|

|

市場調査レポート

商品コード

1386910

ELISpotアッセイ・FluoroSpotアッセイの世界市場:製品別、用途別、エンドユーザー別 - 予測(~2028年)ELISpot and FluoroSpot Assay Market by Product (Assay kit (Technique, Utility, Analyte (T Cell and B Cell assay)), Analyzer), Application (Transplants, Infectious Diseases, Vaccine Development, Cancer Research), End User - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ELISpotアッセイ・FluoroSpotアッセイの世界市場:製品別、用途別、エンドユーザー別 - 予測(~2028年) |

|

出版日: 2023年11月20日

発行: MarketsandMarkets

ページ情報: 英文 234 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

レポートの概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2028年 |

| 基準年 | 2023年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(100万米ドル ) |

| セグメント | 製品、用途、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

世界のELISpotアッセイ・FluoroSpotアッセイの市場規模は、2023年に2億9,200万米ドル、2028年までに4億2,100万米ドルに達し、予測期間にCAGRで7.6%の成長が見込まれています。

市場は、腫瘍におけるELISpotアッセイとFluoroSpotアッセイの使用の増加や、バイオテクノロジーとバイオ製薬産業の成長などの要因によって牽引されています。一方、代替の検出技術が利用可能なことから、今後数年間は市場成長がある程度制限される見込みです。

「アッセイキットが予測期間に製品市場で最大の市場シェアを占めます。」

キットが2022年に大きな市場シェアを占めました。これは、キットがELISAなどの他のアッセイと比較して高い特異性と感度、優れた検出限界という利点を提供し、また、研究や診断の分野で幅広く利用されているためです。

「診断用途セグメントが最大の市場シェアを占めました。」

診断用途が2022年に最大の市場シェアを占めましたが、ワクチン開発、臨床試験、がん研究などの研究用途での利用を考慮すると、研究用途が2023年~2028年にもっとも速く成長すると予測されます。

「アジア太平洋がもっとも高いCAGRとなります」

アジア太平洋が2022年以降、大きな市場シェアを維持する可能性が高いです。アジア太平洋市場は、非感染性疾患(NCD)の増加、ワクチンに関する研究資金、疾患のプロファイルの変化によって後押しされています。一方で北米は、主要企業のプレゼンスや、先進技術を利用したELISpotアッセイ・FluoroSpotアッセイのキットと分析機の入手可能性により、今後数年間に大きな成長を示す見込みです。

「欧州が予測期間に3番目に高いCAGRで成長すると推定されます。」

この市場の成長は、欧州が有する優れた研究と学術の伝統や、自己免疫疾患と感染症を含む慢性疾患の発症率の増加、欧州の多くの国々で研究と医療に対する政府資金が先進の診断技術の開発と採用を支援していることなどによるものです。

当レポートでは、世界のELISpotアッセイ・FluoroSpotアッセイ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- ELISpotアッセイ・FluoroSpotアッセイ市場の概要

- ELISpotアッセイ・FluoroSpotアッセイキット市場:技術別(2023年~2028年)

- 北米のELISpotアッセイ・FluoroSpotアッセイ市場:製品別、国別(2022年)

- ELISpotアッセイ・FluoroSpotアッセイ市場:地理的な成長機会

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- サプライチェーン分析

- 技術分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 購入プロセスにおける主なステークホルダー

- 購入基準

- 規制情勢

- 米国

- カナダ

- 欧州

- 日本

- 中国

- インド

- ロシア

- サウジアラビア

- メキシコ

- ブラジル

- 韓国

- 中東

- アフリカ

- 主な会議とイベント

- 特許分析

- 価格分析

- 貿易分析

- エコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

第6章 ELISpotアッセイ・FluoroSpotアッセイ市場:製品別

- イントロダクション

- アッセイキット

- アッセイキット市場:技術別

- アッセイキット市場:用途別

- アッセイキット市場:分析物別

- アナライザー

- 補助製品

第7章 ELISpotアッセイ・FluoroSpotアッセイ市場:用途別

- イントロダクション

- 診断用途

- 感染症

- 移植

- 研究用と

- ワクチン開発

- 臨床試験

- がん研究

第8章 ELISpotアッセイ・FluoroSpotアッセイ市場:エンドユーザー別

- イントロダクション

- 病院、臨床研究所

- 研究機関

- バイオ製薬企業、開発業務受託機関

第9章 ELISpotアッセイ・FluoroSpotアッセイ市場:地域別

- イントロダクション

- 北米

- 北米の不況の影響

- 米国

- カナダ

- 欧州

- 欧州の不況の影響

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋の不況の影響

- 中国

- 日本

- インド

- その他のアジア太平洋

- その他の地域

第10章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場シェア分析

- 収益シェア分析

- 企業の評価マトリクス

- 中小企業/スタートアップの評価マトリクス

- 競合ベンチマーキング

- 企業のフットプリント

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- OXFORD IMMUNOTEC USA, INC. (SUBSIDIARY OF REVVITY, INC.)

- BECTON, DICKINSON AND COMPANY

- BIO-TECHNE

- CELLULAR TECHNOLOGY LIMITED

- MABTECH

- ABCAM PLC

- MERCK KGAA

- AUTOIMMUN DIAGNOSTIKA GMBH

- U-CYTECH

- MIKROGEN DIAGNOSTIK

- MEDIX BIOCHEMICA

- ABNOVA CORPORATION

- ANOGEN-YES BIOTECH LABORATORIES LTD.

- BIORBYT LTD.

- BIOSYS SCIENTIFIC DEVICES GMBH

- その他の企業

- JACKSON IMMUNORESEARCH INC.

- IST SCIENTIFIC

- SERVA ELECTROPHORESIS GMBH

- ACROBIOSYSTEMS

- NATIONAL ANALYTICAL CORPORATION

- STEMCELL TECHNOLOGIES

- ZENBIO, INC.

- BOC SCIENCES

- TOKYO CHEMICAL INDUSTRY CO., LTD.

- MP BIOMEDICALS

第12章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2028 |

| Base Year | 2023 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Million |

| Segments | Product, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, ROW |

The global ELISpot and FluoroSpot Assays Market is expected to reach USD 421 million by 2028 from USD 292 million in 2023, at a CAGR of 7.6% during the forecast period. Market is driven by factors such as Increasing use of ELISpot and FluoroSpot assays in oncology, growth in biotechnology and biopharmaceutical industries. On the other hand, availability of alternative detection technologies is expected to limit market growth to a certain extent in the coming years.

"The Assay kits accounted for the largest market share in the ELISpot and FluoroSpot Assays product' smarket, during the forecast period"

The ELISpot and FluoroSpot Assay Products market is segmented into Assay kits, Analyzers, and Ancillary Products. In 2022, kits accounted for a sizable market share because they offer advantages in terms of high specificity and sensitivity and better detection limits as compared to other assays such as ELISA as well as their wide applications in the field of research and diagnostics.

"Diagnostic application segment accounted for the largest market share"

Based on type of application, the ELISpot and FluoroSpot Assays market is segmented into Diagnostic and Research Application. The Diagnostic application segment accounted for the largest market share in 2022., while research application is expected to grow at the fastest rate in the years ahead, from 2023 to 2028 considering their practice in several research applications, such as vaccine development, clinical trials, and cancer research.

"APAC region accounted for the highest CAGR"

The global ELISpot and FluoroSpot Assays market is divided into four regions: North America, Asia-Pacific, Europe, and Rest of the World. According to the regional analysis, the Asia-Pacific region is likely to retain a significant market share in 2022 and the future. The Asia-Pacific market is being propelled by an increase in non-communicable (NCD), research funding on vaccines and changing disease profiles. North America, on the other hand, will experience significant growth in the coming years due to the presence of key players, the availability of technologically advanced ELISpot and FluoroSpot assay kits and analyzers.

"Europe is estimated to register the third highest CAGR during the forecast period."

In this report, the ELISpot and FluoroSpot Assays market is segmented into four major regional segments: North America, Europe, Asia Pacific, Rest of the world. The market in Europe is projected to register the third highest growth rate during the forecast period. The growth in this market is due to Europe has a strong tradition of research and academic excellence, the rising incidence of chronic diseases, including autoimmune disorders and infectious diseases, government funding for research and healthcare in many European countries supports the development and adoption of advanced diagnostic technologies.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 32%, Tier 2 - 44%, and Tier 3 - 24%

- By Designation: C-level - 30%, D-level - 34%, and Others - 36%

- By Region: North America - 40%, Europe - 28%, Asia Pacific - 20%, and the Rest of the World - 12%

Lits of Companies Profiled in the Report:

- Oxford Immunotec USA, Inc. (Subsidiary of Revvity Inc.) (UK)

- Becton, Dickinson and Company (BD) (US)

- Cellular Technology Limited (CTL) (US)

- Mabtech (Sweden)

- Abcam plc. (UK)

- Bio-Techne (US)

- Merck KGaA (Germany)

- Autoimmun Diagnostika GmbH (Germany)

- U-CyTech (Netherland)

- Mikrogen Diagnostik (Germany)

- Medix Biochemica (Finland)

- Abnova Corporation (Taiwan)

- Anogen-Yes Biotech Laboratories Ltd. (Canada)

- Biorbyt Ltd (UK)

- BIOSYS Scientific Devices GmbH (Germany)

- Jackson ImmunoResearch Inc. (US)

- iST Scientific (UK)

- SERVA Electrophoresis GmbH (Germany)

- ACROBiosystems (US)

- NATIONAL ANALYTICAL CORPORATION (India)

- STEMCELL Technologies. (Canada)

- ZenBio, Inc (US)

- BOC Sciences (US)

- Tokyo Chemical Industry Co., Ltd. (TCI) (Japan)

- MP Biomedicals (California)

Research Coverage:

This report studies the ELISpot and FluoroSpot Assays market based on product, applications, End user, and region. The report also analyses factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth. It evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders. The report also studies micromarkets with respect to their growth trends, prospects, and contributions to the total ELISpot and FluoroSpot Assays market. The report forecasts the revenue of the market segments with respect to four major regions.

Reasons to Buy the Report:

The report provides insights on the following pointers:

Market Drivers: Comprehensive information about driving factors of the markets. The report analyses the markets drivers across key geographic regions.

Market Penetration: Comprehensive information on ELISpot and FluoroSpot assay products offered by the top 25 players in the market. The report analyses the ELISpot and FluoroSpot Assays market by product, application, end user and region.

Market Development: Comprehensive information about lucrative emerging markets. The report analyses the markets for various securement devices across key geographic regions.

Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the ELISpot and FluoroSpot Assays market

Competitive Assessment: In-depth assessment of market shares and strategies of the leading players in the ELISpot and FluoroSpot Assays market

Market Position: It will upkeep stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SEGMENTATION

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 MARKET STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 2 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 REVENUE SHARE ANALYSIS ILLUSTRATION: OXFORD IMMUNOTEC USA, INC. (SUBSIDIARY OF REVVITY, INC.) (UK)

- FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.1 GROWTH FORECAST

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 8 TOP-DOWN APPROACH

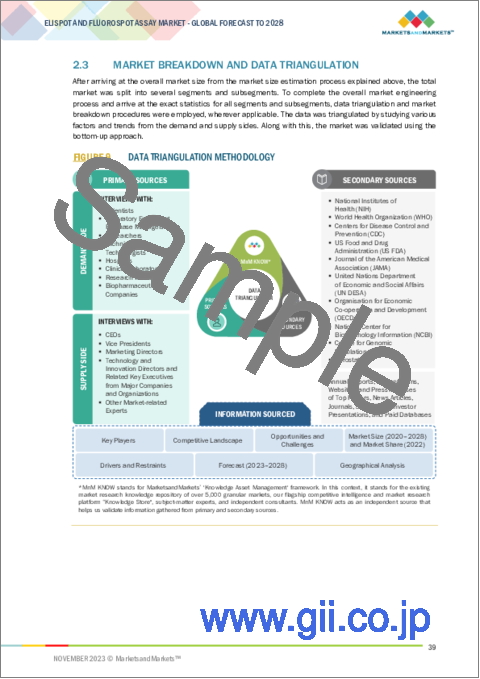

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 10 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ELISPOT AND FLUOROSPOT ASSAYS MARKET OVERVIEW

- FIGURE 14 RISING INCIDENCE OF CHRONIC AND INFECTIOUS DISEASES TO DRIVE MARKET

- 4.2 ELISPOT AND FLUOROSPOT ASSAY KITS MARKET, BY TECHNIQUE, 2023-2028

- FIGURE 15 ELISPOT ASSAY KITS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT AND COUNTRY (2022)

- FIGURE 16 ASSAY KITS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN ELISPOT AND FLUOROSPOT ASSAYS MARKET IN 2022

- 4.4 ELISPOT AND FLUOROSPOT ASSAYS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 17 ASIA PACIFIC COUNTRIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 ELISPOT AND FLUOROSPOT ASSAYS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing incidence of chronic and infectious diseases and growing awareness about early disease diagnosis

- FIGURE 19 INCIDENCE OF DIABETES, BY REGION, 2019 VS. 2030 VS. 2045 (MILLION)

- TABLE 2 GLOBAL INCIDENCE OF INFECTIOUS DISEASES

- 5.2.1.2 Increasing vaccine development to address challenges of antimicrobial resistance

- 5.2.1.3 Increasing use of ELISpot and FluoroSpot assays in oncology

- TABLE 3 INCIDENCE OF CANCER IN MEN, 2020

- TABLE 4 INCIDENCE OF CANCER IN WOMEN, 2020

- 5.2.1.4 ELISpot assays as diagnostic tool in drug hypersensitivity reaction

- TABLE 5 EXAMPLES OF ELISPOT ASSAYS IN DRUG HYPERSENSITIVITY REACTIONS

- 5.2.1.5 Growth in biotechnology and biopharmaceutical industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent requirements for approval of ELISpot and FluoroSpot assay instruments and consumables

- 5.2.2.2 High cost of assay kits and analyzers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Use of FluoroSpot assays for multiple-analyte detection in single well

- 5.2.3.2 Emerging economies

- FIGURE 20 HEALTHCARE EXPENDITURE PER CAPITA IN BRIC COUNTRIES, 2012-2020

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of alternative detection technologies

- 5.2.4.2 Dearth of skilled professionals

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 22 DIRECT DISTRIBUTION-PREFERRED STRATEGY FOR PROMINENT COMPANIES

- 5.5 TECHNOLOGY ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 INTENSITY OF COMPETITIVE RIVALRY

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 BARGAINING POWER OF SUPPLIERS

- 5.6.5 THREAT OF SUBSTITUTES

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- 5.7.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR END USERS

- TABLE 7 KEY BUYING CRITERIA FOR END USERS

- 5.8 REGULATORY LANDSCAPE

- TABLE 8 REGULATORY AUTHORITIES GOVERNING ELISPOT AND FLUOROSPOT ASSAYS MARKET

- 5.8.1 US

- TABLE 9 US: CLASSIFICATION OF ELISPOT AND FLUOROSPOT ASSAY PRODUCTS

- FIGURE 25 US: REGULATORY PROCESS FOR IVD DEVICES

- 5.8.2 CANADA

- FIGURE 26 CANADA: REGULATORY PROCESS FOR IVD DEVICES

- 5.8.3 EUROPE

- TABLE 10 EUROPE: CLASSIFICATION OF IVD DEVICES

- 5.8.4 JAPAN

- FIGURE 27 JAPAN: REGULATORY PROCESS FOR IVD DEVICES

- TABLE 11 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.8.5 CHINA

- TABLE 12 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.8.6 INDIA

- FIGURE 28 INDIA: REGULATORY PROCESS FOR IVD DEVICES

- 5.8.7 RUSSIA

- TABLE 13 RUSSIA: CLASSIFICATION OF IVD DEVICES

- 5.8.8 SAUDI ARABIA

- TABLE 14 SAUDI ARABIA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.8.9 MEXICO

- FIGURE 29 MEXICO: REGULATORY PROCESS FOR IVD DEVICES

- TABLE 15 MEXICO: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.8.10 BRAZIL

- FIGURE 30 BRAZIL: REGULATORY PROCESS FOR IVD DEVICES

- 5.8.11 SOUTH KOREA

- TABLE 16 SOUTH KOREA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.8.12 MIDDLE EAST

- 5.8.13 AFRICA

- 5.9 KEY CONFERENCES AND EVENTS

- TABLE 17 LIST OF CONFERENCES AND EVENTS, 2023-2025

- 5.10 PATENT ANALYSIS

- FIGURE 31 PATENT ANALYSIS FOR ELISPOT AND FLUOROSPOT ASSAYS

- 5.11 PRICING ANALYSIS

- TABLE 18 ELISPOT AND FLUOROSPOT ASSAYS MARKET: PRICE RANGE FOR ELISPOT AND FLUOROSPOT ASSAY PRODUCTS

- TABLE 19 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS (2022)

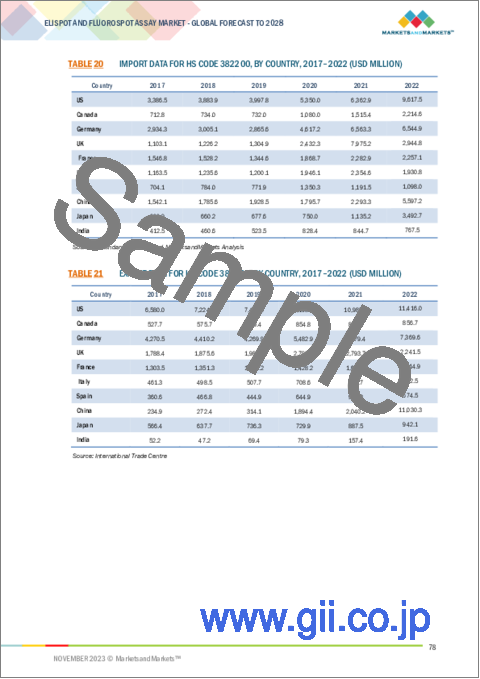

- 5.12 TRADE ANALYSIS

- 5.12.1 TRADE ANALYSIS FOR ELISPOT AND FLUOROSPOT ASSAYS

- TABLE 20 IMPORT DATA FOR HS CODE 382200, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 21 EXPORT DATA FOR HS CODE 382200, BY COUNTRY, 2017-2022 (USD MILLION)

- 5.13 ECOSYSTEM ANALYSIS

- 5.13.1 ROLE IN ECOSYSTEM

- FIGURE 32 KEY PLAYERS OPERATING IN ELISPOT AND FLUOROSPOT ASSAYS MARKET

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

6 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 22 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- 6.2 ASSAY KITS

- TABLE 23 ELISPOT AND FLUOROSPOT ASSAY KITS MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 24 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAY KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 25 EUROPE: ELISPOT AND FLUOROSPOT ASSAY KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 26 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAY KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- 6.2.1 ASSAY KITS MARKET, BY TECHNIQUE

- TABLE 27 ELISPOT AND FLUOROSPOT ASSAY KITS MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 6.2.1.1 ELISpot assay kits

- 6.2.1.1.1 Need for highly sensitive immune monitoring requirements in clinical trials to drive market

- 6.2.1.1 ELISpot assay kits

- TABLE 28 ELISPOT ASSAY KITS MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: ELISPOT ASSAY KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 30 EUROPE: ELISPOT ASSAY KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: ELISPOT ASSAY KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- 6.2.1.2 FluoroSpot assay kits

- 6.2.1.2.1 Increasing demand for multiple analyte detection and technological advancements to support market growth

- 6.2.1.2 FluoroSpot assay kits

- TABLE 32 FLUOROSPOT ASSAY KITS MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: FLUOROSPOT ASSAY KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 34 EUROPE: FLUOROSPOT ASSAY KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: FLUOROSPOT ASSAY KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- 6.2.2 ASSAY KITS MARKET, BY UTILITY

- TABLE 36 ELISPOT AND FLUOROSPOT ASSAY KITS MARKET, BY UTILITY, 2020-2028 (USD MILLION)

- 6.2.2.1 Diagnostic kits

- 6.2.2.1.1 Need for early diagnosis of infections to drive market

- 6.2.2.1 Diagnostic kits

- TABLE 37 CANCER CASES, BY TYPE, 2020

- TABLE 38 DIAGNOSTIC KITS MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: DIAGNOSTIC KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 40 EUROPE: DIAGNOSTIC KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: DIAGNOSTIC KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- 6.2.2.2 Research kits

- 6.2.2.2.1 Increasing investments in vaccine research, clinical trials, and cancer research to drive market

- 6.2.2.2 Research kits

- TABLE 42 RESEARCH KITS MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: RESEARCH KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 44 EUROPE: RESEARCH KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: RESEARCH KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- 6.2.3 ASSAY KITS MARKET, BY ANALYTE

- TABLE 46 ELISPOT AND FLUOROSPOT ASSAY KITS MARKET, BY ANALYTE, 2020-2028 (USD MILLION)

- 6.2.3.1 T-cell-based kits

- 6.2.3.1.1 Low concentrations of infection-released analytes necessitate use of T-cell-based kits

- 6.2.3.1 T-cell-based kits

- TABLE 47 T-CELL-BASED KITS MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: T-CELL-BASED KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 49 EUROPE: T-CELL-BASED KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: T-CELL-BASED KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- 6.2.3.2 B-cell-based kits

- 6.2.3.2.1 Detection of B-cell-based antibodies useful to study cell response post-infection/vaccination

- 6.2.3.2 B-cell-based kits

- TABLE 51 B-CELL-BASED KITS MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: B-CELL-BASED KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 53 EUROPE: B-CELL-BASED KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 54 ASIA PACIFIC: B-CELL-BASED KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- 6.2.3.3 Other analyte kits

- TABLE 55 OTHER ANALYTE KITS MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: OTHER ANALYTE KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 57 EUROPE: OTHER ANALYTE KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC: OTHER ANALYTE KITS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- 6.3 ANALYZERS

- 6.3.1 ADOPTION OF ASSAY KITS TO DRIVE USE OF ANALYZERS

- TABLE 59 ELISPOT AND FLUOROSPOT ANALYZERS MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: ELISPOT AND FLUOROSPOT ANALYZERS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 61 EUROPE: ELISPOT AND FLUOROSPOT ANALYZERS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 62 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ANALYZERS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- 6.4 ANCILLARY PRODUCTS

- 6.4.1 REPEATED USAGE OF ANCILLARY PRODUCTS INTEGRAL TO RELIABILITY AND SUCCESS OF ELISPOT AND FLUOROSPOT ASSAYS

- TABLE 63 ELISPOT AND FLUOROSPOT ANCILLARY PRODUCTS MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: ELISPOT AND FLUOROSPOT ANCILLARY PRODUCTS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 65 EUROPE: ELISPOT AND FLUOROSPOT ANCILLARY PRODUCTS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ANCILLARY PRODUCTS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

7 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 67 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 7.2 DIAGNOSTIC APPLICATIONS

- TABLE 68 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2020-2028 (USD MILLION)

- TABLE 69 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY REGION, 2020-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 71 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2020-2028 (USD MILLION)

- 7.2.1 INFECTIOUS DISEASES

- 7.2.1.1 Rising prevalence of infectious diseases to drive market

- TABLE 73 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR INFECTIOUS DISEASES, BY REGION, 2020-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 75 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2020-2028 (USD MILLION)

- 7.2.2 TRANSPLANTS

- 7.2.2.1 Growing incidence of infections caused during transplant procedures to drive demand

- FIGURE 33 PATIENTS ON WAITING LIST FOR ORGAN TRANSPLANTS, 2023

- FIGURE 34 NUMBER OF TRANSPLANTS PERFORMED IN 2023

- TABLE 77 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR TRANSPLANTS, BY REGION, 2020-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR TRANSPLANTS, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 79 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR TRANSPLANTS, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR TRANSPLANTS, BY COUNTRY, 2020-2028 (USD MILLION)

- 7.3 RESEARCH APPLICATIONS

- TABLE 81 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2020-2028 (USD MILLION)

- TABLE 82 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2020-2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 84 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 85 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2020-2028 (USD MILLION)

- 7.3.1 VACCINE DEVELOPMENT

- 7.3.1.1 Largest and fastest-growing segment of market

- TABLE 86 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR VACCINE DEVELOPMENT, BY REGION, 2020-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR VACCINE DEVELOPMENT, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 88 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR VACCINE DEVELOPMENT, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR VACCINE DEVELOPMENT, BY COUNTRY, 2020-2028 (USD MILLION)

- 7.3.2 CLINICAL TRIALS

- 7.3.2.1 Growing number of clinical trials to drive demand

- FIGURE 35 NUMBER OF CLINICAL TRIALS, BY REGION, 2010-2021

- FIGURE 36 NUMBER OF REGISTERED CLINICAL STUDIES, 2023

- TABLE 90 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR CLINICAL TRIALS, BY REGION, 2020-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR CLINICAL TRIALS, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 92 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR CLINICAL TRIALS, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR CLINICAL TRIALS, BY COUNTRY, 2020-2028 (USD MILLION)

- 7.3.3 CANCER RESEARCH

- 7.3.3.1 Rising prevalence of cancer to support market growth

- TABLE 94 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR CANCER RESEARCH, BY REGION, 2020-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR CANCER RESEARCH, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 96 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR CANCER RESEARCH, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR CANCER RESEARCH, BY COUNTRY, 2020-2028 (USD MILLION)

8 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 98 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 8.2 HOSPITAL AND CLINICAL LABORATORIES

- 8.2.1 IMPROVING HEALTHCARE INFRASTRUCTURE IN DEVELOPING COUNTRIES TO DRIVE MARKET

- TABLE 99 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR HOSPITAL AND CLINICAL LABORATORIES, BY REGION, 2020-2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR HOSPITAL AND CLINICAL LABORATORIES, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 101 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR HOSPITAL AND CLINICAL LABORATORIES, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR HOSPITAL AND CLINICAL LABORATORIES, BY COUNTRY, 2020-2028 (USD MILLION)

- 8.3 RESEARCH INSTITUTES

- 8.3.1 FASTEST-GROWING END USER OF ELISPOT AND FLUOROSPOT ASSAYS

- TABLE 103 GRANTS, BY CANCER TYPE, 2023

- TABLE 104 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR RESEARCH INSTITUTES, BY REGION, 2020-2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR RESEARCH INSTITUTES, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 106 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR RESEARCH INSTITUTES, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR RESEARCH INSTITUTES, BY COUNTRY, 2020-2028 (USD MILLION)

- 8.4 BIOPHARMACEUTICAL COMPANIES AND CONTRACT RESEARCH ORGANIZATIONS

- 8.4.1 GROWTH IN BIOTECHNOLOGY INDUSTRY TO PROPEL GROWTH

- TABLE 108 ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR BIOPHARMACEUTICAL COMPANIES AND CROS, BY REGION, 2020-2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR BIOPHARMACEUTICAL COMPANIES AND CROS, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 110 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR BIOPHARMACEUTICAL COMPANIES AND CROS, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET FOR BIOPHARMACEUTICAL COMPANIES AND CROS, BY COUNTRY, 2020-2028 (USD MILLION)

9 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 112 ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY REGION, 2020-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 37 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET SNAPSHOT

- TABLE 113 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- 9.2.2 US

- 9.2.2.1 Rising prevalence of chronic diseases to drive market

- TABLE 117 US: KEY MACROINDICATORS

- TABLE 118 US: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 119 US: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 120 US: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Rising healthcare expenditure to drive adoption of ELISpot and FluoroSpot assays

- TABLE 121 CANADA: KEY MACROINDICATORS

- TABLE 122 CANADA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 123 CANADA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 124 CANADA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.3 EUROPE

- TABLE 125 EUROPE: HEALTHCARE EXPENDITURE, BY COUNTRY

- 9.3.1 EUROPE: RECESSION IMPACT

- TABLE 126 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 127 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 128 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 129 EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 Fastest-growing country in European ELISpot and FluoroSpot assays market

- TABLE 130 GERMANY: KEY MACROINDICATORS

- TABLE 131 GERMANY: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 132 GERMANY: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 133 GERMANY: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Rising prevalence of NCDs to drive market

- TABLE 134 UK: KEY MACROINDICATORS

- TABLE 135 UK: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 136 UK: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 137 UK: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.3.4 FRANCE

- 9.3.4.1 Need for early disease diagnosis to support market growth

- TABLE 138 FRANCE: KEY MACROINDICATORS

- TABLE 139 FRANCE: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 140 FRANCE: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 141 FRANCE: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Increasing incidence of cancer to propel market

- TABLE 142 ITALY: KEY MACROINDICATORS

- TABLE 143 ITALY: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 144 ITALY: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 145 ITALY: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.3.6 SPAIN

- 9.3.6.1 High incidence of chronic diseases to drive market

- TABLE 146 SPAIN: KEY MACROINDICATORS

- TABLE 147 SPAIN: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 148 SPAIN: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 149 SPAIN: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 150 REST OF EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 151 REST OF EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 152 REST OF EUROPE: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 38 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET SNAPSHOT

- TABLE 153 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Rising focus on vaccine development and cancer research to drive market

- TABLE 157 CHINA: KEY MACROINDICATORS

- TABLE 158 CHINA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 159 CHINA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 160 CHINA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Increased focus on vaccine research to support market growth

- TABLE 161 JAPAN: KEY MACROINDICATORS

- TABLE 162 JAPAN: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 163 JAPAN: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 164 JAPAN: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Increasing focus on cancer research and therapy to drive market

- TABLE 165 INDIA: KEY MACROINDICATORS

- TABLE 166 INDIA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 167 INDIA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 168 INDIA: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 169 REST OF ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.5 REST OF THE WORLD

- TABLE 172 REST OF THE WORLD: POPULATION AGED 65 AND ABOVE, 2022

- 9.5.1 REST OF THE WORLD: RECESSION IMPACT

- TABLE 173 REST OF THE WORLD: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY PRODUCT, 2020-2028 (USD MILLION)

- TABLE 174 REST OF THE WORLD: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 175 REST OF THE WORLD: ELISPOT AND FLUOROSPOT ASSAYS MARKET, BY END USER, 2020-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 176 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ELISPOT AND FLUOROSPOT ASSAYS MARKET

- 10.3 MARKET SHARE ANALYSIS

- TABLE 177 ELISPOT AND FLUOROSPOT ASSAYS MARKET: DEGREE OF COMPETITION

- 10.4 REVENUE SHARE ANALYSIS

- FIGURE 39 REVENUE ANALYSIS OF KEY PUBLIC PLAYERS IN ELISPOT AND FLUOROSPOT ASSAYS MARKET

- FIGURE 40 ELISPOT AND FLUOROSPOT ASSAYS: MARKET RANKING ANALYSIS, 2022

- 10.5 COMPANY EVALUATION MATRIX

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 41 ELISPOT AND FLUOROSPOT ASSAYS MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.6 SME/STARTUP EVALUATION MATRIX

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 42 ELISPOT AND FLUOROSPOT ASSAYS MARKET: SME/STARTUP EVALUATION MATRIX, 2022

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 178 ELISPOT AND FLUOROSPOT ASSAYS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 10.8 COMPANY FOOTPRINT

- TABLE 179 COMPANY FOOTPRINT

- TABLE 180 PRODUCT FOOTPRINT

- TABLE 181 REGIONAL FOOTPRINT

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- TABLE 182 KEY PRODUCT LAUNCHES, JANUARY 2020-OCTOBER 2023

- 10.9.2 DEALS

- TABLE 183 KEY DEALS, JANUARY 2020-OCTOBER 2023

- 10.9.3 OTHER DEVELOPMENTS

- TABLE 184 OTHER KEY DEVELOPMENTS, JANUARY 2020-OCTOBER 2023

11 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 11.1 KEY PLAYERS

- 11.1.1 OXFORD IMMUNOTEC USA, INC. (SUBSIDIARY OF REVVITY, INC.)

- TABLE 185 OXFORD IMMUNOTEC USA, INC. (SUBSIDIARY OF REVVITY, INC.): BUSINESS OVERVIEW

- FIGURE 43 REVVITY, INC.: COMPANY SNAPSHOT (2023)

- 11.1.2 BECTON, DICKINSON AND COMPANY

- TABLE 186 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- FIGURE 44 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- 11.1.3 BIO-TECHNE

- TABLE 187 BIO-TECHNE: BUSINESS OVERVIEW

- FIGURE 45 BIO-TECHNE: COMPANY SNAPSHOT (2023)

- 11.1.4 CELLULAR TECHNOLOGY LIMITED

- TABLE 188 CELLULAR TECHNOLOGY LIMITED: BUSINESS OVERVIEW

- 11.1.5 MABTECH

- TABLE 189 MABTECH: BUSINESS OVERVIEW

- 11.1.6 ABCAM PLC

- TABLE 190 ABCAM PLC: BUSINESS OVERVIEW

- FIGURE 46 ABCAM PLC: COMPANY SNAPSHOT (2022)

- 11.1.7 MERCK KGAA

- TABLE 191 MERCK KGAA: BUSINESS OVERVIEW

- FIGURE 47 MERCK KGAA: COMPANY SNAPSHOT (2022)

- 11.1.8 AUTOIMMUN DIAGNOSTIKA GMBH

- TABLE 192 AUTOIMMUN DIAGNOSTIKA GMBH: BUSINESS OVERVIEW

- 11.1.9 U-CYTECH

- TABLE 193 U-CYTECH: BUSINESS OVERVIEW

- 11.1.10 MIKROGEN DIAGNOSTIK

- TABLE 194 MIKROGEN DIAGNOSTIK: BUSINESS OVERVIEW

- 11.1.11 MEDIX BIOCHEMICA

- TABLE 195 MEDIX BIOCHEMICA: BUSINESS OVERVIEW

- 11.1.12 ABNOVA CORPORATION

- TABLE 196 ABNOVA CORPORATION: BUSINESS OVERVIEW

- 11.1.13 ANOGEN-YES BIOTECH LABORATORIES LTD.

- TABLE 197 ANOGEN-YES BIOTECH LABORATORIES LTD.: BUSINESS OVERVIEW

- 11.1.14 BIORBYT LTD.

- TABLE 198 BIORBYT LTD.: BUSINESS OVERVIEW

- 11.1.15 BIOSYS SCIENTIFIC DEVICES GMBH

- TABLE 199 BIOSYS SCIENTIFIC DEVICES GMBH: BUSINESS OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 JACKSON IMMUNORESEARCH INC.

- TABLE 200 JACKSON IMMUNORESEARCH INC.: BUSINESS OVERVIEW

- 11.2.2 IST SCIENTIFIC

- TABLE 201 IST SCIENTIFIC: BUSINESS OVERVIEW

- 11.2.3 SERVA ELECTROPHORESIS GMBH

- TABLE 202 SERVA ELECTROPHORESIS GMBH: BUSINESS OVERVIEW

- 11.2.4 ACROBIOSYSTEMS

- TABLE 203 ACROBIOSYSTEMS: BUSINESS OVERVIEW

- 11.2.5 NATIONAL ANALYTICAL CORPORATION

- TABLE 204 NATIONAL ANALYTICAL CORPORATION: BUSINESS OVERVIEW

- 11.2.6 STEMCELL TECHNOLOGIES

- TABLE 205 STEMCELL TECHNOLOGIES: BUSINESS OVERVIEW

- 11.2.7 ZENBIO, INC.

- TABLE 206 ZENBIO, INC.: BUSINESS OVERVIEW

- 11.2.8 BOC SCIENCES

- TABLE 207 BOC SCIENCES: BUSINESS OVERVIEW

- 11.2.9 TOKYO CHEMICAL INDUSTRY CO., LTD.

- TABLE 208 TOKYO CHEMICAL INDUSTRY CO., LTD.: BUSINESS OVERVIEW

- 11.2.10 MP BIOMEDICALS

- TABLE 209 MP BIOMEDICALS: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS