|

|

市場調査レポート

商品コード

1129146

WTTxの世界市場:コンポーネント別(ハードウェア、プラットフォーム・ソリューション、サービス)、動作周波数別(1.8GHz~Sub6GHz、6GHz~24GHz、24GHz超)、組織規模別(大企業、中小企業)、地域別 - 2027年までの予測WTTx Market by Component (Hardware, Platforms and Solutions, and Services), Operating Frequency (1.8 GHz - SUB 6 GHz, 6 GHz - 24 GHz, above 24 GHz), Organization Size (Large and Small-Medium Enterprises), and Region- Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| WTTxの世界市場:コンポーネント別(ハードウェア、プラットフォーム・ソリューション、サービス)、動作周波数別(1.8GHz~Sub6GHz、6GHz~24GHz、24GHz超)、組織規模別(大企業、中小企業)、地域別 - 2027年までの予測 |

|

出版日: 2022年09月13日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のWTTxの市場規模は、2022年の49億米ドルから2027年までに330億米ドルに達し、予測期間中にCAGRで46.4%の成長が予測されています。

エコシステムにおける様々な主要企業が、競争力のある多様な市場を形成しています。スマートシティ設立に向けた政府の取り組みや、未開拓の地方や都市部におけるWTTx・5Gの展開範囲などが、今後のWTTx市場の普及を促進すると予想されます。経済発展における高速インターネットの重要性を認識し、世界各国の政府は、サービスが行き届いていない地域におけるブロードバンドネットワークの建設に資金や補助金を提供する大規模なプロジェクトを推進しています。

コンポーネント別では、CPE(Customer Premise Equipment)セグメントが予測期間中に大きな市場規模を占める

CPE(Customer Premise Equipment)は、無線ブロードバンドを展開するためのネットワーク設備で、ユーザー端末に設置されるものです。CPEは、3G、4G、5Gなどの無線信号や有線ブロードバンド通信を、端末機器が利用できるようにLAN信号に変換する設備です。4G/5Gの信号をWi-Fi信号に変換し、ネットワーク用のハードウェア機器に供給することで、様々な機器を同時にインターネットに接続することができるようになります。

組織規模別では、中小企業セグメントが予測期間中に最も高いCAGRを記録

中小企業は、大企業に比べて予算が限られているという大きな課題に直面しており、ビジネスプロセスの複雑性を解決し、コストを最適化するためのより良い方法を必要としています。ワイヤレスブロードバンドソリューションを導入することで、中小企業はコストを削減し、ビジネス効率を向上させることができます。WTTxソリューションの導入は、サービスコストの削減と、より広いカバレッジ、高速かつ低遅延のネットワークの提供に役立ち、中小企業の加入者体験の向上と成長を保証することになります。

予測期間中、アジア太平洋地域が最高の成長率を記録

アジア太平洋地域は、WTTx技術の開発への投資と参加により、この産業のホットスポットとなっています。GSMA Mobile Economyレポートによると、この地域は2020年から2025年の間に3,310億米ドルの投資を計画していました。国際電気通信連合(ITU)によると、この地域のインターネットユーザーは2019年から2021年にかけて24%増加しました。アジア太平洋地域は、ワイヤレスソリューションとサービスの中心的なホットスポットとして浮上し、WTTx市場の成長を牽引しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- WTTx市場:サプライチェーン分析

- エコシステム

- WTTx市場企業の平均販売価格モデル

- 技術分析

- ケーススタディ分析

- 特許分析

- WTTx市場の収益シフト

- ポーターのファイブフォース分析

- 規制情勢

- 主な利害関係者と購入基準

- 主な会議とイベント

第6章 WTTx市場:コンポーネント別

- イントロダクション

- ハードウェア

- プラットフォーム・ソリューション

- サービス

第7章 WTTx市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第8章 WTTx市場:動作周波数別

- イントロダクション

- 1.8GHz~Sub6GHz

- 6GHz~24GHz

- 24GHz超

第9章 WTTx市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他

- アジア太平洋地域

- 中国

- インド

- 韓国

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

第10章 競合情勢

- 概要

- 主要企業が採用した戦略

- 主要企業の市場シェア分析

- 過去の収益分析

- 競合ベンチマーキング

- WTTx市場における主要企業の市場ランキング

- 企業の評価象限

- スタートアップ/中小企業の評価象限

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- HUAWEI

- NOKIA

- ERICSSON

- QUALCOMM

- SAMSUNG

- COMMSCOPE

- ELTEL GROUP

- AIRSPAN

- INSEEGO

- GEMTEK

- FIBOCOM

- ANRITSU

- その他の主要企業

- KEYSIGHT TECHNOLOGIES

- TECHNICOLOR

- LUMINE

- REMCOM

- COHERE TECHNOLOGIES

- EDX

- KELLY

- DIGI INTERNATIONAL

- BLINQ NETWORKS

- AVSYSTEM

- TARANA WIRELESS

- TELRAD NETWORKS

- JATON TECHNOLOGY LIMITED

第12章 隣接/関連市場

第13章 付録

The global WTTx market size is projected to grow from USD 4.9 billion in 2022 to USD 33.0 billion by 2027, at a CAGR of 46.4% during the forecast period. Various key players in the ecosystem have led to a competitive and diverse market. Government initiatives to establish smart cities and WTTx-5G deployment coverage in untapped rural and urban regions are expected to drive the adoption of the WTTx market in the future. Recognizing the significance of high-speed internet to economic development, governments worldwide are pursuing large-scale projects to fund or subsidize the construction of broadband networks in underserved areas. For instance, the Federal Communications Commission's Rural Digital Opportunity Fund (RDOF) awarded USD 9 billion to various wired, fixed wireless, and satellite operators in the US. It also introduced Connected America Fund 2 (CAFFI), whose funding allowed broadband deployment to rural areas.

By component, customer premise equipment segment to account for larger market size during forecast period

Customer Premise Equipment (CPE) is an equipment in networking used to deploy wireless broadband that is kept at the user terminal. CPE devices convert wireless signals, such as 3G, 4G, and 5G, and wired broadband transmissions into LAN signals for usage by terminal devices. CPE can be considered to be a combination of router and MiFi. CPE is a device that can repeat mobile signals such as 4G signals and issue Wi-Fi signals. It allows various devices to connect to the internet simultaneously by converting 4G/5G signals to Wi-Fi signals and supplying them to hardware devices for networking.

By organization size, SMEs segment to grow at highest CAGR during forecast period

SMEs face a greater challenge of a limited budget than large enterprises and require better methods to resolve complexities and optimize the cost of their business processes. Implementing wireless broadband solutions can help SMEs reduce costs and improve business efficiency. For less affluent markets and those without 5G coverage, a 4G connection is available as an alternate. Adopting WTTx solutions would reduce service costs and help provide greater coverage, high-speed, and low-latency networks, which would warrant enhanced subscriber experience and growth for SMEs.

Asia Pacific to register highest growth rate during forecast period

The investment and participation of Asia Pacific in the development of WTTx technology has made the region a hotspot for this industry. According to the GSMA Mobile Economy report, the region had planned to invest USD 331 billion between 2020 and 2025. The pandemic has accelerated the adoption of connected, digital solutions to enable business operations efficiently in this region and witnessed the rapid growth of the internet and wireless broadband service users. According to International Telecommunication Union (ITU), internet users in this region increased by 24% between 2019 and 2021. Asia Pacific has emerged as a central hotspot for wireless solutions and services and drives the growth of the WTTx market.

Breakdown of primaries

The study contains various industry experts' insights, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 18%, Tier 2 - 9%, and Tier 3 - 73%

- By Designation: C-level - 9%, D-level - 18%, and Others - 73%

- By Region: North America - 55%, Europe - 9%, Asia Pacific - 36%

The major players covered in the WTTx report include Huawei (China), Nokia (Finland), Ericsson (Sweden), Qualcomm (US), CommScope (US), Samsung (South Korea), Eltel Group (Sweden), Airspan (US), Inseego (US), Gemtek (Taiwan), Fibocom (China), Anritsu (Japan), Keysight Technologies (US), Technicolor (France), Lumine (Canada), Remcom (US), Cohere Technologies (US), EDX (US), Kelly (Canada), Digi International (US), BLiNQ Networks (Canada), AVSystem (Poland), Tarana Wireless (US), Telrad Networks (Israel), and Jaton Technology Ltd (China). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the WTTx.

Research Coverage

The market study covers the WTTx market size across segments. It aims at estimating the market size and the growth potential across segments, including component, organization size, operating frequency, and region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the global WTTx market and its subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 WTTX MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- FIGURE 2 WTTX MARKET: GEOGRAPHIC SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY

- TABLE 1 USD EXCHANGE RATES, 2019-2021

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 WTTX MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primary profiles

- 2.1.2.4 Primary sources

- 2.1.2.5 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF WTTX MARKET

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- 2.2.3 WTTX MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- 2.2.4 WTTX MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- 2.2.5 GROWTH FORECAST ASSUMPTIONS

- TABLE 2 MARKET GROWTH ASSUMPTIONS

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 FACTOR ASSESSMENT

- TABLE 3 FACTOR ASSESSMENT: WTTX MARKET

3 EXECUTIVE SUMMARY

- FIGURE 10 WTTX MARKET, 2020-2027 (USD MILLION)

- FIGURE 11 WTTX MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 WTTX MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 WTTX MARKET, BY OPERATING FREQUENCY, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 WTTX MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 WTTX MARKET OVERVIEW

- FIGURE 15 INCREASING USE OF ECOMMERCE AND MCOMMERCE PLATFORMS TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICA: WTTX MARKET, BY OPERATING FREQUENCY AND ORGANIZATION SIZE (2022)

- FIGURE 16 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

- 4.3 ASIA PACIFIC: WTTX MARKET, BY OPERATING FREQUENCY AND ORGANIZATION SIZE (2022)

- FIGURE 17 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

- 4.4 EUROPE: WTTX MARKET, BY OPERATING FREQUENCY AND ORGANIZATION SIZE (2022)

- FIGURE 18 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

- 4.5 GEOGRAPHICAL SNAPSHOT OF WTTX MARKET

- FIGURE 19 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: WTTX MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Government initiatives to establish smart cities

- 5.2.1.2 WTTx-5G deployment coverage in untapped rural and urban regions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Adverse impact of millimeter-wave frequency circuitries on environment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 WTTx offering economic benefits to mobile network operators

- 5.2.3.2 Surge in cross-selling trends of 5G mobiles and lower cost routers

- FIGURE 21 PROJECTED NET ADDITIONS WORLDWIDE (MILLION) 2021-2025

- 5.2.3.3 Generation of new revenue streams for mobile operators

- 5.2.3.4 Increased work from home activities give rise to household broadband penetration

- FIGURE 22 GLOBE TELECOM FIXED BROADBAND SUBSCRIBERS (THOUSANDS)

- 5.2.4 CHALLENGES

- 5.2.4.1 Maintaining QoS and integration of technologies

- 5.2.4.2 Handling millimeter waves to maintain radio link performance

- 5.3 WTTX MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 WTTX MARKET: SUPPLY CHAIN

- 5.4 ECOSYSTEM

- FIGURE 24 WTTX MARKET: ECOSYSTEM

- TABLE 4 WTTX MARKET: ECOSYSTEM

- 5.5 AVERAGE SELLING PRICE MODEL OF WTTX MARKET PLAYERS

- TABLE 5 PRICING MODELS AND INDICATIVE PRICE POINTS, 2021-2022

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 INTRODUCTION

- 5.6.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 5.6.3 AUGMENTED REALITY/VIRTUAL REALITY

- 5.6.4 INTERNET OF THINGS

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 CASE STUDY 1: OPTUS USED ERICSSON'S SOLUTION TO PROVIDE WIRELESS BROADBAND 5G SERVICES

- 5.7.2 CASE STUDY 2: KDDI DELIVERS NETWORK TO YAKUSUGI BY USING COMMSCOPE'S SOLUTION

- 5.7.3 CASE STUDY 3: ZAIN KSA DEPLOYED NOKIA'S SOLUTIONS FOR 5G-WTTX

- 5.7.4 CASE STUDY 4: CHUNGHWA TELECOM REAPED ECONOMIC BENEFITS BY DEPLOYING ERICSSON'S SOLUTION

- 5.7.5 CASE STUDY 5: DIALOG DEPLOYED HUAWEI'S SOLUTIONS TO INCREASE HOME BROADBAND PENETRATION

- 5.7.6 CASE STUDY 6: TELENOR GROUP DEPLOYS ELTEL SOLUTIONS

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.8.2 DOCUMENT TYPES OF PATENTS

- TABLE 6 PATENTS FILED, 2019-2022

- 5.8.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 25 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2019-2022

- 5.8.3.1 Top applicants

- FIGURE 26 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019-2022

- TABLE 7 US: TOP TEN PATENT OWNERS IN WTTX MARKET, 2019-2022

- TABLE 8 LIST OF A FEW PATENTS IN WTTX MARKET, 2020-2022

- 5.9 REVENUE SHIFT FOR WTTX MARKET

- FIGURE 27 REVENUE IMPACT ON WTTX MARKET

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 WTTX MARKET: PORTER'S FIVE FORCES MODEL

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 DEGREE OF COMPETITION

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1.1 North America

- 5.11.1.1.1 US

- 5.11.1.1.2 Canada

- 5.11.1.2 Europe

- 5.11.1.3 Asia Pacific

- 5.11.1.3.1 China

- 5.11.1.3.2 Australia

- 5.11.1.3.3 Japan

- 5.11.1.4 Middle East and Africa

- 5.11.1.4.1 Saudi Arabia

- 5.11.1.1 North America

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA

- TABLE 16 KEY BUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 17 WTTX MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 WTTX MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: MARKET DRIVERS

- FIGURE 30 PLATFORMS AND SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- TABLE 18 WTTX MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 19 WTTX MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2 HARDWARE

- 6.2.1 SHIFT TOWARD WTTX HARDWARE INSTALLATION BECAUSE OF ENHANCED SIGNAL QUALITY

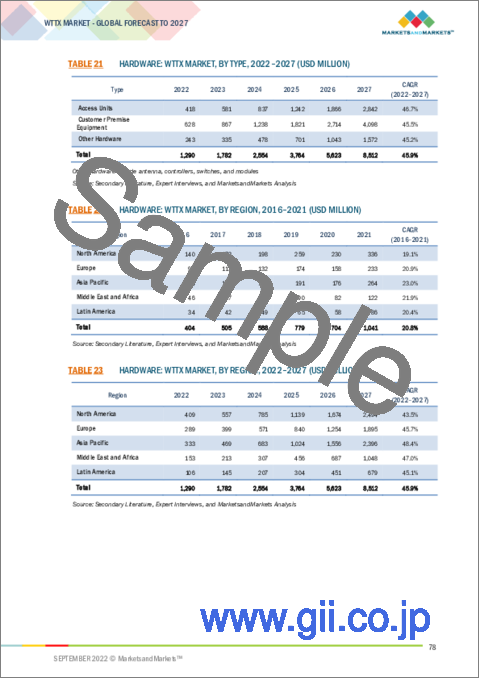

- TABLE 20 HARDWARE: WTTX MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 21 HARDWARE: WTTX MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 22 HARDWARE: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 23 HARDWARE: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.2 CUSTOMER PREMISE EQUIPMENT

- 6.2.2.1 WTTx deployment leads to growing demand for customer premise equipment

- TABLE 24 CUSTOMER PREMISE EQUIPMENT: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 25 CUSTOMER PREMISE EQUIPMENT: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.3 ACCESS UNITS

- 6.2.3.1 Short-range and large-range applications coverage with two kinds of access unit

- TABLE 26 ACCESS UNITS: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 27 ACCESS UNITS: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.4 OTHER HARDWARE

- 6.2.4.1 Telecoms adopting WTTx devices to reduce operational costs and enhance customer experience

- TABLE 28 OTHER HARDWARE: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 29 OTHER HARDWARE: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 PLATFORMS AND SOLUTIONS

- 6.3.1 WTTX SOLUTIONS PROVIDE ENHANCED OVERALL SIGNAL STRENGTH AND BROADBAND SPEEDS

- TABLE 30 PLATFORMS AND SOLUTIONS: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 31 PLATFORMS AND SOLUTIONS: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 SERVICES

- 6.4.1 INCREASED B2B COMMUNICATION AND IMPROVED SPECTRAL EFFICIENCY LED TO RISE IN WTTX MARKET SERVICES ADOPTION

- TABLE 32 SERVICES: WTTX MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 33 SERVICES: WTTX MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 34 SERVICES: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 35 SERVICES: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4.2 MANAGED SERVICES

- 6.4.2.1 Managing in-house services forced organizations to outsource certain processes

- TABLE 36 MANAGED SERVICES: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 37 MANAGED SERVICES: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4.3 PROFESSIONAL SERVICES

- TABLE 38 PROFESSIONAL SERVICES: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 39 PROFESSIONAL SERVICES: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

7 WTTX MARKET, BY ORGANIZATION SIZE

- 7.1 INTRODUCTION

- 7.1.1 ORGANIZATION SIZE: WTTX MARKET DRIVERS

- FIGURE 31 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 40 WTTX MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 41 WTTX MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 7.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 7.2.1 ADOPTION OF DIGITAL SOLUTIONS TO REDUCE COSTS AND PROVIDE USERS ENHANCED EXPERIENCE

- TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 43 SMALL AND MEDIUM-SIZED ENTERPRISES: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 LARGE ENTERPRISES

- 7.3.1 WTTX SOLUTIONS MEET REQUIREMENTS OF HOME, ENTERPRISE, AND DIFFERENT INDUSTRIES

- TABLE 44 LARGE ENTERPRISES: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 45 LARGE ENTERPRISES: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

8 WTTX MARKET, BY OPERATING FREQUENCY

- 8.1 INTRODUCTION

- 8.1.1 OPERATING FREQUENCY: WTTX MARKET DRIVERS

- FIGURE 32 6 GHZ - 24 GHZ SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

- TABLE 46 WTTX MARKET, BY OPERATING FREQUENCY, 2016-2021 (USD MILLION)

- TABLE 47 WTTX MARKET, BY OPERATING FREQUENCY, 2022-2027 (USD MILLION)

- 8.2 1.8 GHZ - SUB 6GHZ

- 8.2.1 LOWER FREQUENCY SIGNALS HELP ENHANCE GEOGRAPHIC COVERAGE

- TABLE 48 1.8 GHZ - SUB 6 GHZ: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 49 1.8 GHZ - SUB 6 GHZ: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 6 GHZ - 24 GHZ

- 8.3.1 24 GHZ OFFERS LOWER PROPAGATION LOSS COMPARED TO OTHER MMWAVE BANDS

- TABLE 50 6 GHZ - 24 GHZ: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 51 6 GHZ - 24 GHZ: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 ABOVE 24 GHZ

- 8.4.1 HIGHER BANDWIDTHS TO KEEP EVERYONE CONNECTED IN BUSY ENVIRONMENTS

- TABLE 52 ABOVE 24 GHZ: WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 53 ABOVE 24 GHZ: WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

9 WTTX MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 33 WTTX MARKET: REGIONAL SNAPSHOT (2022)

- FIGURE 34 WTTX MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

- TABLE 54 WTTX MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 55 WTTX MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 56 NORTH AMERICA: WTTX MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 57 NORTH AMERICA: WTTX MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: WTTX MARKET, BY HARDWARE, 2016-2021 (USD MILLION)

- TABLE 59 NORTH AMERICA: WTTX MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: WTTX MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 61 NORTH AMERICA: WTTX MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 62 NORTH AMERICA: WTTX MARKET, BY OPERATING FREQUENCY, 2016-2021 (USD MILLION)

- TABLE 63 NORTH AMERICA: WTTX MARKET, BY OPERATING FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 64 NORTH AMERICA: WTTX MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 65 NORTH AMERICA: WTTX MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 66 NORTH AMERICA: WTTX MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 67 NORTH AMERICA: WTTX MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Remarkable growth of smart infrastructure

- TABLE 68 US: WTTX MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 69 US: WTTX MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 70 US: WTTX MARKET, BY HARDWARE, 2016-2021 (USD MILLION)

- TABLE 71 US: WTTX MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- TABLE 72 US: WTTX MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 73 US: WTTX MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 74 US: WTTX MARKET, BY OPERATING FREQUENCY, 2016-2021 (USD MILLION)

- TABLE 75 US: WTTX MARKET, BY OPERATING FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 76 US: WTTX MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 77 US: WTTX MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Improve network connectivity to automate work process

- 9.3 EUROPE

- 9.3.1 PESTLE ANALYSIS: EUROPE

- TABLE 78 EUROPE: WTTX MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 79 EUROPE: WTTX MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 80 EUROPE: WTTX MARKET, BY HARDWARE, 2016-2021 (USD MILLION)

- TABLE 81 EUROPE: WTTX MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- TABLE 82 EUROPE: WTTX MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 83 EUROPE: WTTX MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 84 EUROPE: WTTX MARKET, BY OPERATING FREQUENCY, 2016-2021 (USD MILLION)

- TABLE 85 EUROPE: WTTX MARKET, BY OPERATING FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 86 EUROPE: WTTX MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 87 EUROPE: WTTX MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 88 EUROPE: WTTX MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 89 EUROPE: WTTX MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Need to connect premises with fixed wireless technology

- TABLE 90 UK: WTTX MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 91 UK: WTTX MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 92 UK: WTTX MARKET, BY HARDWARE, 2016-2021 (USD MILLION)

- TABLE 93 UK: WTTX MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- TABLE 94 UK: WTTX MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 95 UK: WTTX MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 96 UK: WTTX MARKET, BY OPERATING FREQUENCY, 2016-2021 (USD MILLION)

- TABLE 97 UK: WTTX MARKET, BY OPERATING FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 98 UK: WTTX MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 99 UK: WTTX MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.3.3 GERMANY

- 9.3.3.1 Need to support Industry 4.0 and digitalization

- 9.3.4 FRANCE

- 9.3.4.1 Rising need to provide high-speed internet

- 9.3.5 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- TABLE 100 ASIA PACIFIC: WTTX MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 101 ASIA PACIFIC: WTTX MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 102 ASIA PACIFIC: WTTX MARKET, BY HARDWARE, 2016-2021 (USD MILLION)

- TABLE 103 ASIA PACIFIC: WTTX MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- TABLE 104 ASIA PACIFIC: WTTX MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 105 ASIA PACIFIC: WTTX MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 106 ASIA PACIFIC: WTTX MARKET, BY OPERATING FREQUENCY, 2016-2021 (USD MILLION)

- TABLE 107 ASIA PACIFIC: WTTX MARKET, BY OPERATING FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 108 ASIA PACIFIC: WTTX MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 109 ASIA PACIFIC: WTTX MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 110 ASIA PACIFIC: WTTX MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 111 ASIA PACIFIC: WTTX MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Accelerating 5G network deployment

- 9.4.3 INDIA

- 9.4.3.1 Increasing investments to boost 5G deployment

- TABLE 112 INDIA: WTTX MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 113 INDIA: WTTX MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 114 INDIA: WTTX MARKET, BY HARDWARE, 2016-2021 (USD MILLION)

- TABLE 115 INDIA: WTTX MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- TABLE 116 INDIA: WTTX MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 117 INDIA: WTTX MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 118 INDIA: WTTX MARKET, BY OPERATING FREQUENCY, 2016-2021 (USD MILLION)

- TABLE 119 INDIA: WTTX MARKET, BY OPERATING FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 120 INDIA: WTTX MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 121 INDIA: WTTX MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Increasing demand for 5G and 6G wireless technology

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST AND AFRICA

- 9.5.1 PESTLE ANALYSIS: MIDDLE EAST AND AFRICA

- TABLE 122 MIDDLE EAST AND AFRICA: WTTX MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 123 MIDDLE EAST AND AFRICA: WTTX MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 124 MIDDLE EAST AND AFRICA: WTTX MARKET, BY HARDWARE, 2016-2021 (USD MILLION)

- TABLE 125 MIDDLE EAST AND AFRICA: WTTX MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- TABLE 126 MIDDLE EAST AND AFRICA: WTTX MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 127 MIDDLE EAST AND AFRICA: WTTX MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 128 MIDDLE EAST AND AFRICA: WTTX MARKET, BY OPERATING FREQUENCY, 2016-2021 (USD MILLION)

- TABLE 129 MIDDLE EAST AND AFRICA: WTTX MARKET, BY OPERATING FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 130 MIDDLE EAST AND AFRICA: WTTX MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 131 MIDDLE EAST AND AFRICA: WTTX MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 132 MIDDLE EAST AND AFRICA: WTTX MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 133 MIDDLE EAST AND AFRICA: WTTX MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.5.2 SAUDI ARABIA

- 9.5.2.1 Government initiatives to enhance wireless coverage to surge demand for WTTx solutions

- 9.5.3 UAE

- 9.5.3.1 To achieve digital vision 2030 and develop to most connected country

- TABLE 134 UAE: WTTX MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 135 UAE: WTTX MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 136 UAE: WTTX MARKET, BY HARDWARE, 2016-2021 (USD MILLION)

- TABLE 137 UAE: WTTX MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- TABLE 138 UAE: WTTX MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 139 UAE: WTTX MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 140 UAE: WTTX MARKET, BY OPERATING FREQUENCY, 2016-2021 (USD MILLION)

- TABLE 141 UAE: WTTX MARKET, BY OPERATING FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 142 UAE: WTTX MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 143 UAE: WTTX MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 Infrastructure development to drive market

- 9.5.5 REST OF MIDDLE EAST AND AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 PESTLE ANALYSIS: LATIN AMERICA

- TABLE 144 LATIN AMERICA: WTTX MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 145 LATIN AMERICA: WTTX MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 146 LATIN AMERICA: WTTX MARKET, BY HARDWARE, 2016-2021 (USD MILLION)

- TABLE 147 LATIN AMERICA: WTTX MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- TABLE 148 LATIN AMERICA: WTTX MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 149 LATIN AMERICA: WTTX MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 150 LATIN AMERICA: WTTX MARKET, BY OPERATING FREQUENCY, 2016-2021 (USD MILLION)

- TABLE 151 LATIN AMERICA: WTTX MARKET, BY OPERATING FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 152 LATIN AMERICA: WTTX MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 153 LATIN AMERICA: WTTX MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 154 LATIN AMERICA: WTTX MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 155 LATIN AMERICA: WTTX MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.6.2 BRAZIL

- 9.6.2.1 Increased investments in digital infrastructure to surge demand for WTTx solutions

- TABLE 156 BRAZIL: WTTX MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 157 BRAZIL: WTTX MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 158 BRAZIL: WTTX MARKET, BY HARDWARE, 2016-2021 (USD MILLION)

- TABLE 159 BRAZIL: WTTX MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- TABLE 160 BRAZIL: WTTX MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 161 BRAZIL: WTTX MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 162 BRAZIL: WTTX MARKET, BY OPERATING FREQUENCY, 2016-2021 (USD MILLION)

- TABLE 163 BRAZIL: WTTX MARKET, BY OPERATING FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 164 BRAZIL: WTTX MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 165 BRAZIL: WTTX MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.6.3 MEXICO

- 9.6.3.1 Increasing number of internet users to drive market growth

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 166 STRATEGIES ADOPTED BY KEY PLAYERS IN WTTX MARKET

- 10.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 167 WTTX MARKET: DEGREE OF COMPETITION

- 10.4 HISTORICAL REVENUE ANALYSIS

- FIGURE 36 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019-2021 (USD MILLION)

- 10.5 COMPETITIVE BENCHMARKING

- TABLE 168 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 169 WTTX MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 170 WTTX MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 171 WTTX MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- TABLE 172 WTTX MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES BY REGION

- TABLE 173 WTTX MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS

- 10.6 MARKET RANKING OF KEY PLAYERS IN WTTX MARKET, 2022

- FIGURE 37 MARKET RANKING OF KEY PLAYERS, 2022

- 10.7 COMPANY EVALUATION QUADRANT

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- FIGURE 38 WTTX MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2022

- 10.8 STARTUP/SME EVALUATION QUADRANT

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- FIGURE 39 WTTX MARKET (STARTUP): COMPANY EVALUATION MATRIX, 2022

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- TABLE 174 PRODUCT LAUNCHES, JANUARY 2019-JULY 2022

- 10.9.2 DEALS

- TABLE 175 DEALS, JANUARY 2019-JULY 2022

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)**

- 11.1.1 HUAWEI

- TABLE 176 HUAWEI: BUSINESS OVERVIEW

- FIGURE 40 HUAWEI: COMPANY SNAPSHOT

- TABLE 177 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 HUAWEI: PRODUCT LAUNCHES

- 11.1.2 NOKIA

- TABLE 179 NOKIA: BUSINESS OVERVIEW

- FIGURE 41 NOKIA: COMPANY SNAPSHOT

- TABLE 180 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 NOKIA: PRODUCT LAUNCHES

- TABLE 182 NOKIA: DEALS

- 11.1.3 ERICSSON

- TABLE 183 ERICSSON: BUSINESS OVERVIEW

- FIGURE 42 ERICSSON: COMPANY SNAPSHOT

- TABLE 184 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 ERICSSON: DEALS

- 11.1.4 QUALCOMM

- TABLE 186 QUALCOMM: BUSINESS OVERVIEW

- FIGURE 43 QUALCOMM: COMPANY SNAPSHOT

- TABLE 187 QUALCOMM: PRODUCTS OFFERED

- TABLE 188 QUALCOMM: PRODUCT LAUNCHES

- TABLE 189 QUALCOMM: DEALS

- 11.1.5 SAMSUNG

- TABLE 190 SAMSUNG: BUSINESS OVERVIEW

- FIGURE 44 SAMSUNG: COMPANY SNAPSHOT

- TABLE 191 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 SAMSUNG: PRODUCT LAUNCHES

- TABLE 193 SAMSUNG: DEALS

- TABLE 194 SAMSUNG: OTHERS

- 11.1.6 COMMSCOPE

- TABLE 195 COMMSCOPE: BUSINESS OVERVIEW

- FIGURE 45 COMMSCOPE: COMPANY SNAPSHOT

- TABLE 196 COMMSCOPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 COMMSCOPE: PRODUCT LAUNCHES

- TABLE 198 COMMSCOPE: DEALS

- 11.1.7 ELTEL GROUP

- TABLE 199 ELTEL GROUP: BUSINESS OVERVIEW

- FIGURE 46 ELTEL: COMPANY SNAPSHOT

- TABLE 200 ELTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 ELTEL: DEALS

- 11.1.8 AIRSPAN

- TABLE 202 AIRSPAN: BUSINESS OVERVIEW

- FIGURE 47 AIRSPAN: COMPANY SNAPSHOT

- TABLE 203 AIRSPAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 AIRSPAN: PRODUCT LAUNCHES

- TABLE 205 AIRSPAN: DEALS

- TABLE 206 AIRSPAN: OTHERS

- 11.1.9 INSEEGO

- TABLE 207 INSEEGO: BUSINESS OVERVIEW

- FIGURE 48 INSEEGO: COMPANY SNAPSHOT

- TABLE 208 INSEEGO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 INSEEGO: PRODUCT LAUNCHES

- TABLE 210 INSEEGO: DEALS

- 11.1.10 GEMTEK

- TABLE 211 GEMTEK: BUSINESS OVERVIEW

- FIGURE 49 GEMTEK: COMPANY SNAPSHOT

- TABLE 212 GEMTEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.11 FIBOCOM

- TABLE 213 FIBOCOM: BUSINESS OVERVIEW

- FIGURE 50 FIBOCOM: COMPANY SNAPSHOT

- TABLE 214 FIBOCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 FIBOCOM: PRODUCT LAUNCHES

- TABLE 216 FIBOCOM: DEALS

- 11.1.12 ANRITSU

- TABLE 217 ANRITSU: BUSINESS OVERVIEW

- FIGURE 51 ANRITSU: COMPANY SNAPSHOT

- TABLE 218 ANRITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 ANRITSU: PRODUCT LAUNCHES

- TABLE 220 ANRITSU: DEALS

- * Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 11.2 OTHER KEY PLAYERS

- 11.2.1 KEYSIGHT TECHNOLOGIES

- 11.2.2 TECHNICOLOR

- 11.2.3 LUMINE

- 11.2.4 REMCOM

- 11.2.5 COHERE TECHNOLOGIES

- 11.2.6 EDX

- 11.2.7 KELLY

- 11.2.8 DIGI INTERNATIONAL

- 11.2.9 BLINQ NETWORKS

- 11.2.10 AVSYSTEM

- 11.2.11 TARANA WIRELESS

- 11.2.12 TELRAD NETWORKS

- 11.2.13 JATON TECHNOLOGY LIMITED

12 ADJACENT/RELATED MARKETS

- 12.1 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET

- 12.1.1 MARKET OVERVIEW

- 12.1.2 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY TECHNOLOGY

- TABLE 221 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY TECHNOLOGY, 2020-2026 (USD MILLION)

- 12.1.2.1 Wi-Fi

- TABLE 222 WI-FI: WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY REGION, 2020-2026 (USD MILLION)

- 12.1.3 CELLULAR M2M

- TABLE 223 CELLULAR M2M: WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY REGION, 2020-2026 (USD MILLION)

- 12.1.4 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY OFFERING

- TABLE 224 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY OFFERING, 2017-2020 (USD MILLION)

- TABLE 225 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY OFFERING, 2020-2026 (USD MILLION)

- 12.1.5 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY APPLICATION

- 12.1.5.1 Introduction

- TABLE 226 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 227 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY APPLICATION, 2020-2026 (USD MILLION)

- 12.2 5G SERVICES MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 5G SERVICES MARKET, BY END USER

- TABLE 228 5G SERVICES MARKET, BY END USER, 2020-2026 (USD BILLION)

- TABLE 229 CONSUMERS: 5G SERVICES MARKET, BY REGION, 2020-2026 (USD BILLION)

- TABLE 230 ENTERPRISES: 5G SERVICES MARKET, BY REGION, 2020-2026 (USD BILLION)

- 12.2.4 5G SERVICES MARKET, BY COMMUNICATION TYPE

- TABLE 231 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2020-2026 (USD BILLION)

- TABLE 232 FIXED WIRELESS ACCESS: 5G SERVICES MARKET, BY REGION, 2020-2026 (USD BILLION)

- TABLE 233 ENHANCED MOBILE BROADBAND: 5G SERVICES MARKET, BY REGION, 2020-2026 (USD BILLION)

- TABLE 234 MASSIVE MACHINE-TYPE COMMUNICATIONS: 5G SERVICES MARKET, BY REGION, 2020-2026 (USD BILLION)

- TABLE 235 ULTRA-RELIABLE, LOW-LATENCY: 5G SERVICES MARKET, BY REGION, 2020-2026 (USD BILLION)

- 12.2.5 5G SERVICES MARKET, BY ENTERPRISE

- TABLE 236 5G SERVICES MARKET, BY ENTERPRISE, 2020-2026 (USD BILLION)

- 12.2.6 5G SERVICES MARKET, BY REGION

- TABLE 237 5G SERVICES MARKET, BY REGION, 2020-2026 (USD BILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS