|

|

市場調査レポート

商品コード

1158145

バルブポジショナーの世界市場:タイプ(デジタル、空圧、電空)、作動部(単動、複動)、産業(石油・ガス、エネルギー・電力、水・廃水処理、化学)、地域別 - 2027年までの予測Valve Positioner Market by Type (Digital, Pneumatic, Electro-pneumatic), Actuation (Single-acting, Double-acting), Industry (Oil & Gas, Energy & Power, Water & Wastewater Treatment, Chemical) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| バルブポジショナーの世界市場:タイプ(デジタル、空圧、電空)、作動部(単動、複動)、産業(石油・ガス、エネルギー・電力、水・廃水処理、化学)、地域別 - 2027年までの予測 |

|

出版日: 2022年11月16日

発行: MarketsandMarkets

ページ情報: 英文 200 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のバルブポジショナーの市場規模は、2022年の18億米ドルから、2027年には24億米ドルに成長すると予測されており、予測期間中はCAGR5.6%で成長すると見込まれています。

様々なプラント操業におけるスマートバルブポジショナー導入の増加、都市人口の増加、新興経済諸国における産業の増加が、バルブポジショナー市場成長の促進要因となっています。

"水・廃水処理産業市場は、予測期間中に最も高いCAGRで成長"

水・廃水処理産業には、水の供給、廃水管理、水処理プラントが含まれます。水が希少資源であることから、水の効率的な管理と供給が必要になっています。水処理業界では、ポンプシステムや蒸気システムで水撃問題が常に発生し、配管の破損や機器の損傷、さらにはシステム全体の故障につながる可能性があります。従って、水撃問題はポンプシステムのプロセスに影響を与え、全体のポンプシステムの完全な失敗およびポンプシステムの修理費用か取り替えに加わります起因します。バルブポジショナは、産業界のユーザーに幅広いソリューションとサポートを提供します。また、エネルギー効率の向上、品質の監視、変化する環境規制への対応など、プラントのさまざまなニーズにお応えします。空気圧式およびデジタル式のバルブポジショナは、水処理に広く使用されています。

"アジア太平洋地域は、2022年から2027年の間にバルブポジショナー市場に大きな成長機会を提供"

アジア太平洋地域は、中国やインドなどの急成長している経済圏で構成されています。都市人口の増加により水不足が発生し、排水処理システムの新規・改良に対する需要が高まっています。同様に、人口の増加、生活水準の向上、新興経済諸国は、アジア太平洋地域のエネルギー需要の上昇につながっています。電力需要の増加は、石油・ガスや電力などのエネルギー部門の発展につながるでしょう。このことは、デジタルポジショナーなどのバルブオートメーションソリューションの需要を生み出すでしょう。

この調査レポートは、バルブポジショナー市場をタイプ、作動、産業、地域に基づいて分類しています。また、バルブポジショナー市場に関連する主な促進要因・抑制要因・課題・機会について説明し、2027年までの予測を行います。これらとは別に、本レポートはバルブポジショナーのエコシステムに含まれるすべての企業のリーダーシップマッピングと分析でも構成されています。

レポート購入の主なメリット

本レポートは、バルブポジショナー市場全体とサブセグメントの収益数の最も近い近似値に関する情報を提供することで、この市場における市場リーダー/新規参入者を支援するものです。本レポートは、利害関係者が競合情勢を理解し、より良いビジネスの位置づけと適切な市場参入戦略を計画するためのより多くの洞察を得るのに役立ちます。また、利害関係者が市場の鼓動を理解するのに役立ち、主要な市場促進要因・抑制要因・課題・機会に関する情報を提供します。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ

- 貿易分析

- 特許分析

- 主な会議とイベント、2022年~2023年

- 規制と基準

第6章 バルブポジショナー市場:タイプ別

- イントロダクション

- 空気圧ポジショナー

- 電空ポジショナー

- デジタルポジショナー

第7章 バルブポジショナー市場:作動別

- イントロダクション

- 単動ポジショナー

- 複動ポジショナー

第8章 バルブポジショナー市場:業界別

- イントロダクション

- 石油・ガス

- 水・廃水処理

- エネルギー・電力

- 化学

- 製紙用パルプ

- 医薬品

- 金属・鉱業

- 飲食品

- その他

第9章 バルブポジショナー市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋地域

- 中国

- 日本

- インド

- その他アジア太平洋地域

- その他の地域

- 中東およびアフリカ

- 南米

第10章 競合情勢

- 概要

- 主要企業5社収益分析

- 市場シェア分析、2021年

- 競合リーダーシップマッピング、2021

- 中小企業(SME)評価マトリックス、2021年

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- EMERSON ELECTRIC CO.

- ABB

- FLOWSERVE CORPORATION

- SIEMENS AG

- SCHNEIDER ELECTRIC

- SMC

- AZBIL CORPORATION

- BAKER HUGHES COMPANY

- ROTORK PLC

- VALMET(NELES CORPORATION)

- その他企業

- SAMSON AG

- VRG CONTROLS

- FESTO INC.

- BADGER METER, INC.

- CONTROLAIR

- CRANE CO.

- CHRISTIAN BURKERT GMBH & CO. KG

- GEMU GROUP

- DWYER INSTRUMENTS LTD

- VALVE RELATED CONTROLS, INC

- POWER-GENEX LTD.

- VAL CONTROLS

- BRAY INTERNATIONAL

- NIHON KOSO CO., LTD.

- SPIRAX-SARCO LIMITED

第12章 隣接および関連市場

- イントロダクション

- 隣接市場の制限

- 機能別:産業用バルブ市場

- オン/オフバルブ

- コントロールバルブ

第13章 付録

The valve positioner market is projected to grow from USD 1.8 billion in 2022 to USD 2.4 billion in 2027; it is expected to grow at a CAGR of 5.6% during the forecasted period. Rising adoption of smart valve positioners in various plant operations and increasing urban population, and the growing number of industries in developing economies are the driving factors for the valve positioner market growth.

"Market for water and wastewater treatment industry to grow at the highest CAGR during the forecast period."

The water & wastewater treatment industry includes water supply, wastewater management, and water treatment plants. Effective management and supply of water have become necessary as water is a scarce resource. In the water & wastewater treatment industry, water hammer issue always occurs in pumping system or steam systems which can lead to pipe breakage, equipment damage, or even total system failure. Therefore, water hammer issue impacts the process of pumping system and results in complete failure of the whole pumping system and adds to repair cost or replacement of the pumping system. Valve positioners offer a broad range of solutions and support to industrial users. They also help plants to increase energy efficiency, monitor quality and meet the changing environmental regulations. Pneumatic and digital valve positioners are widely used for water management.

"Asia Pacific to offer significant growth opportunities for valve positioner market between 2022 and 2027."

Asia Pacific consists of some of the fastest-growing economies, such as China and India. Owing to the increasing urban population, which resulted in water scarcity, there is a high demand for new and improved wastewater treatment systems. Similarly, growing population, increasing standards of living, and developing economies have led to the rising demand for energy in Asia Pacific. The increasing demand for electricity would lead to the development of the energy sector, which includes oil & gas, and power. This, in turn, would generate a demand for valve automation solutions, such as digital positioners, in the region.

The report profiles key players in the valve positioner market with their respective market ranking analyses. Prominent players profiled in this report are Emerson Electric Co. (US), ABB (Switzerland), Flowserve Corporation (US), Siemens AG (Germany), Schneider Electric (France), SMC (Japan), Azbil Corporation (Japan), Baker Hughes Company (US), Rotork plc (UK), Valmet (Finland). Samson AG (Germany), VRG Controls (US), Festo Inc. (Germany), Badger Meter, Inc. (US), ControlAir (US), Crane Co. (US), Christian Burkert GmbH & Co. KG (Germany), GEMU Group (Germany), Dwyer Instruments LTD (US), Valve Related Controls, Inc (US), Power-Genex Ltd. (South Korea), Val Controls (Denmark), Bray International (US), Nihon KOSO Co., Ltd. (Japan), Spirax-Sarco Limited (UK).

Research Coverage:

This research report categorizes the valve positioner market on the basis of type, actuation, industry, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the valve positioner market and forecasts the same till 2027. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the valve positioner ecosystem.

Key Benefits of Buying the Report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall valve positioner market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 VALVE POSITIONER MARKET: SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- FIGURE 2 VALVE POSITIONER MARKET: GEOGRAPHIC SEGMENTATION

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 VALVE POSITIONER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 List of key primary interview participants

- 2.1.3.3 Breakdown of primaries

- 2.1.3.4 Key data from primary sources

- 2.1.3.5 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market share using bottom-up analysis (demand side)

- FIGURE 4 VALVE POSITIONER MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to capture market share using top-down analysis (supply side)

- FIGURE 5 VALVE POSITIONER MARKET: TOP-DOWN APPROACH

- FIGURE 6 VALVE POSITIONER MARKET: SUPPLY-SIDE ANALYSIS

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 VALVE POSITIONER MARKET, 2018-2027 (USD MILLION)

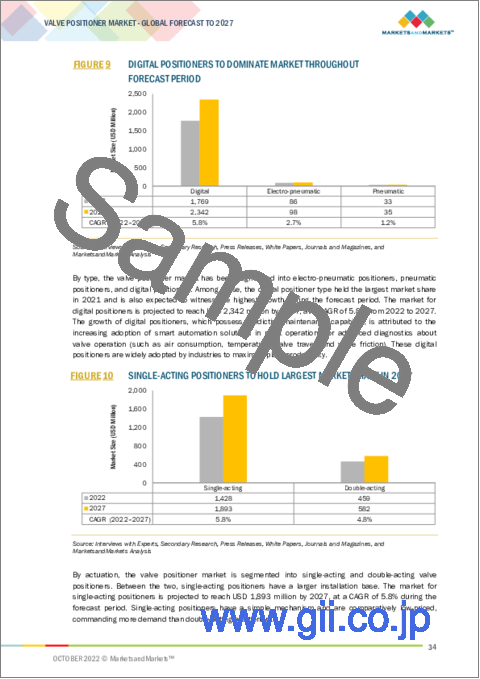

- FIGURE 9 DIGITAL POSITIONERS TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 10 SINGLE-ACTING POSITIONERS TO HOLD LARGEST MARKET SHARE IN 2027

- FIGURE 11 WATER & WASTEWATER TREATMENT INDUSTRY TO OFFER SIGNIFICANT GROWTH OPPORTUNITIES FROM 2022 TO 2027

- FIGURE 12 ASIA PACIFIC EXPECTED TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR KEY PLAYERS IN VALVE POSITIONER MARKET

- FIGURE 13 RISING ADOPTION OF SMART VALVE POSITIONERS IN VARIOUS PLANT OPERATIONS IN PROCESS INDUSTRIES TO BOOST MARKET GROWTH

- 4.2 VALVE POSITIONER MARKET, BY TYPE

- FIGURE 14 DIGITAL POSITIONERS TO HOLD LARGER MARKET SIZE IN 2027

- 4.3 VALVE POSITIONER MARKET IN ASIA PACIFIC, BY INDUSTRY AND COUNTRY

- FIGURE 15 ENERGY & POWER AND CHINA TO ACCOUNT FOR LARGEST MARKET SHARES IN ASIA PACIFIC IN 2027

- 4.4 VALVE POSITIONER MARKET, BY COUNTRY

- FIGURE 16 US TO HOLD LARGEST SIZE OF VALVE POSITIONER MARKET IN 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 VALVE POSITIONER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing importance of monitoring and control in process industries for efficient output

- 5.2.1.2 Rising demand for fuel and power

- FIGURE 18 GLOBAL TREND OF PRIMARY ENERGY CONSUMPTION (IN MTOE)

- 5.2.1.3 Rising adoption of smart valve positioners in various plant operations

- 5.2.1.4 Increasing urban population and growing number of industries in emerging economies

- FIGURE 19 VALVE POSITIONER MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of standardized norms, certifications, and governing policies

- FIGURE 20 VALVE POSITIONER MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Deployment of IIoT and rising awareness regarding digitalization

- 5.2.3.2 Focus of industry players on offering improved customer service

- FIGURE 21 VALVE POSITIONER MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Positioner overshoot and oversized valves hinder operation of control valves

- FIGURE 22 VALVE POSITIONER MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY ORIGINAL EQUIPMENT MANUFACTURERS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 24 VALVE POSITIONER MARKET: ECOSYSTEM ANALYSIS

- TABLE 1 VALVE POSITIONER MARKET: ECOSYSTEM

- 5.5 PRICING ANALYSIS

- TABLE 2 INDICATIVE PRICES OF VALVE POSITIONERS

- 5.5.1 AVERAGE SELLING PRICES OF DIFFERENT TYPES OF VALVE POSITIONERS OFFERED BY KEY PLAYERS

- FIGURE 25 AVERAGE SELLING PRICES OF DIFFERENT TYPES OF VALVE POSITIONERS OFFERED BY KEY PLAYERS

- TABLE 3 AVERAGE SELLING PRICES OF DIFFERENT TYPES OF VALVE POSITIONERS OFFERED BY KEY PLAYERS (USD)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN VALVE POSITIONER MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 DIGITALIZATION AND INTEGRATION OF ADVANCED TECHNOLOGIES INTO INDUSTRIAL VALVES

- 5.7.2 IMPACT OF IOT ON PROCESS INDUSTRIES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES ON VALVE POSITIONER MARKET, 2021

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS ON BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- 5.10 CASE STUDIES

- TABLE 7 MITSUBISHI CHEMICAL CORPORATION USED CLOUD-BASED SERVICES WITH SMART VALVE POSITIONERS TO IMPROVE PLANT OPERATION

- TABLE 8 SIEMENS AG USED PS2 DIGITAL VALVE POSITIONER ON FEEDWATER VALVE AND START-UP VALVE IN POWER PLANT

- TABLE 9 AZBIL CORPORATION VALVE POSITIONER REDUCED MAINTENANCE WORKLOAD OF AN EASTERN PETROCHEMICAL COMPANY (SHARQ)

- 5.11 TRADE ANALYSIS

- FIGURE 29 IMPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- FIGURE 30 EXPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 10 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- FIGURE 32 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

- TABLE 11 LIST OF FEW PATENTS IN VALVE POSITIONER MARKET, 2020-2022

- 5.13 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 12 VALVE POSITIONER MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.14 REGULATIONS & STANDARDS

- 5.14.1 STANDARDS

- TABLE 13 STANDARDS FOR VALVE POSITIONER MARKET

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 VALVE POSITIONER MARKET, BY TYPE

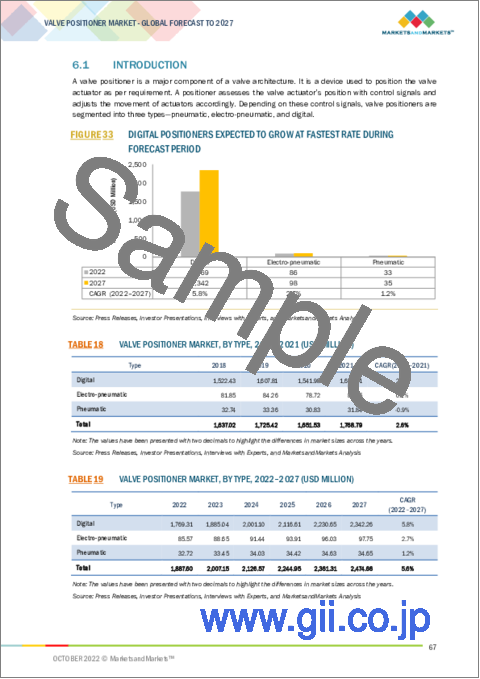

- 6.1 INTRODUCTION

- FIGURE 33 DIGITAL POSITIONERS EXPECTED TO GROW AT FASTEST RATE DURING FORECAST PERIOD

- TABLE 18 VALVE POSITIONER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 19 VALVE POSITIONER MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 6.2 PNEUMATIC POSITIONERS

- 6.2.1 PNEUMATIC POSITIONERS ENSURE ACCURATE OPERATION OF CONTROL VALVES DEALING WITH PNEUMATIC SIGNALS

- FIGURE 34 WORKING PRINCIPLE OF PNEUMATIC POSITIONERS

- 6.3 ELECTRO-PNEUMATIC POSITIONERS

- 6.3.1 FEATURES OF ELECTRO-PNEUMATIC POSITIONERS MAKE THEM WIDELY ADOPTED ACROSS INDUSTRIES

- FIGURE 35 SALIENT FEATURES OF ELECTRO-PNEUMATIC POSITIONER

- 6.4 DIGITAL POSITIONERS

- 6.4.1 DIGITAL POSITIONERS WIDELY PREFERRED OVER ANALOG POSITIONERS

- FIGURE 36 ADVANTAGES OF DIGITAL POSITIONERS

7 VALVE POSITIONER MARKET, BY ACTUATION

- 7.1 INTRODUCTION

- FIGURE 37 SINGLE-ACTING POSITIONERS EXPECTED TO LEAD VALVE POSITIONER MARKET DURING FORECAST PERIOD

- TABLE 20 VALVE POSITIONER MARKET, BY ACTUATION, 2018-2021 (USD MILLION)

- TABLE 21 VALVE POSITIONER MARKET, BY ACTUATION, 2022-2027 (USD MILLION)

- 7.2 SINGLE-ACTING POSITIONERS

- 7.2.1 SINGLE-ACTING POSITIONERS ACCOUNT FOR LARGER MARKET SHARE COMPARED WITH DOUBLE-ACTING POSITIONERS

- FIGURE 38 SCHEMATIC OF SINGLE-ACTING POSITIONERS

- 7.3 DOUBLE-ACTING POSITIONERS

- 7.3.1 DOUBLE-ACTING POSITIONERS HAVE COMPLEX WORKING MECHANISMS COMPARED WITH SINGLE-ACTING POSITIONERS

- FIGURE 39 SCHEMATIC OF DOUBLE-ACTING POSITIONERS

8 VALVE POSITIONER MARKET, BY INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 40 VALVE POSITIONER MARKET, BY INDUSTRY

- FIGURE 41 WATER & WASTEWATER TREATMENT INDUSTRY EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 22 VALVE POSITIONER MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 23 VALVE POSITIONER MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 8.2 OIL & GAS

- 8.2.1 MINIMIZE DAILY MAINTENANCE WORK IN OIL & GAS PLANTS

- FIGURE 42 GLOBAL TREND OF OIL PRODUCTION (THOUSAND BARRELS DAILY)

- TABLE 24 OIL & GAS: VALVE POSITIONER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 25 OIL & GAS: VALVE POSITIONER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 26 OIL & GAS: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 27 OIL & GAS: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 28 OIL & GAS: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 29 OIL & GAS: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 30 OIL & GAS: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 31 OIL & GAS: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 32 OIL & GAS: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 33 OIL & GAS: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.3 WATER & WASTEWATER TREATMENT

- 8.3.1 SUPPORT EFFECTIVE MANAGEMENT AND UTILIZATION OF WATER

- TABLE 34 WATER & WASTEWATER TREATMENT: VALVE POSITIONER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 WATER & WASTEWATER TREATMENT: VALVE POSITIONER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 36 WATER & WASTEWATER TREATMENT: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 37 WATER & WASTEWATER TREATMENT: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 38 WATER & WASTEWATER TREATMENT: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 39 WATER & WASTEWATER TREATMENT: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 40 WATER & WASTEWATER TREATMENT: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 41 WATER & WASTEWATER TREATMENT: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 42 WATER & WASTEWATER TREATMENT: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 43 WATER & WASTEWATER TREATMENT: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.4 ENERGY & POWER

- 8.4.1 HELP CONTROL VALVES PERFORM BETTER IN POWER STATIONS

- TABLE 44 ENERGY & POWER: VALVE POSITIONER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 ENERGY & POWER: VALVE POSITIONER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 46 ENERGY & POWER: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 47 ENERGY & POWER: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 48 ENERGY & POWER: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 49 ENERGY & POWER: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 50 ENERGY & POWER: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 51 ENERGY & POWER: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 52 ENERGY & POWER: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 53 ENERGY & POWER: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.5 CHEMICAL

- 8.5.1 SUSTAINABLE DEVELOPMENT OF CHEMICAL INDUSTRY FUELS GROWTH OF VALVE POSITIONER MARKET

- TABLE 54 CHEMICAL: VALVE POSITIONER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 55 CHEMICAL: VALVE POSITIONER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 56 CHEMICAL: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 57 CHEMICAL: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 58 CHEMICAL: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 59 CHEMICAL: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 60 CHEMICAL: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 61 CHEMICAL: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 62 CHEMICAL: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 63 CHEMICAL: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.6 PAPER & PULP

- 8.6.1 HELP PREDICTIVE MAINTENANCE OF EQUIPMENT USED IN PAPER AND PULP MANUFACTURING

- TABLE 64 PAPER & PULP: VALVE POSITIONER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 65 PAPER & PULP: VALVE POSITIONER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 66 PAPER & PULP: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 67 PAPER & PULP: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 68 PAPER & PULP: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 69 PAPER & PULP: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 70 PAPER & PULP: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 71 PAPER & PULP: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 72 PAPER & PULP: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 73 PAPER & PULP: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.7 PHARMACEUTICAL

- 8.7.1 WATCH FLOW CONTROL OF PROCESSES IN PHARMACEUTICAL INDUSTRY

- TABLE 74 PHARMACEUTICAL: VALVE POSITIONER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 75 PHARMACEUTICAL: VALVE POSITIONER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 76 PHARMACEUTICAL: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 77 PHARMACEUTICAL: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 78 PHARMACEUTICAL: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 79 PHARMACEUTICAL: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 80 PHARMACEUTICAL: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 81 PHARMACEUTICAL: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 82 PHARMACEUTICAL: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 83 PHARMACEUTICAL: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.8 METALS & MINING

- 8.8.1 RISING DEMAND FOR PREDICTIVE MAINTENANCE ENCOURAGES USE OF VALVE POSITIONERS IN METALS & MINING INDUSTRY

- TABLE 84 METALS & MINING: VALVE POSITIONER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 85 METALS & MINING: VALVE POSITIONER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 86 METALS & MINING: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 87 METALS & MINING: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 88 METALS & MINING: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 89 METALS & MINING: VALVE POSITIONER MARKET IN EUROPE, 2022-2027 (USD MILLION)

- TABLE 90 METALS & MINING: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 91 METALS & MINING: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 92 METALS & MINING: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 93 METALS & MINING: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.9 FOOD & BEVERAGE

- 8.9.1 OFFER MONITORING AND SELF-DIAGNOSIS OF FERMENTATION PROCESS

- TABLE 94 FOOD & BEVERAGE: VALVE POSITIONER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 95 FOOD & BEVERAGE: VALVE POSITIONER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 96 FOOD & BEVERAGE: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 97 FOOD & BEVERAGE: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 98 FOOD & BEVERAGE: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 99 FOOD & BEVERAGE: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 100 FOOD & BEVERAGE: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 101 FOOD & BEVERAGE: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 102 FOOD & BEVERAGE: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 103 FOOD & BEVERAGE: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.10 OTHERS

- TABLE 104 OTHERS: VALVE POSITIONER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 105 OTHERS: VALVE POSITIONER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 106 OTHERS: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 107 OTHERS: VALVE POSITIONER MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 108 OTHERS: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 109 OTHERS: VALVE POSITIONER MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 110 OTHERS: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 111 OTHERS: VALVE POSITIONER MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 112 OTHERS: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 113 OTHERS: VALVE POSITIONER MARKET IN ROW, BY COUNTRY, 2022-2027 (USD MILLION)

9 VALVE POSITIONER MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 43 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 114 VALVE POSITIONER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 115 VALVE POSITIONER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 44 NORTH AMERICA: VALVE POSITIONER MARKET SNAPSHOT

- TABLE 116 NORTH AMERICA: VALVE POSITIONER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 117 NORTH AMERICA: VALVE POSITIONER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 118 NORTH AMERICA: VALVE POSITIONER MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 119 NORTH AMERICA: VALVE POSITIONER MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Oil & gas industry to drive growth of valve positioner market in US

- 9.2.2 CANADA

- 9.2.2.1 Need for strong heating and HVAC applications to boost valve positioner market in Canada

- 9.2.3 MEXICO

- 9.2.3.1 Growing process industry to help enhance valve positioner market in Mexico

- 9.3 EUROPE

- FIGURE 45 EUROPE: VALVE POSITIONER MARKET SNAPSHOT

- TABLE 120 EUROPE: VALVE POSITIONER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 121 EUROPE: VALVE POSITIONER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 122 EUROPE: VALVE POSITIONER MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 123 EUROPE: VALVE POSITIONER MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 9.3.1 UK

- 9.3.1.1 Water & wastewater treatment industry to support valve positioner market in UK

- 9.3.2 GERMANY

- 9.3.2.1 Growing process industries and valve market in Germany to encourage valve positioner market

- 9.3.3 FRANCE

- 9.3.3.1 Nuclear plants to drive demand for valve positioners in France

- 9.3.4 REST OF EUROPE

- 9.4 ASIA PACIFIC

- FIGURE 46 ASIA PACIFIC: VALVE POSITIONER MARKET SNAPSHOT

- TABLE 124 ASIA PACIFIC: VALVE POSITIONER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 125 ASIA PACIFIC: VALVE POSITIONER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 126 ASIA PACIFIC: VALVE POSITIONER MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 127 ASIA PACIFIC: VALVE POSITIONER MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Medium-sized players to support export of valve-related products in country

- 9.4.2 JAPAN

- 9.4.2.1 Reintegration of nuclear plants likely to boost growth of valve positioner market in Japan

- 9.4.3 INDIA

- 9.4.3.1 Growing demand for energy & power and effective water management to propel growth of valve positioner market in India

- 9.4.4 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD (ROW)

- TABLE 128 ROW: VALVE POSITIONER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 129 ROW: VALVE POSITIONER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 130 ROW: VALVE POSITIONER MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 131 ROW: VALVE POSITIONER MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 9.5.1 MIDDLE EAST & AFRICA

- 9.5.1.1 Oil & gas industry to uplift valve positioner market in Middle East

- 9.5.2 SOUTH AMERICA

- 9.5.2.1 Brazil contributes significantly to growth of valve positioner market in South America

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 TOP 5 COMPANY REVENUE ANALYSIS

- FIGURE 47 VALVE POSITIONER MARKET: REVENUE ANALYSIS OF 5 KEY PLAYERS, 2017-2021

- 10.3 MARKET SHARE ANALYSIS, 2021

- TABLE 132 VALVE POSITIONER MARKET SHARE ANALYSIS (2021)

- 10.4 COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- FIGURE 48 VALVE POSITIONER MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.4.5 VALVE POSITIONER MARKET: COMPANY FOOTPRINT

- TABLE 133 COMPANY FOOTPRINT

- TABLE 134 POSITIONER-TYPE FOOTPRINT OF COMPANIES

- TABLE 135 INDUSTRY FOOTPRINT OF COMPANIES

- TABLE 136 REGIONAL FOOTPRINTS OF COMPANIES

- 10.5 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION MATRIX, 2021

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- FIGURE 49 VALVE POSITIONER MARKET, SME EVALUATION QUADRANT, 2021

- 10.5.5 SMES EVALUATION MATRIX

- TABLE 137 VALVE POSITIONER MARKET: DETAILED LIST OF KEY SMES

- TABLE 138 VALVE POSITIONER MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 10.6 COMPETITIVE SCENARIO AND TRENDS

- 10.6.1 PRODUCT LAUNCHES

- TABLE 139 VALVE POSITIONER MARKET: PRODUCT LAUNCHES, JUNE 2019-APRIL 2022

- 10.6.2 DEALS

- TABLE 140 VALVE POSITIONER MARKET: DEALS, SEPTEMBER 2019-MARCH 2022

- 10.6.3 OTHERS

- TABLE 141 VALVE POSITIONER MARKET: OTHERS, NOVEMBER 2020

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions offered, Recent Developments, and MnM View)**

- 11.1.1 EMERSON ELECTRIC CO.

- TABLE 142 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 50 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 143 EMERSON ELECTRIC CO.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.2 ABB

- TABLE 144 ABB: COMPANY OVERVIEW

- FIGURE 51 ABB: COMPANY SNAPSHOT

- TABLE 145 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.3 FLOWSERVE CORPORATION

- TABLE 146 FLOWSERVE CORPORATION: COMPANY OVERVIEW

- FIGURE 52 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

- TABLE 147 FLOWSERVE CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.4 SIEMENS AG

- TABLE 148 SIEMENS AG: COMPANY OVERVIEW

- FIGURE 53 SIEMENS AG: COMPANY SNAPSHOT

- TABLE 149 SIEMENS AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.5 SCHNEIDER ELECTRIC

- TABLE 150 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 54 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 151 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.6 SMC

- TABLE 152 SMC: COMPANY OVERVIEW

- FIGURE 55 SMC: COMPANY SNAPSHOT

- TABLE 153 SMC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.7 AZBIL CORPORATION

- TABLE 154 AZBIL CORPORATION: COMPANY OVERVIEW

- FIGURE 56 AZBIL CORPORATION: COMPANY SNAPSHOT

- TABLE 155 AZBIL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.8 BAKER HUGHES COMPANY

- TABLE 156 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- FIGURE 57 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- TABLE 157 BAKER HUGHES COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.9 ROTORK PLC

- TABLE 158 ROTORK PLC: COMPANY OVERVIEW

- FIGURE 58 ROTORK PLC: COMPANY SNAPSHOT

- TABLE 159 ROTORK PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.10 VALMET (NELES CORPORATION)

- TABLE 160 VALMET: COMPANY OVERVIEW

- FIGURE 59 VALMET (NELES CORPORATION): COMPANY SNAPSHOT

- TABLE 161 VALMET: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- * Business Overview, Products/Services/Solutions offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 SAMSON AG

- TABLE 162 SAMSON AG: COMPANY OVERVIEW

- 11.2.2 VRG CONTROLS

- TABLE 163 VRG CONTROLS: COMPANY OVERVIEW

- 11.2.3 FESTO INC.

- TABLE 164 FESTO INC.: COMPANY OVERVIEW

- 11.2.4 BADGER METER, INC.

- TABLE 165 BADGER METER, INC.: COMPANY OVERVIEW

- 11.2.5 CONTROLAIR

- TABLE 166 CONTROLAIR: COMPANY OVERVIEW

- 11.2.6 CRANE CO.

- TABLE 167 CRANE CO.: COMPANY OVERVIEW

- 11.2.7 CHRISTIAN BURKERT GMBH & CO. KG

- TABLE 168 CHRISTIAN BURKERT GMBH & CO. KG: COMPANY OVERVIEW

- 11.2.8 GEMU GROUP

- TABLE 169 GEMU GROUP: COMPANY OVERVIEW

- 11.2.9 DWYER INSTRUMENTS LTD

- TABLE 170 DWYER INSTRUMENTS LTD: COMPANY OVERVIEW

- 11.2.10 VALVE RELATED CONTROLS, INC

- TABLE 171 VALVE RELATED CONTROLS, INC: COMPANY OVERVIEW

- 11.2.11 POWER-GENEX LTD.

- TABLE 172 POWER-GENEX LTD.: COMPANY OVERVIEW

- 11.2.12 VAL CONTROLS

- TABLE 173 VAL CONTROLS: COMPANY OVERVIEW

- 11.2.13 BRAY INTERNATIONAL

- TABLE 174 BRAY INTERNATIONAL: COMPANY OVERVIEW

- 11.2.14 NIHON KOSO CO., LTD.

- TABLE 175 NIHON KOSO CO., LTD.: COMPANY OVERVIEW

- 11.2.15 SPIRAX-SARCO LIMITED

- TABLE 176 SPIRAX-SARCO LIMITED.: COMPANY OVERVIEW

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 ADJACENT MARKET LIMITATIONS

- 12.3 INDUSTRIAL VALVES MARKET, BY FUNCTION

- TABLE 177 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2017-2020 (USD BILLION)

- TABLE 178 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2021-2026 (USD BILLION)

- 12.3.1 ON/OFF VALVES

- 12.3.1.1 On/off valves accounted for larger market share in 2020

- 12.3.2 CONTROL VALVES

- 12.3.2.1 Control valves to witness significant growth during forecast period

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS