luxury interiors and higher-quality seating materials to drive market

- TABLE 106 FRANCE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 107 FRANCE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 108 FRANCE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 109 FRANCE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.4.4 UK

- 9.4.4.1 Increasing use of polybutylene terephthalate in automotive sector to drive market

- TABLE 110 UK: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 111 UK: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 112 UK: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 113 UK: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.4.5 REST OF EUROPE

- TABLE 114 REST OF EUROPE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 115 REST OF EUROPE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 116 REST OF EUROPE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 117 REST OF EUROPE: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.5 ROW

- TABLE 118 ROW: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 119 ROW: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 120 ROW: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 121 ROW: 1,4-BUTANEDIOL MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 122 ROW: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 123 ROW: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 124 ROW: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 125 ROW: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.5.1 MIDDLE EAST & AFRICA

- TABLE 126 MIDDLE EAST & AFRICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.5.2 SOUTH AMERICA

- TABLE 130 SOUTH AMERICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 131 SOUTH AMERICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 132 SOUTH AMERICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2019-2021 (KILOTON)

- TABLE 133 SOUTH AMERICA: 1,4-BUTANEDIOL MARKET, BY APPLICATION, 2022-2029 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 KEY PLAYERS' STRATEGIES

- 10.2 STRATEGIES ADOPTED BY KEY MARKET PLAYERS (2019-2024)

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS (2019-2024)

- 10.3 REVENUE ANALYSIS

- FIGURE 34 REVENUE ANALYSIS OF TOP THREE PLAYERS (2018-2022)

- 10.4 MARKET SHARE ANALYSIS

- 10.4.1 RANKING OF KEY MARKET PLAYERS, 2023

- FIGURE 35 RANKING OF TOP FIVE PLAYERS IN 1,4-BUTANEDIOL MARKET, 2023

- FIGURE 36 MARKET SHARE ANALYSIS

- TABLE 134 DEGREE OF COMPETITION: 1,4-BUTANEDIOL MARKET

- 10.4.1.1 DCC (Taiwan)

- 10.4.1.2 BASF-SE (Germany)

- 10.4.1.3 Xinjiang Tianye Group Co., Ltd. (China)

- 10.4.1.4 Mitsubishi Chemical Group Corporation (Japan)

- 10.4.1.5 Nan Ya Plastics Corporation (Taiwan)

- 10.5 BRAND/PRODUCT COMPARISON

- FIGURE 37 BRAND/PRODUCT COMPARISON

- 10.5.1 1,4 BUTANEDIOL BY BASF-SE

- 10.5.2 1,4 BUTANEDIOL BY DCC

- 10.5.3 1,4 BUTANEDIOL BY XINJIANG TIANYE GROUP CO., LTD.

- 10.5.4 1,4 BUTANEDIOL BY MITSUBISHI CHEMICAL GROUP CORPORATION

- 10.5.5 1,4 BUTANEDIOL BY NAN YA PLASTICS CORPORATION

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 38 COMPANY EVALUATION MATRIX: 1,4-BUTANEDIOL MARKET (TIER 1 COMPANIES)

- 10.6.5 COMPANY FOOTPRINT

- FIGURE 39 COMPANY FOOTPRINT (15 COMPANIES)

- TABLE 135 COMPANY REGION FOOTPRINT (15 COMPANIES)

- TABLE 136 BY TECHNOLOGY FOOTPRINT (15 COMPANIES)

- TABLE 137 BY APPLICATION FOOTPRINT (15 COMPANIES)

- TABLE 138 BY TYPE FOOTPRINT (15 COMPANIES)

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 40 STARTUPS/SMES EVALUATION MATRIX: 1,4-BUTANEDIOL MARKET

- 10.7.5 COMPETITIVE BENCHMARKING

- TABLE 139 1,4-BUTANEDIOL MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 140 1,4-BUTANEDIOL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.8 COMPANY EVALUATION AND FINANCIAL METRICS

- FIGURE 41 COMPANY EVALUATION

- FIGURE 42 EV/EBITDA

- FIGURE 43 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- 10.9 COMPETITIVE SCENARIO AND TRENDS

- 10.9.1 PRODUCT LAUNCHES

- TABLE 141 1,4-BUTANEDIOL MARKET: PRODUCT LAUNCHES (JANUARY 2019-APRIL 2024)

- 10.9.2 DEALS

- TABLE 142 1,4-BUTANEDIOL MARKET: DEALS (JANUARY 2019-APRIL 2024)

- 10.9.3 EXPANSIONS

- TABLE 143 1,4-BUTANEDIOL MARKET: EXPANSIONS (JANUARY 2019-APRIL 2024)

11 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 11.1 KEY PLAYERS

- 11.1.1 BASF SE

- TABLE 144 BASF SE: COMPANY OVERVIEW

- FIGURE 44 BASF SE: COMPANY SNAPSHOT

- TABLE 145 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 BASF SE: DEALS

- TABLE 147 BASF SE: EXPANSIONS

- 11.1.2 SINOPEC YIZHENG CHEMICAL FIBRE COMPANY LIMITED

- TABLE 148 SINOPEC YIZHENG CHEMICAL FIBRE CO., LTD: COMPANY OVERVIEW

- TABLE 149 SINOPEC YIZHENG CHEMICAL FIBRE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.3 DCC

- TABLE 150 DCC: COMPANY OVERVIEW

- TABLE 151 DCC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.4 NAN YA PLASTICS CORPORATION

- TABLE 152 NAN YA PLASTICS CORPORATION: COMPANY OVERVIEW

- FIGURE 45 NAN YA PLASTICS CORPORATION: COMPANY SNAPSHOT

- TABLE 153 NAN YA PLASTICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.5 XINJIANG TIANYE GROUP CO., LTD.

- TABLE 154 XINJIANG TIANYE GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 155 XINJIANG TIANYE GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.6 MITSUBISHI CHEMICAL GROUP CORPORATION

- TABLE 156 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- FIGURE 46 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- TABLE 157 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 MITSUBISHI CHEMICAL GROUP CORPORATION: EXPANSIONS

- 11.1.7 SIPCHEM COMPANY

- TABLE 159 SIPCHEM COMPANY: COMPANY OVERVIEW

- FIGURE 47 SIPCHEM COMPANY: COMPANY SNAPSHOT

- TABLE 160 SIPCHEM COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 SIPCHEM COMPANY: DEALS

- 11.1.8 ASHLAND

- TABLE 162 ASHLAND: COMPANY OVERVIEW

- FIGURE 48 ASHLAND: COMPANY SNAPSHOT

- TABLE 163 ASHLAND.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 ASHLAND: DEALS

- 11.1.9 EVONIK INDUSTRIES AG

- TABLE 165 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- FIGURE 49 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- TABLE 166 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 EVONIK INDUSTRIES AG: EXPANSIONS

- 11.1.10 INEOS

- TABLE 168 INEOS: COMPANY OVERVIEW

- FIGURE 50 INEOS: COMPANY SNAPSHOT

- TABLE 169 INEOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 INEOS: DEALS

- 11.1.11 GENOMATICA, INC

- TABLE 171 GENOMATICA, INC: COMPANY OVERVIEW

- TABLE 172 GENOMATICA, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 GENOMATICA INC.: DEALS

- TABLE 174 GENOMATICA INC: EXPANSIONS

- 11.1.12 MITSUI & CO. ITALIA S.P.A.

- TABLE 175 MITSUI & CO. ITALIA S.P.A.: COMPANY OVERVIEW

- FIGURE 51 MITSUI & CO. ITALIA S.P.A.: COMPANY SNAPSHOT

- TABLE 176 MITSUI & CO. ITALIA S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 MITSUI & CO. ITALIA S.P.A.: DEALS

- 11.1.13 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- TABLE 178 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY OVERVIEW

- FIGURE 52 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY SNAPSHOT

- TABLE 179 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 LYONDELLBASELL INDUSTRIES HOLDINGS B.V: DEALS

- 11.1.14 MERCK KGAA

- TABLE 181 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 53 MERCK KGAA: COMPANY SNAPSHOT

- TABLE 182 MERCK KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 MERCK KGAA: EXPANSIONS

- 11.1.15 SHANXI SANWEI GROUP CO., LTD

- TABLE 184 SHANXI SANWEI GROUP CO., LTD: COMPANY OVERVIEW

- TABLE 185 SHANXI SANWEI GROUP CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.2 OTHER PLAYERS

- 11.2.1 TOKYO CHEMICAL INDUSTRY CO., LTD.

- TABLE 186 TOKYO CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- 11.2.2 SPECTRUM CHEMICAL

- TABLE 187 SPECTRUM CHEMICAL: COMPANY OVERVIEW

- 11.2.3 XINJIANG BLUE RIDGE TUNHE SCI.&TECH. CO. LTD.

- TABLE 188 XINJIANG BLUE RIDGE TUNHE SCI.&TECH. CO. LTD.: COMPANY OVERVIEW

- 11.2.4 SK GEO CENTRIC CO., LTD.

- TABLE 189 SK GEO CENTRIC CO., LTD.: COMPANY OVERVIEW

- 11.2.4.1 Recent developments

- TABLE 190 SK GEO CENTRIC CO., LTD.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 191 SK GEO CENTRIC CO., LTD..: DEALS

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 1,4-BUTANEDIOL INTERCONNECTED MARKET

- 12.4 POLYETHYLENE TEREPHTHALATE (PET) & POLYBUTYLENE TEREPHTHALATE (PBT) RESINS MARKET

- 12.4.1 MARKET DEFINITION

- 12.4.2 MARKET OVERVIEW

- 12.4.3 POLYETHYLENE TEREPHTHALATE (PET) & POLYBUTYLENE TEREPHTHALATE (PBT) RESINS MARKET, BY TYPE

- TABLE 192 POLYETHYLENE TEREPHTHALATE (PET) & POLYBUTYLENE TEREPHTHALATE (PBT) RESINS MARKET, BY TYPE 2019-2026 (USD MILLION)

- 12.4.4 POLYETHYLENE TEREPHTHALATE (PET) & POLYBUTYLENE TEREPHTHALATE (PBT) RESINS MARKET, BY APPLICATION

- TABLE 193 POLYBUTYLENE TEREPHTHALATE (PBT) RESINS MARKET, BY APPLICATION, 2019-2026 (USD MILLION)

- 12.4.4.1 Transparent & Non-transparent PET

- 12.4.4.2 Recycled PET

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS