|

|

市場調査レポート

商品コード

1512227

水酸化ナトリウムの世界市場:グレード別、製造プロセス別、用途別、地域別 - 2029年までの予測Sodium Hydroxide Market by Grade, Production Process, Application, Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 水酸化ナトリウムの世界市場:グレード別、製造プロセス別、用途別、地域別 - 2029年までの予測 |

|

出版日: 2024年07月09日

発行: MarketsandMarkets

ページ情報: 英文 262 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

水酸化ナトリウムの市場規模は、2024年に449億米ドルになるとみられ、4.4%のCAGRで拡大し、2029年には556億米ドルに達すると予測されます。

急速に拡大する建設業界は、住宅と非住宅の両方のインフラを世界規模で包含しており、塗料とコーティング剤の需要を大幅に押し上げています。この需要の急増は、二酸化チタンが塗料・コーティング産業の主要成分であることから、二酸化チタンの需要をさらに促進することにつながっています。自動車や建設分野での塗料やコーティングの広範な使用は、この動向に影響を与える主な要因です。その結果、水酸化ナトリウムは二酸化チタンの製造工程でしばしば使用されるため、二酸化チタンの消費増加は水酸化ナトリウム市場に好影響を与えると予想されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(10億米ドル)、数量(キロトン) |

| セグメント | グレード別、製造プロセス別、用途別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

有機化学品セグメントは、予測期間中に水酸化ナトリウムの用途で最も急成長すると予測されています。苛性ソーダを使用して製造される主な有機化学品には、プロピレンオキシド、ポリカーボネート、エチレンアミン、エピクロルヒドリンなどがあります。さらに、多くの有機化学薬品メーカーが、ガスのスクラビング・プロセスや中和に水酸化ナトリウムを使用しています。酸化プロピレンは、硬質ポリウレタンフォームと軟質ポリウレタンフォームの製造に不可欠なポリエーテルポリオールの製造に欠かせません。これらの発泡体は、カーシート、アームレスト、ライナー、フロア、その他様々な内装、外装、ボンネット下の部品に使用されています。エピクロルヒドリンは、建築・建設、塗料・コーティング、電子・電気システムなど、多くの最終用途産業で利用されています。

メンブレンセルプロセスは、予測期間中、水酸化ナトリウム市場における他の生産方法の中で最も急速な成長を遂げると予測されています。この技術では、塩素イオンとナトリウムイオンを分けるために特殊な膜を使用します。この膜は、塩素ガスと食塩水を別の区画に分離したまま、ナトリウムイオンの移動を容易にします。安全な原料を使用し、電力消費を最小限に抑え、高品質の水酸化ナトリウムを生産できることから、メンブレンセル技術を採用する企業が増えています。

当レポートでは、世界の水酸化ナトリウム市場について調査し、グレード別、製造プロセス別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界の動向

- 顧客のビジネスに影響を与える動向と混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- マクロ経済分析

- 自動車産業の投資と資金調達のシナリオ

第7章 水酸化ナトリウム市場、グレード別

- イントロダクション

- 固体

- 50%重量/重量溶液

- その他

第8章 水酸化ナトリウム市場、製造プロセス別

- イントロダクション

- ダイヤフラムセル

- メンブレンセル

- その他

第9章 水酸化ナトリウム市場、用途別

- イントロダクション

- アルミナ

- 無機化学

- 有機化学

- 食品

- パルプ・紙

- 石鹸・洗剤

- 繊維

- 水治療

- バイオディーゼル

- その他

第10章 水酸化ナトリウム市場、地域別

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析(2023年)

- 収益分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- TATA CHEMICALS LTD.

- OLIN CORPORATION

- WESTLAKE CORPORATION

- OCCIDENTAL PETROLEUM CORPORATION

- DOW

- BASF SE

- NOURYON

- XINJIANG ZHONGTAI CHEMICAL CO., LTD.

- FORMOSA PLASTICS CORPORATION

- GRASIM INDUSTRIES LIMITED

- その他の企業

- BEFAR GROUP CO., LTD.

- INEOS GROUP AG

- ASAHIMAS CHEMICAL COMPANY

- COOGEE

- VYNOVA

- GUJARAT ALKALIES AND CHEMICALS LIMITED

- COVESTRO AG

- HANWHA SOLUTIONS CHEMICAL DIVISION

- SHIN-ETSU CHEMICAL CO., LTD.

- ANHUI BAYI CHEMICAL INDUSTRY CO., LTD.

- NAMA

- HAWKINS

- DIVERSEY, INC.

- TESSENDERLO GROUP

- KEMIRA

第13章 付録

The sodium hydroxide market size is projected to grow from USD 44.9 billion in 2024 and is projected to reach USD 55.6 Billion by 2029, at a CAGR of 4.4%. The rapidly expanding construction industry, encompassing both residential and non-residential infrastructure on a global scale, is significantly propelling the demand for paints and coatings. This surge in demand is, leads to further driving the demand of titanium dioxide, as titanium dioxide is a key ingredient in paints & coating industry. The widespread use of paints and coatings in the automotive and construction sectors is a major factor influencing this trend. Consequently, the increased consumption of titanium dioxide is expected to have a favorable impact on the sodium hydroxide market, as sodium hydroxide is often used in the production process of titanium dioxide.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Segments | Application, Grade, Production Process and Region |

| Regions covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

Organic Chemicals is projected to be the fastest-growing segment by application in Sodium Hydroxide market"

The organic chemicals segment is projected to be the fastest-growing application of sodium hydroxide during the forecast period. Major organic chemicals are manufactured using caustic soda include propylene oxide, polycarbonates, ethylene amines, and epichlorohydrin. Additionally, many organic chemical manufacturers use sodium hydroxide for gas scrubbing processes and neutralization. Propylene oxide is crucial in producing polyether polyols, which are essential for manufacturing both rigid and flexible polyurethane foams. These foams find applications in car seats, armrests, liners, floors, and various other interior, exterior, and under-the-bonnet components. Epichlorohydrin is utilized in numerous end-use industries, including building & construction, paints & coatings, and electronics & electrical systems.

"Membrane cell process is projected to be the fastest-growing segment by production process in Sodium Hydroxide market"

The membrane cell process is anticipated to experience the most rapid growth among other production methods in the Sodium Hydroxide market during the forecast period. This technique employs a specialized membrane to divide chlorine and sodium ions. The membrane facilitates the migration of sodium ions while keeping chlorine gas and the brine segregated in a separate compartment on the other side. Businesses are increasingly adopting membrane cell technology due to its utilization of safe raw materials, minimal electricity consumption, and its ability to produce high-quality sodium hydroxide.

"Asia Pacific is projected to be the fastest growing segment in Sodium Hydroxide market by region"

Asia Pacific is the largest and fastest growing market for Sodium Hydroxide, followed by Europe and North America. Within this dynamic landscape, China emerges as the largest and fastest growing market during the forecast period. This burgeoning market trajectory owes its momentum to several factors, notably the swift pace of industrialization, escalating demand across diverse applications, and augmented governmental investments. In addition to these compelling market dynamics, various enterprises are strategically honing their focus on these burgeoning markets. They are expanding their presence through multifaceted approaches such as establishing manufacturing plants, distribution centers, and research and development centers. This strategic maneuvering underscores a concerted effort to not only meet burgeoning demand but also to solidify their foothold in these rapidly evolving market landscapes.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments and the information gathered through secondary research.

The break-up of primary interviews is given below:

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Others: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America;10%, MEA:20%

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: Tata Chemicals Ltd. (India), Olin Corporation (US), Westlake Corporation (US), Occidental Petroleum Corporation (US), Dow (US), Formosa Plastics Corporation (Taiwan), BASF SE (Germany), Xinjiang Zhongtai Chemical Co., Ltd (China), Nouryon (Netherlands), Grasim Industries Limited (India), and others are covered in the sodium hydroxide market.

Research Coverage

The market study covers the sodium hydroxide market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on cooling type, wear parts, end-use industry and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the sodium hydroxide market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall sodium hydroxide market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for alumina in major end-use industries, Steady growth of chemicals industry), restraints (Environmental impact), opportunities (Industrialization in emerging economies) influencing the growth of the sodium hydroxide market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the sodium hydroxide market

- Market Development: Comprehensive information about lucrative markets - the report analyses the sodium hydroxide market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the sodium hydroxide market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Tata Chemicals Ltd. (India), Olin Corporation (US), Westlake Corporation (US), Occidental Petroleum Corporation (US), Dow (US), Formosa Plastics Corporation (Taiwan), BASF SE (Germany), Xinjiang Zhongtai Chemical Co., Ltd (China), Nouryon (Netherlands), Grasim Industries Limited (India), and others are the top manufacturers covered in the sodium hydroxide market, and among others in the sodium hydroxide market. The report also helps stakeholders understand the pulse of the sodium hydroxide market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKETS COVERED

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 REGIONS COVERED

- 1.3.4 INCLUSIONS & EXCLUSIONS

- 1.3.5 CURRENCY CONSIDERED

- 1.3.6 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 SODIUM HYDROXIDE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 2 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF INTERVIEWS WITH EXPERTS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY SIDE

- 2.3 DATA TRIANGULATION

- FIGURE 6 SODIUM HYDROXIDE MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RECESSION IMPACT

- 2.6 RISKS ASSOCIATED WITH SODIUM HYDROXIDE MARKET

- 2.7 LIMITATIONS

- 2.8 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

- FIGURE 7 50% W/W SOLUTION SEGMENT TO DOMINATE MARKET

- FIGURE 8 ORGANIC CHEMICALS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 MEMBRANE CELL TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN SODIUM HYDROXIDE MARKET

- FIGURE 11 ORGANIC CHEMICALS SECTOR TO OFFER GROWTH OPPORTUNITIES DURING FORECAST PERIOD

- 4.2 SODIUM HYDROXIDE MARKET, BY GRADE AND COUNTRY, 2023

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN 2023

- 4.3 SODIUM HYDROXIDE MARKET, BY GRADE

- FIGURE 13 50% W/W SOLUTION SEGMENT TO LEAD MARKET

- 4.4 SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS

- FIGURE 14 MEMBRANE CELL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 SODIUM HYDROXIDE MARKET, BY APPLICATION

- FIGURE 15 ORGANIC CHEMICALS TO BE LARGEST APPLICATION THROUGH 2029

- 4.6 SODIUM HYDROXIDE MARKET, BY KEY COUNTRIES

- FIGURE 16 CHINA TO BE FASTEST-GROWING MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SODIUM HYDROXIDE MARKET

- 5.2.1 DRIVERS

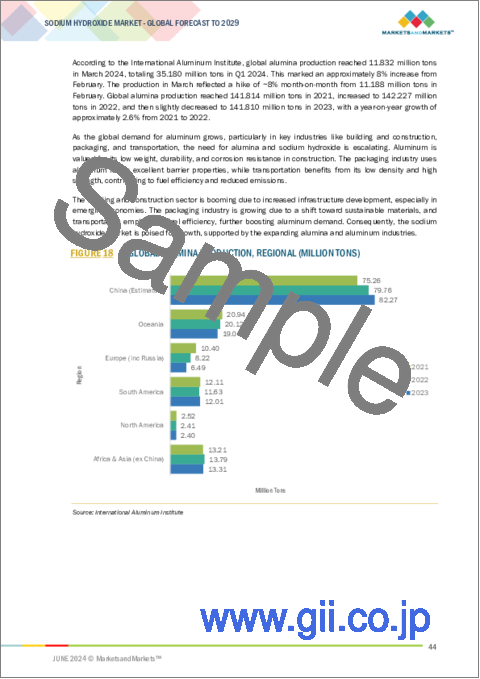

- FIGURE 18 GLOBAL ALUMINA PRODUCTION, REGIONAL (MILLION TONS)

- FIGURE 19 GLOBAL ALUMINA PRODUCTION, 2021-2023 (MILLION TONS)

- 5.2.1.1 Steady growth of chemical industry

- TABLE 1 APPLICATIONS OF CAUSTIC SODA IN VARIOUS PRODUCTS USED IN DIFFERENT END-USE INDUSTRIES

- FIGURE 20 WORLD CHEMICALS SALES, 2022 (USD BILLION)

- FIGURE 21 WORLD CHEMICALS SALES COMPARISON, 2012-2022 (% SHARES)

- 5.2.1.2 Growing demand for paper and pulp

- 5.2.1.3 Increasing focus on water quality and stricter regulations for water treatment

- 5.2.2 RESTRAINTS

- 5.2.2.1 Adverse effects on health and environment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Industrialization in emerging economies

- 5.2.3.2 Rising demand for sodium hydroxide in battery manufacturing

- 5.2.4 CHALLENGES

- 5.2.4.1 Highly corrosive nature of caustic soda and compliance with safety standards

6 INDUSTRY TRENDS

- 6.1 TRENDS & DISRUPTIONS IMPACTING CUSTOMER'S BUSINESSES

- FIGURE 22 REVENUE SHIFT FOR SODIUM HYDROXIDE MANUFACTURERS

- 6.2 PRICING ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GRADE

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GRADE

- TABLE 2 AVERAGE SELLING PRICE TREND BY GRADE, BY KEY PLAYER, 2023 (USD/TON)

- 6.2.2 AVERAGE SELLING PRICE RANGE OF SODIUM HYDROXIDE, BY REGION, 2022-2029

- FIGURE 24 AVERAGE SELLING PRICE TREND OF SODIUM HYDROXIDE, BY REGION (USD/TON)

- 6.2.3 AVERAGE SELLING PRICE TREND OF SODIUM HYDROXIDE, BY REGION

- TABLE 3 AVERAGE SELLING PRICE, BY REGION, 2022-2029 (USD/UNIT)

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SUPPLIERS

- 6.3.2 MANUFACTURERS

- 6.3.3 DISTRIBUTORS

- 6.3.4 END USERS

- 6.4 ECOSYSTEM ANALYSIS

- FIGURE 25 ECOSYSTEM/MARKET MAP

- TABLE 4 ROLE IN ECOSYSTEM OF SODIUM HYDROXIDE MARKET

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Mercury cell

- 6.5.1.2 Diaphragm cell

- 6.5.1.3 Membrane cell

- 6.5.1.4 Sodium-ion battery

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Increasing application in pharmaceutical industry

- 6.5.2.2 Complementing hydrogen production

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PATENT ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 METHODOLOGY

- 6.6.3 PATENT ANALYSIS, 2014-2023

- FIGURE 26 LIST OF MAJOR PATENTS FOR SODIUM HYDROXIDE MARKET (2014-2023)

- TABLE 5 LIST OF PATENTS FOR SODIUM HYDROXIDE

- 6.7 TRADE ANALYSIS

- FIGURE 27 EXPORT SCENARIO: HS CODE 2815 SODIUM HYDROXIDE "CAUSTIC SODA," POTASSIUM HYDROXIDE "CAUSTIC POTASH"; PEROXIDES OF SODIUM OR POTASSIUM, 2014-2023 (USD MILLION)

- FIGURE 28 IMPORT SCENARIO: HS CODE 2815 SODIUM HYDROXIDE "CAUSTIC SODA," POTASSIUM HYDROXIDE "CAUSTIC POTASH"; PEROXIDES OF SODIUM OR POTASSIUM, 2014-2023 (USD MILLION)

- 6.8 KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 6 DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- 6.9 TARIFF & REGULATORY LANDSCAPE

- 6.9.1 TARIFF

- 6.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 SODIUM HYDROXIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 SODIUM HYDROXIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 BARGAINING POWER OF SUPPLIERS

- 6.10.2 BARGAINING POWER OF BUYERS

- 6.10.3 INTENSITY OF COMPETITIVE RIVALRY

- 6.10.4 THREAT OF NEW ENTRANTS

- 6.10.5 THREAT OF SUBSTITUTES

- 6.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 6.11.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR SODIUM HYDROXIDE MARKET

- TABLE 12 KEY BUYING CRITERIA FOR SODIUM HYDROXIDE INDUSTRY

- 6.12 CASE STUDY ANALYSIS

- 6.12.1 CASE STUDY 1: CHEMICAL TANKER INCIDENT INVOLVING CAUSTIC SODA SPLASH AT RIVER ROADSTEAD

- 6.12.2 CASE STUDY 2: SHINTECH (SALT & CAUSTIC SODA) - PLAQUEMINE, LA

- 6.12.3 CASE STUDY 3: SP CHEMICALS CASE STUDY, XINPU CHEMICAL CO., LTD.

- 6.12.4 CASE STUDY 4: SODIUM HYDROXIDE (CAUSTIC SODA) REPLACEMENT AT FRUIT PROCESSING PLANT, PACIFIC NORTHWEST

- 6.13 MACROECONOMIC ANALYSIS

- 6.13.1 INTRODUCTION

- 6.13.2 GDP TRENDS AND FORECASTS

- TABLE 13 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- 6.13.3 CONSTRUCTION INDUSTRY AS PERCENTAGE OF GDP, BY KEY COUNTRY, 2021

- TABLE 14 CONSTRUCTION INDUSTRY AS PERCENTAGE OF GDP, BY KEY COUNTRY, 2021

- 6.13.4 RANKING OF WORLD'S TOP PULP PRODUCERS

- TABLE 15 TOP PULP PRODUCING COUNTRIES, 2020

- 6.13.5 RANKING OF WORLD'S TOP PAPER PRODUCERS

- TABLE 16 TOP PAPER PRODUCING COUNTRIES, 2020

- 6.13.6 TOP ALUMINUM PRODUCING REGIONS

- FIGURE 32 TOP ALUMINUM PRODUCING REGIONS

- 6.14 AUTOMOTIVE INDUSTRY INVESTMENT & FUNDING SCENARIO

- FIGURE 33 INVESTOR DEALS & FUNDING IN AUTOMOTIVE SECTOR SOARED IN 2021

7 SODIUM HYDROXIDE MARKET, BY GRADE

- 7.1 INTRODUCTION

- FIGURE 34 50% W/W SOLUTION SEGMENT DOMINATED SODIUM HYDROXIDE MARKET IN 2023

- TABLE 17 SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 18 SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 19 SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (KILOTON)

- TABLE 20 SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- 7.2 SOLID

- 7.2.1 WIDELY USED FOR TEXTILE PROCESSING

- 7.3 50% W/W SOLUTION

- 7.3.1 HIGH DEMAND FROM NUMEROUS END-USE INDUSTRIES

- 7.4 OTHER GRADES

8 SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS

- 8.1 INTRODUCTION

- FIGURE 35 MEMBRANE CELL SEGMENT TO LEAD SODIUM HYDROXIDE MARKET DURING FORECAST PERIOD

- TABLE 21 SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (USD MILLION)

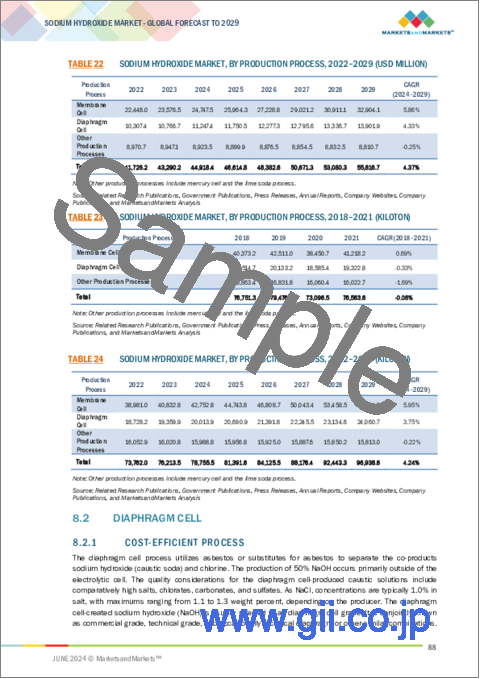

- TABLE 22 SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2022-2029 (USD MILLION)

- TABLE 23 SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (KILOTON)

- TABLE 24 SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2022-2029 (KILOTON)

- 8.2 DIAPHRAGM CELL

- 8.2.1 COST-EFFICIENT PROCESS

- 8.3 MEMBRANE CELL

- 8.3.1 PRODUCTION OF HIGH-QUALITY SODIUM HYDROXIDE

- 8.4 OTHER PRODUCTION PROCESSES

9 SODIUM HYDROXIDE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 36 ORGANIC CHEMICALS SEGMENT TO LEAD SODIUM HYDROXIDE MARKET DURING FORECAST PERIOD

- TABLE 25 SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 26 SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 27 SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 28 SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 9.2 ALUMINA

- 9.2.1 INCREASED USE OF ALUMINA IN AUTOMOTIVE INDUSTRY

- 9.3 INORGANIC CHEMICAL

- 9.3.1 GROWING CONSTRUCTION AND DETERGENT INDUSTRIES

- 9.4 ORGANIC CHEMICAL

- 9.4.1 KEY RAW MATERIAL FOR COMMERCIAL PRODUCTION OF VARIOUS ORGANIC CHEMICALS

- 9.5 FOOD

- 9.5.1 CHANGING FOOD PREFERENCES FOR PROCESSED FOODS

- 9.6 PULP & PAPER

- 9.6.1 INCREASED DEMAND FOR PULP & PAPER IN PACKAGING SECTOR

- 9.7 SOAP & DETERGENT

- 9.7.1 DEMAND FROM INSTITUTIONAL & INDUSTRIAL CLEANING APPLICATION

- 9.8 TEXTILE

- 9.8.1 GROWTH OF TEXTILE INDUSTRY IN ASIA PACIFIC

- 9.9 WATER TREATMENT

- 9.9.1 RISING CONCERN FOR WATER FILTRATION

- 9.10 BIODIESEL

- 9.10.1 INCREASING DEMAND FOR CLEAN ENERGY

- 9.11 OTHERS

10 SODIUM HYDROXIDE MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 37 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 29 SODIUM HYDROXIDE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 SODIUM HYDROXIDE MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 31 SODIUM HYDROXIDE MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 32 SODIUM HYDROXIDE MARKET, BY REGION, 2022-2029 (KILOTON)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT

- FIGURE 38 ASIA PACIFIC: SODIUM HYDROXIDE MARKET SNAPSHOT

- TABLE 33 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 34 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 35 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 36 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 37 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (KILOTON)

- TABLE 38 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 39 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (USD MILLION)

- TABLE 40 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2022-2029 (USD MILLION)

- TABLE 41 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (KILOTON)

- TABLE 42 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2022-2029 (KILOTON)

- TABLE 43 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 44 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 45 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 46 ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.2.2 CHINA

- 10.2.2.1 High demand in alumina, pulp & paper, and textile applications

- TABLE 47 CHINA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 48 CHINA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 49 CHINA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 50 CHINA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.2.3 JAPAN

- 10.2.3.1 Growing pulp & paper and water treatment sectors

- FIGURE 39 TRENDS OF PAPERBOARD PRODUCTION IN JAPAN

- TABLE 51 JAPAN: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 52 JAPAN: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 53 JAPAN: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 54 JAPAN: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.2.4 INDIA

- 10.2.4.1 Increasing FDI in manufacturing sector

- TABLE 55 INDIA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 56 INDIA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 57 INDIA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 58 INDIA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.2.5 INDONESIA

- 10.2.5.1 Growth in paper & pulp sector

- TABLE 59 GLOBAL WATER TREATMENT PROJECTS

- TABLE 60 INDONESIA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 61 INDONESIA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 62 INDONESIA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 63 INDONESIA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.2.6 REST OF ASIA PACIFIC

- TABLE 64 REST OF ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 66 REST OF ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 67 REST OF ASIA PACIFIC: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.3 EUROPE

- TABLE 68 EUROPE: SODIUM HYDROXIDE MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 69 EUROPE: SODIUM HYDROXIDE MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 70 EUROPE: SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 71 EUROPE: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 72 EUROPE: SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (KILOTON)

- TABLE 73 EUROPE: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 74 EUROPE: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (USD MILLION)

- TABLE 75 EUROPE: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2022-2029 (USD MILLION)

- TABLE 76 EUROPE: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (KILOTON)

- TABLE 77 EUROPE: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2022-2029 (KILOTON)

- TABLE 78 EUROPE: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 79 EUROPE: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 80 EUROPE: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 81 EUROPE: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.3.1 RECESSION IMPACT

- FIGURE 40 ASIA PACIFIC: SODIUM HYDROXIDE MARKET SNAPSHOT

- 10.3.2 GERMANY

- 10.3.2.1 Favorable economic environment for construction and chemical sectors

- TABLE 82 GERMANY: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 83 GERMANY: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 84 GERMANY: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 85 GERMANY: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.3.3 FRANCE

- 10.3.3.1 Growing demand for caustic soda in various end-use industries

- TABLE 86 FRANCE: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 87 FRANCE: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 88 FRANCE: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 89 FRANCE: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.3.4 ITALY

- 10.3.4.1 Extensive use in growing chemical industry

- TABLE 90 ITALY: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 91 ITALY: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 92 ITALY: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 93 ITALY: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.3.5 UK

- 10.3.5.1 Steady increase in construction and chemical sectors

- TABLE 94 UK: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 95 UK: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 96 UK: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 97 UK: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.3.6 SPAIN

- 10.3.6.1 Increased export base, urbanization, and high disposable income

- TABLE 98 SPAIN: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 99 SPAIN: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 100 SPAIN: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 101 SPAIN: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.3.7 REST OF EUROPE

- TABLE 102 REST OF EUROPE: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 103 REST OF EUROPE: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 104 REST OF EUROPE: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 105 REST OF EUROPE: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.4 NORTH AMERICA

- 10.4.1 RECESSION IMPACT

- TABLE 106 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 107 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 108 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 109 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 110 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (KILOTON)

- TABLE 111 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 112 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (USD MILLION)

- TABLE 113 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2022-2029 (USD MILLION)

- TABLE 114 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (KILOTON)

- TABLE 115 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS , 2022-2029 (KILOTON)

- TABLE 116 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 117 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 118 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 119 NORTH AMERICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.4.2 US

- 10.4.2.1 Steady growth in demand from several industrial applications

- TABLE 120 US: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 121 US: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 122 US: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 123 US: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.4.3 CANADA

- 10.4.3.1 Rising use for water treatment

- TABLE 124 WATER TREATMENT PROJECTS

- TABLE 125 CANADA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 126 CANADA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 127 CANADA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 128 CANADA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.4.4 MEXICO

- 10.4.4.1 Increasing demand in several end-use industries

- TABLE 129 MEXICO: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 130 MEXICO: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 131 MEXICO: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 132 MEXICO: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 RECESSION IMPACT

- TABLE 133 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 135 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (KILOTON)

- TABLE 138 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 139 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2022-2029 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (KILOTON)

- TABLE 142 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2022-2029 (KILOTON)

- TABLE 143 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 146 MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.5.2 GCC COUNTRIES

- TABLE 147 GCC COUNTRIES: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 148 GCC COUNTRIES: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 149 GCC COUNTRIES: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 150 GCC COUNTRIES: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.5.2.1 Saudi Arabia

- 10.5.2.1.1 Saudi Vision 2030 to play a pivotal role in driving market

- 10.5.2.1 Saudi Arabia

- TABLE 151 SAUDI ARABIA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 152 SAUDI ARABIA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 154 SAUDI ARABIA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 155 SAUDI ARABIA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.5.2.2 Rest of GCC countries

- TABLE 156 REST OF GCC COUNTRIES: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 157 REST OF GCC COUNTRIES: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 158 REST OF GCC COUNTRIES: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 159 REST OF GCC COUNTRIES: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.5.2.3 Iran

- 10.5.2.3.1 Growing use in food processing, biofuels, and textiles

- 10.5.2.3 Iran

- TABLE 160 IRAN: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 161 IRAN: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 162 IRAN: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 163 IRAN: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- TABLE 164 REST OF MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 166 REST OF MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 167 REST OF MIDDLE EAST & AFRICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.6 SOUTH AMERICA

- 10.6.1 RECESSION IMPACT

- TABLE 168 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 169 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 170 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 171 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 172 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (KILOTON)

- TABLE 173 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 174 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (USD MILLION)

- TABLE 175 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2022-2029 (USD MILLION)

- TABLE 176 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2018-2021 (KILOTON)

- TABLE 177 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY PRODUCTION PROCESS, 2022-2029 (KILOTON)

- TABLE 178 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 179 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 180 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 181 SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.6.2 BRAZIL

- 10.6.2.1 Extensive use in growing pulp & paper sector

- TABLE 182 BRAZIL: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 183 BRAZIL: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 184 BRAZIL: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 185 BRAZIL: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.6.3 ARGENTINA

- 10.6.3.1 New investment opportunities across various industries

- TABLE 186 ARGENTINA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 187 ARGENTINA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 188 ARGENTINA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 189 ARGENTINA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- 10.6.4 REST OF SOUTH AMERICA

- TABLE 190 REST OF SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 191 REST OF SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 192 REST OF SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 193 REST OF SOUTH AMERICA: SODIUM HYDROXIDE MARKET, BY APPLICATION, 2022-2029 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 194 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN SODIUM HYDROXIDE MARKET

- 11.3 MARKET SHARE ANALYSIS (2023)

- FIGURE 41 MARKET SHARE OF KEY PLAYERS IN SODIUM HYDROXIDE MARKET, 2023

- TABLE 195 SODIUM HYDROXIDE MARKET: DEGREE OF COMPETITION

- 11.4 REVENUE ANALYSIS

- FIGURE 42 REVENUE ANALYSIS FOR KEY COMPANIES (2019-2023)

- 11.5 COMPANY VALUATION & FINANCIAL METRICS

- FIGURE 43 COMPANY VALUATION (USD BILLION)

- FIGURE 44 FINANCIAL MATRIX: EV/EBITDA RATIO

- 11.6 BRAND/PRODUCT COMPARISON

- FIGURE 45 SODIUM HYDROXIDE MARKET: BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 46 SODIUM HYDROXIDE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 11.7.5 COMPANY FOOTPRINT

- FIGURE 47 SODIUM HYDROXIDE MARKET: COMPANY OVERALL FOOTPRINT (10 COMPANIES)

- TABLE 196 SODIUM HYDROXIDE MARKET: COMPANY FOOTPRINT (10 COMPANIES)

- TABLE 197 SODIUM HYDROXIDE MARKET: APPLICATION FOOTPRINT (10 COMPANIES)

- TABLE 198 SODIUM HYDROXIDE MARKET: GRADE FOOTPRINT (10 COMPANIES)

- TABLE 199 SODIUM HYDROXIDE MARKET: PRODUCTION PROCESS FOOTPRINT (10 COMPANIES)

- TABLE 200 SODIUM HYDROXIDE MARKET: REGIONAL FOOTPRINT (10 COMPANIES)

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- FIGURE 48 SODIUM HYDROXIDE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 11.8.5 COMPETITIVE BENCHMARKING

- TABLE 201 SODIUM HYDROXIDE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 202 SODIUM HYDROXIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 203 SODIUM HYDROXIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 204 SODIUM HYDROXIDE MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, AUGUST 2018-MARCH 2024

- 11.9.2 DEALS

- TABLE 205 SODIUM HYDROXIDE MARKET: DEALS, AUGUST 2018-MARCH 2024

- 11.9.3 EXPANSIONS

- TABLE 206 SODIUM HYDROXIDE MARKET: EXPANSIONS, AUGUST 2018-MARCH 2024

- 11.9.4 OTHER DEVELOPMENTS

- TABLE 207 SODIUM HYDROXIDE MARKET: OTHER DEVELOPMENTS, AUGUST 2018-MARCH 2024

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 TATA CHEMICALS LTD.

- TABLE 208 TATA CHEMICALS LTD.: COMPANY OVERVIEW

- FIGURE 49 TATA CHEMICALS LTD.: COMPANY SNAPSHOT

- TABLE 209 TATA CHEMICALS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 TATA CHEMICALS LTD.: DEALS, AUGUST 2018-MAY 2024

- TABLE 211 TATA CHEMICALS LTD.: EXPANSIONS, AUGUST 2018-MAY 2024

- 12.1.2 OLIN CORPORATION

- TABLE 212 OLIN CORPORATION: COMPANY OVERVIEW

- FIGURE 50 OLIN CORPORATION: COMPANY SNAPSHOT

- TABLE 213 OLIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 OLIN CORPORATION: DEALS, AUGUST 2018-MAY 2024

- TABLE 215 OLIN CORPORATION: OTHER DEVELOPMENTS, AUGUST 2018-MAY 2024

- 12.1.3 WESTLAKE CORPORATION

- TABLE 216 WESTLAKE CORPORATION: COMPANY OVERVIEW

- FIGURE 51 WESTLAKE CORPORATION: COMPANY SNAPSHOT

- TABLE 217 WESTLAKE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 WESTLAKE CORPORATION: PRODUCT LAUNCHES, AUGUST 2018-MAY 2024

- TABLE 219 WESTLAKE CORPORATION: DEALS, AUGUST 2018-MAY 2024

- TABLE 220 WESTLAKE CORPORATION: OTHER DEVELOPMENTS, AUGUST 2018-MAY 2024

- 12.1.4 OCCIDENTAL PETROLEUM CORPORATION

- TABLE 221 OCCIDENTAL PETROLEUM CORPORATION: COMPANY OVERVIEW

- FIGURE 52 OCCIDENTAL PETROLEUM CORPORATION: COMPANY SNAPSHOT

- TABLE 222 OCCIDENTAL PETROLEUM CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.5 DOW

- TABLE 223 DOW: COMPANY OVERVIEW

- FIGURE 53 DOW: COMPANY SNAPSHOT

- TABLE 224 DOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 DOW: PRODUCT LAUNCHES, AUGUST 2018-MAY 2024

- 12.1.6 BASF SE

- TABLE 226 BASF SE: COMPANY OVERVIEW

- FIGURE 54 BASF SE: COMPANY SNAPSHOT

- TABLE 227 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.7 NOURYON

- TABLE 228 NOURYON: COMPANY OVERVIEW

- TABLE 229 NOURYON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.8 XINJIANG ZHONGTAI CHEMICAL CO., LTD.

- TABLE 230 XINJIANG ZHONGTAI CHEMICAL CO. LTD.: COMPANY OVERVIEW

- FIGURE 55 XINJIANG ZHONGTAI CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- TABLE 231 XINJIANG ZHONGTAI CHEMICAL CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.9 FORMOSA PLASTICS CORPORATION

- TABLE 232 FORMOSA PLASTICS CORPORATION: COMPANY OVERVIEW

- FIGURE 56 FORMOSA PLASTICS CORPORATION: COMPANY SNAPSHOT

- TABLE 233 FORMOSA PLASTICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.10 GRASIM INDUSTRIES LIMITED

- TABLE 234 GRASIM INDUSTRIES LIMITED: COMPANY OVERVIEW

- FIGURE 57 GRASIM INDUSTRIES LIMITED: COMPANY SNAPSHOT

- TABLE 235 GRASIM INDUSTRIES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 GRASIM INDUSTRIES LIMITED: EXPANSIONS, AUGUST 2018-MARCH 2024

- 12.2 OTHER PLAYERS

- 12.2.1 BEFAR GROUP CO., LTD.

- TABLE 237 BEFAR GROUP CO., LTD.: COMPANY OVERVIEW

- 12.2.2 INEOS GROUP AG

- TABLE 238 INEOS GROUP AG: COMPANY OVERVIEW

- 12.2.3 ASAHIMAS CHEMICAL COMPANY

- TABLE 239 ASAHIMAS CHEMICAL COMPANY: COMPANY OVERVIEW

- 12.2.4 COOGEE

- TABLE 240 COOGEE: COMPANY OVERVIEW

- 12.2.5 VYNOVA

- TABLE 241 VYNOVA: COMPANY OVERVIEW

- 12.2.6 GUJARAT ALKALIES AND CHEMICALS LIMITED

- TABLE 242 GUJARAT ALKALIES AND CHEMICALS LIMITED: COMPANY OVERVIEW

- 12.2.7 COVESTRO AG

- TABLE 243 COVESTRO AG: COMPANY OVERVIEW

- 12.2.8 HANWHA SOLUTIONS CHEMICAL DIVISION

- TABLE 244 HANWHA SOLUTIONS CHEMICAL DIVISION: COMPANY OVERVIEW

- 12.2.9 SHIN-ETSU CHEMICAL CO., LTD.

- TABLE 245 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- 12.2.10 ANHUI BAYI CHEMICAL INDUSTRY CO., LTD.

- TABLE 246 ANHUI BAYI CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- 12.2.11 NAMA

- TABLE 247 NAMA: COMPANY OVERVIEW

- 12.2.12 HAWKINS

- TABLE 248 HAWKINS: COMPANY OVERVIEW

- 12.2.13 DIVERSEY, INC.

- TABLE 249 DIVERSEY, INC.: COMPANY OVERVIEW

- 12.2.14 TESSENDERLO GROUP

- TABLE 250 TESSENDERLO GROUP: COMPANY OVERVIEW

- 12.2.15 KEMIRA

- TABLE 251 KEMIRA: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS