|

|

市場調査レポート

商品コード

1138434

タンパク質加水分解酵素の世界市場:供給源別 (微生物、動物、植物)・生産方法別 (発酵、抽出)・製品別・用途別 (洗剤、医薬品、食品、繊維・皮革)・地域別の将来予測 (2027年まで)Protein Hydrolysis Enzymes Market by Source (Microorganisms, Animals, Plants), Method of Production (Fermentation and Extraction), Product, Application (Detergent, Pharmaceuticals, Food, Textiles & Leather) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| タンパク質加水分解酵素の世界市場:供給源別 (微生物、動物、植物)・生産方法別 (発酵、抽出)・製品別・用途別 (洗剤、医薬品、食品、繊維・皮革)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年10月11日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のタンパク質加水分解酵素の市場規模は、2022年から2027年にかけて6.2%のCAGRで成長し、2027年までに29億米ドルに達すると予測されています。

化学物質の代替品として、特に洗剤・食品用途でタンパク質加水分解酵素の使用が増加しているため、市場は大きな成長を遂げています。また、肉類・ベーカリー製品の消費量の増加に伴い、食品市場での消費量が増加しています。さらに、製薬業界におけるタンパク質加水分解酵素の重要性の増大が、同市場に大きな成長機会をもたらしています。

用途別では、2022年に洗剤産業が市場を支配していました。洗剤製剤に使用されるタンパク質加水分解酵素やその他の酵素は、高い活性と幅広いpH・温度範囲での安定性を持っています。限外ろ過や逆浸透膜などの新しい処理技術の採用は、洗浄作業に新たな道を提供します。

地域別では、アジア太平洋のタンパク質加水分解酵素市場が予測期間中に8.40%のCAGRで成長すると予測されます。アジア太平洋地域は、人口の多さ、世帯収入の増加、疾病の増加により、最も急速に成長する市場であると予測されています。

当レポートでは、世界のタンパク質加水分解酵素の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、供給源別・生産方法別・製品別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 産業動向

- イントロダクション

- 顧客のビジネスに影響を与える傾向

- バリューチェーン分析

- 貿易分析

- 酵素

- 技術分析

- 特許分析

- エコシステムマップとサプライチェーン分析

- ポーターのファイブフォース分析

- ケーススタディ

- 価格分析

- 関税・規制の状況

- 主な利害関係者と購入基準

- 主な会議とイベント

第7章 タンパク質加水分解酵素市場:供給源別

- イントロダクション

- 微生物

- 動物

- トリプシン

- キモトリプシン

- ペプシン

- パンクレアチン

- 植物

- パパン

- ブロメライン

- その他の植物製品

第8章 タンパク質加水分解酵素市場:生産方法別

- イントロダクション

- 発酵

- 抽出

第9章 タンパク質加水分解酵素市場:製品別

- イントロダクション

- 動物製品

- トリプシン

- ペプシン

- レニン

- その他の動物製品

- 植物製品

- パパン

- ブロメライン

- その他の植物製品

- 微生物製品

- アルカリプロテアーゼ

- 酸性プロテアーゼ

- 中性プロテアーゼ

- その他の微生物製品

第10章 タンパク質加水分解酵素市場:用途別

- イントロダクション

- 洗剤

- 医薬品

- 食品

- 繊維・皮革

- その他の用途

- 飼料

- 銀回収

第11章 タンパク質加水分解酵素市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- デンマーク

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア・ニュージーランド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- ブラジル

- アルゼンチン

- 南アフリカ

- その他の国々

第12章 競合情勢

- 概要

- 市場評価フレームワーク

- 市場シェア分析

- 主要企業のランキング

- 主要市場・企業の収益分析

- 企業評価クアドラント (主要企業)

- スタートアップの評価クアドラント

- 競合シナリオ

- 製品の発売

- 資本取引

- その他の動向

第13章 企業プロファイル

- 主要企業

- NOVOZYMES

- ASSOCIATED BRITISH FOODS

- DSM

- DUPONT

- BASF SE

- ADVANCED ENZYME TECHNOLOGIES

- DYADIC INTERNATIONAL, INC.

- CHR. HANSEN HOLDING A/S

- AMANO ENZYME

- SPECIALTY ENZYMES & BIOTECHNOLOGIES

- CREATIVE ENZYMES

- JIANGSU BOLI BIOPRODUCTS CO., LTD

- BIOCATALYSTS

- AUMGENE BIOSCIENCES

- MERCK KGAA

- BIOSEUTICA

- ROSSARI BIOTECH LIMITED

第14章 隣接・関連市場

- イントロダクション

- 酵素市場

- 食品酵素市場

第15章 付録

The protein hydrolysis enzymes market is projected to reach USD 2.9 Billion by 2027 growing at a CAGR of 6.2% from 2022 to 2027. With the increasing use of protein hydrolysis enzymes as chemical substitutes, particularly in detergent and food applications, the market for protein hydrolysis enzymes has experienced significant growth. Protein hydrolysis enzymes are increasingly being consumed in the food market with the increased consumption of meat and bakery products. Moreover, the increasing implications of protein hydrolysis enzymes in the pharmaceutical industry pose significant growth opportunities in the market. The growing market demand for protein hydrolysis enzymes is propelling the players in the market to adopt strategies such as product launches, deals and expansions to increase their market penetration. In November 2021, Biocatalysts launched a new product named "Promod 324L" for the pet food industry. It improved the processibility of the protein by increasing the solubility and reducing the viscosity of the protein. In October 2020, BASF expanded the detergent enzyme technology to provide key ingredients for the home care and I&I industry.

"Detergent industry has high demand in application segment."

The detergent industry dominated the protein hydrolysis enzymes by application segment in 2022. Protein hydrolysis enzymes and other enzymes used in detergent formulations have high activity and stability over a broad range of pH and temperature. Subtilisins are a prototypical group of bacterial serine proteases used extensively in detergents. Protein stains such as grass, blood, eggs, and human sweat are eliminated by proteolysis in laundry detergents. In addition, Serine proteases are the most important group for detergent applications. Adoption of new processing technologies such as ultrafiltration and reverse osmosis offers new avenues to cleaning operations. Specific application of enzymes in detergents includes dishwashing, cleaning of medical devices, laundry, color and fabric care, ware-washing applications, and floor cleaning. The usage of enzymes helps in higher product quality, lower manufacturing cost, and less waste, and reduced energy consumption. Major manufacturers of protein hydrolysis enzymes in the detergent industry include Novozymes (Denmark), BASF SE (Germany), AB Enzymes (UK), and Creative Enzymes (US).

"Asia Pacific is projected to witness the growth of 8.40% during the forecast period in the protein hydrolysis enzymes market."

The protein hydrolysis enzymes market in the Asia Pacific region is projected to grow at a CAGR of 8.40% during the forecast period. Asia Pacific is projected to be the fastest growing market owing to high population base, rising dispose income, and rising incidences of diseases in the region. The region is expected to grow at a higher rate owing to the growing urbanization and increased demand in the packaged food, soap & washing powder, livestock feed, and pharmaceutical sectors. China, Japan, South Korea, and India have a reputation in the global pharmaceutical market for the continuous innovations done by their homegrown biotechnological firms. Protein hydrolysis enzymes are being developed in various forms to suit the varied needs of the food industries as well. The market for proteases in the Asia-Pacific region is expected to have positive growth in the future.

The break-up of Primaries:

By Company Type: Demand side - 43%, Supply side - 57%

By Designation: C level - 29%, Managers - 21%, Executives - 50%

By Region: North America - 34%, Europe - 37%, Asia Pacific - 16%, RoW -13%

Leading players profiled in this report:

- Novozymes (Denmark)

- Associated British Foods (UK)

- DSM (Netherlands)

- DuPont (US)

- BASF (Germany)

- Advanced Enzyme Technologies (India)

- Chr. Hansen Holding A/S (Denmark)

- Dyadic International (US)

Research Coverage:

The report segments the protein hydrolysis enzymes market based on source, method of production, product, application, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global protein hydrolysis enzymes market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the protein hydrolysis enzymes market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights into the major countries/regions in which the protein hydrolysis enzymes market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.4 REGIONS COVERED

- FIGURE 2 REGION SEGMENTATION

- 1.5 YEARS CONSIDERED

- FIGURE 3 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED

- 1.7 VOLUME UNIT CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 4 PROTEIN HYDROLYSIS ENZYMES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE ANALYSIS

- FIGURE 6 KEY ECONOMIES BASED ON GDP, 2019-2021 (USD TRILLION)

- 2.2.3 SUPPLY-SIDE ANALYSIS

- 2.2.3.1 Research & development of protein hydrolysis enzymes

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 APPROACH ONE (BASED ON APPLICATIONS, BY REGION)

- FIGURE 7 APPROACH ONE (BASED ON APPLICATIONS, BY REGION)

- 2.3.2 APPROACH TWO (BASED ON GLOBAL MARKET)

- FIGURE 8 APPROACH TWO (BASED ON GLOBAL MARKET)

- 2.4 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 2 PROTEIN HYDROLYSIS ENZYMES MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 10 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 PROTEIN HYDROLYSIS ENZYMES MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PROTEIN HYDROLYSIS ENZYMES MARKET PLAYERS

- FIGURE 13 GROWING CONSUMPTION OF PROTEIN COUPLED WITH RISING HEALTH AWARENESS AMONG END CONSUMERS TO DRIVE MARKET

- 4.2 PROTEIN HYDROLYSIS ENZYMES MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

- FIGURE 14 US WAS LARGEST MARKET GLOBALLY FOR PROTEIN HYDROLYSIS ENZYMES IN 2021

- 4.3 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION & COUNTRY

- FIGURE 15 CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2022

- 4.4 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION

- FIGURE 16 PHARMACEUTICALS TO DOMINATE PROTEIN HYDROLYSIS ENZYMES MARKET

- 4.5 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE

- FIGURE 17 MICROORGANISM-BASED ENZYMES TO DOMINATE PROTEIN HYDROLYSIS ENZYMES MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 MARKET DYNAMICS: PROTEIN HYDROLYSIS ENZYMES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in consumption of protein, coupled with rise in health awareness among end consumers

- FIGURE 19 GLOBAL PER CAPITA PROTEIN CONSUMPTION, BY REGION, 2000-2019 (GRAM/CAPITA)

- 5.2.1.2 Multiple applications in food sector

- FIGURE 20 GLOBAL PER CAPITA MEAT CONSUMPTION, BY COUNTRY, 2021 (KILOGRAM/CAPITA)

- TABLE 3 IMPORT AND EXPORT OF BAKERY PRODUCTS, BY COUNTRY, 2020 (USD BILLION)

- 5.2.1.3 Increase in prevalence of chronic diseases

- FIGURE 21 NEW CANCER CASES, BY CANCER TYPE, 2020 (MILLION)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Varying government regulations and standards

- 5.2.2.2 High entry barriers for new companies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in demand for natural and environment-friendly products

- 5.2.4 CHALLENGES

- 5.2.4.1 Side effects associated with certain proteases

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMERS' BUSINESSES

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 22 RESEARCH AND ENZYME DEVELOPMENT CONTRIBUTES MAXIMUM VALUE TO OVERALL WORTH OF PROTEIN HYDROLYSIS ENZYMES

- 6.4 TRADE ANALYSIS

- 6.4.1 ENZYMES

- TABLE 4 TOP 10 EXPORTERS AND IMPORTERS OF ENZYMES, 2021 (USD THOUSAND)

- 6.5 TECHNOLOGY ANALYSIS

- 6.6 PATENT ANALYSIS

- TABLE 5 LIST OF IMPORTANT PATENTS FOR PROTEIN HYDROLYSIS ENZYMES MARKET, 2019-2022

- 6.7 ECOSYSTEM MAP & SUPPLY CHAIN ANALYSIS

- FIGURE 23 ENZYME DEVELOPMENT AND PRODUCTION PLAY A VITAL ROLE IN SUPPLY CHAIN

- 6.7.1 PROTEIN HYDROLYSIS ENZYMES: MARKET MAP

- FIGURE 24 PROTEIN HYDROLYSIS ENZYMES ECOSYSTEM MAP

- 6.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 PROTEIN HYDROLYSIS ENZYMES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 PROTEIN HYDROLYSIS ENZYMES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.8.1 THREAT FROM NEW ENTRANTS

- 6.8.2 THREAT FROM SUBSTITUTES

- 6.8.3 BARGAINING POWER OF SUPPLIERS

- 6.8.4 BARGAINING POWER OF BUYERS

- 6.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.9 CASE STUDIES

- 6.9.1 DSM AND NOVOZYMES COLLABORATED TO ADDRESS GROWING FEED RAW MATERIAL PRICES

- 6.10 PRICING ANALYSIS

- TABLE 7 AVERAGE SELLING PRICES OF PROTEIN HYDROLYSIS ENZYMES, BY APPLICATION, 2018-2022 (USD/KG)

- TABLE 8 AVERAGE SELLING PRICES OF PROTEIN HYDROLYSIS ENZYMES, BY REGION, 2018-2022 (USD/KG)

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 NORTH AMERICA

- 6.11.2.1 US

- TABLE 10 PROTEASE PREPARATIONS APPROVED AS FOOD ADDITIVES LISTED IN 21 CFR 173 AND AFFIRMED AS GRAS IN 21 CFR 184

- 6.11.2.2 Canada

- TABLE 11 CANADA: LIST OF PERMITTED FOOD ENZYMES

- 6.11.3 EUROPE

- 6.11.4 ASIA PACIFIC

- 6.11.4.1 China

- 6.11.4.2 India

- 6.11.4.3 Australia & New Zealand

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING MICROBIAL PRODUCTS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MICROBIAL PRODUCTS

- 6.12.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 13 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 6.13 KEY CONFERENCES & EVENTS

- TABLE 14 PROTEIN HYDROLYSIS ENZYMES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

7 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE

- 7.1 INTRODUCTION

- TABLE 15 TYPES OF PROTEASES ALONG WITH FUNCTIONAL GROUPS AND THEIR SOURCES

- FIGURE 28 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2021 VS. 2027 (USD MILLION)

- TABLE 16 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 17 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- 7.2 MICROORGANISMS

- 7.2.1 SUSTAINABILITY OFFERED TO DRIVE DEMAND FOR MICROORGANISM-BASED ENZYMES

- TABLE 18 MICROORGANISM-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 19 MICROORGANISM-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 ANIMALS

- 7.3.1 TRYPSIN

- 7.3.1.1 Significance in hydrolysis of food proteins to fuel demand

- 7.3.2 CHYMOTRYPSIN

- 7.3.2.1 Applications in pharmaceutical sector to drive demand

- 7.3.3 PEPSIN

- 7.3.3.1 Rise in demand from food, pharmaceutical, and leather industries

- 7.3.4 PANCREATIN

- 7.3.4.1 Demand in treating pancreatic deficiencies to propel growth

- TABLE 20 ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 21 ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.1 TRYPSIN

- 7.4 PLANTS

- 7.4.1 PAPAIN

- 7.4.1.1 Wide range of industrial applications to boost market traction

- 7.4.2 BROMELAIN

- 7.4.2.1 Extensive application in food industry to drive segment

- 7.4.3 OTHER PLANT PRODUCTS

- TABLE 22 PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 23 PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4.1 PAPAIN

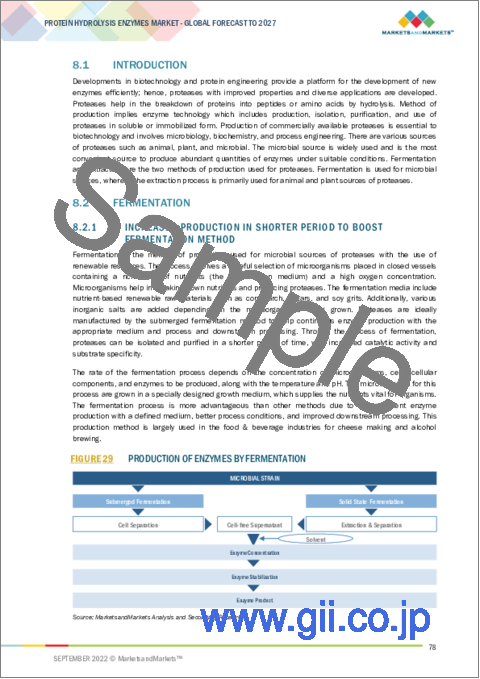

8 PROTEIN HYDROLYSIS ENZYMES MARKET, BY METHOD OF PRODUCTION

- 8.1 INTRODUCTION

- 8.2 FERMENTATION

- 8.2.1 INCREASED PRODUCTION IN SHORTER PERIOD TO BOOST FERMENTATION METHOD

- FIGURE 29 PRODUCTION OF ENZYMES BY FERMENTATION

- TABLE 24 USE OF PROTEASES IN BREWING

- 8.3 EXTRACTION

- 8.3.1 APPLICATION PRODUCING ENZYMES FROM ANIMAL AND PLANTS TO DRIVE SEGMENT

9 PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT

- 9.1 INTRODUCTION

- FIGURE 30 PROTEIN HYDROLYSIS ENZYMES MARKET, BY MICROBIAL PRODUCTS, 2021 VS. 2027 (USD MILLION)

- TABLE 25 ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 26 ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 27 PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 28 PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 29 MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 30 PROTEIN HYDROLYSIS ENZYMES MARKET, BY MICROBIAL PRODUCTS, 2022-2027 (USD MILLION)

- 9.2 ANIMAL PRODUCTS

- 9.2.1 TRYPSIN

- 9.2.1.1 Higher demand from leather industry to drive segment growth

- TABLE 31 TRYPSIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 32 TRYPSIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2.2 PEPSIN

- 9.2.2.1 Use as supplement in treating anemic conditions to drive segment

- TABLE 33 PEPSIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 34 PEPSIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2.3 RENIN

- 9.2.3.1 Applications in cheese making to drive segment growth

- TABLE 35 RENIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 RENIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2.4 OTHER ANIMAL PRODUCTS

- TABLE 37 APPLICATIONS OF DIFFERENT PROTEIN HYDROLYSIS ENZYMES IN ANIMALS

- TABLE 38 OTHER ANIMAL PRODUCTS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 OTHER ANIMAL PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2.1 TRYPSIN

- 9.3 PLANT PRODUCTS

- 9.3.1 PAPAIN

- 9.3.1.1 Use in cell isolation procedures across industries to drive segment

- TABLE 40 PAPAIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 41 PAPAIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.2 BROMELAIN

- 9.3.2.1 Growth in research and innovation for applications in pharmaceutical sector

- TABLE 42 BROMELAIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 BROMELAIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.3 OTHER PLANT PRODUCTS

- TABLE 44 OTHER PLANT PRODUCTS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 OTHER PLANT PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.1 PAPAIN

- 9.4 MICROBIAL PRODUCTS

- 9.4.1 ALKALINE PROTEASES

- 9.4.1.1 Growth in R&D on alkaline proteases to boost segment growth

- TABLE 46 ALKALINE PROTEASES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 ALKALINE PROTEASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4.2 ACID PROTEASES

- 9.4.2.1 Acid proteases used to enhance bioethanol yields

- TABLE 48 ACID PROTEASES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 49 ACID PROTEASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4.3 NEUTRAL PROTEASES

- 9.4.3.1 Neutral proteases offer broad range of substrate specificity and variety

- TABLE 50 NEUTRAL PROTEASES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 NEUTRAL PROTEASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4.4 OTHER MICROBIAL PRODUCTS

- TABLE 52 OTHER MICROBIAL PRODUCTS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 53 OTHER MICROBIAL PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4.1 ALKALINE PROTEASES

10 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 31 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2021 VS. 2027 (USD MILLION)

- FIGURE 32 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2021 VS. 2027 (METRIC TON)

- TABLE 54 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 55 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 56 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (METRIC TON)

- TABLE 57 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (METRIC TON)

- 10.2 DETERGENTS

- 10.2.1 HIGH ACTIVITY AND STABILITY OVER A WIDE RANGE OF TEMPERATURES TO BOOST APPLICATIONS IN DETERGENTS

- TABLE 58 DETERGENT APPLICATIONS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 59 DETERGENT APPLICATIONS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 60 DETERGENT APPLICATIONS MARKET, BY REGION, 2018-2021 (METRIC TON)

- TABLE 61 DETERGENT APPLICATIONS MARKET, BY REGION, 2022-2027 (METRIC TON)

- 10.3 PHARMACEUTICALS

- 10.3.1 DEMAND FOR ALTERNATIVES TO TRADITIONAL ANTIBIOTICS TO BOOST SEGMENT

- TABLE 62 PHARMACEUTICAL APPLICATIONS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 63 PHARMACEUTICAL APPLICATIONS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 64 PHARMACEUTICAL APPLICATIONS MARKET, BY REGION, 2018-2021 (METRIC TON)

- TABLE 65 PHARMACEUTICAL APPLICATIONS MARKET, BY REGION, 2022-2027 (METRIC TON)

- 10.4 FOOD

- 10.4.1 DEMAND FOR IMPROVED FLAVOR AND TEXTURE OF FOOD TO FUEL SEGMENT GROWTH

- TABLE 66 APPLICATIONS OF VARIOUS PROTEASES IN FOOD

- TABLE 67 FOOD APPLICATIONS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 68 FOOD APPLICATIONS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 69 FOOD APPLICATIONS MARKET, BY REGION, 2018-2021 (METRIC TON)

- TABLE 70 FOOD APPLICATIONS MARKET, BY REGION, 2022-2027 (METRIC TON)

- 10.5 TEXTILES & LEATHER

- 10.5.1 NEED FOR DECREASED PROCESSING TIME AND ENHANCED MATERIAL QUALITY TO PROPEL SEGMENT

- TABLE 71 TEXTILES & LEATHER APPLICATIONS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 72 TEXTILES & LEATHER APPLICATIONS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 73 TEXTILES & LEATHER APPLICATIONS MARKET, BY REGION, 2018-2021 (METRIC TON)

- TABLE 74 TEXTILES & LEATHER APPLICATIONS MARKET, BY REGION, 2022-2027 (METRIC TON)

- 10.6 OTHER APPLICATIONS

- 10.6.1 FEED

- 10.6.2 SILVER RECOVERY

- TABLE 75 OTHER APPLICATIONS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 76 OTHER APPLICATIONS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 77 OTHER APPLICATIONS MARKET, BY REGION, 2018-2021 (METRIC TON)

- TABLE 78 OTHER APPLICATIONS MARKET, BY REGION, 2022-2027 (METRIC TON)

11 PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION

- 11.1 INTRODUCTION

- TABLE 79 PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 80 PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 81 PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2018-2021 (METRIC TON)

- TABLE 82 PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2022-2027 (METRIC TON)

- FIGURE 33 PROTEIN HYDROLYSIS ENZYMES MARKET, BY KEY COUNTRY, CAGR (2022-2027)

- 11.2 NORTH AMERICA

- FIGURE 34 NORTH AMERICA: ENZYMES MARKET SNAPSHOT

- TABLE 83 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 84 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018-2021 (METRIC TON)

- TABLE 86 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022-2027 (METRIC TON)

- TABLE 87 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 88 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 89 NORTH AMERICA: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 94 NORTH AMERICA: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 95 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 96 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 97 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (METRIC TON)

- TABLE 98 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (METRIC TON)

- 11.2.1 US

- 11.2.1.1 High demand from textile and pharmaceutical sectors to boost market

- TABLE 99 US: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 100 US: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 101 US: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 102 US: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Regulatory approval of proteases from Bacillus species in food applications to augment market growth

- TABLE 103 CANADA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 104 CANADA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 105 CANADA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 106 CANADA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.2.3 MEXICO

- 11.2.3.1 Growing demand from food industry to boost market

- TABLE 107 MEXICO: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 108 MEXICO: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 109 MEXICO: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 110 MEXICO: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.3 EUROPE

- TABLE 111 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 112 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 113 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018-2021 (METRIC TON)

- TABLE 114 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022-2027 (METRIC TON)

- TABLE 115 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 116 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 117 EUROPE: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 118 EUROPE: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 119 EUROPE: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 120 EUROPE: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 121 EUROPE: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 122 EUROPE: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 123 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 124 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 125 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (METRIC TON)

- TABLE 126 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (METRIC TON)

- 11.3.1 GERMANY

- 11.3.1.1 Rise in demand from baking industry in Germany

- TABLE 127 GERMANY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 128 GERMANY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 129 GERMANY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 130 GERMANY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.3.2 FRANCE

- 11.3.2.1 Extensive application of proteases in French clothing industry

- TABLE 131 FRANCE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 132 FRANCE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 133 FRANCE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 134 FRANCE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Varied applications in food industry to influence market growth

- TABLE 135 UK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 136 UK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 137 UK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 138 UK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.3.4 SPAIN

- 11.3.4.1 Rise in demand for meat and meat products to boost demand

- TABLE 139 SPAIN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 140 SPAIN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 141 SPAIN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 142 SPAIN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.3.5 ITALY

- 11.3.5.1 Multifunctionality of proteases to boost applications in Italian textile & leather industry

- TABLE 143 ITALY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 144 ITALY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 145 ITALY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 146 ITALY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.3.6 DENMARK

- 11.3.6.1 Increased demand from food processing industries to drive market

- TABLE 147 DENMARK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 148 DENMARK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 149 DENMARK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 150 DENMARK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 151 REST OF EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 152 REST OF EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 153 REST OF EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 154 REST OF EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.4 ASIA PACIFIC

- TABLE 155 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 156 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 157 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018-2021 (METRIC TON)

- TABLE 158 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022-2027 (METRIC TON)

- TABLE 159 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 160 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 161 ASIA PACIFIC: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 162 ASIA PACIFIC: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 163 ASIA PACIFIC: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 164 ASIA PACIFIC: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 165 ASIA PACIFIC: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 166 ASIA PACIFIC: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 167 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 168 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 169 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (METRIC TON)

- TABLE 170 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (METRIC TON)

- 11.4.1 CHINA

- 11.4.1.1 Rise in investments in R&D to drive Chinese market growth

- TABLE 171 CHINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 172 CHINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 173 CHINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 174 CHINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.4.2 INDIA

- 11.4.2.1 Demand from pharmaceutical sector to drive Indian market

- TABLE 175 INDIA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 176 INDIA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 177 INDIA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 178 INDIA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.4.3 JAPAN

- 11.4.3.1 Advancements in pharmaceutical sector to boost market growth

- TABLE 179 JAPAN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 180 JAPAN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 181 JAPAN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 182 JAPAN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Innovations in healthcare with incorporation of proteases to drive market growth

- TABLE 183 SOUTH KOREA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 184 SOUTH KOREA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 185 SOUTH KOREA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 186 SOUTH KOREA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 Increase in demand for alcohol and winemaking to propel market demand

- TABLE 187 AUSTRALIA & NEW ZEALAND: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 188 AUSTRALIA & NEW ZEALAND: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 189 AUSTRALIA & NEW ZEALAND: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 190 AUSTRALIA & NEW ZEALAND: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 191 REST OF ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 192 REST OF ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 194 REST OF ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.5 REST OF THE WORLD (ROW)

- TABLE 195 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 196 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 197 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018-2021 (METRIC TON)

- TABLE 198 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022-2027 (METRIC TON)

- TABLE 199 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 200 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 201 ROW: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 202 ROW: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 203 ROW: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 204 ROW: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 205 ROW: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 206 ROW: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 207 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 208 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 209 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (METRIC TON)

- TABLE 210 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (METRIC TON)

- 11.5.1 BRAZIL

- 11.5.1.1 Government policies for biofuel production to drive demand

- TABLE 211 BRAZIL: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 212 BRAZIL: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 213 BRAZIL: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 214 BRAZIL: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.5.2 ARGENTINA

- 11.5.2.1 Rise in demand from dairy industry to propel market growth

- TABLE 215 ARGENTINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 216 ARGENTINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 217 ARGENTINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 218 ARGENTINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Growth potential of South African pharmaceutical and detergent industry to drive market

- TABLE 219 SOUTH AFRICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 220 SOUTH AFRICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 221 SOUTH AFRICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 222 SOUTH AFRICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.5.4 OTHERS IN ROW

- TABLE 223 OTHERS IN ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 224 OTHERS IN ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 225 OTHERS IN ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 226 OTHERS IN ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET EVALUATION FRAMEWORK

- FIGURE 35 MARKET EVALUATION FRAMEWORK, JANUARY 2019-SEPTEMBER 2022

- 12.3 MARKET SHARE ANALYSIS

- TABLE 227 PROTEIN HYDROLYSIS ENZYMES MARKET SHARE ANALYSIS, 2021

- 12.4 RANKING OF KEY PLAYERS

- 12.5 REVENUE ANALYSIS OF MAJOR MARKET PLAYERS

- FIGURE 36 REVENUE ANALYSIS OF MAJOR MARKET PLAYERS, 2019-2021 (USD BILLION)

- 12.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 37 KEY PLAYERS COMPANY EVALUATION QUADRANT, 2022

- 12.6.4.1 COMPETITIVE BENCHMARKING

- TABLE 228 PROTEIN HYDROLYSIS ENZYMES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY SOURCE

- TABLE 229 PROTEIN HYDROLYSIS ENZYMES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY PRODUCT

- TABLE 230 PROTEIN HYDROLYSIS ENZYMES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY APPLICATION

- TABLE 231 PROTEIN HYDROLYSIS ENZYMES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

- TABLE 232 PROTEIN HYDROLYSIS ENZYMES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, OVERALL FOOTPRINT

- 12.7 STARTUP EVALUATION QUADRANT

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 STARTING BLOCKS

- 12.7.3 RESPONSIVE COMPANIES

- 12.7.4 DYNAMIC COMPANIES

- FIGURE 38 SME/STARTUP EVALUATION QUADRANT, 2022

- 12.7.4.1 COMPETITIVE BENCHMARKING

- TABLE 233 PROTEIN HYDROLYSIS ENZYMES MARKET: DETAILED LIST OF SMES

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- TABLE 234 PROTEIN HYDROLYSIS ENZYMES MARKET: PRODUCT LAUNCHES, 2019-2021

- 12.8.2 DEALS

- TABLE 235 PROTEIN HYDROLYSIS ENZYMES MARKET: DEALS, 2019-2022

- 12.8.3 OTHER DEVELOPMENTS

- TABLE 236 PROTEIN HYDROLYSIS ENZYMES MARKET: OTHER DEVELOPMENTS, 2020

13 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, MNM view)**

- 13.1 KEY PLAYERS

- 13.1.1 NOVOZYMES

- TABLE 237 NOVOZYMES: BUSINESS OVERVIEW

- FIGURE 39 NOVOZYMES: COMPANY SNAPSHOT

- TABLE 238 NOVOZYMES: PRODUCTS OFFERED

- TABLE 239 NOVOZYMES: PRODUCT LAUNCHES

- TABLE 240 NOVOZYMES: DEALS

- 13.1.2 ASSOCIATED BRITISH FOODS

- TABLE 241 ASSOCIATED BRITISH FOODS: BUSINESS OVERVIEW

- FIGURE 40 ASSOCIATED BRITISH FOODS: COMPANY SNAPSHOT

- TABLE 242 ASSOCIATED BRITISH FOODS: PRODUCTS OFFERED

- TABLE 243 ASSOCIATED BRITISH FOODS: PRODUCT LAUNCHES

- TABLE 244 ASSOCIATED BRITISH FOODS: DEALS

- 13.1.3 DSM

- TABLE 245 DSM: BUSINESS OVERVIEW

- FIGURE 41 DSM: COMPANY SNAPSHOT

- TABLE 246 DSM: PRODUCTS OFFERED

- TABLE 247 DSM: DEALS

- 13.1.4 DUPONT

- TABLE 248 DUPONT: BUSINESS OVERVIEW

- FIGURE 42 DUPONT: COMPANY SNAPSHOT

- TABLE 249 DUPONT: PRODUCTS OFFERED

- 13.1.5 BASF SE

- TABLE 250 BASF SE: BUSINESS OVERVIEW

- FIGURE 43 BASF SE: COMPANY SNAPSHOT

- TABLE 251 BASF SE: PRODUCTS OFFERED

- TABLE 252 BASF SE: DEALS

- TABLE 253 BASF SE: OTHER DEVELOPMENTS

- 13.1.6 ADVANCED ENZYME TECHNOLOGIES

- TABLE 254 ADVANCED ENZYME TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 44 ADVANCED ENZYME TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 255 ADVANCED ENZYME TECHNOLOGIES: PRODUCTS OFFERED

- 13.1.7 DYADIC INTERNATIONAL, INC.

- TABLE 256 DYADIC INTERNATIONAL, INC.: BUSINESS OVERVIEW

- FIGURE 45 DYADIC INTERNATIONAL, INC.: COMPANY SNAPSHOT

- TABLE 257 DYADIC INTERNATIONAL, INC.: PRODUCTS OFFERED

- TABLE 258 DYADIC INTERNATIONAL, INC.: DEALS

- 13.1.8 CHR. HANSEN HOLDING A/S

- TABLE 259 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

- FIGURE 46 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

- TABLE 260 CHR. HANSEN HOLDING A/S: PRODUCTS OFFERED

- TABLE 261 CHR. HANSEN HOLDING A/S: PRODUCT LAUNCHES

- 13.1.9 AMANO ENZYME

- TABLE 262 AMANO ENZYME: BUSINESS OVERVIEW

- TABLE 263 AMANO ENZYME: PRODUCTS OFFERED

- TABLE 264 AMANO ENZYME: PRODUCT LAUNCHES

- 13.1.10 SPECIALTY ENZYMES & BIOTECHNOLOGIES

- TABLE 265 SPECIALTY ENZYMES & BIOTECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 266 SPECIALTY ENZYMES & BIOTECHNOLOGIES: PRODUCTS OFFERED

- 13.1.11 CREATIVE ENZYMES

- TABLE 267 CREATIVE ENZYMES: BUSINESS OVERVIEW

- TABLE 268 CREATIVE ENZYMES: PRODUCTS OFFERED

- 13.1.12 JIANGSU BOLI BIOPRODUCTS CO., LTD

- TABLE 269 JIANGSU BOLI BIOPRODUCTS CO., LTD: BUSINESS OVERVIEW

- TABLE 270 JIANGSU BOLI BIOPRODUCTS CO., LTD: PRODUCTS OFFERED

- 13.1.13 BIOCATALYSTS

- TABLE 271 BIOCATALYSTS: BUSINESS OVERVIEW

- TABLE 272 BIOCATALYSTS: PRODUCTS OFFERED

- TABLE 273 BIOCATALYSTS: PRODUCT LAUNCHES

- 13.1.14 AUMGENE BIOSCIENCES

- TABLE 274 AUMGENE BIOSCIENCES: BUSINESS OVERVIEW

- TABLE 275 AUMGENE BIOSCIENCES: PRODUCTS OFFERED

- 13.1.15 MERCK KGAA

- TABLE 276 MERCK KGAA: BUSINESS OVERVIEW

- FIGURE 47 MERCK KGAA: COMPANY SNAPSHOT

- TABLE 277 MERCK KGAA: PRODUCTS OFFERED

- 13.1.16 BIOSEUTICA

- TABLE 278 BIOSEUTICA: BUSINESS OVERVIEW

- TABLE 279 BIOSEUTICA: PRODUCTS OFFERED

- 13.1.17 ROSSARI BIOTECH LIMITED

- TABLE 280 ROSSARI BIOTECH LIMITED: BUSINESS OVERVIEW

- TABLE 281 ROSSARI BIOTECH LIMITED: PRODUCTS OFFERED

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 282 ADJACENT MARKETS TO THE PROTEIN HYDROLYSIS ENZYMES MARKET

- 14.2 ENZYMES MARKET

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- TABLE 283 ENZYMES MARKET, BY PRODUCT TYPE, 2017-2025 (USD MILLION)

- 14.3 FOOD ENZYMES MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 284 FOOD ENZYMES MARKET, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 285 FOOD ENZYMES MARKET, BY TYPE, 2021-2026 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS